Liquidity risk in European bond markets

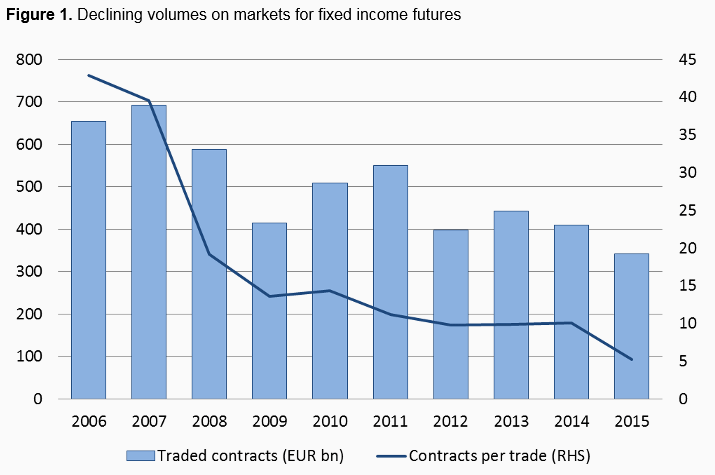

There are signs of liquidity decline and liquidity illusion in euro area government bond markets. Citibank research suggests that liquidity risk is rising due to increased capital requirements for dealers, reduced market maker inventories, enhanced dealer transparency rules, elevated assets under management of bond funds, and the liquidity transformation provided by these funds.