A new McKinsey report estimates that total debt of households, corporates, and governments has expanded 40% since 2007, reaching a total of 286% of GDP last year. Government debt ratios will be hard to contain through fiscal tightening and economic growth alone. China’s non-financial debt has quadrupled, with credit quality critically dependent on the real estate sector.

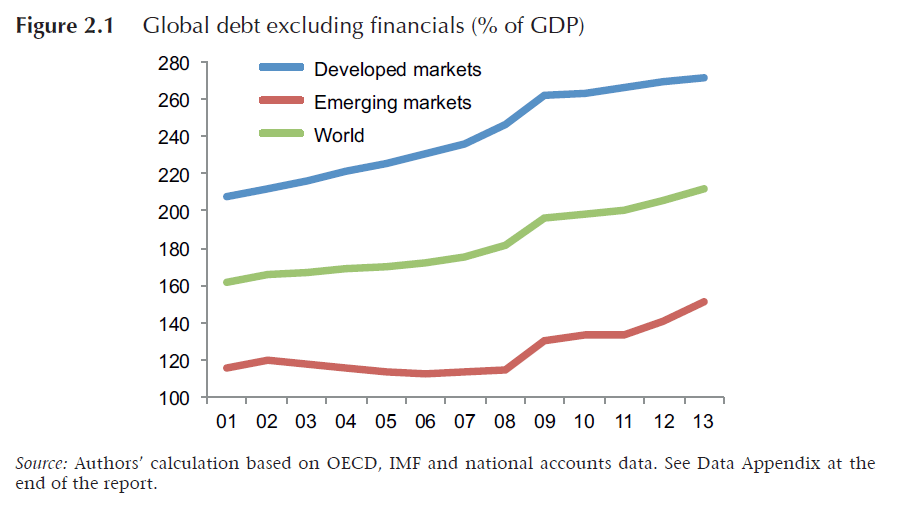

On aggregate, global financial leverage has further increased since the great financial crisis. Most worrisome is the declining debt service capacity of public and private borrowers due to falling potential GDP growth and inflation. This precarious development virtually enforces very low real interest rates. EM leverage has increased fastest in recent years. China in particular poses maybe the greatest global debt problem.

Non-conventional monetary policy has inflated central banks’ balance sheets and compressed long-term yields. A new BIS paper makes some points on why reversing this portfolio effect is problematic. The financial system has much greater exposure to government bond yield risk than in the past. Spillover risks for private debt and emerging markets are elevated. And conflicts may arise between central bank and public debt management policies, increasing uncertainty for markets.

According to Nomura’s Zhiwei Zhang and Wendy Chen, “China is displaying the same three symptoms that Japan, the US and parts of Europe all showed before suffering financial crises: a rapid build-up of leverage, elevated property prices and a decline in potential growth…the most vulnerable areas are local government financing vehicles, property developers, trust companies and credit guarantee companies.”