How salience theory explains the mispricing of risk

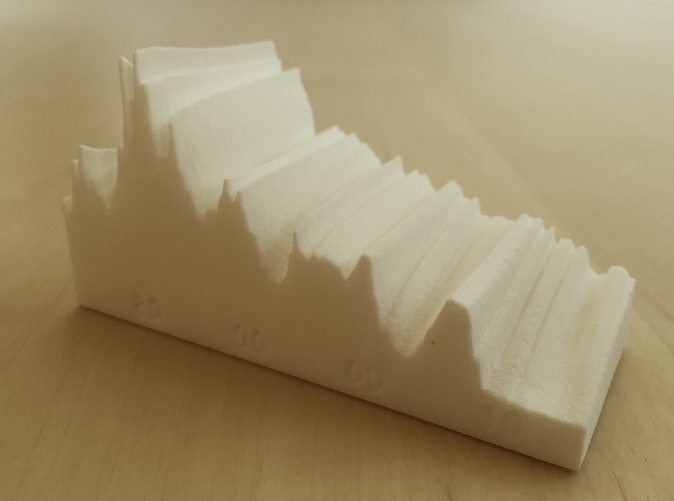

Salience theory suggests that decision makers exaggerate the probability of extreme events if they are aware of their possibility. This gives rise to subjective probability distributions and undermines conventional rationality. In particular, salience theory explains skewness preference, i.e. the overpricing of assets with a positive skew and the under-pricing of contracts with a negative skew. There is ample evidence of skewness preference, most obviously the overpayment for insurance contracts and lottery tickets. In financial markets, growth stocks with positively-skewed expected returns have historically been overpriced relative to value stocks. This is important for macro trading. For example, a specific publicly discussed disaster risk should pay an excessive premium, and short-volatility strategies in times of fear of large drawdowns for the underlying should have positive expected value.