Bank survey scores #

This category group contains real-time standardized bank lending survey measures of credit demand and supply conditions. The surveys are conducted by central banks and, conceptually, should indicate changes in lending conditions before they are recorded in actual credit data. Vintages are standardized using historical means and standard deviations on the survey level. The purpose of standardization, based on expanding samples, is to replicate the market’s information state on what was considered normal in terms of level and deviation and to make metrics more intuitive and comparable across countries.

Loan demand conditions #

Ticker : BLSDSCORE_NSA

Label : Bank lending survey, credit demand z-score.

Definition : Bank lending survey, normalized score of the survey assessment of credit demand.

Notes :

-

This is a quantamental metric based on quarterly-frequency vintages of bank lending survey indices related to past credit demand conditions. These survey metrics are available for the United States, the Eurozone, Japan, the UK, India, Turkey, Norway, Czech Republic, Poland, Russia, New Zealand, and the Philippines. Canada also has a bank lending survey but no specific loan demand category.

-

Survey index values are transformed into z-scores based on past expanding data samples in order to replicate the market’s information state on survey readings relative to what is considered as “normal”. For an in-depth explanation of how the z-scores are computed, see Appendix 1 .

-

If there is no aggregate credit demand index available, an average of company and household loan demand is used, which may themselves be average scores of different sub-sectors. All survey indices used for this metric are summarized in Appendix 2 .

Ticker : BLSDSCORE_NSA_D1Q1QL1 / _D2Q2QL2 / _D1Q1QL4

Label : Bank lending survey, credit demand z-score: diff q/q / diff 2q/2q / diff oya (q)

Definition : Bank lending survey, normalized score of the survey assessment of credit demand: difference of last quarter over previous quarter / difference of last 2 quarters over previous 2 quarters / difference over a year ago, quarterly values

Notes :

-

This is a quantamental metric based on quarterly-frequency vintages of bank lending survey indices related to past credit demand conditions. These survey metrics are available for the United States, the Eurozone, Japan, the UK, India, Turkey, Norway, Czech Republic, Poland, Russia, New Zealand, and the Philippines. Canada also has a bank lending survey but no specific loan demand category.

-

Survey index values are transformed into z-scores based on past expanding data samples in order to replicate the market’s information state on survey readings relative to what is considered as “normal”. For an in-depth explanation of how the z-scores are computed, see Appendix 1 .

-

If there is no aggregate credit demand index available, an average of company and household loan demand is used, which may themselves be average scores of different sub-sectors. All survey indices used for this metric are summarized in Appendix 2 .

Loan supply conditions #

Ticker : BLSCSCORE_NSA

Label : Bank lending survey, credit supply (easing standards) z-score.

Definition : Bank lending survey, normalized score of the survey assessment of credit standards, with positive values indicating easing standards.

Notes :

-

This is a quantamental metric based on quarterly-frequency vintages of bank lending survey indices related to past credit standards, whereby positive values indicate easing conditions. These survey metrics are available for the United States, the Eurozone, Japan, the UK, Canada, India, Turkey, Norway, Czech Republic, Poland, Russia, New Zealand, and the Philippines.

-

Survey index values are transformed into z-scores based on past expanding data samples in order to replicate the market’s information state on survey readings relative to what is considered as “normal”. For an in-depth explanation of how the z-scores are computed, see Appendix 1 .

-

If there is no aggregate credit demand index available, an average of company and household loan demand is used, which may themselves be average scores of different sub-sectors. All survey indices used for this metric are summarized in Appendix 2 .

Ticker : BLSCSCORE_NSA_D1Q1QL1 / _D2Q2QL2 / _D1Q1QL4

Label : Bank lending survey, credit supply (easing standards) z-score: diff q/q / diff 2q/2q / diff oya (q)

Definition : Bank lending survey, normalized score of the survey assessment of credit standards, with positive values indicating easing standards: difference of last quarter over previous quarter / difference of last 2 quarters over previous 2 quarters / difference over a year ago, quarterly values

Notes :

-

This is a quantamental metric based on quarterly-frequency vintages of bank lending survey indices related to past credit standards, whereby positive values indicate easing conditions. These survey metrics are available for the United States, the Eurozone, Japan, the UK, Canada, India, Turkey, Norway, Czech Republic, Poland, Russia, New Zealand, and the Philippines.

-

Survey index values are transformed into z-scores based on past expanding data samples in order to replicate the market’s information state on survey readings relative to what is considered as “normal”. For an in-depth explanation of how the z-scores are computed, see Appendix 1 .

-

If there is no aggregate credit demand index available, an average of company and household loan demand is used, which may themselves be average scores of different sub-sectors. All survey indices used for this metric are summarized in Appendix 2 .

Imports #

Only the standard Python data science packages and the specialized

macrosynergy

package are needed.

import os

import pandas as pd

import macrosynergy.management as msm

import macrosynergy.panel as msp

from macrosynergy.download import JPMaQSDownload

from timeit import default_timer as timer

from datetime import timedelta, date

import warnings

warnings.simplefilter("ignore")

The

JPMaQS

indicators we consider are downloaded using the J.P. Morgan Dataquery API interface within the

macrosynergy

package. This is done by specifying

ticker strings

, formed by appending an indicator category code

<category>

to a currency area code

<cross_section>

. These constitute the main part of a full quantamental indicator ticker, taking the form

DB(JPMAQS,<cross_section>_<category>,<info>)

, where

<info>

denotes the time series of information for the given cross-section and category.

The following types of information are available:

-

valuegiving the latest available values for the indicator -

eop_lagreferring to days elapsed since the end of the observation period -

mop_lagreferring to the number of days elapsed since the mean observation period -

gradedenoting a grade of the observation, giving a metric of real time information quality.

After instantiating the

JPMaQSDownload

class within the

macrosynergy.download

module, one can use the

download(tickers,

start_date,

metrics)

method to obtain the data. Here

tickers

is an array of ticker strings,

start_date

is the first release date to be considered and

metrics

denotes the types of information requested.

# Cross-sections of interest

cids_dmca = sorted(["CAD", "EUR", "GBP", "JPY", "NOK", "NZD", "USD", "DEM", "ITL", "ESP", "FRF", "NLG"])

cids_emea = sorted(["CZK", "PLN", "RUB", "TRY"])

cids_emas = sorted([

"INR",

"PHP",

])

cids = cids_dmca + cids_emea + cids_emas

# Quantamental categories of interest

main = [

# Demand

"BLSDSCORE_NSA",

"BLSDSCORE_NSA_D1Q1QL1",

"BLSDSCORE_NSA_D2Q2QL2",

"BLSDSCORE_NSA_D1Q1QL4",

# Supply

"BLSCSCORE_NSA",

"BLSCSCORE_NSA_D1Q1QL1",

"BLSCSCORE_NSA_D2Q2QL2",

"BLSCSCORE_NSA_D1Q1QL4",

]

econ = [

"NIR_NSA",

"RIR_NSA",

"NEER_NSA_P1M1ML12",

] # economic context

mark = [

"DU05YXR_NSA",

"DU05YXR_VT10",

"EQCCODR_VT10",

"EQCCOSR_VT10",

"EQCCODR_NSA",

"EQCCOSR_NSA",

"EQXR_NSA",

"EQXR_VT10",

] # market links

xcats = main + econ + mark

# Download series from J.P. Morgan DataQuery by tickers

start_date = "2000-01-01"

tickers = [cid + "_" + xcat for cid in cids for xcat in xcats]

print(f"Maximum number of tickers is {len(tickers)}")

# Retrieve credentials

client_id: str = os.getenv("DQ_CLIENT_ID")

client_secret: str = os.getenv("DQ_CLIENT_SECRET")

# Download from DataQuery

with JPMaQSDownload(client_id=client_id, client_secret=client_secret) as downloader:

start = timer()

df = downloader.download(

tickers=tickers,

start_date=start_date,

metrics=["value", "eop_lag", "mop_lag", "grading"],

suppress_warning=True,

show_progress=True,

)

end = timer()

dfd = df

print("Download time from DQ: " + str(timedelta(seconds=end - start)))

Maximum number of tickers is 342

Downloading data from JPMaQS.

Timestamp UTC: 2025-03-26 11:07:57

Connection successful!

Requesting data: 100%|█████████████████████████████████████████████████████████████████| 69/69 [00:15<00:00, 4.45it/s]

Downloading data: 100%|████████████████████████████████████████████████████████████████| 69/69 [00:26<00:00, 2.64it/s]

Some expressions are missing from the downloaded data. Check logger output for complete list.

260 out of 1368 expressions are missing. To download the catalogue of all available expressions and filter the unavailable expressions, set `get_catalogue=True` in the call to `JPMaQSDownload.download()`.

Some dates are missing from the downloaded data.

2 out of 6585 dates are missing.

Download time from DQ: 0:00:45.941121

Availability #

cids_exp = cids # cids expected in category panels

msm.missing_in_df(dfd, xcats=main, cids=cids_exp)

No missing XCATs across DataFrame.

Missing cids for BLSCSCORE_NSA: []

Missing cids for BLSCSCORE_NSA_D1Q1QL1: []

Missing cids for BLSCSCORE_NSA_D1Q1QL4: []

Missing cids for BLSCSCORE_NSA_D2Q2QL2: []

Missing cids for BLSDSCORE_NSA: ['CAD']

Missing cids for BLSDSCORE_NSA_D1Q1QL1: ['CAD']

Missing cids for BLSDSCORE_NSA_D1Q1QL4: ['CAD']

Missing cids for BLSDSCORE_NSA_D2Q2QL2: ['CAD']

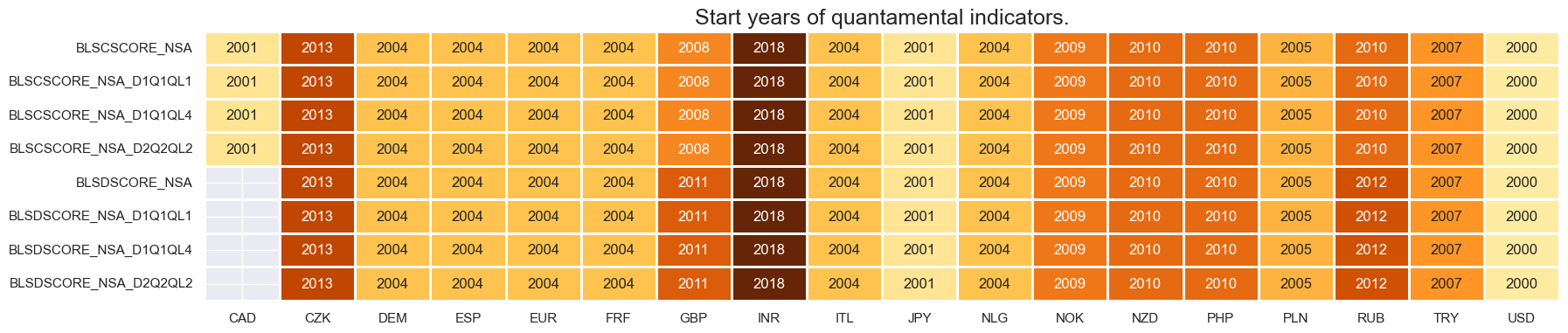

Bank lending surveys have typically less history than business and consumer surveys. Quantamental information states start from 2000/01 for the U.S., Canada, and Japan. Also, some developed markets and most emerging markets to not release such surveys at all. Some available emerging market data only start in the 2010s.

For the explanation of currency symbols, which are related to currency areas or countries for which categories are available, please view Appendix 3 .

xcatx = main

cidx = cids_exp

dfx = msm.reduce_df(dfd, xcats=xcatx, cids=cidx)

dfs = msm.check_startyears(

dfx,

)

msm.visual_paneldates(dfs, size=(20, 4))

print("Last updated:", date.today())

Last updated: 2025-03-26

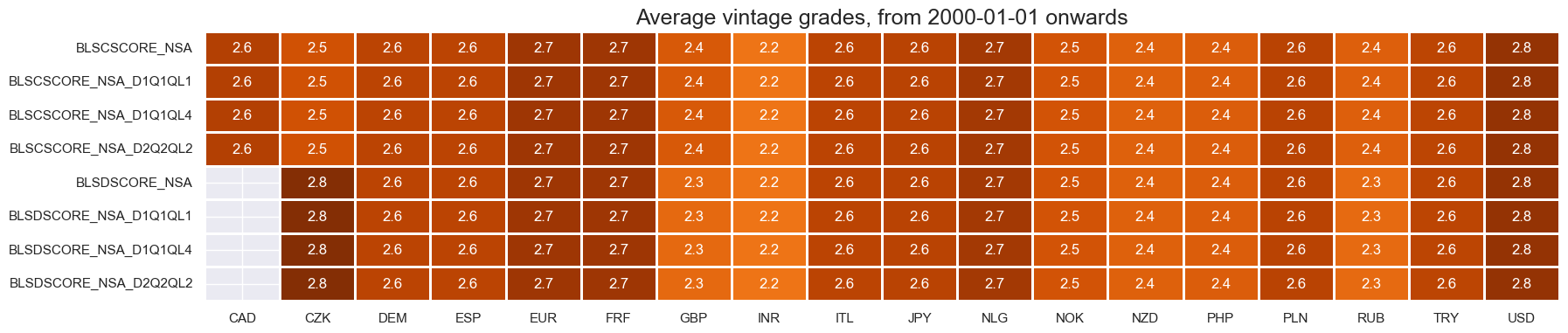

Average grades are on the low side at the moment, as electronic vintage records are not yet easily available. This, in turn, reflects that these surveys are not as carefully watched by markets as broad business surveys.

xcatx = main

cidx = cids

plot = msp.heatmap_grades(

dfd,

xcats=xcatx,

cids=cidx,

start=start_date,

size=(20, 4),

title=f"Average vintage grades, from {start_date} onwards",

)

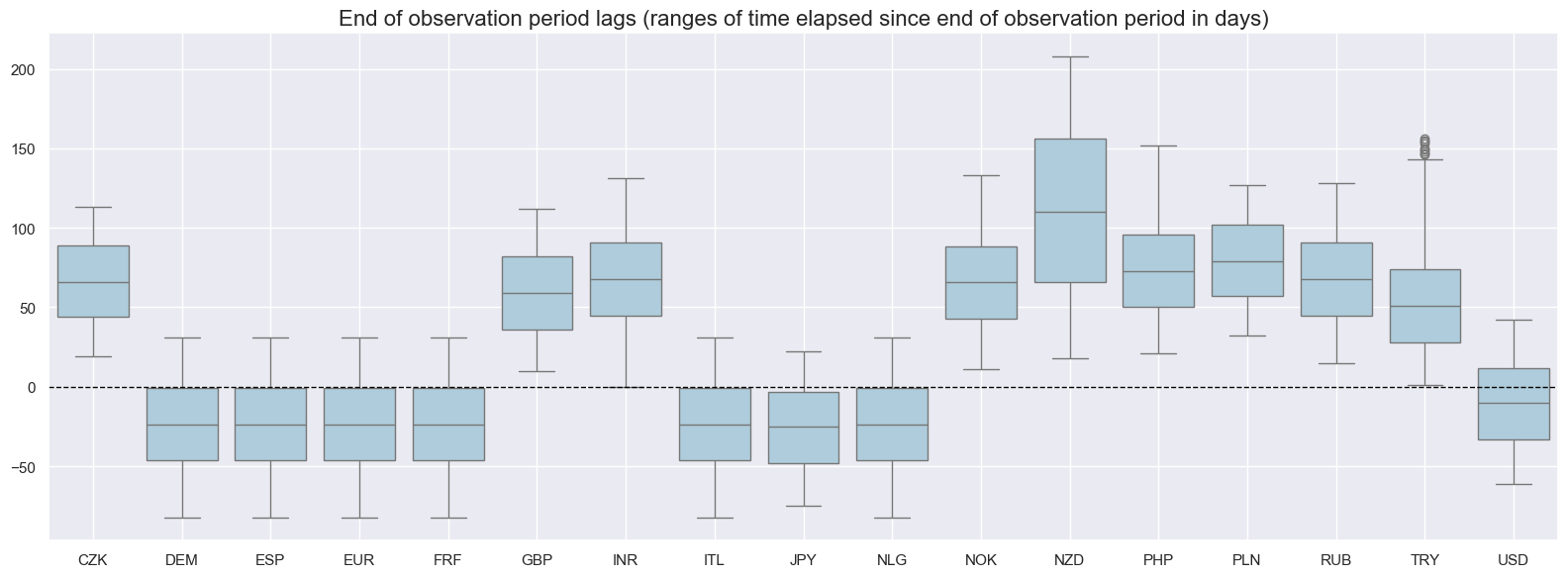

Timeliness of reporting versus the declared observation period is quite different across countries. This may partly reflect different labeling conventions, however.

xcatx = main[0:1]

cidx = cids

msp.view_ranges(

dfd,

xcats=xcatx,

cids=cidx,

val="eop_lag",

title="End of observation period lags (ranges of time elapsed since end of observation period in days)",

start="2000-01-01",

kind="box",

size=(16, 6),

)

History #

Survey scores #

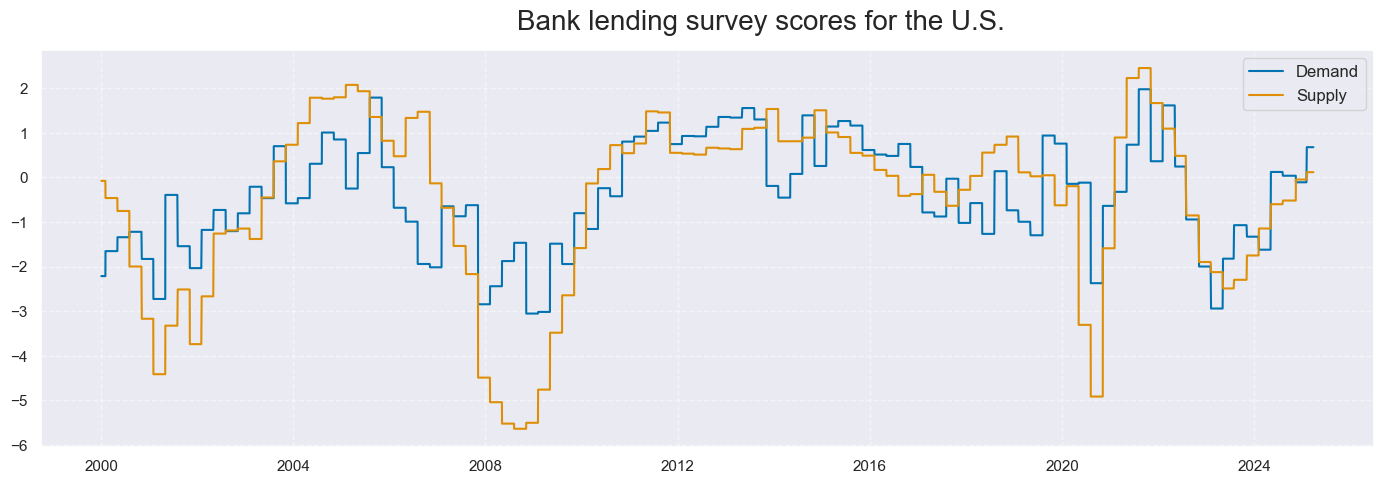

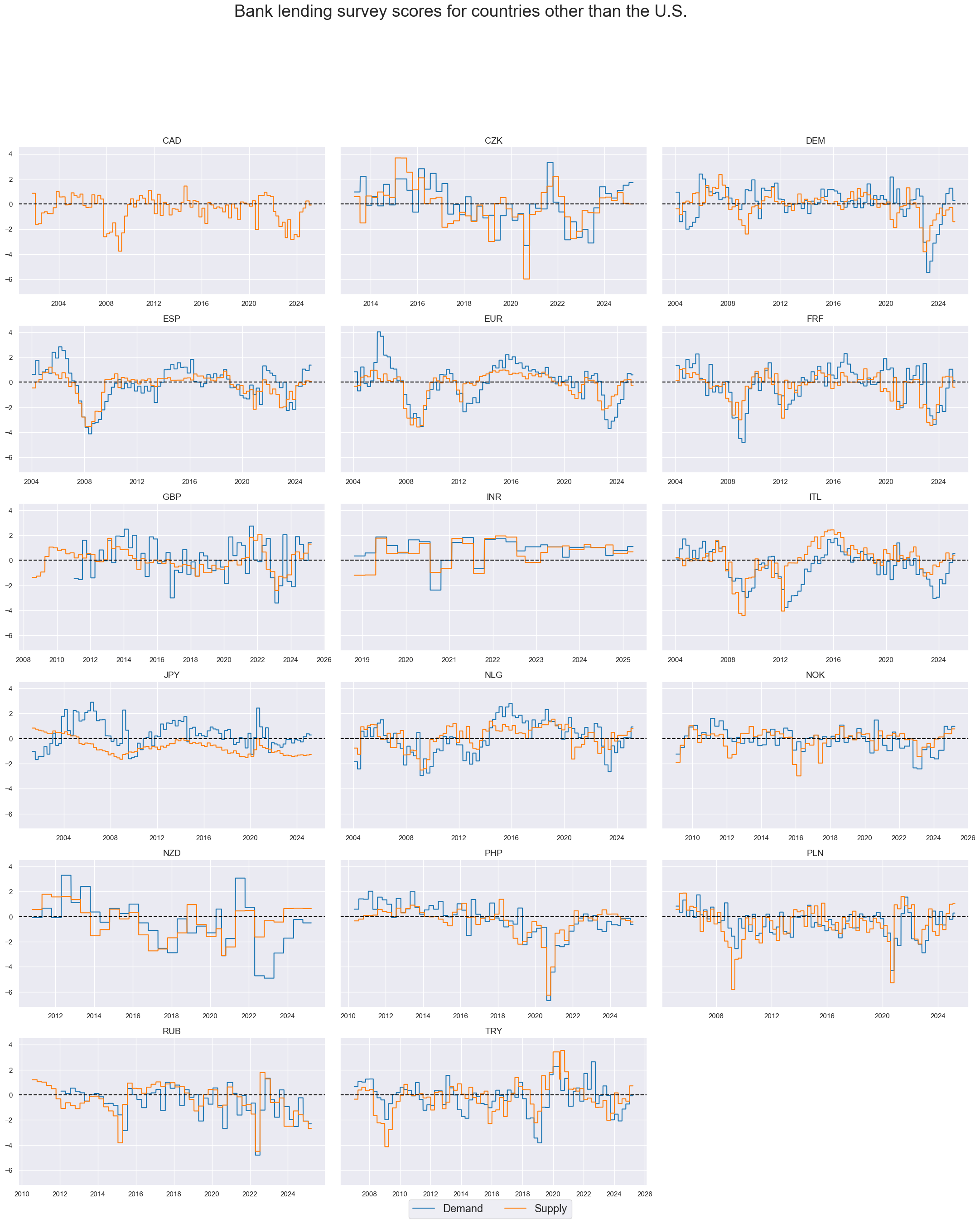

Demand and supply scores have been positively correlated, but also displayed marked differences in level and dynamics. In the United States, supply conditions worsened a lot more than demand conditions during various crises. Credit supply in the euro area looked more stable. In Japan, information states of supply conditions showed tightness for over a decade, whilst demand was recovering. Credit demand in the UK has been conspicuously volatile, reflecting mainly variations in demand for mortgage credit.

xcatx = ["BLSDSCORE_NSA", "BLSCSCORE_NSA"]

msp.view_timelines(

dfd,

xcats=xcatx,

cids=["USD"],

start=start_date,

title="Bank lending survey scores for the U.S.",

xcat_labels=["Demand", "Supply"],

ncol=3,

same_y=True,

title_adj=1.03,

title_xadj=0.54,

title_fontsize=20,

size=(14, 5),

all_xticks=True,

label_adj=0.05,

)

xcatx = ["BLSDSCORE_NSA", "BLSCSCORE_NSA"]

cidx = list(set(cids) - set(["USD"]))

cidx.sort()

msp.view_timelines(

dfd,

xcats=xcatx,

cids=cidx,

start=start_date,

title="Bank lending survey scores for countries other than the U.S.",

xcat_labels=["Demand", "Supply"],

ncol=3,

same_y=True,

title_adj=1.05,

title_xadj=0.47,

title_fontsize=27,

legend_fontsize=17,

size=(12, 7),

aspect=1.7,

all_xticks=True,

label_adj=0.05,

)

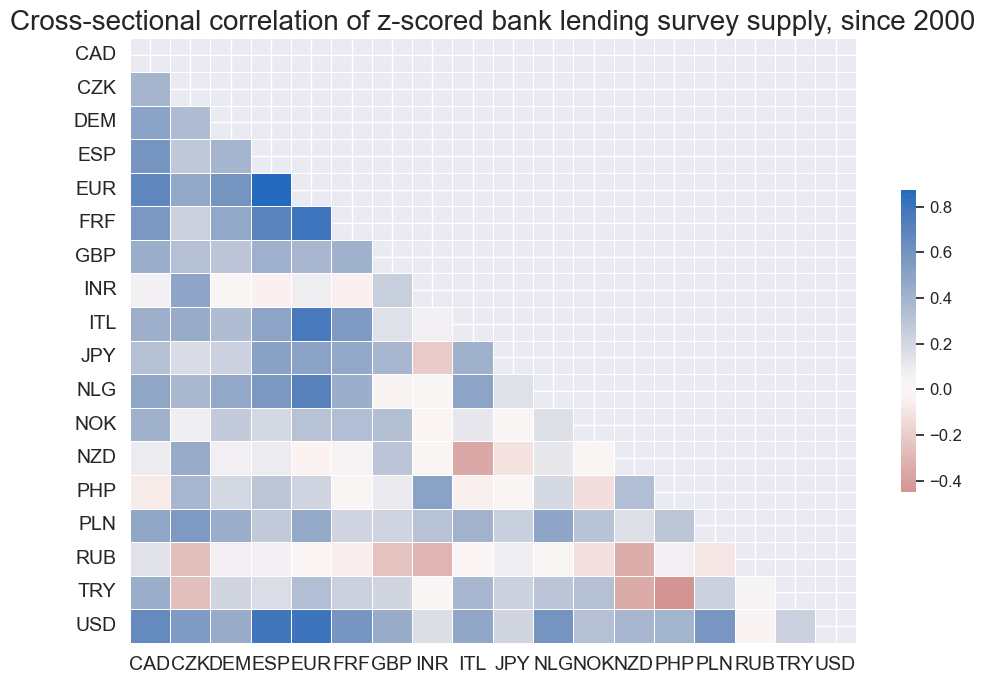

Quantamental indicators of bank supply scores have mostly been positively correlated. All countries, except Russia, have displayed positive correlation with U.S. conditions.

msp.correl_matrix(

dfx,

xcats="BLSCSCORE_NSA",

cids=cidx + ["USD"],

size=(10, 7),

start=start_date,

title="Cross-sectional correlation of z-scored bank lending survey supply, since 2000",

)

Changes in survey scores #

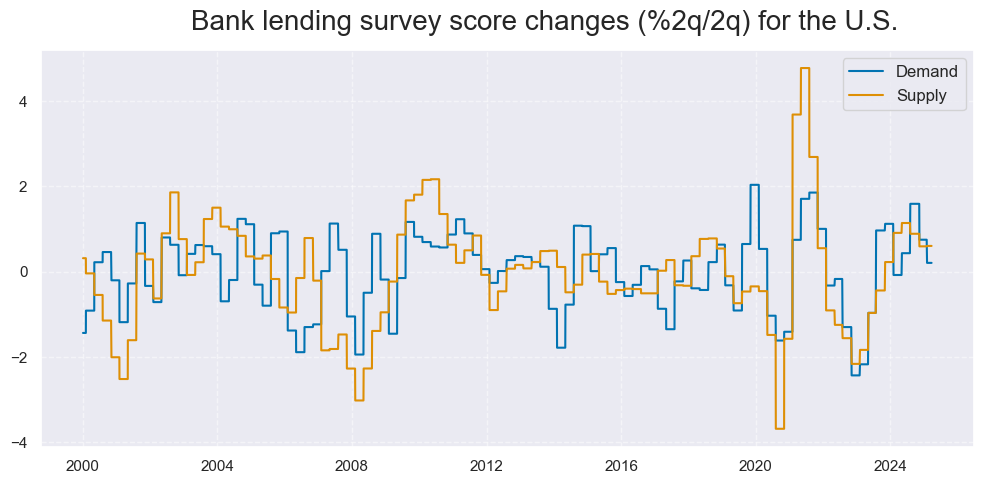

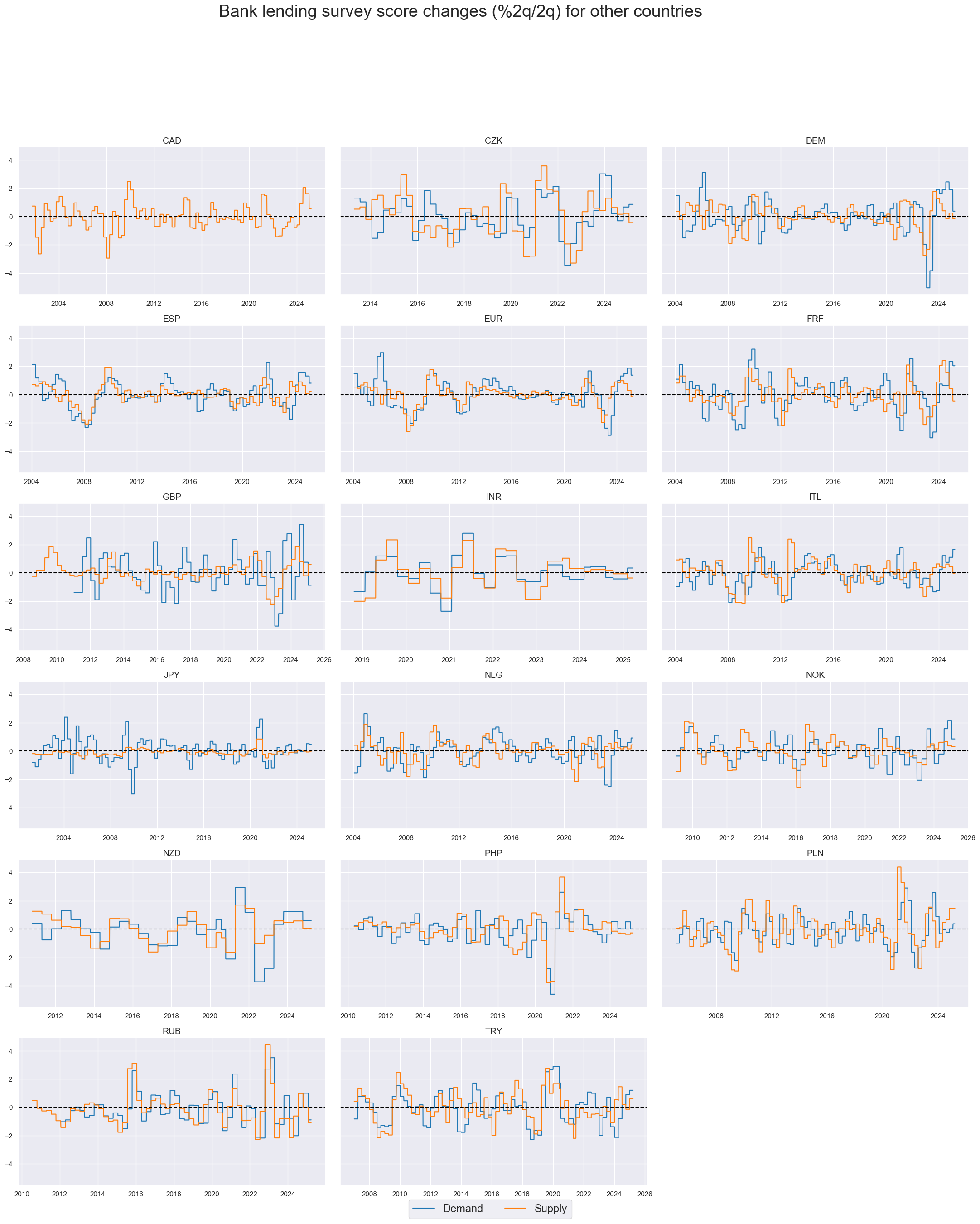

Changes in demand and supply scores have often looked markedly different. For example, in the U.S. supply condition posted a marked deterioration in the run-up of the great financial crisis, long before demand conditions.

xcatx = ["BLSDSCORE_NSA_D2Q2QL2", "BLSCSCORE_NSA_D2Q2QL2"]

msp.view_timelines(

dfd,

xcats=xcatx,

cids=["USD"],

start=start_date,

title="Bank lending survey score changes (%2q/2q) for the U.S.",

xcat_labels=["Demand", "Supply"],

ncol=3,

same_y=True,

title_adj=1.03,

title_xadj=0.54,

title_fontsize=20,

size=(10, 5),

all_xticks=True,

label_adj=0.05,

)

msp.view_timelines(

dfd,

xcats=xcatx,

cids=cidx,

start=start_date,

title="Bank lending survey score changes (%2q/2q) for other countries",

xcat_labels=["Demand", "Supply"],

ncol=3,

same_y=True,

title_adj=1.05,

title_xadj=0.47,

title_fontsize=27,

legend_fontsize=17,

size=(12, 7),

aspect=1.7,

all_xticks=True,

label_adj=0.05,

)

Importance #

Research links #

“Corporate credit markets have historically been especially prone to herding. The main drivers of herding have been past returns, rating changes and liquidity. Sell herding has been particularly strong and flows have been disproportionate after very large price moves. Herding can be persistent and lead to significant price distortions. Non-fundamental price overshooting is a valid basis for profitable contrarian trading strategies.” Macrosynergy

“Global banks drive lending booms in local currency markets. Most importantly, they explain how currency strength fuels rather than curbs financial expansion in small and emerging economies, leading to escalating dynamics. Conversely, dollar strength can trigger a tightening spiral.” Macrosynergy

“[The empirical analysis] shows that monetary tightening has highly heterogeneous effects across spending categories. While consumer discretionary spending contracts strongly, households do not reduce spending on consumer staples.” Grigoli and Sandri

Empirical clues #

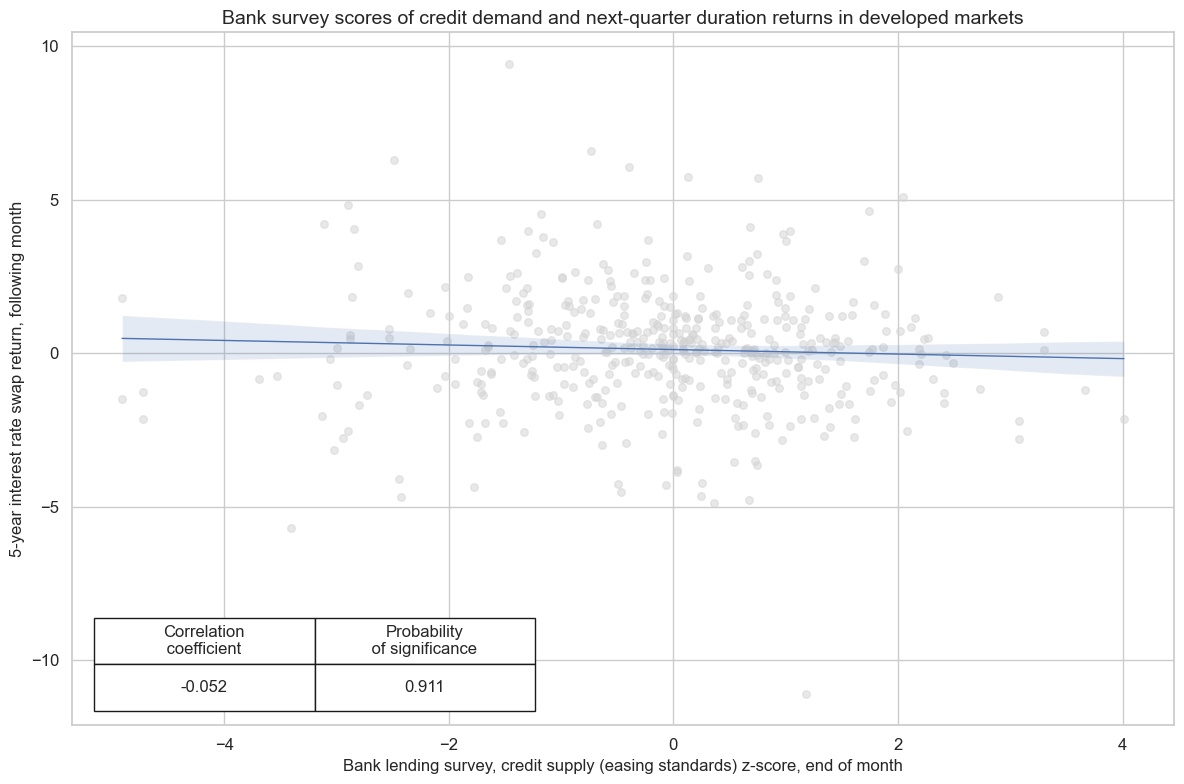

In the developed world, both credit demand and supply conditions have negatively predicted to subsequent duration returns at monthly or quarterly frequencies. Deteriorating credit conditions are plausibly a harbinger of declining yields and they force central banks to ease monetary conditions. The predictive power of the supply scores has been statistically significant for developed countries, even under consideration of the short history of lending surveys and excluding pseudo replication for the panel of countries.

xcatx = ["BLSDSCORE_NSA", "DU05YXR_NSA"]

cidx = cids_dmca

cr = msp.CategoryRelations(

dfd,

xcats=xcatx,

cids=cidx,

freq="Q",

lag=1,

xcat_aggs=["last", "sum"],

start=start_date,

)

cr.reg_scatter(

title="Bank survey scores of credit demand and next-quarter duration returns in developed markets",

labels=False,

coef_box="lower left",

ylab="5-year interest rate swap return, following month",

xlab="Bank lending survey, credit supply (easing standards) z-score, end of month",

prob_est="map",

)

BLSDSCORE_NSA misses: ['CAD'].

DU05YXR_NSA misses: ['DEM', 'ESP', 'FRF', 'ITL', 'NLG'].

xcatx = ["BLSCSCORE_NSA", "DU05YXR_NSA"]

cidx = cids_dmca

cr = msp.CategoryRelations(

dfd,

xcats=xcatx,

cids=cidx,

freq="Q",

lag=1,

xcat_aggs=["last", "sum"],

start=start_date,

)

cr.reg_scatter(

title="Bank survey scores of credit supply and next-quarter duration returns in developed markets",

labels=False,

coef_box="lower left",

ylab="5-year interest rate swap return, following quarter",

xlab="Bank lending survey, credit supply (easing standards) z-score, end of quarter",

prob_est="map",

)

DU05YXR_NSA misses: ['DEM', 'ESP', 'FRF', 'ITL', 'NLG'].

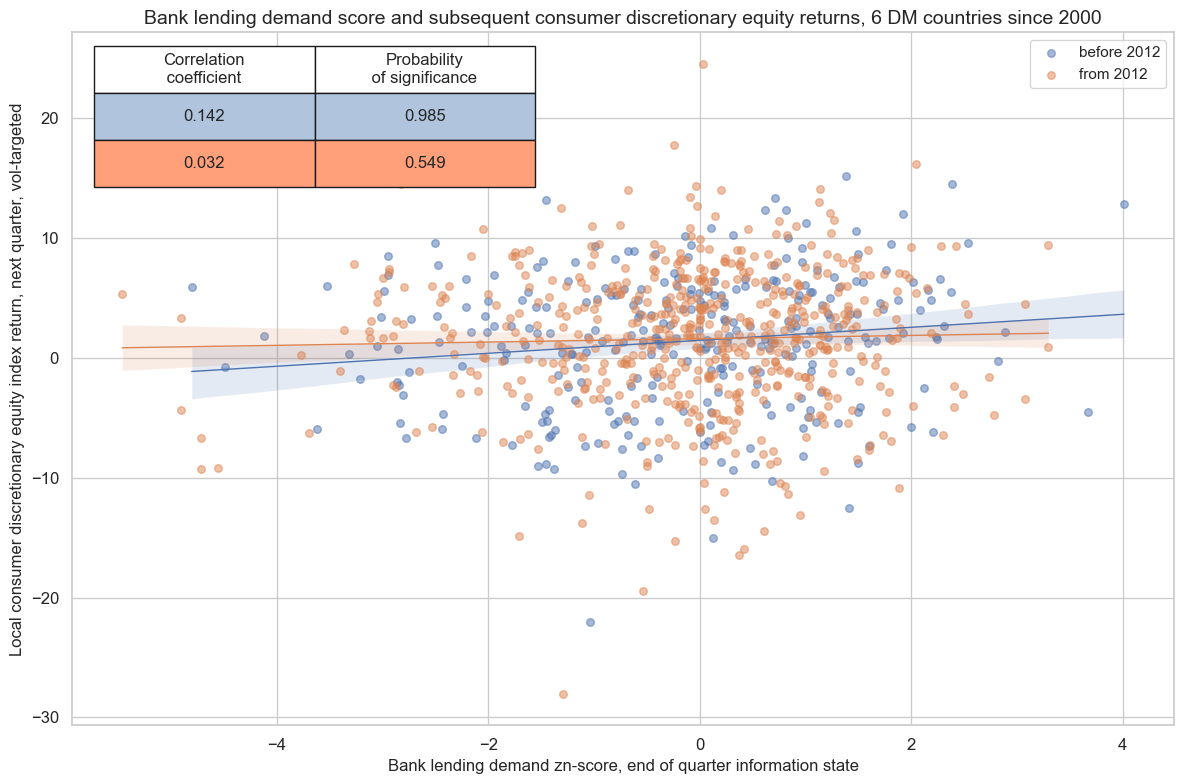

There is a connection between credit conditions durable goods sales, as the latter funds the former. As a result, one can find a strongly positive predictive relationship between bank lending demand scores and subsequent equity returns in the consumer discretionary goods sector for a panel of 6 available developed countries since 2000. This relation has been fairly stable across time.

By contrast, the predictive relations of bank survey scores with the overall equity market have been weaker and not stable across time.

xcatx = ["BLSDSCORE_NSA", "EQCCODR_VT10"]

unavailable = ["CAD", "CZK", "PLN", "RUB", "TRY", "INR", "PHP"]

cidx = list(set(cids) - set(unavailable))

cidx.sort()

cr = msp.CategoryRelations(

dfd,

xcats=xcatx,

cids=cidx,

freq="Q",

lag=1,

xcat_aggs=["last", "sum"],

years=None,

)

cr.reg_scatter(

title="Bank lending demand score and subsequent consumer discretionary equity returns, 6 DM countries since 2000",

labels=False,

separator=2012,

coef_box="upper left",

xlab="Bank lending demand zn-score, end of quarter information state",

ylab="Local consumer discretionary equity index return, next quarter, vol-targeted",

reg_robust=False,

)

Appendices #

Appendix 1: Methodology of scoring #

Indices or diffusion indices of national bank lending surveys are normalized, i.e., transformed into z-scores based concurrent vintages. The purpose of this (effectively sequential) normalization is to replicate the market’s information state on survey readings relative to what is considered as “normal” in terms of mean and standard deviation.

For the estimation of the mean in early vintages we give greater weight to theoretical neutral levels. In particular, we apply a custom z-scoring methodology to each survey’s vintage based on the principle of a sliding scale for the weights of empirical versus theoretical neutral level:

-

We compute a changeable measure of neutral level based on the available vintage length. For up to 5 years of data this is a weighted average of neutral level and realised median. For all surveys in the sample, the theoretical nominal neutral level is zero as survey questions are formulated in terms of change, e.g. tightening or easing of credit standards. As time progresses, the weight of the historical median increases linearly in depence upon the available history from 0% to 100% and the weight of the notional neutral level decreases accordingly. From a 5-year history onward only the sample median is used as the measure of the neutral level.

-

To standardize variation, we compute the median absolute deviation to normalize deviations of confidence levels from their presumed neutral level. We require at least 4 observations, for the quarterly data, to estimate it.

We finally calculate the z-score for the vintage values as

where \(X_{i, t}\) is the value of the indicator for country \(i\) at time \(t\) , \(\bar{X_i|t}\) is the measure of the neutral level for country \(i\) at time \(t\) based on information up to that date, and \(\sigma_i|t\) is the median absolute deviation for country \(i\) at time \(t\) based on information up to that date.

Appendix 2: Survey details #

surveys = pd.DataFrame(

[

{

"country": "Canada",

"source": "Bank of Canada",

"details": "Canada Senior Loan Officer Survey Lending Conditions Overall",

},

{

"country": "Czech Republic",

"source": "Czech National Bank",

"details": "Changes in Demand for Loans or Credit Lines to Non-Financial Corporations, Overall",

},

{

"country": "Czech Republic",

"source": "Czech National Bank",

"details": "Changes in Overall Demand for Loans to Households Apart from Normal Seasonal Fluctuations, Loans for House Purchase",

},

{

"country": "Czech Republic",

"source": "Czech National Bank",

"details": "Changes in Overall Demand for Loans to Households Apart from Normal Seasonal Fluctuations, Consumer Credit & Other Lending",

},

{

"country": "Czech Republic",

"source": "Czech National Bank",

"details": "Changes in Credit Standards as Applied to the Approval of Loans or Credit Lines to Non-Financial Corporations, Overall",

},

{

"country": "Czech Republic",

"source": "Czech National Bank",

"details": "Changes in Your Bank's Credit Standards as Applied to the Approval of Loans or Credit Lines to Households, Loans for House Purchase",

},

{

"country": "Czech Republic",

"source": "Czech National Bank",

"details": "Changes in Your Bank's Credit Standards as Applied to the Approval of Loans or Credit Lines to Households, Consumer Credit & Other Lending",

},

{

"country": "Euro Area",

"source": "ECB",

"details": "Euro Area Bank Lending Survey Enterprise Loan Demand",

},

{

"country": "Euro Area",

"source": "ECB",

"details": "Euro Area Bank Lending Survey Consumer Credit Loan Demand",

},

{

"country": "Euro Area",

"source": "ECB",

"details": "Euro Area Bank Lending Survey Loans for House Purchases Loan Demand",

},

{

"country": "Euro Area",

"source": "ECB",

"details": "Euro Area Bank Lending Survey Enterprise Credit Standards Loan Supply",

},

{

"country": "Euro Area",

"source": "ECB",

"details": "Euro Area Bank Lending Survey Household Consumer Credit Credit Standards Loan Supply",

},

{

"country": "Euro Area",

"source": "ECB",

"details": "Euro Area Bank Lending Survey Household Loans for House Purchases Credit Standards Loan Supply",

},

{

"country": "India",

"source": "Reserve Bank of India",

"details": "India Bank Lending Survey Loan Demand All Sectors",

},

{

"country": "India",

"source": "Reserve Bank of India",

"details": "India Bank Lending Survey Loan Terms & Cnoditions All Sectors",

},

{

"country": "Japan",

"source": "Bank of Japan",

"details": "Japan Senior Loan Officer Opinion Survey Demand for Loans Firms",

},

{

"country": "Japan",

"source": "Bank of Japan",

"details": "Japan Senior Loan Officer Opinion Survey Demand for Loans Households Secured and Unsecured",

},

{

"country": "Japan",

"source": "Bank of Japan",

"details": "Japan Senior Loan Officer Opinion Survey Credit Standards Large Firms",

},

{

"country": "Japan",

"source": "Bank of Japan",

"details": "Japan Senior Loan Officer Opinion Survey Credit Standards Medium-Sized Firms",

},

{

"country": "Japan",

"source": "Bank of Japan",

"details": "Japan Senior Loan Officer Opinion Survey Credit Standards Small Firms",

},

{

"country": "Japan",

"source": "Bank of Japan",

"details": "Japan Senior Loan Officer Opinion Survey Credit Standards Households Secured and Unsecured",

},

{

"country": "New Zealand",

"source": "Reserve Bank of New Zealand",

"details": "Loan Demand, Corporate/Institutional Loans",

},

{

"country": "New Zealand",

"source": "Reserve Bank of New Zealand",

"details": "Loan Demand, SME Business Loans",

},

{

"country": "New Zealand",

"source": "Reserve Bank of New Zealand",

"details": "Loan Demand, Commercial Property Loans",

},

{

"country": "New Zealand",

"source": "Reserve Bank of New Zealand",

"details": "Loan Demand, Consumer Loans",

},

{

"country": "New Zealand",

"source": "Reserve Bank of New Zealand",

"details": "Loan Demand, Residential Mortgage Loans",

},

{

"country": "New Zealand",

"source": "Reserve Bank of New Zealand",

"details": "Credit Availability, Residential Mortgage Loans",

},

{

"country": "New Zealand",

"source": "Reserve Bank of New Zealand",

"details": "Credit Availability, Consumer Loans",

},

{

"country": "New Zealand",

"source": "Reserve Bank of New Zealand",

"details": "Credit Availability, Commercial Property Loans",

},

{

"country": "New Zealand",

"source": "Reserve Bank of New Zealand",

"details": "Credit Availability, SME Businesses Loans",

},

{

"country": "New Zealand",

"source": "Reserve Bank of New Zealand",

"details": "Credit Availability, Corporate/Institutional Loans",

},

{

"country": "Norway",

"source": "Norges Bank",

"details": "Lending to Households, Residential Mortgage Demand, Aggregate Demand",

},

{

"country": "Norway",

"source": "Norges Bank",

"details": "Lending to Non-Financial Corporations, Credit Demand, Total",

},

{

"country": "Norway",

"source": "Norges Bank",

"details": "Lending to Households, Credit Standard, Total",

},

{

"country": "Norway",

"source": "Norges Bank",

"details": "Lending to Non-Financial Corporations, Credit Standard, Total",

},

{

"country": "Philippines",

"source": "Central Bank of the Philippines",

"details": "Philippines Senior Loan Officer Opinion Survey Enterprises Overall Demand for Loans",

},

{

"country": "Philippines",

"source": "Central Bank of the Philippines",

"details": "Philippines Senior Loan Officer Opinion Survey Loans for Households Overall Demand for Loans",

},

{

"country": "Philippines",

"source": "Central Bank of the Philippines",

"details": "Philippines Senior Loan Officer Opinion Survey Enterprises Banks Credit Standards for Loans",

},

{

"country": "Philippines",

"source": "Central Bank of the Philippines",

"details": "Philippines Senior Loan Officer Opinion Survey Loans to Households Banks Credit Standards for Loans",

},

{

"country": "Poland",

"source": "National Bank of Poland",

"details": "Corporate Sector, Demand for Loans, Large Enterprises Long Term Loans",

},

{

"country": "Poland",

"source": "National Bank of Poland",

"details": "Corporate Sector, Demand for Loans, Large Enterprises Short Term Loans",

},

{

"country": "Poland",

"source": "National Bank of Poland",

"details": "Demand for Loans, Small- & Medium-Sized Enterprises Short Term Loans",

},

{

"country": "Poland",

"source": "National Bank of Poland",

"details": "Demand for Loans, Small- & Medium-Sized Enterprises Long Term Loans",

},

{

"country": "Poland",

"source": "National Bank of Poland",

"details": "Household Sector, Demand for Loans, Housing Loans",

},

{

"country": "Poland",

"source": "National Bank of Poland",

"details": "Household Sector, Demand for Loans, Other Consumer Loans",

},

{

"country": "Poland",

"source": "National Bank of Poland",

"details": "Corporate Sector, Credit Standards, Large Enterprises Short Term Loans",

},

{

"country": "Poland",

"source": "National Bank of Poland",

"details": "Corporate Sector, Credit Standards, Large Enterprises Long Term Loans",

},

{

"country": "Poland",

"source": "National Bank of Poland",

"details": "Corporate Sector, Credit Standards, Small- & Medium-Sized Enterprises Short Term Loans",

},

{

"country": "Poland",

"source": "National Bank of Poland",

"details": "Corporate Sector, Credit Standards, Small- & Medium-Sized Enterprises Long Term Loans",

},

{

"country": "Poland",

"source": "National Bank of Poland",

"details": "Household Sector, Credit Standards, Housing Loans",

},

{

"country": "Poland",

"source": "National Bank of Poland",

"details": "Household Sector, Credit Standards, Other Consumer Loans",

},

{

"country": "Russia",

"source": "The Central Bank of the Russian Federation",

"details": "Households, Lending in General, Demand for New Loans",

},

{

"country": "Russia",

"source": "The Central Bank of the Russian Federation",

"details": "Large Companies, Demand for New Loans",

},

{

"country": "Russia",

"source": "The Central Bank of the Russian Federation",

"details": "Small & Medium Enterprises, Demand for New Loans",

},

{

"country": "Russia",

"source": "The Central Bank of the Russian Federation",

"details": "Households, Lending in General, General Lending Conditions",

},

{

"country": "Russia",

"source": "The Central Bank of the Russian Federation",

"details": "Large Companies, General Lending Conditions",

},

{

"country": "Russia",

"source": "The Central Bank of the Russian Federation",

"details": "Small & Medium Enterprises, General Lending Conditions",

},

{

"country": "Turkey",

"source": "Central Bank of Turkey",

"details": "Turkey Bank Loans Tendency Survey All Enterprises Demand for Loans",

},

{

"country": "Turkey",

"source": "Central Bank of Turkey",

"details": "Turkey Bank Loans Tendency Survey Consumer Loans Demand for Loans",

},

{

"country": "Turkey",

"source": "Central Bank of Turkey",

"details": "Turkey Bank Loans Tendency Survey Consumer Loans Housing Demand for Loans",

},

{

"country": "Turkey",

"source": "Central Bank of Turkey",

"details": "Turkey Bank Loans Tendency Survey All Enterprises Credit Standards",

},

{

"country": "Turkey",

"source": "Central Bank of Turkey",

"details": "Turkey Bank Loans Tendency Survey Consumer Loans Credit Standards",

},

{

"country": "Turkey",

"source": "Central Bank of Turkey",

"details": "Turkey Bank Loans Tendency Survey Consumer Loans Housing Loans Credit Standards",

},

{

"country": "United Kingdom",

"source": "Bank of England",

"details": "United Kingdom Credit Conditions Survey Overall Demand for Lending from Small Businesses",

},

{

"country": "United Kingdom",

"source": "Bank of England",

"details": "United Kingdom Credit Conditions Survey Overall Demand for Lending from Medium PNFCs",

},

{

"country": "United Kingdom",

"source": "Bank of England",

"details": "United Kingdom Credit Conditions Survey Overall Demand for Lending from Large PNFCs",

},

{

"country": "United Kingdom",

"source": "Bank of England",

"details": "United Kingdom Credit Conditions Survey Unsecured Lending Demand for Total Unsecured Lending from Households",

},

{

"country": "United Kingdom",

"source": "Bank of England",

"details": "United Kingdom Credit Conditions Survey Secured Lending Households Demand of Secured Lending for House Purchases",

},

{

"country": "United Kingdom",

"source": "Bank of England",

"details": "United Kingdom Credit Conditions Survey Availability of Credit provided to the Corporate Sector",

},

{

"country": "United Kingdom",

"source": "Bank of England",

"details": "United Kingdom Credit Conditions Survey Unsecured Lending Availability of Unsecured Credit for Households",

},

{

"country": "United Kingdom",

"source": "Bank of England",

"details": "United Kingdom Credit Conditions Survey Secured Lending Availability of Secured Credit for Households",

},

{

"country": "United States",

"source": "Federal Reserve",

"details": "United States Senior Loan Officer Opinion Survey on Bank Lending Practices reporting Stronger Demand across Loan Categories",

},

{

"country": "United States",

"source": "Federal Reserve",

"details": "United States Senior Loan Officer Opinion Survey on Bank Lending Practices reporting Tightening Credit Standards across Loan Categories",

},

]

)

from IPython.display import HTML

HTML(surveys.to_html(index=False))

| country | source | details |

|---|---|---|

| Canada | Bank of Canada | Canada Senior Loan Officer Survey Lending Conditions Overall |

| Czech Republic | Czech National Bank | Changes in Demand for Loans or Credit Lines to Non-Financial Corporations, Overall |

| Czech Republic | Czech National Bank | Changes in Overall Demand for Loans to Households Apart from Normal Seasonal Fluctuations, Loans for House Purchase |

| Czech Republic | Czech National Bank | Changes in Overall Demand for Loans to Households Apart from Normal Seasonal Fluctuations, Consumer Credit & Other Lending |

| Czech Republic | Czech National Bank | Changes in Credit Standards as Applied to the Approval of Loans or Credit Lines to Non-Financial Corporations, Overall |

| Czech Republic | Czech National Bank | Changes in Your Bank's Credit Standards as Applied to the Approval of Loans or Credit Lines to Households, Loans for House Purchase |

| Czech Republic | Czech National Bank | Changes in Your Bank's Credit Standards as Applied to the Approval of Loans or Credit Lines to Households, Consumer Credit & Other Lending |

| Euro Area | ECB | Euro Area Bank Lending Survey Enterprise Loan Demand |

| Euro Area | ECB | Euro Area Bank Lending Survey Consumer Credit Loan Demand |

| Euro Area | ECB | Euro Area Bank Lending Survey Loans for House Purchases Loan Demand |

| Euro Area | ECB | Euro Area Bank Lending Survey Enterprise Credit Standards Loan Supply |

| Euro Area | ECB | Euro Area Bank Lending Survey Household Consumer Credit Credit Standards Loan Supply |

| Euro Area | ECB | Euro Area Bank Lending Survey Household Loans for House Purchases Credit Standards Loan Supply |

| India | Reserve Bank of India | India Bank Lending Survey Loan Demand All Sectors |

| India | Reserve Bank of India | India Bank Lending Survey Loan Terms & Cnoditions All Sectors |

| Japan | Bank of Japan | Japan Senior Loan Officer Opinion Survey Demand for Loans Firms |

| Japan | Bank of Japan | Japan Senior Loan Officer Opinion Survey Demand for Loans Households Secured and Unsecured |

| Japan | Bank of Japan | Japan Senior Loan Officer Opinion Survey Credit Standards Large Firms |

| Japan | Bank of Japan | Japan Senior Loan Officer Opinion Survey Credit Standards Medium-Sized Firms |

| Japan | Bank of Japan | Japan Senior Loan Officer Opinion Survey Credit Standards Small Firms |

| Japan | Bank of Japan | Japan Senior Loan Officer Opinion Survey Credit Standards Households Secured and Unsecured |

| New Zealand | Reserve Bank of New Zealand | Loan Demand, Corporate/Institutional Loans |

| New Zealand | Reserve Bank of New Zealand | Loan Demand, SME Business Loans |

| New Zealand | Reserve Bank of New Zealand | Loan Demand, Commercial Property Loans |

| New Zealand | Reserve Bank of New Zealand | Loan Demand, Consumer Loans |

| New Zealand | Reserve Bank of New Zealand | Loan Demand, Residential Mortgage Loans |

| New Zealand | Reserve Bank of New Zealand | Credit Availability, Residential Mortgage Loans |

| New Zealand | Reserve Bank of New Zealand | Credit Availability, Consumer Loans |

| New Zealand | Reserve Bank of New Zealand | Credit Availability, Commercial Property Loans |

| New Zealand | Reserve Bank of New Zealand | Credit Availability, SME Businesses Loans |

| New Zealand | Reserve Bank of New Zealand | Credit Availability, Corporate/Institutional Loans |

| Norway | Norges Bank | Lending to Households, Residential Mortgage Demand, Aggregate Demand |

| Norway | Norges Bank | Lending to Non-Financial Corporations, Credit Demand, Total |

| Norway | Norges Bank | Lending to Households, Credit Standard, Total |

| Norway | Norges Bank | Lending to Non-Financial Corporations, Credit Standard, Total |

| Philippines | Central Bank of the Philippines | Philippines Senior Loan Officer Opinion Survey Enterprises Overall Demand for Loans |

| Philippines | Central Bank of the Philippines | Philippines Senior Loan Officer Opinion Survey Loans for Households Overall Demand for Loans |

| Philippines | Central Bank of the Philippines | Philippines Senior Loan Officer Opinion Survey Enterprises Banks Credit Standards for Loans |

| Philippines | Central Bank of the Philippines | Philippines Senior Loan Officer Opinion Survey Loans to Households Banks Credit Standards for Loans |

| Poland | National Bank of Poland | Corporate Sector, Demand for Loans, Large Enterprises Long Term Loans |

| Poland | National Bank of Poland | Corporate Sector, Demand for Loans, Large Enterprises Short Term Loans |

| Poland | National Bank of Poland | Demand for Loans, Small- & Medium-Sized Enterprises Short Term Loans |

| Poland | National Bank of Poland | Demand for Loans, Small- & Medium-Sized Enterprises Long Term Loans |

| Poland | National Bank of Poland | Household Sector, Demand for Loans, Housing Loans |

| Poland | National Bank of Poland | Household Sector, Demand for Loans, Other Consumer Loans |

| Poland | National Bank of Poland | Corporate Sector, Credit Standards, Large Enterprises Short Term Loans |

| Poland | National Bank of Poland | Corporate Sector, Credit Standards, Large Enterprises Long Term Loans |

| Poland | National Bank of Poland | Corporate Sector, Credit Standards, Small- & Medium-Sized Enterprises Short Term Loans |

| Poland | National Bank of Poland | Corporate Sector, Credit Standards, Small- & Medium-Sized Enterprises Long Term Loans |

| Poland | National Bank of Poland | Household Sector, Credit Standards, Housing Loans |

| Poland | National Bank of Poland | Household Sector, Credit Standards, Other Consumer Loans |

| Russia | The Central Bank of the Russian Federation | Households, Lending in General, Demand for New Loans |

| Russia | The Central Bank of the Russian Federation | Large Companies, Demand for New Loans |

| Russia | The Central Bank of the Russian Federation | Small & Medium Enterprises, Demand for New Loans |

| Russia | The Central Bank of the Russian Federation | Households, Lending in General, General Lending Conditions |

| Russia | The Central Bank of the Russian Federation | Large Companies, General Lending Conditions |

| Russia | The Central Bank of the Russian Federation | Small & Medium Enterprises, General Lending Conditions |

| Turkey | Central Bank of Turkey | Turkey Bank Loans Tendency Survey All Enterprises Demand for Loans |

| Turkey | Central Bank of Turkey | Turkey Bank Loans Tendency Survey Consumer Loans Demand for Loans |

| Turkey | Central Bank of Turkey | Turkey Bank Loans Tendency Survey Consumer Loans Housing Demand for Loans |

| Turkey | Central Bank of Turkey | Turkey Bank Loans Tendency Survey All Enterprises Credit Standards |

| Turkey | Central Bank of Turkey | Turkey Bank Loans Tendency Survey Consumer Loans Credit Standards |

| Turkey | Central Bank of Turkey | Turkey Bank Loans Tendency Survey Consumer Loans Housing Loans Credit Standards |

| United Kingdom | Bank of England | United Kingdom Credit Conditions Survey Overall Demand for Lending from Small Businesses |

| United Kingdom | Bank of England | United Kingdom Credit Conditions Survey Overall Demand for Lending from Medium PNFCs |

| United Kingdom | Bank of England | United Kingdom Credit Conditions Survey Overall Demand for Lending from Large PNFCs |

| United Kingdom | Bank of England | United Kingdom Credit Conditions Survey Unsecured Lending Demand for Total Unsecured Lending from Households |

| United Kingdom | Bank of England | United Kingdom Credit Conditions Survey Secured Lending Households Demand of Secured Lending for House Purchases |

| United Kingdom | Bank of England | United Kingdom Credit Conditions Survey Availability of Credit provided to the Corporate Sector |

| United Kingdom | Bank of England | United Kingdom Credit Conditions Survey Unsecured Lending Availability of Unsecured Credit for Households |

| United Kingdom | Bank of England | United Kingdom Credit Conditions Survey Secured Lending Availability of Secured Credit for Households |

| United States | Federal Reserve | United States Senior Loan Officer Opinion Survey on Bank Lending Practices reporting Stronger Demand across Loan Categories |

| United States | Federal Reserve | United States Senior Loan Officer Opinion Survey on Bank Lending Practices reporting Tightening Credit Standards across Loan Categories |

Appendix 3: Currency symbols #

The word ‘cross-section’ refers to currencies, currency areas or economic areas. In alphabetical order, these are AUD (Australian dollar), BRL (Brazilian real), CAD (Canadian dollar), CHF (Swiss franc), CLP (Chilean peso), CNY (Chinese yuan renminbi), COP (Colombian peso), CZK (Czech Republic koruna), DEM (German mark), ESP (Spanish peseta), EUR (Euro), FRF (French franc), GBP (British pound), HKD (Hong Kong dollar), HUF (Hungarian forint), IDR (Indonesian rupiah), ITL (Italian lira), JPY (Japanese yen), KRW (Korean won), MXN (Mexican peso), MYR (Malaysian ringgit), NLG (Dutch guilder), NOK (Norwegian krone), NZD (New Zealand dollar), PEN (Peruvian sol), PHP (Phillipine peso), PLN (Polish zloty), RON (Romanian leu), RUB (Russian ruble), SEK (Swedish krona), SGD (Singaporean dollar), THB (Thai baht), TRY (Turkish lira), TWD (Taiwanese dollar), USD (U.S. dollar), ZAR (South African rand).