Equity trading strategies with macro and random forests #

The random forest is a machine learning model composed of many different “decision tree” models. Decision trees are sequences of “if-else” statements, where “learning” in the regression case corresponds to learning good decision rules from data. The random forest constructs each of these trees to, hopefully, be both reasonable forecasters and be as uncorrelated with one another as possible. The average prediction made by the trees is the prediction made by the random forest.

Get packages and JPMaQS data #

Packages #

import os

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

from macrosynergy.download import JPMaQSDownload

import macrosynergy.management as msm

import macrosynergy.panel as msp

import macrosynergy.pnl as msn

import macrosynergy.signal as mss

import macrosynergy.learning as msl

import macrosynergy.visuals as msv

from sklearn.linear_model import LinearRegression

from sklearn.ensemble import RandomForestRegressor

from sklearn.pipeline import Pipeline

from sklearn.metrics import make_scorer

from timeit import default_timer as timer

from datetime import timedelta, date, datetime

import warnings

from IPython.display import HTML

warnings.filterwarnings("ignore")

Previously prepared quantamental categories #

# Import data from csv file created preparation notebook

# https://macrosynergy.com/academy/notebooks/sectoral-equity-indicators/

INPUT_PATH = os.path.join(os.getcwd(), r"../../../equity_sectoral_notebook_data.csv")

df_csv = pd.read_csv(INPUT_PATH, index_col=0)

df_csv["real_date"] = pd.to_datetime(df_csv["real_date"]).dt.date

df_csv = msm.utils.standardise_dataframe(df_csv)

df_csv = df_csv.sort_values(["cid", "xcat", "real_date"])

# Equity sector labels and cross sections

sector_labels = {

"ALL": "All sectors",

"COD": "Cons. discretionary",

"COS": "Cons. staples",

"CSR": "Communication services",

"ENR": "Energy",

"FIN": "Financials",

"HLC": "Healthcare",

"IND": "Industrials",

"ITE": "Information tech",

"MAT": "Materials",

"REL": "Real estate",

"UTL": "Utilities",

}

cids_secs = list(sector_labels.keys())

# Equity countries cross sections

cids_eq = [

"AUD",

"CAD",

"CHF",

"EUR",

"GBP",

"ILS",

"JPY",

"NOK",

"NZD",

"SEK",

"SGD",

"USD",

]

# Base category tickes of quantamental categories created by data preparation notebook:

# https://macrosynergy.com/academy/notebooks/sectoral-equity-indicators/

output_growth = [

# industrial prod

"XIP_SA_P1M1ML12_3MMA",

"XIP_SA_P1M1ML12_3MMA_WG",

# construction

"XCSTR_SA_P1M1ML12_3MMA",

"XCSTR_SA_P1M1ML12_3MMA_WG",

# Excess GDP growth

"XRGDPTECH_SA_P1M1ML12_3MMA",

"XRGDPTECH_SA_P1M1ML12_3MMA_WG",

]

private_consumption = [

# Consumer surveys

"CCSCORE_SA",

"CCSCORE_SA_D3M3ML3",

"CCSCORE_SA_WG",

"CCSCORE_SA_D3M3ML3_WG",

"XNRSALES_SA_P1M1ML12_3MMA",

"XRRSALES_SA_P1M1ML12_3MMA",

"XNRSALES_SA_P1M1ML12_3MMA_WG",

"XRRSALES_SA_P1M1ML12_3MMA_WG",

"XRPCONS_SA_P1M1ML12_3MMA",

"XRPCONS_SA_P1M1ML12_3MMA_WG",

]

export = [

"XEXPORTS_SA_P1M1ML12_3MMA",

]

labour_market = [

"UNEMPLRATE_NSA_3MMA_D1M1ML12",

"UNEMPLRATE_SA_3MMAv5YMA",

"UNEMPLRATE_NSA_3MMA_D1M1ML12_WG",

"UNEMPLRATE_SA_3MMAv5YMA_WG",

"XEMPL_NSA_P1M1ML12_3MMA",

"XEMPL_NSA_P1M1ML12_3MMA_WG",

"XRWAGES_NSA_P1M1ML12",

]

business_surveys = [

# Manufacturing

"MBCSCORE_SA",

"MBCSCORE_SA_D3M3ML3",

"MBCSCORE_SA_WG",

"MBCSCORE_SA_D3M3ML3_WG",

# Services

"SBCSCORE_SA",

"SBCSCORE_SA_D3M3ML3",

"SBCSCORE_SA_WG",

"SBCSCORE_SA_D3M3ML3_WG",

# Construction

"CBCSCORE_SA",

"CBCSCORE_SA_D3M3ML3",

"CBCSCORE_SA_WG",

"CBCSCORE_SA_D3M3ML3_WG",

]

private_credit = [

"XPCREDITBN_SJA_P1M1ML12",

"XPCREDITBN_SJA_P1M1ML12_WG",

# liquidity conditions

"INTLIQGDP_NSA_D1M1ML1",

"INTLIQGDP_NSA_D1M1ML6",

]

broad_inflation = [

# Inflation

"XCPIC_SA_P1M1ML12",

"XCPIH_SA_P1M1ML12",

"XPPIH_NSA_P1M1ML12",

]

specific_inflation = [

"XCPIE_SA_P1M1ML12",

"XCPIF_SA_P1M1ML12",

"XCPIE_SA_P1M1ML12_WG",

"XCPIF_SA_P1M1ML12_WG",

]

private_and_public_debt = [

"HHINTNETGDP_SA_D1M1ML12",

"HHINTNETGDP_SA_D1M1ML12_WG",

"CORPINTNETGDP_SA_D1Q1QL4",

"CORPINTNETGDP_SA_D1Q1QL4_WG",

"XGGDGDPRATIOX10_NSA",

]

commodity_inventories = [

"BMLXINVCSCORE_SA",

"REFIXINVCSCORE_SA",

"BASEXINVCSCORE_SA",

]

commodity_markets = [

"BMLCOCRY_SAVT10_21DMA",

"COXR_VT10vWTI_21DMA"

]

real_appreciation_tot = [

"CXPI_NSA_P1M12ML1",

"CMPI_NSA_P1M12ML1",

"CTOT_NSA_P1M12ML1",

"REEROADJ_NSA_P1M12ML1",

]

interest_rates = [

"RIR_NSA",

"RYLDIRS02Y_NSA",

"RYLDIRS05Y_NSA",

"RSLOPEMIDDLE_NSA",

]

# All economic categories

ecos = output_growth + private_consumption + export + labour_market + business_surveys + private_credit + broad_inflation + specific_inflation + private_and_public_debt + commodity_inventories + commodity_markets + real_appreciation_tot + interest_rates

# Equity categories

eqrets = [

"EQC" + sec + ret for sec in cids_secs for ret in ["XR_NSA", "R_NSAvALL", "R_VT10vALL"]

]

# All categories

all_xcats = [x + suff for x in ecos + ecos for suff in ["_ZN", "_ZN_NEG"]] + eqrets

# Resultant tickers

tickers = [cid + "_" + xcat for cid in cids_eq for xcat in all_xcats]

print(f"Maximum number of tickers is {len(tickers)}")

Maximum number of tickers is 3552

Download additional data from JPMaQS #

# Additional tickers for download from JPMaQS

untradeable = [

"EQCCODUNTRADABLE_NSA",

"EQCCOSUNTRADABLE_NSA",

"EQCCSRUNTRADABLE_NSA",

"EQCENRUNTRADABLE_NSA",

"EQCFINUNTRADABLE_NSA",

"EQCHLCUNTRADABLE_NSA",

"EQCINDUNTRADABLE_NSA",

"EQCITEUNTRADABLE_NSA",

"EQCMATUNTRADABLE_NSA",

"EQCRELUNTRADABLE_NSA",

"EQCUTLUNTRADABLE_NSA",

] # dummy variables for dates where certain sectors were untradeable

bmrs = [

"USD_EQXR_NSA",

"USD_EQXR_VT10"

] # U.S. equity returns for correlation analysis

xtickers = [cid + "_" + xcat for cid in cids_eq for xcat in untradeable] + bmrs

print(f"Maximum number of tickers is {len(xtickers)}")

Maximum number of tickers is 134

# Download series from J.P. Morgan DataQuery by tickers

start_date = "2000-01-01"

# Retrieve credentials

client_id: str = os.getenv("DQ_CLIENT_ID")

client_secret: str = os.getenv("DQ_CLIENT_SECRET")

# Download from DataQuery

with JPMaQSDownload(client_id=client_id, client_secret=client_secret) as downloader:

start = timer()

assert downloader.check_connection()

df_jpmaqs = downloader.download(

tickers=xtickers,

start_date=start_date,

metrics=["value"],

suppress_warning=True,

show_progress=True,

)

end = timer()

print("Download time from DQ: " + str(timedelta(seconds=end - start)))

Downloading data from JPMaQS.

Timestamp UTC: 2025-03-18 13:03:01

Connection successful!

Requesting data: 100%|███████████████████████████████████████████████████████████████████| 7/7 [00:01<00:00, 4.61it/s]

Downloading data: 100%|██████████████████████████████████████████████████████████████████| 7/7 [00:40<00:00, 5.77s/it]

Some expressions are missing from the downloaded data. Check logger output for complete list.

1 out of 134 expressions are missing. To download the catalogue of all available expressions and filter the unavailable expressions, set `get_catalogue=True` in the call to `JPMaQSDownload.download()`.

Some dates are missing from the downloaded data.

3 out of 6579 dates are missing.

Download time from DQ: 0:00:44.461112

df = msm.update_df(df_csv, df_jpmaqs)

# Dictionary of featire category labels

cat_labels = {

"BASEXINVCSCORE_SA_ZN": {

"Group": "Commodity inventories",

"Label": "Excess crude inventory score",

"Description": "Crude oil excess inventory z-score, seasonally adjusted",

"Geography": "global",

},

"BMLCOCRY_SAVT10_21DMA_ZN": {

"Group": "Market metrics",

"Label": "Base metals carry",

"Description": "Nominal carry for base metals basket, seasonally and vol-adjusted, 21 days moving average",

"Geography": "global",

},

"BMLXINVCSCORE_SA_ZN": {

"Group": "Commodity inventories",

"Label": "Excess metal inventory score",

"Description": "Base metal excess inventory z-score, seasonally adjusted",

"Geography": "global",

},

"CBCSCORE_SA_D3M3ML3_WG_ZN": {

"Group": "Business surveys",

"Label": "Construction confidence, q/q",

"Description": "Construction business confidence score, seas. adjusted, change q/q",

"Geography": "weighted",

},

"CBCSCORE_SA_D3M3ML3_ZN": {

"Group": "Business surveys",

"Label": "Construction confidence, q/q",

"Description": "Construction business confidence score, seas. adjusted, change q/q",

"Geography": "local",

},

"CBCSCORE_SA_WG_ZN": {

"Group": "Business surveys",

"Label": "Construction confidence",

"Description": "Construction business confidence score, seas. adjusted",

"Geography": "weighted",

},

"CBCSCORE_SA_ZN": {

"Group": "Business surveys",

"Label": "Construction confidence",

"Description": "Construction business confidence score, seas. adjusted",

"Geography": "local",

},

"CCSCORE_SA_D3M3ML3_WG_ZN": {

"Group": "Private consumption",

"Label": "Consumer confidence, q/q",

"Description": "Consumer confidence score, seasonally adjusted, change q/q",

"Geography": "weighted",

},

"CCSCORE_SA_D3M3ML3_ZN": {

"Group": "Private consumption",

"Label": "Consumer confidence, q/q",

"Description": "Consumer confidence score, seasonally adjusted, change q/q",

"Geography": "local",

},

"CCSCORE_SA_WG_ZN": {

"Group": "Private consumption",

"Label": "Consumer confidence",

"Description": "Consumer confidence score, seasonally adjusted",

"Geography": "weighted",

},

"CCSCORE_SA_ZN": {

"Group": "Private consumption",

"Label": "Consumer confidence",

"Description": "Consumer confidence score, seasonally adjusted",

"Geography": "local",

},

"CMPI_NSA_P1M12ML1_ZN": {

"Group": "Real appreciation",

"Label": "Import prices, %oya",

"Description": "Commodity-based import price index, %oya",

"Geography": "local",

},

"CTOT_NSA_P1M12ML1_ZN": {

"Group": "Real appreciation",

"Label": "Terms-of-trade, %oya",

"Description": "Commodity-based terms-of-trade, %oya",

"Geography": "local",

},

"CXPI_NSA_P1M12ML1_ZN": {

"Group": "Real appreciation",

"Label": "Export prices, %oya",

"Description": "Commodity-based export price index, %oya",

"Geography": "local",

},

"COXR_VT10vWTI_21DMA_ZN": {

"Group": "Market metrics",

"Label": "Refined vs crude oil returns",

"Description": "Refined oil products vs crude oil vol-targeted return differential, 21 days moving average",

"Geography": "global",

},

"INTLIQGDP_NSA_D1M1ML1_ZN": {

"Group": "Private credit",

"Label": "Intervention liquidity, diff m/m",

"Description": "Intervention liquidity to GDP ratio, change over the last month",

"Geography": "local",

},

"INTLIQGDP_NSA_D1M1ML6_ZN": {

"Group": "Private credit",

"Label": "Intervention liquidity, diff 6m",

"Description": "Intervention liquidity to GDP ratio, change overlast 6 months",

"Geography": "local",

},

"MBCSCORE_SA_D3M3ML3_WG_ZN": {

"Group": "Business surveys",

"Label": "Manufacturing confidence, q/q",

"Description": "Manufacturing business confidence score, seas. adj., change q/q",

"Geography": "weighted",

},

"MBCSCORE_SA_D3M3ML3_ZN": {

"Group": "Business surveys",

"Label": "Manufacturing confidence, q/q",

"Description": "Manufacturing business confidence score, seas. adj., change q/q",

"Geography": "local",

},

"MBCSCORE_SA_WG_ZN": {

"Group": "Business surveys",

"Label": "Manufacturing confidence",

"Description": "Manufacturing business confidence score, seasonally adjusted",

"Geography": "weighted",

},

"MBCSCORE_SA_ZN": {

"Group": "Business surveys",

"Label": "Manufacturing confidence",

"Description": "Manufacturing business confidence score, seasonally adjusted",

"Geography": "local",

},

"REEROADJ_NSA_P1M12ML1_ZN": {

"Group": "Real appreciation",

"Label": "Open-adj REER, %oya",

"Description": "Openness-adjusted real effective exchange rate, %oya",

"Geography": "local",

},

"REFIXINVCSCORE_SA_ZN": {

"Group": "Commodity inventories",

"Label": "Excess refined oil inventory score",

"Description": "Refined oil product excess inventory z-score, seas. adjusted",

"Geography": "global",

},

"RIR_NSA_ZN": {

"Group": "Market metrics",

"Label": "Real 1-month rate",

"Description": "Real 1-month interest rate",

"Geography": "local",

},

"RSLOPEMIDDLE_NSA_ZN": {

"Group": "Market metrics",

"Label": "Real 5y-2y yield",

"Description": "Real IRS yield differentials, 5-years versus 2-years",

"Geography": "local",

},

"RYLDIRS02Y_NSA_ZN": {

"Group": "Market metrics",

"Label": "Real 2-year yield",

"Description": "Real 2-year IRS yield",

"Geography": "local",

},

"RYLDIRS05Y_NSA_ZN": {

"Group": "Market metrics",

"Label": "Real 5-year yield",

"Description": "Real 5-year IRS yield",

"Geography": "local",

},

"SBCSCORE_SA_D3M3ML3_WG_ZN": {

"Group": "Business surveys",

"Label": "Service confidence, q/q",

"Description": "Services business confidence score, seas. adjusted, change q/q",

"Geography": "weighted",

},

"SBCSCORE_SA_D3M3ML3_ZN": {

"Group": "Business surveys",

"Label": "Service confidence, q/q",

"Description": "Services business confidence score, seas. adjusted, change q/q",

"Geography": "local",

},

"SBCSCORE_SA_WG_ZN": {

"Group": "Business surveys",

"Label": "Service confidence",

"Description": "Services business confidence score, seasonally adjusted",

"Geography": "weighted",

},

"SBCSCORE_SA_ZN": {

"Group": "Business surveys",

"Label": "Service confidence",

"Description": "Services business confidence score, seasonally adjusted",

"Geography": "local",

},

"UNEMPLRATE_NSA_3MMA_D1M1ML12_WG_ZN": {

"Group": "Labour market",

"Label": "Unemployment rate, diff oya",

"Description": "Unemployment rate, change oya",

"Geography": "weighted",

},

"UNEMPLRATE_NSA_3MMA_D1M1ML12_ZN": {

"Group": "Labour market",

"Label": "Unemployment rate, diff oya",

"Description": "Unemployment rate, change oya",

"Geography": "local",

},

"UNEMPLRATE_SA_3MMAv5YMA_WG_ZN": {

"Group": "Labour market",

"Label": "Unemployment rate, diff vs 5yma",

"Description": "Unemployment rate, difference vs 5-year moving average",

"Geography": "weighted",

},

"UNEMPLRATE_SA_3MMAv5YMA_ZN": {

"Group": "Labour market",

"Label": "Unemployment rate, diff vs 5yma",

"Description": "Unemployment rate, difference vs 5-year moving average",

"Geography": "local",

},

"XCPIC_SA_P1M1ML12_ZN": {

"Group": "Inflation - broad",

"Label": "Excess core CPI, %oya",

"Description": "Core CPI, %oya, in excess of effective inflation target",

"Geography": "local",

},

"XCPIE_SA_P1M1ML12_WG_ZN": {

"Group": "Inflation - specific",

"Label": "Excess energy CPI, %oya",

"Description": "Energy CPI, %oya, in excess of effective inflation target",

"Geography": "weighted",

},

"XCPIE_SA_P1M1ML12_ZN": {

"Group": "Inflation - specific",

"Label": "Excess energy CPI, %oya",

"Description": "Energy CPI, %oya, in excess of effective inflation target",

"Geography": "local",

},

"XCPIF_SA_P1M1ML12_WG_ZN": {

"Group": "Inflation - specific",

"Label": "Excess food CPI, %oya",

"Description": "Food CPI, %oya, in excess of effective inflation target",

"Geography": "weighted",

},

"XCPIF_SA_P1M1ML12_ZN": {

"Group": "Inflation - specific",

"Label": "Excess food CPI, %oya",

"Description": "Food CPI, %oya, in excess of effective inflation target",

"Geography": "local",

},

"XCPIH_SA_P1M1ML12_ZN": {

"Group": "Inflation - broad",

"Label": "Excess headline CPI, %oya",

"Description": "Headline CPI, %oya, in excess of effective inflation target",

"Geography": "local",

},

"XCSTR_SA_P1M1ML12_3MMA_WG_ZN": {

"Group": "Output growth",

"Label": "Excess construction growth",

"Description": "Construction output, %oya, 3mma, in excess of 5-y median GDP growth",

"Geography": "weighted",

},

"XCSTR_SA_P1M1ML12_3MMA_ZN": {

"Group": "Output growth",

"Label": "Excess construction growth",

"Description": "Construction output, %oya, 3mma, in excess of 5-y median GDP growth",

"Geography": "local",

},

"XEMPL_NSA_P1M1ML12_3MMA_WG_ZN": {

"Group": "Labour market",

"Label": "Excess employment growth",

"Description": "Employment growth, %oya, 3mma, in excess of population growth",

"Geography": "weighted",

},

"XEMPL_NSA_P1M1ML12_3MMA_ZN": {

"Group": "Labour market",

"Label": "Excess employment growth",

"Description": "Employment growth, %oya, 3mma, in excess of population growth",

"Geography": "local",

},

"XEXPORTS_SA_P1M1ML12_3MMA_ZN": {

"Group": "Exports",

"Label": "Excess export growth",

"Description": "Exports growth, %oya, 3mma, in excess of 5-year median GDP growth",

"Geography": "local",

},

"XGGDGDPRATIOX10_NSA_ZN": {

"Group": "Debt",

"Label": "Excess projected gov. debt",

"Description": "Government debt-to-GDP ratio proj. in 10 years, in excess of 100%",

"Geography": "local",

},

"CORPINTNETGDP_SA_D1Q1QL4_WG_ZN": {

"Group": "Debt",

"Label": "Corporate debt servicing, %oya",

"Description": "Corporate net debt servicing-to-GDP ratio, seasonally-adjusted, %oya",

"Geography": "weighted",

},

"CORPINTNETGDP_SA_D1Q1QL4_ZN": {

"Group": "Debt",

"Label": "Corporate debt servicing, %oya",

"Description": "Corporate net debt servicing-to-GDP ratio, seasonally-adjusted, %oya",

"Geography": "local",

},

"HHINTNETGDP_SA_D1M1ML12_WG_ZN": {

"Group": "Debt",

"Label": "Households debt servicing, %oya",

"Description": "Households net debt servicing-to-GDP ratio, seasonally-adjusted, %oya",

"Geography": "weighted",

},

"HHINTNETGDP_SA_D1M1ML12_ZN": {

"Group": "Debt",

"Label": "Households debt servicing, %oya",

"Description": "Households net debt servicing-to-GDP ratio, seasonally-adjusted, %oya",

"Geography": "local",

},

"XIP_SA_P1M1ML12_3MMA_WG_ZN": {

"Group": "Output growth",

"Label": "Excess industry growth",

"Description": "Industrial output, %oya, 3mma, in excess of 5-y median GDP growth",

"Geography": "weighted",

},

"XIP_SA_P1M1ML12_3MMA_ZN": {

"Group": "Output growth",

"Label": "Excess industry growth",

"Description": "Industrial output, %oya, 3mma, in excess of 5-y median GDP growth",

"Geography": "local",

},

"XNRSALES_SA_P1M1ML12_3MMA_WG_ZN": {

"Group": "Private consumption",

"Label": "Excess retail sales growth",

"Description": "Nominal retail sales, %oya, 3mma, in excess of 5-y median GDP growth",

"Geography": "weighted",

},

"XNRSALES_SA_P1M1ML12_3MMA_ZN": {

"Group": "Private consumption",

"Label": "Excess retail sales growth",

"Description": "Nominal retail sales, %oya, 3mma, in excess of 5-y median GDP growth",

"Geography": "local",

},

"XRRSALES_SA_P1M1ML12_3MMA_WG_ZN": {

"Group": "Private consumption",

"Label": "Excess real retail growth",

"Description": "Real retail sales, %oya, 3mma, in excess of 5-y median GDP growth",

"Geography": "weighted",

},

"XRRSALES_SA_P1M1ML12_3MMA_ZN": {

"Group": "Private consumption",

"Label": "Excess real retail growth",

"Description": "Real retail sales, %oya, 3mma, in excess of 5-y median GDP growth",

"Geography": "local",

},

"XPCREDITBN_SJA_P1M1ML12_WG_ZN": {

"Group": "Private credit",

"Label": "Excess credit growth",

"Description": "Private credit, %oya, 3mma, in excess of 5-y median GDP growth",

"Geography": "weighted",

},

"XPCREDITBN_SJA_P1M1ML12_ZN": {

"Group": "Private credit",

"Label": "Excess credit growth",

"Description": "Private credit, %oya, 3mma, in excess of 5-y median GDP growth",

"Geography": "local",

},

"XPPIH_NSA_P1M1ML12_ZN": {

"Group": "Inflation - broad",

"Label": "Excess PPI, %oya",

"Description": "Producer price inflation, %oya, in excess of eff. inflation target",

"Geography": "local",

},

"XRGDPTECH_SA_P1M1ML12_3MMA_WG_ZN": {

"Group": "Output growth",

"Label": "Excess GDP growth",

"Description": "Real GDP, %oya, 3mma, using HF data, in excess of 5-y med. GDP growth",

"Geography": "weighted",

},

"XRGDPTECH_SA_P1M1ML12_3MMA_ZN": {

"Group": "Output growth",

"Label": "Excess GDP growth",

"Description": "Real GDP, %oya, 3mma, using HF data, in excess of 5-y med. GDP growth",

"Geography": "local",

},

"XRPCONS_SA_P1M1ML12_3MMA_WG_ZN": {

"Group": "Private consumption",

"Label": "Excess consumption growth",

"Description": "Real private consumption, %oya, 3mma, in excess of 5-y median GDP growth",

"Geography": "weighted",

},

"XRPCONS_SA_P1M1ML12_3MMA_ZN": {

"Group": "Private consumption",

"Label": "Excess real consum growth",

"Description": "Real private consumption, %oya, 3mma, in excess of 5-y median GDP growth",

"Geography": "local",

},

"XRWAGES_NSA_P1M1ML12_ZN": {

"Group": "Labour market",

"Label": "Excess real wage growth",

"Description": "Real wage growth, %oya, in excess of medium-term productivity growth",

"Geography": "local",

},

}

cat_labels = pd.DataFrame(cat_labels).T

cat_alllabel_dict = cat_labels[["Label", "Geography"]].agg(", ".join, axis=1).to_dict()

cat_labels = (

cat_labels

.reset_index(drop=False)

.rename(columns={"index": "Category"})

.set_index(["Group", "Category"])

.sort_index()

)

cat_groups_count = (

cat_labels.index.to_frame()

.reset_index(drop=True)

.groupby("Group")["Category"].count()

.sort_values(ascending=True)

)

fig = cat_groups_count.plot.barh(

ylabel="",

fontsize=11

)

fig.set_title(label="Number of categories by aggregate macro group", pad=20)

fig.title.set_size(16)

plt.plot()

[]

Feature filtering and imputation #

Cross-section availability requirement #

# All normalized macroeconomic categories

all_macroz = [x + "_ZN" for x in ecos]

# Identify categories with less than 10 cross sections

df_macro = df[df["xcat"].isin(all_macroz)]

cid_counts = df_macro.groupby('xcat')['cid'].nunique()

xcatx_low_cid = cid_counts[cid_counts < 10].index.tolist()

print("Categories with less than 10 cross sections:\n")

for xcat in xcatx_low_cid:

print(xcat)

# Remove categories with less than 10 cross sections

macroz = [x for x in all_macroz if not x in xcatx_low_cid]

# Identify categories that have short history

df_macro = df[df["xcat"].isin(macroz)]

cutoff_date = pd.Timestamp("2003-01-01")

min_dates = df_macro.groupby('xcat')['real_date'].min()

xcatx_late_start = min_dates[min_dates >= cutoff_date].index.tolist()

print("\nCategories that start after 2002:\n")

for xcat in xcatx_late_start:

print(xcat)

# Remove categories that start late

macroz = [x for x in macroz if not x in xcatx_late_start]

Categories with less than 10 cross sections:

CBCSCORE_SA_D3M3ML3_WG_ZN

CBCSCORE_SA_D3M3ML3_ZN

CBCSCORE_SA_WG_ZN

CBCSCORE_SA_ZN

CORPINTNETGDP_SA_D1Q1QL4_WG_ZN

CORPINTNETGDP_SA_D1Q1QL4_ZN

HHINTNETGDP_SA_D1M1ML12_WG_ZN

HHINTNETGDP_SA_D1M1ML12_ZN

Categories that start after 2002:

COXR_VT10vWTI_21DMA_ZN

# Reduce label dictionary

cat_label_dict = {k:v for k, v in cat_alllabel_dict.items() if k in macroz}

# Visualize remaining macroeconomic categories

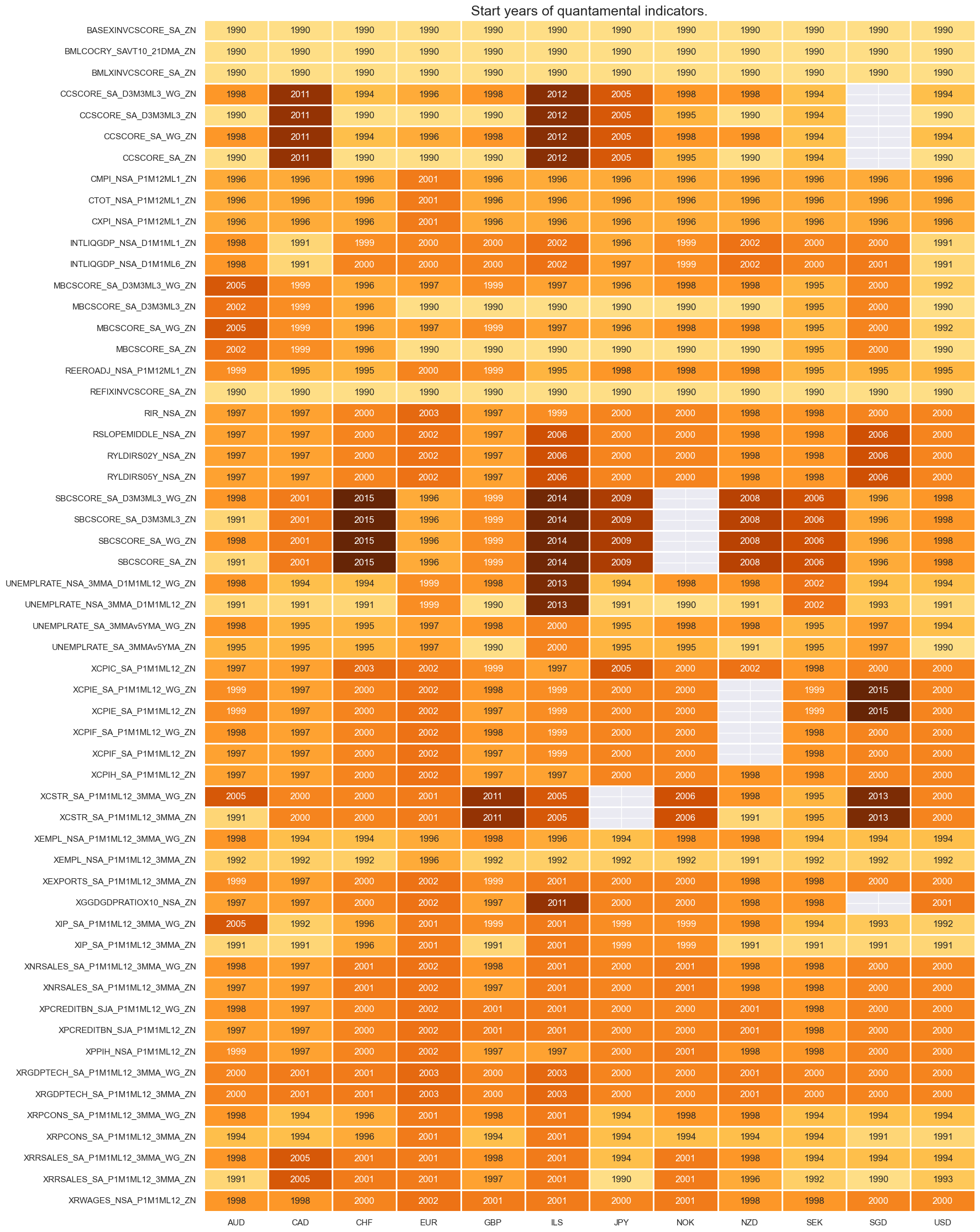

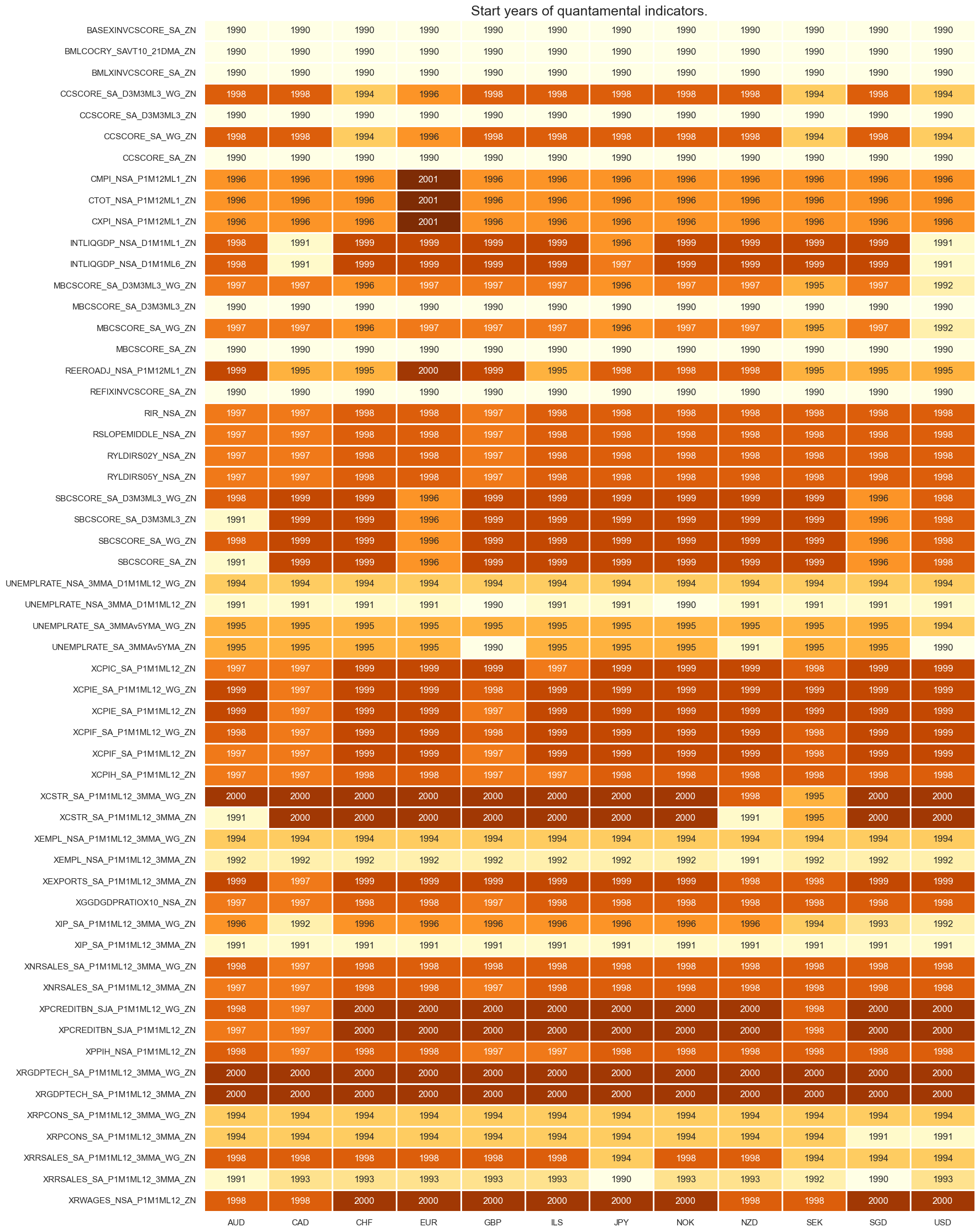

msm.check_availability(df, xcats=macroz, cids=cids_eq, missing_recent=False)

Conditional imputation of missing cross-sections #

# Impute cross-sectional values if majority of cross sections are available

# Set parameters

impute_missing_cids = True

min_ratio_cids = 0.4

# Exclude categories than cannot logically be imputed

non_imputables = [

"CXPI_NSA_P1M12ML1_ZN",

"CMPI_NSA_P1M12ML1_ZN",

"CTOT_NSA_P1M12ML1_ZN",

"REEROADJ_NSA_P1M12ML1_ZN",

]

imputables = list(set(macroz) - set(non_imputables))

if impute_missing_cids:

df_impute = msp.impute_panel(

df=df, xcats=imputables, cids=cids_eq, threshold=min_ratio_cids

)

dfx = msm.update_df(df, df_impute)

else:

dfx = df.copy()

# Visualize imputed macroeconomic categories

msm.check_availability(dfx, xcats=macroz, cids=cids_eq, missing_recent=False)

Equity sectoral return blacklisting #

sector_blacklist = {}

for sec in list(set(cids_secs) - {"ALL"}):

dfb = df[df["xcat"] == f"EQC{sec}UNTRADABLE_NSA"].loc[:, ["cid", "xcat", "real_date", "value"]]

dfba = (

dfb.groupby(["cid", "real_date"])

.aggregate(value=pd.NamedAgg(column="value", aggfunc="max"))

.reset_index()

)

dfba["xcat"] = f"EQC{sec}BLACK"

sector_blacklist[sec] = msp.make_blacklist(dfba, f"EQC{sec}BLACK")

Visualize target availability #

targets = [

x for x in eqrets if x.endswith(("R_NSAvALL", "R_VT10vALL"))

]

msm.check_availability(dfx, targets, missing_recent=False)

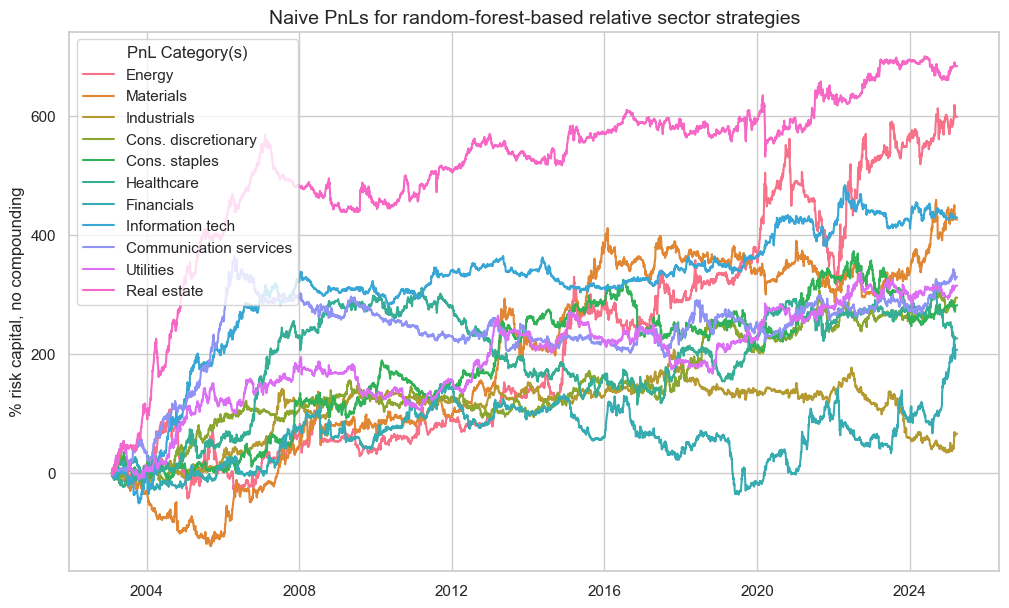

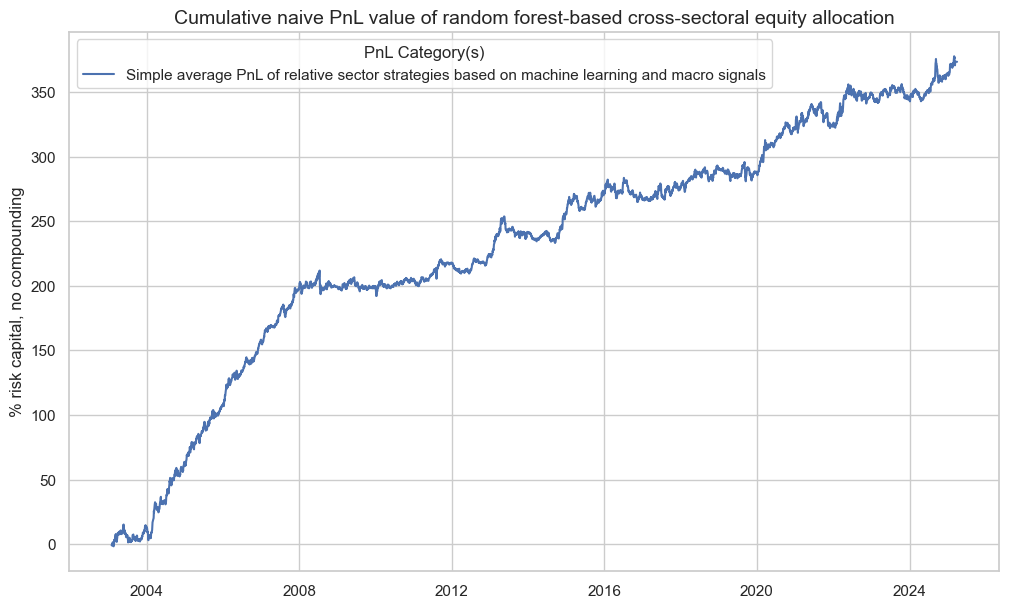

Sectoral signals and naive PnLs #

Common pipeline for all sectors #

default_target_type = "R_VT10vALL"

Model hyperparameters #

# Model dictionary

default_models = {

"rf": RandomForestRegressor(

n_estimators = 100,

random_state = 42,

)

}

# Hyperparameter grid

default_hparam_grid = {

"rf": {

"max_samples": [0.1, 0.25],

"max_features": ["sqrt", 0.5],

"min_samples_leaf": [1, 3, 6, 9]

},

}

Cross-validation splitter #

default_splitter = {"Validation": msl.RecencyKFoldPanelSplit(n_periods=12, n_splits = 1)}

Validation metric #

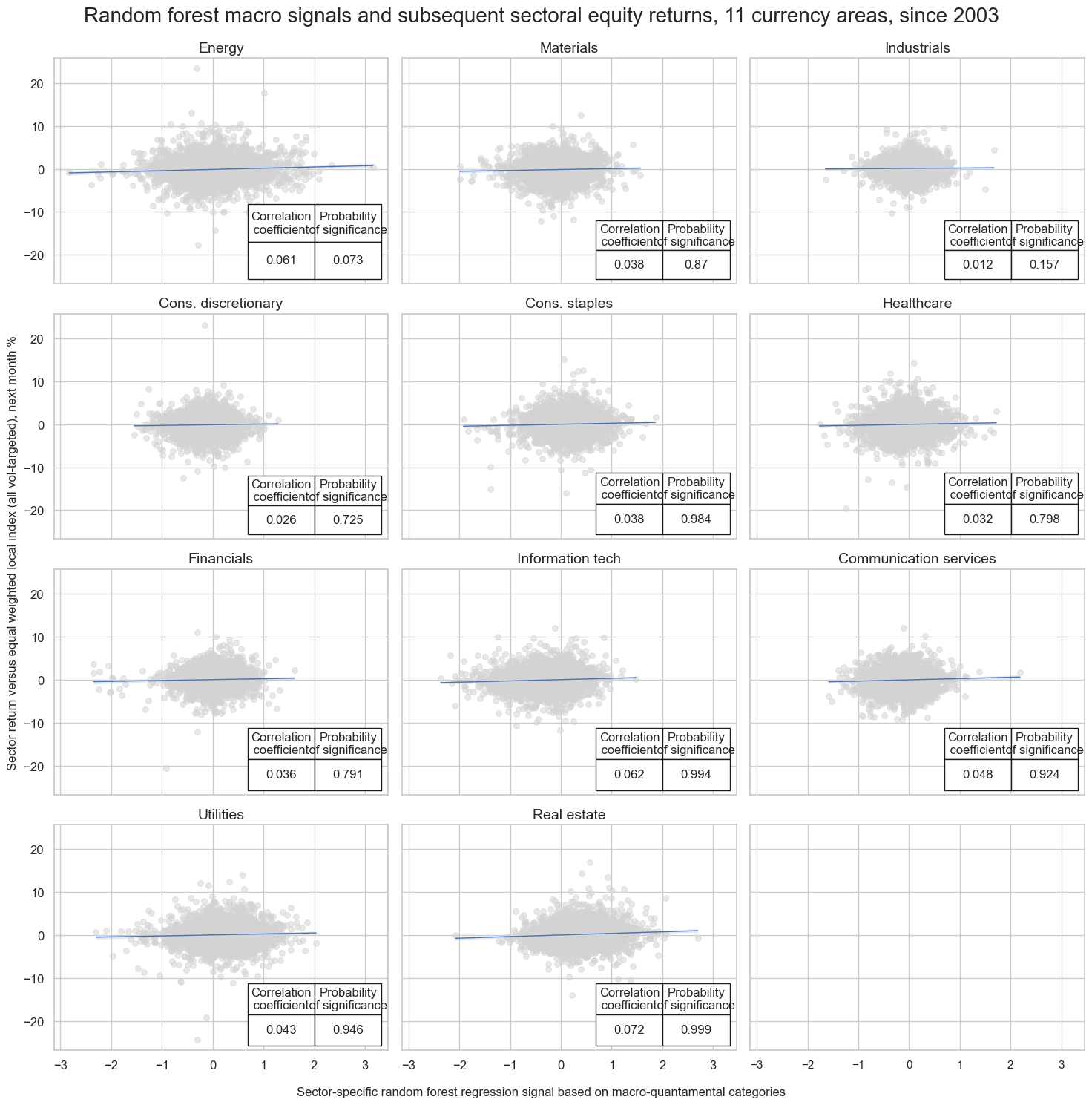

We use the probability of significance of correlation over the panel, arising from the MAP test, accounting for cross-sectional correlations in the panel, as a suitable performance metric. This should encourage the model selection process to favour models with evidence of predictive power, as well as capturing sufficient cross-sectional variation.

default_metric = {

"MAP": make_scorer(msl.panel_significance_probability, greater_is_better=True),

}

Dynamics of the backtest #

The initial training set is the smallest possible training set comprising two years’ of data for two cross-sections. This is specified by setting

min_periods

=

24

and

min_cids

=

2

. Model selection occurs each month, by specifying

test_size

=

1

. The start date of the backtest is January 2003, since the initial training set absorbs data.

# Default parameters

default_test_size = 1 # retraining interval in months

default_min_cids = 2 # minimum number of cids to start predicting

default_min_periods = 24 # minimum number of periods to start predicting

default_split_functions = None

default_start_date = "2003-01-31" # start date for the analysis

Energy #

Factor selection and signal generation #

sector = "ENR"

enr_dict = {

"sector_name": sector_labels[sector],

"signal_name": f"{sector}SOL",

"pnl_name": f"{sector_labels[sector]} learning-based signal",

"xcatx": macroz,

"cidx": list(set(cids_eq)-set(["CHF"])), # CHF has no energy companies

"ret": f"EQC{sector}{default_target_type}",

"freq": "M",

"black": sector_blacklist[sector],

"srr": None,

"pnls": None,

}

xcatx = enr_dict["xcatx"] + [enr_dict["ret"]]

cidx = enr_dict["cidx"]

so_enr = msl.SignalOptimizer(

df=dfx,

xcats=xcatx,

cids=cidx,

blacklist=enr_dict["black"],

freq=enr_dict["freq"],

lag=1,

xcat_aggs=["last", "sum"],

)

secname = enr_dict["sector_name"]

signal_name = enr_dict["signal_name"]

so_enr.calculate_predictions(

name=signal_name,

models=default_models,

scorers=default_metric,

hyperparameters=default_hparam_grid,

inner_splitters=default_splitter,

test_size=default_test_size,

min_cids=default_min_cids,

min_periods=default_min_periods,

n_jobs_outer=-1,

split_functions=default_split_functions,

)

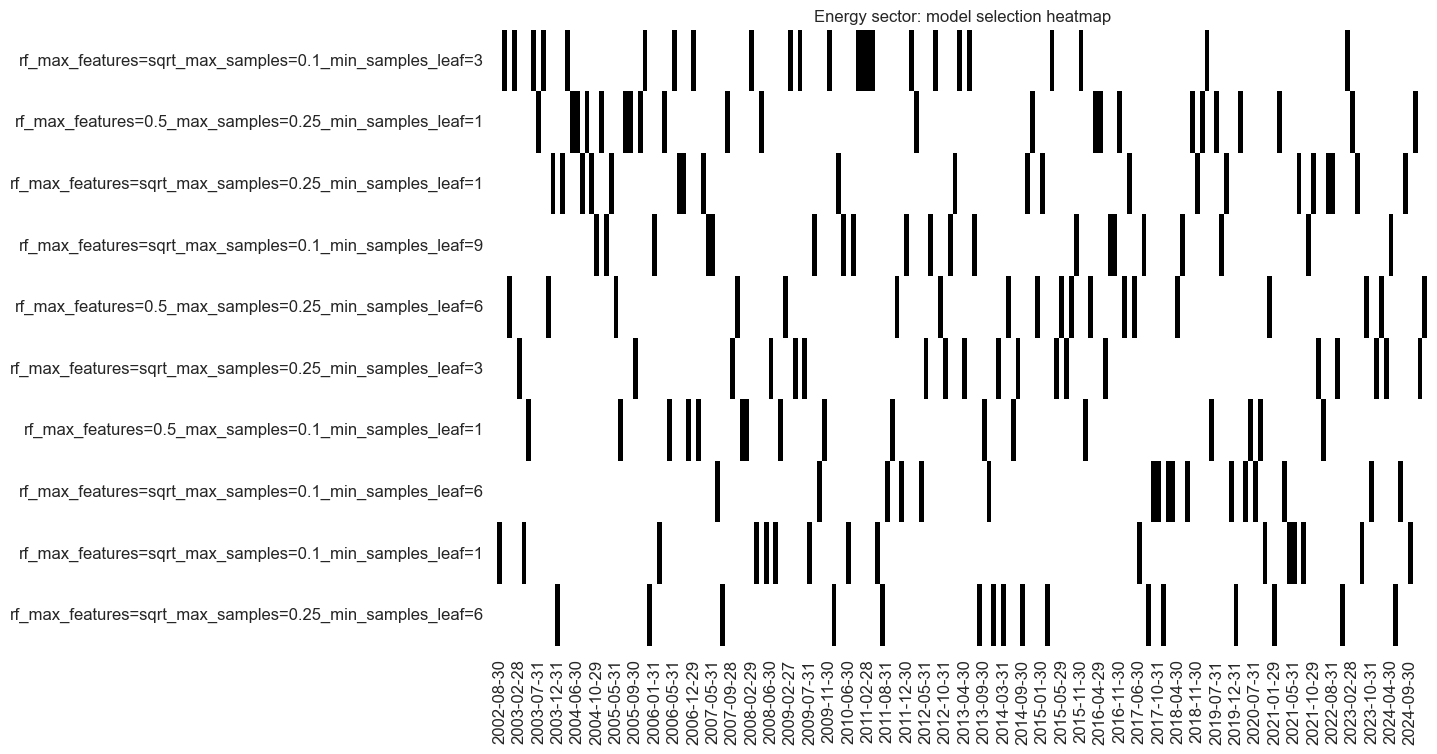

so_enr.models_heatmap(

signal_name,

cap=10,

title=f"{secname} sector: model selection heatmap",

)

# Store signals

dfa = so_enr.get_optimized_signals()

dfx = msm.update_df(dfx, dfa)

enr_importances = (

so_enr.feature_importances.describe()

.iloc[:, 1:]

.sort_values(by="mean", axis=1, ascending=False)

)

enr_importances

| BMLXINVCSCORE_SA_ZN | BMLCOCRY_SAVT10_21DMA_ZN | REFIXINVCSCORE_SA_ZN | BASEXINVCSCORE_SA_ZN | REEROADJ_NSA_P1M12ML1_ZN | RYLDIRS05Y_NSA_ZN | XPPIH_NSA_P1M1ML12_ZN | XRWAGES_NSA_P1M1ML12_ZN | XCSTR_SA_P1M1ML12_3MMA_WG_ZN | CCSCORE_SA_WG_ZN | ... | UNEMPLRATE_NSA_3MMA_D1M1ML12_WG_ZN | CTOT_NSA_P1M12ML1_ZN | XEMPL_NSA_P1M1ML12_3MMA_ZN | MBCSCORE_SA_ZN | XRGDPTECH_SA_P1M1ML12_3MMA_WG_ZN | XIP_SA_P1M1ML12_3MMA_ZN | XEMPL_NSA_P1M1ML12_3MMA_WG_ZN | UNEMPLRATE_SA_3MMAv5YMA_WG_ZN | INTLIQGDP_NSA_D1M1ML6_ZN | INTLIQGDP_NSA_D1M1ML1_ZN | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | ... | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 |

| mean | 0.030927 | 0.030094 | 0.024739 | 0.022718 | 0.021585 | 0.020675 | 0.020389 | 0.020245 | 0.019975 | 0.019587 | ... | 0.015361 | 0.015102 | 0.015038 | 0.014972 | 0.014865 | 0.014725 | 0.014700 | 0.014543 | 0.013790 | 0.013005 |

| min | 0.000000 | 0.009212 | 0.004156 | 0.005009 | 0.011105 | 0.007890 | 0.008432 | 0.007092 | 0.002683 | 0.003043 | ... | 0.002792 | 0.007286 | 0.000000 | 0.003520 | 0.004578 | 0.000388 | 0.006040 | 0.001652 | 0.003973 | 0.003130 |

| 25% | 0.024789 | 0.025452 | 0.020337 | 0.019671 | 0.018761 | 0.017459 | 0.016626 | 0.017363 | 0.017500 | 0.016902 | ... | 0.013154 | 0.013047 | 0.012971 | 0.012874 | 0.012466 | 0.012885 | 0.012704 | 0.012961 | 0.011421 | 0.011130 |

| 50% | 0.029669 | 0.029542 | 0.024300 | 0.023108 | 0.021182 | 0.020781 | 0.019060 | 0.020288 | 0.019665 | 0.018822 | ... | 0.015214 | 0.014534 | 0.015272 | 0.014778 | 0.014652 | 0.014541 | 0.014521 | 0.014691 | 0.013366 | 0.012912 |

| 75% | 0.036705 | 0.034473 | 0.028142 | 0.026200 | 0.024050 | 0.023294 | 0.022669 | 0.022118 | 0.022515 | 0.022045 | ... | 0.017299 | 0.016414 | 0.017252 | 0.016932 | 0.016736 | 0.016469 | 0.016623 | 0.016469 | 0.015574 | 0.014926 |

| max | 0.068146 | 0.065267 | 0.048316 | 0.045445 | 0.050443 | 0.055328 | 0.045022 | 0.041524 | 0.037962 | 0.040932 | ... | 0.030651 | 0.040133 | 0.039301 | 0.035290 | 0.030890 | 0.027474 | 0.025039 | 0.025664 | 0.028522 | 0.022455 |

| std | 0.011594 | 0.007470 | 0.007346 | 0.005843 | 0.004575 | 0.005386 | 0.005957 | 0.004405 | 0.004936 | 0.004658 | ... | 0.003907 | 0.003629 | 0.003765 | 0.003564 | 0.003489 | 0.003330 | 0.003006 | 0.003419 | 0.003595 | 0.003205 |

8 rows × 56 columns

xcatx = enr_dict["signal_name"]

secname = enr_dict["sector_name"]

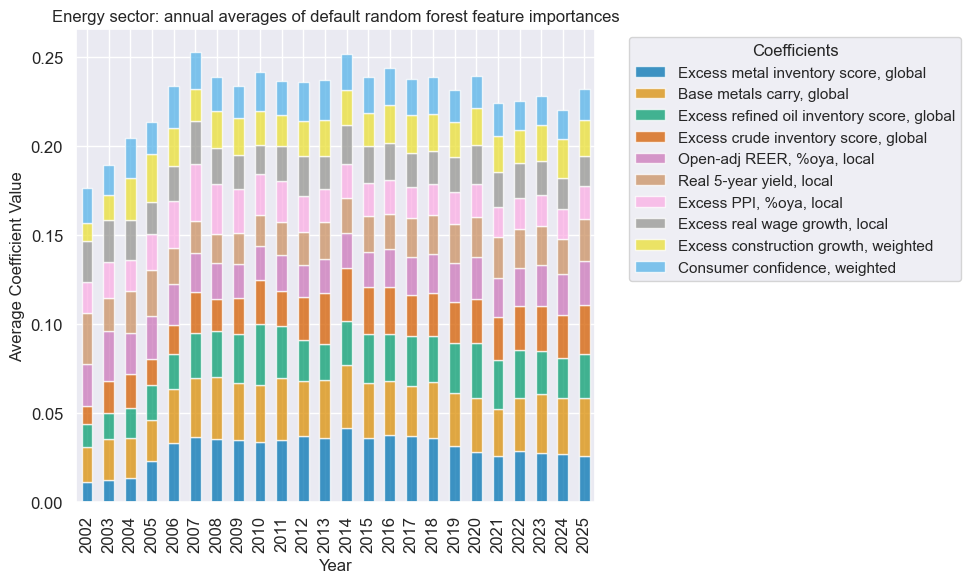

so_enr.coefs_stackedbarplot(

name=xcatx,

ftrs=list(enr_importances.columns[:10]),

ftrs_renamed=cat_label_dict,

title=f"{secname} sector: annual averages of default random forest feature importances",

)

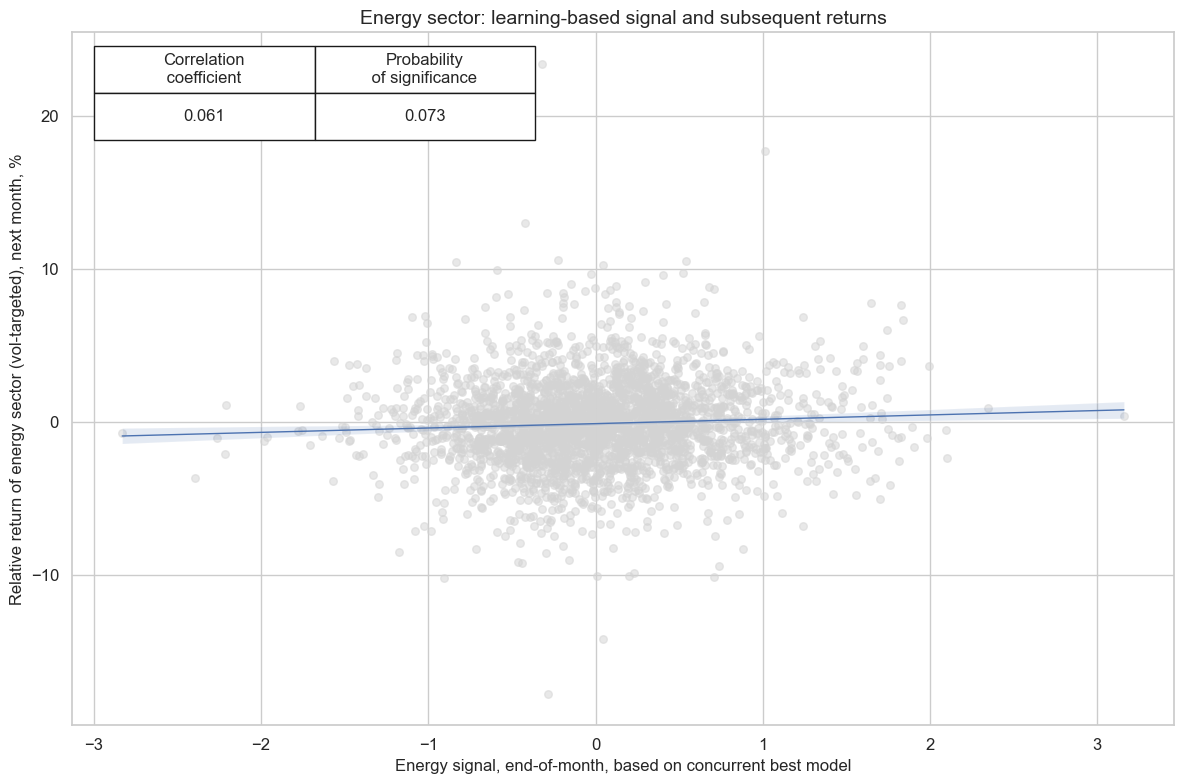

Signal quality check #

xcatx = [enr_dict["signal_name"], enr_dict["ret"]]

cidx = enr_dict["cidx"]

secname = enr_dict["sector_name"]

cr_enr = msp.CategoryRelations(

df=dfx,

xcats=xcatx,

cids=cidx,

freq=enr_dict["freq"],

lag=1,

blacklist=enr_dict["black"],

xcat_aggs=["last", "sum"],

slip=1,

xcat_trims=[30, 30], # trim dodgy data point

)

cr_enr.reg_scatter(

title=f"{secname} sector: learning-based signal and subsequent returns",

labels=False,

prob_est="map",

xlab=f"{secname} signal, end-of-month, based on concurrent best model",

ylab=f"Relative return of {secname.lower()} sector (vol-targeted), next month, %",

coef_box="upper left",

size=(12, 8),

)

xcatx = [enr_dict["signal_name"]]

cidx = enr_dict["cidx"]

secname = enr_dict["sector_name"]

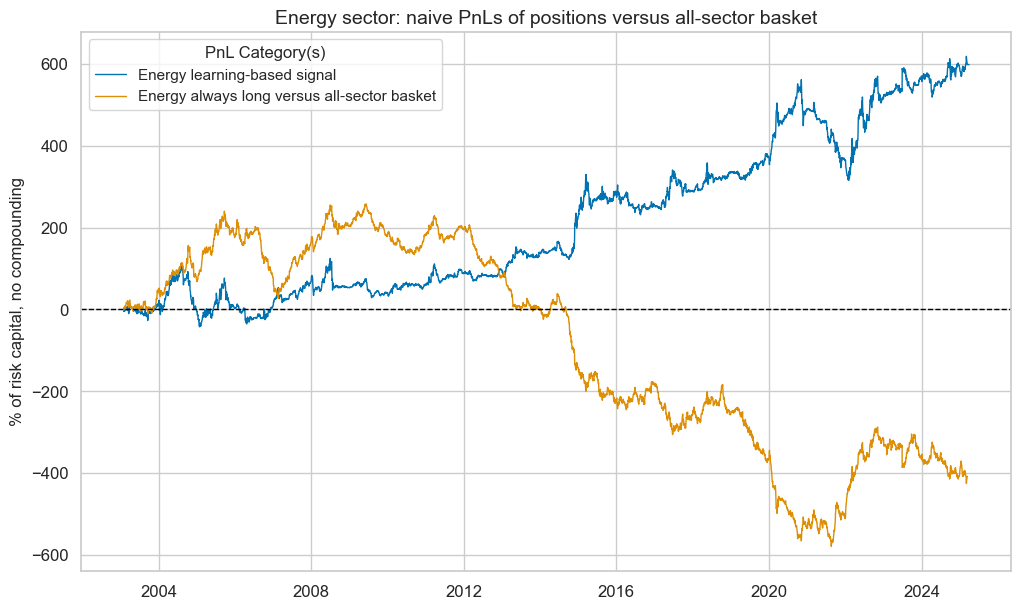

pnl_enr = msn.NaivePnL(

df=dfx,

ret=enr_dict["ret"],

sigs=xcatx,

cids=cidx,

start=default_start_date,

blacklist=enr_dict["black"],

bms=["USD_EQXR_NSA"],

)

for xcat in xcatx:

pnl_enr.make_pnl(

sig=xcat,

sig_op="zn_score_pan",

rebal_freq="monthly",

neutral="zero",

rebal_slip=1,

vol_scale=None,

thresh=2,

pnl_name=enr_dict["pnl_name"],

)

pnl_enr.make_long_pnl(

vol_scale=None, label=f"{secname} always long versus all-sector basket"

)

pnl_enr.plot_pnls(

pnl_cats=pnl_enr.pnl_names,

title=f"{secname} sector: naive PnLs of positions versus all-sector basket",

title_fontsize=14,

)

enr_dict["pnls"] = pnl_enr

pnl_enr.evaluate_pnls(pnl_cats=pnl_enr.pnl_names)

| xcat | Energy learning-based signal | Energy always long versus all-sector basket |

|---|---|---|

| Return % | 27.019865 | -18.469388 |

| St. Dev. % | 57.909781 | 53.016948 |

| Sharpe Ratio | 0.466586 | -0.348368 |

| Sortino Ratio | 0.675189 | -0.478872 |

| Max 21-Day Draw % | -87.604987 | -78.404808 |

| Max 6-Month Draw % | -147.524394 | -186.69396 |

| Peak to Trough Draw % | -246.496899 | -837.214078 |

| Top 5% Monthly PnL Share | 0.952336 | -1.395043 |

| USD_EQXR_NSA correl | -0.058604 | -0.047811 |

| Traded Months | 267 | 267 |

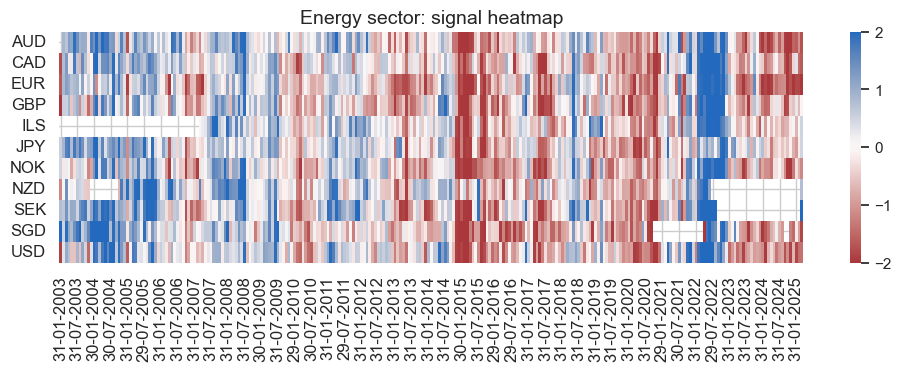

secname = enr_dict["sector_name"]

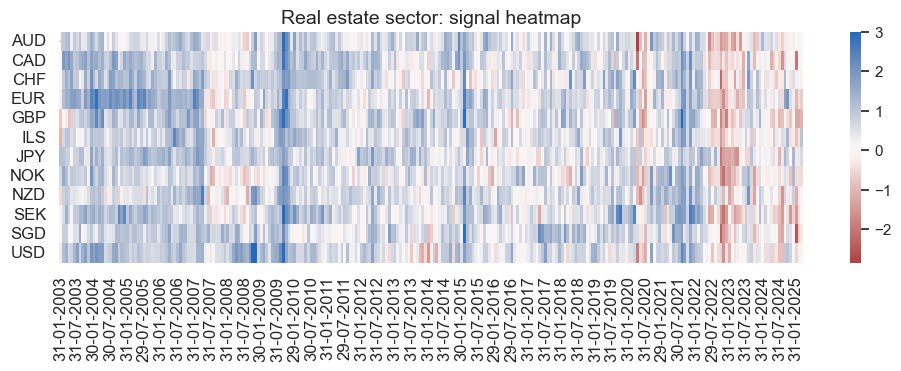

pnl_enr.signal_heatmap(

pnl_name=enr_dict["pnl_name"],

figsize=(12, 3),

title=f"{secname} sector: signal heatmap",

)

Materials #

Factor selection and signal generation #

sector = "MAT"

mat_dict = {

"sector_name": sector_labels[sector],

"signal_name": f"{sector}SOL",

"pnl_name": f"{sector_labels[sector]} learning-based signal",

"xcatx": macroz,

"cidx": cids_eq,

"ret": f"EQC{sector}{default_target_type}",

"freq": "M",

"black": sector_blacklist[sector],

"srr": None,

"pnls": None,

}

xcatx = mat_dict["xcatx"] + [mat_dict["ret"]]

cidx = mat_dict["cidx"]

so_mat = msl.SignalOptimizer(

df=dfx,

xcats=xcatx,

cids=cidx,

blacklist=mat_dict["black"],

freq=mat_dict["freq"],

lag=1,

xcat_aggs=["last", "sum"],

)

secname = mat_dict["sector_name"]

signal_name = mat_dict["signal_name"]

so_mat.calculate_predictions(

name=signal_name,

models=default_models,

scorers=default_metric,

hyperparameters=default_hparam_grid,

inner_splitters=default_splitter,

test_size=default_test_size,

min_cids=default_min_cids,

min_periods=default_min_periods,

n_jobs_outer=-1,

split_functions=default_split_functions,

)

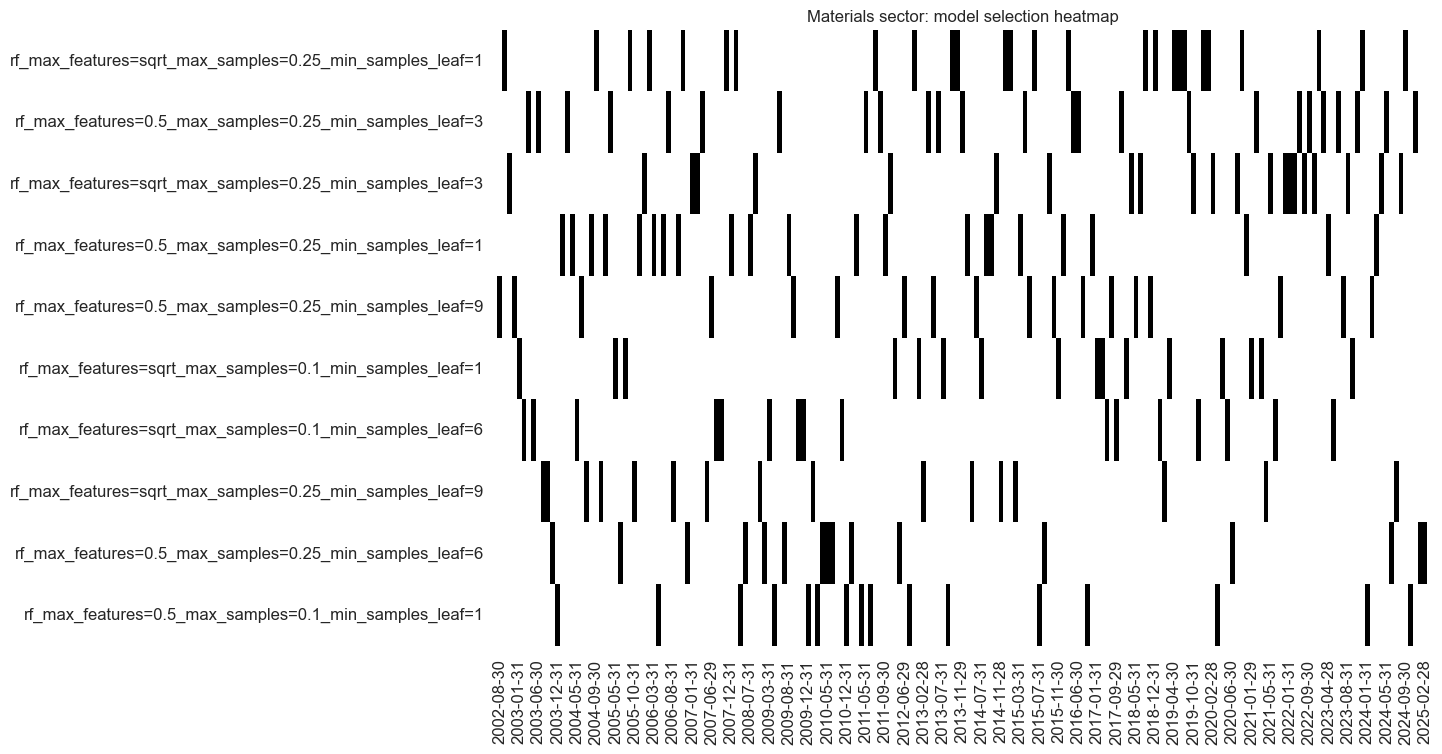

so_mat.models_heatmap(

signal_name,

cap=10,

title=f"{secname} sector: model selection heatmap",

)

# Store signals

dfa = so_mat.get_optimized_signals()

dfx = msm.update_df(dfx, dfa)

mat_importances = (

so_mat.feature_importances.describe()

.iloc[:, 1:]

.sort_values(by="mean", axis=1, ascending=False)

)

mat_importances

| REFIXINVCSCORE_SA_ZN | BMLCOCRY_SAVT10_21DMA_ZN | REEROADJ_NSA_P1M12ML1_ZN | SBCSCORE_SA_D3M3ML3_WG_ZN | CCSCORE_SA_WG_ZN | XCPIF_SA_P1M1ML12_WG_ZN | SBCSCORE_SA_D3M3ML3_ZN | RIR_NSA_ZN | BASEXINVCSCORE_SA_ZN | BMLXINVCSCORE_SA_ZN | ... | RSLOPEMIDDLE_NSA_ZN | UNEMPLRATE_NSA_3MMA_D1M1ML12_WG_ZN | XCPIE_SA_P1M1ML12_ZN | MBCSCORE_SA_WG_ZN | XRGDPTECH_SA_P1M1ML12_3MMA_WG_ZN | MBCSCORE_SA_ZN | XRGDPTECH_SA_P1M1ML12_3MMA_ZN | XIP_SA_P1M1ML12_3MMA_ZN | INTLIQGDP_NSA_D1M1ML1_ZN | INTLIQGDP_NSA_D1M1ML6_ZN | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | ... | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 |

| mean | 0.027414 | 0.027049 | 0.022460 | 0.022121 | 0.021919 | 0.021428 | 0.021095 | 0.020548 | 0.020401 | 0.020377 | ... | 0.015399 | 0.015342 | 0.015168 | 0.015146 | 0.015032 | 0.014260 | 0.014090 | 0.013875 | 0.012206 | 0.011865 |

| min | 0.007395 | 0.014302 | 0.010688 | 0.006639 | 0.009518 | 0.009580 | 0.007751 | 0.008293 | 0.006952 | 0.001908 | ... | 0.003000 | 0.007019 | 0.006584 | 0.004917 | 0.000000 | 0.004926 | 0.003038 | 0.002698 | 0.003795 | 0.004800 |

| 25% | 0.023650 | 0.023519 | 0.019665 | 0.019426 | 0.019022 | 0.018857 | 0.018734 | 0.017751 | 0.017253 | 0.015761 | ... | 0.013849 | 0.013341 | 0.013634 | 0.012960 | 0.013299 | 0.012679 | 0.011831 | 0.012321 | 0.010495 | 0.010215 |

| 50% | 0.027418 | 0.026524 | 0.022170 | 0.021804 | 0.021169 | 0.020629 | 0.020799 | 0.020361 | 0.019915 | 0.020936 | ... | 0.015407 | 0.014969 | 0.014956 | 0.014993 | 0.014808 | 0.014342 | 0.014043 | 0.013927 | 0.012253 | 0.011580 |

| 75% | 0.030734 | 0.029970 | 0.024573 | 0.024508 | 0.023796 | 0.023231 | 0.023141 | 0.023172 | 0.023492 | 0.024669 | ... | 0.016882 | 0.016645 | 0.016761 | 0.016988 | 0.016928 | 0.016275 | 0.015985 | 0.015305 | 0.014348 | 0.013206 |

| max | 0.043441 | 0.059587 | 0.041570 | 0.037830 | 0.038766 | 0.041611 | 0.034210 | 0.035389 | 0.041623 | 0.038614 | ... | 0.028934 | 0.031476 | 0.031369 | 0.031679 | 0.027276 | 0.023415 | 0.025331 | 0.030235 | 0.019331 | 0.028560 |

| std | 0.006042 | 0.006272 | 0.004554 | 0.004668 | 0.004484 | 0.004530 | 0.004227 | 0.004572 | 0.005204 | 0.006792 | ... | 0.002997 | 0.003495 | 0.002820 | 0.003364 | 0.003275 | 0.002851 | 0.003396 | 0.003003 | 0.002874 | 0.002573 |

8 rows × 56 columns

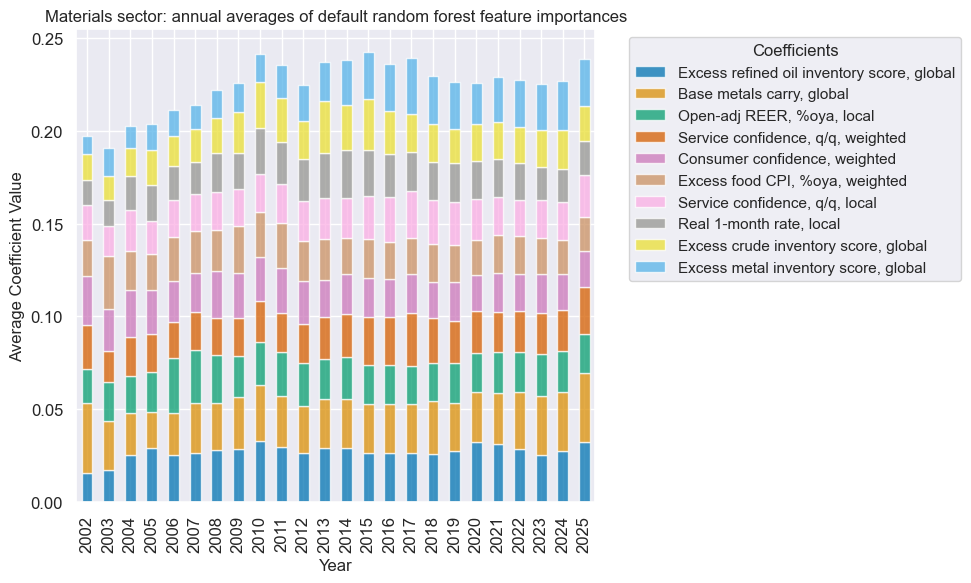

xcatx = mat_dict["signal_name"]

secname = mat_dict["sector_name"]

so_mat.coefs_stackedbarplot(

name=xcatx,

ftrs=list(mat_importances.columns[:10]),

ftrs_renamed=cat_label_dict,

title=f"{secname} sector: annual averages of default random forest feature importances",

)

Signal quality check #

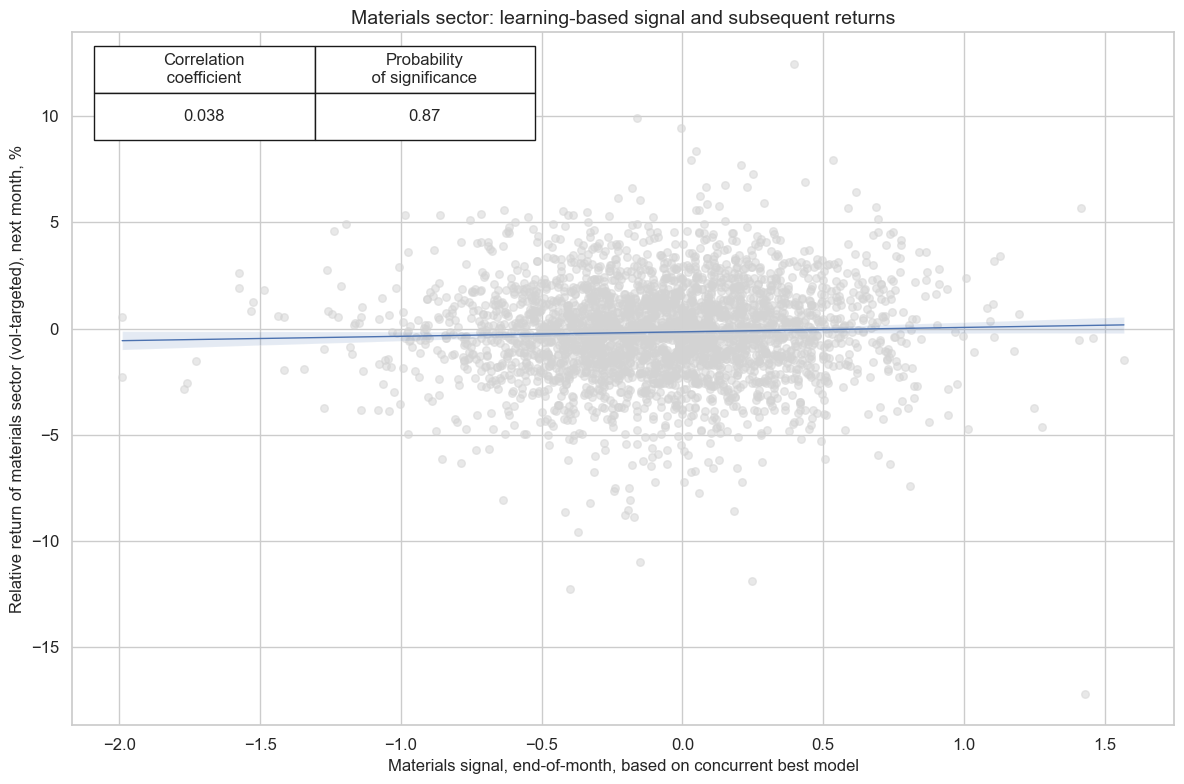

xcatx = [mat_dict["signal_name"], mat_dict["ret"]]

cidx = mat_dict["cidx"]

secname = mat_dict["sector_name"]

cr_mat = msp.CategoryRelations(

df=dfx,

xcats=xcatx,

cids=cidx,

freq=mat_dict["freq"],

blacklist=mat_dict["black"],

lag=1,

xcat_aggs=["last", "sum"],

slip=1,

xcat_trims=[2, 20],

)

cr_mat.reg_scatter(

title=f"{secname} sector: learning-based signal and subsequent returns",

labels=False,

prob_est="map",

xlab=f"{secname} signal, end-of-month, based on concurrent best model",

ylab=f"Relative return of {secname.lower()} sector (vol-targeted), next month, %",

coef_box="upper left",

size=(12, 8),

)

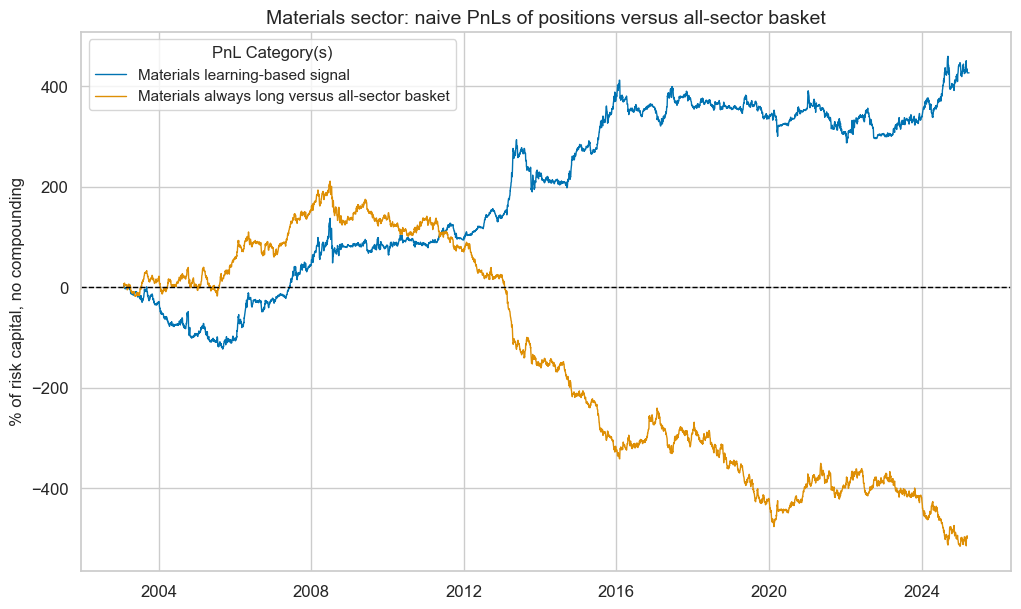

xcatx = [mat_dict["signal_name"]]

cidx = mat_dict["cidx"]

secname = mat_dict["sector_name"]

pnl_name = mat_dict["pnl_name"]

pnl_mat = msn.NaivePnL(

df=dfx,

ret=mat_dict["ret"],

sigs=xcatx,

cids=cidx,

start=default_start_date,

blacklist=mat_dict["black"],

bms=["USD_EQXR_NSA"],

)

for xcat in xcatx:

pnl_mat.make_pnl(

sig=xcat,

sig_op="zn_score_pan",

rebal_freq="monthly",

neutral="zero",

rebal_slip=1,

vol_scale=None,

thresh=2,

pnl_name=pnl_name,

)

pnl_mat.make_long_pnl(

vol_scale=None, label=f"{secname} always long versus all-sector basket"

)

pnl_mat.plot_pnls(

pnl_cats=pnl_mat.pnl_names,

title=f"{secname} sector: naive PnLs of positions versus all-sector basket",

title_fontsize=14,

)

mat_dict["pnls"] = pnl_mat

pnl_mat.evaluate_pnls(pnl_cats=pnl_mat.pnl_names)

| xcat | Materials learning-based signal | Materials always long versus all-sector basket |

|---|---|---|

| Return % | 19.239838 | -22.3526 |

| St. Dev. % | 43.681819 | 40.209911 |

| Sharpe Ratio | 0.440454 | -0.555898 |

| Sortino Ratio | 0.619307 | -0.76508 |

| Max 21-Day Draw % | -74.894154 | -61.657388 |

| Max 6-Month Draw % | -92.416881 | -152.838949 |

| Peak to Trough Draw % | -127.270629 | -725.96649 |

| Top 5% Monthly PnL Share | 1.175033 | -0.718067 |

| USD_EQXR_NSA correl | -0.015116 | 0.02638 |

| Traded Months | 267 | 267 |

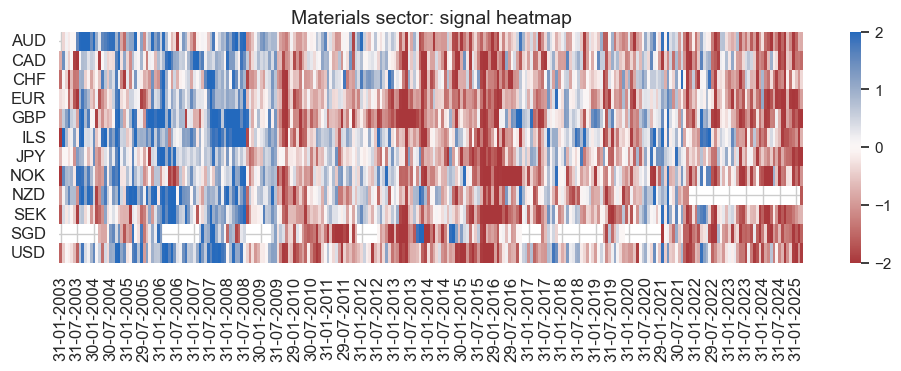

secname = mat_dict["sector_name"]

xcatx = mat_dict["signal_name"]

pnl_mat.signal_heatmap(

pnl_name=f"{secname} learning-based signal",

figsize=(12, 3),

title=f"{secname} sector: signal heatmap",

)

Industrials #

Factor selection and signal generation #

sector = "IND"

ind_dict = {

"sector_name": sector_labels[sector],

"signal_name": f"{sector}SOL",

"pnl_name": f"{sector_labels[sector]} learning-based signal",

"xcatx": macroz,

"cidx": cids_eq,

"ret": f"EQC{sector}{default_target_type}",

"freq": "M",

"black": sector_blacklist[sector],

"srr": None,

"pnls": None,

}

xcatx = ind_dict["xcatx"] + [ind_dict["ret"]]

cidx = ind_dict["cidx"]

so_ind = msl.SignalOptimizer(

df=dfx,

xcats=xcatx,

cids=cidx,

blacklist=ind_dict["black"],

freq=ind_dict["freq"],

lag=1,

xcat_aggs=["last", "sum"],

)

secname = ind_dict["sector_name"]

signal_name = ind_dict["signal_name"]

so_ind.calculate_predictions(

name=signal_name,

models=default_models,

scorers=default_metric,

hyperparameters=default_hparam_grid,

inner_splitters=default_splitter,

test_size=default_test_size,

min_cids=default_min_cids,

min_periods=default_min_periods,

n_jobs_outer=-1,

split_functions=default_split_functions,

)

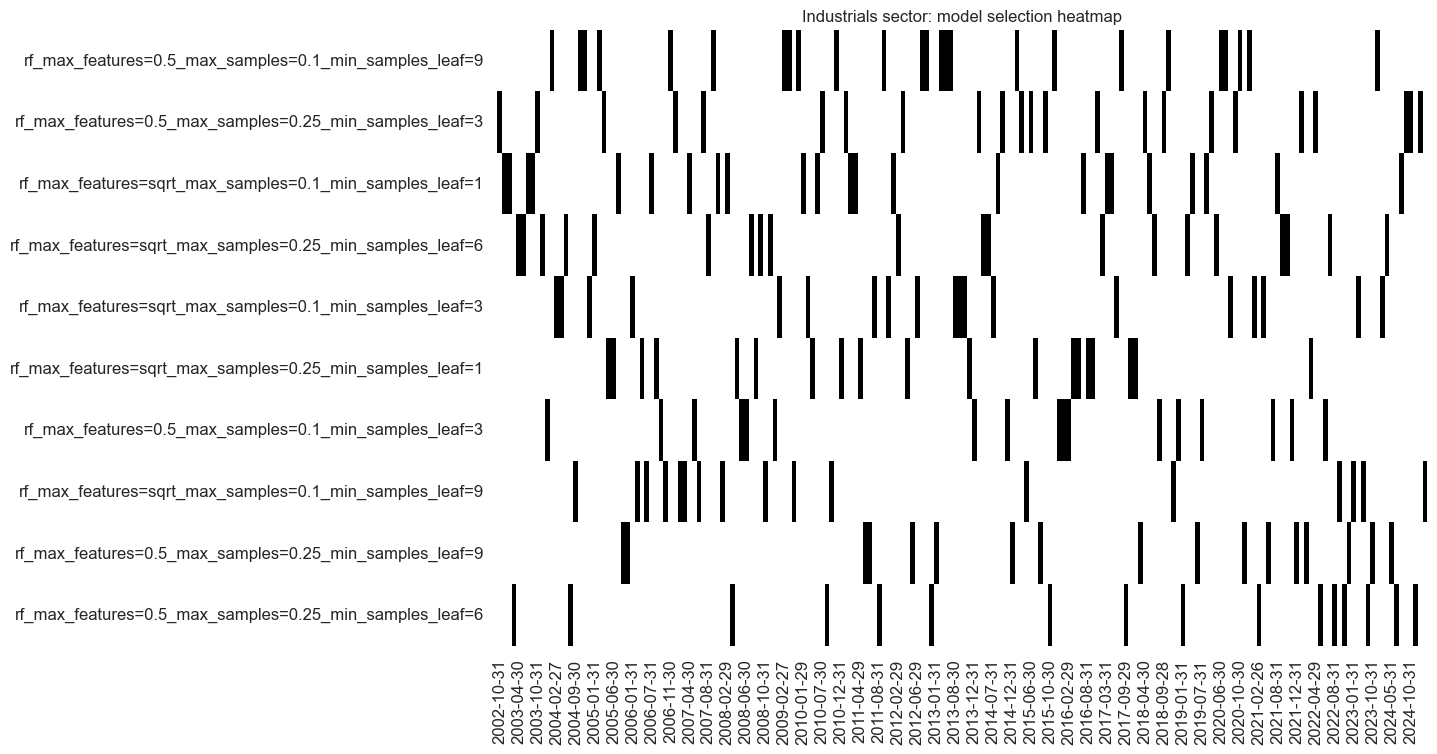

so_ind.models_heatmap(

signal_name,

cap=10,

title=f"{secname} sector: model selection heatmap",

)

# Store signals

dfa = so_ind.get_optimized_signals()

dfx = msm.update_df(dfx, dfa)

ind_importances = (

so_ind.feature_importances.describe()

.iloc[:, 1:]

.sort_values(by="mean", axis=1, ascending=False)

)

ind_importances

| BMLCOCRY_SAVT10_21DMA_ZN | BMLXINVCSCORE_SA_ZN | CCSCORE_SA_WG_ZN | XCPIC_SA_P1M1ML12_ZN | BASEXINVCSCORE_SA_ZN | XRWAGES_NSA_P1M1ML12_ZN | XGGDGDPRATIOX10_NSA_ZN | MBCSCORE_SA_D3M3ML3_ZN | XCPIE_SA_P1M1ML12_WG_ZN | REEROADJ_NSA_P1M12ML1_ZN | ... | UNEMPLRATE_NSA_3MMA_D1M1ML12_ZN | XRGDPTECH_SA_P1M1ML12_3MMA_ZN | XRPCONS_SA_P1M1ML12_3MMA_WG_ZN | XEMPL_NSA_P1M1ML12_3MMA_WG_ZN | XIP_SA_P1M1ML12_3MMA_ZN | XRPCONS_SA_P1M1ML12_3MMA_ZN | XCPIH_SA_P1M1ML12_ZN | RIR_NSA_ZN | XEMPL_NSA_P1M1ML12_3MMA_ZN | INTLIQGDP_NSA_D1M1ML1_ZN | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | ... | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 |

| mean | 0.035782 | 0.026190 | 0.021598 | 0.020993 | 0.020895 | 0.020396 | 0.020269 | 0.019732 | 0.019598 | 0.019488 | ... | 0.015653 | 0.015401 | 0.015255 | 0.015094 | 0.015050 | 0.014864 | 0.014674 | 0.014487 | 0.014246 | 0.013209 |

| min | 0.001200 | 0.001582 | 0.008547 | 0.008321 | 0.001103 | 0.010902 | 0.005734 | 0.009563 | 0.000398 | 0.009110 | ... | 0.001919 | 0.005062 | 0.005769 | 0.004008 | 0.002141 | 0.006500 | 0.000000 | 0.002947 | 0.004472 | 0.001726 |

| 25% | 0.029026 | 0.021877 | 0.018609 | 0.018905 | 0.018042 | 0.017701 | 0.017809 | 0.017123 | 0.016979 | 0.017398 | ... | 0.013528 | 0.013470 | 0.013813 | 0.013272 | 0.013410 | 0.013215 | 0.012972 | 0.012256 | 0.012710 | 0.011091 |

| 50% | 0.033740 | 0.026367 | 0.020932 | 0.020921 | 0.021057 | 0.019834 | 0.020234 | 0.019195 | 0.019106 | 0.019147 | ... | 0.015182 | 0.015275 | 0.015160 | 0.015190 | 0.015275 | 0.014849 | 0.014709 | 0.014735 | 0.014494 | 0.013062 |

| 75% | 0.040701 | 0.031144 | 0.023798 | 0.023198 | 0.024177 | 0.021917 | 0.023116 | 0.021464 | 0.021519 | 0.021143 | ... | 0.017085 | 0.017002 | 0.016606 | 0.016932 | 0.016577 | 0.016284 | 0.016159 | 0.016766 | 0.016095 | 0.014729 |

| max | 0.087346 | 0.048761 | 0.057077 | 0.034853 | 0.036690 | 0.045568 | 0.033274 | 0.038618 | 0.035167 | 0.036525 | ... | 0.033791 | 0.025962 | 0.043339 | 0.027769 | 0.028080 | 0.023900 | 0.028253 | 0.025962 | 0.025550 | 0.032641 |

| std | 0.011091 | 0.008236 | 0.005121 | 0.003976 | 0.005166 | 0.004871 | 0.004086 | 0.004233 | 0.004670 | 0.003669 | ... | 0.003430 | 0.002867 | 0.003433 | 0.003176 | 0.003307 | 0.002759 | 0.003117 | 0.003645 | 0.003023 | 0.003710 |

8 rows × 56 columns

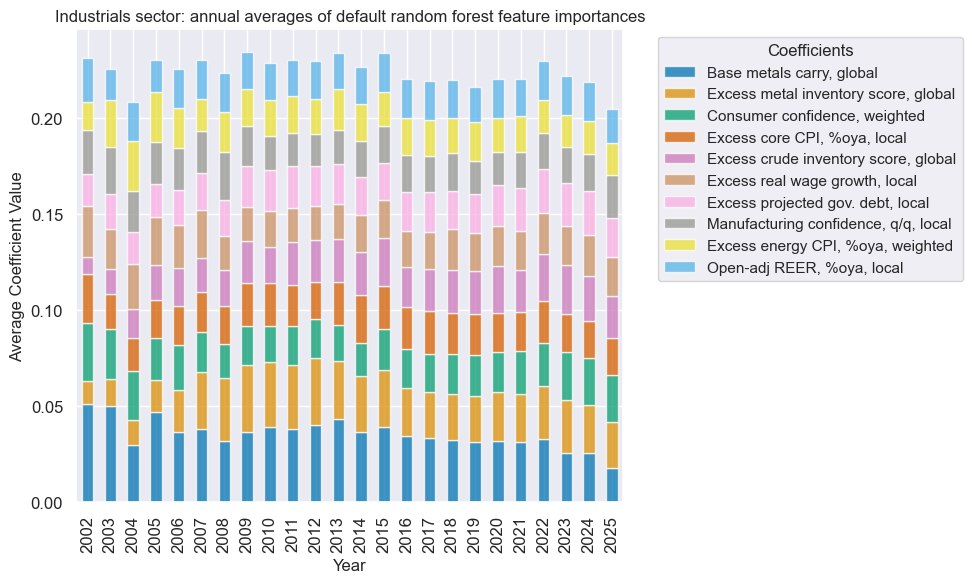

xcatx = ind_dict["signal_name"]

secname = ind_dict["sector_name"]

so_ind.coefs_stackedbarplot(

name=xcatx,

ftrs=list(ind_importances.columns[:10]),

ftrs_renamed=cat_label_dict,

title=f"{secname} sector: annual averages of default random forest feature importances",

)

Signal quality check #

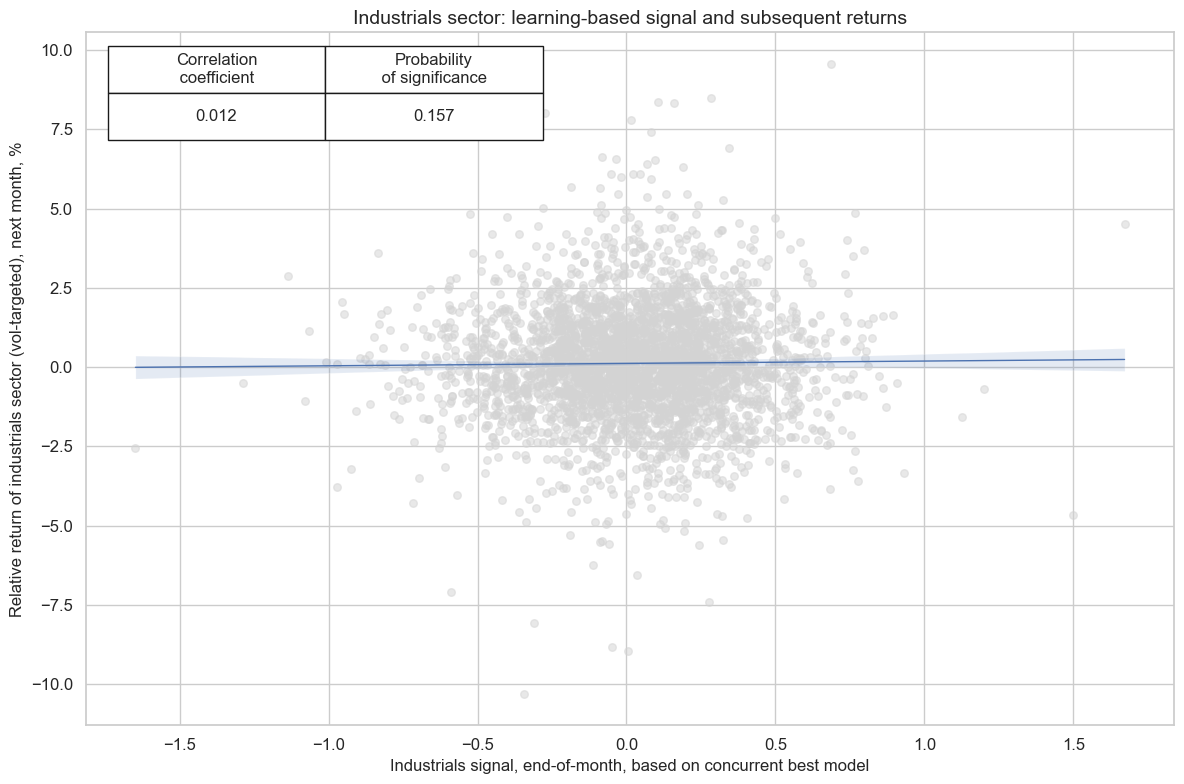

xcatx = [ind_dict["signal_name"], ind_dict["ret"]]

cidx = ind_dict["cidx"]

secname = ind_dict["sector_name"]

cr_ind = msp.CategoryRelations(

df=dfx,

xcats=xcatx,

cids=cidx,

freq=ind_dict["freq"],

blacklist=ind_dict["black"],

lag=1,

xcat_aggs=["last", "sum"],

slip=1,

)

cr_ind.reg_scatter(

title=f"{secname} sector: learning-based signal and subsequent returns",

labels=False,

prob_est="map",

xlab=f"{secname} signal, end-of-month, based on concurrent best model",

ylab=f"Relative return of {secname.lower()} sector (vol-targeted), next month, %",

coef_box="upper left",

size=(12, 8),

)

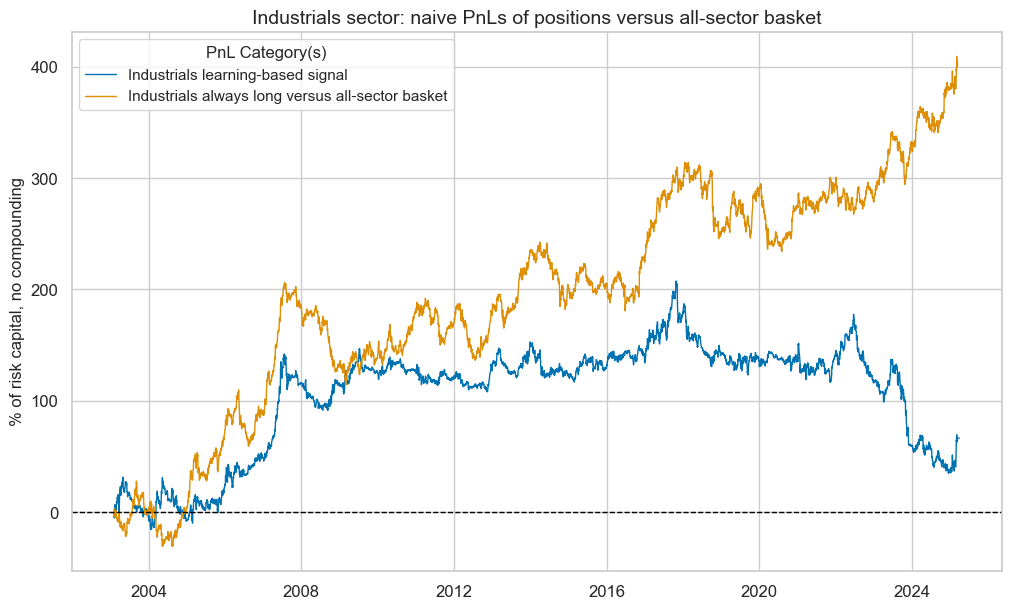

xcatx = [ind_dict["signal_name"]]

cidx = ind_dict["cidx"]

secname = ind_dict["sector_name"]

pnl_name = ind_dict["pnl_name"]

pnl_ind = msn.NaivePnL(

df=dfx,

ret=ind_dict["ret"],

sigs=xcatx,

cids=cidx,

start=default_start_date,

bms=["USD_EQXR_NSA"],

blacklist=ind_dict["black"],

)

for xcat in xcatx:

pnl_ind.make_pnl(

sig=xcat,

sig_op="zn_score_pan",

rebal_freq="monthly",

neutral="zero",

rebal_slip=1,

vol_scale=None,

thresh=2,

pnl_name=pnl_name,

)

pnl_ind.make_long_pnl(

vol_scale=None, label=f"{secname} always long versus all-sector basket"

)

pnl_ind.plot_pnls(

pnl_cats=pnl_ind.pnl_names,

title=f"{secname} sector: naive PnLs of positions versus all-sector basket",

title_fontsize=14,

)

ind_dict["pnls"] = pnl_ind

pnl_ind.evaluate_pnls(pnl_cats=pnl_ind.pnl_names)

| xcat | Industrials learning-based signal | Industrials always long versus all-sector basket |

|---|---|---|

| Return % | 2.99681 | 18.300281 |

| St. Dev. % | 27.296944 | 31.947543 |

| Sharpe Ratio | 0.109786 | 0.572823 |

| Sortino Ratio | 0.155486 | 0.819209 |

| Max 21-Day Draw % | -35.858828 | -54.172009 |

| Max 6-Month Draw % | -77.279286 | -63.203195 |

| Peak to Trough Draw % | -172.77989 | -91.886853 |

| Top 5% Monthly PnL Share | 3.59211 | 0.794551 |

| USD_EQXR_NSA correl | -0.001896 | 0.263312 |

| Traded Months | 267 | 267 |

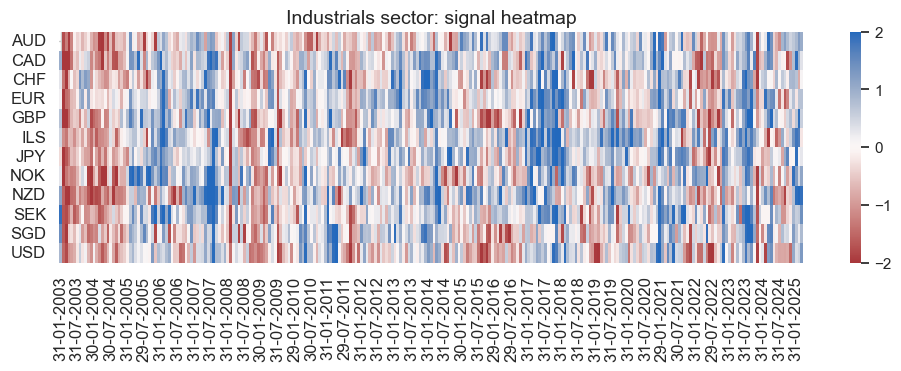

xcatx = ind_dict["signal_name"]

pnl_ind.signal_heatmap(

pnl_name=f"{secname} learning-based signal",

figsize=(12, 3),

title=f"{secname} sector: signal heatmap",

)

Consumer discretionary #

Factor selection and signal generation #

sector = "COD"

cod_dict = {

"sector_name": sector_labels[sector],

"signal_name": f"{sector}SOL",

"pnl_name": f"{sector_labels[sector]} learning-based signal",

"xcatx": macroz,

"cidx": cids_eq,

"ret": f"EQC{sector}{default_target_type}",

"freq": "M",

"black": sector_blacklist[sector],

"srr": None,

"pnls": None,

}

xcatx = cod_dict["xcatx"] + [cod_dict["ret"]]

cidx = cod_dict["cidx"]

so_cod = msl.SignalOptimizer(

df=dfx,

xcats=xcatx,

cids=cidx,

blacklist=cod_dict["black"],

freq=cod_dict["freq"],

lag=1,

xcat_aggs=["last", "sum"],

)

secname = cod_dict["sector_name"]

signal_name = cod_dict["signal_name"]

so_cod.calculate_predictions(

name=signal_name,

models=default_models,

scorers=default_metric,

hyperparameters=default_hparam_grid,

inner_splitters=default_splitter,

test_size=default_test_size,

min_cids=default_min_cids,

min_periods=default_min_periods,

n_jobs_outer=-1,

split_functions=default_split_functions,

)

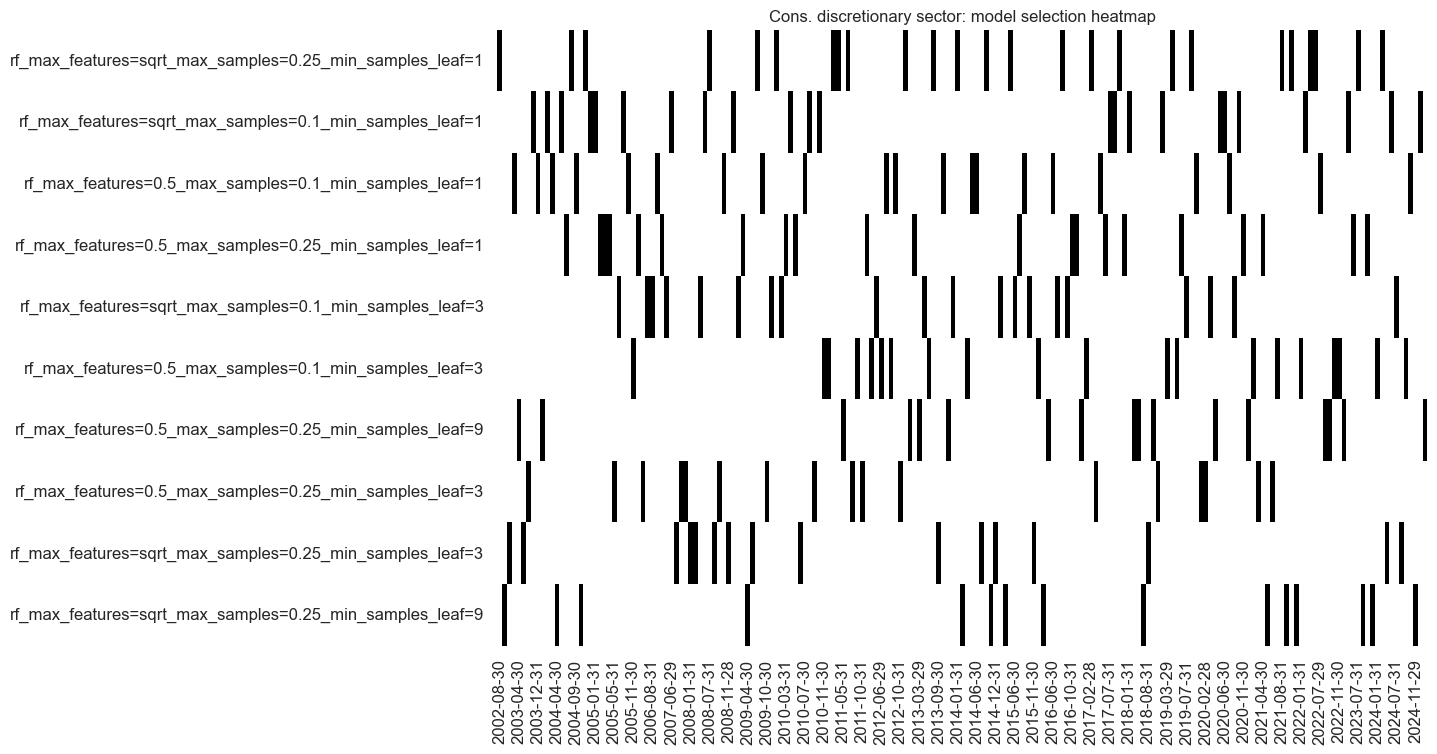

so_cod.models_heatmap(

signal_name,

cap=10,

title=f"{secname} sector: model selection heatmap",

)

# Store signals

dfa = so_cod.get_optimized_signals()

dfx = msm.update_df(dfx, dfa)

cod_importances = (

so_cod.feature_importances.describe()

.iloc[:, 1:]

.sort_values(by="mean", axis=1, ascending=False)

)

cod_importances

| XGGDGDPRATIOX10_NSA_ZN | BMLCOCRY_SAVT10_21DMA_ZN | CXPI_NSA_P1M12ML1_ZN | SBCSCORE_SA_WG_ZN | XRWAGES_NSA_P1M1ML12_ZN | REEROADJ_NSA_P1M12ML1_ZN | REFIXINVCSCORE_SA_ZN | RYLDIRS05Y_NSA_ZN | RYLDIRS02Y_NSA_ZN | XCSTR_SA_P1M1ML12_3MMA_ZN | ... | XIP_SA_P1M1ML12_3MMA_ZN | CMPI_NSA_P1M12ML1_ZN | XRRSALES_SA_P1M1ML12_3MMA_WG_ZN | XRPCONS_SA_P1M1ML12_3MMA_ZN | XEMPL_NSA_P1M1ML12_3MMA_ZN | MBCSCORE_SA_WG_ZN | XRGDPTECH_SA_P1M1ML12_3MMA_ZN | INTLIQGDP_NSA_D1M1ML6_ZN | XPCREDITBN_SJA_P1M1ML12_WG_ZN | INTLIQGDP_NSA_D1M1ML1_ZN | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | ... | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 |

| mean | 0.023720 | 0.022884 | 0.021065 | 0.020744 | 0.020660 | 0.020552 | 0.020328 | 0.020307 | 0.020209 | 0.020147 | ... | 0.016136 | 0.016098 | 0.016097 | 0.015706 | 0.015676 | 0.015588 | 0.015326 | 0.014716 | 0.014528 | 0.013099 |

| min | 0.005425 | 0.004415 | 0.012036 | 0.002538 | 0.009775 | 0.008190 | 0.008505 | 0.008254 | 0.010714 | 0.008822 | ... | 0.009056 | 0.006869 | 0.000000 | 0.006480 | 0.000000 | 0.002798 | 0.008000 | 0.005364 | 0.002427 | 0.004376 |

| 25% | 0.020339 | 0.020078 | 0.018426 | 0.018718 | 0.018207 | 0.018561 | 0.017812 | 0.017741 | 0.017637 | 0.017676 | ... | 0.014114 | 0.013944 | 0.014115 | 0.014244 | 0.013938 | 0.013636 | 0.013681 | 0.012040 | 0.012425 | 0.011148 |

| 50% | 0.023477 | 0.022541 | 0.020640 | 0.020686 | 0.020199 | 0.020335 | 0.020242 | 0.020563 | 0.019872 | 0.019740 | ... | 0.016033 | 0.015886 | 0.015470 | 0.015748 | 0.015579 | 0.015842 | 0.015222 | 0.013599 | 0.014420 | 0.013183 |

| 75% | 0.026788 | 0.025686 | 0.022816 | 0.022753 | 0.022655 | 0.022469 | 0.022743 | 0.022598 | 0.022159 | 0.021900 | ... | 0.017760 | 0.018247 | 0.017740 | 0.017207 | 0.018010 | 0.017568 | 0.016969 | 0.015767 | 0.016280 | 0.014892 |

| max | 0.043029 | 0.042228 | 0.038962 | 0.031806 | 0.044011 | 0.036594 | 0.035118 | 0.034091 | 0.055859 | 0.036420 | ... | 0.043016 | 0.025852 | 0.040442 | 0.024967 | 0.032890 | 0.028128 | 0.026256 | 0.035685 | 0.030991 | 0.028887 |

| std | 0.005174 | 0.005089 | 0.004082 | 0.004021 | 0.004167 | 0.003641 | 0.004283 | 0.004323 | 0.004684 | 0.004086 | ... | 0.003433 | 0.003143 | 0.003898 | 0.002873 | 0.003687 | 0.003406 | 0.002775 | 0.004601 | 0.003149 | 0.003064 |

8 rows × 56 columns

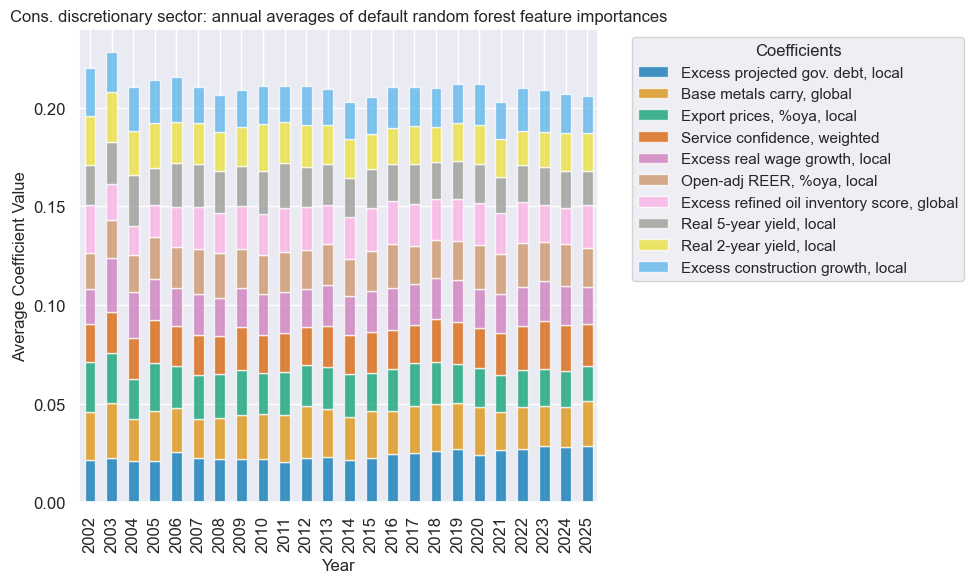

xcatx = cod_dict["signal_name"]

secname = cod_dict["sector_name"]

so_cod.coefs_stackedbarplot(

name=xcatx,

ftrs=list(cod_importances.columns[:10]),

ftrs_renamed=cat_label_dict,

title=f"{secname} sector: annual averages of default random forest feature importances",

)

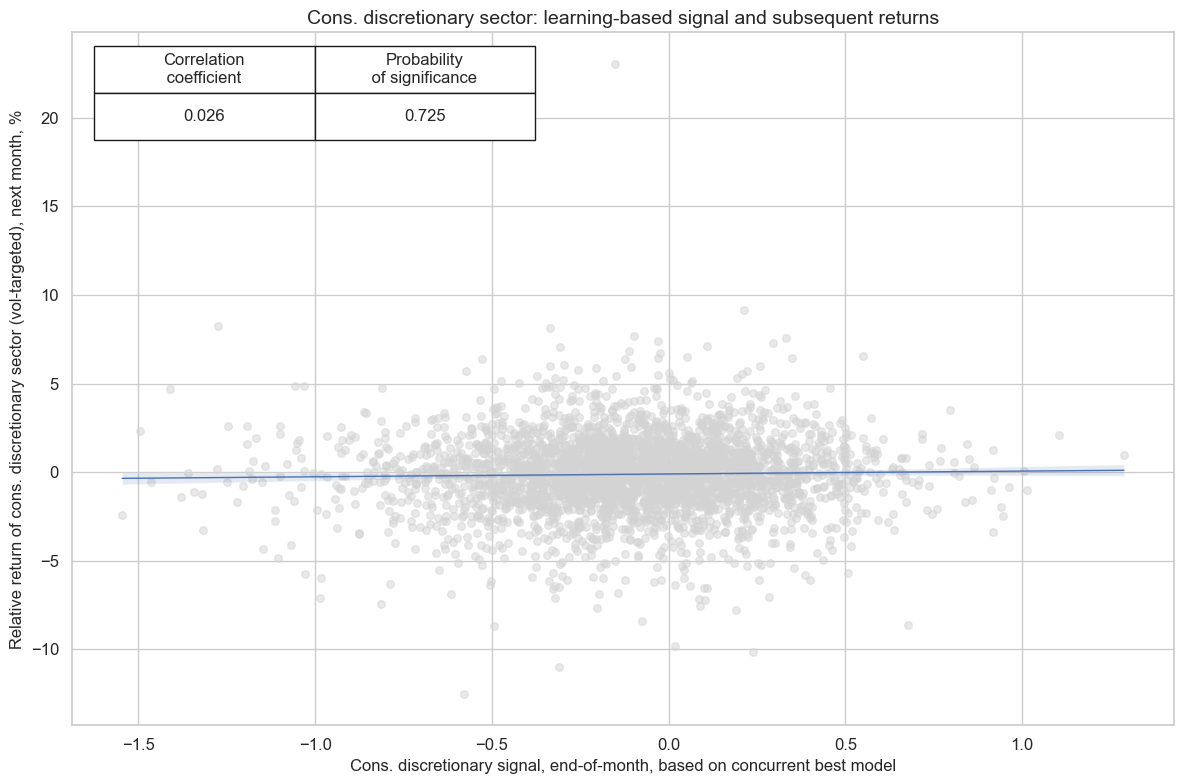

Signal quality check #

xcatx = [cod_dict["signal_name"], cod_dict["ret"]]

cidx = cod_dict["cidx"]

signal_name = cod_dict["signal_name"]

cr_cod = msp.CategoryRelations(

df=dfx,

xcats=xcatx,

cids=cidx,

freq=cod_dict["freq"],

blacklist=cod_dict["black"],

lag=1,

xcat_aggs=["last", "sum"],

slip=1,

)

cr_cod.reg_scatter(

title=f"{secname} sector: learning-based signal and subsequent returns",

labels=False,

prob_est="map",

xlab=f"{secname} signal, end-of-month, based on concurrent best model",

ylab=f"Relative return of {secname.lower()} sector (vol-targeted), next month, %",

coef_box="upper left",

size=(12, 8),

)

xcatx = [cod_dict["signal_name"]]

cidx = cod_dict["cidx"]

secname = cod_dict["sector_name"]

signal_name = cod_dict["signal_name"]

pnl_name = cod_dict["pnl_name"]

pnl_cod = msn.NaivePnL(

df=dfx,

ret=cod_dict["ret"],

sigs=xcatx,

cids=cidx,

start=default_start_date,

blacklist=cod_dict["black"],

bms=["USD_EQXR_NSA"],

)

for xcat in xcatx:

pnl_cod.make_pnl(

sig=xcat,

sig_op="zn_score_pan",

rebal_freq="monthly",

neutral="zero",

rebal_slip=1,

vol_scale=None,

thresh=2,

pnl_name=pnl_name,

)

pnl_cod.make_long_pnl(

vol_scale=None, label=f"{secname} always long versus all-sector basket"

)

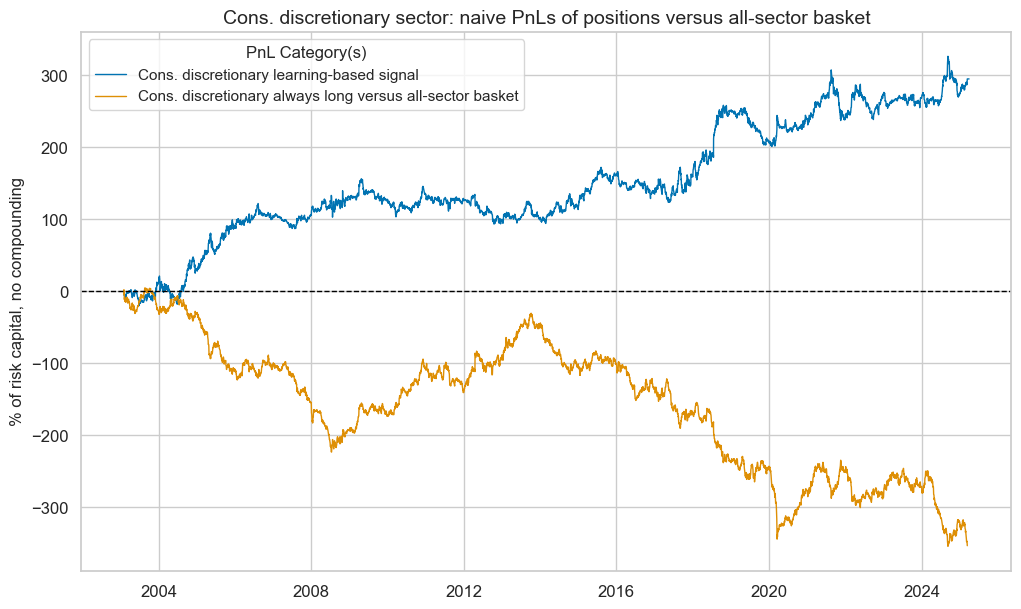

pnl_cod.plot_pnls(

pnl_cats=pnl_cod.pnl_names,

title=f"{secname} sector: naive PnLs of positions versus all-sector basket",

title_fontsize=14,

)

cod_dict["pnls"] = pnl_cod

pnl_cod.evaluate_pnls(pnl_cats=pnl_cod.pnl_names)

| xcat | Cons. discretionary learning-based signal | Cons. discretionary always long versus all-sector basket |

|---|---|---|

| Return % | 13.310832 | -15.978518 |

| St. Dev. % | 31.809486 | 31.322219 |

| Sharpe Ratio | 0.418455 | -0.510134 |

| Sortino Ratio | 0.611507 | -0.705453 |

| Max 21-Day Draw % | -36.940937 | -68.480798 |

| Max 6-Month Draw % | -58.975361 | -96.360886 |

| Peak to Trough Draw % | -70.278802 | -358.531109 |

| Top 5% Monthly PnL Share | 1.04814 | -0.737259 |

| USD_EQXR_NSA correl | -0.006917 | 0.095431 |

| Traded Months | 267 | 267 |

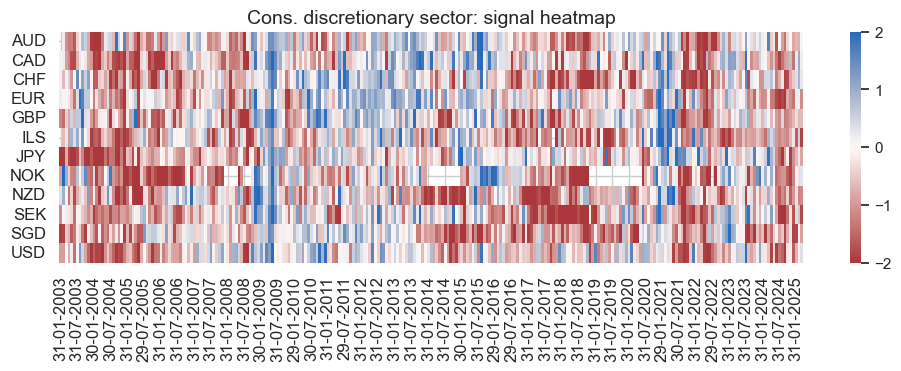

pnl_name = cod_dict["pnl_name"]

secname = cod_dict["sector_name"]

pnl_cod.signal_heatmap(

pnl_name=f"{secname} learning-based signal",

figsize=(12, 3),

title=f"{secname} sector: signal heatmap",

)

Consumer staples #

Factor selection and signal generation #

sector = "COS"

cos_dict = {

"sector_name": sector_labels[sector],

"signal_name": f"{sector}SOL",

"pnl_name": f"{sector_labels[sector]} learning-based signal",

"xcatx": macroz,

"cidx": cids_eq,

"ret": f"EQC{sector}{default_target_type}",

"freq": "M",

"black": sector_blacklist[sector],

"srr": None,

"pnls": None,

}

xcatx = cos_dict["xcatx"] + [cos_dict["ret"]]

cidx = cos_dict["cidx"]

so_cos = msl.SignalOptimizer(

df=dfx,

xcats=xcatx,

cids=cidx,

blacklist=cos_dict["black"],

freq=cos_dict["freq"],

lag=1,

xcat_aggs=["last", "sum"],

)

secname = cos_dict["sector_name"]

signal_name = cos_dict["signal_name"]

so_cos.calculate_predictions(

name=signal_name,

models=default_models,

scorers=default_metric,

hyperparameters=default_hparam_grid,

inner_splitters=default_splitter,

test_size=default_test_size,

min_cids=default_min_cids,

min_periods=default_min_periods,

n_jobs_outer=-1,

split_functions=default_split_functions,

)

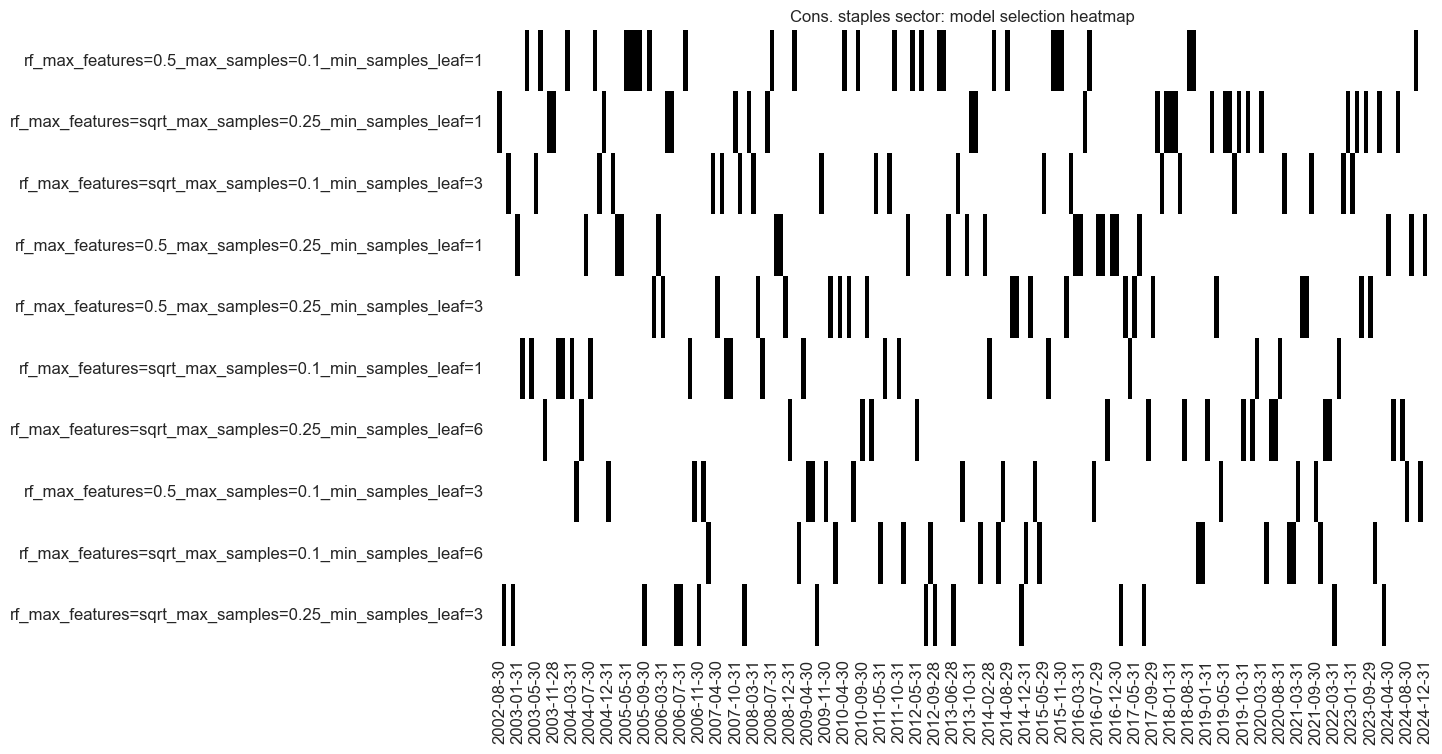

so_cos.models_heatmap(

signal_name,

cap=10,

title=f"{secname} sector: model selection heatmap",

)

# Store signals

dfa = so_cos.get_optimized_signals()

dfx = msm.update_df(dfx, dfa)

cos_importances = (

so_cos.feature_importances.describe()

.iloc[:, 1:]

.sort_values(by="mean", axis=1, ascending=False)

)

cos_importances

| BMLCOCRY_SAVT10_21DMA_ZN | CCSCORE_SA_WG_ZN | REEROADJ_NSA_P1M12ML1_ZN | XCPIF_SA_P1M1ML12_WG_ZN | XGGDGDPRATIOX10_NSA_ZN | RYLDIRS02Y_NSA_ZN | RYLDIRS05Y_NSA_ZN | XIP_SA_P1M1ML12_3MMA_WG_ZN | XRGDPTECH_SA_P1M1ML12_3MMA_WG_ZN | SBCSCORE_SA_D3M3ML3_WG_ZN | ... | UNEMPLRATE_NSA_3MMA_D1M1ML12_WG_ZN | INTLIQGDP_NSA_D1M1ML6_ZN | XRPCONS_SA_P1M1ML12_3MMA_ZN | XPPIH_NSA_P1M1ML12_ZN | XEMPL_NSA_P1M1ML12_3MMA_ZN | XRPCONS_SA_P1M1ML12_3MMA_WG_ZN | MBCSCORE_SA_WG_ZN | MBCSCORE_SA_ZN | CMPI_NSA_P1M12ML1_ZN | INTLIQGDP_NSA_D1M1ML1_ZN | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | ... | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 |

| mean | 0.030157 | 0.024069 | 0.023923 | 0.022014 | 0.020905 | 0.020691 | 0.020386 | 0.019763 | 0.019729 | 0.018906 | ... | 0.016139 | 0.016108 | 0.016090 | 0.016060 | 0.015942 | 0.015932 | 0.015433 | 0.015346 | 0.014584 | 0.014198 |

| min | 0.013596 | 0.015575 | 0.014411 | 0.011093 | 0.003462 | 0.009548 | 0.011545 | 0.011905 | 0.008197 | 0.008619 | ... | 0.008253 | 0.009533 | 0.007149 | 0.007429 | 0.006567 | 0.008011 | 0.006665 | 0.006510 | 0.006187 | 0.004975 |

| 25% | 0.025807 | 0.020668 | 0.021228 | 0.018115 | 0.017665 | 0.016654 | 0.018259 | 0.016571 | 0.015770 | 0.016757 | ... | 0.013540 | 0.013454 | 0.014459 | 0.014369 | 0.014403 | 0.013922 | 0.013399 | 0.013700 | 0.012842 | 0.012064 |

| 50% | 0.029968 | 0.022965 | 0.023401 | 0.020101 | 0.021223 | 0.020174 | 0.020438 | 0.018308 | 0.017930 | 0.019150 | ... | 0.015510 | 0.015275 | 0.016031 | 0.016081 | 0.016171 | 0.015534 | 0.015764 | 0.015556 | 0.014787 | 0.014135 |

| 75% | 0.034097 | 0.026491 | 0.026160 | 0.024199 | 0.024560 | 0.024059 | 0.022173 | 0.021438 | 0.021581 | 0.021054 | ... | 0.018204 | 0.018512 | 0.017752 | 0.017601 | 0.017659 | 0.017627 | 0.017429 | 0.017042 | 0.016022 | 0.015899 |

| max | 0.049511 | 0.044102 | 0.052365 | 0.065414 | 0.038626 | 0.042761 | 0.040571 | 0.045291 | 0.062926 | 0.029366 | ... | 0.035063 | 0.026862 | 0.028448 | 0.031605 | 0.024552 | 0.028617 | 0.022328 | 0.026688 | 0.024257 | 0.024153 |

| std | 0.006278 | 0.005038 | 0.004585 | 0.006757 | 0.005430 | 0.005823 | 0.003647 | 0.005054 | 0.006634 | 0.003355 | ... | 0.003841 | 0.003531 | 0.002808 | 0.002854 | 0.002888 | 0.003207 | 0.002820 | 0.002978 | 0.002672 | 0.003033 |

8 rows × 56 columns

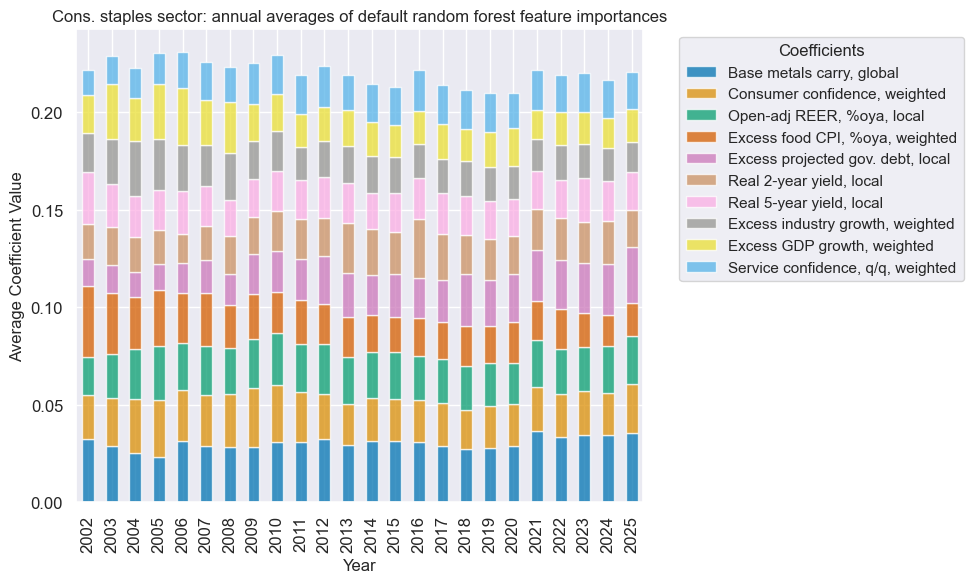

xcatx = cos_dict["signal_name"]

secname = cos_dict["sector_name"]

so_cos.coefs_stackedbarplot(

name=xcatx,

ftrs=list(cos_importances.columns[:10]),

ftrs_renamed=cat_label_dict,

title=f"{secname} sector: annual averages of default random forest feature importances",

)

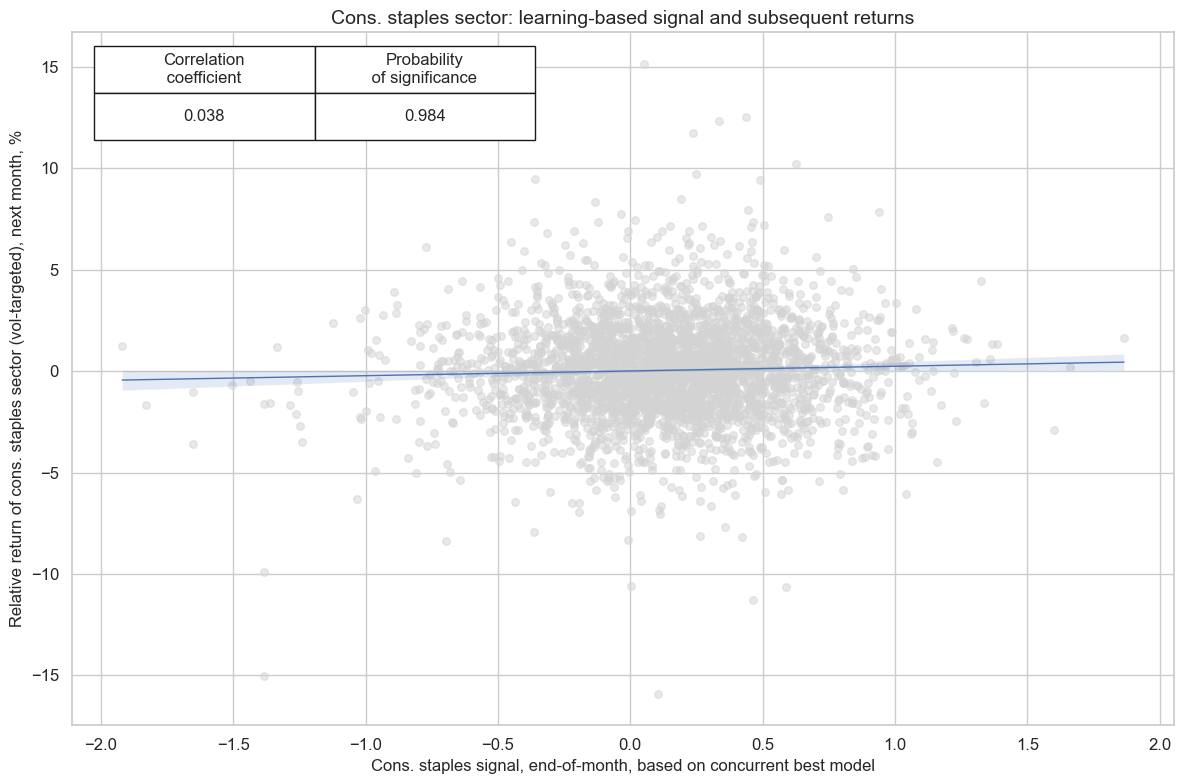

Signal quality check #

xcatx = [cos_dict["signal_name"], cos_dict["ret"]]

cidx = cos_dict["cidx"]

secname = cos_dict["sector_name"]

cr_cos = msp.CategoryRelations(

df=dfx,

xcats=xcatx,

cids=cidx,

freq=cos_dict["freq"],

blacklist=cos_dict["black"],

lag=1,

xcat_aggs=["last", "sum"],

slip=1,

)

cr_cos.reg_scatter(

title=f"{secname} sector: learning-based signal and subsequent returns",

labels=False,

prob_est="map",

xlab=f"{secname} signal, end-of-month, based on concurrent best model",

ylab=f"Relative return of {secname.lower()} sector (vol-targeted), next month, %",

coef_box="upper left",

size=(12, 8),

)

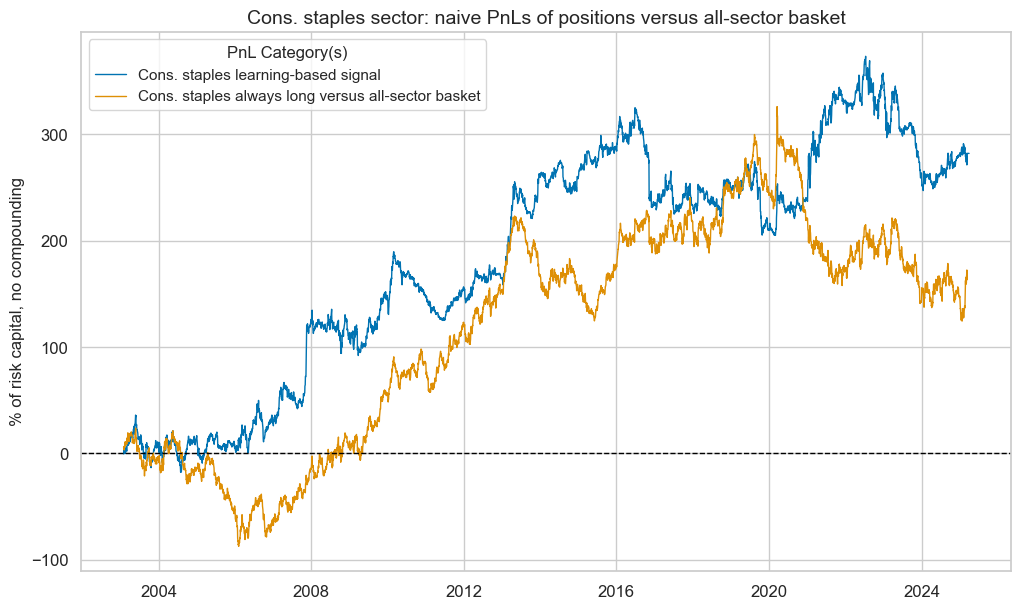

xcatx = [cos_dict["signal_name"]]

cidx = cos_dict["cidx"]

secname = cos_dict["sector_name"]

signal_name = cos_dict["signal_name"]

pnl_name = cos_dict["pnl_name"]

pnl_cos = msn.NaivePnL(

df=dfx,

ret=cos_dict["ret"],

sigs=xcatx,

cids=cidx,

start=default_start_date,

blacklist=cos_dict["black"],

bms=["USD_EQXR_NSA"],

)

for xcat in xcatx:

pnl_cos.make_pnl(

sig=xcat,

sig_op="zn_score_pan",

rebal_freq="monthly",

neutral="zero",

rebal_slip=1,

vol_scale=None,

thresh=2,

pnl_name=pnl_name,

)

pnl_cos.make_long_pnl(

vol_scale=None, label=f"{secname} always long versus all-sector basket"

)

pnl_cos.plot_pnls(

pnl_cats=pnl_cos.pnl_names,

title=f"{secname} sector: naive PnLs of positions versus all-sector basket",

title_fontsize=14,

)

cos_dict["pnls"] = pnl_cos

pnl_cos.evaluate_pnls(pnl_cats=pnl_cos.pnl_names)

| xcat | Cons. staples learning-based signal | Cons. staples always long versus all-sector basket |

|---|---|---|

| Return % | 12.729819 | 7.386778 |

| St. Dev. % | 37.829007 | 37.762289 |

| Sharpe Ratio | 0.336509 | 0.195613 |

| Sortino Ratio | 0.478747 | 0.281357 |

| Max 21-Day Draw % | -52.720556 | -33.681565 |

| Max 6-Month Draw % | -90.375119 | -93.828486 |

| Peak to Trough Draw % | -126.18286 | -201.569822 |

| Top 5% Monthly PnL Share | 1.438746 | 2.354328 |

| USD_EQXR_NSA correl | -0.064439 | -0.138678 |

| Traded Months | 267 | 267 |

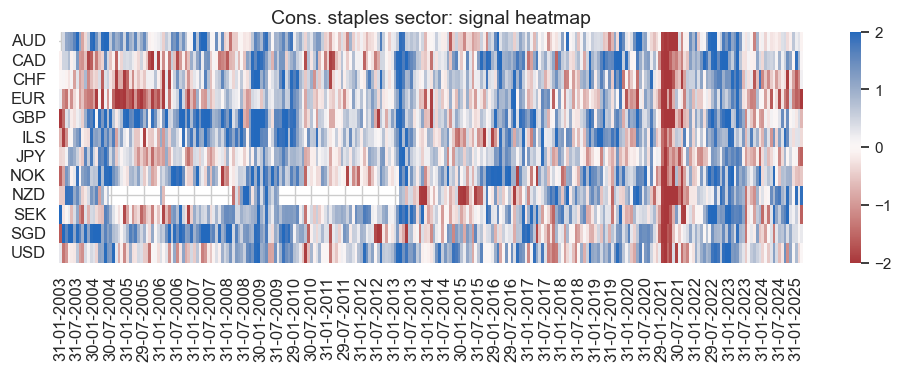

pnl_name = cos_dict["pnl_name"]

secname = cos_dict["sector_name"]

pnl_cos.signal_heatmap(

pnl_name=pnl_name,

figsize=(12, 3),

title=f"{secname} sector: signal heatmap",

)

Healthcare #

Factor selection and signal generation #

sector = "HLC"

hlc_dict = {

"sector_name": sector_labels[sector],

"signal_name": f"{sector}SOL",

"pnl_name": f"{sector_labels[sector]} learning-based signal",

"xcatx": macroz,

"cidx": cids_eq,

"ret": f"EQC{sector}{default_target_type}",

"freq": "M",

"black": sector_blacklist[sector],

"srr": None,

"pnls": None,

}

xcatx = hlc_dict["xcatx"] + [hlc_dict["ret"]]

cidx = hlc_dict["cidx"]

so_hlc = msl.SignalOptimizer(

df=dfx,

xcats=xcatx,

cids=cidx,

blacklist=hlc_dict["black"],

freq=hlc_dict["freq"],

lag=1,

xcat_aggs=["last", "sum"],

)

secname = hlc_dict["sector_name"]

signal_name = hlc_dict["signal_name"]

so_hlc.calculate_predictions(

name=signal_name,

models=default_models,

scorers=default_metric,

hyperparameters=default_hparam_grid,

inner_splitters=default_splitter,

test_size=default_test_size,

min_cids=default_min_cids,

min_periods=default_min_periods,

n_jobs_outer=-1,

split_functions=default_split_functions,

)

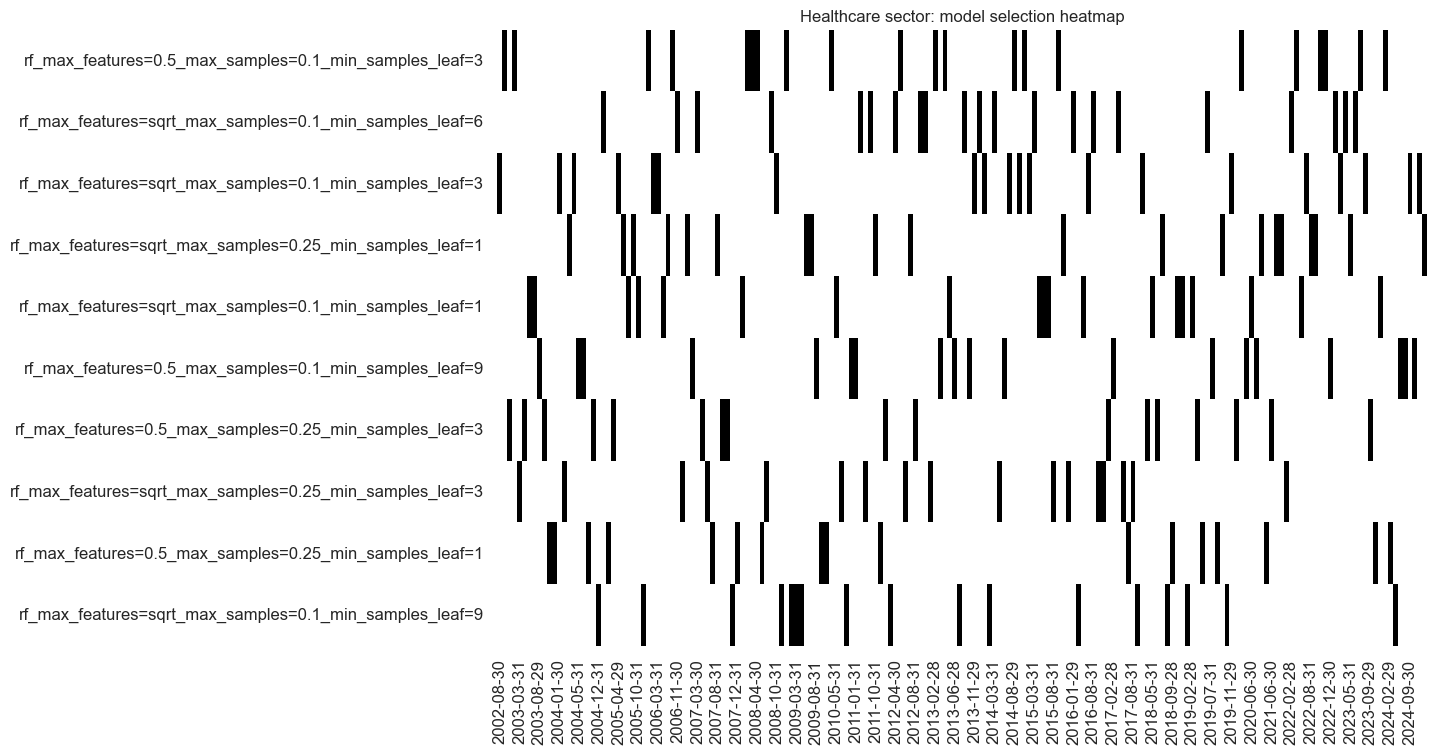

so_hlc.models_heatmap(

signal_name,

cap=10,

title=f"{secname} sector: model selection heatmap",

)

# Store signals

dfa = so_hlc.get_optimized_signals()

dfx = msm.update_df(dfx, dfa)

hlc_importances = (

so_hlc.feature_importances.describe()

.iloc[:, 1:]

.sort_values(by="mean", axis=1, ascending=False)

)

hlc_importances

| BMLCOCRY_SAVT10_21DMA_ZN | XRWAGES_NSA_P1M1ML12_ZN | REFIXINVCSCORE_SA_ZN | XCPIC_SA_P1M1ML12_ZN | XGGDGDPRATIOX10_NSA_ZN | BMLXINVCSCORE_SA_ZN | REEROADJ_NSA_P1M12ML1_ZN | XCPIF_SA_P1M1ML12_WG_ZN | INTLIQGDP_NSA_D1M1ML6_ZN | XCSTR_SA_P1M1ML12_3MMA_ZN | ... | XPCREDITBN_SJA_P1M1ML12_WG_ZN | XRGDPTECH_SA_P1M1ML12_3MMA_ZN | XEMPL_NSA_P1M1ML12_3MMA_ZN | UNEMPLRATE_NSA_3MMA_D1M1ML12_WG_ZN | UNEMPLRATE_SA_3MMAv5YMA_WG_ZN | XEMPL_NSA_P1M1ML12_3MMA_WG_ZN | XIP_SA_P1M1ML12_3MMA_ZN | RYLDIRS02Y_NSA_ZN | XRGDPTECH_SA_P1M1ML12_3MMA_WG_ZN | INTLIQGDP_NSA_D1M1ML1_ZN | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | ... | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 |

| mean | 0.028836 | 0.022154 | 0.021328 | 0.021144 | 0.021050 | 0.019896 | 0.019867 | 0.019775 | 0.019761 | 0.019534 | ... | 0.015664 | 0.015538 | 0.015405 | 0.015398 | 0.015327 | 0.015251 | 0.015046 | 0.015034 | 0.014766 | 0.012400 |

| min | 0.010444 | 0.011627 | 0.000000 | 0.001824 | 0.005830 | 0.005647 | 0.006950 | 0.010341 | 0.006135 | 0.010893 | ... | 0.004780 | 0.003910 | 0.003051 | 0.004595 | 0.002467 | 0.006907 | 0.007852 | 0.002245 | 0.005999 | 0.000000 |

| 25% | 0.023714 | 0.019355 | 0.017098 | 0.018512 | 0.018416 | 0.016864 | 0.017720 | 0.017549 | 0.014760 | 0.017126 | ... | 0.013829 | 0.013552 | 0.013630 | 0.013150 | 0.013432 | 0.013427 | 0.013374 | 0.012737 | 0.013133 | 0.010878 |

| 50% | 0.026868 | 0.021686 | 0.021552 | 0.020574 | 0.020974 | 0.020205 | 0.019845 | 0.019464 | 0.017453 | 0.019279 | ... | 0.015973 | 0.015623 | 0.015585 | 0.014772 | 0.015331 | 0.015048 | 0.015252 | 0.015094 | 0.014687 | 0.012463 |

| 75% | 0.031702 | 0.023954 | 0.024864 | 0.023787 | 0.023622 | 0.023262 | 0.021969 | 0.021538 | 0.023129 | 0.021409 | ... | 0.017566 | 0.017730 | 0.017440 | 0.017121 | 0.017098 | 0.016843 | 0.016846 | 0.017051 | 0.016350 | 0.013980 |

| max | 0.069668 | 0.051637 | 0.038789 | 0.034993 | 0.035036 | 0.031932 | 0.030898 | 0.039004 | 0.057846 | 0.040786 | ... | 0.028892 | 0.028128 | 0.024407 | 0.035665 | 0.026220 | 0.035937 | 0.029368 | 0.027214 | 0.034353 | 0.026342 |

| std | 0.008301 | 0.004621 | 0.006325 | 0.004370 | 0.004210 | 0.005067 | 0.003405 | 0.003782 | 0.007294 | 0.004089 | ... | 0.003141 | 0.003377 | 0.003157 | 0.003827 | 0.003025 | 0.003296 | 0.002820 | 0.003448 | 0.003034 | 0.002887 |

8 rows × 56 columns

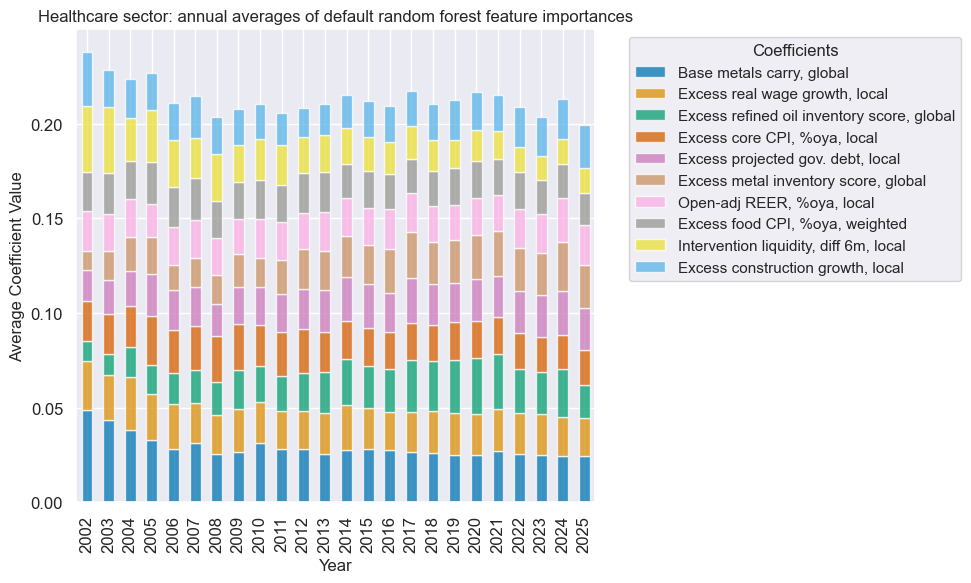

xcatx = hlc_dict["signal_name"]

secname = hlc_dict["sector_name"]

so_hlc.coefs_stackedbarplot(

name=xcatx,

ftrs=list(hlc_importances.columns[:10]),

ftrs_renamed=cat_label_dict,

title=f"{secname} sector: annual averages of default random forest feature importances",

)

Signal quality check #

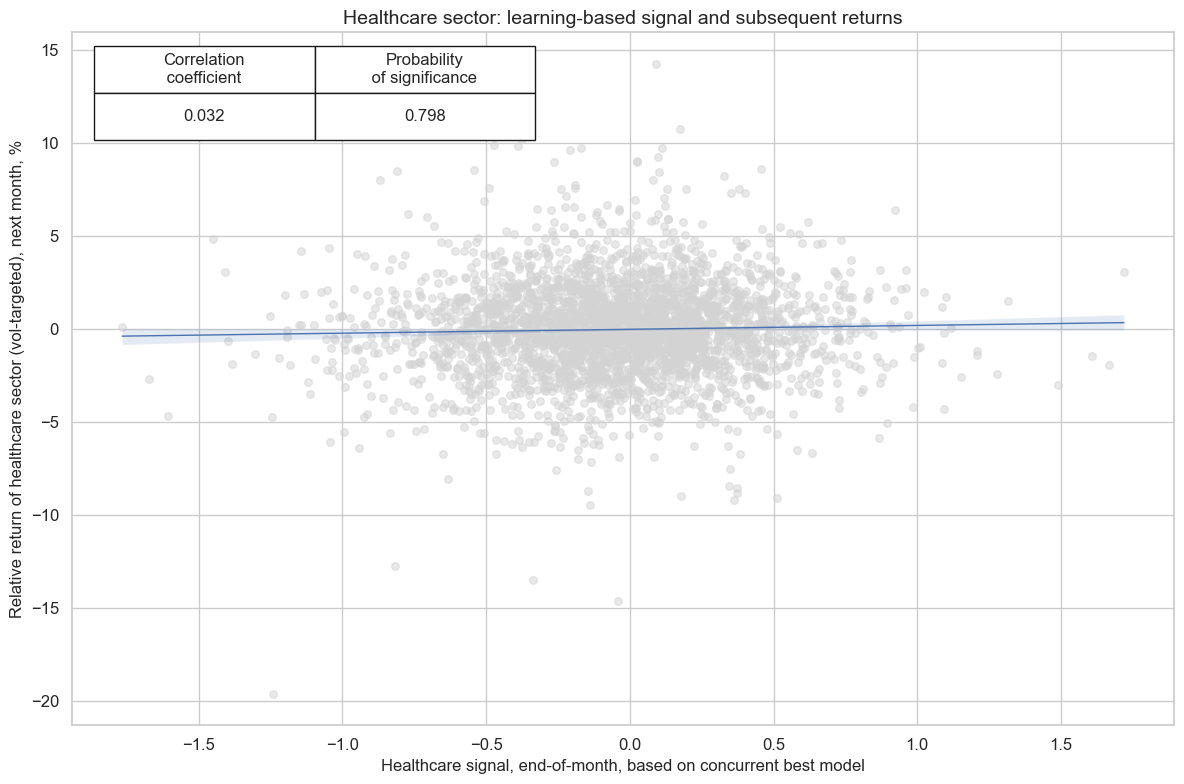

xcatx = [hlc_dict["signal_name"], hlc_dict["ret"]]

cidx = hlc_dict["cidx"]

secname = hlc_dict["sector_name"]

cr_hlc = msp.CategoryRelations(

df=dfx,

xcats=xcatx,

cids=cidx,

freq=hlc_dict["freq"],

blacklist=hlc_dict["black"],

lag=1,

xcat_aggs=["last", "sum"],

slip=1,

)

cr_hlc.reg_scatter(

title=f"{secname} sector: learning-based signal and subsequent returns",

labels=False,

prob_est="map",

xlab=f"{secname} signal, end-of-month, based on concurrent best model",

ylab=f"Relative return of {secname.lower()} sector (vol-targeted), next month, %",

coef_box="upper left",

size=(12, 8),

)

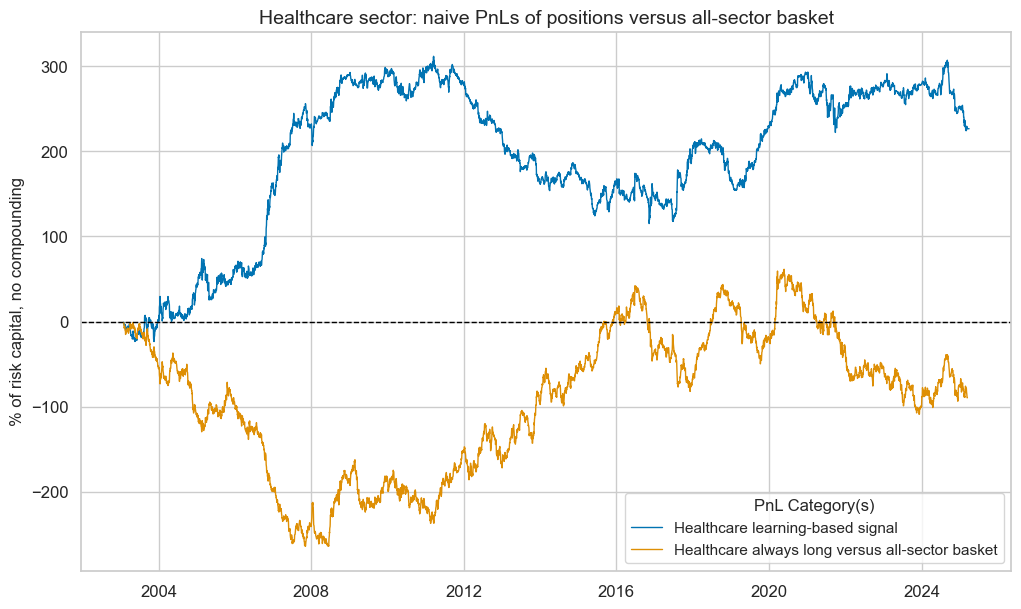

xcatx = [hlc_dict["signal_name"]]

cidx = hlc_dict["cidx"]

secname = hlc_dict["sector_name"]

signal_name = hlc_dict["signal_name"]

pnl_name = hlc_dict["pnl_name"]

pnl_hlc = msn.NaivePnL(

df=dfx,

ret=hlc_dict["ret"],

sigs=xcatx,

cids=cidx,

start=default_start_date,

blacklist=hlc_dict["black"],

bms=["USD_EQXR_NSA"],

)

for xcat in xcatx:

pnl_hlc.make_pnl(

sig=xcat,

sig_op="zn_score_pan",

rebal_freq="monthly",

neutral="zero",

rebal_slip=1,

vol_scale=None,

thresh=2,

pnl_name=pnl_name,

)

pnl_hlc.make_long_pnl(

vol_scale=None, label=f"{secname} always long versus all-sector basket"

)

pnl_hlc.plot_pnls(

pnl_cats=pnl_hlc.pnl_names,

title=f"{secname} sector: naive PnLs of positions versus all-sector basket",

title_fontsize=14,

)

hlc_dict["pnls"] = pnl_hlc

pnl_hlc.evaluate_pnls(pnl_cats=pnl_hlc.pnl_names)

| xcat | Healthcare learning-based signal | Healthcare always long versus all-sector basket |

|---|---|---|

| Return % | 10.222537 | -4.044239 |

| St. Dev. % | 36.745511 | 38.50816 |

| Sharpe Ratio | 0.278198 | -0.105023 |

| Sortino Ratio | 0.398907 | -0.150517 |

| Max 21-Day Draw % | -40.391137 | -47.409795 |

| Max 6-Month Draw % | -82.460974 | -93.207315 |

| Peak to Trough Draw % | -196.363809 | -262.724098 |

| Top 5% Monthly PnL Share | 1.461796 | -4.156891 |

| USD_EQXR_NSA correl | 0.025846 | -0.159044 |

| Traded Months | 267 | 267 |

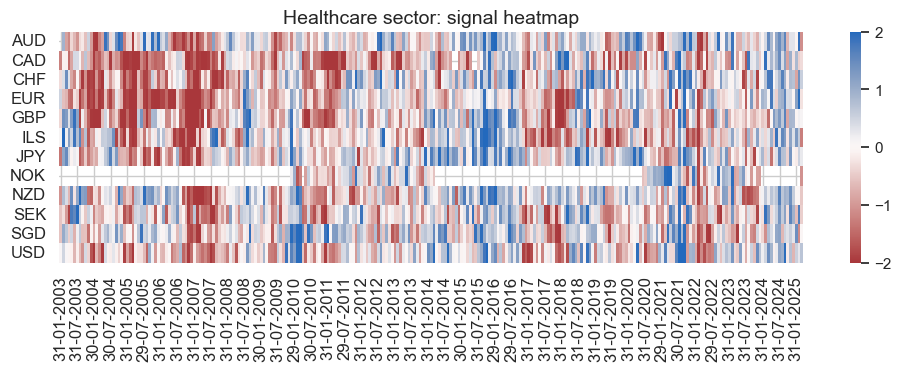

pnl_name = hlc_dict["pnl_name"]

secname = hlc_dict["sector_name"]

pnl_hlc.signal_heatmap(

pnl_name=pnl_name,

figsize=(12, 3),

title=f"{secname} sector: signal heatmap",

)

Financials #

Factor selection and signal generation #

sector = "FIN"

fin_dict = {

"sector_name": sector_labels[sector],

"signal_name": f"{sector}SOL",

"pnl_name": f"{sector_labels[sector]} learning-based signal",

"xcatx": macroz,

"cidx": cids_eq,

"ret": f"EQC{sector}{default_target_type}",

"freq": "M",

"black": sector_blacklist[sector],

"srr": None,

"pnls": None,

}

xcatx = fin_dict["xcatx"] + [fin_dict["ret"]]

cidx = fin_dict["cidx"]

so_fin = msl.SignalOptimizer(

df=dfx,

xcats=xcatx,

cids=cidx,

blacklist=fin_dict["black"],

freq=fin_dict["freq"],

lag=1,

xcat_aggs=["last", "sum"],

)

secname = fin_dict["sector_name"]

signal_name = fin_dict["signal_name"]

so_fin.calculate_predictions(

name=signal_name,

models=default_models,

scorers=default_metric,

hyperparameters=default_hparam_grid,

inner_splitters=default_splitter,

test_size=default_test_size,

min_cids=default_min_cids,

min_periods=default_min_periods,

n_jobs_outer=-1,

split_functions=default_split_functions,

)

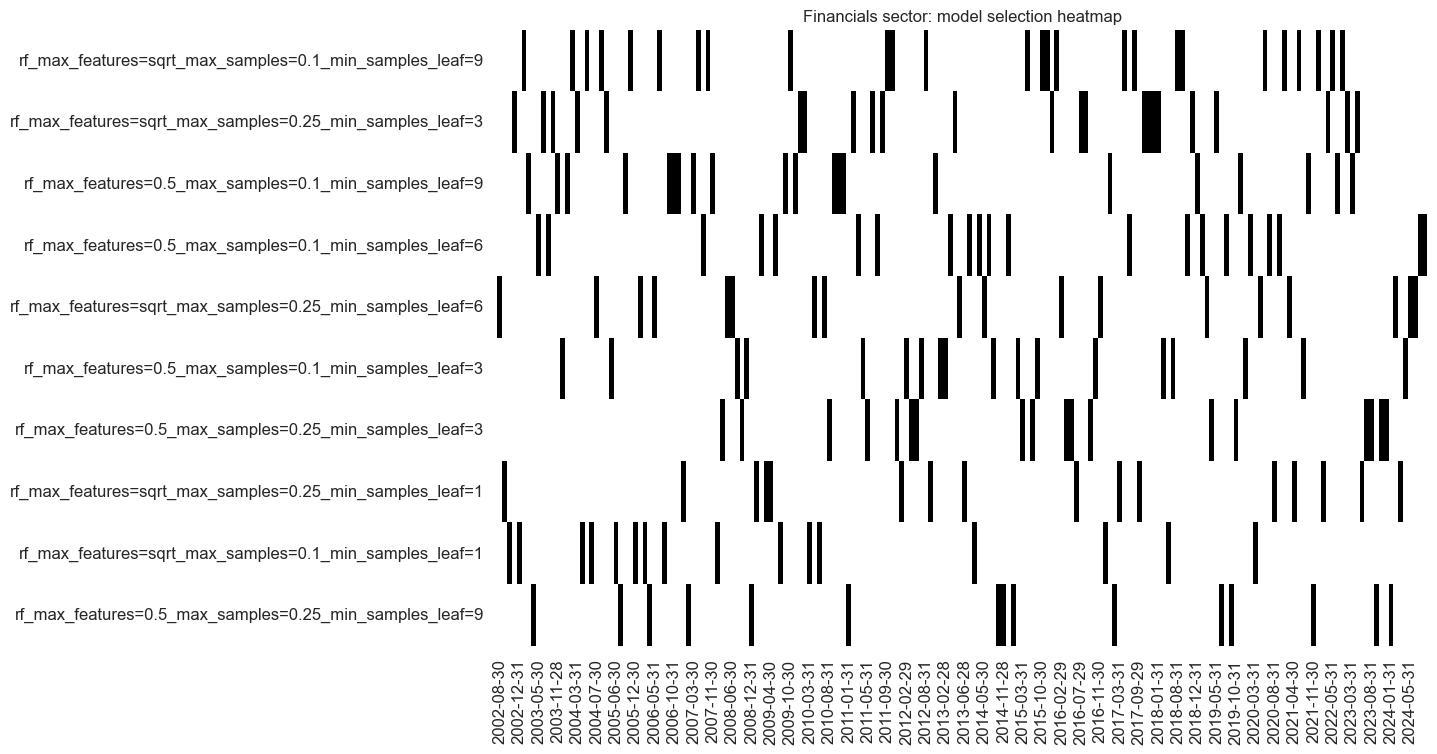

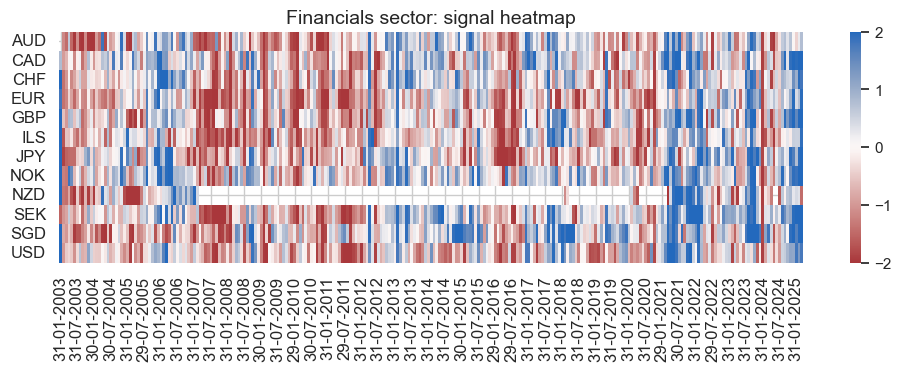

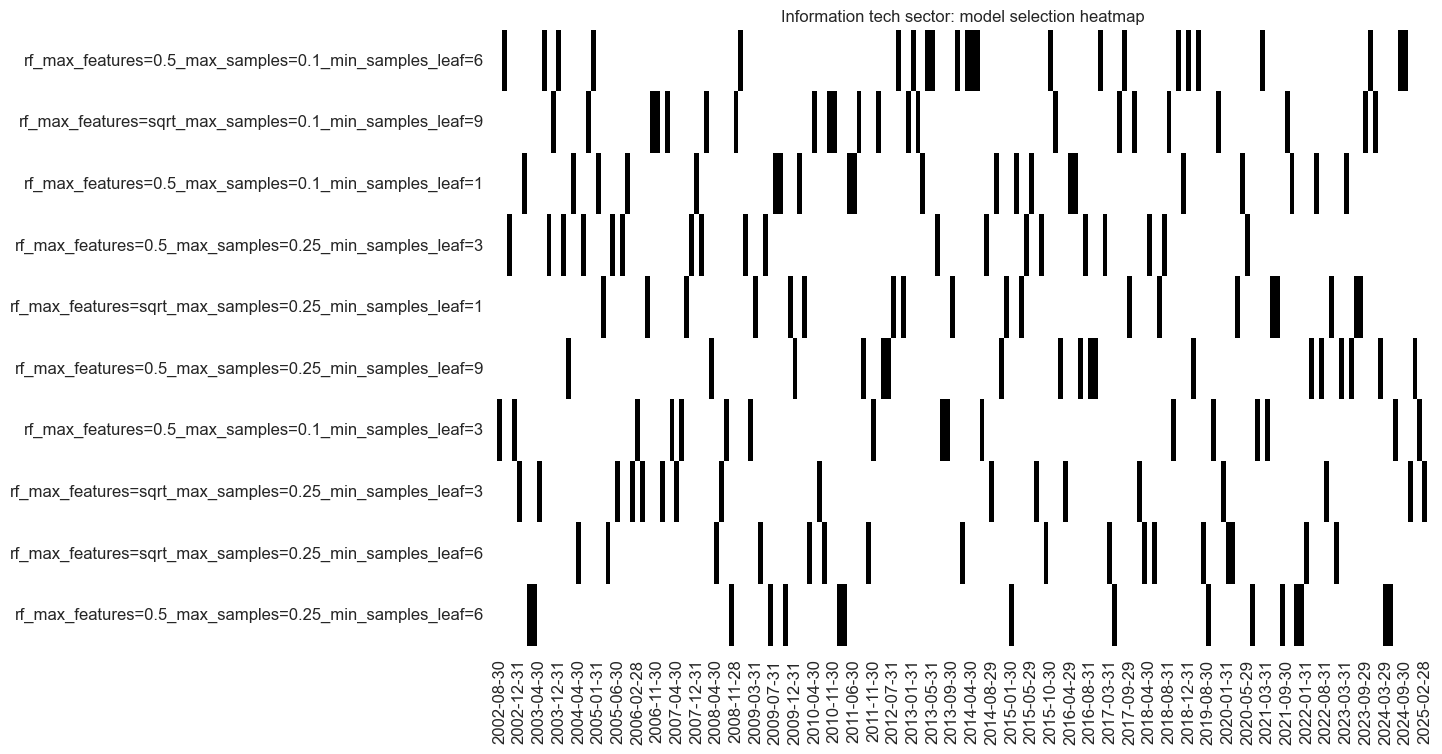

so_fin.models_heatmap(

signal_name,

cap=10,

title=f"{secname} sector: model selection heatmap",

)

# Store signals

dfa = so_fin.get_optimized_signals()

dfx = msm.update_df(dfx, dfa)

fin_importances = (

so_fin.feature_importances.describe()

.iloc[:, 1:]

.sort_values(by="mean", axis=1, ascending=False)

)

fin_importances

| BMLCOCRY_SAVT10_21DMA_ZN | XGGDGDPRATIOX10_NSA_ZN | REEROADJ_NSA_P1M12ML1_ZN | REFIXINVCSCORE_SA_ZN | CCSCORE_SA_ZN | XNRSALES_SA_P1M1ML12_3MMA_ZN | CXPI_NSA_P1M12ML1_ZN | XRRSALES_SA_P1M1ML12_3MMA_WG_ZN | XCPIC_SA_P1M1ML12_ZN | RYLDIRS05Y_NSA_ZN | ... | XRPCONS_SA_P1M1ML12_3MMA_ZN | UNEMPLRATE_SA_3MMAv5YMA_WG_ZN | RIR_NSA_ZN | XRGDPTECH_SA_P1M1ML12_3MMA_ZN | UNEMPLRATE_NSA_3MMA_D1M1ML12_WG_ZN | XEMPL_NSA_P1M1ML12_3MMA_WG_ZN | XPCREDITBN_SJA_P1M1ML12_WG_ZN | XEMPL_NSA_P1M1ML12_3MMA_ZN | INTLIQGDP_NSA_D1M1ML1_ZN | XRGDPTECH_SA_P1M1ML12_3MMA_WG_ZN | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | ... | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 | 271.000000 |

| mean | 0.033372 | 0.025287 | 0.023579 | 0.023166 | 0.021470 | 0.021100 | 0.020746 | 0.020217 | 0.020046 | 0.019836 | ... | 0.015416 | 0.015063 | 0.015060 | 0.015057 | 0.014955 | 0.014866 | 0.014655 | 0.014585 | 0.014475 | 0.013548 |

| min | 0.010865 | 0.004436 | 0.009034 | 0.003472 | 0.005645 | 0.006083 | 0.006847 | 0.005977 | 0.000000 | 0.005035 | ... | 0.004102 | 0.002416 | 0.004604 | 0.003904 | 0.000000 | 0.000000 | 0.003381 | 0.003631 | 0.000000 | 0.001632 |

| 25% | 0.027656 | 0.021381 | 0.019419 | 0.017802 | 0.018313 | 0.018005 | 0.018185 | 0.017301 | 0.017408 | 0.016759 | ... | 0.013452 | 0.013413 | 0.012890 | 0.013293 | 0.012199 | 0.013143 | 0.013017 | 0.012837 | 0.012398 | 0.011708 |

| 50% | 0.031273 | 0.023962 | 0.021537 | 0.023353 | 0.021124 | 0.020685 | 0.020399 | 0.019593 | 0.019095 | 0.019420 | ... | 0.015217 | 0.015100 | 0.015275 | 0.014994 | 0.014086 | 0.014942 | 0.014668 | 0.014678 | 0.014073 | 0.013921 |

| 75% | 0.037369 | 0.027731 | 0.025729 | 0.027977 | 0.024535 | 0.023980 | 0.023038 | 0.022346 | 0.021670 | 0.022126 | ... | 0.017081 | 0.016805 | 0.017201 | 0.016782 | 0.017015 | 0.017023 | 0.016298 | 0.016837 | 0.016570 | 0.015091 |

| max | 0.077338 | 0.055350 | 0.060381 | 0.038759 | 0.036812 | 0.043096 | 0.037422 | 0.060037 | 0.037514 | 0.045437 | ... | 0.036349 | 0.025588 | 0.026185 | 0.030416 | 0.039819 | 0.030730 | 0.025728 | 0.022955 | 0.030388 | 0.029012 |

| std | 0.009122 | 0.006131 | 0.007212 | 0.007033 | 0.005216 | 0.004871 | 0.004253 | 0.004962 | 0.004339 | 0.005024 | ... | 0.003325 | 0.003413 | 0.003587 | 0.003272 | 0.004550 | 0.003251 | 0.003280 | 0.003126 | 0.003767 | 0.003065 |

8 rows × 56 columns

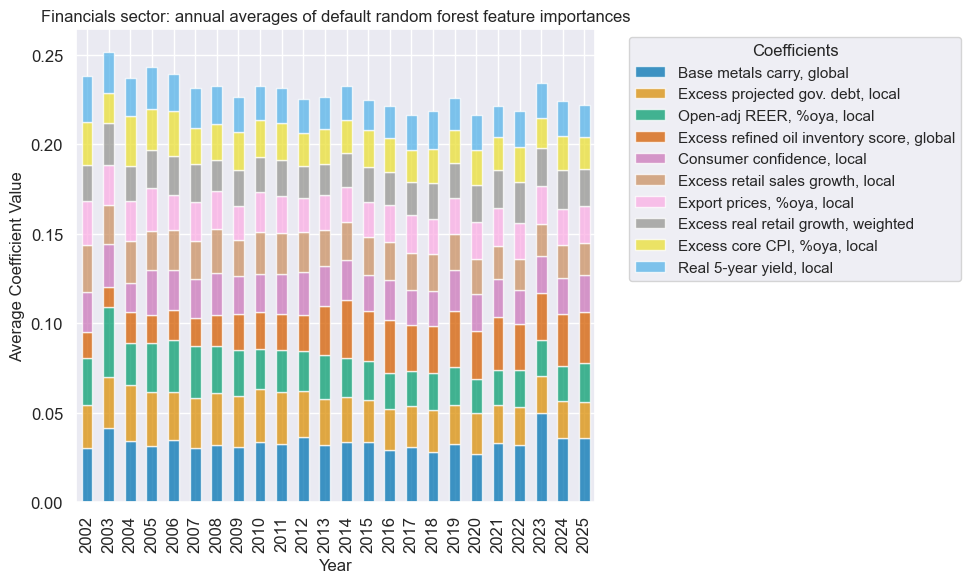

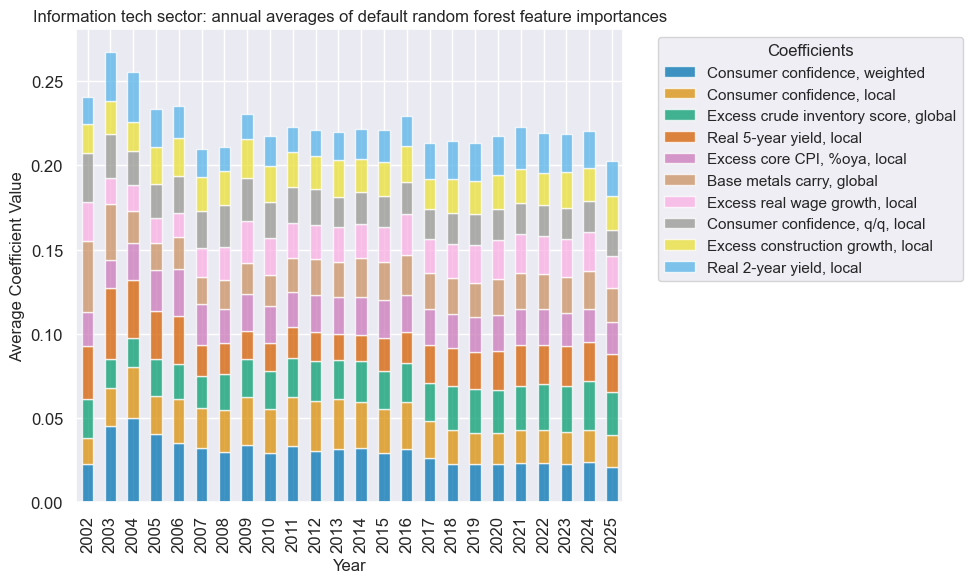

xcatx = fin_dict["signal_name"]

secname = fin_dict["sector_name"]

so_fin.coefs_stackedbarplot(

name=xcatx,

ftrs=list(fin_importances.columns[:10]),

ftrs_renamed=cat_label_dict,

title=f"{secname} sector: annual averages of default random forest feature importances",

)

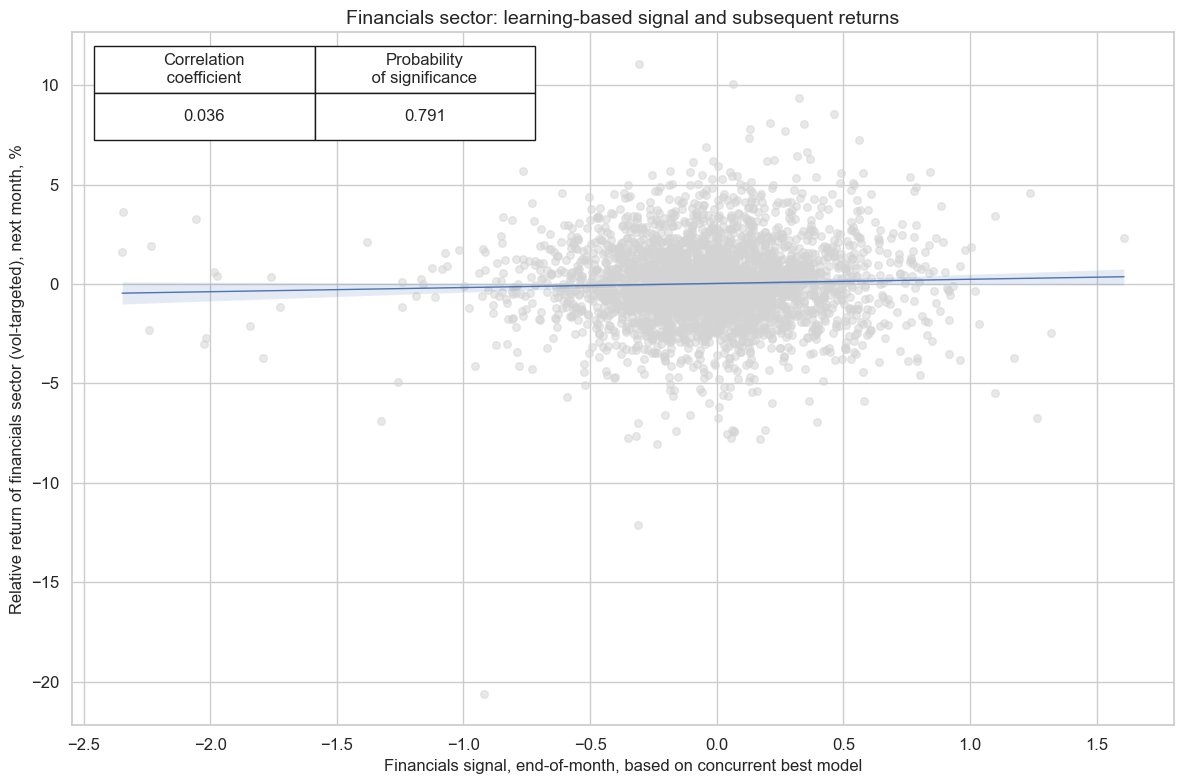

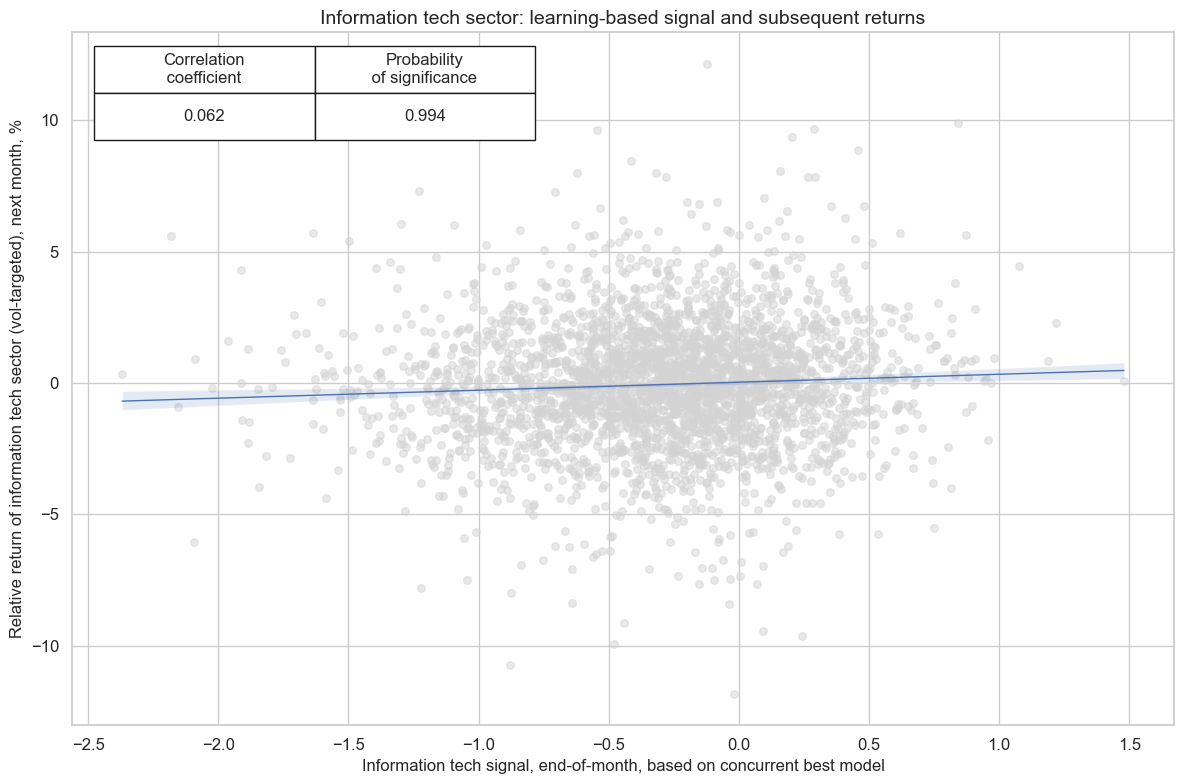

Signal quality check #

xcatx = [fin_dict["signal_name"], fin_dict["ret"]]

cidx = fin_dict["cidx"]

secname = fin_dict["sector_name"]

cr_fin = msp.CategoryRelations(

df=dfx,

xcats=xcatx,

cids=cidx,

freq=fin_dict["freq"],

blacklist=fin_dict["black"],

lag=1,

xcat_aggs=["last", "sum"],

slip=1,

)

cr_fin.reg_scatter(

title=f"{secname} sector: learning-based signal and subsequent returns",

labels=False,

prob_est="map",

xlab=f"{secname} signal, end-of-month, based on concurrent best model",

ylab=f"Relative return of {secname.lower()} sector (vol-targeted), next month, %",

coef_box="upper left",

size=(12, 8),

)

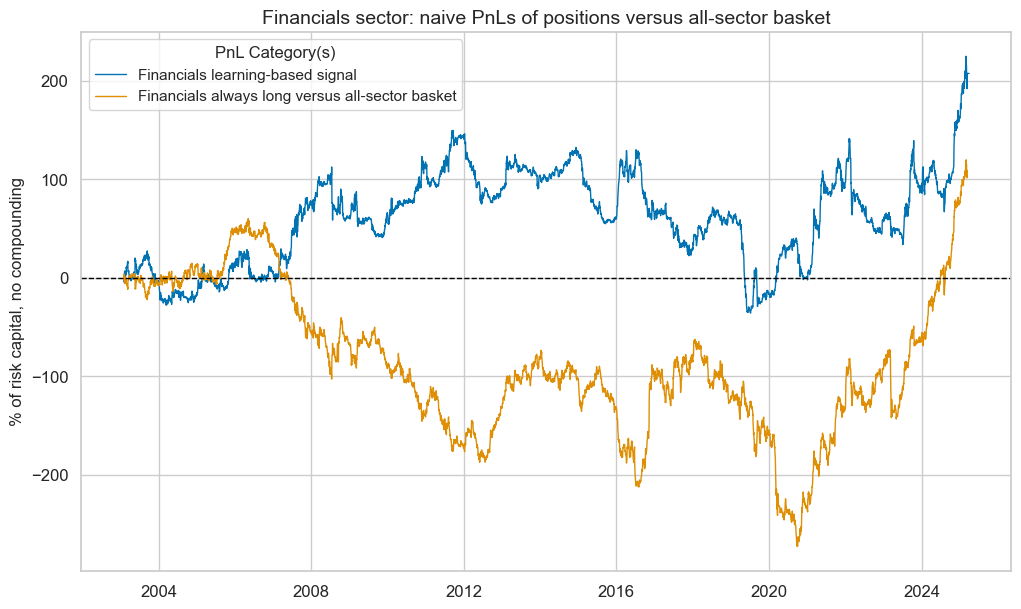

xcatx = [fin_dict["signal_name"]]

cidx = fin_dict["cidx"]

secname = fin_dict["sector_name"]

signal_name = fin_dict["signal_name"]

pnl_name = fin_dict["pnl_name"]

pnl_fin = msn.NaivePnL(

df=dfx,

ret=fin_dict["ret"],

sigs=xcatx,

cids=cidx,

start=default_start_date,

blacklist=fin_dict["black"],

bms=["USD_EQXR_NSA"],

)

for xcat in xcatx:

pnl_fin.make_pnl(

sig=xcat,

sig_op="zn_score_pan",

rebal_freq="monthly",

neutral="zero",

rebal_slip=1,

vol_scale=None,

thresh=2,

pnl_name=pnl_name,

)

pnl_fin.make_long_pnl(

vol_scale=None, label=f"{secname} always long versus all-sector basket"

)

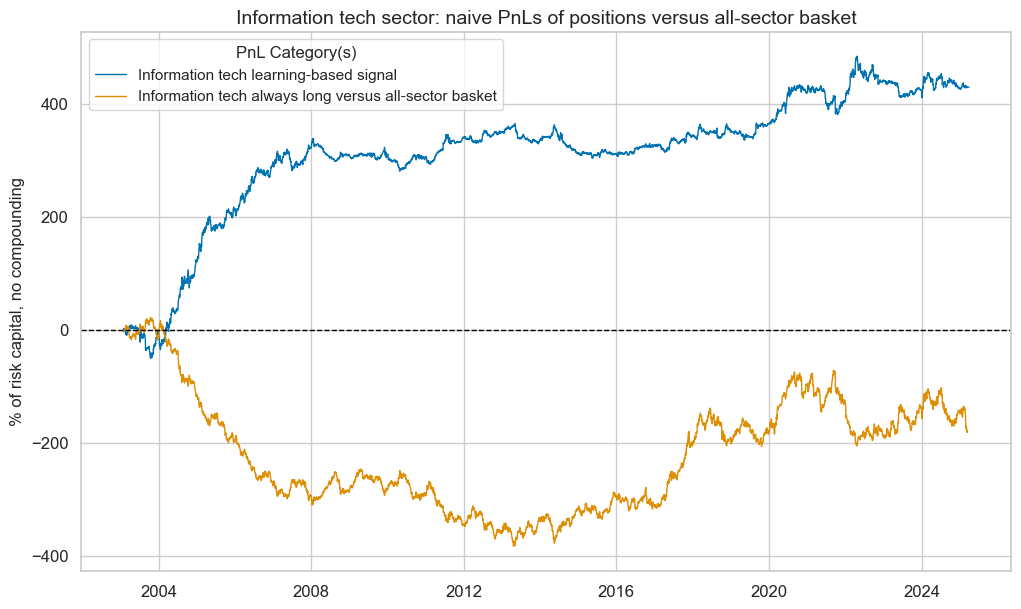

pnl_fin.plot_pnls(

pnl_cats=pnl_fin.pnl_names,

title=f"{secname} sector: naive PnLs of positions versus all-sector basket",

title_fontsize=14,

)

fin_dict["pnls"] = pnl_fin

pnl_fin.evaluate_pnls(pnl_cats=pnl_fin.pnl_names)

| xcat | Financials learning-based signal | Financials always long versus all-sector basket |

|---|---|---|

| Return % | 9.365027 | 4.921724 |

| St. Dev. % | 37.156358 | 38.288158 |

| Sharpe Ratio | 0.252044 | 0.128544 |

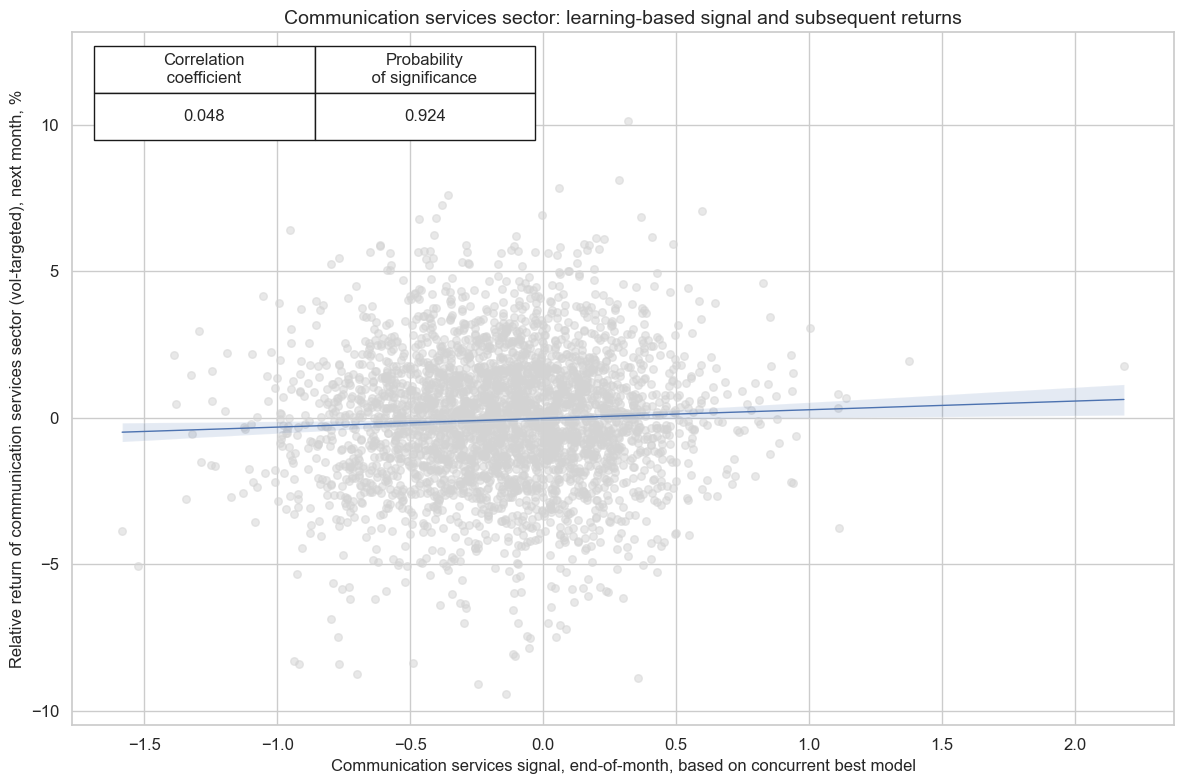

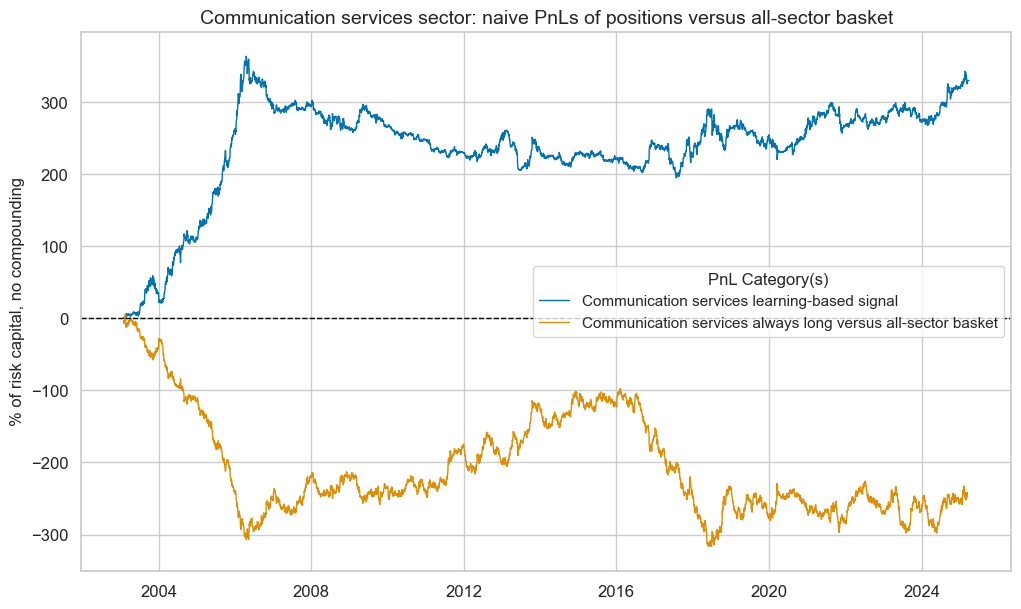

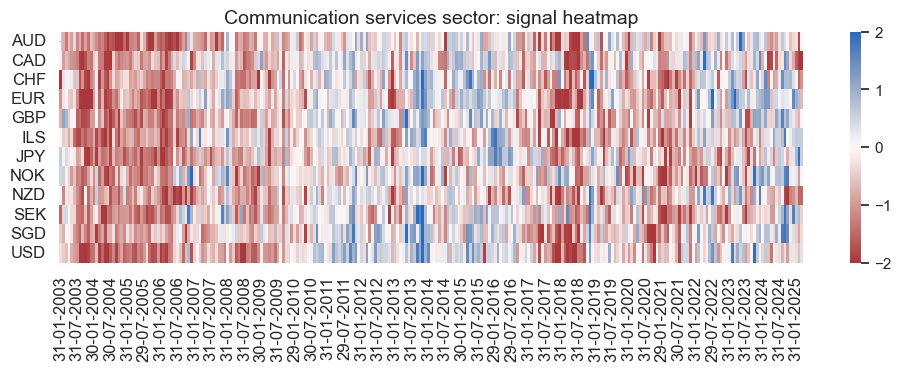

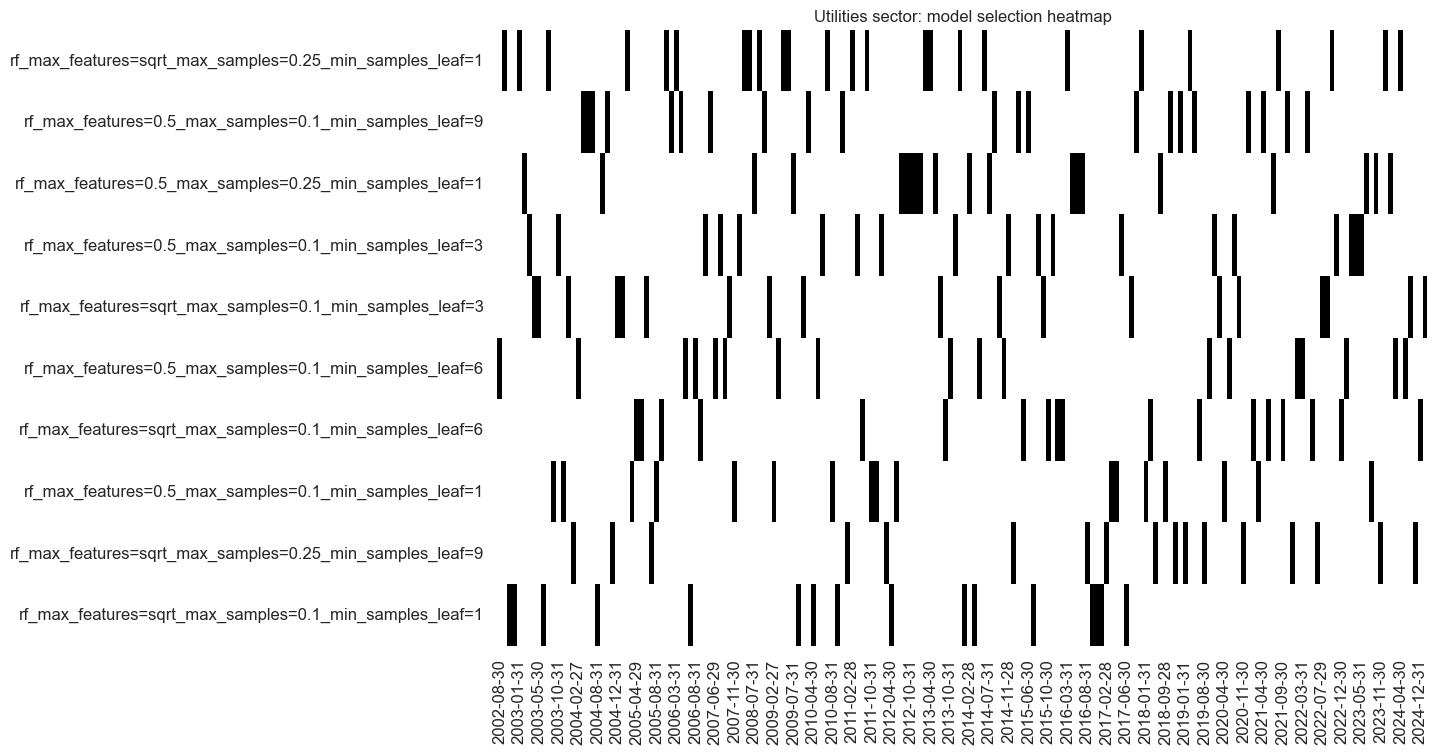

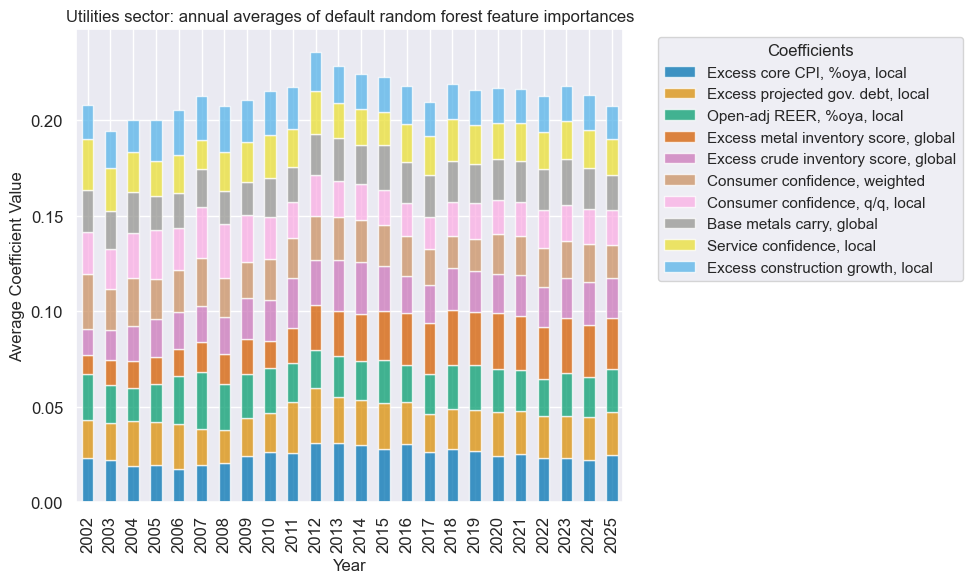

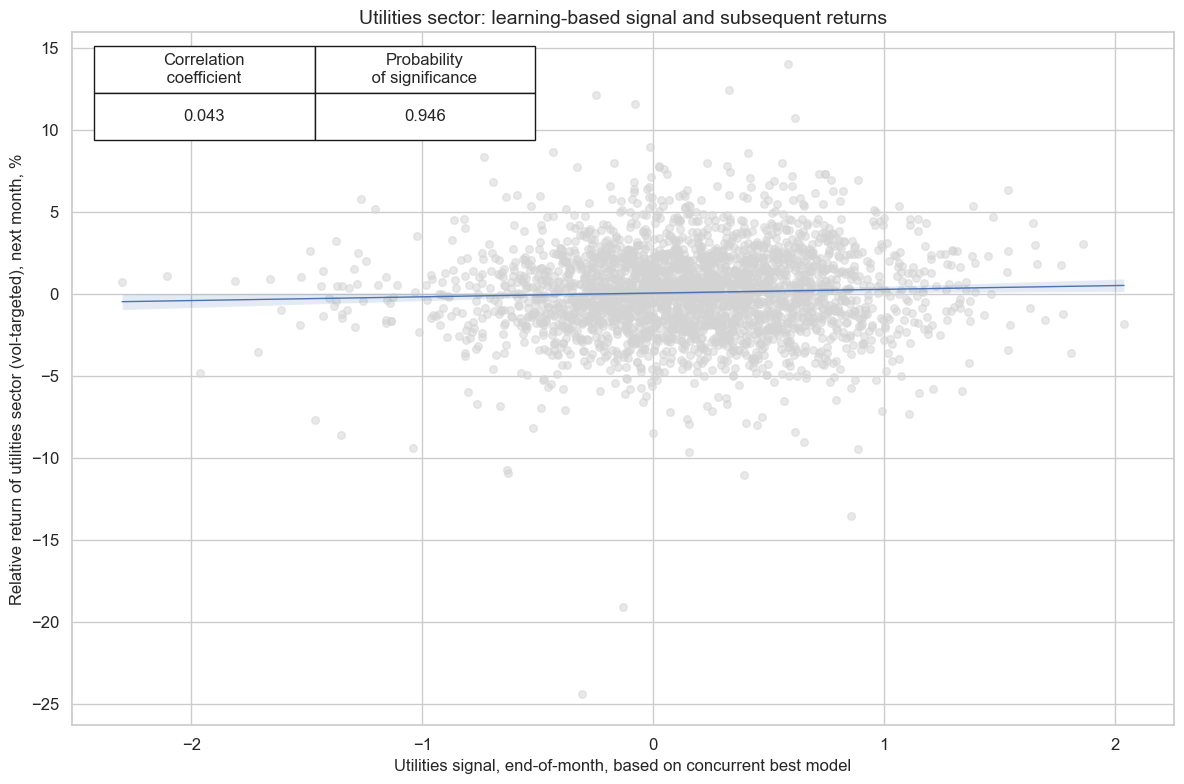

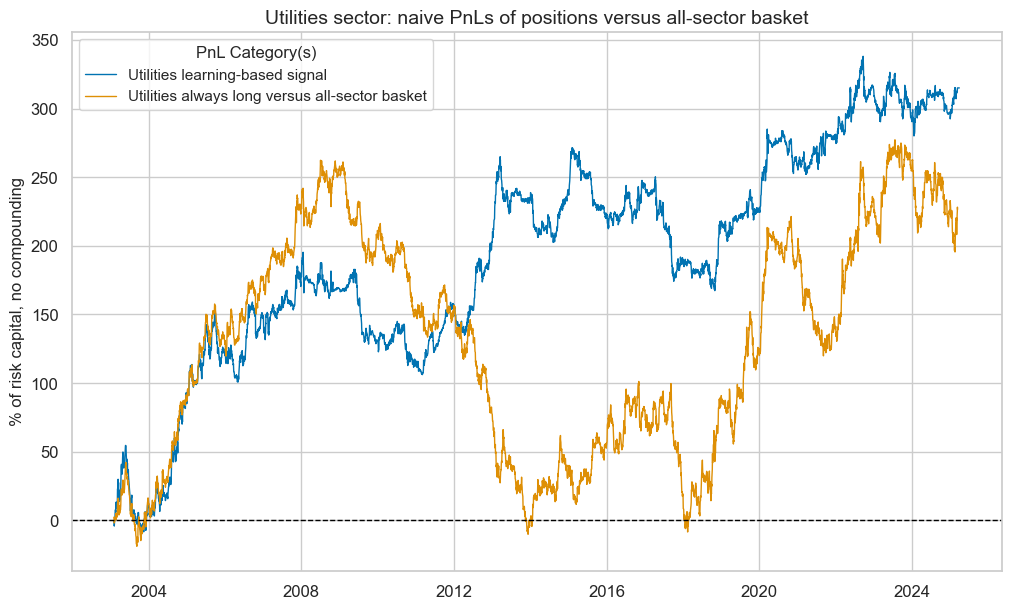

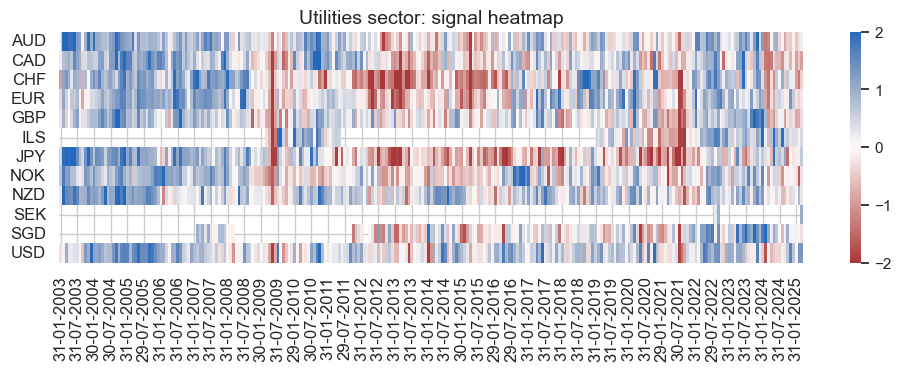

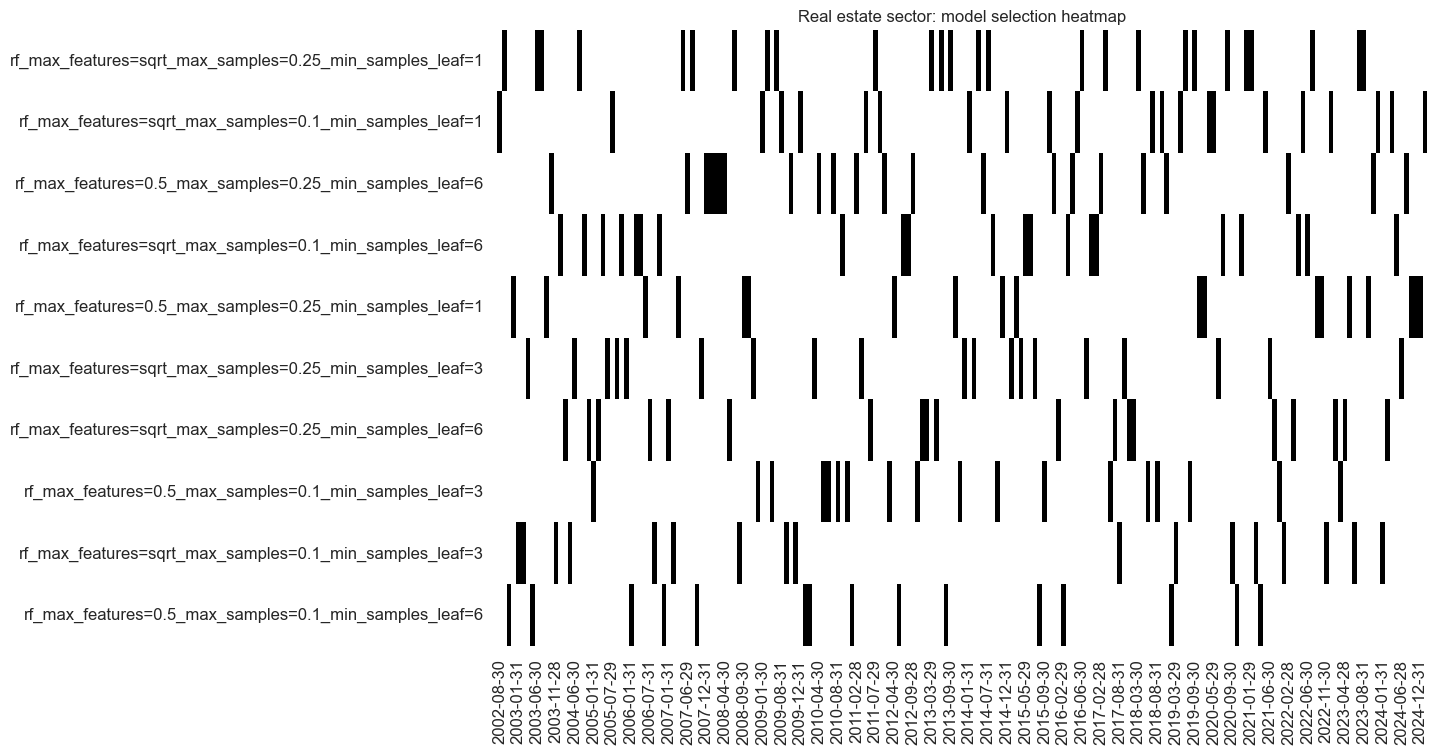

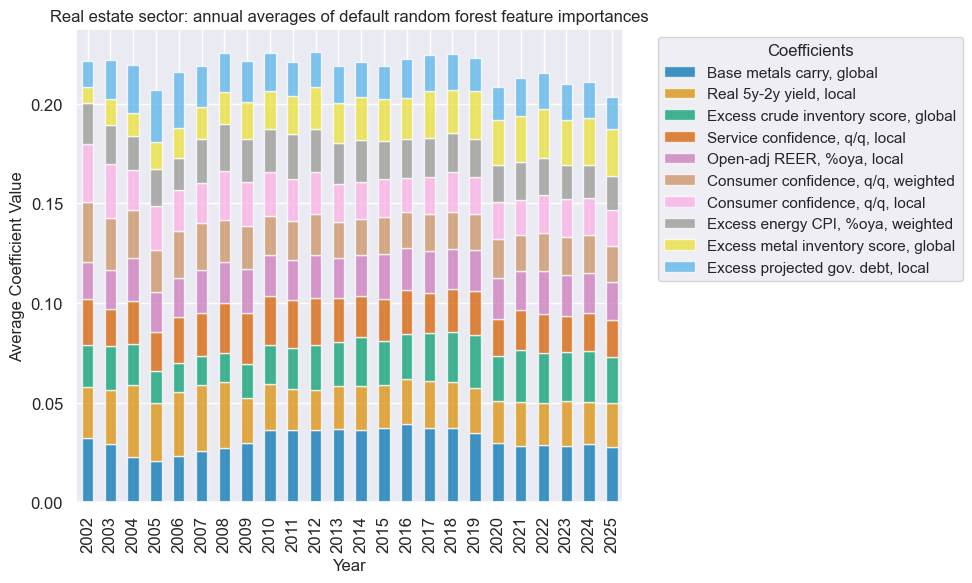

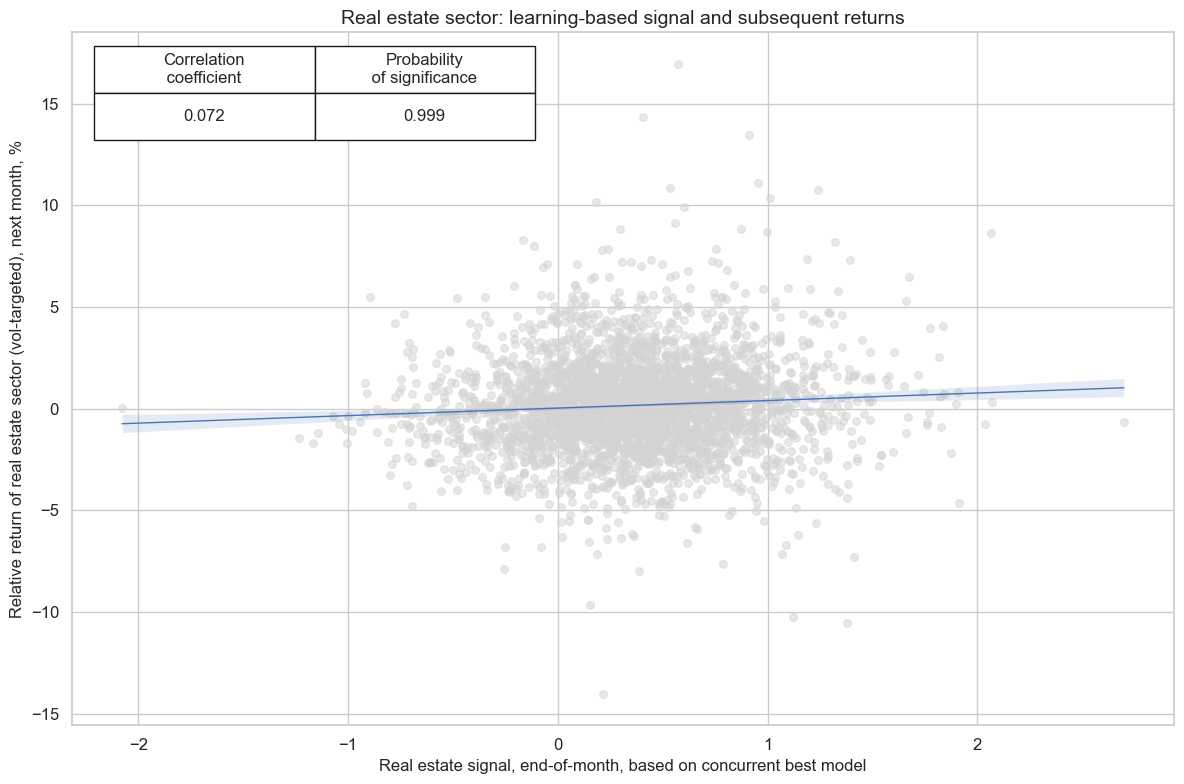

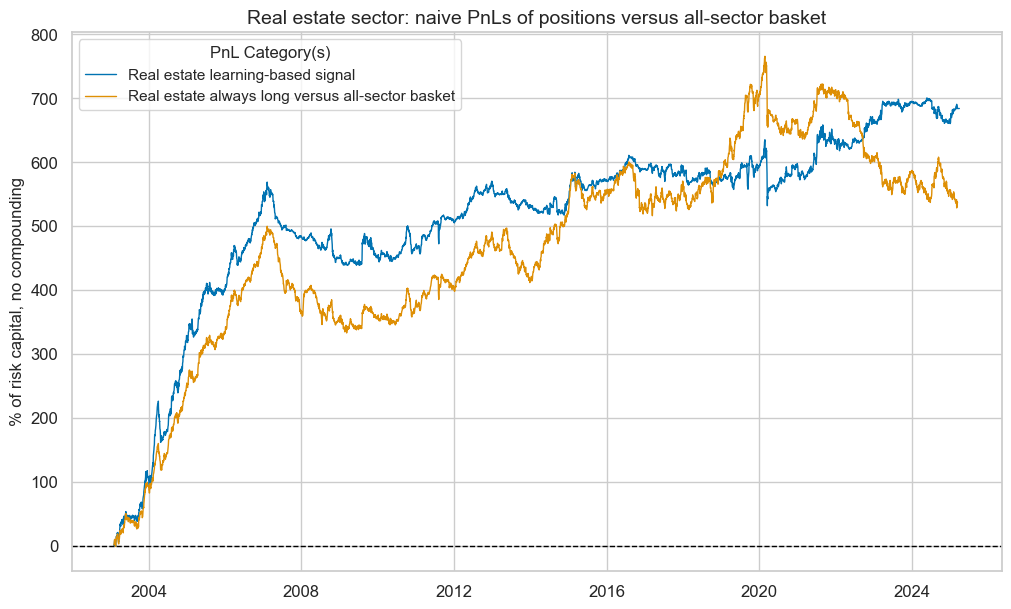

| Sortino Ratio | 0.354122 | 0.187923 |