Systematic country allocation for dollar-based equity investors #

Get packages and JPMaQS data #

Get packages #

import os

# Retrieve credentials

client_id: str = os.getenv("DQ_CLIENT_ID")

client_secret: str = os.getenv("DQ_CLIENT_SECRET")

# Define any Proxy settings required (http/https)

PROXY = {}

START_DATE = "1995-01-01"

import tqdm

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

import warnings

import os

import gc

from datetime import date, datetime

from sklearn.linear_model import LinearRegression, Ridge

from sklearn.ensemble import RandomForestRegressor

from sklearn.pipeline import Pipeline

from sklearn.metrics import make_scorer, mean_squared_error

import macrosynergy.management as msm

import macrosynergy.panel as msp

import macrosynergy.signal as mss

import macrosynergy.pnl as msn

import macrosynergy.learning as msl

import macrosynergy.visuals as msv

from macrosynergy.panel.cross_asset_effects import cross_asset_effects

from macrosynergy.panel.panel_imputer import MeanPanelImputer

from macrosynergy.panel.adjust_weights import adjust_weights

from macrosynergy.download import JPMaQSDownload

warnings.simplefilter("ignore")

This notebook uses macrosynergy package version 1.3.8dev0+28f8af1

Special convenience functions for this notebook #

# Wrapper for SignalOptimizer class

def run_single_signal_optimizer(

df: pd.DataFrame,

xcats: list,

cids: list,

blacklist,

signal_freq: str,

signal_name: str,

models: dict,

hyperparameters: dict,

learning_config: dict,

) -> tuple:

"""

Wrapping function around msl.SignalOptimizer for a given set of models and hyperparameters

"""

assert set(models.keys()) == set(hyperparameters.keys()), "The provided pair of model and grid names do not match."

required_config = ["scorer", "splitter", "test_size", "min_cids", "min_periods", "split_functions"]

assert all([learning_config.get(x, None) is not None for x in required_config])

so = msl.SignalOptimizer(

df=df,

xcats=xcats,

cids=cids,

blacklist=blacklist,

freq=signal_freq,

lag=1,

xcat_aggs=["last", "sum"],

)

so.calculate_predictions(

name=signal_name,

models=models,

scorers=learning_config.get("scorer"),

hyperparameters=hyperparameters,

inner_splitters=learning_config.get("splitter"),

test_size=learning_config.get("test_size"),

min_cids=learning_config.get("min_cids"),

min_periods=learning_config.get("min_periods"),

n_jobs_outer=-1,

split_functions=learning_config.get("split_functions"),

)

# cleanup

gc.collect()

return so

Get data from JPMaQS #

# Cross-sections of interest - equity markets

cids_dmeq = [

'AUD',

'CAD',

'CHF',

'EUR',

'GBP',

'JPY',

'SEK',

'SGD',

'USD',

]

cids_emeq = [

'BRL',

'CNY',

'INR',

'KRW',

'MXN',

'MYR',

'PLN',

'THB',

'TWD',

'ZAR'

]

cids_eq = sorted(cids_dmeq + cids_emeq)

# Category tickers

inf = (

[

f"{cat}_{at}"

for cat in [

"CPIXFE",

"CPIH",

]

for at in [

"SJA_P3M3ML3AR",

"SJA_P1Q1QL1AR",

"SA_P1M1ML12",

"SA_P1Q1QL4",

]

]

+ ["INFTEFF_NSA"]

)

cons = [

f"{cat}_{at}"

for cat in ["RPCONS", "RRSALES"]

for at in [

"SA_P3M3ML3AR",

"SA_P1Q1QL1AR",

"SA_P1M1ML12",

"SA_P1Q1QL4",

]

]

surveys = [

f"{cat}_{at}"

for cat in ["CCSCORE", "MBCSCORE"]

for at in [

"SA",

"SA_D3M3ML3",

"SA_D1Q1QL1",

"SA_D1M1ML12",

"SA_D1Q1QL4",

]

]

labour = [

"UNEMPLRATE_NSA_3MMA_D1M1ML12",

"UNEMPLRATE_NSA_D1Q1QL4",

"UNEMPLRATE_SA_3MMAv5YMA",

]

liquid = ["INTLIQGDP_NSA_D1M1ML3", "INTLIQGDP_NSA_D1M1ML6"]

flows = [

f"{flow}_NSA_D1M1ML12" for flow in ["NIIPGDP", "IIPLIABGDP"]

]

trade = (

[

f"{cat}_{at}"

for cat in ["CABGDPRATIO", "MTBGDPRATIO"]

for at in [

"SA_3MMAv60MMA",

"SA_1QMAv20QMA",

"NSA_12MMA",

"NSA_1YMA",

]

]

)

fxrel = [

f"{cat}_NSA_{t}"

for cat in ["REEROADJ", "CTOT"]

for t in ["P1W4WL1", "P1M1ML12", "P1M12ML1"]

] + [f"PPPFXOVERVALUE_NSA_{t}" for t in ["P1M12ML1"]]

fin = [

"RIR_NSA",

"RYLDIRS02Y_NSA",

"RYLDIRS05Y_NSA",

"EQCRR_VT10",

]

add = [

"RGDP_SA_P1Q1QL4_20QMM",

]

eco = (

inf

+ cons

+ labour

+ surveys

+ liquid

+ flows

+ trade

+ fxrel

+ fin

+ add

)

mkt = [

"EQXR_NSA",

"EQXR_VT10",

"FXXRUSD_NSA",

"EQXRxEASD_NSA",

"EQCALLRUSD_NSA",

"EQCALLXRxEASD_NSA", # Support for eq futures vol

"FXXRUSDxEASD_NSA",

"FXTARGETED_NSA",

"FXUNTRADABLE_NSA",

]

xcats = eco + mkt

# Resultant indicator tickers

tickers = [cid + "_" + xcat for cid in cids_eq for xcat in xcats] + ["USD_DU05YXR_NSA", "GLD_COXR_NSA"]

print(f"Maximum number of tickers is {len(tickers)}")

Maximum number of tickers is 1199

# Download from DataQuery

with JPMaQSDownload(

client_id=client_id, client_secret=client_secret

) as downloader:

df: pd.DataFrame = downloader.download(

tickers=tickers,

start_date=START_DATE,

metrics=["value"],

suppress_warning=True,

show_progress=True,

report_time_taken=True,

proxy=PROXY,

)

Downloading data from JPMaQS.

Timestamp UTC: 2025-09-19 14:51:45

Connection successful!

Requesting data: 100%|█████████████████████████████████████████████████████████████████| 60/60 [00:12<00:00, 4.88it/s]

Downloading data: 100%|████████████████████████████████████████████████████████████████| 60/60 [00:41<00:00, 1.46it/s]

Time taken to download data: 56.79 seconds.

Some expressions are missing from the downloaded data. Check logger output for complete list.

343 out of 1199 expressions are missing. To download the catalogue of all available expressions and filter the unavailable expressions, set `get_catalogue=True` in the call to `JPMaQSDownload.download()`.

dfx = df.copy()

Availability and pre-processing #

Data cleaning and renaming #

# Removing Australia and New Zealand CPI multiple transformation frequencies - maintaining monthly version now

dfx = dfx.loc[

~(

(dfx["cid"].isin(["AUD", "NZD"])) & (dfx["xcat"].isin(inf)) & (dfx["xcat"].str.contains("Q"))

)

]

# Replace quarterly tickers with approximately equivalent monthly tickers

dict_repl = {

"CPIXFE_SJA_P1Q1QL1AR": "CPIXFE_SJA_P3M3ML3AR",

"CPIXFE_SA_P1Q1QL4": "CPIXFE_SA_P1M1ML12",

"CPIH_SJA_P1Q1QL1AR": "CPIH_SJA_P3M3ML3AR",

"CPIH_SA_P1Q1QL4": "CPIH_SA_P1M1ML12",

"UNEMPLRATE_NSA_D1Q1QL4":"UNEMPLRATE_NSA_3MMA_D1M1ML12",

"RPCONS_SA_P1Q1QL4": "RPCONS_SA_P1M1ML12",

"RPCONS_SA_P1Q1QL1AR": "RPCONS_SA_P3M3ML3AR",

"RRSALES_SA_P1Q1QL1AR": "RRSALES_SA_P3M3ML3AR",

"RRSALES_SA_P1Q1QL4": "RRSALES_SA_P1M1ML12",

"CCSCORE_SA_D1Q1QL1": "CCSCORE_SA_D3M3ML3",

"MBCSCORE_SA_D1Q1QL1": "MBCSCORE_SA_D3M3ML3",

"SBCSCORE_SA_D1Q1QL1": "SBCSCORE_SA_D3M3ML3",

"CCSCORE_SA_D1Q1QL4": "CCSCORE_SA_D1M1ML12",

"MBCSCORE_SA_D1Q1QL4": "MBCSCORE_SA_D1M1ML12",

"SBCSCORE_SA_D1Q1QL4": "SBCSCORE_SA_D1M1ML12",

"CABGDPRATIO_SA_1QMAv20QMA": "CABGDPRATIO_SA_3MMAv60MMA",

"CABGDPRATIO_NSA_1YMA": "CABGDPRATIO_NSA_12MMA",

"MTBGDPRATIO_NSA_1YMA": "MTBGDPRATIO_NSA_12MMA",

}

dfx["xcat2"] = dfx["xcat"].map(dict_repl).fillna(dfx["xcat"])

dfx = dfx.drop(columns="xcat").rename(columns={"xcat2": "xcat"})

Availability before and after renaming #

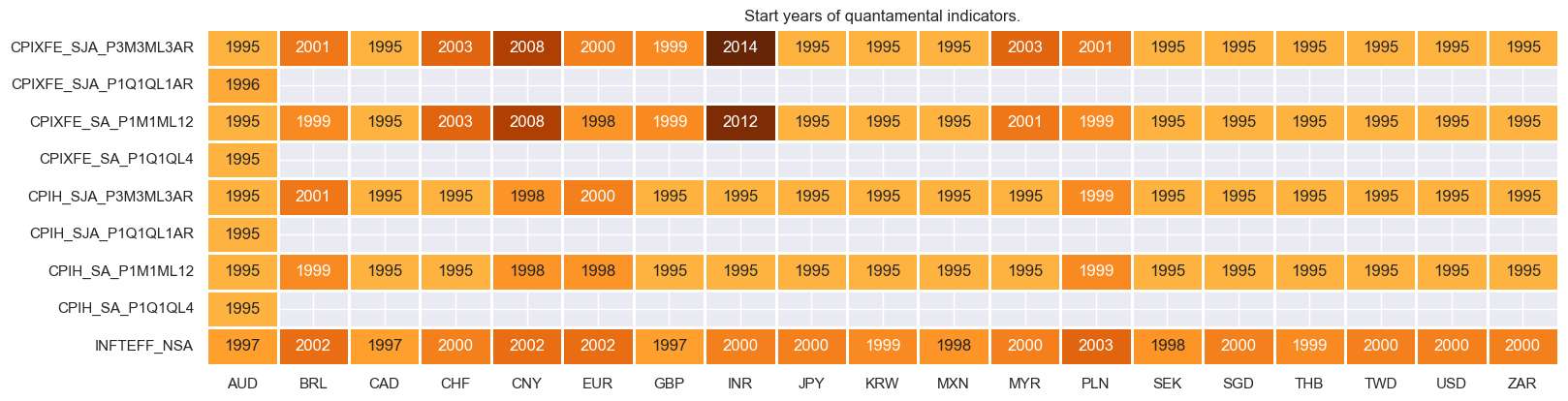

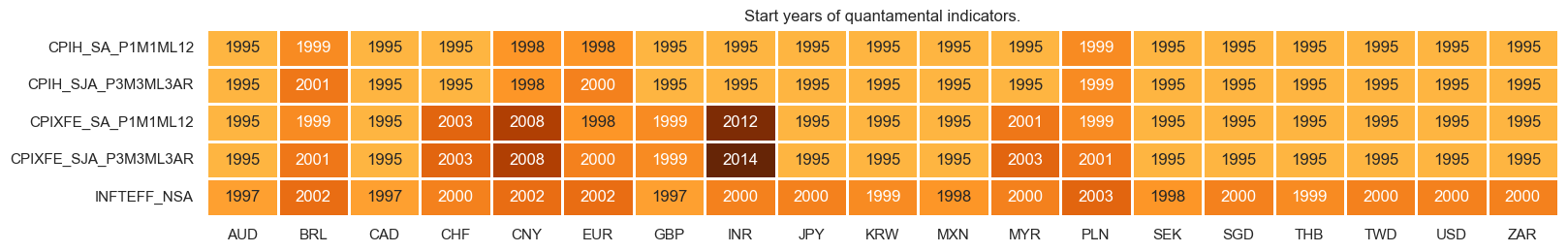

xcatx = inf

msm.check_availability(df=df, xcats=xcatx, cids=cids_eq, missing_recent=False)

msm.check_availability(df=dfx, xcats=sorted(list(set(xcatx) - set(dict_repl.keys()))), cids=cids_eq, missing_recent=False)

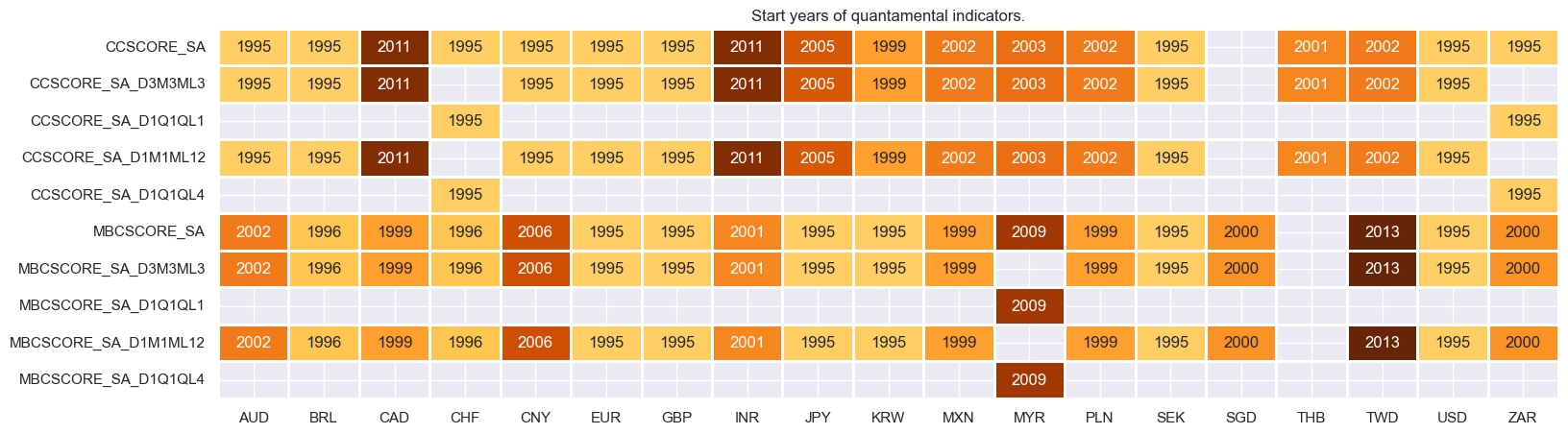

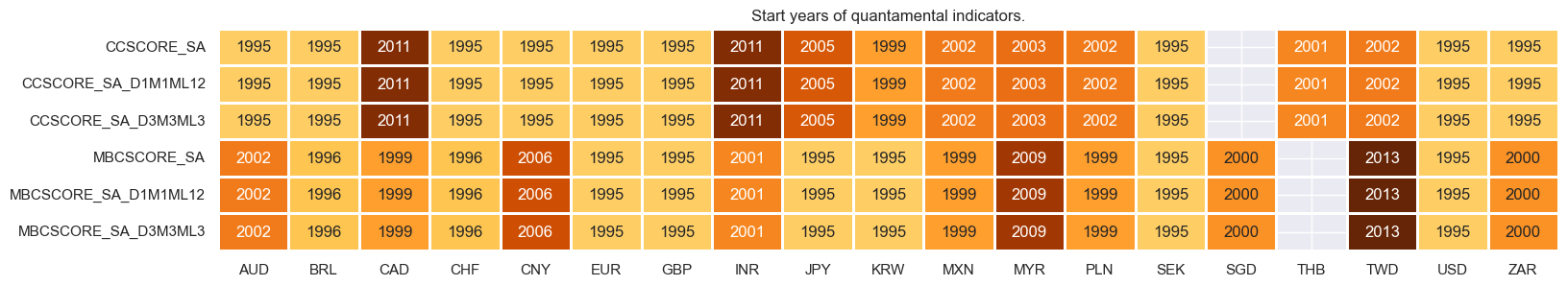

xcatx = surveys

msm.check_availability(df=df, xcats=xcatx, cids=cids_eq, missing_recent=False)

msm.check_availability(df=dfx, xcats=sorted(list(set(xcatx) - set(dict_repl.keys()))), cids=cids_eq, missing_recent=False)

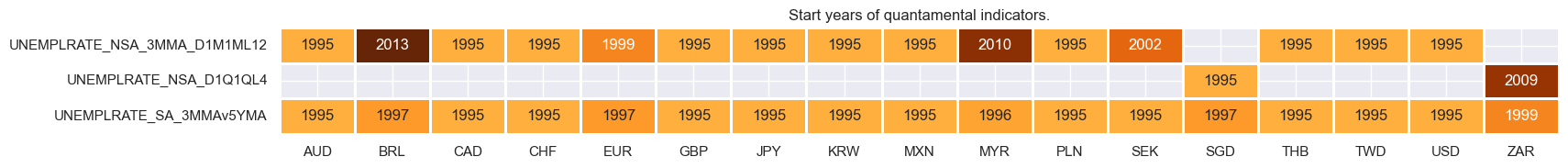

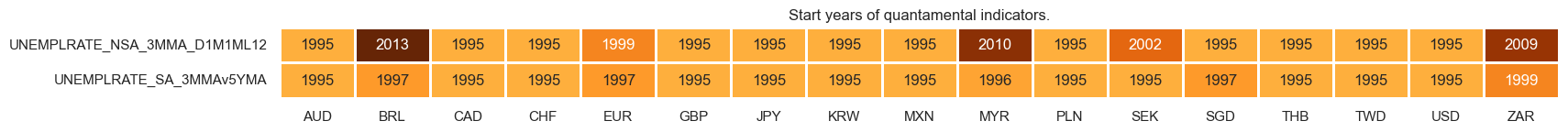

xcatx = labour

msm.check_availability(df=df, xcats=xcatx, cids=cids_eq, missing_recent=False)

msm.check_availability(df=dfx, xcats=sorted(list(set(xcatx) - set(dict_repl.keys()))), cids=cids_eq, missing_recent=False)

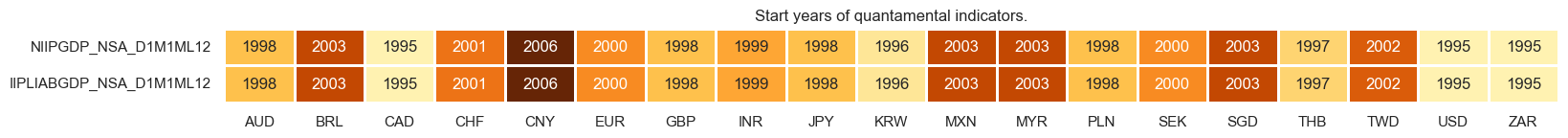

xcatx = flows

msm.check_availability(df=dfx, xcats=xcatx, cids=cids_eq, missing_recent=False)

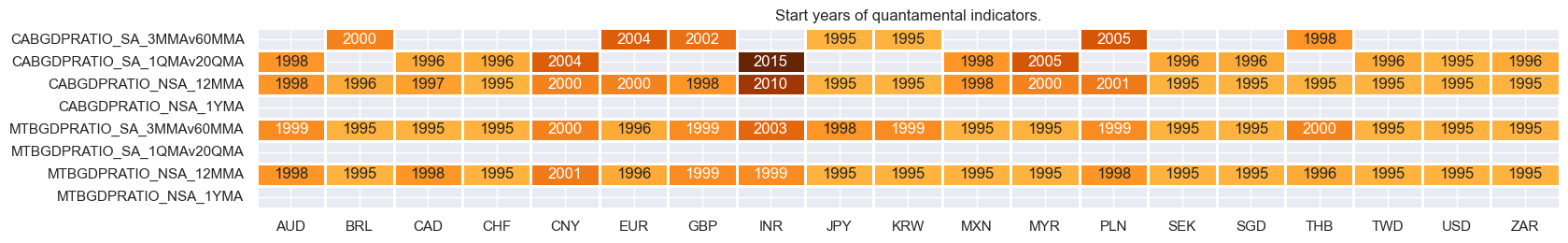

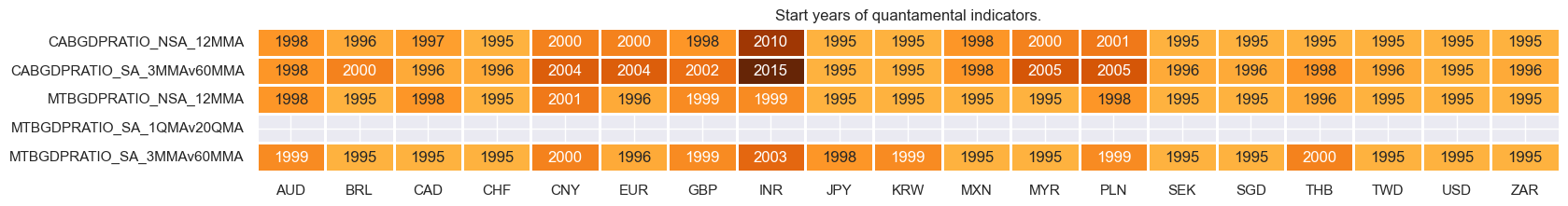

xcatx = trade

msm.check_availability(df=df, xcats=xcatx, cids=cids_eq, missing_recent=False)

msm.check_availability(df=dfx, xcats=sorted(list(set(xcatx) - set(dict_repl.keys()))), cids=cids_eq, missing_recent=False)

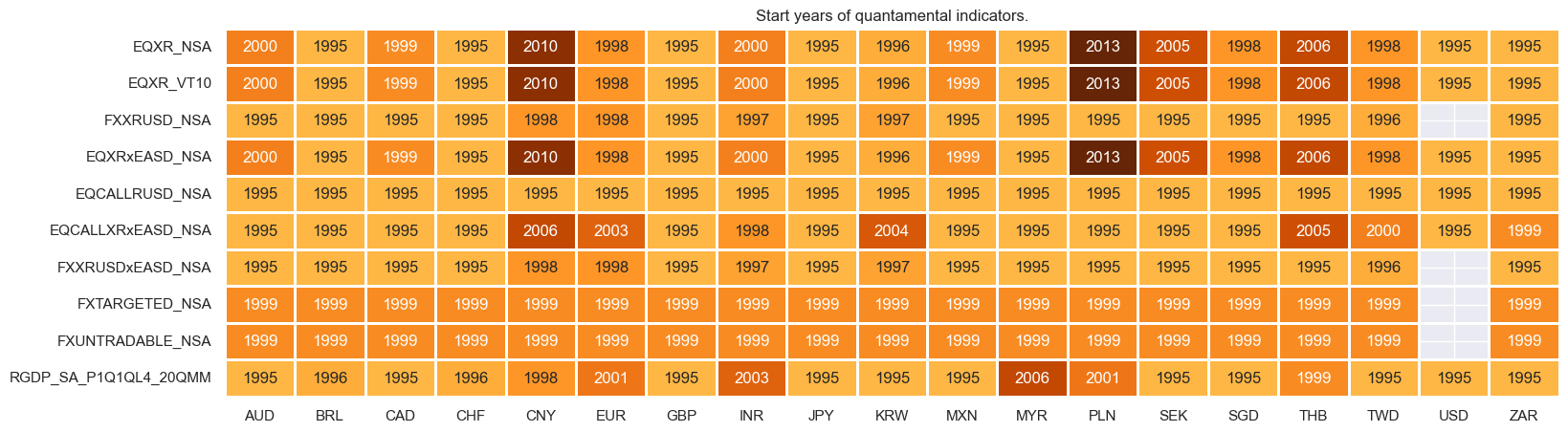

xcatx = mkt + add

msm.check_availability(df=dfx, xcats=xcatx, cids=cids_eq, missing_recent=False)

# Initiate dictionary for conceptual factors

concept_factors = {}

Blacklisting #

Before running the analysis, we use

make_blacklist()

helper function from

macrosynergy

package, which creates a standardized dictionary of blacklist periods, i.e. periods that affect the validity of an indicator, based on standardized panels of binary categories.

Put simply, this function allows converting category variables into blacklist dictionaries that can then be passed to other functions. Below, we picked two indicators for FX tradability and flexibility.

FXTARGETED_NSA

is an exchange rate target dummy, which takes a value of 1 if the exchange rate is targeted through a peg or any regime that significantly reduces exchange rate flexibility and 0 otherwise.

FXUNTRADABLE_NSA

is also a dummy variable that takes the value one if liquidity in the main FX forward market is limited or there is a distortion between tradable offshore and untradable onshore contracts.

# Binary flag from JPMaQS

fxuntrad = ["FXUNTRADABLE_NSA"]

fxuntrad = dfx[dfx["xcat"].isin(fxuntrad)].loc[:, ["cid", "xcat", "real_date", "value"]]

# Constructing a binary variable based on history availability of equity futures returns in local currency

equity_target = "EQXR_NSA"

eq_ret_availability = dfx.loc[dfx["xcat"] == equity_target].groupby(["cid"])["real_date"].min()

earliest_return = eq_ret_availability.min()

equntrad = pd.DataFrame(

{"value": 0},

index=pd.MultiIndex.from_product([cids_eq, pd.date_range(start=earliest_return, end=datetime.today().date(), freq="B")], names=["cid", "real_date"])

).reset_index(drop=False).assign(

xcat="EQUNTRADABLE_NSA"

)

equntrad["eqxr_start"] = equntrad["cid"].map(eq_ret_availability)

mask = pd.to_datetime(equntrad["real_date"]) <= pd.to_datetime(equntrad["eqxr_start"])

equntrad.loc[mask, "value"] = 1.0

# Combining the two

total_untrad = pd.concat([fxuntrad, equntrad], axis=0, ignore_index=True).sort_values(["cid", "xcat", "real_date"])

# Create blacklisting dictionary

equsdblack = (

total_untrad.groupby(["cid", "real_date"])

.aggregate(value=pd.NamedAgg(column="value", aggfunc="max"))

.reset_index()

)

equsdblack["xcat"] = "EQUSDBLACK"

equsdblack = msp.make_blacklist(equsdblack, "EQUSDBLACK")

equsdblack

{'AUD': (Timestamp('1995-01-02 00:00:00'), Timestamp('2000-05-03 00:00:00')),

'BRL': (Timestamp('1995-01-02 00:00:00'), Timestamp('1995-03-01 00:00:00')),

'CAD': (Timestamp('1995-01-02 00:00:00'), Timestamp('1999-11-24 00:00:00')),

'CHF': (Timestamp('1995-01-02 00:00:00'), Timestamp('1995-01-02 00:00:00')),

'CNY': (Timestamp('1995-01-02 00:00:00'), Timestamp('2010-04-19 00:00:00')),

'EUR': (Timestamp('1995-01-02 00:00:00'), Timestamp('1998-06-23 00:00:00')),

'GBP': (Timestamp('1995-01-02 00:00:00'), Timestamp('1995-01-02 00:00:00')),

'INR': (Timestamp('1995-01-02 00:00:00'), Timestamp('2000-09-26 00:00:00')),

'JPY': (Timestamp('1995-01-02 00:00:00'), Timestamp('1995-01-02 00:00:00')),

'KRW': (Timestamp('1995-01-02 00:00:00'), Timestamp('1996-05-06 00:00:00')),

'MXN': (Timestamp('1995-01-02 00:00:00'), Timestamp('1999-12-02 00:00:00')),

'MYR_1': (Timestamp('1995-01-02 00:00:00'), Timestamp('1995-12-18 00:00:00')),

'MYR_2': (Timestamp('2018-07-02 00:00:00'), Timestamp('2025-09-18 00:00:00')),

'PLN': (Timestamp('1995-01-02 00:00:00'), Timestamp('2013-09-24 00:00:00')),

'SEK': (Timestamp('1995-01-02 00:00:00'), Timestamp('2005-02-16 00:00:00')),

'SGD': (Timestamp('1995-01-02 00:00:00'), Timestamp('1998-09-08 00:00:00')),

'THB_1': (Timestamp('1995-01-02 00:00:00'), Timestamp('2006-05-01 00:00:00')),

'THB_2': (Timestamp('2007-01-01 00:00:00'), Timestamp('2008-11-28 00:00:00')),

'TWD': (Timestamp('1995-01-02 00:00:00'), Timestamp('1998-07-22 00:00:00')),

'USD': (Timestamp('1995-01-02 00:00:00'), Timestamp('1995-01-02 00:00:00')),

'ZAR': (Timestamp('1995-01-02 00:00:00'), Timestamp('1995-01-02 00:00:00'))}

Feature engineering #

Auxiliary and benchmark categories #

# Stitching for India and China: extending consistent core with corresponding headline

cidx = ["INR", "CNY"]

merging_xcatx = {

"CPIXFE_SA_P1M1ML12": ["CPIXFE_SA_P1M1ML12", "CPIH_SA_P1M1ML12"],

"CPIXFE_SJA_P3M3ML3AR": ["CPIXFE_SJA_P3M3ML3AR", "CPIH_SJA_P3M3ML3AR"],

}

for new_cat, xcatx in merging_xcatx.items():

dfa = msm.merge_categories(df=dfx, xcats=xcatx, new_xcat=new_cat, cids=cidx)

dfx = msm.update_df(dfx, dfa)

# Benchmark categories used for several calculations

cidx = cids_eq

calcs = [

"INFTEBASIS = INFTEFF_NSA.clip(lower=2)",

"LTNGROWTH_SA = RGDP_SA_P1Q1QL4_20QMM + INFTEFF_NSA",

"LTNGROWTHBASIS_SA = RGDP_SA_P1Q1QL4_20QMM + INFTEBASIS",

]

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cidx)

dfx = msm.update_df(dfx, dfa)

# Extend equity volatility for countries with late-starting futures using cash indices

cidx = cids_eq

merging_xcatx = {

"EQXRxEASD_NSA_EXT": ["EQXRxEASD_NSA", "EQCALLXRxEASD_NSA",]

}

for new_cat, xcatx in merging_xcatx.items():

dfa = msm.merge_categories(df=dfx, xcats=xcatx, new_xcat=new_cat, cids=cidx)

dfx = msm.update_df(dfx, dfa)

# Pseudo U.S. series with logical zero values

cidx = ["USD"]

calcs = ["FXXRUSDxEASD_NSA = 0 * RIR_NSA",]

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cidx)

dfx = msm.update_df(dfx, dfa)

Excess inflation #

# Scaled excess inflation and changes thereof

cidx = cids_eq

calcs = [

# Centering the price trends around inflation target

f"X{cat}_{atf}S = ( {cat}_{atf} - INFTEFF_NSA ) / INFTEBASIS"

for cat in ["CPIXFE", "CPIH",]

for atf in ["SJA_P3M3ML3AR", "SA_P1M1ML12"]

]

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cidx)

dfx = msm.update_df(dfx, dfa)

# All constituents, signs, and weights

xinf = {

"XCPIXFE_SJA_P3M3ML3ARS": {"eq_sign": -1, "fx_sign": 1, "weight": 1 / 4},

"XCPIXFE_SA_P1M1ML12S": {"eq_sign": -1, "fx_sign": 1, "weight": 1 / 4},

"XCPIH_SJA_P3M3ML3ARS": {"eq_sign": -1, "fx_sign": 1, "weight": 1 / 4},

"XCPIH_SA_P1M1ML12S": {"eq_sign": -1, "fx_sign": 1, "weight": 1 / 4},

}

# Differentials to USD

xcatx = list(xinf.keys())

cidx = cids_eq

for xc in xcatx:

dfa = msp.make_relative_value(

dfx,

xcats=xcatx,

cids=cidx,

basket=["USD"], # basket does not use all cross-sections

rel_meth="subtract",

postfix="vUSD",

)

dfx = msm.update_df(df=dfx, df_add=dfa)

# Visualize

xcatx = ["XCPIH_SA_P1M1ML12S", "XCPIH_SA_P1M1ML12SvUSD"]

cidx = cids_eq

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=5,

start="1995-01-01",

same_y=True,

height=2,

title="Annual headline inflation, in percentage excess of target",

xcat_labels=[

"Outright",

"Vs US"

]

)

# Extract USD equity effects

cidx = cids_eq

for xc, params in xinf.items():

dfa = cross_asset_effects(

df=dfx,

cids=cidx,

effect_name=xc + "_F",

signal_xcats={"eq": xc, "fx": xc + "vUSD"},

weights_xcats={"eq": "EQXRxEASD_NSA_EXT", "fx": "FXXRUSDxEASD_NSA"},

signal_signs={k.replace("_sign", ""): v for k, v in params.items() if "sign" in k},

)

dfx = msm.update_df(dfx, dfa.loc[dfa["xcat"] == f"{xc}_F"])

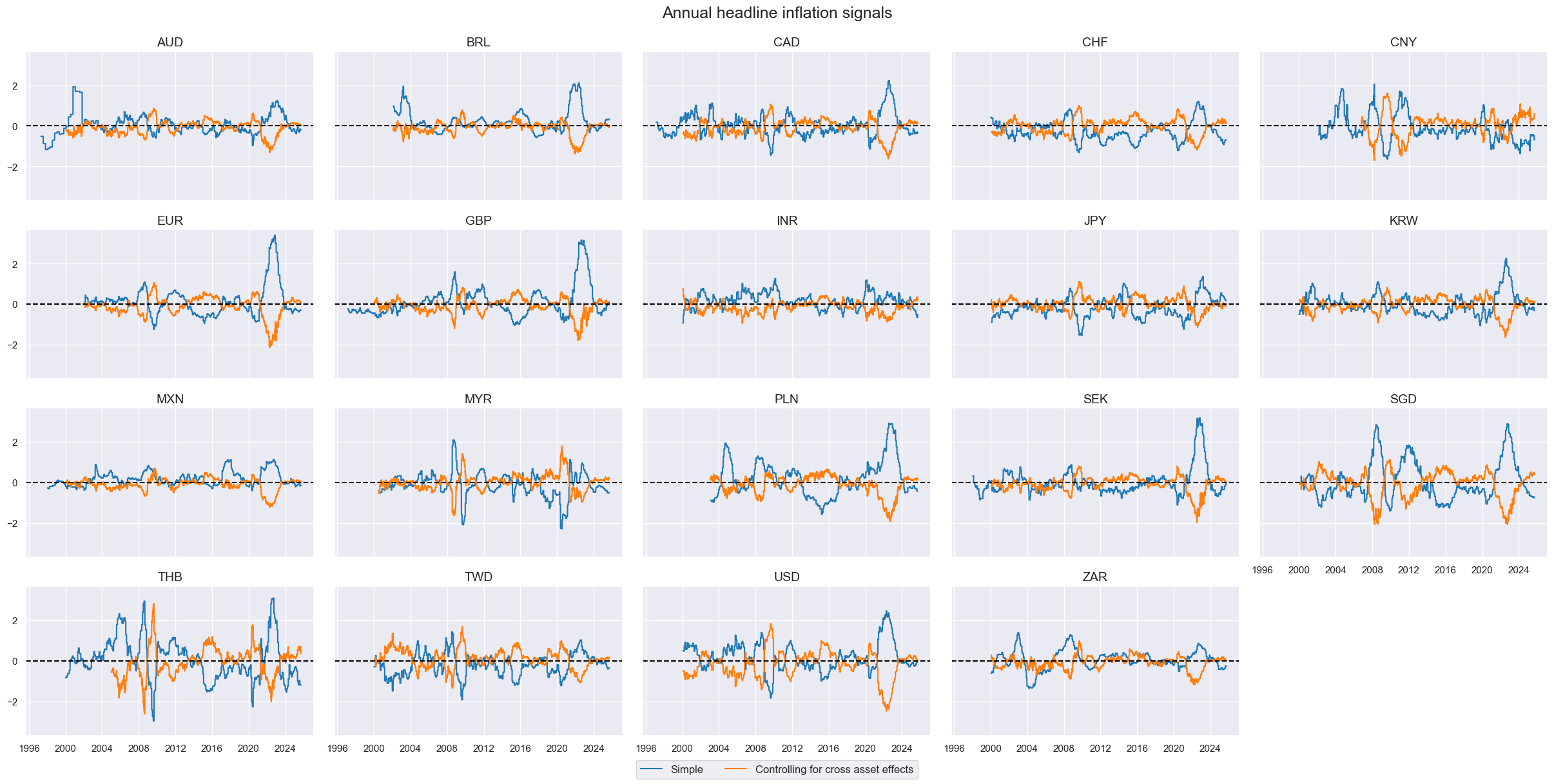

# Visualize

xcatx = ["XCPIH_SA_P1M1ML12S", "XCPIH_SA_P1M1ML12S_F"]

cidx = cids_eq

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=5,

start="1995-01-01",

same_y=True,

height=2,

title="Annual headline inflation signals",

xcat_labels=["Simple", "Controlling for cross asset effects"]

)

# Score the quantamental factors

xcatx = [xc + "_F" for xc in list(xinf.keys())]

cidx = cids_eq

for xc in xcatx:

dfa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

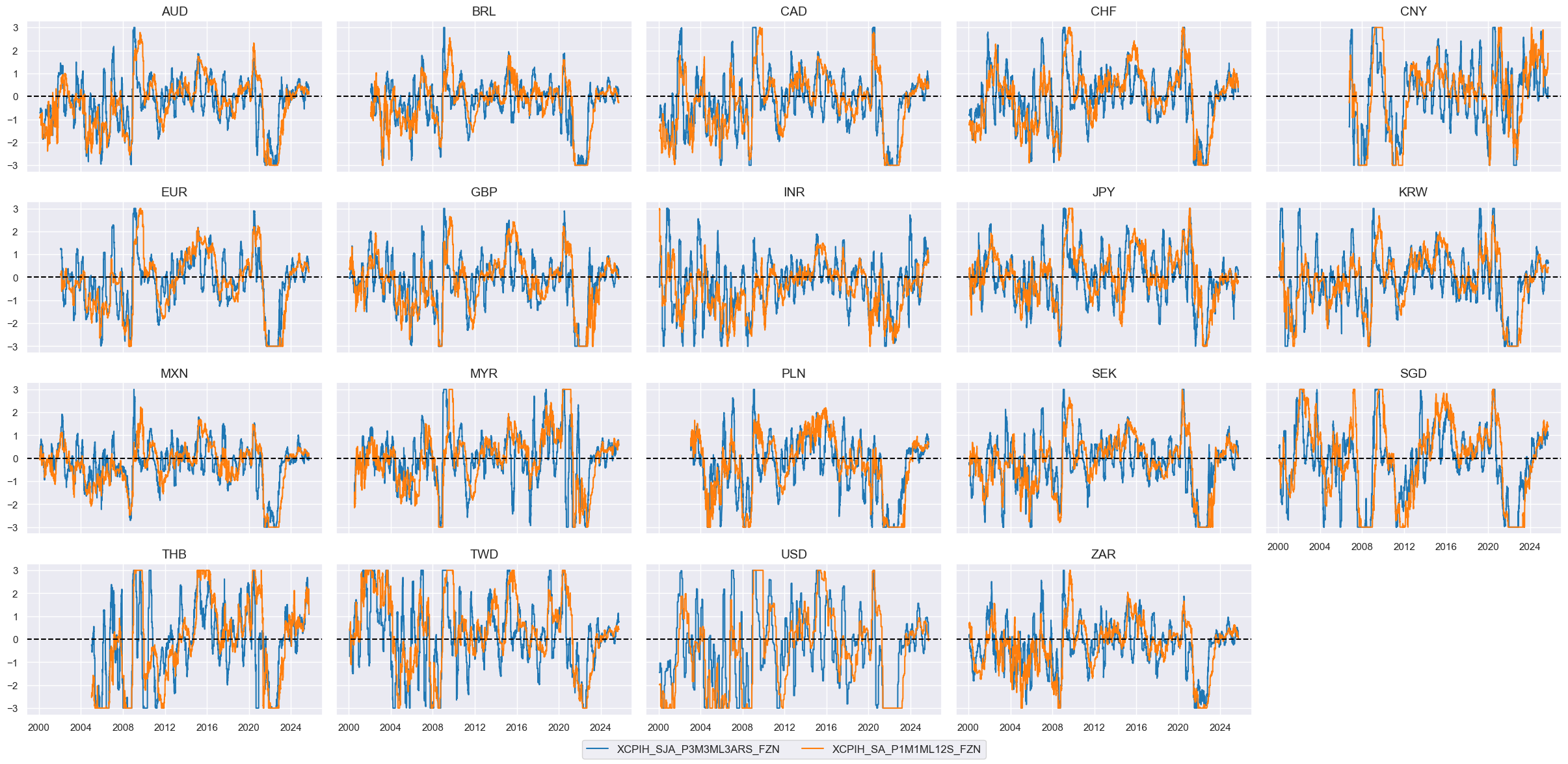

# Visualize

xcatx = ["XCPIH_SJA_P3M3ML3ARS_FZN", "XCPIH_SA_P1M1ML12S_FZN"]

cidx = cids_eq

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=5,

start="1995-01-01",

same_y=True,

height=2,

)

# Calculate the conceptual factor score

xcatx = [xc + "_FZN" for xc in list(xinf.keys())]

cidx = cids_eq

weights = [xinf[xc]["weight"] for xc in list(xinf.keys())]

cfs = "XINF"

dfa = msp.linear_composite(

df=dfx,

xcats=xcatx,

cids=cids_eq,

weights=weights,

new_xcat=cfs,

complete_xcats=False,

)

dfx= msm.update_df(dfx, dfa)

# Re-score

dfa = msp.make_zn_scores(

dfx,

xcat=cfs,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

concept_factors[cfs] = "Inflation effect"

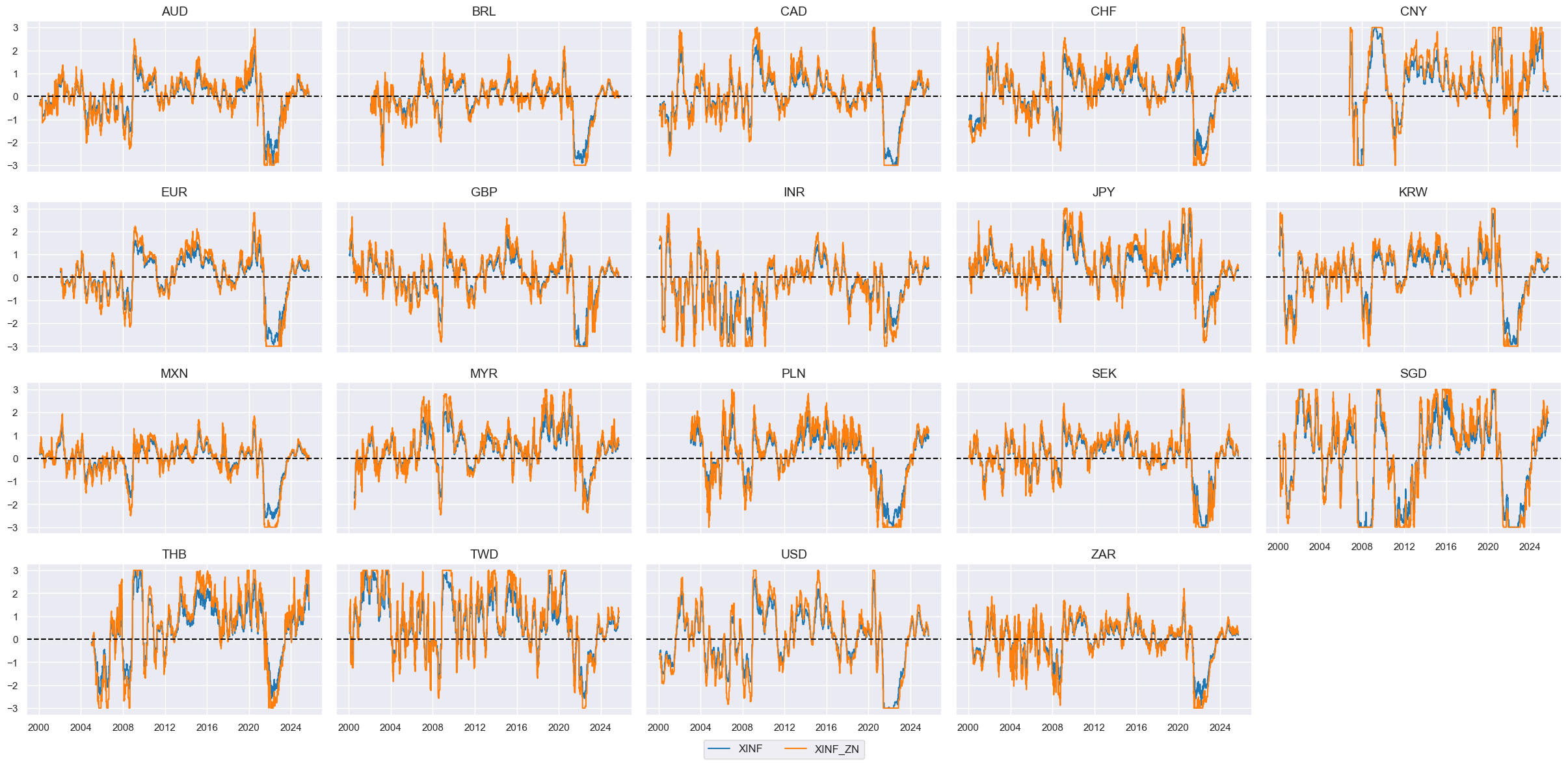

# Visualize

cfs = "XINF"

xcatx = [cfs, f"{cfs}_ZN"]

cidx = cids_eq

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=5,

start="1995-01-01",

same_y=True,

height=2,

)

Currency weakness #

# Imputing PPP for USD

cidx = ["USD"]

calcs = [

f"PPPFXOVERVALUE_NSA_{t} = 0 * EQXR_VT10" for t in ["P1M12ML1"]

]

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cidx)

dfx = msm.update_df(dfx, dfa)

# TWD unavailable for this indicator (will only use REERs)

# All constituents, signs, and weights

fx_weak = {

'PPPFXOVERVALUE_NSA_P1M12ML1': {"eq_sign": -1, "fx_sign": -1, "weight": 3/6},

'REEROADJ_NSA_P1M12ML1': {"eq_sign": -1, "fx_sign": -1, "weight": 1/6},

'REEROADJ_NSA_P1M1ML12': {"eq_sign": -1, "fx_sign": -1, "weight": 1/6},

'REEROADJ_NSA_P1W4WL1': {"eq_sign": -1, "fx_sign": -1, "weight": 1/6},

}

# USD equity effects are indicators with appropriate signs

cidx = cids_eq

calcs = []

for xc, params in fx_weak.items():

s = "N" if params["eq_sign"] < 0 else ""

calcs.append(f"{xc}{s}_F = {xc} * {params["eq_sign"]}")

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cidx)

dfx = msm.update_df(dfx, dfa)

# Score the quantamental factors

postfixes = ["N" if v["eq_sign"] < 0 else "" for v in fx_weak.values()]

fx_weaks = [k + s + "_F" for k, s in zip(fx_weak.keys(), postfixes)]

xcatx = fx_weaks

cidx = cids_eq

for xc in xcatx:

dfa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

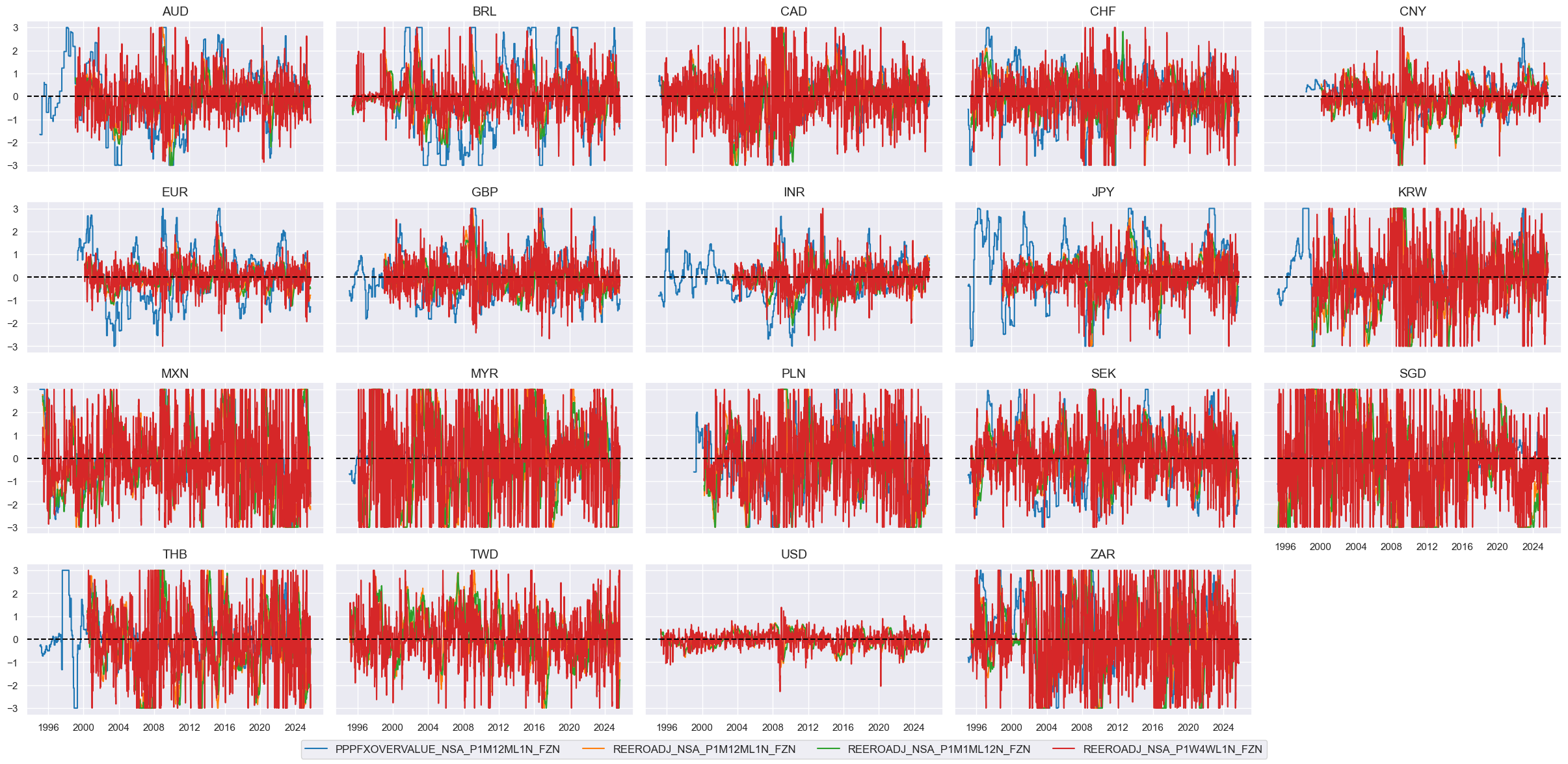

# Visualize

xcatx = [xc + "ZN" for xc in fx_weaks]

cidx = cids_eq

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=5,

start="1995-01-01",

same_y=True,

height=2,

)

# Calculate the conceptual factor score

xcatx = [xc + "ZN" for xc in fx_weaks]

cidx = cids_eq

weights = [fx_weak[xc]["weight"] for xc in list(fx_weak.keys())]

cfs = "FXWEAK"

dfa = msp.linear_composite(

df=dfx,

xcats=xcatx,

cids=cids_eq,

weights=weights,

new_xcat=cfs,

complete_xcats=False,

)

dfx= msm.update_df(dfx, dfa)

# Re-score

dfa = msp.make_zn_scores(

dfx,

xcat=cfs,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

concept_factors[cfs] = "Currency weakness"

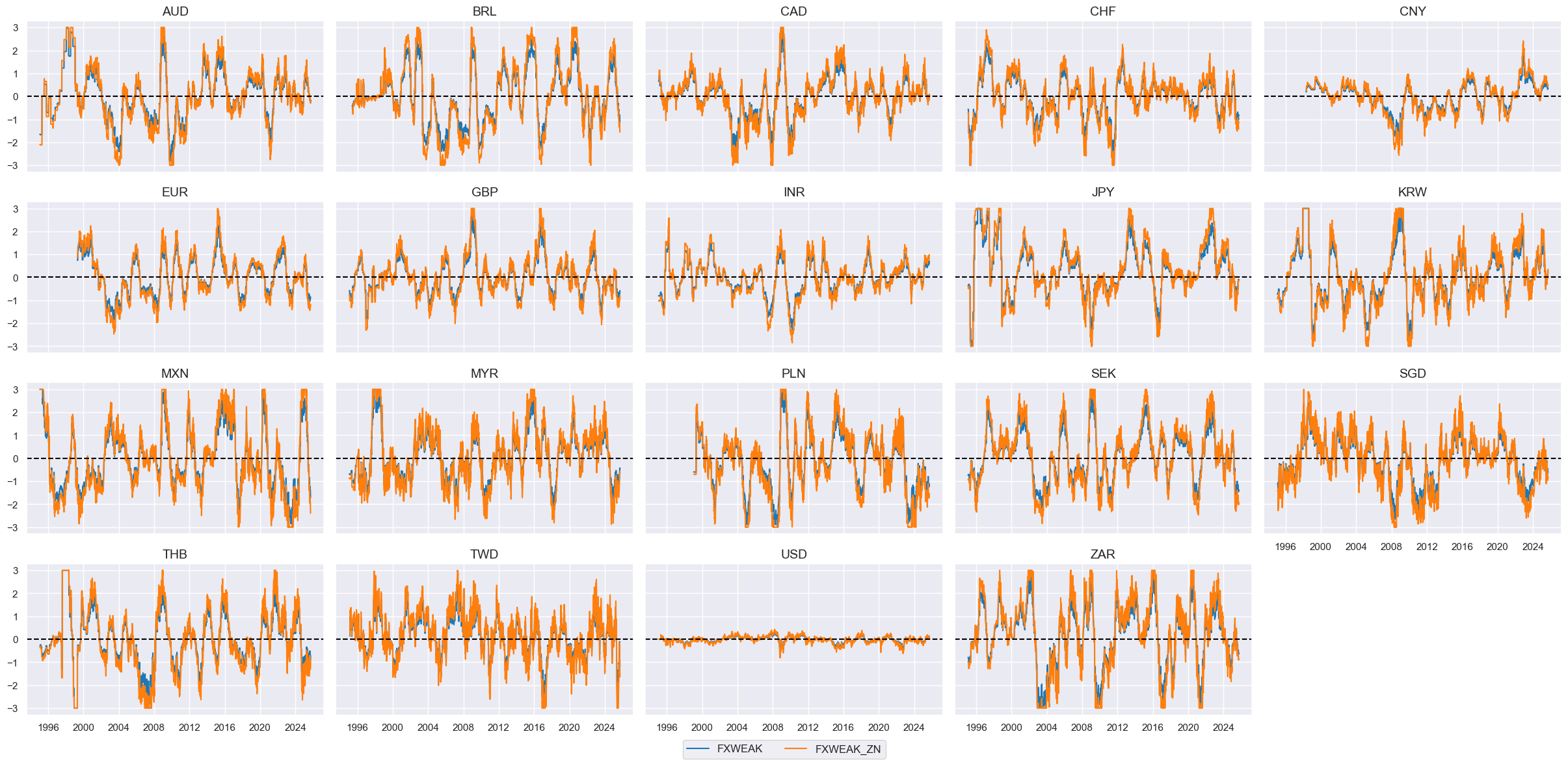

# Visualize

cfs = "FXWEAK"

xcatx = [cfs, f"{cfs}_ZN"]

cidx = cids_eq

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=5,

start="1995-01-01",

same_y=True,

height=2,

)

Terms-of-trade improvement #

# All constituents, signs, and weights

tot = {

'CTOT_NSA_P1M12ML1': {"eq_sign": 1, "fx_sign": 1, "weight": 1/3},

'CTOT_NSA_P1M1ML12': {"eq_sign": 1, "fx_sign": 1, "weight": 1/3},

'CTOT_NSA_P1W4WL1': {"eq_sign": 1, "fx_sign": 1, "weight": 1/3},

}

# USD equity effects are indicators with appropriate signs

cidx = cids_eq

calcs = []

for xc, params in tot.items():

s = "N" if params["eq_sign"] < 0 else ""

calcs.append(f"{xc}{s}_F = {xc} * {params["eq_sign"]}")

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cidx)

dfx = msm.update_df(dfx, dfa)

# Score the quantamental factors

postfixes = ["N" if v["eq_sign"] < 0 else "" for v in tot.values()]

tots = [k + s + "_F" for k, s in zip(tot.keys(), postfixes)]

xcatx = tots

cidx = cids_eq

for xc in xcatx:

dfa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

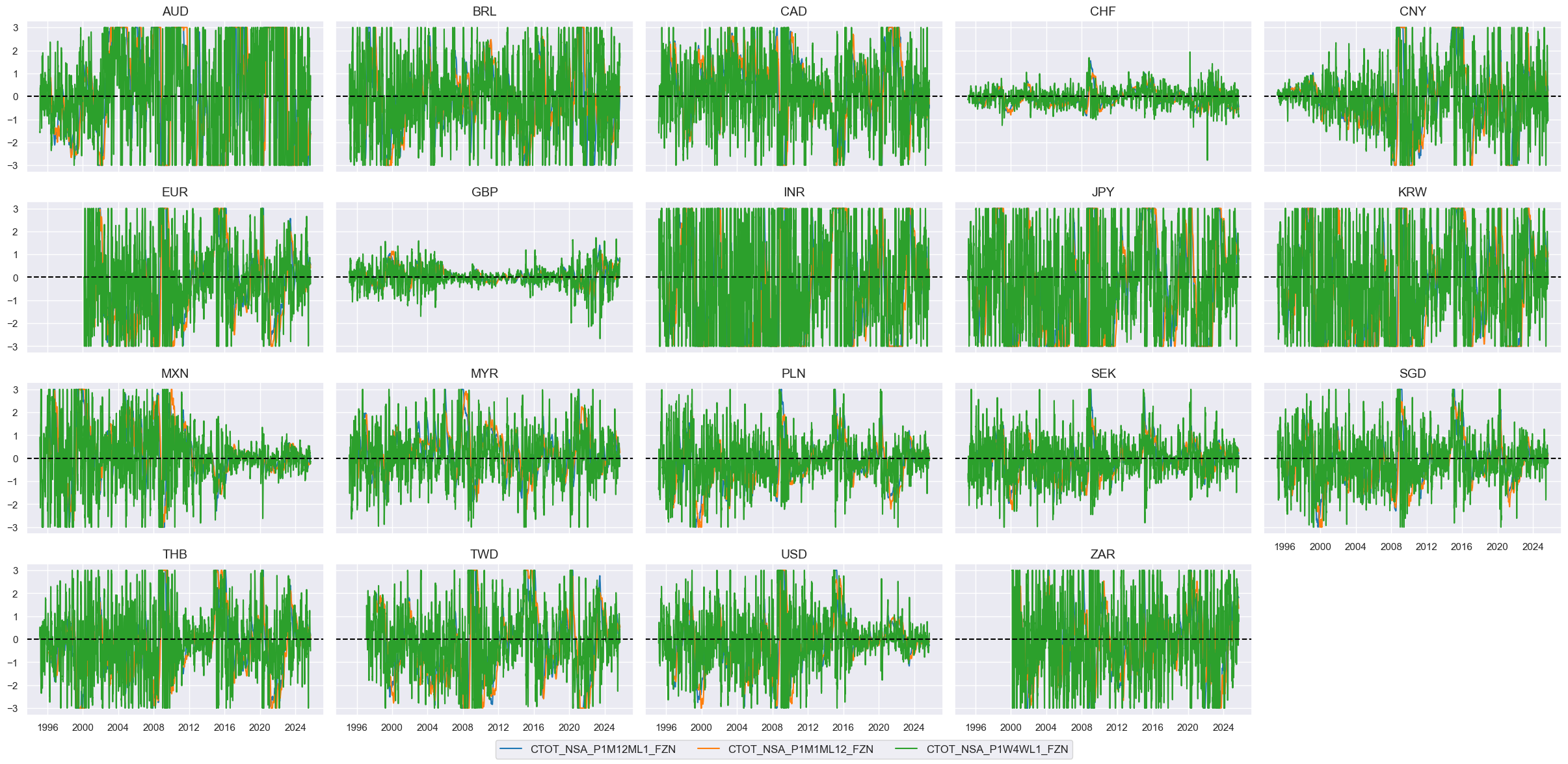

# Visualize

xcatx = [xc + "ZN" for xc in tots]

cidx = cids_eq

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=5,

start="1995-01-01",

same_y=True,

height=2,

)

# Calculate the conceptual factor score

xcatx = [xc + "ZN" for xc in tots]

cidx = cids_eq

weights = [tot[xc]["weight"] for xc in list(tot.keys())]

cfs = "TOTIMPROVE"

dfa = msp.linear_composite(

df=dfx,

xcats=xcatx,

cids=cids_eq,

weights=weights,

new_xcat=cfs,

complete_xcats=False,

)

dfx= msm.update_df(dfx, dfa)

# Re-score

dfa = msp.make_zn_scores(

dfx,

xcat=cfs,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

concept_factors[cfs] = "Terms-of-trade improvement"

# Visualize

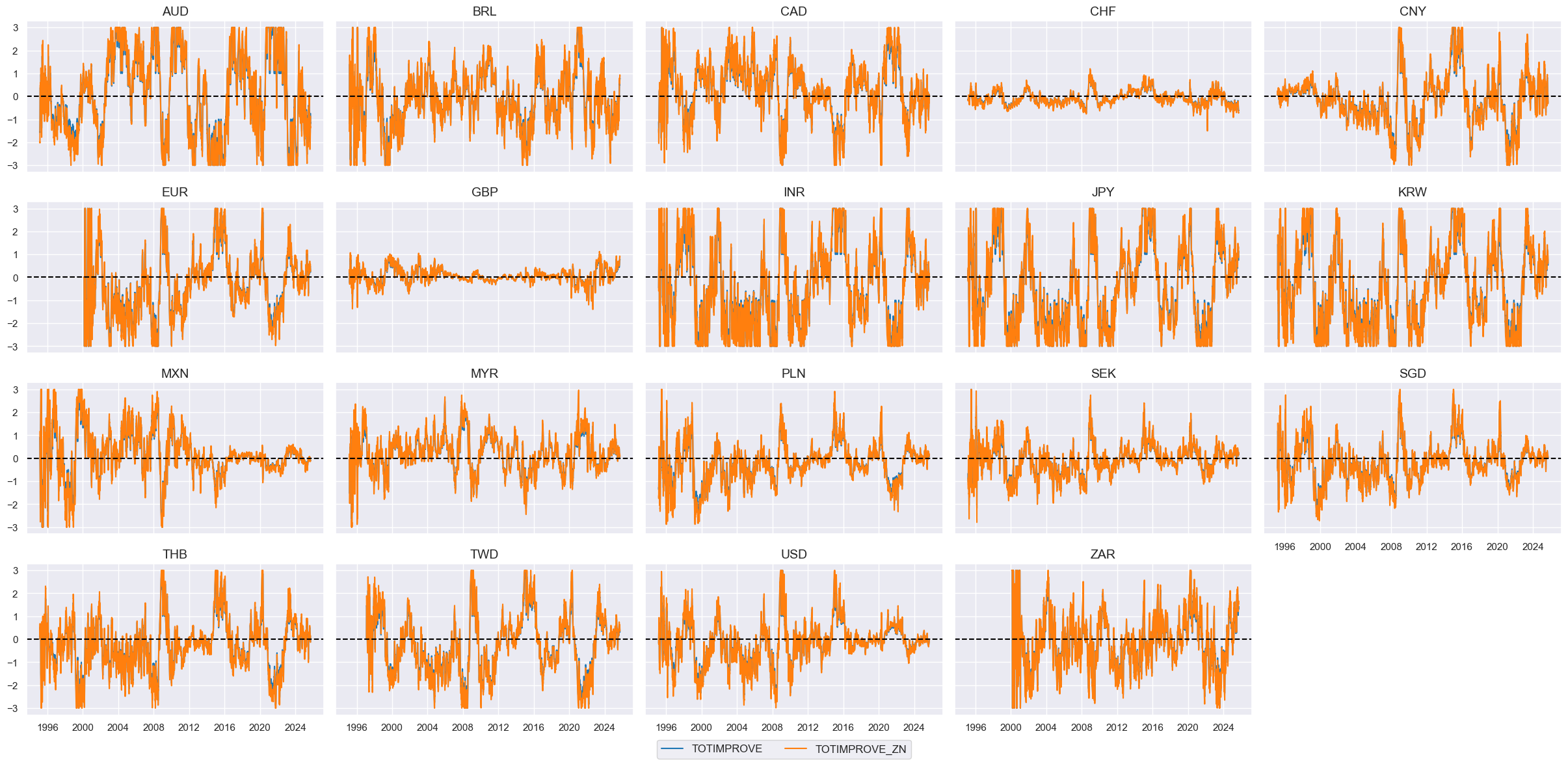

cfs = "TOTIMPROVE"

xcatx = [cfs, f"{cfs}_ZN"]

cidx = cids_eq

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=5,

start="1995-01-01",

same_y=True,

height=2,

)

External balances #

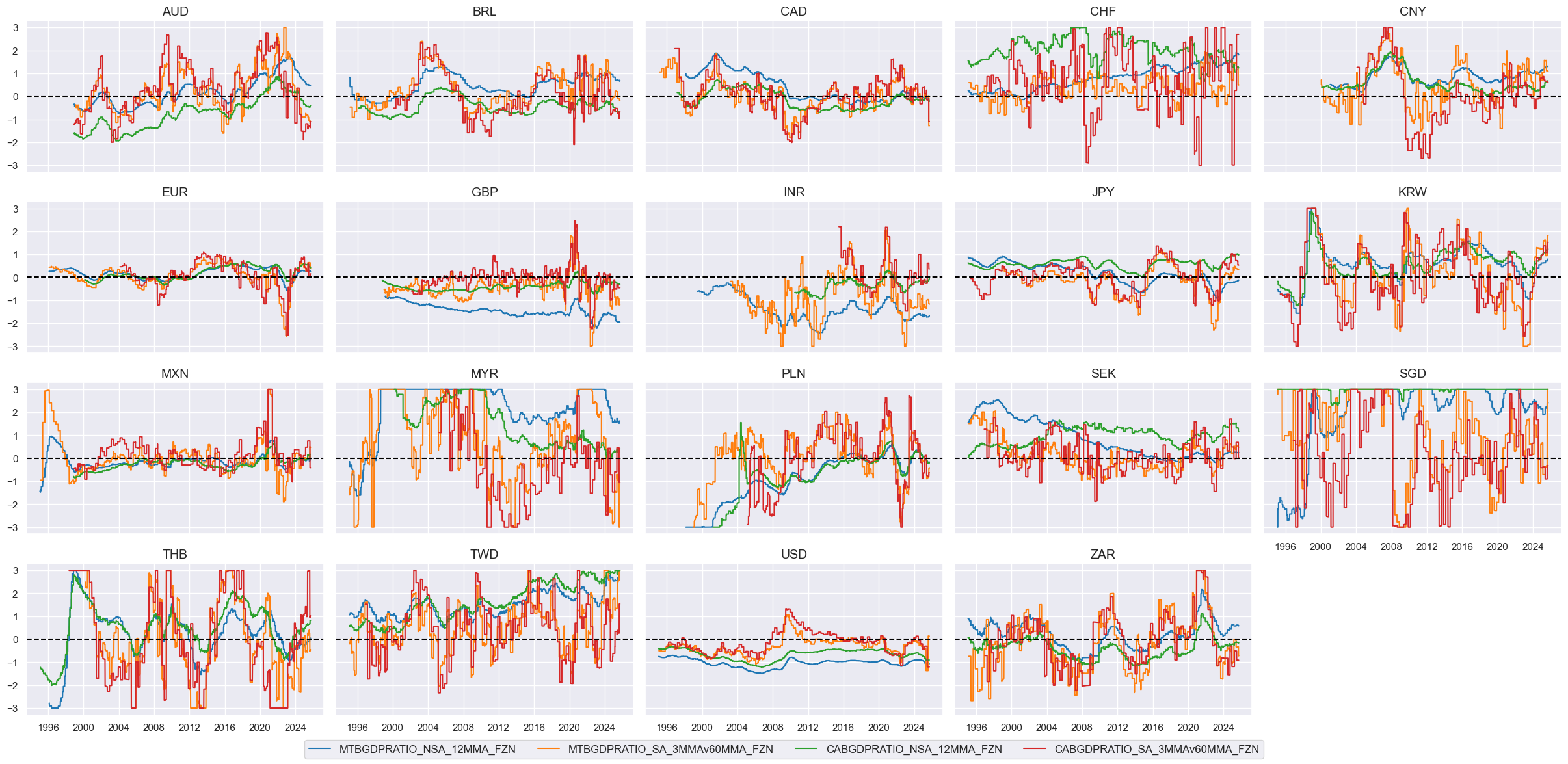

# All constituents, signs, and weights

xbal = {

'MTBGDPRATIO_NSA_12MMA': {"eq_sign": 1, "fx_sign": 1, "weight": 1/4},

'MTBGDPRATIO_SA_3MMAv60MMA': {"eq_sign": 1, "fx_sign": 1, "weight": 1/4},

'CABGDPRATIO_NSA_12MMA': {"eq_sign": 1, "fx_sign": 1, "weight": 1/4},

'CABGDPRATIO_SA_3MMAv60MMA': {"eq_sign": 1, "fx_sign": 1, "weight": 1/4},

}

# USD equity effects are indicators with appropriate signs

cidx = cids_eq

calcs = []

for xc, params in xbal.items():

s = "N" if params["eq_sign"] < 0 else ""

calcs.append(f"{xc}{s}_F = {xc} * {params["eq_sign"]}")

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cidx)

dfx = msm.update_df(dfx, dfa)

# Score the quantamental factors

postfixes = ["N" if v["eq_sign"] < 0 else "" for v in xbal.values()]

xbals = [k + s + "_F" for k, s in zip(xbal.keys(), postfixes)]

xcatx = xbals

cidx = cids_eq

for xc in xcatx:

dfa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

# Visualize

xcatx = [xc + "ZN" for xc in xbals]

cidx = cids_eq

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=5,

start="1995-01-01",

same_y=True,

height=2,

)

# Calculate the conceptual factor score

xcatx = [xc + "ZN" for xc in xbals]

cidx = cids_eq

weights = [xbal[xc]["weight"] for xc in list(xbal.keys())]

cfs = "XBALSTRENGTH"

dfa = msp.linear_composite(

df=dfx,

xcats=xcatx,

cids=cids_eq,

weights=weights,

new_xcat=cfs,

complete_xcats=False,

)

dfx= msm.update_df(dfx, dfa)

# Re-score

dfa = msp.make_zn_scores(

dfx,

xcat=cfs,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

concept_factors[cfs] = "External balance strength"

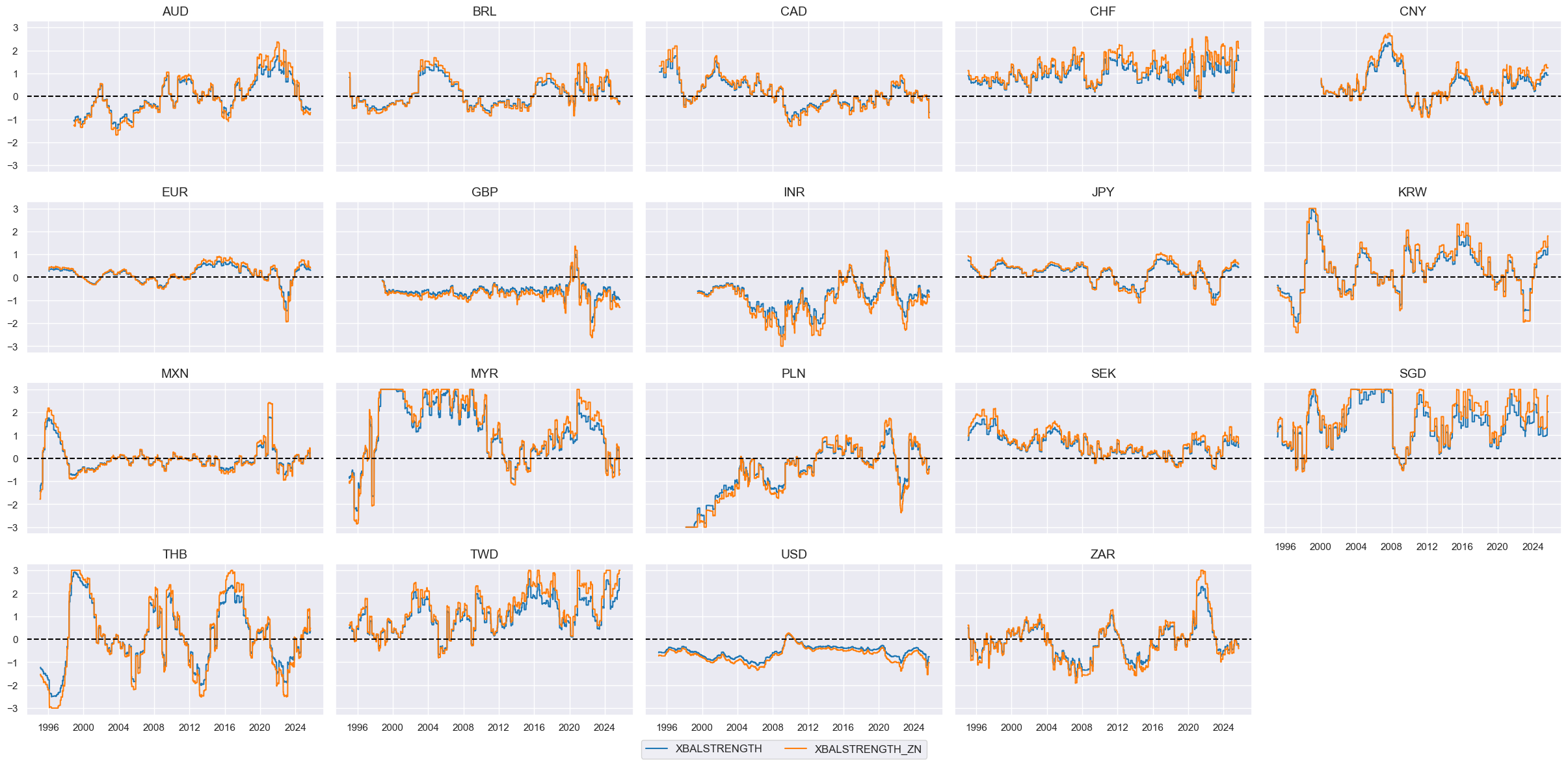

# Visualize

cfs = "XBALSTRENGTH"

xcatx = [cfs, f"{cfs}_ZN"]

cidx = cids_eq

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=5,

start="1995-01-01",

same_y=True,

height=2,

)

Investment position improvement #

# All constituents, signs, and weights

iip = {

'IIPLIABGDP_NSA_D1M1ML12': {"eq_sign": -1, "fx_sign": -1, "weight": 1/2},

'NIIPGDP_NSA_D1M1ML12': {"eq_sign": 1, "fx_sign": 1, "weight": 1/2},

}

# USD equity effects are indicators with appropriate signs

cidx = cids_eq

calcs = []

for xc, params in iip.items():

s = "N" if params["eq_sign"] < 0 else ""

calcs.append(f"{xc}{s}_F = {xc} * {params["eq_sign"]}")

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cidx)

dfx = msm.update_df(dfx, dfa)

# Score the quantamental factors

postfixes = ["N" if v["eq_sign"] < 0 else "" for v in iip.values()]

iips = [k + s + "_F" for k, s in zip(iip.keys(), postfixes)]

xcatx = iips

cidx = cids_eq

for xc in xcatx:

dfa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

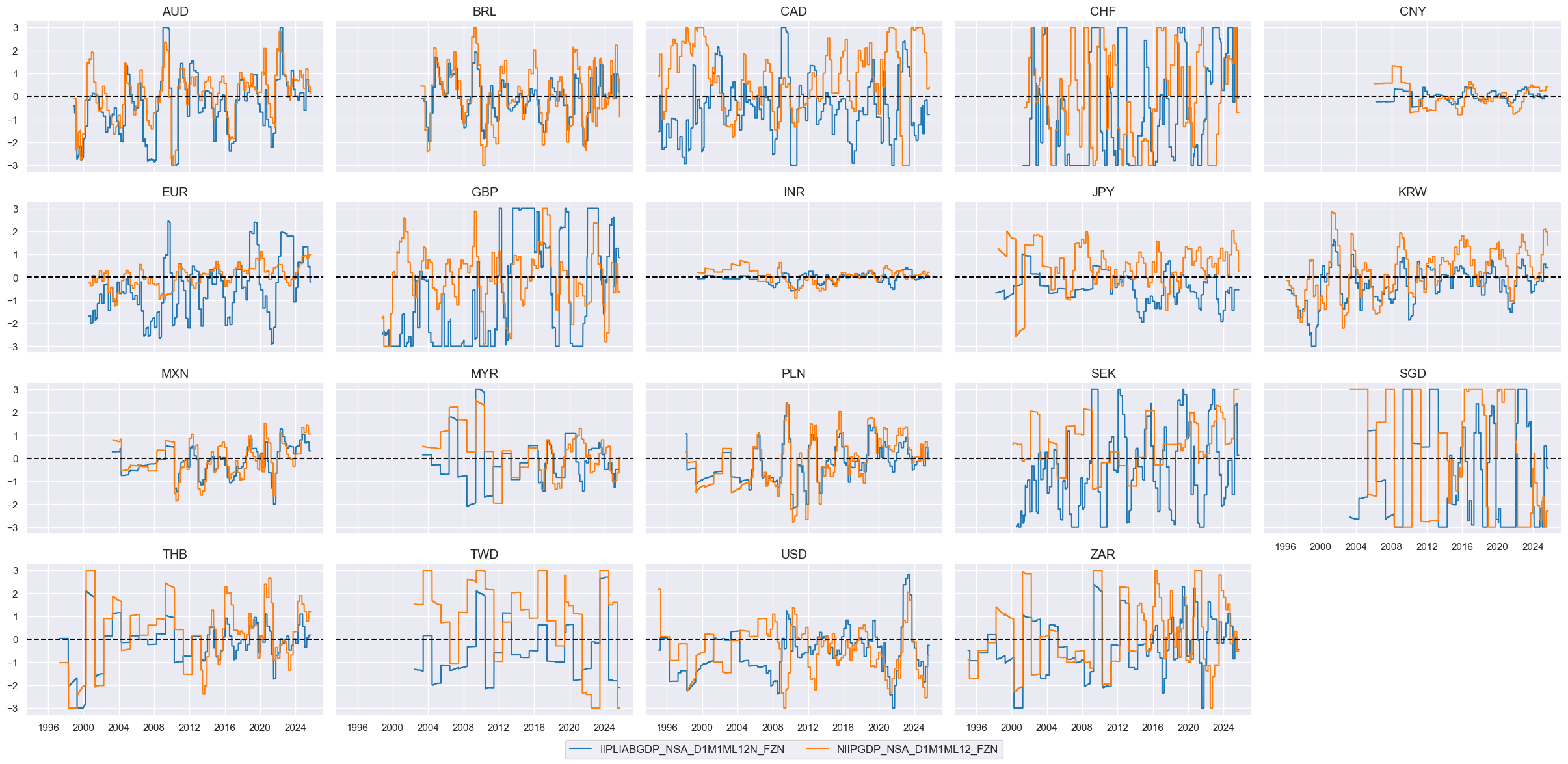

# Visualize

xcatx = [xc + "ZN" for xc in iips]

cidx = cids_eq

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=5,

start="1995-01-01",

same_y=True,

height=2,

)

# Calculate the conceptual factor score

xcatx = [xc + "ZN" for xc in iips]

cidx = cids_eq

weights = [iip[xc]["weight"] for xc in list(iip.keys())]

cfs = "IIPIMPROVE"

dfa = msp.linear_composite(

df=dfx,

xcats=xcatx,

cids=cids_eq,

weights=weights,

new_xcat=cfs,

complete_xcats=False,

)

dfx= msm.update_df(dfx, dfa)

# Re-score

dfa = msp.make_zn_scores(

dfx,

xcat=cfs,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

concept_factors[cfs] = "Investment position improvement"

# Visualize

cfs = "IIPIMPROVE"

xcatx = [cfs, f"{cfs}_ZN"]

cidx = cids_eq

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=5,

start="1995-01-01",

same_y=True,

height=2,

)

Liquidity growth #

# All constituents, signs, and weights

liq = {

'INTLIQGDP_NSA_D1M1ML3': {"eq_sign": 1, "fx_sign": 1, "weight": 1/2},

'INTLIQGDP_NSA_D1M1ML6': {"eq_sign": 1, "fx_sign": 1, "weight": 1/2},

}

# USD equity effects are indicators with appropriate signs

cidx = cids_eq

calcs = []

for xc, params in liq.items():

s = "N" if params["eq_sign"] < 0 else ""

calcs.append(f"{xc}{s}_F = {xc} * {params["eq_sign"]}")

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cidx)

dfx = msm.update_df(dfx, dfa)

# Score the quantamental factors

postfixes = ["N" if v["eq_sign"] < 0 else "" for v in liq.values()]

liqs = [k + s + "_F" for k, s in zip(liq.keys(), postfixes)]

xcatx = liqs

cidx = cids_eq

for xc in xcatx:

dfa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

# Visualize

xcatx = [xc + "ZN" for xc in liqs]

cidx = cids_eq

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=5,

start="1995-01-01",

same_y=True,

height=2,

)

# Calculate the conceptual factor score

xcatx = [xc + "ZN" for xc in liqs]

cidx = cids_eq

weights = [liq[xc]["weight"] for xc in list(liq.keys())]

cfs = "LIQGROW"

dfa = msp.linear_composite(

df=dfx,

xcats=xcatx,

cids=cids_eq,

weights=weights,

new_xcat=cfs,

complete_xcats=False,

)

dfx= msm.update_df(dfx, dfa)

# Re-score

dfa = msp.make_zn_scores(

dfx,

xcat=cfs,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

concept_factors[cfs] = "Liquidity growth"

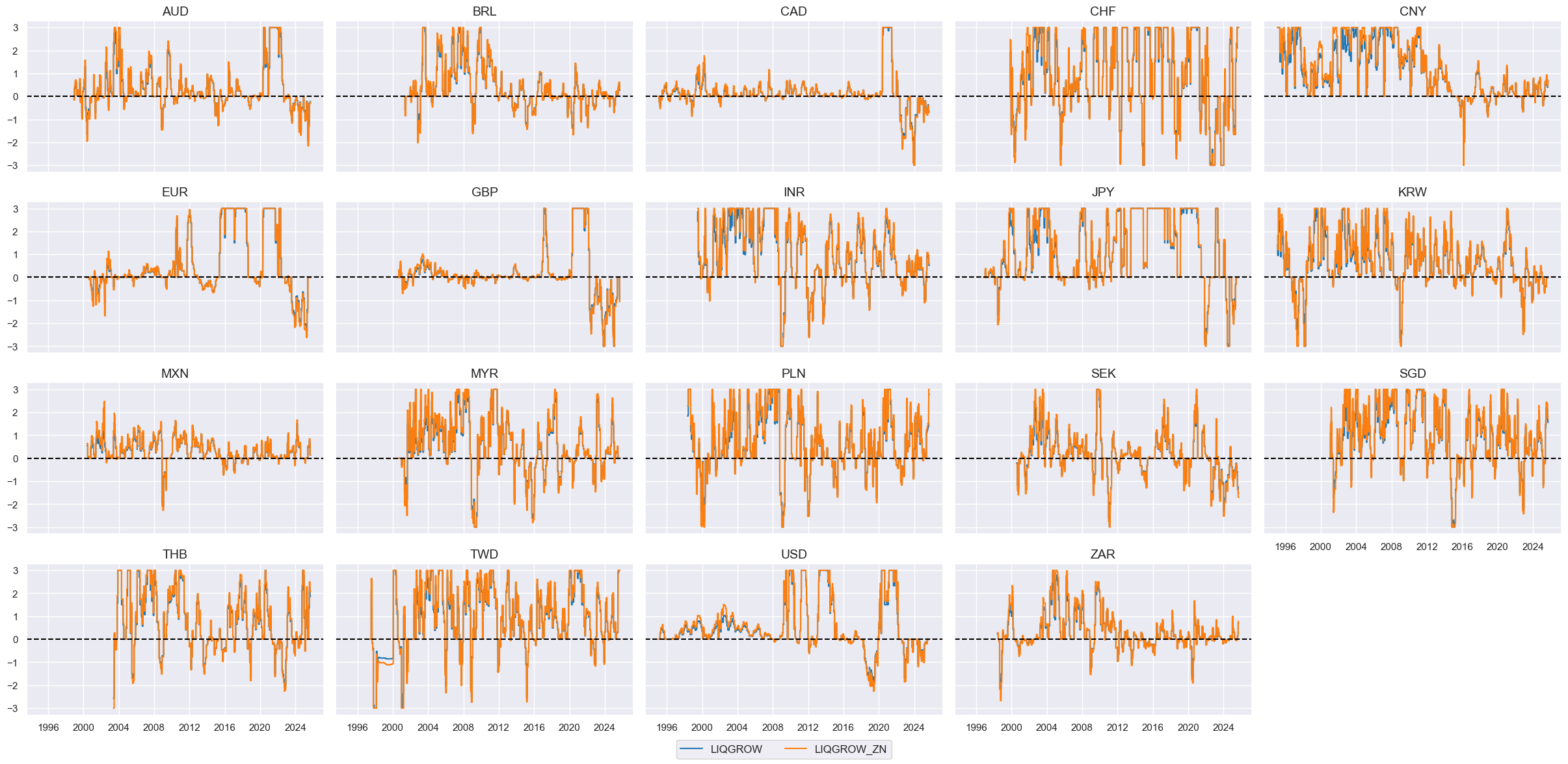

# Visualize

cfs = "LIQGROW"

xcatx = [cfs, f"{cfs}_ZN"]

cidx = cids_eq

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=5,

start="1995-01-01",

same_y=True,

height=2,

)

Overheating #

# Computing real consumption / sales trends in excess of long term growth support

cidx = cids_eq

calcs = [

"XRPCONS_SA_P1M1ML12 = RPCONS_SA_P1M1ML12 - RGDP_SA_P1Q1QL4_20QMM",

"XRRSALES_SA_P1M1ML12 = RRSALES_SA_P1M1ML12 - RGDP_SA_P1Q1QL4_20QMM"

]

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cidx)

dfx = msm.update_df(dfx, dfa)

# All constituents, signs, and weights

xdem = {

'XRPCONS_SA_P1M1ML12': {"eq_sign": -1, "fx_sign": 1, "weight": 1/4},

'XRRSALES_SA_P1M1ML12': {"eq_sign": -1, "fx_sign": 1, "weight": 1/4},

'UNEMPLRATE_NSA_3MMA_D1M1ML12': {"eq_sign": 1, "fx_sign": -1, "weight": 1/4},

'UNEMPLRATE_SA_3MMAv5YMA': {"eq_sign": 1, "fx_sign": -1, "weight": 1/4},

}

# Differentials to USD

xcatx = list(xdem.keys())

cidx = cids_eq

for xc in xcatx:

dfa = msp.make_relative_value(

dfx,

xcats=xcatx,

cids=cidx,

basket=["USD"], # basket does not use all cross-sections

rel_meth="subtract",

postfix="vUSD",

)

dfx = msm.update_df(df=dfx, df_add=dfa)

# Visualize

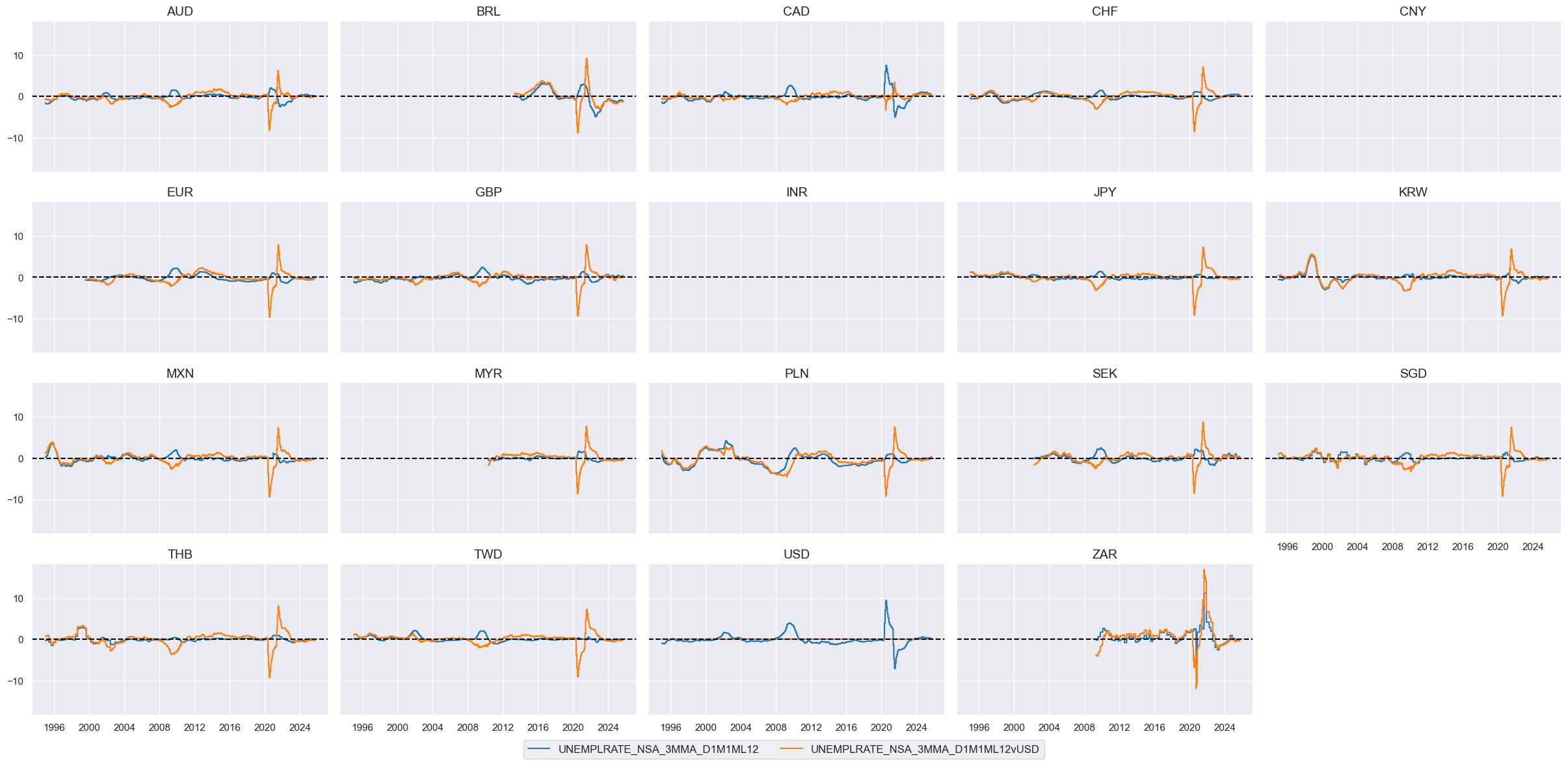

xcatx = ["UNEMPLRATE_NSA_3MMA_D1M1ML12", "UNEMPLRATE_NSA_3MMA_D1M1ML12vUSD"]

cidx = cids_eq

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=5,

start="1995-01-01",

same_y=True,

height=2,

)

# Extract USD equity effects

cidx = cids_eq

for xc, params in xdem.items():

dfa = cross_asset_effects(

df=dfx,

cids=cidx,

effect_name=xc + "_F",

signal_xcats={"eq": xc, "fx": xc + "vUSD"},

weights_xcats={"eq": "EQXRxEASD_NSA_EXT", "fx": "FXXRUSDxEASD_NSA"},

signal_signs={k.replace("_sign", ""): v for k, v in params.items() if "sign" in k},

)

dfx = msm.update_df(dfx, dfa.loc[dfa["xcat"] == f"{xc}_F"])

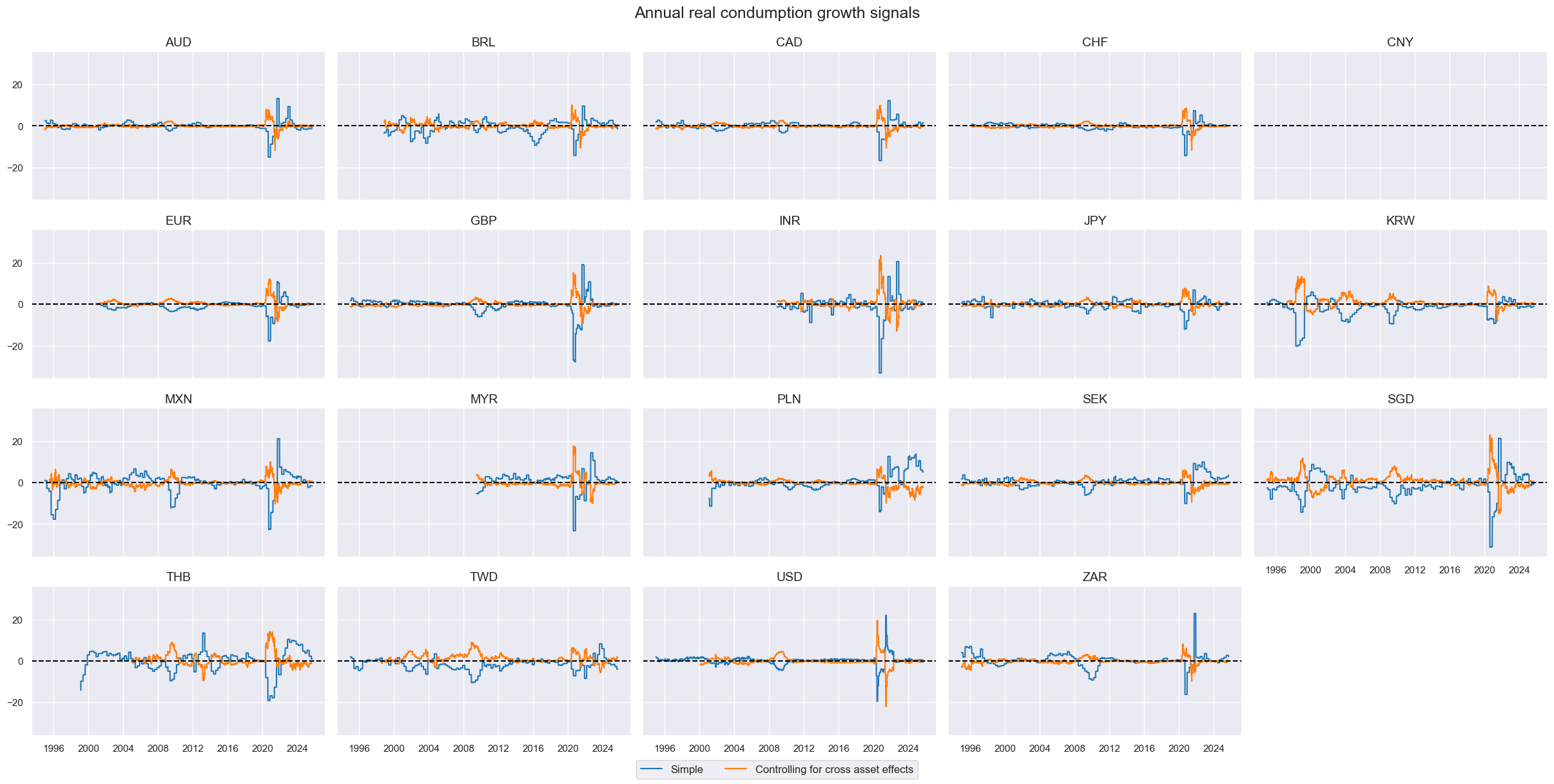

# Visualize

xcatx = ["XRPCONS_SA_P1M1ML12", "XRPCONS_SA_P1M1ML12_F"]

cidx = cids_eq

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=5,

start="1995-01-01",

same_y=True,

height=2,

title="Annual real condumption growth signals",

xcat_labels=["Simple", "Controlling for cross asset effects"]

)

# Score the quantamental factors

xcatx = [xc + "_F" for xc in list(xdem.keys())]

cidx = cids_eq

for xc in xcatx:

dfa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

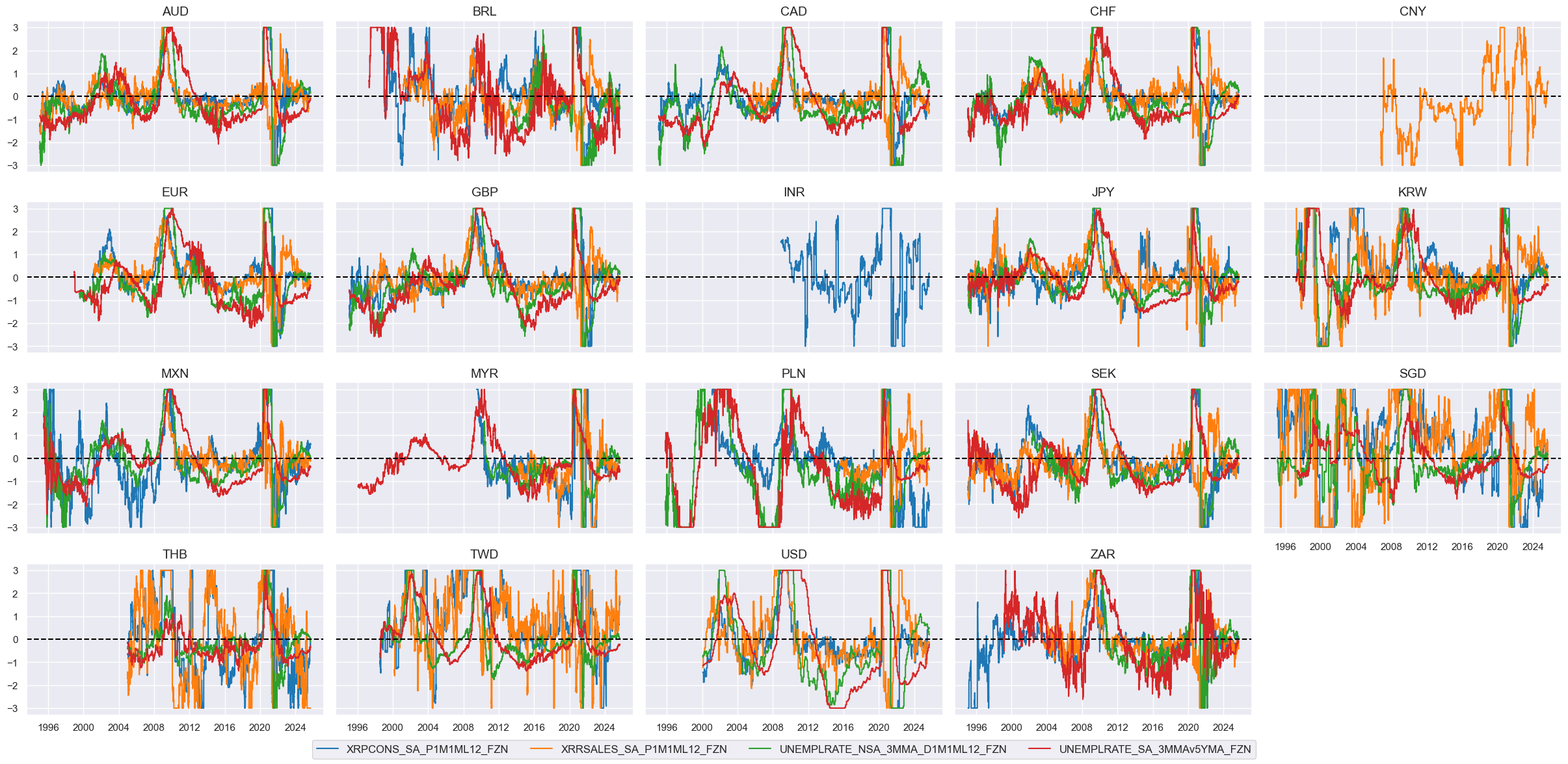

# Visualize

xcatx = [xc + "_FZN" for xc in list(xdem.keys())]

cidx = cids_eq

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=5,

start="1995-01-01",

same_y=True,

height=2,

)

# Calculate the conceptual factor score

xcatx = [xc + "_FZN" for xc in list(xdem.keys())]

cidx = cids_eq

weights = [xdem[xc]["weight"] for xc in list(xdem.keys())]

cfs = "OVERHEAT"

dfa = msp.linear_composite(

df=dfx,

xcats=xcatx,

cids=cids_eq,

weights=weights,

new_xcat=cfs,

complete_xcats=False,

)

dfx= msm.update_df(dfx, dfa)

# Re-score

dfa = msp.make_zn_scores(

dfx,

xcat=cfs,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

concept_factors[cfs] = "Overheating effect"

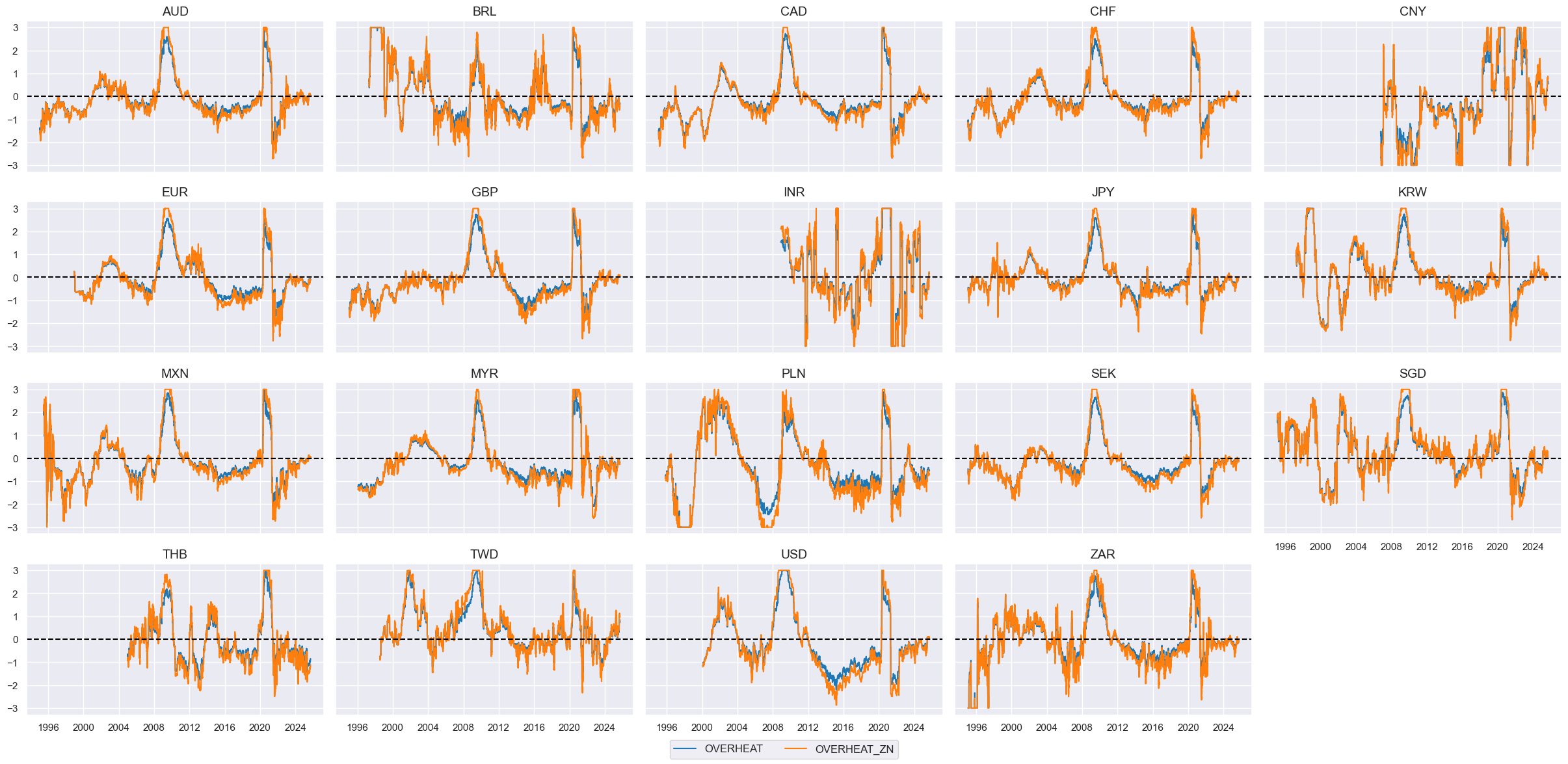

# Visualize

cfs = "OVERHEAT"

xcatx = [cfs, f"{cfs}_ZN"]

cidx = cids_eq

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=5,

start="1995-01-01",

same_y=True,

height=2,

)

Confidence improvement #

# All constituents, signs, and weights

conf = {

'MBCSCORE_SA_D3M3ML3': {"eq_sign": 1, "fx_sign": 1, "weight": 1/4},

'MBCSCORE_SA_D1M1ML12': {"eq_sign": 1, "fx_sign": 1, "weight": 1/4},

'CCSCORE_SA_D3M3ML3': {"eq_sign": 1, "fx_sign": 1, "weight": 1/4},

'CCSCORE_SA_D1M1ML12': {"eq_sign": 1, "fx_sign": 1, "weight": 1/4},

}

# USD equity effects are indicators with appropriate signs

cidx = cids_eq

calcs = []

for xc, params in conf.items():

s = "N" if params["eq_sign"] < 0 else ""

calcs.append(f"{xc}{s}_F = {xc} * {params["eq_sign"]}")

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cidx)

dfx = msm.update_df(dfx, dfa)

# Score the quantamental factors

postfixes = ["N" if v["eq_sign"] < 0 else "" for v in conf.values()]

confs = [k + s + "_F" for k, s in zip(conf.keys(), postfixes)]

xcatx = confs

cidx = cids_eq

for xc in xcatx:

dfa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

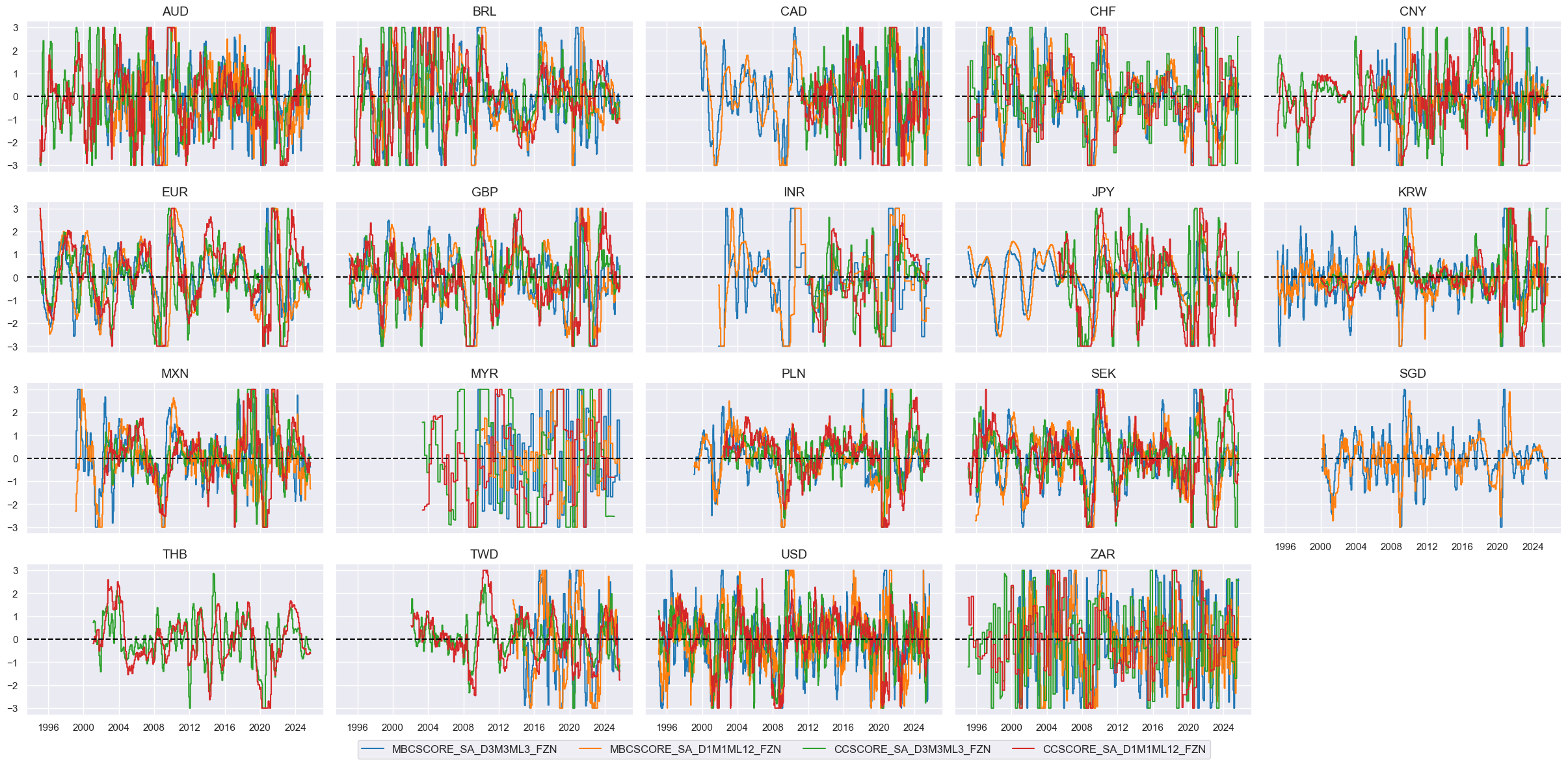

# Visualize

xcatx = [xc + "ZN" for xc in confs]

cidx = cids_eq

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=5,

start="1995-01-01",

same_y=True,

height=2,

)

# Calculate the conceptual factor score

xcatx = [xc + "ZN" for xc in confs]

cidx = cids_eq

weights = [conf[xc]["weight"] for xc in list(conf.keys())]

cfs = "CONFUP"

dfa = msp.linear_composite(

df=dfx,

xcats=xcatx,

cids=cids_eq,

weights=weights,

new_xcat=cfs,

complete_xcats=False,

)

dfx= msm.update_df(dfx, dfa)

# Re-score

dfa = msp.make_zn_scores(

dfx,

xcat=cfs,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

concept_factors[cfs] = "Confidence improvement"

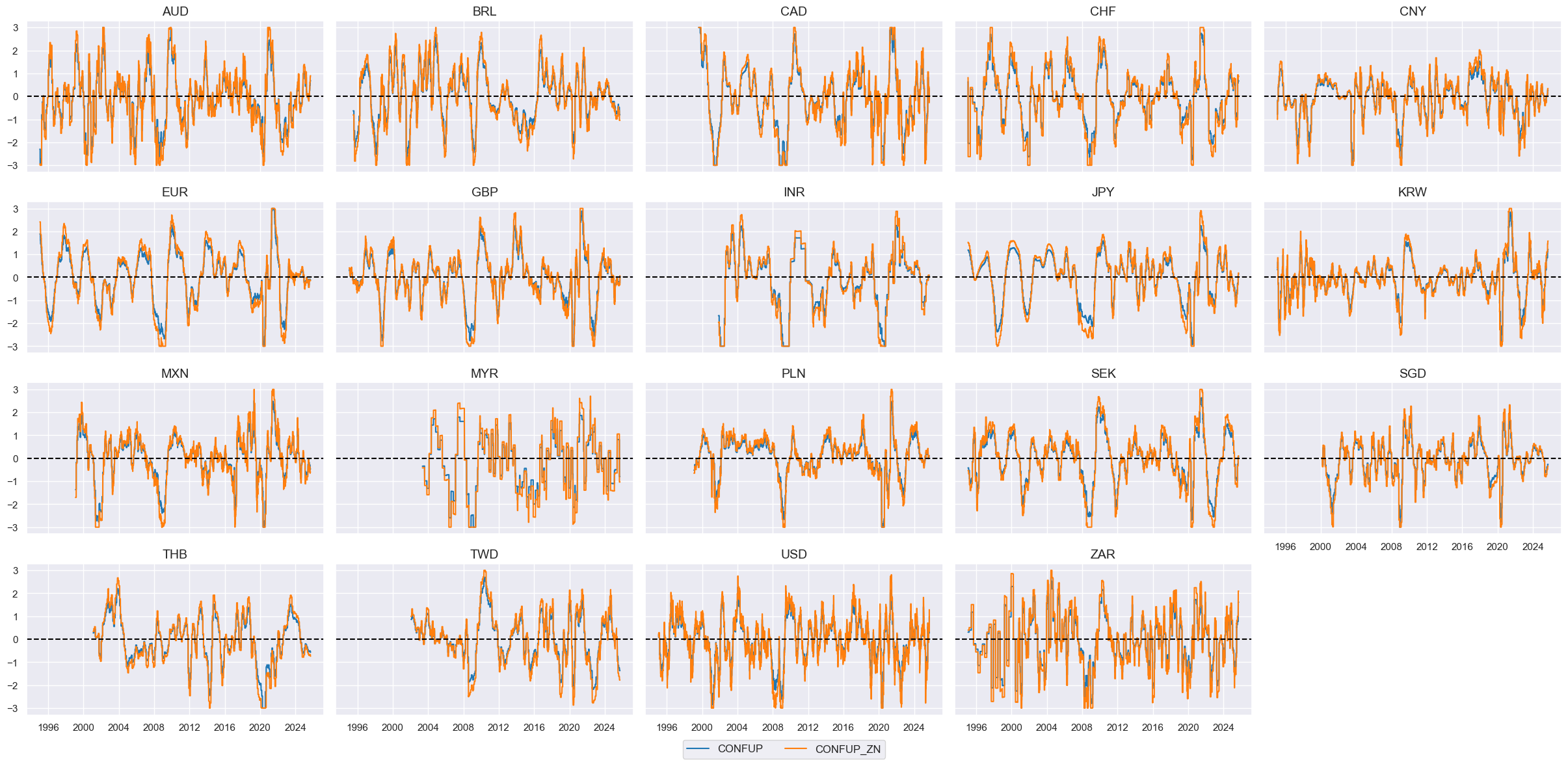

# Visualize

cfs = "CONFUP"

xcatx = [cfs, f"{cfs}_ZN"]

cidx = cids_eq

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=5,

start="1995-01-01",

same_y=True,

height=2,

)

Real yields #

# Real rate dynamics

cidx = cids_eq

calcs = [

"RIR_NSA_1MMA = RIR_NSA.rolling(21).mean()",

"RIR_NSA_1MMAL1 = RIR_NSA.shift(21)",

"RIR_NSA_D1M1ML1 = RIR_NSA_1MMA - RIR_NSA_1MMAL1",

"RYLDIRS02Y_NSA_1MMA = RYLDIRS02Y_NSA.rolling(21).mean()",

"RYLDIRS02Y_NSA_1MMA_L1 = RYLDIRS02Y_NSA_1MMA.shift(21)",

"RYLDIRS02Y_NSA_D1M1ML1 = RYLDIRS02Y_NSA_1MMA - RYLDIRS02Y_NSA_1MMA_L1",

"RYLDIRS05Y_NSA_1MMA = RYLDIRS05Y_NSA.rolling(21).mean()",

"RYLDIRS05Y_NSA_1MMA_L1 = RYLDIRS05Y_NSA_1MMA.shift(21)",

"RYLDIRS05Y_NSA_D1M1ML1 = RYLDIRS05Y_NSA_1MMA - RYLDIRS05Y_NSA_1MMA_L1"

]

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cidx)

dfx = msm.update_df(dfx, dfa)

# All constituents, signs, and weights

ryield = {

'RIR_NSA': {"eq_sign": -1, "fx_sign": 1, "weight": 1/6},

'RIR_NSA_D1M1ML1': {"eq_sign": -1, "fx_sign": 1, "weight": 1/6},

'RYLDIRS02Y_NSA': {"eq_sign": -1, "fx_sign": 1, "weight": 1/6},

'RYLDIRS02Y_NSA_D1M1ML1': {"eq_sign": -1, "fx_sign": 1, "weight": 1/6},

'RYLDIRS05Y_NSA': {"eq_sign": -1, "fx_sign": 1, "weight": 1/6},

'RYLDIRS05Y_NSA_D1M1ML1': {"eq_sign": -1, "fx_sign": 1, "weight": 1/6},

}

# Differentials to USD

xcatx = list(ryield.keys())

cidx = cids_eq

for xc in xcatx:

dfa = msp.make_relative_value(

dfx,

xcats=xcatx,

cids=cidx,

basket=["USD"], # basket does not use all cross-sections

rel_meth="subtract",

postfix="vUSD",

)

dfx = msm.update_df(df=dfx, df_add=dfa)

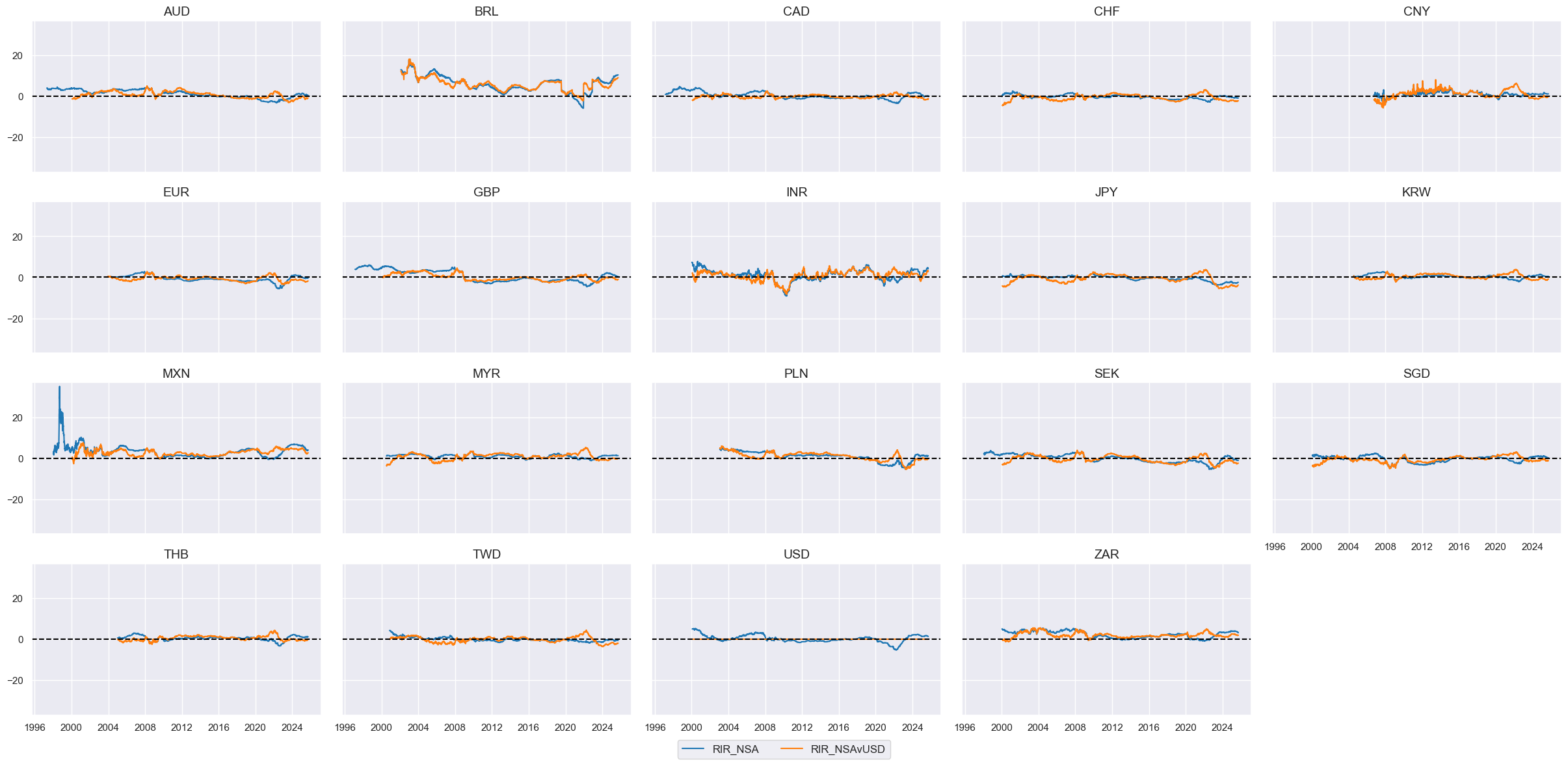

# Visualize

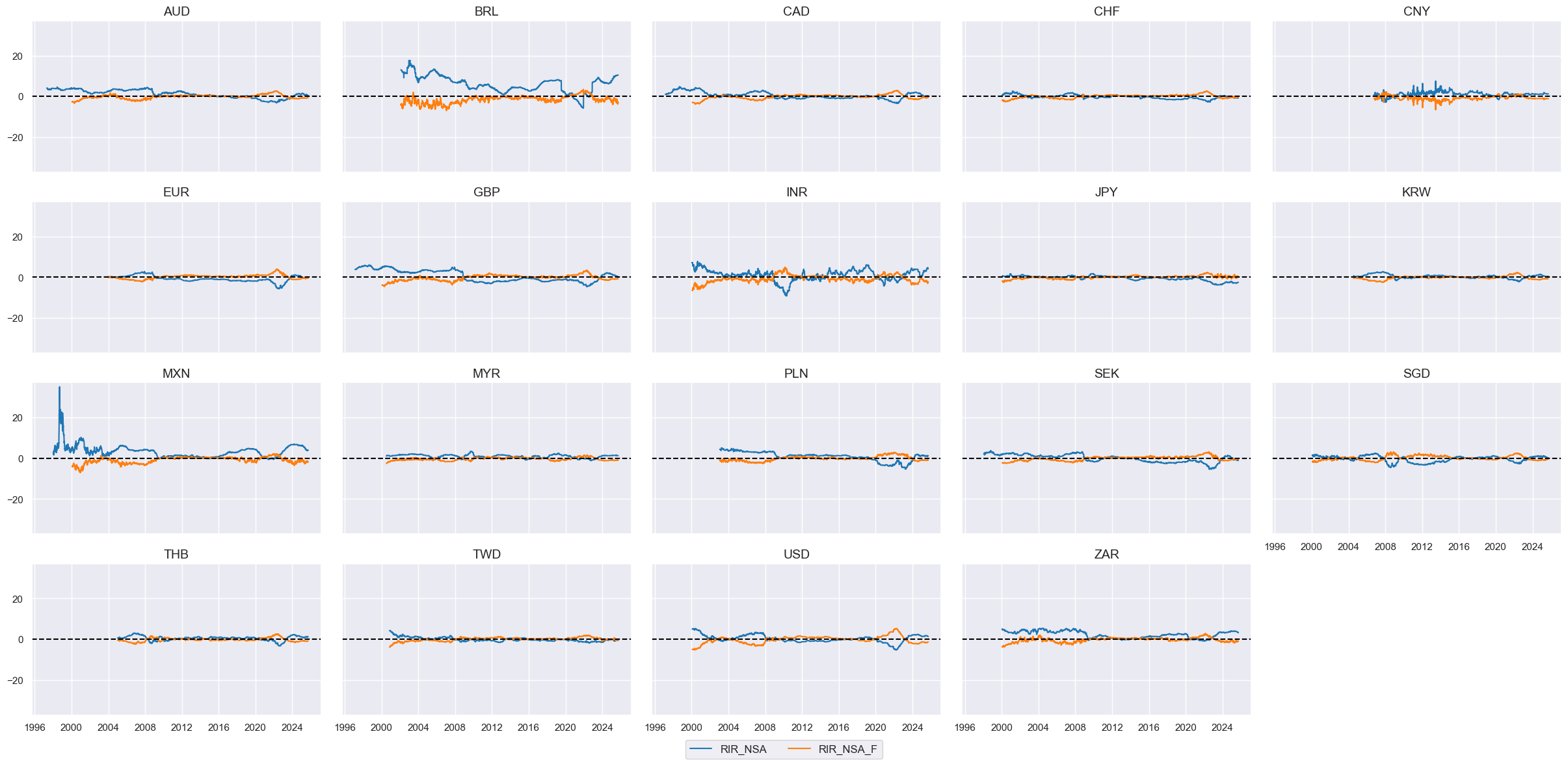

xcatx = ["RIR_NSA", "RIR_NSAvUSD"]

cidx = cids_eq

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=5,

start="1995-01-01",

same_y=True,

height=2,

)

# Extract USD equity effects

cidx = cids_eq

for xc, params in ryield.items():

dfa = cross_asset_effects(

df=dfx,

cids=cidx,

effect_name=xc + "_F",

signal_xcats={"eq": xc, "fx": xc + "vUSD"},

weights_xcats={"eq": "EQXRxEASD_NSA_EXT", "fx": "FXXRUSDxEASD_NSA"},

signal_signs={k.replace("_sign", ""): v for k, v in params.items() if "sign" in k},

)

dfx = msm.update_df(dfx, dfa.loc[dfa["xcat"] == f"{xc}_F"])

# Visualize

xcatx = ["RIR_NSA", "RIR_NSA_F"]

cidx = cids_eq

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=5,

start="1995-01-01",

same_y=True,

height=2,

)

# Score the quantamental factors

xcatx = [xc + "_F" for xc in list(ryield.keys())]

cidx = cids_eq

for xc in xcatx:

dfa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

# Visualize

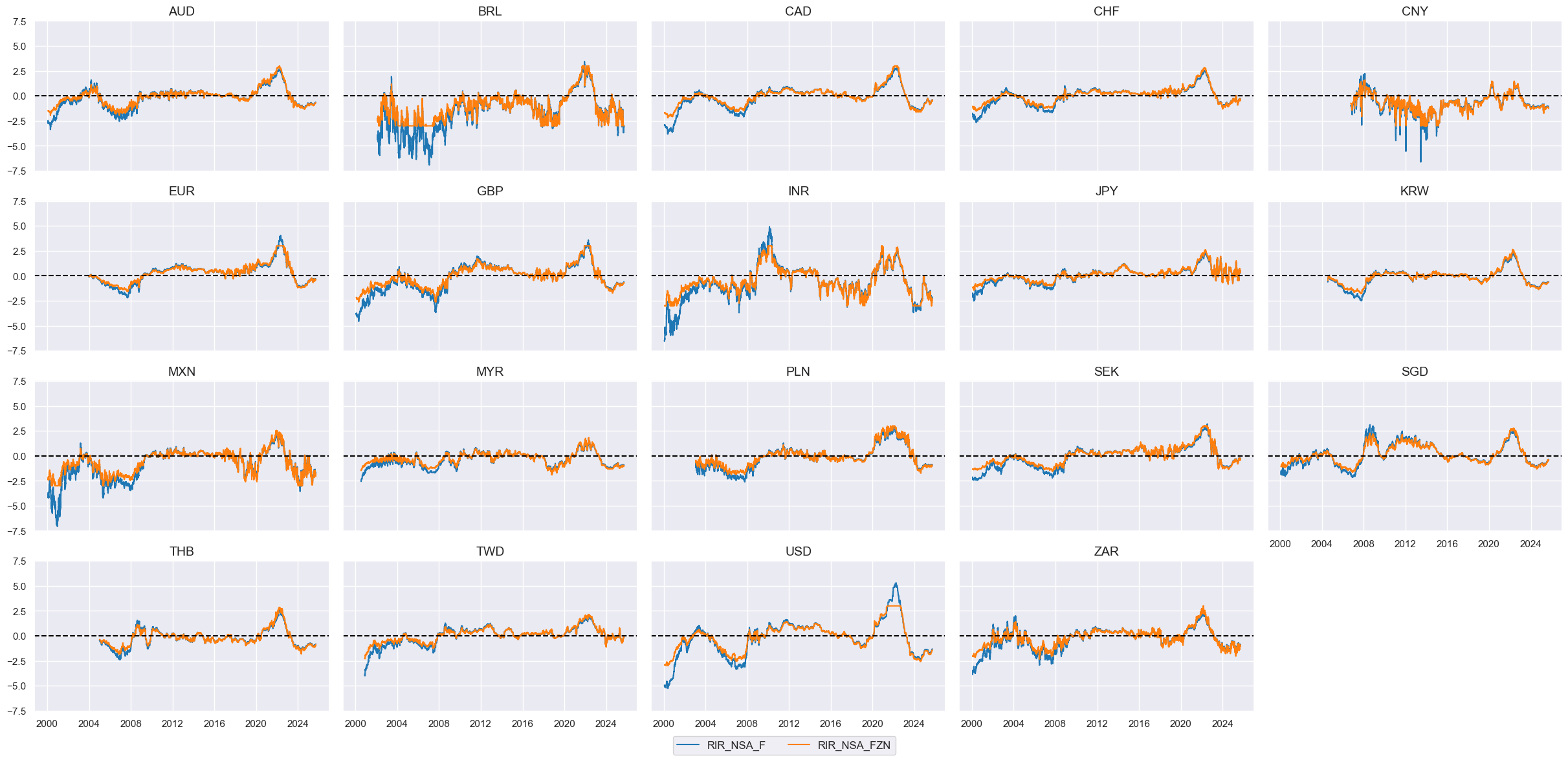

xcatx = ["RIR_NSA_F", "RIR_NSA_FZN"]

cidx = cids_eq

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=5,

start="1995-01-01",

same_y=True,

height=2,

)

# Calculate the conceptual factor score

xcatx = [xc + "_FZN" for xc in list(ryield.keys())]

cidx = cids_eq

weights = [ryield[xc]["weight"] for xc in list(ryield.keys())]

cfs = "RYIELD"

dfa = msp.linear_composite(

df=dfx,

xcats=xcatx,

cids=cids_eq,

weights=weights,

new_xcat=cfs,

complete_xcats=False,

)

dfx= msm.update_df(dfx, dfa)

# Re-score

dfa = msp.make_zn_scores(

dfx,

xcat=cfs,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

concept_factors[cfs] = "Real yield effect"

# Visualize

cfs = "RYIELD"

xcatx = [cfs, f"{cfs}_ZN"]

cidx = cids_eq

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=5,

start="1995-01-01",

same_y=True,

height=2,

)

Joint factor visualizations and relative factor calculation #

cfs_names = {k + "_ZN": v for k, v in concept_factors.items()}

rcfs_names = {k + "_ZNvGLB": v for k, v in concept_factors.items()}

xcatx = list(cfs_names.keys())

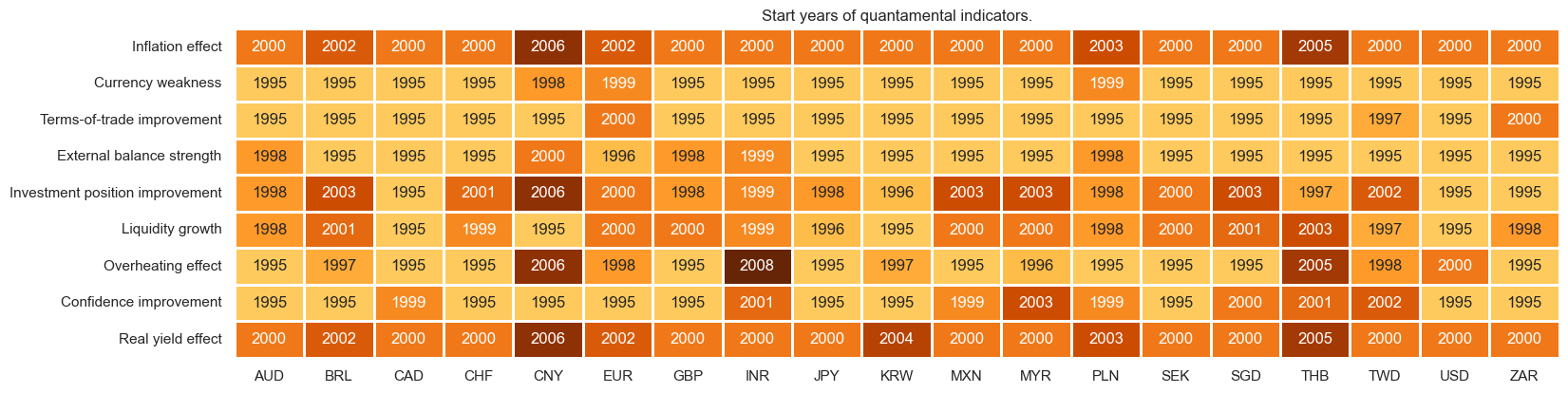

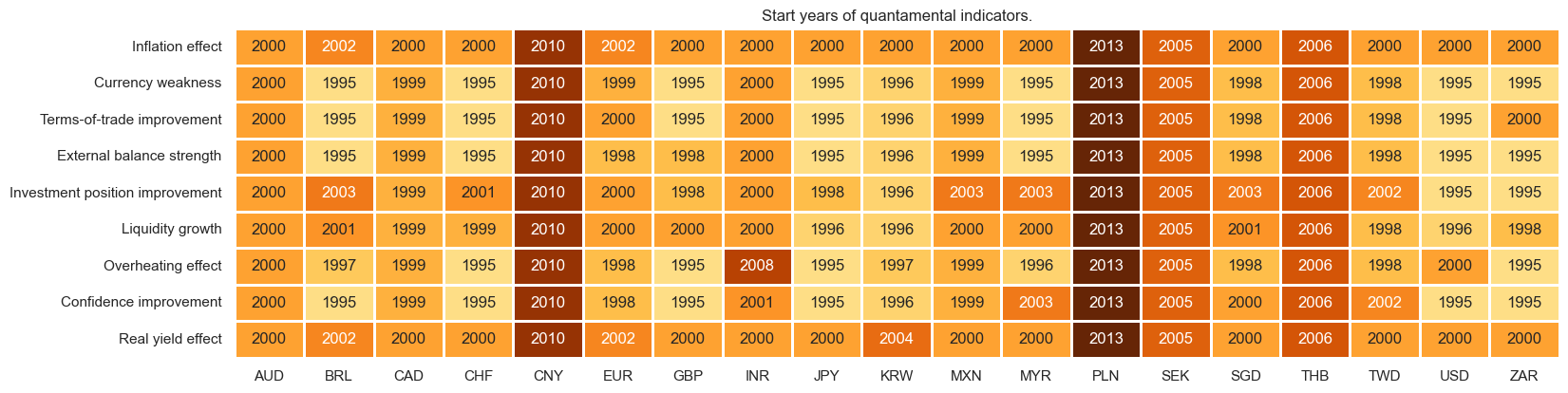

msm.check_availability(

df=dfx,

xcats=xcatx,

cids=cids_eq,

missing_recent=False,

start="1995-01-01",

xcat_labels=cfs_names,

)

cidx = cids_eq

xcatx = list(cfs_names.keys())

start = "1995-01-01"

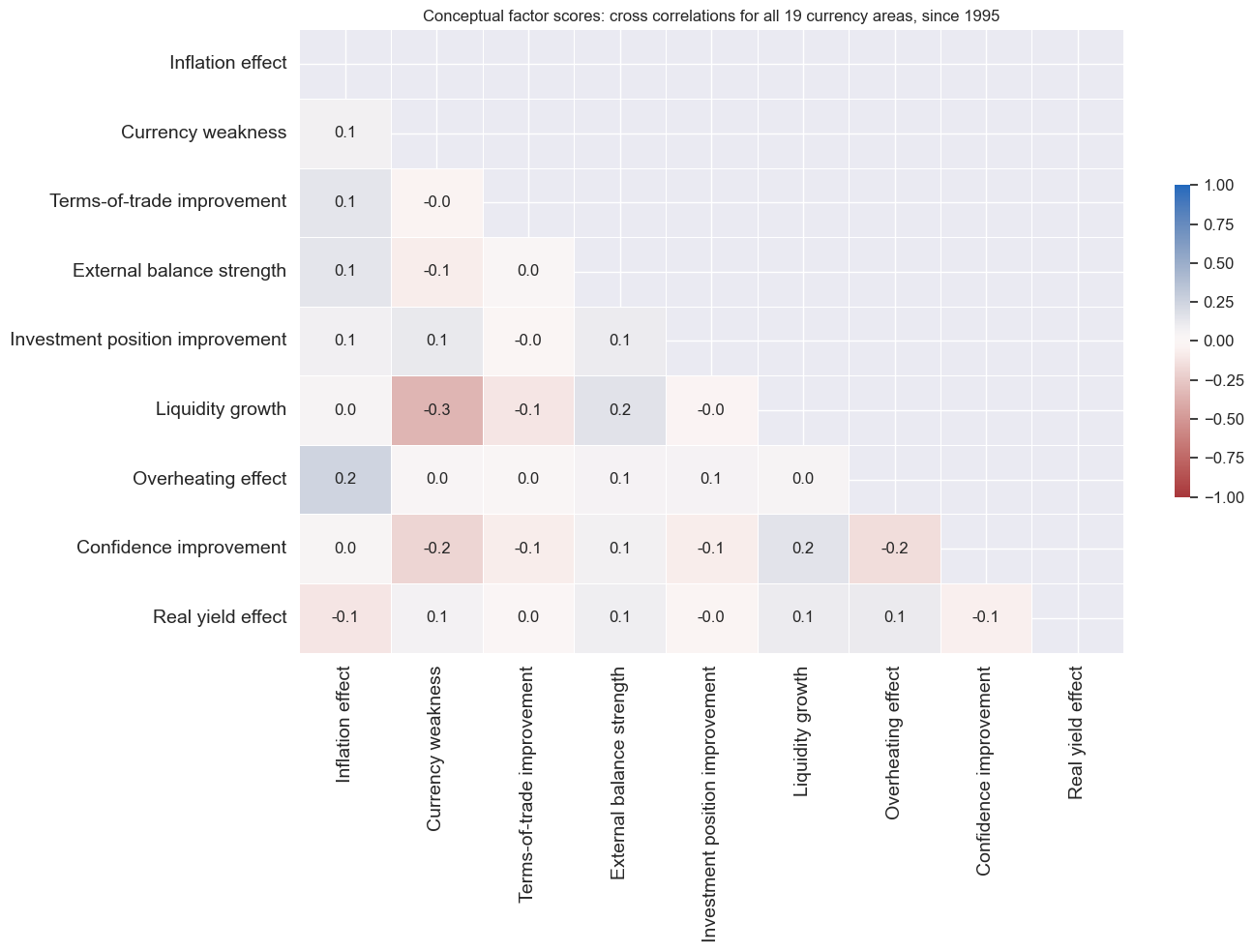

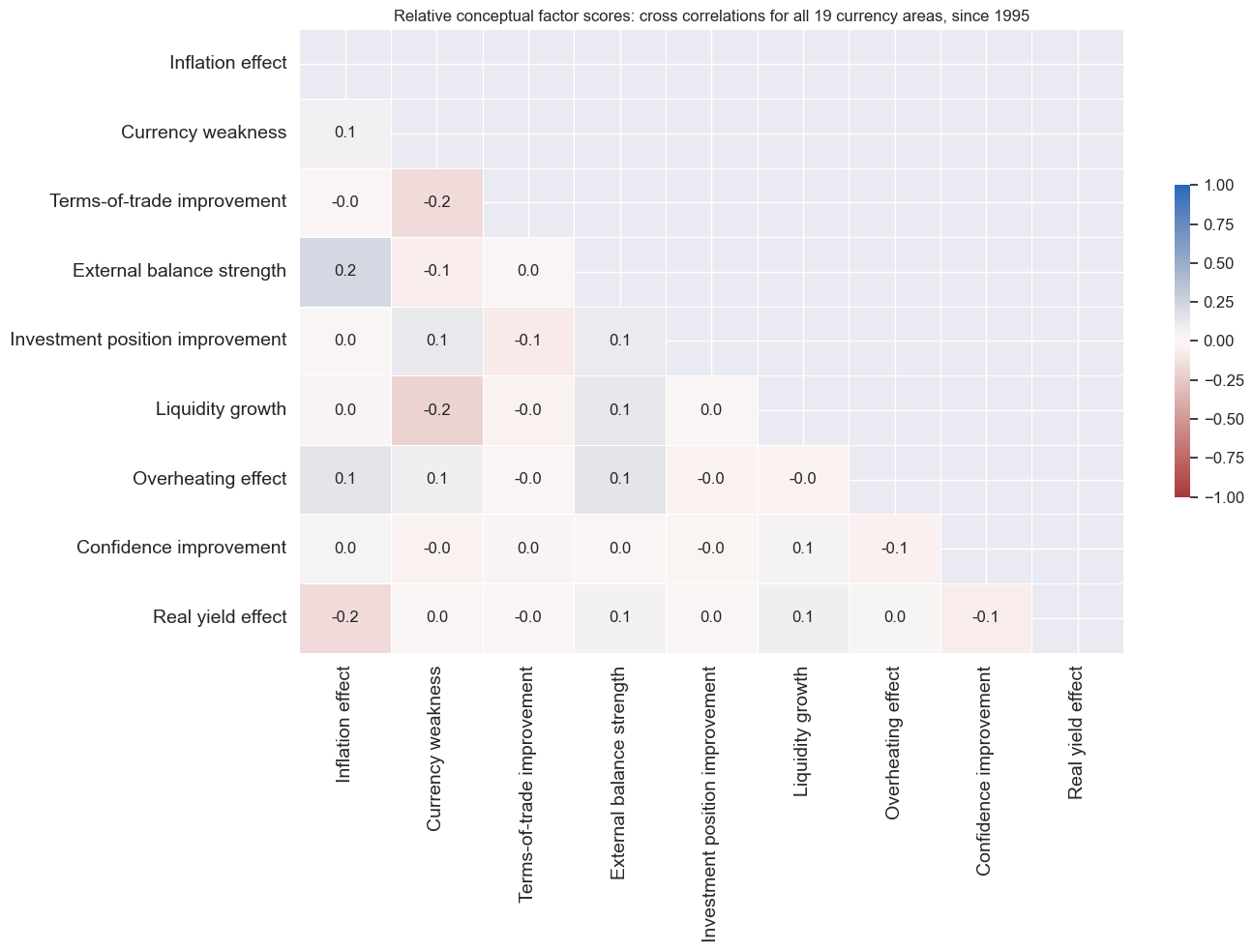

msp.correl_matrix(

dfx,

cids=cidx,

xcats=xcatx,

max_color=1.0,

annot=True,

fmt=".1f",

freq="M",

cluster=False,

title="Conceptual factor scores: cross correlations for all 19 currency areas, since 1995",

xcat_labels=cfs_names,

start=start,

size=(14, 10)

)

cidx = cids_eq

xcatx = list(cfs_names.keys())

start_date = "1995-01-01"

dfa = msp.make_relative_value(

dfx,

xcats=xcatx,

cids=cidx,

start=start_date,

blacklist=equsdblack,

rel_meth="subtract",

complete_cross=False,

postfix="vGLB",

)

dfx = msm.update_df(dfx, dfa)

xcatx = list(rcfs_names.keys())

msm.check_availability(

df=dfx,

xcats=xcatx,

cids=cids_eq,

missing_recent=False,

start="1995-01-01",

xcat_labels=rcfs_names,

)

cidx = cids_eq

xcatx = list(rcfs_names.keys())

start = "1995-01-01"

msp.correl_matrix(

dfx,

cids=cidx,

xcats=xcatx,

max_color=1.0,

annot=True,

fmt=".1f",

freq="M",

cluster=False,

title="Relative conceptual factor scores: cross correlations for all 19 currency areas, since 1995",

xcat_labels=rcfs_names,

start=start,

size=(14, 10)

)

Conceptual risk-parity #

xcatx = list(rcfs_names.keys())

cidx = cids_eq

new_cat = "MACRO_REL"

dfa = msp.linear_composite(

dfx,

xcats=xcatx,

cids=cidx,

normalize_weights=True,

complete_xcats=False,

new_xcat=new_cat,

)

dfx = msm.update_df(dfx, dfa)

dfazn = msp.make_zn_scores(

dfx,

xcat=new_cat,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfazn)

# Visualize

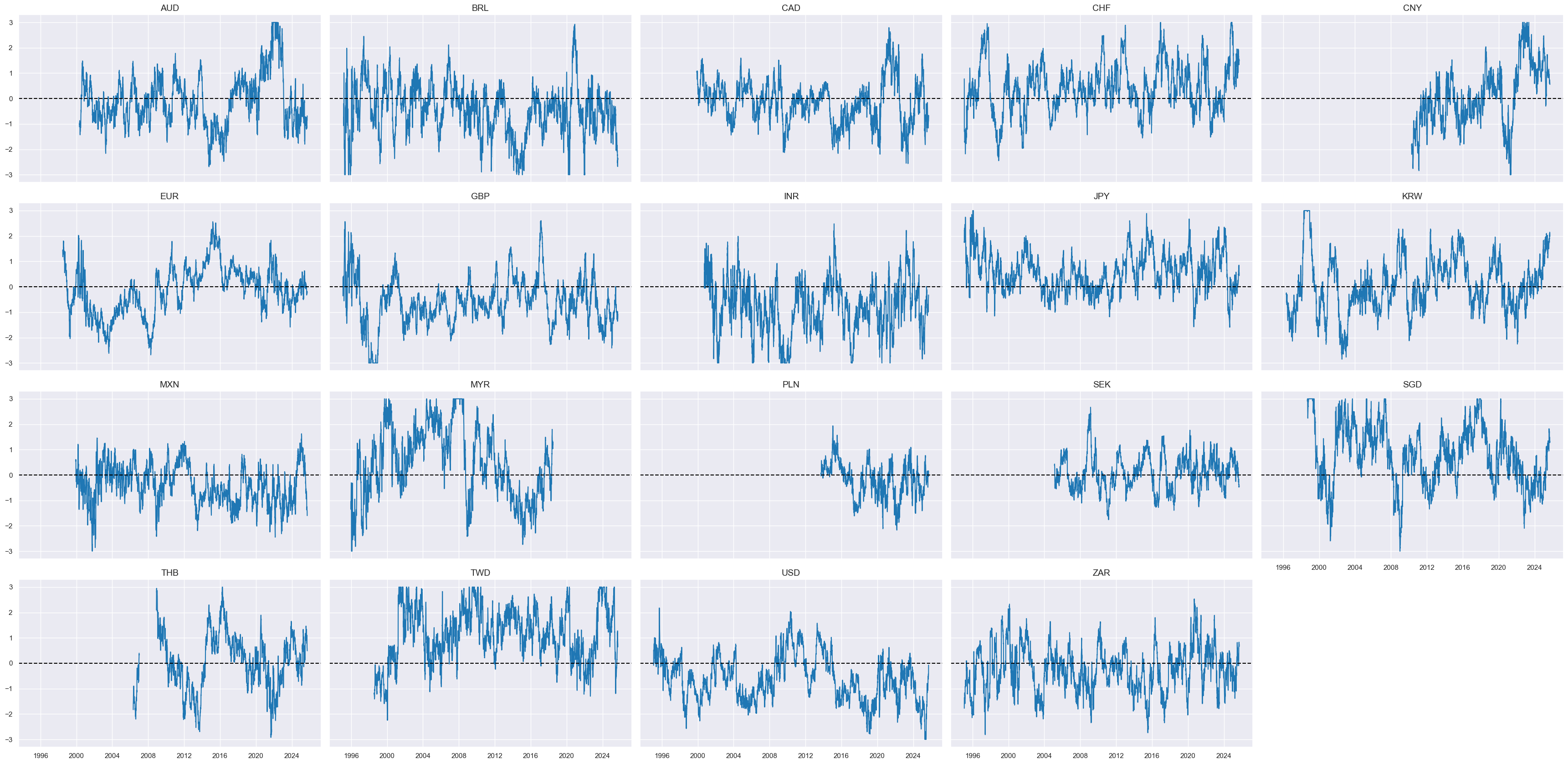

xcatx = ["MACRO_REL_ZN"]

cidx = cids_eq

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=5,

start="1995-01-01",

same_y=True,

)

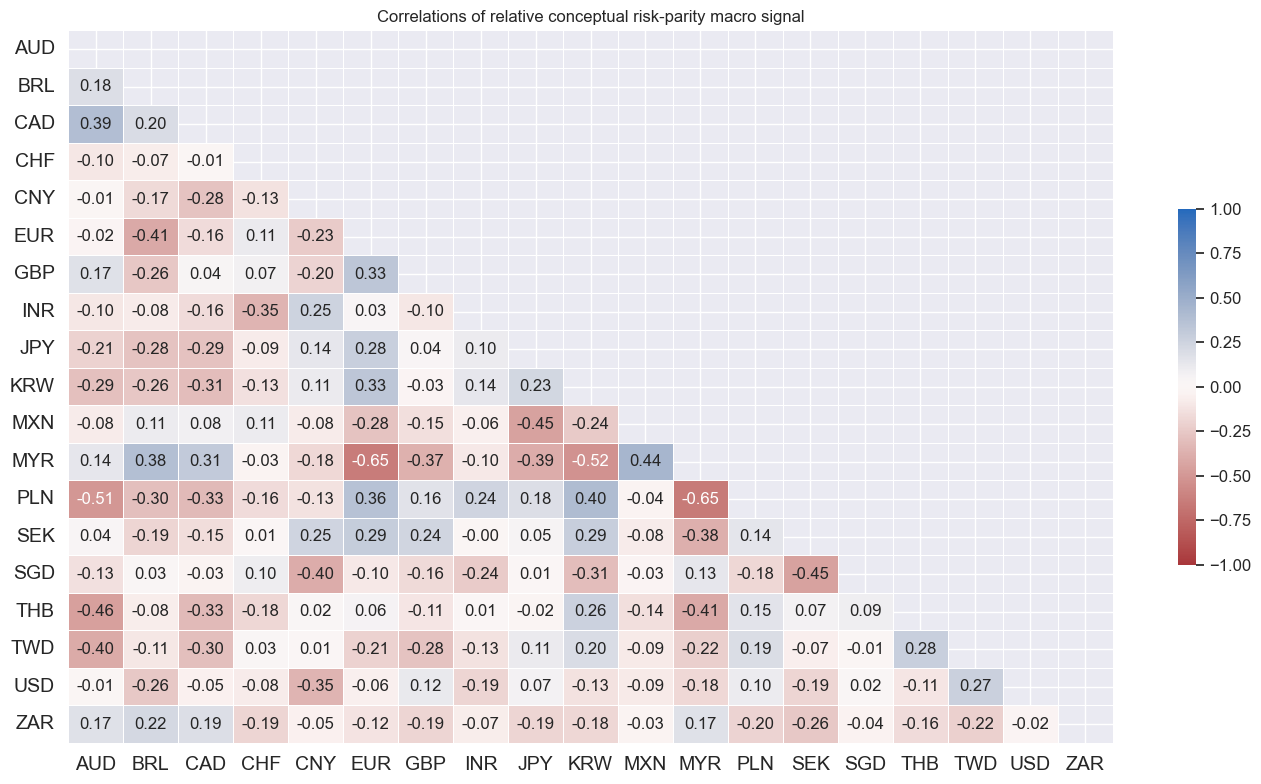

cidx = cids_eq

msp.correl_matrix(

dfx,

cids=cidx,

xcats=["MACRO_REL_ZN"],

max_color=1.0,

annot=True,

fmt=".2f",

cluster=False,

start="2000-01-01",

title="Correlations of relative conceptual risk-parity macro signal",

)

Targets #

Synthetic equity index returns in USD #

cidx = list(set(cids_eq) - {"USD"})

calcs = ["EQXRUSD_NSA = EQXR_NSA + FXXRUSD_NSA"]

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cidx)

dfx = msm.update_df(dfx, dfa)

calcs = ["EQXRUSD_NSA = EQXR_NSA"]

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=["USD"])

dfx = msm.update_df(dfx, dfa)

cidx = cids_eq

xcatx = ["EQXR_NSA", "EQXRUSD_NSA"]

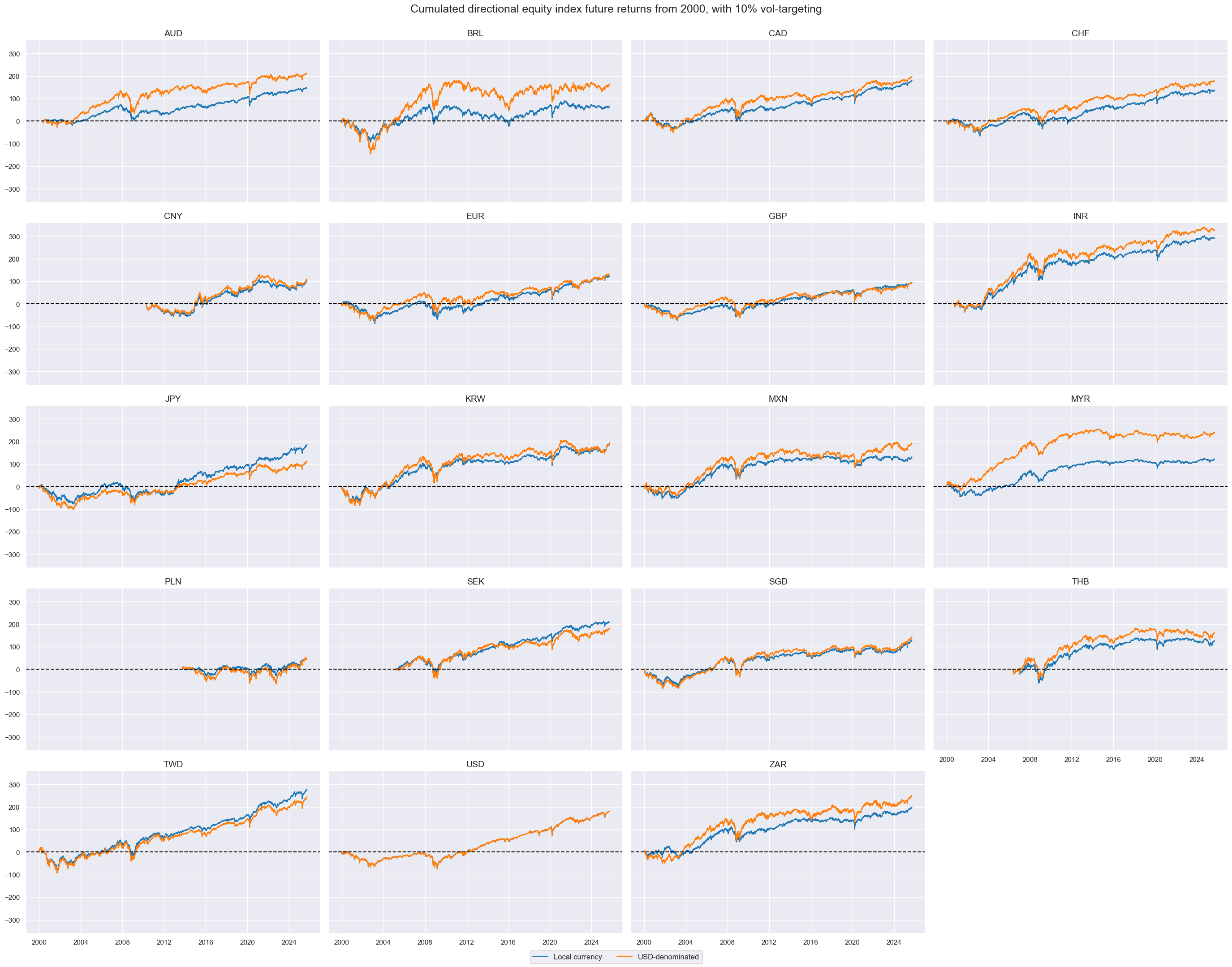

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

start="2000-01-01",

same_y=True,

cumsum=True,

title="Cumulated directional equity index future returns from 2000, with 10% vol-targeting",

xcat_labels=["Local currency", "USD-denominated"],

)

Vol-targeted country index returns in USD #

cidx = cids_eq

dfa = msp.historic_vol(

dfx,

xcat="EQXRUSD_NSA",

cids=cidx,

lback_meth="sq",

half_life=11,

lback_periods=37,

postfix="_ASD",

est_freq="M",

)

dfx = msm.update_df(dfx, dfa)

cidx = cids_eq

calcs = [

"EQXRUSD_NSA_ASDL1 = EQXRUSD_NSA_ASD.shift(1)",

"EQXRUSD_VT10 = 10 * EQXRUSD_NSA / EQXRUSD_NSA_ASDL1",

]

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cidx)

dfx = msm.update_df(dfx, dfa)

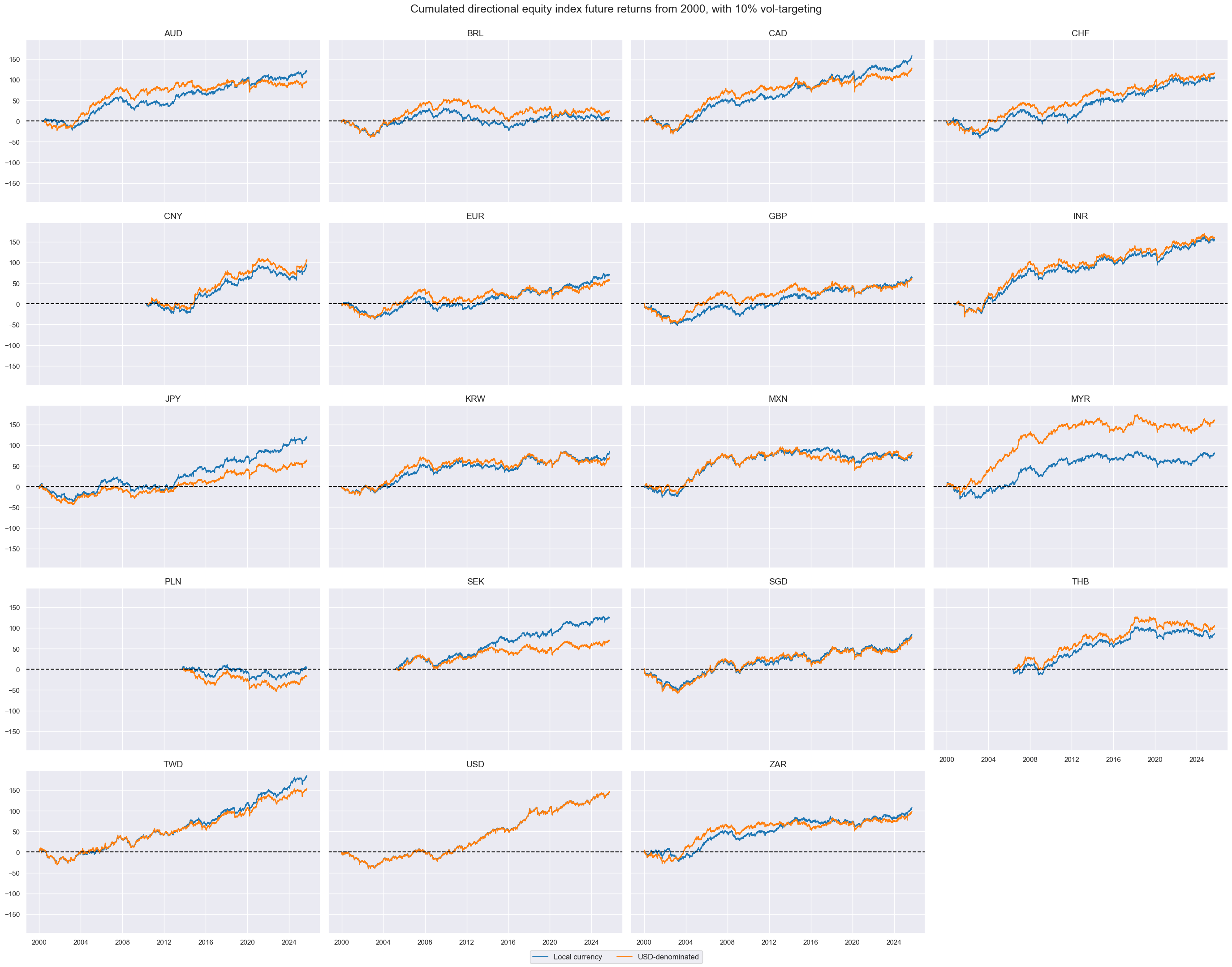

cidx = cids_eq

xcatx = ["EQXR_VT10", "EQXRUSD_VT10"]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

start="2000-01-01",

same_y=True,

cumsum=True,

title="Cumulated directional equity index future returns from 2000, with 10% vol-targeting",

xcat_labels=["Local currency", "USD-denominated"]

)

Relative country equity returns #

cidx = cids_eq

xcatx = ["EQXR_NSA", "EQXR_VT10"]

start_date = "1995-01-01"

dfa = msp.make_relative_value(

dfx,

xcats=xcatx,

cids=cidx,

start=start_date,

blacklist=None,

rel_meth="subtract",

complete_cross=False,

postfix="vGLB",

)

dfx = msm.update_df(dfx, dfa)

cidx = cids_eq

xcatx = ["EQXRUSD_NSA", "EQXRUSD_VT10", "EQCALLRUSD_NSA"]

start_date = "1995-01-01"

dfa = msp.make_relative_value(

dfx,

xcats=xcatx,

cids=cidx,

start=start_date,

blacklist=equsdblack, # Using the FX Blacklisting for returns in USD

rel_meth="subtract",

complete_cross=False,

postfix="vGLB",

)

dfx = msm.update_df(dfx, dfa)

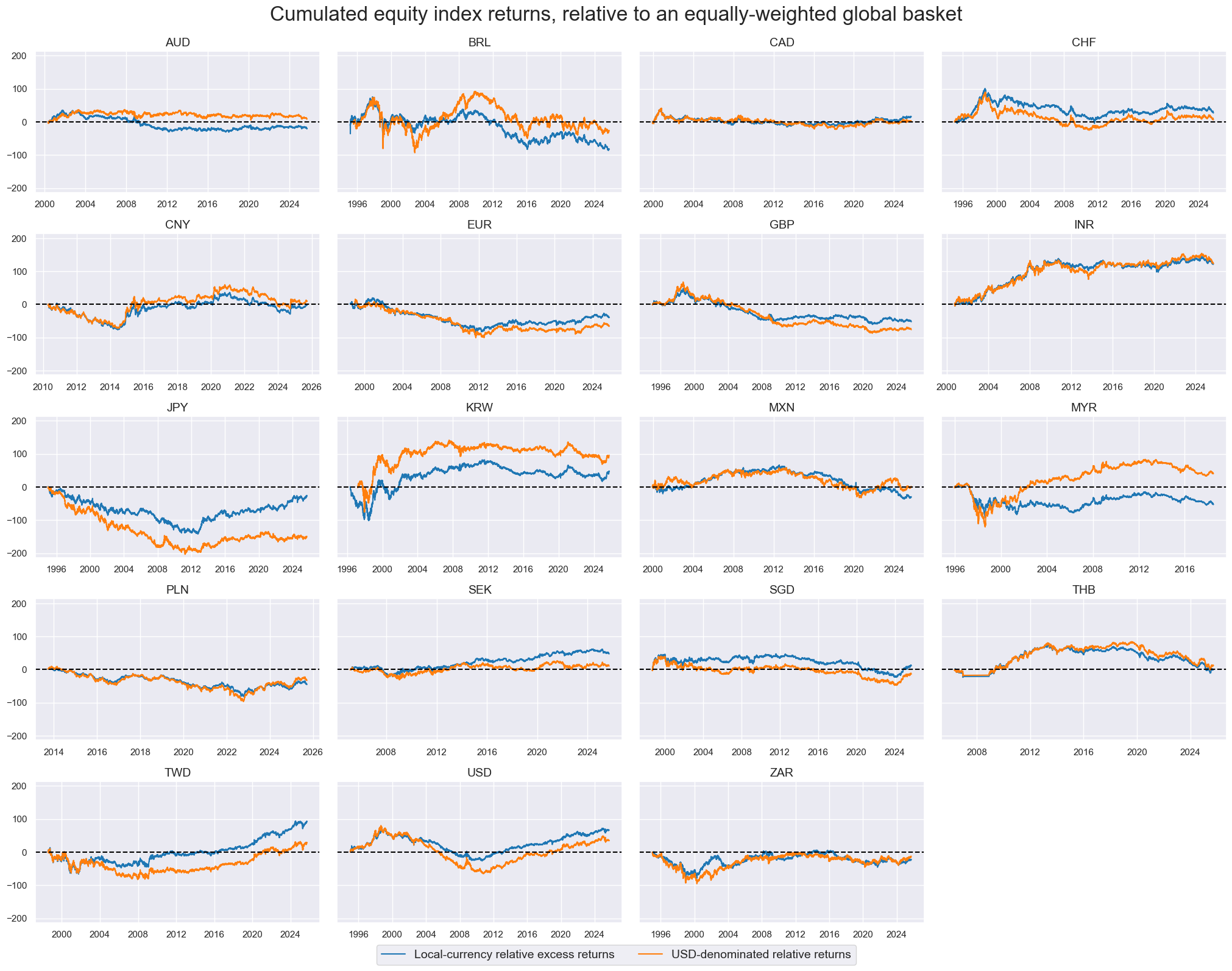

cidx = cids_eq

xcatx = ["EQXR_NSAvGLB", "EQXRUSD_NSAvGLB"]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

start="1995-01-01",

same_y=True,

cumsum=True,

all_xticks=True,

title="Cumulated equity index returns, relative to an equally-weighted global basket",

title_fontsize=24,

xcat_labels=["Local-currency relative excess returns", "USD-denominated relative returns"],

legend_fontsize=14,

height=2.1,

blacklist=equsdblack,

)

Value checks #

Statistical learning preparation #

default_learn_config = {

"scorer": {"negmse": make_scorer(mean_squared_error, greater_is_better=False)},

"splitter": {"Expanding": msl.ExpandingKFoldPanelSplit(n_splits=3)},

"split_functions": {"Expanding": lambda n: n // 24},

# retraining interval in months

"test_size": 3,

# minimum number of cids to start predicting

"min_cids": 2,

# minimum number of periods to start predicting

"min_periods": 24,

}

# List of dictionaries for two learning pipelines

learning_models = [

{

"ols": msl.ModifiedLinearRegression(method="analytic", positive=True),

"twls": msl.ModifiedTimeWeightedLinearRegression(method="analytic", positive=True),

},

{

"ridge": Ridge(positive=True),

},

]

# Hyperparameter grid

learning_grid = [

{

"ols": {"fit_intercept": [True, False]},

"twls": {"half_life": [12, 24, 36, 60], "fit_intercept": [True, False]},

},

{

"ridge": {

"fit_intercept": [True, False],

"alpha": [

1,

10,

100,

250,

500,

1000,

2000,

],

},

},

]

# list of tuples containg both the model specification and the corresponding hyperparameter grid search

model_and_grids = list(zip(learning_models, learning_grid))

default_start_date = "2002-12-31" # start date for the PnL analysis

Cross-country equity trading strategy #

dict_eq_rel = {

"sigs": ["MACRO_REL_ZN"] + list(rcfs_names.keys()),

"targs": ["EQXRUSD_VT10vGLB"],

"cidx": cids_eq,

"start": default_start_date,

"black": equsdblack,

"freq": "M",

"srr": None,

"pnls": None,

}

Statistical learning #

dix = dict_eq_rel

factors = list(rcfs_names.keys())

ret = dix["targs"][0]

cidx = dix["cidx"]

freq = dix["freq"]

blax = dix["black"]

trained_rel_models = {}

for pair in model_and_grids:

model, grid = pair

opt_pipeline_name = '-'.join(list(model.keys()))

signal_name = f"{opt_pipeline_name.upper()}_REL"

trained_rel_models[signal_name] = run_single_signal_optimizer(

df=dfx,

xcats=factors + [ret],

cids=cidx,

blacklist=blax,

signal_freq=freq,

signal_name=signal_name,

models=model,

hyperparameters=grid,

learning_config=default_learn_config,

)

dfa = trained_rel_models[signal_name].get_optimized_signals()

dfx = msm.update_df(dfx, dfa)

# z-scoring the expected returns for a given model

dfazn = msp.make_zn_scores(

dfx,

xcat=signal_name,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfazn)

dix["models"] = trained_rel_models.values()

dix["sigs"] = list(set([x+"_ZN" for x in list(trained_rel_models.keys())] + dix["sigs"]))

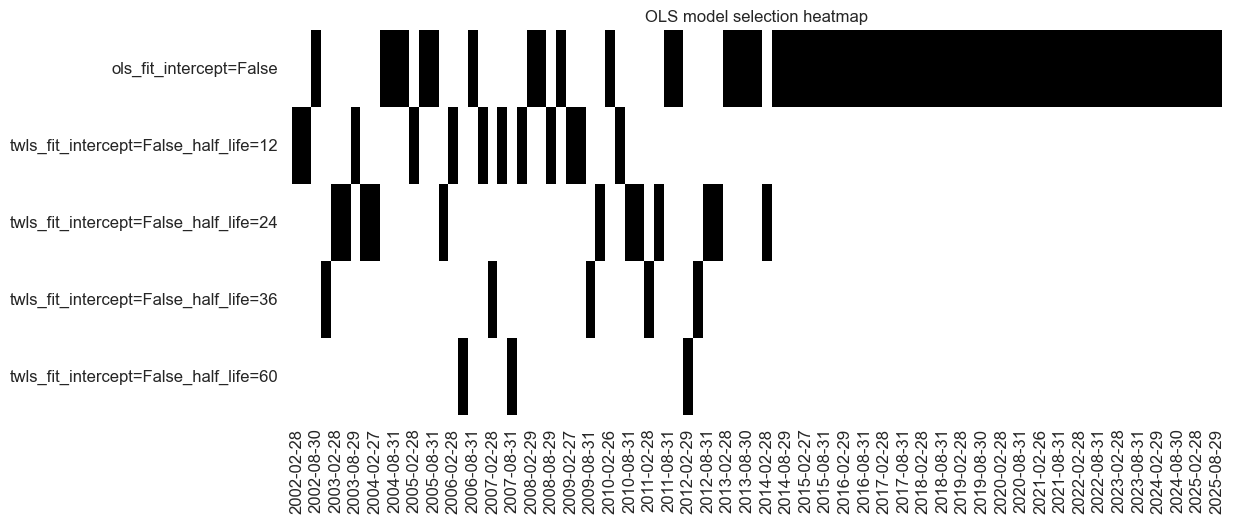

dix = dict_eq_rel

trained_models = list(dix["models"])

learned_sigx = "OLS-TWLS_REL"

trained_models[0].models_heatmap(

learned_sigx,

cap=10,

figsize=(12, 5),

title=f"OLS model selection heatmap",

)

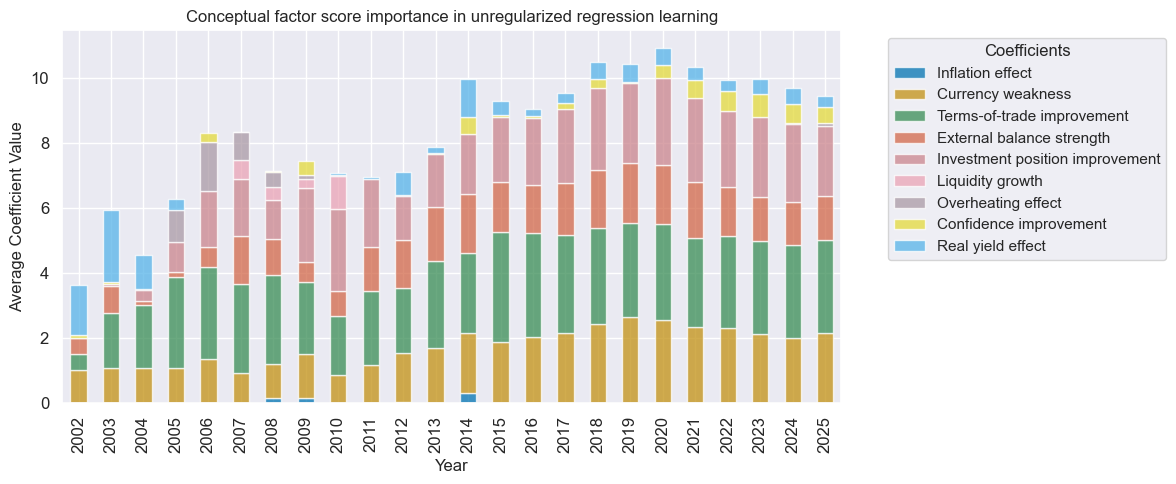

trained_models[0].coefs_stackedbarplot(

name=learned_sigx,

figsize=(12, 5),

ftrs_renamed=rcfs_names,

title="Conceptual factor score importance in unregularized regression learning",

)

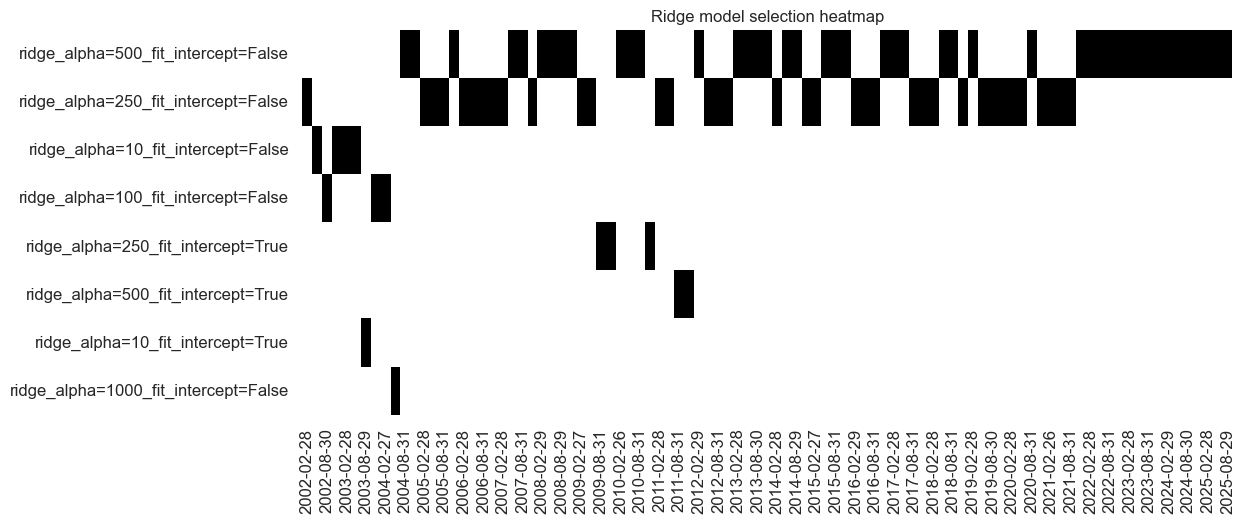

dix = dict_eq_rel

trained_models = list(dix["models"])

learned_sigx = "RIDGE_REL"

trained_models[1].models_heatmap(

learned_sigx,

cap=10,

figsize=(12, 5),

title="Ridge model selection heatmap",

)

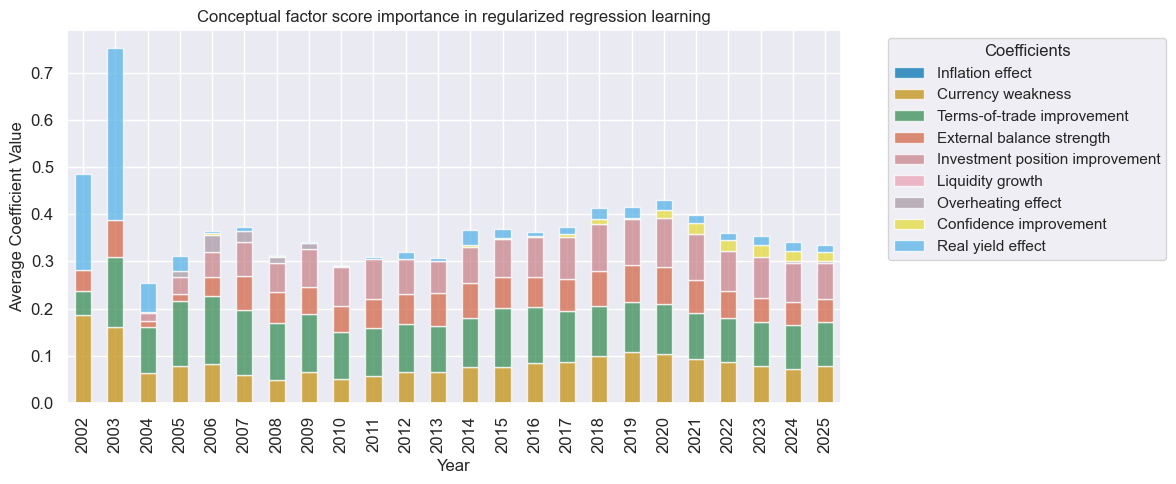

trained_models[1].coefs_stackedbarplot(

name=learned_sigx,

figsize=(12, 5),

ftrs_renamed=rcfs_names,

title="Conceptual factor score importance in regularized regression learning",

)

Specs and panel test #

dix = dict_eq_rel

cidx = dix["cidx"]

sigs = ["MACRO_REL_ZN", "OLS-TWLS_REL_ZN", "RIDGE_REL_ZN"]

targ = dix["targs"][0]

blax = dix["black"]

start = dix["start"]

catregs = {

x: msp.CategoryRelations(

df=dfx,

xcats=[x, targ],

cids=cidx,

freq="Q",

lag=1,

blacklist=blax,

xcat_aggs=["last", "sum"],

slip=1,

)

for x in sigs

}

dix["catregs"] = catregs

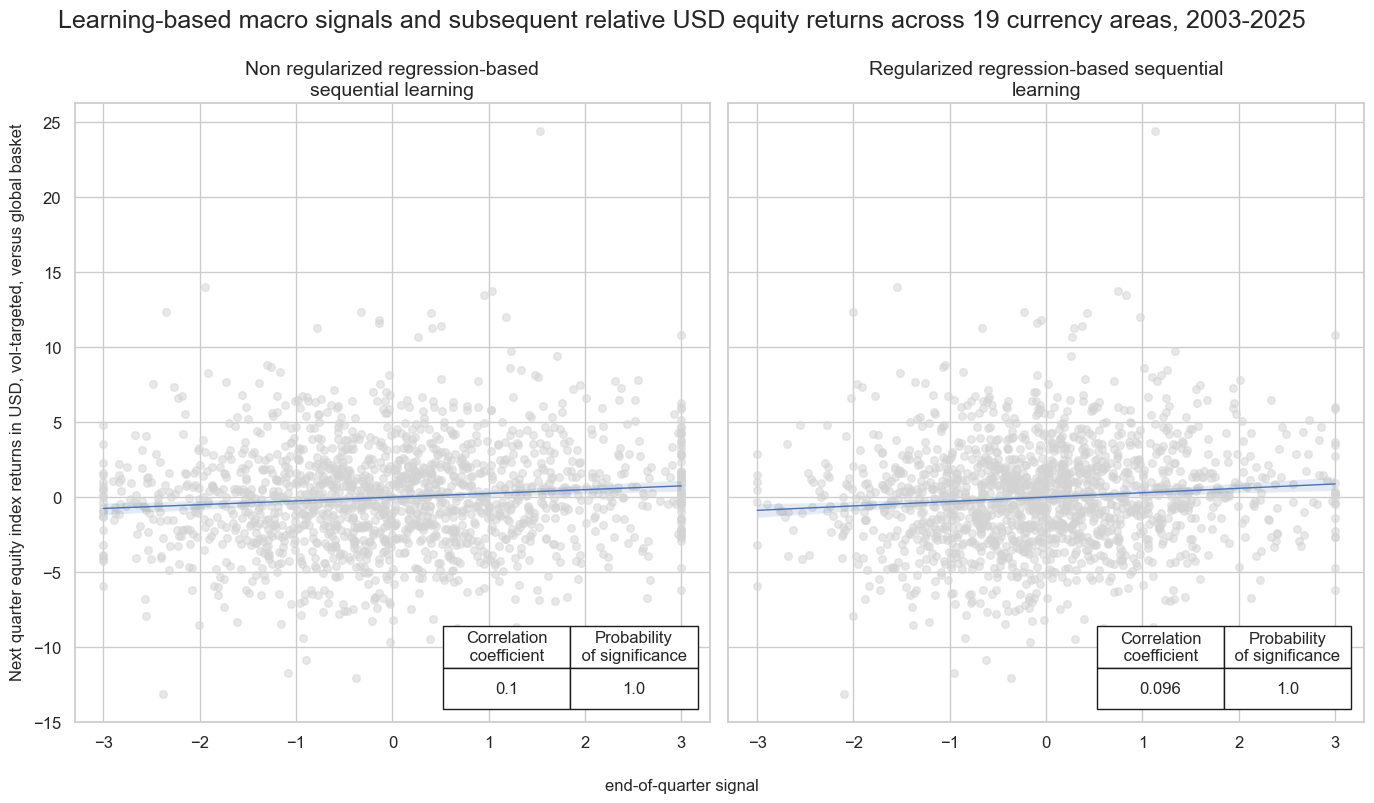

catregs = dix["catregs"]

msv.multiple_reg_scatter(

cat_rels=list(catregs.values())[1:],

ncol=2,

nrow=1,

figsize=(14, 8),

title=f"Learning-based macro signals and subsequent relative USD equity returns across 19 currency areas, 2003-2025",

title_xadj=0.5,

title_yadj=0.99,

title_fontsize=18,

xlab="end-of-quarter signal",

ylab="Next quarter equity index returns in USD, vol-targeted, versus global basket",

coef_box="lower right",

prob_est="map",

single_chart=True,

subplot_titles=[

"Non regularized regression-based sequential learning",

"Regularized regression-based sequential learning",

],

)

Accuracy and correlation check #

dix = dict_eq_rel

sigx = ["OLS-TWLS_REL_ZN", "RIDGE_REL_ZN"]

targx = dix["targs"]

cidx = dix["cidx"]

start = dix["start"]

blax = dix["black"]

srr = mss.SignalReturnRelations(

dfx,

cids=cidx,

sigs=sigx,

rets=targx,

freqs="M",

start=start,

blacklist=blax,

)

dix["srr"] = srr

dix = dict_eq_rel

srr = dix["srr"]

display(srr.multiple_relations_table().astype("float").round(3))

| accuracy | bal_accuracy | pos_sigr | pos_retr | pos_prec | neg_prec | pearson | pearson_pval | kendall | kendall_pval | auc | ||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Return | Signal | Frequency | Aggregation | |||||||||||

| EQXRUSD_VT10vGLB | OLS-TWLS_REL_ZN | M | last | 0.516 | 0.515 | 0.487 | 0.488 | 0.504 | 0.527 | 0.066 | 0.0 | 0.041 | 0.0 | 0.515 |

| RIDGE_REL_ZN | M | last | 0.519 | 0.518 | 0.481 | 0.488 | 0.507 | 0.530 | 0.069 | 0.0 | 0.042 | 0.0 | 0.518 |

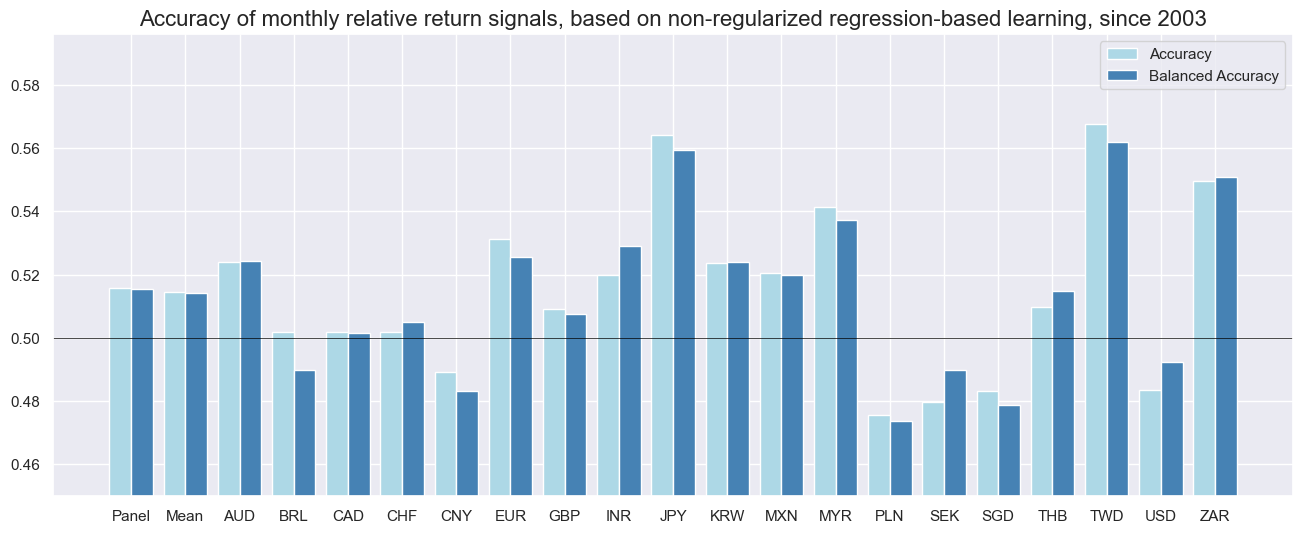

srr.accuracy_bars(

sigs=["OLS-TWLS_REL_ZN"],

type="cross_section",

title="Accuracy of monthly relative return signals, based on non-regularized regression-based learning, since 2003",

size=(16, 6),

)

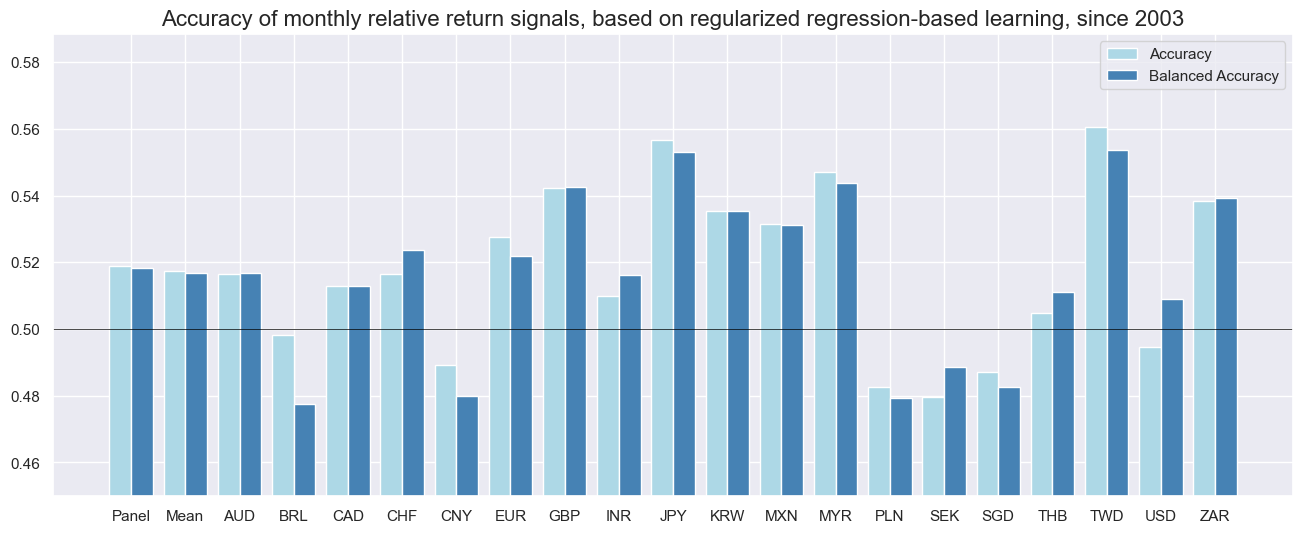

srr.accuracy_bars(

sigs=["RIDGE_REL_ZN"],

type="cross_section",

title="Accuracy of monthly relative return signals, based on regularized regression-based learning, since 2003",

size=(16, 6),

)

Naive PnL #

dix = dict_eq_rel

sigx = dix["sigs"]

targx = dix["targs"][0]

cidx = dix["cidx"]

start = dix["start"]

blax = dix["black"]

pnl = msn.NaivePnL(

df=dfx,

ret=targx,

sigs=sigx,

cids=cidx,

start=start,

blacklist=blax,

bms=["USD_EQXRUSD_VT10", "USD_DU05YXR_NSA", "GLD_COXR_NSA"],

)

for sig in sigx:

pnl.make_pnl(

sig=sig,

sig_op="zn_score_pan",

rebal_freq="monthly",

neutral="zero",

rebal_slip=1,

vol_scale=10,

thresh=3,

pnl_name=f"PNL_{sig}_PZN",

)

pnl.make_long_pnl(vol_scale=10, label="Long only")

dix["pnls"] = pnl

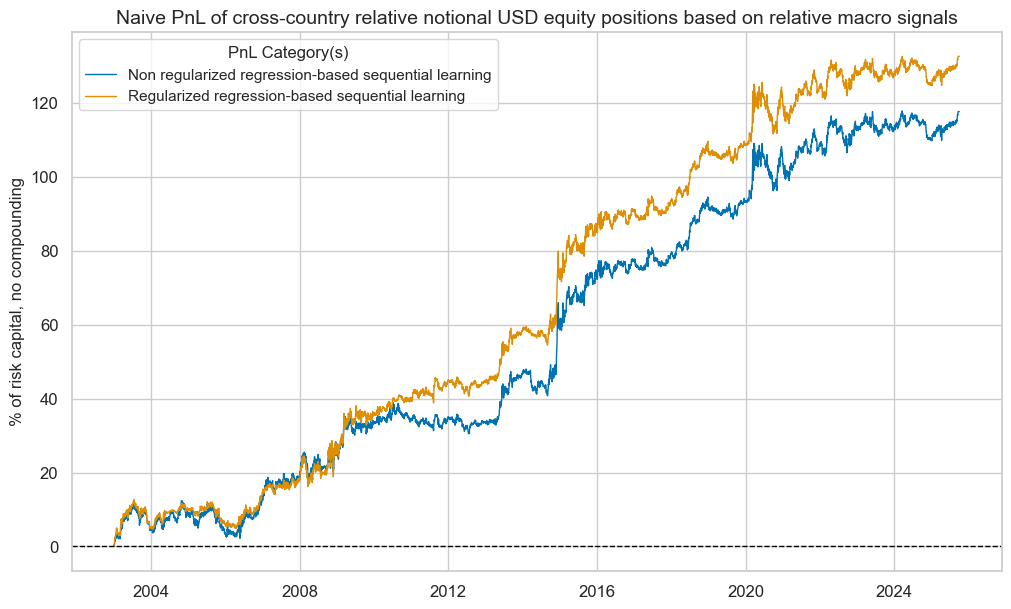

dix = dict_eq_rel

pnl = dix["pnls"]

sigx = [

"OLS-TWLS_REL_ZN",

"RIDGE_REL_ZN",

]

pns = [f"PNL_{sig}_PZN" for sig in sigx]

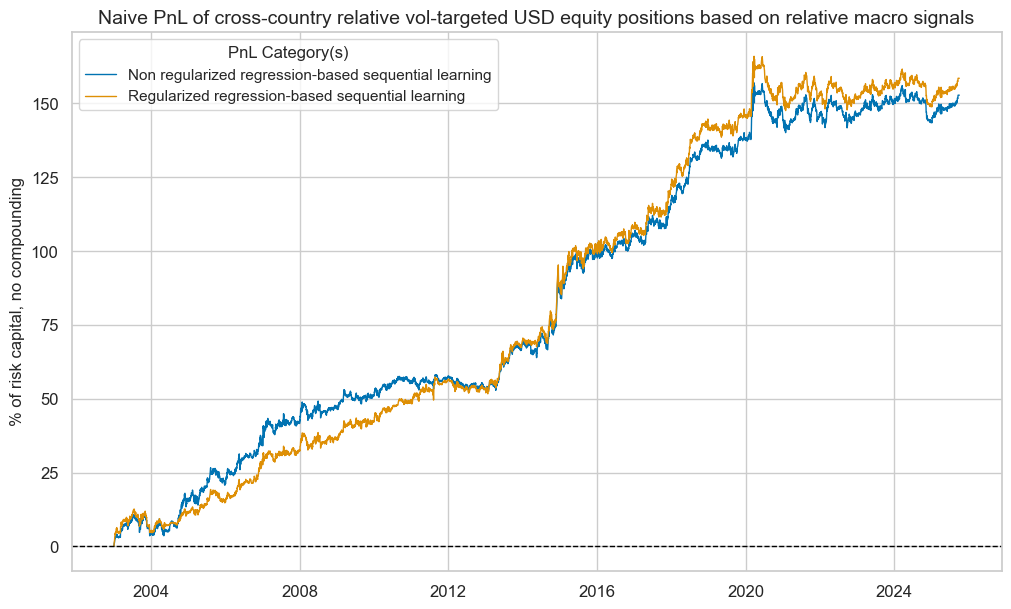

pnl.plot_pnls(

pnl_cats=pns,

title="Naive PnL of cross-country relative vol-targeted USD equity positions based on relative macro signals",

xcat_labels={

"PNL_OLS-TWLS_REL_ZN_PZN": "Non regularized regression-based sequential learning",

"PNL_RIDGE_REL_ZN_PZN": "Regularized regression-based sequential learning",

},

title_fontsize=14,

)

display(pnl.evaluate_pnls(pnl_cats=pns).astype("float").round(3))

| xcat | PNL_OLS-TWLS_REL_ZN_PZN | PNL_RIDGE_REL_ZN_PZN |

|---|---|---|

| Return % | 6.719 | 6.970 |

| St. Dev. % | 10.000 | 10.000 |

| Sharpe Ratio | 0.672 | 0.697 |

| Sortino Ratio | 0.979 | 1.016 |

| Max 21-Day Draw % | -7.851 | -8.401 |

| Max 6-Month Draw % | -12.200 | -13.513 |

| Peak to Trough Draw % | -16.853 | -18.377 |

| Top 5% Monthly PnL Share | 0.556 | 0.564 |

| USD_EQXRUSD_VT10 correl | -0.149 | -0.155 |

| USD_DU05YXR_NSA correl | 0.047 | 0.040 |

| GLD_COXR_NSA correl | 0.009 | 0.002 |

| Traded Months | 274.000 | 274.000 |

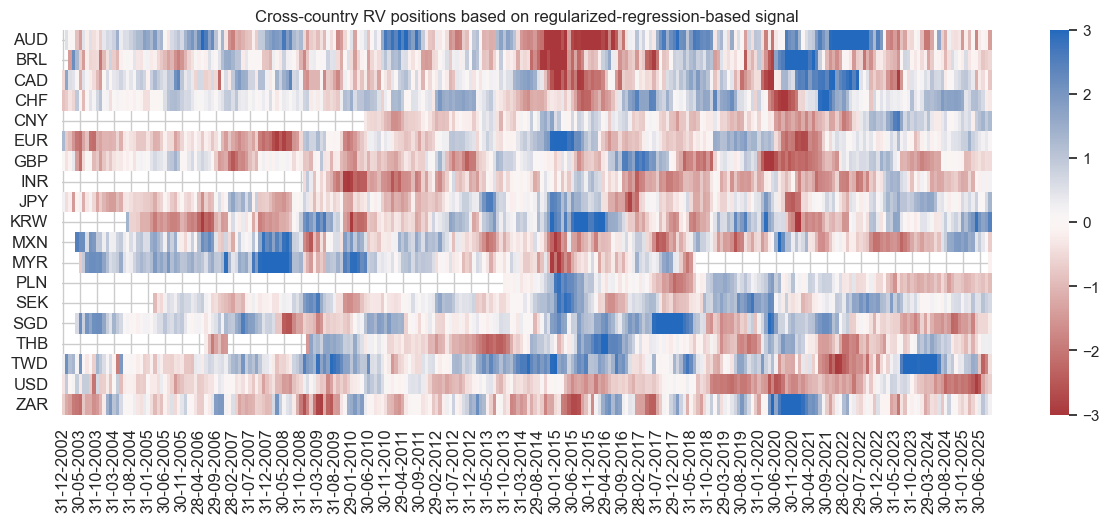

dix = dict_eq_rel

pnl = dix["pnls"]

pnl.signal_heatmap(

pnl_name="PNL_RIDGE_REL_ZN_PZN",

title="Cross-country RV positions based on regularized-regression-based signal",

figsize=(15, 5),

)

dix = dict_eq_rel

pnl = dix["pnls"]

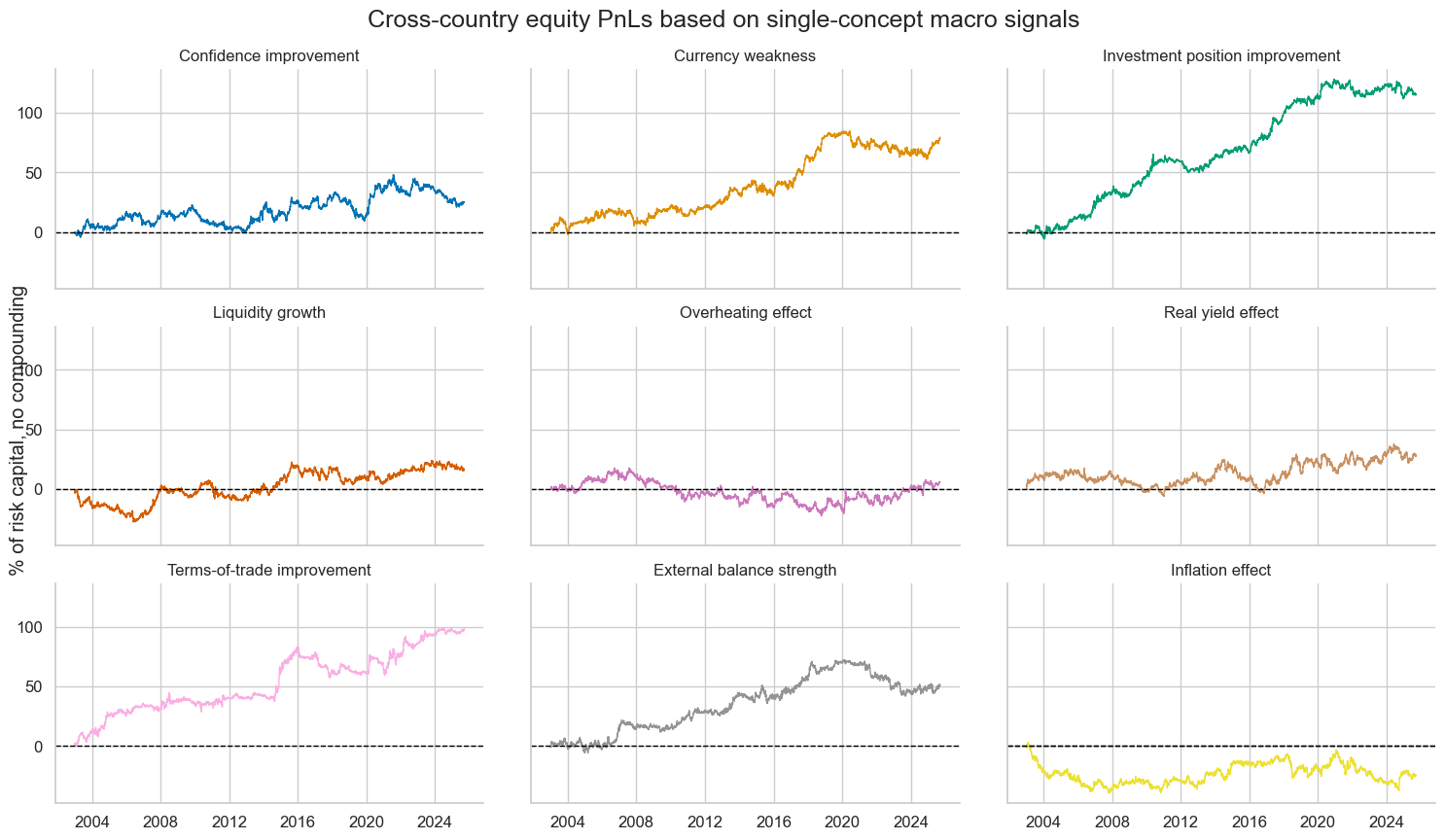

sigx = sorted(list(set(dix["sigs"]) - {"MACRO_REL_ZN", "OLS-TWLS_REL_ZN", "RIDGE_REL_ZN", "RF_REL_ZN"}))

pns = [f"PNL_{sig}_PZN" for sig in sigx]

pnl.plot_pnls(

pnl_cats=pns,

title="Cross-country equity PnLs based on single-concept macro signals",

title_fontsize=18,

xcat_labels={f"PNL_{k}_PZN": v for k, v in rcfs_names.items()},

facet=True

)

display(

pnl.evaluate_pnls(pnl_cats=pns).transpose().drop(columns="St. Dev. %").rename(index={f"PNL_{k}_PZN": v for k, v in rcfs_names.items()}).astype("float").round(2)

)

| Return % | Sharpe Ratio | Sortino Ratio | Max 21-Day Draw % | Max 6-Month Draw % | Peak to Trough Draw % | Top 5% Monthly PnL Share | USD_EQXRUSD_VT10 correl | USD_DU05YXR_NSA correl | GLD_COXR_NSA correl | Traded Months | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| xcat | |||||||||||

| Confidence improvement | 1.10 | 0.11 | 0.16 | -9.29 | -16.48 | -27.28 | 3.24 | 0.03 | 0.01 | 0.02 | 274.0 |

| Inflation effect | -1.09 | -0.11 | -0.15 | -11.69 | -19.61 | -42.41 | -2.86 | -0.20 | 0.03 | -0.02 | 274.0 |

| External balance strength | 2.25 | 0.23 | 0.32 | -9.36 | -13.07 | -30.68 | 1.35 | -0.32 | 0.06 | -0.04 | 274.0 |

| Liquidity growth | 0.70 | 0.07 | 0.10 | -8.79 | -13.86 | -27.21 | 4.76 | -0.22 | 0.05 | -0.03 | 274.0 |

| Terms-of-trade improvement | 4.37 | 0.44 | 0.63 | -11.68 | -13.68 | -25.93 | 1.01 | 0.07 | 0.02 | 0.04 | 274.0 |

| Investment position improvement | 5.08 | 0.51 | 0.72 | -8.55 | -11.07 | -16.45 | 0.61 | -0.13 | 0.03 | -0.02 | 274.0 |

| Real yield effect | 1.22 | 0.12 | 0.17 | -10.36 | -13.17 | -28.81 | 2.91 | -0.08 | 0.00 | 0.01 | 274.0 |

| Overheating effect | 0.26 | 0.03 | 0.04 | -9.24 | -13.78 | -40.40 | 11.16 | -0.27 | 0.04 | -0.04 | 274.0 |

| Currency weakness | 3.50 | 0.35 | 0.51 | -8.16 | -14.39 | -24.15 | 0.98 | -0.00 | -0.02 | -0.02 | 274.0 |

dix = dict_eq_rel

sigx = dix["sigs"]

targx = "EQXRUSD_NSAvGLB" # Simplification for trading

cidx = dix["cidx"]

start = dix["start"]

blax = dix["black"]

pnl = msn.NaivePnL(

df=dfx,

ret=targx,

sigs=sigx,

cids=cidx,

start=start,

blacklist=blax,

bms=["USD_EQXRUSD_VT10", "USD_DU05YXR_NSA", "GLD_COXR_NSA"],

)

for sig in sigx:

pnl.make_pnl(

sig=sig,

sig_op="zn_score_pan",

rebal_freq="monthly",

neutral="zero",

rebal_slip=1,

vol_scale=10,

thresh=3,

pnl_name=f"PNL_{sig}_PZN",

)

pnl.make_long_pnl(vol_scale=10, label="Long only")

dix["pnls_nsa"] = pnl

dix = dict_eq_rel

pnl = dix["pnls_nsa"]

sigx = [

"OLS-TWLS_REL_ZN",

"RIDGE_REL_ZN",

]

pns = [f"PNL_{sig}_PZN" for sig in sigx]

pnl.plot_pnls(

pnl_cats=pns,

title="Naive PnL of cross-country relative notional USD equity positions based on relative macro signals",

xcat_labels={

"PNL_OLS-TWLS_REL_ZN_PZN": "Non regularized regression-based sequential learning",

"PNL_RIDGE_REL_ZN_PZN": "Regularized regression-based sequential learning",

},

title_fontsize=14,

)

display(pnl.evaluate_pnls(pnl_cats=pns).astype("float").round(3))

| xcat | PNL_OLS-TWLS_REL_ZN_PZN | PNL_RIDGE_REL_ZN_PZN |

|---|---|---|

| Return % | 5.172 | 5.830 |

| St. Dev. % | 10.000 | 10.000 |

| Sharpe Ratio | 0.517 | 0.583 |

| Sortino Ratio | 0.753 | 0.850 |

| Max 21-Day Draw % | -7.681 | -7.312 |

| Max 6-Month Draw % | -11.172 | -11.658 |

| Peak to Trough Draw % | -12.831 | -13.941 |

| Top 5% Monthly PnL Share | 0.705 | 0.642 |

| USD_EQXRUSD_VT10 correl | -0.134 | -0.146 |

| USD_DU05YXR_NSA correl | 0.045 | 0.047 |

| GLD_COXR_NSA correl | -0.007 | -0.021 |

| Traded Months | 274.000 | 274.000 |

Global equities cash proxy and relative value modification #

Equal weighted global cash equity portfolio #

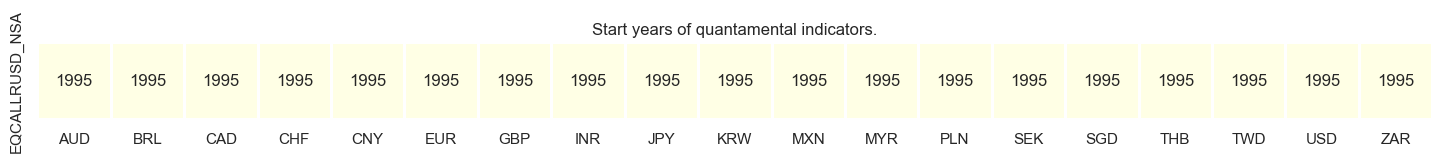

xcatx = ["EQCALLRUSD_NSA"]

msm.check_availability(df=dfx, xcats=xcatx, cids=cids_eq, missing_recent=False)

cidx = cids_eq

# Simple weight in the global equity basket for each country when the equity futures start being traded

calcs = [

"GEQPWGT = 0 * EQXRUSD_NSA + 1",

]

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cidx)

dfa["tot_cids"] = dfa.groupby(["real_date", "xcat"])["value"].transform("count")

dfa["value"] = dfa["value"] / dfa["tot_cids"]

dfx = msm.update_df(dfx, dfa.drop(columns=["tot_cids"]))

JPMaQS macro-aware global cash equity modification #

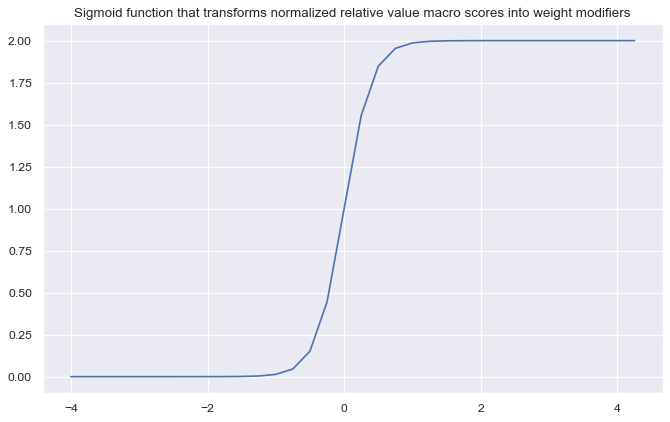

# Define appropriate sigmoid function for adjusting weights

amplitude = 2

steepness = 5

midpoint = 0

def sigmoid(x, a=amplitude, b=steepness, c=midpoint):

return a / (1 + np.exp(-b * (x - c)))

ar = np.array([i / 4 for i in range(-16, 18)])

plt.figure(figsize=(10, 6), dpi=80)

plt.plot(ar, sigmoid(ar))

plt.title("Sigmoid function that transforms normalized relative value macro scores into weight modifiers")

plt.show()

# Calculate adjusted weights

cidx = cids_eq

dfj = adjust_weights(

dfx,

weights_xcat="GEQPWGT",

adj_zns_xcat="RIDGE_REL_ZN",

method="generic",

adj_func=sigmoid,

blacklist=equsdblack,

cids=cidx,

adj_name="GEQPWGT_MOD",

)

dfx = msm.update_df(dfx, dfj)

# Visualize weights

cidx = cids_eq

xcatx = ["GEQPWGT", "GEQPWGT_MOD"]

# Reduce frequency to monthly in accordance with PnL simulation

for xc in xcatx:

dfa = dfx.loc[dfx["xcat"] == xc]

dfa["last_period_bd"] = pd.to_datetime(dfa["real_date"]) + pd.tseries.offsets.BQuarterEnd(0)

mask = pd.to_datetime(dfa["last_period_bd"]) == pd.to_datetime(dfa["real_date"])

dfa.loc[~mask, "value"] = np.nan

dfa["value"] = dfa.groupby("cid")["value"].ffill(limit=75) # max 25 business days

dfa = dfa.drop(columns="xcat").assign(xcat=f"{xc}_M")

dfx = msm.update_df(dfx, dfa)

xcatxx =[xc + "_M" for xc in xcatx]

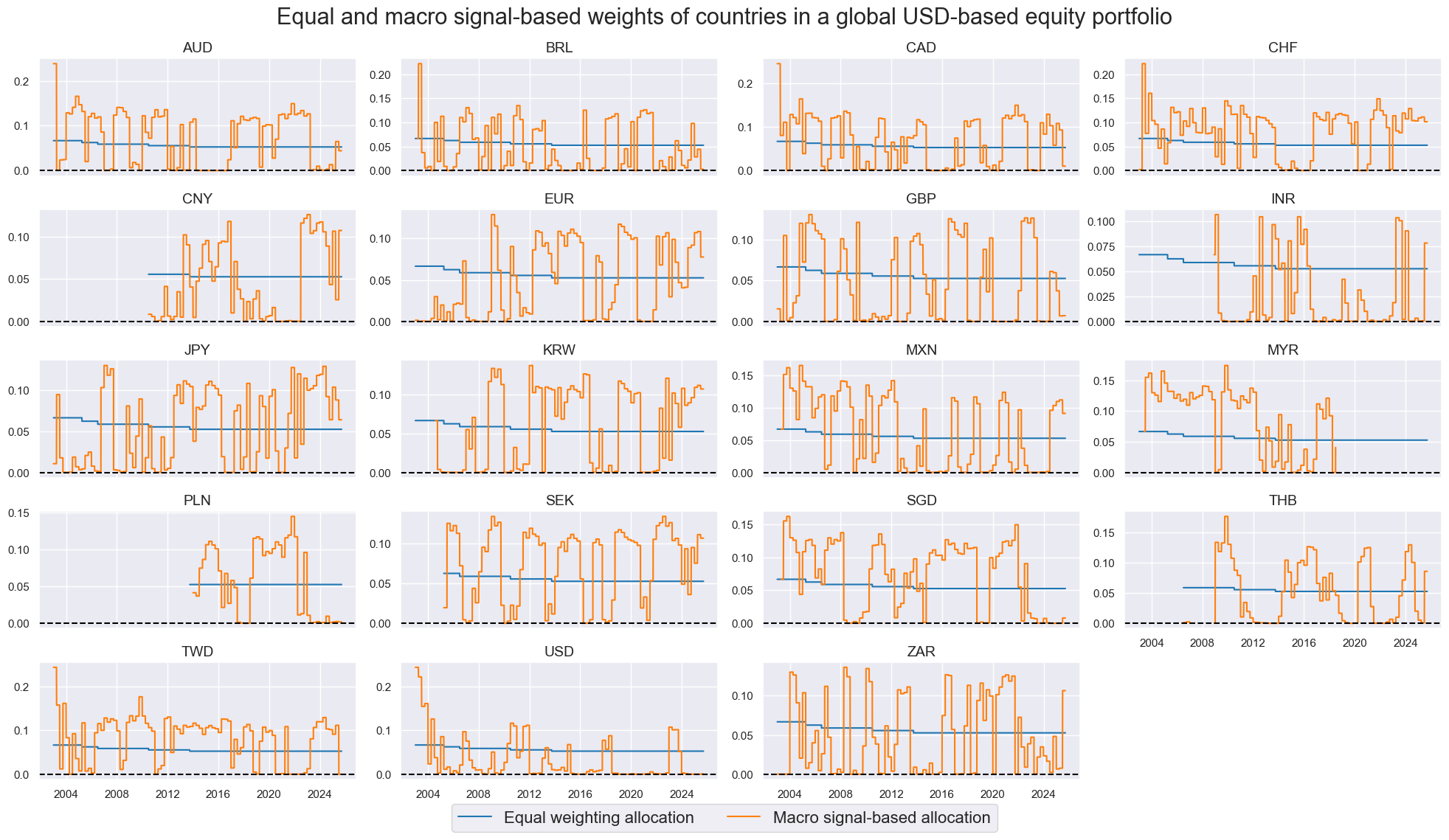

msp.view_timelines(

dfx,

xcats=xcatxx,

cids=cidx,

ncol=4,

start="2003-01-01",

same_y=False,

cumsum=False,

title="Equal and macro signal-based weights of countries in a global USD-based equity portfolio",

title_fontsize=22,

xcat_labels=["Equal weighting allocation", "Macro signal-based allocation"],

height=1.5,

aspect=2.2,

legend_fontsize=16,

)

Long-only US Equity portfolio #

cidx = ["USD"]

calcs = [

# Always long one unit of US equity

"USEQPWGT = 0 * EQCALLRUSD_NSA + 1",

]

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cidx)

dfx = msm.update_df(dfx, dfa)

Evaluation #

dict_mod = {

"sigs": ["GEQPWGT", "GEQPWGT_MOD", "USEQPWGT"],

"targ": "EQCALLRUSD_NSA",

"cidx": cids_eq,

"start": default_start_date,

"black": equsdblack,

"srr": None,

"pnls": None,

}

dix = dict_mod

sigs = dix["sigs"]

ret = dix["targ"]

cidx = dix["cidx"]

start = dix["start"]

black = dix["black"]

pnls = msn.NaivePnL(

df=dfx,

ret=ret,

sigs=sigs,

cids=cidx,

start=start,

blacklist=black,

bms=["USD_EQXRUSD_NSA", "USD_DU05YXR_NSA", "GLD_COXR_NSA"],

)

for sig in sigs:

pnls.make_pnl(

sig=sig,

sig_op="raw",

rebal_freq="quarterly",

neutral="zero",

rebal_slip=1,

vol_scale=10,

)

dix["pnls"] = pnls

dix = dict_mod

pnls = dix["pnls"]

sigs = dix["sigs"]

pnl_cats = ["PNL_" + sig for sig in sigs[:3]]

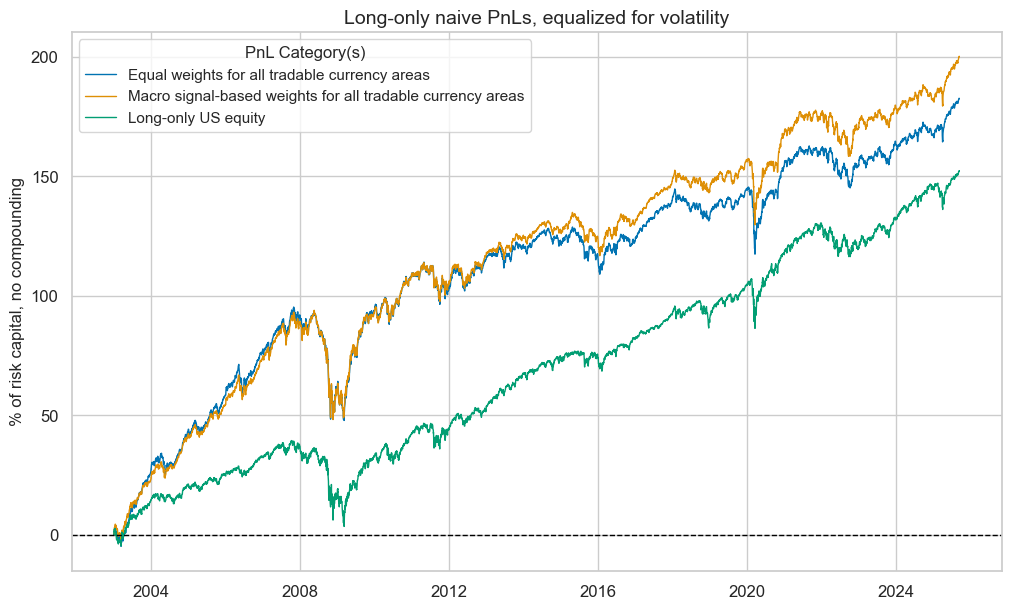

pnls.plot_pnls(

pnl_cats=pnl_cats,

title="Long-only naive PnLs, equalized for volatility",

title_fontsize=14,

compounding=False,

xcat_labels={

"PNL_GEQPWGT": "Equal weights for all tradable currency areas",

"PNL_GEQPWGT_MOD": "Macro signal-based weights for all tradable currency areas",

"PNL_USEQPWGT": "Long-only US equity",

},

)

pnls.evaluate_pnls(pnl_cats=pnl_cats)

| xcat | PNL_GEQPWGT | PNL_GEQPWGT_MOD | PNL_USEQPWGT |

|---|---|---|---|

| Return % | 8.034343 | 8.810116 | 6.709842 |

| St. Dev. % | 10.0 | 10.0 | 10.0 |

| Sharpe Ratio | 0.803434 | 0.881012 | 0.670984 |

| Sortino Ratio | 1.119107 | 1.239666 | 0.943701 |

| Max 21-Day Draw % | -27.8237 | -27.027875 | -20.054564 |

| Max 6-Month Draw % | -43.639174 | -44.046311 | -29.277215 |

| Peak to Trough Draw % | -47.499061 | -45.752625 | -35.975968 |

| Top 5% Monthly PnL Share | 0.523126 | 0.492656 | 0.449502 |

| USD_EQXRUSD_NSA correl | 0.586539 | 0.552719 | 0.983719 |

| USD_DU05YXR_NSA correl | -0.131953 | -0.121444 | -0.234115 |

| GLD_COXR_NSA correl | 0.223277 | 0.211727 | 0.020789 |

| Traded Months | 274 | 274 | 274 |

dix = dict_mod

sigs = dix["sigs"]

ret = dix["targ"]

cidx = dix["cidx"]

start = dix["start"]

black = dix["black"]

pnls = msn.NaivePnL(

df=dfx,

ret=ret,

sigs=sigs,

cids=cidx,

start=start,

blacklist=black,

bms=["USD_EQXRUSD_NSA", "USD_DU05YXR_NSA", "GLD_COXR_NSA"],

)

for sig in sigs:

pnls.make_pnl(

sig=sig,

sig_op="raw",

rebal_freq="quarterly",

neutral="zero",

rebal_slip=1,

vol_scale=None,

)

dix["pnls_cash"] = pnls

dix = dict_mod

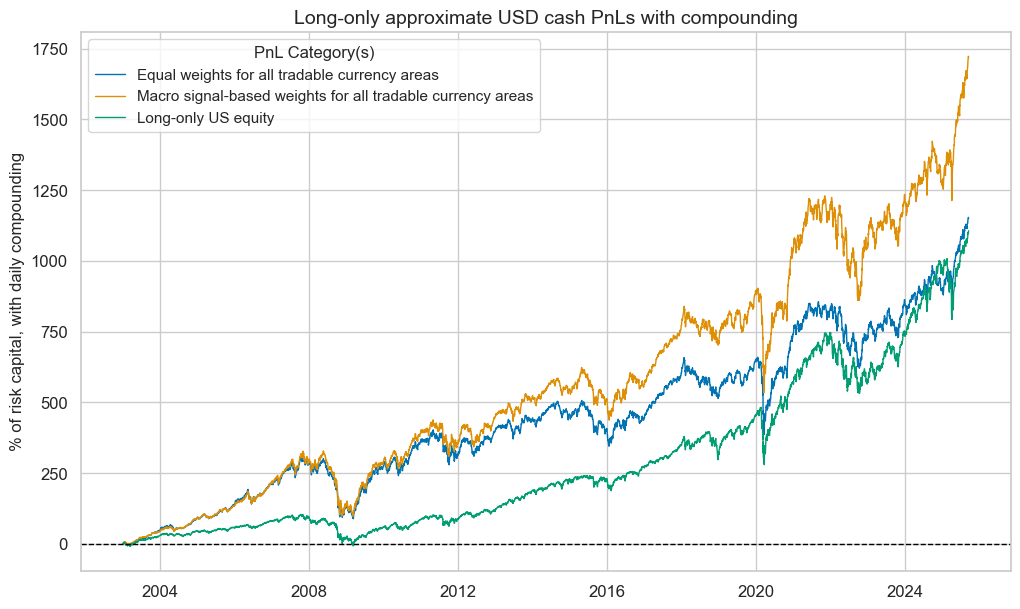

pnls = dix["pnls_cash"]

sigs = dix["sigs"]

pnl_cats = ["PNL_" + sig for sig in sigs]

pnls.plot_pnls(

pnl_cats=pnl_cats,

title="Long-only approximate USD cash PnLs with compounding",

title_fontsize=14,

compounding=True,

xcat_labels={

"PNL_GEQPWGT": "Equal weights for all tradable currency areas",

"PNL_GEQPWGT_MOD": "Macro signal-based weights for all tradable currency areas",

"PNL_USEQPWGT": "Long-only US equity",

},

)

pnls.evaluate_pnls(pnl_cats=pnl_cats)

| xcat | PNL_GEQPWGT | PNL_GEQPWGT_MOD | PNL_USEQPWGT |

|---|---|---|---|

| Return % | 12.295792 | 14.0472 | 12.787229 |

| St. Dev. % | 15.304042 | 15.944399 | 19.057422 |

| Sharpe Ratio | 0.803434 | 0.881012 | 0.670984 |

| Sortino Ratio | 1.119107 | 1.239666 | 0.943701 |

| Max 21-Day Draw % | -42.581507 | -43.094323 | -38.21883 |

| Max 6-Month Draw % | -66.785574 | -70.229196 | -55.794825 |

| Peak to Trough Draw % | -72.692761 | -72.949812 | -68.560921 |

| Top 5% Monthly PnL Share | 0.523126 | 0.492656 | 0.449502 |

| USD_EQXRUSD_NSA correl | 0.586539 | 0.552719 | 0.983719 |

| USD_DU05YXR_NSA correl | -0.131953 | -0.121444 | -0.234115 |

| GLD_COXR_NSA correl | 0.223277 | 0.211727 | 0.020789 |

| Traded Months | 274 | 274 | 274 |