Regression-based macro trading signals #

This notebook illustrates the points discussed in the post

“Regression-based macro trading signals”

on the Macrosynergy website. It demonstrates how regression models can formulate trading signals based on macro indicators using the

macrosynergy.learning

subpackage, together with the popular

scikit-learn

package. The post applies a variety of statistical regression models to construct macro trading signals across three different asset class datasets (5-year interest rate swaps, equity index futures, and FX forward contracts). It summarizes both theoretical basics and empirical findings in order to provide guidance on using a variety of regression methods for macro trading strategy development.

The notebook is organized into four main sections:

-

Get Packages and JPMaQS Data: This section is dedicated to installing and importing the necessary Python packages for the analysis. It includes standard Python libraries like pandas and seaborn, as well as the

scikit-learnpackage and the specializedmacrosynergypackage. -

Transformations and Checks: In this part, the notebook conducts data calculations and transformations to derive relevant signals and targets for the analysis. This involves normalizing feature variables using z-scores and constructing simple linear composite indicators. The notebook tests three different strategies for the three major asset classes, and for each strategy, it considers a different set of plausible and speculative features. Every strategy calculates a conceptual risk parity signal, which is an unweighted average of plausible z-scored features for each strategy. These signals are assigned postfix

_AVGZ-

Duration strategy, with conceptual risk parity signal

DU_AVGZ. Please see The power of macro trends in rates markets for the original version of this strategy -

Equity strategy, with conceptual risk parity signal

EQ_AVGZ. Please see Equity trend following and macro headwinds for the original version of this strategy -

FX strategy, with conceptual risk parity signal

FX_AVGZ. Please see Pure macro FX strategies: the benefits of double diversification for the original version of this strategy

-

-

Predictions: The third part compares different regression-based signals with a natural benchmark, either a different regression-based signal or a conceptual risk parity signal, across rates, equity, and FX datasets. Signal comparison is done by three main criteria:

-

Correlation coefficients of the relation between month-end signals and next month’s target returns.

-

Accuracy and balanced accuracy of month-end signal-based predictions of the direction of next month’s returns.

-

Sharpe and Sortino ratios of naïve PnLs

-

-

Regression comparisons: This part of the notebook compares first the average performance of the optimized OLS model from the previous section (averaged across rates, equity and FX strategies) with conceptual risk parity signal performance (also averaged across the three main strategies). Furthermore, additional optimized regression-based signals are compared to relevant benchmark models. Explored models are tested across each strategy (rates, equity, and FX), and key comparison parameters are averaged across these strategies and summarized in respective tables. The tested regression techniques include:

A regression-based trading signal is a modified point-in-time regression forecast of returns. A regression model can employ several features (explanatory variables) and assign effective weights based on their past relations to target financial returns. The construction of point-in-time regression-based forecasts relies on a statistical learning process that generally involves three operations:

-

the sequential choice of an optimal regression model, based on past predictive performance,

-

a point-in-time estimation of its coefficients, and

-

the prediction of future returns based on that model.

This general method is attractive because regression is a well-understood way of relating explanatory/predictor variables (features) with dependent variables, here called target returns.

NOTE: This notebook is memory-intensive and time-intensive.

Get packages and JPMaQS data #

This notebook primarily relies on the standard packages available in the Python data science stack. However, the

macrosynergy

package is additionally required for two purposes:

-

Downloading JPMaQS data: The macrosynergy package facilitates the retrieval of JPMaQS data used in the notebook. For users using the free Kaggle subset , this part of the

macrosynergypackage is not required. -

For analyzing quantamental data and value propositions: The macrosynergy package provides functionality for performing quick analyses of quantamental data and exploring value propositions. The subpackage macrosynergy.learning integrates the

macrosynergypackage and associated JPMaQS data with the widely-usedscikit-learnlibrary and is used for sequential signal optimization.

For detailed information and a comprehensive understanding of the macrosynergy package and its functionalities, please refer to the “Introduction to Macrosynergy package” notebook on the Macrosynergy Quantamental Academy or visit the following link on Kaggle.

# Run only if needed!

"""

# %%capture

! pip install macrosynergy --upgrade"""

'\n# %%capture\n! pip install macrosynergy --upgrade'

import os

import numpy as np

import pandas as pd

from sklearn.pipeline import Pipeline

from sklearn.linear_model import LinearRegression, ElasticNet

from sklearn.neighbors import KNeighborsRegressor

from sklearn.metrics import (

make_scorer,

r2_score,

)

import macrosynergy.management as msm

import macrosynergy.panel as msp

import macrosynergy.pnl as msn

import macrosynergy.signal as mss

import macrosynergy.learning as msl

from macrosynergy.download import JPMaQSDownload

import warnings

warnings.simplefilter("ignore")

The JPMaQS indicators we consider are downloaded using the J.P. Morgan Dataquery API interface within the

macrosynergy

package. This is done by specifying ticker strings, formed by appending an indicator category code

DB(JPMAQS,<cross_section>_<category>,<info>)

, where

value

giving the latest available values for the indicator

eop_lag

referring to days elapsed since the end of the observation period

mop_lag

referring to the number of days elapsed since the mean observation period

grade

denoting a grade of the observation, giving a metric of real time information quality.

After instantiating the

JPMaQSDownload

class within the

macrosynergy.download

module, one can use the

download(tickers,start_date,metrics)

method to easily download the necessary data, where

tickers

is an array of ticker strings,

start_date

is the first collection date to be considered and

metrics

is an array comprising the times series information to be downloaded. For more information see

here

or use the free dataset on

Kaggle

.

In the cell below, we specified cross-sections used for the analysis. For the abbreviations, please see About Dataset

# Cross-sections of interest - duration

cids_dm = ["AUD", "CAD", "CHF", "EUR", "GBP", "JPY", "NOK", "NZD", "SEK", "USD"]

cids_em = [

"CLP",

"COP",

"CZK",

"HUF",

"IDR",

"ILS",

"INR",

"KRW",

"MXN",

"PLN",

"THB",

"TRY",

"TWD",

"ZAR",

]

cids_du = cids_dm + cids_em

cids_dux = list(set(cids_du) - set(["IDR", "NZD"]))

cids_xg2 = list(set(cids_dux) - set(["EUR", "USD"]))

# Cross-sections of interest - equity

cids_g3 = ["EUR", "JPY", "USD"] # DM large currency areas

cids_dmes = ["AUD", "CAD", "CHF", "GBP", "SEK"] # Smaller DM equity countries

cids_eq = cids_g3 + cids_dmes # DM equity countries

# Cross-sections of interest - FX

cids_dmsc = ["AUD", "CAD", "CHF", "GBP", "NOK", "NZD", "SEK"] # DM small currency areas

cids_latm = ["BRL", "COP", "CLP", "MXN", "PEN"] # Latam

cids_emea = ["CZK", "HUF", "ILS", "PLN", "RON", "RUB", "TRY", "ZAR"] # EMEA

cids_emas = ["IDR", "INR", "KRW", "MYR", "PHP", "SGD", "THB", "TWD"] # EM Asia ex China

cids_dm = cids_g3 + cids_dmsc

cids_em = cids_latm + cids_emea + cids_emas

cids = cids_dm + cids_em

cids_nofx = [

"EUR",

"USD",

"JPY",

"THB",

"SGD",

"RUB",

] # not small or suitable for this analysis for lack of data

cids_fx = list(set(cids) - set(cids_nofx))

cids_dmfx = list(set(cids_dm).intersection(cids_fx))

cids_emfx = list(set(cids_em).intersection(cids_fx))

cids_eur = ["CHF", "CZK", "HUF", "NOK", "PLN", "RON", "SEK"] # trading against EUR

cids_eud = ["GBP", "TRY"] # trading against EUR and USD

cids_usd = list(set(cids_fx) - set(cids_eur + cids_eud)) # trading against USD

# Quantamental categories of interest

infs = [

"CPIH_SA_P1M1ML12",

"CPIC_SJA_P6M6ML6AR",

"INFTEFF_NSA",

"WAGES_NSA_P1M1ML12_3MMA",

"PPIH_NSA_P1M1ML12",

]

grow = [

"PCREDITBN_SJA_P1M1ML12",

"RGDP_SA_P1Q1QL4_20QMA",

"RGDP_SA_P1Q1QL4_20QMM",

"INTRGDP_NSA_P1M1ML12_3MMA",

"INTRGDPv5Y_NSA_P1M1ML12_3MMA",

"RGDPTECH_SA_P1M1ML12_3MMA",

"RGDPTECHv5Y_SA_P1M1ML12_3MMA",

"IP_SA_P1M1ML12_3MMA",

]

surv = [

"MBCSCORE_SA_D3M3ML3",

"MBCSCORE_SA_D1Q1QL1",

"MBCSCORE_SA_D6M6ML6",

"MBCSCORE_SA_D2Q2QL2",

]

labs = [

"EMPL_NSA_P1M1ML12_3MMA",

"EMPL_NSA_P1Q1QL4",

"WFORCE_NSA_P1Y1YL1_5YMM",

"UNEMPLRATE_NSA_3MMA_D1M1ML12",

"UNEMPLRATE_NSA_D1Q1QL4",

"UNEMPLRATE_SA_D3M3ML3",

"UNEMPLRATE_SA_D1Q1QL1",

"UNEMPLRATE_SA_3MMA",

"UNEMPLRATE_SA_3MMAv5YMM",

]

xbls = [

"MTBGDPRATIO_SA_3MMA_D1M1ML3",

"CABGDPRATIO_SA_3MMA_D1M1ML3",

"CABGDPRATIO_SA_1QMA_D1Q1QL1",

"MTBGDPRATIO_SA_6MMA_D1M1ML6",

"CABGDPRATIO_SA_6MMA_D1M1ML6",

"CABGDPRATIO_SA_2QMA_D1Q1QL2",

"MTBGDPRATIO_SA_3MMAv60MMA",

"CABGDPRATIO_SA_3MMAv60MMA",

"CABGDPRATIO_SA_1QMAv20QMA",

]

tots = [

"CTOT_NSA_P1M12ML1",

"CTOT_NSA_P1M1ML12",

"CTOT_NSA_P1M60ML1",

"MTOT_NSA_P1M12ML1",

"MTOT_NSA_P1M1ML12",

"MTOT_NSA_P1M60ML1",

]

main = infs + grow + surv + labs + xbls + tots

mkts = [

"FXTARGETED_NSA",

"FXUNTRADABLE_NSA",

]

rets = [

"DU05YXR_VT10",

"EQXR_VT10",

"EQXR_NSA",

"FXXR_VT10",

]

xcats = main + mkts + rets

# Resultant tickers for download

single_tix = ["USD_GB10YXR_NSA"]

tickers = [cid + "_" + xcat for cid in cids for xcat in xcats] + single_tix

The description of each JPMaQS category is available either on the Macrosynergy Macro Quantamental Academy, or on JPMorgan Markets (password protected). In particular, the set used for this notebook is using Consumer price inflation trends , Inflation targets , Wage growth , PPI Inflation , Intuitive growth estimates , Domestic credit ratios , GDP growth , Technical GDP growth estimates , Industrial production trends , Private credit expansion , Manufacturing confidence scores , Demographic trends , Labor market dynamics , External ratios trends , Terms-of-trade , Duration returns , Equity index future returns , FX forward returns , and FX tradeability and flexibility

# Download series from J.P. Morgan DataQuery by tickers

start_date = "2000-01-01"

end_date = None

# Retrieve credentials

oauth_id = os.getenv("DQ_CLIENT_ID") # Replace with own client ID

oauth_secret = os.getenv("DQ_CLIENT_SECRET") # Replace with own secret

# Download from DataQuery

with JPMaQSDownload(client_id=oauth_id, client_secret=oauth_secret) as downloader:

df = downloader.download(

tickers=tickers,

start_date=start_date,

end_date=end_date,

metrics=["value"],

suppress_warning=True,

show_progress=True,

)

dfx = df.copy()

dfx.info()

Downloading data from JPMaQS.

Timestamp UTC: 2024-12-03 16:32:42

Connection successful!

Requesting data: 100%|█████████████████████████████████████████████████████████████████| 73/73 [00:16<00:00, 4.48it/s]

Downloading data: 100%|████████████████████████████████████████████████████████████████| 73/73 [00:24<00:00, 2.93it/s]

Some expressions are missing from the downloaded data. Check logger output for complete list.

305 out of 1458 expressions are missing. To download the catalogue of all available expressions and filter the unavailable expressions, set `get_catalogue=True` in the call to `JPMaQSDownload.download()`.

Some dates are missing from the downloaded data.

2 out of 6504 dates are missing.

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 7161911 entries, 0 to 7161910

Data columns (total 4 columns):

# Column Dtype

--- ------ -----

0 real_date datetime64[ns]

1 cid object

2 xcat object

3 value float64

dtypes: datetime64[ns](1), float64(1), object(2)

memory usage: 218.6+ MB

Availability #

It is essential to assess data availability before conducting any analysis. It allows for the identification of any potential gaps or limitations in the dataset, which can impact the validity and reliability of the analysis, ensure that a sufficient number of observations for each selected category and cross-section is available, and determine the appropriate periods for analysis.

For the purpose of the below presentation, we have renamed a collection of quarterly-frequency indicators to approximate monthly equivalents in order to have a full panel of similar measures across most countries. The two series’ are not identical but are close substitutes.

Rename quarterly indicators #

dict_repl = {

"EMPL_NSA_P1Q1QL4": "EMPL_NSA_P1M1ML12_3MMA",

"WFORCE_NSA_P1Q1QL4_20QMM": "WFORCE_NSA_P1Y1YL1_5YMM",

"UNEMPLRATE_NSA_D1Q1QL4": "UNEMPLRATE_NSA_3MMA_D1M1ML12",

"WAGES_NSA_P1Q1QL4": "WAGES_NSA_P1M1ML12_3MMA",

"UNEMPLRATE_SA_D1Q1QL1": "UNEMPLRATE_SA_D3M3ML3",

"CABGDPRATIO_SA_1QMA_D1Q1QL1": "CABGDPRATIO_SA_3MMA_D1M1ML3",

"CABGDPRATIO_SA_2QMA_D1Q1QL2": "CABGDPRATIO_SA_6MMA_D1M1ML6",

"CABGDPRATIO_SA_1QMAv20QMA": "CABGDPRATIO_SA_3MMAv60MMA",

"MBCSCORE_SA_D1Q1QL1": "MBCSCORE_SA_D3M3ML3",

"MBCSCORE_SA_D2Q2QL2": "MBCSCORE_SA_D6M6ML6",

}

for key, value in dict_repl.items():

dfx["xcat"] = dfx["xcat"].str.replace(key, value)

Check panel history #

xcatx = infs

msm.check_availability(df=dfx, xcats=xcatx, cids=cids, missing_recent=False)

xcatx = grow

msm.check_availability(df=dfx, xcats=xcatx, cids=cids, missing_recent=False)

xcatx = surv

msm.check_availability(df=dfx, xcats=xcatx, cids=cids, missing_recent=False)

xcatx = xbls

msm.check_availability(df=dfx, xcats=xcatx, cids=cids, missing_recent=False)

xcatx = tots

msm.check_availability(df=dfx, xcats=xcatx, cids=cids, missing_recent=False)

FX-based blacklist dictionary #

Identifying and isolating periods of official exchange rate targets, illiquidity, or convertibility-related distortions in FX markets is the first step in creating an FX trading strategy. These periods can significantly impact the behavior and dynamics of currency markets, and failing to account for them can lead to inaccurate or misleading findings. The

make_blacklist()

helper function creates a standardized dictionary of blacklist periods:

# Create blacklisting dictionary

dfb = df[df["xcat"].isin(["FXTARGETED_NSA", "FXUNTRADABLE_NSA"])].loc[

:, ["cid", "xcat", "real_date", "value"]

]

dfba = (

dfb.groupby(["cid", "real_date"])

.aggregate(value=pd.NamedAgg(column="value", aggfunc="max"))

.reset_index()

)

dfba["xcat"] = "FXBLACK"

fxblack = msp.make_blacklist(dfba, "FXBLACK")

fxblack

{'BRL': (Timestamp('2012-12-03 00:00:00'), Timestamp('2013-09-30 00:00:00')),

'CHF': (Timestamp('2011-10-03 00:00:00'), Timestamp('2015-01-30 00:00:00')),

'CZK': (Timestamp('2014-01-01 00:00:00'), Timestamp('2017-07-31 00:00:00')),

'ILS': (Timestamp('2000-01-03 00:00:00'), Timestamp('2005-12-30 00:00:00')),

'INR': (Timestamp('2000-01-03 00:00:00'), Timestamp('2004-12-31 00:00:00')),

'MYR_1': (Timestamp('2000-01-03 00:00:00'), Timestamp('2007-11-30 00:00:00')),

'MYR_2': (Timestamp('2018-07-02 00:00:00'), Timestamp('2024-12-02 00:00:00')),

'PEN': (Timestamp('2021-07-01 00:00:00'), Timestamp('2021-07-30 00:00:00')),

'RON': (Timestamp('2000-01-03 00:00:00'), Timestamp('2005-11-30 00:00:00')),

'RUB_1': (Timestamp('2000-01-03 00:00:00'), Timestamp('2005-11-30 00:00:00')),

'RUB_2': (Timestamp('2022-02-01 00:00:00'), Timestamp('2024-12-02 00:00:00')),

'SGD': (Timestamp('2000-01-03 00:00:00'), Timestamp('2024-12-02 00:00:00')),

'THB': (Timestamp('2007-01-01 00:00:00'), Timestamp('2008-11-28 00:00:00')),

'TRY_1': (Timestamp('2000-01-03 00:00:00'), Timestamp('2003-09-30 00:00:00')),

'TRY_2': (Timestamp('2020-01-01 00:00:00'), Timestamp('2024-07-31 00:00:00'))}

Transformation and checks #

Duration feature candidates #

To create a rates strategy, we develop a simple, plausible composite signal based on five features, including excess PPI inflation and excess industrial production growth as speculative signal candidates with presumed negative effects.

-

Excess GDP growth trends

-

Excess inflation

-

Excess private credit growth

-

Excess PPI inflation

-

Excess industrial production growth

The original version of this strategy has been described in The power of macro trends in rates markets

Plausible features #

# Excess GDP growth, excess inflation, excess private credit growth

calcs = [

"XGDP_NEG = - INTRGDPv5Y_NSA_P1M1ML12_3MMA",

"XCPI_NEG = - ( CPIC_SJA_P6M6ML6AR + CPIH_SA_P1M1ML12 ) / 2 + INFTEFF_NSA",

"XPCG_NEG = - PCREDITBN_SJA_P1M1ML12 + INFTEFF_NSA + RGDP_SA_P1Q1QL4_20QMA",

]

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cids_dux)

dfx = msm.update_df(dfx, dfa)

du_plaus = dfa["xcat"].unique().tolist()

Speculative features #

Speculative features have weak theoretical backing, and their inclusion simulates the usage of inferior predictors in the signal-generating process.

calcs = [

"XPPIH_NEG = - ( PPIH_NSA_P1M1ML12 - INFTEFF_NSA ) ",

"XIPG_NEG = - ( IP_SA_P1M1ML12_3MMA - RGDP_SA_P1Q1QL4_20QMA ) ",

]

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cids_dux)

dfx = msm.update_df(dfx, dfa)

du_specs = dfa["xcat"].unique().tolist()

Scores and composite #

The process of standardizing the five indicators related to consumer spending and income prospects is achieved through the use of the

make_zn_scores()

function from the

macrosynergy

package. Normalization is a key step in macroeconomic analysis, especially when dealing with data across different categories that vary in units and time series characteristics. In this process, the indicators are centered around a neutral value (zero) using historical data. This normalization is recalculated monthly. To mitigate the impact of statistical outliers, a cutoff of 3 standard deviations is employed. Post-normalization, the indicators (z-scores) are labeled with the suffix

_ZNW3

, indicating their adjusted status.

The

linear_composite

method from the

macrosynergy

package is employed to aggregate the individual category scores into a unified composite indicator. This method offers the flexibility to assign specific weights to each category, which can vary over time. In this instance, equal weights are applied to all categories, resulting in a composite indicator referred to as

DU_AVGZ

. This approach ensures an even contribution from each category to the overall composite measure.

durs = du_plaus + du_specs

xcatx = durs

for xc in xcatx:

dfa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cids_dux,

neutral="zero",

thresh=3,

est_freq="M",

pan_weight=1,

postfix="_ZN3",

)

dfx = msm.update_df(dfx, dfa)

durz = [xc + "_ZN3" for xc in durs]

dfa = msp.linear_composite(

df=dfx,

xcats=durz,

cids=cids_dux,

new_xcat="DU_AVGZ",

)

dfx = msm.update_df(dfx, dfa)

The linear composite of the z-scores of all features used in rates strategy

DU_AVGZ

is displayed below with the help of

view_timelines()

from the

macrosynergy

package:

xcatx = ["DU_AVGZ"]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cids_dux,

ncol=4,

start="2004-01-01",

title=None,

title_fontsize=30,

same_y=False,

cs_mean=False,

xcat_labels=None,

legend_fontsize=16,

)

Equity feature candidates #

To create an equity strategy, we develop a simple, plausible composite signal based on five features, including excess PPI inflation and excess industrial production growth as speculative signal candidates with presumed negative effects.

-

Labor market tightness

-

Excess inflation

-

Presumed index return momentum

-

Excess PPI inflation

-

Excess industrial production growth

This is loosely based on an original strategy described in Equity trend following and macro headwinds .

Plausible features #

eq_plaus = []

Labor market tightness #

Excess wage growth here is defined as wage growth per unit of output in excess of the effective estimated inflation target. Excess wage growth refers to the increase in wages relative to the growth in productivity or output, beyond what is considered consistent with the targeted level of inflation. It indicates a situation where wages are rising at a faster pace than can be justified by the prevailing inflation rate and the overall increase in economic output. Excess wage growth can contribute to inflationary pressures in the economy.

To proxy the impact of the business cycle state on employment growth, a common approach is to calculate the difference between employment growth and the long-term median of workforce growth. This difference is often referred to as “excess employment growth.” By calculating excess employment growth, one can estimate the component of employment growth that is attributable to the business cycle state. This measure helps to identify deviations from the long-term trend and provides insights into the cyclical nature of employment dynamics.

# Composite labor tightness score

calcs = [

# Wage growth

"LPGT = RGDP_SA_P1Q1QL4_20QMM - WFORCE_NSA_P1Y1YL1_5YMM ", # labor productivity growth trend

"XWAGES_NSA_P1M1ML12_3MMA = WAGES_NSA_P1M1ML12_3MMA - LPGT - INFTEFF_NSA ", # excess wages

"XWAGES_TREND_NEG = - XWAGES_NSA_P1M1ML12_3MMA ",

# Employment growth

"XEMPL_NSA_P1M1ML12_3MMA = EMPL_NSA_P1M1ML12_3MMA - WFORCE_NSA_P1Y1YL1_5YMM",

"XEMPL_TREND_NEG = - XEMPL_NSA_P1M1ML12_3MMA",

# Unemployment rate changes

"XURATE_3Mv5Y = UNEMPLRATE_SA_3MMAv5YMM",

]

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cids_eq, blacklist=None)

dfx = msm.update_df(dfx, dfa)

As for the rates strategy,

make_zn_scores()

function from the

macrosynergy

package normalizes the indicators around a neutral value (zero) using historical data. This normalization is recalculated monthly. To mitigate the impact of statistical outliers, a cutoff of 2 standard deviations is employed. Post-normalization, the indicators (z-scores) are labeled with the suffix

_ZN

, indicating their adjusted status.

# Score the equity features

xcatx = [

"XEMPL_TREND_NEG",

"XWAGES_TREND_NEG",

"XURATE_3Mv5Y",

]

cidx = cids_eq

dfa = pd.DataFrame(columns=list(dfx.columns))

for xc in xcatx:

dfaa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 5,

neutral="zero",

pan_weight=0.5, # variance estimated based on panel and cross-sectional variation

thresh=2,

postfix="_ZN",

est_freq="m",

)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

labz = [x + "_ZN" for x in xcatx]

linear_composite

method from the

macrosynergy

package is employed to aggregate the individual category scores into a unified composite indicator

LABSLACK_CZS

with equal weights for each category for simplicity.

# Combine to a single score

xcatx = labz

czs = "LABSLACK_CZS"

cidx = cids_eq

dfa = msp.linear_composite(

df=dfx,

xcats=xcatx,

cids=cidx,

complete_xcats=False,

new_xcat=czs,

)

dfx = msm.update_df(dfx, dfa)

if not czs in eq_plaus:

eq_plaus.append(czs)

Inflation shortfall #

Negative excess inflation is defined as the negative difference of chosen inflation trend and the effective inflation target

INFTEFF_NSA

calcs = [

"XCPIH_NEG = - CPIH_SA_P1M1ML12 + INFTEFF_NSA",

"XCPIC_NEG = - CPIC_SJA_P6M6ML6AR + INFTEFF_NSA",

]

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cids_eq)

dfx = msm.update_df(dfx, dfa)

xinfs = dfa["xcat"].unique().tolist()

As before,

make_zn_scores()

function from the

macrosynergy

package normalizes the indicators around a neutral value (zero) using historical data, recalculated monthly. with a cutoff of 2 standard deviations. Post-normalization, the indicators (z-scores) are labeled with the suffix

_ZN

, indicating their adjusted status.

# Zn score the excess inflation features

cidx = cids_eq

sdate = "1990-01-01"

dfa = pd.DataFrame(columns=list(dfx.columns))

for xc in xinfs:

dfaa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 5,

neutral="zero",

pan_weight=0.5, # variance estimated based on panel and cross-sectional variation

thresh=2,

postfix="_ZN",

est_freq="m",

)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

xinfz = [x + "_ZN" for x in xinfs]

The

linear_composite

method from the

macrosynergy

package aggregates the individual category scores into a unified composite indicator

XCPI_NEG_CZS

.

# Combine to a single score

xcatx = xinfz

czs = "XCPI_NEG_CZS"

cidx = cids_eq

dfa = msp.linear_composite(

df=dfx,

xcats=xcatx,

cids=cidx,

complete_xcats=False,

new_xcat=czs,

)

dfx = msm.update_df(dfx, dfa)

if not czs in eq_plaus:

eq_plaus.append(czs)

Return momentum #

Here we take a standard equity trend indicator as the difference between 50-day and 200-day moving averages:

# Equity momentum

fxrs = ["EQXR_VT10", "EQXR_NSA"]

cidx = cids_eq

calcs = []

for fxr in fxrs:

calc = [

f"{fxr}I = ( {fxr} ).cumsum()",

f"{fxr}I_50DMA = {fxr}I.rolling(50).mean()",

f"{fxr}I_200DMA = {fxr}I.rolling(200).mean()",

f"{fxr}I_50v200DMA = {fxr}I_50DMA - {fxr}I_200DMA",

]

calcs += calc

dfa = msp.panel_calculator(dfx, calcs, cids=cidx)

dfx = msm.update_df(dfx, dfa)

eqtrends = ["EQXR_VT10I_50v200DMA", "EQXR_NSAI_50v200DMA"]

if not eqtrends[0] in eq_plaus:

eq_plaus.append(eqtrends[0])

Speculative features #

Speculative features here are the same as for the duration strategy. We use here negative excess inflation based on producer price inflation and negative excess industrial production growth. Both indicators have weak theoretical backing, and their inclusion simulates the usage of inferior predictors in the signal-generating process.

calcs = [

"XPPIH_NEG = - ( PPIH_NSA_P1M1ML12 - INFTEFF_NSA ) ",

"XIPG_NEG = - ( IP_SA_P1M1ML12_3MMA - RGDP_SA_P1Q1QL4_20QMA ) ",

]

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cids_eq)

dfx = msm.update_df(dfx, dfa)

eq_specs = dfa["xcat"].unique().tolist()

Scores and composite #

Once again, the

make_zn_scores()

function from the

macrosynergy

package normalizes the indicators around a neutral value (zero) using historical data. A cutoff of 3 standard deviations is employed. Post-normalization, the indicators (z-scores) are labeled with the suffix

_ZN3

, indicating their adjusted status. A combined, equally weighted indicator

EQ_AVGZ

is built using

linear_composite

method.

eqs = eq_plaus + eq_specs

xcatx = eqs

for xc in xcatx:

dfa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cids_eq,

neutral="zero",

thresh=3,

est_freq="M",

pan_weight=1,

postfix="_ZN3",

)

dfx = msm.update_df(dfx, dfa)

eqz = [xc + "_ZN3" for xc in eqs]

dfa = msp.linear_composite(

df=dfx,

xcats=eqz,

cids=cids_eq,

new_xcat="EQ_AVGZ",

)

dfx = msm.update_df(dfx, dfa)

The newly build composite unoptimized z-score for equity strategy

EQ_AVGZ

is displayed below with the help of

view_timelines()

from the

macrosynergy

package:

xcatx = ["EQ_AVGZ"]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cids_eq,

ncol=4,

start="2004-01-01",

title=None,

title_fontsize=30,

same_y=False,

cs_mean=False,

xcat_labels=None,

legend_fontsize=16,

)

Foreign exchange feature candidates #

To create a FX strategy, we develop a simple, plausible composite signal based on six features, including excess PPI inflation and excess industrial production growth as speculative signal candidates with presumed positive effects.

-

Changes in external balance ratios

-

Relative GDP growth trends

-

Manufacturing survey score changes

-

Terms-of-trade improvements

-

Excess PPI inflation

-

Excess industrial production growth

The original version of this strategy has been described in a Pure macro FX strategies: the benefits of double diversification .

Plausible features #

fx_plaus = []

External ratio trends #

In the cell below the External ratio trends are zn-scored around zero value, using zero as the neutral value, 3 as the cutoff value for winsorization in terms of standard deviations, 5 years of minimum number of observations, and monthly re-estimation frequency. Since the categories are homogeneous across countries, we use the whole panel as the basis for the parameters rather than individual cross-section.

# First Z-score each monthly external ratio change indicator

xcatx = [

# Very short-term changes

"MTBGDPRATIO_SA_3MMA_D1M1ML3",

"CABGDPRATIO_SA_3MMA_D1M1ML3",

# Short-term changes

"MTBGDPRATIO_SA_6MMA_D1M1ML6",

"CABGDPRATIO_SA_6MMA_D1M1ML6",

# Medium-term changes

"MTBGDPRATIO_SA_3MMAv60MMA",

"CABGDPRATIO_SA_3MMAv60MMA",

]

cidx = cids_fx

dfa = pd.DataFrame(columns=list(dfx.columns))

for xc in xcatx:

dfaa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 5,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

xbdz = [xc + "_ZN" for xc in xcatx]

The

linear_composite

method from the

macrosynergy

package is employed to aggregate the individual category scores into a unified composite indicator

XBT_ALL_CZS

with equal weights for each category for simplicity.

# Combine to a single score

xcatx = xbdz

czs = "XBT_ALL_CZS"

cidx = cids_fx

dfa = msp.linear_composite(

df=dfx,

xcats=xcatx,

cids=cidx,

complete_xcats=False,

new_xcat=czs,

)

dfx = msm.update_df(dfx, dfa)

if not czs in fx_plaus:

fx_plaus.append(czs)

Relative growth trends #

In the cell below we calculate the annual GDP growth trends relative to base currency area:

-

Euro (‘CHF’, ‘CZK’, ‘HUF’, ‘NOK’, ‘PLN’, ‘RON’, ‘SEK’),

-

USD (‘PEN’, ‘COP’, ‘IDR’, ‘THB’, ‘BRL’, ‘MXN’, ‘KRW’, ‘CAD’, ‘NZD’, ‘CLP’, ‘MYR’, ‘ZAR’, ‘AUD’, ‘TWD’, ‘INR’, ‘ILS’, ‘PHP’) or

-

a simple average of the two for (‘GBP’, ‘TRY’).

The new indicators get postfix

_vBM

for “versus Benchmark”

The two cells below calculate the Annual GDP growth trend relative to base currency area and displays its timeline for each cross-section.

# Relative to base currency areas

xcatx = [

# Intuitive growth estimates

"INTRGDP_NSA_P1M1ML12_3MMA",

"INTRGDPv5Y_NSA_P1M1ML12_3MMA",

# Technical growth estimates

"RGDPTECH_SA_P1M1ML12_3MMA",

"RGDPTECHv5Y_SA_P1M1ML12_3MMA",

]

dfa = pd.DataFrame(columns=list(dfx.columns))

for xc in xcatx:

calc_eur = [f"{xc}vBM = {xc} - iEUR_{xc}"]

calc_usd = [f"{xc}vBM = {xc} - iUSD_{xc}"]

calc_eud = [f"{xc}vBM = {xc} - 0.5 * ( iEUR_{xc} + iUSD_{xc} )"]

dfa_eur = msp.panel_calculator(dfx, calcs=calc_eur, cids=cids_eur)

dfa_usd = msp.panel_calculator(dfx, calcs=calc_usd, cids=cids_usd)

dfa_eud = msp.panel_calculator(dfx, calcs=calc_eud, cids=cids_eud)

dfa = msm.update_df(dfa, pd.concat([dfa_eur, dfa_usd, dfa_eud]))

dfx = msm.update_df(dfx, dfa)

grows = dfa["xcat"].unique().tolist()

The

macrosynergy

function

make_zn_scores()

normalizes the Annual GDP growth trend relative to the base currency area around zero adding

_ZN

postfix.

# Normalize relative growth

xcatx = grows

cidx = cids_fx

dfa = pd.DataFrame(columns=list(dfx.columns))

for xc in xcatx:

dfaa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 5,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

growz = [xc + "_ZN" for xc in xcatx]

The

linear_composite

method from the

macrosynergy

package is employed to aggregate the individual category scores into a unified composite indicator

GDPvBM_CZS

.

# Combine to a single score

xcatx = growz

czs = "GDPvBM_CZS"

cidx = cids_fx

dfa = msp.linear_composite(

df=dfx,

xcats=xcatx,

cids=cidx,

complete_xcats=False,

new_xcat=czs,

)

dfx = msm.update_df(dfx, dfa)

if not czs in fx_plaus:

fx_plaus.append(czs)

Manufacturing survey score changes #

The

make_zn_scores()

function from the

macrosynergy

package normalizes the indicators around a neutral value (zero) using historical data. This normalization is recalculated monthly. To mitigate the impact of statistical outliers, a cutoff of 3 standard deviations is employed. Post-normalization, the indicators (z-scores) are labeled with the suffix

_ZN

, indicating their adjusted status.

# Business score changes

xcatx = ["MBCSCORE_SA_D3M3ML3", "MBCSCORE_SA_D6M6ML6"]

cidx = cids_fx

dfa = pd.DataFrame(columns=list(dfx.columns))

for xc in xcatx:

dfaa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 5,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

survz = [xc + "_ZN" for xc in xcatx]

The

linear_composite

method from the

macrosynergy

package is employed to aggregate the individual category scores into a unified composite indicator

MBSURVD_CZ

with equal weights for each category for simplicity.

# Combine to a single score

xcatx = survz

czs = "MBSURVD_CZS"

cidx = cids_fx

dfa = msp.linear_composite(

df=dfx,

xcats=xcatx,

cids=cidx,

complete_xcats=False,

new_xcat=czs,

)

dfx = msm.update_df(dfx, dfa)

if not czs in fx_plaus:

fx_plaus.append(czs)

Terms-of-trade #

The

make_zn_scores()

function from the

macrosynergy

package normalizes the indicators around a neutral value (zero) using historical data. This normalization is recalculated monthly. To mitigate the impact of statistical outliers, a cutoff of 3 standard deviations is employed. Post-normalization, the indicators (z-scores) are labeled with the suffix

_ZN

, indicating their adjusted status.

xcatx = [

# commodity-based changes

"CTOT_NSA_P1M12ML1",

"CTOT_NSA_P1M1ML12",

"CTOT_NSA_P1M60ML1",

# mixed dynamics

"MTOT_NSA_P1M12ML1",

"MTOT_NSA_P1M1ML12",

"MTOT_NSA_P1M60ML1",

]

cidx = cids_fx

dfa = pd.DataFrame(columns=list(dfx.columns))

for xc in xcatx:

dfaa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 5,

neutral="zero",

pan_weight=0.5, # 50% cross-section weight as ToT changes are not fully comparable

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

ttdz = [xc + "_ZN" for xc in xcatx]

The

linear_composite

method from the

macrosynergy

package is employed to aggregate the individual category scores into a unified composite indicator

TTD_ALL_CZS

with equal weights for each category for simplicity.

# Combine to a single score

xcatx = ttdz

czs = "TTD_ALL_CZS"

cidx = cids_fx

dfa = msp.linear_composite(

df=dfx,

xcats=xcatx,

cids=cidx,

complete_xcats=False,

new_xcat=czs,

)

dfx = msm.update_df(dfx, dfa)

if not czs in fx_plaus:

fx_plaus.append(czs)

Speculative features #

Speculative features here are the same as for the previous strategies: the negative excess inflation based on producer price inflation and negative excess industrial production growth. Both indicators have weak theoretical backing, and their inclusion simulates the usage of inferior predictors in the signal-generating process.

calcs = [

"XPPIH = PPIH_NSA_P1M1ML12 - INFTEFF_NSA ",

"XIPG = IP_SA_P1M1ML12_3MMA - RGDP_SA_P1Q1QL4_20QMA ",

]

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cids_fx)

dfx = msm.update_df(dfx, dfa)

fx_specs = dfa["xcat"].unique().tolist()

Scores and composite #

Once again, the

make_zn_scores()

function from the

macrosynergy

package normalizes the indicators around a neutral value (zero) using historical data. A cutoff of 3 standard deviations is employed. Post-normalization, the indicators (z-scores) are labeled with the suffix

_ZN3

, indicating their adjusted status. A combined, equally weighted indicator is built using

linear_composite

method. The new (unoptimized) signal receives the name

FX_AVGZ

fxs = fx_plaus + fx_specs

xcatx = fxs

for xc in xcatx:

dfa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cids_fx,

neutral="zero",

thresh=3,

est_freq="M",

pan_weight=1,

postfix="_ZN3",

)

dfx = msm.update_df(dfx, dfa)

fxz = [xc + "_ZN3" for xc in fxs]

dfa = msp.linear_composite(

df=dfx,

xcats=fxz,

cids=cids_fx,

new_xcat="FX_AVGZ",

)

dfx = msm.update_df(dfx, dfa)

The linear composite of the z-scores of all features used in fx strategy

FX_AVGZ

is displayed below with the help of

view_timelines()

from the

macrosynergy

package:

xcatx = ["FX_AVGZ"]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cids_fx,

ncol=4,

start="2004-01-01",

title=None,

title_fontsize=30,

same_y=False,

cs_mean=False,

xcat_labels=None,

legend_fontsize=16,

)

Features and targets for scikit-learn #

As the first preparation for the statistical learning modelling, we downsample the daily information states to monthly frequency with the help of the

categories_df()

function applying the lag of 1 month and using the last value in the month for explanatory variables and sum for the aggregated target (return). Two dataframes for each strategy are defined:

-

feature dataframe

X_duand target dataframey_dufor the duration strategy -

feature dataframe

X_eqand target dataframey_eqfor the equity strategy -

feature dataframe

X_fxand target dataframey_fxfor the fx strategy

Duration #

# Specify features and target category

xcatx = durz + ["DU05YXR_VT10"]

# Downsample from daily to monthly frequency (features as last and target as sum)

dfw = msm.categories_df(

df=dfx,

xcats=xcatx,

cids=cids_dux,

freq="M",

lag=1,

blacklist=fxblack,

xcat_aggs=["last", "sum"],

)

# Drop rows with missing values and assign features and target

dfw.dropna(inplace=True)

X_du = dfw.iloc[:, :-1]

y_du = dfw.iloc[:, -1]

Equity #

# Specify features and target category

xcatx = eqz + ["EQXR_VT10"]

# Downsample from daily to monthly frequency (features as last and target as sum)

dfw = msm.categories_df(

df=dfx,

xcats=xcatx,

cids=cids_eq,

freq="M",

lag=1,

blacklist=None,

xcat_aggs=["last", "sum"],

)

# Drop rows with missing values and assign features and target

dfw.dropna(inplace=True)

X_eq = dfw.iloc[:, :-1]

y_eq = dfw.iloc[:, -1]

FX #

# Specify features and target category

xcatx = fxz + ["FXXR_VT10"]

# Downsample from daily to monthly frequency (features as last and target as sum)

dfw = msm.categories_df(

df=dfx,

xcats=xcatx,

cids=cids_fx,

freq="M",

lag=1,

blacklist=fxblack,

xcat_aggs=["last", "sum"],

)

# Drop rows with missing values and assign features and target

dfw.dropna(inplace=True)

X_fx = dfw.iloc[:, :-1]

y_fx = dfw.iloc[:, -1]

Prediction #

Here we use standard R2 score for evaluating the performance of regression models.

# Define the optimization criterion

scorer = make_scorer(r2_score, greater_is_better=True)

# Define splits for cross-validation

splitter = msl.RollingKFoldPanelSplit(n_splits=5)

Ordinary least squares #

We test the consequences of using a standard learning process with standard ordinary least squares (OLS) regression to condense the information of multiple candidate features, against a standard conceptual risk parity benchmark. The only important hyperparameter to optimize over is the inclusion of an intercept in the regression. Although all features have a theoretical neutral level at zero, an intercept would correct for any errors in the underlying assumptions. Yet, the price for potential bias is that past long-term seasons of positive or negative target returns translate into sizable intercepts and future directional bias of the regression signal.

Duration #

mods_du_ols = {

"ols": LinearRegression(),

}

grid_du_ols = {

"ols": {"fit_intercept": [True, False]},

}

The following cell uses the

macrosynergy.learning.SignalOptimizer

class for sequential optimization of raw signals based on quantamental features. The features are lagged quantamental indicators, collected in the dataframe

X_du

, and the targets in

y_du

are cumulative returns at the native frequency. Please read

here

for detailed descriptions and examples. The derived signal is labeled

DU_OLS

xcatx = durz + ["DU05YXR_VT10"]

cidx = cids_dux

so_du = msl.SignalOptimizer(

df = dfx,

xcats = xcatx,

cids = cidx,

blacklist = fxblack,

freq = "M",

lag = 1,

xcat_aggs = ["last", "sum"],

)

# Calculate predictions

so_du.calculate_predictions(

name = "DU_OLS",

models = mods_du_ols,

hyperparameters = grid_du_ols,

scorers = {"R2": scorer},

inner_splitters = {"Rolling": splitter},

search_type="grid",

normalize_fold_results=False,

cv_summary="mean",

min_cids=4,

min_periods=36,

test_size=1,

n_jobs_outer = -1,

)

# Get optimized signals

dfa = so_du.get_optimized_signals()

dfx = msm.update_df(dfx, dfa)

# Display model selection heatmap

so_du.models_heatmap(name="DU_OLS", figsize=(18, 6))

Both signals

DU_AVGZ

,

DU_OLS

are displayed below with the help of

view_timelines()

from the

macrosynergy

package:

sigs_du_ols = ["DU_AVGZ", "DU_OLS"]

xcatx = sigs_du_ols

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cids_dux,

ncol=4,

start="2004-01-01",

title=None,

title_fontsize=30,

same_y=False,

cs_mean=False,

xcat_labels=None,

legend_fontsize=16,

)

Value checks #

This section uses extensively the following classes of the

macrosynergy

package:

The

SignalReturnRelations

class of the

macrosynergy

package facilitates a quick assessment of the power of a signal category in predicting the direction of subsequent returns for data in JPMaQS format.

The

NaivePnl()

class is specifically designed to offer a quick and straightforward overview of a simplified Profit and Loss (PnL) profile associated with a set of trading signals. The term “naive” is used because the methods within this class do not factor in transaction costs or position limitations, which may include considerations related to risk management. This omission is intentional because the impact of costs and limitations varies widely depending on factors such as trading size, institutional rules, and regulatory requirements.

For a comparative overview of the signal-return relationship across both signals, one can use the

signals_table()

method.

## Compare optimized signals with simple average z-scores

srr_du_ols = mss.SignalReturnRelations(

df=dfx,

rets=["DU05YXR_VT10"],

sigs=sigs_du_ols,

cids=cids_dux,

cosp=True,

freqs=["M"],

agg_sigs=["last"],

start="2004-01-01",

blacklist=fxblack,

slip=1,

)

srr_du_ols.signals_table().astype("float").round(3)

| accuracy | bal_accuracy | pos_sigr | pos_retr | pos_prec | neg_prec | pearson | pearson_pval | kendall | kendall_pval | auc | ||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Return | Signal | Frequency | Aggregation | |||||||||||

| DU05YXR_VT10 | DU_AVGZ | M | last | 0.517 | 0.518 | 0.495 | 0.537 | 0.555 | 0.481 | 0.066 | 0.000 | 0.037 | 0.000 | 0.518 |

| DU_OLS | M | last | 0.538 | 0.525 | 0.817 | 0.537 | 0.546 | 0.504 | 0.050 | 0.001 | 0.032 | 0.001 | 0.515 |

We estimate the economic value of both composite signals based on a naïve PnL computed according to a standard procedure used in Macrosynergy research posts. A naive PnL is calculated for simple monthly rebalancing in accordance with the composite scores

DU_AVGZ

and

DU_OLS

and score at the end of each month as the basis for the positions of the next month and under consideration of a 1-day slippage for trading. The trading signals are capped at 2 standard deviations in either direction for each currency as a reasonable risk limit, and applied to volatility-targeted positions. This means that one unit of signal translates into one unit of risk (approximated by estimated return volatility) for each currency. The naïve PnL does not consider transaction costs or compounding. For the chart below, the PnL has been scaled to an annualized volatility of 10%

sigs = sigs_du_ols

cidx = cids_dux

pnl_du_ols = msn.NaivePnL(

df=dfx,

ret="DU05YXR_VT10",

sigs=sigs,

cids=cidx,

start="2004-01-01",

blacklist=fxblack,

bms=["USD_GB10YXR_NSA"],

)

for sig in sigs:

pnl_du_ols.make_pnl(

sig=sig,

sig_op="zn_score_pan",

rebal_freq="monthly",

neutral="zero",

rebal_slip=1,

vol_scale=10,

thresh=2,

)

pnl_du_ols.plot_pnls(

title=None,

title_fontsize=14,

xcat_labels=None,

)

pnl_du_ols.evaluate_pnls(pnl_cats=["PNL_" + sig for sig in sigs])

| xcat | PNL_DU_AVGZ | PNL_DU_OLS |

|---|---|---|

| Return % | 4.469729 | 4.643754 |

| St. Dev. % | 10.0 | 10.0 |

| Sharpe Ratio | 0.446973 | 0.464375 |

| Sortino Ratio | 0.633659 | 0.64623 |

| Max 21-Day Draw % | -29.195864 | -23.743326 |

| Max 6-Month Draw % | -41.291288 | -51.187972 |

| Peak to Trough Draw % | -53.720987 | -84.534925 |

| Top 5% Monthly PnL Share | 1.683276 | 1.298576 |

| USD_GB10YXR_NSA correl | -0.026813 | 0.415252 |

| Traded Months | 252 | 252 |

The method

create_results_dataframe()

from

macrosynergy.pnl

displays a small dataframe of key statistics for both signals:

results_du_ols = msn.create_results_dataframe(

title="Performance metrics, PARITY vs OLS, duration",

df=dfx,

ret="DU05YXR_VT10",

sigs=sigs_du_ols,

cids=cids_dux,

sig_ops="zn_score_pan",

sig_adds=0,

sig_negs=[False, False],

neutrals="zero",

threshs=2,

bm="USD_GB10YXR_NSA",

cosp=True,

start="2004-01-01",

blacklist=fxblack,

freqs="M",

agg_sigs="last",

sigs_renamed={"DU_AVGZ": "PARITY", "DU_OLS": "OLS"},

slip=1,

)

results_du_ols

| Accuracy | Bal. Accuracy | Pearson | Kendall | Sharpe | Sortino | Market corr. | |

|---|---|---|---|---|---|---|---|

| PARITY | 0.517 | 0.518 | 0.066 | 0.037 | 0.447 | 0.634 | -0.027 |

| OLS | 0.538 | 0.525 | 0.050 | 0.032 | 0.464 | 0.646 | 0.415 |

Equity #

mods_eq_ols = {

"ols": LinearRegression(),

}

grid_eq_ols = {

"ols": {"fit_intercept": [True, False]},

}

As for the duration strategy above, we deploy

macrosynergy's

SignalOptimizer

class for sequential optimization of raw signals based on quantamental features. The features are lagged quantamental indicators, collected in the dataframe

X_eq

, and the targets in

y_eq

, are cumulative returns at the native frequency. Please read

here

for detailed descriptions and examples. In this context, we aim to generate the signal for the equity strategy

EQ_OLS

, which will then be analyzed in comparison to the previously developed conceptual parity signal,

EQ_AVGZ

.

xcatx = eqz + ["EQXR_VT10"]

cidx = cids_eq

so_eq = msl.SignalOptimizer(

df = dfx,

xcats = xcatx,

cids = cidx,

freq = "M",

lag = 1,

xcat_aggs = ["last", "sum"],

)

# Calculate predictions

so_eq.calculate_predictions(

name = "EQ_OLS",

models = mods_eq_ols,

hyperparameters = grid_eq_ols,

scorers = {"R2": scorer},

inner_splitters = {"Rolling": splitter},

search_type="grid",

normalize_fold_results=False,

cv_summary="mean",

min_cids=4,

min_periods=36,

test_size=1,

n_jobs_outer = -1,

)

# Get optimized signals

dfa = so_eq.get_optimized_signals()

dfx = msm.update_df(dfx, dfa)

# Display model selection heatmap

so_eq.models_heatmap(name="EQ_OLS", figsize=(18, 6))

Both signals

EQ_AVGZ

,

EQ_OLS

are displayed below with the help of

view_timelines()

from the

macrosynergy

package:

sigs_eq_ols = ["EQ_AVGZ", "EQ_OLS"]

xcatx = sigs_eq_ols

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cids_eq,

ncol=4,

start="2004-01-01",

title=None,

title_fontsize=30,

same_y=False,

cs_mean=False,

xcat_labels=None,

legend_fontsize=16,

)

Value checks #

The

SignalReturnRelations

class from the macrosynergy.signal module is designed to analyze, visualize, and compare the relationships between panels of trading signals and panels of subsequent returns and

signals_table()

method is used for a comparative overview of the signal-return relationship across both signals.

## Compare optimized signals with simple average z-scores

srr_eq_ols = mss.SignalReturnRelations(

df=dfx,

rets=["EQXR_VT10"],

sigs=sigs_eq_ols,

cids=cids_eq,

cosp=True,

freqs=["M"],

agg_sigs=["last"],

start="2004-01-01",

slip=1,

)

srr_eq_ols.signals_table().astype("float").round(3)

| accuracy | bal_accuracy | pos_sigr | pos_retr | pos_prec | neg_prec | pearson | pearson_pval | kendall | kendall_pval | auc | ||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Return | Signal | Frequency | Aggregation | |||||||||||

| EQXR_VT10 | EQ_AVGZ | M | last | 0.575 | 0.554 | 0.598 | 0.619 | 0.663 | 0.445 | 0.116 | 0.000 | 0.070 | 0.000 | 0.555 |

| EQ_OLS | M | last | 0.567 | 0.521 | 0.707 | 0.619 | 0.632 | 0.410 | 0.053 | 0.018 | 0.032 | 0.031 | 0.518 |

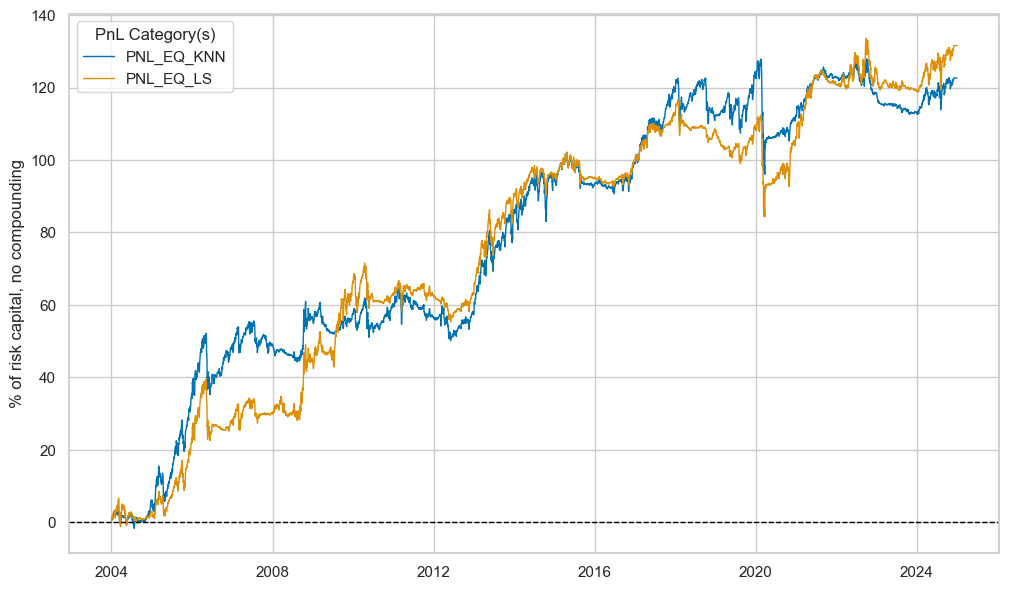

We estimate the economic value of both composite signals based on a naïve PnL computed according to a standard procedure used in Macrosynergy research posts. A naive PnL is calculated for simple monthly rebalancing in accordance with the composite scores

EQ_AVGZ

and

EQ_OLS

and score at the end of each month as the basis for the positions of the next month and under consideration of a 1-day slippage for trading. The trading signals are capped at 2 standard deviations in either direction for each currency as a reasonable risk limit, and applied to volatility-targeted positions. This means that one unit of signal translates into one unit of risk (approximated by estimated return volatility) for each currency. The naïve PnL does not consider transaction costs or compounding. For the chart below, the PnL has been scaled to an annualized volatility of 10%

cidx = cids_eq

sigs = sigs_eq_ols

pnl_eq_ols = msn.NaivePnL(

df=dfx,

ret="EQXR_VT10",

sigs=sigs,

cids=cidx,

start="2004-01-01",

bms=["USD_EQXR_NSA"],

)

for sig in sigs:

pnl_eq_ols.make_pnl(

sig=sig,

sig_op="zn_score_pan",

rebal_freq="monthly",

neutral="zero",

rebal_slip=1,

vol_scale=10,

thresh=2,

)

pnl_eq_ols.plot_pnls(

title=None,

title_fontsize=14,

xcat_labels=None,

)

pnl_eq_ols.evaluate_pnls(pnl_cats=["PNL_" + sig for sig in sigs])

| xcat | PNL_EQ_AVGZ | PNL_EQ_OLS |

|---|---|---|

| Return % | 6.890349 | 6.132868 |

| St. Dev. % | 10.0 | 10.0 |

| Sharpe Ratio | 0.689035 | 0.613287 |

| Sortino Ratio | 0.994469 | 0.843085 |

| Max 21-Day Draw % | -23.686601 | -26.942853 |

| Max 6-Month Draw % | -17.372984 | -19.278729 |

| Peak to Trough Draw % | -24.440076 | -33.320281 |

| Top 5% Monthly PnL Share | 0.752745 | 0.668659 |

| USD_EQXR_NSA correl | 0.050355 | 0.218191 |

| Traded Months | 252 | 252 |

The method

create_results_dataframe()

from

macrosynergy.pnl

displays a small dataframe of key statistics for both signals:

results_eq_ols = msn.create_results_dataframe(

title="Performance metrics, PARITY vs OLS, equity",

df=dfx,

ret="EQXR_VT10",

sigs=sigs_eq_ols,

cids=cids_eq,

sig_ops="zn_score_pan",

sig_adds=0,

neutrals="zero",

threshs=2,

sig_negs=[False, False],

bm="USD_EQXR_NSA",

cosp=True,

start="2004-01-01",

freqs="M",

agg_sigs="last",

sigs_renamed={"EQ_AVGZ": "PARITY", "EQ_OLS": "OLS"},

slip=1,

)

results_eq_ols

| Accuracy | Bal. Accuracy | Pearson | Kendall | Sharpe | Sortino | Market corr. | |

|---|---|---|---|---|---|---|---|

| PARITY | 0.575 | 0.554 | 0.116 | 0.070 | 0.689 | 0.994 | 0.050 |

| OLS | 0.567 | 0.521 | 0.053 | 0.032 | 0.613 | 0.843 | 0.218 |

FX #

mods_fx_ols = {

"ols": LinearRegression(),

}

grid_fx_ols = {

"ols": {"fit_intercept": [True, False]},

}

xcatx = fxz + ["FXXR_VT10"]

cidx = cids_fx

so_fx = msl.SignalOptimizer(

df = dfx,

xcats = xcatx,

cids = cidx,

blacklist=fxblack,

freq = "M",

lag = 1,

xcat_aggs = ["last", "sum"],

)

# Calculate predictions

so_fx.calculate_predictions(

name = "FX_OLS",

models = mods_fx_ols,

hyperparameters = grid_fx_ols,

scorers = {"R2": scorer},

inner_splitters = {"Rolling": splitter},

search_type="grid",

normalize_fold_results=False,

cv_summary="mean",

min_cids=4,

min_periods=36,

test_size=1,

n_jobs_outer = -1,

)

# Get optimized signals

dfa = so_fx.get_optimized_signals()

dfx = msm.update_df(dfx, dfa)

# Display model selection heatmap

so_fx.models_heatmap(name="FX_OLS", figsize=(18, 6))

The same steps are repeated for the FX strategy. The following cell uses the

macrosynergy.learning.SignalOptimizer

class for sequential optimization of raw signals based on quantamental features. The features are lagged quantamental indicators, collected in the dataframe

X_fx

, and the targets in

y_fx

, are cumulative returns at the native frequency. Please read

here

for detailed descriptions and examples. The OLS signal derived in the process receives label

FX_OLS

.

Both signals

FX_AVGZ

,

FX_OLS

are displayed below with the help of

view_timelines()

from the

macrosynergy

package:

sigs_fx_ols = ["FX_AVGZ", "FX_OLS"]

xcatx = sigs_fx_ols

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cids_fx,

ncol=4,

start="2004-01-01",

title=None,

title_fontsize=30,

same_y=False,

cs_mean=False,

xcat_labels=None,

legend_fontsize=16,

)

Value checks #

The

SignalReturnRelations

class from the macrosynergy.signal module is designed to analyze, visualize, and compare the relationships between panels of trading signals and panels of subsequent returns.

## Compare optimized signals with simple average z-scores

srr_fx_ols = mss.SignalReturnRelations(

df=dfx,

rets=["FXXR_VT10"],

sigs=sigs_fx_ols,

cids=cids_fx,

cosp=True,

freqs=["M"],

agg_sigs=["last"],

start="2004-01-01",

blacklist=fxblack,

slip=1,

)

srr_fx_ols.signals_table().astype("float").round(3)

| accuracy | bal_accuracy | pos_sigr | pos_retr | pos_prec | neg_prec | pearson | pearson_pval | kendall | kendall_pval | auc | ||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Return | Signal | Frequency | Aggregation | |||||||||||

| FXXR_VT10 | FX_AVGZ | M | last | 0.510 | 0.509 | 0.518 | 0.534 | 0.543 | 0.475 | 0.035 | 0.008 | 0.026 | 0.003 | 0.509 |

| FX_OLS | M | last | 0.526 | 0.517 | 0.677 | 0.534 | 0.545 | 0.488 | 0.021 | 0.114 | 0.023 | 0.009 | 0.515 |

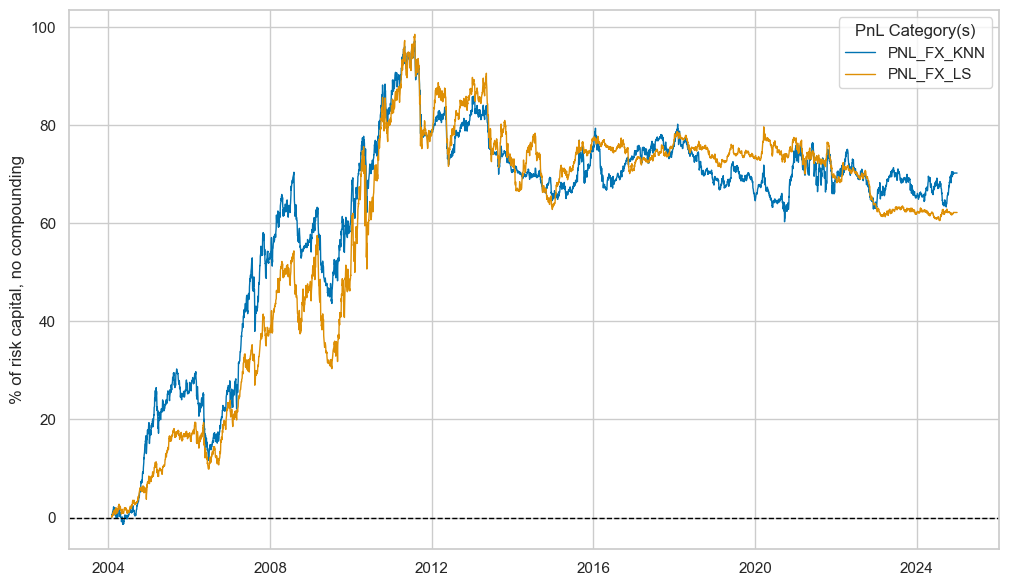

NaivePnl()

class is designed to provide a quick and simple overview of a stylized PnL profile of a set of trading signals. The class is labeled naive because its methods do not consider transaction costs or position limitations, such as risk management considerations. This is deliberate because costs and limitations are specific to trading size, institutional rules, and regulations.

sigs = sigs_fx_ols

pnl_fx_ols = msn.NaivePnL(

df=dfx,

ret="FXXR_VT10",

sigs=sigs,

cids=cids_fx,

start="2004-01-01",

blacklist=fxblack,

bms=["USD_EQXR_NSA"],

)

for sig in sigs:

pnl_fx_ols.make_pnl(

sig=sig,

sig_op="zn_score_pan",

rebal_freq="monthly",

neutral="zero",

rebal_slip=1,

vol_scale=10,

thresh=2,

)

pnl_fx_ols.plot_pnls(

title=None,

title_fontsize=14,

xcat_labels=None,

)

pnl_fx_ols.evaluate_pnls(pnl_cats=["PNL_" + sig for sig in sigs])

| xcat | PNL_FX_AVGZ | PNL_FX_OLS |

|---|---|---|

| Return % | 5.606975 | 2.576528 |

| St. Dev. % | 10.0 | 10.0 |

| Sharpe Ratio | 0.560698 | 0.257653 |

| Sortino Ratio | 0.795164 | 0.354151 |

| Max 21-Day Draw % | -18.456145 | -23.578106 |

| Max 6-Month Draw % | -35.046148 | -22.345334 |

| Peak to Trough Draw % | -47.02541 | -35.169891 |

| Top 5% Monthly PnL Share | 0.852942 | 1.606838 |

| USD_EQXR_NSA correl | -0.06243 | 0.113561 |

| Traded Months | 252 | 252 |

The method

create_results_dataframe()

from

macrosynergy.pnl

displays a small dataframe of key statistics for both signals:

results_fx_ols = msn.create_results_dataframe(

title="Performance metrics, PARITY vs OLS, FX",

df=dfx,

ret="FXXR_VT10",

sigs=sigs_fx_ols,

cids=cids_fx,

sig_ops="zn_score_pan",

sig_adds=0,

sig_negs=[False, False],

neutrals="zero",

threshs=2,

bm="USD_EQXR_NSA",

cosp=True,

start="2004-01-01",

blacklist=fxblack,

freqs="M",

agg_sigs="last",

sigs_renamed={"FX_AVGZ": "PARITY", "FX_OLS": "OLS"},

slip=1,

)

results_fx_ols

| Accuracy | Bal. Accuracy | Pearson | Kendall | Sharpe | Sortino | Market corr. | |

|---|---|---|---|---|---|---|---|

| PARITY | 0.510 | 0.509 | 0.035 | 0.026 | 0.561 | 0.795 | -0.062 |

| OLS | 0.526 | 0.517 | 0.021 | 0.023 | 0.258 | 0.354 | 0.114 |

Regression comparison #

OLS failed to outperform conceptual parity on average for the three types of macro strategies. Whilst the accuracy of OLS signals was higher balanced accuracy, forward correlation coefficients and PnL performance ratios were all lower. Also, market benchmark correlation of OLS-based strategies was on average higher. Underperformance of OLS mainly arose in the FX space and reflected the learning method’s preference for regression models with intercept from 2008 to 2014, which translated the strong season for FX returns of the earlier 2000s into a positive bias for signals during and after the great financial crisis.

The empirical analysis provided two important lessons:

-

Only allow constants if there is a good reason. If the regression intercept picks up longer performance seasons, it will simply extrapolate past return averages.

-

Don’t compare regression signals and fixed-weight signals by correlation metrics. Regression-based signal variation does not arise merely from feature variation, but from changes in model parameters and hyperparameters. And the latter sources of variation have no plausible relation to target return. For example, in the empirical analyses of the duration strategy the OLS signals post lower predictive correlation but produce higher accuracy and balanced accuracy and almost the same performance ratios.

results_ols = (results_du_ols.data + results_eq_ols.data + results_fx_ols.data) / 3

results_ols.style.format("{:.3f}").set_caption(

"Averaged performance metrics, PARITY vs OLS"

).set_table_styles(

[

{

"selector": "caption",

"props": [("text-align", "center"), ("font-weight", "bold")],

}

]

)

| Accuracy | Bal. Accuracy | Pearson | Kendall | Sharpe | Sortino | Market corr. | |

|---|---|---|---|---|---|---|---|

| PARITY | 0.534 | 0.527 | 0.072 | 0.044 | 0.566 | 0.808 | -0.013 |

| OLS | 0.544 | 0.521 | 0.041 | 0.029 | 0.445 | 0.614 | 0.249 |

Non-negative least squares #

NNLS is a regression technique used to approximate the solution of an overdetermined system of linear equations with the additional constraint that the coefficients must be non-negative. This is a bit like placing independent half-flat priors on the feature weights in a Bayesian context. The main advantage of NNLS is that it allows consideration of theoretical priors, reducing dependence on scarce data.

Duration #

mods_du_ls = {

"nnls": LinearRegression(positive=True),

}

grid_du_ls = {

"nnls": {"fit_intercept": [True, False]},

}

The following cell uses the

macrosynergy.learning.SignalOptimizer

class for sequential optimization of raw signals based on quantamental features. The features are lagged quantamental indicators, collected in the dataframe

X_du

, and the targets in

y_du

, are cumulative returns at the native frequency. Please read

here

for detailed descriptions and examples. The signal generated through this process is labeled as

DU_NNLS

.

# Calculate predictions

so_du.calculate_predictions(

name = "DU_NNLS",

models = mods_du_ls,

hyperparameters = grid_du_ls,

scorers = {"R2": scorer},

inner_splitters = {"Rolling": splitter},

search_type="grid",

normalize_fold_results=False,

cv_summary="mean",

min_cids=4,

min_periods=36,

test_size=1,

n_jobs_outer = -1,

)

# Get optimized signals

dfa = so_du.get_optimized_signals(name="DU_NNLS")

dfx = msm.update_df(dfx, dfa)

# Display model selection heatmap

so_du.models_heatmap(name="DU_NNLS", figsize=(18, 6))

Both signals

DU_NNLS

, and

DU_OLS

are displayed below with the help of

view_timelines()

from the

macrosynergy

package:

sigs_du_ls = ["DU_OLS", "DU_NNLS"]

xcatx = sigs_du_ls

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cids_dux,

ncol=4,

start="2004-01-01",

title=None,

title_fontsize=30,

same_y=False,

cs_mean=False,

xcat_labels=None,

legend_fontsize=16,

)

Value checks #

The

SignalReturnRelations

class of the

macrosynergy

package facilitates a quick assessment of the power of a signal category in predicting the direction of subsequent returns for data in JPMaQS format.

The

NaivePnl()

class is specifically designed to offer a quick and straightforward overview of a simplified Profit and Loss (PnL) profile associated with a set of trading signals. The term “naive” is used because the methods within this class do not factor in transaction costs or position limitations, which may include considerations related to risk management. This omission is intentional because the impact of costs and limitations varies widely depending on factors such as trading size, institutional rules, and regulatory requirements.

For a comparative overview of the signal-return relationship across both signals, one can use the

signals_table()

method.

# Compare optimized signals with simple average z-scores

xcatx = sigs_du_ls

srr_du_ls = mss.SignalReturnRelations(

df=dfx,

rets=["DU05YXR_VT10"],

sigs=xcatx,

cids=cids_dux,

cosp=True,

freqs=["M"],

agg_sigs=["last"],

start="2004-01-01",

blacklist=fxblack,

slip=1,

)

srr_du_ls.signals_table().astype("float").round(3)

| accuracy | bal_accuracy | pos_sigr | pos_retr | pos_prec | neg_prec | pearson | pearson_pval | kendall | kendall_pval | auc | ||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Return | Signal | Frequency | Aggregation | |||||||||||

| DU05YXR_VT10 | DU_OLS | M | last | 0.538 | 0.525 | 0.817 | 0.537 | 0.546 | 0.504 | 0.050 | 0.001 | 0.032 | 0.001 | 0.515 |

| DU_NNLS | M | last | 0.536 | 0.520 | 0.861 | 0.537 | 0.542 | 0.497 | 0.062 | 0.000 | 0.043 | 0.000 | 0.509 |

sigs = sigs_du_ls

pnl_du_ls = msn.NaivePnL(

df=dfx,

ret="DU05YXR_VT10",

sigs=sigs,

cids=cids_dux,

start="2004-01-01",

blacklist=fxblack,

bms=["USD_GB10YXR_NSA"],

)

for sig in sigs:

pnl_du_ls.make_pnl(

sig=sig,

sig_op="zn_score_pan",

rebal_freq="monthly",

neutral="zero",

rebal_slip=1,

vol_scale=10,

thresh=2,

)

pnl_du_ls.plot_pnls(

title=None,

title_fontsize=14,

xcat_labels=None,

)

pnl_du_ls.evaluate_pnls(pnl_cats=["PNL_" + sig for sig in sigs])

| xcat | PNL_DU_OLS | PNL_DU_NNLS |

|---|---|---|

| Return % | 4.643754 | 5.385462 |

| St. Dev. % | 10.0 | 10.0 |

| Sharpe Ratio | 0.464375 | 0.538546 |

| Sortino Ratio | 0.643807 | 0.74652 |

| Max 21-Day Draw % | -23.743326 | -24.949941 |

| Max 6-Month Draw % | -51.187972 | -34.29769 |

| Peak to Trough Draw % | -84.534925 | -70.289582 |

| Top 5% Monthly PnL Share | 1.298576 | 1.099648 |

| USD_GB10YXR_NSA correl | 0.415252 | 0.47826 |

| Traded Months | 251 | 251 |

The method

create_results_dataframe()

from

macrosynergy.pnl

displays a small dataframe of key statistics for both signals:

results_du_ls = msn.create_results_dataframe(

title="Performance metrics, OLS vs NNLS, duration",

df=dfx,

ret="DU05YXR_VT10",

sigs=sigs_du_ls,

cids=cids_dux,

sig_ops="zn_score_pan",

sig_adds=0,

neutrals="zero",

sig_negs=[False, False],

threshs=2,

bm="USD_GB10YXR_NSA",

cosp=True,

start="2004-01-01",

freqs="M",

agg_sigs="last",

sigs_renamed={"DU_OLS": "OLS", "DU_NNLS": "NNLS"},

slip=1,

blacklist=fxblack,

)

results_du_ls

| Accuracy | Bal. Accuracy | Pearson | Kendall | Sharpe | Sortino | Market corr. | |

|---|---|---|---|---|---|---|---|

| NNLS | 0.536 | 0.520 | 0.062 | 0.043 | 0.539 | 0.747 | 0.478 |

| OLS | 0.538 | 0.525 | 0.050 | 0.032 | 0.464 | 0.644 | 0.415 |

Equity #

mods_eq_ls = {

"nnls": LinearRegression(positive=True),

}

grid_eq_ls = {

"nnls": {"fit_intercept": [True, False]},

}

The following cell uses the

macrosynergy.learning.SignalOptimizer

class for sequential optimization of raw signals based on quantamental features. The features are lagged quantamental indicators, collected in the dataframe

X_eq

, and the targets in

y_eq

, are cumulative returns at the native frequency. Please read

here

for detailed descriptions and examples. The signal generated through this process is labeled as

EQ_NNLS

.

# Calculate predictions

so_eq.calculate_predictions(

name = "EQ_NNLS",

models = mods_eq_ls,

hyperparameters = grid_eq_ls,

scorers = {"R2": scorer},

inner_splitters = {"Rolling": splitter},

search_type="grid",

normalize_fold_results=False,

cv_summary="mean",

min_cids=4,

min_periods=36,

test_size=1,

n_jobs_outer = -1,

)

# Get optimized signals

dfa = so_eq.get_optimized_signals(name="EQ_NNLS")

dfx = msm.update_df(dfx, dfa)

# Display model selection heatmap

so_eq.models_heatmap(name="EQ_NNLS", figsize=(18, 6))

Both signals

EQ_NNLS

, and

EQ_OLS

are displayed below with the help of

view_timelines()

from the

macrosynergy

package:

sigs_eq_ls = ["EQ_OLS", "EQ_NNLS"]

xcatx = sigs_eq_ls

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cids_eq,

ncol=4,

start="2004-01-01",

title=None,

title_fontsize=30,

same_y=False,

cs_mean=False,

xcat_labels=None,

legend_fontsize=16,

)

Value checks #

The

SignalReturnRelations

class of the

macrosynergy

package facilitates a quick assessment of the power of a signal category in predicting the direction of subsequent returns for data in JPMaQS format.

The

NaivePnl()

class is specifically designed to offer a quick and straightforward overview of a simplified Profit and Loss (PnL) profile associated with a set of trading signals. The term “naive” is used because the methods within this class do not factor in transaction costs or position limitations, which may include considerations related to risk management. This omission is intentional because the impact of costs and limitations varies widely depending on factors such as trading size, institutional rules, and regulatory requirements.

For a comparative overview of the signal-return relationship across both signals, one can use the

signals_table()

method.

## Compare optimized signals with simple average z-scores

srr_eq_ls = mss.SignalReturnRelations(

df=dfx,

rets=["EQXR_VT10"],

sigs=sigs_eq_ls,

cids=cids_eq,

cosp=True,

freqs=["M"],

agg_sigs=["last"],

start="2004-01-01",

slip=1,

)

srr_eq_ls.signals_table().astype("float").round(3)

| accuracy | bal_accuracy | pos_sigr | pos_retr | pos_prec | neg_prec | pearson | pearson_pval | kendall | kendall_pval | auc | ||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Return | Signal | Frequency | Aggregation | |||||||||||

| EQXR_VT10 | EQ_OLS | M | last | 0.567 | 0.521 | 0.707 | 0.619 | 0.632 | 0.410 | 0.053 | 0.018 | 0.032 | 0.031 | 0.518 |

| EQ_NNLS | M | last | 0.570 | 0.526 | 0.705 | 0.619 | 0.634 | 0.417 | 0.069 | 0.002 | 0.040 | 0.008 | 0.523 |

sigs = sigs_eq_ls

pnl_eq_ls = msn.NaivePnL(

df=dfx,

ret="EQXR_VT10",

sigs=sigs,

cids=cids_eq,

bms=["USD_EQXR_NSA"],

start="2004-01-01",

)

for sig in sigs:

pnl_eq_ls.make_pnl(

sig=sig,

sig_op="zn_score_pan",

rebal_freq="monthly",

neutral="zero",

rebal_slip=1,

vol_scale=10,

thresh=2,

)

pnl_eq_ls.plot_pnls(

title=None,

title_fontsize=14,

xcat_labels=None,

)

pnl_eq_ls.evaluate_pnls(pnl_cats=["PNL_" + sig for sig in sigs])

| xcat | PNL_EQ_OLS | PNL_EQ_NNLS |

|---|---|---|

| Return % | 6.132868 | 6.443819 |

| St. Dev. % | 10.0 | 10.0 |

| Sharpe Ratio | 0.613287 | 0.644382 |

| Sortino Ratio | 0.843085 | 0.887975 |

| Max 21-Day Draw % | -26.942853 | -26.921855 |

| Max 6-Month Draw % | -19.278729 | -19.03907 |

| Peak to Trough Draw % | -33.320281 | -31.901698 |

| Top 5% Monthly PnL Share | 0.668659 | 0.645426 |

| USD_EQXR_NSA correl | 0.218191 | 0.175331 |

| Traded Months | 252 | 252 |

The method

create_results_dataframe()

from

macrosynergy.pnl

displays a small dataframe of key statistics for both signals:

results_eq_ls = msn.create_results_dataframe(

title="Performance metrics, NNLS vs OLS, equity",

df=dfx,

ret="EQXR_VT10",

sigs=sigs_eq_ls,

cids=cids_eq,

sig_ops="zn_score_pan",

sig_adds=0,

neutrals="zero",

sig_negs=[False, False],

threshs=2,

bm="USD_EQXR_NSA",

cosp=True,

start="2004-01-01",

freqs="M",

agg_sigs="last",

sigs_renamed={"EQ_OLS": "OLS", "EQ_NNLS": "NNLS"},

slip=1,

)

results_eq_ls

| Accuracy | Bal. Accuracy | Pearson | Kendall | Sharpe | Sortino | Market corr. | |

|---|---|---|---|---|---|---|---|

| NNLS | 0.570 | 0.526 | 0.069 | 0.040 | 0.644 | 0.888 | 0.175 |

| OLS | 0.567 | 0.521 | 0.053 | 0.032 | 0.613 | 0.843 | 0.218 |

FX #

mods_fx_ls = {

"nnls": LinearRegression(positive=True),

}

grid_fx_ls = {

"nnls": {"fit_intercept": [True, False]},

}

As before, we deploy

SignalOptimizer

class for sequential optimization of raw signals based on quantamental features. The features are lagged quantamental indicators, collected in the dataframe

X_fx

, and the targets in

y_fx

, are cumulative returns at the native frequency. Please read

here

for detailed descriptions and examples. The signal generated through this process is labeled as

FX_NNLS

# Calculate predictions

so_fx.calculate_predictions(

name = "FX_NNLS",

models = mods_fx_ls,

hyperparameters = grid_fx_ls,

scorers = {"R2": scorer},

inner_splitters = {"Rolling": splitter},

search_type="grid",

normalize_fold_results=False,

cv_summary="mean",

min_cids=4,

min_periods=36,

test_size=1,

n_jobs_outer = -1,

)

# Get optimized signals

dfa = so_fx.get_optimized_signals(name="FX_NNLS")

dfx = msm.update_df(dfx, dfa)

# Display model selection heatmap

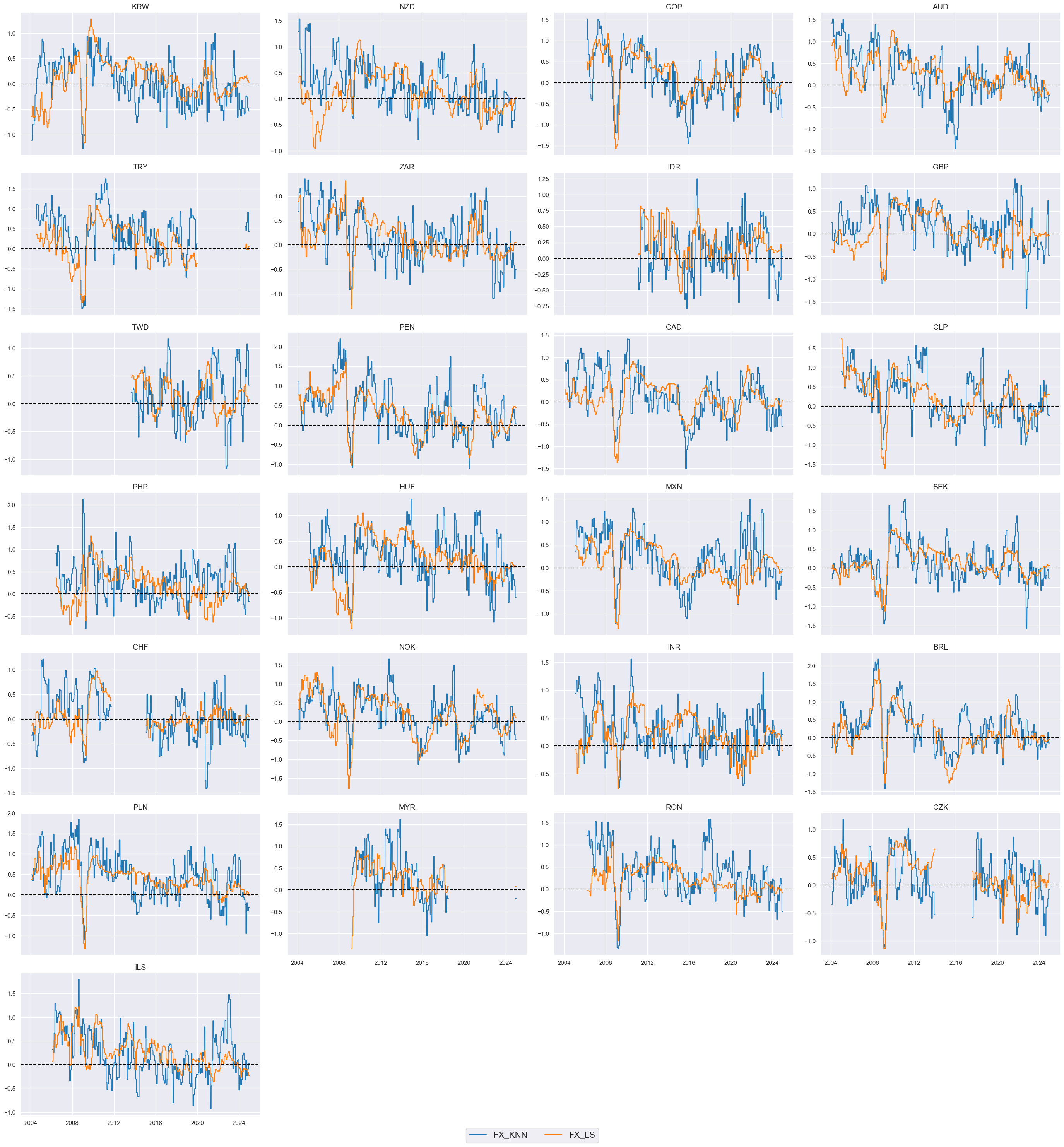

so_fx.models_heatmap(name="FX_NNLS", figsize=(18, 6))