Machine learning for international trading strategies #

Get packages and JPMaQS data #

import numpy as np

import pandas as pd

from pandas import Timestamp

import matplotlib.pyplot as plt

import seaborn as sns

from scipy.stats import norm

import itertools

import warnings

import os

from datetime import date

import macrosynergy.management as msm

import macrosynergy.panel as msp

import macrosynergy.signal as mss

import macrosynergy.learning as msl

import macrosynergy.pnl as msn

import macrosynergy.visuals as msv

from macrosynergy.download import JPMaQSDownload

from macrosynergy.management.utils import merge_categories

from sklearn.linear_model import Ridge

from sklearn.metrics import make_scorer, root_mean_squared_error

from sklearn.pipeline import Pipeline

warnings.simplefilter("ignore")

# Cross-sections of interest

cids_dmeq = ["AUD", "CAD", "CHF", "EUR", "GBP", "JPY", "SEK", "USD"]

cids_aseq = ["KRW", "MYR", "SGD", "THB", "TWD"]

cids_exeq = ["BRL", "TRY", "ZAR"]

cids_nueq = ["MXN", "PLN"]

cids_emeq = cids_aseq + cids_exeq + cids_nueq

cids_eq = sorted(cids_dmeq + cids_emeq)

# External balances and changes

xbal = [

"BXBGDPRATIOE_NSA_12MMA",

"CABGDPRATIO_NSA_12MMA",

"MTBGDPRATIO_NSA_12MMA",

]

xbal_chg = [

"CABGDPRATIO_SA_3MMA_D1M1ML3",

"CABGDPRATIO_SA_1QMA_D1Q1QL1",

"CABGDPRATIO_SA_3MMAv60MMA",

"CABGDPRATIO_SA_1QMAv20QMA",

"MTBGDPRATIO_SA_3MMA_D1M1ML3",

"MTBGDPRATIO_SA_3MMAv60MMA",

]

# Domestic spending growth

imports = [

"IMPORTS_SA_P6M6ML6AR",

"IMPORTS_SA_P1M1ML12_3MMA",

]

rsales = [

"NRSALES_SA_P1M1ML12_3MMA",

"RRSALES_SA_P1M1ML12_3MMA",

"NRSALES_SA_P1Q1QL4",

"RRSALES_SA_P1Q1QL4",

]

pcons = [

"RPCONS_SA_P1M1ML12_3MMA",

"RPCONS_SA_P1Q1QL4",

]

domspend = imports + rsales + pcons

# CPI inflation

cpi = [

"CPIH_SA_P1M1ML12",

"CPIH_SJA_P6M6ML6AR",

"CPIC_SA_P1M1ML12",

"CPIC_SJA_P6M6ML6AR",

]

# Labor market

labor = [

"EMPL_NSA_P1M1ML12_3MMA",

"EMPL_NSA_P1Q1QL4",

"UNEMPLRATE_NSA_3MMA_D1M1ML12",

"UNEMPLRATE_NSA_D1Q1QL4",

]

# FX dynamics and terms of trade

effx = [

"REEROADJ_NSA_P1M1ML12",

"NEEROADJ_NSA_P1M1ML12",

"REER_NSA_P1M1ML12",

]

ctot = [

"CTOT_NSA_P1M1ML12",

"CTOT_NSA_P1M12ML1",

"CTOT_NSA_P1W4WL1",

]

# Business confidence and changes

bus_conf = [

# Manufacturing

"MBCSCORE_SA",

"MBCSCORE_SA_3MMA",

# Services

"SBCSCORE_SA",

"SBCSCORE_SA_3MMA",

# Construction

"CBCSCORE_SA",

"CBCSCORE_SA_3MMA",

]

bus_conf_chg = [

# Manufacturing confidence

"MBCSCORE_SA_D3M3ML3",

"MBCSCORE_SA_D1Q1QL1",

"MBCSCORE_SA_D6M6ML6",

"MBCSCORE_SA_D2Q2QL2",

# Services confidence

"SBCSCORE_SA_D3M3ML3",

"SBCSCORE_SA_D1Q1QL1",

"SBCSCORE_SA_D6M6ML6",

"SBCSCORE_SA_D2Q2QL2",

# Construction confidence

"CBCSCORE_SA_D3M3ML3",

"CBCSCORE_SA_D1Q1QL1",

"CBCSCORE_SA_D6M6ML6",

"CBCSCORE_SA_D2Q2QL2",

]

# Monetary and financial conditions

mon_agg = [

"MNARROW_SJA_P1M1ML12",

"MBROAD_SJA_P1M1ML12",

]

liq = [

"INTLIQGDP_NSA_D1M1ML1",

"INTLIQGDP_NSA_D1M1ML3",

"INTLIQGDP_NSA_D1M1ML6",

]

rir = [

"RIR_NSA",

"RYLDIRS02Y_NSA",

"RYLDIRS05Y_NSA",

]

# Supporting economic indicators

wforce = [

"WFORCE_NSA_P1Y1YL1_5YMM",

"WFORCE_NSA_P1Y1YL1",

"WFORCE_NSA_P1Q1QL4",

]

infes = [

"INFTEFF_NSA",

"INFTARGET_NSA",

"INFE1Y_JA"

]

nugdp = [

"RGDP_SA_P1Q1QL4_20QMM",

"USDGDPWGT_SA_3YMA",

]

extras = wforce + infes + nugdp

# Market indicators

markets = ["EQXR_NSA", "EQXR_VT10"]

# Composite lists

mains = (

rir

+ xbal

+ xbal_chg

+ domspend

+ cpi

+ liq

+ labor

+ effx

+ ctot

+ bus_conf

+ bus_conf_chg

+ mon_agg

)

supports = wforce + extras

xcats = mains + supports + markets

# Resultant tickers

tickers = [cid + "_" + xcat for cid in cids_eq for xcat in xcats]

print(f"Maximum number of tickers is {len(tickers)}")

Maximum number of tickers is 1260

client_id: str = os.getenv("DQ_CLIENT_ID")

client_secret: str = os.getenv("DQ_CLIENT_SECRET")

with JPMaQSDownload(oauth=True, client_id=client_id, client_secret=client_secret) as dq:

assert dq.check_connection()

df = dq.download(

tickers=tickers,

start_date="1990-01-01",

suppress_warning=True,

metrics=["value"],

show_progress=True,

)

assert isinstance(df, pd.DataFrame) and not df.empty

print("Last updated:", date.today())

Downloading data from JPMaQS.

Timestamp UTC: 2025-07-24 11:06:43

Connection successful!

Requesting data: 100%|█████████████████████████████████████████████████████████████████| 61/61 [00:12<00:00, 4.80it/s]

Downloading data: 100%|████████████████████████████████████████████████████████████████| 61/61 [01:34<00:00, 1.54s/it]

Some expressions are missing from the downloaded data. Check logger output for complete list.

301 out of 1206 expressions are missing. To download the catalogue of all available expressions and filter the unavailable expressions, set `get_catalogue=True` in the call to `JPMaQSDownload.download()`.

Last updated: 2025-07-24

dfx = df.copy().sort_values(["cid", "xcat", "real_date"])

dfx.info()

<class 'pandas.core.frame.DataFrame'>

Index: 6579977 entries, 63562 to 6516039

Data columns (total 4 columns):

# Column Dtype

--- ------ -----

0 real_date datetime64[ns]

1 cid object

2 xcat object

3 value float64

dtypes: datetime64[ns](1), float64(1), object(2)

memory usage: 251.0+ MB

Transformations and availability checks #

Renaming #

dict_repl = {

# External balances

"CABGDPRATIO_SA_1QMA_D1Q1QL1": "CABGDPRATIO_SA_3MMA_D1M1ML3",

"CABGDPRATIO_SA_1QMAv20QMA": "CABGDPRATIO_SA_3MMAv60MMA",

# Consumption

"RPCONS_SA_P1Q1QL4": "RPCONS_SA_P1M1ML12_3MMA",

"RRSALES_SA_P1Q1QL4": "RRSALES_SA_P1M1ML12_3MMA",

"NRSALES_SA_P1Q1QL4": "NRSALES_SA_P1M1ML12_3MMA",

# labor

"EMPL_NSA_P1Q1QL4": "EMPL_NSA_P1M1ML12_3MMA",

"UNEMPLRATE_NSA_D1Q1QL4": "UNEMPLRATE_NSA_3MMA_D1M1ML12",

# Business confidence

"MBCSCORE_SA_D1Q1QL1": "MBCSCORE_SA_D3M3ML3",

"MBCSCORE_SA_D2Q2QL2": "MBCSCORE_SA_D6M6ML6",

"SBCSCORE_SA_D1Q1QL1": "SBCSCORE_SA_D3M3ML3",

"SBCSCORE_SA_D2Q2QL2": "SBCSCORE_SA_D6M6ML6",

"CBCSCORE_SA_D1Q1QL1": "CBCSCORE_SA_D3M3ML3",

"CBCSCORE_SA_D2Q2QL2": "CBCSCORE_SA_D6M6ML6",

}

# Ensure 'xcat' exists in dfx before replacement

if "xcat" in dfx.columns:

dfx["xcat"] = dfx["xcat"].replace(dict_repl, regex=False)

else:

print("Column 'xcat' not found in dfx.")

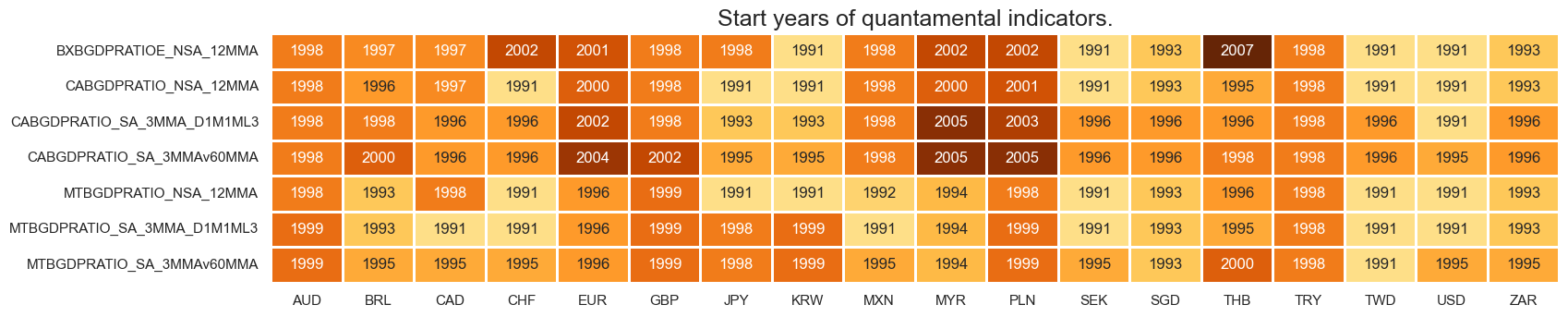

Availability #

# External balances and changes

xcatx = xbal + xbal_chg

msm.check_availability(df=dfx, xcats=xcatx, cids=cids_eq, missing_recent=False)

# Domestic spending growth and support benchmarks

xcatx = domspend + nugdp

msm.check_availability(df=dfx, xcats=xcatx, cids=cids_eq, missing_recent=False)

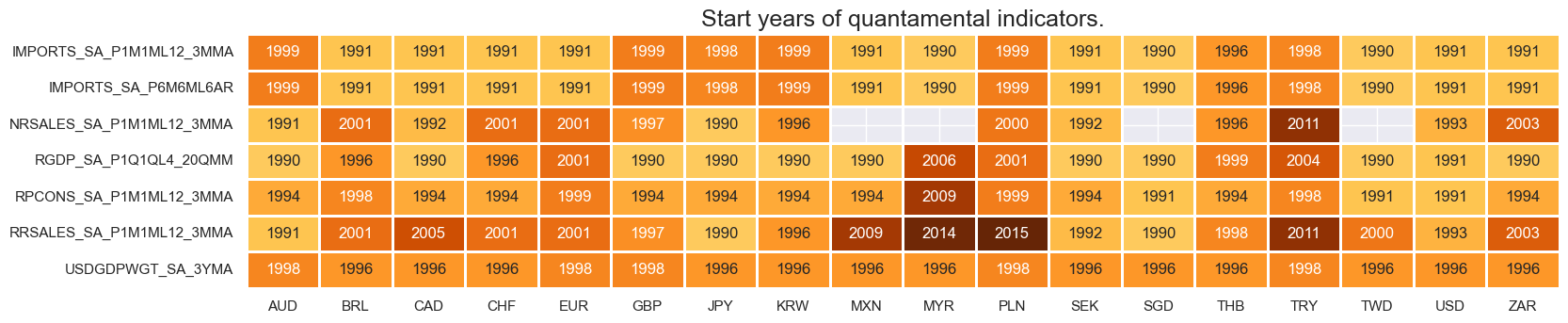

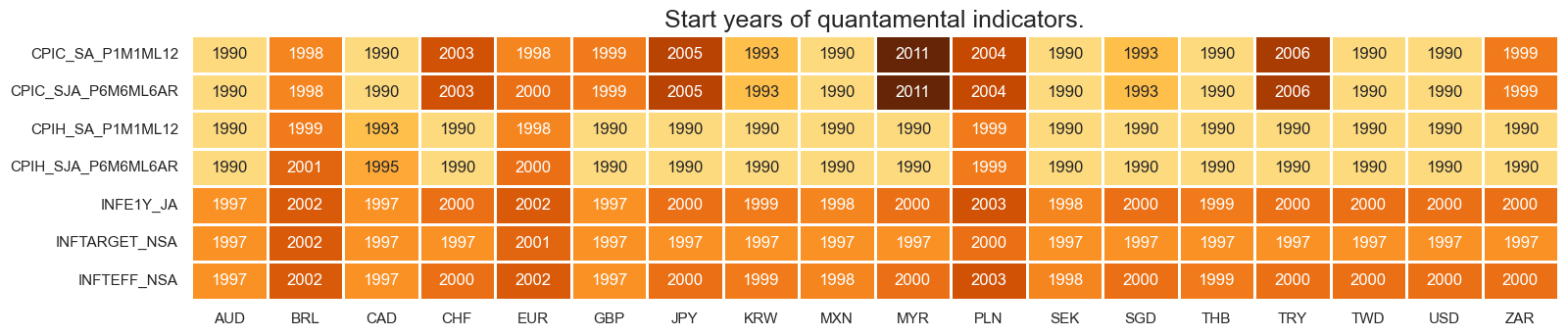

# CPI inflation and benchmarks

xcatx = cpi + infes

msm.check_availability(df=dfx, xcats=xcatx, cids=cids_eq, missing_recent=False)

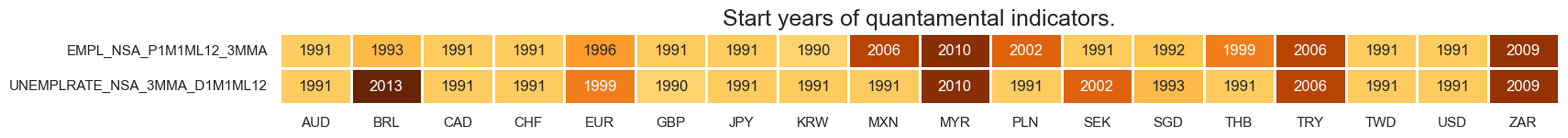

# Labor market

xcatx = labor

msm.check_availability(df=dfx, xcats=xcatx, cids=cids_eq, missing_recent=False)

# Terms of trade and effective exchange rates

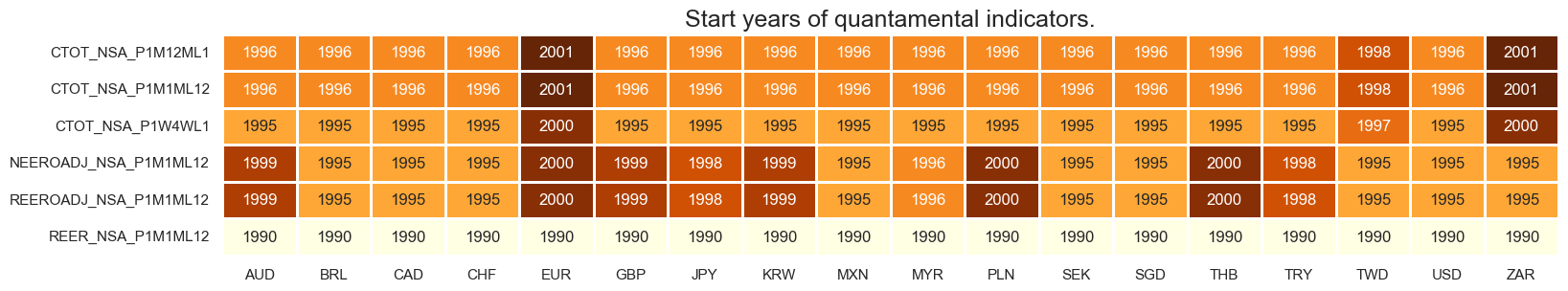

xcatx = effx + ctot

msm.check_availability(df=dfx, xcats=xcatx, cids=cids_eq, missing_recent=False)

# Business confidence and changes

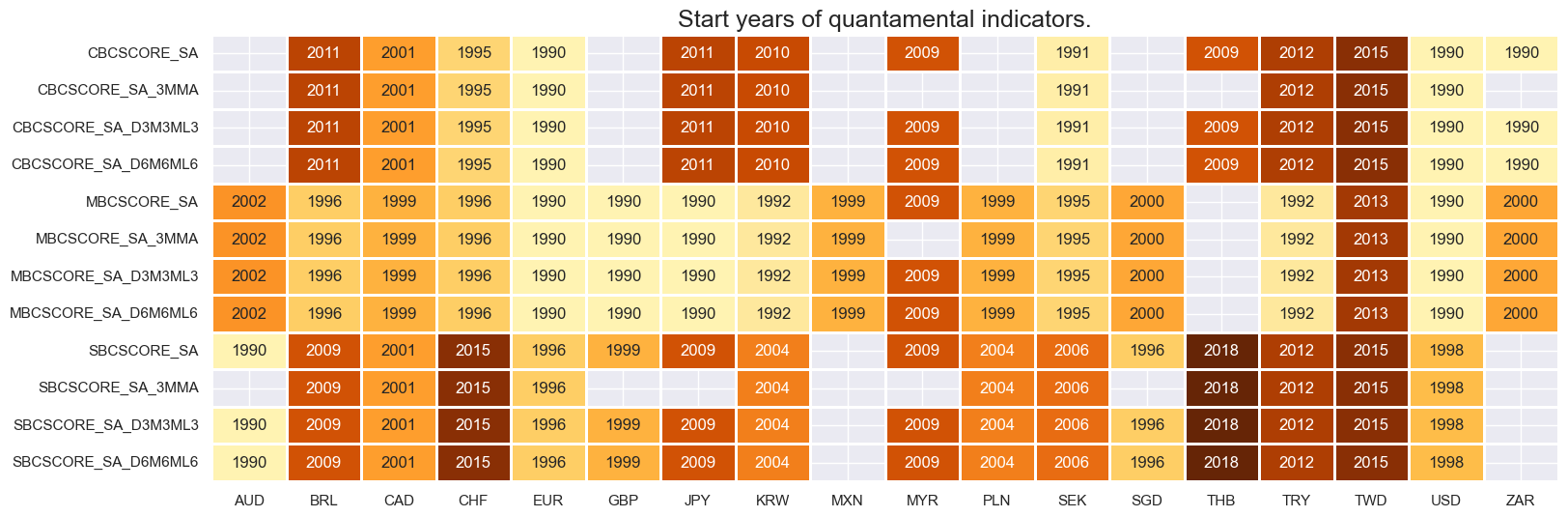

xcatx = bus_conf + bus_conf_chg

msm.check_availability(df=dfx, xcats=xcatx, cids=cids_eq, missing_recent=False)

# Monetary and financial conditions

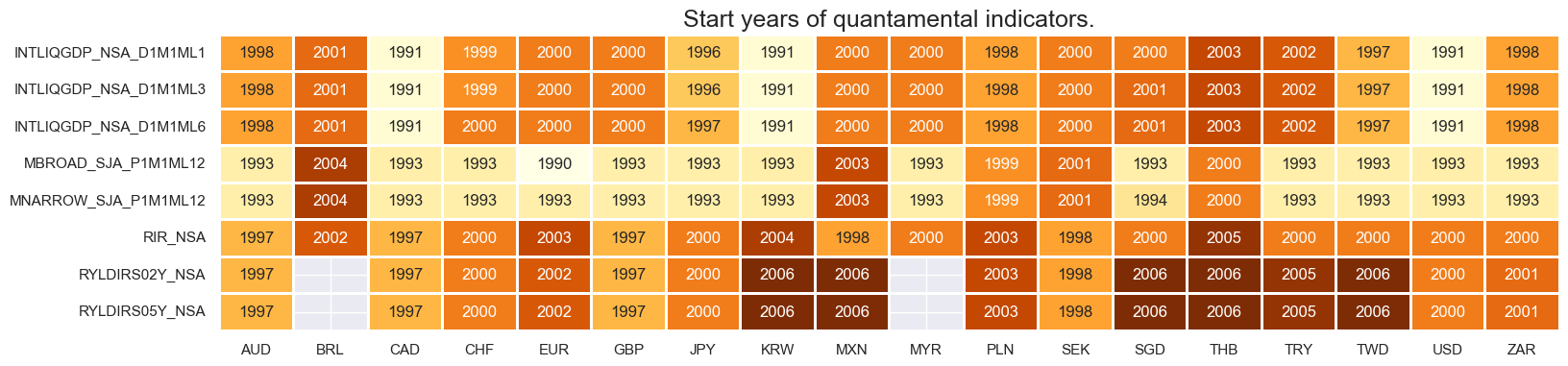

xcatx = mon_agg + liq + rir

msm.check_availability(df=dfx, xcats=xcatx, cids=cids_eq, missing_recent=False)

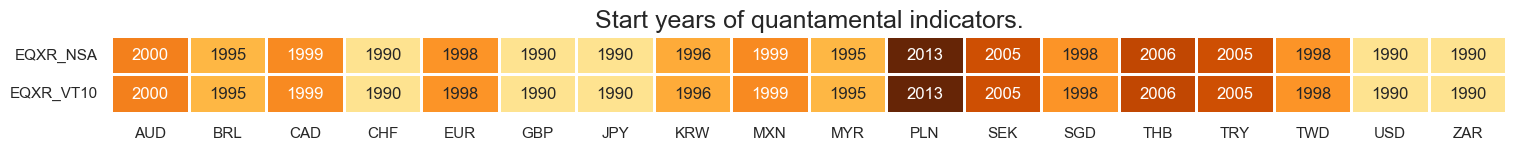

# Equity index futures returns

xcatx = markets

msm.check_availability(df=dfx, xcats=xcatx, cids=cids_eq, missing_recent=False)

Feature engineering #

dict_facts = {}

Domestic spending growth shortfall #

Specs #

# Un-scored indicators and score weights and signs

dict_domspend = {

"IMPORTS_SA_P6M6ML6AR": (0.5, -1),

"IMPORTS_SA_P1M1ML12_3MMA": (0.5, -1),

"NRSALES_SA_P1M1ML12_3MMA": (0.5, -1),

"RRSALES_SA_P1M1ML12_3MMA": (0.5, -1),

"RPCONS_SA_P1M1ML12_3MMA": (1, -1),

}

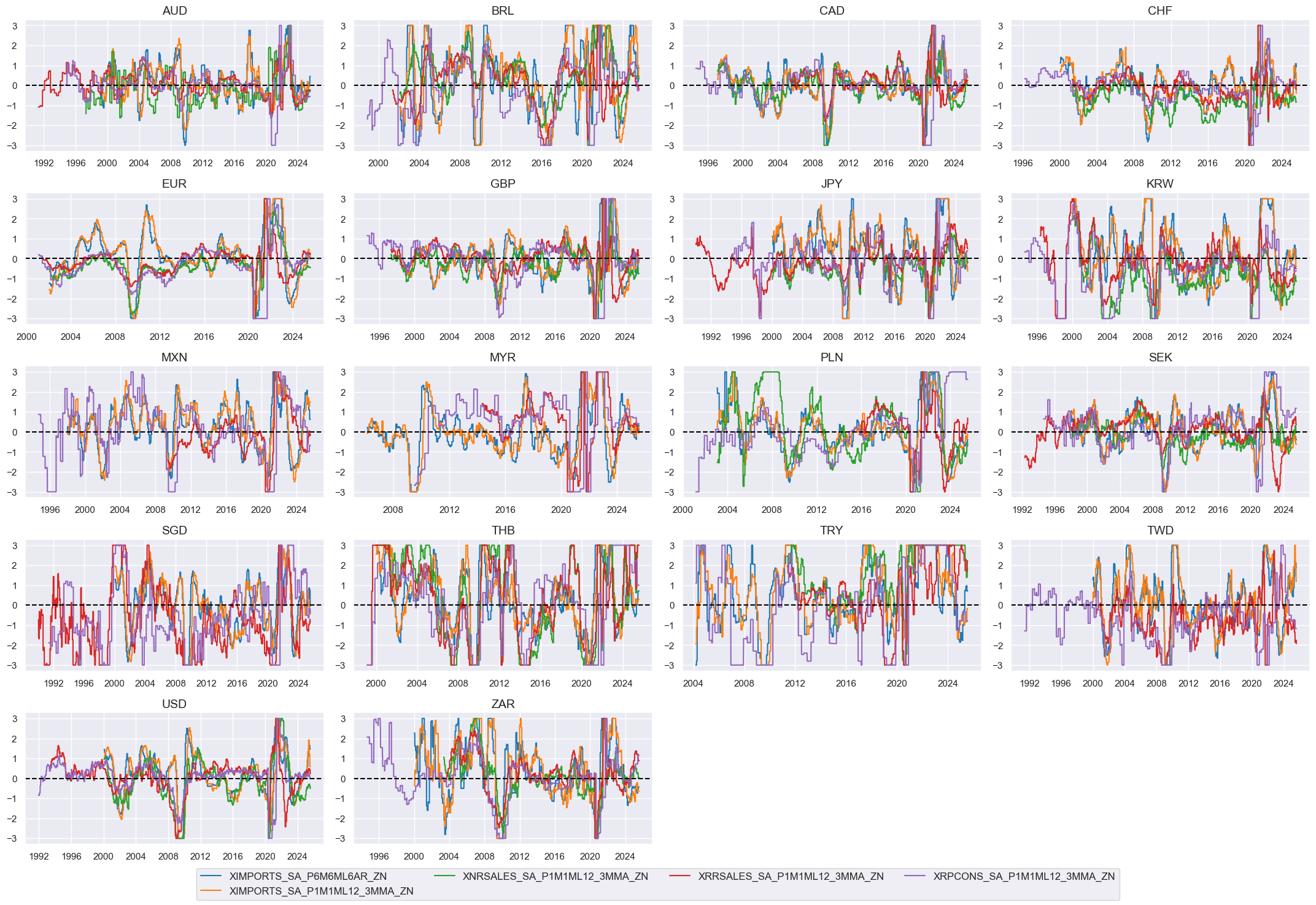

Constituent scores #

# Excess spending growth

xcatx_nominal = [

"IMPORTS_SA_P6M6ML6AR",

"IMPORTS_SA_P1M1ML12_3MMA",

"NRSALES_SA_P1M1ML12_3MMA",

]

xcatx_real = [

"RRSALES_SA_P1M1ML12_3MMA",

"RPCONS_SA_P1M1ML12_3MMA",

]

calcs = [f"X{xc} = {xc} - RGDP_SA_P1Q1QL4_20QMM - INFTEFF_NSA" for xc in xcatx_nominal]

calcs += [f"X{xc} = {xc} - RGDP_SA_P1Q1QL4_20QMM" for xc in xcatx_real]

dfa = msp.panel_calculator(

dfx,

calcs=calcs,

cids=cids_eq,

)

dfx = msm.update_df(dfx, dfa)

# Normalization of excess spending growth indicators

cidx = cids_eq

xcatx = ["X" + xc for xc in list(dict_domspend.keys())]

sdate = "1990-01-01"

for xc in xcatx:

dfaa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 5,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

xspendz = [xcat + "_ZN" for xcat in xcatx]

xcatx = xspendz

cidx = cids_eq

sdate = "1990-01-01"

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=False,

all_xticks=True,

aspect=1.8,

height=2,

)

Composite scores #

# Weighted linear combination for directional signal

cidx = cids_eq

dix = dict_domspend

xcatx = ["X" + k + "_ZN" for k in list(dix.keys())]

weights = [v[0] for v in list(dix.values())]

signs = [v[1] for v in list(dix.values())]

czs = "XSPEND_NEG"

dfa = msp.linear_composite(

dfx,

xcats=xcatx,

cids=cidx,

weights=weights,

signs=signs,

normalize_weights=True,

complete_xcats=False, # score works with what is available

new_xcat=czs,

)

dfx = msm.update_df(dfx, dfa)

# Re-scoring

dfa = msp.make_zn_scores(

dfx,

xcat=czs,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

dict_facts[czs + "_ZN"] = "Domestic spending shortfall"

xcatx = ["XSPEND_NEG_ZN"]

cidx = cids_eq

sdate = "1990-01-01"

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=False,

all_xticks=True,

aspect=1.8,

height=2,

)

Inflation shortfall ratios #

Specs #

# Un-scored indicators and score weights and signs

dict_infl = {

"CPIH_SA_P1M1ML12": (0.5, -1),

"CPIH_SJA_P6M6ML6AR": (0.5, -1),

"CPIC_SA_P1M1ML12": (0.5, -1),

"CPIC_SJA_P6M6ML6AR": (0.5, -1),

}

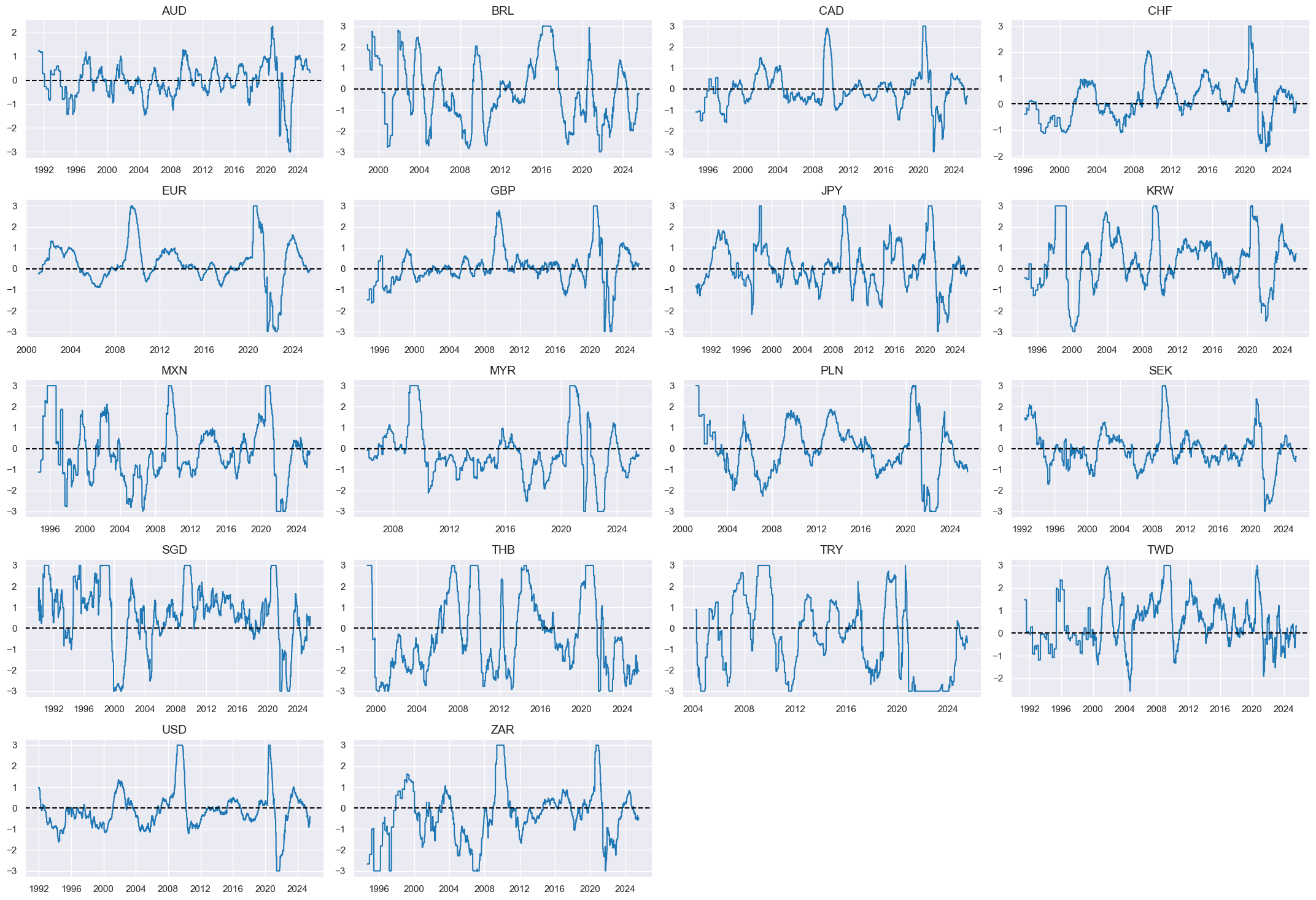

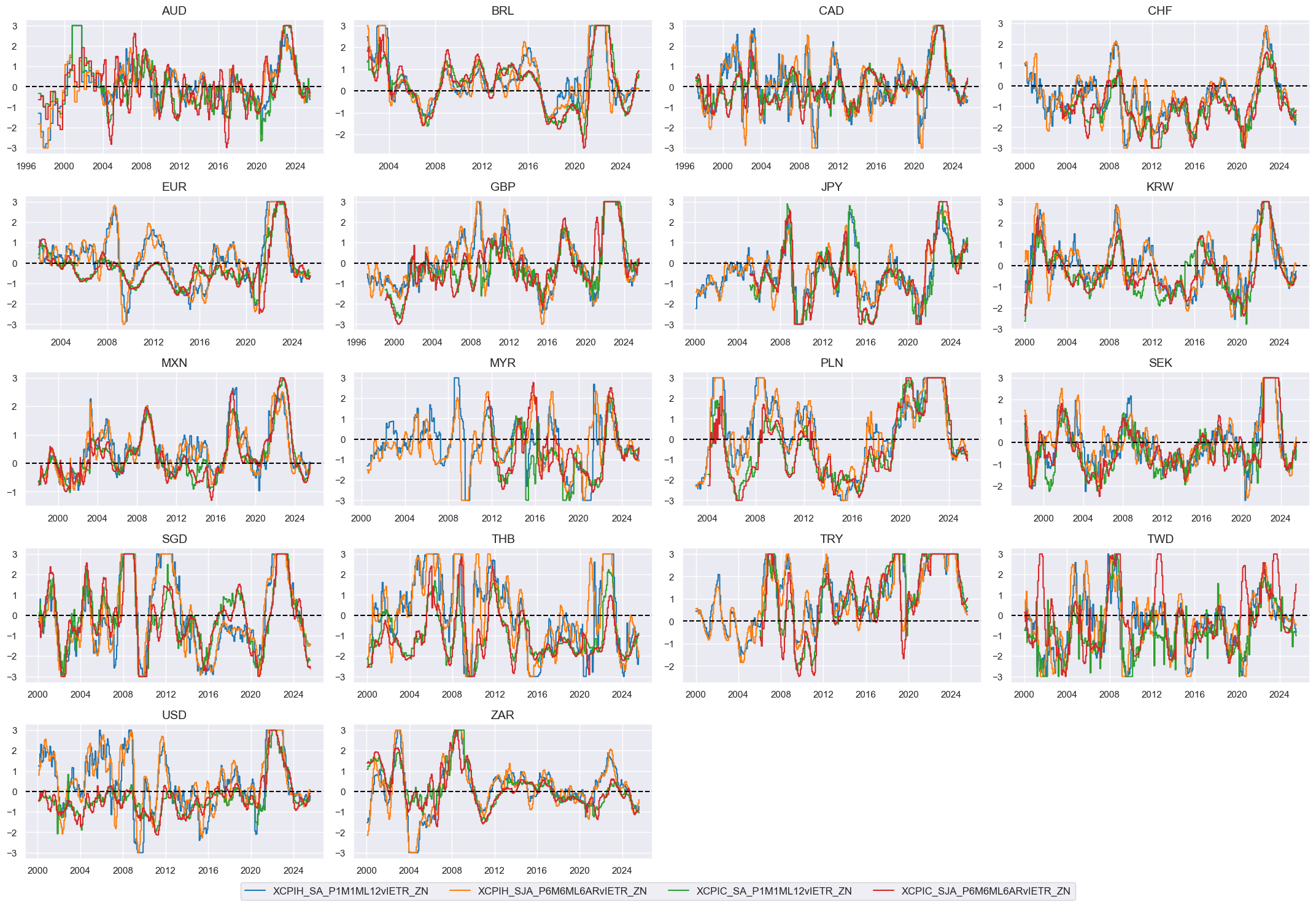

Constituent scores #

# Excess inflation ratios

xcatx = list(dict_infl.keys())

calcs = [f"X{xc}vIETR = ( {xc} - INFTEFF_NSA ) / INFTEFF_NSA .clip(lower=2) " for xc in xcatx]

dfa = msp.panel_calculator(

dfx,

calcs=calcs,

cids=cids_eq,

)

dfx = msm.update_df(dfx, dfa)

# Relative value of constituents

cidx = cids_eq

xcatx = ["X" + xc + "vIETR" for xc in list(dict_infl.keys())]

dfa = msp.make_relative_value(

df=dfx,

xcats=xcatx,

cids=cidx,

postfix="vGLB",

)

dfx = msm.update_df(dfx, dfa)

# Panel-based normalization

cidx = cids_eq

xcatx = ["X" + xc + "vIETR" for xc in list(dict_infl.keys())]

sdate = "1990-01-01"

for xc in xcatx:

dfaa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 5,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

xinflz = [xcat + "_ZN" for xcat in xcatx]

cidx = cids_eq

xcatx = xinflz

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=False,

all_xticks=True,

aspect=1.8,

height=2,

)

Composite scores #

# Weighted linear combination

cidx = cids_eq

dix = dict_infl

xcatx = ["X" + k + "vIETR_ZN" for k in list(dix.keys())]

weights = [v[0] for v in list(dix.values())]

signs = [v[1] for v in list(dix.values())]

czs = "XINFL_NEG"

dfa = msp.linear_composite(

dfx,

xcats=xcatx,

cids=cidx,

weights=weights,

signs=signs,

normalize_weights=True,

complete_xcats=False, # score works with what is available

new_xcat=czs,

)

dfx = msm.update_df(dfx, dfa)

# Re-scoring

dfa = msp.make_zn_scores(

dfx,

xcat=czs,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

dict_facts[czs + "_ZN"] = "Inflation shortfall ratio"

xcatx = ["XINFL_NEG_ZN"]

cidx = cids_eq

sdate = "1990-01-01"

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=False,

all_xticks=True,

aspect=1.8,

height=2,

)

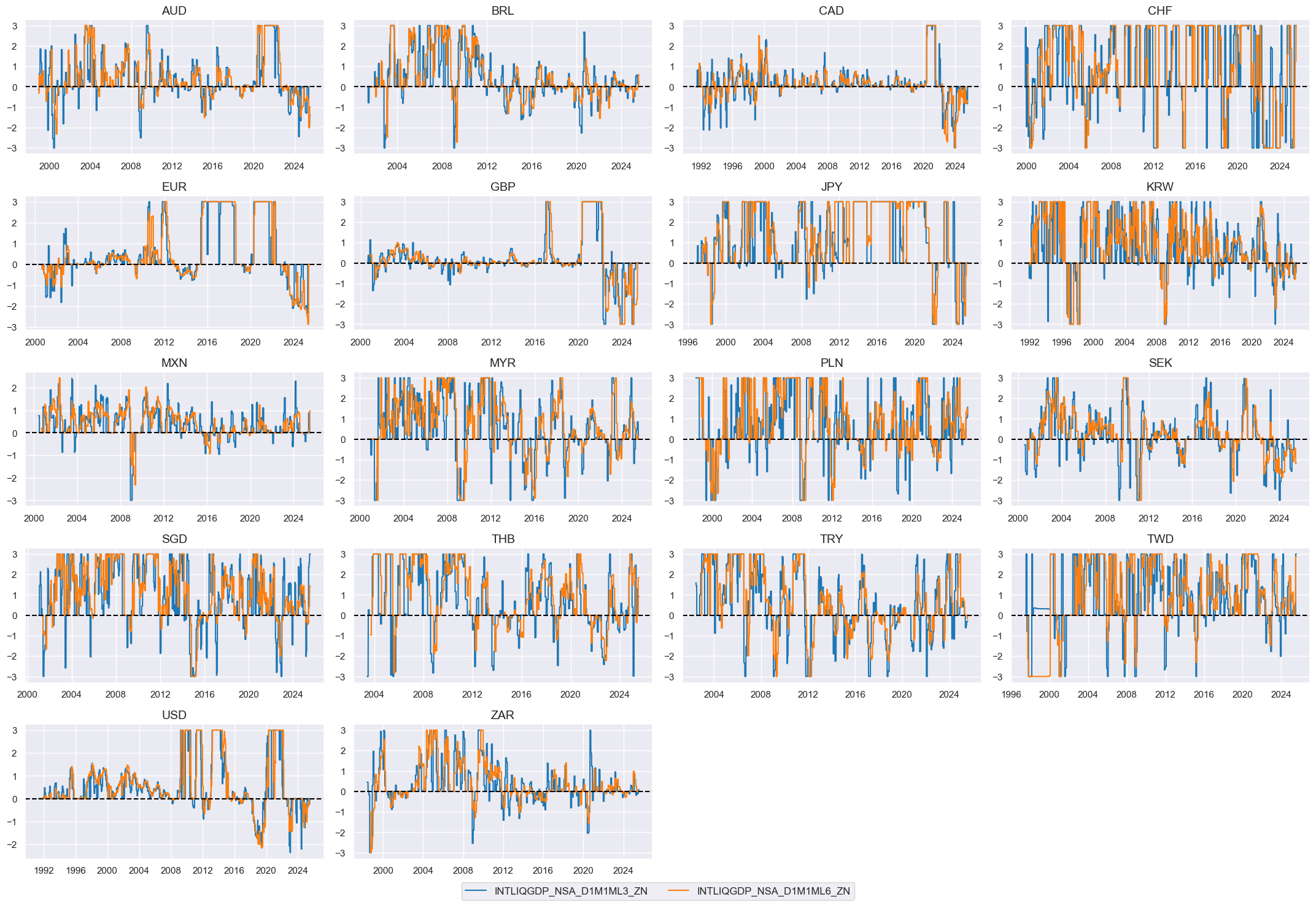

Intervention liquidity growth #

Specs #

# Un-scored indicators and score weights and signs

dict_liq = {

"INTLIQGDP_NSA_D1M1ML3": (1/2, 1),

"INTLIQGDP_NSA_D1M1ML6": (1/2, 1),

}

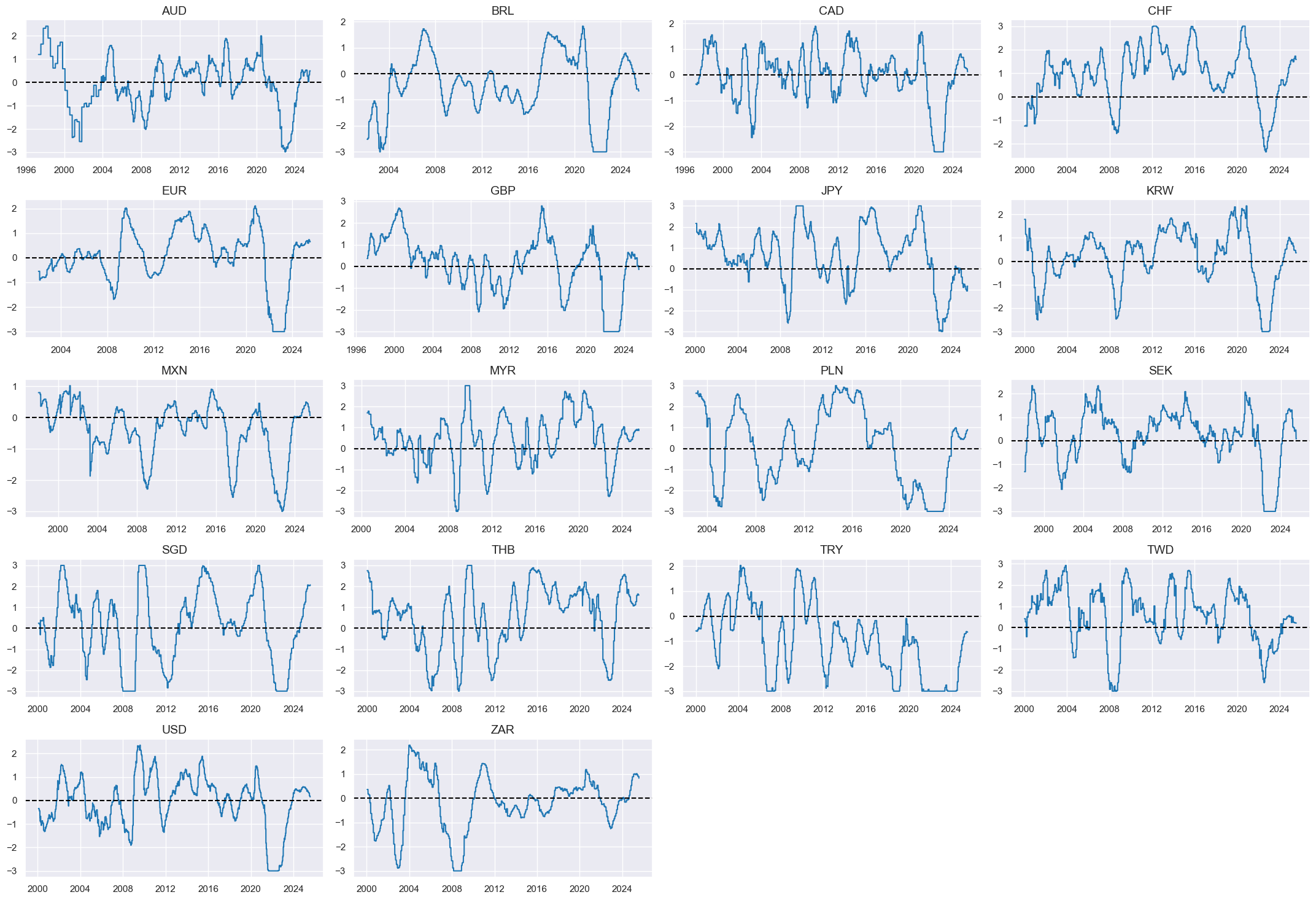

Constituent scores #

# Panel-based normalization

cidx = cids_eq

xcatx = [xc for xc in list(dict_liq.keys())]

sdate = "1990-01-01"

for xc in xcatx:

dfaa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 5,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

liqz = [xcat + "_ZN" for xcat in xcatx]

cidx = cids_eq

xcatx = liqz

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=False,

all_xticks=True,

aspect=1.8,

height=2,

)

Composite scores #

# Weighted linear combination

cidx = cids_eq

dix = dict_liq

xcatx = [k + "_ZN" for k in list(dix.keys())]

weights = [v[0] for v in list(dix.values())]

signs = [v[1] for v in list(dix.values())]

czs = "LIQ"

dfa = msp.linear_composite(

dfx,

xcats=xcatx,

cids=cidx,

weights=weights,

signs=signs,

normalize_weights=True,

complete_xcats=False, # score works with what is available

new_xcat=czs,

)

dfx = msm.update_df(dfx, dfa)

# Re-scoring

dfa = msp.make_zn_scores(

dfx,

xcat=czs,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

dict_facts[czs + "_ZN"] = "Liquidity growth"

xcatx = ["LIQ_ZN"]

cidx = cids_eq

sdate = "1990-01-01"

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=False,

all_xticks=True,

aspect=1.8,

height=2,

)

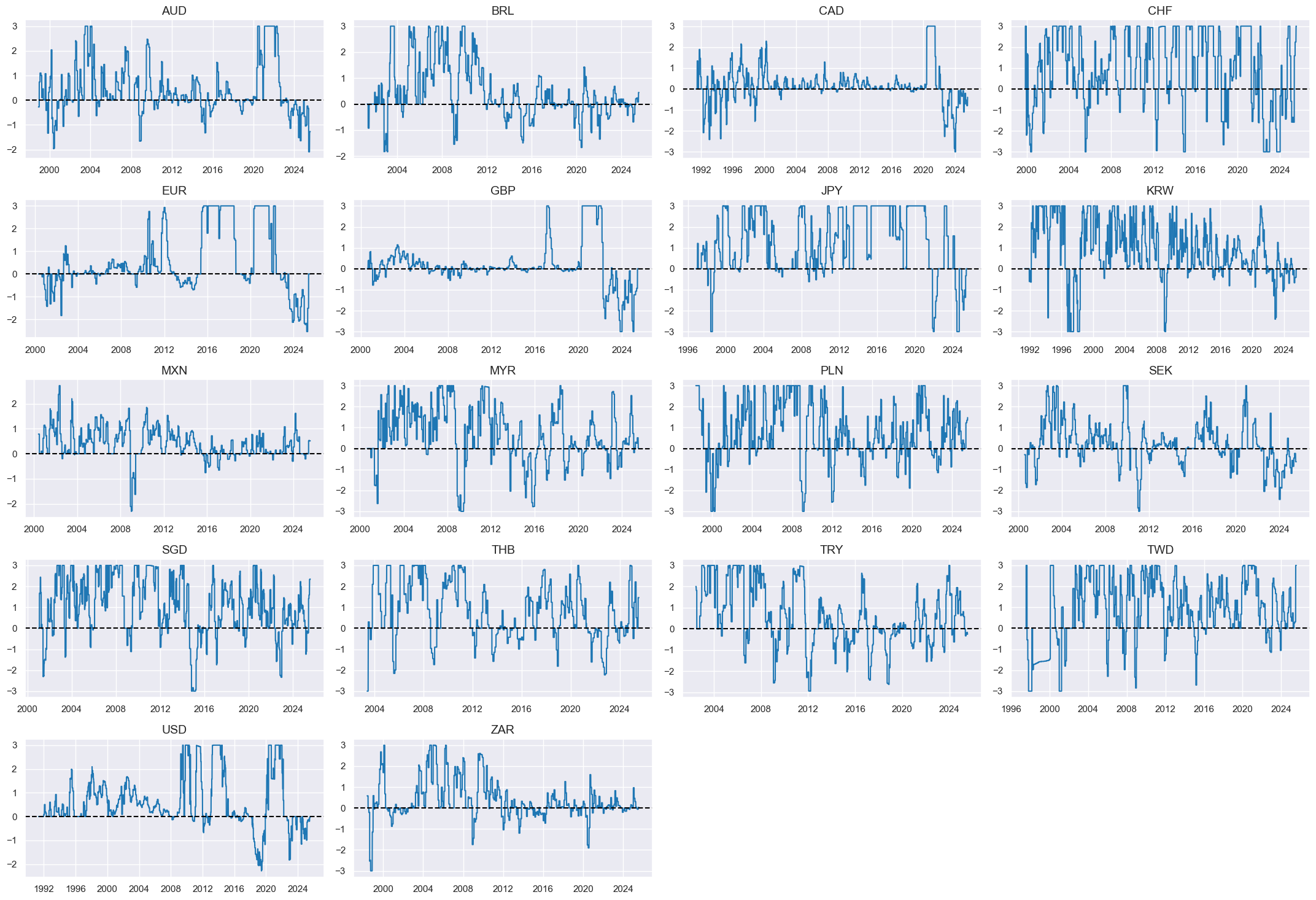

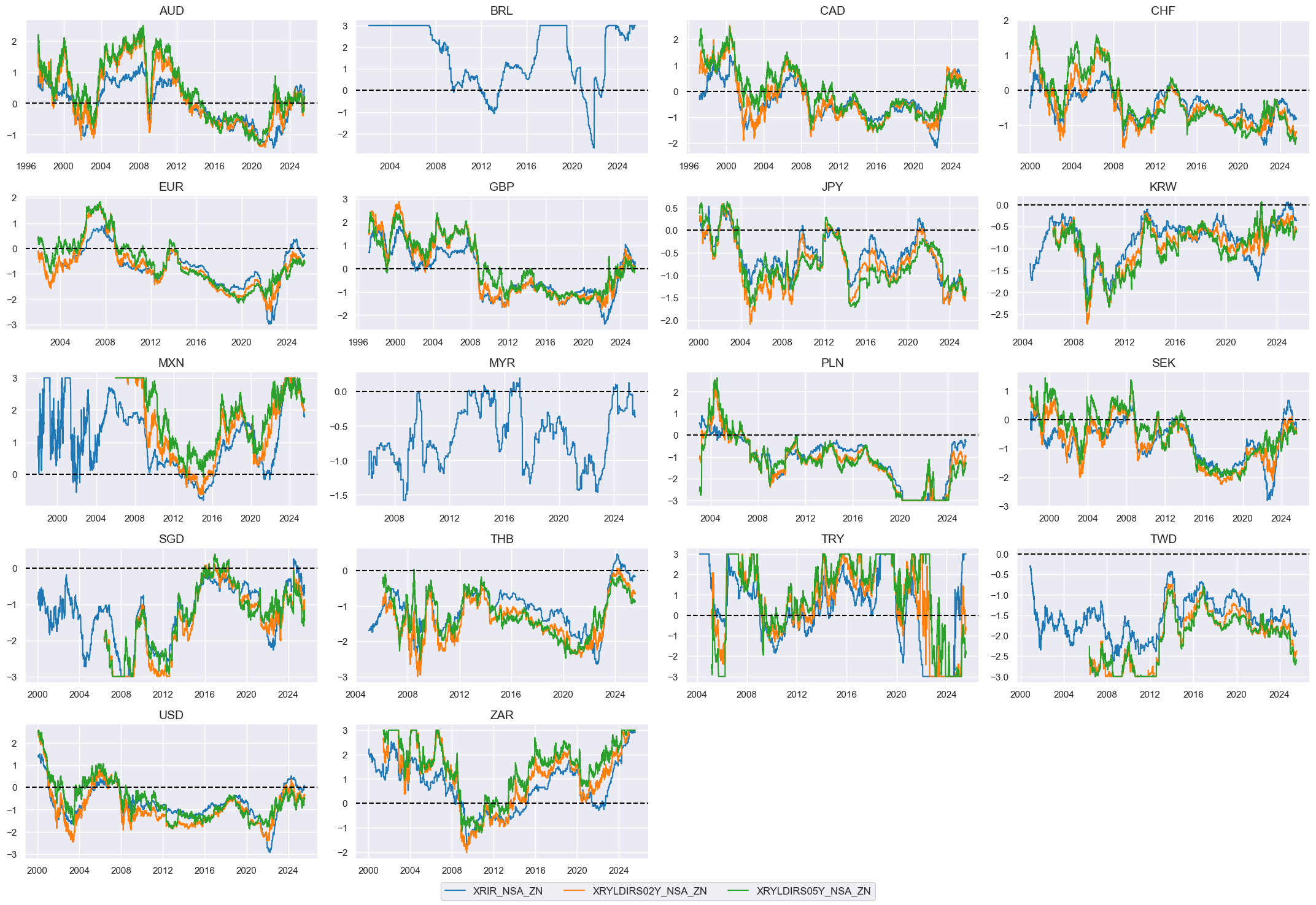

Real interest rates (negative) #

Specs #

# Un-scored indicators and score weights and signs

dict_rir = {

"RIR_NSA": (1/3, -1),

"RYLDIRS02Y_NSA": (1/3, -1),

"RYLDIRS05Y_NSA": (1/3, -1),

}

Constituent scores #

# Excess real rates

xcatx = list(dict_rir.keys())

calcs = [

f"X{xcat} = {xcat} - ( RGDP_SA_P1Q1QL4_20QMM - WFORCE_NSA_P1Y1YL1_5YMM )"

for xcat in xcatx

]

dfa = msp.panel_calculator(

dfx,

calcs=calcs,

cids=cids_eq,

)

dfx = msm.update_df(dfx, dfa)

# Panel-based normalization

cidx = cids_eq

xcatx = [f"X{xcat}" for xcat in list(dict_rir.keys())]

sdate = "1990-01-01"

for xc in xcatx:

dfaa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 5,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

rirz = [xc + "_ZN" for xc in xcatx]

cidx = cids_eq

xcatx = rirz

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=False,

all_xticks=True,

aspect=1.8,

height=2,

)

Composite scores #

# Weighted linear combination

cidx = cids_eq

dix = dict_rir

xcatx = ["X" + k + "_ZN" for k in list(dix.keys())]

weights = [v[0] for v in list(dix.values())]

signs = [v[1] for v in list(dix.values())]

czs = "RIR_NEG"

dfa = msp.linear_composite(

dfx,

xcats=xcatx,

cids=cidx,

weights=weights,

signs=signs,

normalize_weights=True,

complete_xcats=False, # score works with what is available

new_xcat=czs,

)

dfx = msm.update_df(dfx, dfa)

# Re-scoring

dfa = msp.make_zn_scores(

dfx,

xcat=czs,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

dict_facts[czs + "_ZN"] = "Real yield shortfall"

xcatx = ["RIR_NEG_ZN"]

cidx = cids_eq

sdate = "1990-01-01"

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=False,

all_xticks=True,

aspect=1.8,

height=2,

)

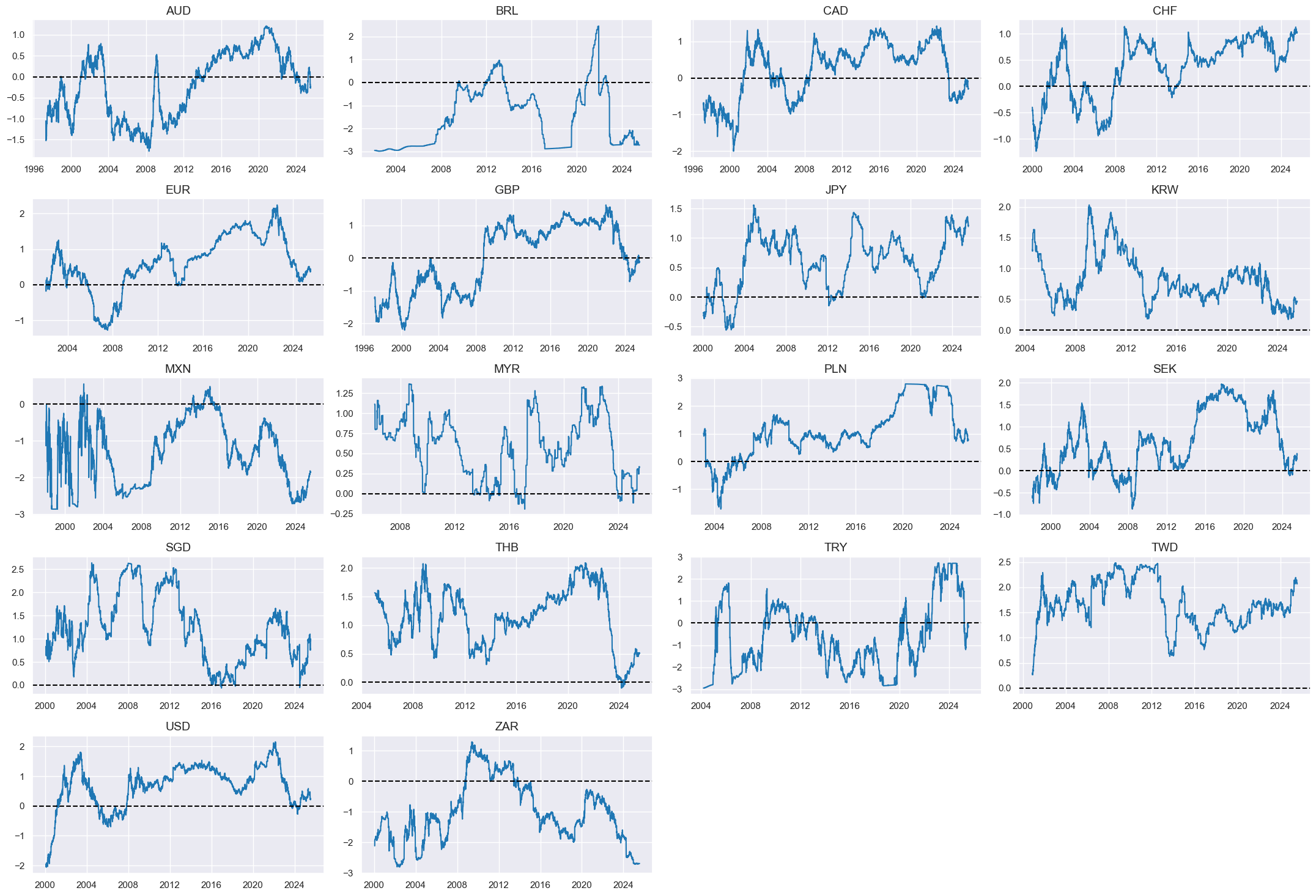

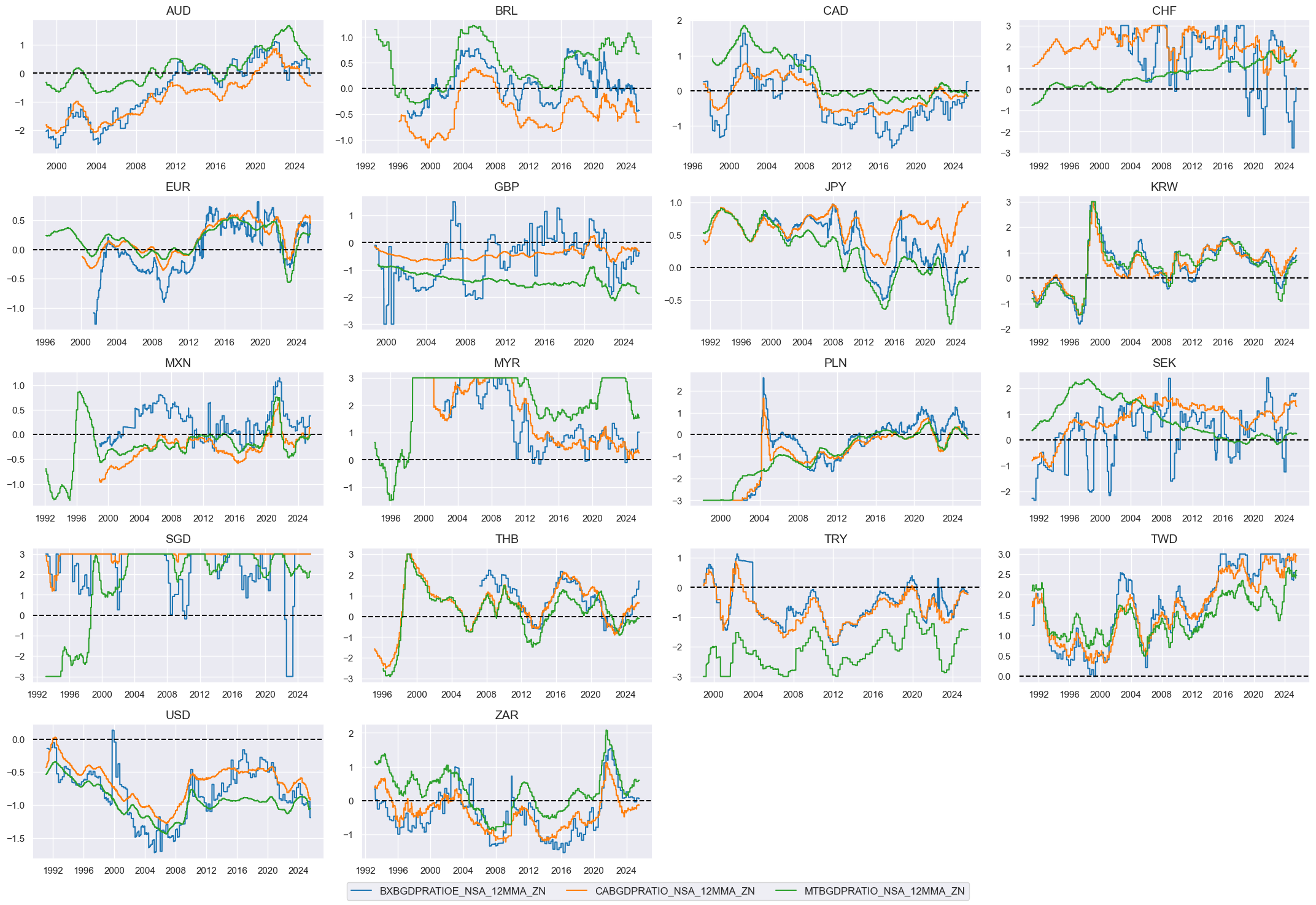

External balances #

Specs #

# Un-scored indicators and score weights and signs

dict_xbal = {

"BXBGDPRATIOE_NSA_12MMA": (1/3, 1),

"CABGDPRATIO_NSA_12MMA": (1/3, 1),

"MTBGDPRATIO_NSA_12MMA": (1/3, 1),

}

Constituent scores #

# Panel-based normalization

cidx = cids_eq

xcatx = [xcat for xcat in list(dict_xbal.keys())]

sdate = "1990-01-01"

for xc in xcatx:

dfaa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 5,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

xbalz = [xc + "_ZN" for xc in xcatx]

cidx = cids_eq

xcatx = xbalz

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=False,

all_xticks=True,

aspect=1.8,

height=2,

)

Composite scores #

# Weighted linear combination

cidx = cids_eq

dix = dict_xbal

xcatx = [k + "_ZN" for k in list(dix.keys())]

weights = [v[0] for v in list(dix.values())]

signs = [v[1] for v in list(dix.values())]

czs = "XBAL"

dfa = msp.linear_composite(

dfx,

xcats=xcatx,

cids=cidx,

weights=weights,

signs=signs,

normalize_weights=True,

complete_xcats=False, # score works with what is available

new_xcat=czs,

)

dfx = msm.update_df(dfx, dfa)

# Re-scoring

dfa = msp.make_zn_scores(

dfx,

xcat=czs,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

dict_facts[czs + "_ZN"] = "External balance ratios"

xcatx = ["XBAL_ZN"]

cidx = cids_eq

sdate = "1990-01-01"

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=False,

all_xticks=True,

aspect=1.8,

height=2,

)

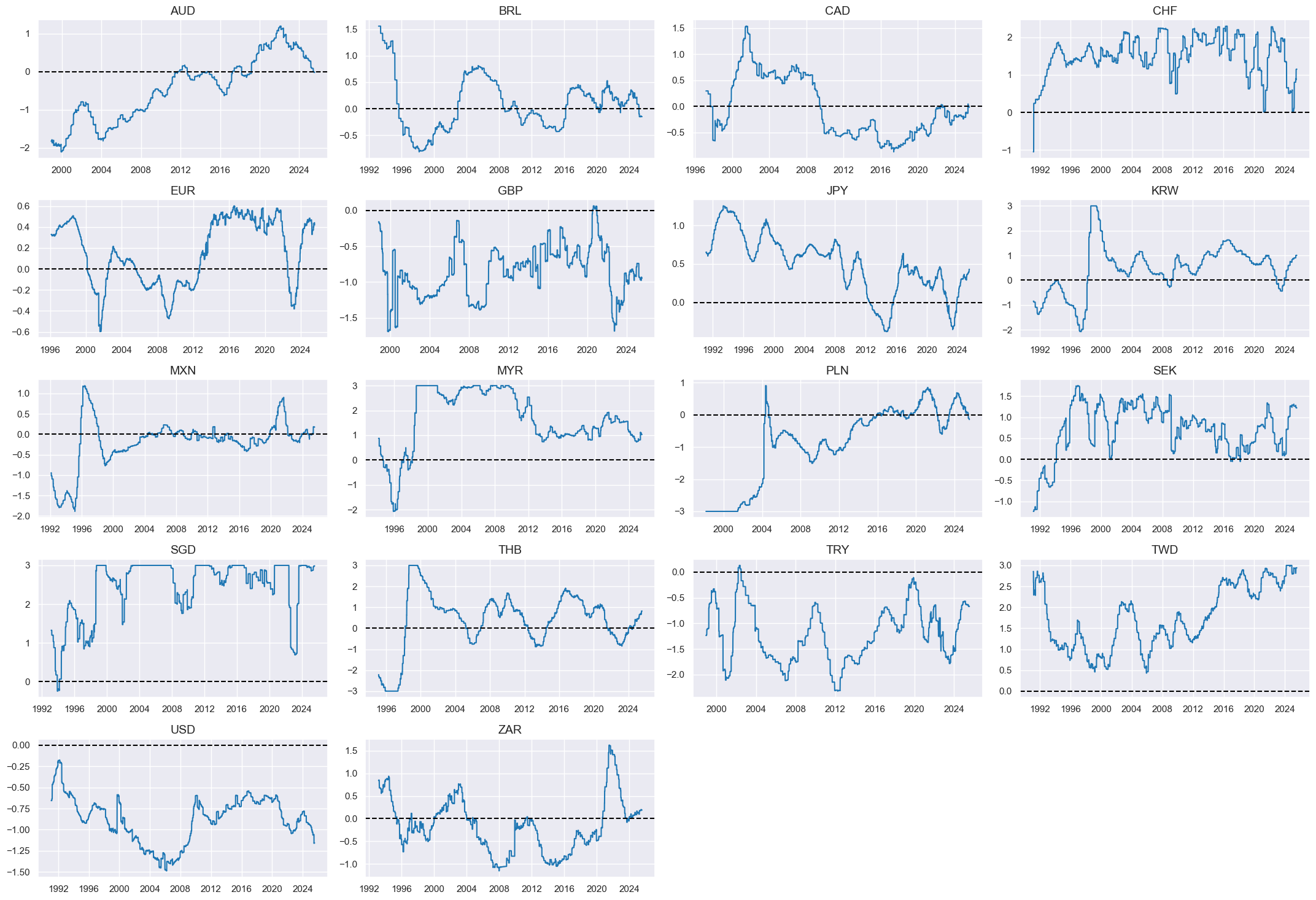

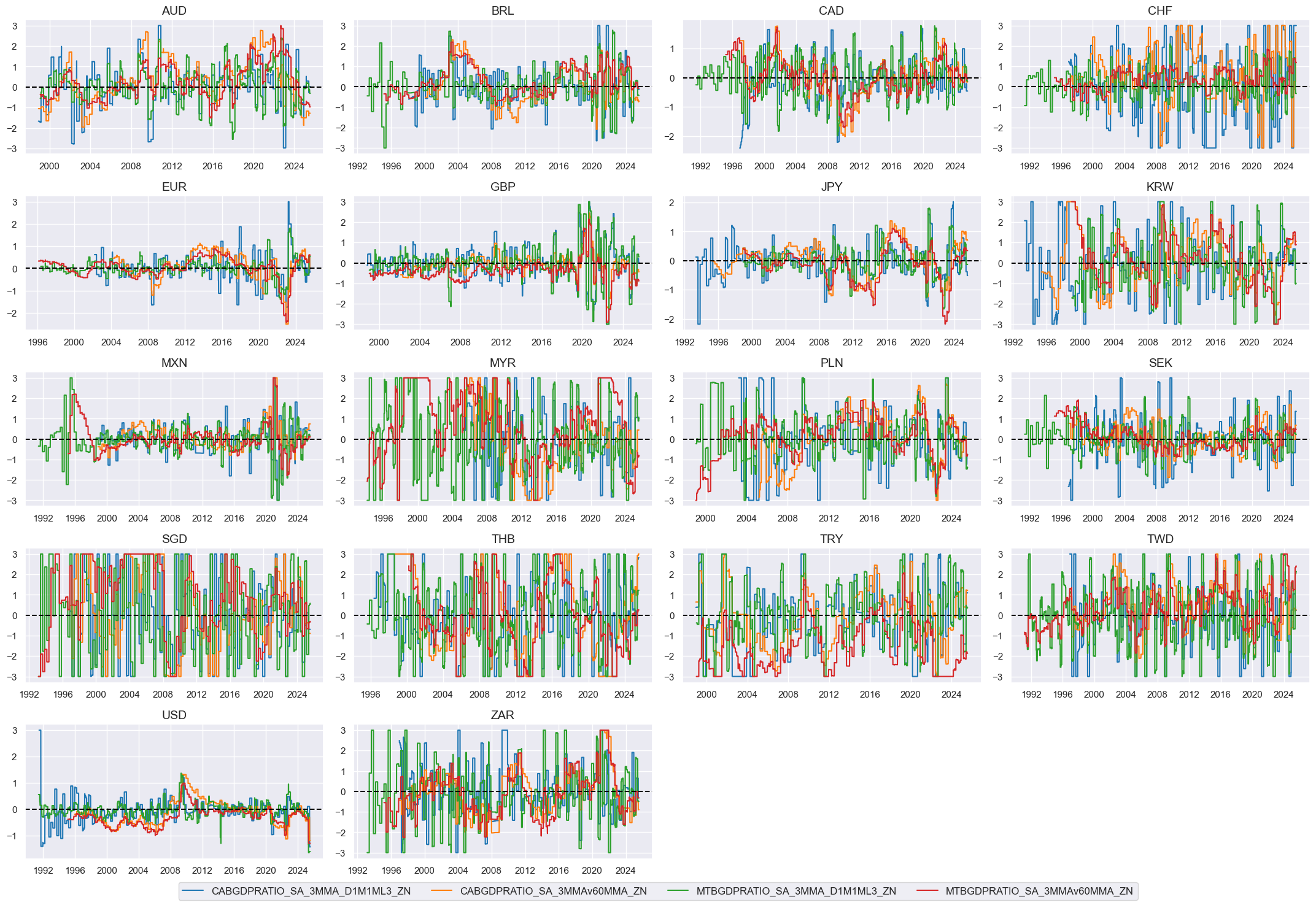

External balance changes #

Specs #

# Un-scored indicators and score weights and signs

dict_xbal_chg = {

"CABGDPRATIO_SA_3MMA_D1M1ML3": (1/4, 1),

"CABGDPRATIO_SA_3MMAv60MMA": (1/4, 1),

"MTBGDPRATIO_SA_3MMA_D1M1ML3": (1/4, 1),

"MTBGDPRATIO_SA_3MMAv60MMA": (1/4, 1),

}

Constituent scores #

# Panel-based normalization

cidx = cids_eq

xcatx = [xcat for xcat in list(dict_xbal_chg.keys())]

sdate = "1990-01-01"

for xc in xcatx:

dfaa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 5,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

xbalchgz = [xc + "_ZN" for xc in xcatx]

cidx = cids_eq

xcatx = xbalchgz

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=False,

all_xticks=True,

aspect=1.8,

height=2,

)

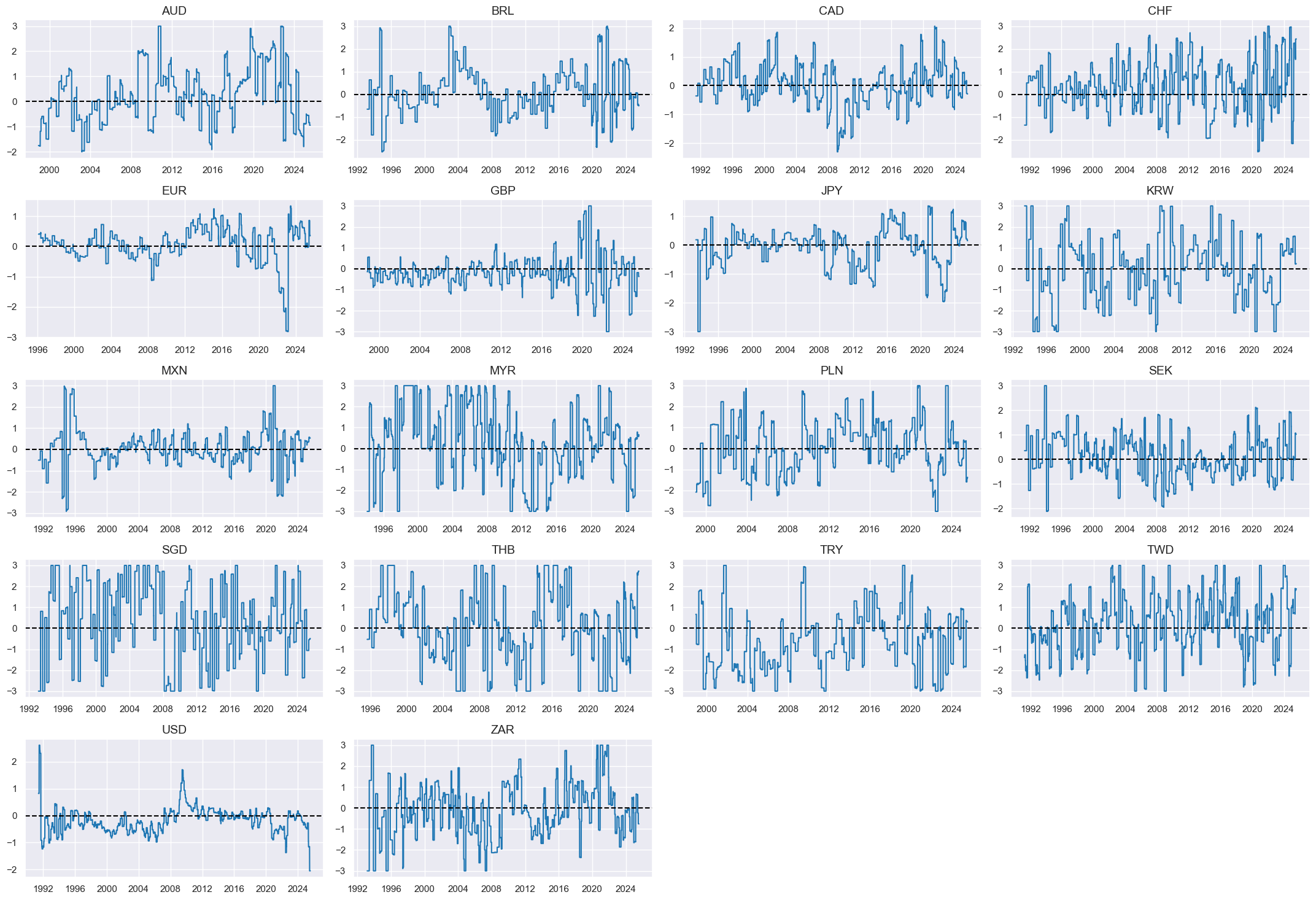

Composite scores #

# Weighted linear combination

cidx = cids_eq

dix = dict_xbal_chg

xcatx = [k + "_ZN" for k in list(dix.keys())]

weights = [v[0] for v in list(dix.values())]

signs = [v[1] for v in list(dix.values())]

czs = "XBAL_CHG"

dfa = msp.linear_composite(

dfx,

xcats=xcatx,

cids=cidx,

weights=weights,

signs=signs,

normalize_weights=True,

complete_xcats=False, # score works with what is available

new_xcat=czs,

)

dfx = msm.update_df(dfx, dfa)

# Re-scoring

dfa = msp.make_zn_scores(

dfx,

xcat=czs,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

dict_facts[czs + "_ZN"] = "External balance changes"

cidx = cids_eq

xcatx = ["XBAL_CHG_ZN"]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=False,

all_xticks=True,

aspect=1.8,

height=2,

)

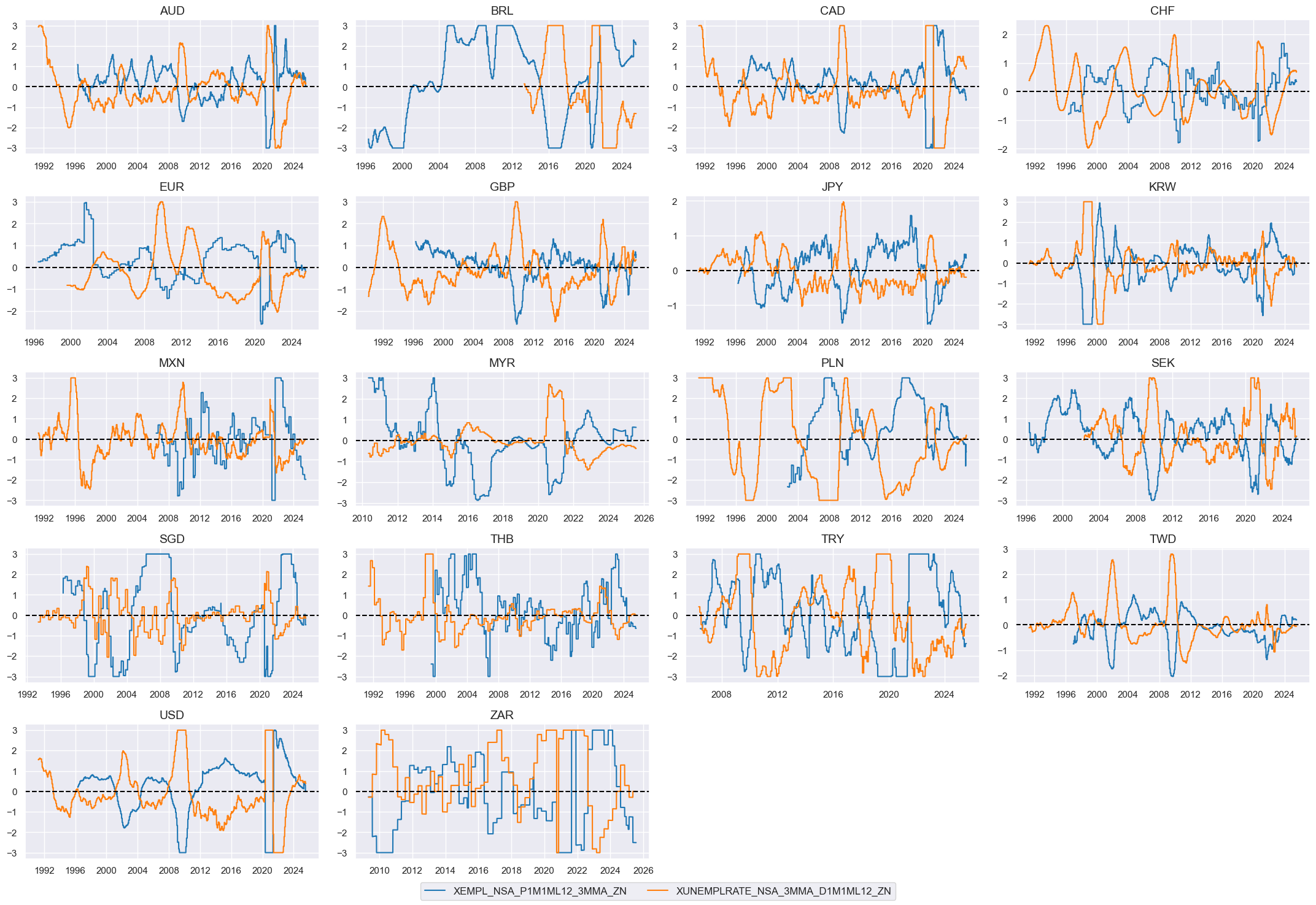

Labor market slackening #

Specs #

# Un-scored indicators and score weights and signs

dict_labor = {

"EMPL_NSA_P1M1ML12_3MMA": (1/2, -1),

"UNEMPLRATE_NSA_3MMA_D1M1ML12": (1/2, 1),

}

Constituent scores #

# Excess employment

calcs = [

"XEMPL_NSA_P1M1ML12_3MMA = EMPL_NSA_P1M1ML12_3MMA - WFORCE_NSA_P1Y1YL1_5YMM",

"XUNEMPLRATE_NSA_3MMA_D1M1ML12 = UNEMPLRATE_NSA_3MMA_D1M1ML12",

]

dfa = msp.panel_calculator(

dfx,

calcs=calcs,

cids=cids_eq,

)

dfx = msm.update_df(dfx, dfa)

# Panel-based normalization

cidx = cids_eq

xcatx = ["X" + xcat for xcat in dict_labor.keys()]

sdate = "1990-01-01"

for xc in xcatx:

dfaa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 5,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

xlabz = [xcat + "_ZN" for xcat in xcatx]

cidx = cids_eq

xcatx = xlabz

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=False,

all_xticks=True,

aspect=1.8,

height=2,

)

Composite scores #

# Weighted linear combination

cidx = cids_eq

dix = dict_labor

xcatx = ["X" + k + "_ZN" for k in list(dix.keys())]

weights = [v[0] for v in list(dix.values())]

signs = [v[1] for v in list(dix.values())]

czs = "XLAB"

dfa = msp.linear_composite(

dfx,

xcats=xcatx,

cids=cidx,

weights=weights,

signs=signs,

normalize_weights=True,

complete_xcats=False, # score works with what is available

new_xcat=czs,

)

dfx = msm.update_df(dfx, dfa)

# Re-scoring

dfa = msp.make_zn_scores(

dfx,

xcat=czs,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

dict_facts[czs + "_ZN"] = "Labor market slackening"

cidx = cids_eq

xcatx = ["XLAB_ZN"]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=False,

all_xticks=True,

aspect=1.8,

height=2,

)

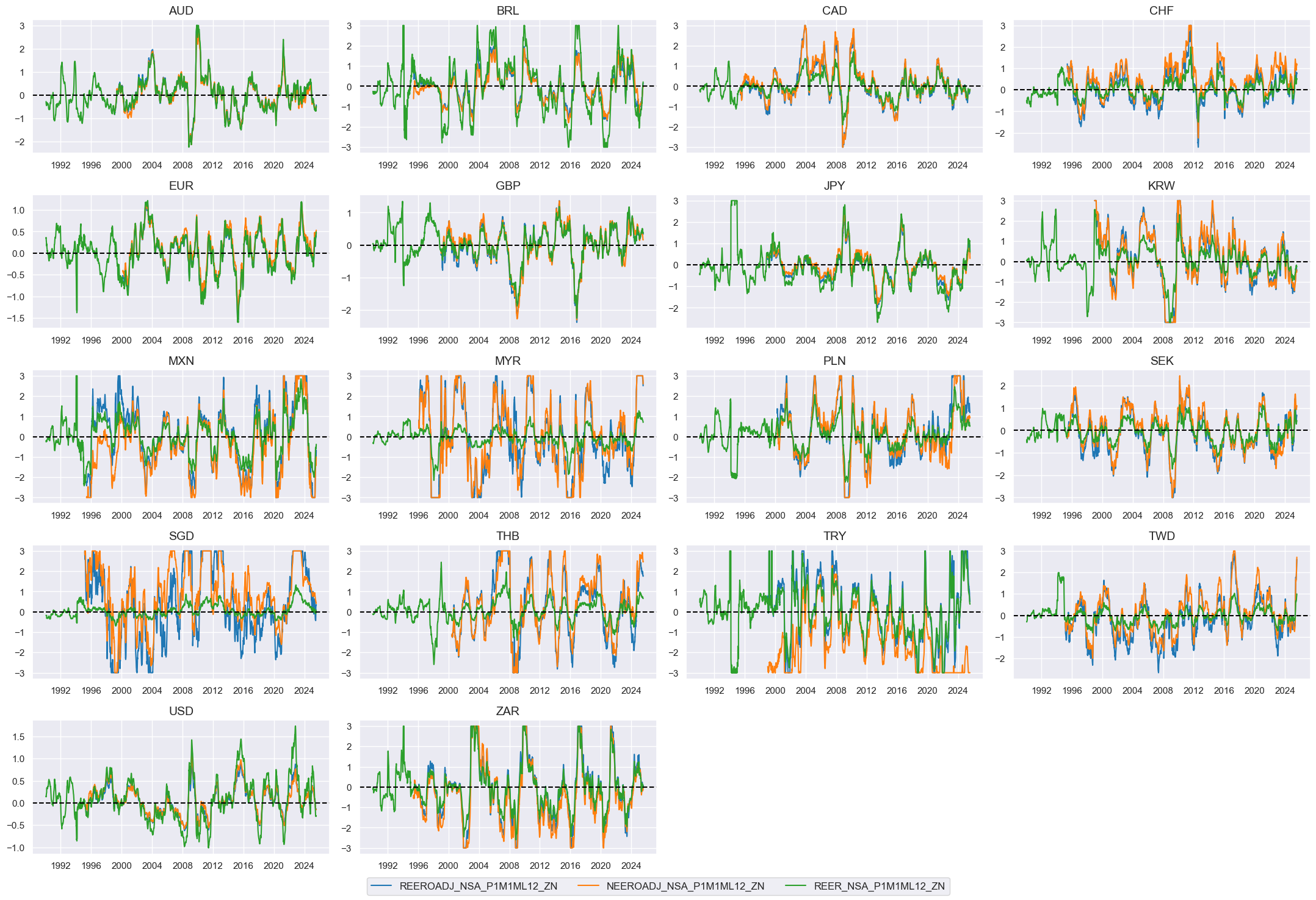

Effective currency depreciation #

Specs #

# Un-scored indicators and weights

dict_fx = {

"REEROADJ_NSA_P1M1ML12": (1/3, -1),

"NEEROADJ_NSA_P1M1ML12": (1/3, -1),

"REER_NSA_P1M1ML12": (1/3, -1),

}

Constituent scores #

# Panel-based normalization

cidx = cids_eq

xcatx = [xcat for xcat in list(dict_fx.keys())]

sdate = "1990-01-01"

for xc in xcatx:

dfaa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 5,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

fxz = [xcat + "_ZN" for xcat in xcatx]

cidx = cids_eq

xcatx = fxz

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=False,

all_xticks=True,

aspect=1.8,

height=2,

)

Composite scores #

# Weighted linear combination

cidx = cids_eq

dix = dict_fx

xcatx = [k + "_ZN" for k in list(dix.keys())]

weights = [v[0] for v in list(dix.values())]

signs = [v[1] for v in list(dix.values())]

czs = "EFFX_NEG"

dfa = msp.linear_composite(

dfx,

xcats=xcatx,

cids=cidx,

weights=weights,

signs=signs,

normalize_weights=True,

complete_xcats=False, # score works with what is available

new_xcat=czs,

)

dfx = msm.update_df(dfx, dfa)

# Re-scoring

dfa = msp.make_zn_scores(

dfx,

xcat=czs,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

dict_facts[czs + "_ZN"] = "Effective FX depreciation"

cidx = cids_eq

xcatx = ["EFFX_NEG_ZN"]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=False,

all_xticks=True,

aspect=1.8,

height=2,

)

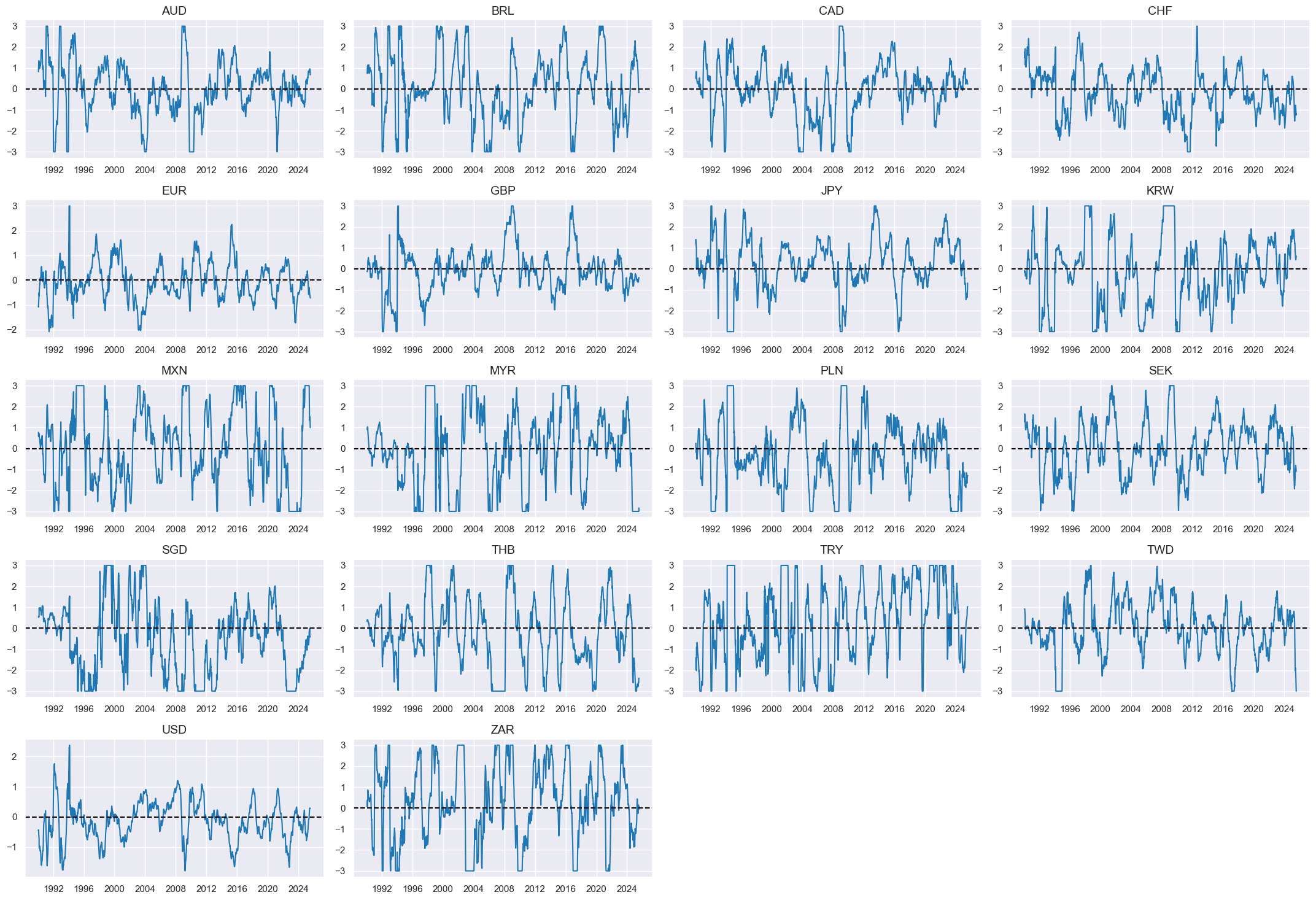

Terms of trade improvement #

Specs #

# Un-scored indicators and weights

dict_tot = {

"CTOT_NSA_P1M1ML12": (1/2, 1),

"CTOT_NSA_P1M12ML1": (1/2, 1),

}

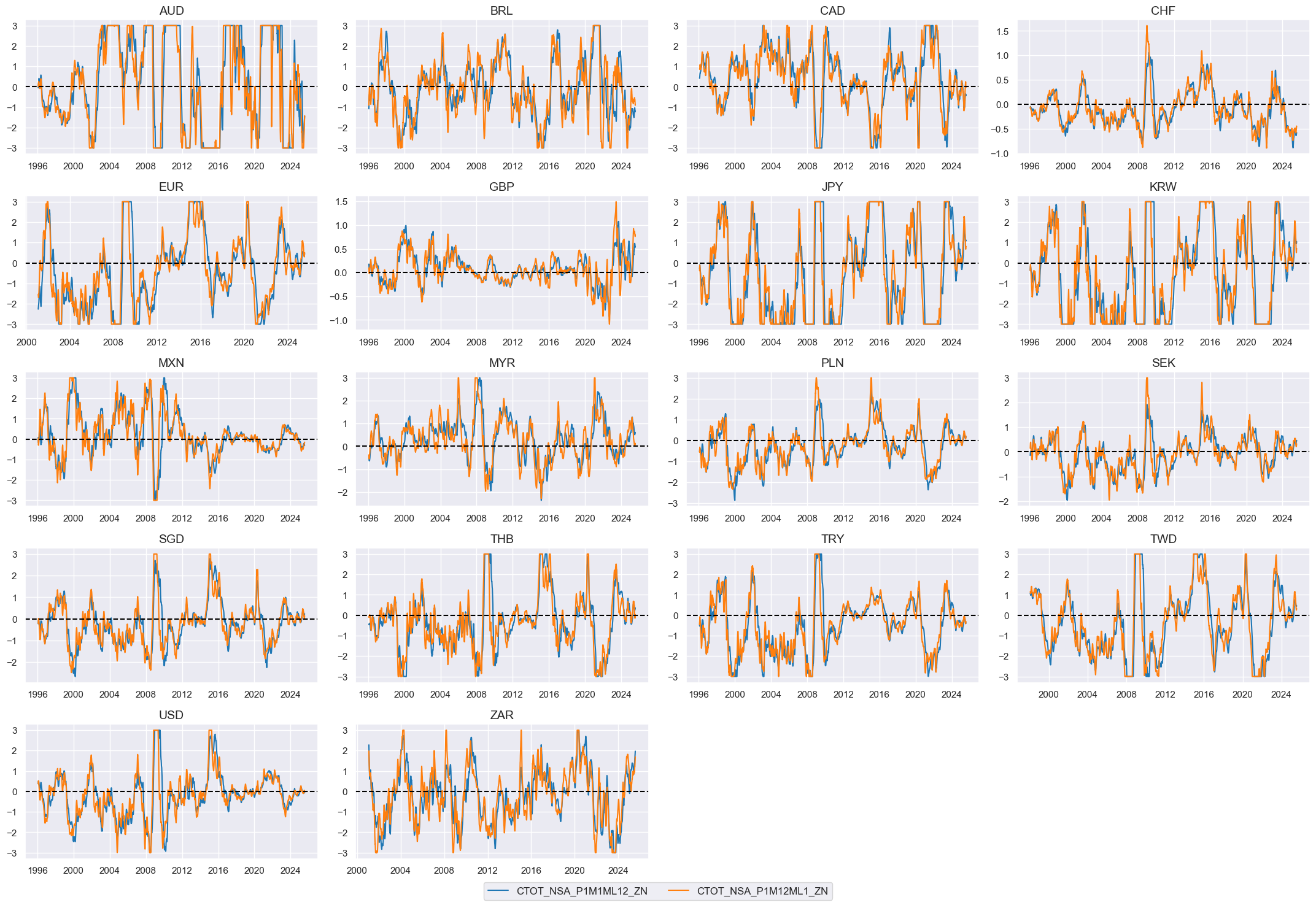

Constituent scores #

# Panel-based normalization

cidx = cids_eq

xcatx = [xcat for xcat in list(dict_tot.keys())]

sdate = "1990-01-01"

for xc in xcatx:

dfaa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 5,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

totz = [xcat + "_ZN" for xcat in xcatx]

cidx = cids_eq

xcatx = totz

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=False,

all_xticks=True,

aspect=1.8,

height=2,

)

Composite scores #

# Weighted linear combination

cidx = cids_eq

dix = dict_tot

xcatx = [k + "_ZN" for k in list(dix.keys())]

weights = [v[0] for v in list(dix.values())]

signs = [v[1] for v in list(dix.values())]

czs = "TOT"

dfa = msp.linear_composite(

dfx,

xcats=xcatx,

cids=cidx,

weights=weights,

signs=signs,

normalize_weights=True,

complete_xcats=False, # score works with what is available

new_xcat=czs,

)

dfx = msm.update_df(dfx, dfa)

# Re-scoring

dfa = msp.make_zn_scores(

dfx,

xcat=czs,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

dict_facts[czs + "_ZN"] = "Terms-of-trade improvement"

cidx = cids_eq

xcatx = ["TOT_ZN"]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=False,

all_xticks=True,

aspect=1.8,

height=2,

)

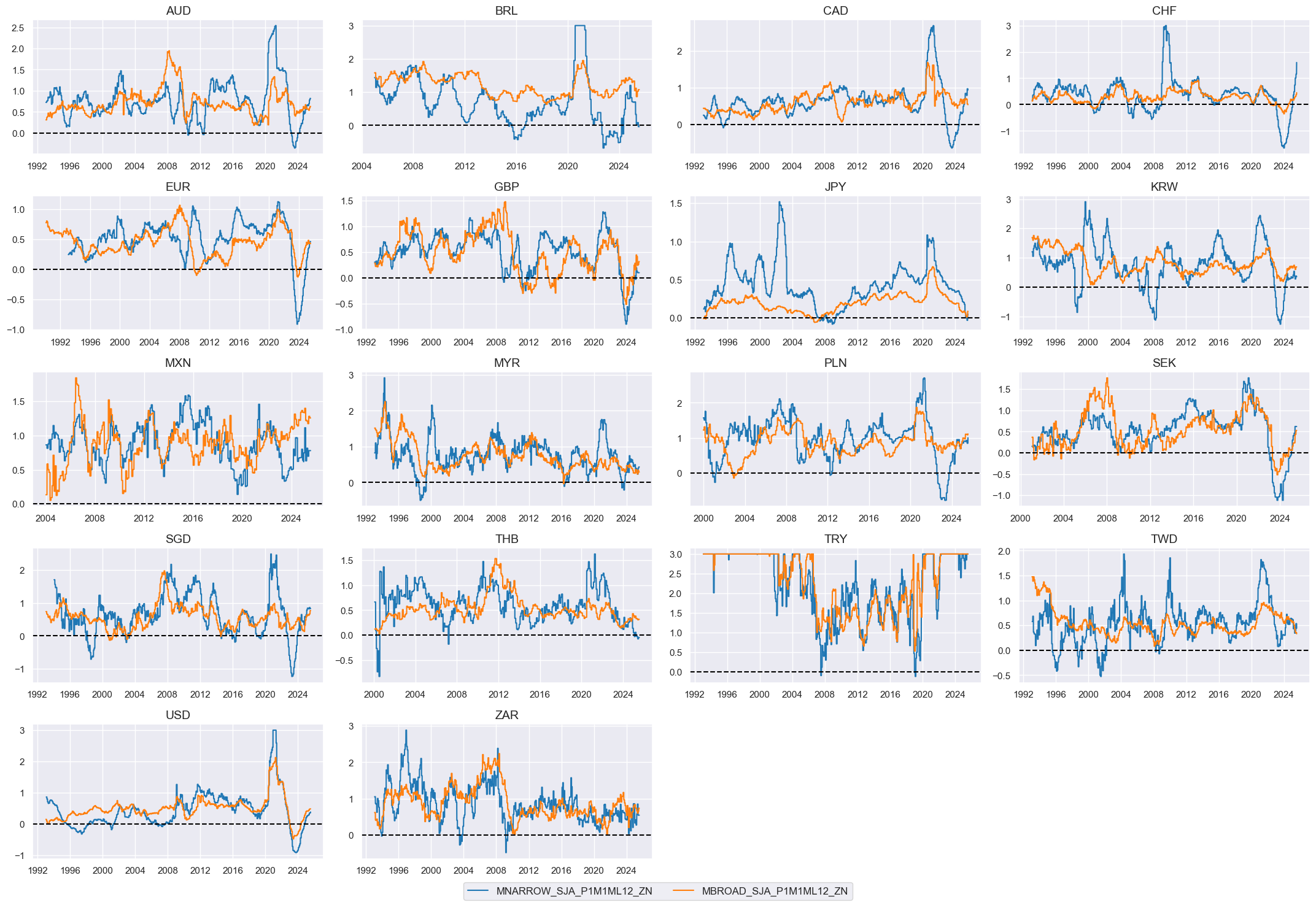

Excess money growth #

Specs #

# Un-scored indicators and weights

dict_mon = {

"MNARROW_SJA_P1M1ML12": (1/2, 1),

"MBROAD_SJA_P1M1ML12": (1/2, 1),

}

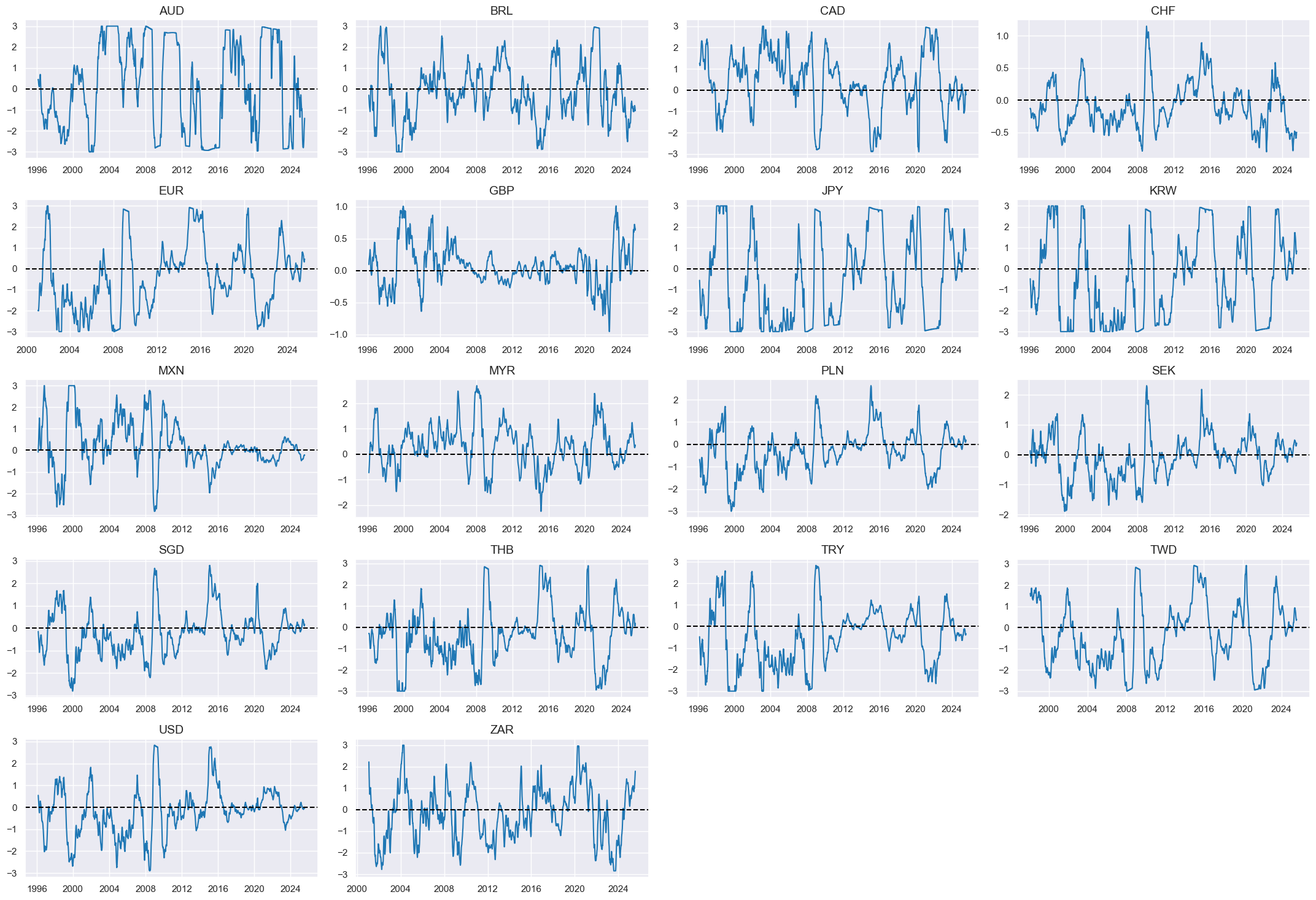

Constituent scores #

# Excess money growth

xcatx = list(dict_mon.keys())

cidx = cids_eq

calcs = [

f"X{xcat} = {xcat} - ( RGDP_SA_P1Q1QL4_20QMM + INFTEFF_NSA )"

for xcat in xcatx

]

dfa = msp.panel_calculator(

df=dfx,

calcs=calcs,

cids=cidx,

)

dfx = msm.update_df(dfx, dfa)

# Panel-based normalization

cidx = cids_eq

xcatx = [xcat for xcat in list(dict_mon.keys())]

sdate = "1990-01-01"

for xc in xcatx:

dfaa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 5,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

monz = [xcat + "_ZN" for xcat in xcatx]

cidx = cids_eq

xcatx = monz

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=False,

all_xticks=True,

aspect=1.8,

height=2,

)

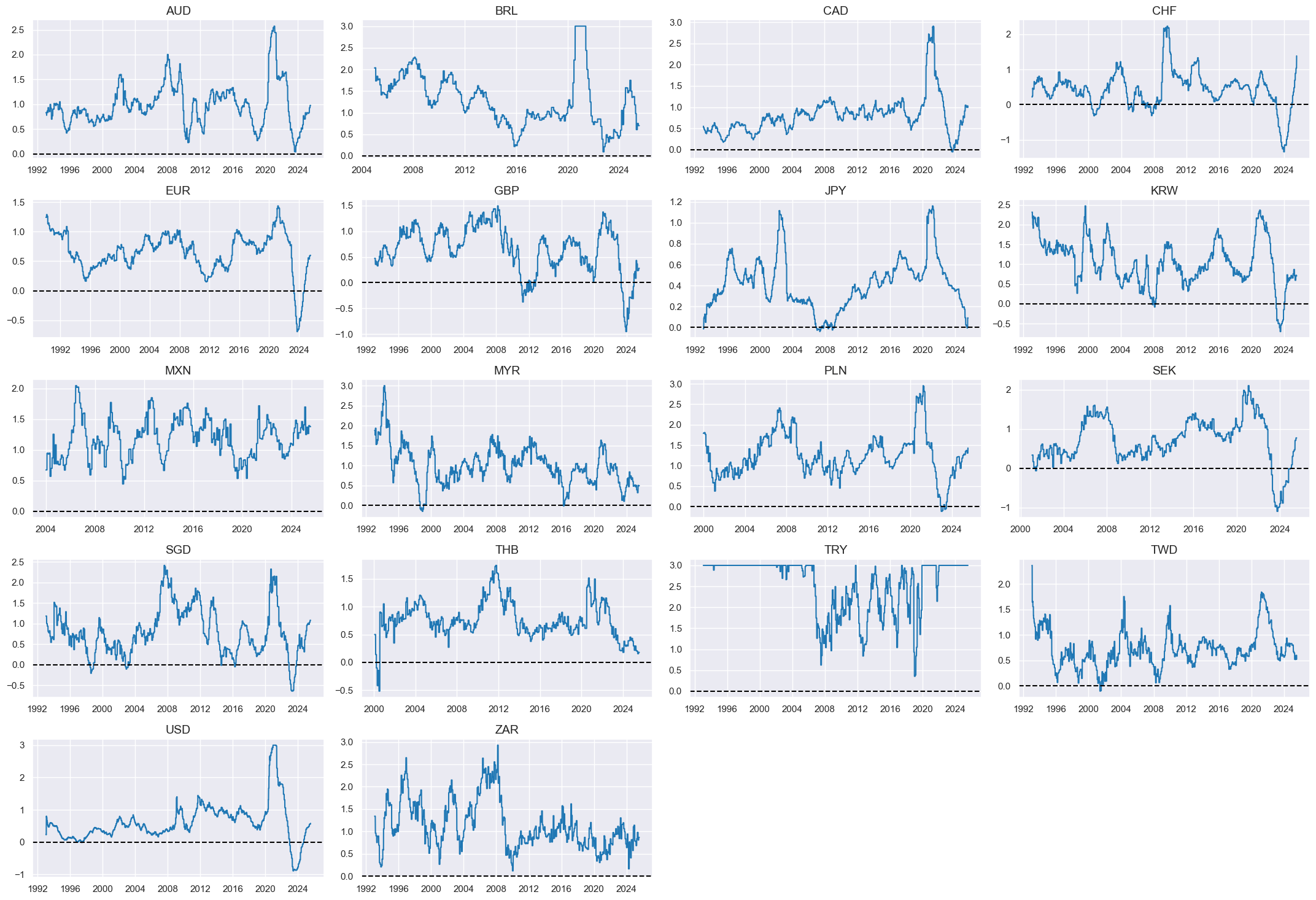

Composite scores #

# Weighted linear combination

cidx = cids_eq

dix = dict_mon

xcatx = [k + "_ZN" for k in list(dix.keys())]

weights = [v[0] for v in list(dix.values())]

signs = [v[1] for v in list(dix.values())]

czs = "MONEY"

dfa = msp.linear_composite(

dfx,

xcats=xcatx,

cids=cidx,

weights=weights,

signs=signs,

normalize_weights=True,

complete_xcats=False, # score works with what is available

new_xcat=czs,

)

dfx = msm.update_df(dfx, dfa)

# Re-scoring

dfa = msp.make_zn_scores(

dfx,

xcat=czs,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

dict_facts[czs + "_ZN"] = "Excess money growth"

cidx = cids_eq

xcatx = ["MONEY_ZN"]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=False,

all_xticks=True,

aspect=1.8,

height=2,

)

Business gloom #

Specs #

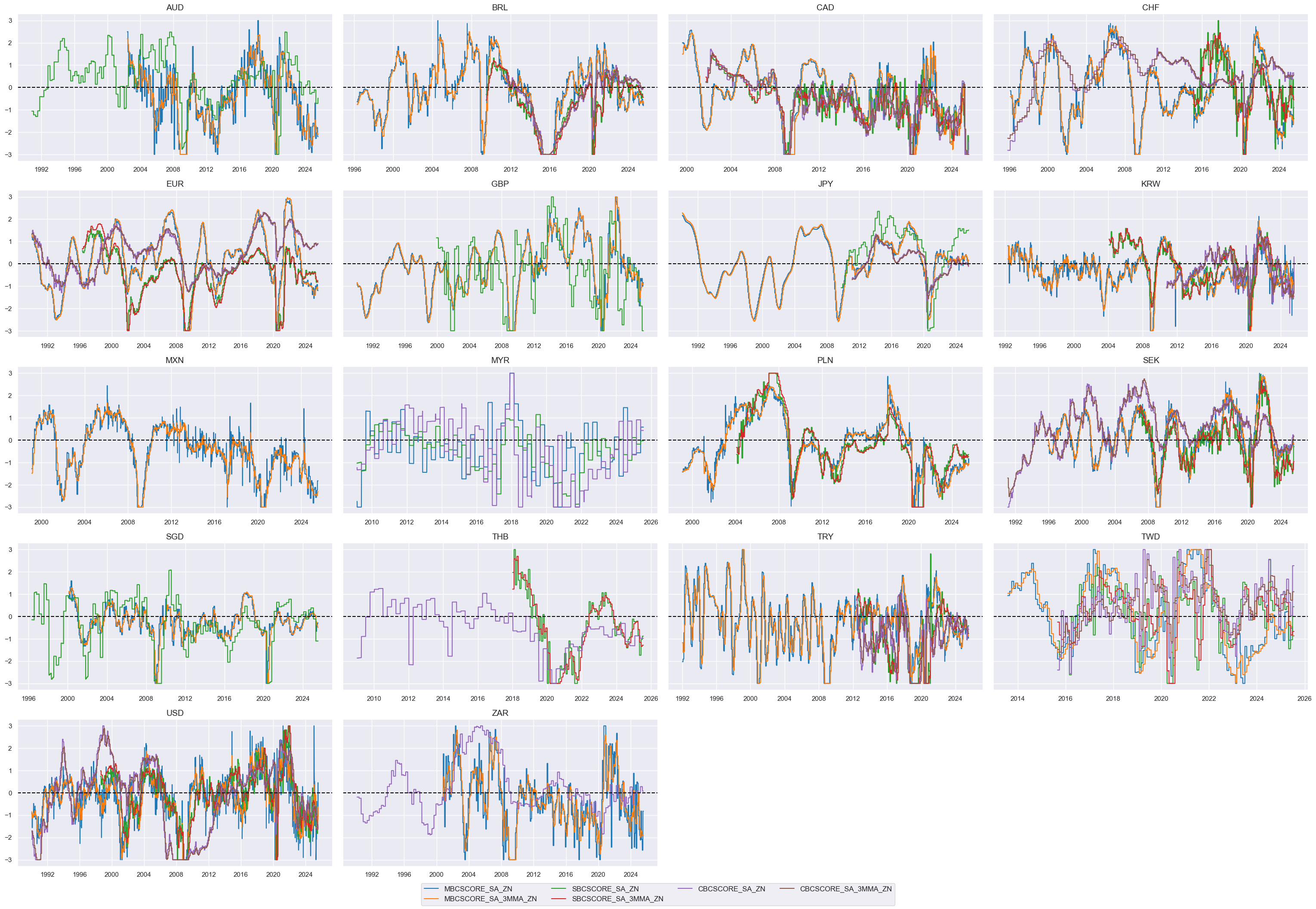

# Un-scored indicators and weights

dict_bsurv = {

"MBCSCORE_SA": (4/18, -1),

"MBCSCORE_SA_3MMA": (4/18, -1),

"SBCSCORE_SA": (4/18, -1),

"SBCSCORE_SA_3MMA": (4/18, -1),

"CBCSCORE_SA": (1/18, -1),

"CBCSCORE_SA_3MMA": (1/18, -1),

}

Constituent scores #

# Panel-based normalization

cidx = cids_eq

xcatx = [xcat for xcat in list(dict_bsurv.keys())]

sdate = "1990-01-01"

for xc in xcatx:

dfaa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 5,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

busz = [xcat + "_ZN" for xcat in xcatx]

cidx = cids_eq

xcatx = busz

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=True,

all_xticks=True,

size=(12, 7),

aspect=1.8

)

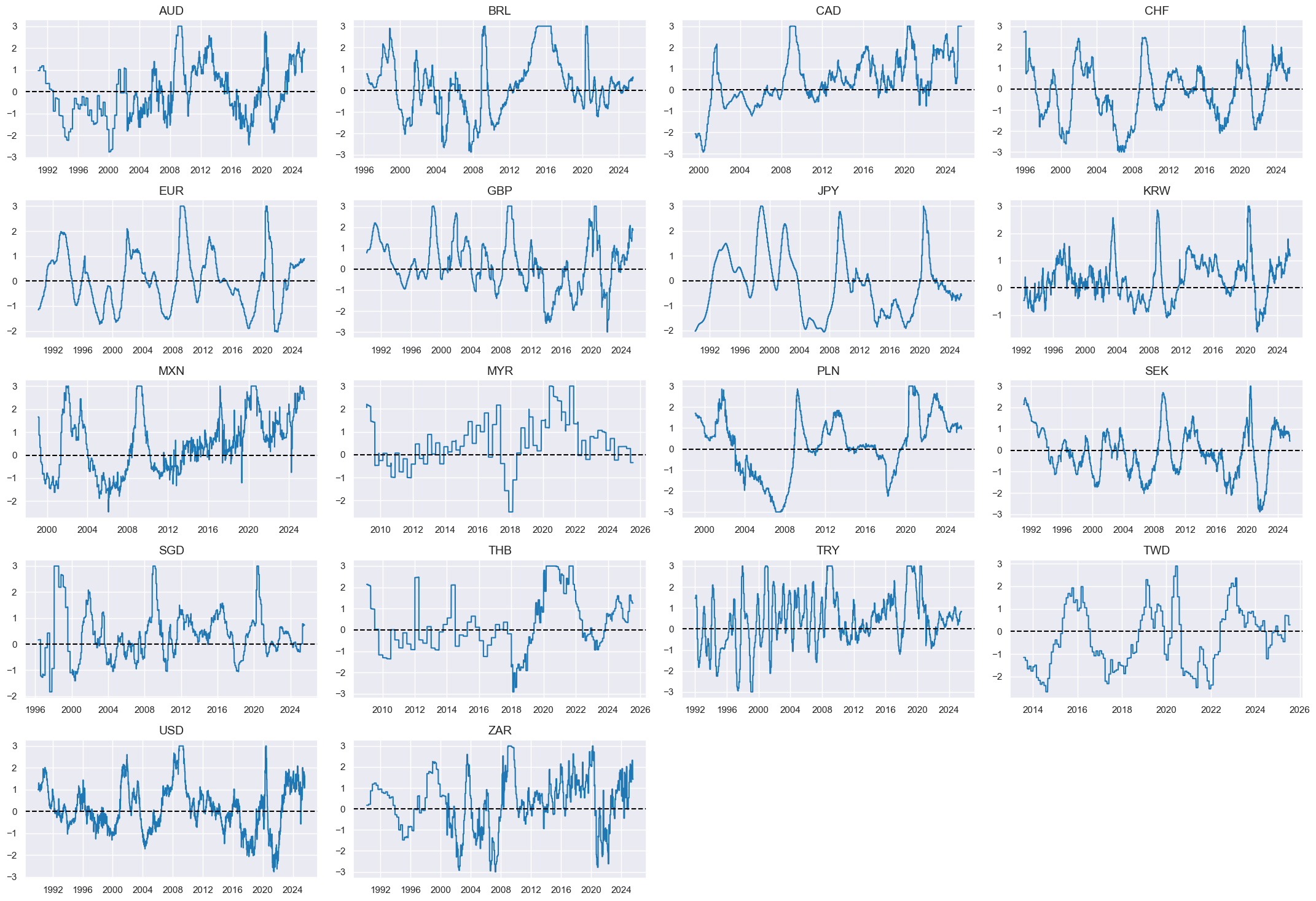

Composite scores #

# Weighted linear combination

cidx = cids_eq

dix = dict_bsurv

xcatx = [k + "_ZN" for k in list(dix.keys())]

weights = [v[0] for v in list(dix.values())]

signs = [v[1] for v in list(dix.values())]

czs = "BSURV_NEG"

dfa = msp.linear_composite(

dfx,

xcats=xcatx,

cids=cidx,

weights=weights,

signs=signs,

normalize_weights=True,

complete_xcats=False, # score works with what is available

new_xcat=czs,

)

dfx = msm.update_df(dfx, dfa)

# Re-scoring

dfa = msp.make_zn_scores(

dfx,

xcat=czs,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

dict_facts[czs + "_ZN"] = "Business gloom"

cidx = cids_eq

xcatx = ["BSURV_NEG_ZN"]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=False,

all_xticks=True,

aspect=1.8,

height=2,

)

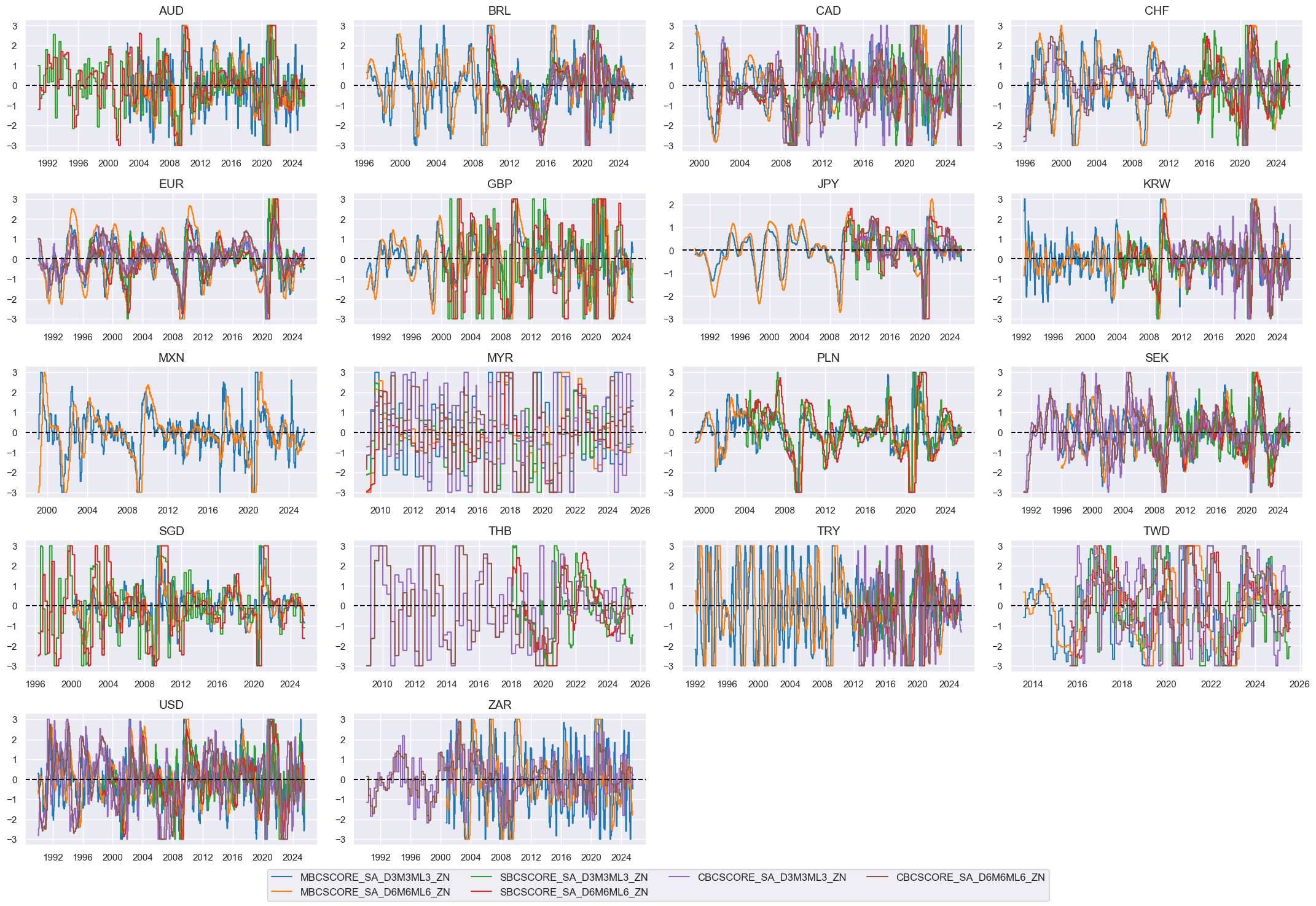

Business sentiment change #

Specs #

# Un-scored indicators and weights

dict_bsurv_chg = {

"MBCSCORE_SA_D3M3ML3": (4/18, 1),

"MBCSCORE_SA_D6M6ML6": (4/18, 1),

"SBCSCORE_SA_D3M3ML3": (4/18, 1),

"SBCSCORE_SA_D6M6ML6": (4/18, 1),

"CBCSCORE_SA_D3M3ML3": (1/18, 1),

"CBCSCORE_SA_D6M6ML6": (1/18, 1),

}

Constituent scores #

# Panel-based normalization

cidx = cids_eq

xcatx = [xcat for xcat in list(dict_bsurv_chg.keys())]

sdate = "1990-01-01"

for xc in xcatx:

dfaa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 5,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

buschgz = [xcat + "_ZN" for xcat in xcatx]

cidx = cids_eq

xcatx = buschgz

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=False,

all_xticks=True,

aspect=1.8,

height=2,

)

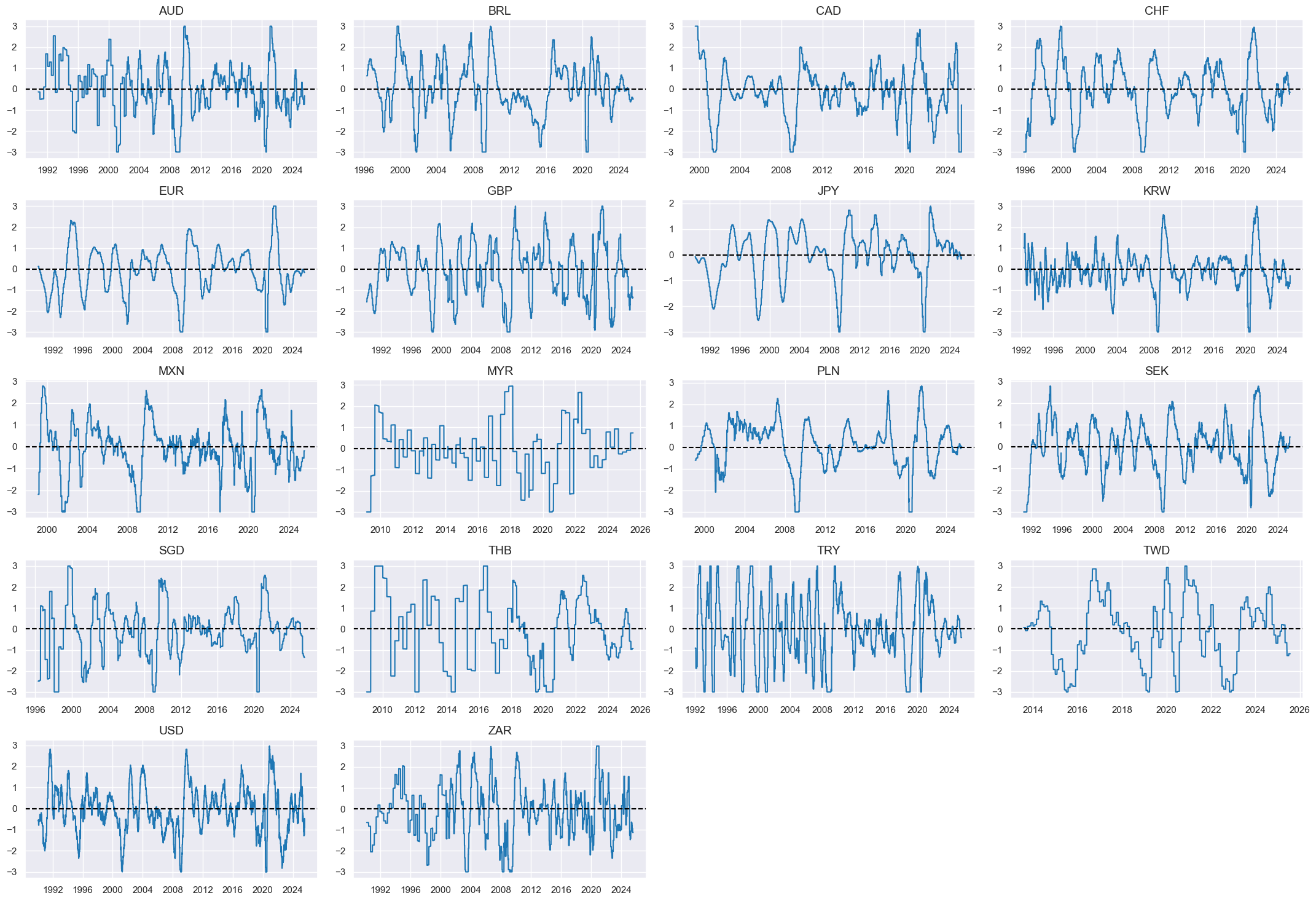

Composite scores #

# Weighted linear combination

cidx = cids_eq

dix = dict_bsurv_chg

xcatx = [k + "_ZN" for k in list(dix.keys())]

weights = [v[0] for v in list(dix.values())]

signs = [v[1] for v in list(dix.values())]

czs = "BSURV_CHG"

dfa = msp.linear_composite(

dfx,

xcats=xcatx,

cids=cidx,

weights=weights,

signs=signs,

normalize_weights=True,

complete_xcats=False, # score works with what is available

new_xcat=czs,

)

dfx = msm.update_df(dfx, dfa)

# Re-scoring

dfa = msp.make_zn_scores(

dfx,

xcat=czs,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

dict_facts[czs + "_ZN"] = "Business sentiment changes"

cidx = cids_eq

xcatx = ["BSURV_CHG_ZN"]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=False,

all_xticks=True,

aspect=1.8,

height=2,

)

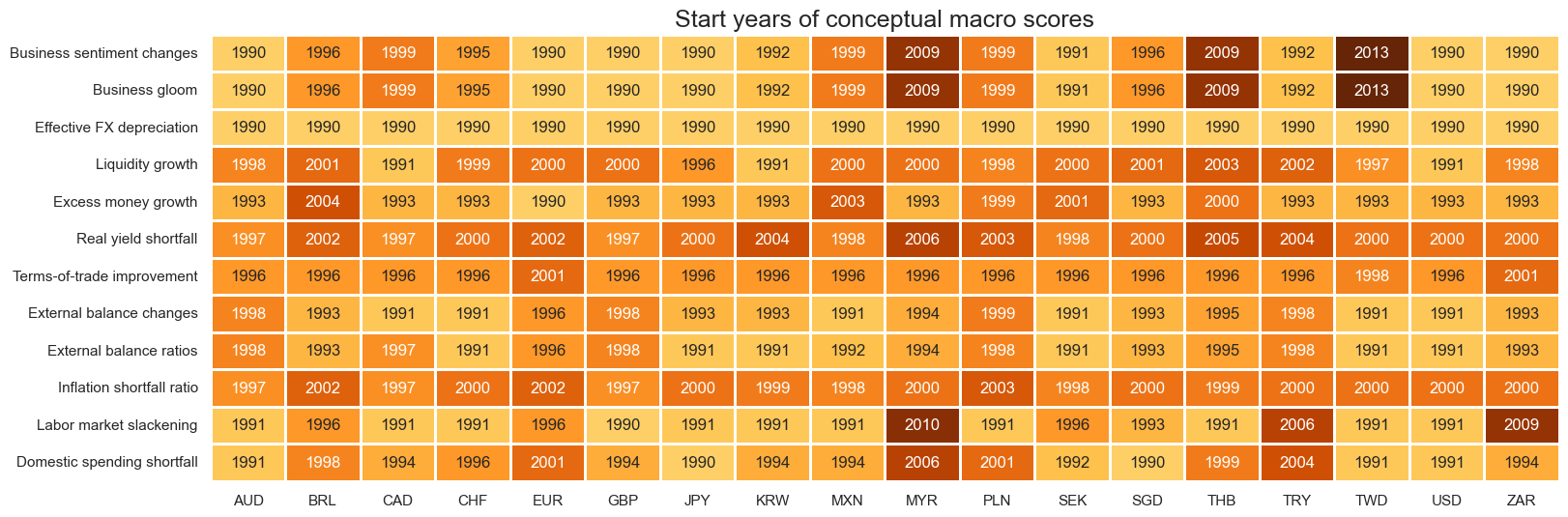

Checks #

# Availability of scores

sorted_facts = sorted(dict_facts.items(), key=lambda item: item[1])

factorz = [k for k, v in sorted_facts] # sort factors by labels for graph

xcatx = factorz

msm.check_availability(

df=dfx,

xcats=xcatx,

cids=cids_eq,

missing_recent=False,

title="Start years of conceptual macro scores",

xcat_labels=dict_facts,

)

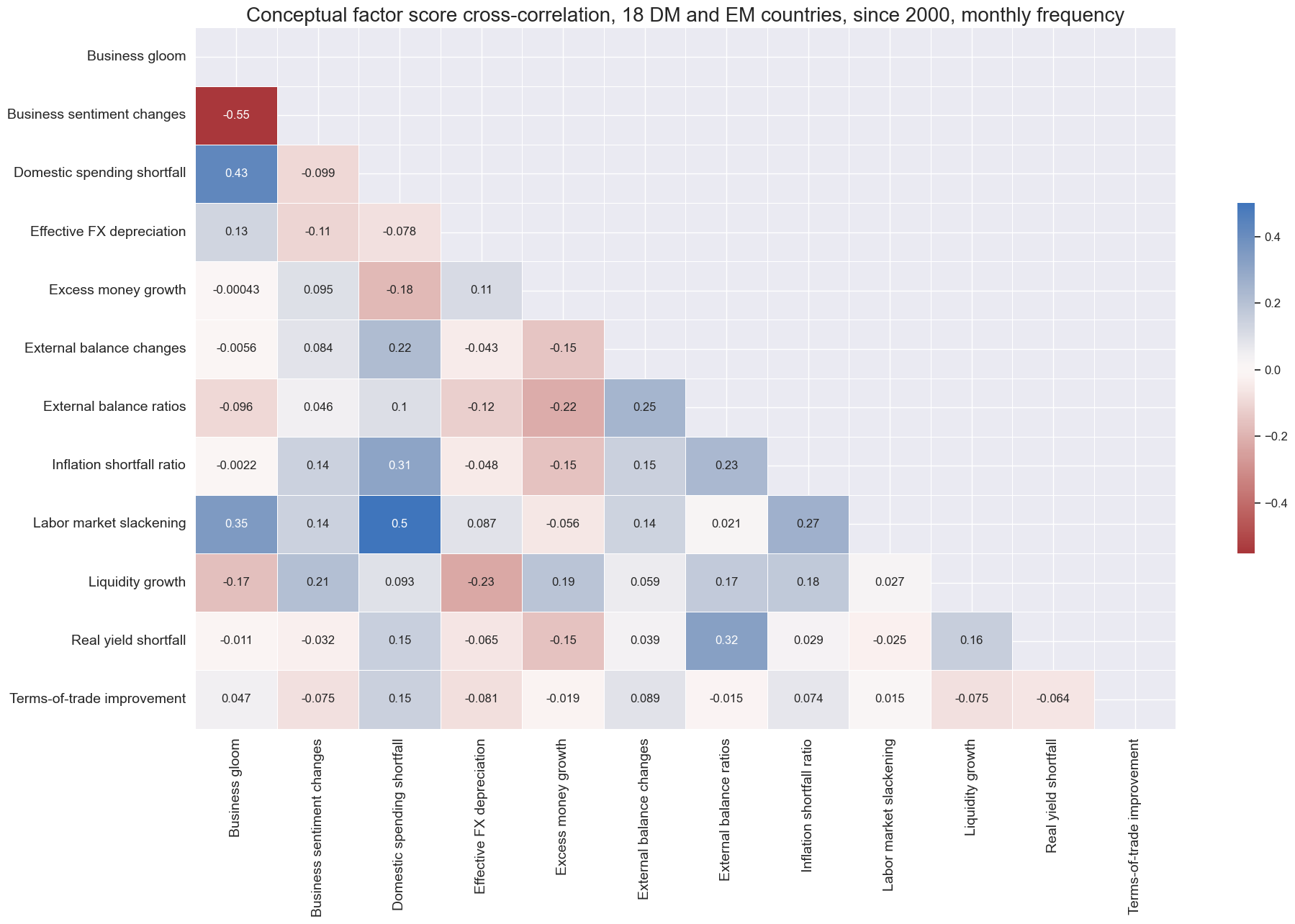

# Conceptual factor cross-correlation

xcatx = factorz

msp.correl_matrix(

df=dfx,

xcats=xcatx,

cids=cids_eq,

freq="m",

title="Conceptual factor score cross-correlation, 18 DM and EM countries, since 2000, monthly frequency",

size=(20, 13),

annot=True,

xcat_labels=dict_facts,

start="2000-01-01",

# cluster=True,

)

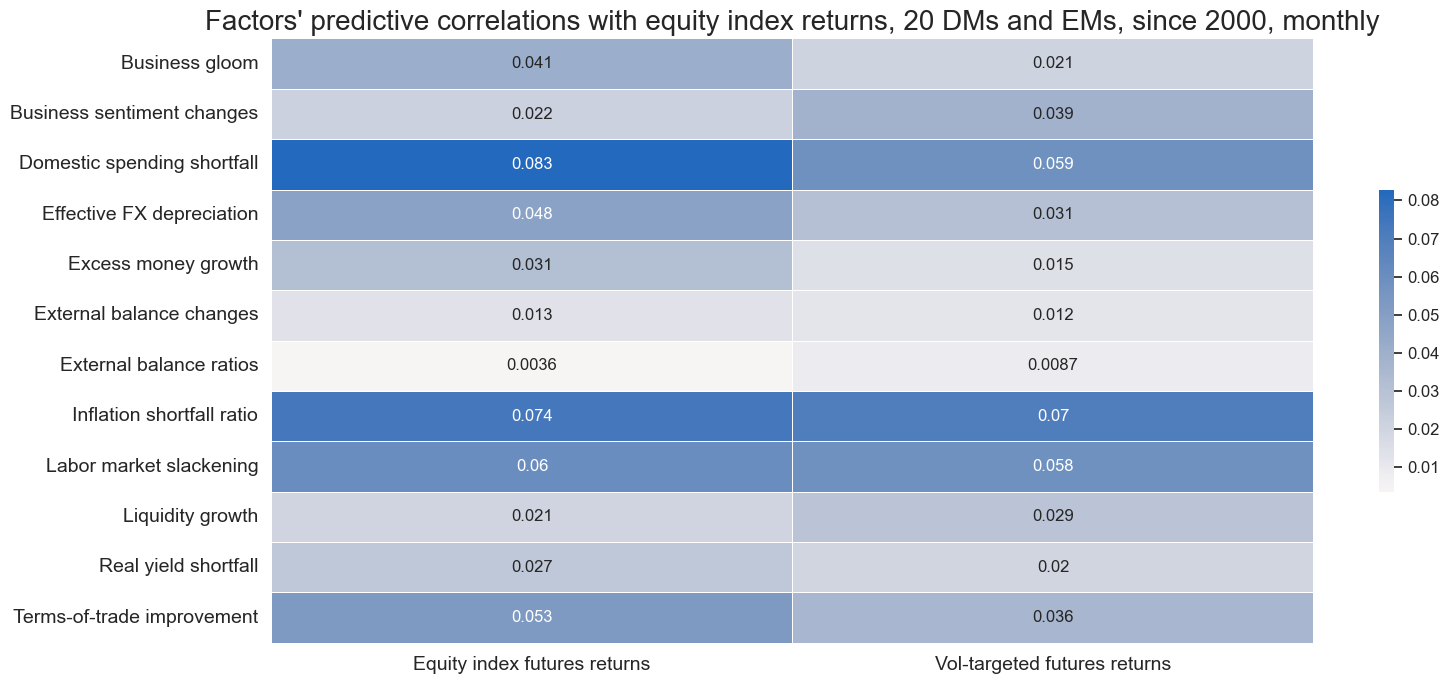

dict_rets = {

"EQXR_NSA": "Equity index futures returns",

"EQXR_VT10": "Vol-targeted futures returns",

}

rets = [k for k in list(dict_rets.keys())]

dict_lags = {f: 1 for f in factorz}

msp.correl_matrix(

dfx,

xcats=rets,

xcats_secondary=factorz,

cids=cids_eq,

freq="M",

title="Factors' predictive correlations with equity index returns, 20 DMs and EMs, since 2000, monthly",

start="2000-01-01",

annot=True,

xcat_labels=dict_rets,

lags_secondary=dict_lags,

xcat_secondary_labels=dict_facts,

size=(16, 7),

)

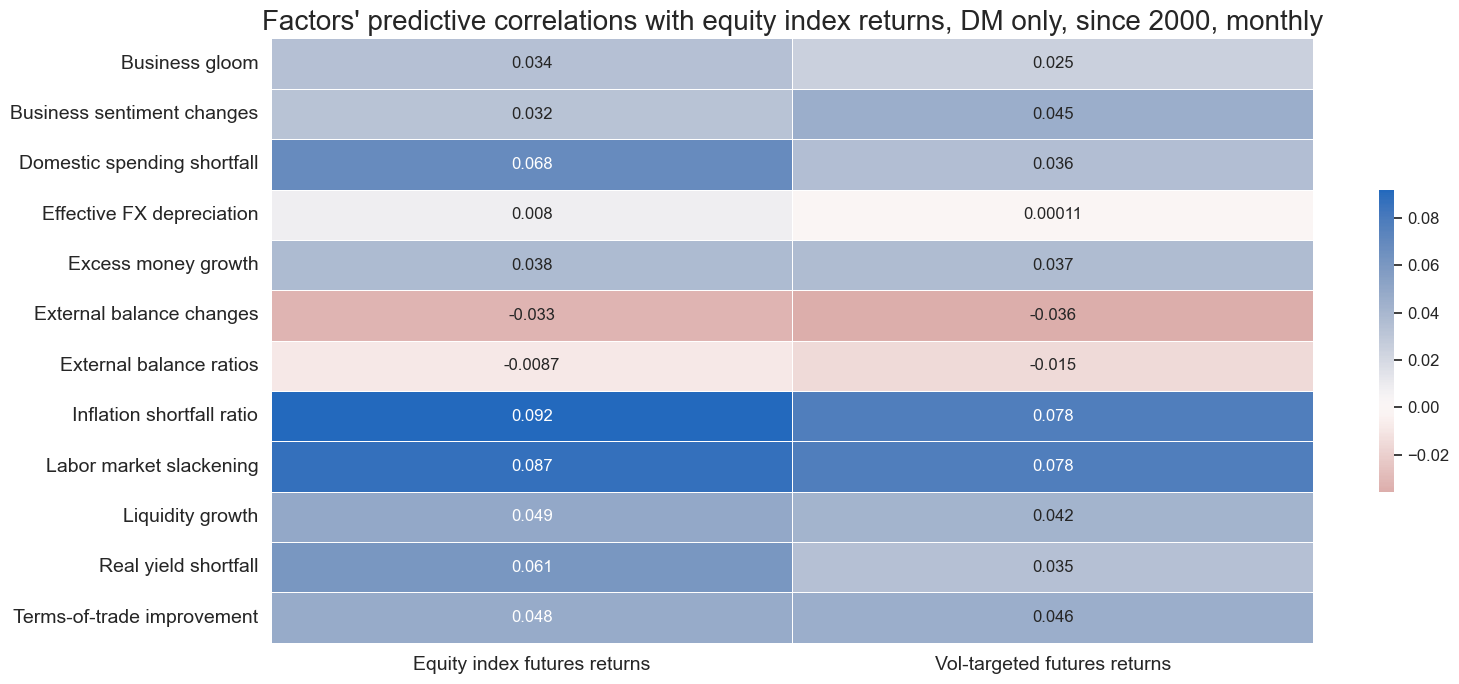

rets = [k for k in list(dict_rets.keys())]

dict_lags = {f: 1 for f in factorz}

msp.correl_matrix(

dfx,

xcats=rets,

xcats_secondary=factorz,

cids=cids_dmeq,

freq="M",

title="Factors' predictive correlations with equity index returns, DM only, since 2000, monthly",

start="2000-01-01",

annot=True,

xcat_labels=dict_rets,

lags_secondary=dict_lags,

xcat_secondary_labels=dict_facts,

size=(16, 7),

)

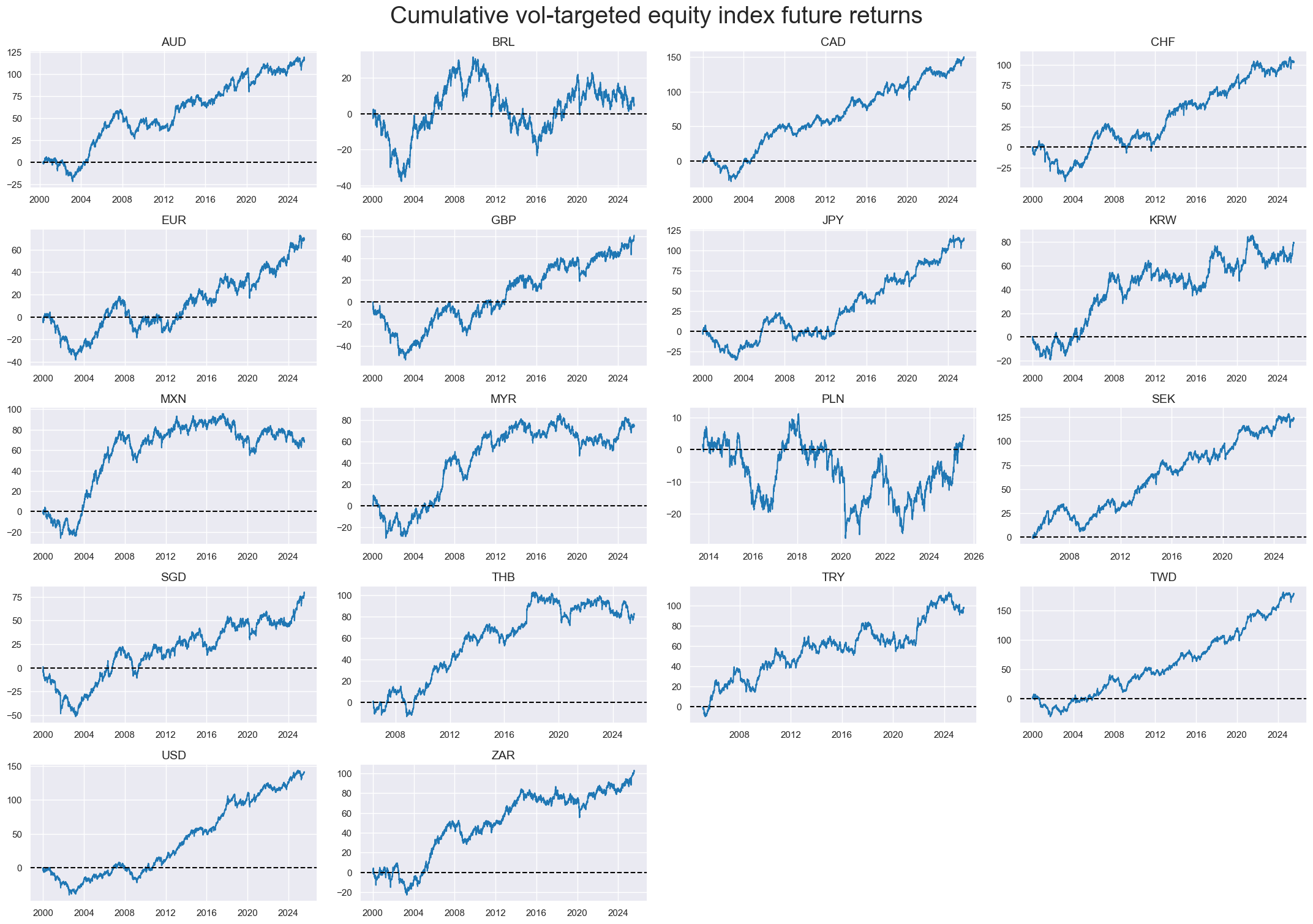

Target returns #

cidx = cids_eq

xcatx = ["EQXR_VT10"]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

cumsum=True,

ncol=4,

start="2000-01-01",

title_fontsize=28,

size=(10, 6),

aspect=1.8,

height=2,

same_y=False,

title="Cumulative vol-targeted equity index future returns",

all_xticks=True,

legend_fontsize=16,

)

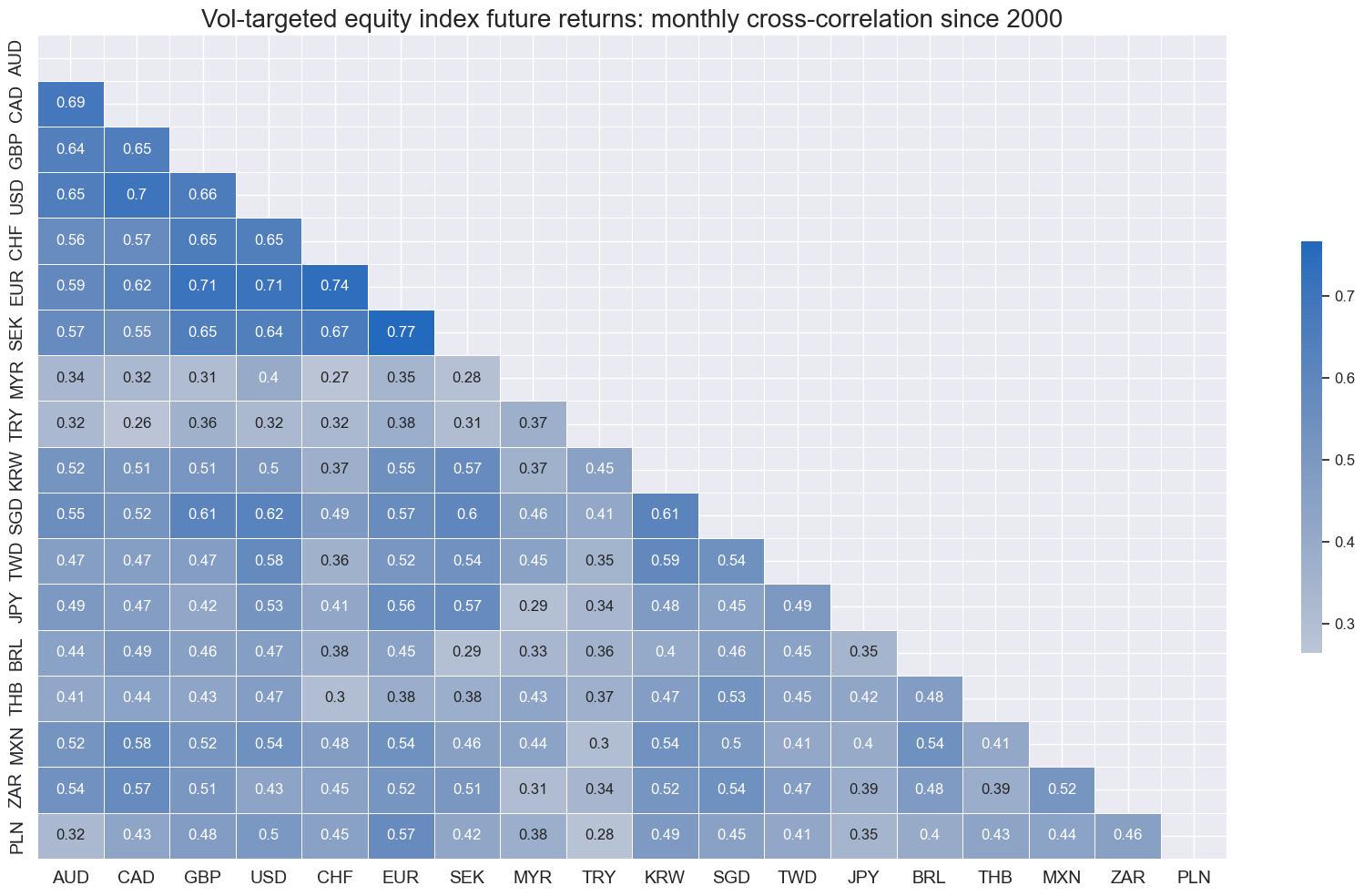

cidx = cids_eq

msp.correl_matrix(

dfx,

xcats="EQXR_VT10",

cids=cidx,

freq="M",

title="Vol-targeted equity index future returns: monthly cross-correlation since 2000",

size=(17, 10),

cluster=True,

annot=True

)

Signal generation with machine learning #

We use a weighted mean with the expanding 10-fold cross-validation splitter to deweight the influence of folds with worse availability.

availability_weights = np.array([i / 11 for i in range(1, 11)])

cv_weights = availability_weights / np.sum(availability_weights)

cv_weights

array([0.01818182, 0.03636364, 0.05454545, 0.07272727, 0.09090909,

0.10909091, 0.12727273, 0.14545455, 0.16363636, 0.18181818])

Pooled model #

start_name = "PooledRidge"

so = msl.SignalOptimizer(

df=dfx,

cids=cids_eq,

xcats=factorz + ["EQXR_VT10"],

xcat_aggs=["last", "sum"],

lag=1,

freq="M",

)

so.calculate_predictions(

name=start_name,

models={

start_name: Pipeline([

("scaler", msl.PanelStandardScaler(with_mean=False)),

("predictor", Ridge(positive=True)),

])

},

hyperparameters={

start_name: {

"predictor__alpha": [1, 10, 100, 1000, 10000],

"predictor__fit_intercept": [True, False],

},

},

scorers={

"RMSE": make_scorer(root_mean_squared_error, greater_is_better=False)

},

inner_splitters={

"Expanding": msl.ExpandingKFoldPanelSplit(n_splits=10),

},

cv_summary=lambda row: np.average(a = row, weights=cv_weights) if len(row) == len(cv_weights) else np.nanmean(row),

test_size=1,

min_periods = 48,

)

dfa = so.get_optimized_signals("PooledRidge")

dfx = msm.update_df(dfx, dfa)

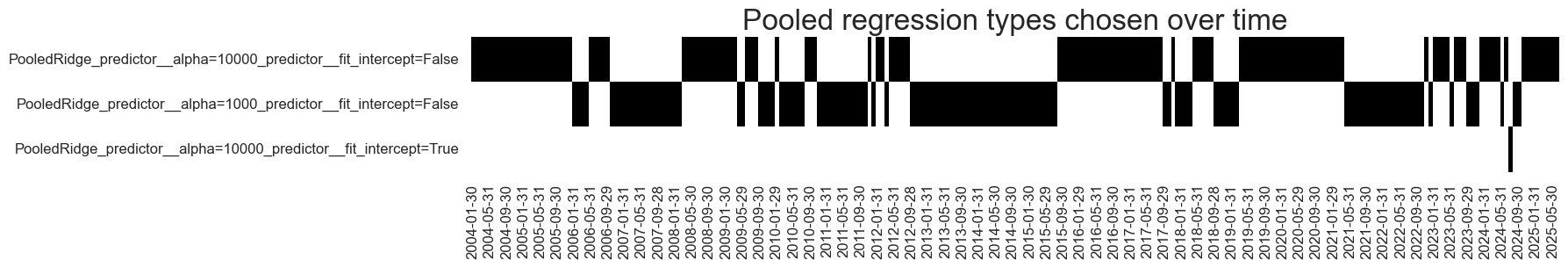

so.models_heatmap(

"PooledRidge",

title="Pooled regression types chosen over time",

title_fontsize=24,

figsize=(16, 2),

)

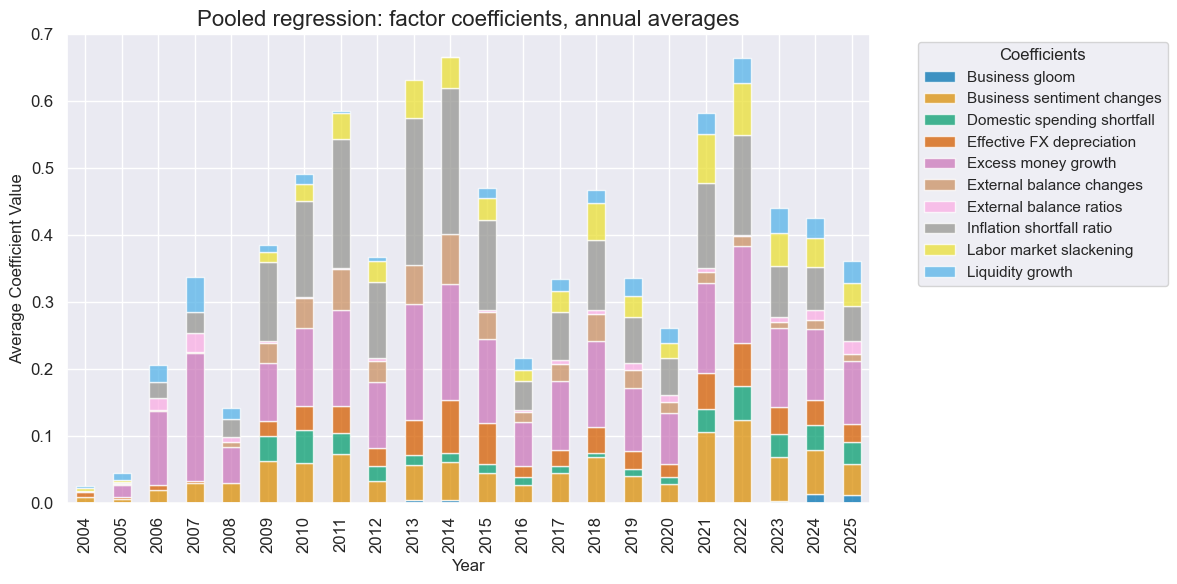

so.coefs_stackedbarplot(

"PooledRidge",

title="Pooled regression: factor coefficients, annual averages",

title_fontsize=16,

figsize=(12, 6),

ftrs_renamed=dict_facts

)

Country models #

strat_name = "CountryRidge"

so.calculate_predictions(

name=strat_name,

models={

strat_name: Pipeline([

("scaler", msl.PanelStandardScaler(with_mean=False)),

(

"predictor",

msl.CountryByCountryRegression(

estimator = Ridge(positive=True)

),

),

])

},

hyperparameters={

strat_name: {

"predictor__estimator__alpha": [1, 10, 100, 1000, 10000],

"predictor__estimator__fit_intercept": [True, False],

},

},

scorers={

"RMSE": make_scorer(root_mean_squared_error, greater_is_better=False)

},

inner_splitters={

"Expanding": msl.ExpandingKFoldPanelSplit(n_splits=10),

},

cv_summary=lambda row: np.average(a = row, weights=cv_weights) if len(row) == len(cv_weights) else np.nanmean(row),

test_size=1,

min_periods = 48

)

dfa = so.get_optimized_signals("CountryRidge")

dfx = msm.update_df(dfx, dfa)

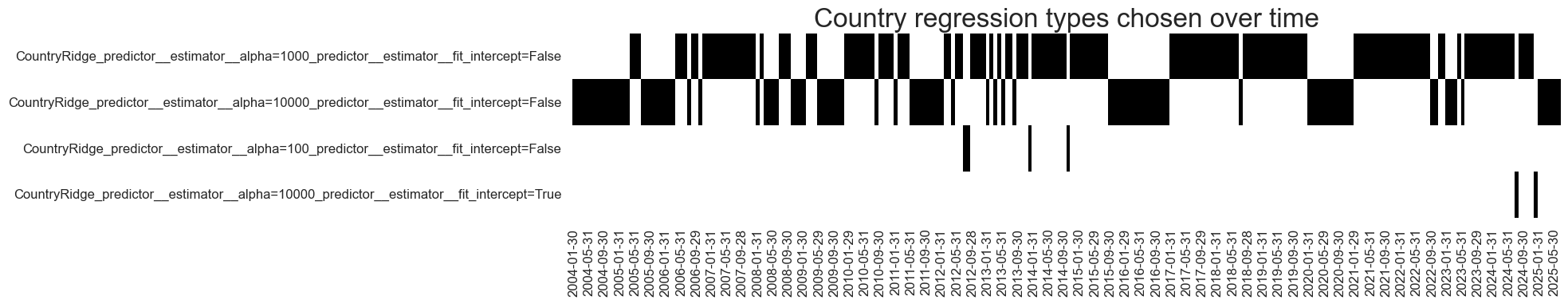

so.models_heatmap(

"CountryRidge",

title="Country regression types chosen over time",

title_fontsize=24,

figsize=(16, 3),

)

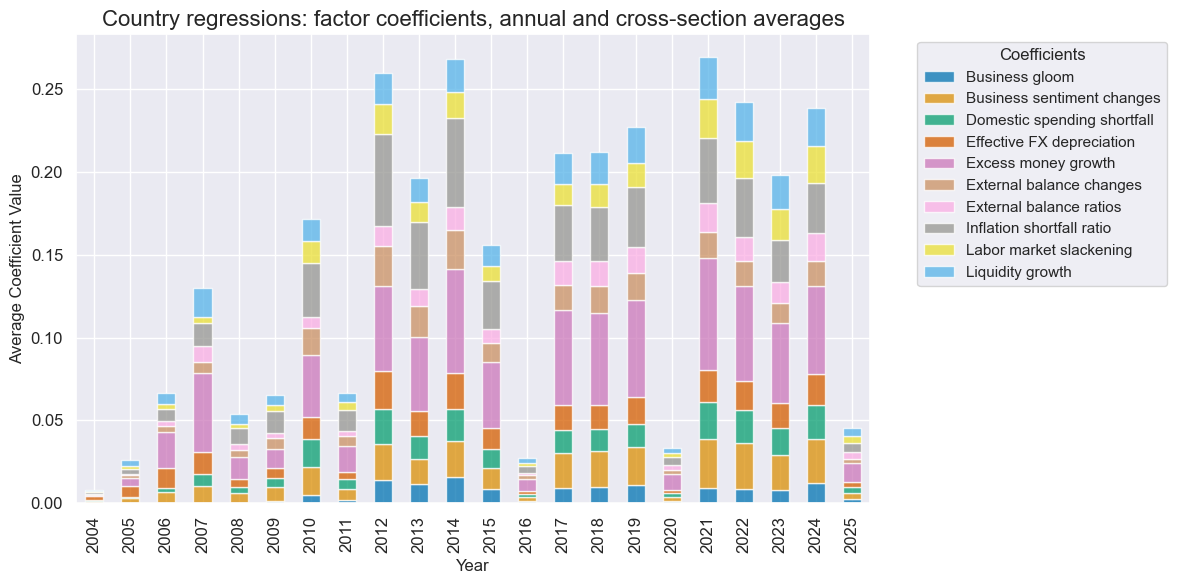

so.coefs_stackedbarplot(

"CountryRidge",

title="Country regressions: factor coefficients, annual and cross-section averages",

title_fontsize=16,

figsize=(12, 6),

ftrs_renamed=dict_facts

)

Global-local method #

strat_name = "GlobalLocal"

so.calculate_predictions(

name=strat_name,

models={

strat_name: Pipeline([

("scaler", msl.PanelStandardScaler(with_mean=False)),

("model", msl.GlobalLocalRegression(positive=True)),

]),

},

hyperparameters={

strat_name: {

"model__local_lambda": [1, 10, 100, 1000, 10000],

"model__global_lambda": [1, 10, 100, 1000, 10000],

"model__fit_intercept": [True, False],

},

},

scorers={

"RMSE": make_scorer(root_mean_squared_error, greater_is_better=False)

},

inner_splitters={

"Expanding": msl.ExpandingKFoldPanelSplit(n_splits=10),

},

cv_summary=lambda row: np.average(a = row, weights=cv_weights) if len(row) == len(cv_weights) else np.nanmean(row),

test_size=1,

min_periods = 48

)

dfa = so.get_optimized_signals(strat_name)

dfx = msm.update_df(dfx, dfa)

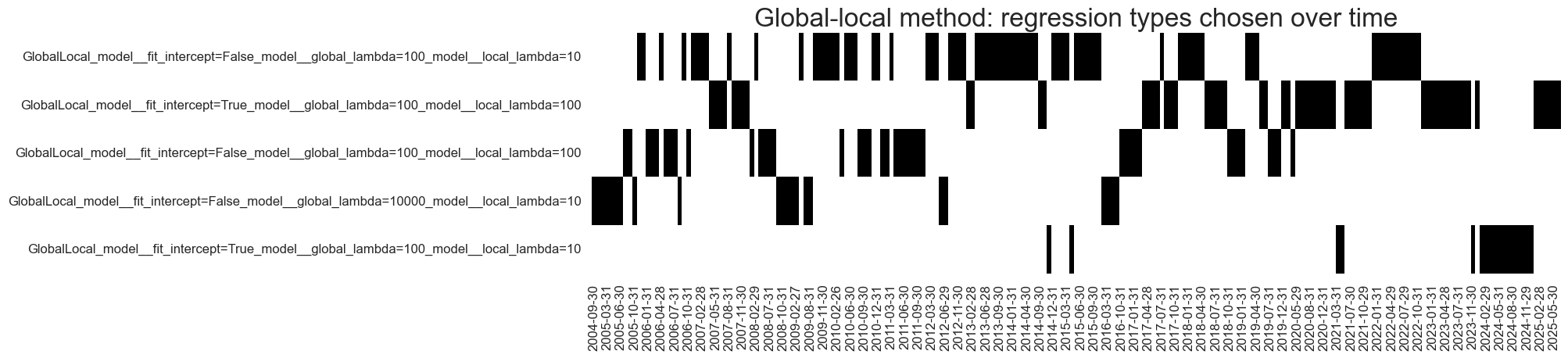

so.models_heatmap(

"GlobalLocal",

title="Global-local method: regression types chosen over time",

title_fontsize=24,

figsize=(16, 4),

)

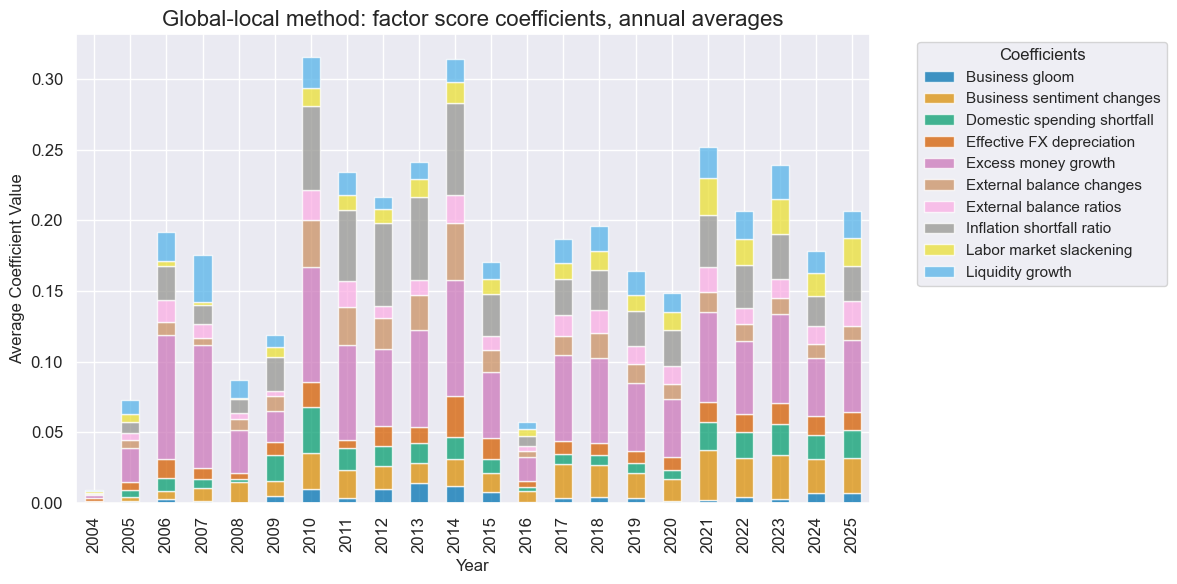

so.coefs_stackedbarplot(

"GlobalLocal",

title="Global-local method: factor score coefficients, annual averages",

title_fontsize=16,

figsize=(12, 6),

ftrs_renamed=dict_facts

)

Long-only signals #

xcatx = ["PooledRidge", "CountryRidge", "GlobalLocal"]

cidx = cids_eq

dfa = msp.panel_calculator(

df = dfx,

calcs = [

f"{xcat}_LO = np.clip( {xcat} , a_min=0, a_max=np.inf )"

for xcat in xcatx

],

cids= cidx

)

dfx = msm.update_df(dfx, dfa)

Value checks #

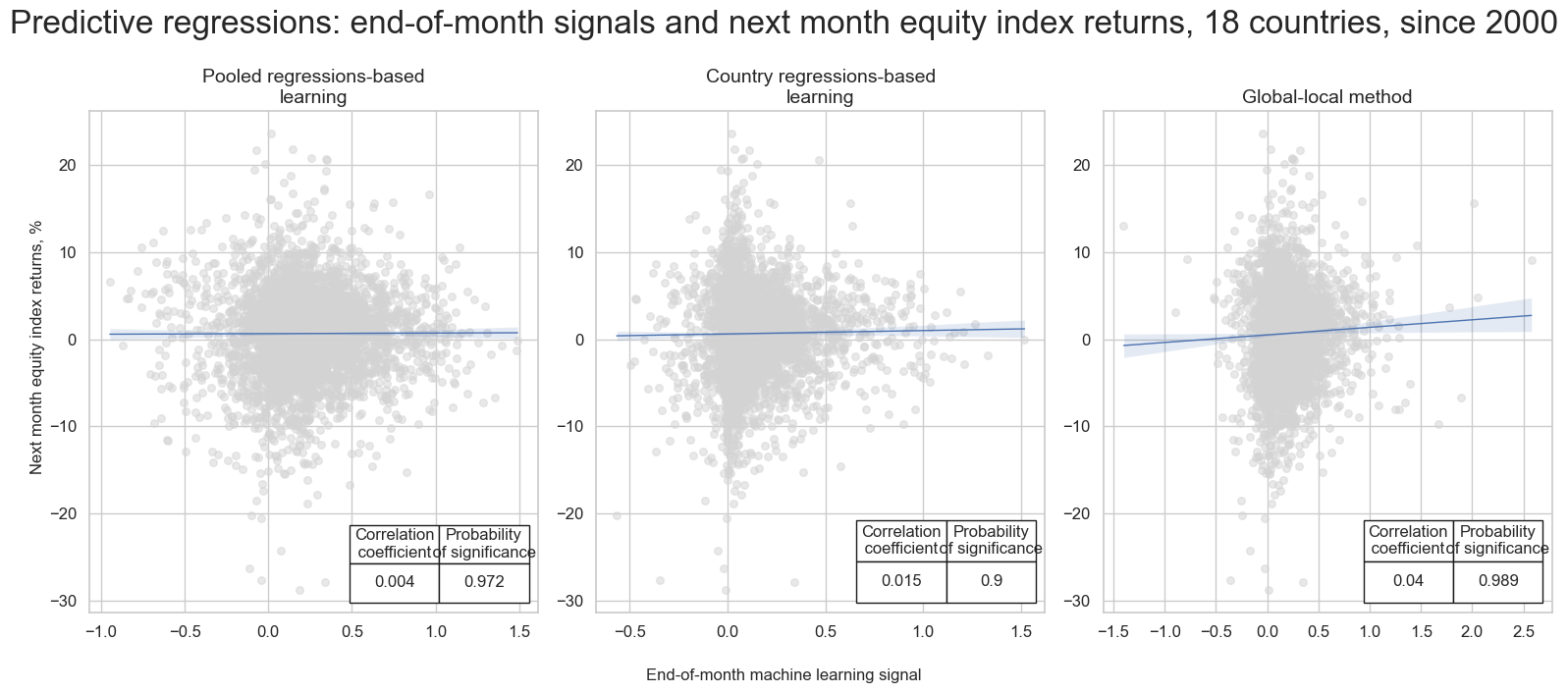

Panel test #

crs = []

xcatx = ["PooledRidge", "CountryRidge", "GlobalLocal"]

for xcat in xcatx:

crs.append(

msp.CategoryRelations(

df=dfx,

xcats=[xcat, "EQXR_NSA"],

cids=cids_eq,

freq="M",

lag=1,

xcat_aggs=["last", "sum"],

slip=0,

)

)

msv.multiple_reg_scatter(

cat_rels=crs,

ncol=3,

nrow=1,

title="Predictive regressions: end-of-month signals and next month equity index returns, 18 countries, since 2000",

title_fontsize=24,

xlab="End-of-month machine learning signal",

ylab="Next month equity index returns, %",

subplot_titles=[

"Pooled regressions-based learning",

"Country regressions-based learning",

"Global-local method",

],

prob_est="map",

coef_box="lower right",

share_axes=False,

figsize=(16, 7),

)

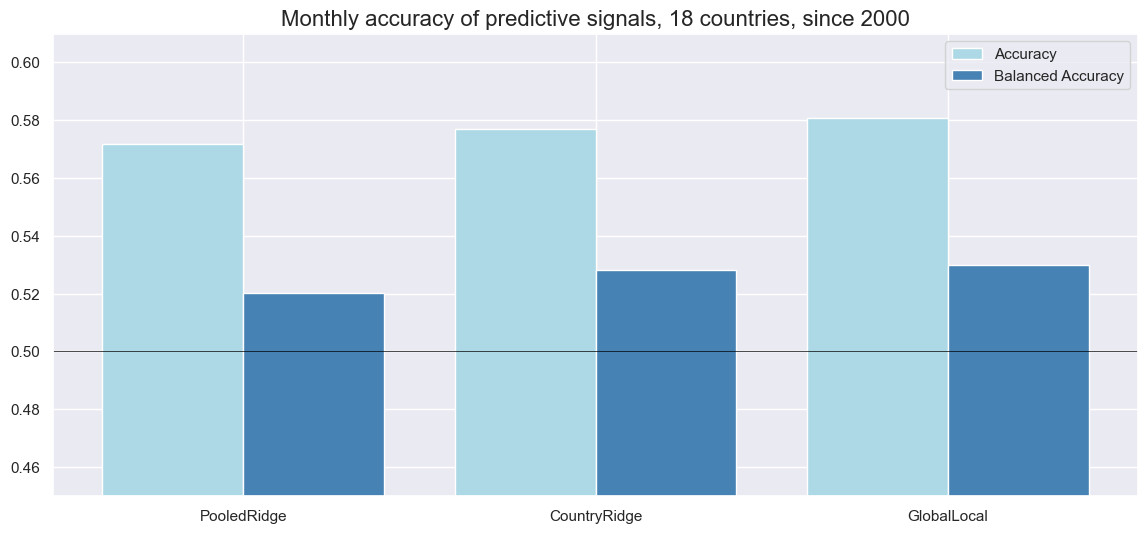

Accuracy and correlation check #

srr = mss.SignalReturnRelations(

df=dfx,

rets=["EQXR_NSA"],

sigs=["PooledRidge", "CountryRidge", "GlobalLocal"],

cids=cids_eq,

freqs="M",

slip=1,

cosp=True,

ms_panel_test=True,

)

display(srr.multiple_relations_table().round(3))

srr.accuracy_bars(

type="signals",

size=(14, 6),

title="Monthly accuracy of predictive signals, 18 countries, since 2000",

)

| accuracy | bal_accuracy | pos_sigr | pos_retr | pos_prec | neg_prec | pearson | pearson_pval | kendall | kendall_pval | auc | map_pval | ||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Return | Signal | Frequency | Aggregation | ||||||||||||

| EQXR_NSA | CountryRidge | M | last | 0.569 | 0.515 | 0.834 | 0.592 | 0.597 | 0.433 | 0.001 | 0.973 | -0.009 | 0.362 | 0.509 | 0.082 |

| GlobalLocal | M | last | 0.581 | 0.530 | 0.865 | 0.592 | 0.600 | 0.460 | 0.040 | 0.010 | 0.019 | 0.069 | 0.514 | 0.014 | |

| PooledRidge | M | last | 0.577 | 0.529 | 0.831 | 0.592 | 0.602 | 0.457 | 0.004 | 0.793 | 0.002 | 0.836 | 0.517 | 0.024 |

Naive PnL #

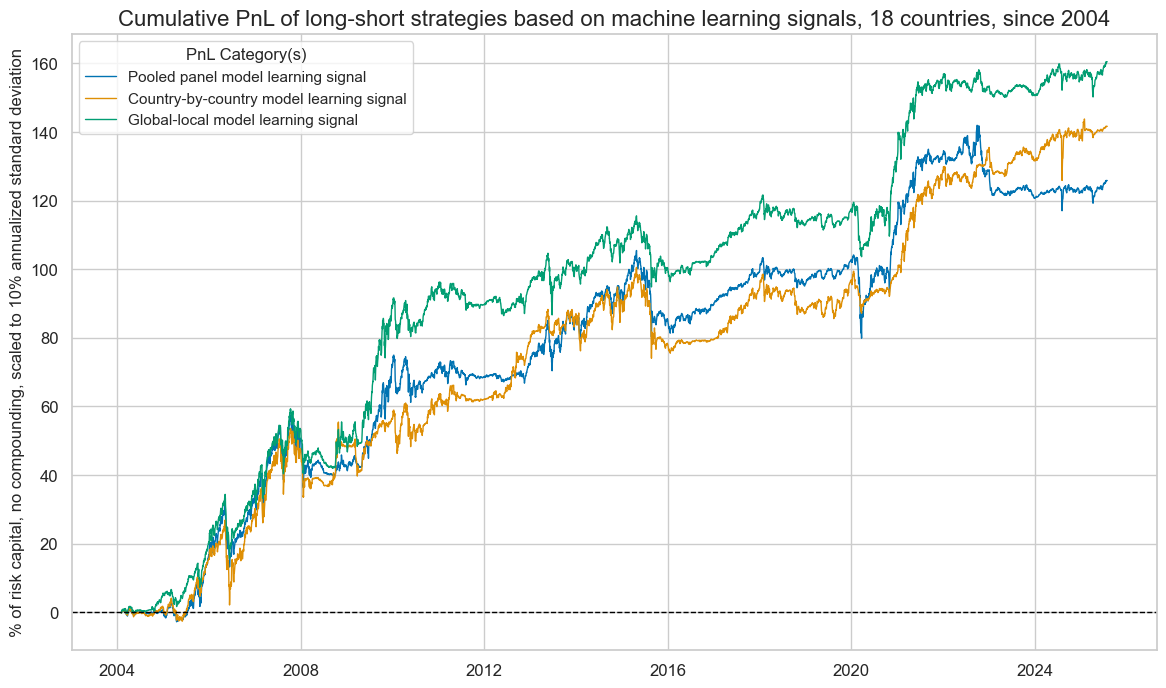

Directional strategy #

xcatx = ["PooledRidge", "CountryRidge", "GlobalLocal"]

pnl = msn.NaivePnL(

df=dfx,

ret="EQXR_NSA",

sigs=xcatx,

cids=cids_eq,

start="2004-01-30",

bms=["USD_EQXR_NSA"],

)

for xcat in xcatx:

pnl.make_pnl(

sig=xcat,

sig_op="zn_score_pan",

rebal_freq="monthly",

sig_add=0,

rebal_slip=1,

vol_scale=10,

neutral="zero",

thresh=3,

)

dict_pnl_labs = {

"PNL_PooledRidge": "Pooled panel model learning signal",

"PNL_CountryRidge": "Country-by-country model learning signal",

"PNL_GlobalLocal": "Global-local model learning signal",

}

pnl.plot_pnls(

title="Cumulative PnL of long-short strategies based on machine learning signals, 18 countries, since 2004",

title_fontsize=16,

figsize=(14, 8),

compounding=False,

ylab="% of risk capital, no compounding, scaled to 10% annualized standard deviation",

xcat_labels=dict_pnl_labs,

)

pnl.evaluate_pnls(

pnl_cats=pnl.pnl_names

)

| xcat | PNL_PooledRidge | PNL_CountryRidge | PNL_GlobalLocal |

|---|---|---|---|

| Return % | 5.853963 | 6.588654 | 7.463408 |

| St. Dev. % | 10.0 | 10.0 | 10.0 |

| Sharpe Ratio | 0.585396 | 0.658865 | 0.746341 |

| Sortino Ratio | 0.805781 | 0.903274 | 1.047545 |

| Max 21-Day Draw % | -22.427272 | -18.7349 | -15.916498 |

| Max 6-Month Draw % | -19.538216 | -21.011779 | -16.417859 |

| Peak to Trough Draw % | -25.544304 | -26.463751 | -20.715635 |

| Top 5% Monthly PnL Share | 0.698658 | 0.559353 | 0.582869 |

| USD_EQXR_NSA correl | 0.332875 | 0.265545 | 0.293153 |

| Traded Months | 259 | 259 | 259 |

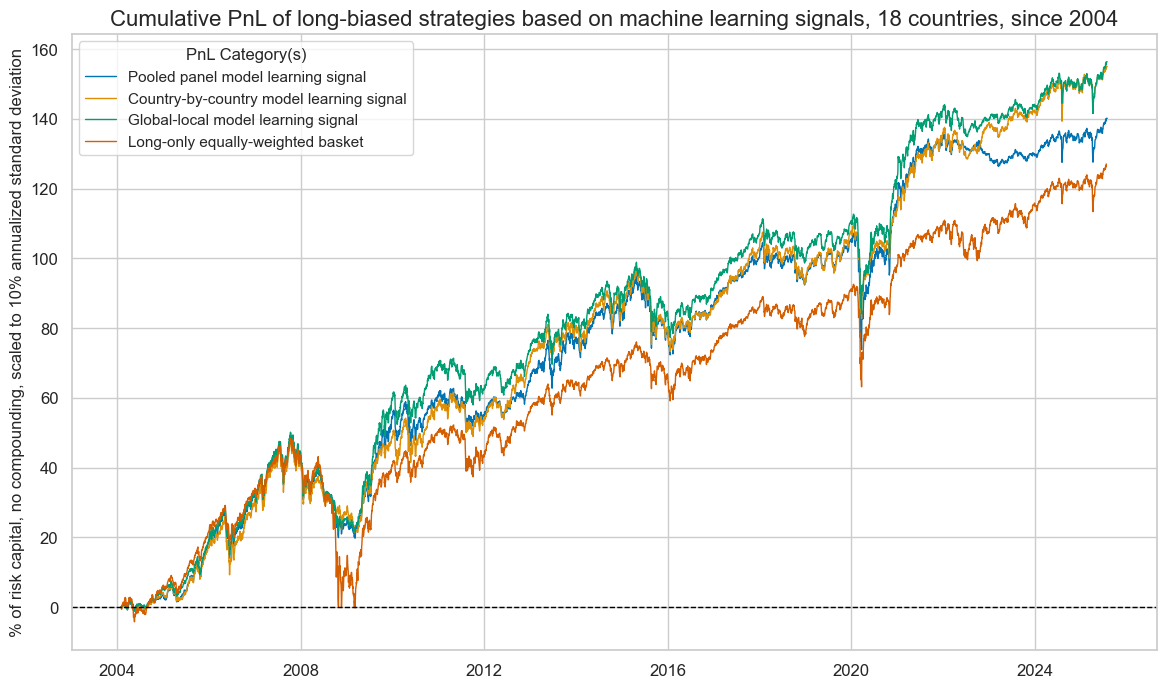

Long-biased directional strategy #

xcatx = ["PooledRidge", "CountryRidge", "GlobalLocal"]

pnl = msn.NaivePnL(

df=dfx,

ret="EQXR_NSA",

sigs=xcatx,

cids=cids_eq,

start="2004-01-30",

bms=["USD_EQXR_NSA"],

)

for xcat in xcatx:

pnl.make_pnl(

sig=xcat,

sig_op="zn_score_pan",

rebal_freq="monthly",

sig_add=1,

rebal_slip=1,

vol_scale=10,

neutral="zero",

thresh=3,

)

dict_pnl_labs = {

"PNL_PooledRidge": "Pooled panel model learning signal",

"PNL_CountryRidge": "Country-by-country model learning signal",

"PNL_GlobalLocal": "Global-local model learning signal",

"LONG": "Long-only equally-weighted basket",

}

pnl.make_long_pnl(vol_scale = 10, label = "LONG")

pnl.plot_pnls(

title="Cumulative PnL of long-biased strategies based on machine learning signals, 18 countries, since 2004",

title_fontsize=16,

figsize=(14, 8),

compounding=False,

ylab="% of risk capital, no compounding, scaled to 10% annualized standard deviation",

xcat_labels=dict_pnl_labs,

)

pnl.evaluate_pnls(

pnl_cats=pnl.pnl_names

)

| xcat | PNL_PooledRidge | PNL_CountryRidge | PNL_GlobalLocal | LONG |

|---|---|---|---|---|

| Return % | 6.520109 | 7.209107 | 7.274139 | 5.918028 |

| St. Dev. % | 10.0 | 10.0 | 10.0 | 10.0 |

| Sharpe Ratio | 0.652011 | 0.720911 | 0.727414 | 0.591803 |

| Sortino Ratio | 0.892398 | 0.988697 | 1.00595 | 0.812708 |

| Max 21-Day Draw % | -31.16346 | -23.755657 | -26.08395 | -27.600784 |

| Max 6-Month Draw % | -27.095839 | -18.927467 | -21.945427 | -40.987411 |

| Peak to Trough Draw % | -33.360623 | -27.427828 | -28.587861 | -48.514801 |

| Top 5% Monthly PnL Share | 0.580874 | 0.47671 | 0.538247 | 0.616752 |

| USD_EQXR_NSA correl | 0.560735 | 0.556759 | 0.566528 | 0.651844 |

| Traded Months | 259 | 259 | 259 | 259 |

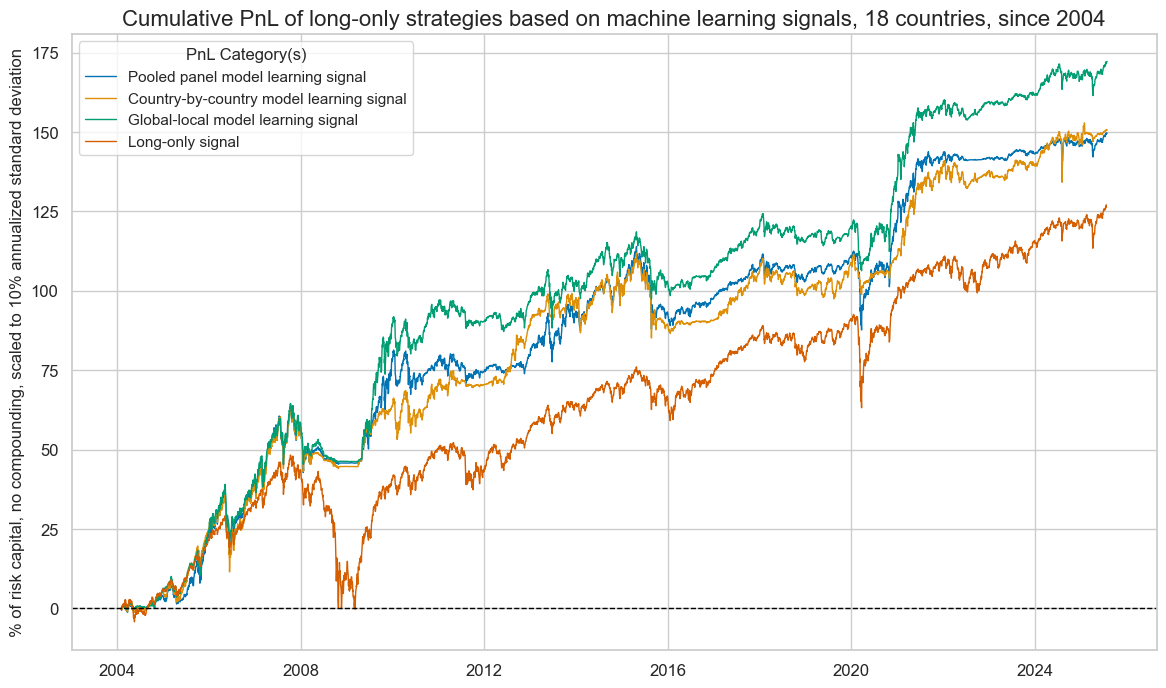

Long-only strategy #

xcatx = ["PooledRidge_LO", "CountryRidge_LO", "GlobalLocal_LO"]

pnl = msn.NaivePnL(

df=dfx,

ret="EQXR_NSA",

sigs=xcatx,

cids=cids_eq,

start="2004-01-30",

bms=["USD_EQXR_NSA"],

)

for xcat in xcatx:

pnl.make_pnl(

sig=xcat,

sig_op="zn_score_pan",

rebal_freq="monthly",

sig_add=0,

rebal_slip=1,

vol_scale=10,

neutral="zero",

thresh=3,

)

dict_pnl_labs = {

"PNL_PooledRidge_LO": "Pooled panel model learning signal",

"PNL_CountryRidge_LO": "Country-by-country model learning signal",

"PNL_GlobalLocal_LO": "Global-local model learning signal",

"LONG": "Long-only signal",

}

pnl.make_long_pnl(vol_scale = 10, label = "LONG")

pnl.plot_pnls(

title="Cumulative PnL of long-only strategies based on machine learning signals, 18 countries, since 2004",

title_fontsize=16,

figsize=(14, 8),

compounding=False,

ylab="% of risk capital, no compounding, scaled to 10% annualized standard deviation",

xcat_labels=dict_pnl_labs,

)

pnl.evaluate_pnls(

pnl_cats=pnl.pnl_names

)

| xcat | PNL_PooledRidge_LO | PNL_CountryRidge_LO | PNL_GlobalLocal_LO | LONG |

|---|---|---|---|---|

| Return % | 6.960735 | 7.007455 | 8.005576 | 5.918028 |

| St. Dev. % | 10.0 | 10.0 | 10.0 | 10.0 |

| Sharpe Ratio | 0.696074 | 0.700745 | 0.800558 | 0.591803 |

| Sortino Ratio | 0.961435 | 0.95619 | 1.123197 | 0.812708 |

| Max 21-Day Draw % | -22.962563 | -18.926469 | -16.246543 | -27.600784 |

| Max 6-Month Draw % | -20.178311 | -21.158479 | -16.791511 | -40.987411 |

| Peak to Trough Draw % | -26.284546 | -26.762323 | -21.183001 | -48.514801 |

| Top 5% Monthly PnL Share | 0.602707 | 0.514416 | 0.554037 | 0.616752 |

| USD_EQXR_NSA correl | 0.448868 | 0.388523 | 0.416048 | 0.651844 |

| Traded Months | 259 | 259 | 259 | 259 |