Macroeconomic cycles and asset class returns #

This notebook offers the necessary code to replicate the research findings discussed in Macrosynergy’s post “Macroeconomic cycles and asset class returns” . Its primary objective is to inspire readers to explore and conduct additional investigations while also providing a foundation for testing their own unique ideas.

Get packages and JPMaQS data #

This notebook primarily relies on the standard packages available in the Python data science stack. However, there is an additional package

macrosynergy

that is required for two purposes:

-

Downloading JPMaQS data: The

macrosynergypackage facilitates the retrieval of JPMaQS data, which is used in the notebook. -

For the analysis of quantamental data and value propositions: The

macrosynergypackage provides functionality for performing quick analyses of quantamental data and exploring value propositions.

For detailed information and a comprehensive understanding of the

macrosynergy

package and its functionalities, please refer to the

“Introduction to Macrosynergy package”

on the Macrosynergy Academy or visit the following link on

Kaggle

.

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

import seaborn as sns

import macrosynergy.management as msm

import macrosynergy.panel as msp

import macrosynergy.signal as mss

import macrosynergy.pnl as msn

from macrosynergy.download import JPMaQSDownload

from datetime import timedelta, date, datetime

from itertools import combinations

import warnings

import os

warnings.simplefilter("ignore")

The JPMaQS indicators we consider are downloaded using the J.P. Morgan Dataquery API interface within the

macrosynergy

package. This is done by specifying ticker strings, formed by appending an indicator category code

DB(JPMAQS,<cross_section>_<category>,<info>)

, where

value

giving the latest available values for the indicator

eop_lag

referring to days elapsed since the end of the observation period

mop_lag

referring to the number of days elapsed since the mean observation period

grade

denoting a grade of the observation, giving a metric of real time information quality.

After instantiating the

JPMaQSDownload

class within the

macrosynergy.download

module, one can use the

download(tickers,start_date,metrics)

method to easily download the necessary data, where

tickers

is an array of ticker strings,

start_date

is the first collection date to be considered and

metrics

is an array comprising the times series information to be downloaded. For more information see

here

.

To ensure reproducibility, only samples between January 2000 (inclusive) and May 2023 (exclusive) are considered.

# General cross-sections lists

cids_g3 = ["EUR", "JPY", "USD"] # DM large currency areas

cids_dmsc = ["AUD", "CAD", "CHF", "GBP", "NOK", "NZD", "SEK"] # DM small currency areas

cids_latm = ["BRL", "COP", "CLP", "MXN", "PEN"] # Latam

cids_emea = ["CZK", "HUF", "ILS", "PLN", "RON", "RUB", "TRY", "ZAR"] # EMEA

cids_emas = ["IDR", "INR", "KRW", "MYR", "PHP", "SGD", "THB", "TWD"] # EM Asia ex China

cids_dm = cids_g3 + cids_dmsc

cids_em = cids_latm + cids_emea + cids_emas

cids = cids_dm + cids_em

cids_nomp = ["COP", "IDR", "INR"] # countries that have no employment growth data

cids_mp = list(set(cids) - set(cids_nomp))

# Equity cross-sections lists

cids_dmeq = ["EUR", "JPY", "USD"] + ["AUD", "CAD", "CHF", "GBP", "SEK"]

cids_emeq = ["BRL", "INR", "KRW", "MXN", "MYR", "SGD", "THB", "TRY", "TWD", "ZAR"]

cids_eq = cids_dmeq + cids_emeq

# FX cross-sections lists

cids_nofx = ["EUR", "USD", "SGD"]

cids_fx = list(set(cids) - set(cids_nofx))

cids_dmfx = set(cids_dm).intersection(cids_fx)

cids_emfx = set(cids_em).intersection(cids_fx)

cids_eur = ["CHF", "CZK", "HUF", "NOK", "PLN", "RON", "SEK"] # trading against EUR

cids_eud = ["GBP", "RUB", "TRY"] # trading against EUR and USD

cids_usd = list(set(cids_fx) - set(cids_eur + cids_eud)) # trading against USD

# IRS cross-section lists

cids_dmsc_du = ["AUD", "CAD", "CHF", "GBP", "NOK", "NZD", "SEK"]

cids_latm_du = ["CLP", "COP", "MXN"] # Latam

cids_emea_du = [

"CZK",

"HUF",

"ILS",

"PLN",

"RON",

"RUB",

"TRY",

"ZAR",

] # EMEA

cids_emas_du = ["CNY", "HKD", "IDR", "INR", "KRW", "MYR", "SGD", "THB", "TWD"]

cids_dmdu = cids_g3 + cids_dmsc_du

cids_emdu = cids_latm_du + cids_emea_du + cids_emas_du

cids_du = cids_dmdu + cids_emdu

JPMaQS indicators are conveniently grouped into 6 main categories: Economic Trends, Macroeconomic balance sheets, Financial conditions, Shocks and risk measures, Stylyzed trading factors, and Generic returns. Each indicator has a separate page with notes, description, availability, statistical measures, and timelines for main currencies. The description of each JPMaQS category is available either under Macro Quantamental Academy , JPMorgan Markets (password protected). In particular, the indicators used in this notebook could be found under Labor market dynamics , Demographic trends , Consumer price inflation trends , Intuitive growth estimates , Long-term GDP growth , Private credit expansion , Equity index future returns , FX forward returns , and Duration returns .

# Category tickers

main = [

"EMPL_NSA_P1M1ML12_3MMA",

"EMPL_NSA_P1Q1QL4",

"WFORCE_NSA_P1Y1YL1_5YMM",

"WFORCE_NSA_P1Q1QL4_20QMM",

"UNEMPLRATE_NSA_3MMA_D1M1ML12",

"UNEMPLRATE_NSA_D1Q1QL4",

"UNEMPLRATE_SA_D1Q1QL4", # potentially NZD only

"UNEMPLRATE_SA_D3M3ML3",

"UNEMPLRATE_SA_D1Q1QL1",

"UNEMPLRATE_SA_3MMA",

"UNEMPLRATE_SA_3MMAv10YMM",

"CPIH_SA_P1M1ML12",

"CPIH_SJA_P6M6ML6AR",

"CPIC_SA_P1M1ML12",

"CPIC_SJA_P6M6ML6AR",

"INFTEFF_NSA",

"INTRGDPv5Y_NSA_P1M1ML12_3MMA",

"RGDP_SA_P1Q1QL4_20QMM",

"PCREDITBN_SJA_P1M1ML12",

]

xtra = ["GB10YXR_NSA"]

rets = [

"EQXR_NSA",

"EQXR_VT10",

"FXTARGETED_NSA",

"FXUNTRADABLE_NSA",

"FXXR_NSA",

"FXXR_VT10",

"FXXRHvGDRB_NSA",

"DU02YXR_NSA",

"DU02YXR_VT10",

"DU05YXR_VT10",

]

xcats = main + rets + xtra

# Download series from J.P. Morgan DataQuery by tickers

start_date = "2000-01-01"

end_date = "2023-05-01"

tickers = [cid + "_" + xcat for cid in cids for xcat in xcats]

print(f"Maximum number of tickers is {len(tickers)}")

# Retrieve credentials

client_id: str = os.getenv("DQ_CLIENT_ID")

client_secret: str = os.getenv("DQ_CLIENT_SECRET")

with JPMaQSDownload(client_id=client_id, client_secret=client_secret) as dq:

df = dq.download(

tickers=tickers,

start_date=start_date,

suppress_warning=True,

metrics=["value"],

report_time_taken=True,

show_progress=True,

)

Maximum number of tickers is 930

Downloading data from JPMaQS.

Timestamp UTC: 2024-11-19 09:42:46

Connection successful!

Requesting data: 100%|██████████| 47/47 [00:09<00:00, 4.84it/s]

Downloading data: 100%|██████████| 47/47 [00:11<00:00, 4.21it/s]

Time taken to download data: 22.68 seconds.

Some expressions are missing from the downloaded data. Check logger output for complete list.

229 out of 930 expressions are missing. To download the catalogue of all available expressions and filter the unavailable expressions, set `get_catalogue=True` in the call to `JPMaQSDownload.download()`.

Some dates are missing from the downloaded data.

3 out of 6494 dates are missing.

display(df["xcat"].unique())

display(df["cid"].unique())

df["ticker"] = df["cid"] + "_" + df["xcat"]

df.head(3)

array(['FXTARGETED_NSA', 'FXXRHvGDRB_NSA', 'DU02YXR_NSA', 'DU02YXR_VT10',

'CPIH_SJA_P6M6ML6AR', 'CPIC_SJA_P6M6ML6AR',

'WFORCE_NSA_P1Y1YL1_5YMM', 'INTRGDPv5Y_NSA_P1M1ML12_3MMA',

'EQXR_VT10', 'DU05YXR_VT10', 'FXUNTRADABLE_NSA', 'FXXR_VT10',

'INFTEFF_NSA', 'FXXR_NSA', 'PCREDITBN_SJA_P1M1ML12',

'RGDP_SA_P1Q1QL4_20QMM', 'EQXR_NSA', 'CPIH_SA_P1M1ML12',

'CPIC_SA_P1M1ML12', 'UNEMPLRATE_SA_3MMAv10YMM',

'UNEMPLRATE_SA_D1Q1QL1', 'EMPL_NSA_P1Q1QL4', 'UNEMPLRATE_SA_3MMA',

'UNEMPLRATE_NSA_D1Q1QL4', 'EMPL_NSA_P1M1ML12_3MMA',

'UNEMPLRATE_NSA_3MMA_D1M1ML12', 'UNEMPLRATE_SA_D3M3ML3',

'GB10YXR_NSA', 'WFORCE_NSA_P1Q1QL4_20QMM'], dtype=object)

array(['INR', 'PHP', 'HUF', 'KRW', 'THB', 'NZD', 'SGD', 'CHF', 'GBP',

'MXN', 'ZAR', 'TRY', 'COP', 'RON', 'SEK', 'ILS', 'CLP', 'EUR',

'AUD', 'JPY', 'USD', 'CAD', 'CZK', 'NOK', 'PLN', 'MYR', 'PEN',

'IDR', 'TWD', 'RUB', 'BRL'], dtype=object)

| real_date | cid | xcat | value | ticker | |

|---|---|---|---|---|---|

| 0 | 2000-01-03 | INR | FXTARGETED_NSA | 1.0 | INR_FXTARGETED_NSA |

| 1 | 2000-01-04 | INR | FXTARGETED_NSA | 1.0 | INR_FXTARGETED_NSA |

| 2 | 2000-01-05 | INR | FXTARGETED_NSA | 1.0 | INR_FXTARGETED_NSA |

scols = ["cid", "xcat", "real_date", "value"] # required columns

dfx = df[scols].copy()

dfx.info()

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 4302461 entries, 0 to 4302460

Data columns (total 4 columns):

# Column Dtype

--- ------ -----

0 cid object

1 xcat object

2 real_date datetime64[ns]

3 value float64

dtypes: datetime64[ns](1), float64(1), object(2)

memory usage: 131.3+ MB

Blacklist dictionaries #

Identifying and isolating periods of official exchange rate targets, illiquidity, or convertibility-related distortions in FX markets is the first step in creating an FX trading strategy. These periods can significantly impact the behavior and dynamics of currency markets, and failing to account for them can lead to inaccurate or misleading findings.

dfb = df[df["xcat"].isin(["FXTARGETED_NSA", "FXUNTRADABLE_NSA"])].loc[

:, ["cid", "xcat", "real_date", "value"]

]

dfba = (

dfb.groupby(["cid", "real_date"])

.aggregate(value=pd.NamedAgg(column="value", aggfunc="max"))

.reset_index()

)

dfba["xcat"] = "FXBLACK"

fxblack = msp.make_blacklist(dfba, "FXBLACK")

fxblack

{'BRL': (Timestamp('2012-12-03 00:00:00'), Timestamp('2013-09-30 00:00:00')),

'CHF': (Timestamp('2011-10-03 00:00:00'), Timestamp('2015-01-30 00:00:00')),

'CZK': (Timestamp('2014-01-01 00:00:00'), Timestamp('2017-07-31 00:00:00')),

'ILS': (Timestamp('2000-01-03 00:00:00'), Timestamp('2005-12-30 00:00:00')),

'INR': (Timestamp('2000-01-03 00:00:00'), Timestamp('2004-12-31 00:00:00')),

'MYR_1': (Timestamp('2000-01-03 00:00:00'), Timestamp('2007-11-30 00:00:00')),

'MYR_2': (Timestamp('2018-07-02 00:00:00'), Timestamp('2024-11-18 00:00:00')),

'PEN': (Timestamp('2021-07-01 00:00:00'), Timestamp('2021-07-30 00:00:00')),

'RON': (Timestamp('2000-01-03 00:00:00'), Timestamp('2005-11-30 00:00:00')),

'RUB_1': (Timestamp('2000-01-03 00:00:00'), Timestamp('2005-11-30 00:00:00')),

'RUB_2': (Timestamp('2022-02-01 00:00:00'), Timestamp('2024-11-18 00:00:00')),

'SGD': (Timestamp('2000-01-03 00:00:00'), Timestamp('2024-11-18 00:00:00')),

'THB': (Timestamp('2007-01-01 00:00:00'), Timestamp('2008-11-28 00:00:00')),

'TRY_1': (Timestamp('2000-01-03 00:00:00'), Timestamp('2003-09-30 00:00:00')),

'TRY_2': (Timestamp('2020-01-01 00:00:00'), Timestamp('2024-07-31 00:00:00'))}

dublack = {

"TRY": fxblack["TRY_2"]

} # create a customized blacklist for TRY to be used later in the code

Availability #

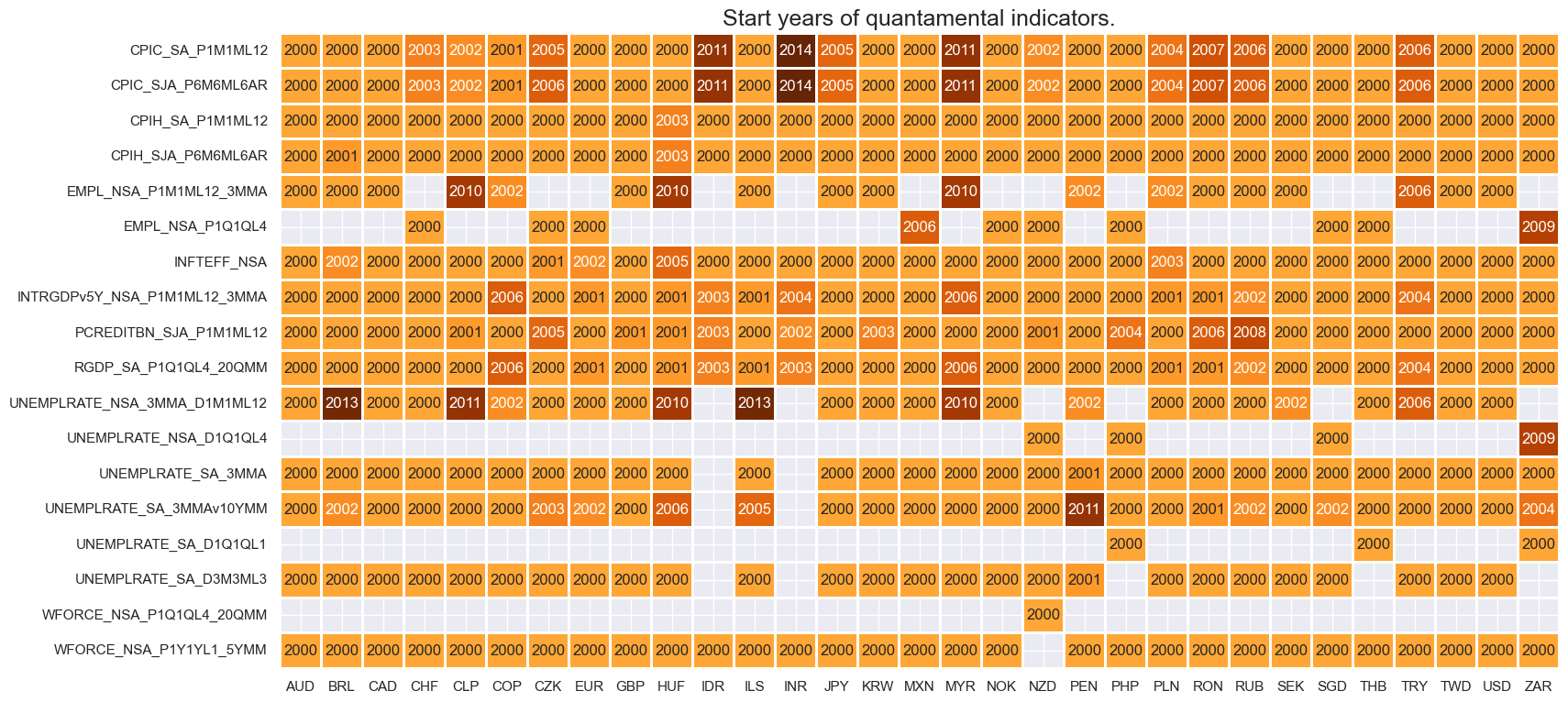

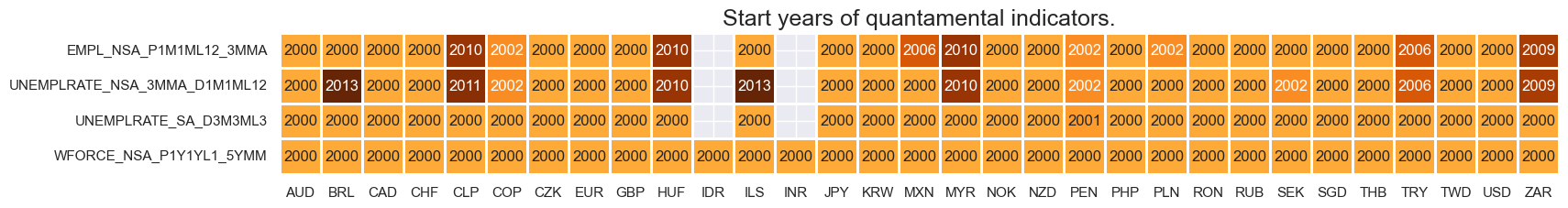

It is important to assess data availability before conducting any analysis. It allows to identify any potential gaps or limitations in the dataset, which can impact the validity and reliability of analysis and ensure that a sufficient number of observations for each selected category and cross-section is available as well as determining the appropriate time periods for analysis.

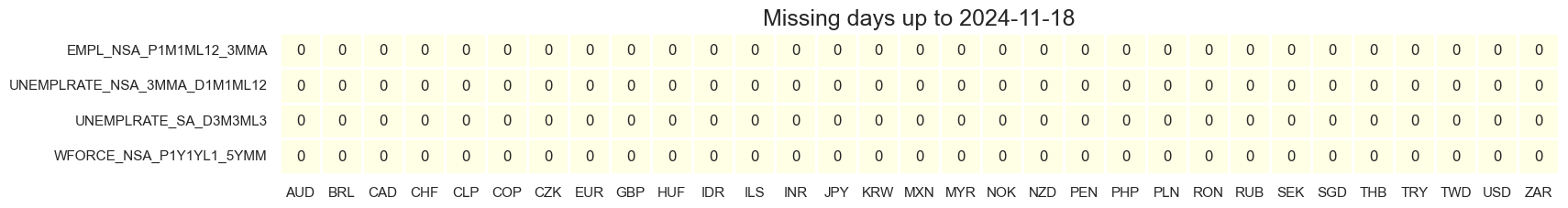

msm.check_availability(df, xcats=main, cids=cids)

Transformations and checks #

Features #

Name replacements #

dict_repl = {

"EMPL_NSA_P1Q1QL4": "EMPL_NSA_P1M1ML12_3MMA",

"WFORCE_NSA_P1Q1QL4_20QMM": "WFORCE_NSA_P1Y1YL1_5YMM",

"UNEMPLRATE_NSA_D1Q1QL4": "UNEMPLRATE_NSA_3MMA_D1M1ML12",

"UNEMPLRATE_SA_D1Q1QL1": "UNEMPLRATE_SA_D3M3ML3",

}

for key, value in dict_repl.items():

dfx["xcat"] = dfx["xcat"].str.replace(key, value)

msm.check_availability(dfx, xcats=list(dict_repl.values()), cids=cids)

Labor market scores #

Excess employment growth #

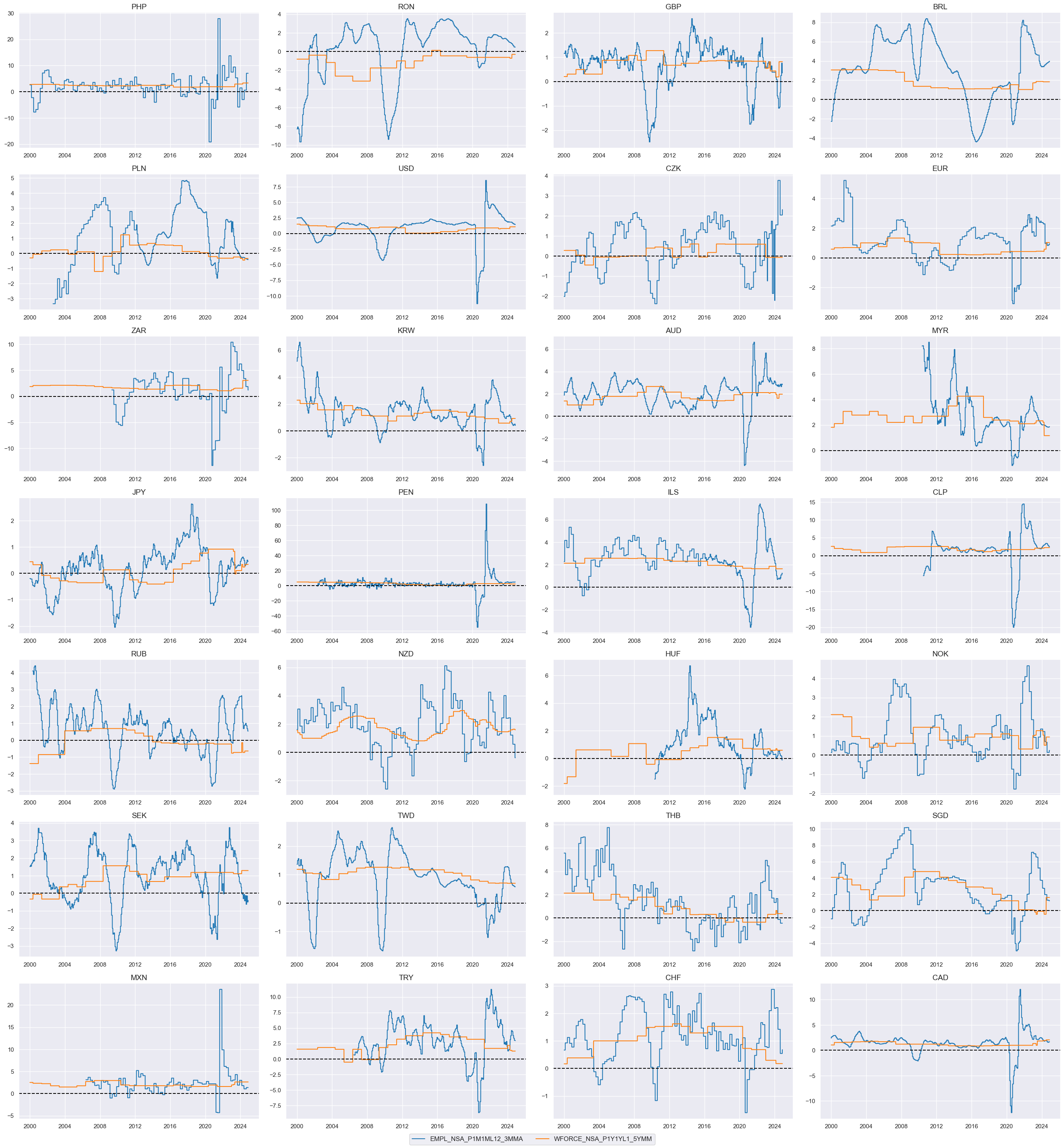

To proxy the impact of the business cycle state on employment growth, a common approach is to calculate the difference between employment growth and the long-term median of workforce growth. This difference is often referred to as “excess employment growth.” By calculating excess employment growth, one can estimate the component of employment growth that is attributable to the business cycle state. This measure helps to identify deviations from the long-term trend and provides insights into the cyclical nature of employment dynamics.

calcs = ["XEMPL_NSA_P1M1ML12_3MMA = EMPL_NSA_P1M1ML12_3MMA - WFORCE_NSA_P1Y1YL1_5YMM "]

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cids, blacklist=None)

dfx = msm.update_df(dfx, dfa)

The

macrosynergy

package provides two useful functions,

view_ranges()

and

view_timelines()

, which facilitate the convenient visualization of data for selected indicators and cross-sections. These functions assist in plotting means, standard deviations, and time series of the chosen indicators.

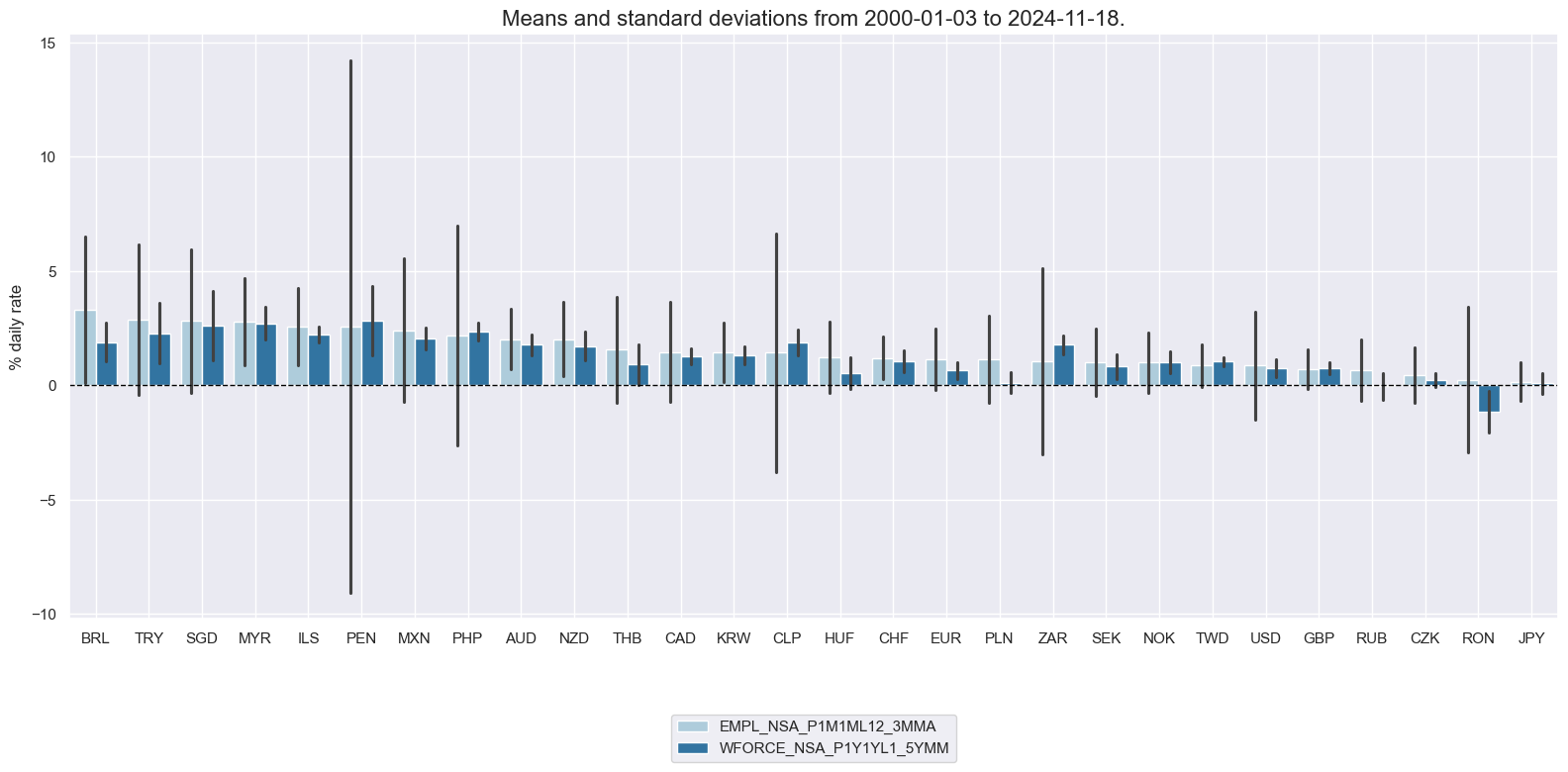

xcatx = ["EMPL_NSA_P1M1ML12_3MMA", "WFORCE_NSA_P1Y1YL1_5YMM"]

cidx = cids_mp

msp.view_ranges(

dfx,

cids=cidx,

xcats=xcatx,

kind="bar",

sort_cids_by="mean",

ylab="% daily rate",

start="2000-01-01",

)

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

cumsum=False,

start="2000-01-01",

same_y=False,

size=(12, 12),

all_xticks=True,

)

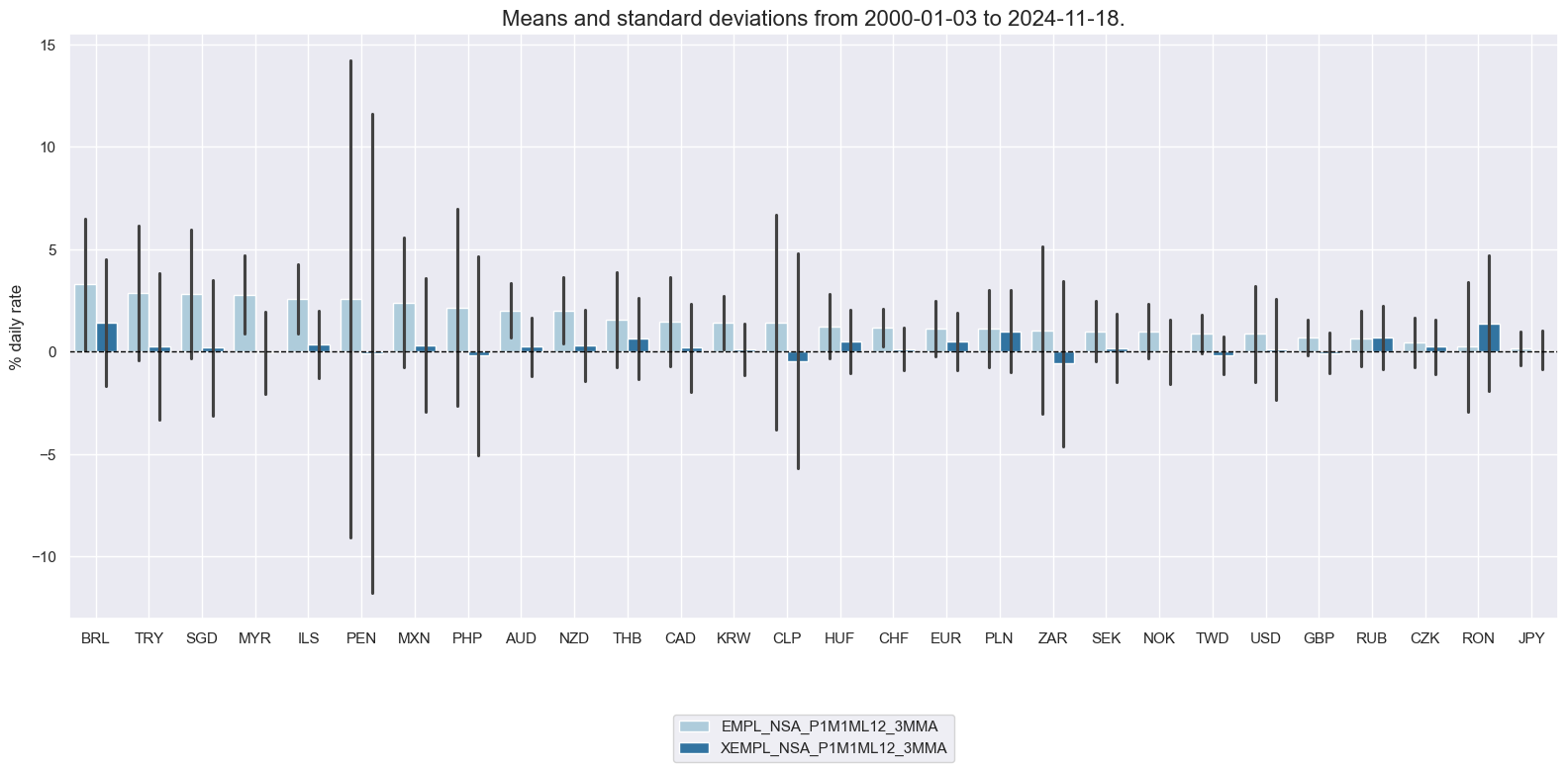

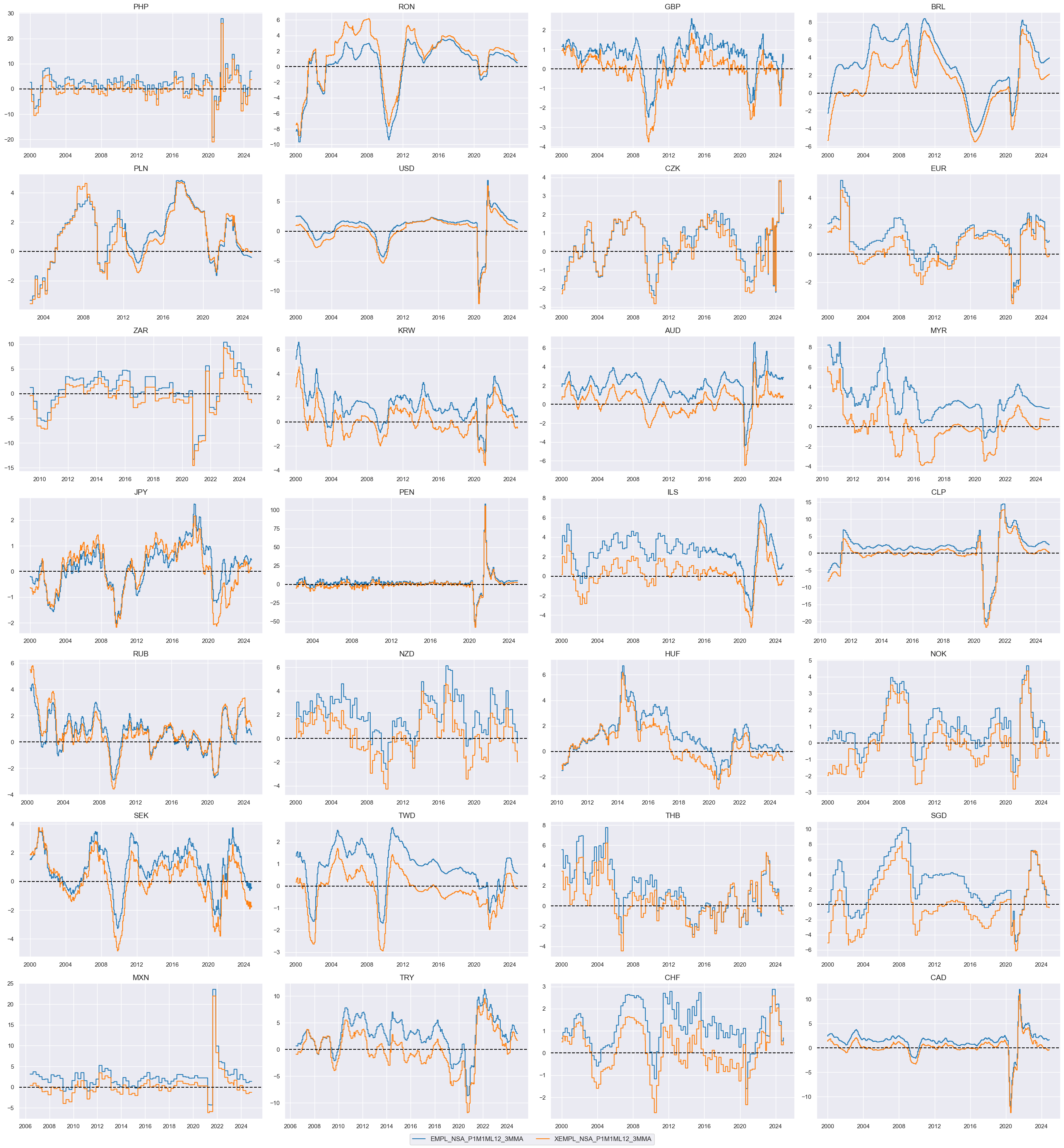

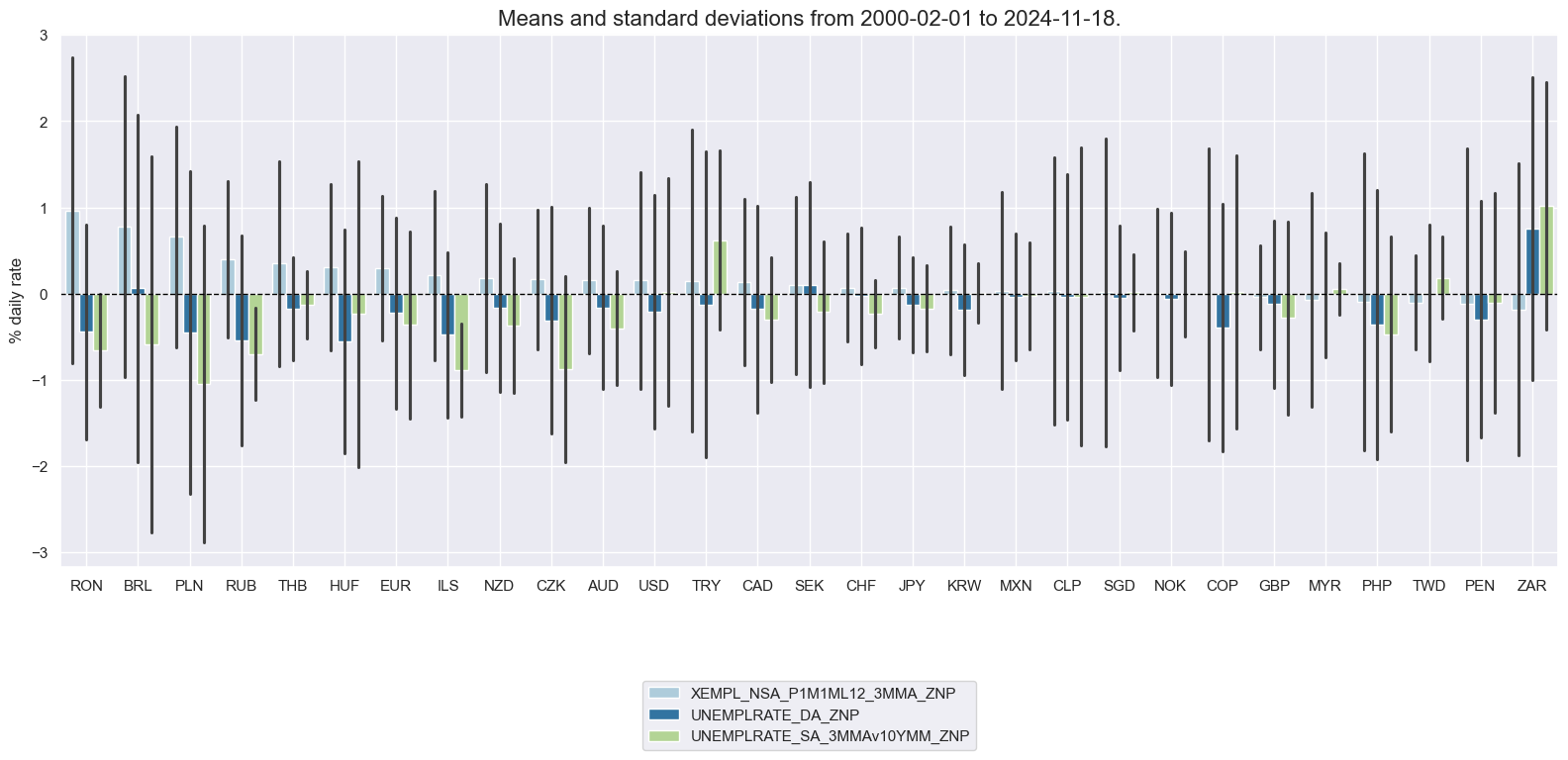

xcatx = ["EMPL_NSA_P1M1ML12_3MMA", "XEMPL_NSA_P1M1ML12_3MMA"]

cidx = cids_mp

msp.view_ranges(

dfx,

cids=cidx,

xcats=xcatx,

kind="bar",

sort_cids_by="mean",

ylab="% daily rate",

start="2000-01-01",

)

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

cumsum=False,

start="2000-01-01",

same_y=False,

size=(12, 12),

all_xticks=True,

)

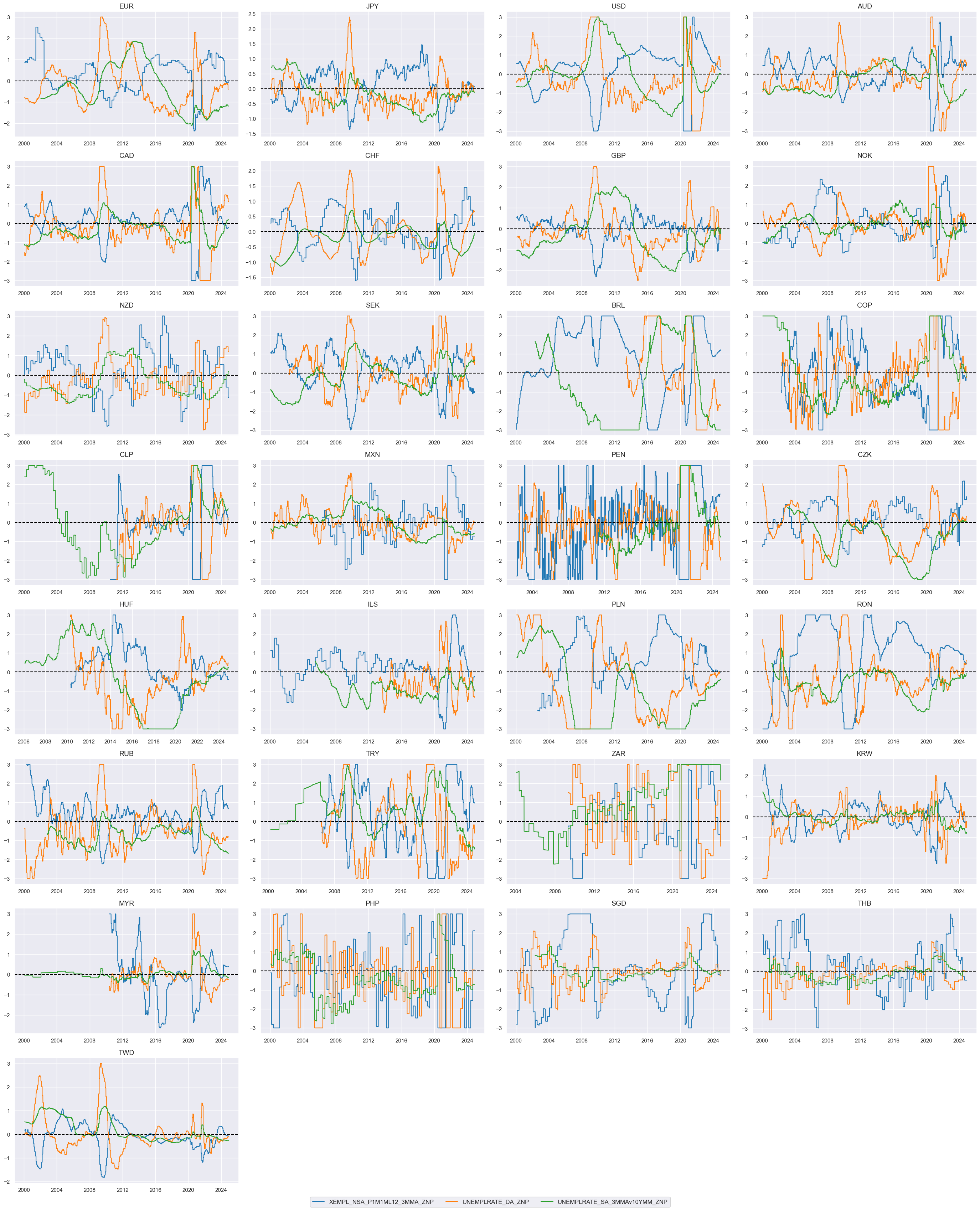

Unemployment rates and gaps #

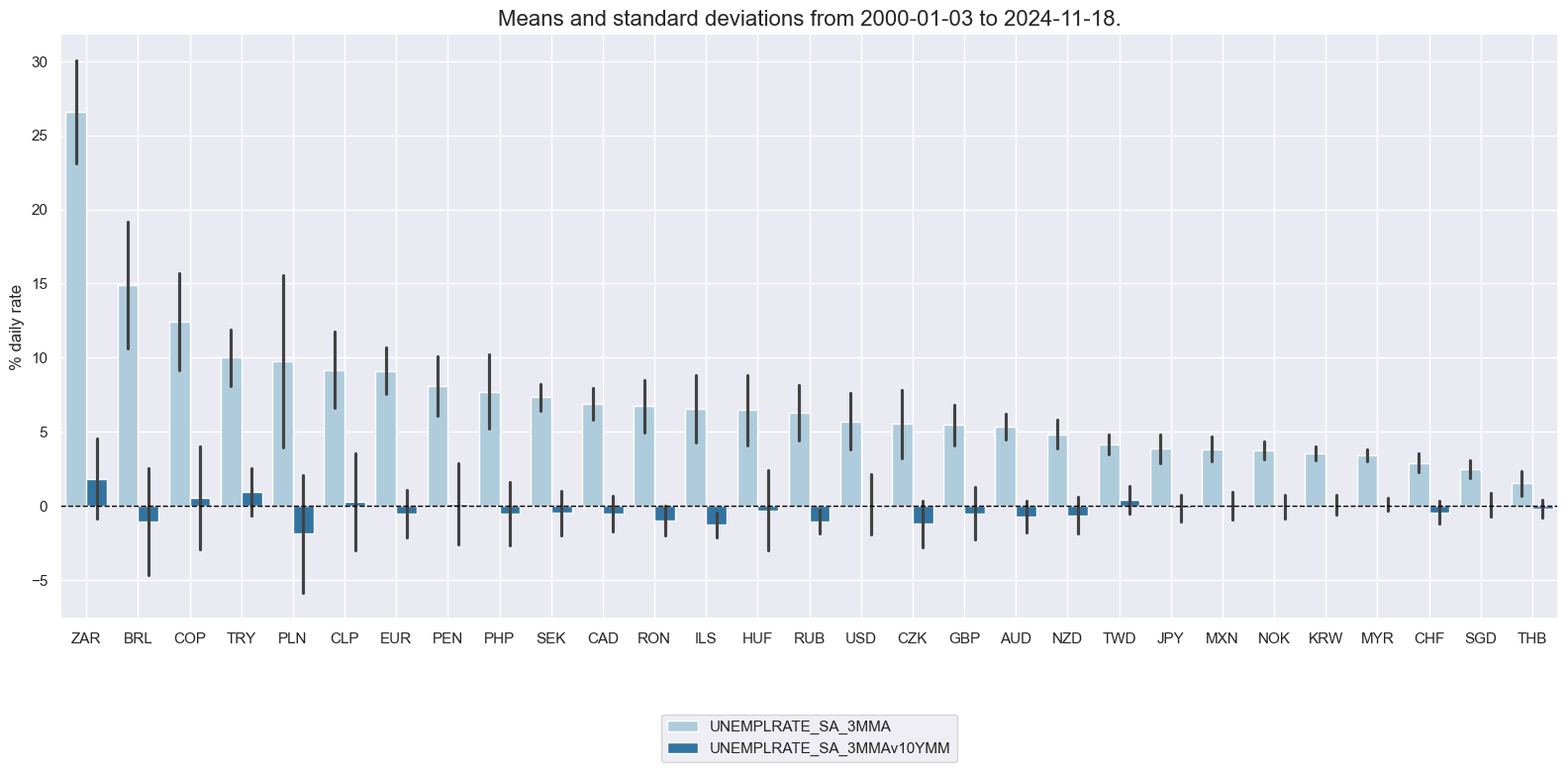

Unemployment rates and unemployment gaps are commonly used measures in labor market analysis. The unemployment rate is a widely used indicator that measures the percentage of the labor force that is unemployed and actively seeking employment. The unemployment gap refers to the difference between the actual unemployment rate and a reference or target unemployment rate. The unemployment gap is used to assess the deviation of the current unemployment rate from the desired or expected level. Here we compare the standard unemployment rate, sa, 3mma with unemployment rate difference, 3-month moving average minus the 10-year moving median. Comparison between the two can give insights into the short-term fluctuations and the long-term trend of the unemployment rate.

xcatx = ["UNEMPLRATE_SA_3MMA", "UNEMPLRATE_SA_3MMAv10YMM"]

cidx = cids

msp.view_ranges(

dfx,

cids=cidx,

xcats=xcatx,

kind="bar",

sort_cids_by="mean",

ylab="% daily rate",

start="2000-01-01",

)

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

cumsum=False,

start="2000-01-01",

same_y=False,

size=(12, 12),

all_xticks=True,

)

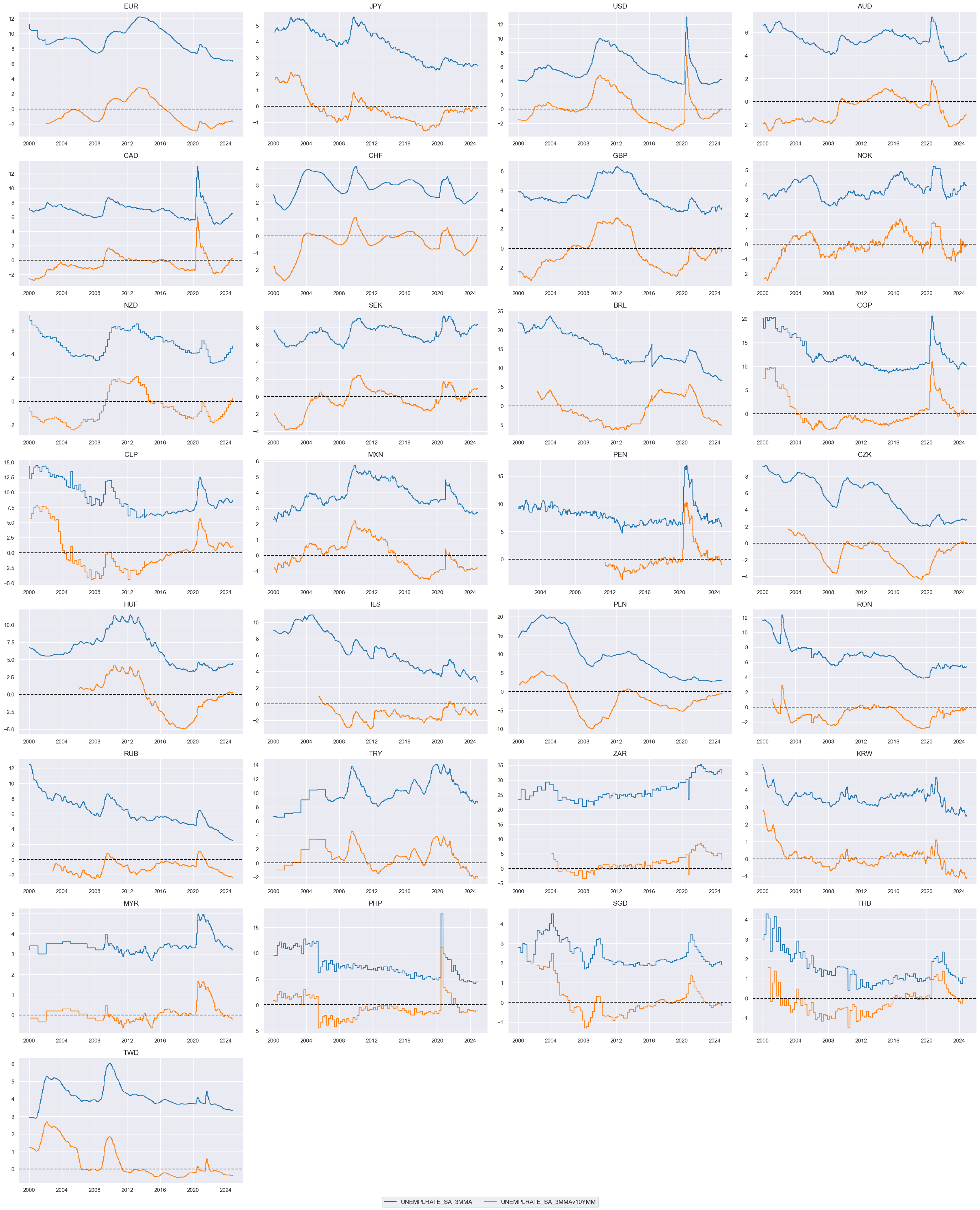

Unemployment changes #

We create a simple average of two unemployment growth indicators: unemploent rate change and unemployment growth:

calcs = [

"UNEMPLRATE_DA = 1/2 * ( UNEMPLRATE_NSA_3MMA_D1M1ML12 + UNEMPLRATE_SA_D3M3ML3 )",

]

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cids, blacklist=None)

dfx = msm.update_df(dfx, dfa)

xcatx = ["UNEMPLRATE_NSA_3MMA_D1M1ML12", "UNEMPLRATE_SA_D3M3ML3", "UNEMPLRATE_DA"]

cidx = cids

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

cumsum=False,

start="2000-01-01",

same_y=False,

size=(12, 12),

all_xticks=True,

)

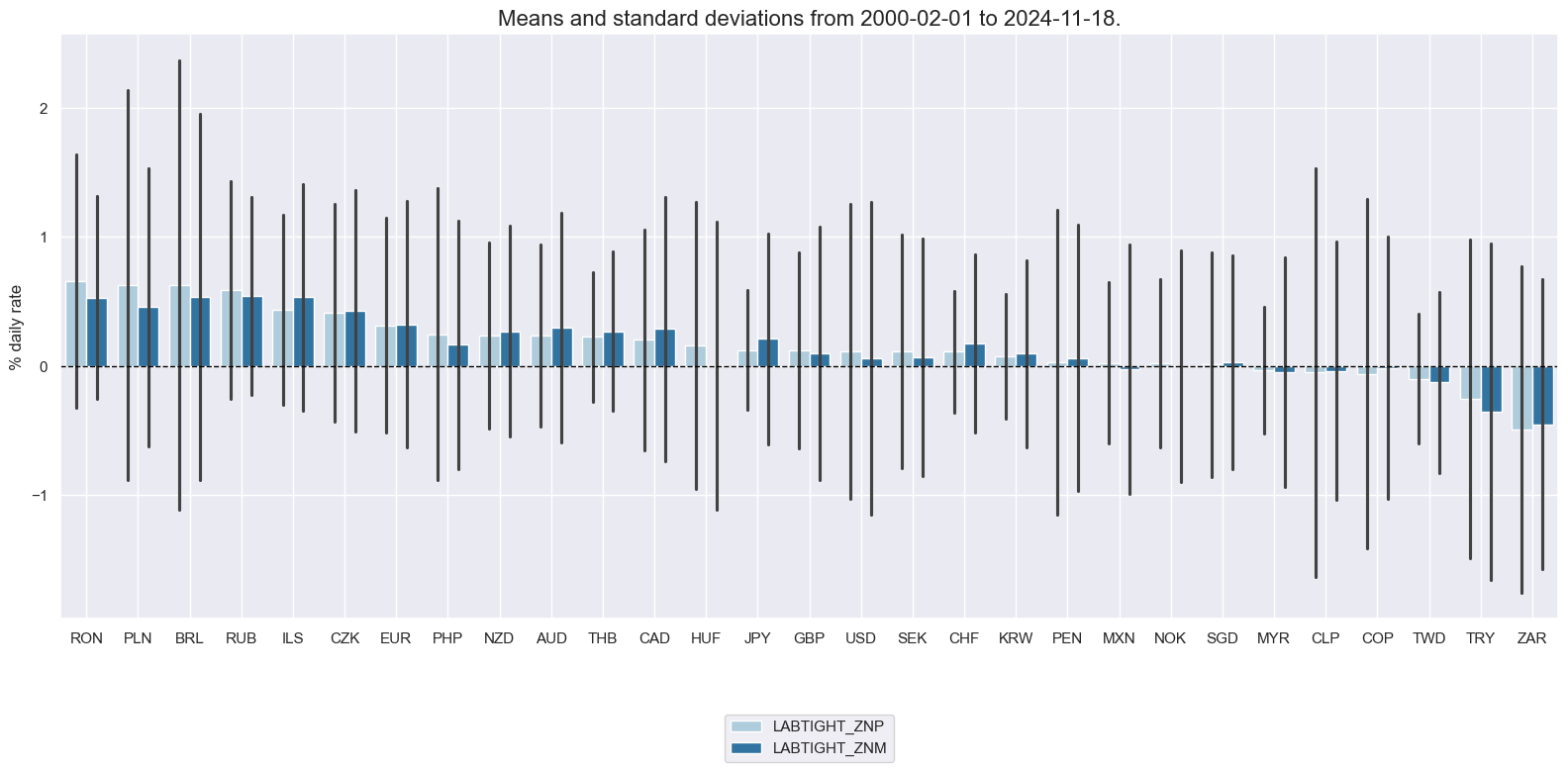

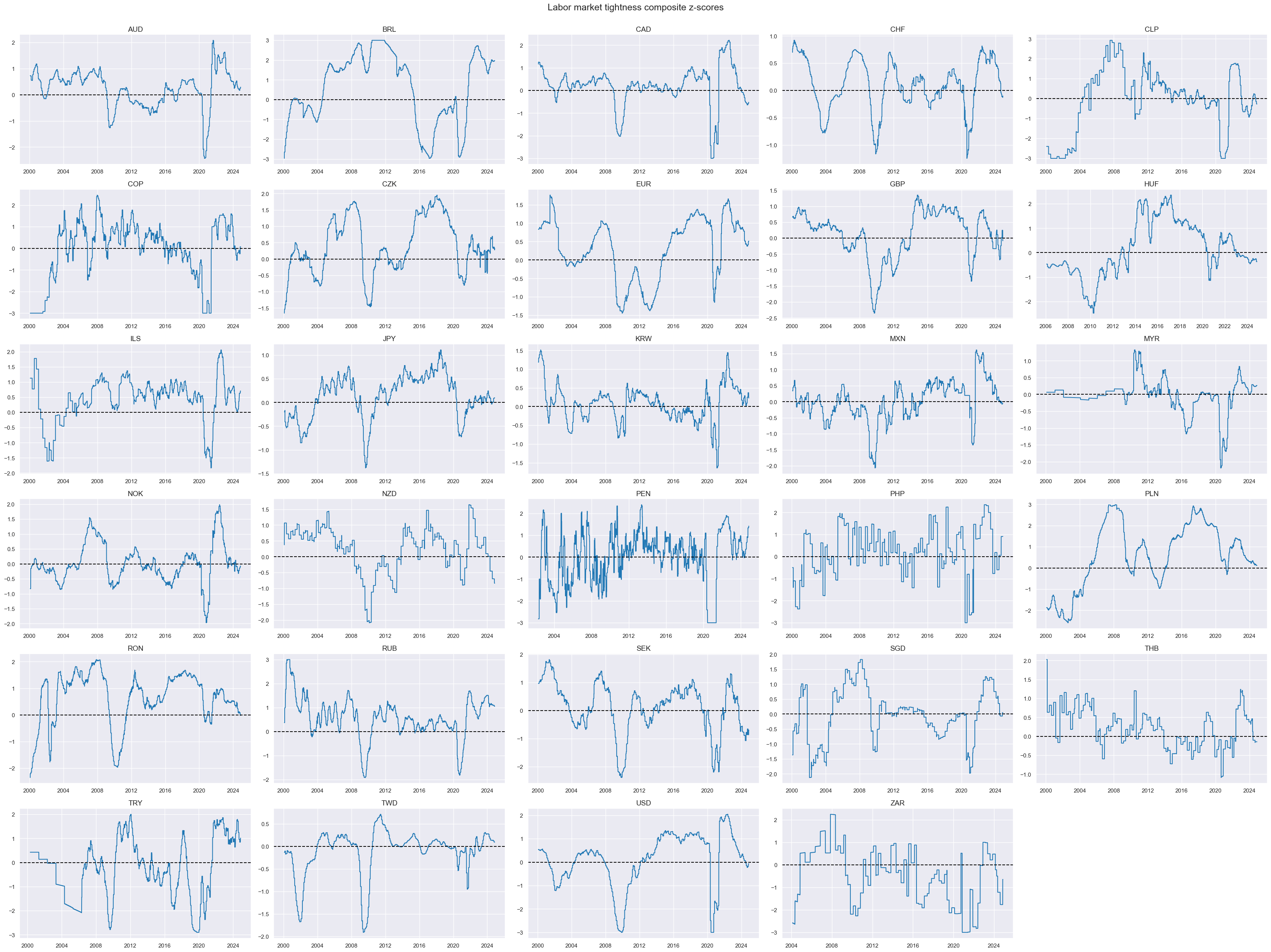

Labor tightening scores #

We compute two types of labor market z-scores. One is based on the panel and assumes no structural differences in the features quantitative effects across sections. The other is half based on cross-section alone, which implies persistent structural differences in distributions and their impact on targets. For a description and possible options of function

make_zn_scores()

please see either

Kaggle

or under

Academy notebooks

.

xcat_lab = [

"XEMPL_NSA_P1M1ML12_3MMA",

"UNEMPLRATE_DA",

"UNEMPLRATE_SA_3MMAv10YMM",

]

cidx = msm.common_cids(dfx, xcat_lab)

pws = [0.25, 1] # cross-sectional and panel-based normalization

for xc in xcat_lab:

for pw in pws:

dfa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=522, # oos scaling after 2 years of panel data

est_freq="m",

neutral="zero",

pan_weight=pw,

thresh=3,

postfix="_ZNP" if pw == 1 else "_ZNM",

)

dfx = msm.update_df(dfx, dfa)

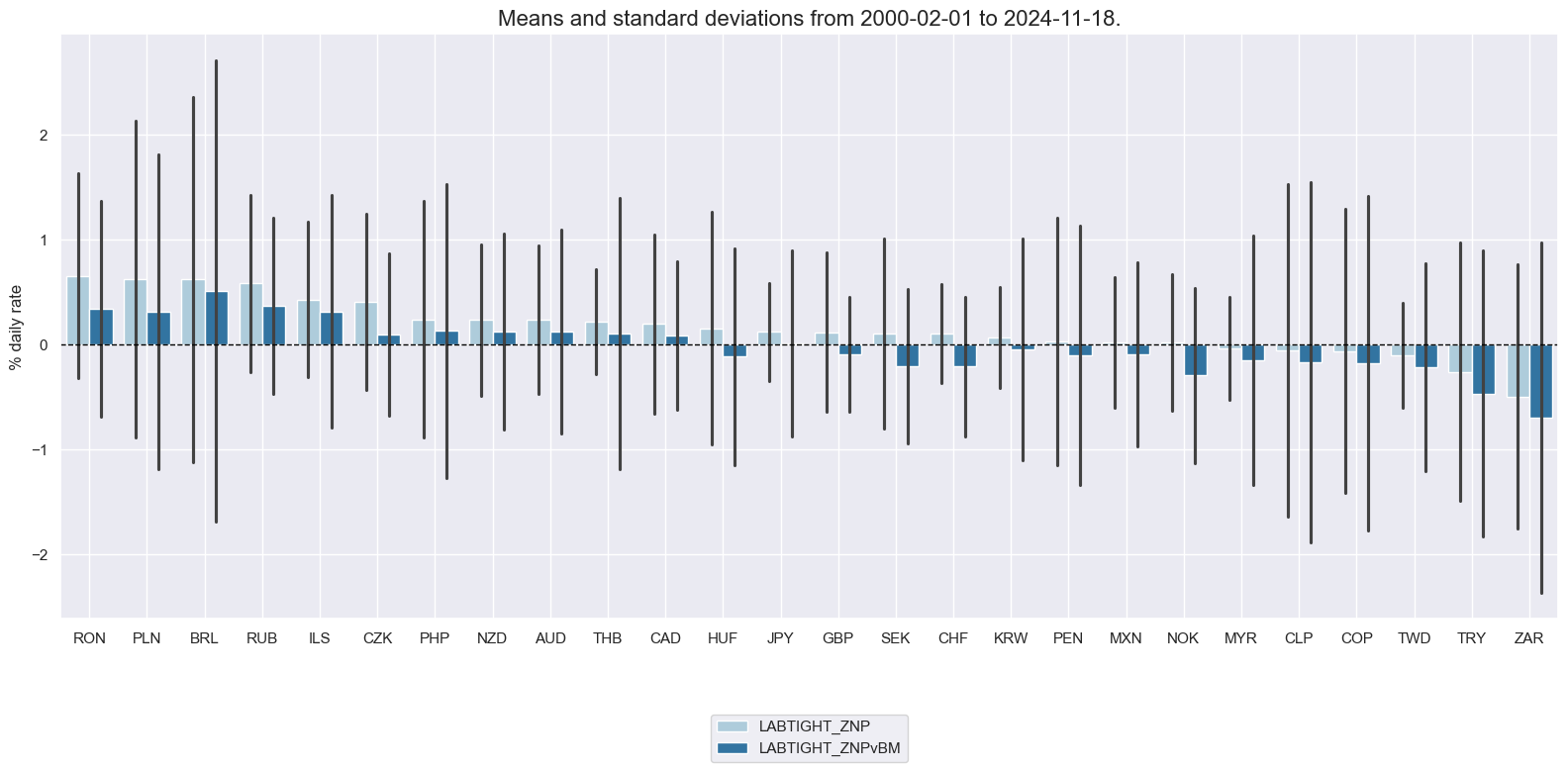

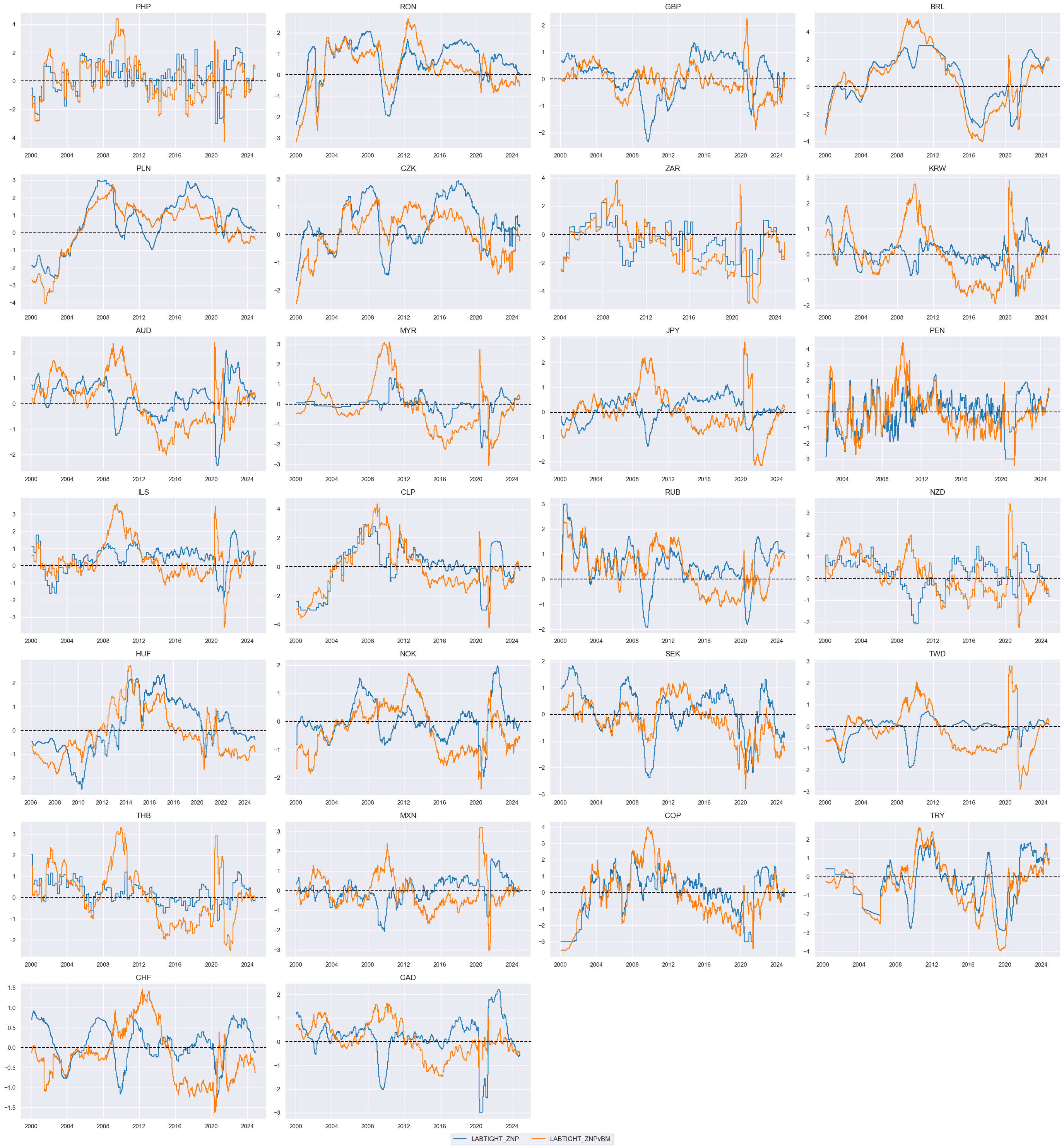

The individual category scores are combined into a single labor market tightness score.

xcatx = [

"XEMPL_NSA_P1M1ML12_3MMA",

"UNEMPLRATE_DA",

"UNEMPLRATE_SA_3MMAv10YMM",

]

cidx = msm.common_cids(dfx, xcat_lab)

# cidx.remove("NZD") # ISSUE: invalid empty series created above

n = len(xcatx)

wx = [1 / n] * n

sx = [1, -1, -1] # signs for tightening

dix = {"ZNP": [xc + "_ZNP" for xc in xcatx], "ZNM": [xc + "_ZNM" for xc in xcatx]}

dfa = pd.DataFrame(columns=dfx.columns).reindex([])

for key, value in dix.items():

dfaa = msp.linear_composite(

dfx,

xcats=value,

weights=wx,

signs=sx,

cids=cidx,

complete_xcats=False, # if some categories are missing the score is based on the remaining

new_xcat="LABTIGHT_" + key,

)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

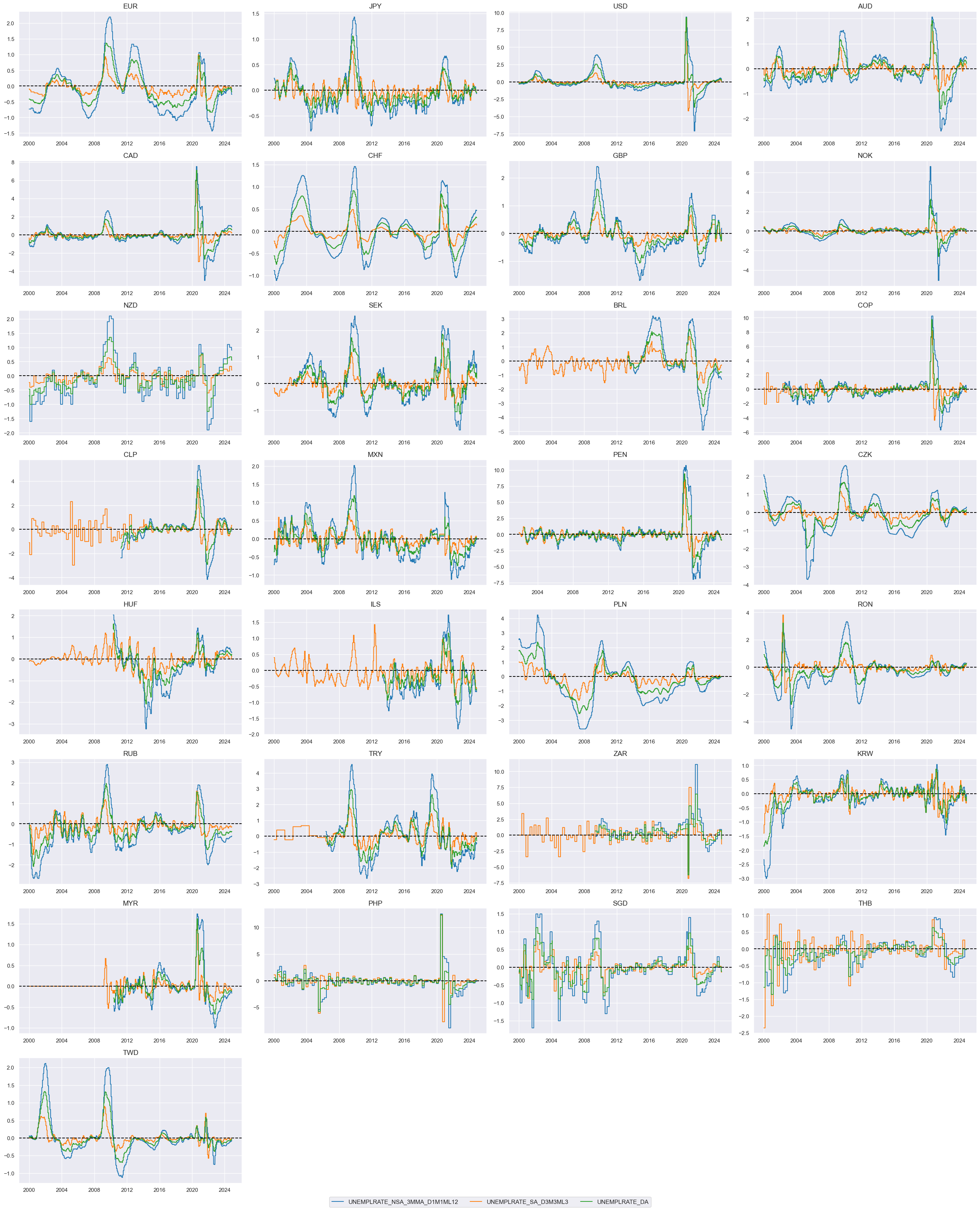

xcatx = [xc + "_ZNP" for xc in xcat_lab]

cidx = cids

msp.view_ranges(

dfx,

cids=cidx,

xcats=xcatx,

kind="bar",

sort_cids_by="mean",

ylab="% daily rate",

start="2000-01-01",

)

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

cumsum=False,

start="2000-01-01",

same_y=False,

size=(12, 12),

all_xticks=True,

)

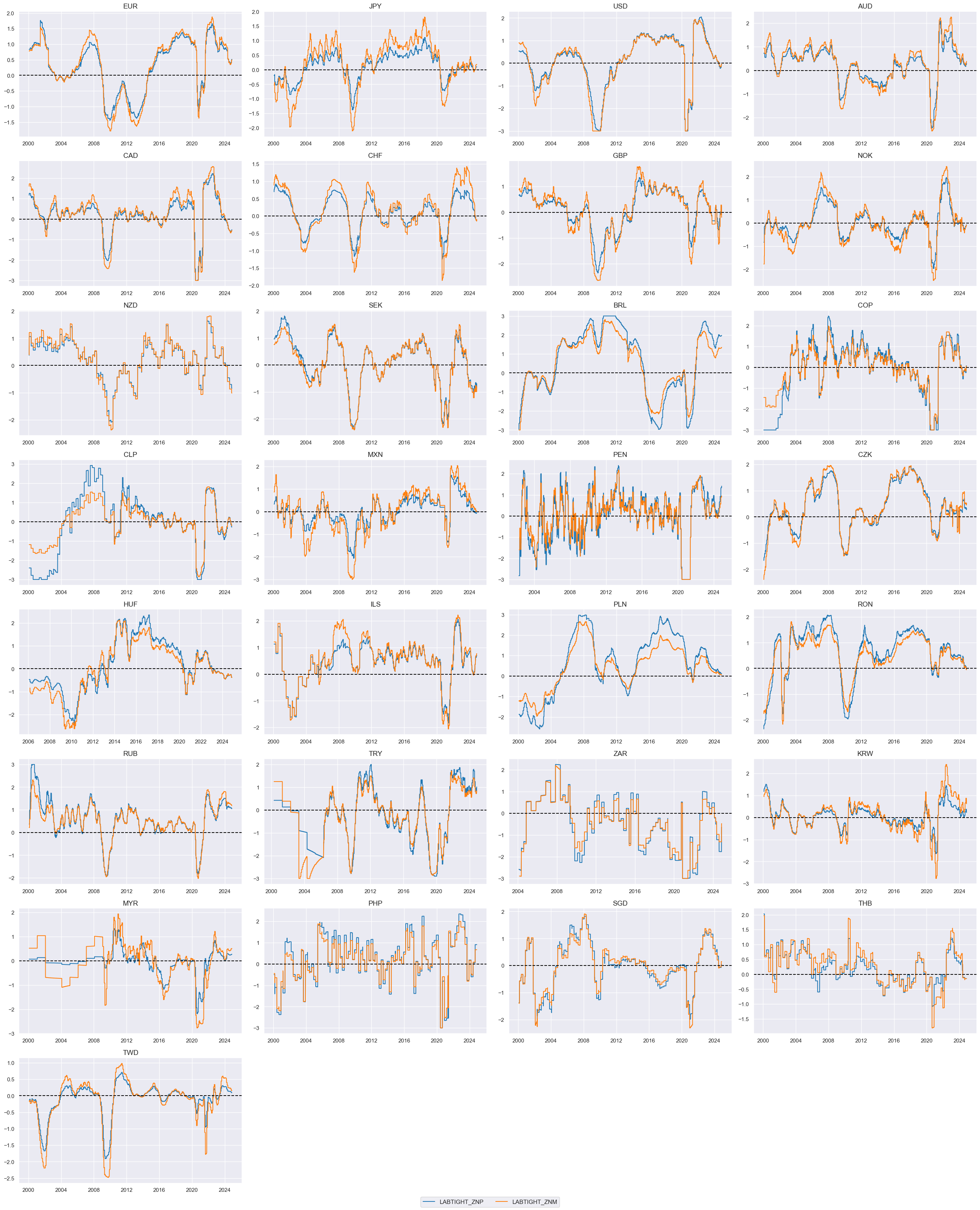

To summarize: we created two Labor market tightening indicators: These are a composite of three quantamental indicators that are jointly tracking the usage of the economy’s labor force. The first is employment growth relative to workforce growth, where the former is measured in % over a year ago and 3-month average and the latter is an estimate based on the latest available 5 years of workforce growth. The second sub-indicator measures changes in the unemployment rate over a year ago and over the last three months, both as a 3-month moving average (view documentation here). The third labor market indicator is the level of the unemployment rate versus a 10-year moving median, again as a 3-month moving average. All three indicators are z-scored, then combined with equal weights, and then the combination is again z-scored for subsequent analysis and aggregation. The difference between the two is the difference in the importance of the panel versus the individual cross-sections for scaling the zn-scores. “_ZNP” indicator uses the whole panel data as the basis for the parameters and “_ZNM” uses 1/4 of the whole panel and 3/4 of an individual cross-section.

xcatx = ["LABTIGHT_ZNP", "LABTIGHT_ZNM"]

cidx = cids

msp.view_ranges(

dfx,

cids=cidx,

xcats=xcatx,

kind="bar",

sort_cids_by="mean",

ylab="% daily rate",

start="2000-01-01",

)

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

cumsum=False,

start="2000-01-01",

same_y=False,

size=(12, 12),

all_xticks=True,

)

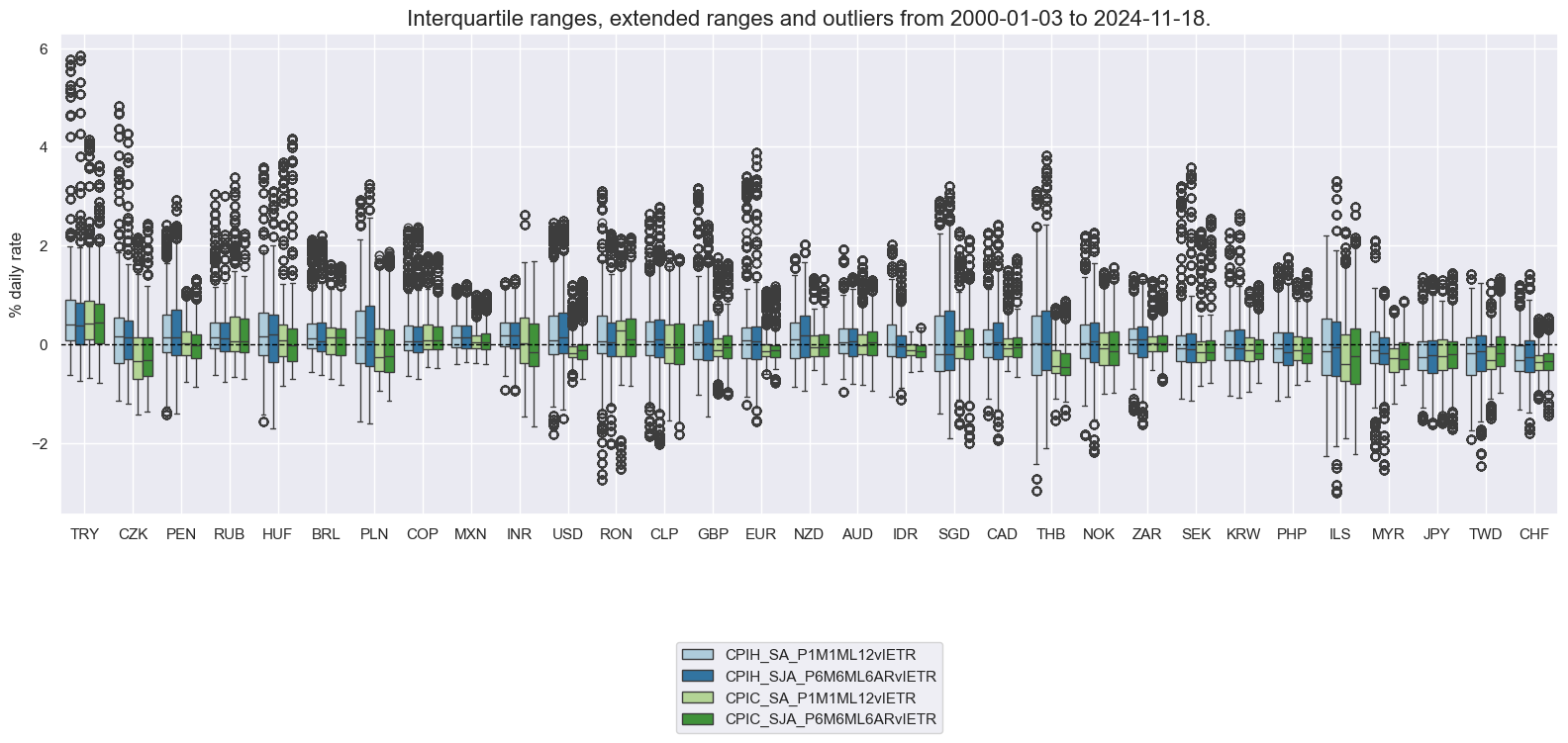

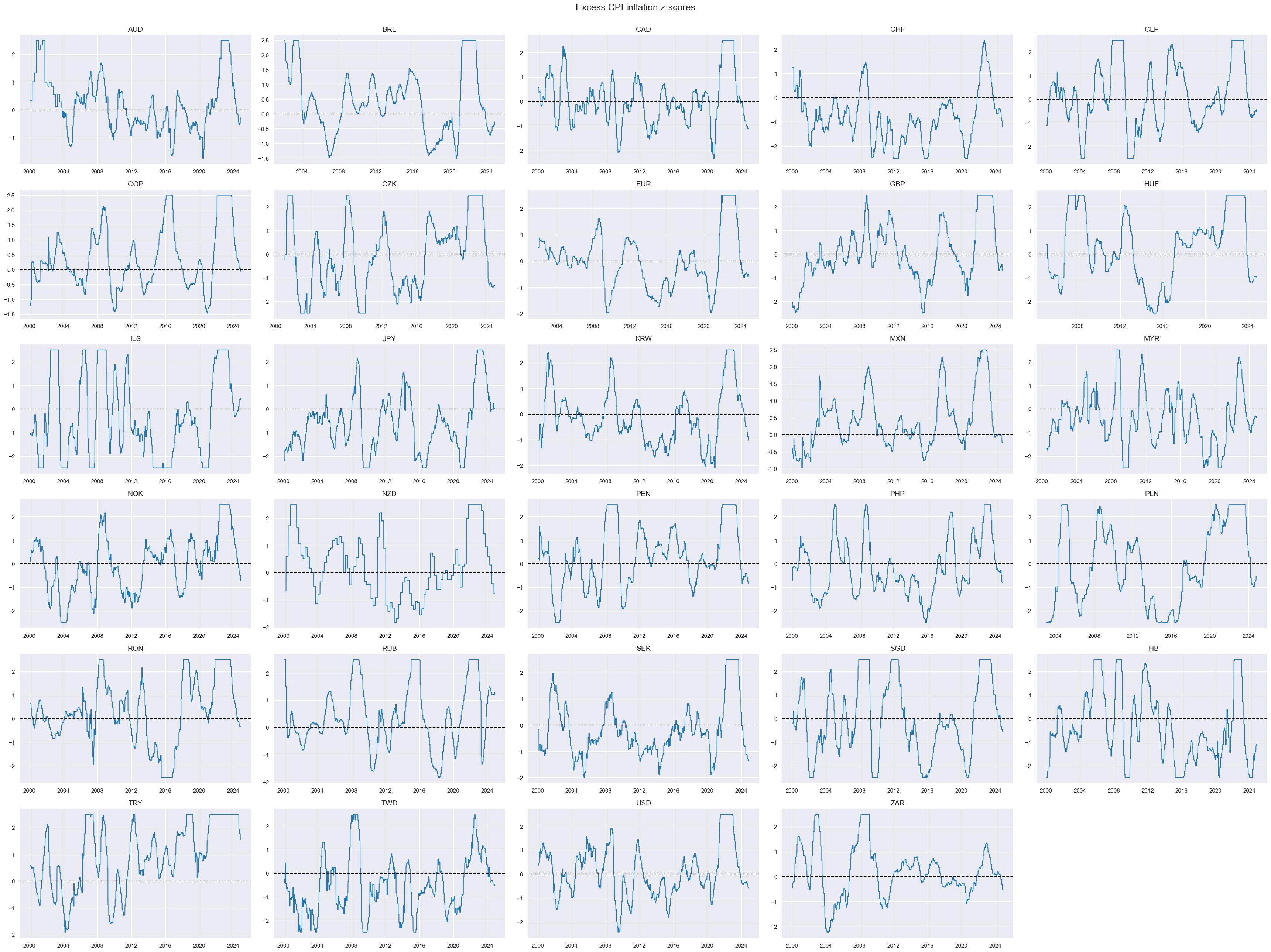

Excess inflation #

Similarly to labor market tightness, we can calculate plausible metrics of excess inflation versus a country’s effective inflation target. To make the targets comparable across markets, the relative target deviations need denominator bases that should never be less than 2, so we clip the Estimated official inflation target for next year at a minimum value of 2 and use it as denominator. We then calculate absolute and relative target deviations for a range of CPI inflation metrics.

dfa = msp.panel_calculator(

dfx,

["INFTEBASIS = INFTEFF_NSA.clip(lower=2)"],

cids=cids,

)

dfx = msm.update_df(dfx, dfa)

infs = [

"CPIH_SA_P1M1ML12",

"CPIH_SJA_P6M6ML6AR",

"CPIC_SA_P1M1ML12",

"CPIC_SJA_P6M6ML6AR",

]

for inf in infs:

calc_iet = f"{inf}vIETR = ( {inf} - INFTEFF_NSA ) / INFTEBASIS"

dfa = msp.panel_calculator(dfx, calcs=[calc_iet], cids=cids)

dfx = msm.update_df(dfx, dfa)

xcatx = [inf + "vIETR" for inf in infs]

cidx = cids

msp.view_ranges(

dfx,

cids=cidx,

xcats=xcatx,

kind="box",

sort_cids_by="mean",

ylab="% daily rate",

start="2000-01-01",

)

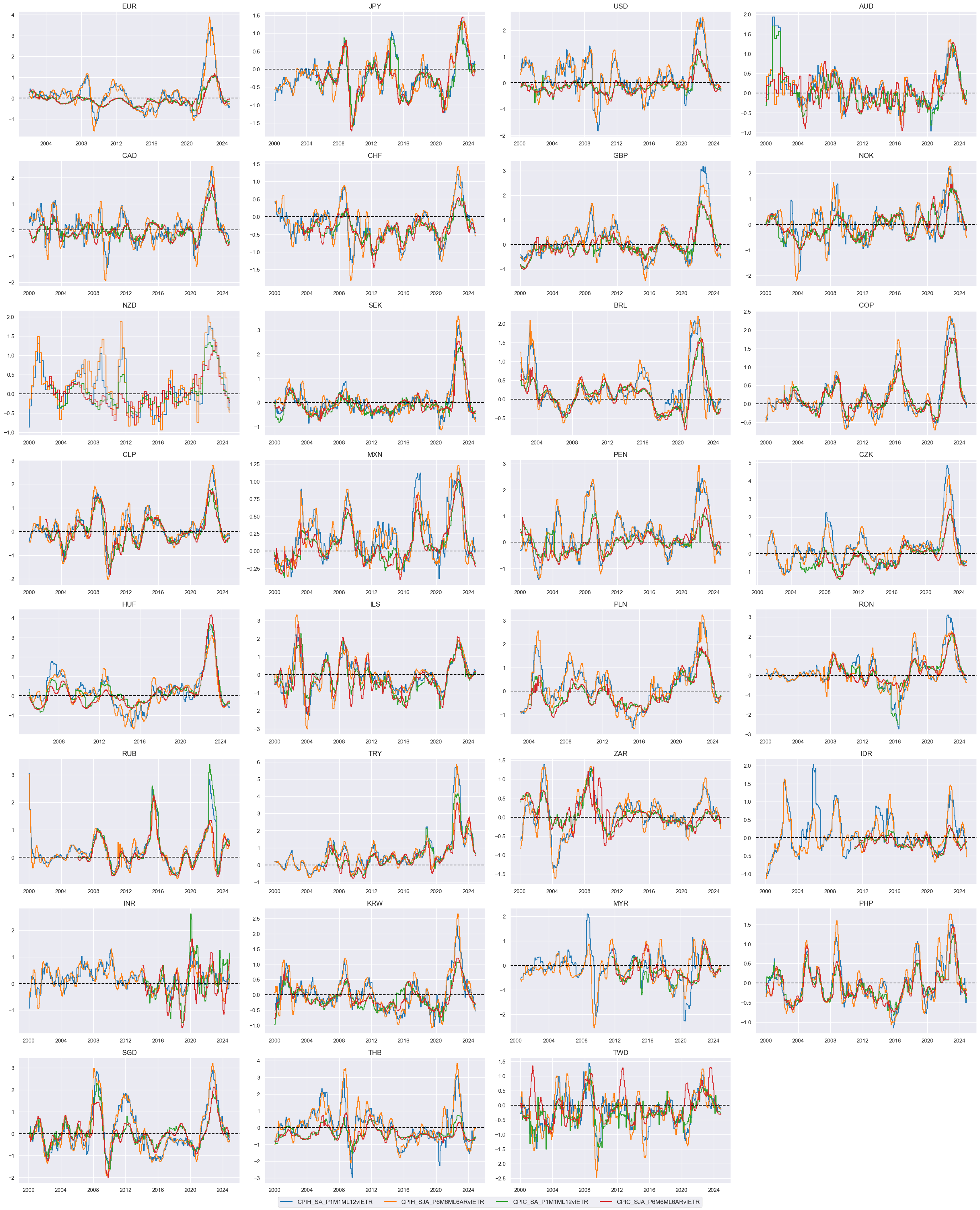

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

cumsum=False,

start="2000-01-01",

same_y=False,

size=(12, 12),

all_xticks=True,

)

The individual excess inflation metrics are similar in size and, hence can be directly combined into a composite excess inflation metric.

xcatx = [inf + "vIETR" for inf in infs]

cidx = cids

dfa = msp.linear_composite(

dfx,

xcats=xcatx,

cids=cidx,

complete_xcats=False, # if some categories are missing the score is based on the remaining

new_xcat="CPI_PCHvIETR",

)

dfx = msm.update_df(dfx, dfa)

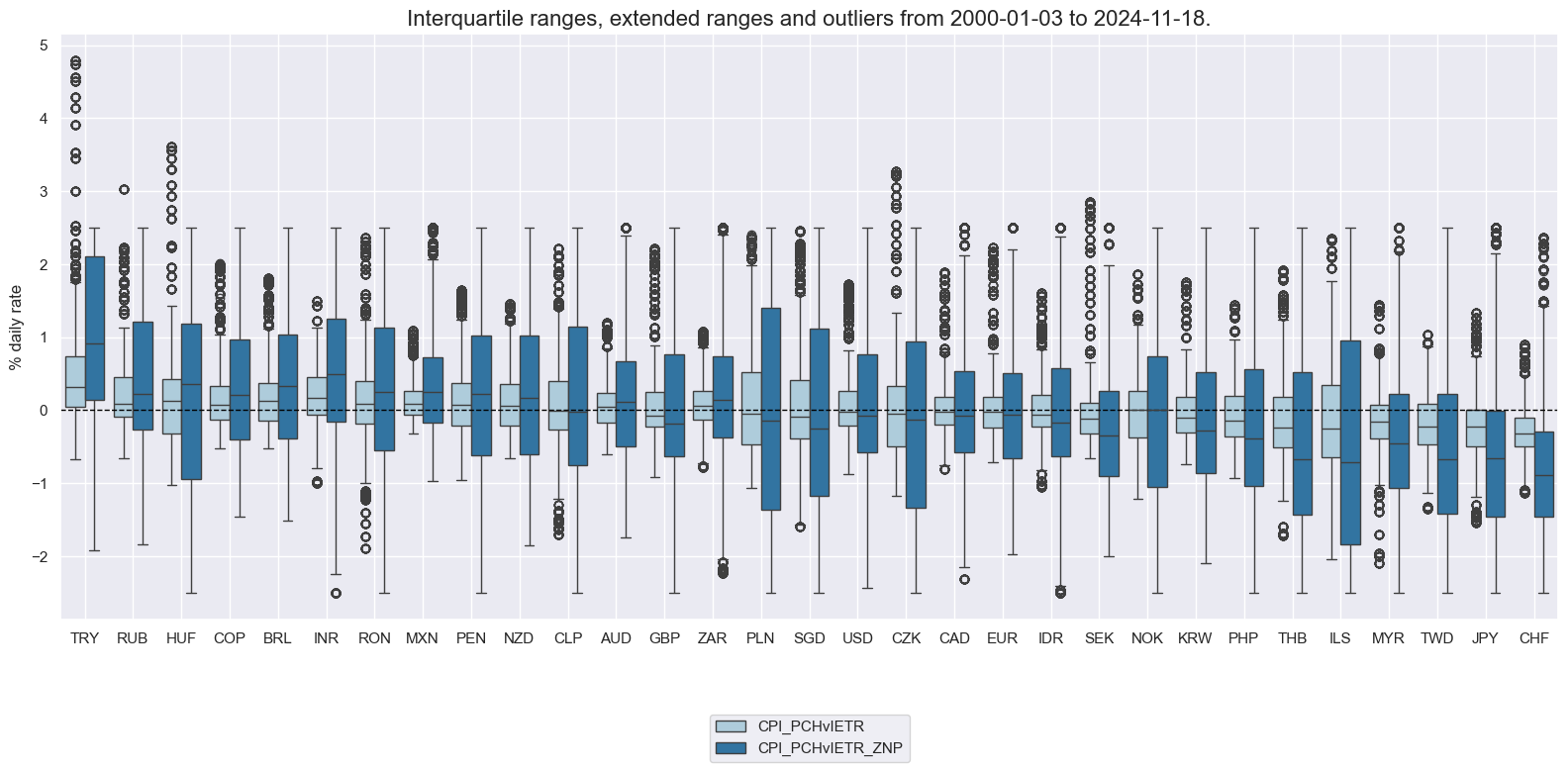

As before, we normalize values for the composite excess inflation metric around zero based on the whole panel.

xcatx = "CPI_PCHvIETR"

cidx = cids

dfa = msp.make_zn_scores(

dfx,

xcat=xcatx,

cids=cidx,

sequential=True,

min_obs=522, # oos scaling after 2 years of panel data

est_freq="m",

neutral="zero",

pan_weight=1,

thresh=2.5,

postfix="_ZNP",

)

dfx = msm.update_df(dfx, dfa)

xcatx = ["CPI_PCHvIETR", "CPI_PCHvIETR_ZNP"]

cidx = cids

msp.view_ranges(

dfx,

cids=cidx,

xcats=xcatx,

kind="box",

sort_cids_by="mean",

ylab="% daily rate",

start="2000-01-01",

)

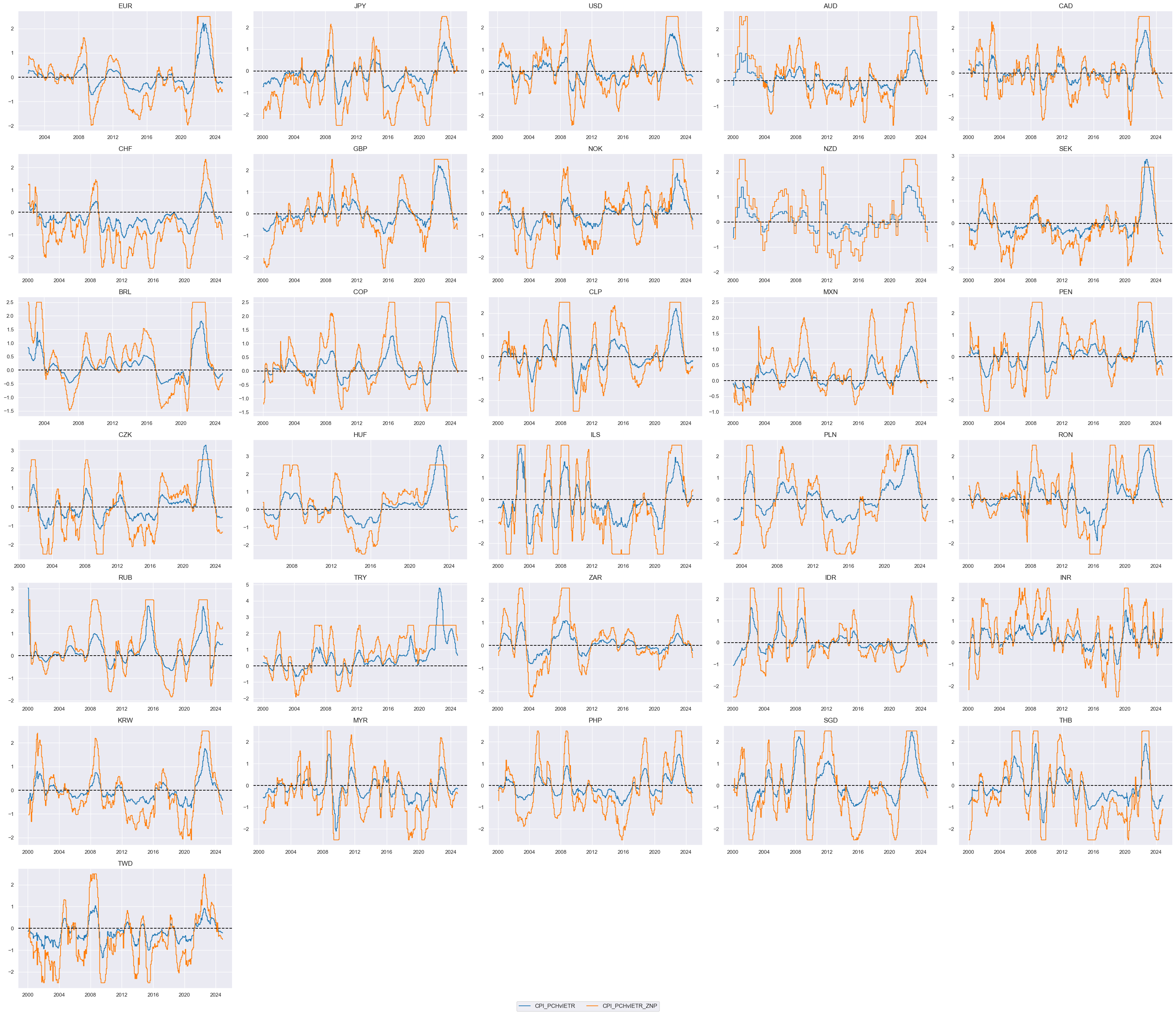

msp.view_timelines(

dfx,

xcats=xcatx[0:2],

cids=cidx,

ncol=5,

cumsum=False,

start="2000-01-01",

same_y=False,

size=(12, 12),

all_xticks=True,

)

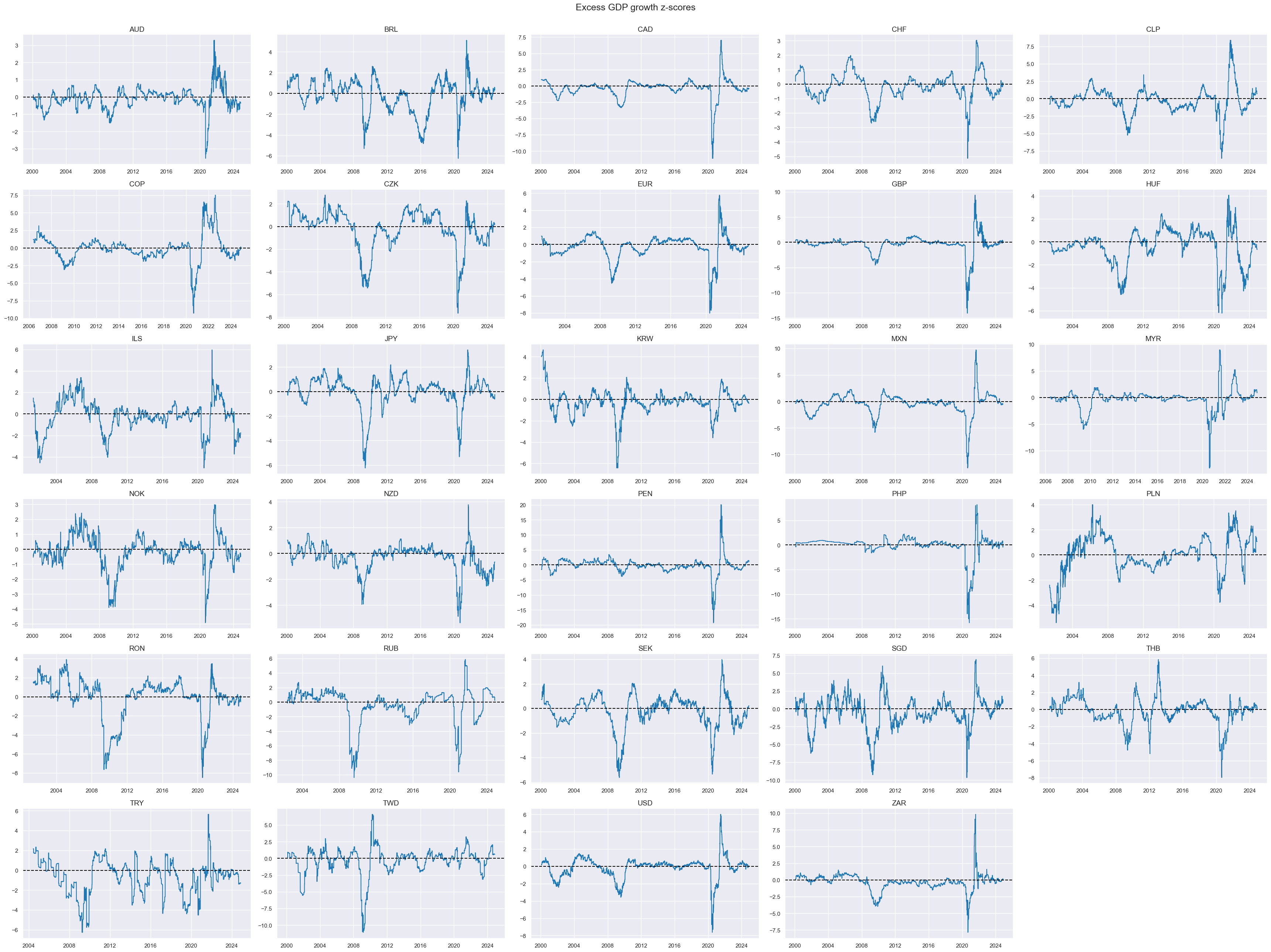

Excess growth #

Excess real-time growth estimates are z-scored for intuitive interpretation and to winsorize large outliers, which often reflect temporary disruptions and data issues. JPMaQS offers a ready-made indicator of excess estimated GDP growth trend, labelled

INTRGDPv5Y_NSA_P1M1ML12_3MMA

. For each day this is the latest estimated GDP growth trend (% over a year ago, 3-month moving average) minus a 5-year median of that country’s actual GDP growth rate. The historic median represents the growth rate that businesses and markets have grown used to. The GDP growth trend is estimated based on actual national accounts and monthly activity data, based on sets of regressions that replicate conventional charting methods in markets (view full documentation here). For subsequent aggregation and analysis, we then z-score the indicator (normalize volatility) around its zero value on an expanding out-of-sample basis using all cross sections for estimating the standard deviations. As before, we normalize values for the indicator around zero based on the whole panel.

xcatx = "INTRGDPv5Y_NSA_P1M1ML12_3MMA"

cidx = cids

dfa = msp.make_zn_scores(

dfx,

xcat=xcatx,

cids=cidx,

sequential=True,

min_obs=522, # oos scaling after 2 years of panel data

est_freq="m",

neutral="zero",

pan_weight=1,

# thresh=3,

postfix="_ZNP",

)

dfx = msm.update_df(dfx, dfa)

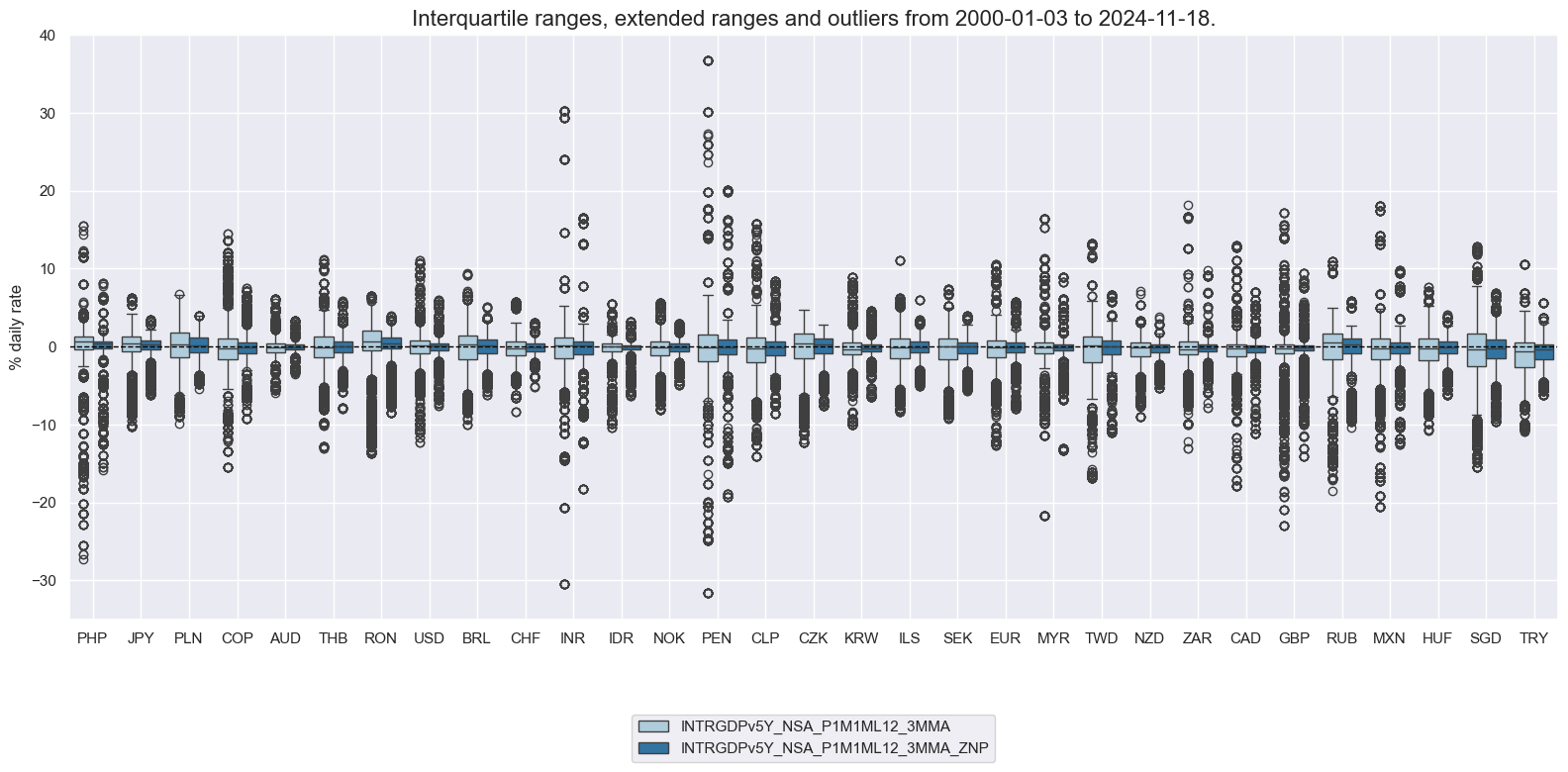

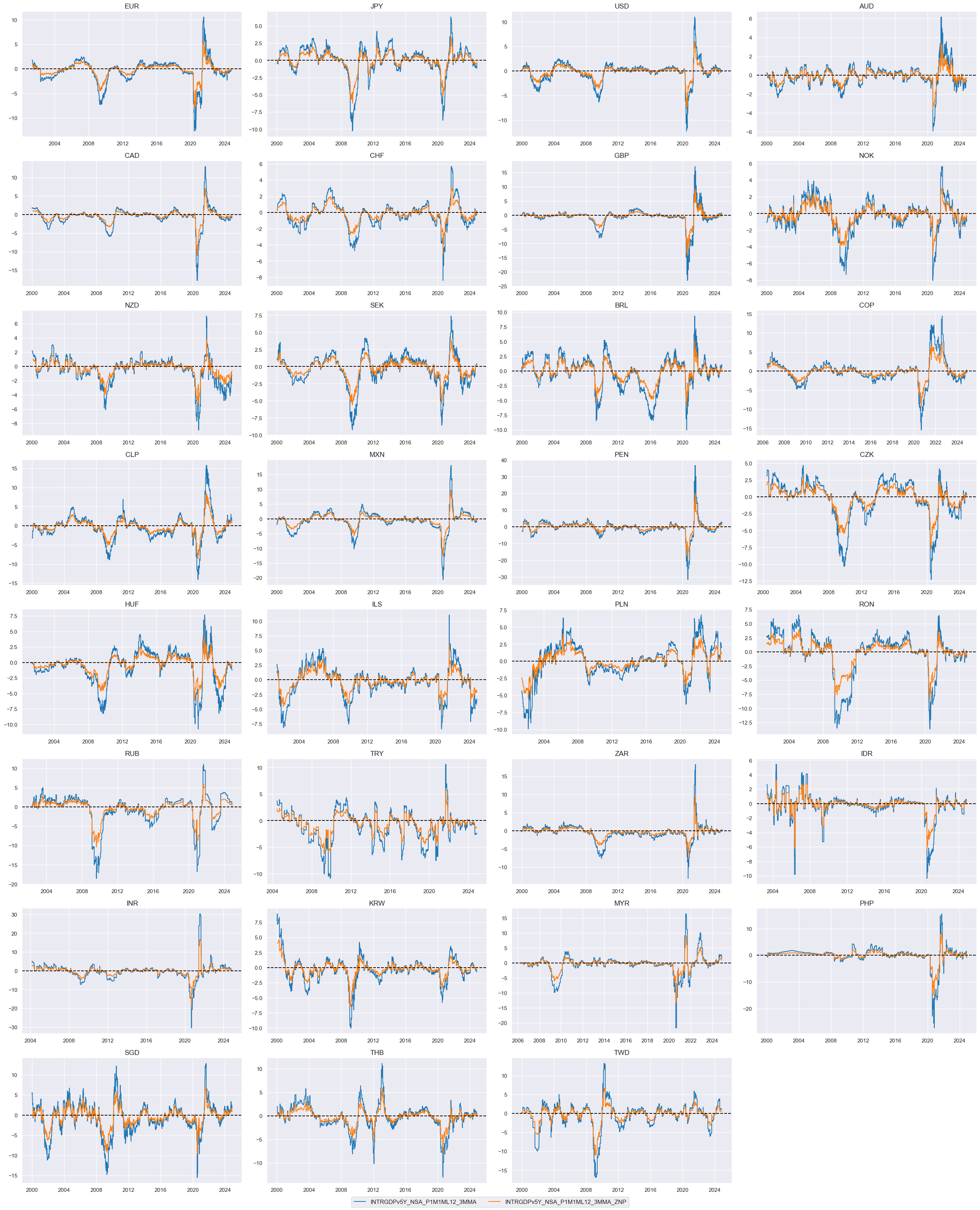

xcatx = ["INTRGDPv5Y_NSA_P1M1ML12_3MMA", "INTRGDPv5Y_NSA_P1M1ML12_3MMA_ZNP"]

cidx = cids

msp.view_ranges(

dfx,

cids=cidx,

xcats=xcatx,

kind="box",

sort_cids_by="mean",

ylab="% daily rate",

start="2000-01-01",

)

msp.view_timelines(

dfx,

xcats=xcatx[0:2],

cids=cidx,

ncol=4,

cumsum=False,

start="2000-01-01",

same_y=False,

size=(12, 12),

all_xticks=True,

)

Features relative to the base currency #

cycles = [

"LABTIGHT",

"CPI_PCHvIETR",

"INTRGDPv5Y_NSA_P1M1ML12_3MMA",

]

xcatx = [cc + "_ZNP" for cc in cycles]

for xc in xcatx:

calc_eur = [f"{xc}vBM = {xc} - iEUR_{xc}"]

calc_usd = [f"{xc}vBM = {xc} - iUSD_{xc}"]

calc_eud = [f"{xc}vBM = {xc} - 0.5 * ( iEUR_{xc} + iUSD_{xc} )"]

dfa_eur = msp.panel_calculator(dfx, calcs=calc_eur, cids=cids_eur)

dfa_usd = msp.panel_calculator(dfx, calcs=calc_usd, cids=cids_usd + ["SGD"])

dfa_eud = msp.panel_calculator(dfx, calcs=calc_eud, cids=cids_eud)

dfa = pd.concat([dfa_eur, dfa_usd, dfa_eud])

dfx = msm.update_df(dfx, dfa)

xcatx = ["LABTIGHT_ZNP", "LABTIGHT_ZNPvBM"]

cidx = cids_fx

msp.view_ranges(

dfx,

cids=cidx,

xcats=xcatx,

kind="bar",

sort_cids_by="mean",

ylab="% daily rate",

start="2000-01-01",

)

msp.view_timelines(

dfx,

xcats=xcatx[0:2],

cids=cidx,

ncol=4,

cumsum=False,

start="2000-01-01",

same_y=False,

size=(12, 12),

all_xticks=True,

)

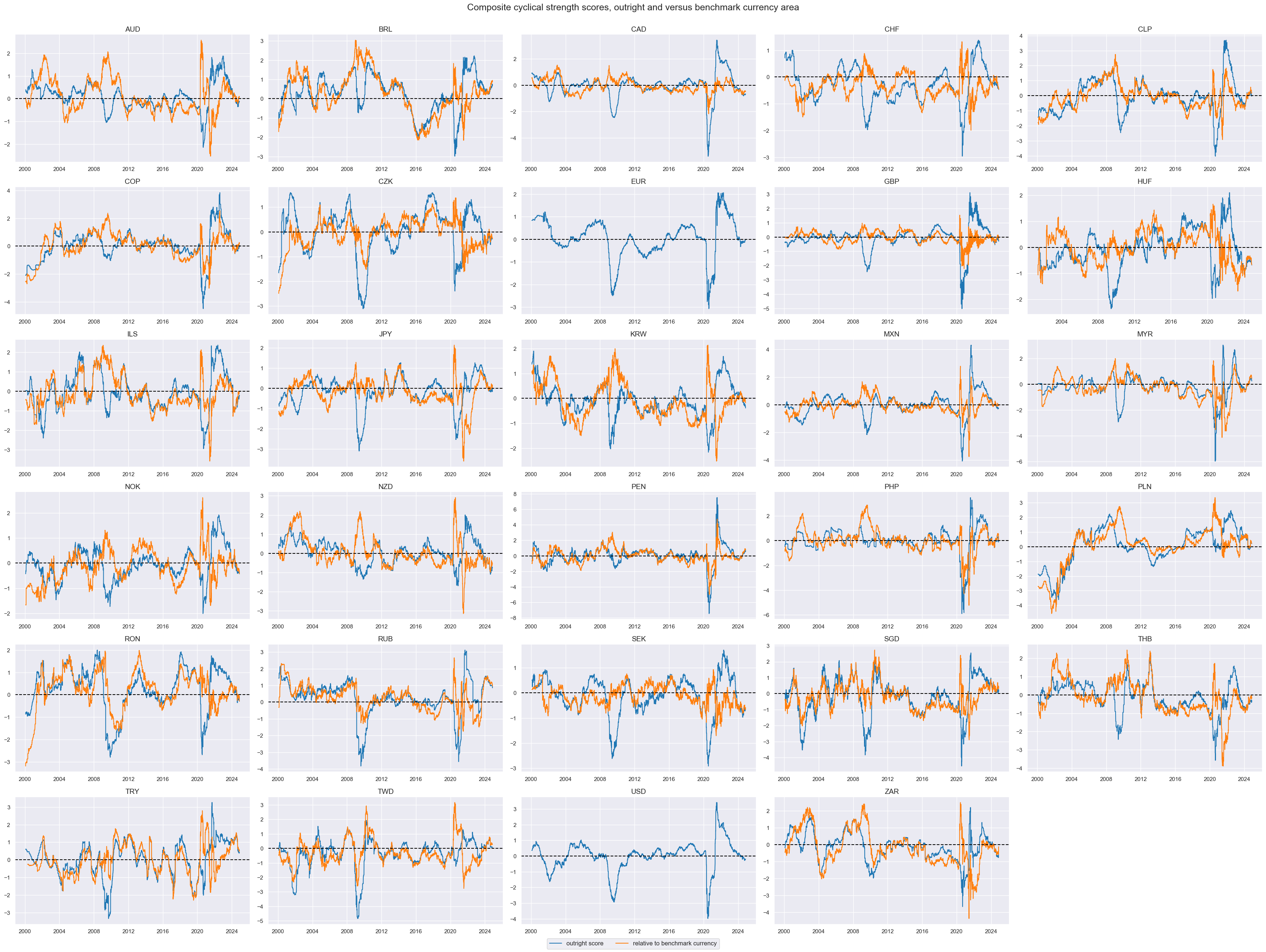

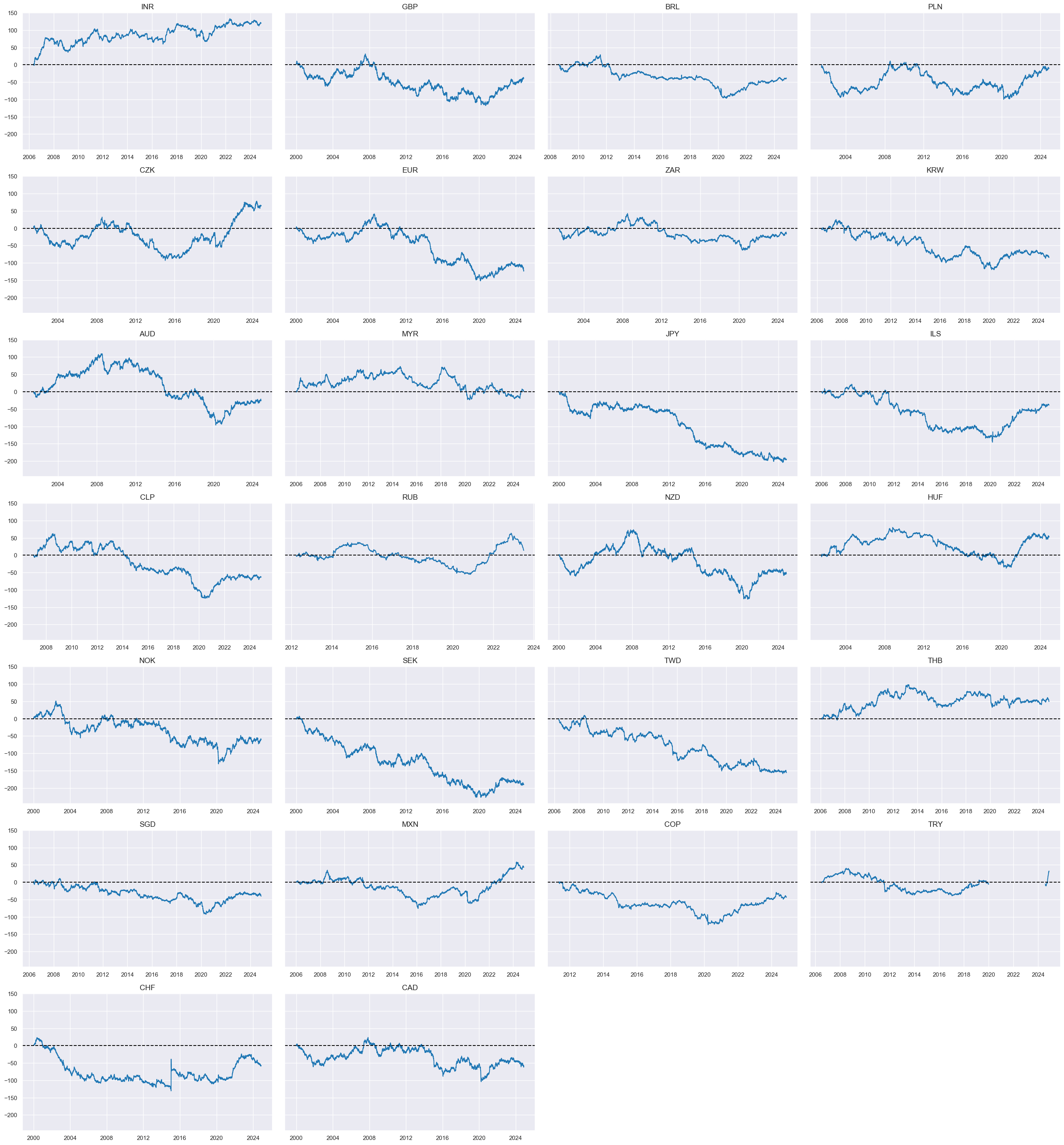

Composite z-scores #

We calculate composite zn-scores of cyclical strength with and without labor market tightness. We also calculate composite zn-score differences to FX base currencies with and without labor market tightness.

# Cyclical strength constituents and list of its keys

d_cs = {

"G": "INTRGDPv5Y_NSA_P1M1ML12_3MMA",

"I": "CPI_PCHvIETR",

"L": "LABTIGHT",

# "C": "XPCREDITBN_SJA_P1M1ML12", not so relevant for cyclical strength

}

cs_keys = list(d_cs.keys())

# Available cross-sections

xcatx_znp = [d_cs[i] + "_ZNP" for i in cs_keys]

cidx_znp = msm.common_cids(dfx, xcatx_znp)

xcatx_vbm = [d_cs[i] + "_ZNPvBM" for i in cs_keys]

cidx_vbm = msm.common_cids(dfx, xcatx_vbm)

d_ar = {"_ZNP": cidx_znp, "_ZNPvBM": cidx_vbm}

# Collect all cycle strength key combinations

cs_combs = [combo for r in range(1, 5) for combo in combinations(cs_keys, r)]

# Use key combinations to calculate all possible factor combinations

dfa = pd.DataFrame(columns=dfx.columns).reindex([])

for cs in cs_combs:

for key, value in d_ar.items():

xcatx = [

d_cs[i] + key for i in cs

] # extract absolute or relative xcat combination

dfaa = msp.linear_composite(

dfx,

xcats=xcatx,

cids=value,

complete_xcats=False, # if some categories are missing the score is based on the remaining

new_xcat="CS" + "".join(cs) + key[4:] + "_ZC",

)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

# Collect factor combinations in lists

cs_all = dfa["xcat"].unique()

cs_dir = [cs for cs in cs_all if "vBM" not in cs]

cs_rel = [cs for cs in cs_all if "vBM" in cs]

xcatx = ["CSG_ZC"]

cidx = cidx_znp

msp.view_timelines(

dfx,

xcats=xcatx[0:2],

cids=cidx,

ncol=5,

cumsum=False,

start="2000-01-01",

same_y=False,

size=(12, 12),

all_xticks=True,

title="Excess GDP growth z-scores",

)

xcatx = ["CSL_ZC"]

cidx = cidx_znp

msp.view_timelines(

dfx,

xcats=xcatx[0:2],

cids=cidx,

ncol=5,

cumsum=False,

start="2000-01-01",

same_y=False,

size=(12, 12),

all_xticks=True,

title="Labor market tightness composite z-scores",

)

xcatx = ["CSI_ZC"]

cidx = cidx_znp

msp.view_timelines(

dfx,

xcats=xcatx[0:2],

cids=cidx,

ncol=5,

cumsum=False,

start="2000-01-01",

same_y=False,

size=(12, 12),

all_xticks=True,

title="Excess CPI inflation z-scores",

)

xcatx = ["CSGIL_ZC", "CSGILvBM_ZC"]

cidx = cidx_znp

msp.view_timelines(

dfx,

xcats=xcatx[0:2],

xcat_labels=["outright score", "relative to benchmark currency"],

cids=cidx,

ncol=5,

cumsum=False,

start="2000-01-01",

same_y=False,

size=(12, 12),

all_xticks=True,

title="Composite cyclical strength scores, outright and versus benchmark currency area",

)

Targets #

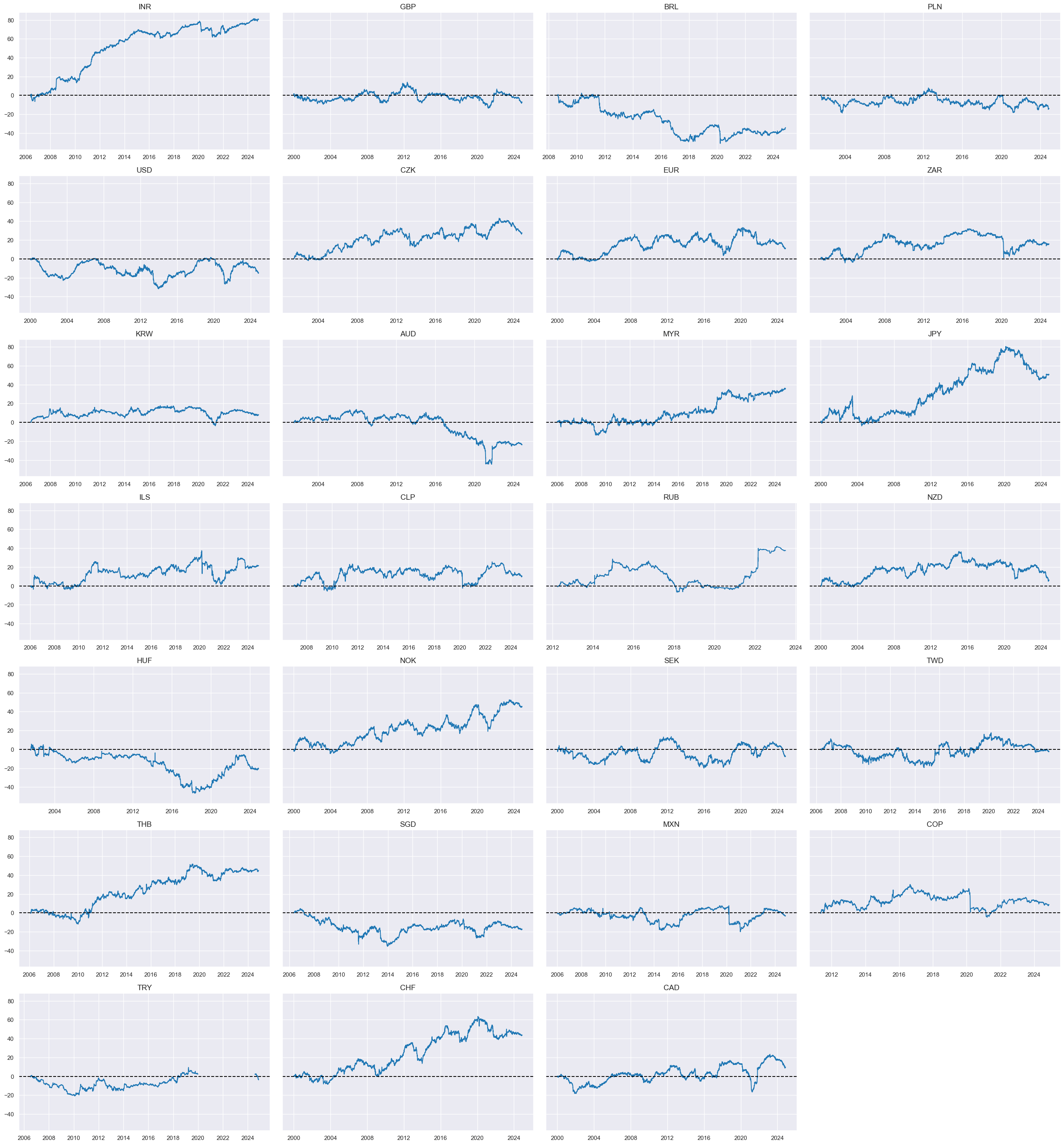

Directional vol-targeted IRS returns #

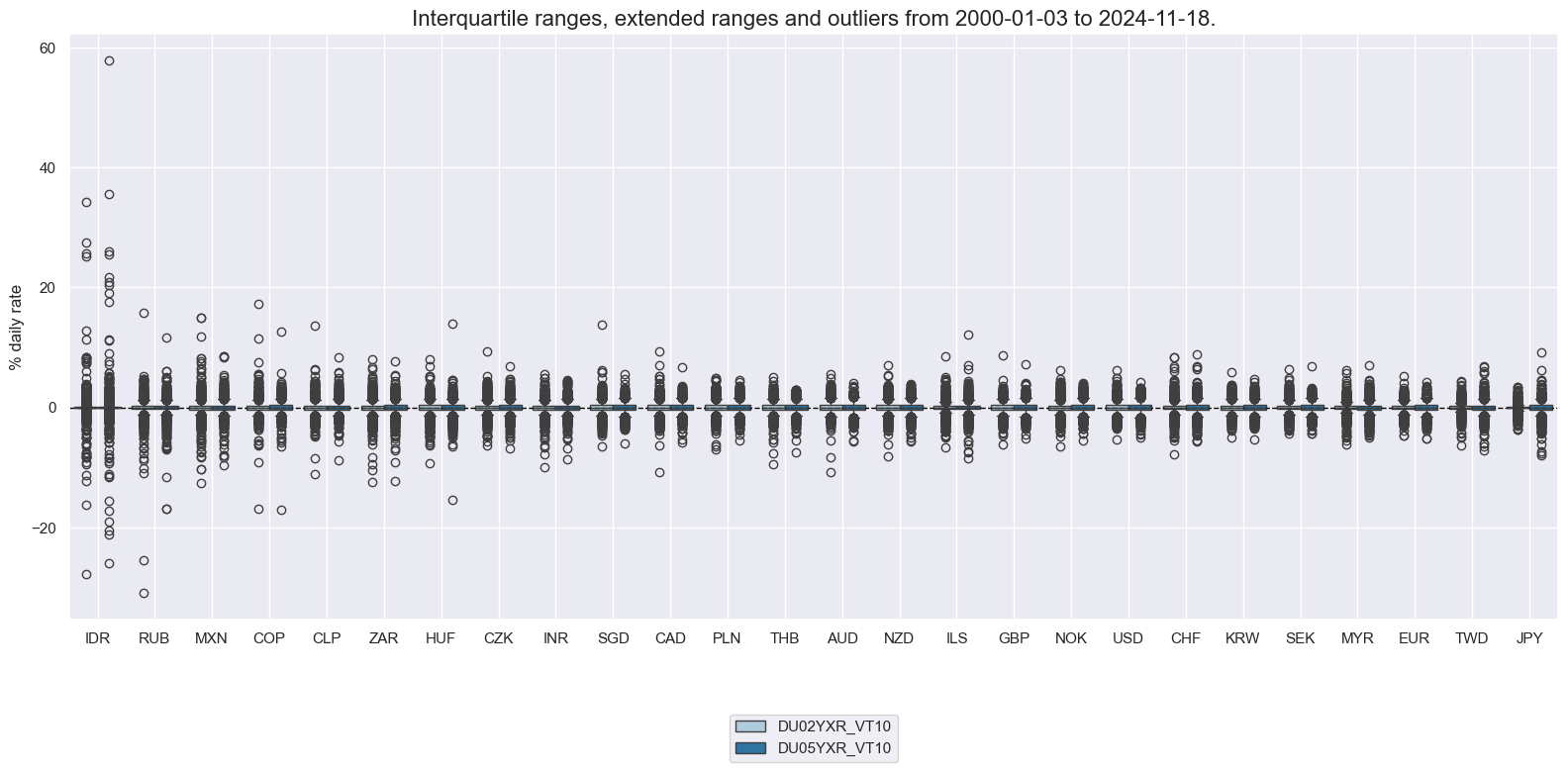

xcatx = ["DU02YXR_VT10", "DU05YXR_VT10"]

cidx = list(set(cids_du) - set(["TRY"]))

msp.view_ranges(

dfx,

cids=cidx,

xcats=xcatx,

kind="box",

sort_cids_by="std",

ylab="% daily rate",

start="2000-01-01",

)

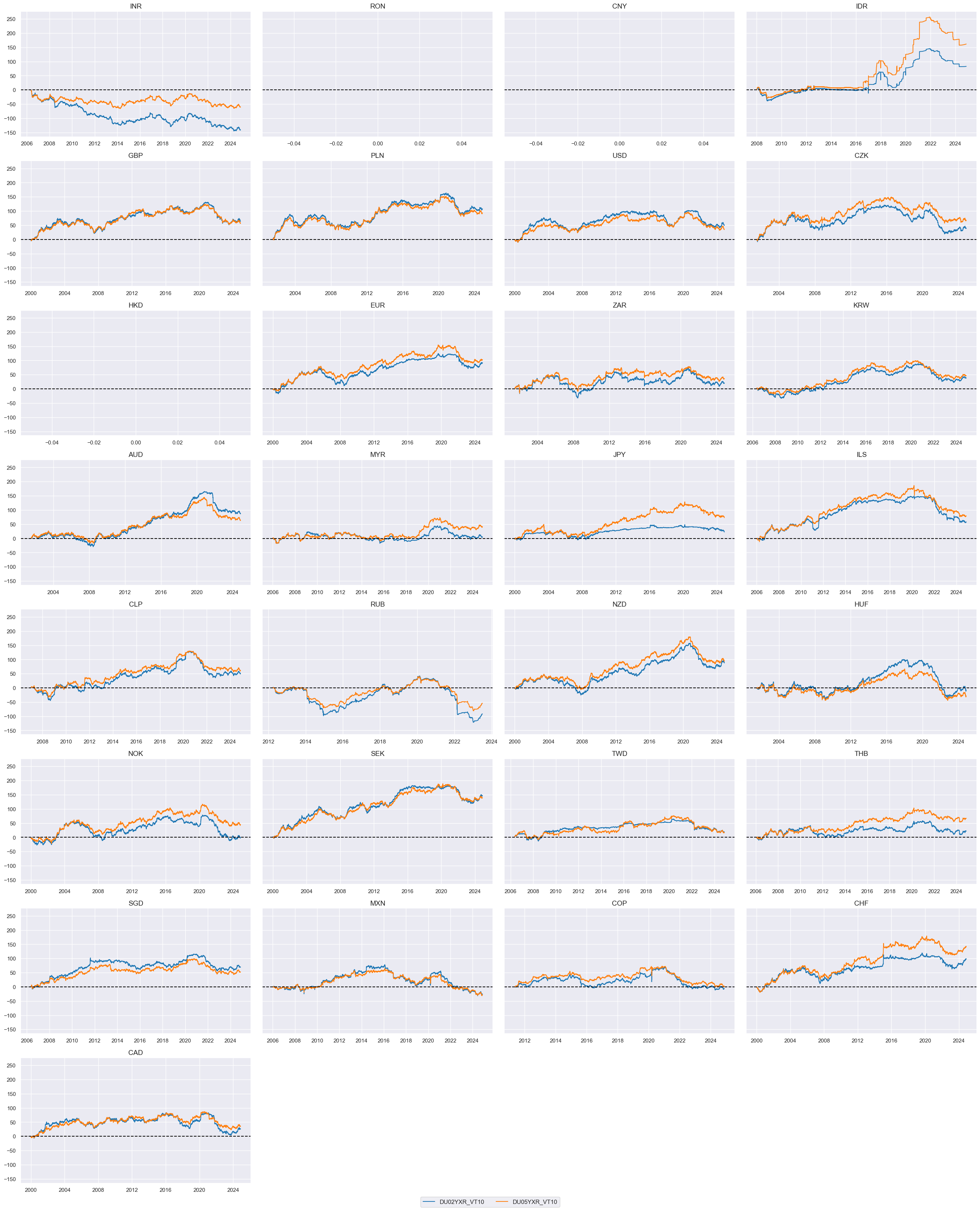

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

cumsum=True,

start="2000-01-01",

same_y=True,

size=(12, 12),

all_xticks=True,

)

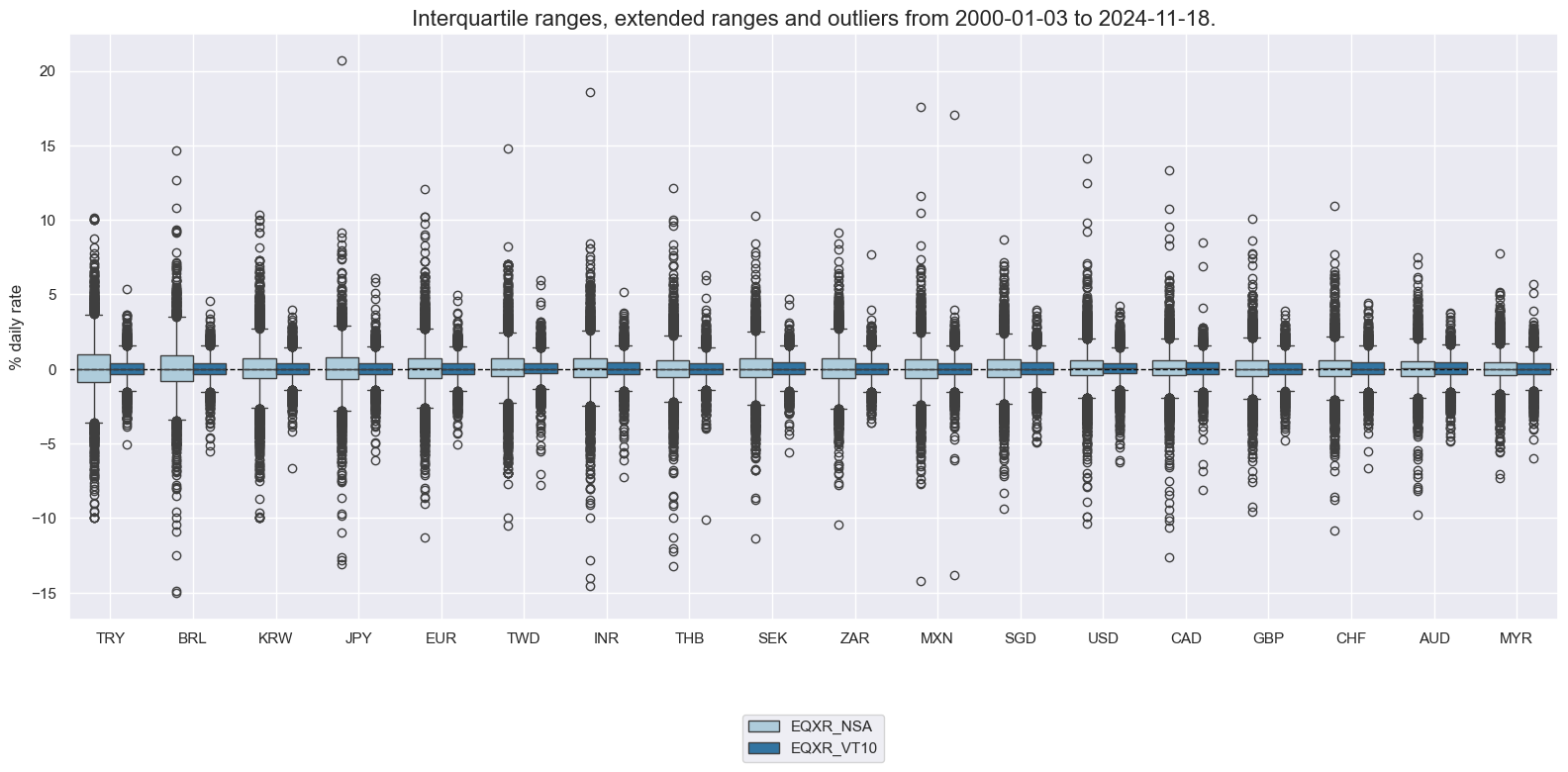

Directional equity returns #

xcatx = ["EQXR_NSA", "EQXR_VT10"]

cidx = cids_eq

msp.view_ranges(

dfx,

cids=cidx,

xcats=xcatx,

kind="box",

sort_cids_by="std",

ylab="% daily rate",

start="2000-01-01",

)

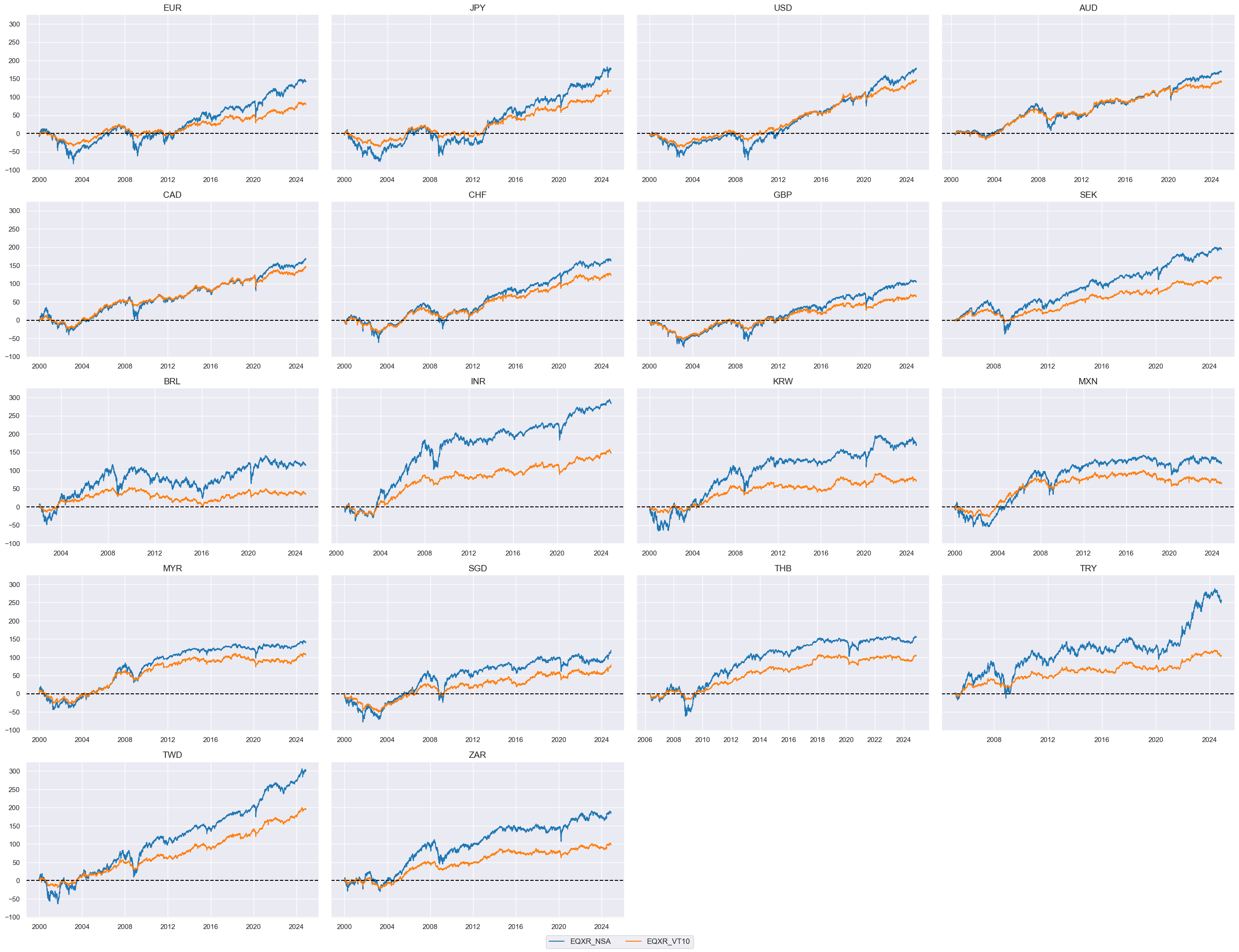

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

cumsum=True,

start="2000-01-01",

same_y=True,

size=(12, 12),

all_xticks=True,

)

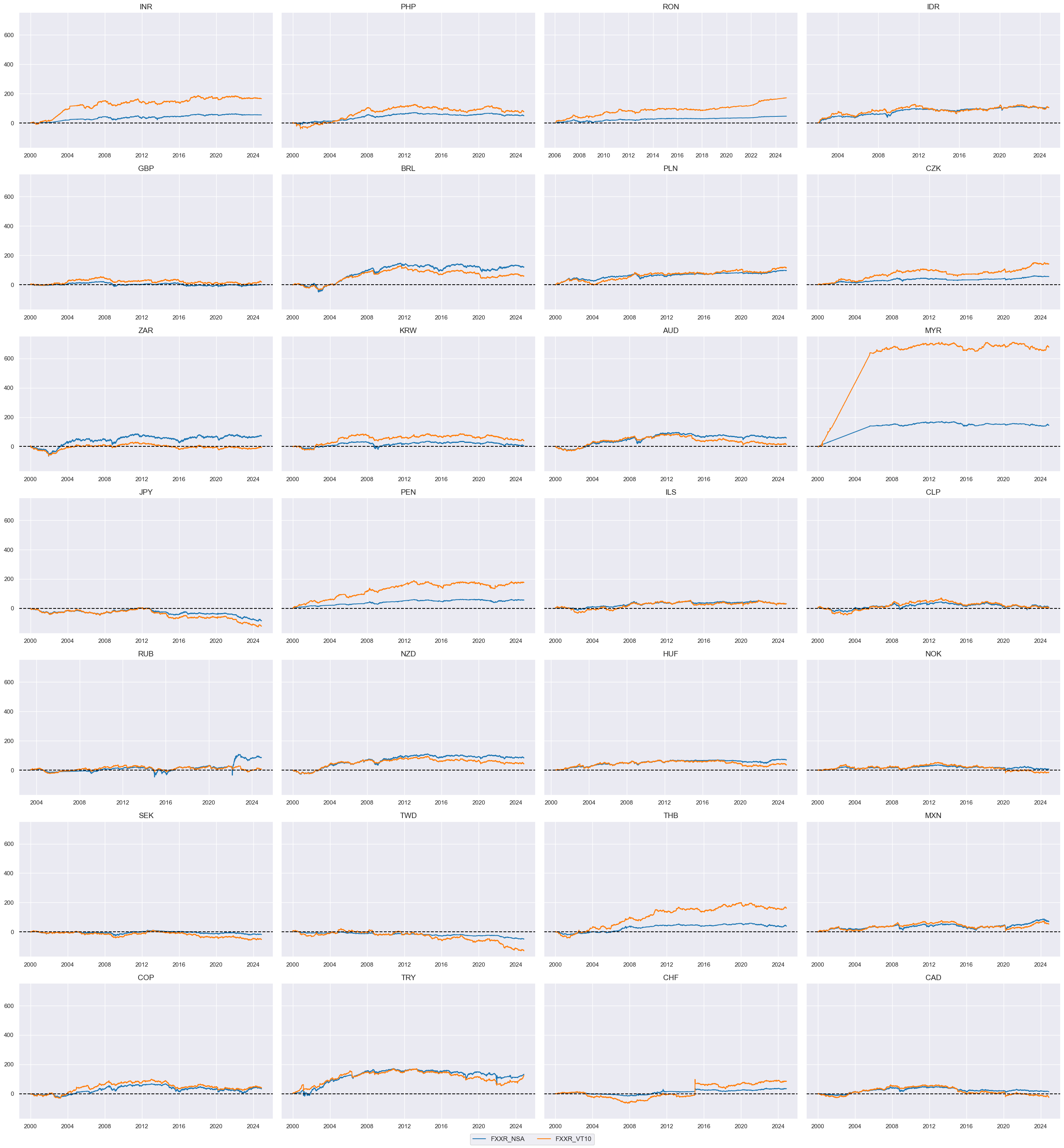

FX returns relative to base currencies #

xcatx = ["FXXR_NSA", "FXXR_VT10"]

cidx = cids_fx

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

cumsum=True,

start="2000-01-01",

same_y=True,

size=(12, 12),

all_xticks=True,

)

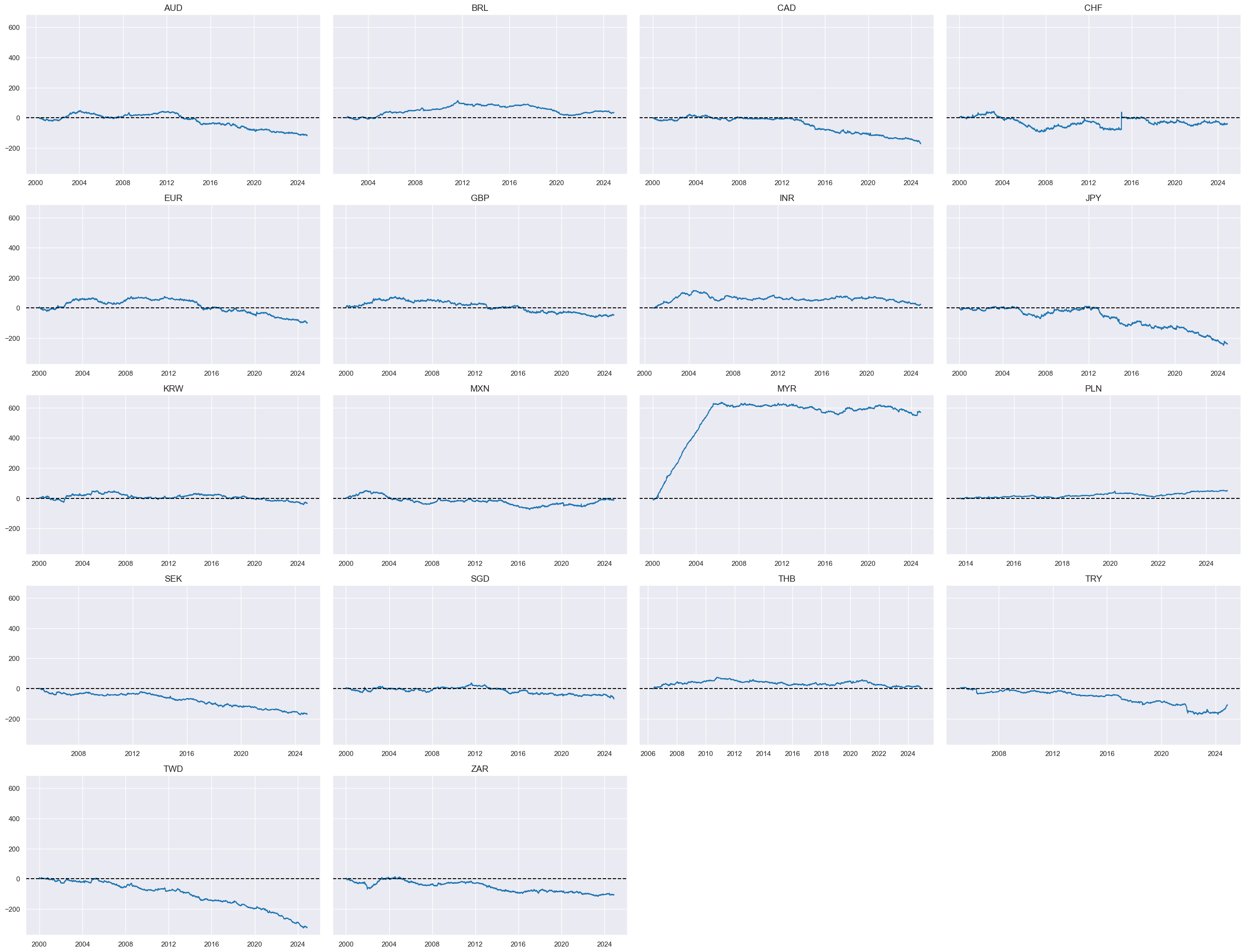

FX versus equity returns #

cidx_fxeq = msm.common_cids(dfx, ["FXXR_VT10", "EQXR_VT10"])

calcs = ["FXvEQXR = FXXR_VT10 - EQXR_VT10 "]

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cidx_fxeq, blacklist=None)

dfx = msm.update_df(dfx, dfa)

xcatx = ["FXvEQXR"]

cidx = cidx_fxeq

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

cumsum=True,

start="2000-01-01",

same_y=True,

size=(12, 12),

all_xticks=True,

)

FX versus IRS returns #

cidx_fxdu = list(

set(msm.common_cids(dfx, ["FXXR_VT10", "DU05YXR_VT10"])) - set(["IDR"])

)

calcs = ["FXvDU05XR = FXXR_VT10 - DU05YXR_VT10 "]

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cidx_fxdu, blacklist=dublack)

dfx = msm.update_df(dfx, dfa)

xcatx = ["FXvDU05XR"]

cidx = cidx_fxdu

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

cumsum=True,

start="2000-01-01",

same_y=True,

size=(12, 12),

all_xticks=True,

)

2s-5s flattener returns #

cidx_du52 = list(

set(msm.common_cids(dfx, ["DU02YXR_VT10", "DU05YXR_VT10"])) - set(["IDR"])

)

calcs = ["DU05v02XR = DU05YXR_VT10 - DU02YXR_VT10 "]

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cidx_du52, blacklist=dublack)

dfx = msm.update_df(dfx, dfa)

xcatx = ["DU05v02XR"]

cidx = cidx_du52

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

cumsum=True,

start="2000-01-01",

same_y=True,

size=(12, 12),

all_xticks=True,

)

Value checks #

Directional equity strategy #

Specs and panel test #

sigs = cs_dir

ms = "CSGIL_ZC" # main signal

oths = list(set(sigs) - set([ms])) # other signals

targ = "EQXR_VT10"

cidx = msm.common_cids(dfx, sigs + [targ])

# cidx = list(set(cids_dm) & set(cidx)) # for DM alone

dict_eqdi = {

"sig": ms,

"rivs": oths,

"targ": targ,

"cidx": cidx,

"black": fxblack,

"srr": None,

"pnls": None,

}

dix = dict_eqdi

sig = dix["sig"]

targ = dix["targ"]

cidx = dix["cidx"]

blax = dix["black"]

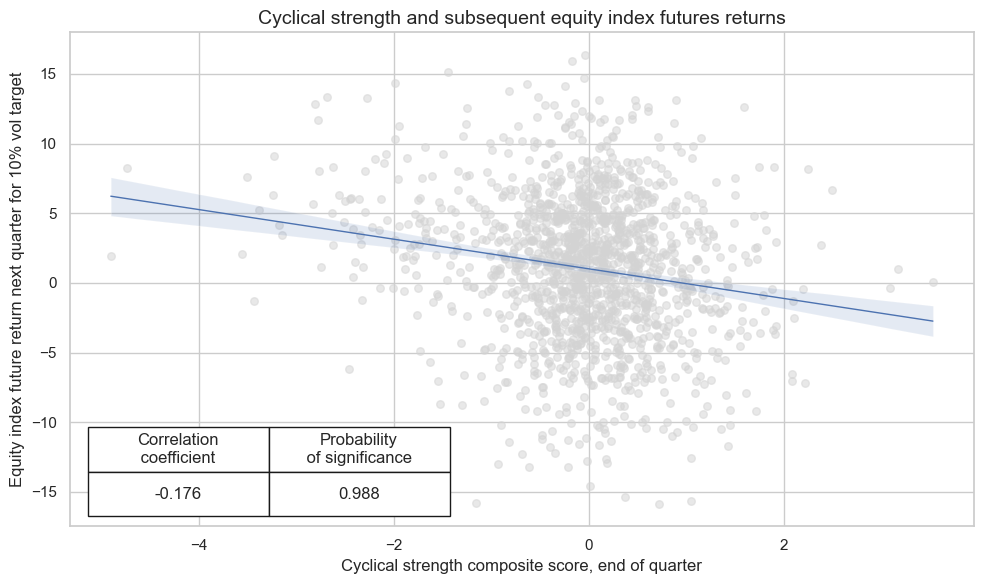

crx = msp.CategoryRelations(

dfx,

xcats=[sig, targ],

cids=cidx,

freq="Q", # quarterly frequency allows for policy inertia

lag=1,

xcat_aggs=["last", "sum"],

start="2000-01-01",

blacklist=blax,

xcat_trims=[None, None],

)

crx.reg_scatter(

labels=False,

coef_box="lower left",

xlab="Cyclical strength composite score, end of quarter",

ylab="Equity index future return next quarter for 10% vol target",

title="Cyclical strength and subsequent equity index futures returns",

size=(10, 6),

prob_est="map",

)

Accuracy and correlation check #

dix = dict_eqdi

sig = dix["sig"]

rivs = dix["rivs"]

targ = dix["targ"]

cidx = dix["cidx"]

blax = dix["black"]

srr = mss.SignalReturnRelations(

dfx,

cids=cidx,

sigs=[sig] + rivs,

sig_neg=[True] + [True] * len(rivs),

rets=targ,

freqs="M",

start="2000-01-01",

blacklist=blax,

)

dix["srr"] = srr

dix = dict_eqdi

srrx = dix["srr"]

display(srrx.summary_table().astype("float").round(3))

| accuracy | bal_accuracy | pos_sigr | pos_retr | pos_prec | neg_prec | pearson | pearson_pval | kendall | kendall_pval | auc | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| M: CSGIL_ZC_NEG/last => EQXR_VT10 | 0.523 | 0.522 | 0.506 | 0.586 | 0.608 | 0.437 | 0.100 | 0.000 | 0.053 | 0.000 | 0.523 |

| Mean years | 0.522 | 0.511 | 0.502 | 0.583 | 0.592 | 0.430 | 0.043 | 0.450 | 0.025 | 0.435 | 0.508 |

| Positive ratio | 0.600 | 0.560 | 0.600 | 0.680 | 0.800 | 0.280 | 0.600 | 0.360 | 0.600 | 0.400 | 0.560 |

| Mean cids | 0.522 | 0.519 | 0.505 | 0.583 | 0.600 | 0.437 | 0.100 | 0.227 | 0.051 | 0.308 | 0.519 |

| Positive ratio | 0.824 | 0.706 | 0.471 | 0.941 | 0.941 | 0.059 | 0.941 | 0.824 | 0.765 | 0.647 | 0.706 |

dix = dict_eqdi

srrx = dix["srr"]

display(srrx.signals_table().sort_index().astype("float").round(3))

| accuracy | bal_accuracy | pos_sigr | pos_retr | pos_prec | neg_prec | pearson | pearson_pval | kendall | kendall_pval | auc | ||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Return | Signal | Frequency | Aggregation | |||||||||||

| EQXR_VT10 | CSGIL_ZC_NEG | M | last | 0.523 | 0.522 | 0.506 | 0.586 | 0.608 | 0.437 | 0.100 | 0.000 | 0.053 | 0.000 | 0.523 |

| CSGI_ZC_NEG | M | last | 0.535 | 0.525 | 0.555 | 0.586 | 0.609 | 0.442 | 0.087 | 0.000 | 0.048 | 0.000 | 0.526 | |

| CSGL_ZC_NEG | M | last | 0.492 | 0.501 | 0.448 | 0.586 | 0.587 | 0.415 | 0.075 | 0.000 | 0.032 | 0.002 | 0.501 | |

| CSG_ZC_NEG | M | last | 0.515 | 0.508 | 0.538 | 0.586 | 0.593 | 0.423 | 0.051 | 0.001 | 0.014 | 0.171 | 0.508 | |

| CSIL_ZC_NEG | M | last | 0.527 | 0.528 | 0.495 | 0.586 | 0.614 | 0.442 | 0.108 | 0.000 | 0.063 | 0.000 | 0.529 | |

| CSI_ZC_NEG | M | last | 0.538 | 0.529 | 0.551 | 0.586 | 0.612 | 0.446 | 0.084 | 0.000 | 0.049 | 0.000 | 0.530 | |

| CSL_ZC_NEG | M | last | 0.496 | 0.515 | 0.396 | 0.586 | 0.604 | 0.425 | 0.082 | 0.000 | 0.046 | 0.000 | 0.514 |

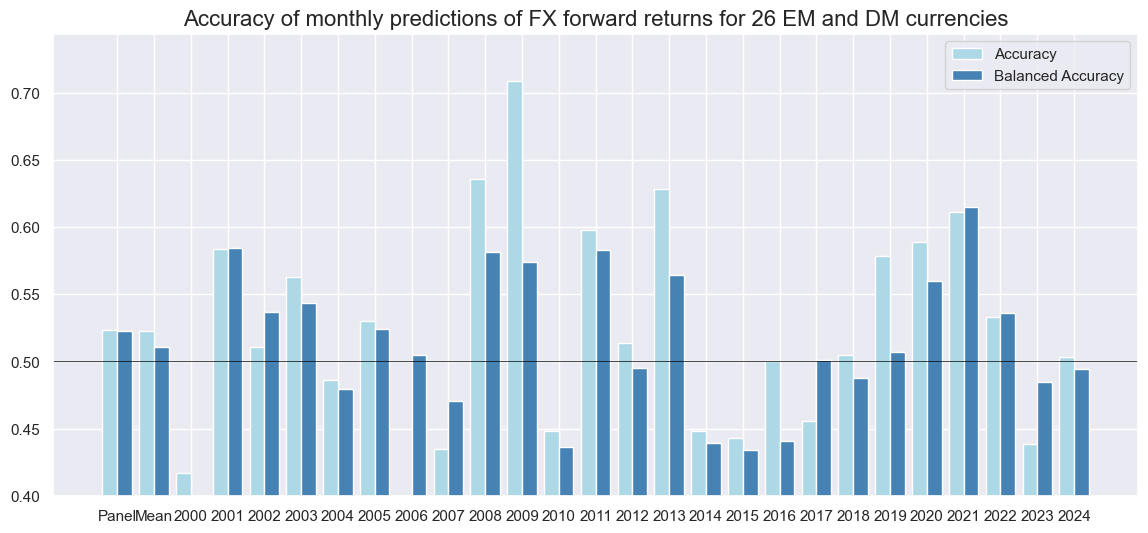

dix = dict_eqdi

srrx = dix["srr"]

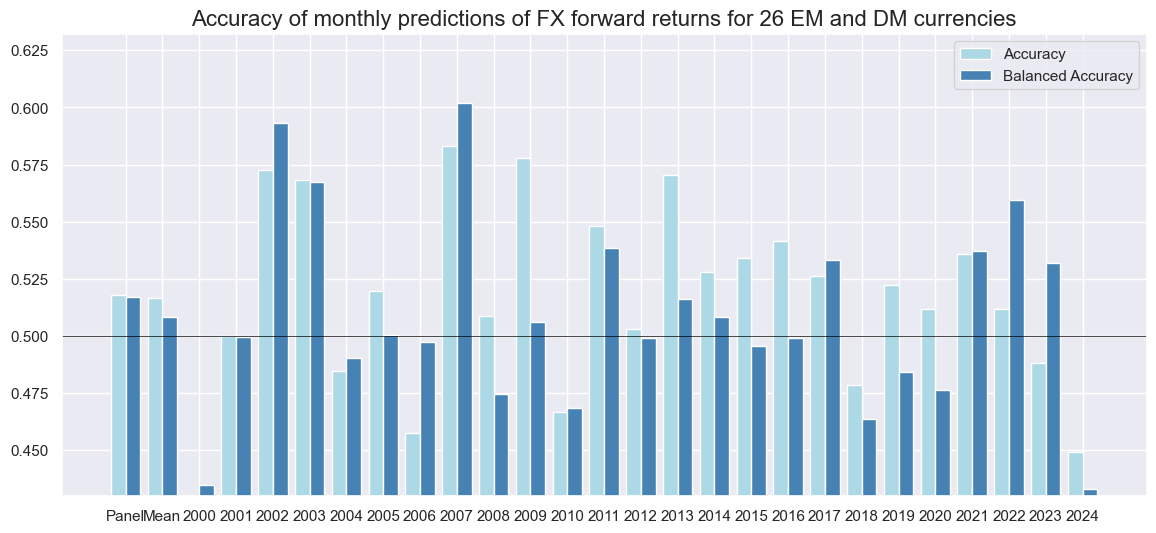

srrx.accuracy_bars(

type="years",

title="Accuracy of monthly predictions of FX forward returns for 26 EM and DM currencies",

size=(14, 6),

)

Naive PnL #

dix = dict_eqdi

sigx = [dix["sig"]] + dix["rivs"]

targ = dix["targ"]

cidx = dix["cidx"]

blax = dix["black"]

naive_pnl = msn.NaivePnL(

dfx,

ret=targ,

sigs=sigx,

cids=cidx,

start="2000-01-01",

blacklist=blax,

bms=["USD_EQXR_NSA"],

)

for sig in sigx:

naive_pnl.make_pnl(

sig,

sig_neg=True,

sig_op="zn_score_pan",

thresh=3,

rebal_freq="monthly",

vol_scale=10,

rebal_slip=1,

pnl_name=sig + "_PZN",

)

for sig in sigx:

naive_pnl.make_pnl(

sig,

sig_neg=True,

sig_op="binary",

thresh=3,

rebal_freq="monthly",

vol_scale=10,

rebal_slip=1,

pnl_name=sig + "_BIN",

)

naive_pnl.make_long_pnl(vol_scale=10, label="Long only")

dix["pnls"] = naive_pnl

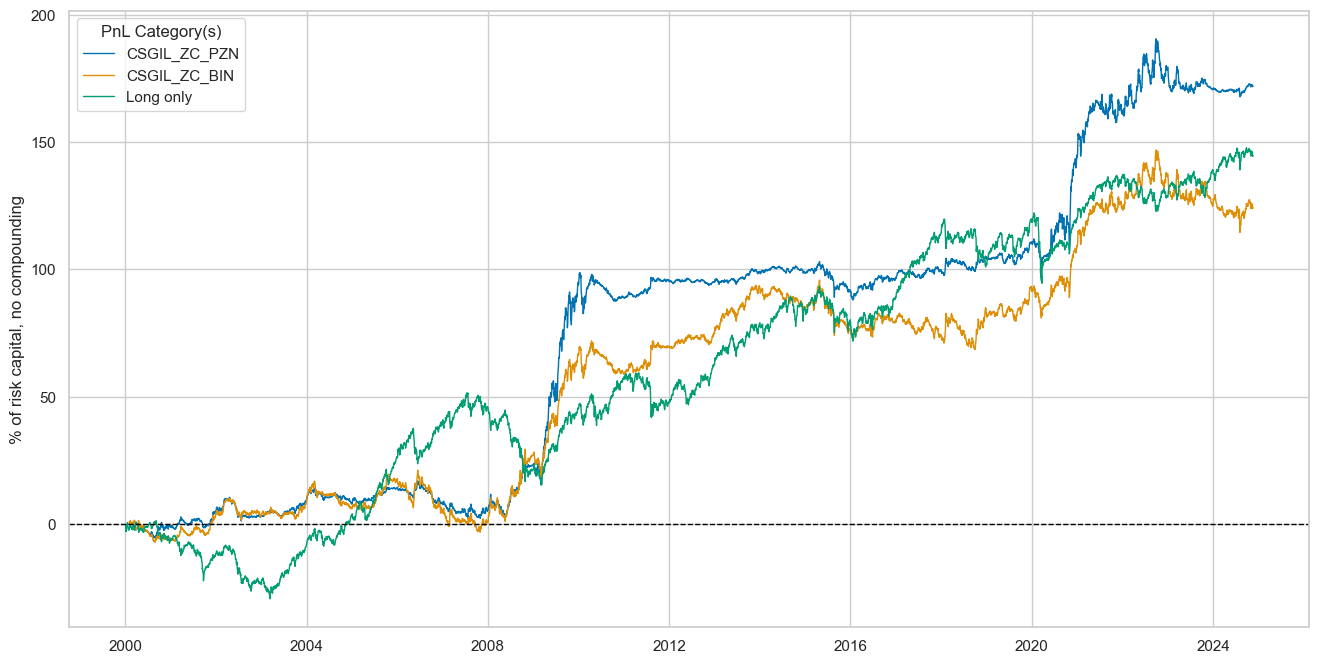

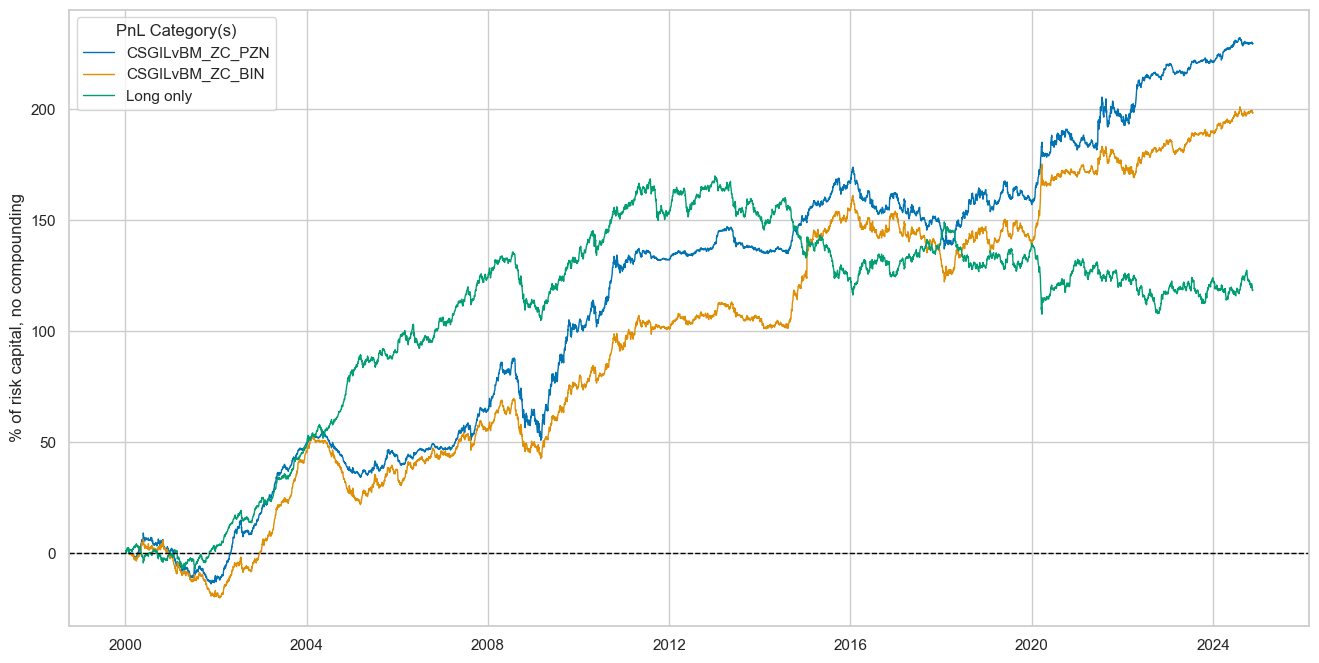

dix = dict_eqdi

sigx = dix["sig"]

naive_pnl = dix["pnls"]

pnls = [sigx + x for x in ["_PZN", "_BIN"]] + ["Long only"]

naive_pnl.plot_pnls(

pnl_cats=pnls,

pnl_cids=["ALL"],

start="2000-01-01",

title=None,

xcat_labels=None,

figsize=(16, 8),

)

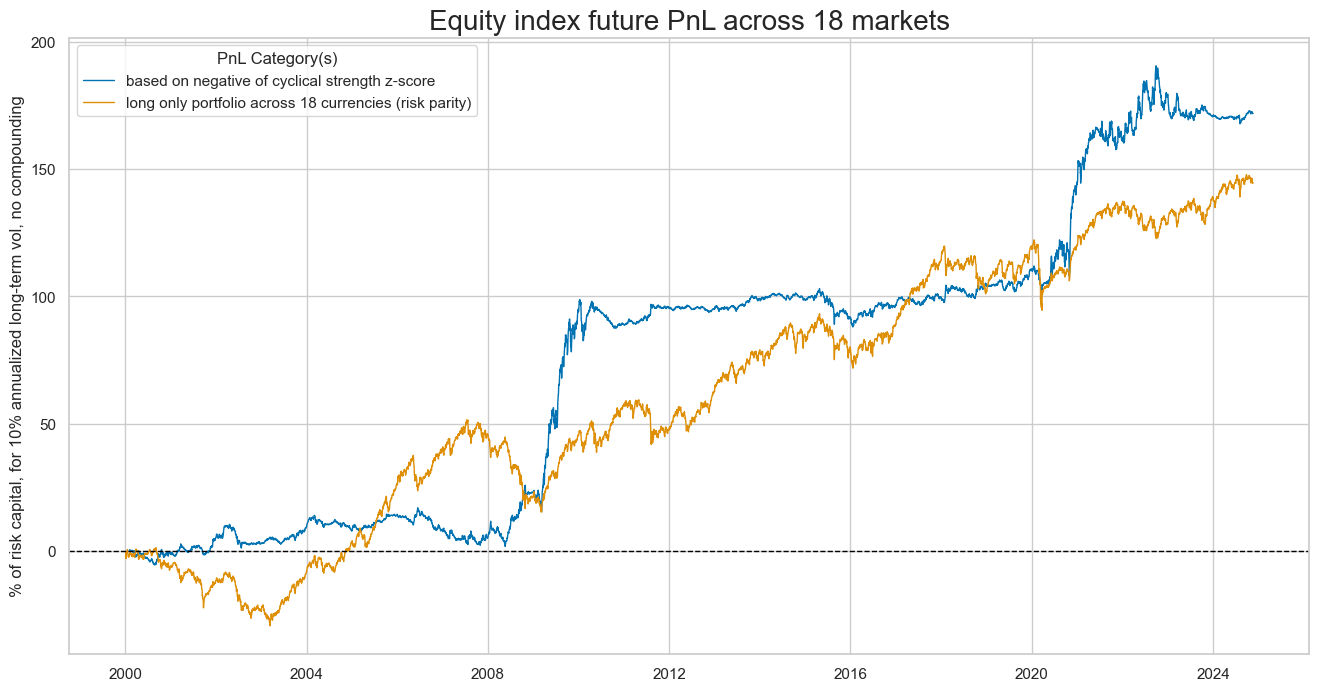

dix = dict_eqdi

sigx = dix["sig"]

naive_pnl = dix["pnls"]

pnls = [sigx + "_PZN"] + ["Long only"]

dict_labels={"CSGIL_ZC_PZN": "based on negative of cyclical strength z-score",

"Long only": "long only portfolio across 18 currencies (risk parity)"}

naive_pnl.plot_pnls(

pnl_cats=pnls,

pnl_cids=["ALL"],

start="2000-01-01",

title="Equity index future PnL across 18 markets",

xcat_labels=dict_labels,

ylab="% of risk capital, for 10% annualized long-term vol, no compounding",

figsize=(16, 8),

)

dix = dict_eqdi

sigx = dix["rivs"]

naive_pnl = dix["pnls"]

pnls = [sig + "_PZN" for sig in sigx]

naive_pnl.plot_pnls(

pnl_cats=pnls,

pnl_cids=["ALL"],

start="2000-01-01",

title=None,

xcat_labels=None,

figsize=(16, 8),

)

dix = dict_eqdi

sigx = [dix["sig"]] + dix["rivs"]

naive_pnl = dix["pnls"]

pnls = [sig + type for sig in sigx for type in ["_PZN", "_BIN"]]

df_eval = naive_pnl.evaluate_pnls(

pnl_cats=pnls,

pnl_cids=["ALL"],

start="2000-01-01",

)

display(df_eval.transpose())

| Return % | St. Dev. % | Sharpe Ratio | Sortino Ratio | Max 21-Day Draw % | Max 6-Month Draw % | Peak to Trough Draw % | Top 5% Monthly PnL Share | USD_EQXR_NSA correl | Traded Months | |

|---|---|---|---|---|---|---|---|---|---|---|

| xcat | ||||||||||

| CSGIL_ZC_PZN | 6.94022 | 10.0 | 0.694022 | 1.056501 | -16.166429 | -16.223607 | -22.790915 | 0.928508 | 0.017189 | 298 |

| CSGI_ZC_PZN | 6.477148 | 10.0 | 0.647715 | 0.969935 | -15.512794 | -16.084488 | -22.115923 | 0.955529 | 0.10583 | 298 |

| CSL_ZC_PZN | 5.084576 | 10.0 | 0.508458 | 0.763275 | -16.256005 | -15.15405 | -32.059263 | 1.02996 | -0.166519 | 298 |

| CSGL_ZC_PZN | 4.921142 | 10.0 | 0.492114 | 0.755367 | -16.141134 | -19.189023 | -43.66662 | 1.277214 | 0.091609 | 298 |

| CSG_ZC_PZN | 3.633014 | 10.0 | 0.363301 | 0.552031 | -14.719867 | -27.121756 | -54.156334 | 1.680659 | 0.252896 | 298 |

| CSI_ZC_PZN | 6.113695 | 10.0 | 0.61137 | 0.88192 | -19.795761 | -24.688366 | -37.621333 | 0.89019 | -0.099871 | 298 |

| CSIL_ZC_PZN | 7.147002 | 10.0 | 0.7147 | 1.058185 | -19.836399 | -23.354137 | -35.725208 | 0.830926 | -0.156898 | 298 |

| CSGIL_ZC_BIN | 5.023701 | 10.0 | 0.50237 | 0.731789 | -12.466828 | -15.689518 | -32.402217 | 0.949469 | -0.037476 | 298 |

| CSGI_ZC_BIN | 5.67273 | 10.0 | 0.567273 | 0.81104 | -15.337639 | -18.773117 | -27.927563 | 0.822128 | 0.049908 | 298 |

| CSL_ZC_BIN | 3.122454 | 10.0 | 0.312245 | 0.470511 | -12.794928 | -18.429408 | -46.73745 | 1.494443 | -0.232358 | 298 |

| CSGL_ZC_BIN | -0.231495 | 10.0 | -0.023149 | -0.033609 | -12.35682 | -20.250482 | -64.493563 | -19.652593 | -0.00372 | 298 |

| CSG_ZC_BIN | 1.415129 | 10.0 | 0.141513 | 0.201447 | -22.879402 | -24.320621 | -50.514564 | 3.033367 | 0.20364 | 298 |

| CSI_ZC_BIN | 6.584364 | 10.0 | 0.658436 | 0.930802 | -21.426654 | -16.073625 | -31.616623 | 0.71571 | -0.009845 | 298 |

| CSIL_ZC_BIN | 6.001176 | 10.0 | 0.600118 | 0.868822 | -13.391313 | -19.065276 | -34.175308 | 0.821154 | -0.127269 | 298 |

dix = dict_eqdi

sig = dix["sig"]

naive_pnl = dix["pnls"]

naive_pnl.signal_heatmap(

pnl_name=sig + "_PZN", freq="q", start="2000-01-01", figsize=(16, 5)

)

Directional FX strategy #

Specs and panel test #

sigs = cs_rel

ms = "CSGILvBM_ZC" # main signal

oths = list(set(sigs) - set([ms])) # other signals

targ = "FXXR_VT10"

cidx = msm.common_cids(dfx, sigs + [targ])

# cidx = list(set(cids_dm) & set(cidx)) # for DM alone

dict_fxdi = {

"sig": ms,

"rivs": oths,

"targ": targ,

"cidx": cidx,

"black": None,

"srr": None,

"pnls": None,

}

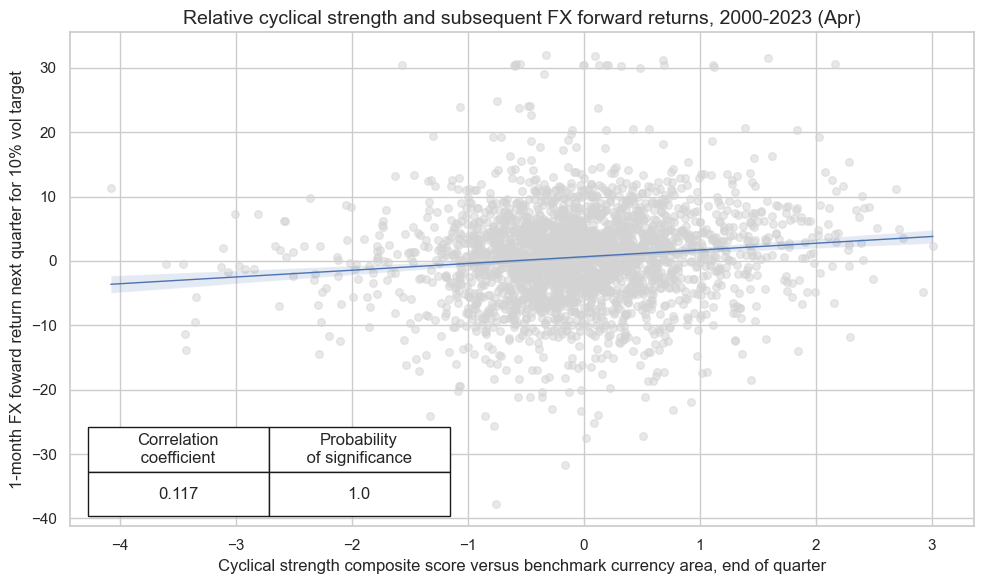

dix = dict_fxdi

sig = dix["sig"]

targ = dix["targ"]

cidx = dix["cidx"]

blax = dix["black"]

crx = msp.CategoryRelations(

dfx,

xcats=[sig, targ],

cids=cidx,

freq="Q", # quarterly frequency allows for policy inertia

lag=1,

xcat_aggs=["last", "sum"],

start="2000-01-01",

blacklist=blax,

xcat_trims=[1000, 40],

)

crx.reg_scatter(

labels=False,

coef_box="lower left",

xlab="Cyclical strength composite score versus benchmark currency area, end of quarter",

ylab="1-month FX foward return next quarter for 10% vol target",

title="Relative cyclical strength and subsequent FX forward returns, 2000-2023 (Apr)",

size=(10, 6),

prob_est="map",

)

Accuracy and correlation check #

dix = dict_fxdi

sig = dix["sig"]

rivs = dix["rivs"]

targ = dix["targ"]

cidx = dix["cidx"]

blax = dix["black"]

srr = mss.SignalReturnRelations(

dfx,

cids=cidx,

sigs=[sig] + rivs,

rets=targ,

freqs="M",

start="2000-01-01",

blacklist=blax,

)

dix["srr"] = srr

dix = dict_fxdi

srrx = dix["srr"]

display(srrx.summary_table().astype("float").round(3))

| accuracy | bal_accuracy | pos_sigr | pos_retr | pos_prec | neg_prec | pearson | pearson_pval | kendall | kendall_pval | auc | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| M: CSGILvBM_ZC/last => FXXR_VT10 | 0.521 | 0.525 | 0.456 | 0.545 | 0.572 | 0.478 | 0.073 | 0.000 | 0.049 | 0.000 | 0.525 |

| Mean years | 0.520 | 0.517 | 0.454 | 0.545 | 0.561 | 0.473 | 0.062 | 0.319 | 0.036 | 0.287 | 0.515 |

| Positive ratio | 0.680 | 0.720 | 0.440 | 0.680 | 0.760 | 0.320 | 0.800 | 0.680 | 0.800 | 0.680 | 0.720 |

| Mean cids | 0.521 | 0.520 | 0.459 | 0.546 | 0.569 | 0.472 | 0.069 | 0.306 | 0.042 | 0.355 | 0.520 |

| Positive ratio | 0.741 | 0.741 | 0.296 | 0.852 | 0.852 | 0.333 | 0.815 | 0.667 | 0.778 | 0.556 | 0.741 |

dix = dict_fxdi

srrx = dix["srr"]

display(srrx.signals_table().sort_index().astype("float").round(3))

| accuracy | bal_accuracy | pos_sigr | pos_retr | pos_prec | neg_prec | pearson | pearson_pval | kendall | kendall_pval | auc | ||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Return | Signal | Frequency | Aggregation | |||||||||||

| FXXR_VT10 | CSGILvBM_ZC | M | last | 0.521 | 0.525 | 0.456 | 0.545 | 0.572 | 0.478 | 0.073 | 0.000 | 0.049 | 0.000 | 0.525 |

| CSGIvBM_ZC | M | last | 0.510 | 0.512 | 0.469 | 0.544 | 0.557 | 0.468 | 0.051 | 0.000 | 0.033 | 0.000 | 0.512 | |

| CSGLvBM_ZC | M | last | 0.520 | 0.522 | 0.478 | 0.545 | 0.568 | 0.476 | 0.059 | 0.000 | 0.043 | 0.000 | 0.522 | |

| CSGvBM_ZC | M | last | 0.512 | 0.513 | 0.480 | 0.539 | 0.552 | 0.474 | 0.023 | 0.048 | 0.016 | 0.037 | 0.513 | |

| CSILvBM_ZC | M | last | 0.528 | 0.531 | 0.469 | 0.544 | 0.577 | 0.485 | 0.082 | 0.000 | 0.056 | 0.000 | 0.531 | |

| CSIvBM_ZC | M | last | 0.516 | 0.518 | 0.470 | 0.541 | 0.561 | 0.476 | 0.054 | 0.000 | 0.036 | 0.000 | 0.519 | |

| CSLvBM_ZC | M | last | 0.526 | 0.528 | 0.472 | 0.543 | 0.573 | 0.484 | 0.074 | 0.000 | 0.056 | 0.000 | 0.528 |

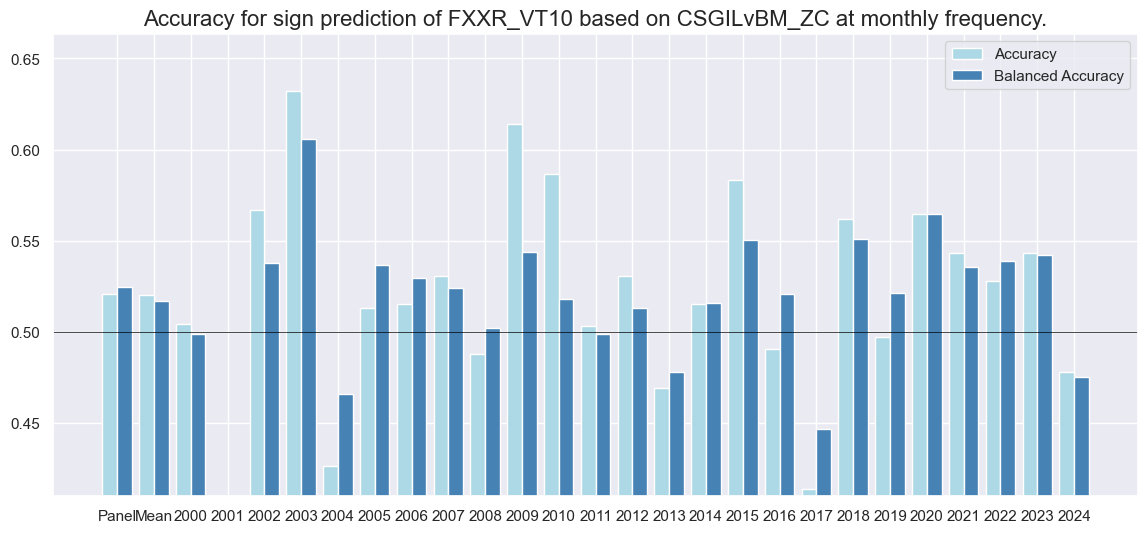

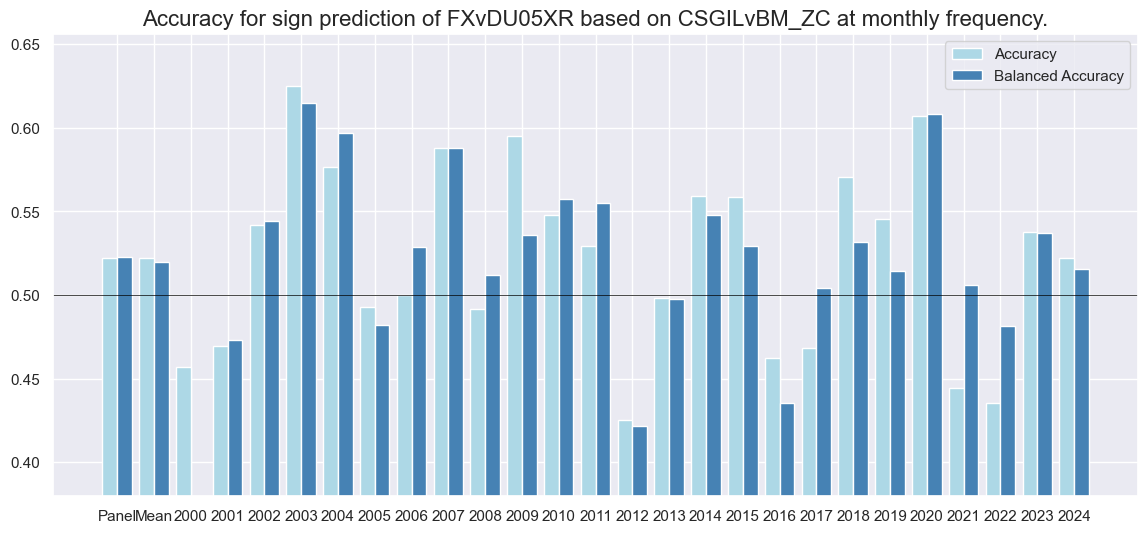

dix = dict_fxdi

srrx = dix["srr"]

srrx.accuracy_bars(

type="years",

# title="",

size=(14, 6),

)

Naive PnL #

dix = dict_fxdi

sigx = [dix["sig"]] + dix["rivs"]

targ = dix["targ"]

cidx = dix["cidx"]

blax = dix["black"]

naive_pnl = msn.NaivePnL(

dfx,

ret=targ,

sigs=sigx,

cids=cidx,

start="2000-01-01",

blacklist=blax,

bms=["USD_EQXR_NSA"],

)

for sig in sigx:

naive_pnl.make_pnl(

sig,

sig_neg=False,

sig_op="zn_score_pan",

thresh=3,

rebal_freq="monthly",

vol_scale=10,

rebal_slip=1,

pnl_name=sig + "_PZN",

)

for sig in sigx:

naive_pnl.make_pnl(

sig,

sig_neg=False,

sig_op="binary",

thresh=3,

rebal_freq="monthly",

vol_scale=10,

rebal_slip=1,

pnl_name=sig + "_BIN",

)

naive_pnl.make_long_pnl(vol_scale=10, label="Long only")

dix["pnls"] = naive_pnl

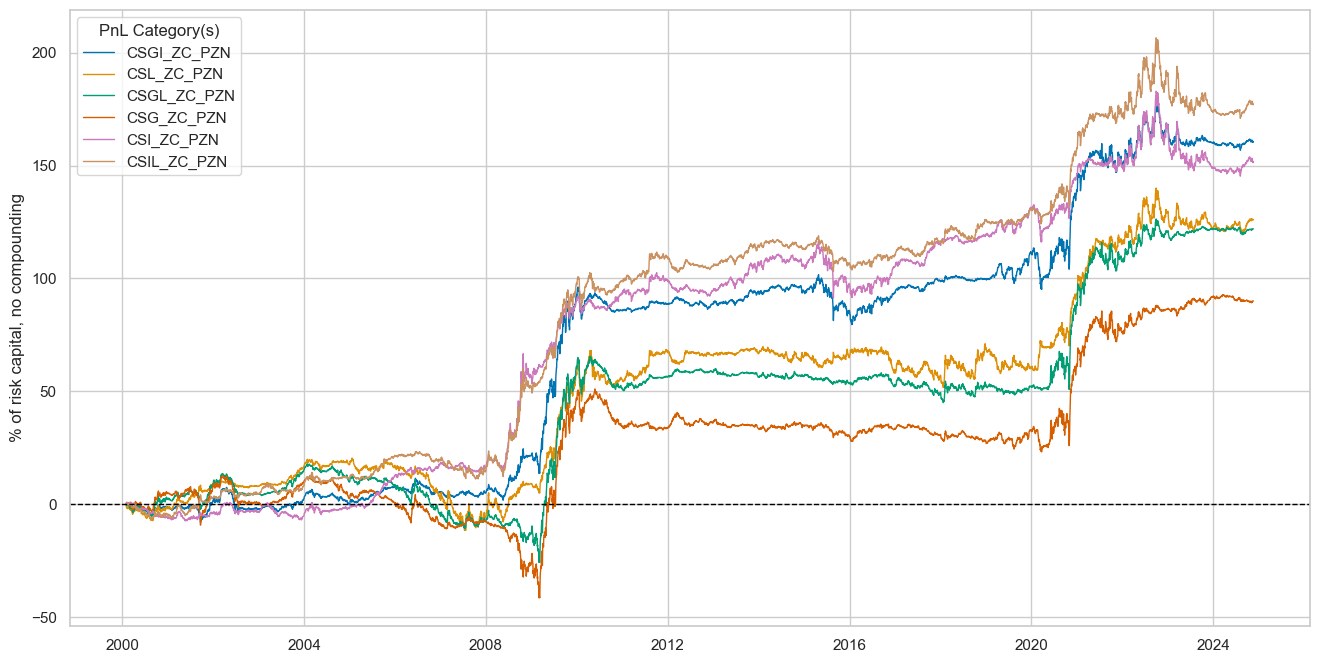

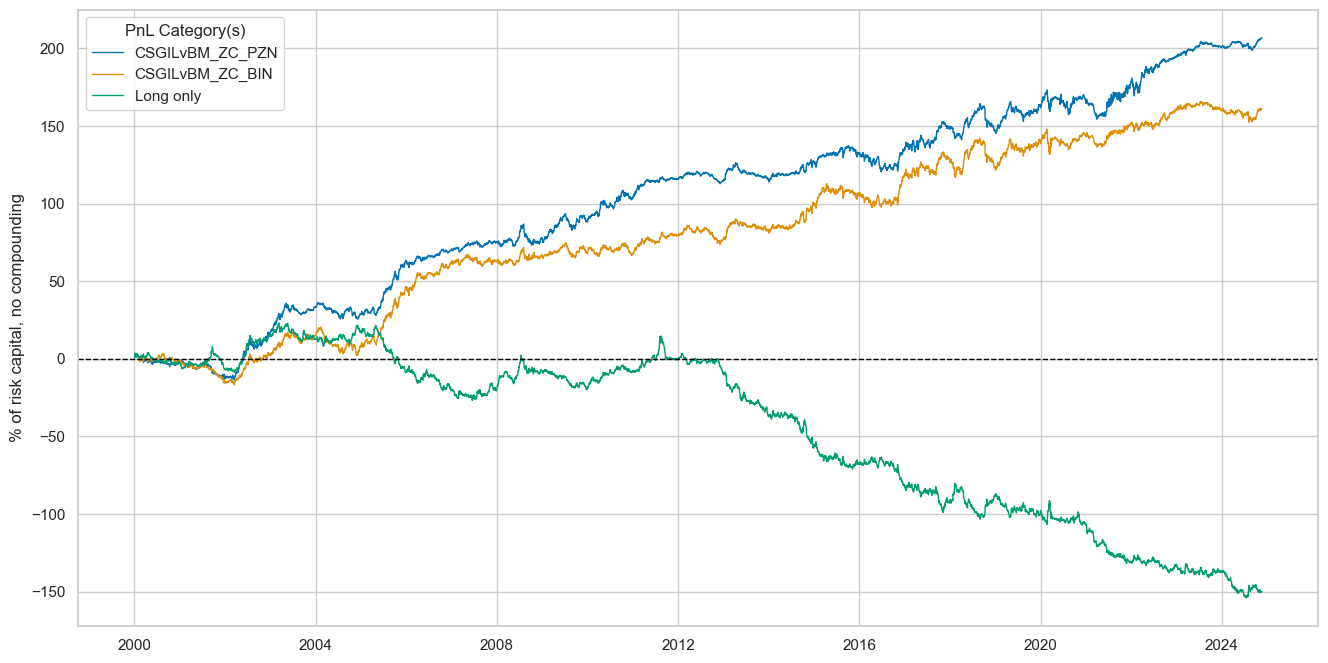

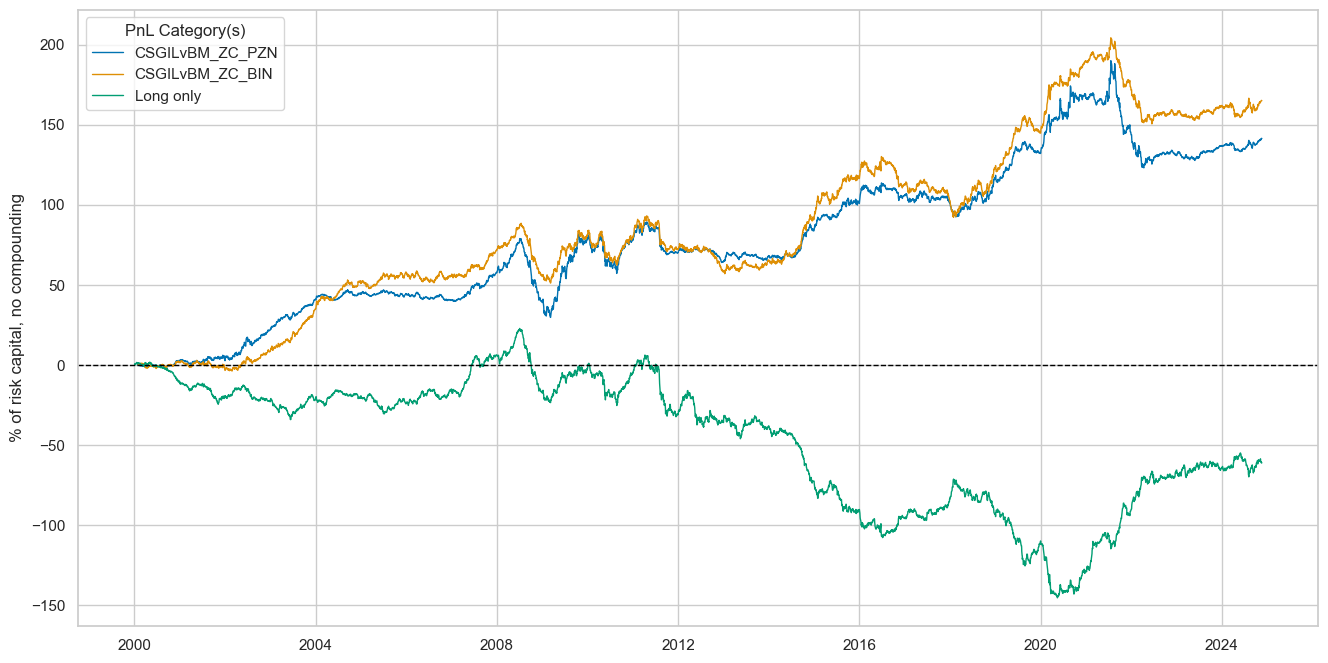

dix = dict_fxdi

sigx = dix["sig"]

naive_pnl = dix["pnls"]

pnls = [sigx + x for x in ["_PZN", "_BIN"]] + ["Long only"]

naive_pnl.plot_pnls(

pnl_cats=pnls,

pnl_cids=["ALL"],

start="2000-01-01",

title=None,

xcat_labels=None,

figsize=(16, 8),

)

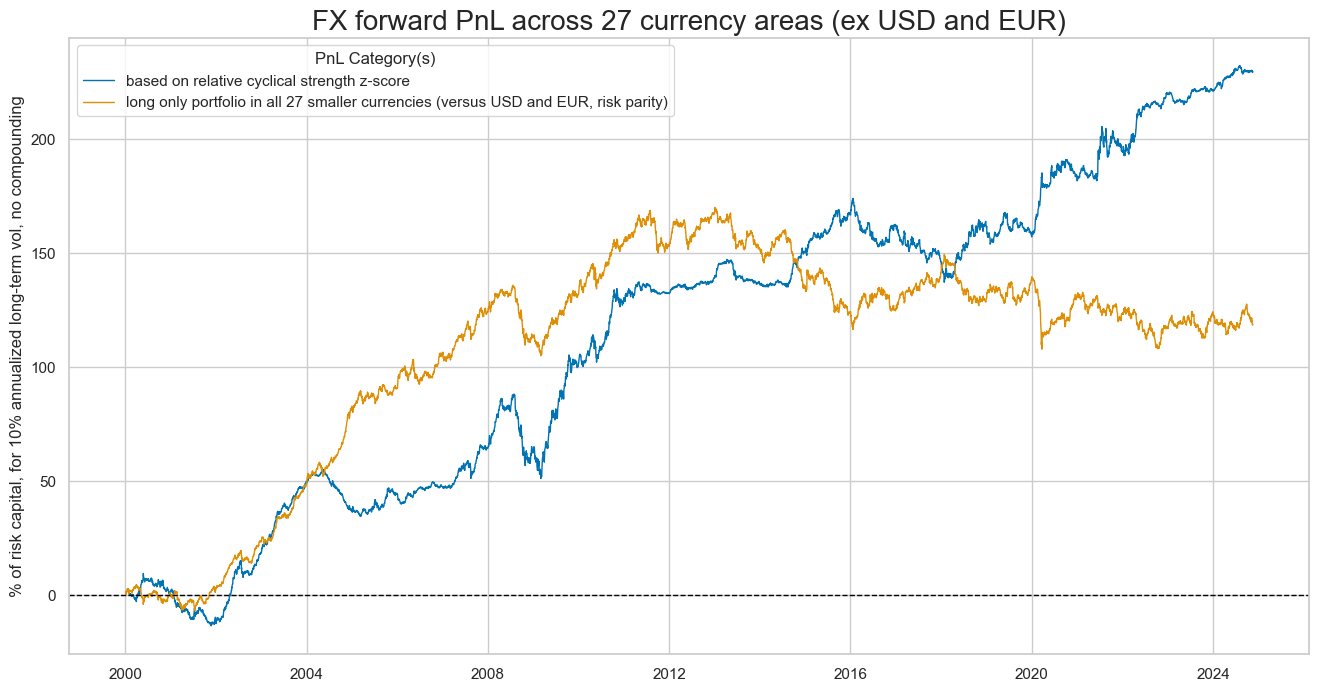

dix = dict_fxdi

sigx = dix["sig"]

naive_pnl = dix["pnls"]

pnls = [sigx + "_PZN"] + ["Long only"]

dict_labels={"CSGILvBM_ZC_PZN":"based on relative cyclical strength z-score",

"Long only": "long only portfolio in all 27 smaller currencies (versus USD and EUR, risk parity)"}

naive_pnl.plot_pnls(

pnl_cats=pnls,

pnl_cids=["ALL"],

start="2000-01-01",

title="FX forward PnL across 27 currency areas (ex USD and EUR)",

xcat_labels=dict_labels,

ylab="% of risk capital, for 10% annualized long-term vol, no compounding",

figsize=(16, 8),

)

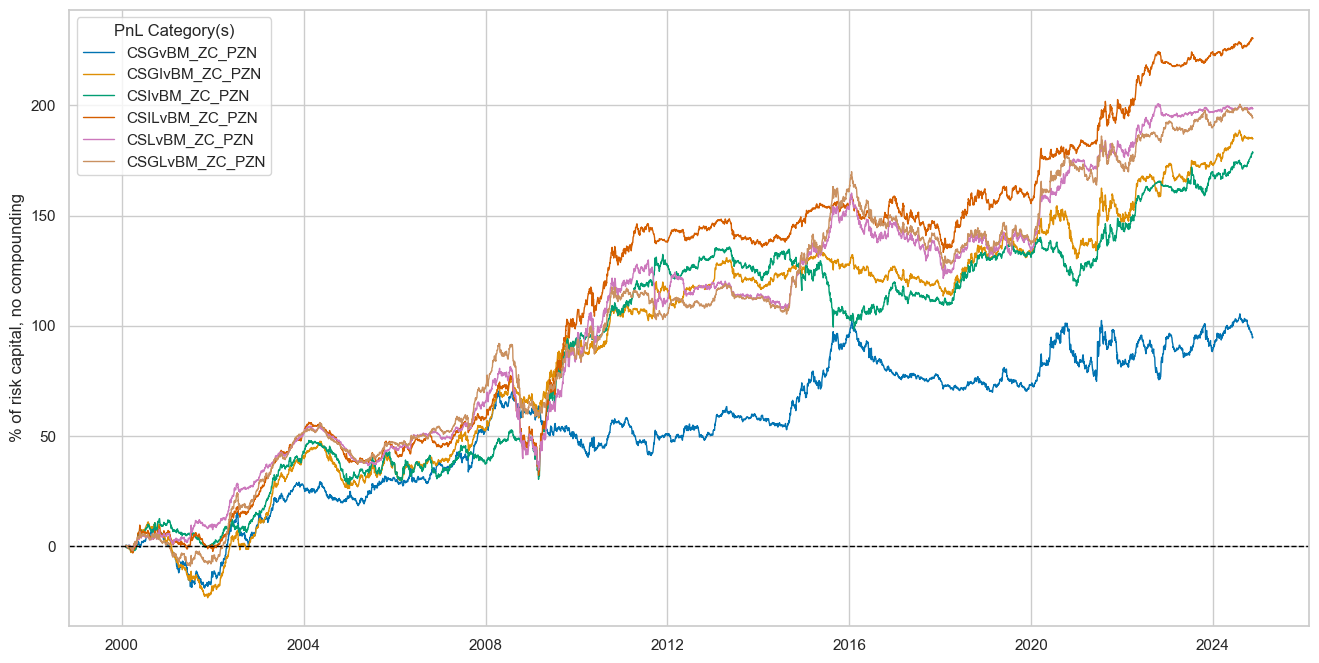

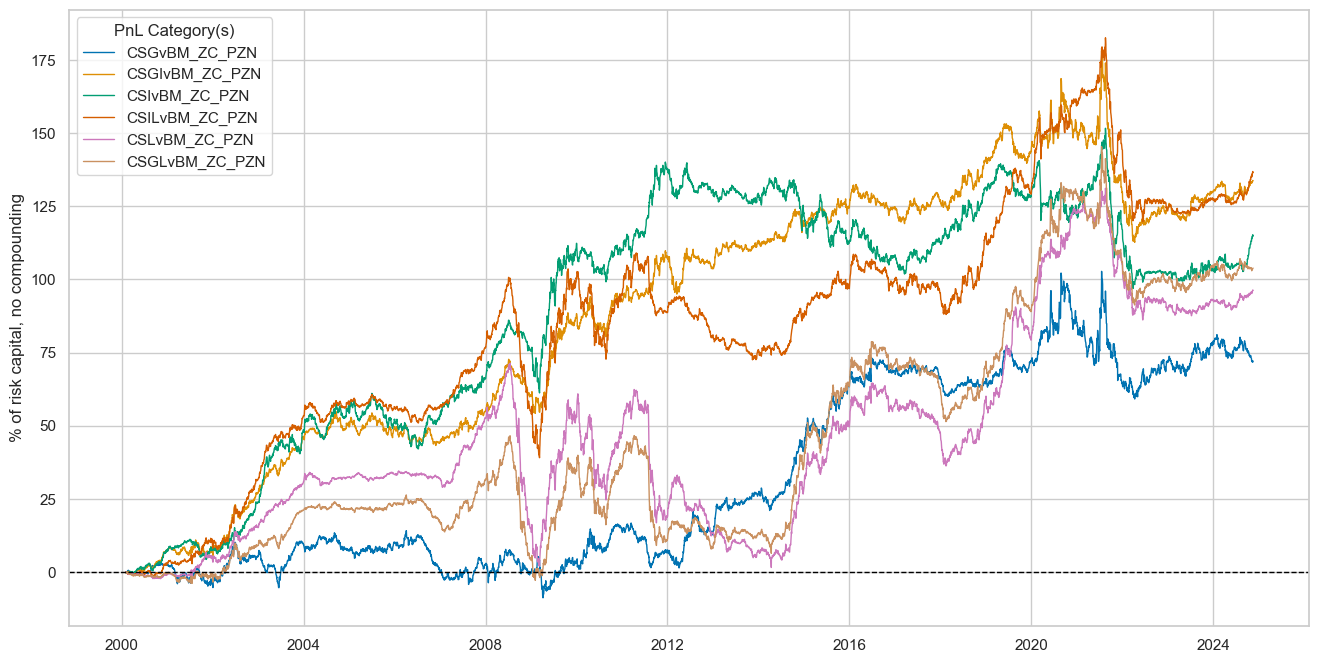

dix = dict_fxdi

sigx = dix["rivs"]

naive_pnl = dix["pnls"]

pnls = [sig + "_PZN" for sig in sigx]

naive_pnl.plot_pnls(

pnl_cats=pnls,

pnl_cids=["ALL"],

start="2000-01-01",

title=None,

xcat_labels=None,

figsize=(16, 8),

)

dix = dict_fxdi

sigx = [dix["sig"]] + dix["rivs"]

naive_pnl = dix["pnls"]

pnls = [sig + type for sig in sigx for type in ["_PZN", "_BIN"]]

df_eval = naive_pnl.evaluate_pnls(

pnl_cats=pnls,

pnl_cids=["ALL"],

start="2000-01-01",

)

display(df_eval.transpose())

| Return % | St. Dev. % | Sharpe Ratio | Sortino Ratio | Max 21-Day Draw % | Max 6-Month Draw % | Peak to Trough Draw % | Top 5% Monthly PnL Share | USD_EQXR_NSA correl | Traded Months | |

|---|---|---|---|---|---|---|---|---|---|---|

| xcat | ||||||||||

| CSGILvBM_ZC_PZN | 9.261088 | 10.0 | 0.926109 | 1.382363 | -15.673803 | -29.756144 | -37.090776 | 0.570461 | 0.066619 | 298 |

| CSGvBM_ZC_PZN | 3.827413 | 10.0 | 0.382741 | 0.557852 | -14.212981 | -22.414324 | -32.459905 | 1.31609 | -0.043541 | 298 |

| CSGIvBM_ZC_PZN | 7.456637 | 10.0 | 0.745664 | 1.115362 | -10.217006 | -22.244731 | -34.453754 | 0.738076 | 0.058735 | 298 |

| CSIvBM_ZC_PZN | 7.197503 | 10.0 | 0.71975 | 1.069246 | -14.530983 | -25.393154 | -37.485675 | 0.716886 | 0.121809 | 298 |

| CSILvBM_ZC_PZN | 9.288838 | 10.0 | 0.928884 | 1.380198 | -17.483943 | -31.51101 | -45.263751 | 0.587457 | 0.105013 | 298 |

| CSLvBM_ZC_PZN | 8.007575 | 10.0 | 0.800757 | 1.167653 | -21.942334 | -39.163553 | -46.777365 | 0.67673 | 0.060382 | 298 |

| CSGLvBM_ZC_PZN | 7.844372 | 10.0 | 0.784437 | 1.163382 | -16.817638 | -30.414612 | -43.802041 | 0.691028 | 0.015146 | 298 |

| CSGILvBM_ZC_BIN | 8.00653 | 10.0 | 0.800653 | 1.200041 | -11.132284 | -22.971975 | -38.928926 | 0.66176 | 0.018296 | 298 |

| CSGvBM_ZC_BIN | 4.778669 | 10.0 | 0.477867 | 0.683746 | -15.351668 | -18.663776 | -25.745332 | 1.076229 | -0.054738 | 298 |

| CSGIvBM_ZC_BIN | 3.096388 | 10.0 | 0.309639 | 0.450092 | -11.777379 | -23.954522 | -39.199084 | 1.472184 | 0.059299 | 298 |

| CSIvBM_ZC_BIN | 4.106984 | 10.0 | 0.410698 | 0.597581 | -10.785082 | -20.777816 | -34.399829 | 1.100338 | 0.085428 | 298 |

| CSILvBM_ZC_BIN | 8.16824 | 10.0 | 0.816824 | 1.215106 | -16.001452 | -27.950346 | -34.228853 | 0.63867 | 0.050056 | 298 |

| CSLvBM_ZC_BIN | 6.899793 | 10.0 | 0.689979 | 0.99368 | -16.002236 | -32.63338 | -40.039205 | 0.790295 | 0.002617 | 298 |

| CSGLvBM_ZC_BIN | 6.053429 | 10.0 | 0.605343 | 0.865733 | -16.844083 | -26.114256 | -49.717024 | 0.846229 | 0.002384 | 298 |

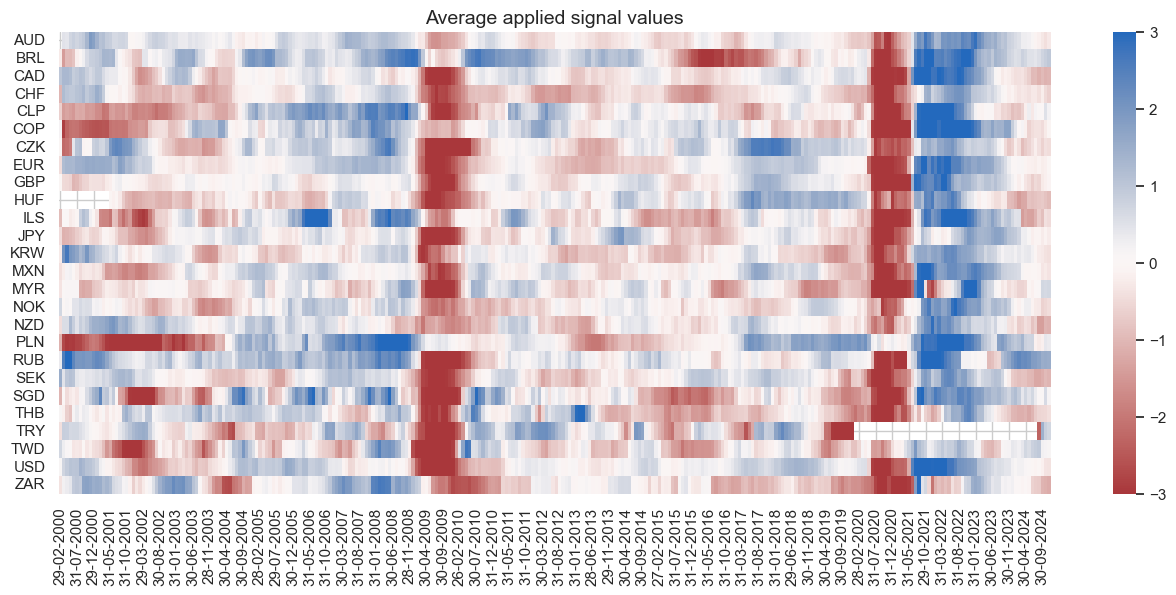

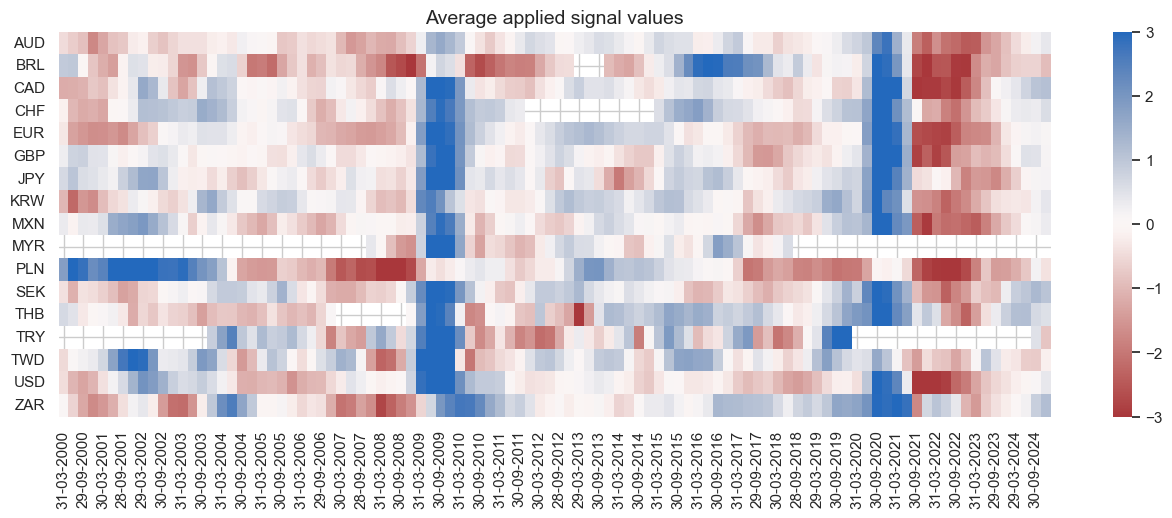

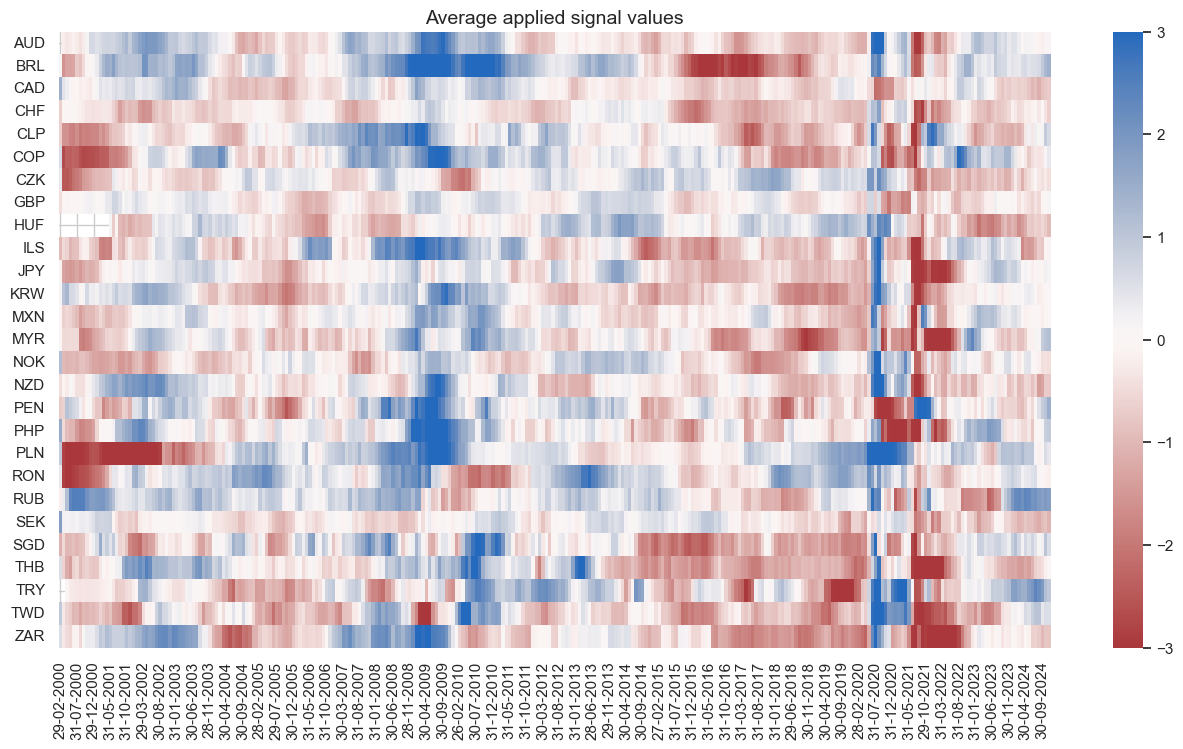

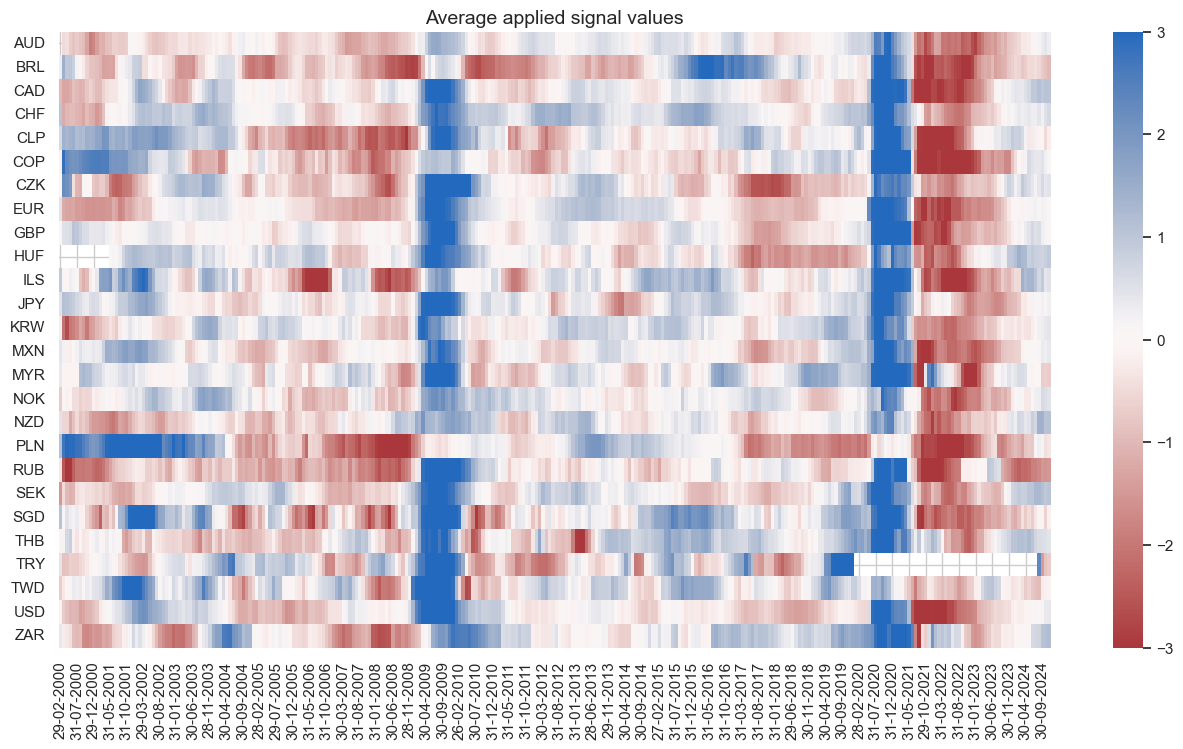

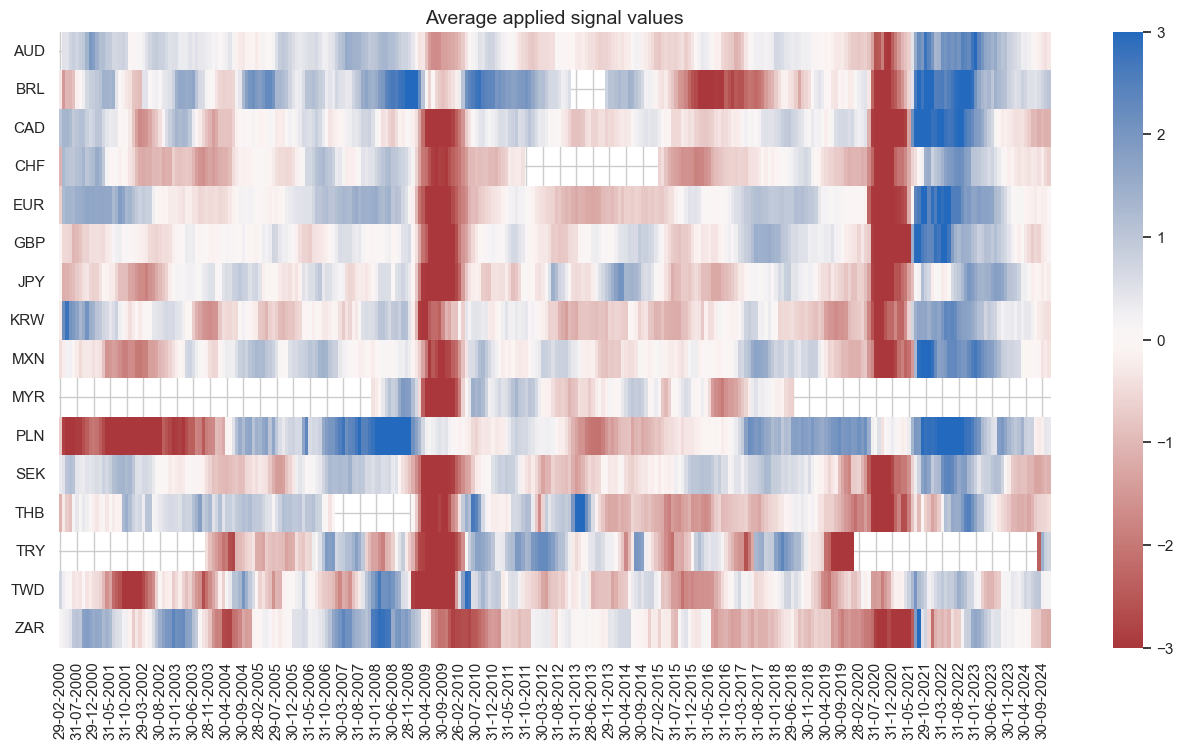

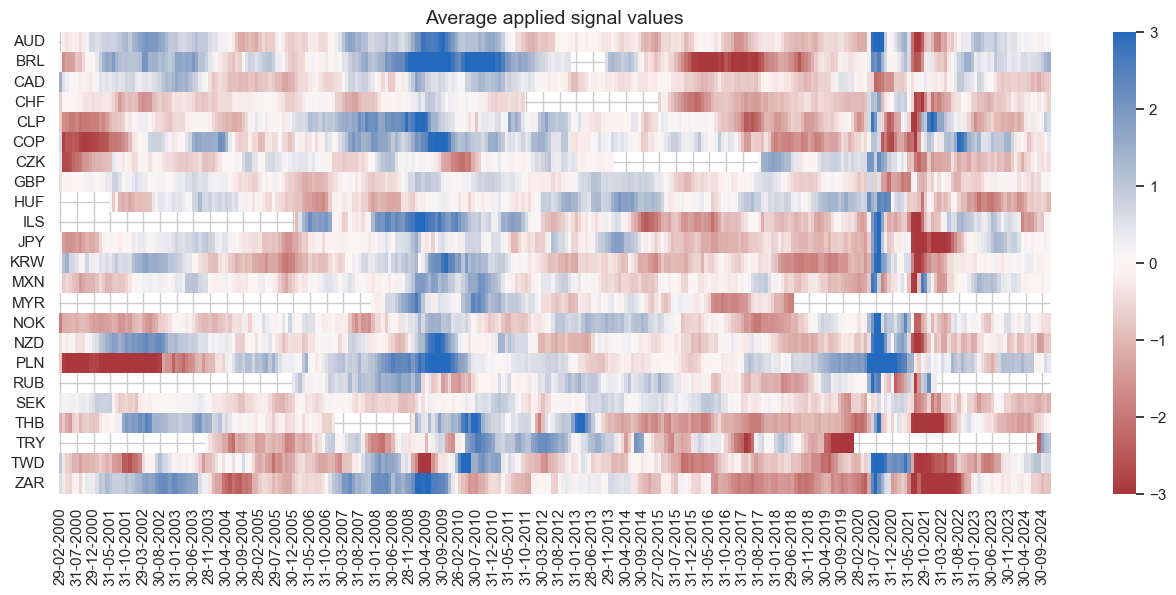

dix = dict_fxdi

sig = dix["sig"]

naive_pnl = dix["pnls"]

naive_pnl.signal_heatmap(

pnl_name=sig + "_PZN", freq="m", start="2000-01-01", figsize=(16, 8)

)

Directional IRS strategy #

Specs and panel test #

sigs = cs_dir

ms = "CSGIL_ZC" # main signal

oths = list(set(sigs) - set([ms])) # other signals

targ = "DU05YXR_VT10" # "DU02YXR_VT10"

cidx = msm.common_cids(dfx, sigs + [targ])

# cidx = list(set(cids_dm) & set(cidx)) # for DM alone

dict_dudi = {

"sig": ms,

"rivs": oths,

"targ": targ,

"cidx": cidx,

"black": dublack,

"srr": None,

"pnls": None,

}

dix = dict_dudi

cidx = dix["cidx"]

print(len(cidx))

", ".join(cidx)

26

'AUD, BRL, CAD, CHF, CLP, COP, CZK, EUR, GBP, HUF, ILS, JPY, KRW, MXN, MYR, NOK, NZD, PLN, RUB, SEK, SGD, THB, TRY, TWD, USD, ZAR'

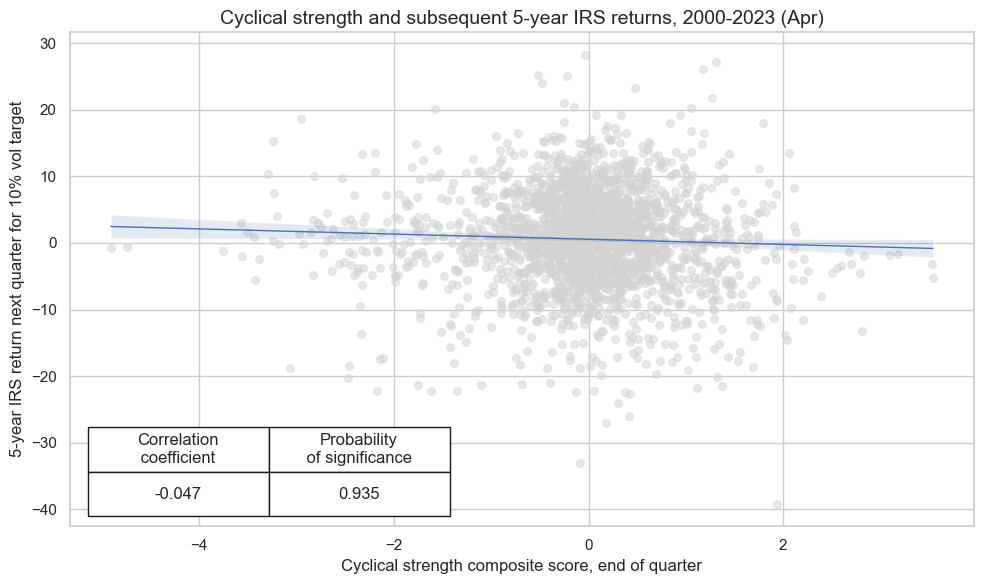

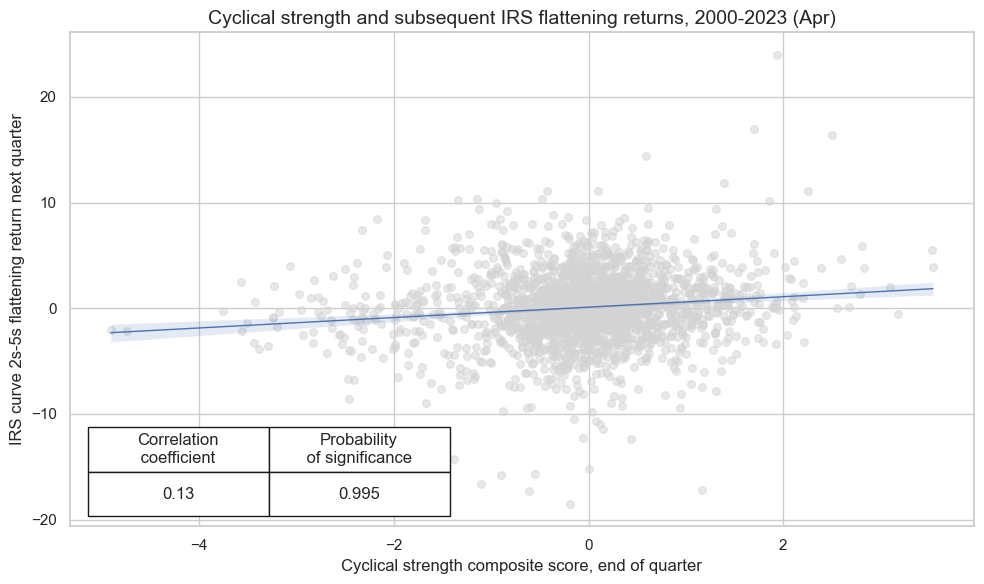

dix = dict_dudi

sig = dix["sig"]

targ = dix["targ"]

cidx = dix["cidx"]

blax = dix["black"]

crx = msp.CategoryRelations(

dfx,

xcats=[sig, targ],

cids=cidx,

freq="Q",

lag=1,

xcat_aggs=["last", "sum"],

start="2000-01-01",

blacklist=blax,

xcat_trims=[None, None],

)

crx.reg_scatter(

labels=False,

coef_box="lower left",

xlab="Cyclical strength composite score, end of quarter",

ylab="5-year IRS return next quarter for 10% vol target",

title="Cyclical strength and subsequent 5-year IRS returns, 2000-2023 (Apr)",

size=(10, 6),

prob_est="map",

)

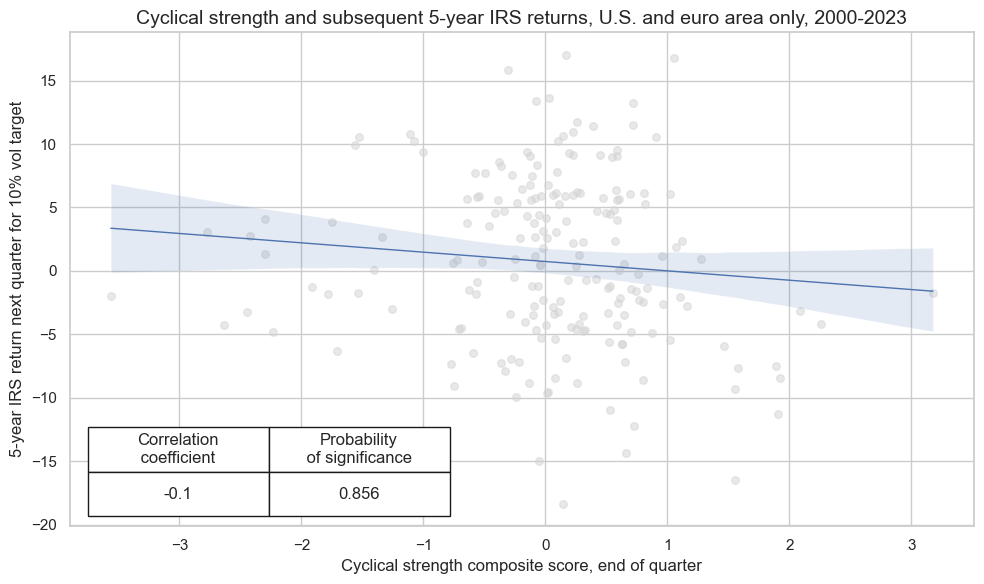

dix = dict_dudi

sig = dix["sig"]

targ = dix["targ"]

cidx = ["EUR", "USD"]

blax = dix["black"]

crx = msp.CategoryRelations(

dfx,

xcats=[sig, targ],

cids=cidx,

freq="Q",

lag=1,

xcat_aggs=["last", "sum"],

start="2000-01-01",

blacklist=blax,

xcat_trims=[None, None],

)

crx.reg_scatter(

labels=False,

coef_box="lower left",

xlab="Cyclical strength composite score, end of quarter",

ylab="5-year IRS return next quarter for 10% vol target",

title="Cyclical strength and subsequent 5-year IRS returns, U.S. and euro area only, 2000-2023",

size=(10, 6),

prob_est="map",

)

Accuracy and correlation check #

dix = dict_dudi

sig = dix["sig"]

rivs = dix["rivs"]

targ = dix["targ"]

cidx = dix["cidx"]

blax = dix["black"]

srr = mss.SignalReturnRelations(

dfx,

cids=cidx,

sigs=[sig] + rivs,

sig_neg=[True] + [True] * len(rivs),

rets=targ,

freqs="M",

start="2000-01-01",

blacklist=blax,

)

dix["srr"] = srr

dix = dict_dudi

srrx = dix["srr"]

display(srrx.summary_table().astype("float").round(3))

| accuracy | bal_accuracy | pos_sigr | pos_retr | pos_prec | neg_prec | pearson | pearson_pval | kendall | kendall_pval | auc | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| M: CSGIL_ZC_NEG/last => DU05YXR_VT10 | 0.527 | 0.527 | 0.502 | 0.546 | 0.573 | 0.482 | 0.046 | 0.000 | 0.034 | 0.000 | 0.527 |

| Mean years | 0.520 | 0.514 | 0.496 | 0.556 | 0.571 | 0.457 | 0.017 | 0.385 | 0.017 | 0.391 | 0.513 |

| Positive ratio | 0.640 | 0.680 | 0.480 | 0.800 | 0.760 | 0.360 | 0.560 | 0.400 | 0.560 | 0.440 | 0.680 |

| Mean cids | 0.527 | 0.527 | 0.498 | 0.544 | 0.572 | 0.482 | 0.045 | 0.457 | 0.032 | 0.485 | 0.527 |

| Positive ratio | 0.885 | 0.923 | 0.462 | 0.962 | 1.000 | 0.308 | 0.808 | 0.538 | 0.846 | 0.500 | 0.923 |

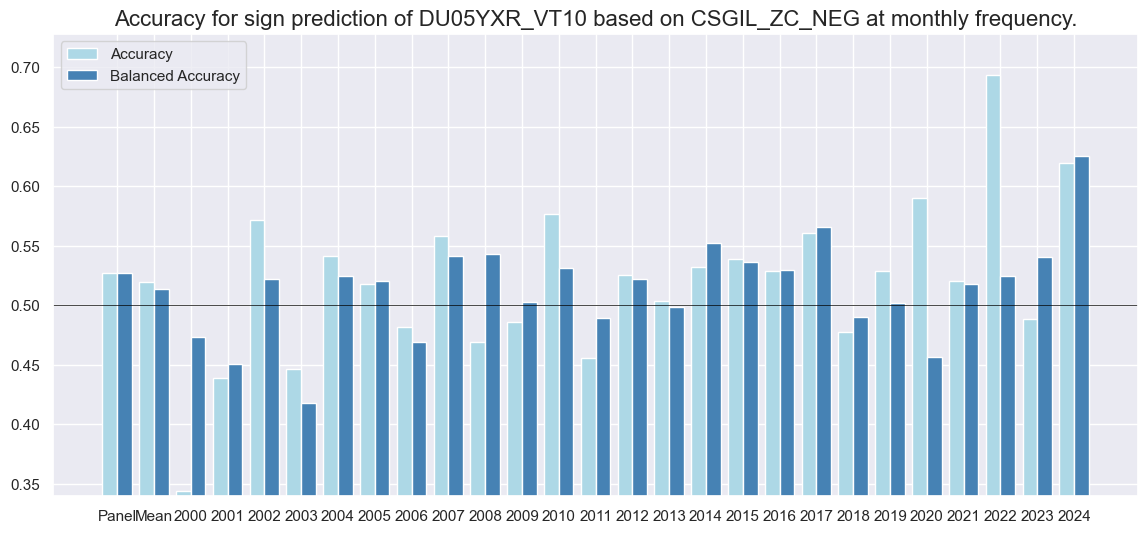

Labor market dynamics are good predictors, labor market status is not, supporting the hypothesis that fixed-income markets are only inattentive to recent dynamics but not to the broad state of the economy.

dix = dict_dudi

srrx = dix["srr"]

display(srrx.signals_table().sort_index().astype("float").round(3))

| accuracy | bal_accuracy | pos_sigr | pos_retr | pos_prec | neg_prec | pearson | pearson_pval | kendall | kendall_pval | auc | ||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Return | Signal | Frequency | Aggregation | |||||||||||

| DU05YXR_VT10 | CSGIL_ZC_NEG | M | last | 0.527 | 0.527 | 0.502 | 0.546 | 0.573 | 0.482 | 0.046 | 0.000 | 0.034 | 0.000 | 0.527 |

| CSGI_ZC_NEG | M | last | 0.529 | 0.524 | 0.562 | 0.546 | 0.567 | 0.482 | 0.049 | 0.000 | 0.033 | 0.000 | 0.524 | |

| CSGL_ZC_NEG | M | last | 0.513 | 0.516 | 0.462 | 0.546 | 0.563 | 0.469 | 0.035 | 0.004 | 0.033 | 0.000 | 0.516 | |

| CSG_ZC_NEG | M | last | 0.516 | 0.512 | 0.549 | 0.546 | 0.556 | 0.467 | 0.033 | 0.007 | 0.029 | 0.000 | 0.512 | |

| CSIL_ZC_NEG | M | last | 0.520 | 0.521 | 0.484 | 0.546 | 0.568 | 0.475 | 0.040 | 0.001 | 0.030 | 0.000 | 0.522 | |

| CSI_ZC_NEG | M | last | 0.525 | 0.522 | 0.536 | 0.545 | 0.565 | 0.479 | 0.035 | 0.004 | 0.027 | 0.001 | 0.522 | |

| CSL_ZC_NEG | M | last | 0.502 | 0.514 | 0.377 | 0.545 | 0.563 | 0.465 | 0.026 | 0.040 | 0.026 | 0.002 | 0.513 |

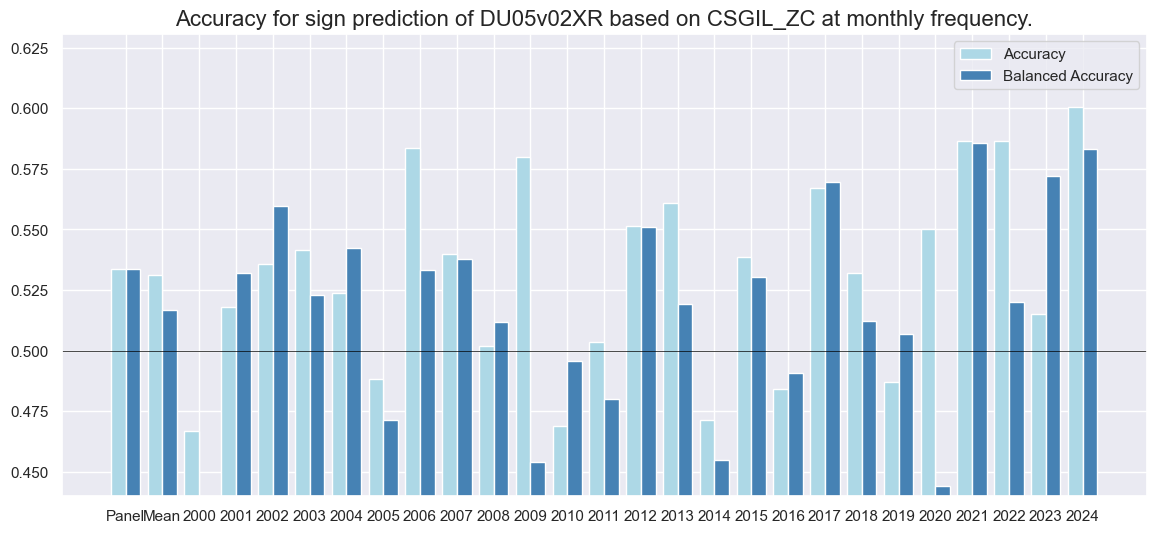

dix = dict_dudi

srrx = dix["srr"]

srrx.accuracy_bars(

type="years",

# title="Accuracy of monthly predictions of FX forward returns for 26 EM and DM currencies",

size=(14, 6),

)

Naive PnL #

dix = dict_dudi

sigx = [dix["sig"]] + dix["rivs"]

targ = dix["targ"]

cidx = dix["cidx"]

blax = dix["black"]

naive_pnl = msn.NaivePnL(

dfx,

ret=targ,

sigs=sigx,

cids=cidx,

start="2000-01-01",

blacklist=blax,

bms=["USD_EQXR_NSA", "USD_DU05YXR_VT10"],

)

for sig in sigx:

naive_pnl.make_pnl(

sig,

sig_neg=True,

sig_op="zn_score_pan",

thresh=3,

rebal_freq="monthly",

vol_scale=10,

rebal_slip=1,

pnl_name=sig + "_PZN",

)

for sig in sigx:

naive_pnl.make_pnl(

sig,

sig_neg=True,

sig_op="binary",

thresh=3,

rebal_freq="monthly",

vol_scale=10,

rebal_slip=1,

pnl_name=sig + "_BIN",

)

naive_pnl.make_long_pnl(vol_scale=10, label="Long only")

dix["pnls"] = naive_pnl

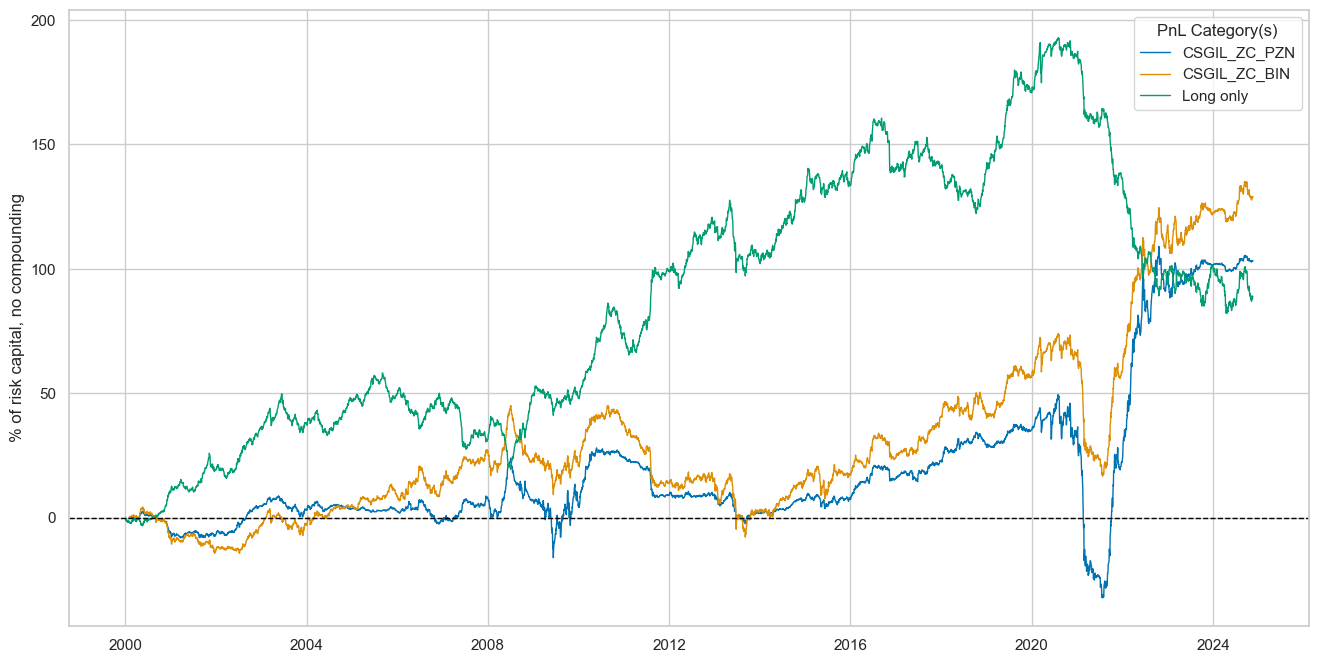

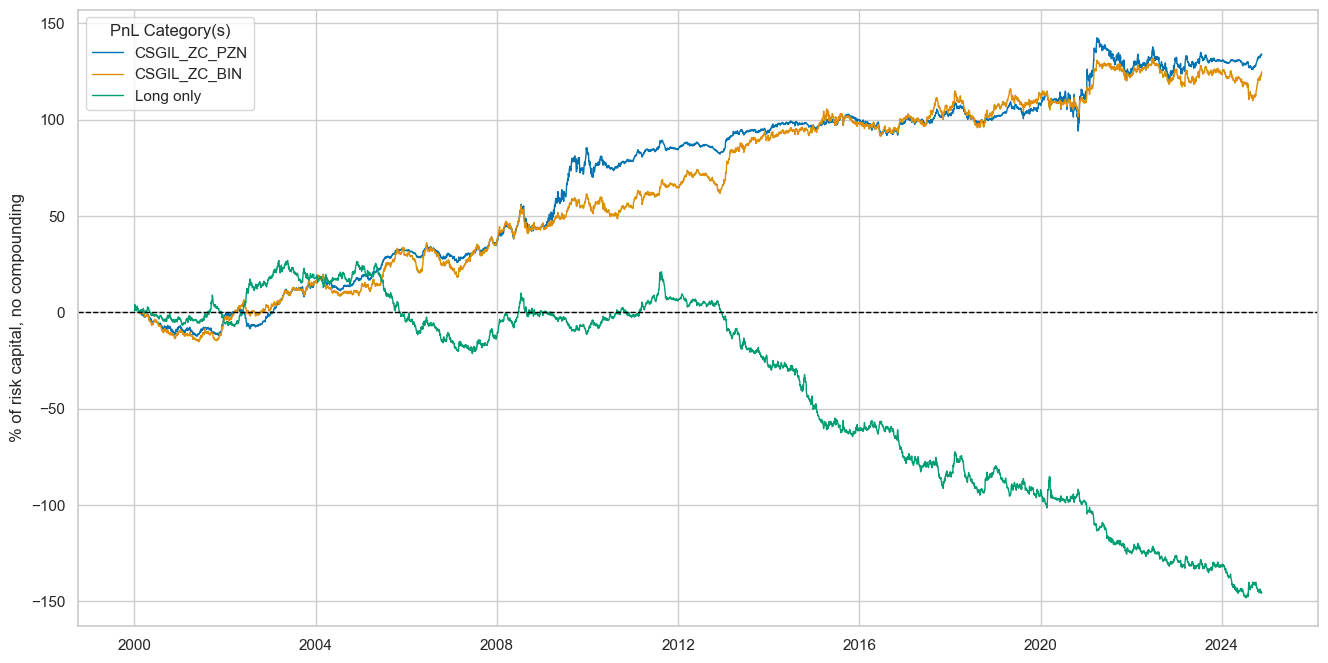

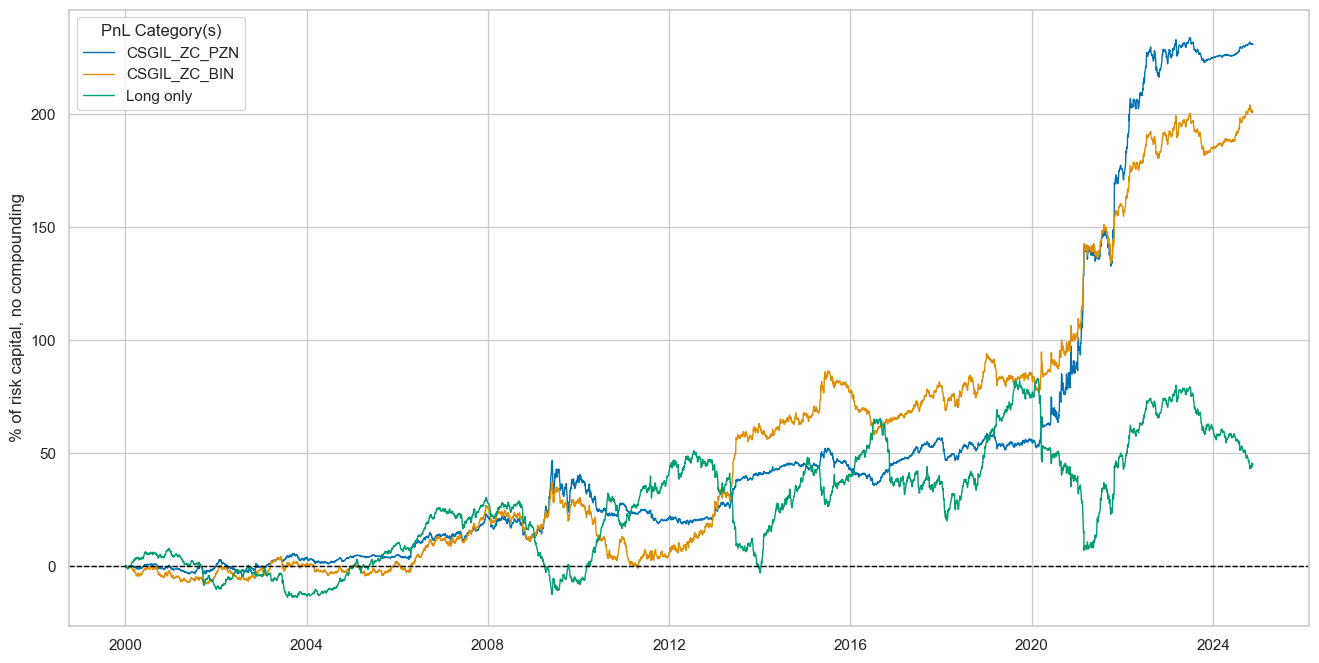

dix = dict_dudi

sigx = dix["sig"]

naive_pnl = dix["pnls"]

pnls = [sigx + x for x in ["_PZN", "_BIN"]] + ["Long only"]

naive_pnl.plot_pnls(

pnl_cats=pnls,

pnl_cids=["ALL"],

start="2000-01-01",

title=None,

xcat_labels=None,

figsize=(16, 8),

)

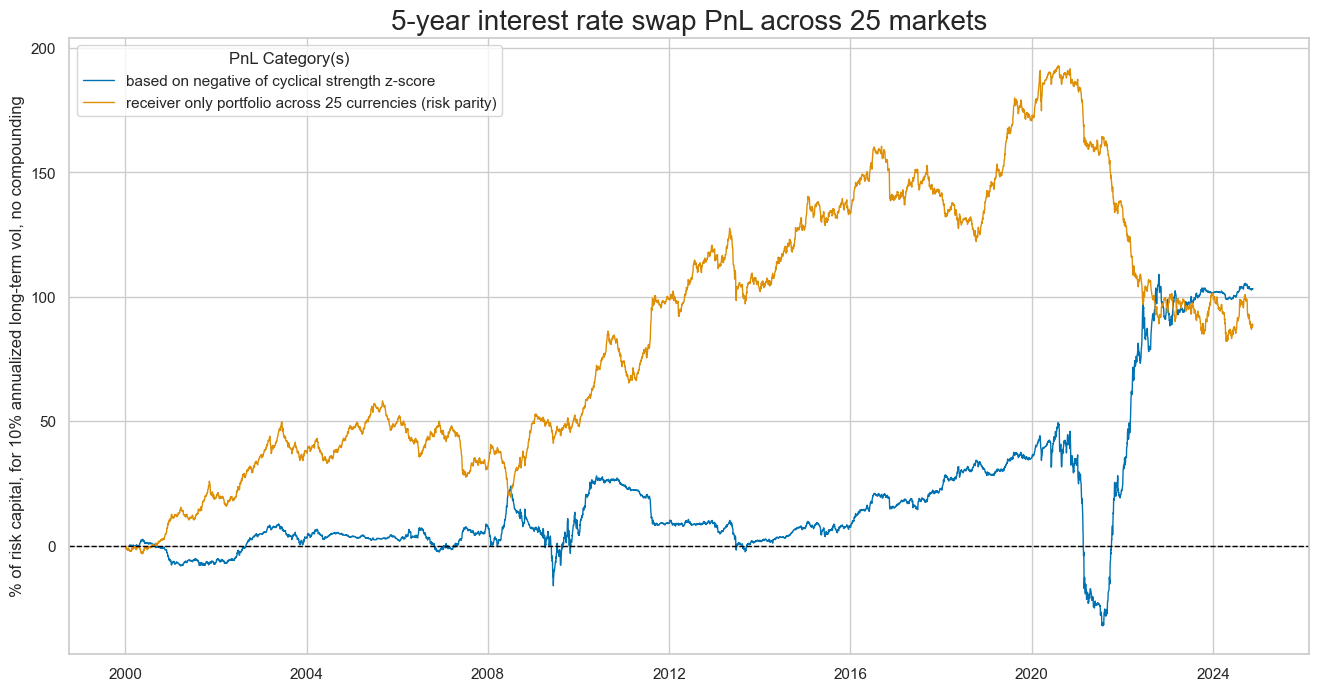

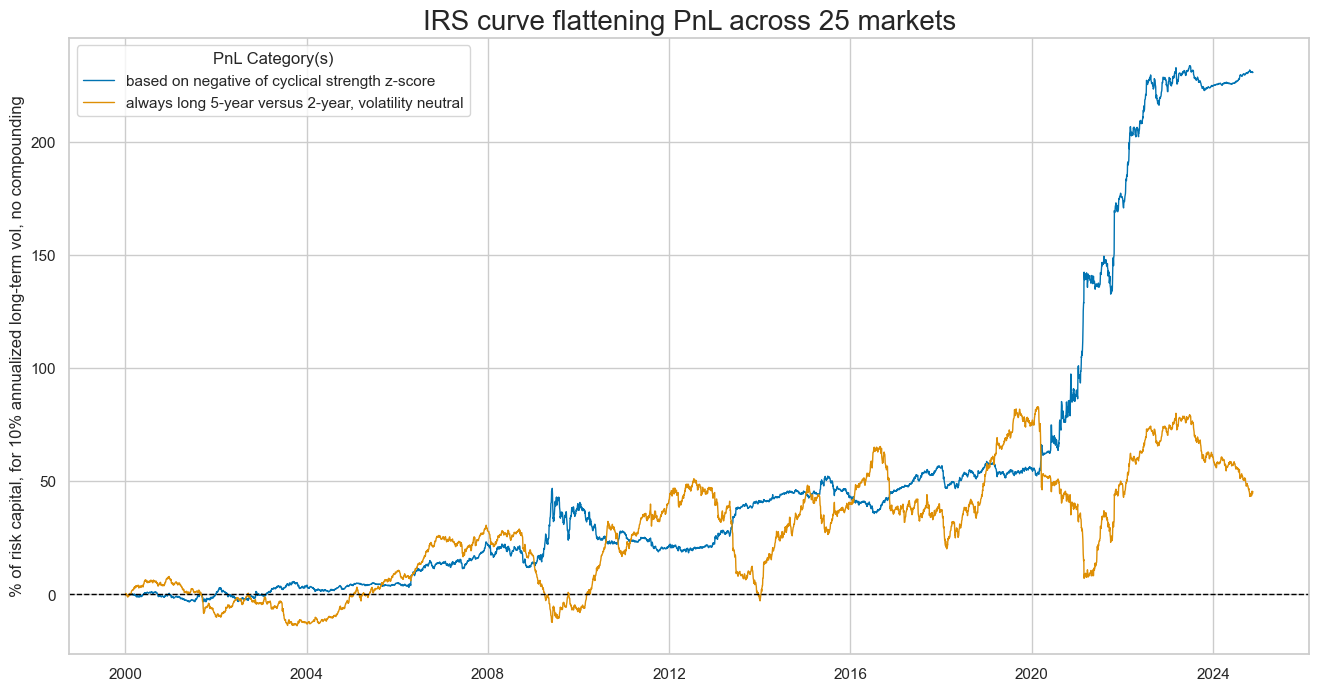

dix = dict_dudi

sigx = dix["sig"]

naive_pnl = dix["pnls"]

pnls = [sigx + "_PZN"] + ["Long only"]

dict_labels={"CSGIL_ZC_PZN":"based on negative of cyclical strength z-score",

"Long only": "receiver only portfolio across 25 currencies (risk parity)"}

naive_pnl.plot_pnls(

pnl_cats=pnls,

pnl_cids=["ALL"],

start="2000-01-01",

title="5-year interest rate swap PnL across 25 markets",

xcat_labels=dict_labels,

ylab="% of risk capital, for 10% annualized long-term vol, no compounding",

figsize=(16, 8),

)

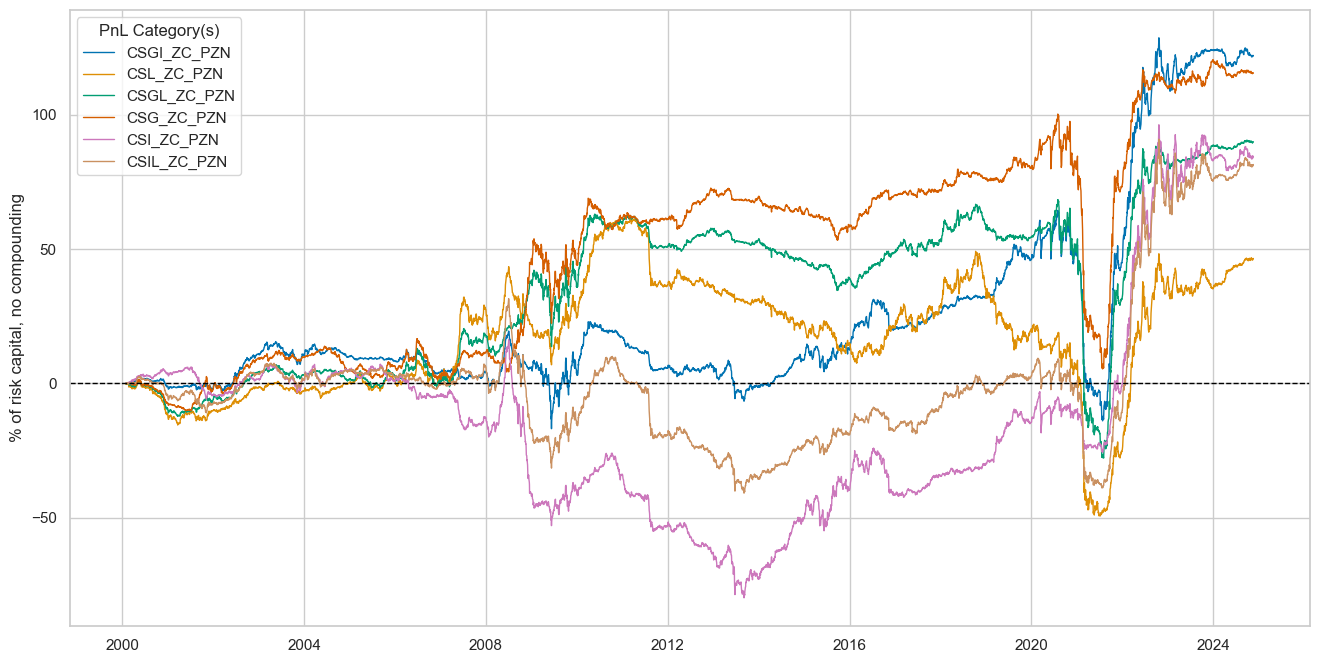

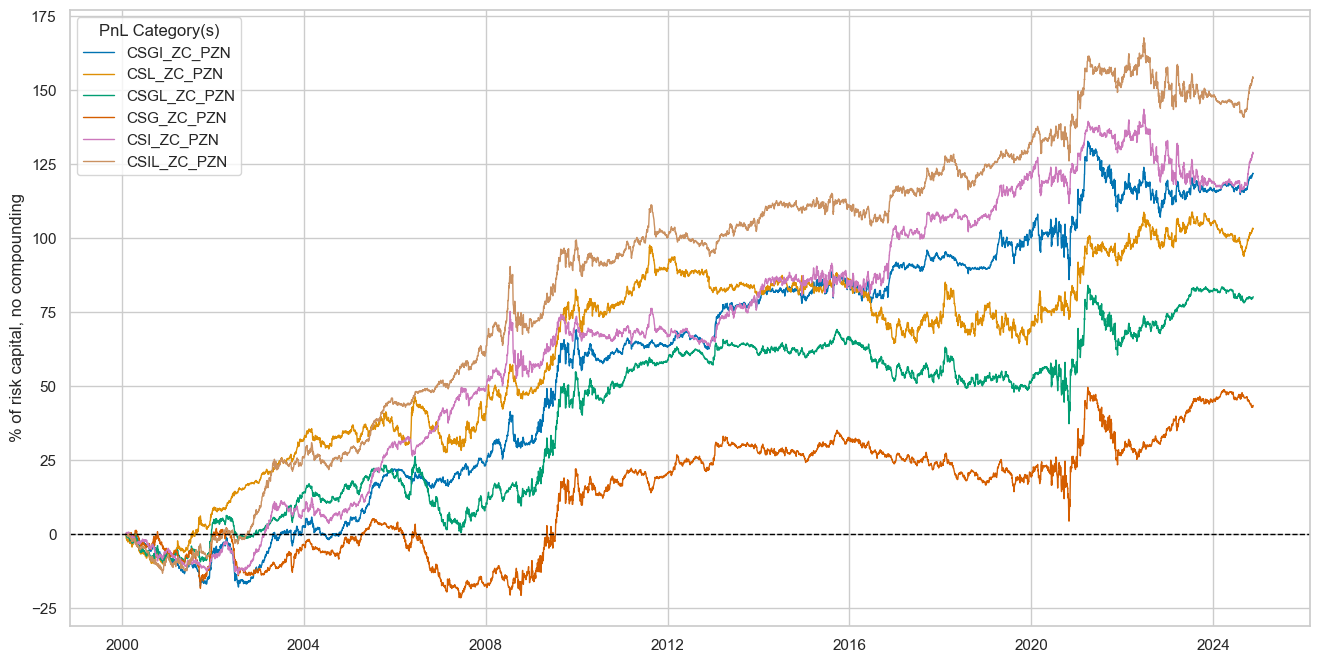

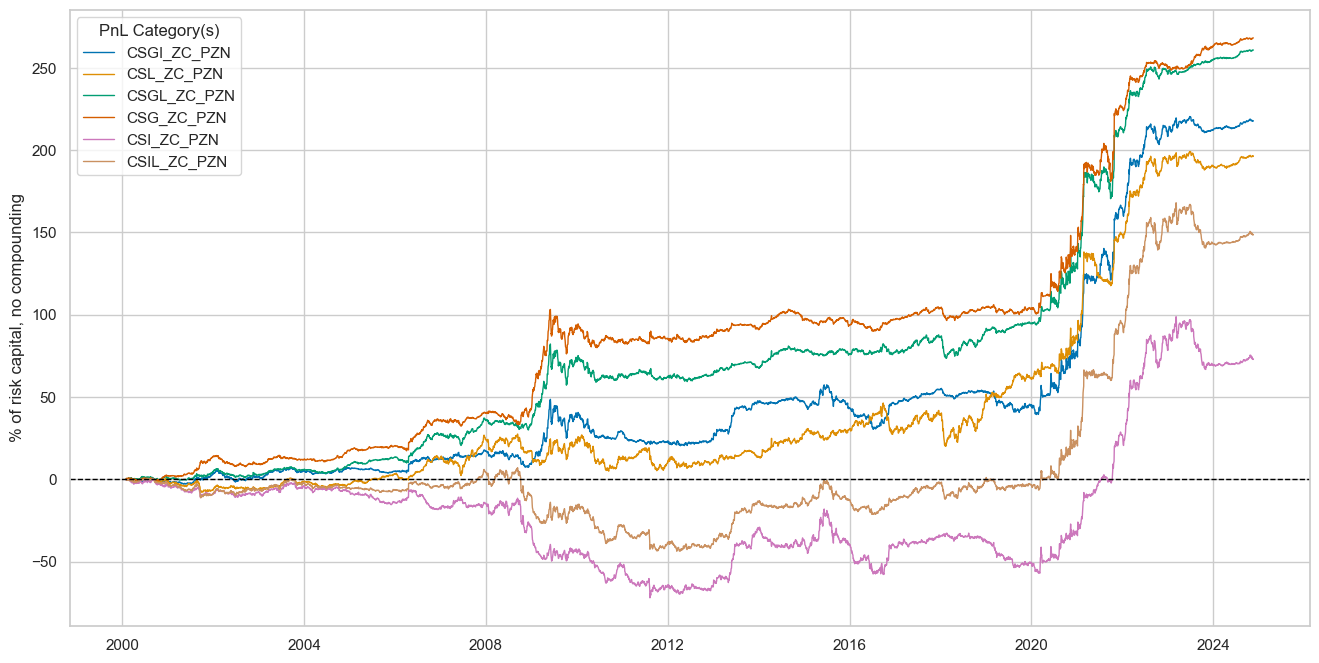

dix = dict_dudi

sigx = dix["rivs"]

naive_pnl = dix["pnls"]

pnls = [sig + "_PZN" for sig in sigx]

naive_pnl.plot_pnls(

pnl_cats=pnls,

pnl_cids=["ALL"],

start="2000-01-01",

title=None,

xcat_labels=None,

figsize=(16, 8),

)

dix = dict_dudi

sigx = [dix["sig"]] + dix["rivs"]

naive_pnl = dix["pnls"]

pnls = [sig + type for sig in sigx for type in ["_PZN", "_BIN"]]

df_eval = naive_pnl.evaluate_pnls(

pnl_cats=pnls,

pnl_cids=["ALL"],

start="2000-01-01",

)

display(df_eval.transpose())

| Return % | St. Dev. % | Sharpe Ratio | Sortino Ratio | Max 21-Day Draw % | Max 6-Month Draw % | Peak to Trough Draw % | Top 5% Monthly PnL Share | USD_EQXR_NSA correl | USD_DU05YXR_VT10 correl | Traded Months | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| xcat | |||||||||||

| CSGIL_ZC_PZN | 4.16784 | 10.0 | 0.416784 | 0.575774 | -45.793736 | -67.90159 | -81.675222 | 1.833909 | -0.047435 | -0.005533 | 298 |

| CSGI_ZC_PZN | 4.923035 | 10.0 | 0.492303 | 0.688027 | -42.362385 | -63.929288 | -78.310767 | 1.560824 | -0.069614 | 0.082674 | 298 |

| CSL_ZC_PZN | 1.874711 | 10.0 | 0.187471 | 0.256665 | -42.063428 | -60.010895 | -110.758683 | 3.355906 | 0.02001 | -0.203839 | 298 |

| CSGL_ZC_PZN | 3.624902 | 10.0 | 0.36249 | 0.492273 | -52.584546 | -79.874424 | -96.209772 | 1.924651 | -0.023304 | -0.02364 | 298 |

| CSG_ZC_PZN | 4.660084 | 10.0 | 0.466008 | 0.644726 | -49.787496 | -77.317165 | -94.870154 | 1.558637 | -0.044899 | 0.102364 | 298 |

| CSI_ZC_PZN | 3.40874 | 10.0 | 0.340874 | 0.481672 | -18.305893 | -56.67491 | -96.044596 | 2.168579 | -0.072866 | 0.021042 | 298 |

| CSIL_ZC_PZN | 3.285492 | 10.0 | 0.328549 | 0.458652 | -30.479786 | -48.210489 | -72.383527 | 2.294462 | -0.041852 | -0.074072 | 298 |

| CSGIL_ZC_BIN | 5.209368 | 10.0 | 0.520937 | 0.72154 | -33.637271 | -47.903753 | -57.261791 | 1.195209 | -0.036136 | -0.002175 | 298 |

| CSGI_ZC_BIN | 5.29339 | 10.0 | 0.529339 | 0.730874 | -32.710023 | -48.204066 | -55.429584 | 1.182556 | -0.063886 | 0.12569 | 298 |

| CSL_ZC_BIN | 0.136479 | 10.0 | 0.013648 | 0.018785 | -33.96345 | -44.599902 | -111.873536 | 41.690982 | 0.034115 | -0.27327 | 298 |

| CSGL_ZC_BIN | 3.087066 | 10.0 | 0.308707 | 0.433864 | -34.966363 | -51.422782 | -77.502358 | 2.06416 | -0.034532 | -0.130907 | 298 |

| CSG_ZC_BIN | 4.083461 | 10.0 | 0.408346 | 0.579857 | -33.989599 | -49.986319 | -66.301527 | 1.572367 | -0.058698 | 0.085706 | 298 |

| CSI_ZC_BIN | 3.390662 | 10.0 | 0.339066 | 0.474978 | -20.217069 | -46.042963 | -93.982369 | 1.87593 | -0.059971 | 0.091732 | 298 |

| CSIL_ZC_BIN | 1.96615 | 10.0 | 0.196615 | 0.269282 | -25.119427 | -44.794831 | -84.641031 | 2.8204 | -0.005302 | -0.037401 | 298 |

dix = dict_dudi

sig = dix["sig"]

naive_pnl = dix["pnls"]

naive_pnl.signal_heatmap(

pnl_name=sig + "_PZN", freq="m", start="2000-01-01", figsize=(16, 8)

)

FX versus equity strategy (directional features) #

Specs and panel test #

sigs = cs_dir

ms = "CSGIL_ZC" # main signal

oths = list(set(sigs) - set([ms])) # other signals

targ = "FXvEQXR"

cidx = msm.common_cids(dfx, sigs + [targ])

cidx = list(set(cidx_fxeq) & set(cidx))

dict_fxeq = {

"sig": ms,

"rivs": oths,

"targ": targ,

"cidx": cidx,

"black": fxblack,

"srr": None,

"pnls": None,

}

dix = dict_fxeq

cidx = dix["cidx"]

cidx.sort()

print(len(cidx))

", ".join(cidx)

17

'AUD, BRL, CAD, CHF, EUR, GBP, JPY, KRW, MXN, MYR, PLN, SEK, SGD, THB, TRY, TWD, ZAR'

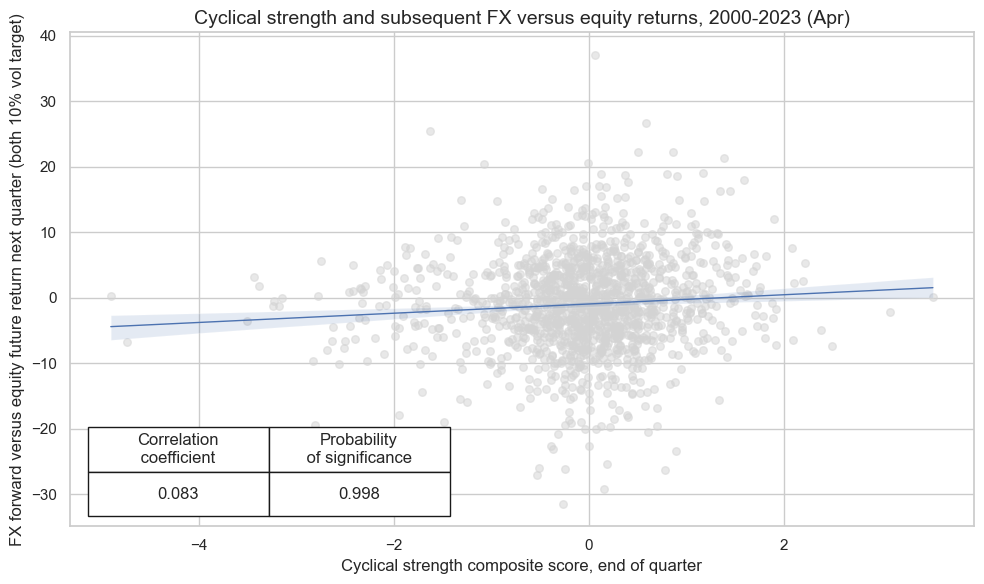

dix = dict_fxeq

sig = dix["sig"]

targ = dix["targ"]

cidx = dix["cidx"]

blax = dix["black"]

crx = msp.CategoryRelations(

dfx,

xcats=[sig, targ],

cids=cidx,

freq="Q", # quarterly frequency allows for policy inertia

lag=1,

xcat_aggs=["last", "sum"],

start="2000-01-01",

blacklist=blax,

xcat_trims=[None, None],

)

crx.reg_scatter(

labels=False,

coef_box="lower left",

xlab="Cyclical strength composite score, end of quarter",

ylab="FX forward versus equity future return next quarter (both 10% vol target)",

title="Cyclical strength and subsequent FX versus equity returns, 2000-2023 (Apr)",

size=(10, 6),

prob_est="map",

)

Accuracy and correlation check #

dix = dict_fxeq

sig = dix["sig"]

rivs = dix["rivs"]

targ = dix["targ"]

cidx = dix["cidx"]

blax = dix["black"]

srr = mss.SignalReturnRelations(

dfx,

cids=cidx,

sigs=[sig] + rivs,

rets=targ,

freqs="M",

start="2000-01-01",

blacklist=blax,

)

dix["srr"] = srr

dix = dict_fxeq

srrx = dix["srr"]

display(srrx.summary_table().astype("float").round(3))

| accuracy | bal_accuracy | pos_sigr | pos_retr | pos_prec | neg_prec | pearson | pearson_pval | kendall | kendall_pval | auc | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| M: CSGIL_ZC/last => FXvEQXR | 0.518 | 0.517 | 0.486 | 0.460 | 0.477 | 0.557 | 0.047 | 0.003 | 0.029 | 0.006 | 0.517 |

| Mean years | 0.517 | 0.508 | 0.491 | 0.461 | 0.466 | 0.551 | 0.046 | 0.396 | 0.016 | 0.430 | 0.506 |

| Positive ratio | 0.680 | 0.480 | 0.400 | 0.280 | 0.280 | 0.720 | 0.680 | 0.360 | 0.480 | 0.320 | 0.480 |

| Mean cids | 0.519 | 0.513 | 0.489 | 0.462 | 0.474 | 0.551 | 0.042 | 0.494 | 0.025 | 0.461 | 0.512 |

| Positive ratio | 0.812 | 0.688 | 0.500 | 0.125 | 0.250 | 0.750 | 0.688 | 0.625 | 0.750 | 0.438 | 0.688 |

dix = dict_fxeq

srrx = dix["srr"]

display(srrx.signals_table().sort_index().astype("float").round(3))

| accuracy | bal_accuracy | pos_sigr | pos_retr | pos_prec | neg_prec | pearson | pearson_pval | kendall | kendall_pval | auc | ||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Return | Signal | Frequency | Aggregation | |||||||||||

| FXvEQXR | CSGIL_ZC | M | last | 0.518 | 0.517 | 0.486 | 0.459 | 0.477 | 0.557 | 0.047 | 0.003 | 0.029 | 0.006 | 0.517 |

| CSGI_ZC | M | last | 0.519 | 0.514 | 0.442 | 0.460 | 0.476 | 0.553 | 0.035 | 0.026 | 0.023 | 0.031 | 0.514 | |

| CSGL_ZC | M | last | 0.497 | 0.500 | 0.546 | 0.459 | 0.460 | 0.541 | 0.027 | 0.084 | 0.014 | 0.177 | 0.500 | |

| CSG_ZC | M | last | 0.501 | 0.497 | 0.456 | 0.460 | 0.456 | 0.538 | 0.006 | 0.680 | -0.003 | 0.798 | 0.497 | |

| CSIL_ZC | M | last | 0.516 | 0.516 | 0.497 | 0.459 | 0.476 | 0.557 | 0.067 | 0.000 | 0.040 | 0.000 | 0.516 | |

| CSI_ZC | M | last | 0.523 | 0.519 | 0.447 | 0.460 | 0.481 | 0.557 | 0.051 | 0.001 | 0.033 | 0.001 | 0.519 | |

| CSL_ZC | M | last | 0.504 | 0.513 | 0.601 | 0.459 | 0.469 | 0.556 | 0.049 | 0.002 | 0.033 | 0.002 | 0.512 |

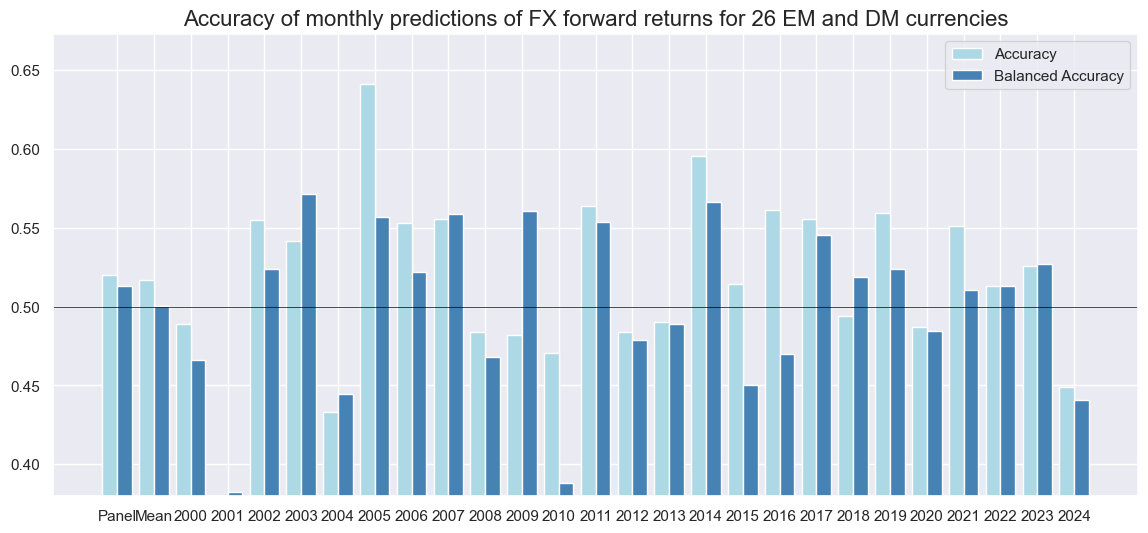

dix = dict_fxeq

srrx = dix["srr"]

srrx.accuracy_bars(

type="years",

title="Accuracy of monthly predictions of FX forward returns for 26 EM and DM currencies",

size=(14, 6),

)

Naive PnL #

dix = dict_fxeq

sigx = [dix["sig"]] + dix["rivs"]

targ = dix["targ"]

cidx = dix["cidx"]

blax = dix["black"]

naive_pnl = msn.NaivePnL(

dfx,

ret=targ,

sigs=sigx,

cids=cidx,

start="2000-01-01",

blacklist=blax,

bms=["USD_EQXR_NSA"],

)

for sig in sigx:

naive_pnl.make_pnl(

sig,

sig_neg=False,

sig_op="zn_score_pan",

thresh=3,

rebal_freq="monthly",

vol_scale=10,

rebal_slip=1,

pnl_name=sig + "_PZN",

)

for sig in sigx:

naive_pnl.make_pnl(

sig,

sig_neg=False,

sig_op="binary",

thresh=3,

rebal_freq="monthly",

vol_scale=10,

rebal_slip=1,

pnl_name=sig + "_BIN",

)

naive_pnl.make_long_pnl(vol_scale=10, label="Long only")

dix["pnls"] = naive_pnl

dix = dict_fxeq

sigx = dix["sig"]

naive_pnl = dix["pnls"]

pnls = [sigx + x for x in ["_PZN", "_BIN"]] + ["Long only"]

naive_pnl.plot_pnls(

pnl_cats=pnls,

pnl_cids=["ALL"],

start="2000-01-01",

title=None,

xcat_labels=None,

figsize=(16, 8),

)

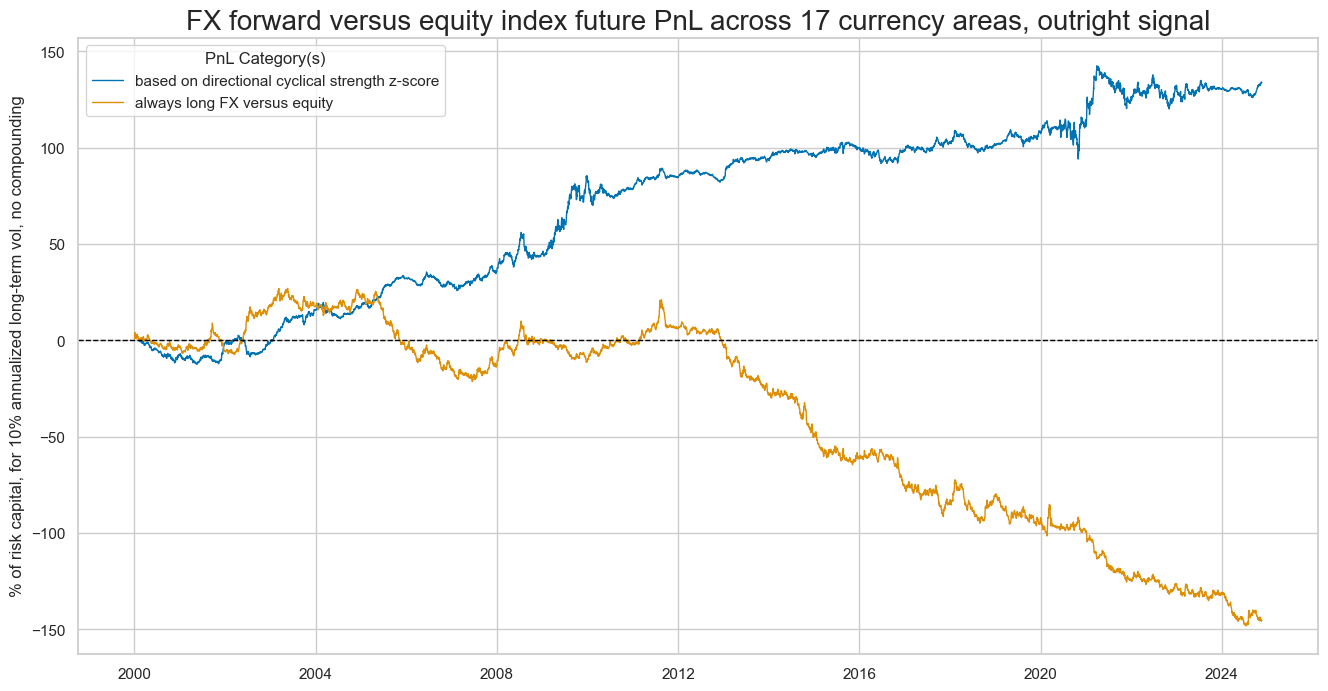

dix = dict_fxeq

sigx = dix["sig"]

naive_pnl = dix["pnls"]

pnls = [sigx + "_PZN"] + ["Long only"]

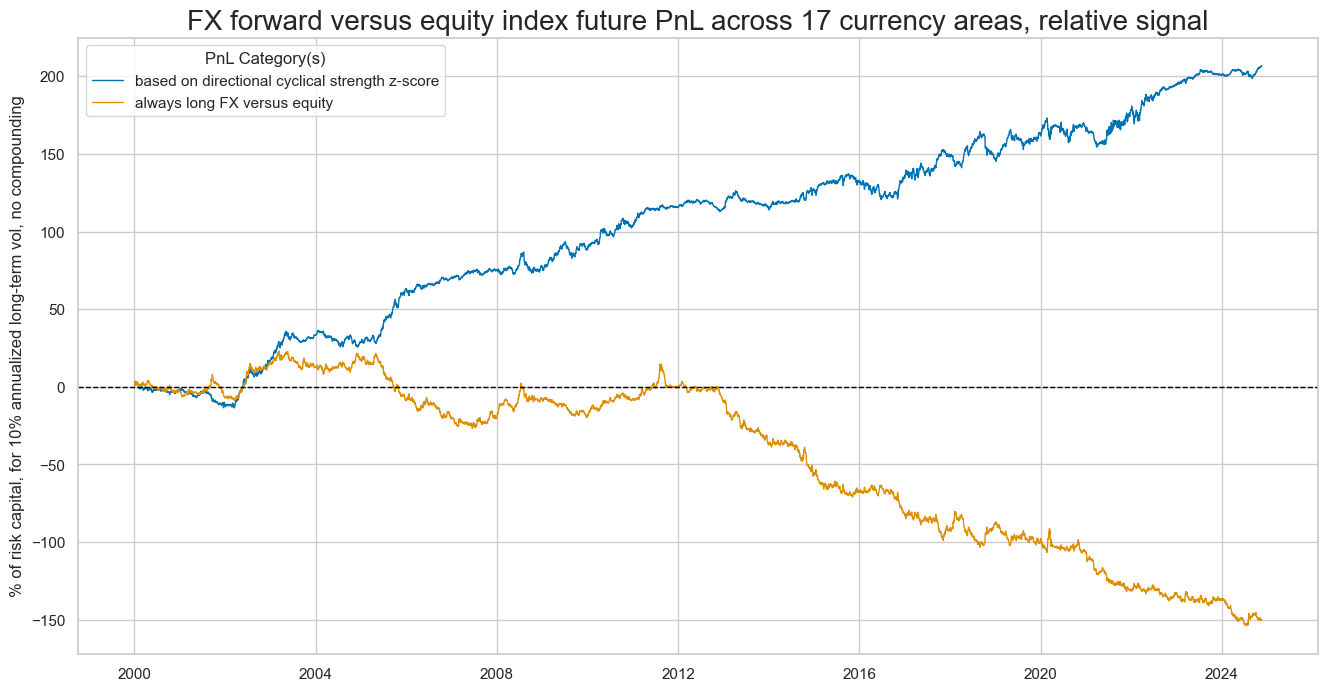

dict_labels={"CSGIL_ZC_PZN":"based on directional cyclical strength z-score",

"Long only": "always long FX versus equity"}

naive_pnl.plot_pnls(

pnl_cats=pnls,

pnl_cids=["ALL"],

start="2000-01-01",

title="FX forward versus equity index future PnL across 17 currency areas, outright signal",

xcat_labels=dict_labels,

ylab="% of risk capital, for 10% annualized long-term vol, no compounding",

figsize=(16, 8),

)

dix = dict_fxeq

sigx = dix["rivs"]

naive_pnl = dix["pnls"]

pnls = [sig + "_PZN" for sig in sigx]

naive_pnl.plot_pnls(

pnl_cats=pnls,

pnl_cids=["ALL"],

start="2000-01-01",

title=None,

xcat_labels=None,

figsize=(16, 8),

)

dix = dict_fxeq

sigx = [dix["sig"]] + dix["rivs"]

naive_pnl = dix["pnls"]

pnls = [sig + type for sig in sigx for type in ["_PZN", "_BIN"]]

df_eval = naive_pnl.evaluate_pnls(

pnl_cats=pnls,

pnl_cids=["ALL"],

start="2000-01-01",

)

display(df_eval.transpose())

| Return % | St. Dev. % | Sharpe Ratio | Sortino Ratio | Max 21-Day Draw % | Max 6-Month Draw % | Peak to Trough Draw % | Top 5% Monthly PnL Share | USD_EQXR_NSA correl | Traded Months | |

|---|---|---|---|---|---|---|---|---|---|---|

| xcat | ||||||||||

| CSGIL_ZC_PZN | 5.404663 | 10.0 | 0.540466 | 0.793665 | -15.437734 | -18.211074 | -22.363847 | 0.991188 | 0.033378 | 298 |

| CSGI_ZC_PZN | 4.913452 | 10.0 | 0.491345 | 0.707903 | -15.231804 | -20.778578 | -25.644142 | 1.084504 | 0.10942 | 298 |

| CSL_ZC_PZN | 4.160296 | 10.0 | 0.41603 | 0.613842 | -11.552108 | -16.627945 | -33.648778 | 1.030258 | -0.135208 | 298 |

| CSGL_ZC_PZN | 3.235519 | 10.0 | 0.323552 | 0.478286 | -16.589878 | -19.892795 | -31.831864 | 1.624277 | 0.033973 | 298 |

| CSG_ZC_PZN | 1.754645 | 10.0 | 0.175465 | 0.256299 | -16.158822 | -23.622871 | -30.677551 | 2.827893 | 0.150313 | 298 |

| CSI_ZC_PZN | 5.181652 | 10.0 | 0.518165 | 0.730243 | -18.322582 | -19.412635 | -28.085692 | 0.822389 | 0.026168 | 298 |

| CSIL_ZC_PZN | 6.211037 | 10.0 | 0.621104 | 0.90086 | -17.658517 | -19.72873 | -26.851595 | 0.753829 | -0.050241 | 298 |

| CSGIL_ZC_BIN | 5.029814 | 10.0 | 0.502981 | 0.72627 | -12.058163 | -18.563666 | -22.077322 | 0.930152 | 0.00776 | 298 |

| CSGI_ZC_BIN | 4.445168 | 10.0 | 0.444517 | 0.632069 | -14.878733 | -18.899299 | -26.300824 | 1.011533 | 0.070574 | 298 |

| CSL_ZC_BIN | 1.955155 | 10.0 | 0.195515 | 0.283652 | -12.969751 | -19.178251 | -54.400372 | 2.08257 | -0.173999 | 298 |

| CSGL_ZC_BIN | 0.476751 | 10.0 | 0.047675 | 0.068455 | -12.738207 | -27.516349 | -63.809396 | 8.66207 | -0.004902 | 298 |

| CSG_ZC_BIN | 0.731409 | 10.0 | 0.073141 | 0.103483 | -17.46463 | -18.319009 | -39.833391 | 5.953649 | 0.12874 | 298 |

| CSI_ZC_BIN | 5.706193 | 10.0 | 0.570619 | 0.797082 | -13.322301 | -13.988839 | -26.350624 | 0.730147 | 0.073024 | 298 |

| CSIL_ZC_BIN | 4.963421 | 10.0 | 0.496342 | 0.715104 | -13.838683 | -16.530162 | -36.938316 | 0.903859 | -0.023113 | 298 |

dix = dict_fxeq

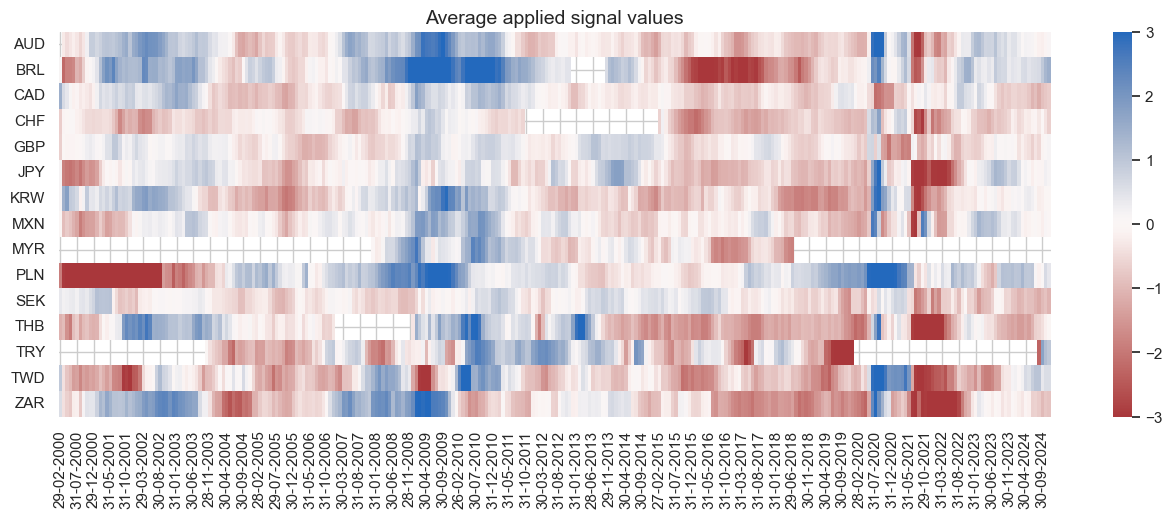

sig = dix["sig"]

naive_pnl = dix["pnls"]

naive_pnl.signal_heatmap(

pnl_name=sig + "_PZN", freq="m", start="2000-01-01", figsize=(16, 8)

)

FX versus equity strategy (relative features) #

Specs and panel test #

sigs = cs_rel

ms = "CSGILvBM_ZC" # main signal

oths = list(set(sigs) - set([ms])) # other signals

targ = "FXvEQXR"

cidx = msm.common_cids(dfx, sigs + [targ])

cidx = list(set(cidx_fxeq) & set(cidx))

dict_fxeq_rf = {

"sig": ms,

"rivs": oths,

"targ": targ,

"cidx": cidx,

"black": fxblack,

"srr": None,

"pnls": None,

}

dix = dict_fxeq_rf

sig = dix["sig"]

targ = dix["targ"]

cidx = dix["cidx"]

blax = dix["black"]

crx = msp.CategoryRelations(

dfx,

xcats=[sig, targ],

cids=cidx,

freq="Q", # quarterly frequency allows for policy inertia

lag=1,

xcat_aggs=["last", "sum"],

start="2000-01-01",

blacklist=blax,

xcat_trims=[None, None],

)

crx.reg_scatter(

labels=False,

coef_box="lower left",

# separator=2011,

# xlab="",

# ylab="",

# title="",

size=(10, 6),

prob_est="map",

)

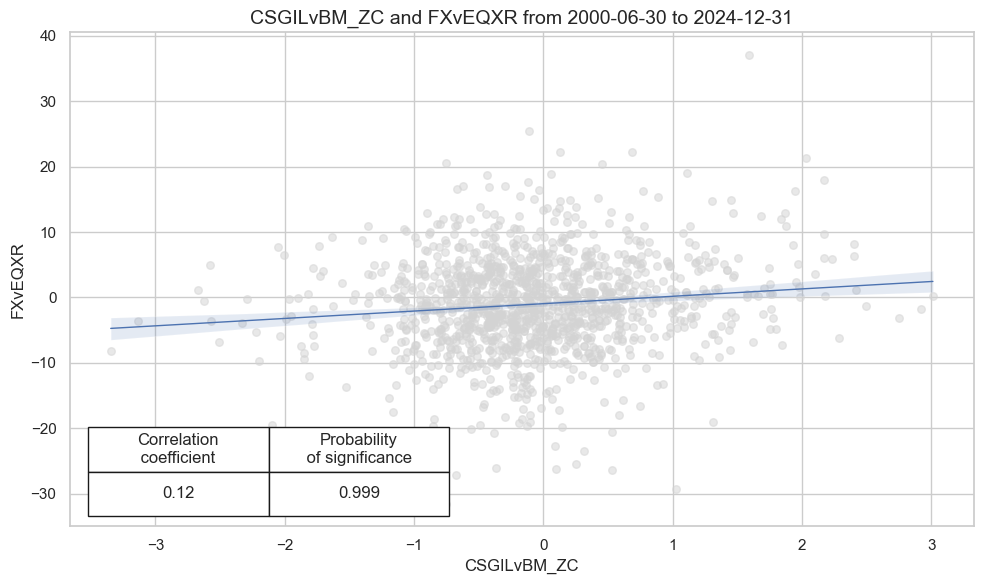

Accuracy and correlation check #

dix = dict_fxeq_rf

sig = dix["sig"]

rivs = dix["rivs"]

targ = dix["targ"]

cidx = dix["cidx"]

blax = dix["black"]

srr = mss.SignalReturnRelations(

dfx,

cids=cidx,

sigs=[sig] + rivs,

rets=targ,

freqs="M",

start="2000-01-01",

blacklist=blax,

)

dix["srr"] = srr

dix = dict_fxeq_rf

srrx = dix["srr"]

display(srrx.summary_table().astype("float").round(3))

| accuracy | bal_accuracy | pos_sigr | pos_retr | pos_prec | neg_prec | pearson | pearson_pval | kendall | kendall_pval | auc | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| M: CSGILvBM_ZC/last => FXvEQXR | 0.520 | 0.513 | 0.414 | 0.460 | 0.475 | 0.551 | 0.079 | 0.000 | 0.041 | 0.000 | 0.513 |

| Mean years | 0.517 | 0.500 | 0.423 | 0.461 | 0.463 | 0.538 | 0.047 | 0.392 | 0.015 | 0.487 | 0.500 |

| Positive ratio | 0.560 | 0.560 | 0.360 | 0.240 | 0.360 | 0.760 | 0.680 | 0.440 | 0.480 | 0.360 | 0.560 |

| Mean cids | 0.518 | 0.505 | 0.424 | 0.462 | 0.467 | 0.543 | 0.055 | 0.334 | 0.028 | 0.434 | 0.505 |

| Positive ratio | 0.733 | 0.533 | 0.267 | 0.133 | 0.200 | 0.800 | 0.733 | 0.533 | 0.667 | 0.467 | 0.533 |

dix = dict_fxeq_rf

srrx = dix["srr"]

display(srrx.signals_table().sort_index().astype("float").round(3))

| accuracy | bal_accuracy | pos_sigr | pos_retr | pos_prec | neg_prec | pearson | pearson_pval | kendall | kendall_pval | auc | ||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Return | Signal | Frequency | Aggregation | |||||||||||

| FXvEQXR | CSGILvBM_ZC | M | last | 0.520 | 0.513 | 0.414 | 0.460 | 0.475 | 0.551 | 0.079 | 0.000 | 0.041 | 0.000 | 0.513 |

| CSGIvBM_ZC | M | last | 0.504 | 0.500 | 0.447 | 0.459 | 0.459 | 0.541 | 0.058 | 0.000 | 0.027 | 0.014 | 0.500 | |

| CSGLvBM_ZC | M | last | 0.518 | 0.513 | 0.432 | 0.460 | 0.474 | 0.551 | 0.062 | 0.000 | 0.039 | 0.000 | 0.512 | |

| CSGvBM_ZC | M | last | 0.506 | 0.503 | 0.460 | 0.459 | 0.463 | 0.543 | 0.030 | 0.067 | 0.014 | 0.204 | 0.503 | |

| CSILvBM_ZC | M | last | 0.519 | 0.514 | 0.435 | 0.460 | 0.476 | 0.553 | 0.083 | 0.000 | 0.046 | 0.000 | 0.514 | |

| CSIvBM_ZC | M | last | 0.512 | 0.508 | 0.452 | 0.457 | 0.466 | 0.551 | 0.052 | 0.001 | 0.031 | 0.005 | 0.508 | |

| CSLvBM_ZC | M | last | 0.530 | 0.526 | 0.436 | 0.459 | 0.488 | 0.563 | 0.066 | 0.000 | 0.042 | 0.000 | 0.525 |

dix = dict_fxeq_rf

srrx = dix["srr"]

srrx.accuracy_bars(

type="years",

title="Accuracy of monthly predictions of FX forward returns for 26 EM and DM currencies",

size=(14, 6),

)

Naive PnL #

dix = dict_fxeq_rf

sigx = [dix["sig"]] + dix["rivs"]

targ = dix["targ"]

cidx = dix["cidx"]

blax = dix["black"]

naive_pnl = msn.NaivePnL(

dfx,

ret=targ,

sigs=sigx,

cids=cidx,

start="2000-01-01",

blacklist=blax,

bms=["USD_EQXR_NSA"],

)

for sig in sigx:

naive_pnl.make_pnl(

sig,

sig_neg=False,

sig_op="zn_score_pan",

thresh=3,

rebal_freq="monthly",

vol_scale=10,

rebal_slip=1,

pnl_name=sig + "_PZN",

)

for sig in sigx:

naive_pnl.make_pnl(

sig,

sig_neg=False,

sig_op="binary",

thresh=3,

rebal_freq="monthly",

vol_scale=10,

rebal_slip=1,

pnl_name=sig + "_BIN",

)

naive_pnl.make_long_pnl(vol_scale=10, label="Long only")

dix["pnls"] = naive_pnl

dix = dict_fxeq_rf

sigx = dix["sig"]

naive_pnl = dix["pnls"]

pnls = [sigx + x for x in ["_PZN", "_BIN"]] + ["Long only"]

naive_pnl.plot_pnls(

pnl_cats=pnls,

pnl_cids=["ALL"],

start="2000-01-01",

title=None,

xcat_labels=None,

figsize=(16, 8),

)

dix = dict_fxeq_rf

sigx = dix["sig"]

naive_pnl = dix["pnls"]

pnls = [sigx + "_PZN"] + ["Long only"]

dict_labels={"CSGILvBM_ZC_PZN": "based on directional cyclical strength z-score",

"Long only": "always long FX versus equity"}

naive_pnl.plot_pnls(

pnl_cats=pnls,

pnl_cids=["ALL"],

start="2000-01-01",

title="FX forward versus equity index future PnL across 17 currency areas, relative signal",

xcat_labels=dict_labels,

ylab="% of risk capital, for 10% annualized long-term vol, no compounding",

figsize=(16, 8),

)

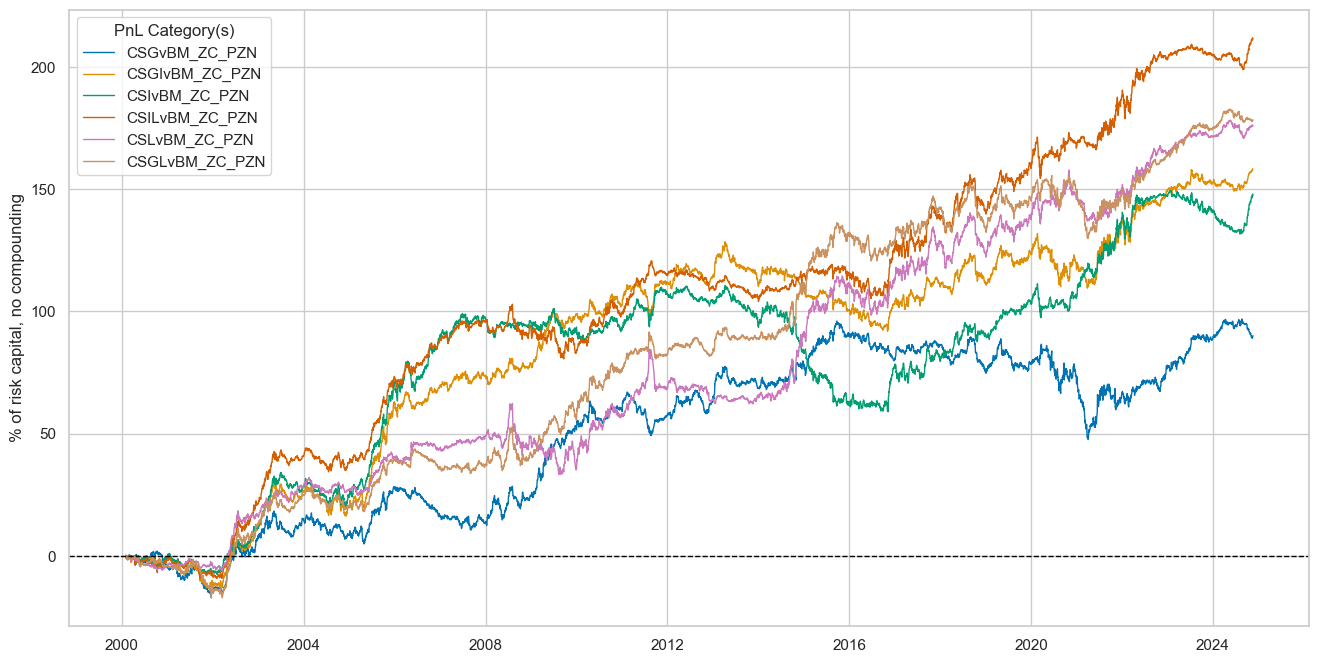

dix = dict_fxeq_rf

sigx = dix["rivs"]

naive_pnl = dix["pnls"]

pnls = [sig + "_PZN" for sig in sigx]

naive_pnl.plot_pnls(

pnl_cats=pnls,

pnl_cids=["ALL"],

start="2000-01-01",

title=None,

xcat_labels=None,

figsize=(16, 8),

)

dix = dict_fxeq_rf

sigx = [dix["sig"]] + dix["rivs"]

naive_pnl = dix["pnls"]

pnls = [sig + type for sig in sigx for type in ["_PZN", "_BIN"]]

df_eval = naive_pnl.evaluate_pnls(

pnl_cats=pnls,

pnl_cids=["ALL"],

start="2000-01-01",

)

display(df_eval.transpose())

| Return % | St. Dev. % | Sharpe Ratio | Sortino Ratio | Max 21-Day Draw % | Max 6-Month Draw % | Peak to Trough Draw % | Top 5% Monthly PnL Share | USD_EQXR_NSA correl | Traded Months | |

|---|---|---|---|---|---|---|---|---|---|---|

| xcat | ||||||||||

| CSGILvBM_ZC_PZN | 8.334418 | 10.0 | 0.833442 | 1.200683 | -13.459492 | -15.37297 | -19.140221 | 0.544992 | 0.053613 | 298 |

| CSGvBM_ZC_PZN | 3.633139 | 10.0 | 0.363314 | 0.518486 | -12.631551 | -28.83066 | -48.408873 | 1.121046 | 0.027406 | 298 |

| CSGIvBM_ZC_PZN | 6.38599 | 10.0 | 0.638599 | 0.919681 | -10.220062 | -20.709122 | -36.673399 | 0.722807 | 0.087613 | 298 |

| CSIvBM_ZC_PZN | 5.946811 | 10.0 | 0.594681 | 0.850107 | -13.722564 | -26.15678 | -51.667236 | 0.776585 | 0.081429 | 298 |

| CSILvBM_ZC_PZN | 8.530024 | 10.0 | 0.853002 | 1.231267 | -15.410937 | -11.863888 | -22.370403 | 0.53846 | 0.044535 | 298 |

| CSLvBM_ZC_PZN | 7.094953 | 10.0 | 0.709495 | 1.03636 | -14.434188 | -19.075401 | -29.061787 | 0.697287 | -0.021247 | 298 |

| CSGLvBM_ZC_PZN | 7.195167 | 10.0 | 0.719517 | 1.044721 | -12.642724 | -23.13424 | -25.77028 | 0.6325 | 0.005897 | 298 |

| CSGILvBM_ZC_BIN | 6.497507 | 10.0 | 0.649751 | 0.92958 | -14.345262 | -17.811849 | -20.399282 | 0.702889 | 0.076423 | 298 |

| CSGvBM_ZC_BIN | 4.76715 | 10.0 | 0.476715 | 0.694914 | -12.277093 | -20.541087 | -24.804862 | 0.98014 | -0.003623 | 298 |

| CSGIvBM_ZC_BIN | 2.422004 | 10.0 | 0.2422 | 0.339401 | -12.81974 | -21.379071 | -54.877378 | 1.784931 | 0.068329 | 298 |

| CSIvBM_ZC_BIN | 3.401567 | 10.0 | 0.340157 | 0.470308 | -16.153116 | -30.66803 | -53.615872 | 1.214478 | 0.094164 | 298 |

| CSILvBM_ZC_BIN | 6.30651 | 10.0 | 0.630651 | 0.895957 | -14.510664 | -17.811018 | -21.484719 | 0.642422 | 0.083834 | 298 |

| CSLvBM_ZC_BIN | 7.564915 | 10.0 | 0.756491 | 1.096419 | -14.209912 | -13.521302 | -20.40971 | 0.638837 | 0.034001 | 298 |

| CSGLvBM_ZC_BIN | 6.013909 | 10.0 | 0.601391 | 0.856516 | -13.891357 | -21.967663 | -30.864419 | 0.741706 | 0.011181 | 298 |

dix = dict_fxeq_rf

sig = dix["sig"]

naive_pnl = dix["pnls"]

naive_pnl.signal_heatmap(

pnl_name=sig + "_PZN", freq="m", start="2000-01-01", figsize=(16, 5)

)

FX versus IRS strategy (relative features) #

Specs and panel test #

sigs = cs_rel

ms = "CSGILvBM_ZC" # main signal

oths = list(set(sigs) - set([ms])) # other signals

targ = "FXvDU05XR"

cidx = msm.common_cids(dfx, sigs + [targ])

cidx = list(set(cidx_fxdu) & set(cidx))

dict_fxdu_rf = {

"sig": ms,

"rivs": oths,

"targ": targ,

"cidx": cidx,

"black": fxblack,

"srr": None,

"pnls": None,

}

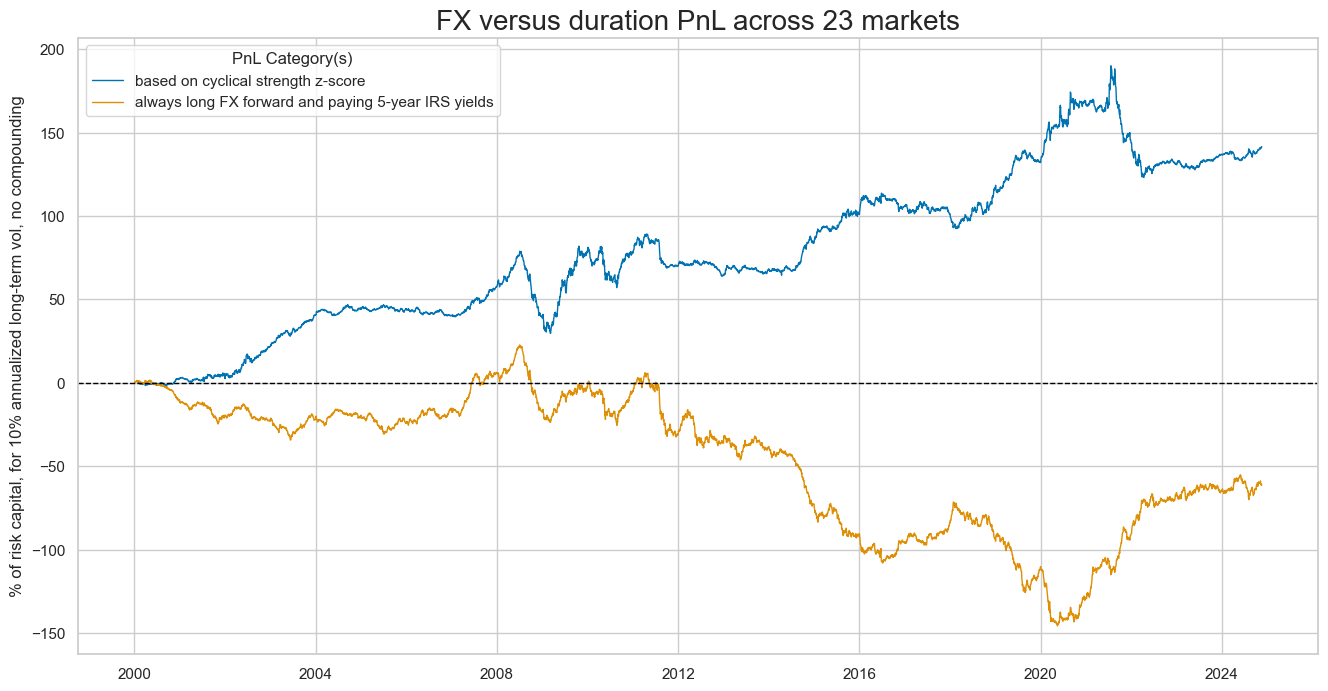

dix = dict_fxdu_rf

sig = dix["sig"]

targ = dix["targ"]

cidx = dix["cidx"]

blax = dix["black"]

crx = msp.CategoryRelations(

dfx,

xcats=[sig, targ],

cids=cidx,

freq="Q", # quarterly frequency allows for policy inertia

lag=1,

xcat_aggs=["last", "sum"],

start="2000-01-01",

blacklist=blax,

xcat_trims=[None, None],

)

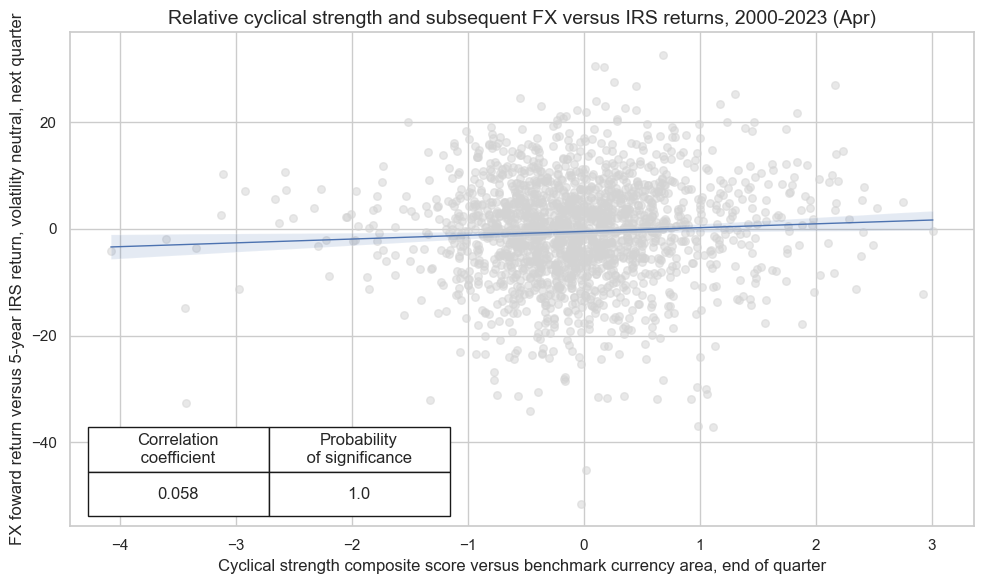

crx.reg_scatter(

labels=False,

coef_box="lower left",

xlab="Cyclical strength composite score versus benchmark currency area, end of quarter",

ylab="FX foward return versus 5-year IRS return, volatility neutral, next quarter",