The predictive power of information state changes #

Get packages and JPMaQS data #

# >>> Define constants <<< #

import os

import warnings

warnings.filterwarnings("ignore", "UserWarning")

# Minimum Macrosynergy package version required for this notebook

REQUIRED_VERSION: str = "0.1.32"

# DataQuery credentials: Remember to replace with your own client ID and secret

DQ_CLIENT_ID: str = os.getenv("DQ_CLIENT_ID")

DQ_CLIENT_SECRET: str = os.getenv("DQ_CLIENT_SECRET")

# Define any Proxy settings required (http/https)

PROXY = {}

# Start date for the data (argument passed to the JPMaQSDownloader class)

START_DATE: str = "1995-01-01"

# Check installed Macrosynergy package meets version requirement

import macrosynergy as msy

msy.check_package_version(required_version=REQUIRED_VERSION)

# Standard library imports

from typing import List, Tuple, Dict

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

import matplotlib as mpl

import seaborn as sns

from scipy.stats import chi2

# Macrosynergy package imports

import macrosynergy.management as msm

import macrosynergy.panel as msp

import macrosynergy.pnl as msn

import macrosynergy.visuals as msv

import macrosynergy.signal as mss

from macrosynergy.download import JPMaQSDownload

Specify and download the data #

# Cross sections to be explored

cids_dm = ["AUD", "CAD", "CHF", "EUR", "GBP", "JPY", "NOK", "NZD", "SEK", "USD"]

cids_em = [

"CLP",

"COP",

"CZK",

"HUF",

"IDR",

"ILS",

"INR",

"KRW",

"MXN",

"PLN",

"THB",

"TRY",

"TWD",

"ZAR",

]

cids = cids_dm + cids_em

cids_wild = ["CNY", "HKD", "RON", "RUB", "SGD"]

cids_non_tradable = ["IDR", "NZD"]

cids_emx = sorted(list(set(cids_em) - set(cids_wild) - set(cids_non_tradable)))

cids_dmx = sorted(list(set(cids_dm) - set(cids_non_tradable)))

cids_du = sorted(cids_dmx + cids_emx)

cids_duxi = np.sort(list(set(cids_du) - set(["INR"])))

# Nested notebook of quantamental groups and categories

isc_feats = {

"growth": {

"RGDPTECH_SA_P1M1ML12": {

"freq": "M", # frequency of the underlying series

"sign": "NEG", # assumed direction of impact

"desc": "Technical real GDP, %oya", # label for charts and tables

},

"INTRGDP_NSA_P1M1ML12": {

"freq": "M",

"sign": "NEG",

"desc": "Intuitive real GDP, %oya"

},

"IP_SA_P6M6ML6AR": {

"freq": "M",

"sign": "NEG",

"desc": "Industrial Production",

},

"RPCONS_SA_P1M1ML12": {

"freq": "M",

"sign": "NEG",

"desc": "Real Private Consumption (monthly)",

},

"RPCONS_SA_P1Q1QL4": {

"freq": "Q",

"sign": "NEG",

"desc": "Real Private consumption (quarterly)",

},

"IMPORTS_SA_P6M6ML6AR": {

"freq": "M",

"sign": "NEG",

"desc": "Import growth",

},

"RRSALES_SA_P1M1ML12_3MMA": {

"freq": "M",

"sign": "NEG",

"desc": "Real retail sales"

},

"RRSALES_SA_P1Q1QL4": {

"freq": "Q",

"sign": "NEG",

"desc": "Real retail sales"

},

},

"inflation": {

"CPIHX_SA_P1M1ML12": {

"freq": "M",

"sign": "NEG",

"desc": "Headline consumer price inflation",

},

"CPICX_SA_P1M1ML12": {

"freq": "M",

"sign": "NEG",

"desc": "Core consumer price inflation",

},

"PPIH_NSA_P1M1ML12": {

"freq": "M",

"sign": "NEG",

"desc": "Producer Price Index %oya",

},

},

"financial": {

"PCREDITGDP_SJA_D1M1ML12": {

"freq": "M",

"sign": "NEG",

"desc": "Private credit as percent of GDP - changes",

},

"MNARROW_SJA_P1M1ML12": {

"freq": "M",

"sign": "NEG",

"desc": "Narrow money yoy change",

},

"MBROAD_SJA_P1M1ML12": {

"freq": "M",

"sign": "NEG",

"desc": "Broad money yoy change",

},

"IIPLIABGDP_NSA": {

"freq": "Q",

"sign": "NEG",

"desc": "international investment position liabilities (ratio to GDP)",

},

"NIIPGDP_NSA": {

"freq": "Q",

"sign": "NEG",

"desc": "Net international investment position (ratio to GDP)",

},

},

"labour": {

"UNEMPLRATE_SA_3MMA": {

"freq": "M",

"sign": "POS",

"desc": "Unemployment rate",

},

"EMPL_NSA_P1M1ML12": {

"freq": "M",

"sign": "NEG",

"desc": "Employment growth"

},

"EMPL_NSA_P1Q1QL4": {

"freq": "Q",

"sign": "NEG",

"desc": "Employment growth",

},

},

"surveys": {

"MBCSCORE_SA": {

"freq": "M",

"sign": "NEG",

"desc": "Manufacturing confidence scores",

},

"SBCSCORE_SA": {

"freq": "M",

"sign": "NEG",

"desc": "Service confidence scores",

},

"CBCSCORE_SA": {

"freq": "M",

"sign": "NEG",

"desc": "Construction confidence score "

},

"CCSCORE_SA": {

"freq": "M",

"sign": "NEG",

"desc": "Consumer confidence score "

}

},

}

# Dictionary of indicators by frequency

pe_freqs = {

ff: [

k + "_" + v["sign"]

for cats in isc_feats.values()

for k, v in cats.items()

if v["freq"] == ff

]

for ff in ("D", "W", "M", "Q")

}

# Lists of categories by frequency for scaling to volatility

daily = pe_freqs["D"]

weekly = pe_freqs["W"]

monthly = pe_freqs["M"]

quarterly = pe_freqs["Q"]

# Modify tickers to include the sign in the name

pe_growth = [xc + "_" + v["sign"] for xc, v in isc_feats["growth"].items()]

pe_inflation = [xc + "_" + v["sign"] for xc, v in isc_feats["inflation"].items()]

pe_financial = [xc + "_" + v["sign"] for xc, v in isc_feats["financial"].items()]

pe_labour = [xc + "_" + v["sign"] for xc, v in isc_feats["labour"].items()]

pe_surveys = [xc + "_" + v["sign"] for xc, v in isc_feats["surveys"].items()]

pe_feats = pe_growth + pe_inflation + pe_financial + pe_labour + pe_surveys

# Category ticker lists for download

main = [

xc for cats in isc_feats.values() for xc in cats.keys()

if xc not in ("CPIHX_SA_P1M1ML12", "CPICX_SA_P1M1ML12")

] + [

"CPIH_SA_P1M1ML12", "CPIHE_SA_P1M1ML12",

"CPIC_SA_P1M1ML12", "CPICE_SA_P1M1ML12",

]

misc = ["USDGDPWGT_SA_3YMA", "EXMOPENNESS_NSA_1YMA", "EXALLOPENNESS_NSA_1YMA"]

mark = ["DU05YXR_VT10", "DU05YXR_NSA"]

xcats = main + mark + misc

# Construct tickers

tickers: List[str] = [

cid + "_" + xcat

for cid in cids

for xcat in xcats

]

print(f"Maximum number of JPMaQS tickers to be downloaded is {len(tickers)}")

Maximum number of JPMaQS tickers to be downloaded is 720

# Download series from J.P. Morgan DataQuery by tickers

with JPMaQSDownload(

client_id=DQ_CLIENT_ID, client_secret=DQ_CLIENT_SECRET, proxy=PROXY

) as downloader:

df: pd.DataFrame = downloader.download(

tickers=tickers,

start_date=START_DATE,

metrics=["value", "eop_lag"], # TODO use mop_lag for time temporal weights (together with eop)

suppress_warning=True,

show_progress=True,

report_time_taken=True,

)

Downloading data from JPMaQS.

Timestamp UTC: 2024-10-29 10:42:25

Connection successful!

Requesting data: 100%|██████████| 72/72 [00:15<00:00, 4.79it/s]

Downloading data: 100%|██████████| 72/72 [00:31<00:00, 2.32it/s]

Time taken to download data: 51.17 seconds.

Some expressions are missing from the downloaded data. Check logger output for complete list.

268 out of 1440 expressions are missing. To download the catalogue of all available expressions and filter the unavailable expressions, set `get_catalogue=True` in the call to `JPMaQSDownload.download()`.

Some dates are missing from the downloaded data.

2 out of 7784 dates are missing.

# Deep copy and fill

dfx = df.copy()

dfx.info()

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 3962870 entries, 0 to 3962869

Data columns (total 5 columns):

# Column Dtype

--- ------ -----

0 real_date datetime64[ns]

1 cid object

2 xcat object

3 value float64

4 eop_lag float64

dtypes: datetime64[ns](1), float64(2), object(2)

memory usage: 151.2+ MB

Blacklist dictionary #

dublack = {"TRY": (pd.Timestamp("2020-01-01 00:00:00"), pd.Timestamp("2100-01-01 00:00:00"))}

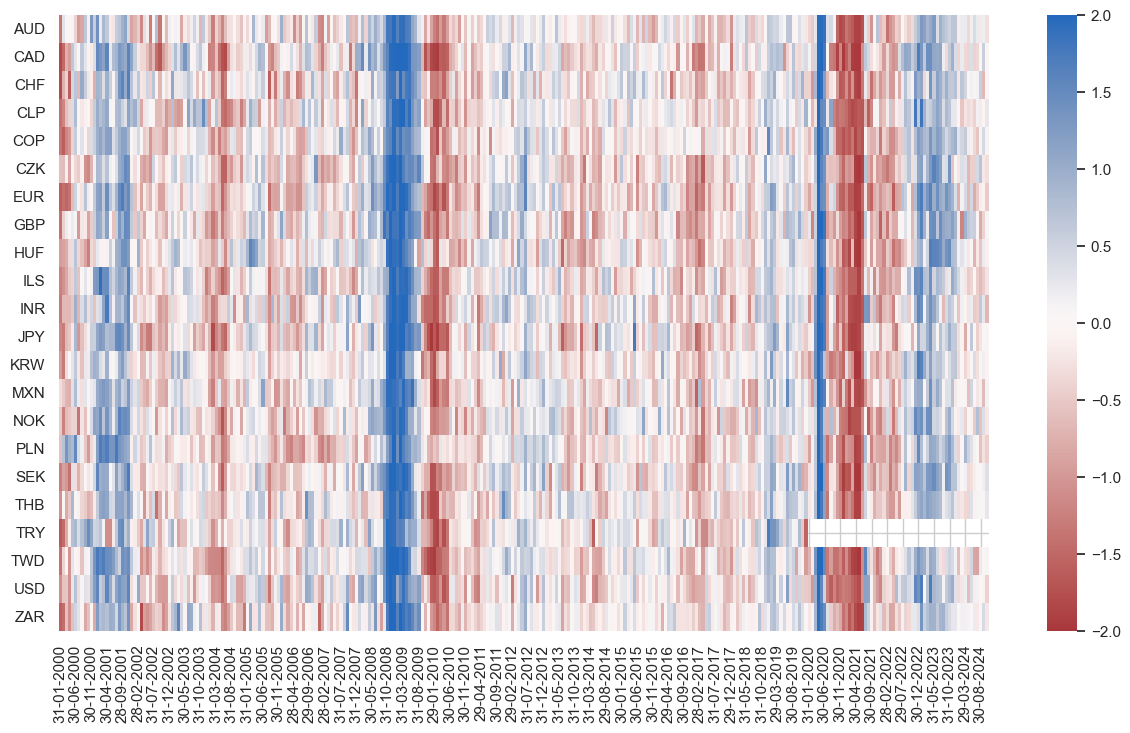

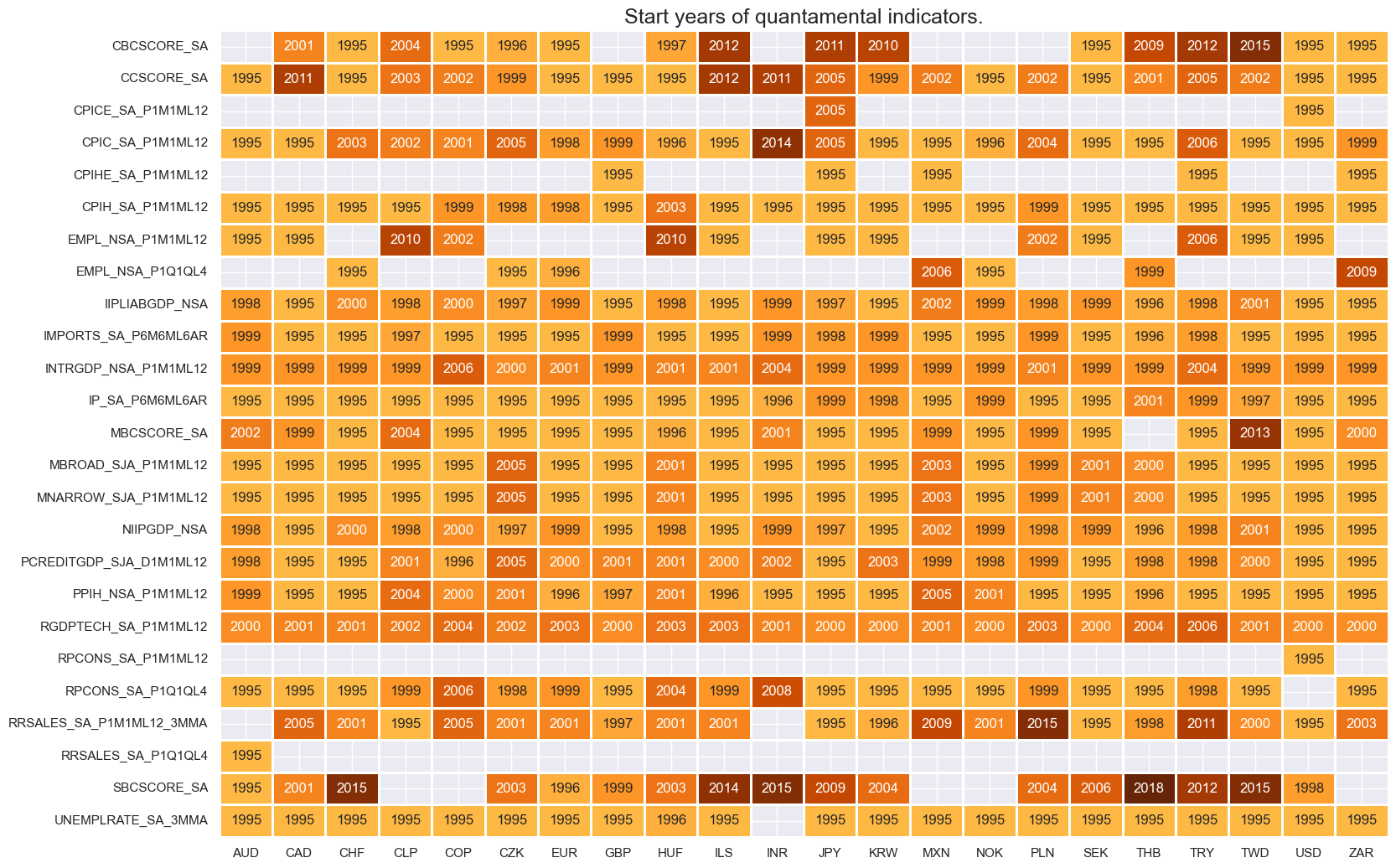

Availability #

msm.check_availability(df=df, xcats=main, cids=cids_du, missing_recent=False)

Transformations and checks #

Extended best CPI changes through hierarchical merging #

# Dictionary for merged core CPI and hierarchies of merged constituents

dict_cpicx = {

"CPICX_" + chg: [cpi + chg for cpi in ["CPICE_", "CPIC_"]]

for chg in ["SA_P1M1ML12"]

}

# Dictionary for merged headline CPI and hierarchies of merged constituents

dict_cpihx = {

"CPIHX_" + chg: [cpi + chg for cpi in ["CPIHE_", "CPIH_"]]

for chg in ["SA_P1M1ML12"]

}

# Merge dictionary of new tickers and hierarchies of merged constituents

dict_cpix = {**dict_cpicx, **dict_cpihx}

store = [

msm.merge_categories(dfx, xcats=v, new_xcat=k)

for k, v in dict_cpix.items()

]

dfx = msm.update_df(dfx, pd.concat(store, axis=0, ignore_index=True))

Explicit positive and negative impact categories #

dfa = dfx[dfx['xcat'].isin([xc[:-4] for xc in pe_feats if xc[-3:] == "NEG"])].copy()

dfa.loc[:, 'value'] = dfa['value'] * -1

dfa.loc[:, 'xcat'] = dfa['xcat'] + "_NEG"

dfx = msm.update_df(dfx, dfa)

dfa = dfx[dfx['xcat'].isin([xc[:-4] for xc in pe_feats if xc[-3:] == "POS"])].copy()

dfa.loc[:, 'xcat'] = dfa['xcat'] + "_POS"

dfx = msm.update_df(dfx, dfa)

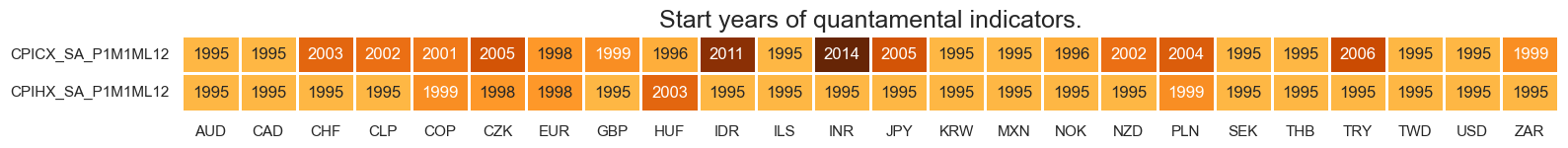

# Check availability of new tickers

xcatx = [k for k in dict_cpix.keys()]

msm.check_availability(dfx, xcats = xcatx, cids=cids, missing_recent=False)

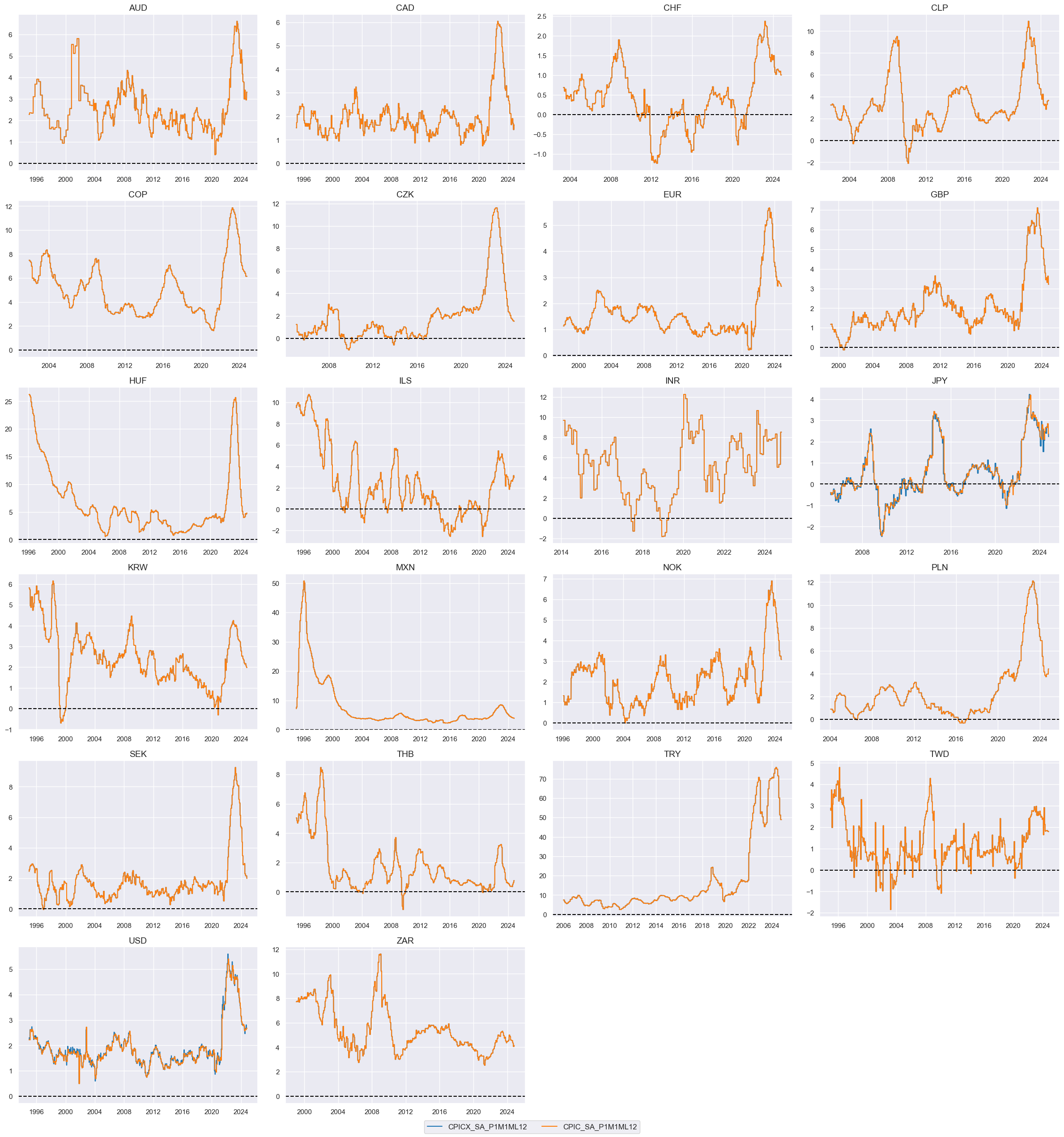

# Compare original and extended measures

xcatx = ["CPICX_SA_P1M1ML12", "CPIC_SA_P1M1ML12"]

cidx = cids_du

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

cumsum=False,

start="1990-01-01",

same_y=False,

all_xticks=True,

title =None,

title_fontsize=28,

aspect=1.4,

size=(8, 8),

)

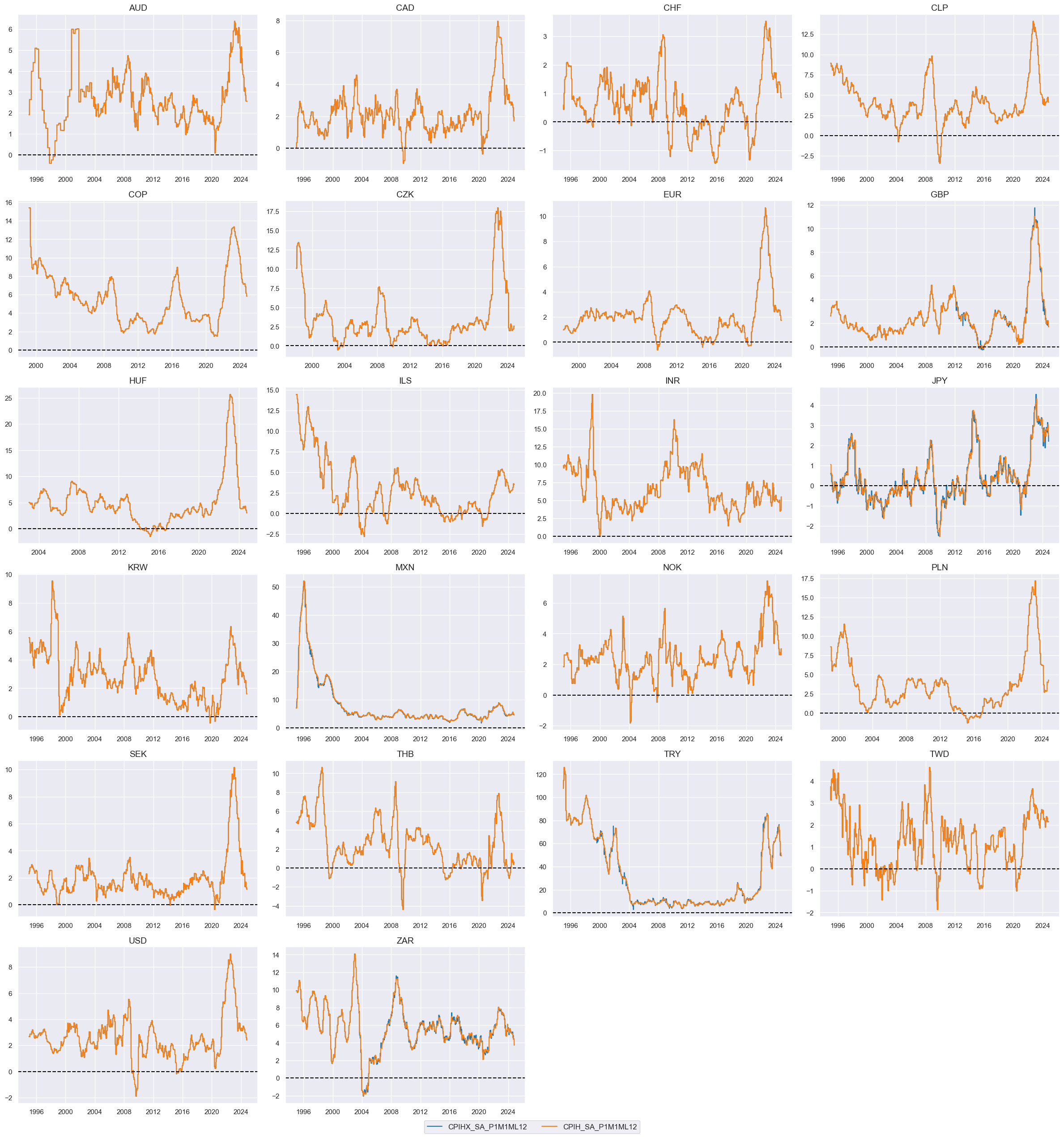

# Compare original and extended measures

xcatx = ["CPIHX_SA_P1M1ML12", "CPIH_SA_P1M1ML12"]

cidx = cids_du

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

cumsum=False,

start="1990-01-01",

same_y=False,

all_xticks=True,

title =None,

title_fontsize=28,

aspect=1.4,

size=(8, 8),

)

Normalized information changes in annualized change units #

df_red = msm.reduce_df(dfx, xcats=pe_feats, cids=cids_du)

# creates sparse dataframe with information state changes

isc_obj = msm.InformationStateChanges.from_qdf(

df=df_red,

norm=True, # normalizes changes by first release values

std="std",

halflife=36, # for volatility scaling only

min_periods=36,

)

dfa = isc_obj.to_qdf(value_column="zscore", postfix="_NIC")

dfx = msm.update_df(dfx, dfa[["real_date", "cid", "xcat", "value"]])

# Information state changes in standard annualized change units

store = []

weights = [

(pe_freqs["D"], np.sqrt(1/262)), # annualization factors for random walks

(pe_freqs["W"], np.sqrt(1/52)),

(pe_freqs["M"], np.sqrt(1/12)),

(pe_freqs["Q"], np.sqrt(1/4)),

]

for xcats, w in weights:

_tmp = msm.reduce_df(dfx, xcats=[x + "_NIC" for x in xcats])

_tmp["value"] *= w

_tmp["xcat"] += "A"

store.append(_tmp[["real_date", "cid", "xcat", "value"]].dropna())

dfa = pd.concat(store, axis=0, ignore_index=True)

dfx = msm.update_df(dfx, dfa)

Winsorized information changes #

# Winsorization 3 annual information state changes for any given release date

xcatx = [xc + "_NICA" for xc in pe_feats]

cidx = cids_du

dfa = msm.reduce_df(dfx, xcats=xcatx, cids=cidx)

dfa["value"] = dfa["value"].clip(lower=-3, upper=3)

dfa["xcat"] += "W"

dfx = msm.update_df(dfx, dfa[["real_date", "cid", "xcat", "value"]].dropna())

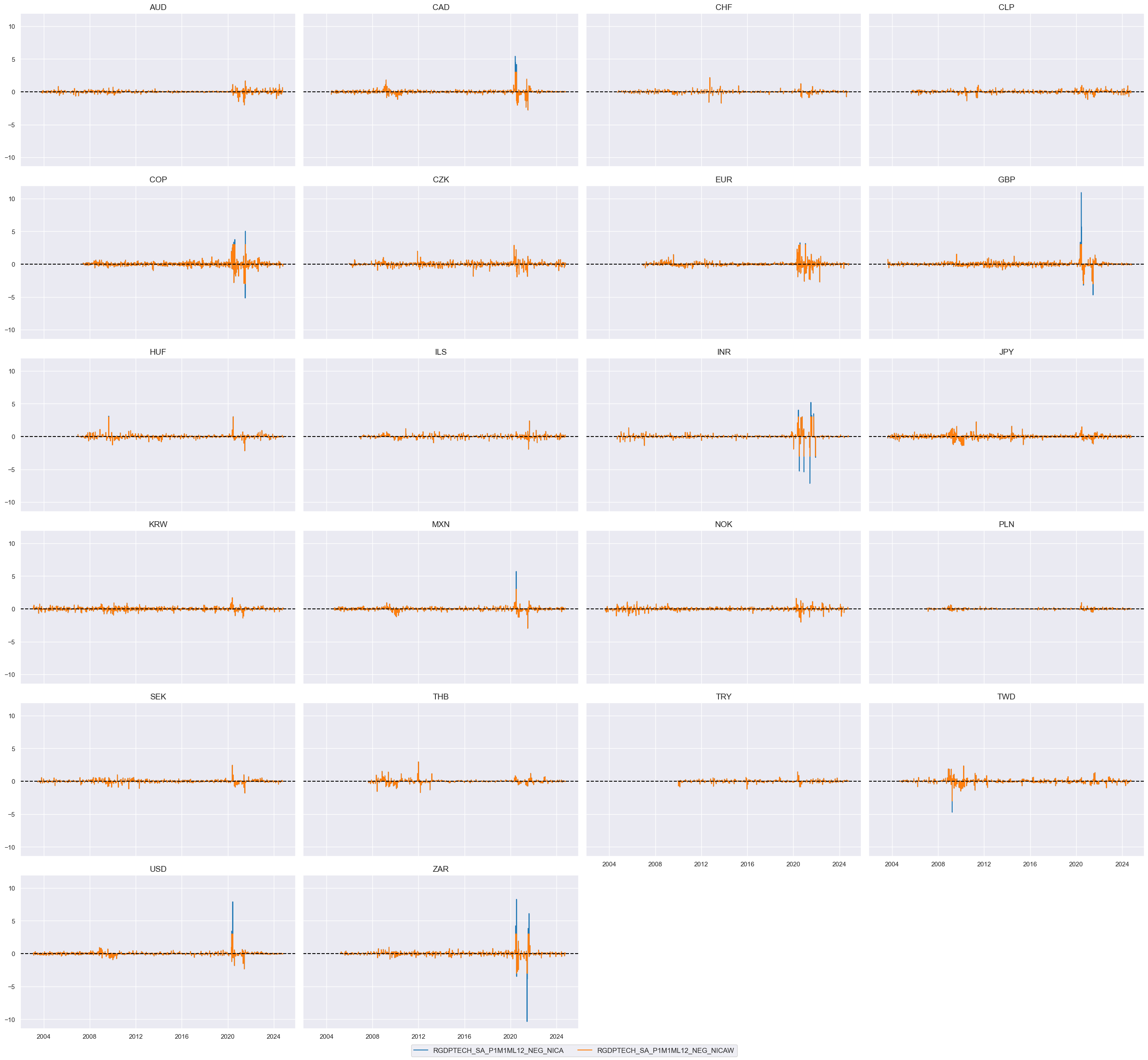

xcatx = ['RGDPTECH_SA_P1M1ML12_NEG_NICA','RGDPTECH_SA_P1M1ML12_NEG_NICAW',]

cidx = cids_du

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

start="2000-01-01",

title=None,

same_y=True,

)

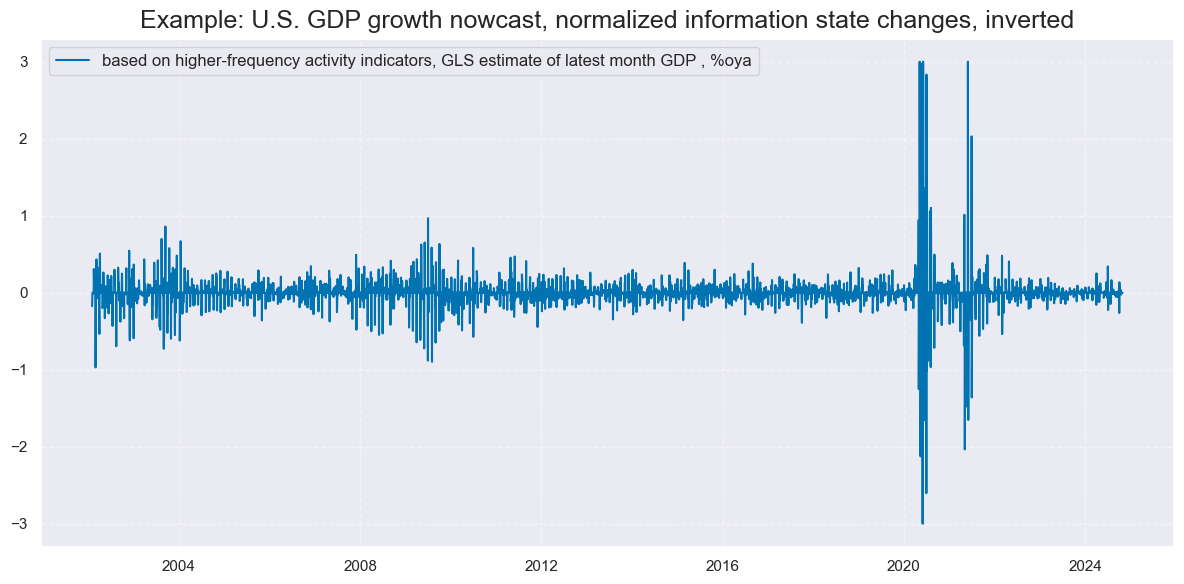

xcatx = ['INTRGDP_NSA_P1M1ML12_NEG_NICAW']

cidx = ["USD"]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=1,

start="2000-01-01",

title="Example: U.S. GDP growth nowcast, normalized information state changes, inverted",

xcat_labels=["based on higher-frequency activity indicators, GLS estimate of latest month GDP , %oya"],

size=(12, 6),

)

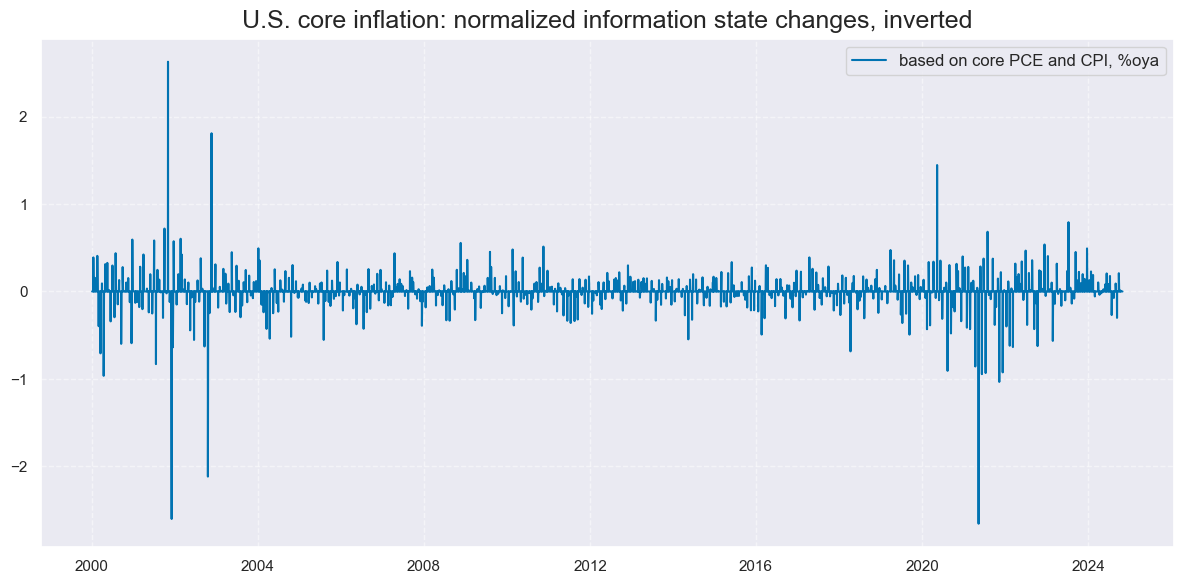

xcatx = ['CPICX_SA_P1M1ML12_NEG_NICAW']

cidx = ["USD"]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=1,

start="2000-01-01",

title="U.S. core inflation: normalized information state changes, inverted",

xcat_labels=["based on core PCE and CPI, %oya"],

size=(12, 6),

)

Moving averages of information changes #

xcatx = [xc + "_NICAW" for xc in pe_feats]

cidx = cids_du

hts=[5, 3] # Half-times

dfa = msm.reduce_df(dfx, xcats=xcatx, cids=cidx)

dfa["ticker"] = dfa["cid"] + "_" + dfa["xcat"]

p = dfa.pivot(index="real_date", columns="ticker", values="value")

store = []

for ht in hts:

proll = p.ewm(halflife=ht).sum()

proll.columns += f"_{ht}DXMS"

_df = proll.stack().to_frame("value").reset_index()

_df[["cid", "xcat"]] = _df["ticker"].str.split("_", n=1, expand=True)

store.append(_df[["cid", "xcat", "real_date", "value"]])

dfx = msm.update_df(dfx, pd.concat(store, axis=0, ignore_index=True))

tranx = [f"_NICAW_{ht}DXMS" for ht in hts]

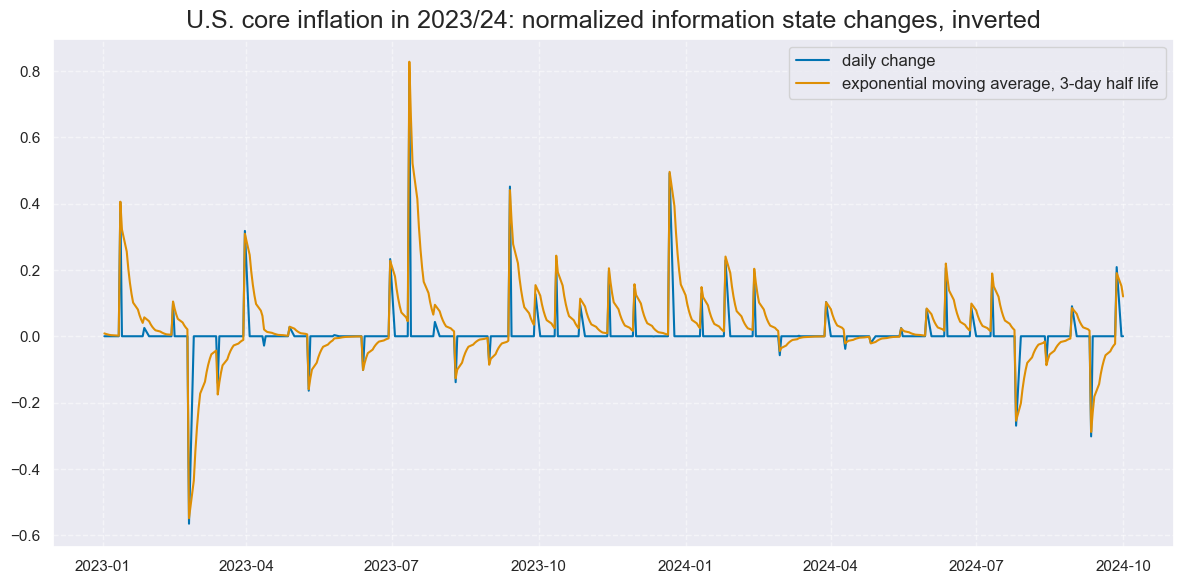

xcatx = ['CPICX_SA_P1M1ML12_NEG_NICAW', "CPICX_SA_P1M1ML12_NEG_NICAW_3DXMS"]

cidx = ["USD"]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=1,

start="2023-01-01",

end="2024-10-01",

title="U.S. core inflation in 2023/24: normalized information state changes, inverted",

xcat_labels=["daily change", "exponential moving average, 3-day half life"],

size=(12, 6),

)

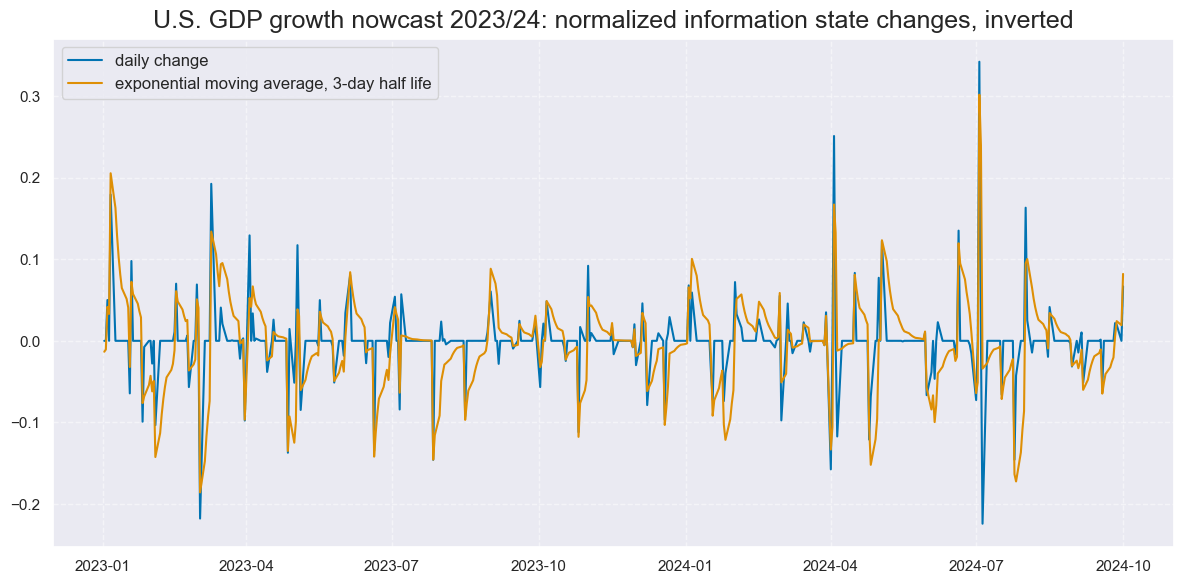

xcatx = ['INTRGDP_NSA_P1M1ML12_NEG_NICAW', "INTRGDP_NSA_P1M1ML12_NEG_NICAW_3DXMS"]

cidx = ["USD"]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=1,

start="2023-01-01",

end="2024-10-01",

title="U.S. GDP growth nowcast 2023/24: normalized information state changes, inverted",

xcat_labels=["daily change", "exponential moving average, 3-day half life"],

size=(12, 6),

)

Group aggregation #

Growth #

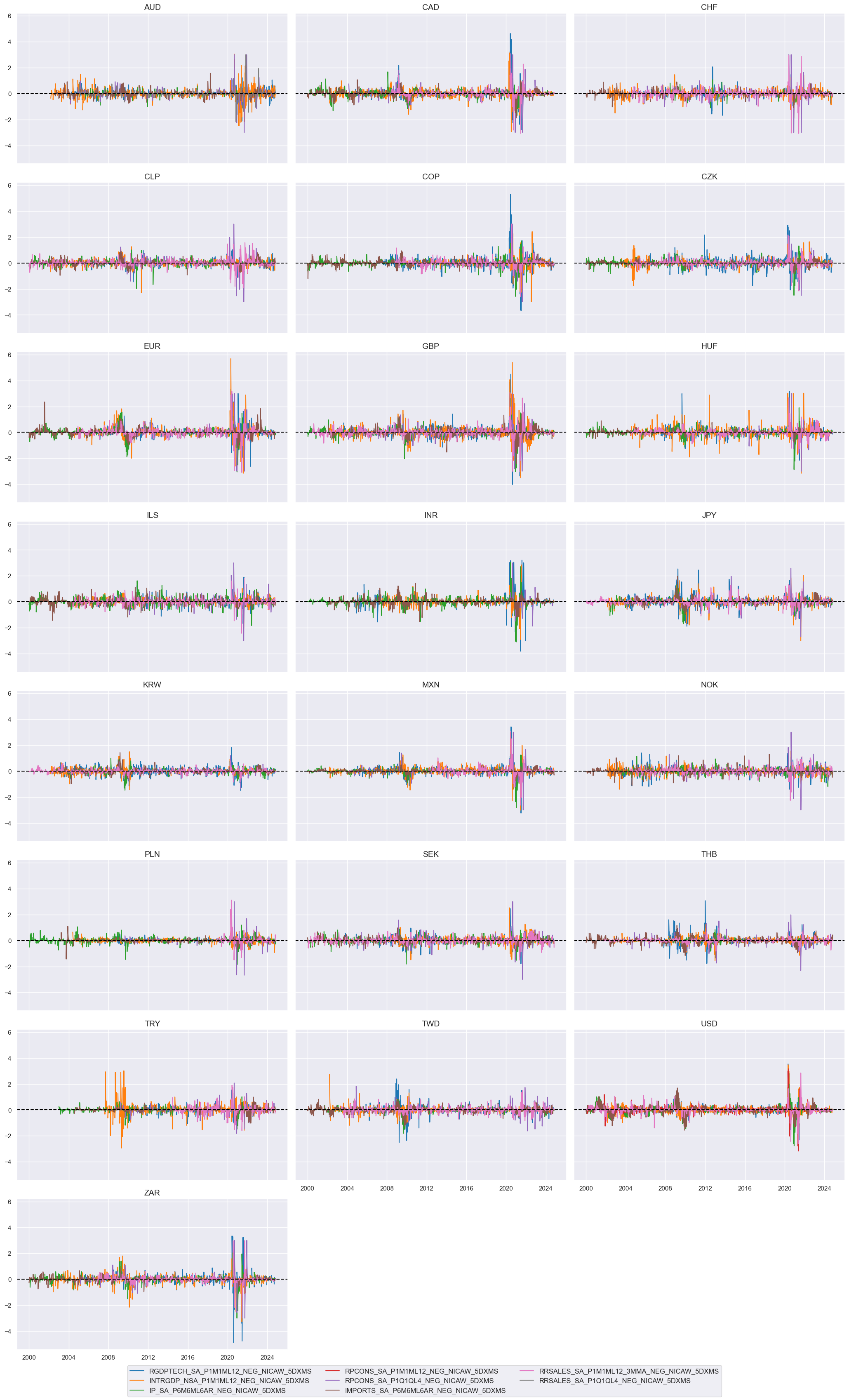

trans = tranx[0]

xcatx = [xc + trans for xc in pe_growth]

cidx = cids_du

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=3,

start="2000-01-01",

title=None,

same_y=True,

)

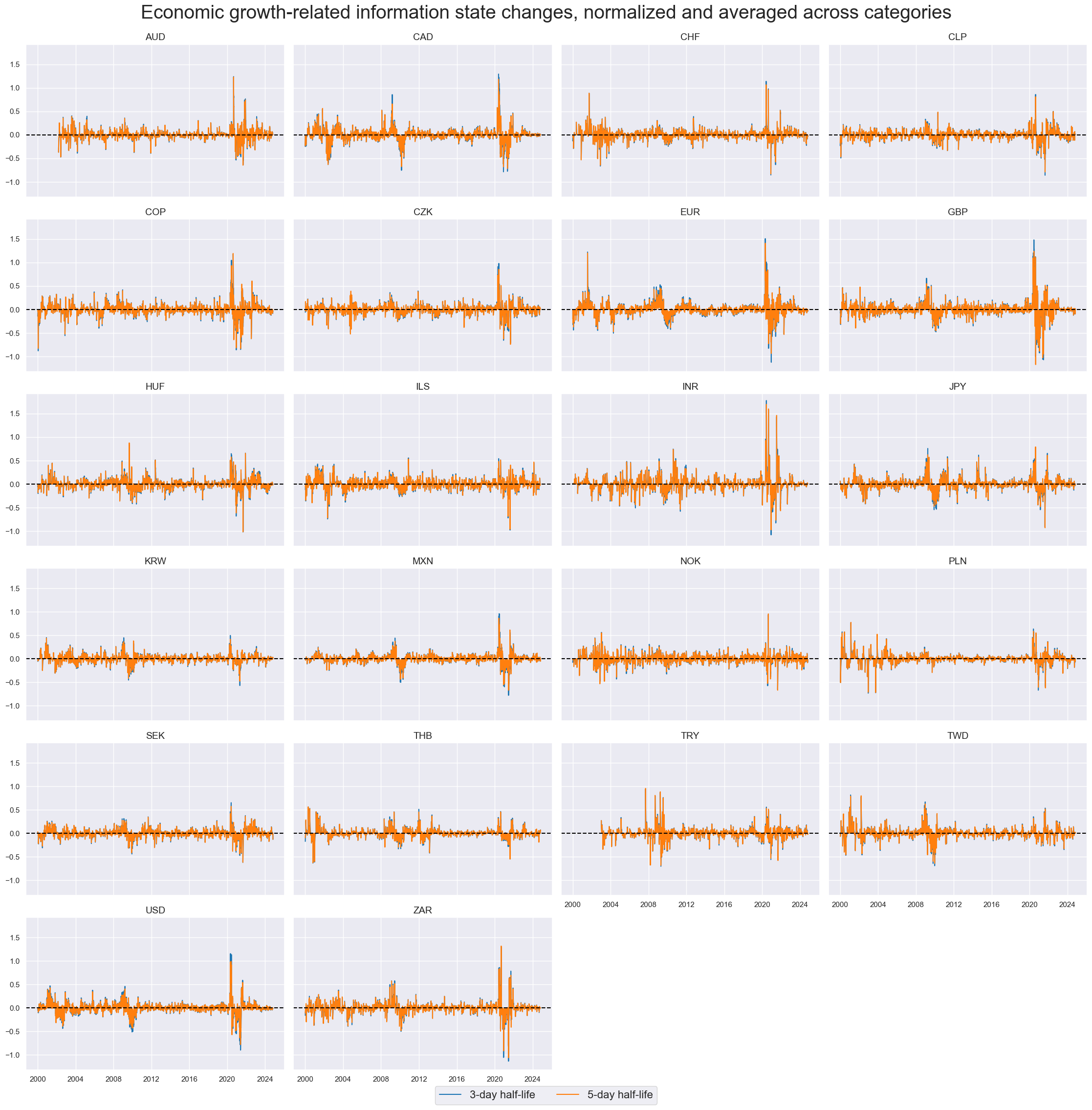

cidx = cids_du

dfr = msm.reduce_df(dfx, xcats=xcatx, cids=cidx)

for trans in tranx:

xcatx = [xc + trans for xc in pe_growth]

dfr = msm.reduce_df(dfx, xcats=xcatx, cids=cidx)

dfa = msp.linear_composite(

df=dfr,

xcats=xcatx,

cids=cidx,

new_xcat="GROWTH" + trans,

)

dfx = msm.update_df(dfx, dfa)

xcatx = ["GROWTH" + trans for trans in tranx]

cidx = cids_du

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

start="2000-01-01",

aspect = 1.5,

height=2.5,

title="Economic growth-related information state changes, normalized and averaged across categories",

title_fontsize=28,

xcat_labels=["3-day half-life", "5-day half-life"],

legend_fontsize=16,

same_y=True,

)

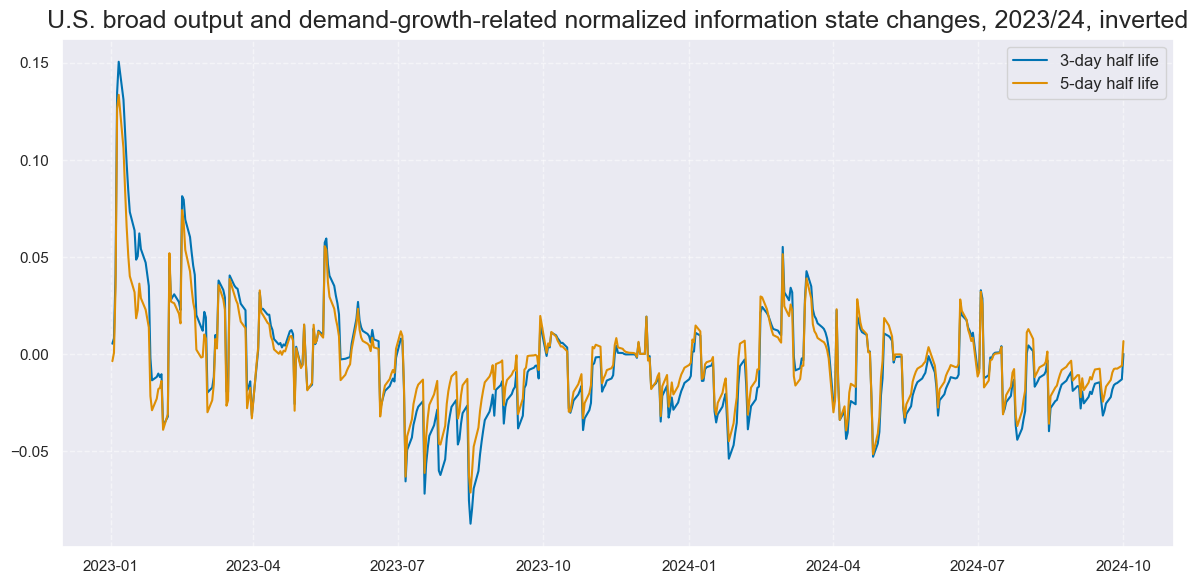

xcatx = ["GROWTH" + trans for trans in tranx]

cidx = ["USD"]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=1,

start="2023-01-01",

end="2024-10-01",

title="U.S. broad output and demand-growth-related normalized information state changes, 2023/24, inverted",

xcat_labels=["3-day half life", "5-day half life"],

size=(12, 6),

)

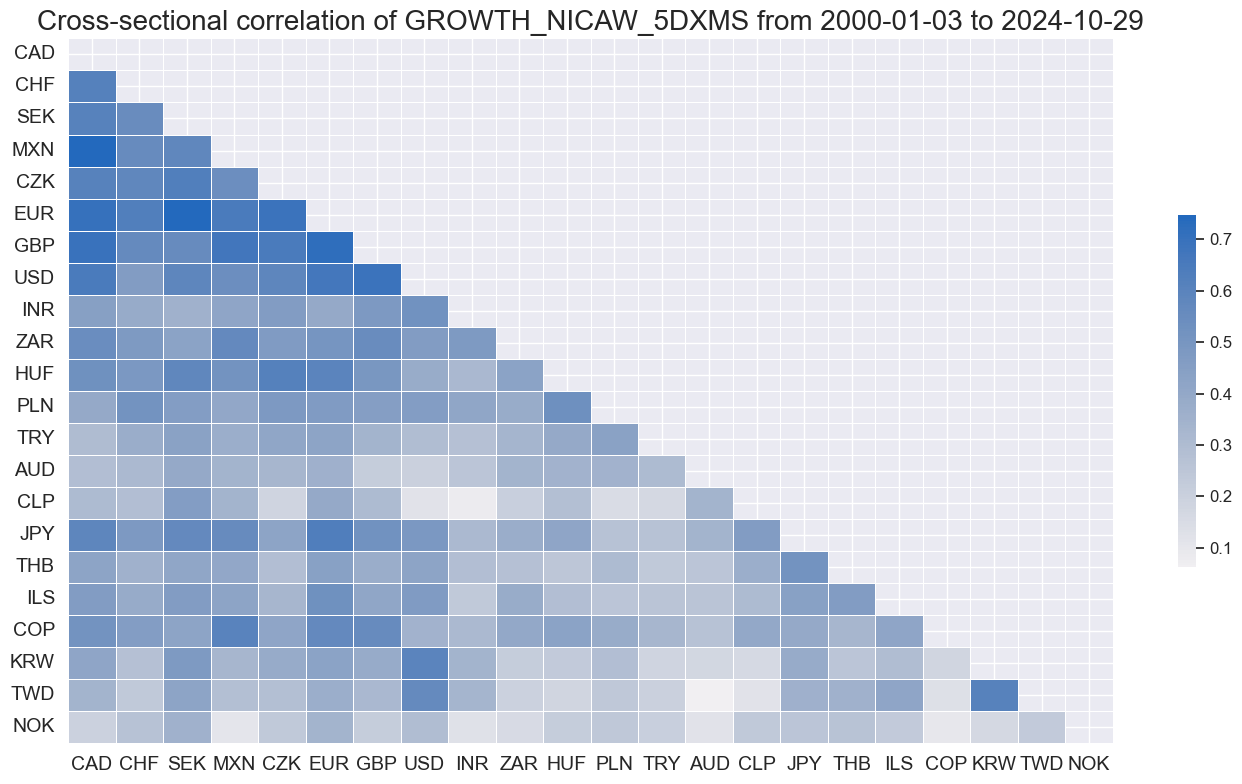

msp.correl_matrix(

dfx,

xcats=["GROWTH" + tranx[0]],

cids=cids_du,

start="2000-01-01",

cluster=True,

freq="M",

)

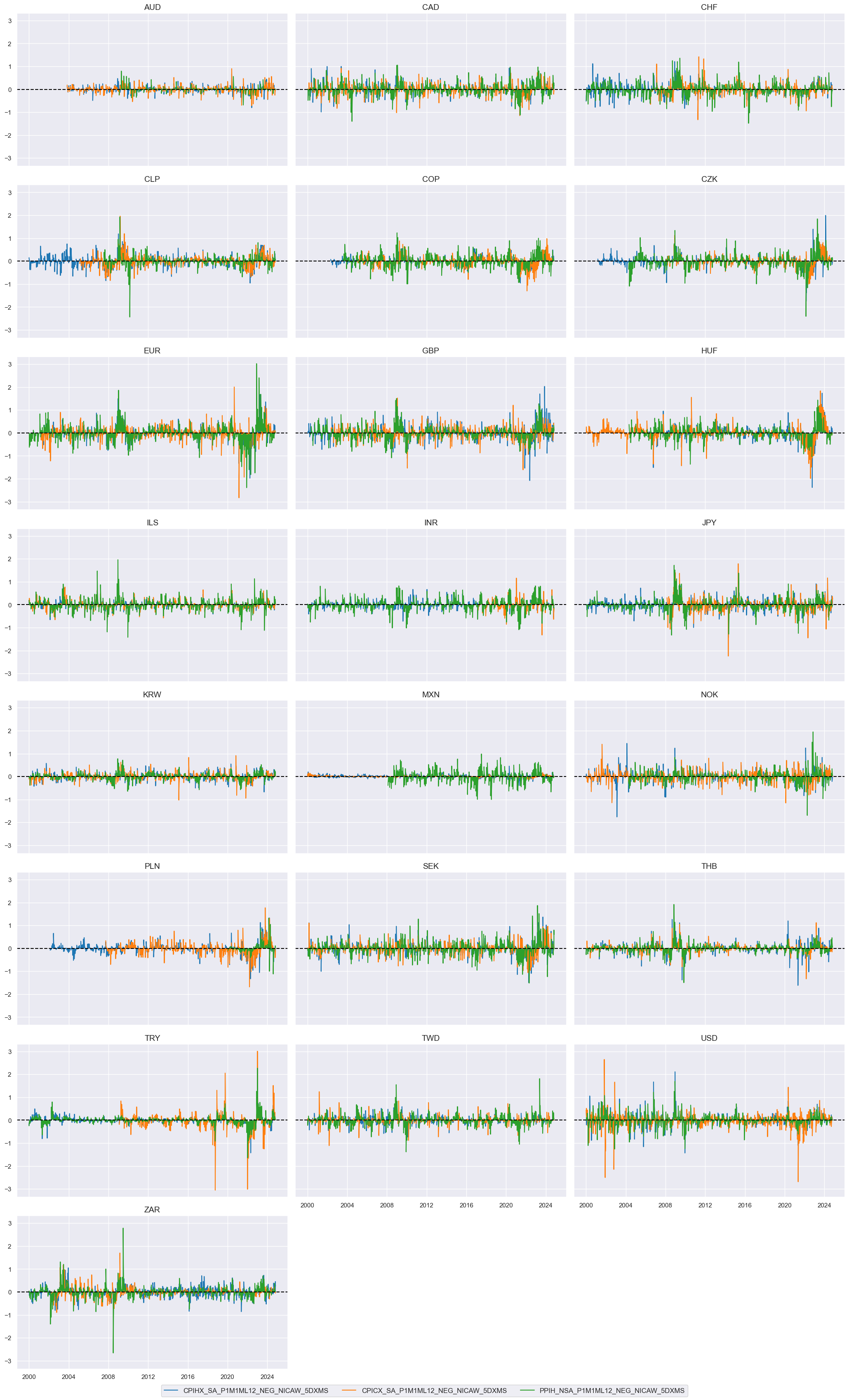

Inflation #

trans = "_NICAW_5DXMS"

xcatx = [xc + trans for xc in pe_inflation]

cidx = cids_du

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=3,

start="2000-01-01",

title=None,

same_y=True,

)

cidx = cids_du

dfr = msm.reduce_df(dfx, xcats=xcatx, cids=cidx)

for trans in tranx:

xcatx = [xc + trans for xc in pe_inflation]

dfr = msm.reduce_df(dfx, xcats=xcatx, cids=cidx)

dfa = msp.linear_composite(

df=dfr,

xcats=xcatx,

cids=cidx,

new_xcat="INFLATION" + trans,

)

dfx = msm.update_df(dfx, dfa)

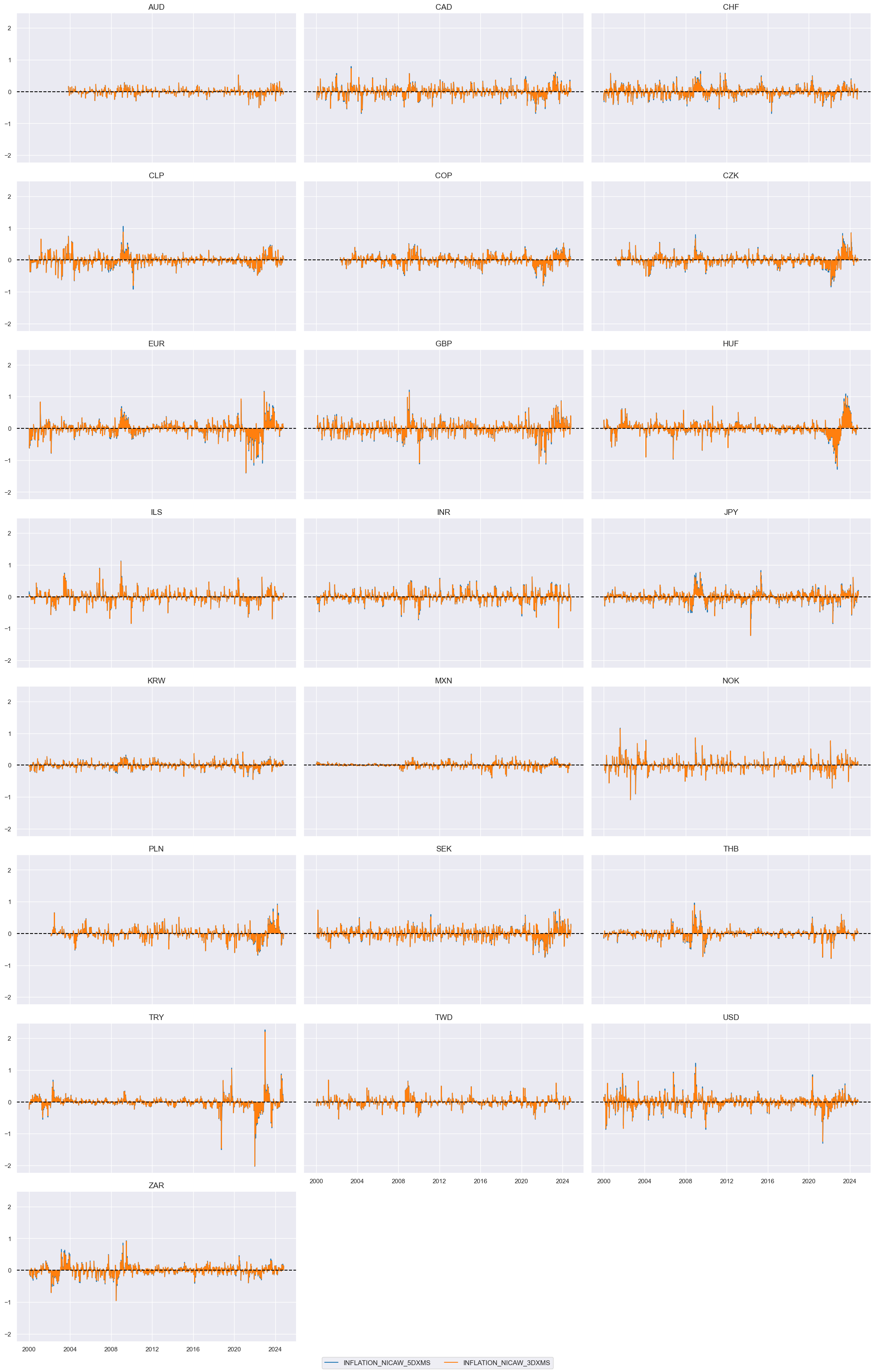

xcatx = ["INFLATION" + trans for trans in tranx]

cidx = cids_du

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=3,

start="2000-01-01",

aspect = 1.7,

title=None,

same_y=True,

)

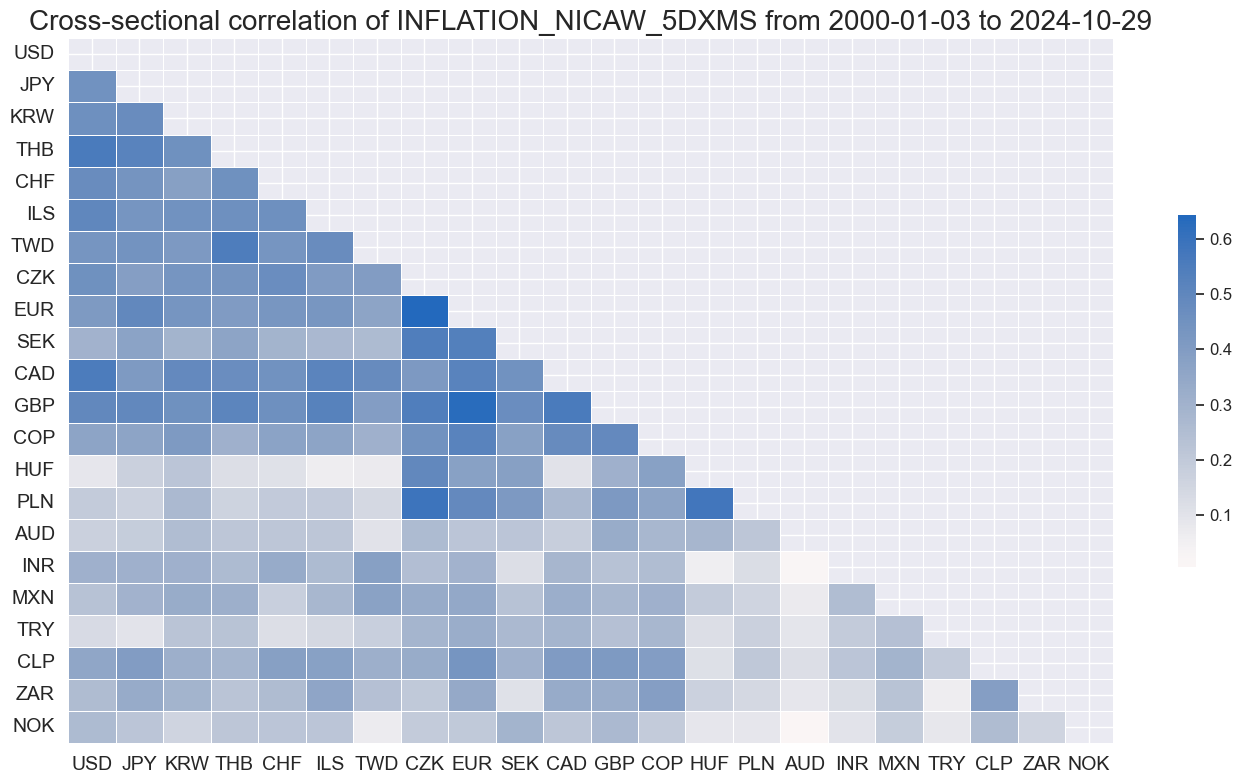

msp.correl_matrix(

dfx,

xcats=["INFLATION" + tranx[0]],

cids=cids_du,

start="2000-01-01",

cluster=True,

freq="M",

)

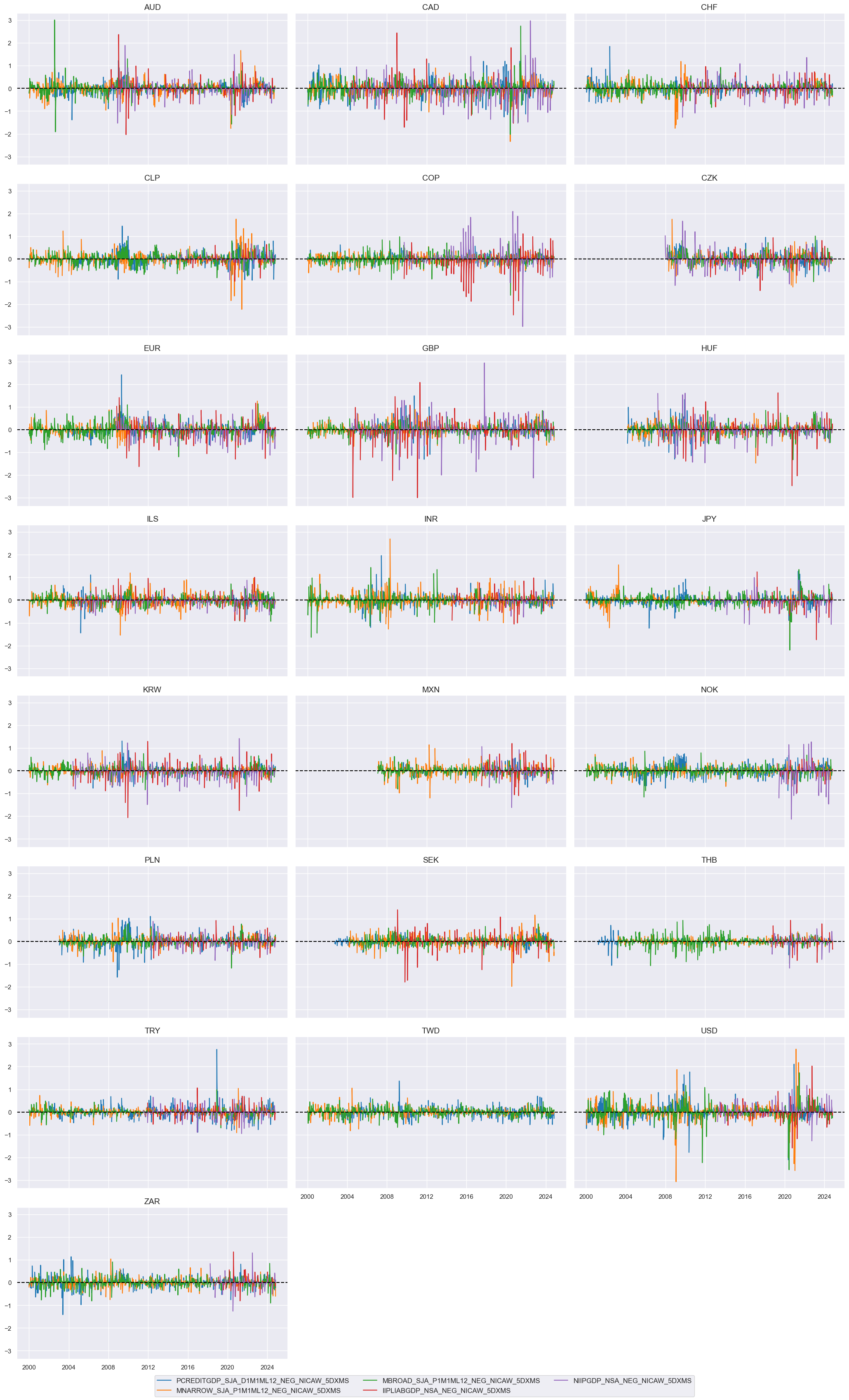

Financial #

trans = tranx[0]

xcatx = [xc + trans for xc in pe_financial]

cidx = cids_du

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=3,

start="2000-01-01",

title=None,

same_y=True,

)

warnings.filterwarnings("ignore")

cidx = cids_du

dfr = msm.reduce_df(dfx, xcats=xcatx, cids=cidx)

for trans in tranx:

xcatx = [xc + trans for xc in pe_financial]

dfr = msm.reduce_df(dfx, xcats=xcatx, cids=cidx)

dfa = msp.linear_composite(

df=dfr,

xcats=xcatx,

cids=cidx,

new_xcat="FINANCIAL" + trans,

)

dfx = msm.update_df(dfx, dfa)

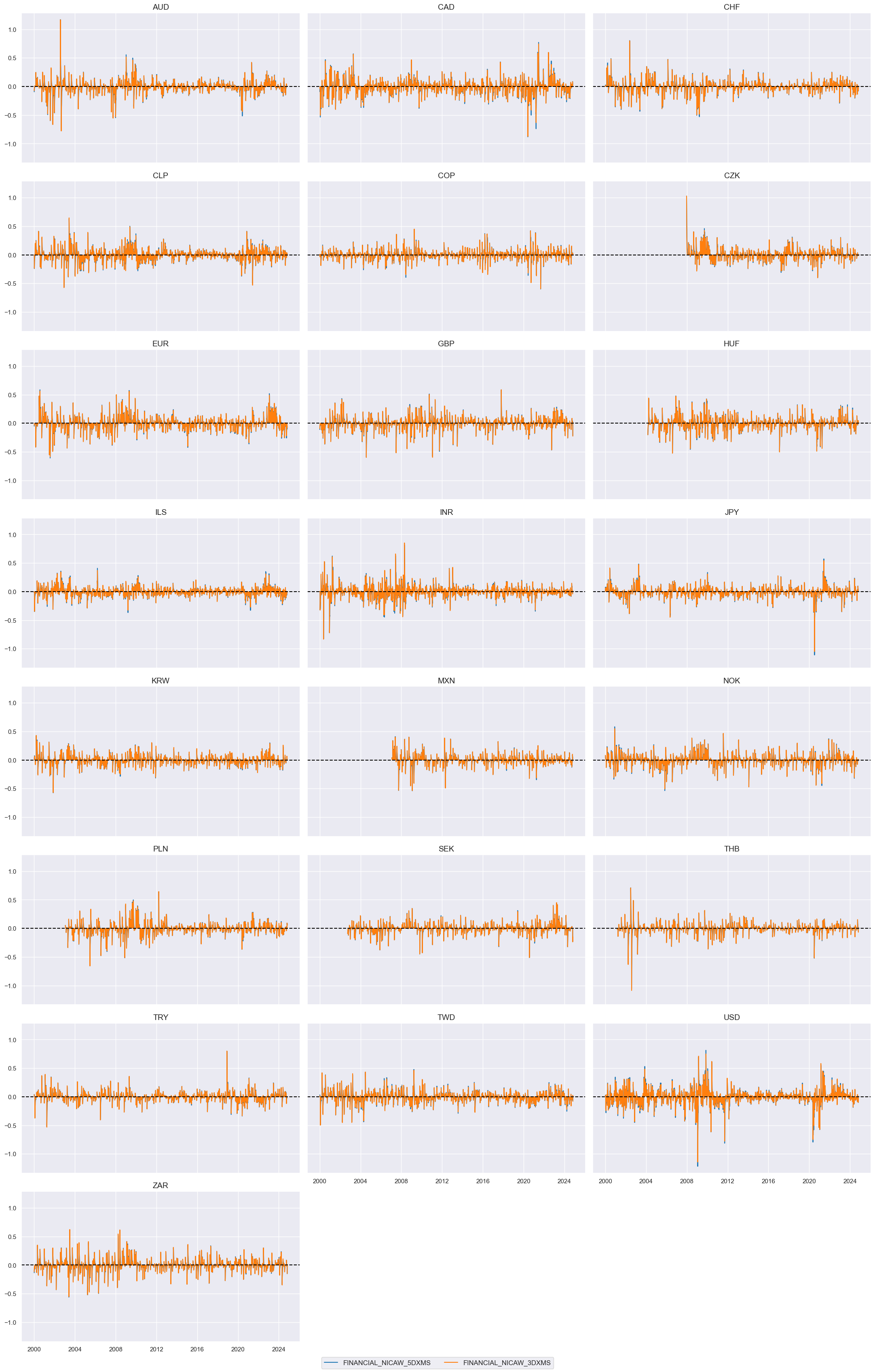

xcatx = ["FINANCIAL" + trans for trans in tranx]

cidx = cids_du

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=3,

start="2000-01-01",

aspect = 1.7,

title=None,

same_y=True,

)

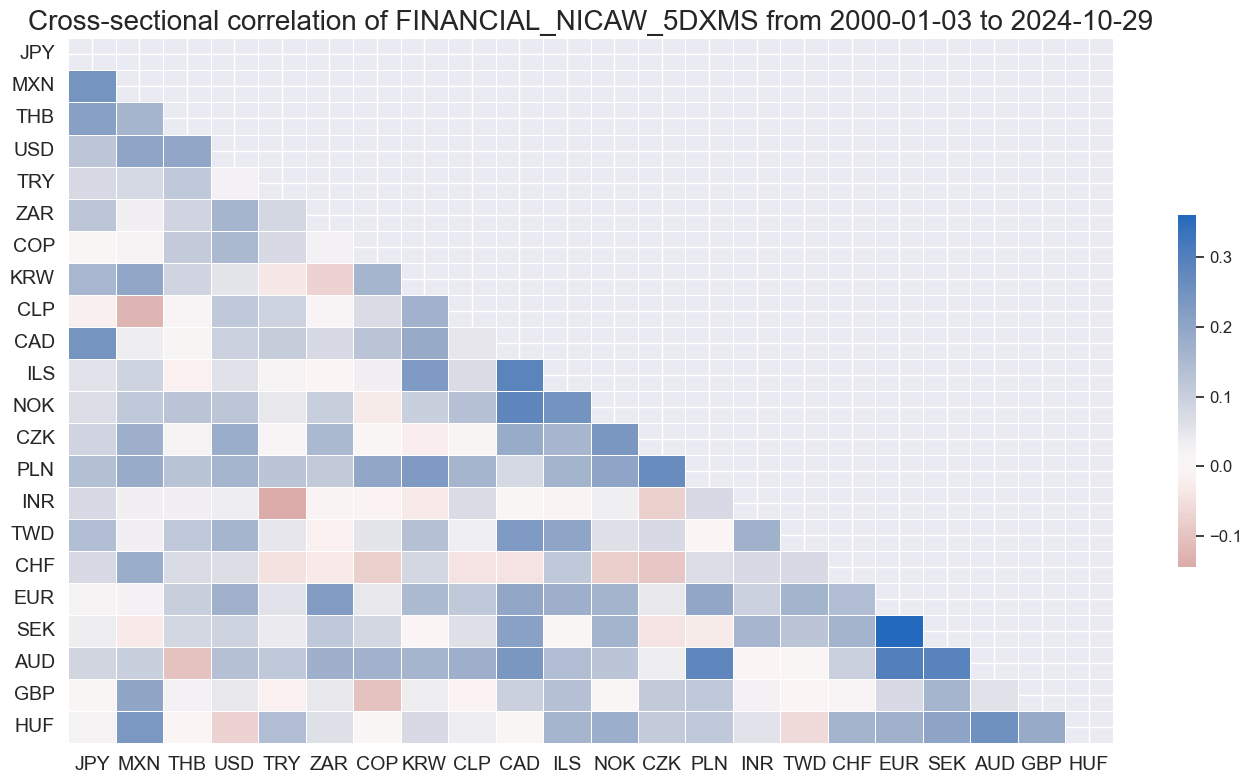

msp.correl_matrix(

dfx,

xcats=["FINANCIAL" + tranx[0]],

cids=cids_du,

start="2000-01-01",

cluster=True,

freq="M",

)

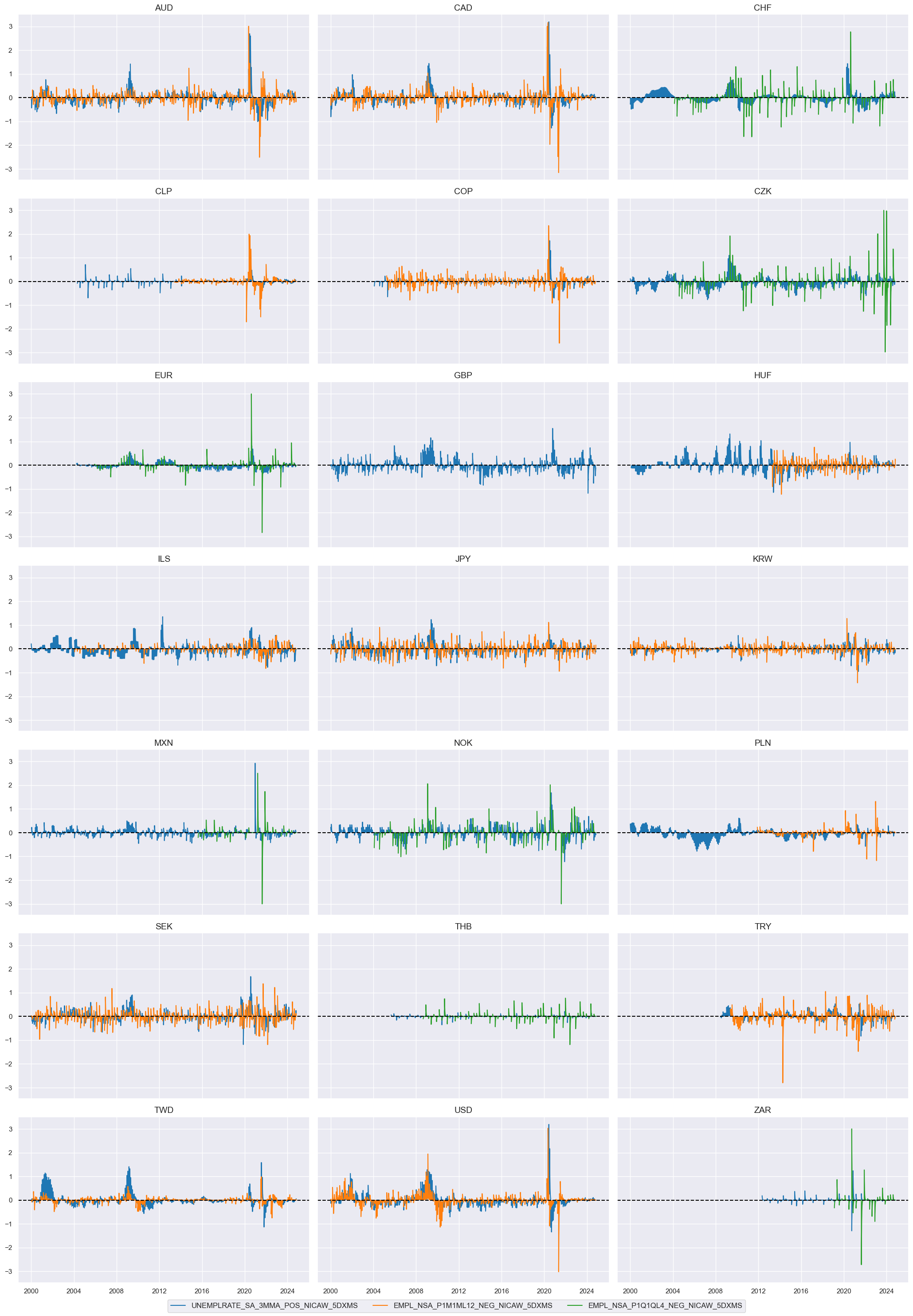

Labour #

trans = tranx[0]

xcatx = [xc + trans for xc in pe_labour]

cidx = cids_du

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=3,

start="2000-01-01",

title=None,

same_y=True,

)

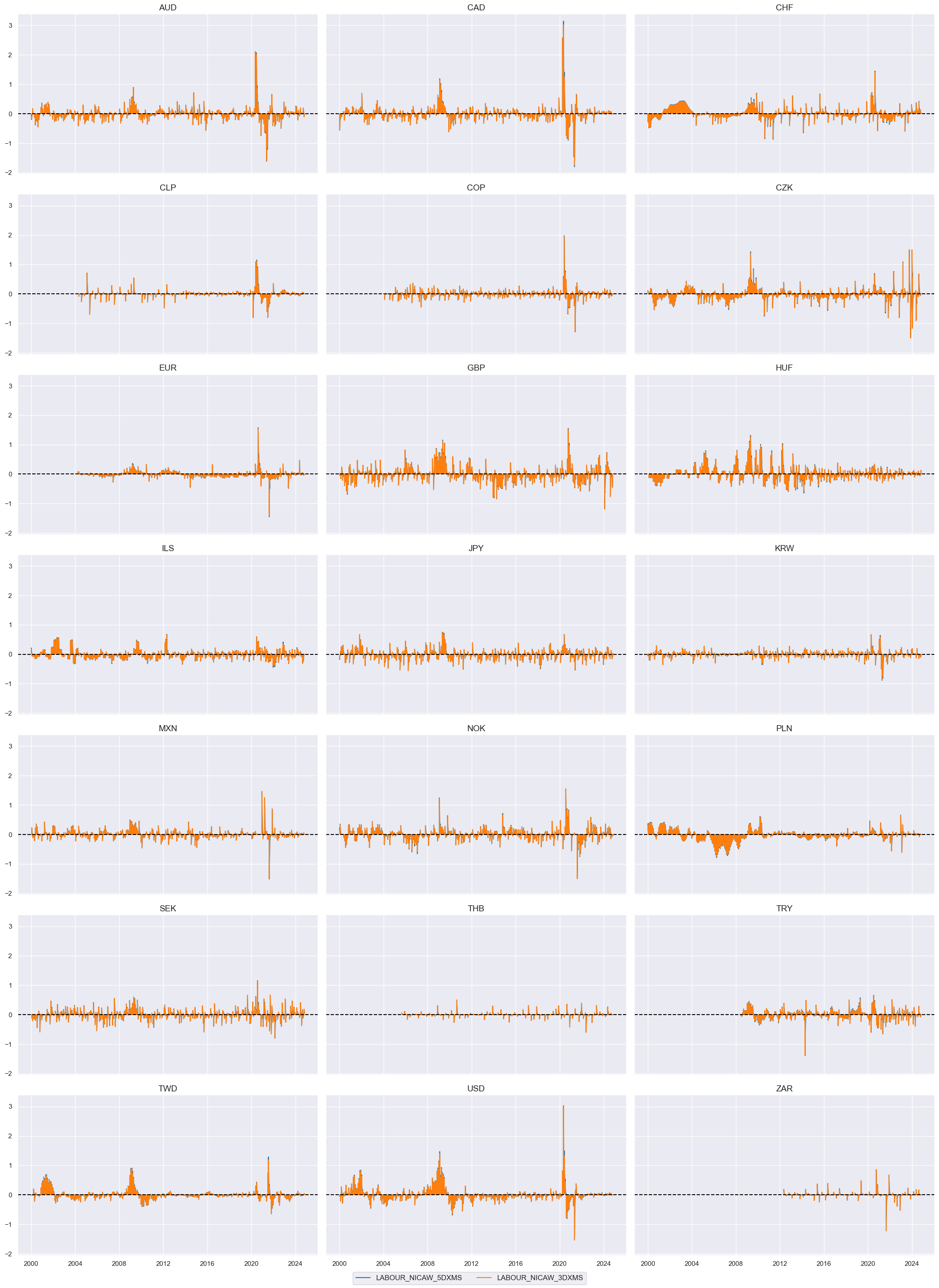

cidx = cids_duxi

dfr = msm.reduce_df(dfx, xcats=xcatx, cids=cidx)

for trans in tranx:

xcatx = [xc + trans for xc in pe_labour]

dfr = msm.reduce_df(dfx, xcats=xcatx, cids=cidx)

dfa = msp.linear_composite(

df=dfr,

xcats=xcatx,

cids=cidx,

new_xcat="LABOUR" + trans,

)

dfx = msm.update_df(dfx, dfa)

xcatx = ["LABOUR" + trans for trans in tranx]

cidx = cids_du

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=3,

start="2000-01-01",

aspect = 1.7,

title=None,

same_y=True,

)

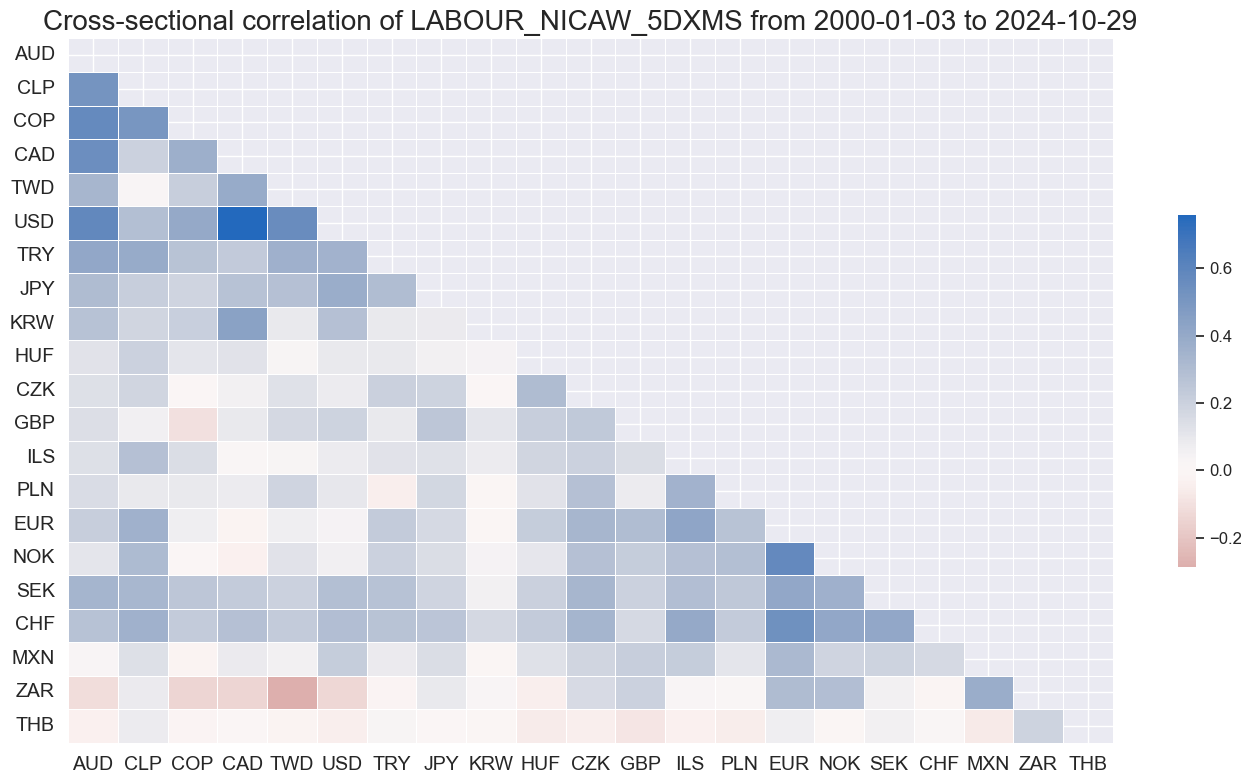

msp.correl_matrix(

dfx,

xcats=["LABOUR" + tranx[0]],

cids=cids_du,

start="2000-01-01",

cluster=True,

freq="M",

)

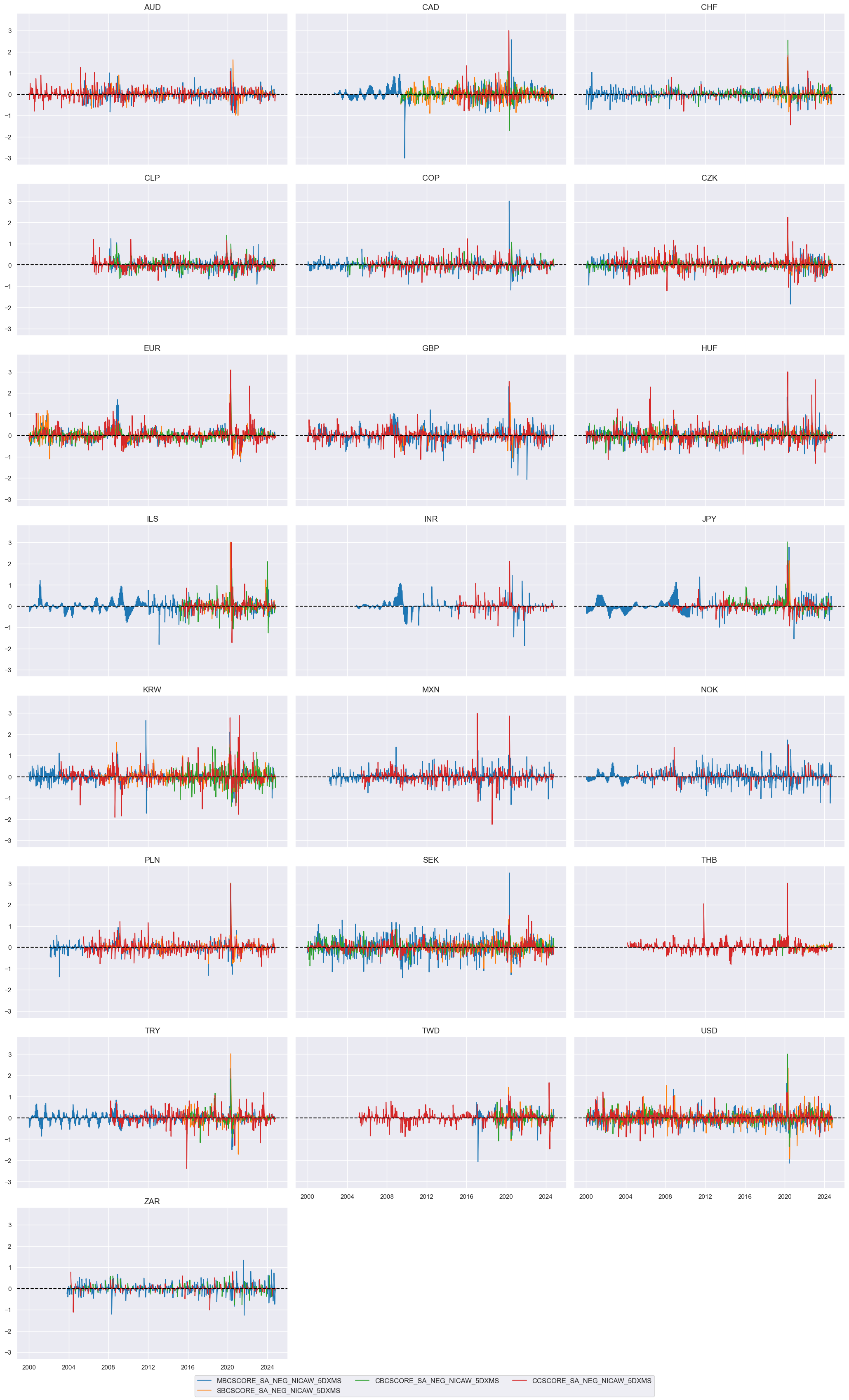

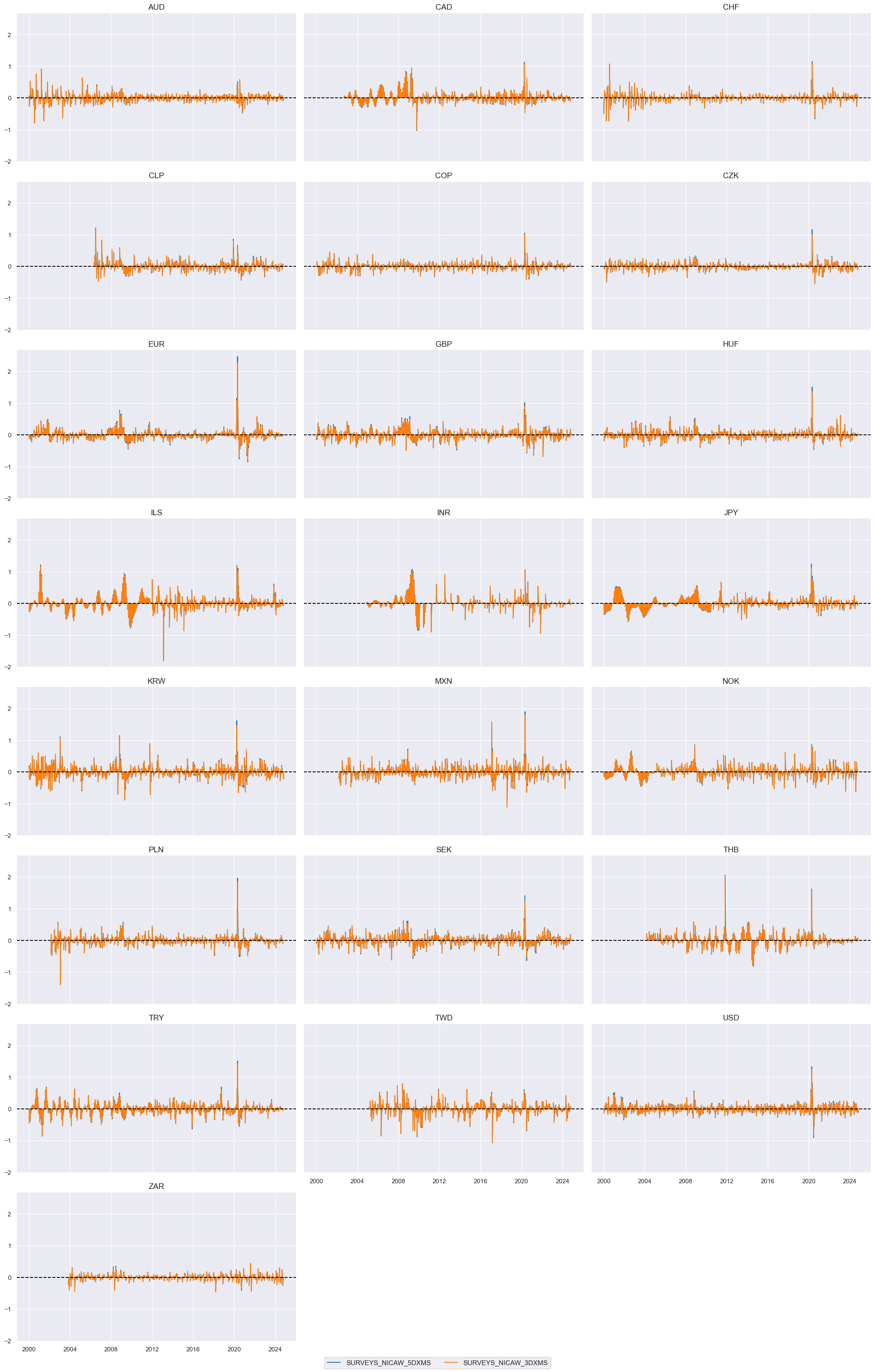

Surveys #

trans = tranx[0]

xcatx = [xc + trans for xc in pe_surveys]

cidx = cids_du

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=3,

start="2000-01-01",

title=None,

same_y=True,

)

cidx = cids_du

dfr = msm.reduce_df(dfx, xcats=xcatx, cids=cidx)

for trans in tranx:

xcatx = [xc + trans for xc in pe_surveys]

dfr = msm.reduce_df(dfx, xcats=xcatx, cids=cidx)

dfa = msp.linear_composite(

df=dfr,

xcats=xcatx,

cids=cidx,

new_xcat="SURVEYS" + trans,

)

dfx = msm.update_df(dfx, dfa)

xcatx = ["SURVEYS" + trans for trans in tranx]

cidx = cids_du

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=3,

start="2000-01-01",

aspect = 1.7,

title=None,

same_y=True,

)

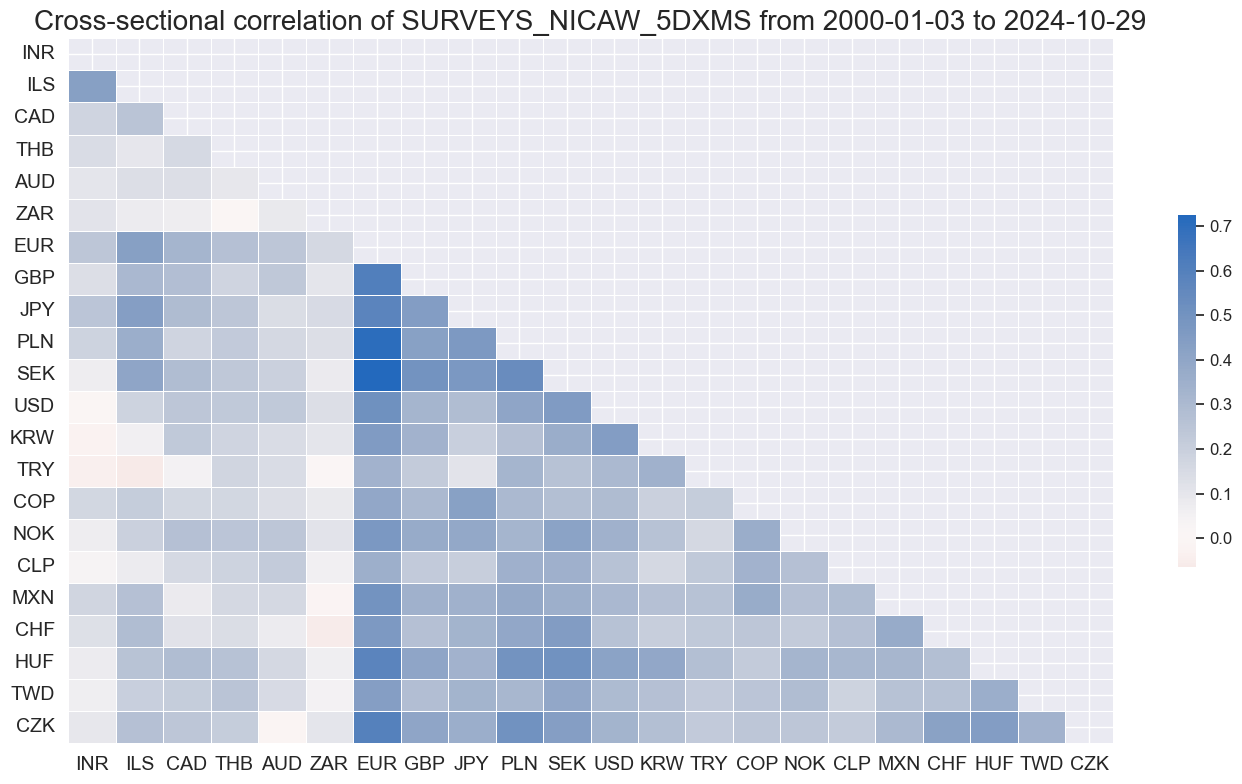

msp.correl_matrix(

dfx,

xcats=["SURVEYS" + tranx[0]],

cids=cids_du,

start="2000-01-01",

cluster=True,

freq="M",

)

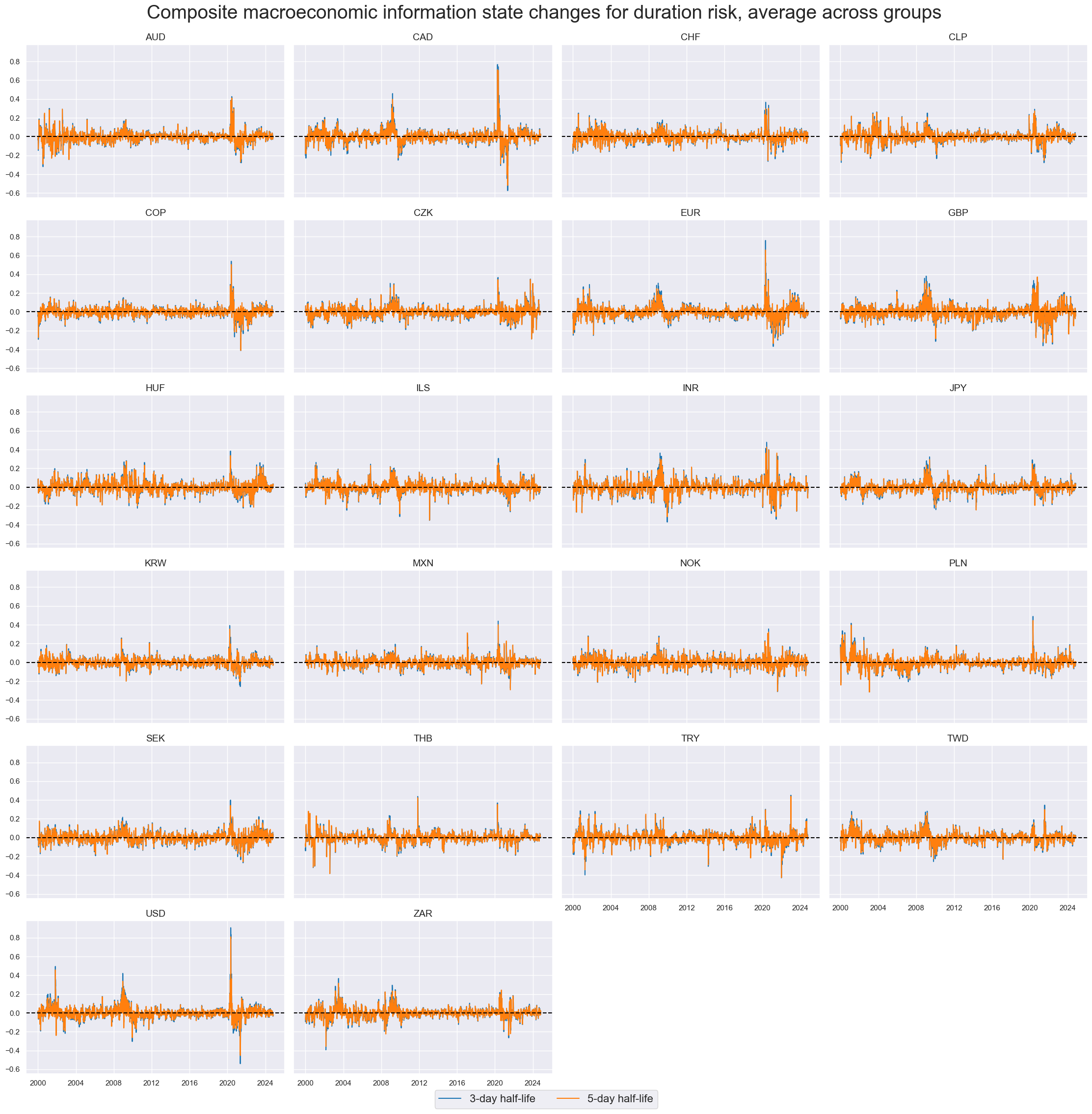

Cross-group aggregation #

cidx = cids_du

groups = ["GROWTH", "INFLATION", "FINANCIAL", "LABOUR", "SURVEYS"]

for trans in tranx:

xcatx = [g + trans for g in groups]

dfa = msp.linear_composite(

df=dfx,

xcats=xcatx,

cids=cidx,

new_xcat="ALL" + trans,

)

dfx = msm.update_df(dfx, dfa)

xcatx = ["ALL" + trans for trans in tranx]

cidx = cids_du

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

start="2000-01-01",

aspect = 1.5,

height=2.5,

title="Composite macroeconomic information state changes for duration risk, average across groups",

title_fontsize=28,

xcat_labels=["3-day half-life", "5-day half-life"],

legend_fontsize=16,

same_y=True,

)

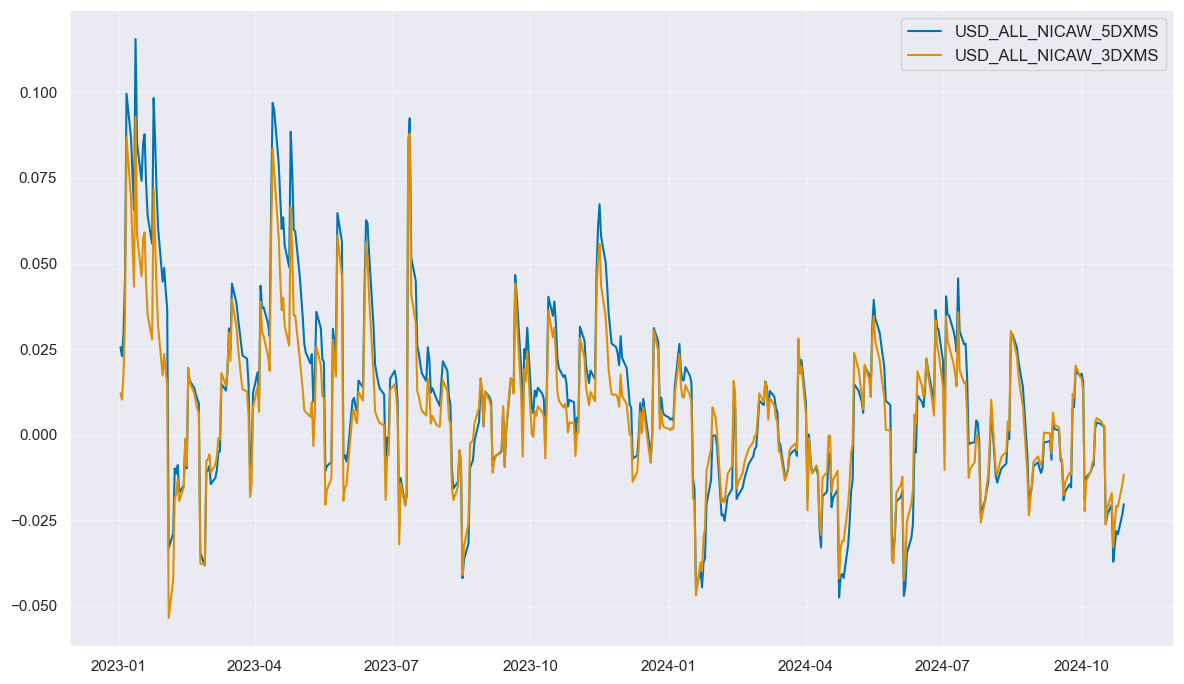

xcatx = ["ALL" + trans for trans in tranx]

cidx = ["USD"]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=1,

start="2023-01-01",

aspect = 1.7,

title=None,

same_y=True,

)

Global information state changes #

groups = ["GROWTH", "INFLATION", "FINANCIAL", "LABOUR", "SURVEYS", "ALL"]

xcats = [group + trans for trans in tranx for group in groups]

dfr = msm.reduce_df(dfx, xcats=xcats + ["USDGDPWGT_SA_3YMA"], cids=cids_du)

store = []

for group in groups:

for trans in tranx:

xc = group + trans

dfa = msp.linear_composite(

dfr,

xcats=xc,

cids=cids_duxi if group == "LABOUR" else cids_du,

weights="USDGDPWGT_SA_3YMA",

new_cid="GLB",

complete_cids=False,

)

store.append(dfa)

dfx = msm.update_df(dfx, pd.concat(store, axis=0, ignore_index=True).dropna())

xcatx = [g + tranx[0] for g in groups]

group_labels = ["Growth", "Inflation", "Financial", "Labour", "Surveys", "Composite"]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=["GLB"],

xcat_grid=True,

ncol=3,

start="2000-01-01",

aspect = 1.5,

height=3,

same_y=True,

title="Global information state changes for duration risk, GDP-weighted average across countries",

title_fontsize=24,

xcat_labels=group_labels

)

Average local-global information state changes #

cidx = cids_du

calcs = []

for g in groups:

for trans in tranx:

calcs += [

f"{g}{trans}_LG = 0.5 * ( {g}{trans} + iGLB_{g}{trans} )"

]

dfa = msp.panel_calculator(dfx, calcs, cids=cidx)

dfx = msm.update_df(dfx, dfa)

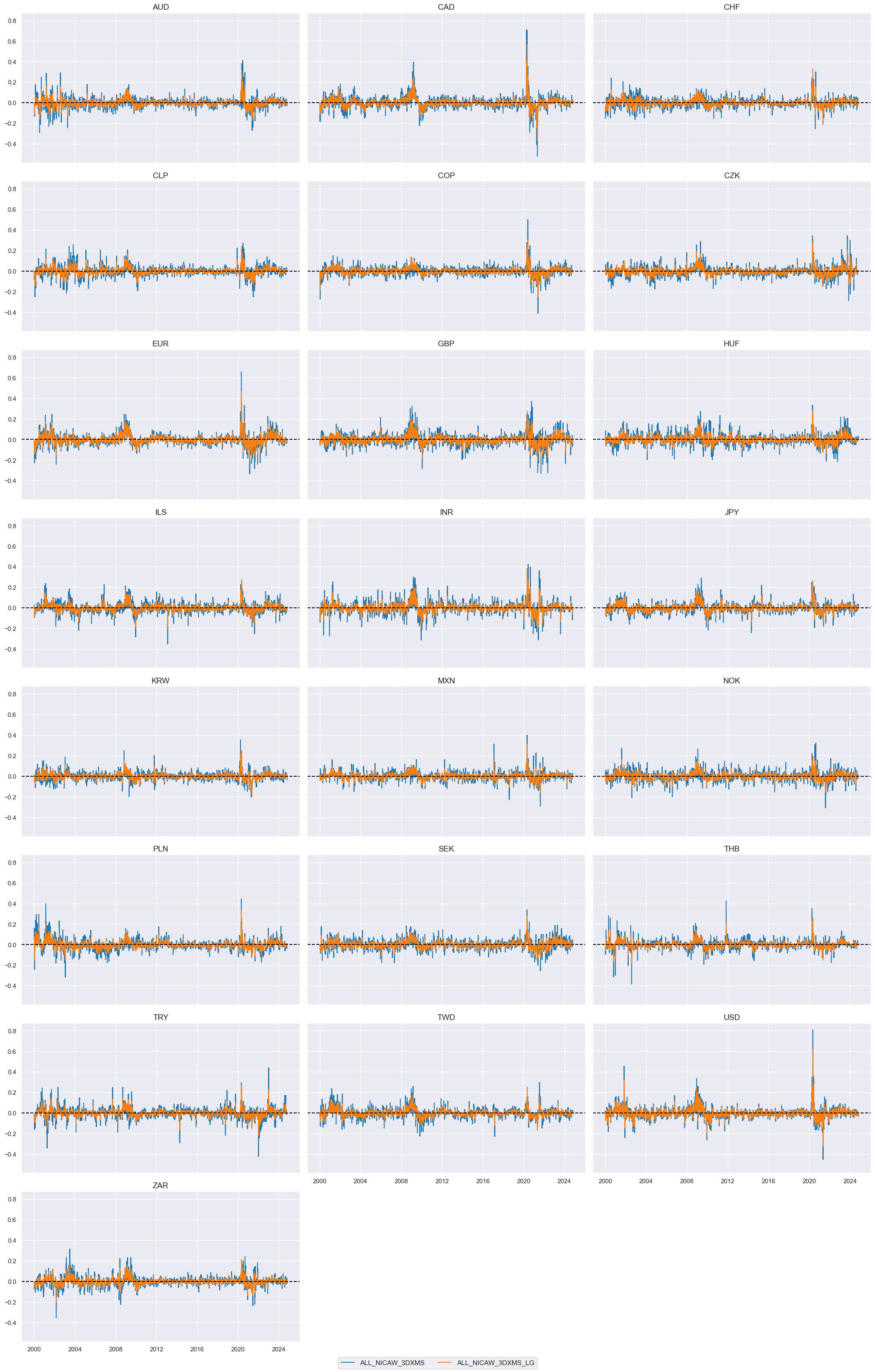

xc = "ALL" + tranx[1]

xcatx = [xc, xc + "_LG"]

cidx = cids_du

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=3,

start="2000-01-01",

aspect = 1.7,

title=None,

same_y=True,

)

Value checks #

Local signals #

Specs and panel test #

groups_ordered = ["ALL", "GROWTH", "LABOUR", "SURVEYS", "INFLATION", "FINANCIAL"]

glabels_ordered = ["Composite", "Growth", "Labour", "Surveys", "Inflation", "Financial"]

ics = [g + tranx[1] for g in groups_ordered]

display(ics)

['ALL_NICAW_3DXMS',

'GROWTH_NICAW_3DXMS',

'LABOUR_NICAW_3DXMS',

'SURVEYS_NICAW_3DXMS',

'INFLATION_NICAW_3DXMS',

'FINANCIAL_NICAW_3DXMS']

dict_local = {

"sigs": ics,

"targs": ["DU05YXR_NSA", "DU05YXR_VT10",],

"cidx": cids_du,

"start": "2000-01-01",

"black": dublack,

"srr": None,

"pnls": None,

}

dix = dict_local

sigs = dix["sigs"]

targ = dix["targs"][1]

cidx = dix["cidx"]

blax = dix["black"]

start = dix["start"]

# Initialize the dictionary to store CategoryRelations instances

dict_cr = {}

for sig in sigs:

dict_cr[sig] = msp.CategoryRelations(

dfx,

xcats=[sig, targ],

cids=cidx,

freq="W",

lag=1,

xcat_aggs=["last", "sum"],

start=start,

blacklist=blax,

)

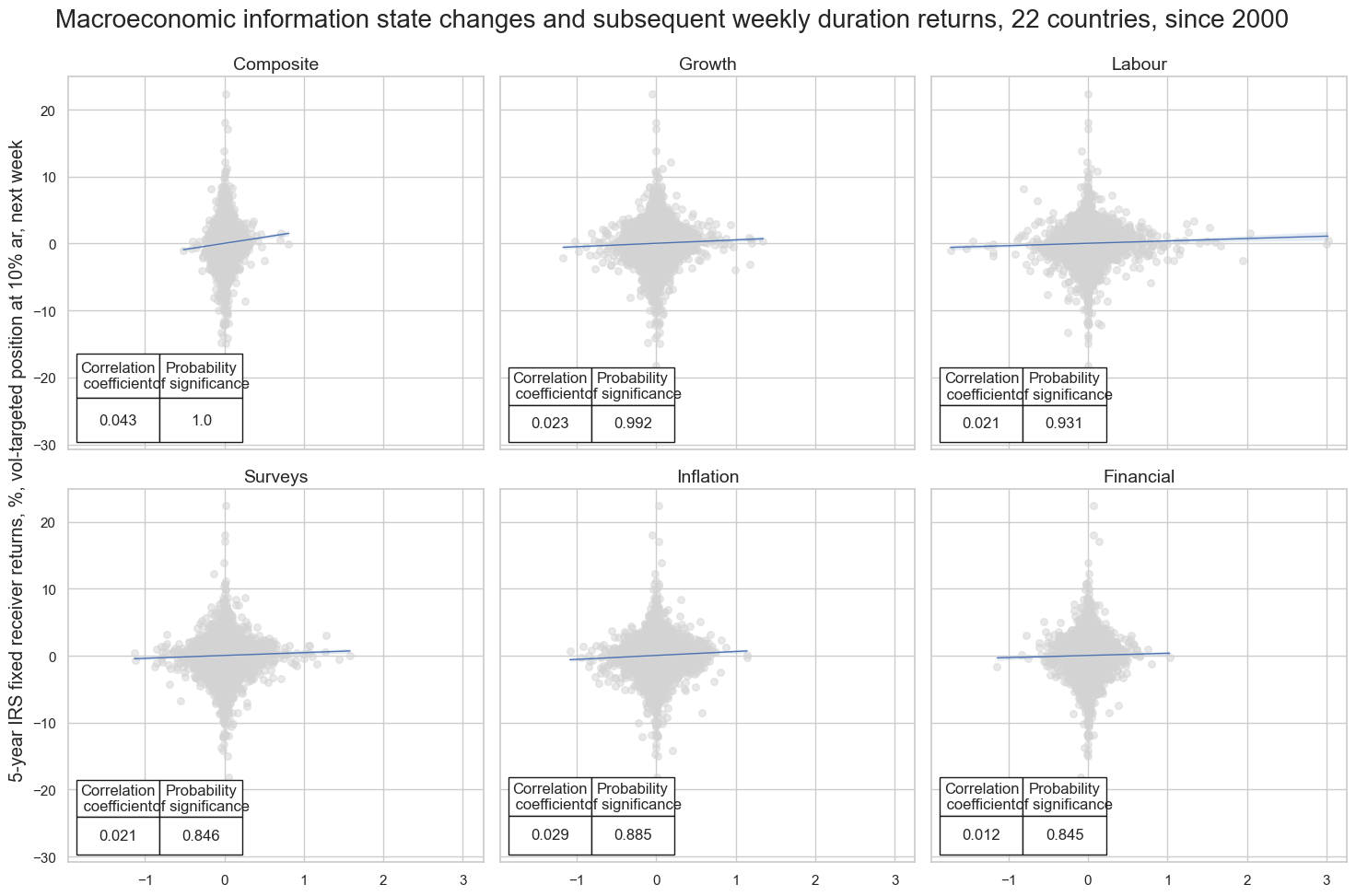

# Plotting the results

crs = list(dict_cr.values())

crs_keys = list(dict_cr.keys())

msv.multiple_reg_scatter(

cat_rels=crs,

title="Macroeconomic information state changes and subsequent weekly duration returns, 22 countries, since 2000",

ylab="5-year IRS fixed receiver returns, %, vol-targeted position at 10% ar, next week",

ncol=3,

nrow=2,

figsize=(15, 10),

prob_est="map",

coef_box="lower left",

subplot_titles=glabels_ordered,

)

LABOUR_NICAW_3DXMS misses: ['INR'].

Accuracy and correlation check #

dix = dict_local

sigx = dix["sigs"]

targx = [dix["targs"][1]]

cidx = dix["cidx"]

start = dix["start"]

blax = dix["black"]

srr = mss.SignalReturnRelations(

dfx,

cids=cidx,

sigs=sigx,

rets=targx,

sig_neg=[False] * len(sigx),

freqs="D",

start=start,

blacklist=blax,

)

dix["srr"] = srr

dix = dict_local

srr = dix["srr"]

display(srr.multiple_relations_table().astype("float").round(3))

| accuracy | bal_accuracy | pos_sigr | pos_retr | pos_prec | neg_prec | pearson | pearson_pval | kendall | kendall_pval | auc | ||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Return | Signal | Frequency | Aggregation | |||||||||||

| DU05YXR_VT10 | ALL_NICAW_3DXMS | D | last | 0.506 | 0.506 | 0.489 | 0.527 | 0.534 | 0.479 | 0.023 | 0.000 | 0.017 | 0.000 | 0.506 |

| FINANCIAL_NICAW_3DXMS | D | last | 0.500 | 0.500 | 0.498 | 0.526 | 0.526 | 0.474 | 0.002 | 0.572 | 0.003 | 0.093 | 0.500 | |

| GROWTH_NICAW_3DXMS | D | last | 0.501 | 0.501 | 0.508 | 0.527 | 0.528 | 0.473 | 0.012 | 0.000 | 0.005 | 0.008 | 0.501 | |

| INFLATION_NICAW_3DXMS | D | last | 0.506 | 0.506 | 0.498 | 0.527 | 0.533 | 0.479 | 0.019 | 0.000 | 0.013 | 0.000 | 0.506 | |

| LABOUR_NICAW_3DXMS | D | last | 0.502 | 0.505 | 0.461 | 0.529 | 0.534 | 0.475 | 0.012 | 0.000 | 0.011 | 0.000 | 0.505 | |

| SURVEYS_NICAW_3DXMS | D | last | 0.501 | 0.501 | 0.496 | 0.527 | 0.528 | 0.474 | 0.011 | 0.000 | 0.008 | 0.000 | 0.501 |

Naive PnL #

dix = dict_local

sigx = dix["sigs"]

targ = dix["targs"][1]

cidx = dix["cidx"]

blax = dix["black"]

start = dix["start"]

dfxx = dfx[["real_date", "cid", "xcat", "value"]]

naive_pnl = msn.NaivePnL(

dfxx,

ret=targ,

sigs=sigx,

cids=cidx,

start=start,

blacklist=blax,

bms=["USD_DU05YXR_NSA"],

)

for sig in sigx:

for bias in [0, 1]:

naive_pnl.make_pnl(

sig,

sig_neg=False,

sig_op='zn_score_pan',

sig_add=bias,

thresh=2,

rebal_freq="daily",

vol_scale=10,

rebal_slip=1,

pnl_name=sig+"_PZN" + str(bias)

)

naive_pnl.make_long_pnl(vol_scale=10, label="Long only")

dix["pnls"] = naive_pnl

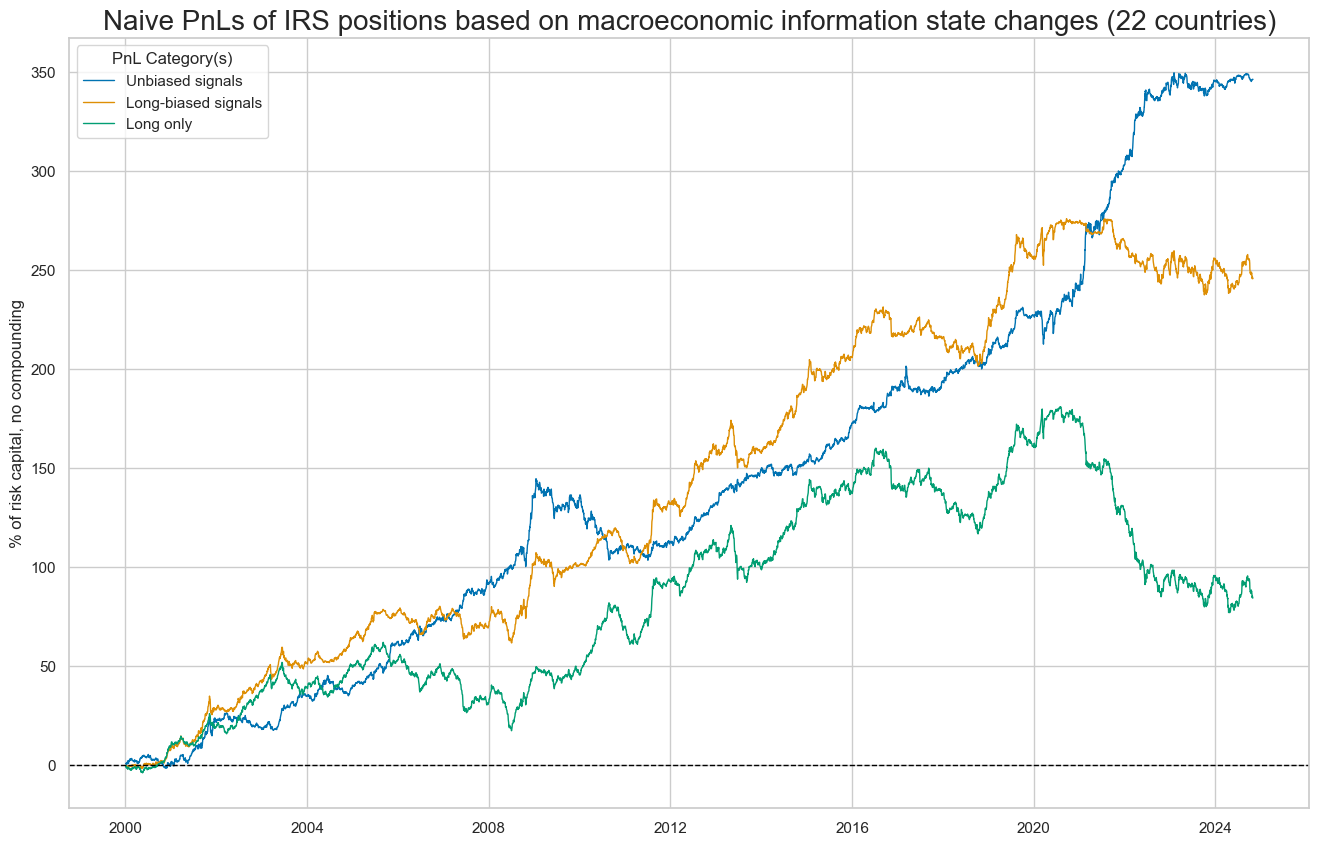

dix = dict_local

sigx = dix["sigs"]

start = dix["start"]

cidx = dix["cidx"]

naive_pnl = dix["pnls"]

pnls = [s + "_PZN" + str(bias) for s in sigx[:1] for bias in [0,1]] + ["Long only"]

naive_pnl.plot_pnls(

pnl_cats=pnls,

pnl_cids=["ALL"],

start=start,

title="Naive PnLs of IRS positions based on macroeconomic information state changes (22 countries)",

xcat_labels=["Unbiased signals", "Long-biased signals", "Long only"],

figsize=(16, 10),

)

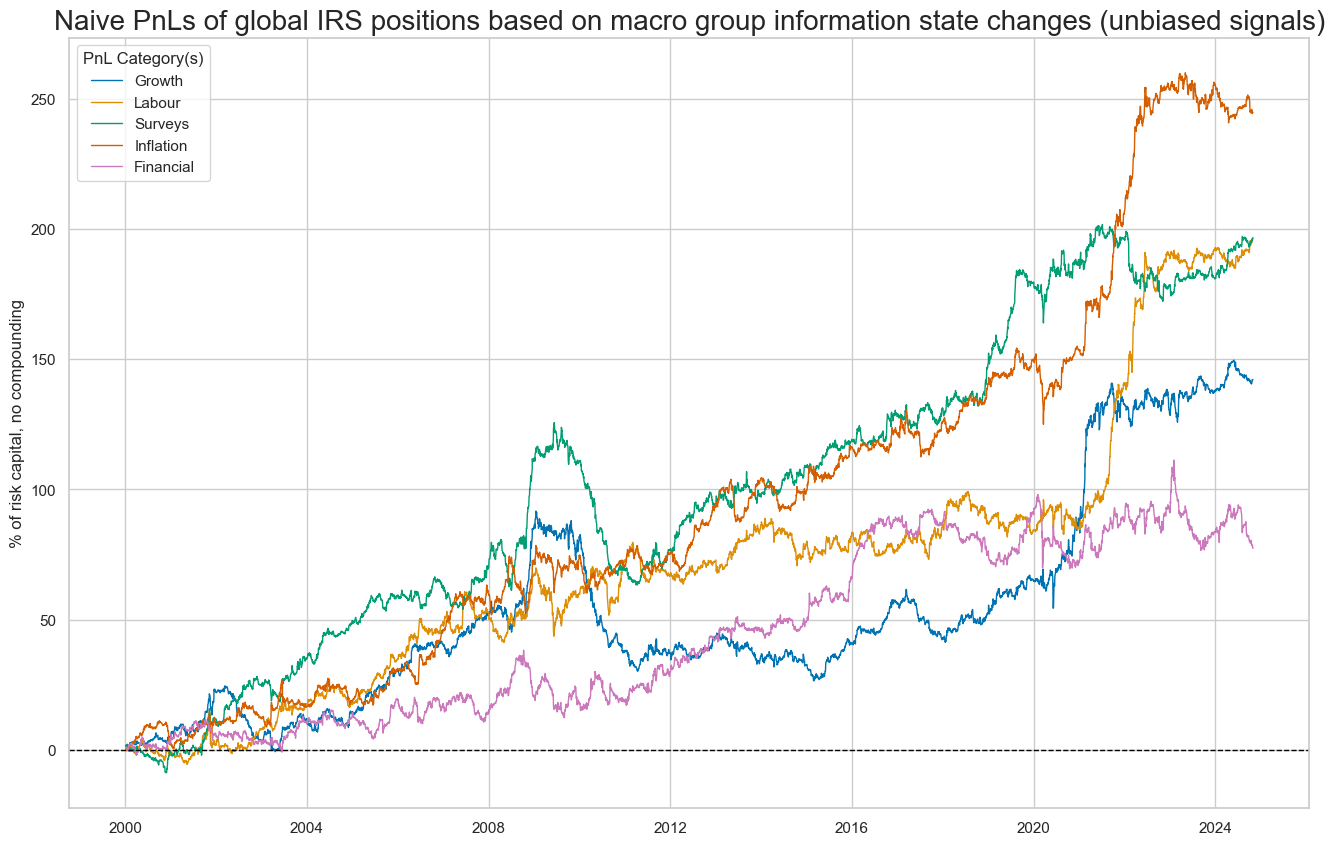

dix = dict_local

sigx = dix["sigs"]

start = dix["start"]

cidx = dix["cidx"]

naive_pnl = dix["pnls"]

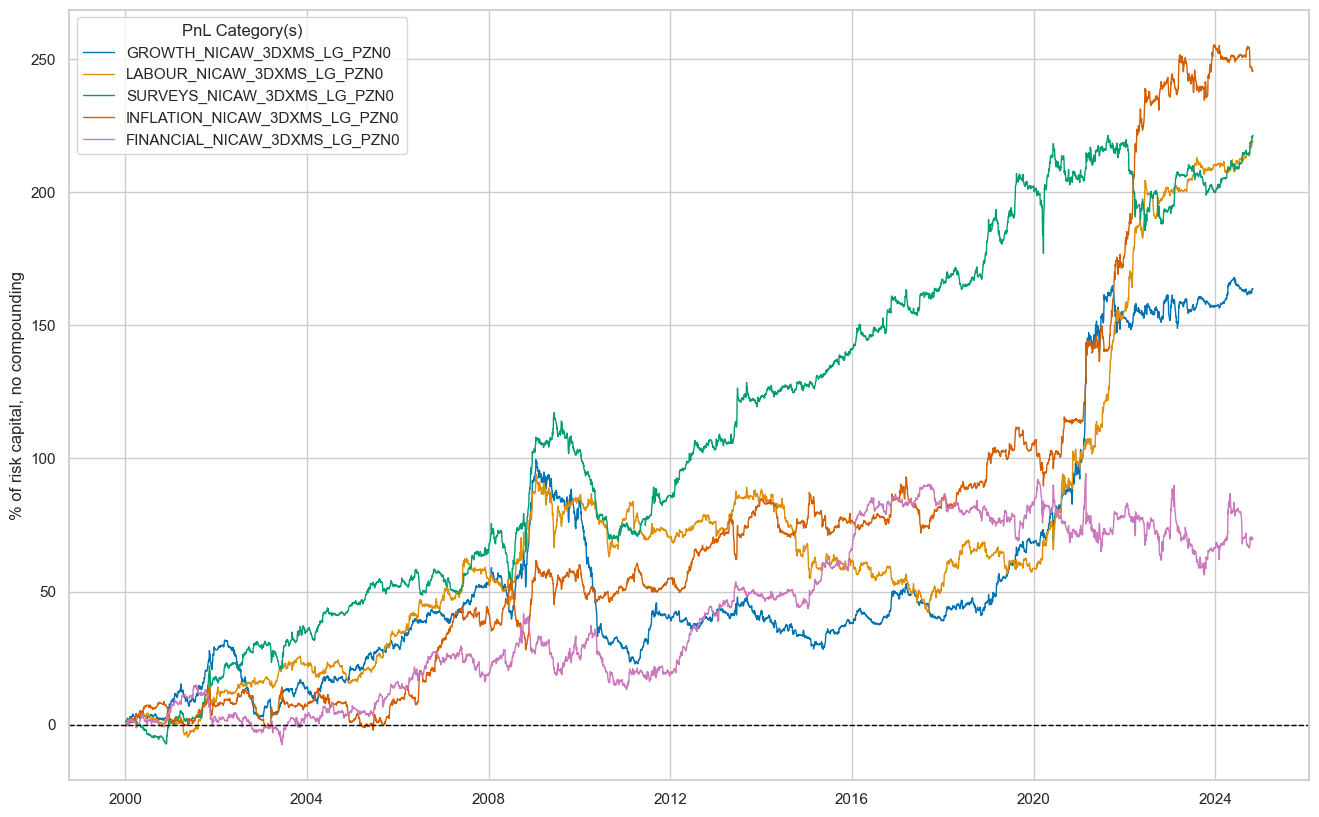

pnls = [s + "_PZN0" for s in sigx[1:]]

naive_pnl.plot_pnls(

pnl_cats=pnls,

pnl_cids=["ALL"],

start=start,

title="Naive PnLs of global IRS positions based on macro group information state changes (unbiased signals)",

xcat_labels=glabels_ordered[1:],

figsize=(16, 10),

)

dix = dict_local

sigx = dix["sigs"]

start = dix["start"]

cidx = dix["cidx"]

naive_pnl = dix["pnls"]

pnls = [s + "_PZN0" for s in sigx[1:]]

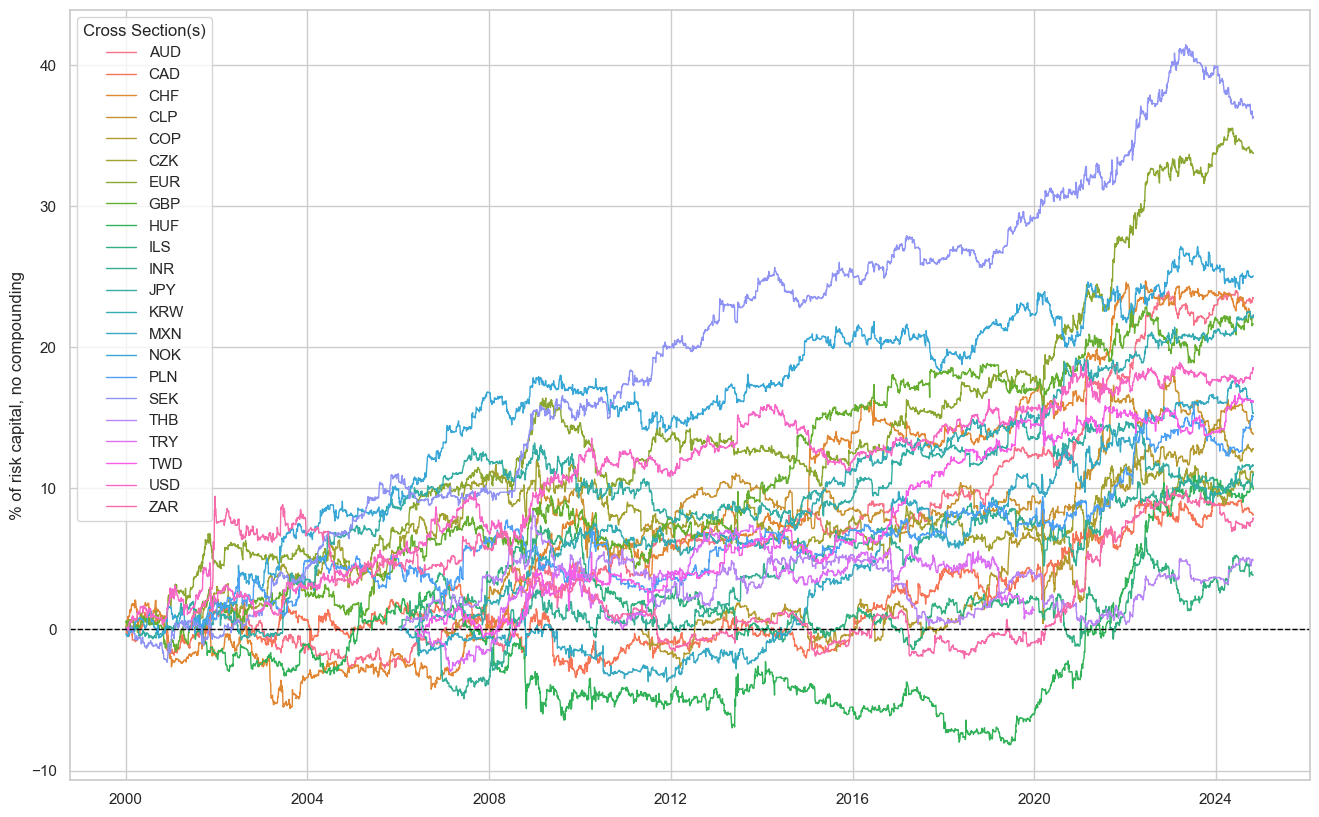

naive_pnl.plot_pnls(

pnl_cats=["ALL_NICAW_3DXMS_PZN0"],

pnl_cids=cids_du,

start=start,

title=None,

xcat_labels=None,

figsize=(16, 10),

)

dix = dict_local

sigx = dix["sigs"]

start = dix["start"]

cidx = dix["cidx"]

naive_pnl = dix["pnls"]

pnls = [s + "_PZN" + str(bias) for s in sigx for bias in [0, 1]] + ["Long only"]

df_eval = naive_pnl.evaluate_pnls(

pnl_cats=pnls,

pnl_cids=["ALL"],

start=start,

)

display(df_eval.transpose())

naive_pnl.signal_heatmap(

pnl_name=pnls[0],

freq="m",

title=None,

figsize=(15, 8)

)

| Return % | St. Dev. % | Sharpe Ratio | Sortino Ratio | Max 21-Day Draw % | Max 6-Month Draw % | Peak to Trough Draw % | Top 5% Monthly PnL Share | USD_DU05YXR_NSA correl | Traded Months | |

|---|---|---|---|---|---|---|---|---|---|---|

| xcat | ||||||||||

| ALL_NICAW_3DXMS_PZN0 | 13.953597 | 10.0 | 1.39536 | 2.20858 | -16.335958 | -21.355854 | -41.150726 | 0.459464 | 0.026586 | 298 |

| ALL_NICAW_3DXMS_PZN1 | 9.898353 | 10.0 | 0.989835 | 1.455298 | -16.450938 | -19.276141 | -38.494343 | 0.638016 | 0.511248 | 298 |

| FINANCIAL_NICAW_3DXMS_PZN0 | 3.118539 | 10.0 | 0.311854 | 0.446787 | -25.374759 | -28.777643 | -34.651849 | 1.356385 | -0.015751 | 298 |

| FINANCIAL_NICAW_3DXMS_PZN1 | 3.971189 | 10.0 | 0.397119 | 0.554171 | -18.115759 | -38.913228 | -99.192403 | 1.481806 | 0.496237 | 298 |

| GROWTH_NICAW_3DXMS_PZN0 | 5.729038 | 10.0 | 0.572904 | 0.872411 | -13.669032 | -34.746661 | -65.186336 | 1.020017 | 0.042372 | 298 |

| GROWTH_NICAW_3DXMS_PZN1 | 5.716771 | 10.0 | 0.571677 | 0.82597 | -18.443251 | -35.608023 | -61.847446 | 1.018723 | 0.513203 | 298 |

| INFLATION_NICAW_3DXMS_PZN0 | 9.86663 | 10.0 | 0.986663 | 1.495564 | -21.086997 | -25.382351 | -29.255001 | 0.656651 | 0.014678 | 298 |

| INFLATION_NICAW_3DXMS_PZN1 | 8.061923 | 10.0 | 0.806192 | 1.155069 | -22.068749 | -19.531088 | -42.715803 | 0.758397 | 0.486954 | 298 |

| LABOUR_NICAW_3DXMS_PZN0 | 7.930081 | 10.0 | 0.793008 | 1.204179 | -15.353489 | -22.563812 | -26.257047 | 0.786437 | -0.022983 | 298 |

| LABOUR_NICAW_3DXMS_PZN1 | 6.925777 | 10.0 | 0.692578 | 0.980699 | -19.980164 | -25.048623 | -61.919153 | 0.790819 | 0.539779 | 298 |

| Long only | 3.398521 | 10.0 | 0.339852 | 0.471101 | -21.138872 | -39.762249 | -103.996698 | 1.613704 | 0.550698 | 298 |

| SURVEYS_NICAW_3DXMS_PZN0 | 7.91497 | 10.0 | 0.791497 | 1.188024 | -15.088031 | -32.162642 | -62.373829 | 0.688419 | 0.041057 | 298 |

| SURVEYS_NICAW_3DXMS_PZN1 | 5.689972 | 10.0 | 0.568997 | 0.813802 | -18.423298 | -44.203508 | -95.335076 | 1.108411 | 0.506475 | 298 |

Local-global signals #

Specs and panel test #

ics_g = [i + "_LG" for i in ics]

dict_lg = {

"sigs": ics_g,

"targs": ["DU05YXR_NSA", "DU05YXR_VT10"],

"cidx": cids_du,

"start": "2000-01-01",

"black": dublack,

"srr": None,

"pnls": None,

}

dix = dict_lg

sigs = dix["sigs"]

targ = dix["targs"][1]

cidx = dix["cidx"]

blax = dix["black"]

start = dix["start"]

# Initialize the dictionary to store CategoryRelations instances

dict_cr = {}

for sig in sigs:

dict_cr[sig] = msp.CategoryRelations(

dfx,

xcats=[sig, targ],

cids=cidx,

freq="W",

lag=1,

xcat_aggs=["last", "sum"],

start=start,

blacklist=blax,

)

# Plotting the results

crs = list(dict_cr.values())

crs_keys = list(dict_cr.keys())

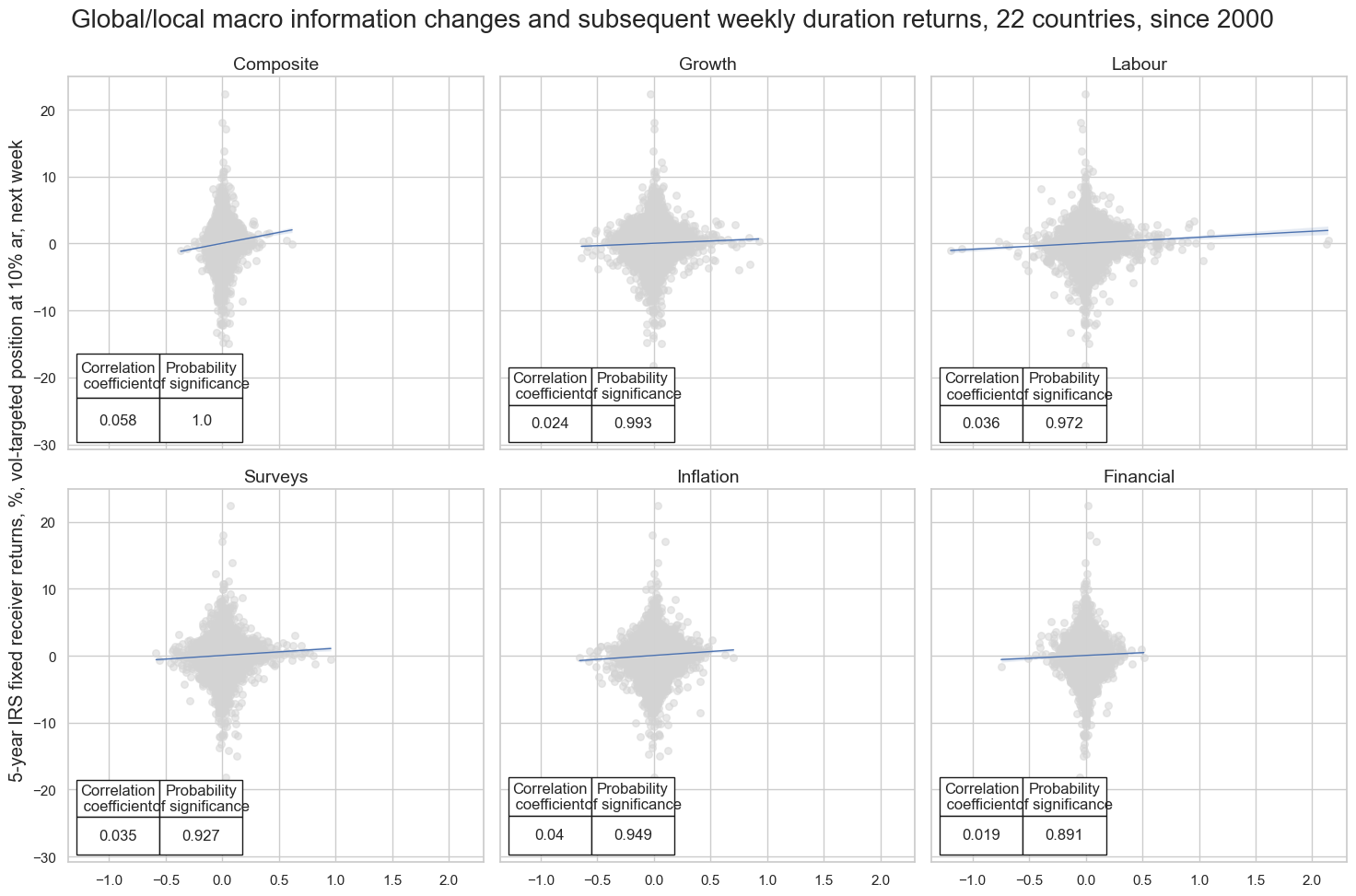

msv.multiple_reg_scatter(

cat_rels=crs,

title="Global/local macro information changes and subsequent weekly duration returns, 22 countries, since 2000",

ylab="5-year IRS fixed receiver returns, %, vol-targeted position at 10% ar, next week",

ncol=3,

nrow=2,

figsize=(15, 10),

prob_est="map",

coef_box="lower left",

subplot_titles=glabels_ordered,

)

LABOUR_NICAW_3DXMS_LG misses: ['INR'].

Accuracy and correlation check #

dix = dict_lg

sigx = dix["sigs"]

targx = [dix["targs"][1]]

cidx = dix["cidx"]

start = dix["start"]

blax = dix["black"]

srr = mss.SignalReturnRelations(

dfx,

cids=cidx,

sigs=sigx,

rets=targx,

sig_neg=[False] * len(sigx),

freqs="D",

start=start,

blacklist=blax,

)

dix["srr"] = srr

dix = dict_lg

srr = dix["srr"]

display(srr.multiple_relations_table().astype("float").round(3))

| accuracy | bal_accuracy | pos_sigr | pos_retr | pos_prec | neg_prec | pearson | pearson_pval | kendall | kendall_pval | auc | ||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Return | Signal | Frequency | Aggregation | |||||||||||

| DU05YXR_VT10 | ALL_NICAW_3DXMS_LG | D | last | 0.508 | 0.510 | 0.474 | 0.527 | 0.537 | 0.482 | 0.034 | 0.000 | 0.024 | 0.000 | 0.510 |

| FINANCIAL_NICAW_3DXMS_LG | D | last | 0.500 | 0.501 | 0.480 | 0.526 | 0.528 | 0.475 | 0.003 | 0.267 | 0.005 | 0.016 | 0.501 | |

| GROWTH_NICAW_3DXMS_LG | D | last | 0.502 | 0.501 | 0.521 | 0.527 | 0.528 | 0.474 | 0.016 | 0.000 | 0.007 | 0.000 | 0.501 | |

| INFLATION_NICAW_3DXMS_LG | D | last | 0.507 | 0.507 | 0.498 | 0.527 | 0.534 | 0.480 | 0.028 | 0.000 | 0.016 | 0.000 | 0.507 | |

| LABOUR_NICAW_3DXMS_LG | D | last | 0.501 | 0.506 | 0.414 | 0.529 | 0.536 | 0.476 | 0.020 | 0.000 | 0.017 | 0.000 | 0.506 | |

| SURVEYS_NICAW_3DXMS_LG | D | last | 0.506 | 0.507 | 0.490 | 0.527 | 0.534 | 0.480 | 0.020 | 0.000 | 0.015 | 0.000 | 0.507 |

Naive PnL #

dix = dict_lg

sigx = dix["sigs"]

targ = dix["targs"][1]

cidx = dix["cidx"]

blax = dix["black"]

start = dix["start"]

dfxx = dfx[["real_date", "cid", "xcat", "value"]]

naive_pnl = msn.NaivePnL(

dfxx,

ret=targ,

sigs=sigx,

cids=cidx,

start=start,

blacklist=blax,

bms=["USD_DU05YXR_NSA"],

)

for sig in sigx:

for bias in [0, 1]:

naive_pnl.make_pnl(

sig,

sig_neg=False,

sig_op='zn_score_pan',

sig_add=bias,

thresh=2,

rebal_freq="daily",

vol_scale=10,

rebal_slip=1,

pnl_name=sig+"_PZN" + str(bias)

)

naive_pnl.make_long_pnl(vol_scale=10, label="Long only")

dix["pnls"] = naive_pnl

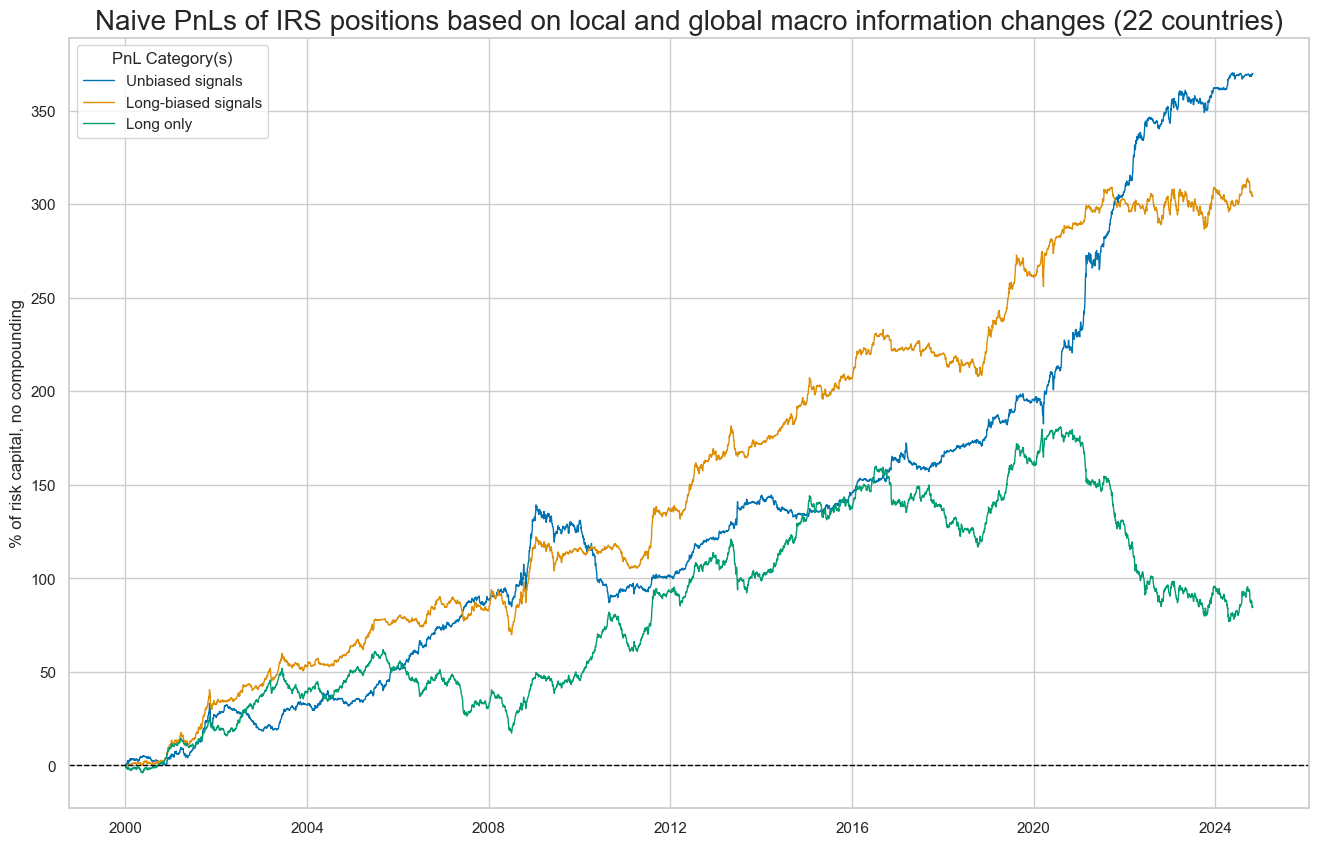

dix = dict_lg

sigx = dix["sigs"]

start = dix["start"]

cidx = dix["cidx"]

naive_pnl = dix["pnls"]

pnls = [s + "_PZN" + str(bias) for s in sigx[:1] for bias in [0,1]] + ["Long only"]

naive_pnl.plot_pnls(

pnl_cats=pnls,

pnl_cids=["ALL"],

start=start,

title="Naive PnLs of IRS positions based on local and global macro information changes (22 countries)",

xcat_labels=["Unbiased signals", "Long-biased signals", "Long only"],

figsize=(16, 10),

)

dix = dict_lg

sigx = dix["sigs"]

start = dix["start"]

cidx = dix["cidx"]

naive_pnl = dix["pnls"]

pnls = [s + "_PZN0" for s in sigx[1:]]

naive_pnl.plot_pnls(

pnl_cats=pnls,

pnl_cids=["ALL"],

start=start,

title=None,

xcat_labels=None,

figsize=(16, 10),

)

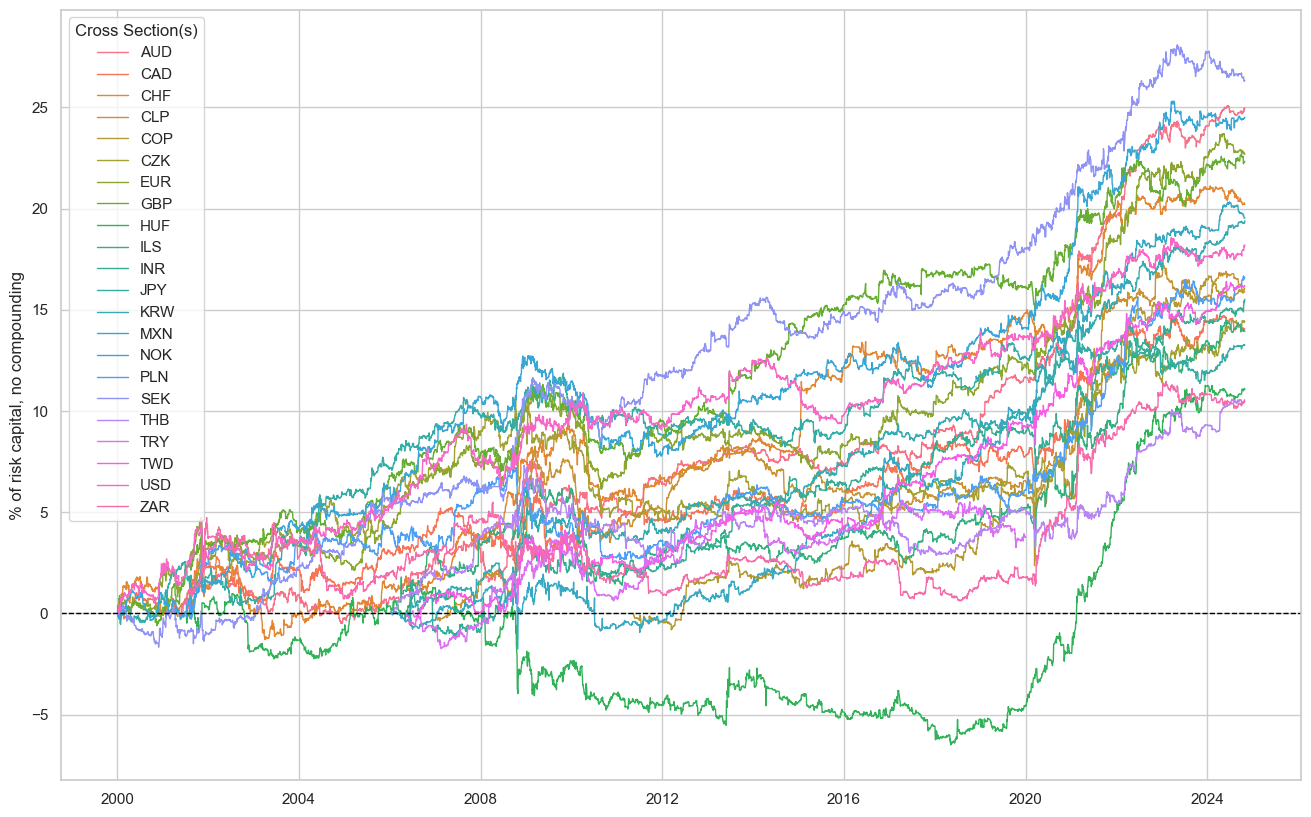

dix = dict_lg

sigx = dix["sigs"]

start = dix["start"]

cidx = dix["cidx"]

naive_pnl = dix["pnls"]

naive_pnl.plot_pnls(

pnl_cats=["ALL_NICAW_3DXMS_LG_PZN0"],

pnl_cids=cids_du,

start=start,

title=None,

xcat_labels=None,

figsize=(16, 10),

)

dix = dict_lg

sigx = dix["sigs"]

start = dix["start"]

cidx = dix["cidx"]

naive_pnl = dix["pnls"]

pnls = [s + "_PZN" + str(bias) for s in sigx for bias in [0, 1]] + ["Long only"]

df_eval = naive_pnl.evaluate_pnls(

pnl_cats=pnls,

pnl_cids=["ALL"],

start=start,

)

display(df_eval.transpose())

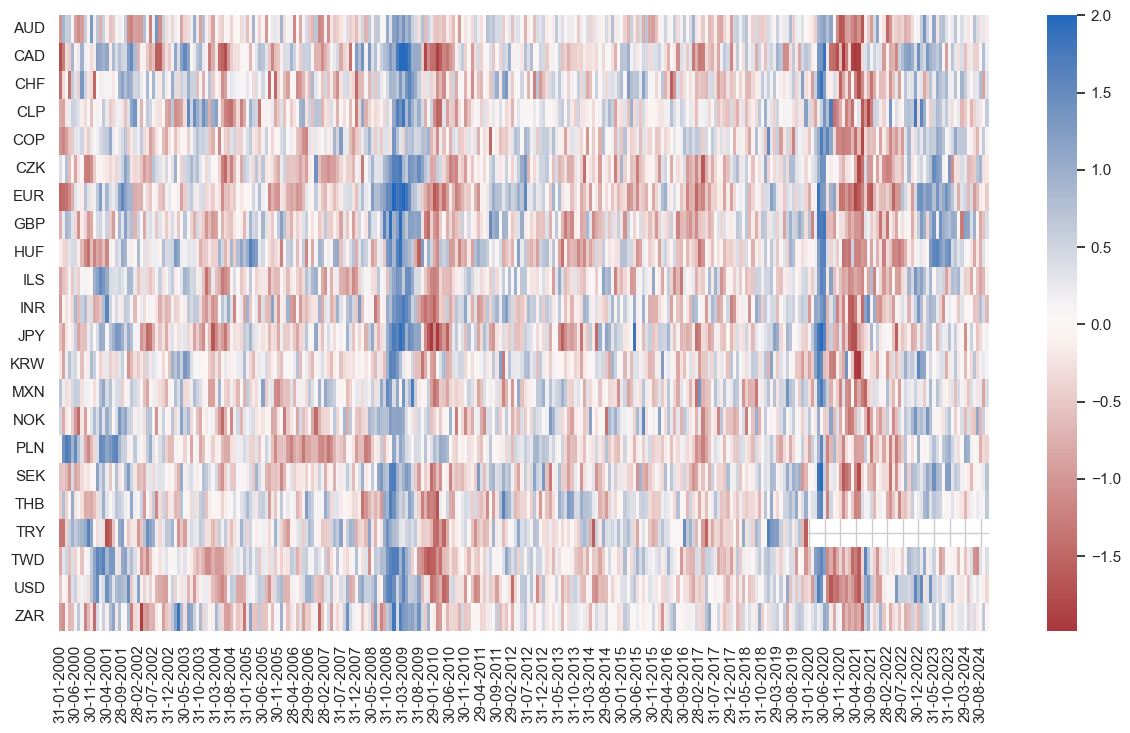

naive_pnl.signal_heatmap(

pnl_name=pnls[0],

freq="m",

title=None,

figsize=(15, 8)

)

| Return % | St. Dev. % | Sharpe Ratio | Sortino Ratio | Max 21-Day Draw % | Max 6-Month Draw % | Peak to Trough Draw % | Top 5% Monthly PnL Share | USD_DU05YXR_NSA correl | Traded Months | |

|---|---|---|---|---|---|---|---|---|---|---|

| xcat | ||||||||||

| ALL_NICAW_3DXMS_LG_PZN0 | 14.906857 | 10.0 | 1.490686 | 2.497836 | -14.403872 | -33.015671 | -52.172818 | 0.495357 | 0.033704 | 298 |

| ALL_NICAW_3DXMS_LG_PZN1 | 12.255711 | 10.0 | 1.225571 | 1.88358 | -14.190356 | -18.114286 | -25.062672 | 0.543717 | 0.470988 | 298 |

| FINANCIAL_NICAW_3DXMS_LG_PZN0 | 2.825407 | 10.0 | 0.282541 | 0.402349 | -17.938011 | -25.838081 | -38.035743 | 1.543662 | 0.004016 | 298 |

| FINANCIAL_NICAW_3DXMS_LG_PZN1 | 4.498172 | 10.0 | 0.449817 | 0.631217 | -17.438893 | -42.354879 | -102.587285 | 1.322724 | 0.459685 | 298 |

| GROWTH_NICAW_3DXMS_LG_PZN0 | 6.59319 | 10.0 | 0.659319 | 1.04164 | -17.853693 | -49.855505 | -76.652691 | 1.019309 | 0.048329 | 298 |

| GROWTH_NICAW_3DXMS_LG_PZN1 | 6.222127 | 10.0 | 0.622213 | 0.913634 | -17.934823 | -37.615203 | -63.685771 | 1.000322 | 0.477298 | 298 |

| INFLATION_NICAW_3DXMS_LG_PZN0 | 9.891651 | 10.0 | 0.989165 | 1.589311 | -14.487484 | -19.24063 | -27.123878 | 0.839074 | 0.014171 | 298 |

| INFLATION_NICAW_3DXMS_LG_PZN1 | 9.31941 | 10.0 | 0.931941 | 1.362069 | -20.553388 | -18.139072 | -26.495349 | 0.723817 | 0.429537 | 298 |

| LABOUR_NICAW_3DXMS_LG_PZN0 | 8.832075 | 10.0 | 0.883208 | 1.369877 | -19.372927 | -21.010886 | -51.859562 | 0.714039 | -0.024294 | 298 |

| LABOUR_NICAW_3DXMS_LG_PZN1 | 8.655081 | 10.0 | 0.865508 | 1.247189 | -19.441368 | -22.405453 | -34.512772 | 0.662323 | 0.500756 | 298 |

| Long only | 3.398521 | 10.0 | 0.339852 | 0.471101 | -21.138872 | -39.762249 | -103.996698 | 1.613704 | 0.550698 | 298 |

| SURVEYS_NICAW_3DXMS_LG_PZN0 | 8.917916 | 10.0 | 0.891792 | 1.376765 | -22.507743 | -33.057383 | -48.135928 | 0.701526 | 0.049212 | 298 |

| SURVEYS_NICAW_3DXMS_LG_PZN1 | 7.224589 | 10.0 | 0.722459 | 1.0576 | -18.373571 | -50.139408 | -92.151844 | 0.941372 | 0.457368 | 298 |