Information state changes and the Treasury market #

Get packages and JPMaQS data #

# >>> Define constants <<< #

import os

# Minimum Macrosynergy package version required for this notebook

MIN_REQUIRED_VERSION: str = "0.1.32"

# DataQuery credentials: Remember to replace with your own client ID and secret

DQ_CLIENT_ID: str = os.getenv("DQ_CLIENT_ID")

DQ_CLIENT_SECRET: str = os.getenv("DQ_CLIENT_SECRET")

# Define any Proxy settings required (http/https)

PROXY = {}

# Start date for the data (argument passed to the JPMaQSDownloader class)

START_DATE: str = "1995-01-01"

# Standard library imports

from typing import List, Tuple, Dict

import warnings

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

import matplotlib as mpl

import seaborn as sns

from scipy.stats import chi2

# Macrosynergy package imports

import macrosynergy.management as msm

import macrosynergy.panel as msp

import macrosynergy.pnl as msn

import macrosynergy.visuals as msv

import macrosynergy.signal as mss

from macrosynergy.download import JPMaQSDownload

warnings.simplefilter("ignore")

# Check installed Macrosynergy package meets version requirement

import macrosynergy as msy

msy.check_package_version(required_version=MIN_REQUIRED_VERSION)

Specify and download the data #

# Cross sections to be explored

cids = ["USD",]

# Quantamental categories of interest

growth = [

"RGDPTECH_SA_P1M1ML12_3MMA", # (-) Technical Real GDP growth

"INTRGDP_NSA_P1M1ML12_3MMA", # (-) Intuitive Growth

]

# Inflation measures

inflation = [

"CPIH_SA_P1M1ML12", # (-) Headline consumer price inflation

"PPIH_NSA_P1M1ML12", # (-) Purchasing Price inflation

]

# Labour market tightness measures

labour = [

"COJLCLAIMS_SA_D4W4WL52", # (+) Initial jobless claims

"EMPL_NSA_P1M1ML12", # (-) Change in empyloyment (non-farm payrolls)

]

# All feature categories

main = growth + inflation + labour

# Market returns (target) categories

rets = [f"{AC}{MAT}_{ADJ}" for AC in ["DU", "GB"] for MAT in ["02YXR", "05YXR", "10YXR"] for ADJ in ["NSA", "VT10"]]

# All category tickers

xcats = main + rets

# All tickers

tickers = [cid + "_" + xcat for cid in cids for xcat in xcats]

print(f"Maximum number of JPMaQS tickers to be downloaded is {len(tickers)}")

Maximum number of JPMaQS tickers to be downloaded is 18

# Download from DataQuery

with JPMaQSDownload(

client_id=DQ_CLIENT_ID, client_secret=DQ_CLIENT_SECRET

) as downloader:

df: pd.DataFrame = downloader.download(

tickers=tickers,

start_date=START_DATE,

metrics=["value", "grading", "eop_lag"],

suppress_warning=True,

show_progress=True,

report_time_taken=True,

proxy=PROXY,

)

Downloading data from JPMaQS.

Timestamp UTC: 2024-10-04 15:00:14

Connection successful!

Requesting data: 100%|██████████| 3/3 [00:00<00:00, 4.86it/s]

Downloading data: 100%|██████████| 3/3 [00:11<00:00, 3.92s/it]

Time taken to download data: 13.68 seconds.

Some dates are missing from the downloaded data.

2 out of 7767 dates are missing.

dfx = df.copy()

dfx.info()

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 137367 entries, 0 to 137366

Data columns (total 6 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 real_date 137367 non-null datetime64[ns]

1 cid 137367 non-null object

2 xcat 137367 non-null object

3 value 137367 non-null float64

4 grading 137367 non-null float64

5 eop_lag 137367 non-null float64

dtypes: datetime64[ns](1), float64(3), object(2)

memory usage: 6.3+ MB

Availability #

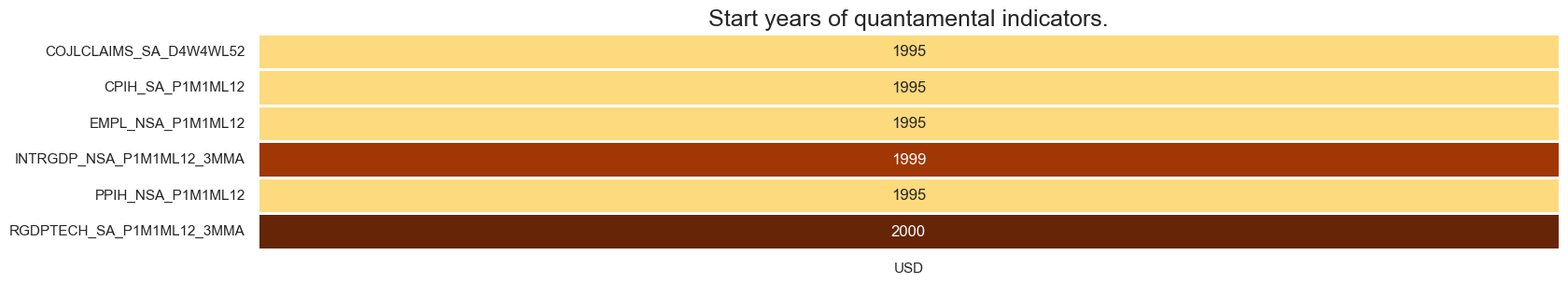

xcatx = main

msm.check_availability(df=dfx, xcats=xcatx, cids=cids, missing_recent=False)

Transformation and checks #

Calculate and list positive effect categories #

dfa = dfx[dfx['xcat'].isin(main)].copy()

dfa.loc[:, 'value'] = dfa['value'] * -1

dfa.loc[:, 'xcat'] = dfa['xcat'] + "_NEG"

dfx = msm.update_df(dfx, dfa)

# Lists for sign change relative to target of 10y gov bonds

positives = [

"COJLCLAIMS_SA_D4W4WL52", # (+) Initial jobless claims

]

negatives = [x for x in main if x not in positives]

# Positive effects features against target

pe_feats = [xc for xc in positives] + [xc + "_NEG" for xc in negatives]

Calculate and add normalized information state changes #

df_red = msm.reduce_df(dfx, xcats=pe_feats, cids=["USD"])

# creates sparse dataframe with information state changes

isc_obj = msm.InformationStateChanges.from_qdf(

df=df_red,

norm=True, # normalizes changes by first release values

std="std",

halflife=12,

min_periods=36,

)

# Revert back to Quantamenal DataFrame information states

dfa = isc_obj.to_qdf(value_column="zscore", postfix="_NIC")

dfx = msm.update_df(dfx, dfa[["real_date", "cid", "xcat", "value"]])

# Calculate [1] Information state changes (IC), and [2] back-out volatility estimates (IC_STD)

for cat in pe_feats:

calcs = [

f"{cat:s}_IC = {cat:s}.diff()", # IC : information state changes

f"{cat:s}_IC_STD = ( {cat:s}_IC / {cat:s}_NIC ).ffill()" # IC_STD: information state changes standard deviations

]

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=["USD"])

dfx = msm.update_df(dfx, dfa)

# Weekly variables adjustment for frequency scaling to monthly unit volatility

weekly = ["COJLCLAIMS_SA_D4W4WL52"]

calcs = [

f"{kk:s}_NICW = np.sqrt(5/21) * {kk:s}_NIC"

for kk in weekly

]

# Monthly variables (no adjustment)

monthly = [kk for kk in pe_feats if kk not in weekly]

calcs += [

f"{kat:s}_NICW = {kat:s}_NIC"

for kat in monthly

]

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=["USD"])

dfx = msm.update_df(dfx, dfa)

# Winsorization for charts

calcs = [

f"{cat:s}_NICWW = {cat:s}_NICW.clip(lower=5, upper=-5)"

for cat in pe_feats

]

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=["USD"])

dfx = msm.update_df(dfx, dfa)

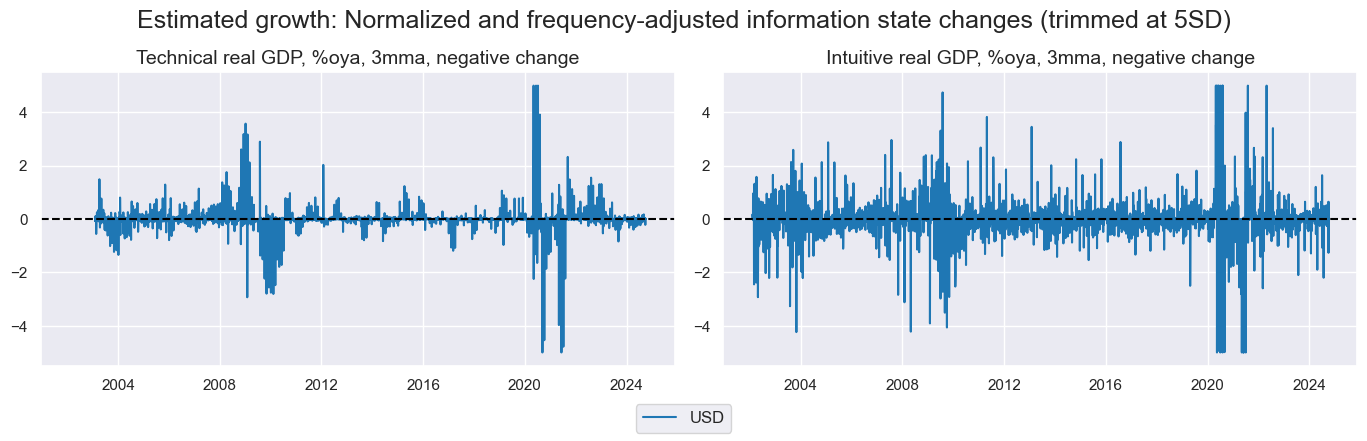

xcatx_labels = {

"RGDPTECH_SA_P1M1ML12_3MMA_NEG": "Technical real GDP, %oya, 3mma, negative change",

"INTRGDP_NSA_P1M1ML12_3MMA_NEG": "Intuitive real GDP, %oya, 3mma, negative change",

}

msp.view_timelines(

dfx,

xcats=[xc + "_NICWW" for xc in xcatx_labels.keys()],

cids=["USD"],

xcat_grid=True,

same_y=False,

ncol=2,

title="Estimated growth: Normalized and frequency-adjusted information state changes (trimmed at 5SD)",

xcat_labels=list(xcatx_labels.values()),

)

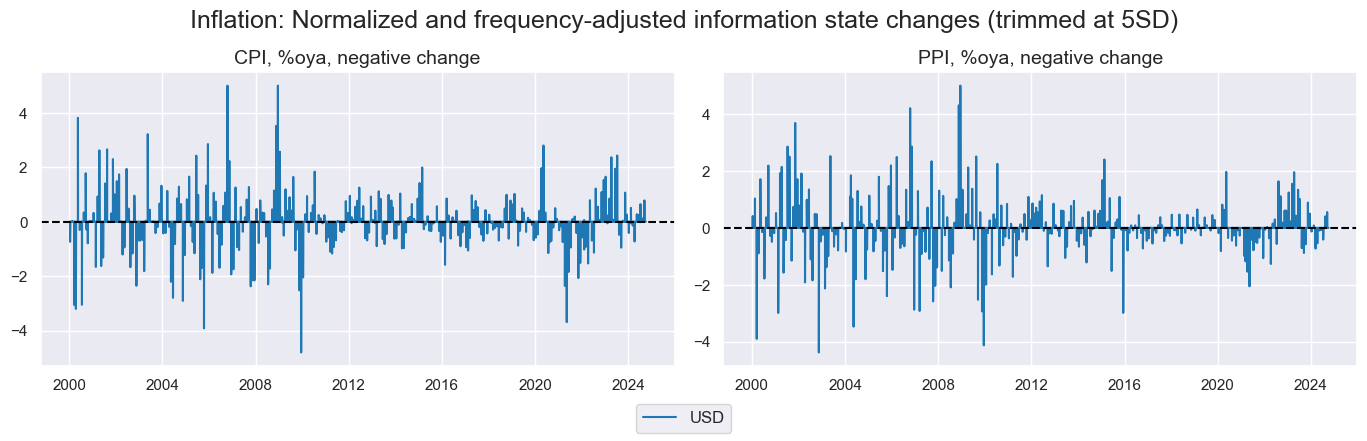

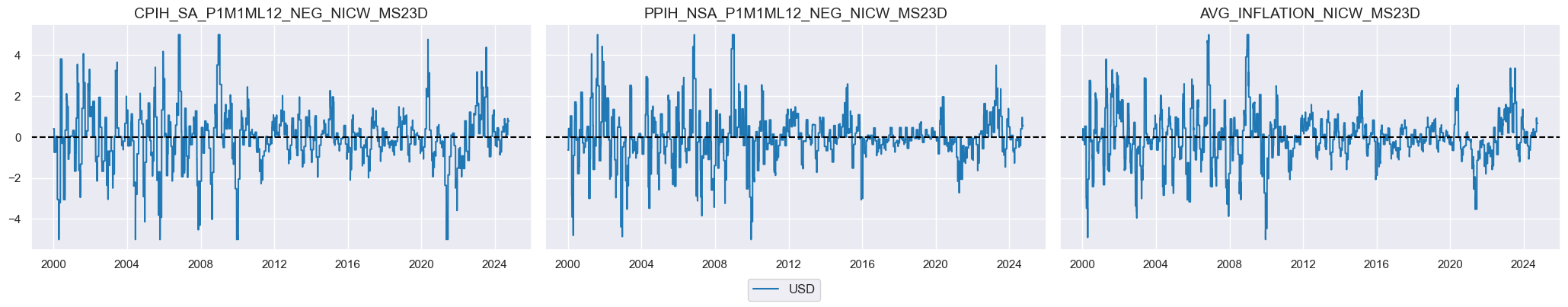

xcatx_labels = {

'CPIH_SA_P1M1ML12_NEG': "CPI, %oya, negative change",

'PPIH_NSA_P1M1ML12_NEG': "PPI, %oya, negative change",

}

msp.view_timelines(

dfx,

xcats=[xc + "_NICWW" for xc in xcatx_labels.keys()],

cids=["USD"],

xcat_grid=True,

same_y=False,

ncol=2,

title="Inflation: Normalized and frequency-adjusted information state changes (trimmed at 5SD)",

xcat_labels=list(xcatx_labels.values()),

)

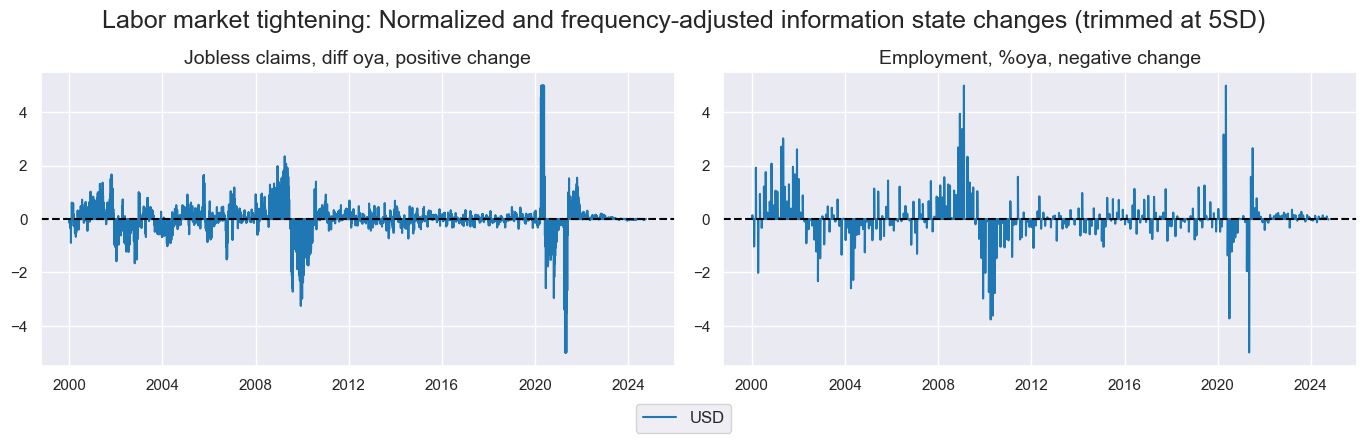

xcatx_labels = {

'COJLCLAIMS_SA_D4W4WL52': "Jobless claims, diff oya, positive change",

'EMPL_NSA_P1M1ML12_NEG': "Employment, %oya, negative change",

}

msp.view_timelines(

dfx,

xcats=[xc + "_NICWW" for xc in xcatx_labels.keys()],

cids=["USD"],

xcat_grid=True,

same_y=False,

ncol=2,

title="Labor market tightening: Normalized and frequency-adjusted information state changes (trimmed at 5SD)",

xcat_labels=list(xcatx_labels.values()),

)

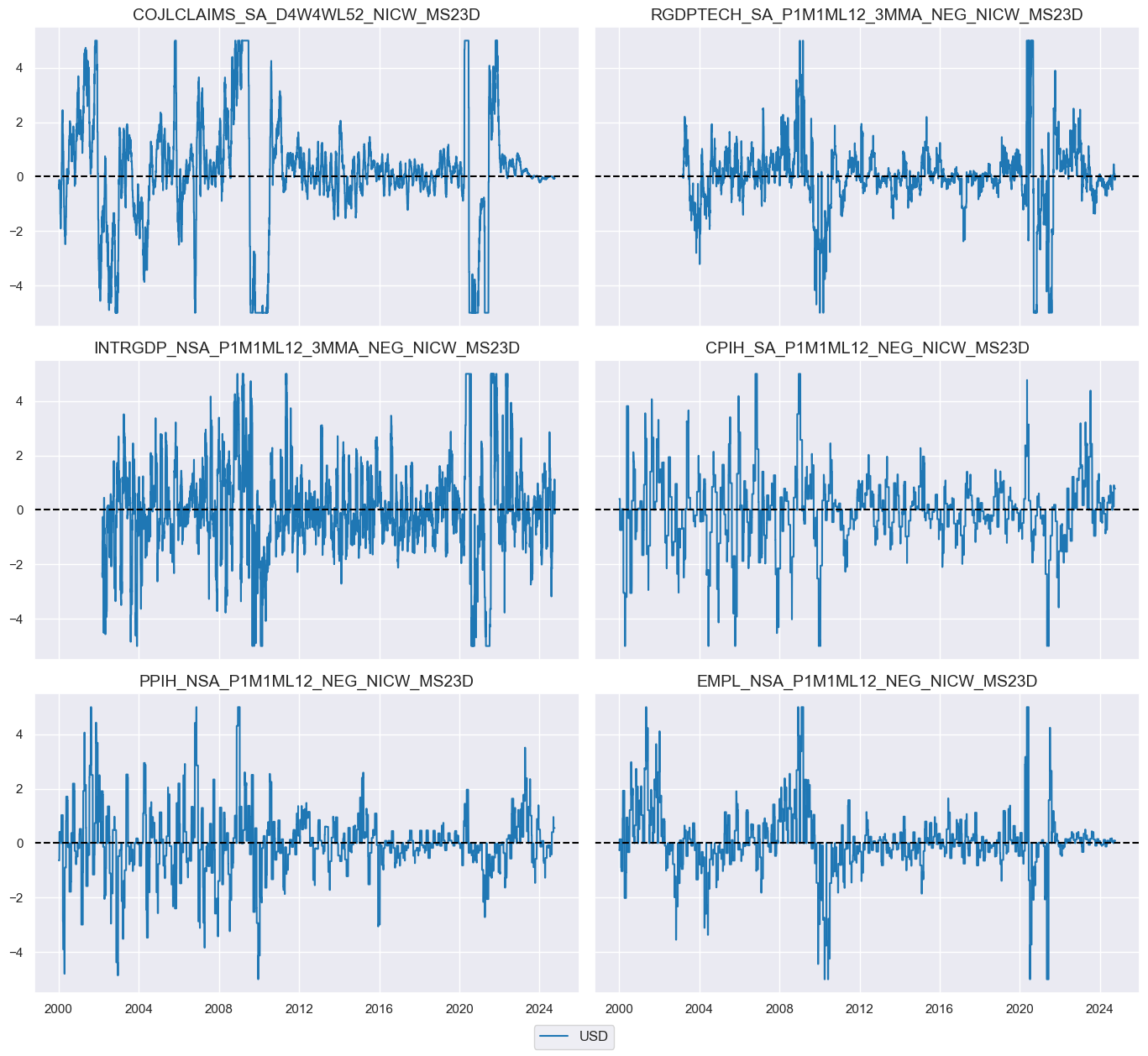

Temporal aggregations #

# Trim/Winsorisation in below!

calcs = [

f"{cat:s}_NICW_MS23D = {cat:s}_NICW.rolling(23).sum().clip(lower=5, upper=-5)"

for cat in pe_feats

]

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=["USD"])

dfx = msm.update_df(dfx, dfa)

# Define aggregation name for below

nic_agg = "_NICW_MS23D"

msp.view_timelines(

dfx,

xcats=[kk + nic_agg for kk in pe_feats],

cids=["USD"],

xcat_grid = True,

same_y = True,

ncol=2,

)

xcatx = [xc + "_NIC" for xc in pe_feats]

df_red = msm.reduce_df(dfx, xcats=xcatx, cids=["USD"])

# Exponential moving average

dfa = msm.temporal_aggregator_exponential(df=df_red, halflife=15, winsorise=None)

dfx = msm.update_df(dfx, dfa) # NICEWM15D

# Equal weighted mean

dfa = msm.temporal_aggregator_mean(df=df_red, window=23, winsorise=None)

dfx = msm.update_df(dfx, dfa) # NICMA23D

# Define aggregation name for below

# nic_agg = "_NICMA23D"

Group aggregation and data checks #

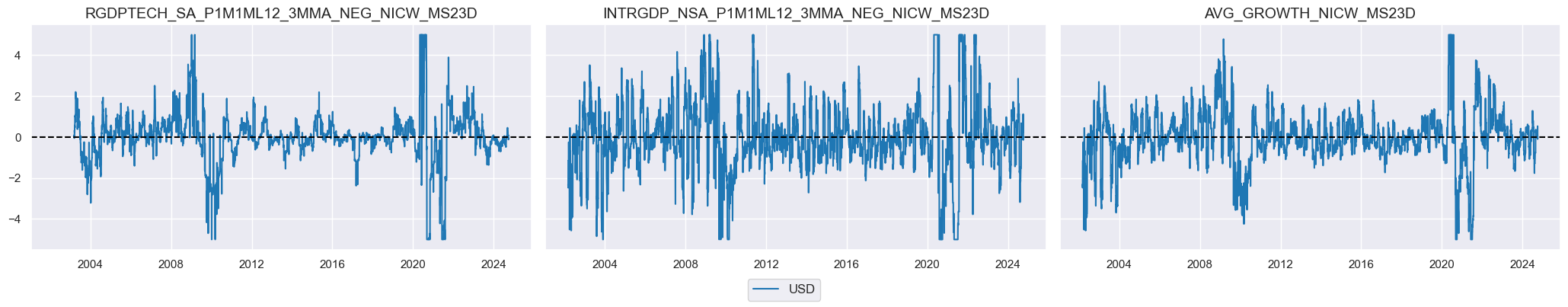

Growth #

growth_nic = [xc + nic_agg for xc in pe_feats if xc.split('_')[0] in [x.split('_')[0] for x in growth]]

xcatx = growth_nic

dfa = msp.linear_composite(

df=dfx,

xcats=xcatx,

cids=["USD"],

new_xcat="AVG_GROWTH" + nic_agg ,

)

dfx = msm.update_df(dfx, dfa)

xcatx = growth_nic + ["AVG_GROWTH" + nic_agg]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=["USD"],

xcat_grid = True,

same_y = True,

ncol=3,

)

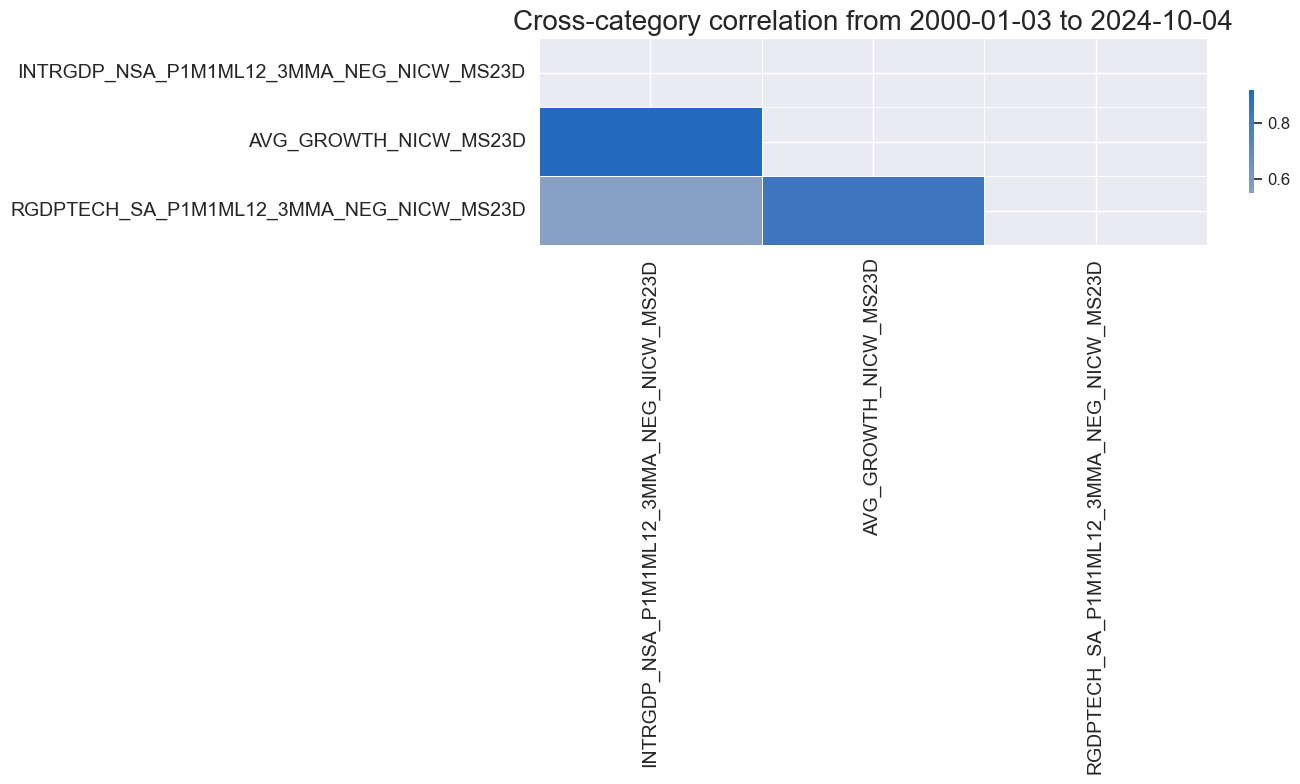

msp.correl_matrix(

dfx,

xcats=xcatx,

cids="USD",

start="2000-01-01",

cluster=True,

freq="M",

)

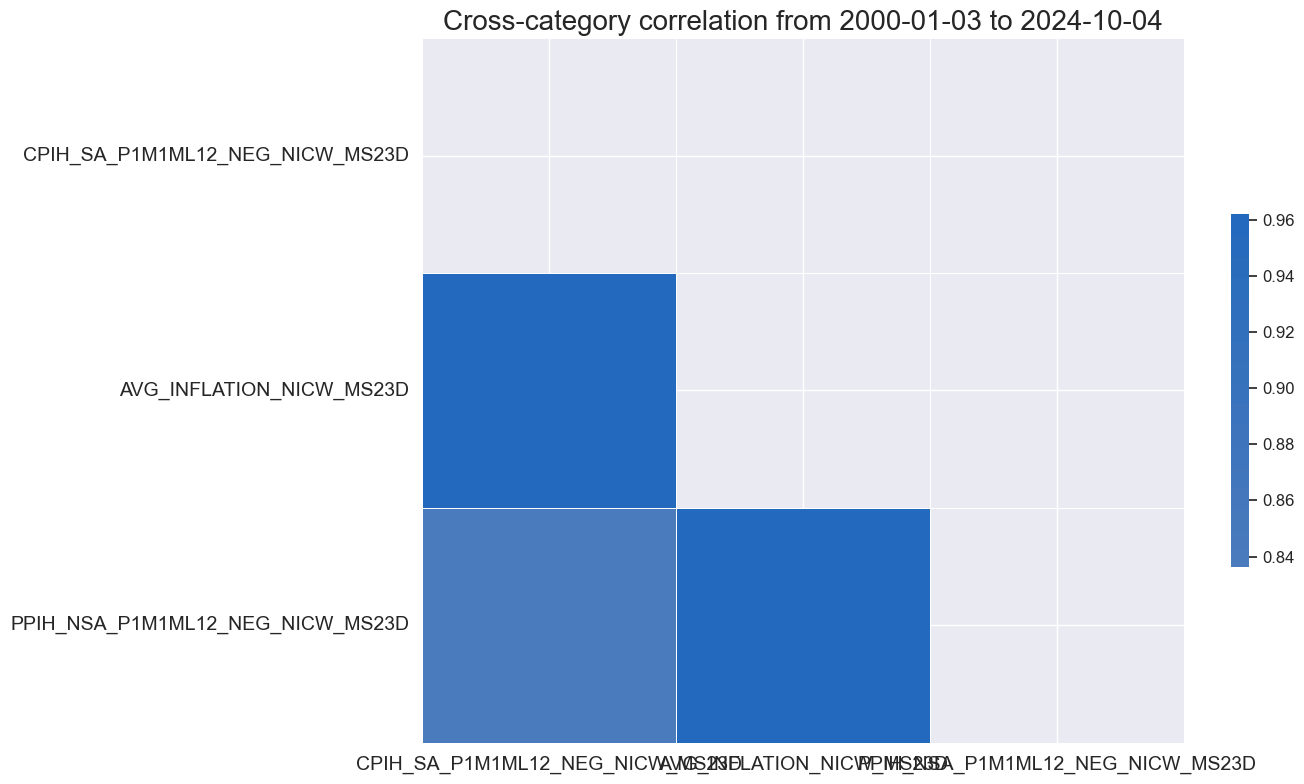

Inflation #

inf_nic = [xc + nic_agg for xc in pe_feats if xc.split('_')[0] in [x.split('_')[0] for x in inflation]]

xcatx = inf_nic

dfa = msp.linear_composite(

df=dfx,

xcats=xcatx,

cids=["USD"],

new_xcat="AVG_INFLATION" + nic_agg ,

)

dfx = msm.update_df(dfx, dfa)

xcatx = inf_nic + ["AVG_INFLATION" + nic_agg]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=["USD"],

xcat_grid = True,

same_y = True,

ncol=3,

)

msp.correl_matrix(

dfx,

xcats=xcatx,

cids="USD",

start="2000-01-01",

cluster=True,

freq="M",

)

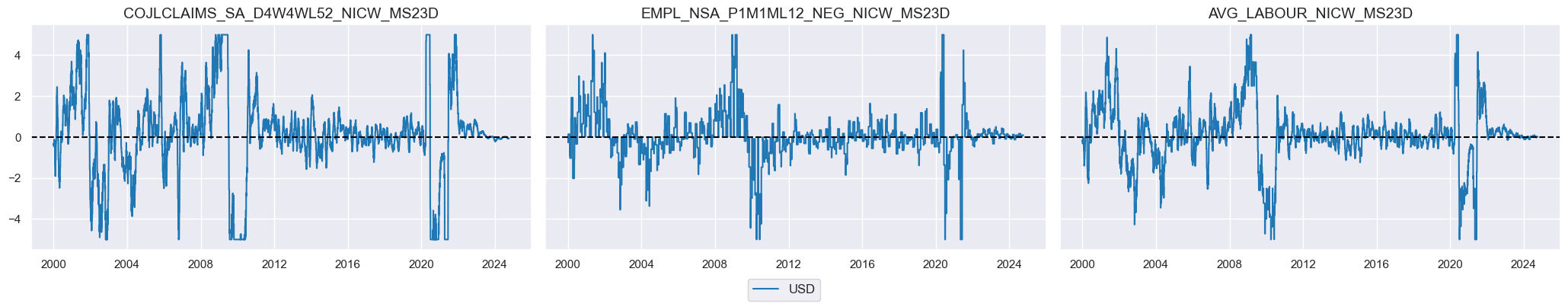

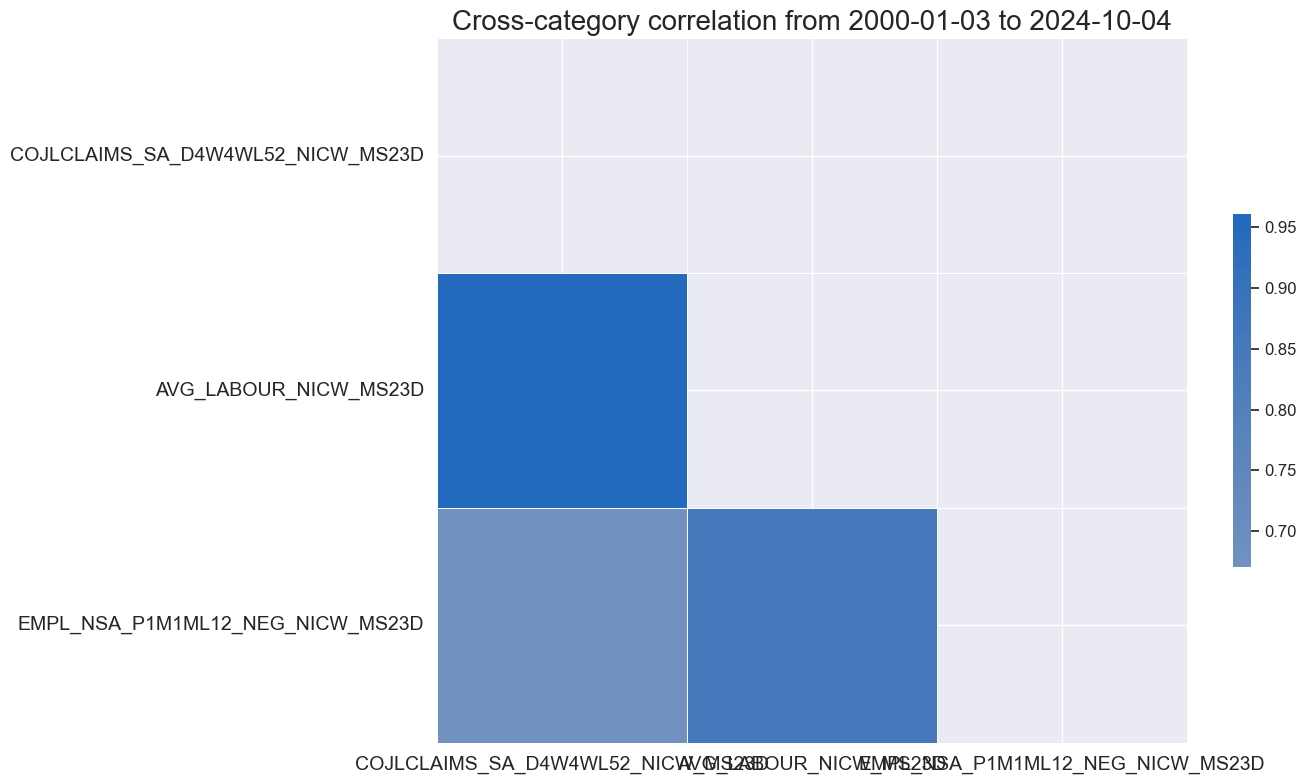

Labour market #

lab_nic = [xc + nic_agg for xc in pe_feats if xc.split('_')[0] in [x.split('_')[0] for x in labour]]

xcatx = lab_nic

dfa = msp.linear_composite(

df=dfx,

xcats=xcatx,

cids=["USD"],

new_xcat="AVG_LABOUR" + nic_agg ,

)

dfx = msm.update_df(dfx, dfa)

xcatx = lab_nic + ["AVG_LABOUR" + nic_agg]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=["USD"],

xcat_grid = True,

same_y = True,

ncol=3,

)

msp.correl_matrix(

dfx,

xcats=xcatx,

cids="USD",

start="2000-01-01",

cluster=True,

freq="M"

)

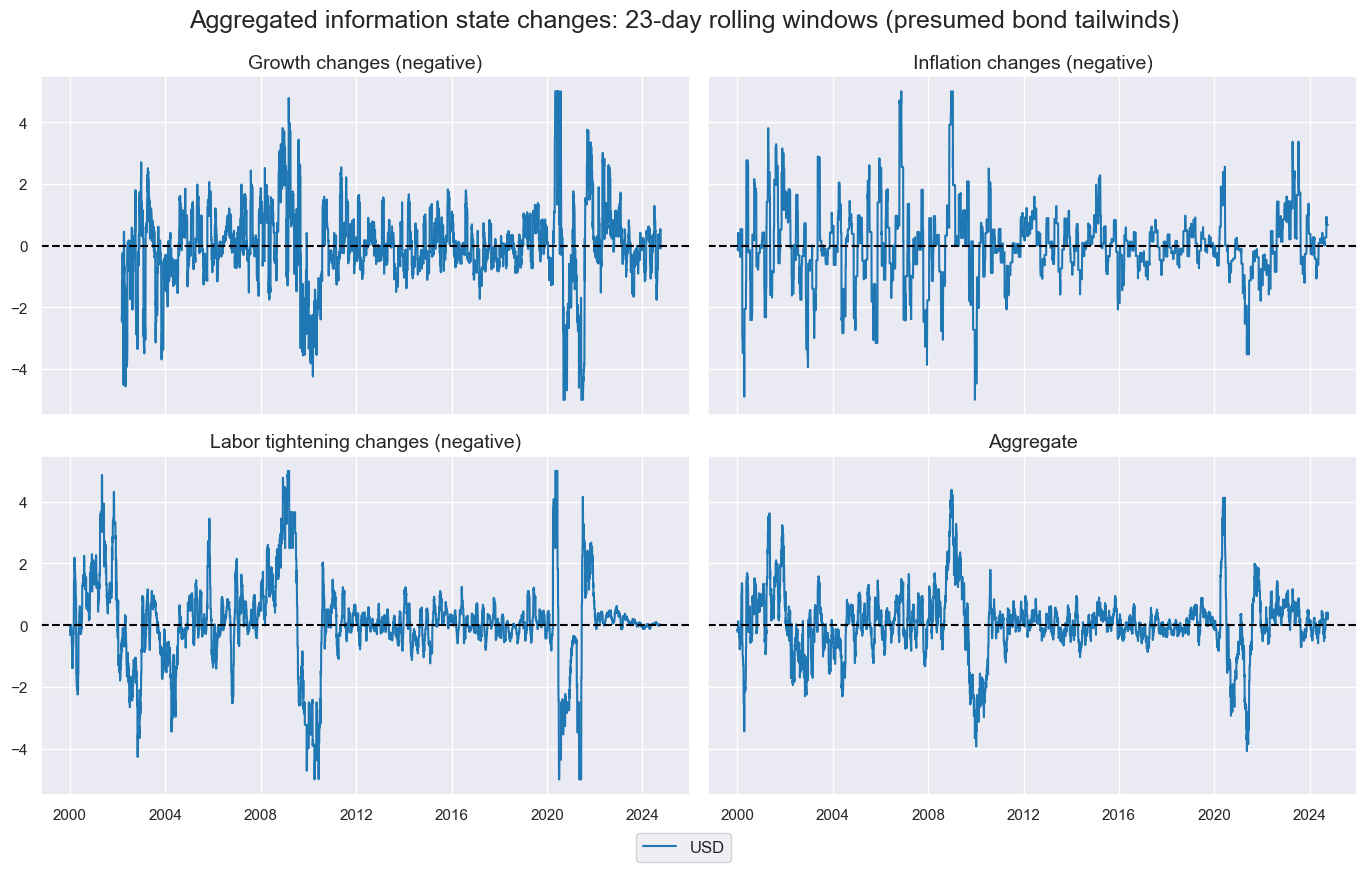

Cross-group aggregation #

groups = ["GROWTH", "INFLATION", "LABOUR"]

xcatx = [f"AVG_{g}{nic_agg}" for g in groups]

dfa = msp.linear_composite(

df=dfx,

xcats=xcatx,

cids=["USD"],

new_xcat=f"AVG_ALL{nic_agg}",

)

dfx = msm.update_df(dfx, dfa)

groups = ["GROWTH", "INFLATION", "LABOUR"]

xcatx = [f"AVG_{g}{nic_agg}" for g in groups + ["ALL"]]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=["USD"],

xcat_grid = True,

ncol=2,

same_y = True,

title="Aggregated information state changes: 23-day rolling windows (presumed bond tailwinds)",

xcat_labels=["Growth changes (negative)", "Inflation changes (negative)", "Labor tightening changes (negative)", "Aggregate"]

)

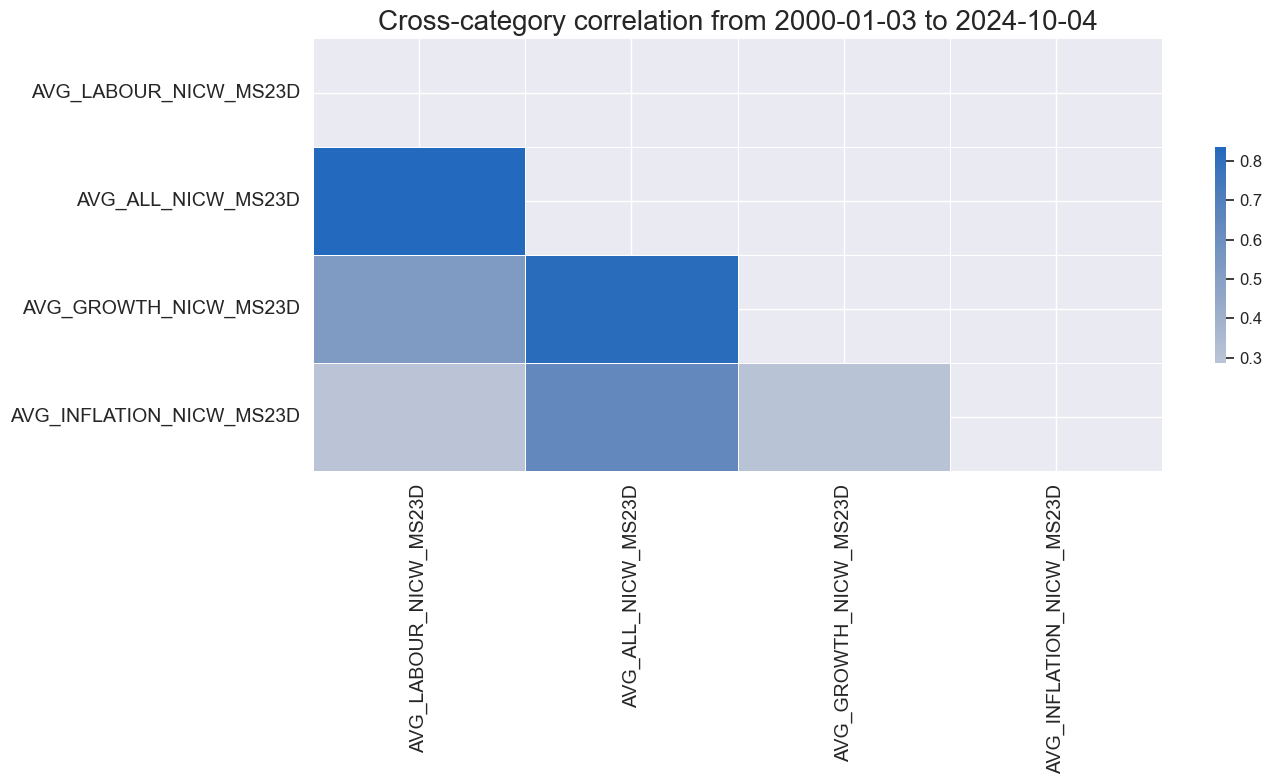

msp.correl_matrix(

dfx,

xcats=xcatx,

cids="USD",

start="2000-01-01",

cluster=True,

freq="M"

)

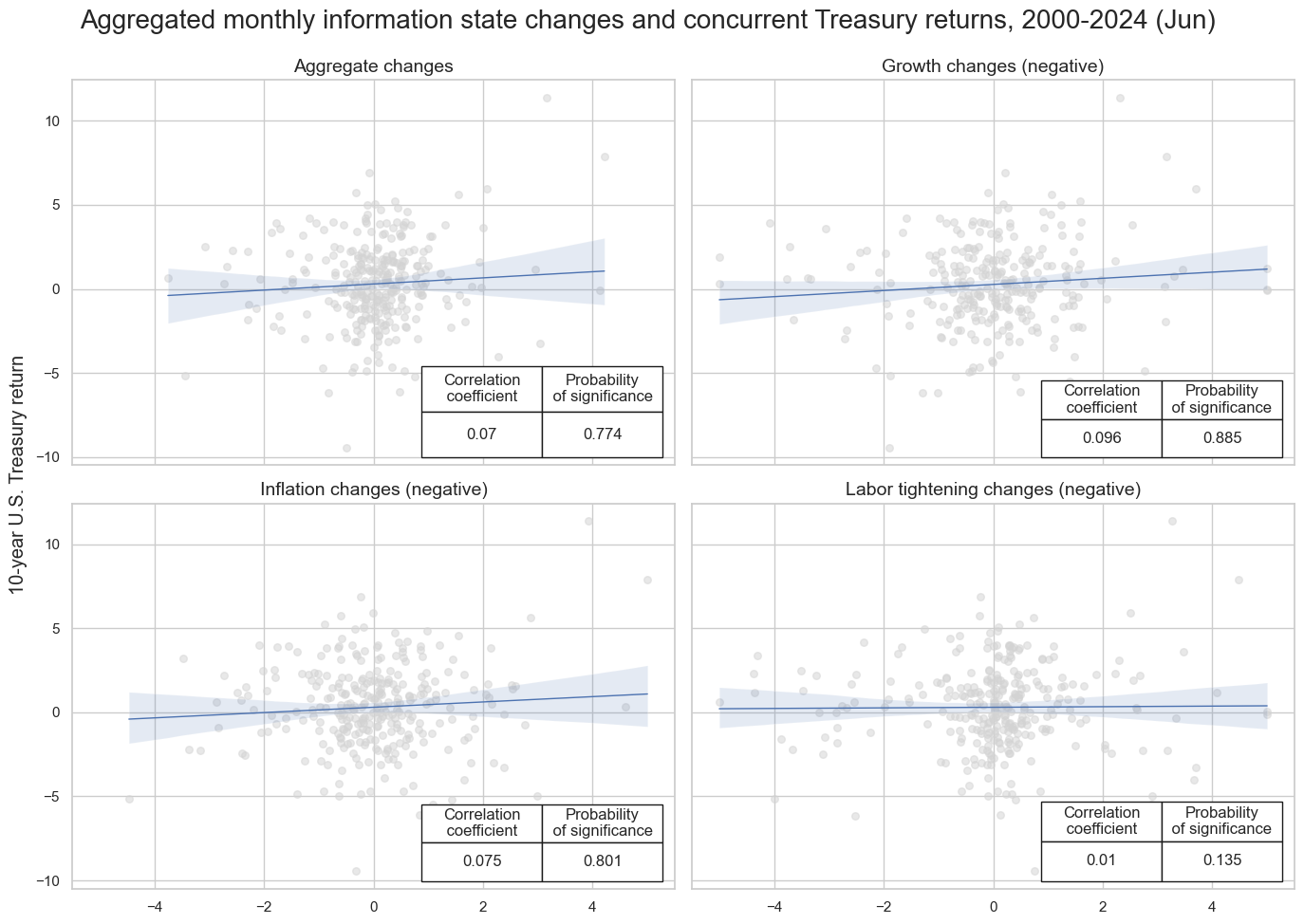

Treasury correlations #

nic_agg = "_NICW_MS23D"

dict_groups = {

"sigx": [f"AVG_{g}{nic_agg}" for g in ["ALL"] + groups],

"ret": "GB10YXR_NSA",

"cidx": ["USD"],

"freq": "M",

"start": "2000-01-01",

"black": None,

"srr": None,

"pnls": None,

}

dix = dict_groups

sigx = dix["sigx"]

ret = dix["ret"]

cidx = dix["cidx"]

freq = dix["freq"]

start = dix["start"]

catregs = {}

for sig in sigx:

catregs[sig] = msp.CategoryRelations(

dfx,

xcats=[sig, ret],

cids=cidx,

freq=freq,

lag=0,

xcat_aggs=["last", "sum"],

start=start,

)

msv.multiple_reg_scatter(

cat_rels=[v for k, v in catregs.items()],

ncol=2,

nrow=2,

figsize=(14, 10),

title="Aggregated monthly information state changes and concurrent Treasury returns, 2000-2024 (Jun)",

title_xadj=0.5,

title_yadj=0.99,

title_fontsize=20,

xlab=None,

ylab="10-year U.S. Treasury return",

coef_box="lower right",

single_chart=True,

subplot_titles=[

"Aggregate changes",

"Growth changes (negative)",

"Inflation changes (negative)",

"Labor tightening changes (negative)",

],

)

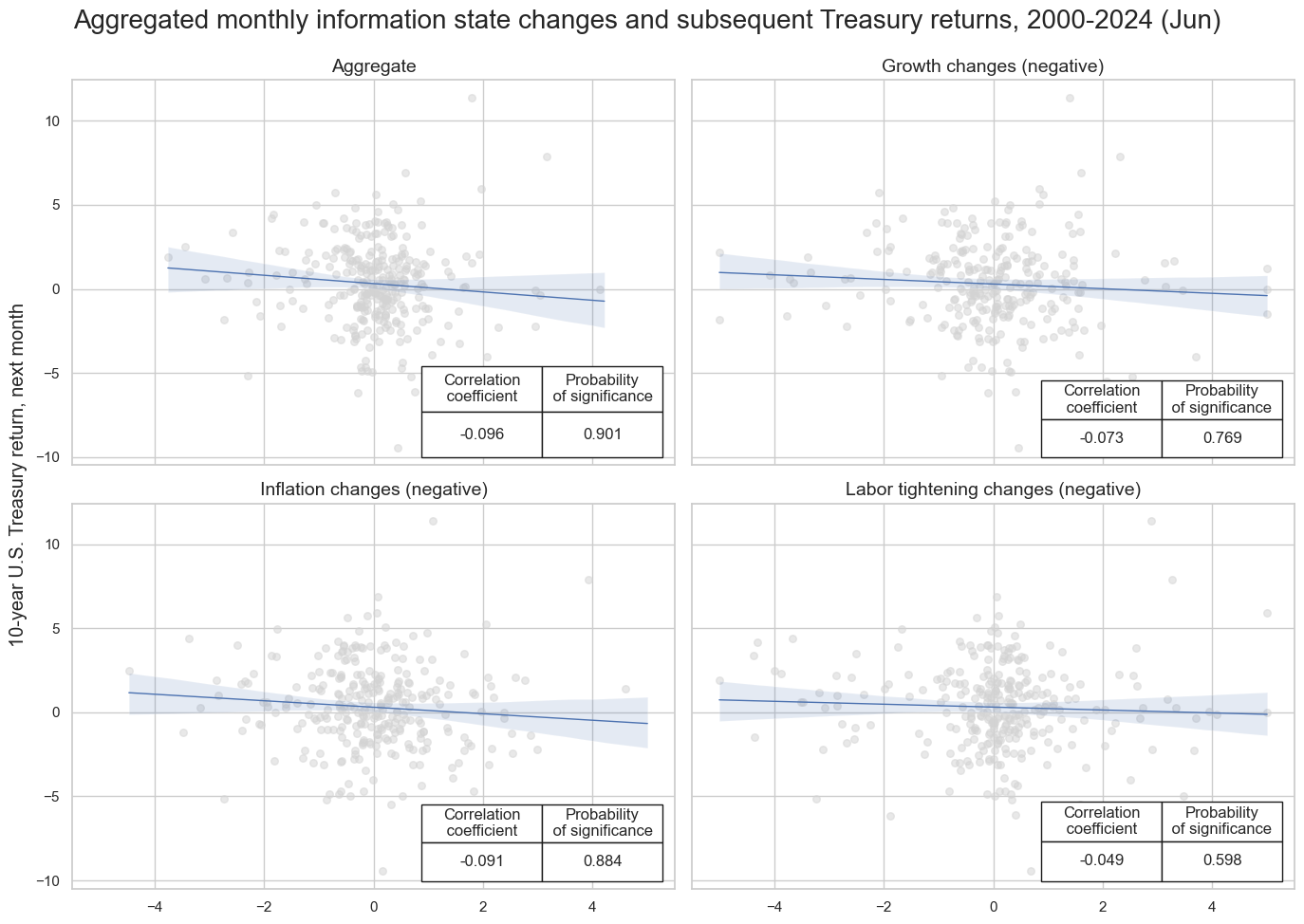

dix = dict_groups

sigx = dix['sigx']

ret = dix['ret']

cidx = dix["cidx"]

freq = dix["freq"]

start = dix["start"]

catregs = {}

for sig in sigx:

catregs[sig] = msp.CategoryRelations(

dfx,

xcats=[sig, ret],

cids=cidx,

freq=freq,

lag=1,

xcat_aggs=["last", "sum"],

start=start,

)

msv.multiple_reg_scatter(

cat_rels=[v for k, v in catregs.items()],

ncol=2,

nrow=2,

figsize=(14, 10),

title="Aggregated monthly information state changes and subsequent Treasury returns, 2000-2024 (Jun)",

title_xadj=0.5,

title_yadj=0.99,

title_fontsize=20,

xlab=None,

ylab="10-year U.S. Treasury return, next month",

coef_box="lower right",

single_chart=True,

subplot_titles=[

"Aggregate",

"Growth changes (negative)",

"Inflation changes (negative)",

"Labor tightening changes (negative)",

],

)

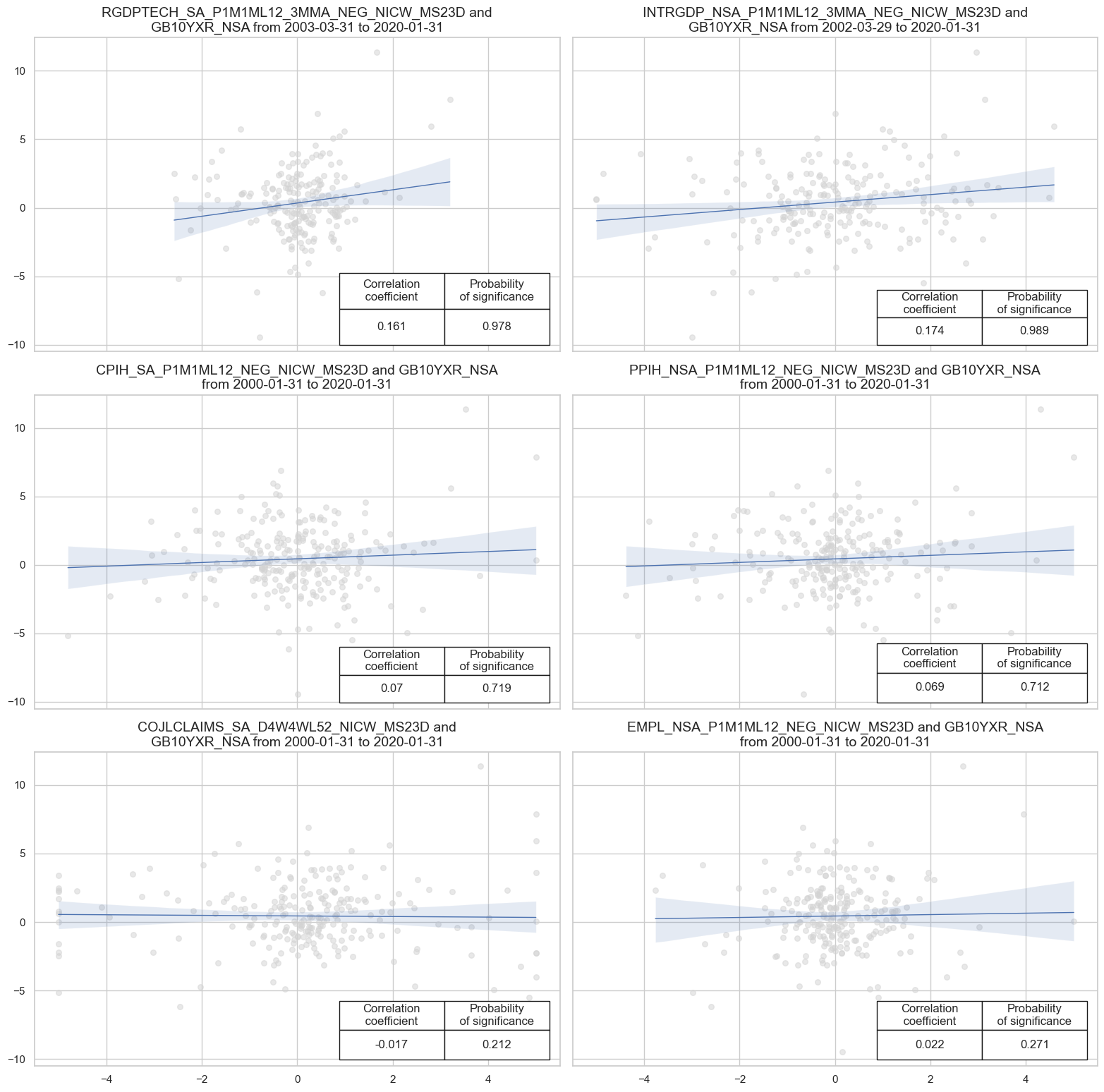

xcatx= growth_nic + inf_nic + lab_nic

dict_all = {

"sigx": xcatx,

"ret": "GB10YXR_NSA",

"cidx": ["USD"],

"freq": "M",

"start": "2000-01-01",

"black": None,

"srr": None,

"pnls": None,

}

dix = dict_all

sigx = dix['sigx']

ret = dix['ret']

cidx = dix["cidx"]

freq = dix["freq"]

start = dix["start"]

catregs = {}

for sig in sigx:

catregs[sig] = msp.CategoryRelations(

dfx,

xcats=[sig, ret],

cids=cidx,

freq=freq,

lag=0,

xcat_aggs=["last", "sum"],

start=start,

end="2020-01-01"

)

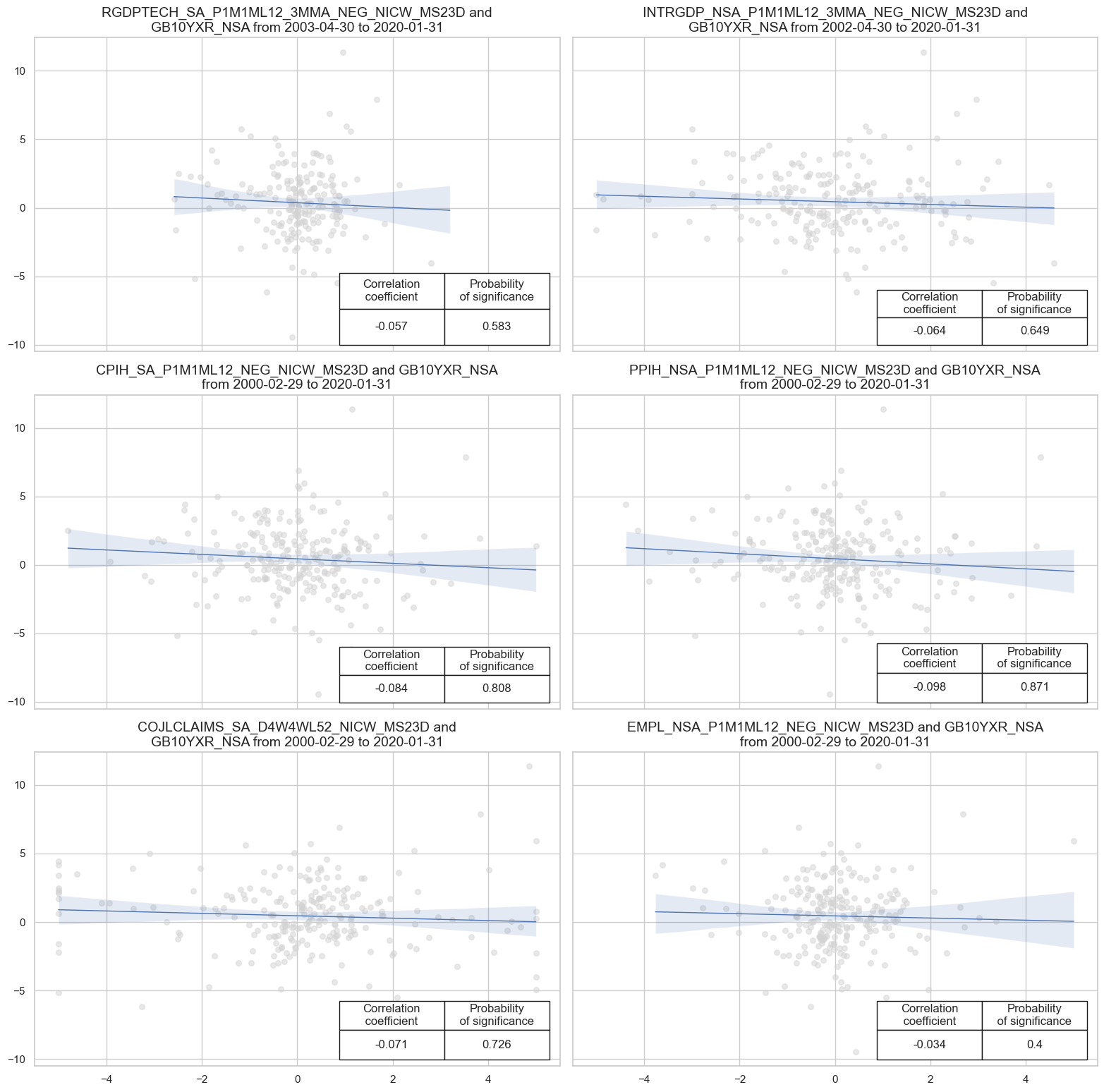

msv.multiple_reg_scatter(

cat_rels=[v for k, v in catregs.items()],

ncol=2,

nrow=3,

figsize=(16, 16),

title=None,

title_xadj=0.5,

title_yadj=0.99,

title_fontsize=12,

xlab=None,

ylab=None,

coef_box="lower right",

single_chart=True,

# separator=2012,

)

dix = dict_all

sigx = dix['sigx']

ret = dix['ret']

cidx = dix["cidx"]

freq = dix["freq"]

start = dix["start"]

catregs = {}

for sig in sigx:

catregs[sig] = msp.CategoryRelations(

dfx,

xcats=[sig, ret],

cids=cidx,

freq=freq,

lag=1,

xcat_aggs=["last", "sum"],

start=start,

end="2020-01-01"

)

msv.multiple_reg_scatter(

cat_rels=[v for k, v in catregs.items()],

ncol=2,

nrow=3,

figsize=(16, 16),

title=None,

title_xadj=0.5,

title_yadj=0.99,

title_fontsize=12,

xlab=None,

ylab=None,

coef_box="lower right",

single_chart=True,

# separator=2012,

)