Global FX scorecards #

Get packages and JPMaQS data #

import numpy as np

import pandas as pd

from pandas import Timestamp

import matplotlib.pyplot as plt

from datetime import date

import matplotlib.colors as MBC_CHANGEolors

from matplotlib.colors import LinearSegmentedColormap

import seaborn as sns

import os

from datetime import datetime

import macrosynergy.management as msm

import macrosynergy.panel as msp

import macrosynergy.signal as mss

import macrosynergy.pnl as msn

import macrosynergy.visuals as msv

from macrosynergy.management.utils import merge_categories

from sklearn.linear_model import LinearRegression, ElasticNet

from macrosynergy.download import JPMaQSDownload

from macrosynergy.visuals import ScoreVisualisers

pd.set_option('display.width', 400)

import warnings

warnings.simplefilter("ignore")

# Cross-sections of interest

cids_dm = [

"AUD",

"CAD",

"CHF",

"EUR",

"GBP",

"JPY",

"NOK",

"NZD",

"SEK",

"USD",

] # DM currency areas

cids_latm = ["BRL", "COP", "CLP", "MXN", "PEN"] # Latam countries

cids_emea = ["CZK", "HUF", "ILS", "PLN", "RON", "RUB", "TRY", "ZAR"] # EMEA countries

cids_emas = [

"CNY",

"IDR",

"INR",

"KRW",

"MYR",

"PHP",

"SGD",

"THB",

"TWD",

] # EM Asia countries

cids_dmfx = sorted(list(set(cids_dm) - set(["USD"])))

cids_emfx = sorted(set(cids_latm + cids_emea + cids_emas) - set(["CNY", "SGD"]))

cids_fx = sorted(cids_dmfx + cids_emfx)

cids = sorted(cids_dm + cids_emfx)

cids_eur = ["CHF", "NOK", "SEK", "PLN", "HUF", "CZK", "RON"] # trading against EUR

cids_eud = ["GBP", "RUB", "TRY"] # trading against EUR and USD

cids_usd = list(set(cids_fx) - set(cids_eur + cids_eud)) # trading against USD

# Quantamental categories

# Economic activity

output_growth = [

"INTRGDP_NSA_P1M1ML12_3MMA",

"RGDPTECH_SA_P1M1ML12_3MMA",

"IP_SA_P6M6ML6AR",

"IP_SA_P1M1ML12_3MMA"

]

mbconf_change = [

"MBCSCORE_SA_D3M3ML3",

"MBCSCORE_SA_D6M6ML6",

"MBCSCORE_SA_D1Q1QL1",

"MBCSCORE_SA_D2Q2QL2"

]

labtight_change = [

"EMPL_NSA_P1M1ML12_3MMA",

"EMPL_NSA_P1Q1QL4",

"UNEMPLRATE_NSA_3MMA_D1M1ML12",

"UNEMPLRATE_NSA_D1Q1QL4",

"UNEMPLRATE_SA_D6M6ML6",

"UNEMPLRATE_SA_D2Q2QL2"

]

cons_growth = [

"RPCONS_SA_P1M1ML12_3MMA",

"RPCONS_SA_P1Q1QL4",

"CCSCORE_SA",

"CCSCORE_SA_D6M6ML6",

"CCSCORE_SA_D2Q2QL2",

"RRSALES_SA_P1M1ML12_3MMA",

"RRSALES_SA_P1Q1QL4",

]

# Monetary policy

cpi_inf = [

"CPIH_SA_P1M1ML12",

"CPIH_SJA_P6M6ML6AR",

"CPIC_SA_P1M1ML12",

"CPIC_SJA_P6M6ML6AR",

"INFE2Y_JA",

]

pcredit_growth = [

"PCREDITBN_SJA_P1M1ML12",

"PCREDITGDP_SJA_D1M1ML12"

]

real_rates = [

"RIR_NSA",

"RYLDIRS05Y_NSA",

"FXCRR_NSA",

"FXCRR_VT10",

"FXCRRHvGDRB_NSA"

]

liq_expansion = [

"MBASEGDP_SA_D1M1ML3",

"MBASEGDP_SA_D1M1ML6",

"INTLIQGDP_NSA_D1M1ML3",

"INTLIQGDP_NSA_D1M1ML6",

]

# External position and valuation

xbal_ratch = [

"CABGDPRATIO_NSA_12MMA",

"BXBGDPRATIO_NSA_12MMA",

"MTBGDPRATIO_SA_6MMA_D1M1ML6",

"BXBGDPRATIO_NSA_12MMA_D1M1ML3",

]

iliabs_accum = [

"IIPLIABGDP_NSA_D1Mv2YMA",

"IIPLIABGDP_NSA_D1Mv5YMA",

]

ppp_overval = [

"PPPFXOVERVALUE_NSA_P1DvLTXL1",

"PPPFXOVERVALUE_NSA_D1M60ML1",

]

reer_apprec = [

"REER_NSA_P1M60ML1",

]

# Price competitiveness and dynamics

tot_pchange = [

"CTOT_NSA_P1W4WL1",

"CTOT_NSA_P1M1ML12",

"CTOT_NSA_P1M60ML1",

"MTOT_NSA_P1M60ML1"

]

ppi_pchange = [

"PGDPTECH_SA_P1M1ML12_3MMA",

"PGDPTECHX_SA_P1M1ML12_3MMA",

"PPIH_NSA_P1M1ML12",

"PPIH_SA_P6M6ML6AR"

]

# Complementary categories

complements = [

"WFORCE_NSA_P1Y1YL1_5YMM",

"INFTEFF_NSA",

"RGDP_SA_P1Q1QL4_20QMM"

]

# ALl macro categories

econ_act = output_growth + mbconf_change + labtight_change + cons_growth

mon_pol = cpi_inf + pcredit_growth + real_rates + liq_expansion

ext_pos = xbal_ratch + iliabs_accum + ppp_overval + reer_apprec

price_dyn = tot_pchange + ppi_pchange

macro = econ_act + mon_pol + ext_pos + price_dyn + complements

# Market categories

blacks = [

"FXTARGETED_NSA",

"FXUNTRADABLE_NSA",

]

rets = [

"FXXR_NSA",

"FXXR_VT10",

"FXXRHvGDRB_NSA",

]

mkts = blacks + rets

# ALl categories

xcats = macro + mkts

# Tickers for download

single_tix = ["USD_GB10YXR_NSA", "EUR_FXXR_NSA", "USD_EQXR_NSA"]

tickers = [cid + "_" + xcat for cid in cids for xcat in xcats] + single_tix

# Download series from J.P. Morgan DataQuery by tickers

start_date = "1998-01-01"

end_date = (pd.Timestamp.today() - pd.offsets.BDay(1)).strftime('%Y-%m-%d')

# Retrieve credentials

oauth_id = os.getenv("DQ_CLIENT_ID") # Replace with own client ID

oauth_secret = os.getenv("DQ_CLIENT_SECRET") # Replace with own secret

# Download from DataQuery

downloader = JPMaQSDownload(client_id=oauth_id, client_secret=oauth_secret)

df = downloader.download(

tickers=tickers,

start_date=start_date,

end_date=end_date,

metrics=["value"],

suppress_warning=True,

show_progress=True,

)

dfx = df.copy()

dfx.info()

Downloading data from JPMaQS.

Timestamp UTC: 2025-02-27 10:29:42

Connection successful!

Requesting data: 100%|██████████| 94/94 [00:19<00:00, 4.93it/s]

Downloading data: 100%|██████████| 94/94 [00:55<00:00, 1.69it/s]

Some expressions are missing from the downloaded data. Check logger output for complete list.

273 out of 1862 expressions are missing. To download the catalogue of all available expressions and filter the unavailable expressions, set `get_catalogue=True` in the call to `JPMaQSDownload.download()`.

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 10327528 entries, 0 to 10327527

Data columns (total 4 columns):

# Column Dtype

--- ------ -----

0 real_date datetime64[ns]

1 cid object

2 xcat object

3 value float64

dtypes: datetime64[ns](1), float64(1), object(2)

memory usage: 315.2+ MB

Renaming, availability and blacklisting #

Renaming quarterly categories #

dict_repl = {

"EMPL_NSA_P1Q1QL4": "EMPL_NSA_P1M1ML12_3MMA",

"UNEMPLRATE_NSA_D1Q1QL4": "UNEMPLRATE_NSA_3MMA_D1M1ML12",

"UNEMPLRATE_SA_D2Q2QL2": "UNEMPLRATE_SA_D6M6ML6",

"MBCSCORE_SA_D1Q1QL1": "MBCSCORE_SA_D3M3ML3",

"MBCSCORE_SA_D2Q2QL2": "MBCSCORE_SA_D6M6ML6",

"RPCONS_SA_P1Q1QL4": "RPCONS_SA_P1M1ML12_3MMA",

"CCSCORE_SA_D2Q2QL2": "CCSCORE_SA_D6M6ML6",

"RRSALES_SA_P1Q1QL4": "RRSALES_SA_P1M1ML12_3MMA",

}

for key, value in dict_repl.items():

dfx["xcat"] = dfx["xcat"].str.replace(key, value)

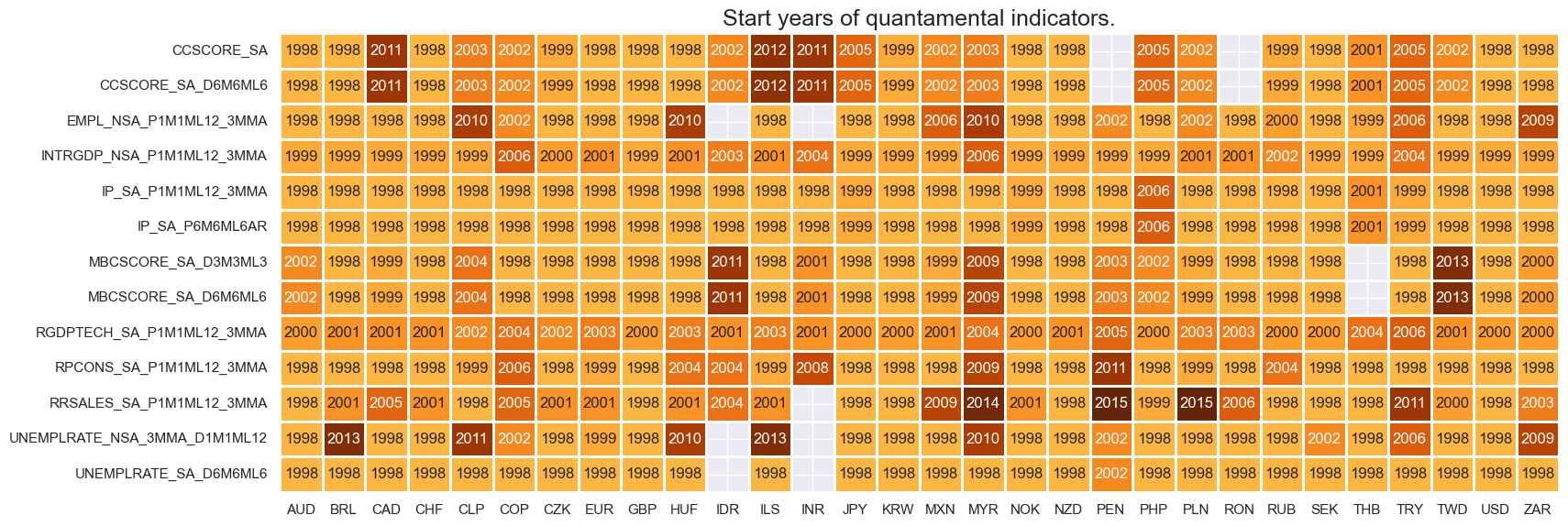

Check availability #

xcatx = econ_act

msm.check_availability(df=dfx, xcats=xcatx, cids=cids, missing_recent=False)

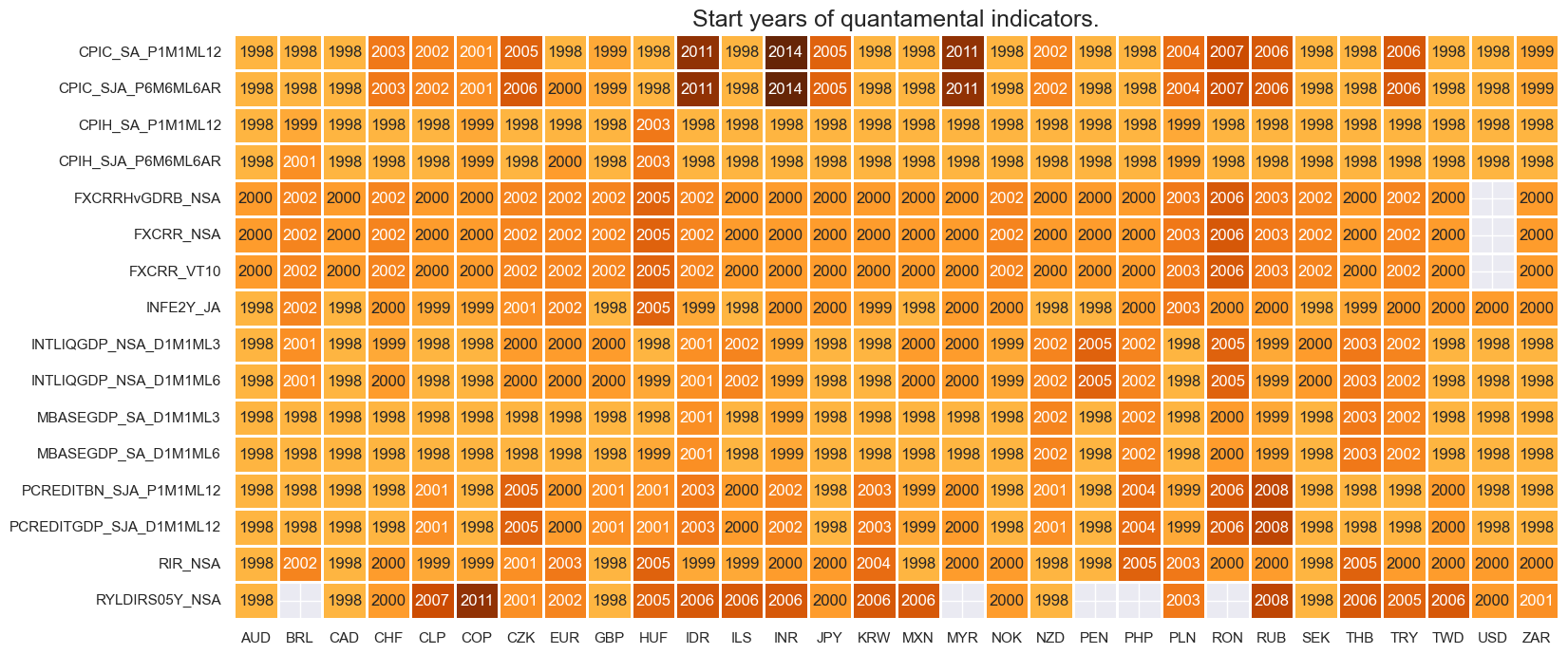

xcatx = mon_pol

msm.check_availability(df=dfx, xcats=xcatx, cids=cids, missing_recent=False)

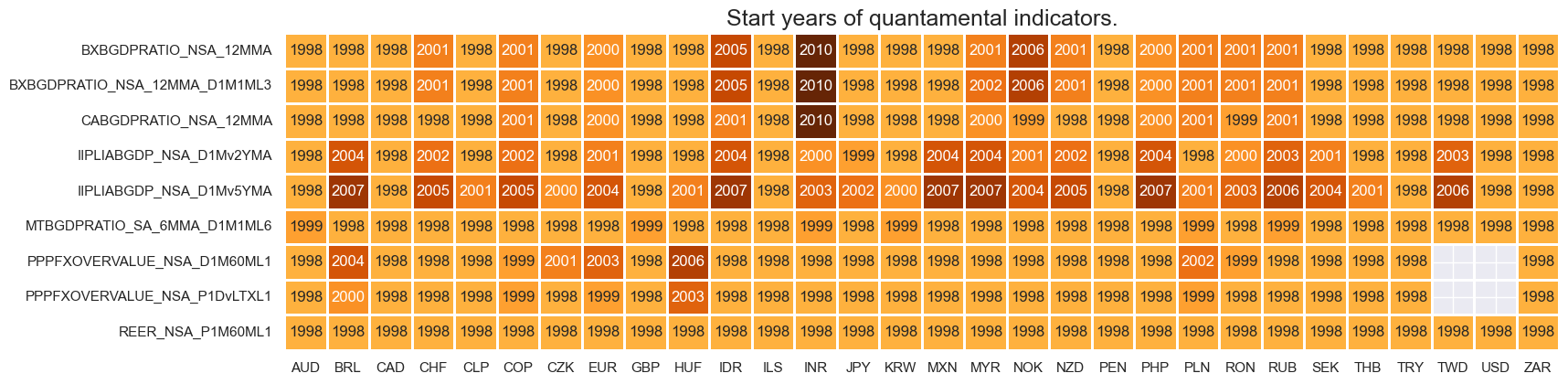

xcatx = ext_pos

msm.check_availability(df=dfx, xcats=xcatx, cids=cids, missing_recent=False)

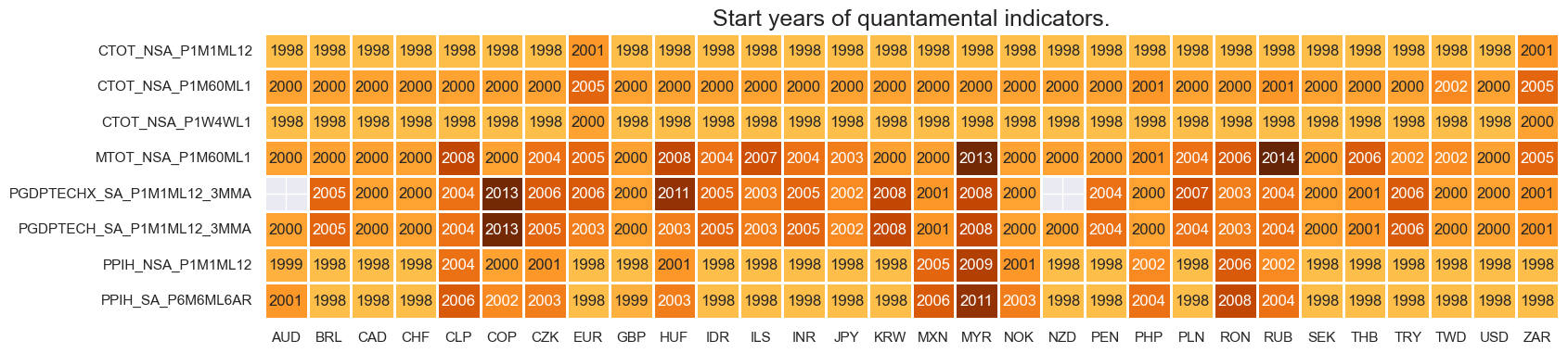

xcatx = price_dyn

msm.check_availability(df=dfx, xcats=xcatx, cids=cids, missing_recent=False)

Blacklisting dictionary for empirical research #

# Create blacklisting dictionary

dfb = df[df["xcat"].isin(["FXTARGETED_NSA", "FXUNTRADABLE_NSA"])].loc[

:, ["cid", "xcat", "real_date", "value"]

]

dfba = (

dfb.groupby(["cid", "real_date"])

.aggregate(value=pd.NamedAgg(column="value", aggfunc="max"))

.reset_index()

)

dfba["xcat"] = "FXBLACK"

fxblack = msp.make_blacklist(dfba, "FXBLACK")

fxblack

{'BRL': (Timestamp('2012-12-03 00:00:00'), Timestamp('2013-09-30 00:00:00')),

'CHF': (Timestamp('2011-10-03 00:00:00'), Timestamp('2015-01-30 00:00:00')),

'CZK': (Timestamp('2014-01-01 00:00:00'), Timestamp('2017-07-31 00:00:00')),

'ILS': (Timestamp('1999-01-01 00:00:00'), Timestamp('2005-12-30 00:00:00')),

'INR': (Timestamp('1999-01-01 00:00:00'), Timestamp('2004-12-31 00:00:00')),

'MYR_1': (Timestamp('1999-01-01 00:00:00'), Timestamp('2007-11-30 00:00:00')),

'MYR_2': (Timestamp('2018-07-02 00:00:00'), Timestamp('2025-02-26 00:00:00')),

'PEN': (Timestamp('2021-07-01 00:00:00'), Timestamp('2021-07-30 00:00:00')),

'RON': (Timestamp('1999-01-01 00:00:00'), Timestamp('2005-11-30 00:00:00')),

'RUB_1': (Timestamp('1999-01-01 00:00:00'), Timestamp('2005-11-30 00:00:00')),

'RUB_2': (Timestamp('2022-02-01 00:00:00'), Timestamp('2025-02-26 00:00:00')),

'THB': (Timestamp('2007-01-01 00:00:00'), Timestamp('2008-11-28 00:00:00')),

'TRY_1': (Timestamp('1999-01-01 00:00:00'), Timestamp('2003-09-30 00:00:00')),

'TRY_2': (Timestamp('2020-01-01 00:00:00'), Timestamp('2024-07-31 00:00:00'))}

Factor construction and checks #

# Initiate category dictionary for thematic factors

dict_themes = {}

# Initiate labeling dictionary

dict_lab = {}

Economic activity factors #

# Governing dictionary for constituent factors

dict_ea = {

"OUTPUT_GROWTH": {

"INTRGDP_NSA_P1M1ML12_3MMA": ["vBM", ""],

"RGDPTECH_SA_P1M1ML12_3MMA": ["vBM", ""],

"IP_SA_P6M6ML6AR": ["vBM", ""],

"IP_SA_P1M1ML12_3MMA": ["vBM", ""],

},

"MBC_CHANGE": {

"MBCSCORE_SA_D3M3ML3": ["", ""],

"MBCSCORE_SA_D6M6ML6": ["", ""],

},

"LAB_TIGHT": {

"EMPL_NSA_P1M1ML12_3MMA": ["vBM", ""],

"UNEMPLRATE_NSA_3MMA_D1M1ML12": ["vBM", "_NEG"],

"UNEMPLRATE_SA_D6M6ML6": ["vBM", "_NEG"],

},

"CONS_GROWTH": {

"RPCONS_SA_P1M1ML12_3MMA": ["vBM", ""],

"CCSCORE_SA": ["vBM", ""],

"CCSCORE_SA_D6M6ML6": ["vBM", ""],

"RRSALES_SA_P1M1ML12_3MMA": ["vBM", ""],

},

}

# Dictionary for transformed category names

dicx_ea = {}

# Add labels (in final transformed form)

dict_lab["OUTPUT_GROWTHZN"] = "Relative output growth"

dict_lab["MBC_CHANGEZN"] = "Industry confidence change"

dict_lab["LAB_TIGHTZN"] = "Relative labor tightening"

dict_lab["CONS_GROWTHZN"] = "Relative consumption growth"

dict_lab["INTRGDP_NSA_P1M1ML12_3MMAvBMZN"] = "Intuitive GDP nowcast, %oya, 3mma, relative"

dict_lab["RGDPTECH_SA_P1M1ML12_3MMAvBMZN"] = "Technical GDP nowcast, %oya, 3mma, relative"

dict_lab["IP_SA_P6M6ML6ARvBMZN"] = "Industry output, %6m/6m, saar, relative"

dict_lab["IP_SA_P1M1ML12_3MMAvBMZN"] = "Industry output, %oya, 3mma, relative"

dict_lab["MBCSCORE_SA_D3M3ML3ZN"] = "Industry confidence, diff 3m/3m, sa"

dict_lab["MBCSCORE_SA_D6M6ML6ZN"] = "Industry confidence, diff 6m/6m, sa"

dict_lab["EMPL_NSA_P1M1ML12_3MMAvBMZN"] = "Employment, %oya, 3mma, relative"

dict_lab["UNEMPLRATE_NSA_3MMA_D1M1ML12vBM_NEGZN"] = "Unempl. rate, diff oya, 3mma, relative, negative"

dict_lab["UNEMPLRATE_SA_D6M6ML6vBM_NEGZN"] = "Unempl. rate, diff 6m/6m, sa, relative, negative"

dict_lab["RPCONS_SA_P1M1ML12_3MMAvBMZN"] = "Real private consumption, %oya, 3mma, relative"

dict_lab["CCSCORE_SAvBMZN"] = "Consumer confidence, sa, relative"

dict_lab["CCSCORE_SA_D6M6ML6vBMZN"] = "Consumer confidence, diff 6m/6m, sa, relative"

dict_lab["RRSALES_SA_P1M1ML12_3MMAvBMZN"] = "Real retail sales, %oya, 3mma, relative"

# Production of factors and thematic factors

dix = dict_ea

dicx = dicx_ea

for fact in dix.keys():

# Original factors

xcatx = list(dix[fact].keys())

dicx[fact] = {}

dicx[fact]["OR"] = xcatx

# Relatives to benchmark (if required)

vbms = [values[0] for values in dix[fact].values()]

xcatxx = [xc for xc, bm in zip(xcatx, vbms) if bm == "vBM"]

if len(xcatxx) > 0:

dfa_usd = msp.make_relative_value(

dfx, xcatxx, cids_usd, basket=["USD"], postfix="vBM"

)

dfa_eur = msp.make_relative_value(

dfx, xcatxx, cids_eur, basket=["EUR"], postfix="vBM"

)

dfa_eud = msp.make_relative_value(

dfx, xcatxx, cids_eud, basket=["EUR", "USD"], postfix="vBM"

)

dfa = pd.concat([dfa_eur, dfa_usd, dfa_eud])

dfx = msm.update_df(dfx, dfa)

dicx[fact]["BM"] = [xc + bm for xc, bm in zip(xcatx, vbms)]

# Sign for hypothesized positive relation

xcatxx = dicx[fact]["BM"]

negs = [values[1] for values in dix[fact].values()]

calcs = []

for xc, neg in zip(xcatxx, negs):

if neg == "_NEG":

calcs += [f"{xc}_NEG = - {xc}"]

if len(calcs) > 0:

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cids_fx)

dfx = msm.update_df(dfx, dfa)

dicx[fact]["SG"] = [xc + neg for xc, neg in zip(xcatxx, negs)]

# Sequential scoring

xcatxx = dicx[fact]["SG"]

cidx = cids_fx

dfa = pd.DataFrame(columns=list(dfx.columns))

for xc in xcatxx:

dfaa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="ZN",

est_freq="m",

)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

dicx[fact]["ZN"] = [xc + "ZN" for xc in xcatxx]

# Checking original and modified constituents

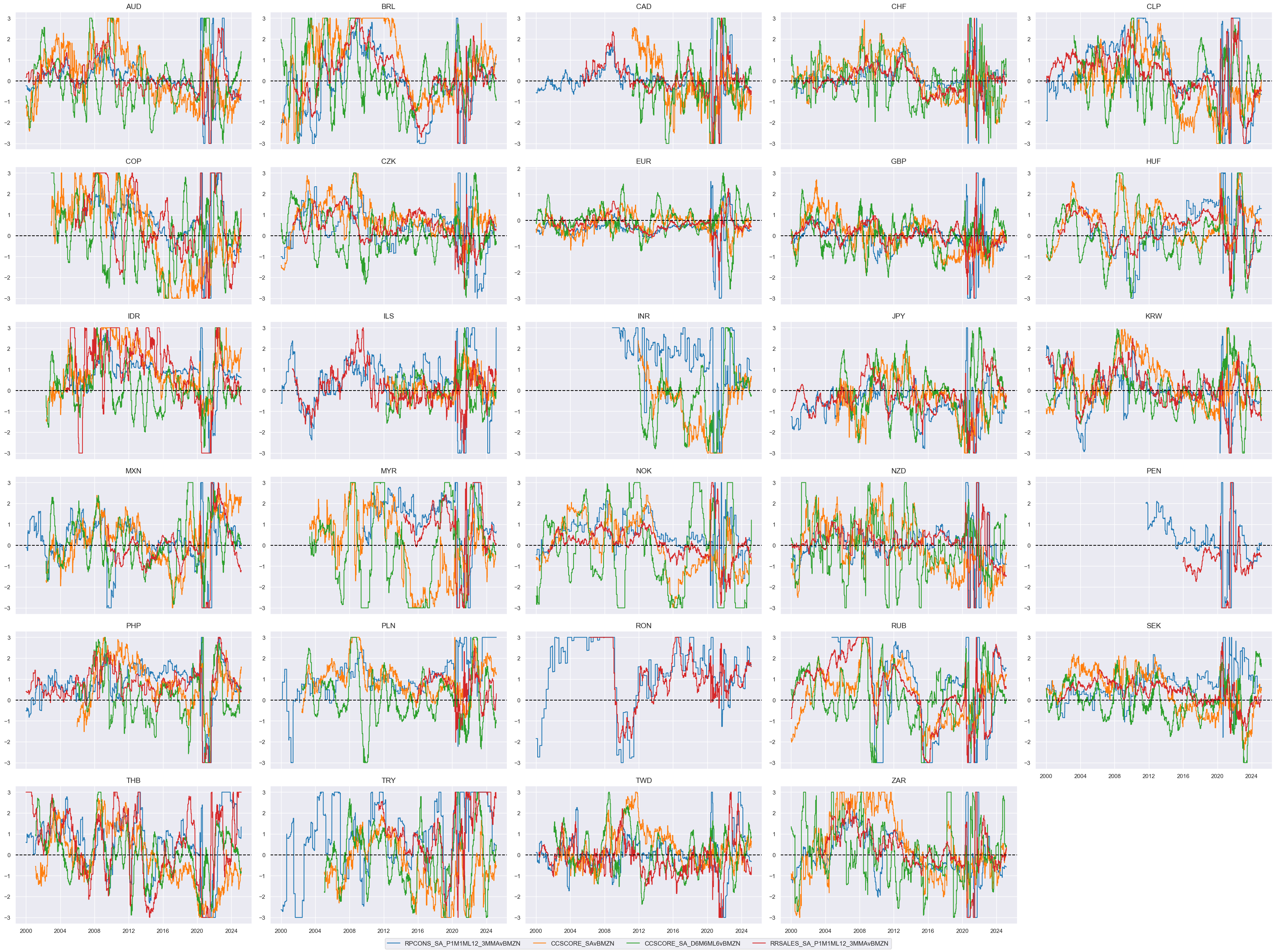

fact = "CONS_GROWTH" # "OUTPUT_GROWTH", "MBC_CHANGE", "LAB_TIGHT", "CONS_GROWTH"

xcatx = dicx_ea[fact]["ZN"] # "OR", "BM", "SG", "ZN"

cidx = cids_fx

msp.view_timelines(

df=dfx,

xcats=xcatx,

cids=cidx,

start="2000-01-01",

aspect=1.6,

same_y=False,

ncol=5,

title = None,

xcat_labels = None

)

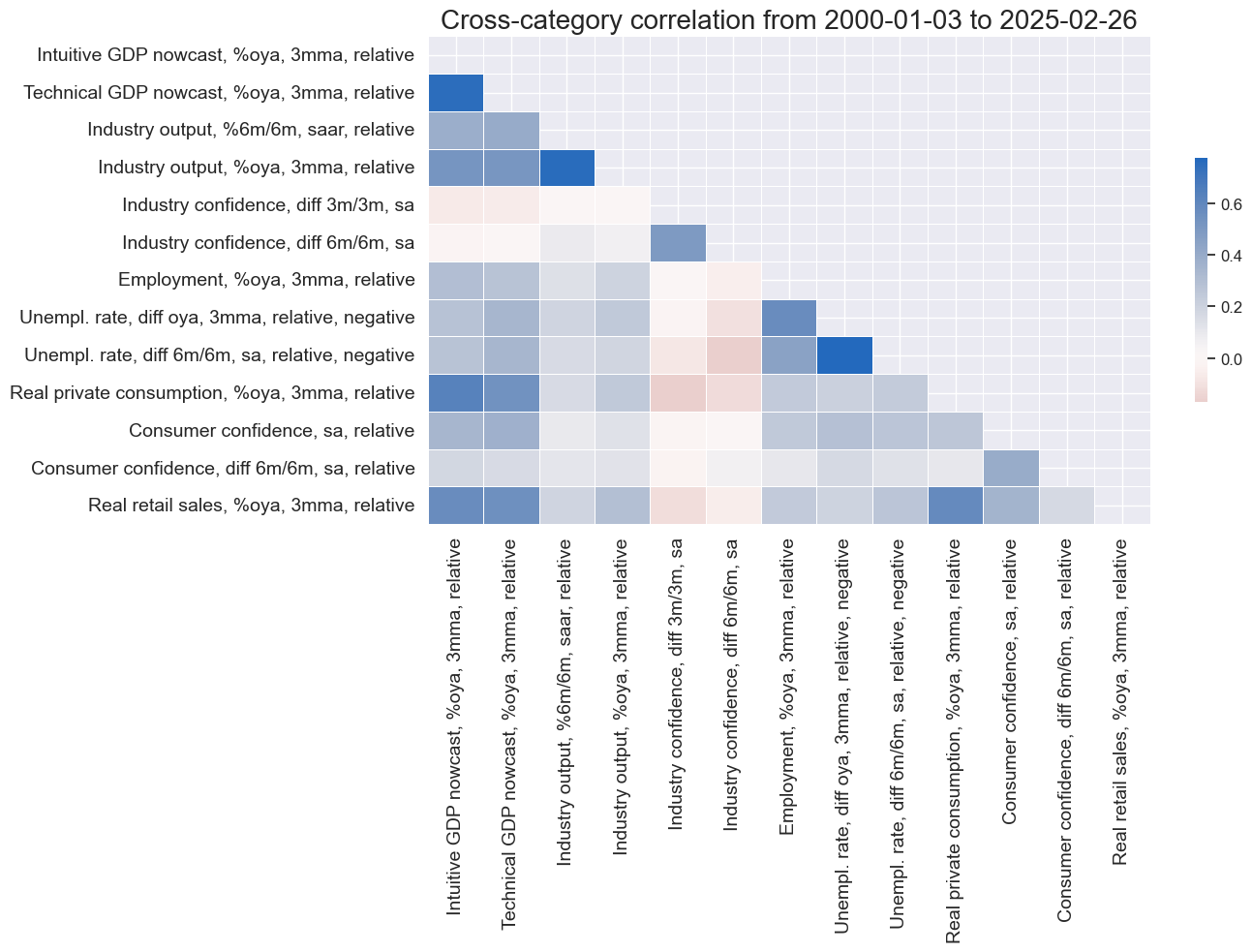

# Correlation matrix of final constituents

xcatx = [item for value in dicx_ea.values() if 'ZN' in value for item in value['ZN']]

cidx = cids_fx

sdate = "2000-01-01"

labels = [dict_lab[xc] for xc in xcatx]

msp.correl_matrix(

dfx,

xcats=xcatx,

cids=cidx,

start=sdate,

freq="M",

cluster=False,

title=None,

size=(14, 10),

xcat_labels=labels,

)

# Factors and re-scoring

dicx = dicx_ea

cidx = cids_fx

factors = list(dicx.keys())

# Factors as average of constituent scores

for fact in factors:

xcatx = dicx[fact]["ZN"]

dfa = msp.linear_composite(

dfx,

xcats=xcatx,

cids=cidx,

complete_xcats=False,

new_xcat=fact,

)

dfx = msm.update_df(dfx, dfa)

# Sequential re-scoring

dfa = pd.DataFrame(columns=list(dfx.columns))

for fact in factors:

dfaa = msp.make_zn_scores(

dfx,

xcat=fact,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="ZN",

est_freq="m",

)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

dict_themes["REL_ECON_GROWTH"] = [fact + "ZN" for fact in factors]

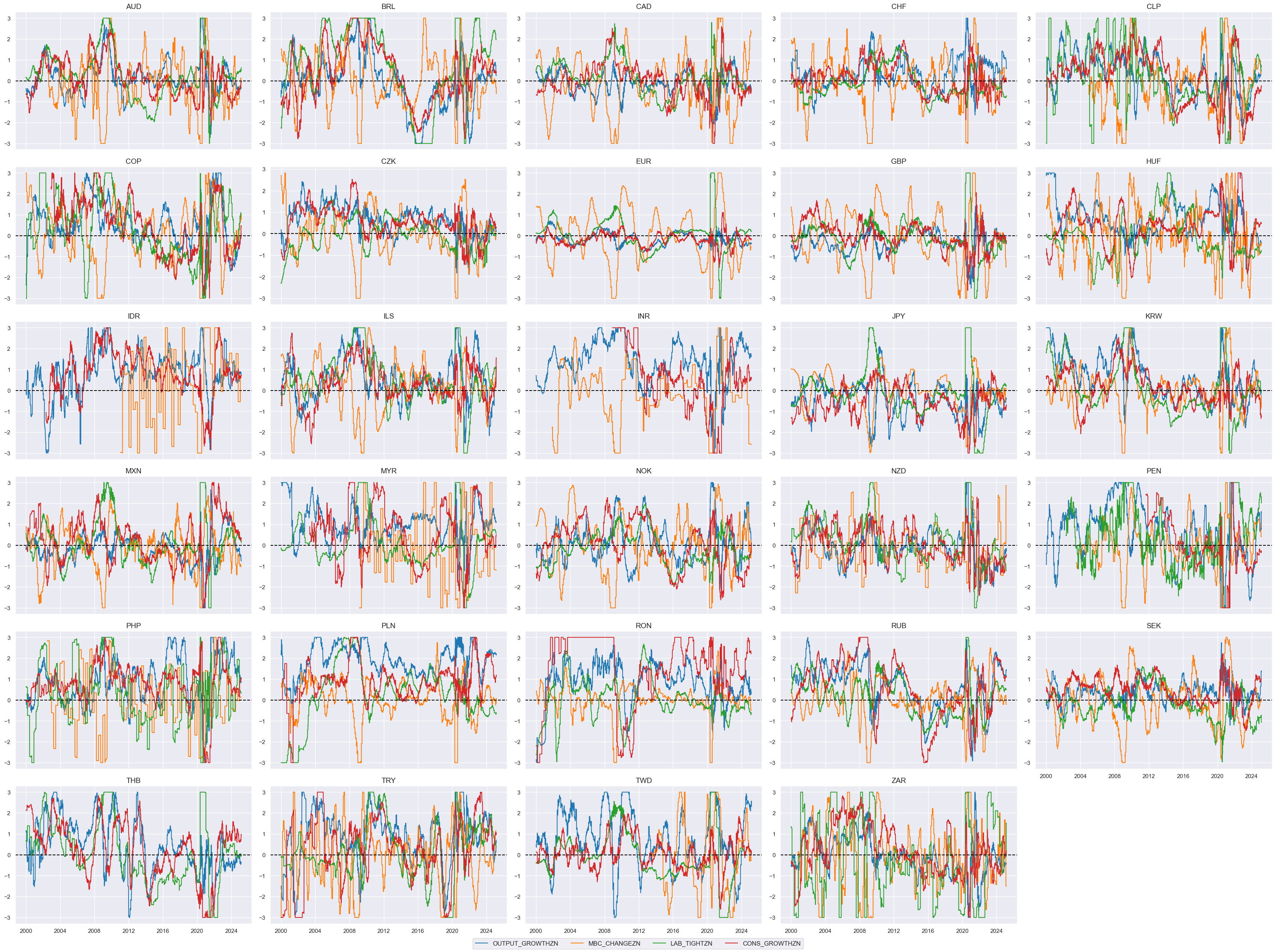

# Checking constituent factor timelines

xcatx = dict_themes["REL_ECON_GROWTH"]

cidx = cids_fx

msp.view_timelines(

df=dfx,

xcats=xcatx,

cids=cidx,

start="2000-01-01",

aspect=1.6,

same_y=False,

ncol=5,

title = None,

xcat_labels = None

)

Monetary policy factors #

# Preparation of categories for constituent factors

cidx = cids

# Preparation: for relative target deviations, we need denominator bases that should never be less than 2

dfa = msp.panel_calculator(df, ["INFTEBASIS = INFTEFF_NSA.clip(lower=2)"], cids=cidx)

dfx = msm.update_df(dfx, dfa)

xcatx = cpi_inf + pcredit_growth

calcs = [f"XR{xc} = ( {xc} - INFTEFF_NSA ) / INFTEBASIS" for xc in xcatx]

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cidx)

dfx = msm.update_df(dfx, dfa)

# Governing dictionary for constituent factors

dict_mp = {

"EXCESS_INFLATION": {

"XRCPIH_SA_P1M1ML12": ["vBM", ""],

"XRCPIH_SJA_P6M6ML6AR": ["vBM", ""],

"XRCPIC_SA_P1M1ML12": ["vBM", ""],

"XRCPIC_SJA_P6M6ML6AR": ["vBM", ""],

"XRINFE2Y_JA": ["vBM", ""],

},

"XPCREDIT_GROWTH": {

"XRPCREDITBN_SJA_P1M1ML12": ["vBM", ""],

"XRPCREDITGDP_SJA_D1M1ML12": ["vBM", ""],

},

"REAL_RATES": {

"RIR_NSA": ["vBM", ""],

"RYLDIRS05Y_NSA": ["vBM", ""],

"FXCRR_NSA": ["", ""],

"FXCRR_VT10": ["", ""],

"FXCRRHvGDRB_NSA": ["", ""],

},

"LIQ_TIGHT": {

"MBASEGDP_SA_D1M1ML3": ["vBM", "_NEG"],

"MBASEGDP_SA_D1M1ML6": ["vBM", "_NEG"],

"INTLIQGDP_NSA_D1M1ML3": ["vBM", "_NEG"],

"INTLIQGDP_NSA_D1M1ML6": ["vBM", "_NEG"],

},

}

# Dictionary for transformed category names

dicx_mp = {}

# Add labels (in final transformed form)

dict_lab["EXCESS_INFLATIONZN"] = "Relative excess inflation ratios"

dict_lab["XPCREDIT_GROWTHZN"] = "Relative excess credit growth"

dict_lab["REAL_RATESZN"] = "Real rate differentials and carry"

dict_lab["LIQ_TIGHTZN"] = "Relative liquidity tightening"

dict_lab["XRCPIH_SA_P1M1ML12vBMZN"] = "Excess headline CPI inflation, %oya, relative"

dict_lab["XRCPIH_SJA_P6M6ML6ARvBMZN"] = "Excess headline CPI inflation, %6m/6m, saar, relative"

dict_lab["XRCPIC_SA_P1M1ML12vBMZN"] = "Excess core CPI inflation, %oya, relative"

dict_lab["XRCPIC_SJA_P6M6ML6ARvBMZN"] = "Excess core CPI inflation, %6m/6m, saar, relative"

dict_lab["XRINFE2Y_JAvBMZN"] = "Excess 2-year inflation expectations, %, relative"

dict_lab["XRPCREDITBN_SJA_P1M1ML12vBMZN"] = "Excess private credit growth, %oya, relative"

dict_lab["XRPCREDITGDP_SJA_D1M1ML12vBMZN"] = "Excess private credit growth, diff as % of GDP, relative"

dict_lab["RIR_NSAvBMZN"] = "Real 1-month interest rate differential"

dict_lab["RYLDIRS05Y_NSAvBMZN"] = "Real 5-year IRS yield differential"

dict_lab["FXCRR_NSAZN"] = "Real FX forward carry"

dict_lab["FXCRR_VT10ZN"] = "Real FX forward carry for 10% ar vol target"

dict_lab["FXCRRHvGDRB_NSAZN"] = "Real hedged FX forward carry"

dict_lab["MBASEGDP_SA_D1M1ML3vBM_NEGZN"] = "Monetary base, as % of GDP, diff over 3m, relative, negative"

dict_lab["MBASEGDP_SA_D1M1ML6vBM_NEGZN"] = "Monetary base, as % of GDP, diff over 6m, relative, negative"

dict_lab["INTLIQGDP_NSA_D1M1ML3vBM_NEGZN"] = "Intervention liquidity, as % of GDP, %oya, 3mma, relative, negative"

dict_lab["INTLIQGDP_NSA_D1M1ML6vBM_NEGZN"] = "Intervention liquidity, as % of GDP, %oya, 6mma, relative, negative"

# Production of factors and thematic factors

dix = dict_mp

dicx = dicx_mp

for fact in dix.keys():

# Original factors

xcatx = list(dix[fact].keys())

dicx[fact] = {}

dicx[fact]["OR"] = xcatx

# Relatives to benchmark (if required)

vbms = [values[0] for values in dix[fact].values()]

xcatxx = [xc for xc, bm in zip(xcatx, vbms) if bm == "vBM"]

if len(xcatxx) > 0:

dfa_usd = msp.make_relative_value(

dfx, xcatxx, cids_usd, basket=["USD"], postfix="vBM"

)

dfa_eur = msp.make_relative_value(

dfx, xcatxx, cids_eur, basket=["EUR"], postfix="vBM"

)

dfa_eud = msp.make_relative_value(

dfx, xcatxx, cids_eud, basket=["EUR", "USD"], postfix="vBM"

)

dfa = pd.concat([dfa_eur, dfa_usd, dfa_eud])

dfx = msm.update_df(dfx, dfa)

dicx[fact]["BM"] = [xc + bm for xc, bm in zip(xcatx, vbms)]

# Sign for hypothesized positive relation

xcatxx = dicx[fact]["BM"]

negs = [values[1] for values in dix[fact].values()]

calcs = []

for xc, neg in zip(xcatxx, negs):

if neg == "_NEG":

calcs += [f"{xc}_NEG = - {xc}"]

if len(calcs) > 0:

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cids_fx)

dfx = msm.update_df(dfx, dfa)

dicx[fact]["SG"] = [xc + neg for xc, neg in zip(xcatxx, negs)]

# Sequential scoring

xcatxx = dicx[fact]["SG"]

cidx = cids_fx

dfa = pd.DataFrame(columns=list(dfx.columns))

for xc in xcatxx:

dfaa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="ZN",

est_freq="m",

)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

dicx[fact]["ZN"] = [xc + "ZN" for xc in xcatxx]

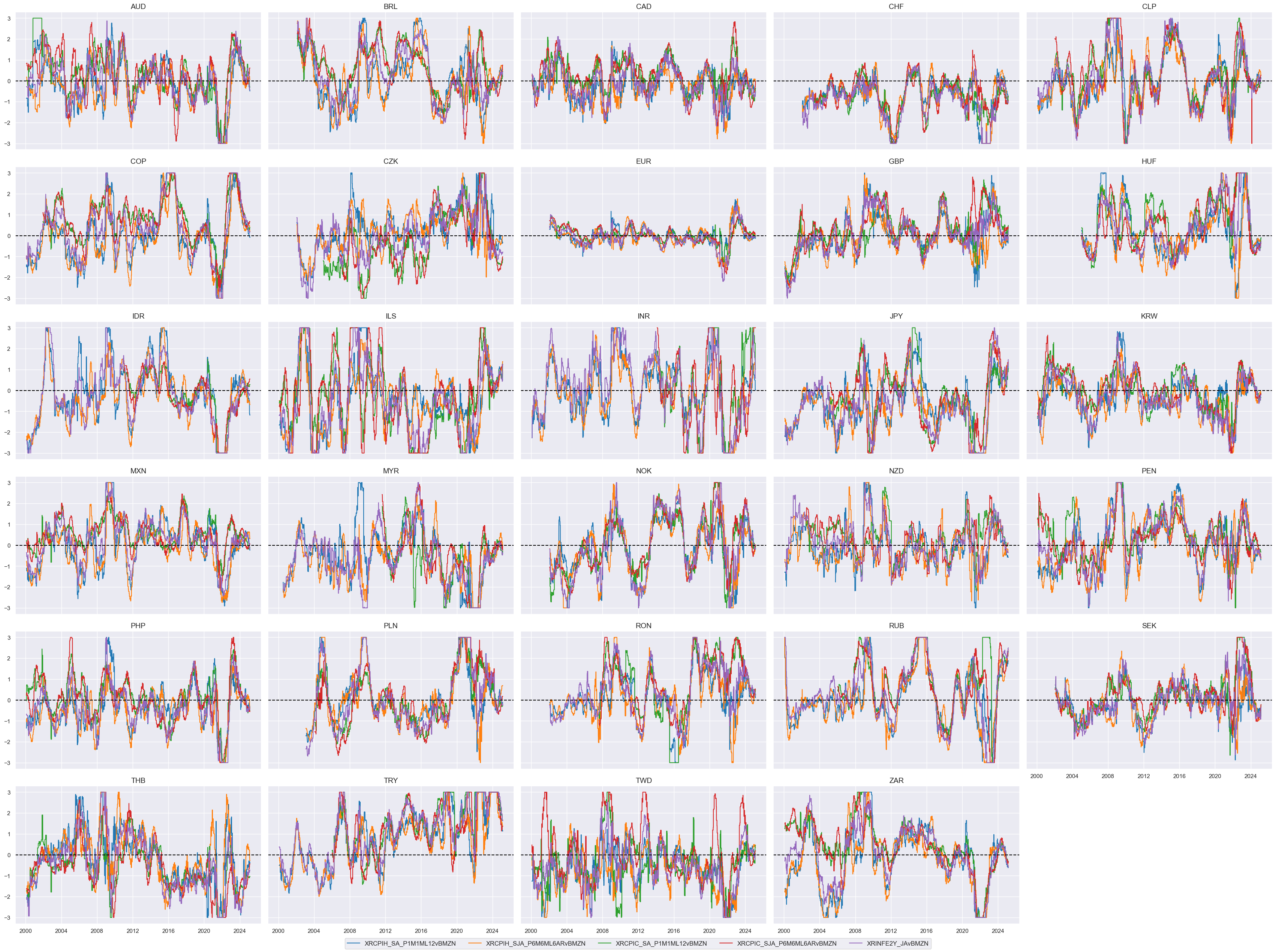

# Checking original and modified constituents

fact = "EXCESS_INFLATION" # "EXCESS_INFLATION", "XPCREDIT_GROWTH", "REAL_RATES", "LIQ_TIGHT"

xcatx = dicx_mp[fact]["ZN"] # "OR", "BM", "SG", "ZN"

cidx = cids_fx

msp.view_timelines(

df=dfx,

xcats=xcatx,

cids=cidx,

start="2000-01-01",

aspect=1.6,

same_y=True,

ncol=5,

title = None,

xcat_labels = None

)

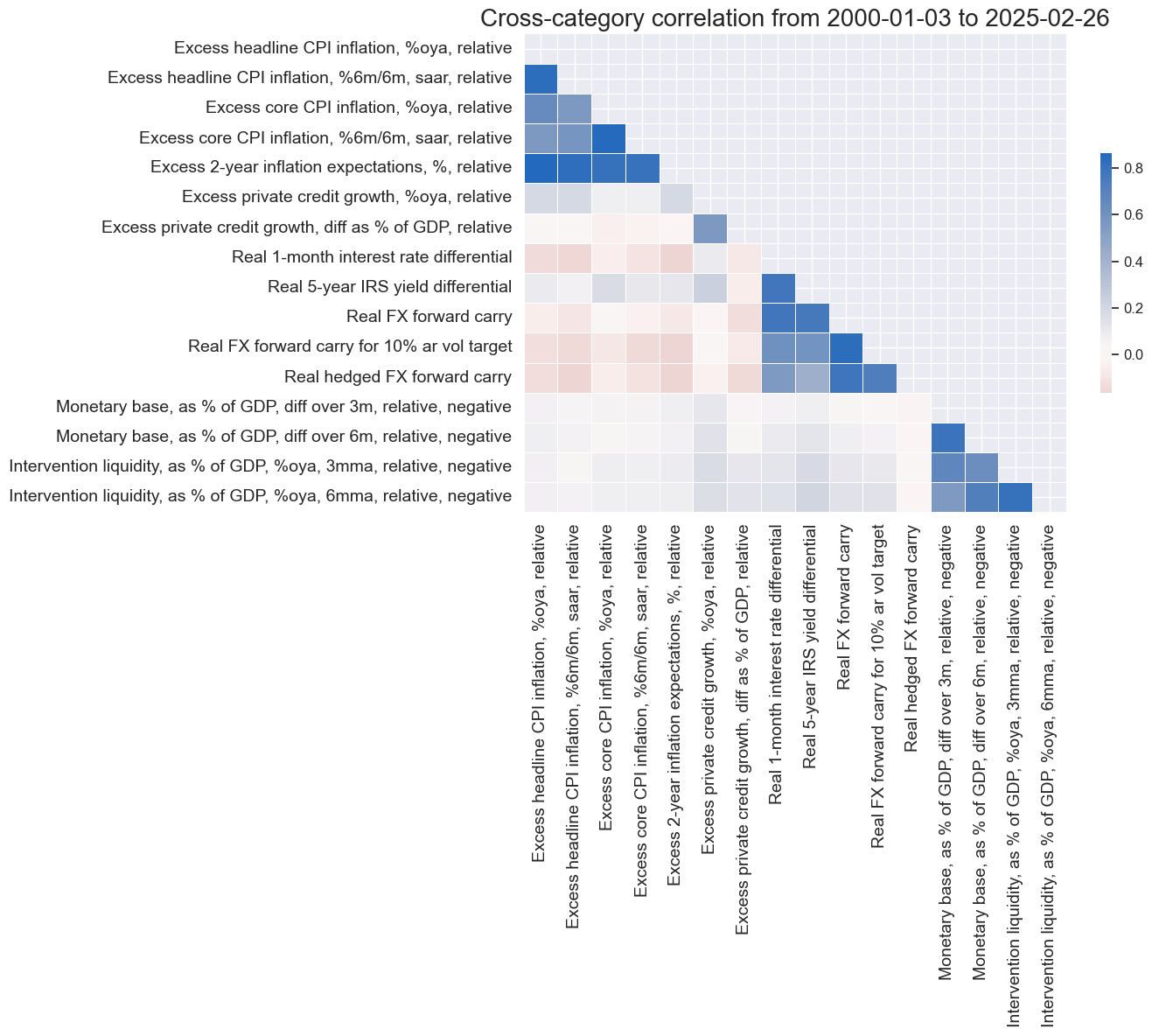

# Correlation matrix of final constituents

xcatx = [item for value in dicx_mp.values() if 'ZN' in value for item in value['ZN']]

cidx = cids_fx

sdate = "2000-01-01"

labels = [dict_lab[xc] for xc in xcatx]

msp.correl_matrix(

dfx,

xcats=xcatx,

cids=cidx,

start=sdate,

freq="M",

cluster=False,

title=None,

size=(14, 12),

xcat_labels=labels,

)

# Factors and re-scoring

dicx = dicx_mp

cidx = cids_fx

factors = list(dicx.keys())

# Factors as average of constituent scores

for fact in factors:

xcatx = dicx[fact]["ZN"]

dfa = msp.linear_composite(

dfx,

xcats=xcatx,

cids=cidx,

complete_xcats=False,

new_xcat=fact,

)

dfx = msm.update_df(dfx, dfa)

# Sequential re-scoring

dfa = pd.DataFrame(columns=list(dfx.columns))

for fact in factors:

dfaa = msp.make_zn_scores(

dfx,

xcat=fact,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="ZN",

est_freq="m",

)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

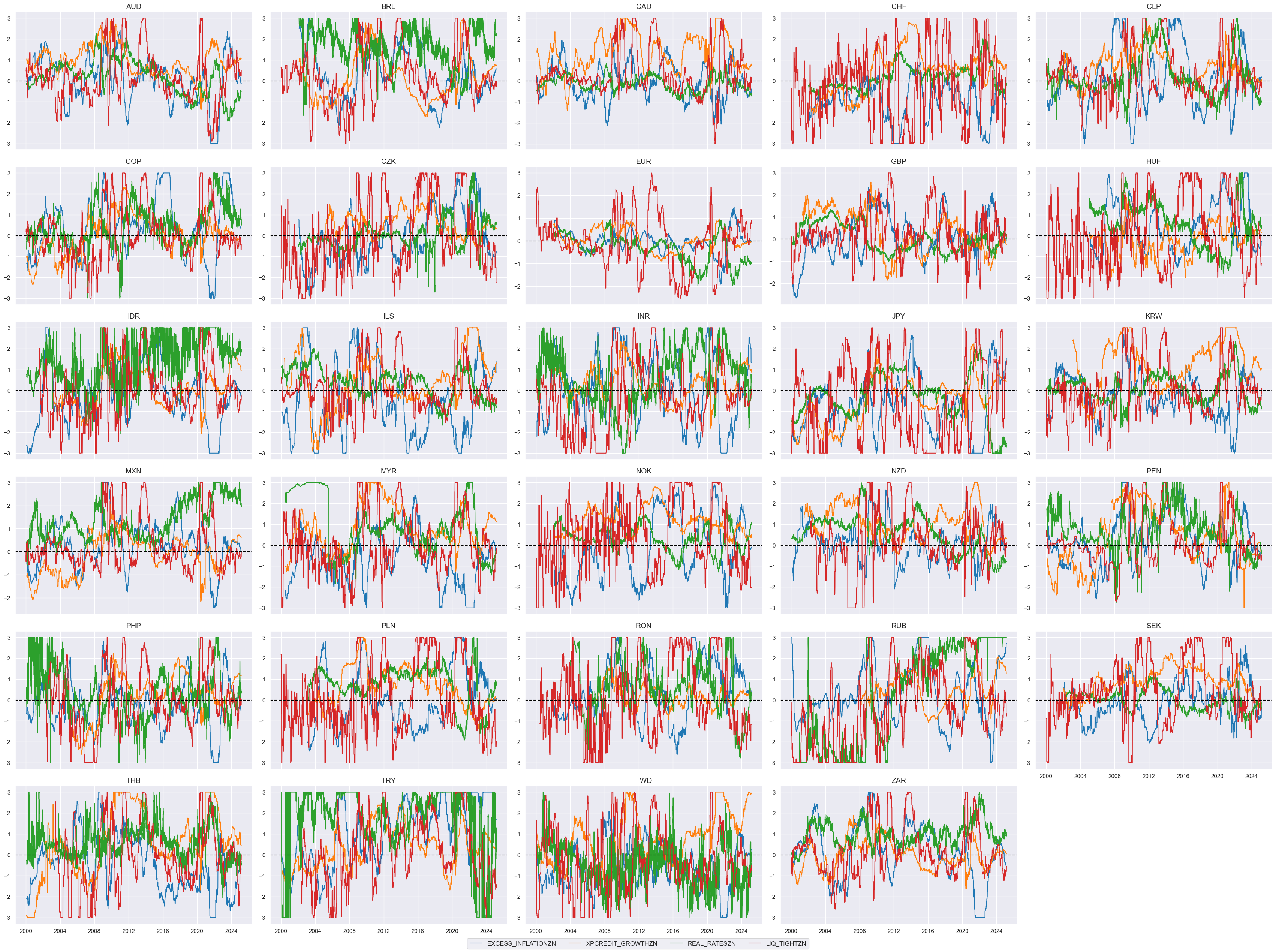

dict_themes["REL_MONPOL_TIGHT"] = [fact + "ZN" for fact in factors]

# Checking constituent factor timelines

xcatx = dict_themes["REL_MONPOL_TIGHT"]

cidx = cids_fx

msp.view_timelines(

df=dfx,

xcats=xcatx,

cids=cidx,

start="2000-01-01",

aspect=1.6,

same_y=False,

ncol=5,

title = None,

xcat_labels = None

)

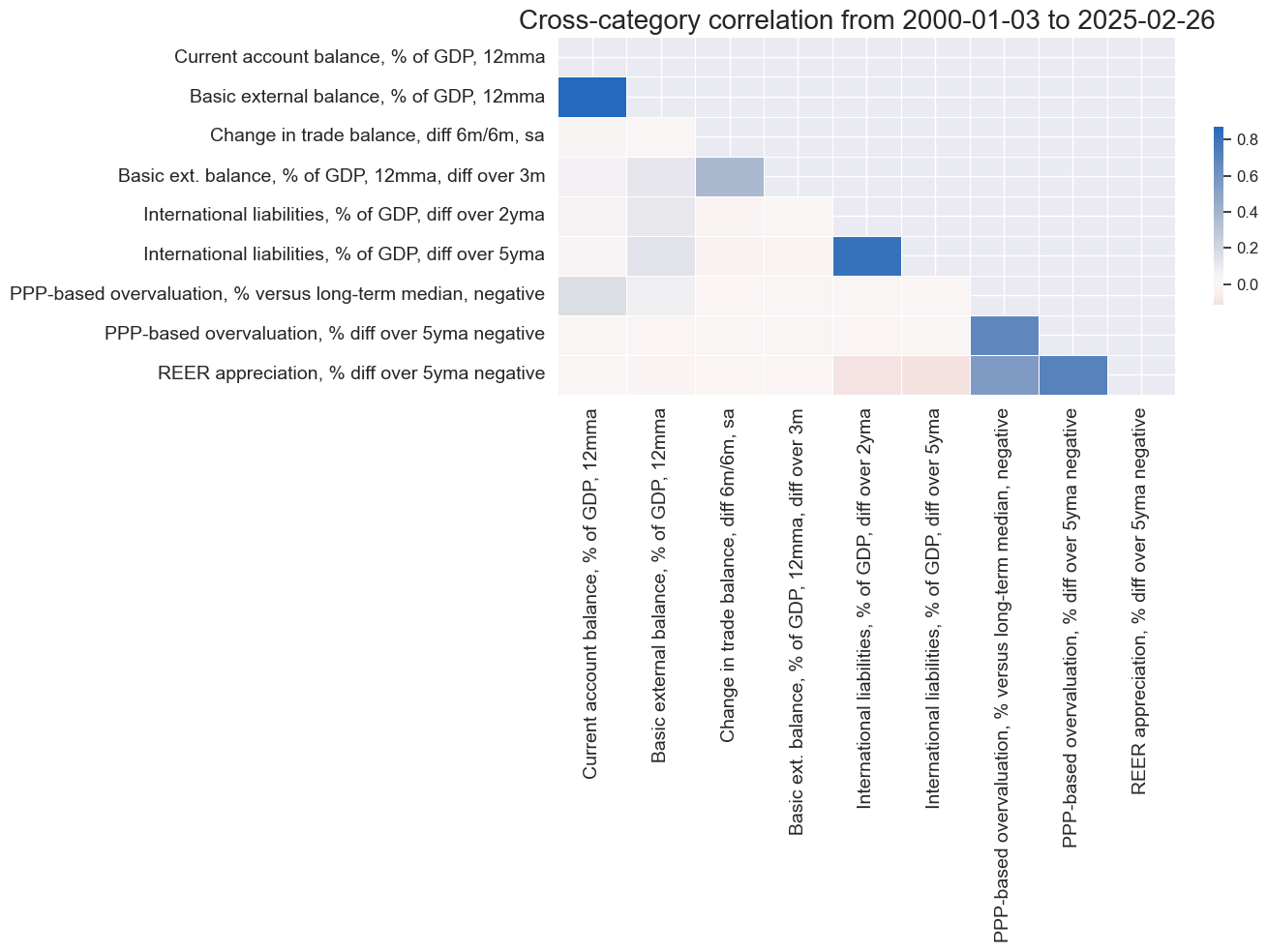

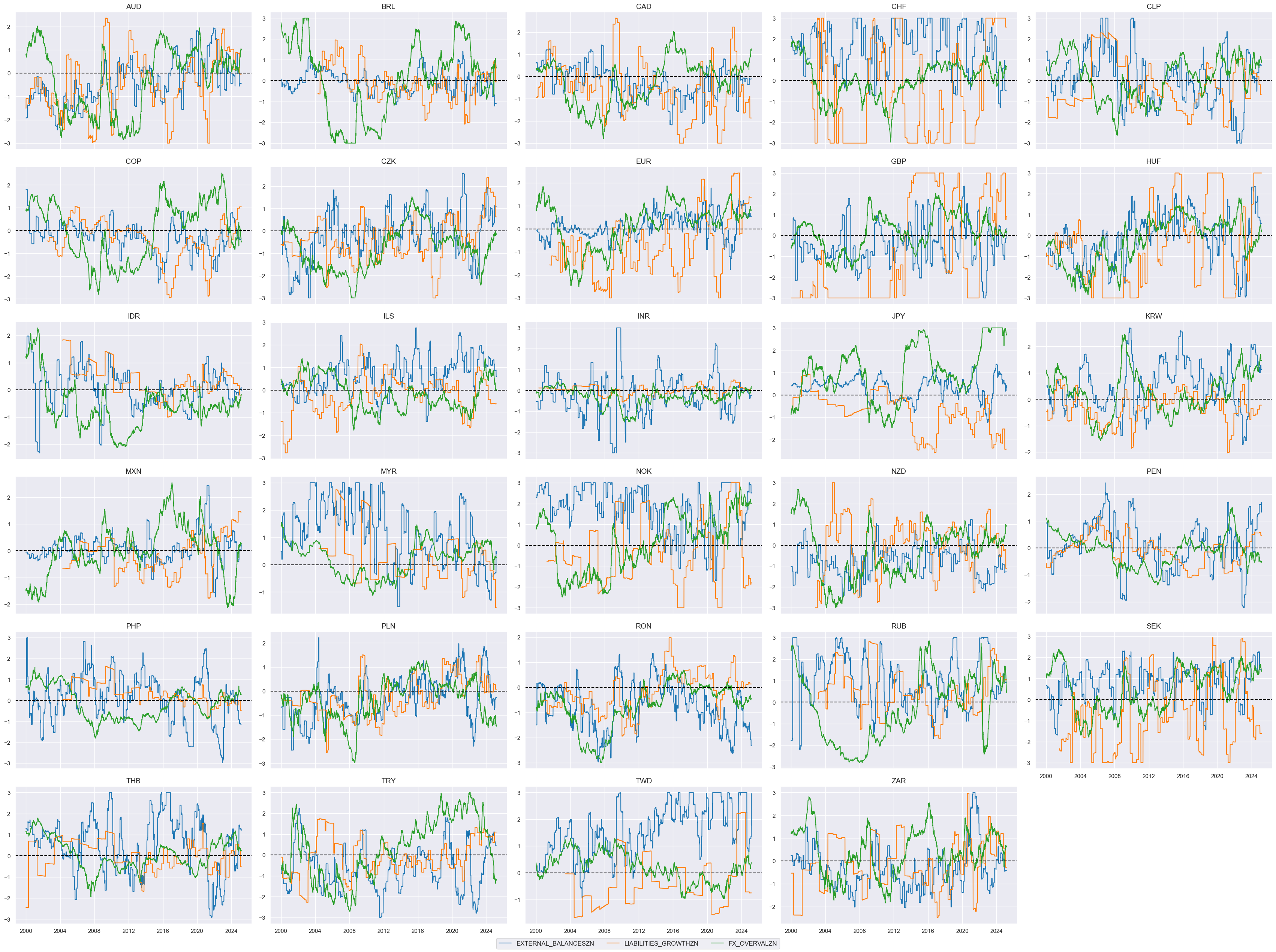

External position and valuation factors #

# Governing dictionary for constituent factors

dict_xv = {

"EXTERNAL_BALANCES": {

"CABGDPRATIO_NSA_12MMA": ["", ""],

"BXBGDPRATIO_NSA_12MMA": ["", ""],

"MTBGDPRATIO_SA_6MMA_D1M1ML6": ["", ""],

"BXBGDPRATIO_NSA_12MMA_D1M1ML3": ["", ""],

},

"LIABILITIES_GROWTH": {

"IIPLIABGDP_NSA_D1Mv2YMA": ["", "_NEG"],

"IIPLIABGDP_NSA_D1Mv5YMA": ["", "_NEG"],

},

"FX_OVERVAL": {

"PPPFXOVERVALUE_NSA_P1DvLTXL1": ["", "_NEG"],

"PPPFXOVERVALUE_NSA_D1M60ML1": ["", "_NEG"],

"REER_NSA_P1M60ML1": ["", "_NEG"],

},

}

# Dictionary for transformed category names

dicx_xv = {}

# Add labels (in final transformed form)

dict_lab["EXTERNAL_BALANCESZN"] = "External balances ratios"

dict_lab["LIABILITIES_GROWTHZN"] = "Liabilities growth (negative)"

dict_lab["FX_OVERVALZN"] = "FX overvaluation (negative)"

dict_lab["CABGDPRATIO_NSA_12MMAZN"] = "Current account balance, % of GDP, 12mma"

dict_lab["BXBGDPRATIO_NSA_12MMAZN"] = "Basic external balance, % of GDP, 12mma"

dict_lab["MTBGDPRATIO_SA_6MMA_D1M1ML6ZN"] = "Change in trade balance, diff 6m/6m, sa"

dict_lab["BXBGDPRATIO_NSA_12MMA_D1M1ML3ZN"] = "Basic ext. balance, % of GDP, 12mma, diff over 3m"

dict_lab["IIPLIABGDP_NSA_D1Mv2YMA_NEGZN"] = "International liabilities, % of GDP, diff over 2yma"

dict_lab["IIPLIABGDP_NSA_D1Mv5YMA_NEGZN"] = "International liabilities, % of GDP, diff over 5yma"

dict_lab["PPPFXOVERVALUE_NSA_P1DvLTXL1_NEGZN"] = "PPP-based overvaluation, % versus long-term median, negative"

dict_lab["PPPFXOVERVALUE_NSA_D1M60ML1_NEGZN"] = "PPP-based overvaluation, % diff over 5yma negative"

dict_lab["REER_NSA_P1M60ML1_NEGZN"] = "REER appreciation, % diff over 5yma negative"

# Production of factors and thematic factors

dix = dict_xv

dicx = dicx_xv

for fact in dix.keys():

# Original factors

xcatx = list(dix[fact].keys())

dicx[fact] = {}

dicx[fact]["OR"] = xcatx

# Relatives to benchmark (if required)

vbms = [values[0] for values in dix[fact].values()]

xcatxx = [xc for xc, bm in zip(xcatx, vbms) if bm == "vBM"]

if len(xcatxx) > 0:

dfa_usd = msp.make_relative_value(

dfx, xcatxx, cids_usd, basket=["USD"], postfix="vBM"

)

dfa_eur = msp.make_relative_value(

dfx, xcatxx, cids_eur, basket=["EUR"], postfix="vBM"

)

dfa_eud = msp.make_relative_value(

dfx, xcatxx, cids_eud, basket=["EUR", "USD"], postfix="vBM"

)

dfa = pd.concat([dfa_eur, dfa_usd, dfa_eud])

dfx = msm.update_df(dfx, dfa)

dicx[fact]["BM"] = [xc + bm for xc, bm in zip(xcatx, vbms)]

# Sign for hypothesized positive relation

xcatxx = dicx[fact]["BM"]

negs = [values[1] for values in dix[fact].values()]

calcs = []

for xc, neg in zip(xcatxx, negs):

if neg == "_NEG":

calcs += [f"{xc}_NEG = - {xc}"]

if len(calcs) > 0:

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cids_fx)

dfx = msm.update_df(dfx, dfa)

dicx[fact]["SG"] = [xc + neg for xc, neg in zip(xcatxx, negs)]

# Sequential scoring

xcatxx = dicx[fact]["SG"]

cidx = cids_fx

dfa = pd.DataFrame(columns=list(dfx.columns))

for xc in xcatxx:

dfaa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="ZN",

est_freq="m",

)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

dicx[fact]["ZN"] = [xc + "ZN" for xc in xcatxx]

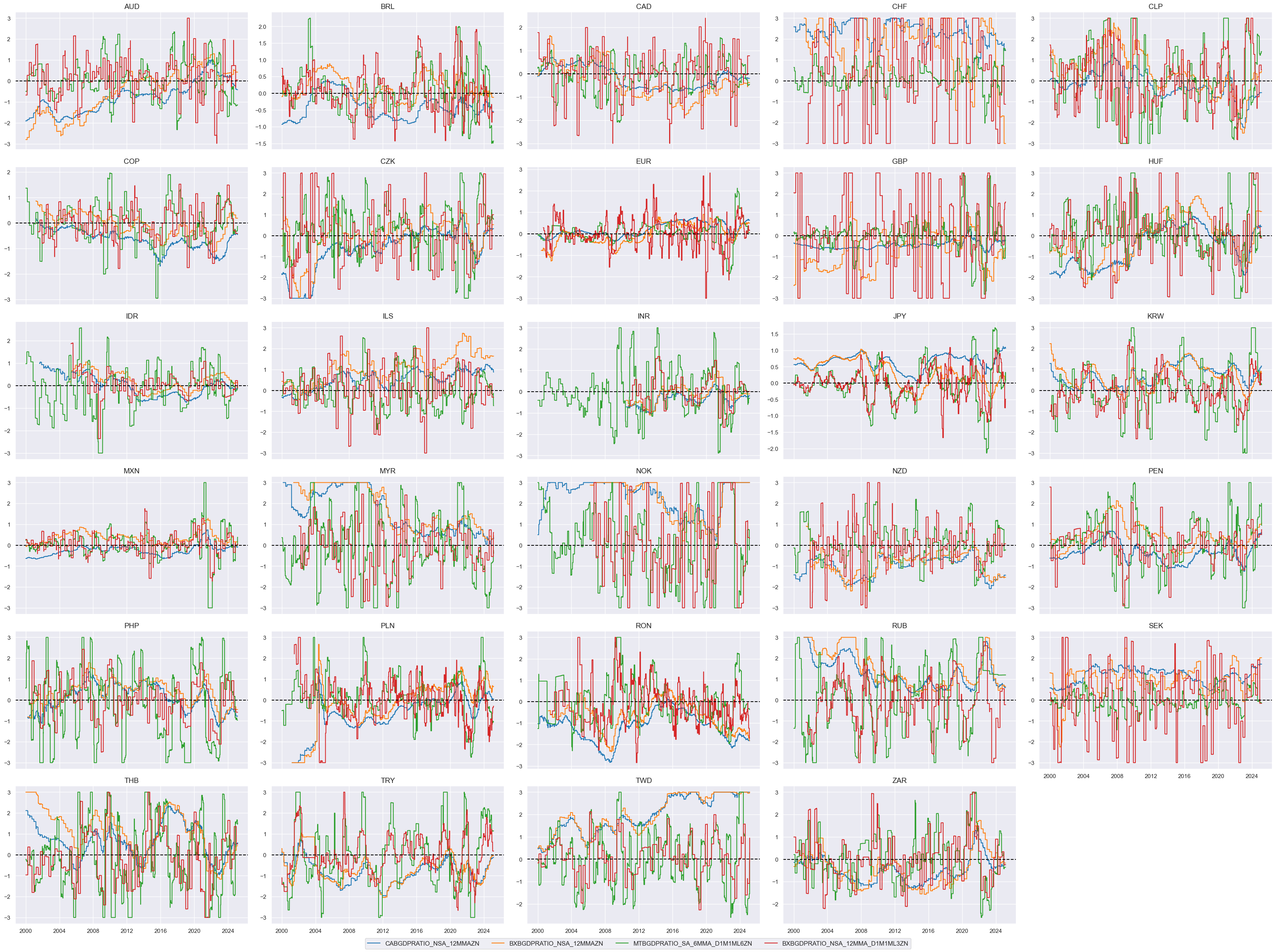

# Checking original and modified constituents

fact = "EXTERNAL_BALANCES" # "EXTERNAL_BALANCES", "LIABILITIES_GROWTH", "FX_OVERVAL"

xcatx = dicx_xv[fact]["ZN"] # "OR", "BM", "SG", "ZN"

cidx = cids_fx

msp.view_timelines(

df=dfx,

xcats=xcatx,

cids=cidx,

start="2000-01-01",

aspect=1.6,

same_y=False,

ncol=5,

title = None,

xcat_labels = None

)

# Correlation matrix of final constituents

xcatx = [item for value in dicx_xv.values() if 'ZN' in value for item in value['ZN']]

cidx = cids_fx

sdate = "2000-01-01"

labels = [dict_lab[xc] for xc in xcatx]

msp.correl_matrix(

dfx,

xcats=xcatx,

cids=cidx,

start=sdate,

freq="M",

cluster=False,

title=None,

size=(14, 10),

xcat_labels=labels,

)

# Factors and re-scoring

dicx = dicx_xv

cidx = cids_fx

factors = list(dicx.keys())

# Factors as average of constituent scores

for fact in factors:

xcatx = dicx[fact]["ZN"]

dfa = msp.linear_composite(

dfx,

xcats=xcatx,

cids=cidx,

complete_xcats=False,

new_xcat=fact,

)

dfx = msm.update_df(dfx, dfa)

# Sequential re-scoring

dfa = pd.DataFrame(columns=list(dfx.columns))

for fact in factors:

dfaa = msp.make_zn_scores(

dfx,

xcat=fact,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="ZN",

est_freq="m",

)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

dict_themes["EXTERNAL_VALUE"] = [fact + "ZN" for fact in factors]

# Checking constituent factor timelines

xcatx = dict_themes["EXTERNAL_VALUE"]

cidx = cids_fx

msp.view_timelines(

df=dfx,

xcats=xcatx,

cids=cidx,

start="2000-01-01",

aspect=1.6,

same_y=False,

ncol=5,

title = None,

xcat_labels = None

)

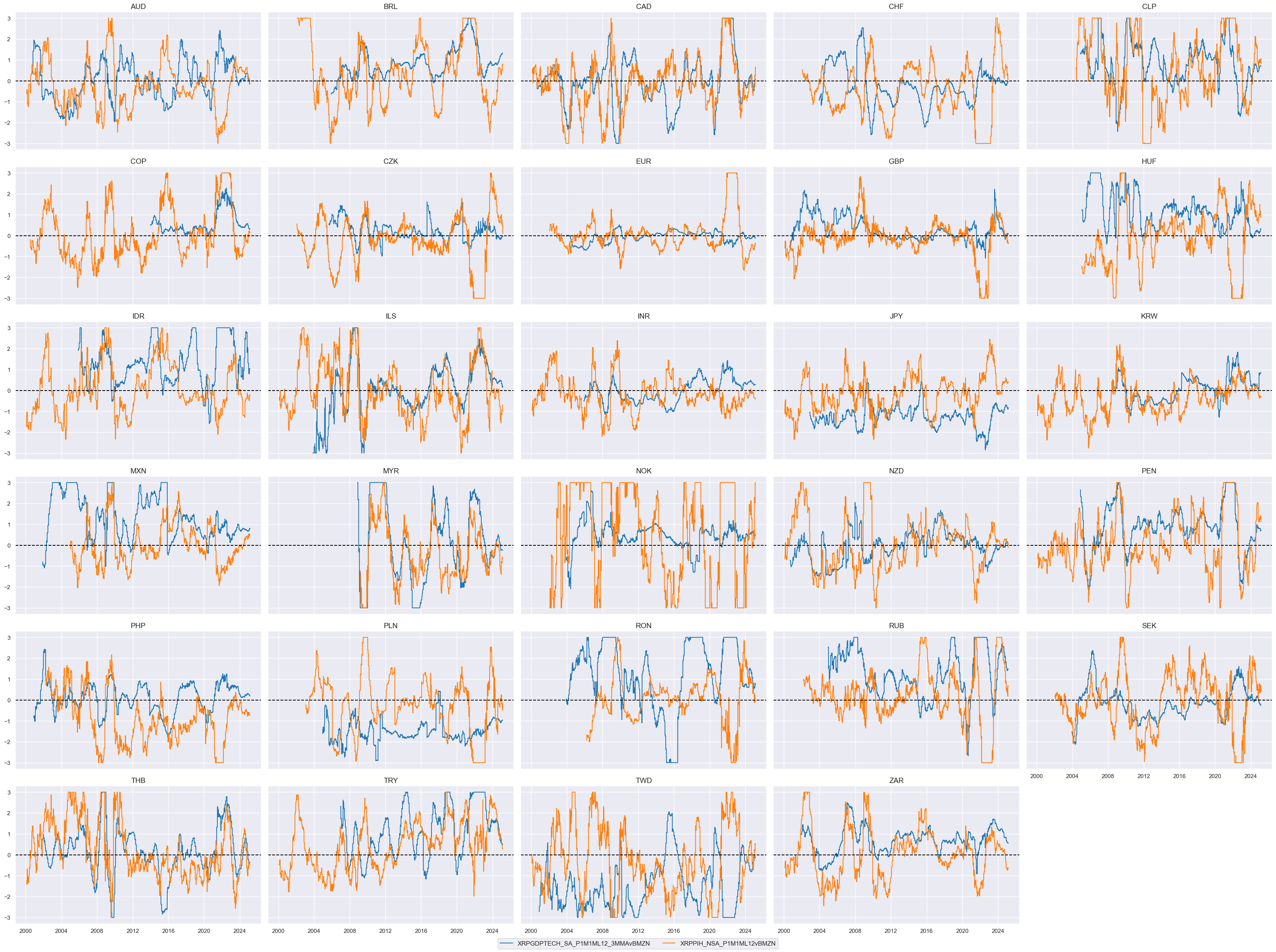

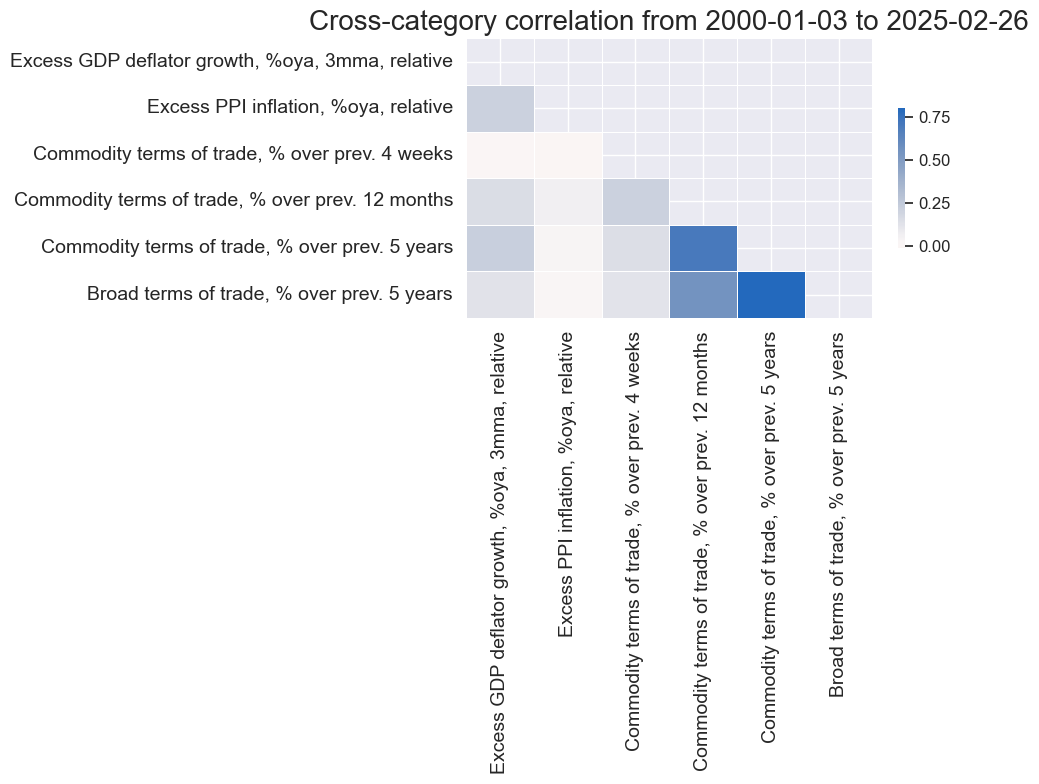

Price competitiveness factors #

# Preparation of categories for constituent factors

xcatx = ppi_pchange

cidx = cids

calcs = [f"XR{xc} = ( {xc} - INFTEFF_NSA ) / INFTEBASIS" for xc in xcatx]

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cidx)

dfx = msm.update_df(dfx, dfa)

# Governing dictionary for constituent factors

dict_pc = {

"EXCESS_PPIGROWTH": {

"XRPGDPTECH_SA_P1M1ML12_3MMA": ["vBM", ""],

"XRPPIH_NSA_P1M1ML12": ["vBM", ""],

},

"TOT_CHANGE": {

"CTOT_NSA_P1W4WL1": ["", ""],

"CTOT_NSA_P1M1ML12": ["", ""],

"CTOT_NSA_P1M60ML1": ["", ""],

"MTOT_NSA_P1M60ML1": ["", ""],

},

}

# Dictionary for transformed category names

dicx_pc = {}

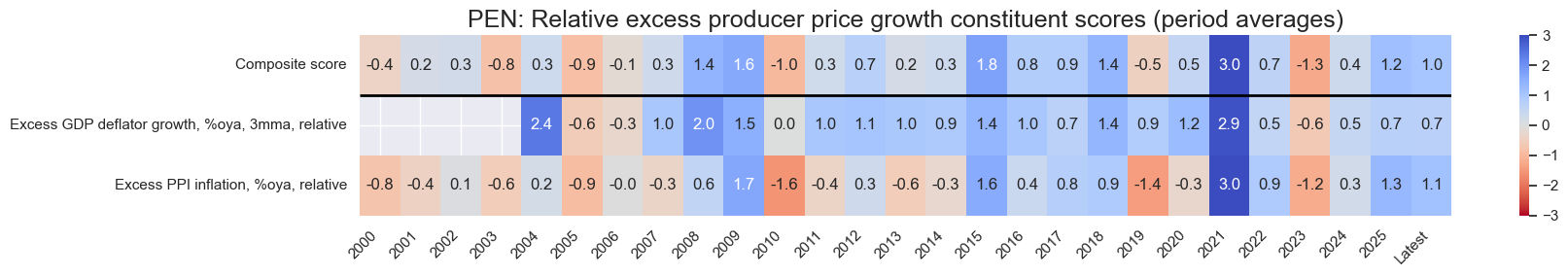

dict_lab["EXCESS_PPIGROWTHZN"] = "Relative excess producer price growth"

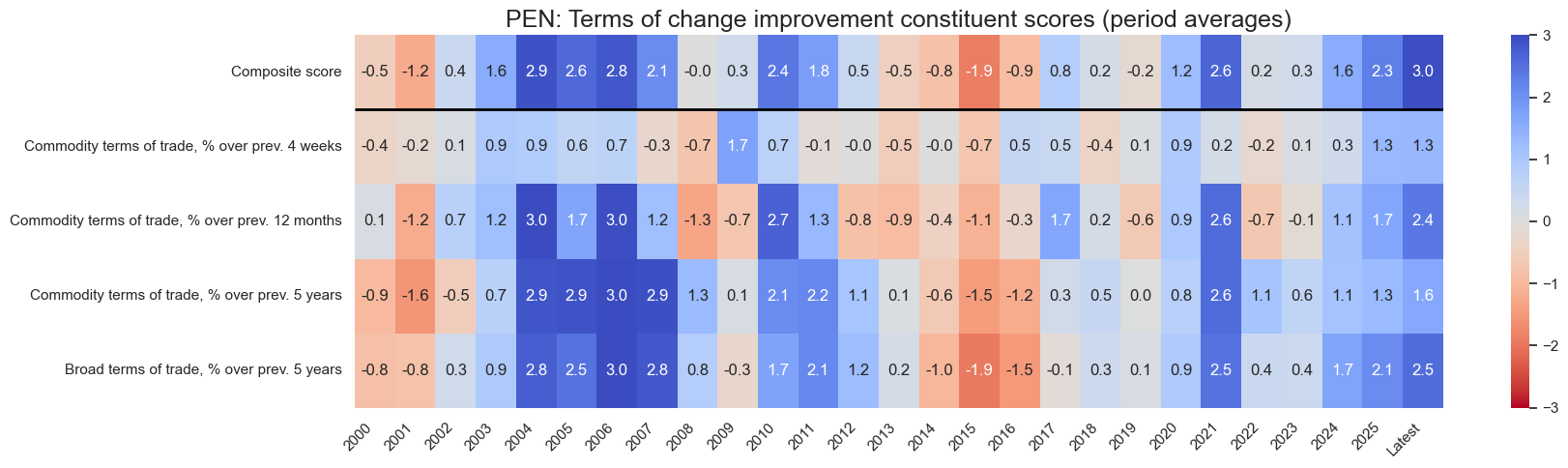

dict_lab["TOT_CHANGEZN"] = "Terms of change improvement"

dict_lab["XRPGDPTECH_SA_P1M1ML12_3MMAvBMZN"] = "Excess GDP deflator growth, %oya, 3mma, relative"

dict_lab["XRPPIH_NSA_P1M1ML12vBMZN"] = "Excess PPI inflation, %oya, relative"

dict_lab["CTOT_NSA_P1W4WL1ZN"] = "Commodity terms of trade, % over prev. 4 weeks"

dict_lab["CTOT_NSA_P1M1ML12ZN"] = "Commodity terms of trade, % over prev. 12 months"

dict_lab["CTOT_NSA_P1M60ML1ZN"] = "Commodity terms of trade, % over prev. 5 years"

dict_lab["MTOT_NSA_P1M60ML1ZN"] = "Broad terms of trade, % over prev. 5 years"

# Production of factors and thematic factors

dix = dict_pc

dicx = dicx_pc

for fact in dix.keys():

# Original factors

xcatx = list(dix[fact].keys())

dicx[fact] = {}

dicx[fact]["OR"] = xcatx

# Relatives to benchmark (if required)

vbms = [values[0] for values in dix[fact].values()]

xcatxx = [xc for xc, bm in zip(xcatx, vbms) if bm == "vBM"]

if len(xcatxx) > 0:

dfa_usd = msp.make_relative_value(

dfx, xcatxx, cids_usd, basket=["USD"], postfix="vBM"

)

dfa_eur = msp.make_relative_value(

dfx, xcatxx, cids_eur, basket=["EUR"], postfix="vBM"

)

dfa_eud = msp.make_relative_value(

dfx, xcatxx, cids_eud, basket=["EUR", "USD"], postfix="vBM"

)

dfa = pd.concat([dfa_eur, dfa_usd, dfa_eud])

dfx = msm.update_df(dfx, dfa)

dicx[fact]["BM"] = [xc + bm for xc, bm in zip(xcatx, vbms)]

# Sign for hypothesized positive relation

xcatxx = dicx[fact]["BM"]

negs = [values[1] for values in dix[fact].values()]

calcs = []

for xc, neg in zip(xcatxx, negs):

if neg == "_NEG":

calcs += [f"{xc}_NEG = - {xc}"]

if len(calcs) > 0:

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cids_fx)

dfx = msm.update_df(dfx, dfa)

dicx[fact]["SG"] = [xc + neg for xc, neg in zip(xcatxx, negs)]

# Sequential scoring

xcatxx = dicx[fact]["SG"]

cidx = cids_fx

dfa = pd.DataFrame(columns=list(dfx.columns))

for xc in xcatxx:

dfaa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="ZN",

est_freq="m",

)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

dicx[fact]["ZN"] = [xc + "ZN" for xc in xcatxx]

# Checking original and modified constituents

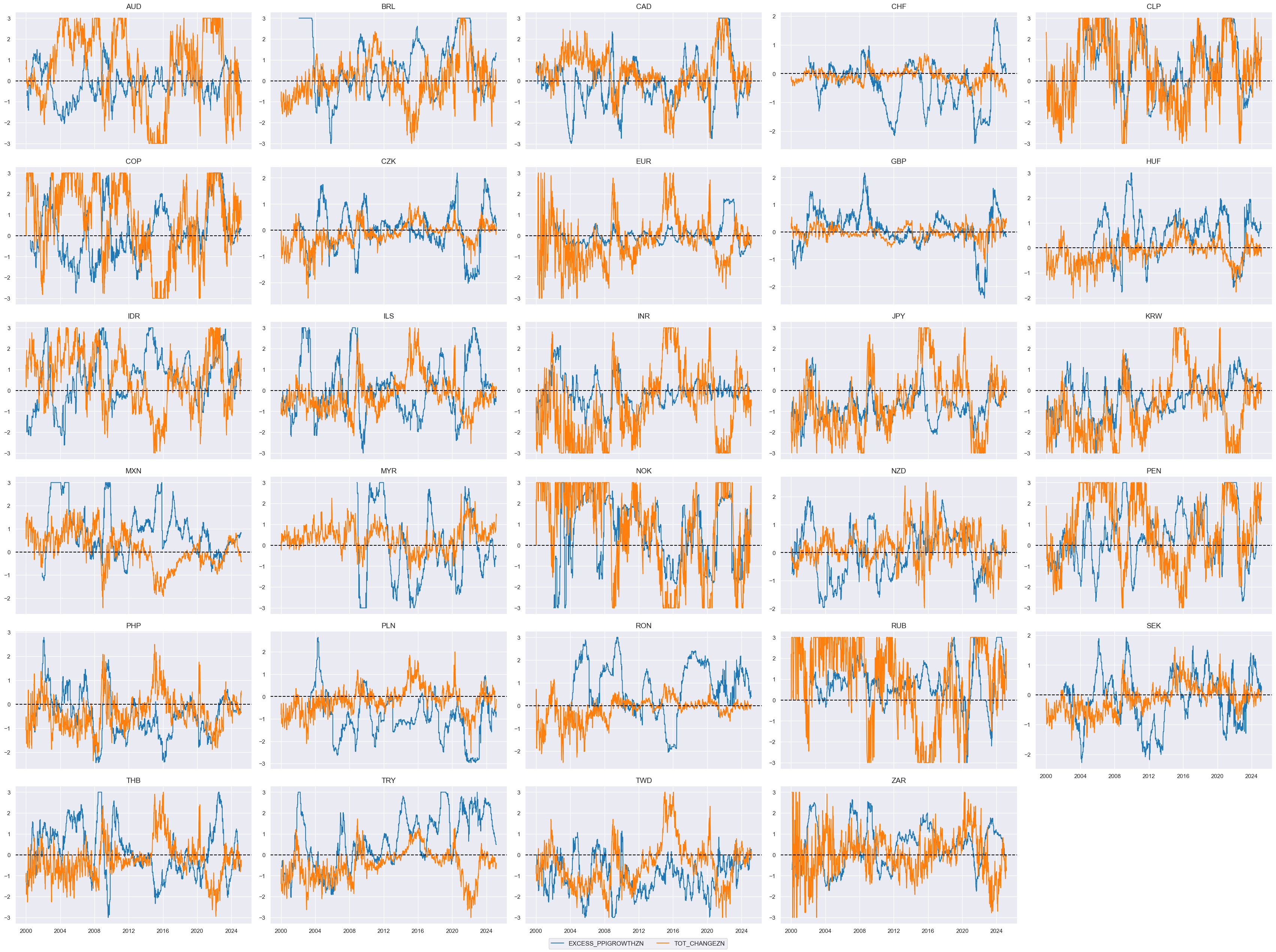

fact = "EXCESS_PPIGROWTH" # "EXCESS_PPIGROWTH", "TOT_CHANGE"

xcatx = dicx_pc[fact]["ZN"] # "OR", "BM", "SG", "ZN"

cidx = cids_fx

msp.view_timelines(

df=dfx,

xcats=xcatx,

cids=cidx,

start="2000-01-01",

aspect=1.6,

same_y=True,

ncol=5,

title = None,

xcat_labels = None

)

# Correlation matrix of final constituents

xcatx = [item for value in dicx_pc.values() if 'ZN' in value for item in value['ZN']]

cidx = cids_fx

sdate = "2000-01-01"

labels = [dict_lab[xc] for xc in xcatx]

msp.correl_matrix(

dfx,

xcats=xcatx,

cids=cidx,

start=sdate,

freq="M",

cluster=False,

title=None,

size=(10, 8),

xcat_labels=labels,

)

# Factors and re-scoring

dicx = dicx_pc

cidx = cids_fx

factors = list(dicx.keys())

# Factors as average of constituent scores

for fact in factors:

xcatx = dicx[fact]["ZN"]

dfa = msp.linear_composite(

dfx,

xcats=xcatx,

cids=cidx,

complete_xcats=False,

new_xcat=fact,

)

dfx = msm.update_df(dfx, dfa)

# Sequential re-scoring

dfa = pd.DataFrame(columns=list(dfx.columns))

for fact in factors:

dfaa = msp.make_zn_scores(

dfx,

xcat=fact,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="ZN",

est_freq="m",

)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

dict_themes["REL_PRICE_COMPETE"] = [fact + "ZN" for fact in factors]

# Checking constituent factor timelines

xcatx = dict_themes["REL_PRICE_COMPETE"]

cidx = cids_fx

msp.view_timelines(

df=dfx,

xcats=xcatx,

cids=cidx,

start="2000-01-01",

aspect=1.6,

same_y=False,

ncol=5,

title = None,

xcat_labels = None

)

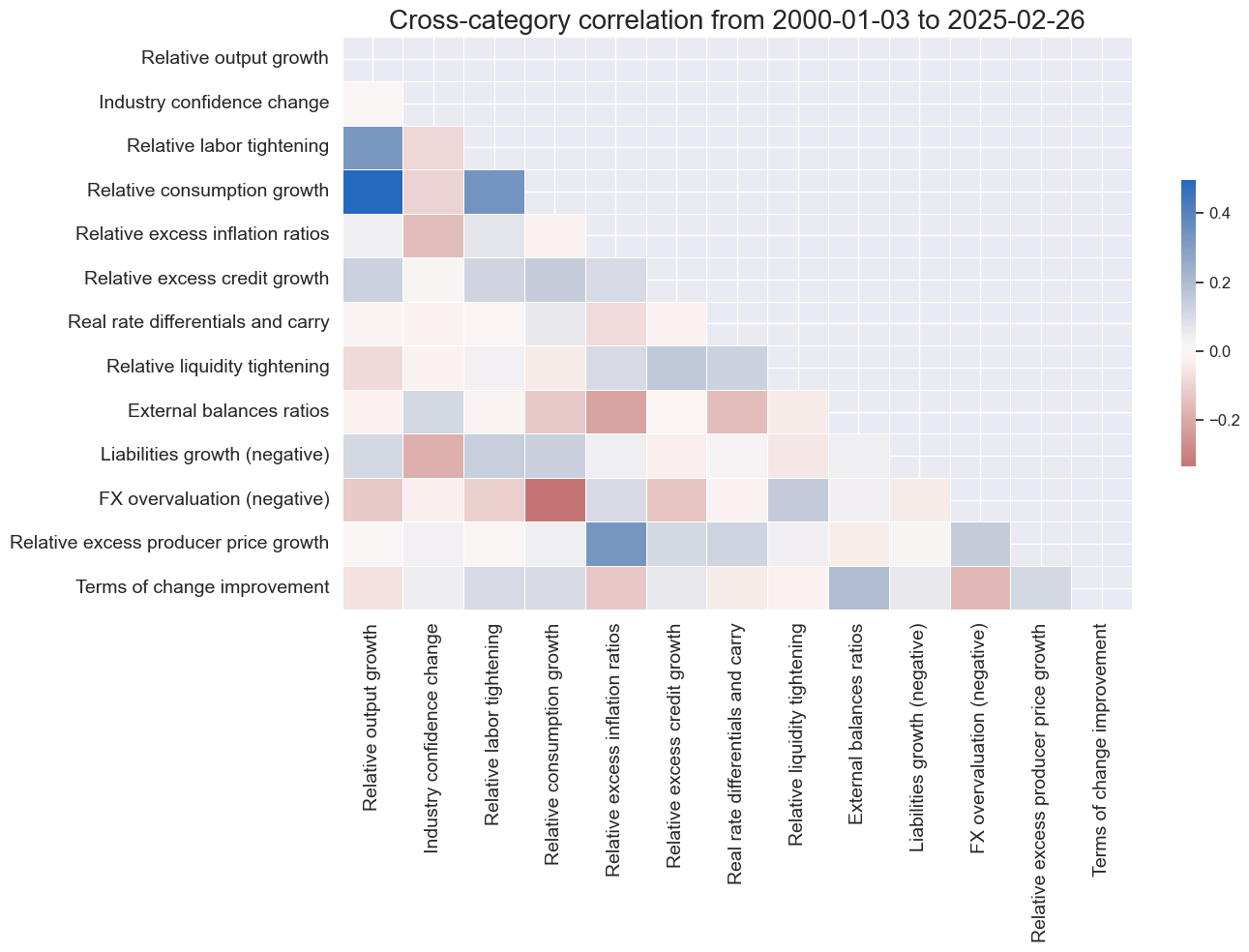

Thematic factor calculation and checks #

Basic factor correlations #

# Correlation matrix of basic factors

xcatx = [item for sublist in dict_themes.values() for item in sublist]

cidx = cids_fx

sdate = "2000-01-01"

labels = [dict_lab[xc] for xc in xcatx]

msp.correl_matrix(

dfx,

xcats=xcatx,

cids=cidx,

start=sdate,

freq="M",

cluster=False,

title=None,

size=(14, 10),

xcat_labels=labels,

)

Thematic factor calculation #

# Themes and re-scoring

cidx = cids_fx

themes = list(dict_themes.keys())

# Themes as average of factor scores

for theme in themes:

xcatx = dict_themes[theme]

dfa = msp.linear_composite(

dfx,

xcats=xcatx,

cids=cidx,

complete_xcats=False,

new_xcat=theme,

)

dfx = msm.update_df(dfx, dfa)

# Sequential re-scoring

dfa = pd.DataFrame(columns=list(dfx.columns))

for theme in themes:

dfaa = msp.make_zn_scores(

dfx,

xcat=theme,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="ZN",

est_freq="m",

)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

themez = [theme + "ZN" for theme in themes]

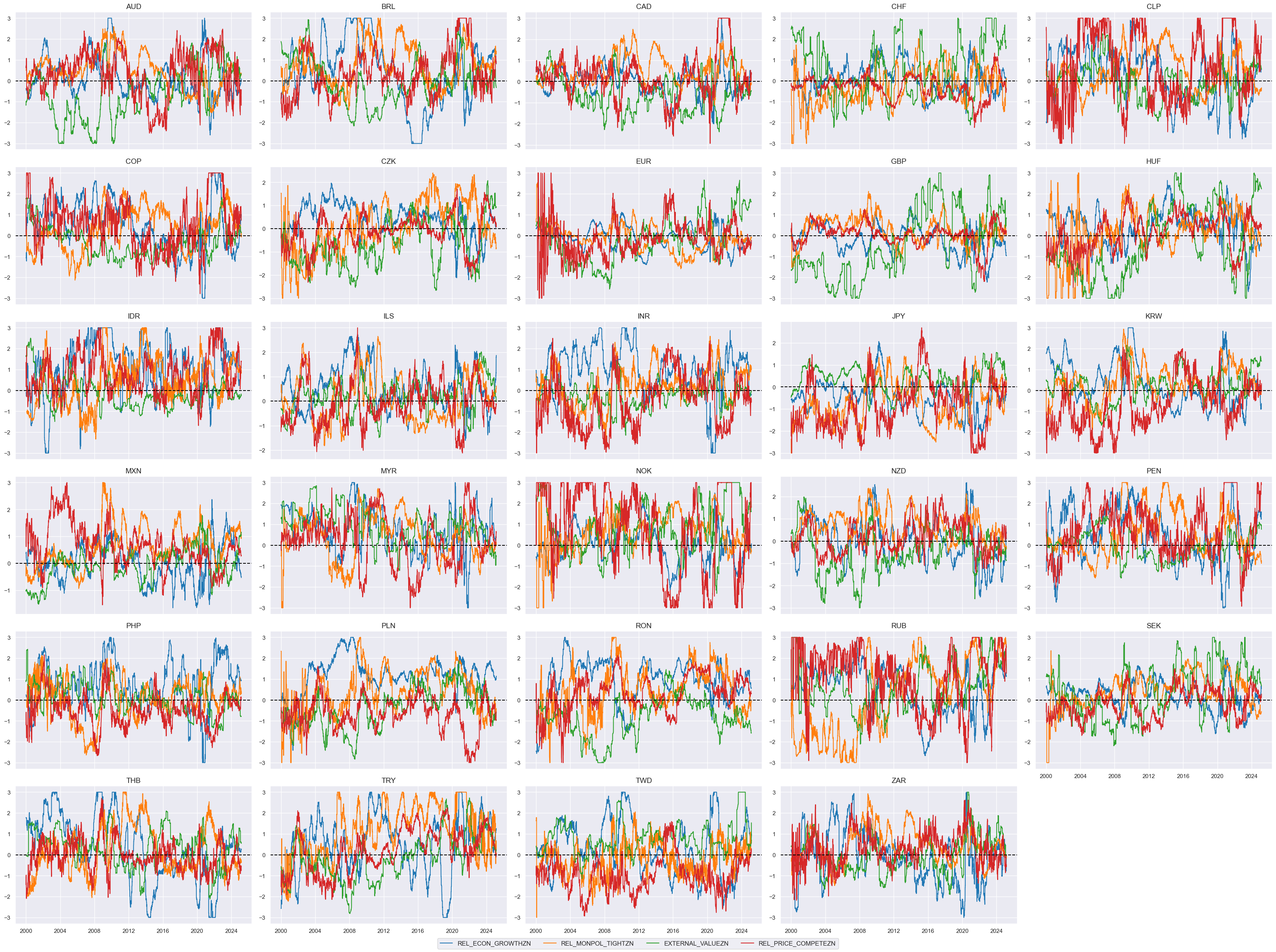

# Checking constituent factor timelines

xcatx = themez

cidx = cids_fx

msp.view_timelines(

df=dfx,

xcats=xcatx,

cids=cidx,

start="2000-01-01",

aspect=1.6,

same_y=False,

ncol=5,

title = None,

xcat_labels = None

)

dict_lab["REL_ECON_GROWTHZN"] = "Relative economic activity"

dict_lab["REL_MONPOL_TIGHTZN"] = "Relative monetary tightening bias"

dict_lab["EXTERNAL_VALUEZN"] = "External balances and valuation"

dict_lab["REL_PRICE_COMPETEZN"] = "Relative price competitiveness"

dict_lab["Composite"] = "Composite score"

labels = [dict_lab[xc] for xc in xcatx]

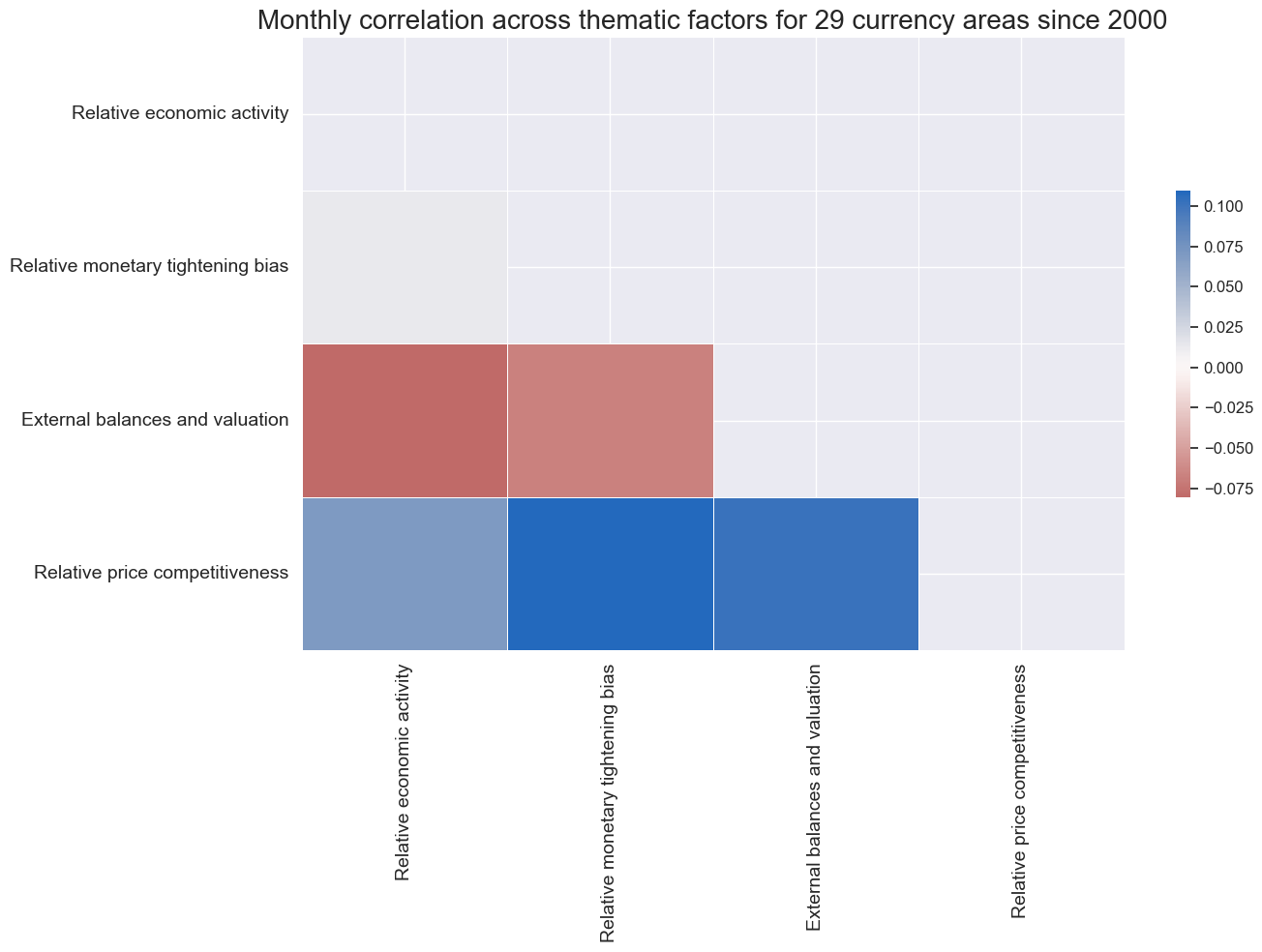

# Correlation of thematic factors

xcatx = themez

cidx = cids_fx

sdate = "2000-01-01"

labels = [dict_lab[xc] for xc in xcatx]

msp.correl_matrix(

dfx,

xcats=xcatx,

cids=cidx,

start=sdate,

freq="M",

cluster=False,

title="Monthly correlation across thematic factors for 29 currency areas since 2000",

size=(14, 10),

xcat_labels=labels,

)

Composite score calculation #

xcatx = themez

cidx = cids_fx

dfa = msp.linear_composite(

dfx,

xcats=xcatx,

cids=cidx,

complete_xcats=False,

new_xcat="COMPOSITE",

)

dfx = msm.update_df(dfx, dfa)

# Sequential re-scoring

dfa = msp.make_zn_scores(

dfx,

xcat="COMPOSITE",

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

cidx = cids_fx

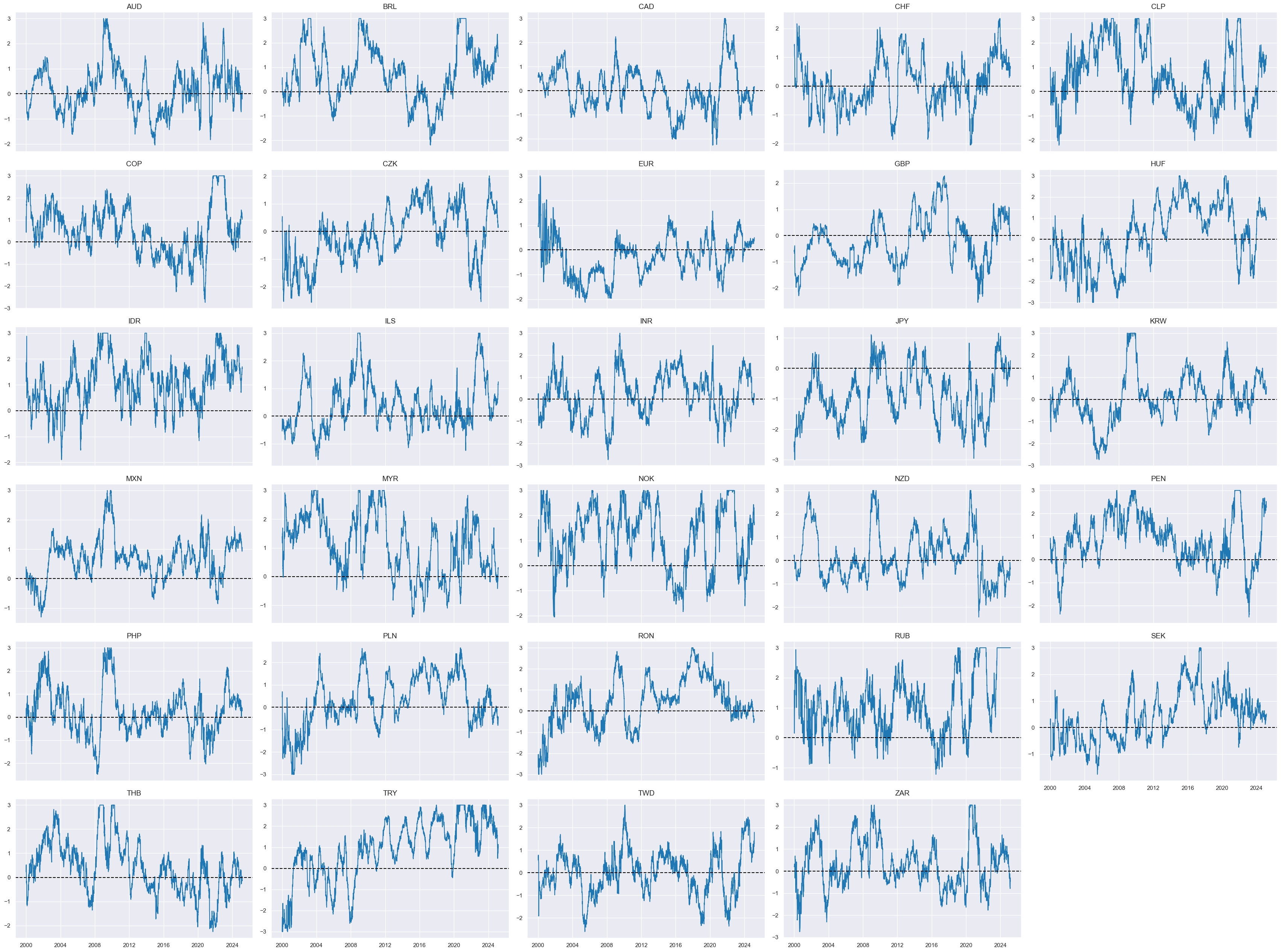

msp.view_timelines(

df=dfx,

xcats="COMPOSITEZN",

cids=cidx,

start="2000-01-01",

aspect=1.6,

same_y=False,

ncol=5,

title = None,

xcat_labels = None

)

Structural and labelling dictionaries #

# Dictionary of thematic factor structure

dict_struct = {

"REL_ECON_GROWTHZN": {

key + "ZN": [

"".join([sub_key] + [val for val in values if val]) + "ZN"

for sub_key, values in sub_dict.items()

]

for key, sub_dict in dict_ea.items()

},

"REL_MONPOL_TIGHTZN": {

key + "ZN": [

"".join([sub_key] + [val for val in values if val]) + "ZN"

for sub_key, values in sub_dict.items()

]

for key, sub_dict in dict_mp.items()

},

"EXTERNAL_VALUEZN": {

key + "ZN": [

"".join([sub_key] + [val for val in values if val]) + "ZN"

for sub_key, values in sub_dict.items()

]

for key, sub_dict in dict_xv.items()

},

"REL_PRICE_COMPETEZN": {

key + "ZN": [

"".join([sub_key] + [val for val in values if val]) + "ZN"

for sub_key, values in sub_dict.items()

]

for key, sub_dict in dict_pc.items()

},

}

# Create dictionary of subordinate factors and constituents

dict_struct_flat = {

sub_key: values

for main_key, sub_dict in dict_struct.items()

for sub_key, values in sub_dict.items()

}

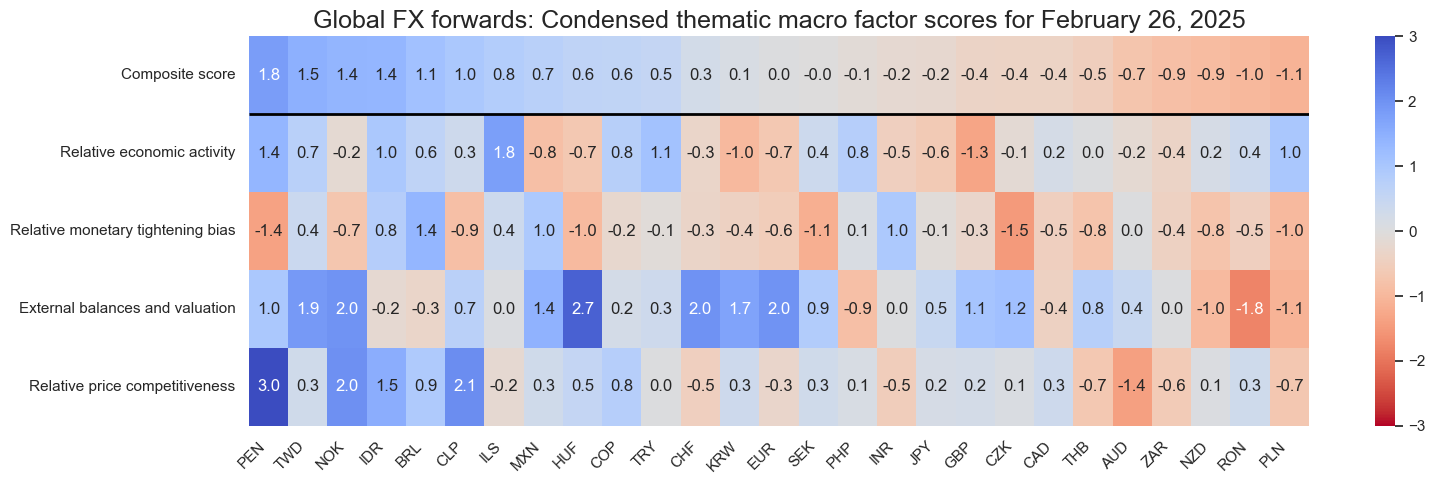

Global condensed scorecard #

Snapshot #

xcatx = list(dict_struct.keys())

cidx = cids_fx

# Set data of snapshot

backdate = datetime.strptime("2007-08-01", "%Y-%m-%d")

lastdate = datetime.strptime(end_date, "%Y-%m-%d")

snapdate = lastdate # lastdate or backdate

# Exclude all non-tradaeble currencies at snapshot date

exclude_cidx = [key[:3] for key in fxblack.keys() if snapdate in fxblack[key]]

cidx = [cid for cid in cidx if cid not in exclude_cidx]

sv_glb4 = ScoreVisualisers(

df=dfx,

cids=cidx,

xcats = xcatx,

no_zn_scores=False,

rescore_composite=True,

blacklist=fxblack,

)

sv_glb4.view_snapshot(

cids=cidx,

date=snapdate,

transpose=True,

sort_by_composite = True,

title=f"Global FX forwards: Condensed thematic macro factor scores for {snapdate.strftime("%B %d, %Y")}",

title_fontsize=18,

figsize=(16, 5),

xcats=xcatx + ["Composite"],

xcat_labels=dict_lab,

round_decimals=1,

)

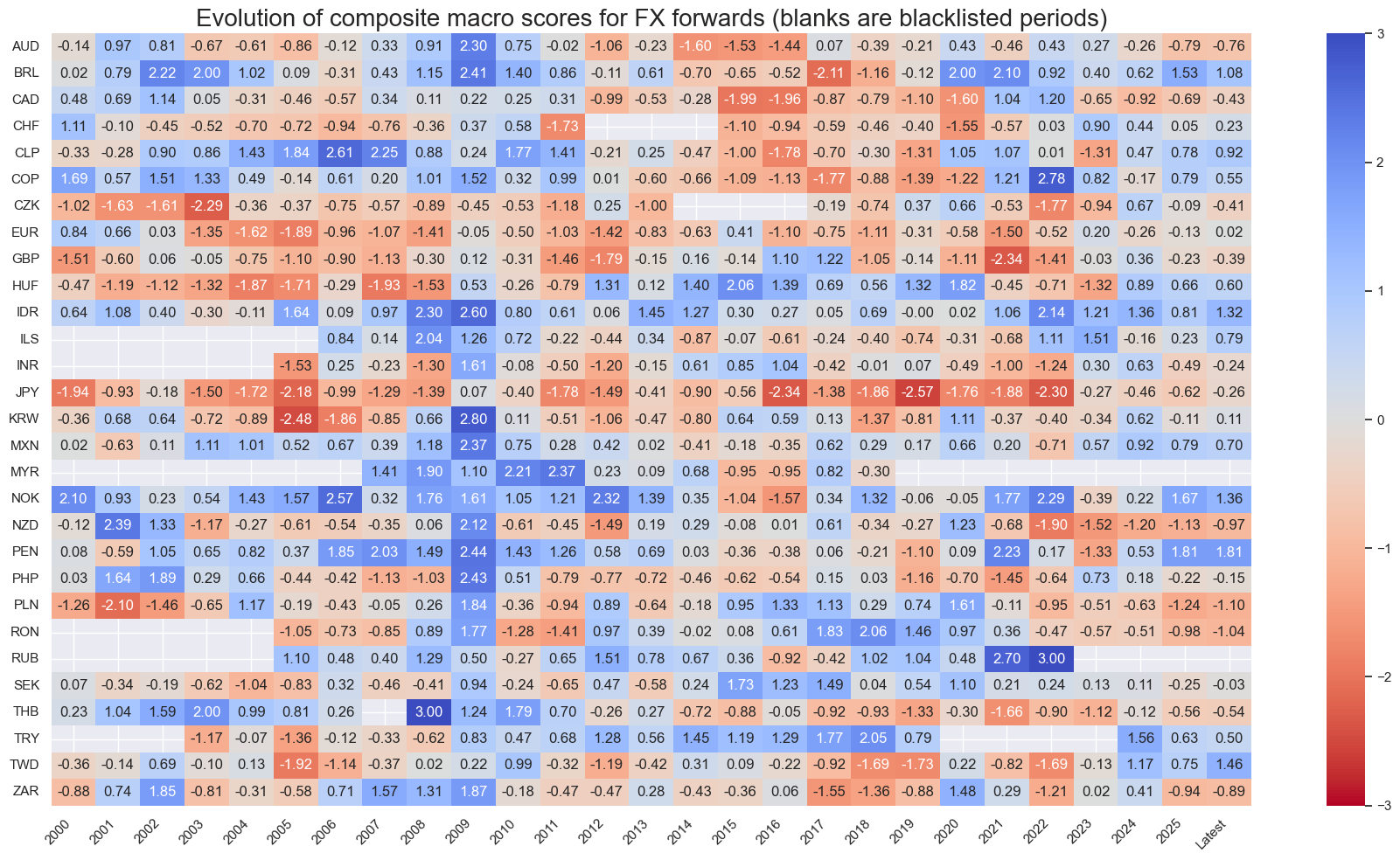

cidx = cids_fx

xcatx = list(dict_struct.keys())

svx = ScoreVisualisers(

df=dfx,

cids=cidx,

xcats = xcatx,

no_zn_scores=False,

rescore_composite=True,

blacklist=fxblack,

)

svx.view_score_evolution(

xcat="Composite",

cids=cidx,

freq="A",

include_latest_day=True,

transpose=False,

title="Evolution of composite macro scores for FX forwards (blanks are blacklisted periods)",

start="2000-01-01",

figsize=(18, 10),

)

Latest day: 2025-02-26 00:00:00

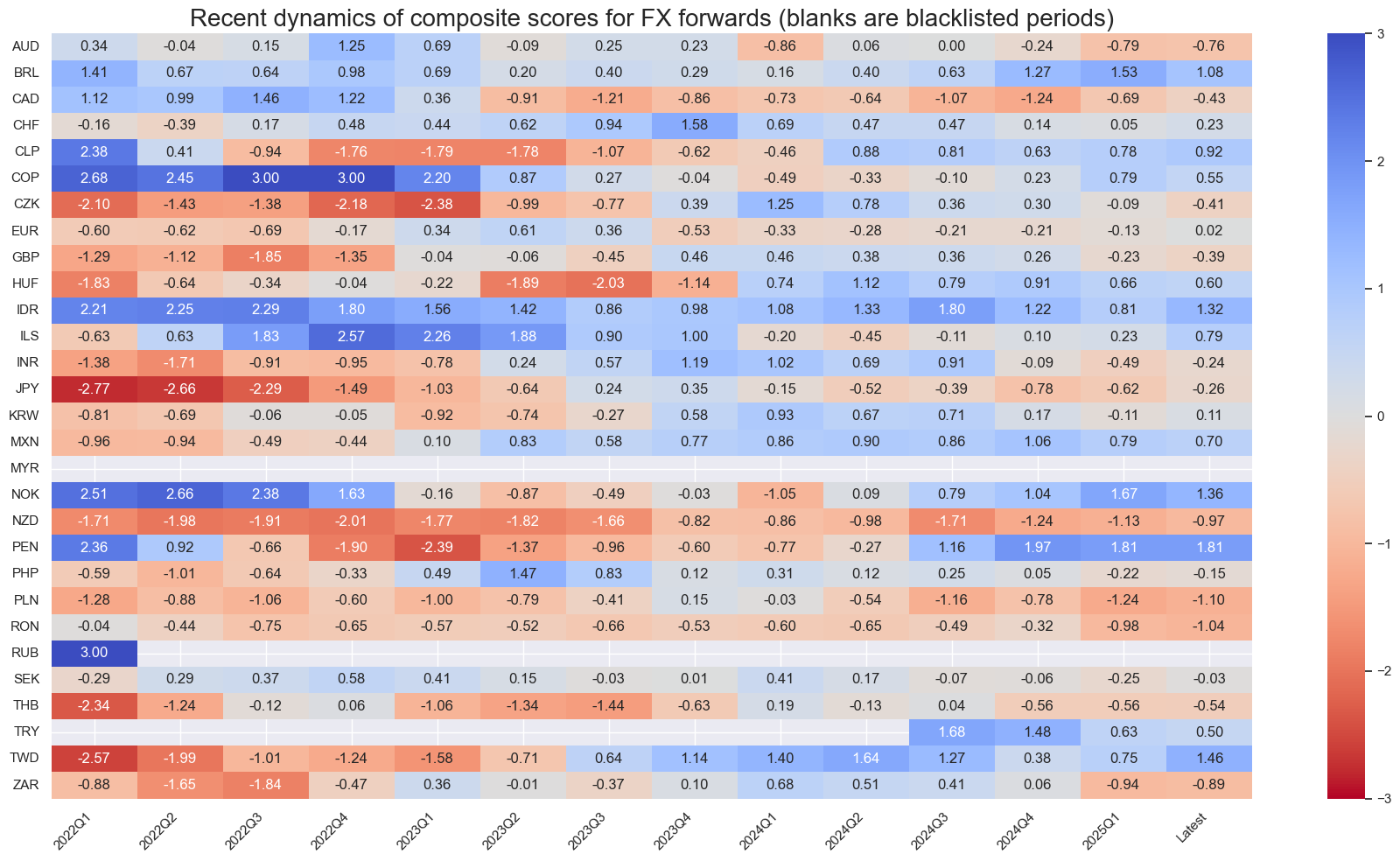

svx.view_score_evolution(

xcat="Composite",

cids=cidx,

freq="Q",

include_latest_day=True,

transpose=False,

title="Recent dynamics of composite scores for FX forwards (blanks are blacklisted periods)",

start="2022-01-01",

figsize=(18, 10),

)

Latest day: 2025-02-26 00:00:00

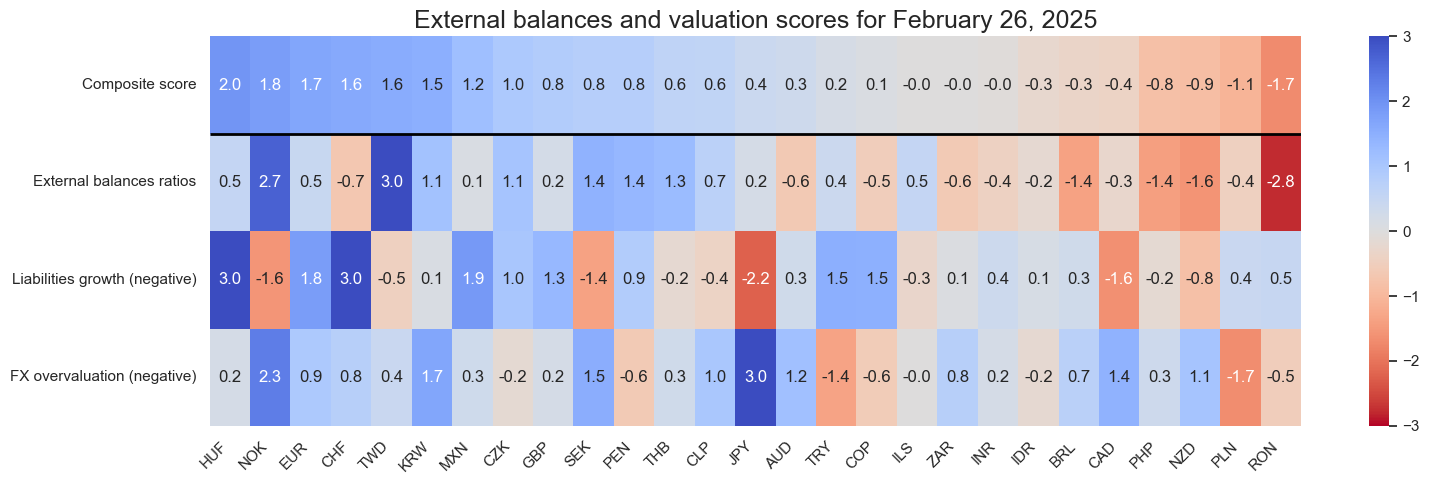

Thematic snapshot #

focus = 'EXTERNAL_VALUEZN'

dix = dict_struct_flat if focus in dict_struct_flat.keys() else dict_struct

label = dict_lab[focus]

xcatx = list(dix[focus])

cidx = cids_fx

# Set data of snapshot

backdate = datetime.strptime("2012-08-01", "%Y-%m-%d")

lastdate = datetime.strptime(end_date, "%Y-%m-%d")

snapdate = lastdate # lastdate or backdate

# Exclude all non-tradaeble currencies at snapshot date

exclude_cidx = [key[:3] for key in fxblack.keys() if snapdate in fxblack[key]]

cidx = [cid for cid in cidx if cid not in exclude_cidx]

sv_focus = ScoreVisualisers(

df=dfx,

cids=cidx,

xcats = xcatx,

no_zn_scores=False,

rescore_composite=True,

)

sv_focus.view_snapshot(

cids=cidx,

date=snapdate,

transpose=True,

sort_by_composite = True,

title=f"{label} scores for {snapdate.strftime("%B %d, %Y")}",

title_fontsize=18,

figsize=(16, 5),

xcats=xcatx + ["Composite"],

xcat_labels=dict_lab,

round_decimals=1,

)

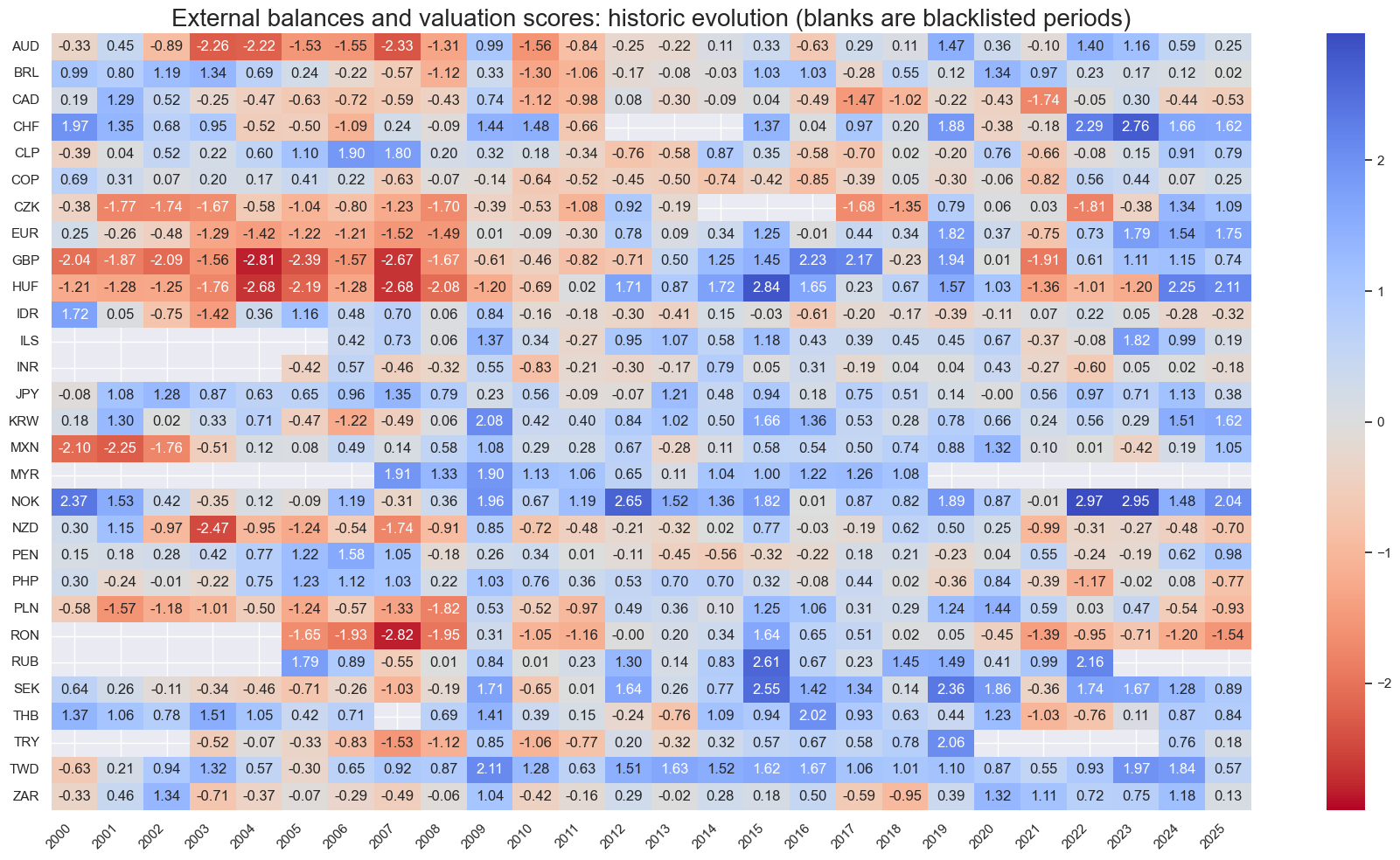

focus = 'EXTERNAL_VALUEZN'

dix = dict_struct_flat if focus in dict_struct_flat.keys() else dict_struct

label = dict_lab[focus]

xcatx = list(dix[focus])

cidx = cids_fx

sv_focus_x = ScoreVisualisers(

df=dfx,

cids=cidx,

xcats = xcatx,

no_zn_scores=False,

rescore_composite=True,

blacklist=fxblack,

)

sv_focus_x.view_score_evolution(

xcat="Composite",

cids=cidx,

freq="A",

include_latest_day=False,

transpose=False,

title=f"{label} scores: historic evolution (blanks are blacklisted periods)",

start="2000-01-01",

figsize=(18, 10),

)

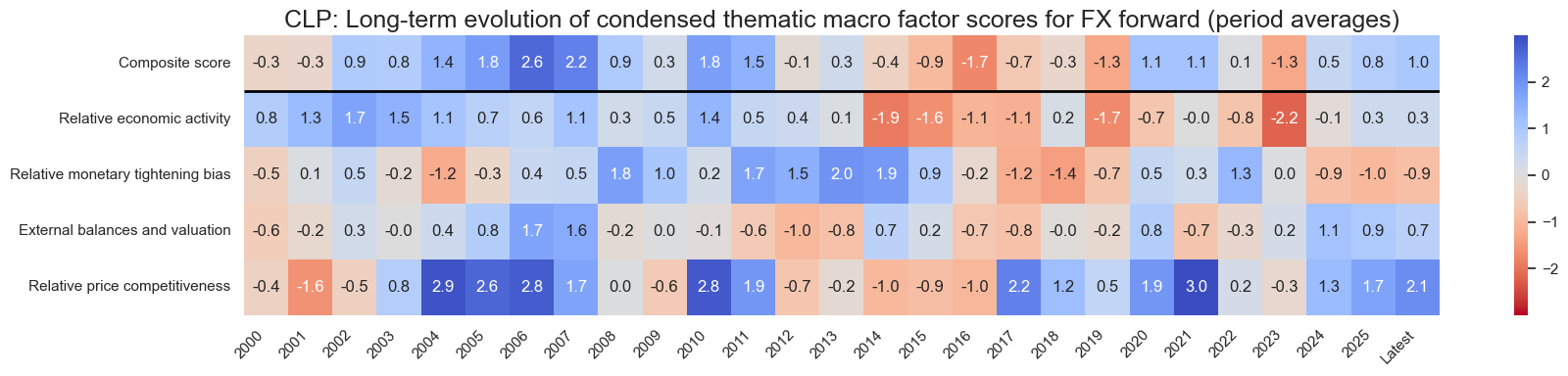

Country composite and thematic factor developments #

xcatx = list(dict_struct.keys()) + ["Composite"]

cid = "CLP"

sv_glb4.view_cid_evolution(

cid=cid,

xcats=xcatx,

xcat_labels=dict_lab,

freq="A",

transpose=False,

title=f"{cid}: Long-term evolution of condensed thematic macro factor scores for FX forward (period averages)",

title_fontsize=18,

figsize=(18, 4),

round_decimals=1,

start="2000-01-01",

)

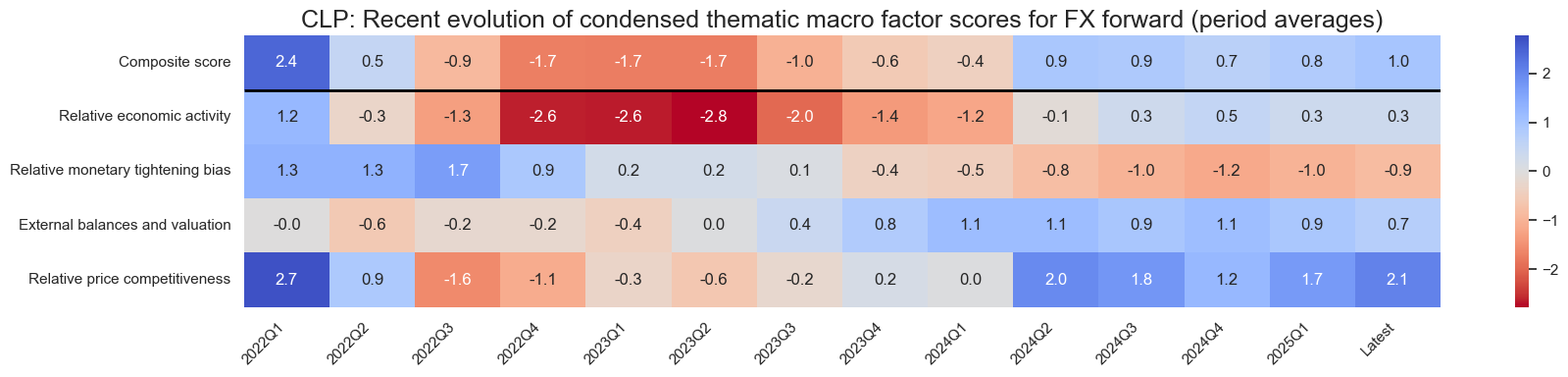

sv_glb4.view_cid_evolution(

cid=cid,

xcats=xcatx,

xcat_labels=dict_lab,

freq="Q",

transpose=False,

title=f"{cid}: Recent evolution of condensed thematic macro factor scores for FX forward (period averages)",

title_fontsize=18,

figsize=(18, 4),

round_decimals=1,

start="2022-01-01",

)

Latest day: 2025-02-26 00:00:00

Latest day: 2025-02-26 00:00:00

Drilling down 1 level: subordinate factor developments #

sv_glb4_themes = {}

for theme in list(dict_struct.keys()):

sv_glb4_themes[theme] = ScoreVisualisers(

dfx,

cids=cidx,

xcats=list(dict_struct[theme]),

thresh=3,

no_zn_scores=True,

complete_xcats=False,

rescore_composite=True,

)

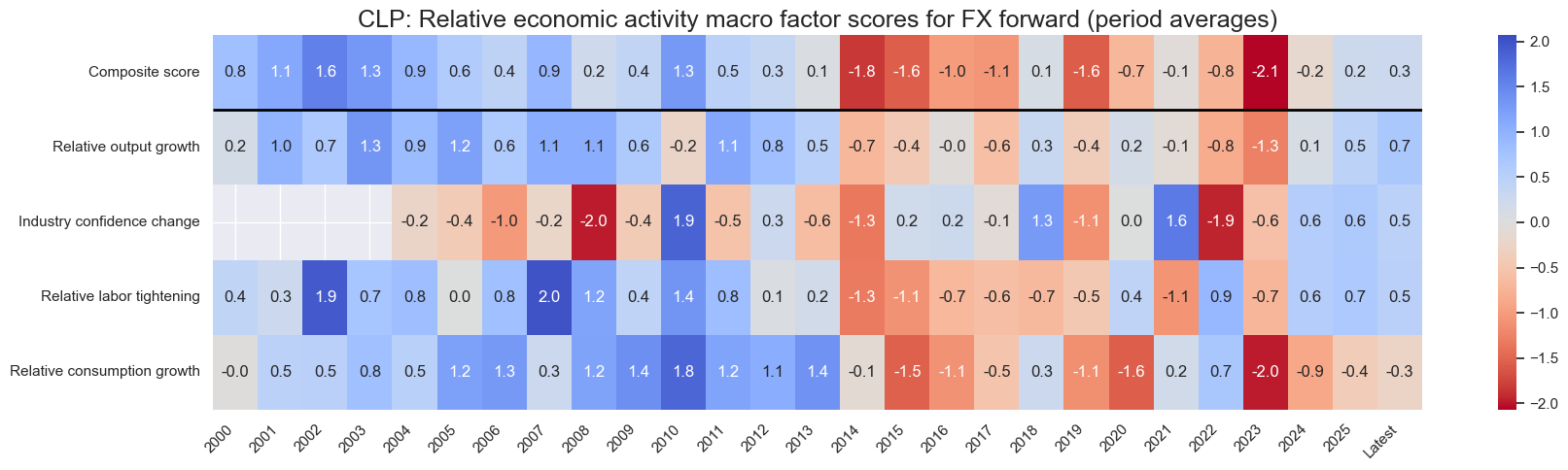

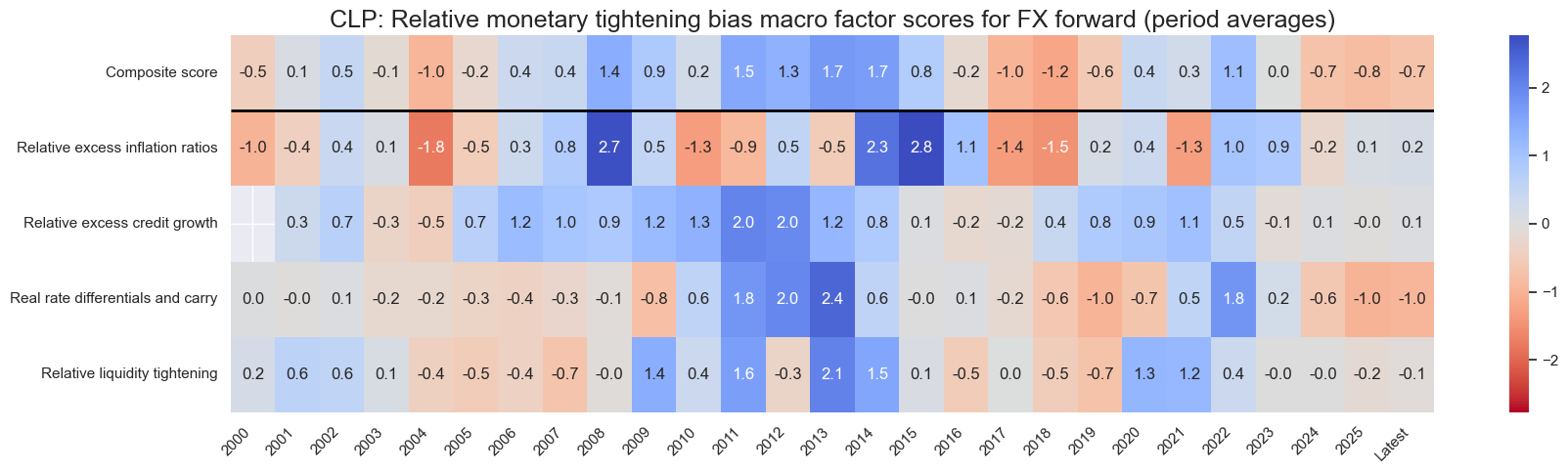

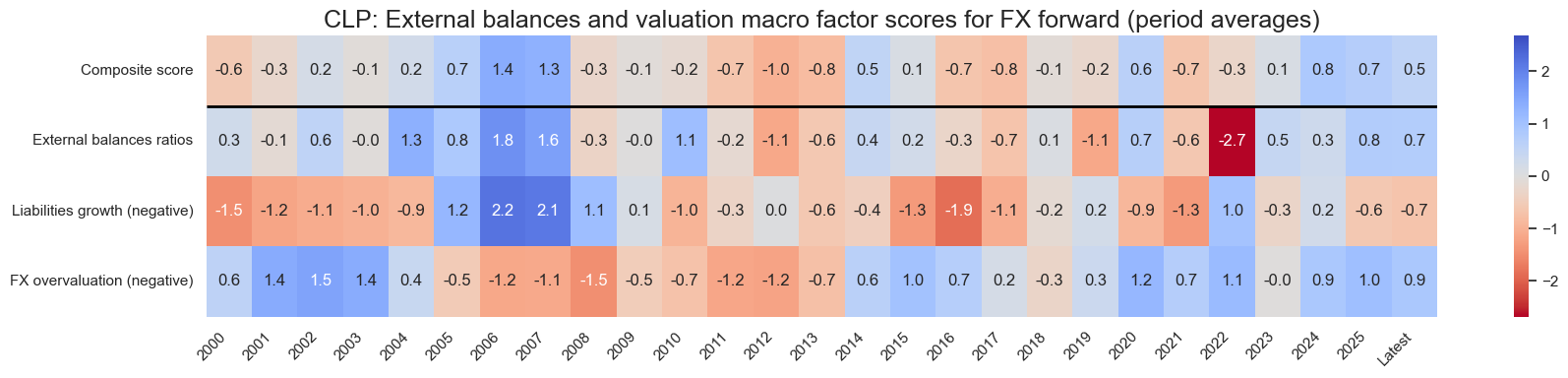

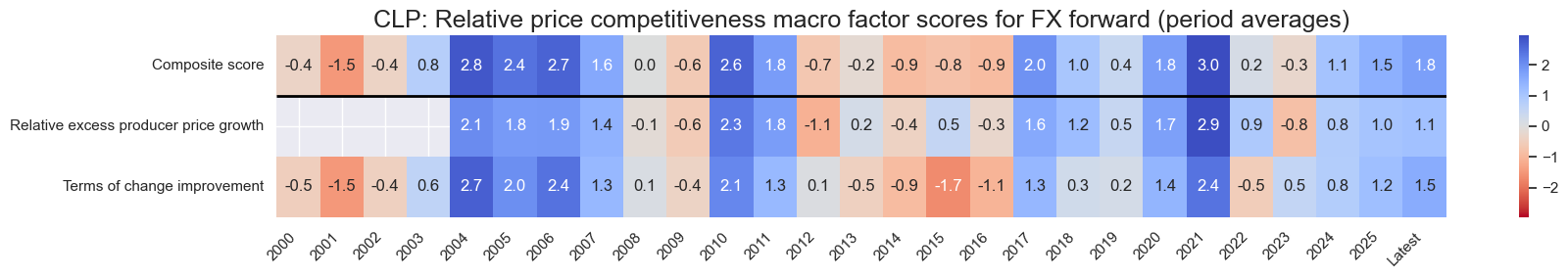

cid = "CLP"

for i in sv_glb4_themes:

xcatx = list(dict_struct[i]) + ["Composite"]

sv_glb4_themes[i].view_cid_evolution(

cid=cid,

xcats=xcatx,

xcat_labels=dict_lab,

freq="A",

transpose=False,

title=f"{cid}: {dict_lab[i]} macro factor scores for FX forward (period averages)",

title_fontsize=18,

figsize=(18, len(xcatx)),

round_decimals=1,

start="2000-01-01",

)

Latest day: 2025-02-26 00:00:00

Latest day: 2025-02-26 00:00:00

Latest day: 2025-02-26 00:00:00

Latest day: 2025-02-26 00:00:00

Drilling down 2 levels: constituent developments #

cidx = cids_fx

xcatx = list(dict_struct_flat.keys())

sv_glb4_factors = {}

for fact in list(dict_struct_flat.keys()):

if fact == "MBC_CHANGEZN":

cidx = list(set(cids_fx) - set(["THB"]))

elif fact == "LAB_TIGHTZN":

cidx = list(set(cids_fx) - set(["IDR", "INR"]))

else:

cidx = cids_fx

sv_glb4_factors[fact] = ScoreVisualisers(

dfx,

cids=cidx,

xcats=[constituent for constituent in dict_struct_flat[fact]],

xcat_labels=dict_lab,

thresh=3,

no_zn_scores=True,

complete_xcats=False,

rescore_composite=True,

)

cid = "PEN"

theme = "REL_PRICE_COMPETEZN" # 'REL_ECON_GROWTHZN', 'REL_MONPOL_TIGHTZN', 'EXTERNAL_VALUEZN', 'REL_PRICE_COMPETEZN'

factors = dict_struct[theme].keys()

svx = {fact: sv_glb4_factors[fact] for fact in factors}

for i in svx:

xcatx = [xc for xc in list(dict_struct_flat[i])] + ["Composite"]

sv_glb4_factors[i].view_cid_evolution(

cid=cid,

xcats=xcatx,

xcat_labels=dict_lab,

freq="A",

transpose=False,

title=f"{cid}: {dict_lab[i]} constituent scores (period averages)",

title_fontsize=18,

figsize=(18, len(xcatx)),

round_decimals=1,

start="2000-01-01",

)

Latest day: 2025-02-26 00:00:00

Latest day: 2025-02-26 00:00:00

Predictive power #

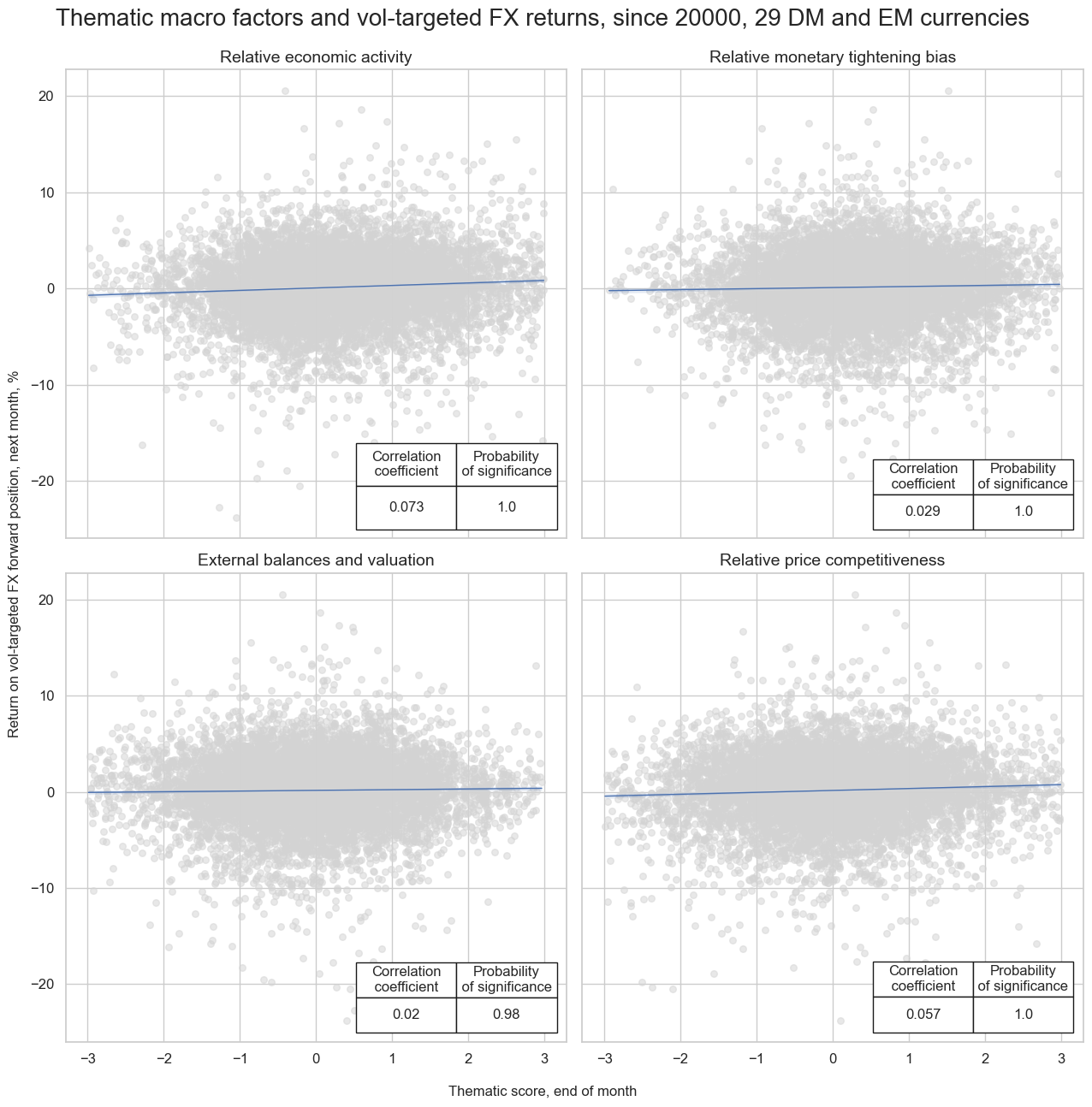

sigx = list(dict_struct.keys())

ret = "FXXR_VT10"

cidx = cids_fx

freq = "m"

start = "2000-01-01"

catregs = {}

for sig in sigx:

catregs[sig] = msp.CategoryRelations(

dfx,

xcats=[sig, ret],

cids=cidx,

freq=freq,

lag=1,

xcat_aggs=["last", "sum"],

start=start,

blacklist=fxblack,

xcat_trims=[3, 30] # remove single outlier for charts

)

msv.multiple_reg_scatter(

cat_rels=[v for k, v in catregs.items()],

ncol=2,

nrow=2,

figsize=(13, 13),

title="Thematic macro factors and vol-targeted FX returns, since 20000, 29 DM and EM currencies",

xlab="Thematic score, end of month",

ylab="Return on vol-targeted FX forward position, next month, %",

coef_box="lower right",

prob_est="map",

single_chart=True,

subplot_titles=[dict_lab[sig] for sig in sigx],

)

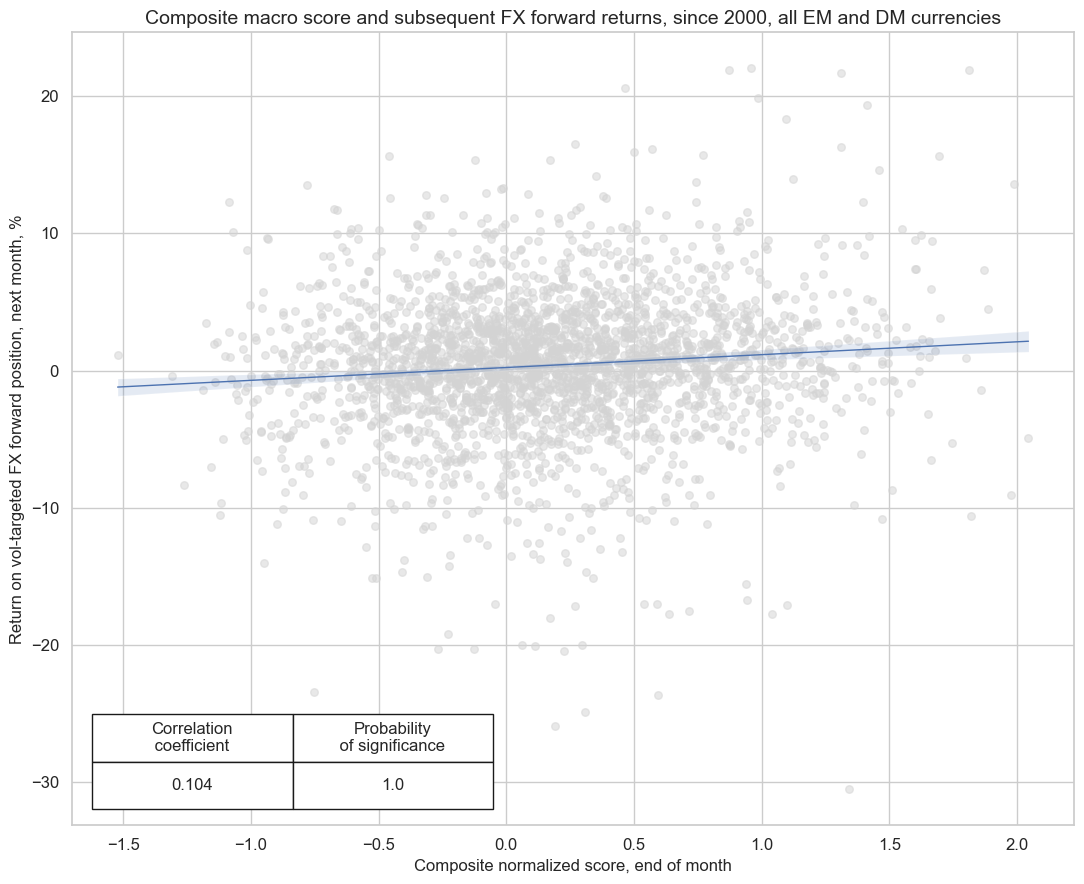

sig = "COMPOSITE"

ret = "FXXR_NSA"

cidx = cids_fx

freq = "m"

start = "2000-01-01"

crx = msp.CategoryRelations(

dfx,

xcats=[sig, ret],

cids=cidx,

freq="Q",

lag=1,

slip=1,

xcat_aggs=["last", "sum"],

start=start,

blacklist=fxblack,

)

crx.reg_scatter(

labels=False,

coef_box="lower left",

xlab="Composite normalized score, end of month",

ylab="Return on vol-targeted FX forward position, next month, %",

title="Composite macro score and subsequent FX forward returns, since 2000, all EM and DM currencies",

size=(11, 9),

prob_est="map",

)

sig = "COMPOSITE"

targ = "FXXR_VT10"

cidx = cids_fx

blax = fxblack

sdate = "2000-01-01"

pnls = msn.NaivePnL(

df=dfx,

ret=targ,

sigs=[sig],

cids=cidx,

start=sdate,

blacklist=blax,

bms=["USD_GB10YXR_NSA", "EUR_FXXR_NSA", "USD_EQXR_NSA"],

)

pnls.make_pnl(

sig=sig,

sig_op="raw",

rebal_freq="monthly",

neutral="zero",

rebal_slip=1,

vol_scale=10,

)

pnls.make_long_pnl(vol_scale=10, label="Long only")

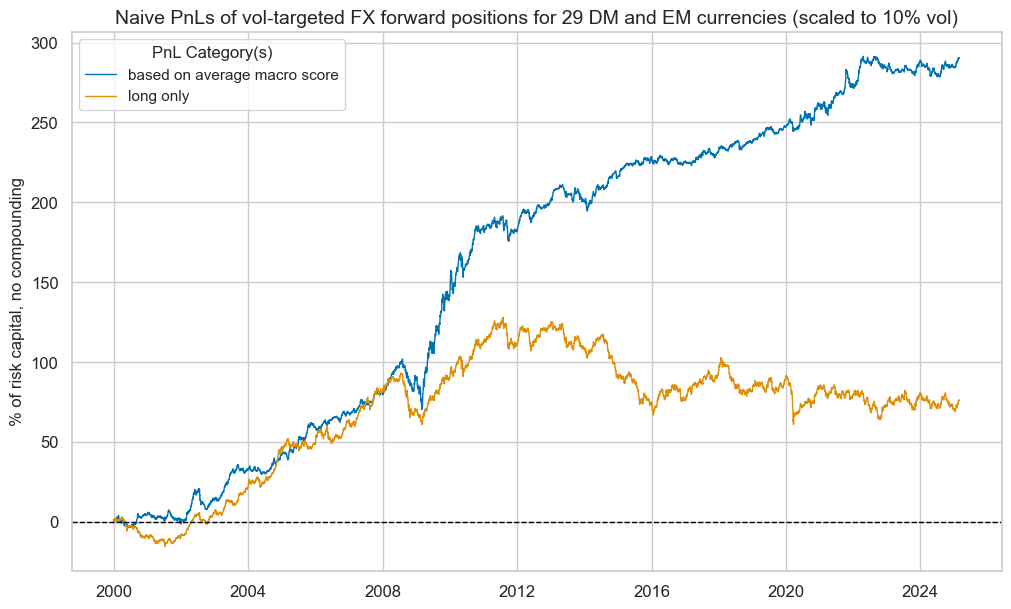

pnls.plot_pnls(

title="Naive PnLs of vol-targeted FX forward positions for 29 DM and EM currencies (scaled to 10% vol)",

title_fontsize=14,

xcat_labels=["based on average macro score", "long only"],

)

display(pnls.evaluate_pnls(["PNL_COMPOSITE", "Long only"]))

| xcat | PNL_COMPOSITE | Long only |

|---|---|---|

| Return % | 11.541294 | 3.022929 |

| St. Dev. % | 10.0 | 10.0 |

| Sharpe Ratio | 1.154129 | 0.302293 |

| Sortino Ratio | 1.709637 | 0.414842 |

| Max 21-Day Draw % | -15.363176 | -23.478791 |

| Max 6-Month Draw % | -23.875106 | -26.723264 |

| Peak to Trough Draw % | -31.634174 | -67.08462 |

| Top 5% Monthly PnL Share | 0.501389 | 1.488394 |

| USD_GB10YXR_NSA correl | -0.106215 | -0.04457 |

| EUR_FXXR_NSA correl | 0.207925 | 0.453604 |

| USD_EQXR_NSA correl | 0.237383 | 0.301809 |

| Traded Months | 302 | 302 |

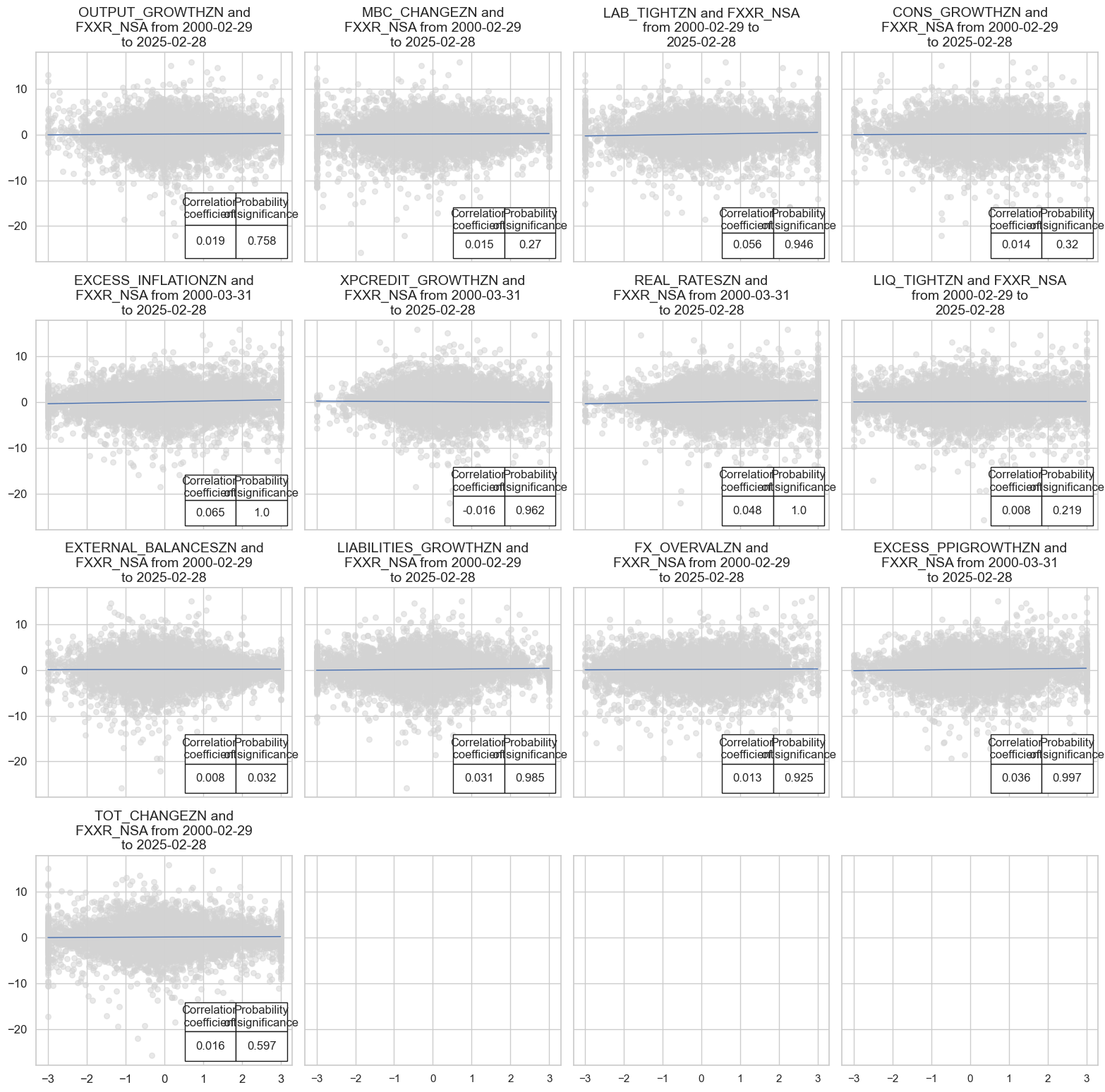

sigx = list(dict_struct_flat.keys())

ret = "FXXR_NSA"

cidx = cids_fx

freq = "m"

start = "2000-01-01"

catregs = {}

for sig in sigx:

catregs[sig] = msp.CategoryRelations(

dfx,

xcats=[sig, ret],

cids=cidx,

freq=freq,

lag=1,

xcat_aggs=["last", "sum"],

start=start,

blacklist=fxblack,

# xcat_trims=[3, 20] # for presentation purposes only

)

msv.multiple_reg_scatter(

cat_rels=[v for k, v in catregs.items()],

ncol=4,

nrow=4,

figsize=(16, 16),

title=None,

xlab=None,

ylab=None,

coef_box="lower right",

prob_est="map",

single_chart=True,

# subplot_titles=[dict_groups_labels[key] for key in sigx],

)

MBC_CHANGEZN misses: ['THB'].

LAB_TIGHTZN misses: ['IDR', 'INR'].