FX signals with ML and common sense #

Get packages and JPMaQS data #

import os

import numpy as np

import pandas as pd

from sklearn.pipeline import Pipeline

from sklearn.linear_model import LinearRegression, ElasticNet

from sklearn.ensemble import RandomForestRegressor

from sklearn.metrics import (

make_scorer,

r2_score,

)

import macrosynergy.management as msm

import macrosynergy.panel as msp

import macrosynergy.pnl as msn

import macrosynergy.signal as mss

import macrosynergy.learning as msl

import macrosynergy.visuals as msv

from macrosynergy.download import JPMaQSDownload

import warnings

warnings.simplefilter("ignore")

# Cross-sections of interest - FX

cids_g3 = ["EUR", "USD"] # DM large currency areas

cids_dmfx = ["AUD", "CAD", "CHF", "GBP", "JPY", "NOK", "NZD", "SEK"] # 8 DM currency areas

cids_emfx = ["CZK", "ILS", "KRW", "MXN", "PLN", "THB", "TWD", "ZAR"] # 8 EM currency areas

cids_fx = cids_dmfx + cids_emfx

cids_dm = cids_g3 + cids_dmfx

cids = cids_dm + cids_emfx

cids_eur = ["CHF", "NOK", "SEK", "PLN", "HUF", "CZK"] # trading against EUR

cids_eud = ["GBP"] # trading against EUR and USD

cids_usd = list(set(cids_fx) - set(cids_eur + cids_eud)) # trading against USD

# Quantamental categories for factor and target calculations

xbds = [

"MTBGDPRATIO_SA_3MMA_D1M1ML3",

"MTBGDPRATIO_SA_6MMA_D1M1ML6",

"MTBGDPRATIO_NSA_12MMA_D1M1ML3",

"BXBGDPRATIO_NSA_12MMA_D1M1ML3"

]

xbrs = [

"CABGDPRATIO_NSA_12MMA",

"BXBGDPRATIO_NSA_12MMA"

]

pcg = [

"PCREDITBN_SJA_P1M1ML12"

]

ipgs = [

"IP_SA_P6M6ML6AR",

"IP_SA_P1M1ML12_3MMA"

]

ir = [

"RIR_NSA",

]

ctots = [

"CTOT_NSA_P1M1ML12",

"CTOT_NSA_P1M12ML1",

"CTOT_NSA_P1W4WL1",

]

surv = [

"MBCSCORE_SA_D3M3ML3",

"MBCSCORE_SA_D1Q1QL1",

"MBCSCORE_SA_D6M6ML6",

"MBCSCORE_SA_D2Q2QL2",

]

ppi = [

"PGDPTECH_SA_P1M1ML12_3MMA",

"PPIH_NSA_P1M1ML12_3MMA"

]

gdps = [

"INTRGDP_NSA_P1M1ML12_3MMA",

"RGDPTECH_SA_P1M1ML12_3MMA",

]

emp = [

"UNEMPLRATE_SA_D3M3ML3",

"UNEMPLRATE_SA_D6M6ML6",

"UNEMPLRATE_SA_D1Q1QL1",

"UNEMPLRATE_SA_D2Q2QL2",

"UNEMPLRATE_NSA_3MMA_D1M1ML12",

"UNEMPLRATE_NSA_D1Q1QL4",

]

iip = [

"IIPLIABGDP_NSA_D1Mv2YMA",

"IIPLIABGDP_NSA_D1Mv5YMA",

]

cpi = [

"CPIC_SA_P1M1ML12",

"CPIC_SJA_P6M6ML6AR",

"CPIH_SA_P1M1ML12",

"CPIH_SJA_P6M6ML6AR",

"INFE1Y_JA",

"INFE2Y_JA",

"INFE5Y_JA",

]

main = xbds + xbrs + pcg + ipgs + ir + ctots + surv + ppi + gdps + emp + iip + cpi

adds = [

"INFTEFF_NSA",

"RGDP_SA_P1Q1QL4_20QMM"

]

mkts = [

"FXTARGETED_NSA",

"FXUNTRADABLE_NSA",

]

rets = [

"FXXR_NSA",

"FXXR_VT10",

"FXXRHvGDRB_NSA",

]

xcats = main + mkts + rets + adds

# Resultant tickers for download

single_tix = ["USD_GB10YXR_NSA", "EUR_FXXR_NSA", "USD_EQXR_NSA"]

tickers = [cid + "_" + xcat for cid in cids for xcat in xcats] + single_tix

# Download series from J.P. Morgan DataQuery by tickers

start_date = "1990-01-01"

end_date = None

# Retrieve credentials

oauth_id = os.getenv("DQ_CLIENT_ID") # Replace with own client ID

oauth_secret = os.getenv("DQ_CLIENT_SECRET") # Replace with own secret

# Download from DataQuery

downloader = JPMaQSDownload(client_id=oauth_id, client_secret=oauth_secret)

df = downloader.download(

tickers=tickers,

start_date=start_date,

end_date=end_date,

metrics=["value"],

suppress_warning=True,

show_progress=True,

)

dfx = df.copy()

dfx.info()

Downloading data from JPMaQS.

Timestamp UTC: 2024-12-20 09:56:12

Connection successful!

Requesting data: 100%|█████████████████████████████████████████████████████████████████| 39/39 [00:08<00:00, 4.83it/s]

Downloading data: 100%|████████████████████████████████████████████████████████████████| 39/39 [00:27<00:00, 1.40it/s]

Some expressions are missing from the downloaded data. Check logger output for complete list.

97 out of 776 expressions are missing. To download the catalogue of all available expressions and filter the unavailable expressions, set `get_catalogue=True` in the call to `JPMaQSDownload.download()`.

Some dates are missing from the downloaded data.

2 out of 9127 dates are missing.

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 5033333 entries, 0 to 5033332

Data columns (total 4 columns):

# Column Dtype

--- ------ -----

0 real_date datetime64[ns]

1 cid object

2 xcat object

3 value float64

dtypes: datetime64[ns](1), float64(1), object(2)

memory usage: 153.6+ MB

Availability and blacklisting #

Renaming #

Rename quarterly tickers to roughly equivalent monthly tickers to simplify subsequent operations.

dict_repl = {

"UNEMPLRATE_NSA_D1Q1QL4": "UNEMPLRATE_NSA_3MMA_D1M1ML12",

"UNEMPLRATE_SA_D1Q1QL1": "UNEMPLRATE_SA_D3M3ML3",

"UNEMPLRATE_SA_D2Q2QL2": "UNEMPLRATE_SA_D6M6ML6",

"MBCSCORE_SA_D1Q1QL1": "MBCSCORE_SA_D3M3ML3",

"MBCSCORE_SA_D2Q2QL2": "MBCSCORE_SA_D6M6ML6",

}

for key, value in dict_repl.items():

dfx["xcat"] = dfx["xcat"].str.replace(key, value)

Check availability #

Prior to commencing any analysis, it is crucial to evaluate the accessibility of data. This evaluation serves several purposes, including identifying potential data gaps or constraints within the dataset. Such gaps can significantly influence the trustworthiness and accuracy of the analysis. Moreover, it aids in verifying that ample observations are accessible for each chosen category and cross-section. Additionally, it assists in establishing suitable timeframes for conducting the analysis.

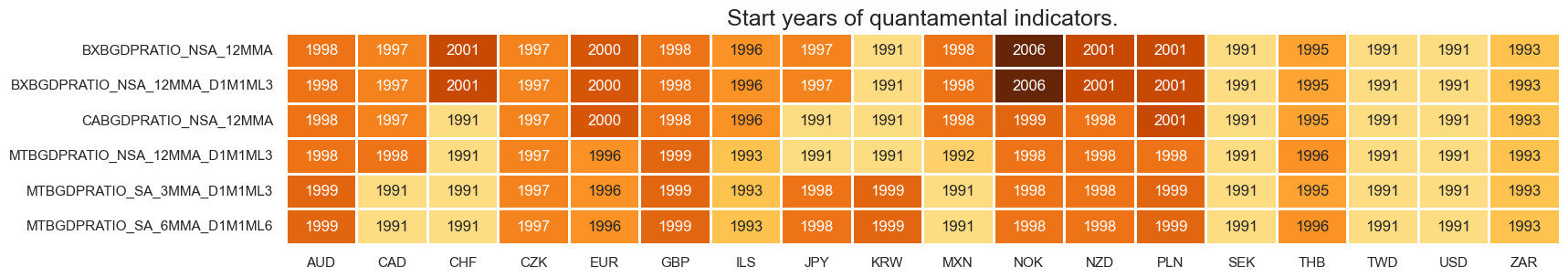

xcatx = xbds + xbrs

msm.check_availability(df=dfx, xcats=xcatx, cids=cids, missing_recent=False)

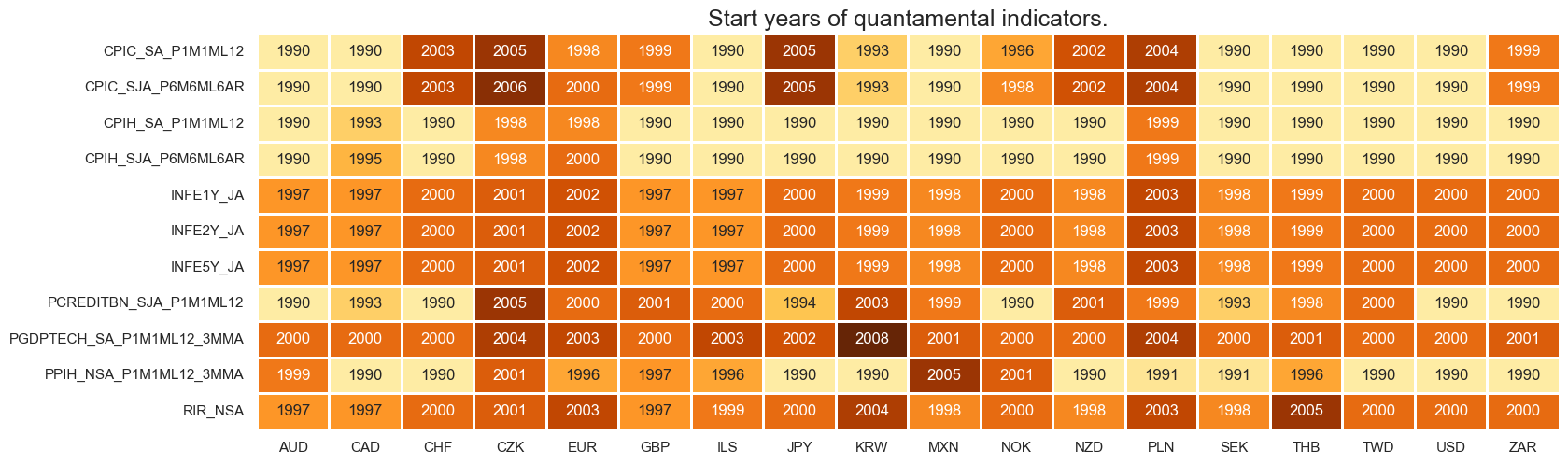

xcatx = cpi + ppi + ir + pcg

msm.check_availability(df=dfx, xcats=xcatx, cids=cids, missing_recent=False)

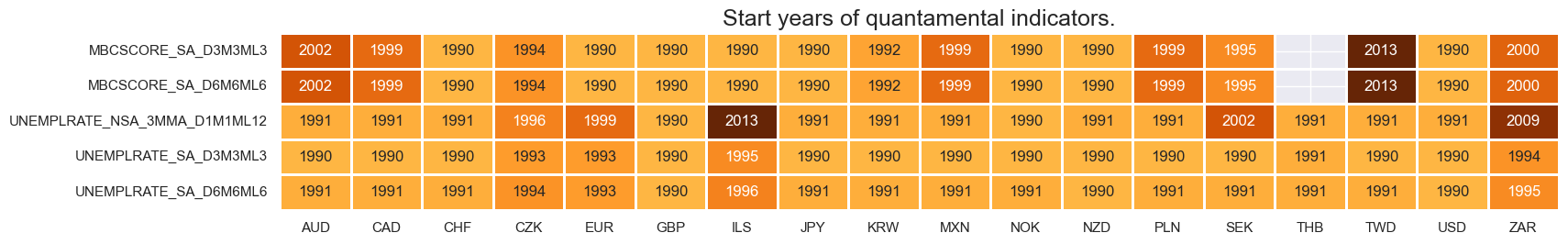

xcatx = surv + emp

msm.check_availability(df=dfx, xcats=xcatx, cids=cids, missing_recent=False)

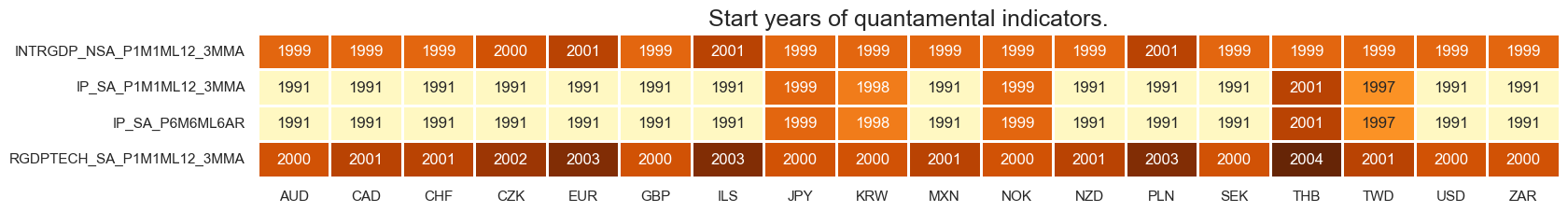

xcatx = gdps + ipgs

msm.check_availability(df=dfx, xcats=xcatx, cids=cids, missing_recent=False)

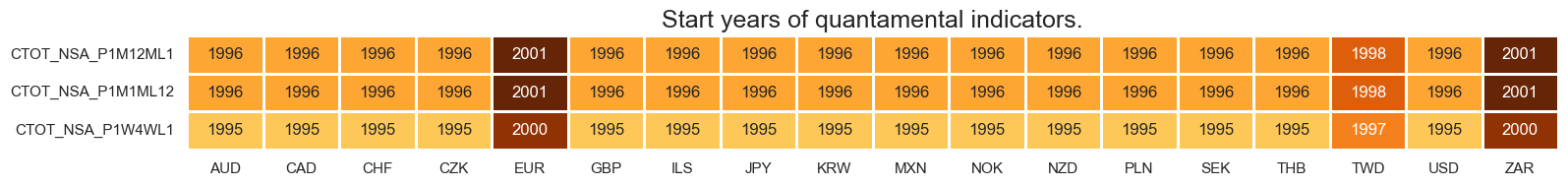

xcatx = ctots

msm.check_availability(df=dfx, xcats=xcatx, cids=cids, missing_recent=False)

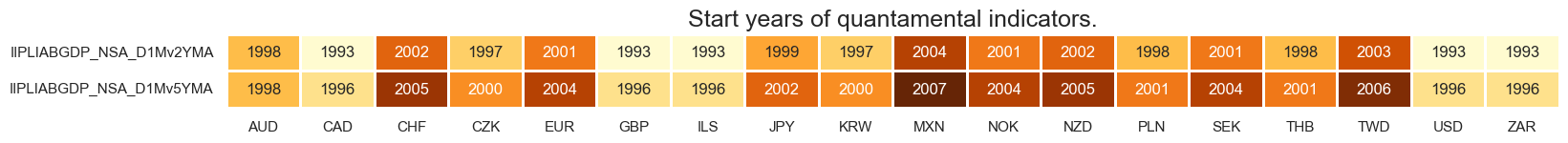

xcatx = iip

msm.check_availability(df=dfx, xcats=xcatx, cids=cids, missing_recent=False)

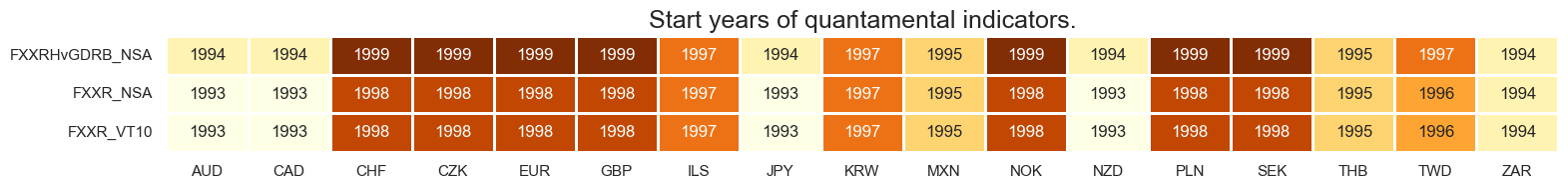

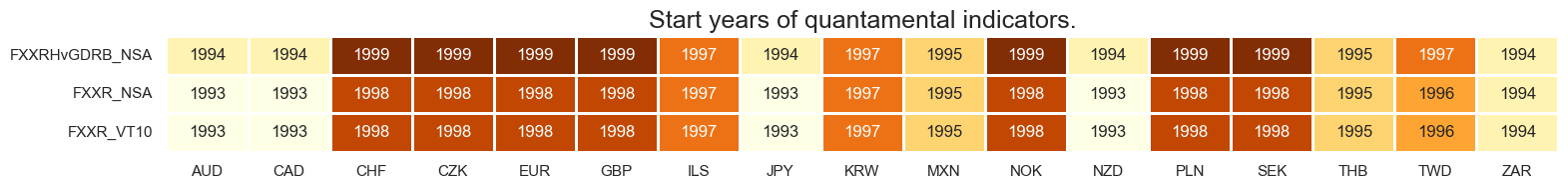

xcatx = rets

msm.check_availability(df=dfx, xcats=xcatx, cids=cids, missing_recent=False)

Blacklisting #

Identifying and isolating periods of official exchange rate targets, illiquidity, or convertibility-related distortions in FX markets is the first step in creating an FX trading strategy. These periods can significantly impact the behavior and dynamics of currency markets, and failing to account for them can lead to inaccurate or misleading findings. A standard blacklist dictionary (

fxblack

in the cell below) can be passed to several

macrosynergy

package functions that exclude the blacklisted periods from related analyses.

# Create blacklisting dictionary

dfb = df[df["xcat"].isin(["FXTARGETED_NSA", "FXUNTRADABLE_NSA"])].loc[

:, ["cid", "xcat", "real_date", "value"]

]

dfba = (

dfb.groupby(["cid", "real_date"])

.aggregate(value=pd.NamedAgg(column="value", aggfunc="max"))

.reset_index()

)

dfba["xcat"] = "FXBLACK"

fxblack = msp.make_blacklist(dfba, "FXBLACK")

fxblack

{'CHF': (Timestamp('2011-10-03 00:00:00'), Timestamp('2015-01-30 00:00:00')),

'CZK': (Timestamp('2014-01-01 00:00:00'), Timestamp('2017-07-31 00:00:00')),

'ILS': (Timestamp('1999-01-01 00:00:00'), Timestamp('2005-12-30 00:00:00')),

'THB': (Timestamp('2007-01-01 00:00:00'), Timestamp('2008-11-28 00:00:00'))}

Factor computation and checks #

Single-concept calculations #

# Initiate factor dictionary

factors = {}

International liabilities trends #

# Combine to single trend measure

cidx = cids

xcatx = [

"IIPLIABGDP_NSA_D1Mv2YMA",

"IIPLIABGDP_NSA_D1Mv5YMA",

]

xtic = "IIPLIABGDP_D"

label = "International liabilities trend"

dfa = msp.linear_composite(

dfx,

xcats=xcatx,

cids=cidx,

weights=[1/2, 1/5],

normalize_weights=True,

complete_xcats=False,

new_xcat=xtic,

)

dfx = msm.update_df(dfx, dfa)

factors[xtic] =[label, "ABS", "NEG"] # info on benchmark/sign adjustments

External balances trends #

# Combine to single trend measure

cidx = cids

xcatx = [

"MTBGDPRATIO_SA_3MMA_D1M1ML3",

"MTBGDPRATIO_SA_6MMA_D1M1ML6",

"BXBGDPRATIO_NSA_12MMA_D1M1ML3"

]

xtic = "XBAL_D"

label = "External balances change"

dfa = msp.linear_composite(

dfx,

xcats=xcatx,

cids=cidx,

weights=[1, 1/2, 1],

normalize_weights=True,

complete_xcats=False,

new_xcat=xtic,

)

dfx = msm.update_df(dfx, dfa)

factors[xtic] =[label, "ABS", "POS"] # info on benchmark/sign adjustments

External balances ratios #

# Combine to single ratio

cidx = cids

xcatx = [

"CABGDPRATIO_NSA_12MMA",

"BXBGDPRATIO_NSA_12MMA"

]

xtic = "XBALR"

label = "External balances ratios"

dfa = msp.linear_composite(

dfx,

xcats=xcatx,

cids=cidx,

normalize_weights=True,

complete_xcats=False,

new_xcat=xtic,

)

dfx = msm.update_df(dfx, dfa)

factors[xtic] =[label, "ABS", "POS"] # info on benchmark/sign adjustments

Unemployment rate changes #

# Combine to annualized change average

xcatx = [

"UNEMPLRATE_SA_D3M3ML3",

"UNEMPLRATE_SA_D6M6ML6",

"UNEMPLRATE_NSA_3MMA_D1M1ML12",

]

cidx = cids

xtic = "URATE_D"

label = "Unemployment rate change"

dfa = msp.linear_composite(

dfx,

xcats=xcatx,

cids=cidx,

weights=[4, 2, 1],

normalize_weights=True,

complete_xcats=False,

new_xcat=xtic,

)

dfx = msm.update_df(dfx, dfa)

factors[xtic] =[label, "REL", "NEG"] # info on benchmark/sign adjustments

Excess CPI inflation pressure #

cidx = cids

xcatx = [

"CPIC_SA_P1M1ML12",

"CPIC_SJA_P6M6ML6AR",

"CPIH_SA_P1M1ML12",

"CPIH_SJA_P6M6ML6AR",

"INFE1Y_JA",

"INFE2Y_JA",

"INFE5Y_JA",

]

dfa = msp.linear_composite(

dfx,

xcats=xcatx,

cids=cidx,

complete_xcats=False,

new_xcat="INF",

)

dfx = msm.update_df(dfx, dfa)

cidx = cids

xtic = "XINF"

label = "Excess CPI inflation pressure"

calcs = [f"{xtic} = INF - INFTEFF_NSA"]

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cidx)

dfx = msm.update_df(dfx, dfa)

factors[xtic] =[label, "REL", "POS"] # info on benchmark/sign adjustments

Excess producer price inflation #

cidx = cids

xcatx = [

"PGDPTECH_SA_P1M1ML12_3MMA",

"PPIH_NSA_P1M1ML12_3MMA"

]

dfa = msp.linear_composite(

dfx,

xcats=xcatx,

cids=cidx,

complete_xcats=False,

new_xcat="PPI_P",

)

dfx = msm.update_df(dfx, dfa)

cidx = cids

xtic = "XPPI_P"

label = "Excess producer inflation"

calcs = [f"{xtic} = PPI_P - INFTEFF_NSA"]

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cidx)

dfx = msm.update_df(dfx, dfa)

factors[xtic] =[label, "REL", "POS"] # info on benchmark/sign adjustments

Real credit growth #

cidx = cids

xtic = "RPCREDIT_P"

label = "Real credit growth"

calcs = [f"{xtic} = PCREDITBN_SJA_P1M1ML12 - INFTEFF_NSA"]

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cidx)

dfx = msm.update_df(dfx, dfa)

factors[xtic] =[label, "REL", "POS"] # info on benchmark/sign adjustments

Real GDP growth estimates #

cidx = cids

xcatx = [

"RGDPTECH_SA_P1M1ML12_3MMA",

"INTRGDP_NSA_P1M1ML12_3MMA",

]

xtic = "RGDP_P"

label = "Real GDP growth"

dfa = msp.linear_composite(

dfx,

xcats=xcatx,

cids=cidx,

complete_xcats=False,

new_xcat=xtic,

)

dfx = msm.update_df(dfx, dfa)

factors[xtic] =[label, "REL", "POS"] # info on benchmark/sign adjustments

Industrial production growth #

cidx = cids

xcatx = [

"IP_SA_P6M6ML6AR",

"IP_SA_P1M1ML12_3MMA"

]

xtic = "IP_P"

label = "Industry growth"

dfa = msp.linear_composite(

dfx,

xcats=xcatx,

cids=cidx,

complete_xcats=False,

new_xcat=xtic,

)

dfx = msm.update_df(dfx, dfa)

factors[xtic] =[label, "REL", "POS"] # info on benchmark/sign adjustments

Manufacturing confidence improvement #

cidx = cids

xcatx = ["MBCSCORE_SA_D3M3ML3", "MBCSCORE_SA_D6M6ML6"]

xtic = "MBSCORE_D"

label = "Manufacturing confidence change"

dfa = msp.linear_composite(

dfx,

xcats=xcatx,

cids=cidx,

weights=[2, 1],

normalize_weights=True,

complete_xcats=False,

new_xcat=xtic,

)

dfx = msm.update_df(dfx, dfa)

factors[xtic] =[label, "ABS", "POS"] # info on benchmark/sign adjustments

Commodity-based terms of trade improvement #

cidx = cids

xcatx = ["CTOT_NSA_P1M1ML12", "CTOT_NSA_P1M12ML1", "CTOT_NSA_P1W4WL1"]

xtic = "CTOT_P"

label = "Terms-of-trade change"

dfa = msp.linear_composite(

dfx,

xcats=xcatx,

cids=cidx,

weights=[1/12, 1/6, 2],

normalize_weights=True,

complete_xcats=False,

new_xcat=xtic,

)

dfx = msm.update_df(dfx, dfa)

factors[xtic] =[label, "ABS", "POS"] # info on benchmark/sign adjustments

Transformations and visualizations #

Relative values #

# Calculate relative values to benchmark currency areas

xcatx = [f for f in factors.keys() if factors[f][1] == "REL"]

dfa_usd = msp.make_relative_value(dfx, xcatx, cids_usd, basket=["USD"], postfix="vBM")

dfa_eur = msp.make_relative_value(dfx, xcatx, cids_eur, basket=["EUR"], postfix="vBM")

dfa_eud = msp.make_relative_value(

dfx, xcatx, cids_eud, basket=["EUR", "USD"], postfix="vBM"

)

dfa = pd.concat([dfa_eur, dfa_usd, dfa_eud])

dfx = msm.update_df(dfx, dfa)

# Modified factor dictionary

factors_r = {(f + "vBM" if k[1] == "REL" else f): k for f, k in factors.items()}

Negative values #

# Negative values where required

xcatx = [f for f in factors_r.keys() if factors_r[f][2] == "NEG"]

calcs = []

for xc in xcatx:

calcs += [f"{xc}_NEG = - {xc}"]

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cids_fx)

dfx = msm.update_df(dfx, dfa)

# Modified factor dictionary

factors_rn = {(f + "_NEG" if k[2] == "NEG" else f): k for f, k in factors_r.items()}

Normalization #

# Zn-scores

xcatx = [f for f in factors_rn.keys()]

cidx = cids_fx

dfa = pd.DataFrame(columns=list(dfx.columns))

for xc in xcatx:

dfaa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

# Modified factor dictionary

factorz = {f + "_ZN": k for f, k in factors_rn.items()}

# Labels dictionary

xtix = [f for f in factorz.keys()]

labs = [

(

"Relative " + v[0][:1].lower() + v[0][1:] + ", negative"

if v[1] == "REL" and v[2] == "NEG"

else (

"Relative " + v[0][:1].lower() + v[0][1:]

if v[1] == "REL" and v[2] == "POS"

else v[0] + ", negative" if v[2] == "NEG" else v[0]

)

)

for v in factorz.values()

]

factorz_labs = dict(zip(xtix, labs))

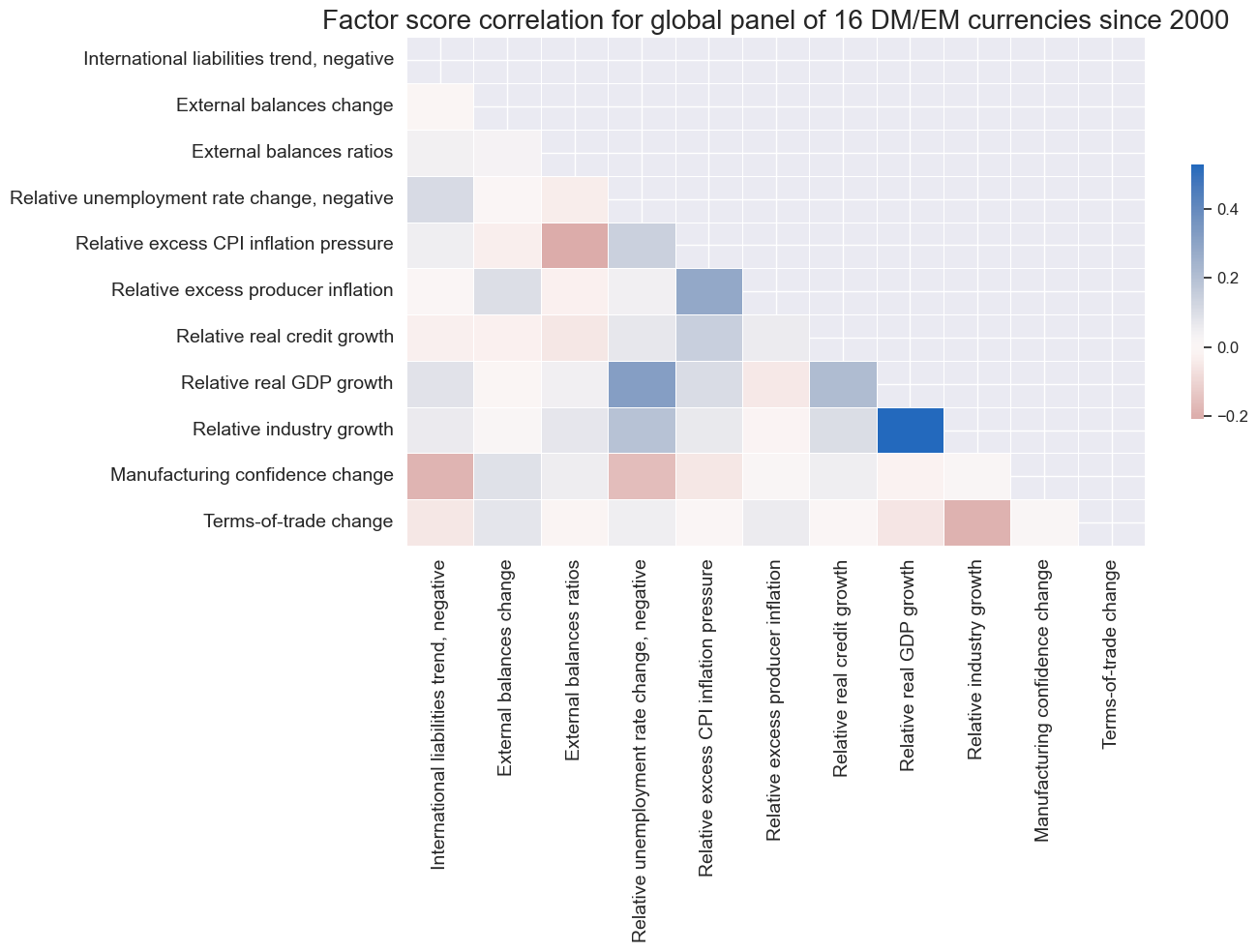

Visual checks #

cidx = cids_fx

xcatx = [f for f in factorz.keys()]

sdate = "2000-01-01"

renaming_dict = factorz_labs

dfx_corr = dfx.copy()

for key, value in renaming_dict.items():

dfx_corr["xcat"] = dfx_corr["xcat"].str.replace(key, value)

msp.correl_matrix(

dfx_corr,

xcats=list(renaming_dict.values()),

cids=cidx,

start=sdate,

freq="M",

cluster=False,

title="Factor score correlation for global panel of 16 DM/EM currencies since 2000",

size=(14, 10),

)

exts = [

"IIPLIABGDP_D_NEG_ZN",

"XBAL_D_ZN",

"XBALR_ZN",

]

cidx = cids_fx

xcatx = exts

msp.view_timelines(

df=dfx,

xcats=xcatx,

cids=cidx,

start="2000-01-01",

aspect=1.4,

ncol=4,

title = "International liability trends, external balances trends and external balances ratios",

xcat_labels = ["International liabilities", "External balances trends", "External balances ratios"]

)

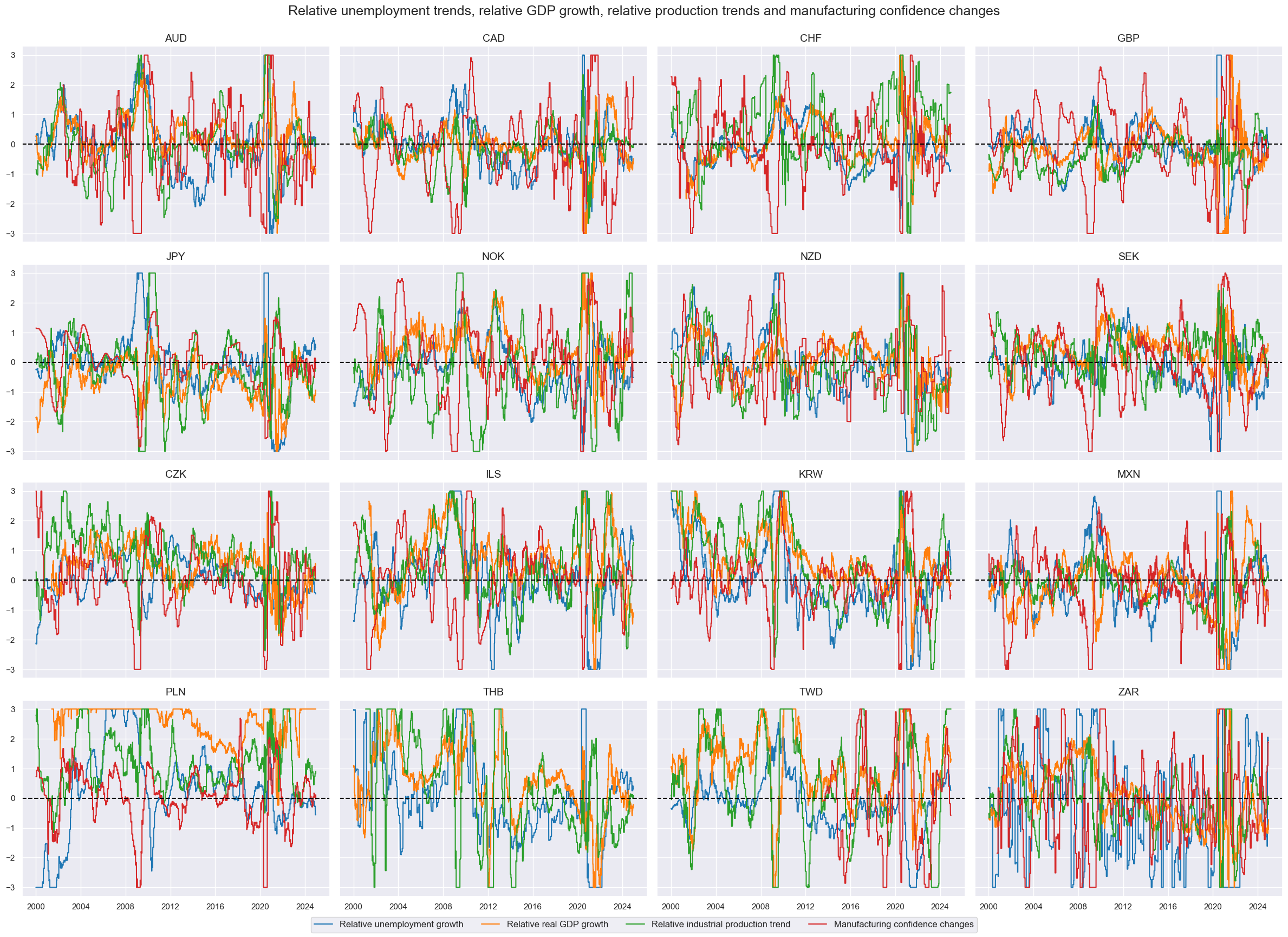

acts = [

"URATE_DvBM_NEG_ZN",

"RGDP_PvBM_ZN",

"IP_PvBM_ZN",

"MBSCORE_D_ZN",

]

cidx = cids_fx

xcatx = acts

msp.view_timelines(

df=dfx,

xcats=xcatx,

cids=cidx,

start="2000-01-01",

aspect=1.4,

ncol=4,

title = "Relative unemployment trends, relative GDP growth, relative production trends and manufacturing confidence changes",

xcat_labels = ["Relative unemployment growth", "Relative real GDP growth", "Relative industrial production trend", "Manufacturing confidence changes"]

)

incs = [

"XINFvBM_ZN",

"XPPI_PvBM_ZN",

"RPCREDIT_PvBM_ZN",

]

cidx = cids_fx

xcatx = incs

msp.view_timelines(

df=dfx,

xcats=xcatx,

cids=cidx,

start="2000-01-01",

aspect=1.4,

ncol=4,

title = "Relative excess inflation, relative excess producer inflation, relative private credit growth",

xcat_labels = ["Relative excess inflation", "Relative excess producer inflation", "Relative real credit growth"]

)

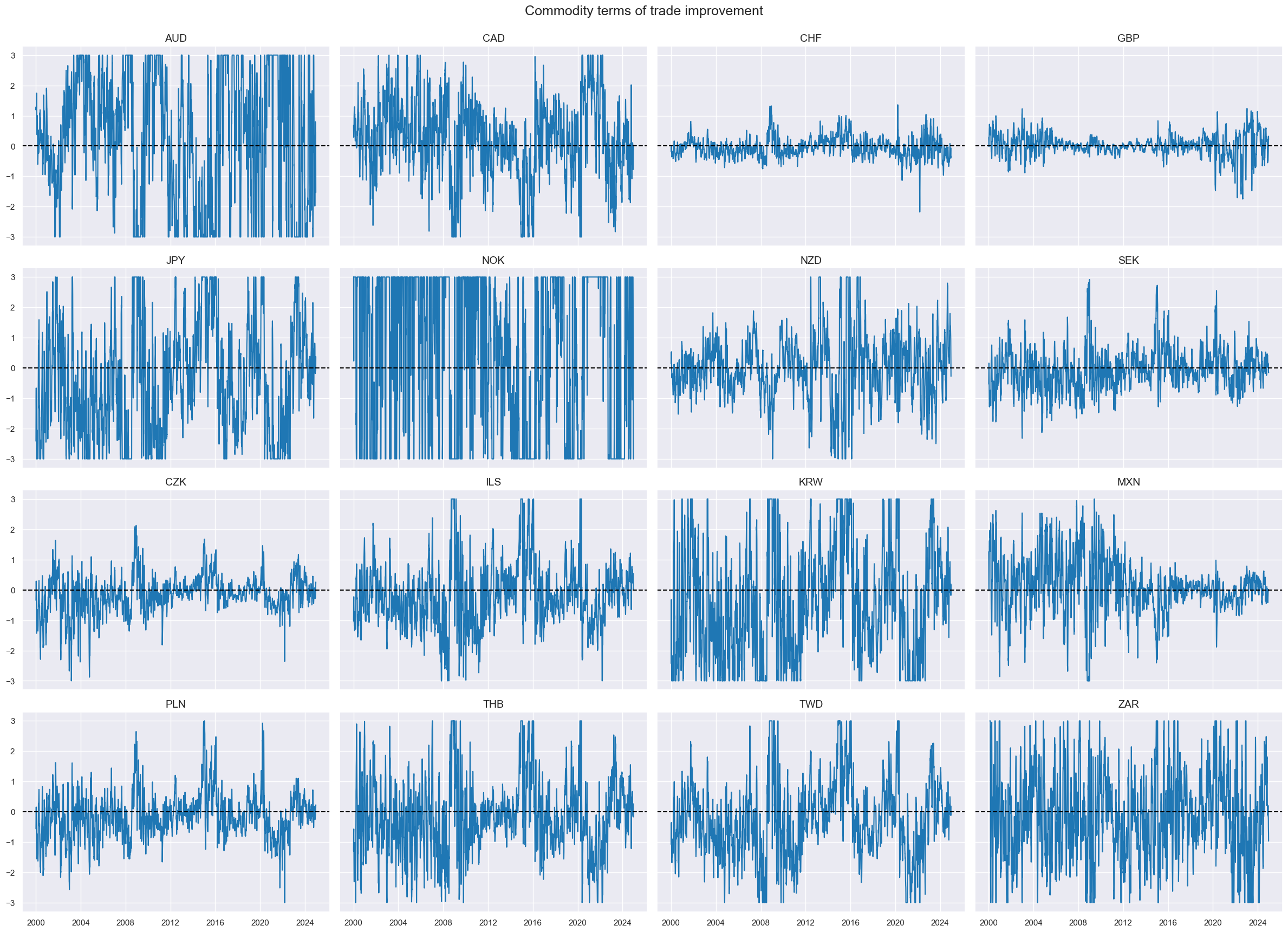

cidx = cids_fx

xcatx = ["CTOT_P_ZN"]

msp.view_timelines(

df=dfx,

xcats=xcatx,

cids=cidx,

start="2000-01-01",

aspect=1.4,

ncol=4,

title = "Commodity terms of trade improvement",

xcat_labels = ["Terms of trade improvement"]

)

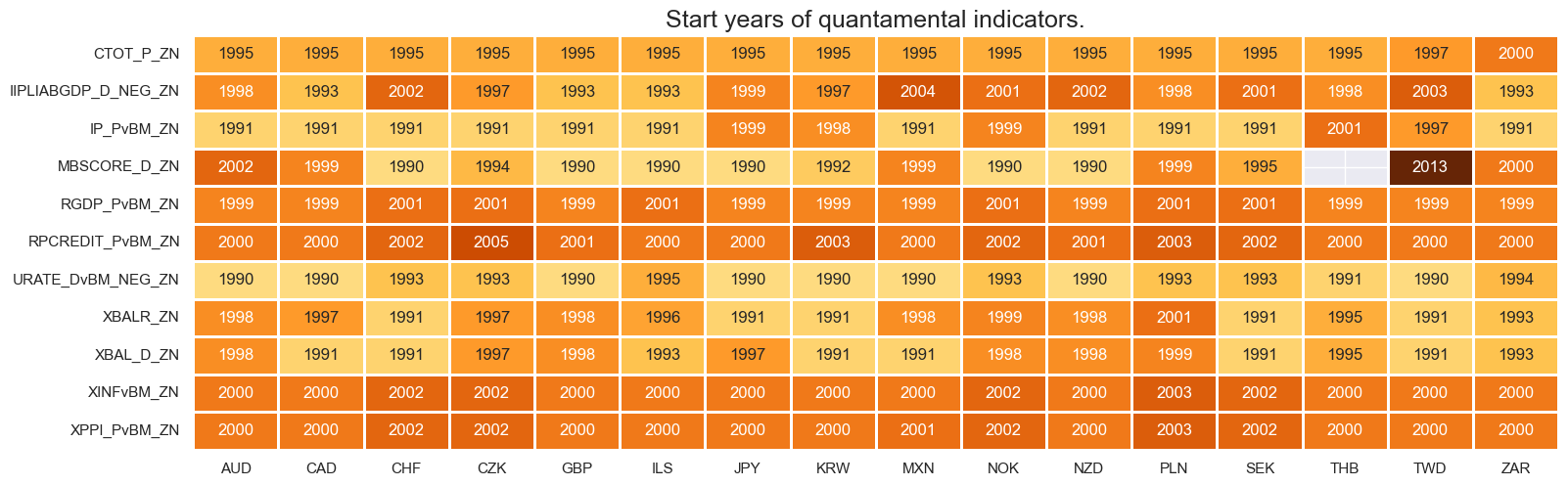

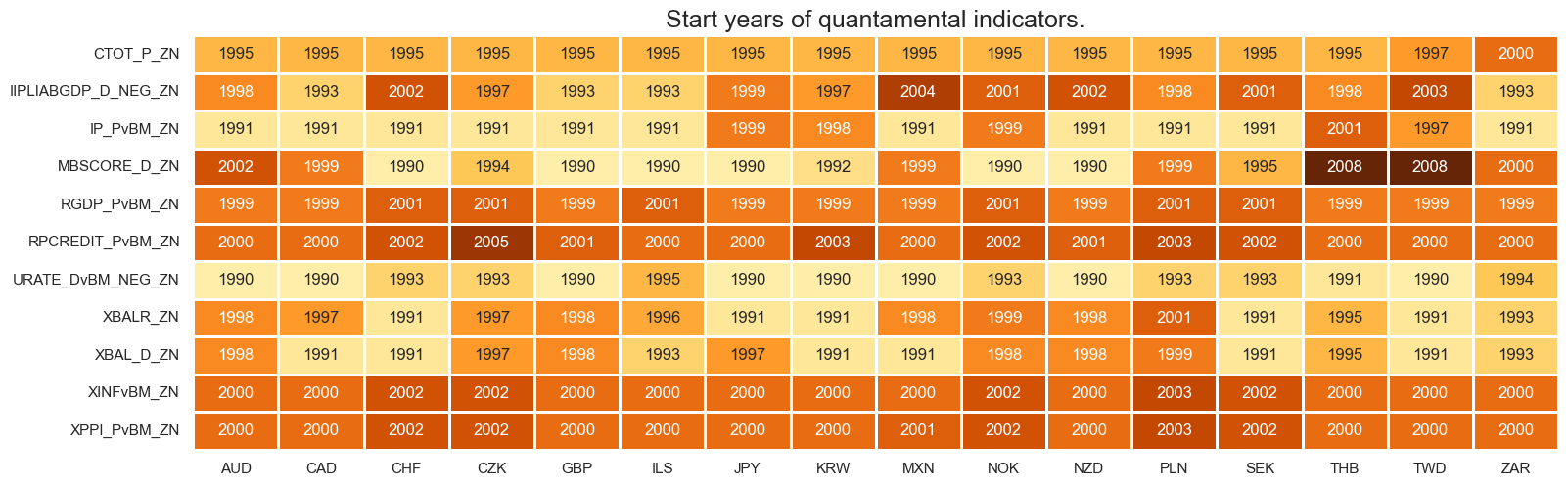

Availability checks and imputations #

xcatx = [f for f in factorz.keys()]

dfxx = dfx.copy()

msm.check_availability(dfxx, xcatx, missing_recent=False)

cidx = cids_fx

xcatx = ["MBSCORE_D_ZN", "URATE_DvBM_NEG_ZN", "XBALR_ZN"]

dfa = msp.impute_panel(

dfx, cidx, xcatx, threshold=0.8, impute_empty_tickers=True, start_date="2008-01-01"

)

dfx = msm.update_df(dfx, dfa)

xcatx = [f for f in factorz.keys()]

msm.check_availability(dfx, xcatx, missing_recent=False)

Target return checks #

targs = [

"FXXR_NSA",

"FXXR_VT10",

"FXXRHvGDRB_NSA",

]

xcatx = targs

msm.check_availability(dfx, xcatx, missing_recent=False)

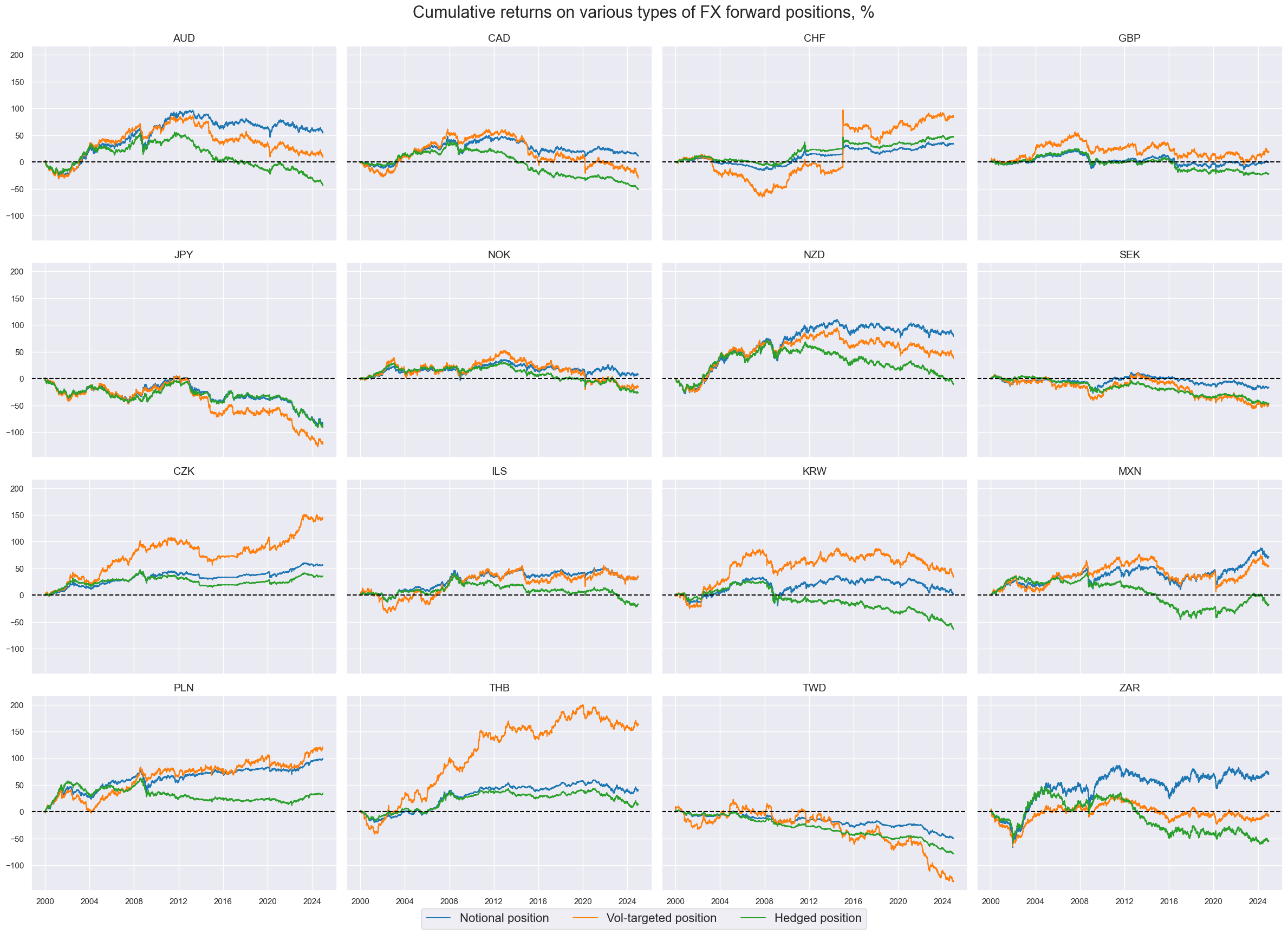

cidx = cids_fx

xcatx = targs

msp.view_timelines(

df=dfx,

xcats=xcatx,

cids=cidx,

title="Cumulative returns on various types of FX forward positions, %",

title_fontsize=22,

xcat_labels=["Notional position", "Vol-targeted position", "Hedged position"],

cumsum=True,

start="2000-01-01",

aspect=1.4,

ncol=4,

legend_fontsize = 16,

)

Preparations for statistical learning #

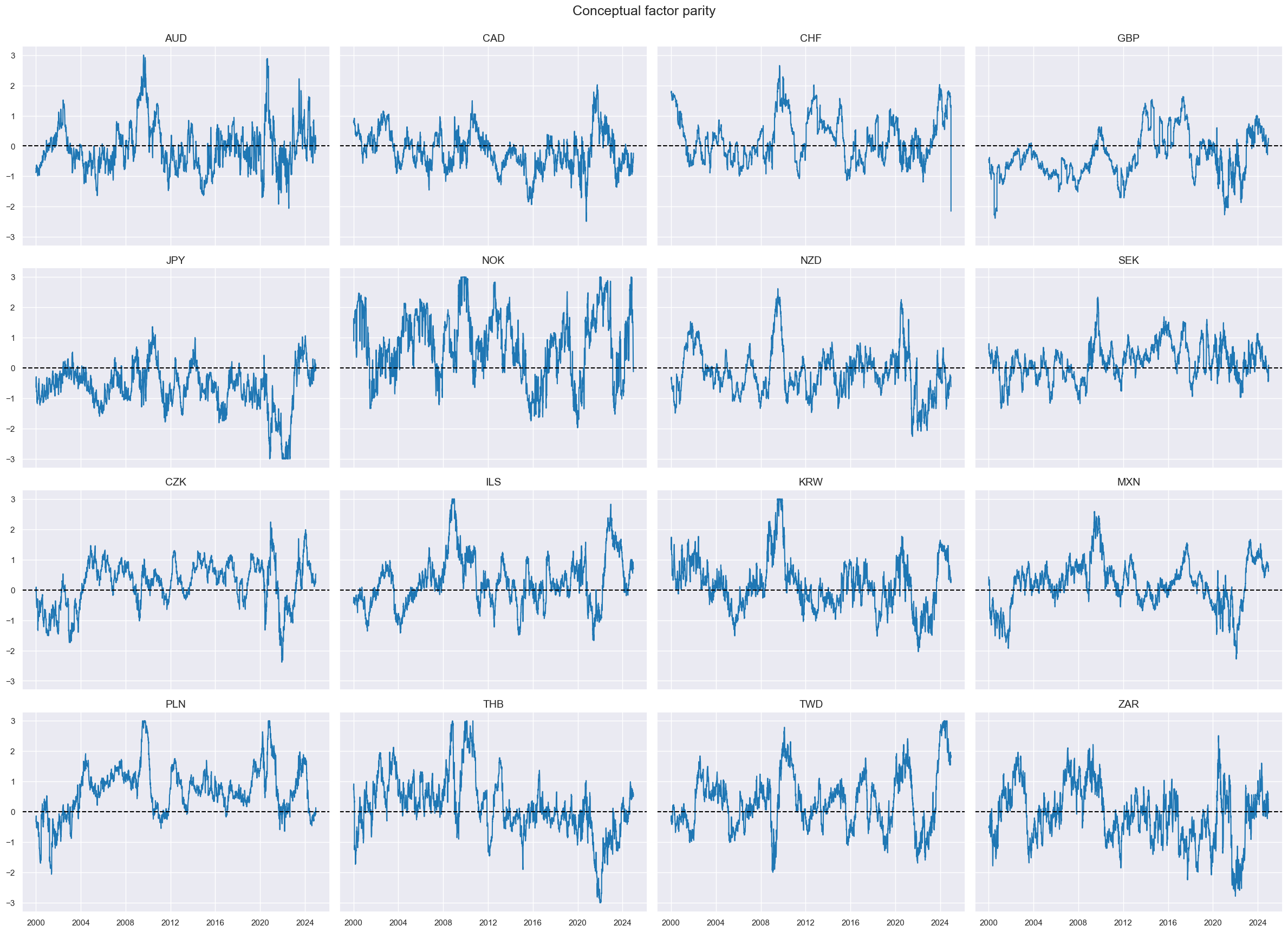

Conceptual parity as benchmark #

# Linear equally-weighted combination of all available candidates

xcatx = [f for f in factorz.keys()]

cidx = cids_fx

dfax = msp.linear_composite(

df=dfx,

xcats=xcatx,

cids=cidx,

new_xcat="ALL_AVG",

)

dfa = msp.make_zn_scores(

dfax,

xcat="ALL_AVG",

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="Z",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

cidx = cids_fx

xcatx = ["ALL_AVGZ"]

msp.view_timelines(

df=dfx,

xcats=xcatx,

cids=cidx,

start="2000-01-01",

aspect=1.4,

ncol=4,

title = "Conceptual factor parity",

)

Convert data to scikit-learn format (redundant) #

cidx = cids_fx

targ = "FXXR_VT10"

xcatx = [f for f in factorz.keys()] + [targ]

# Downsample from daily to monthly frequency (features as last and target as sum)

dfw = msm.categories_df(

df=dfx,

xcats=xcatx,

cids=cidx,

freq="M",

lag=1,

blacklist=fxblack,

xcat_aggs=["last", "sum"],

)

# Drop rows with missing values and assign features and target

dfw.dropna(inplace=True)

X_fx = dfw.iloc[:, :-1]

y_fx = dfw.iloc[:, -1]

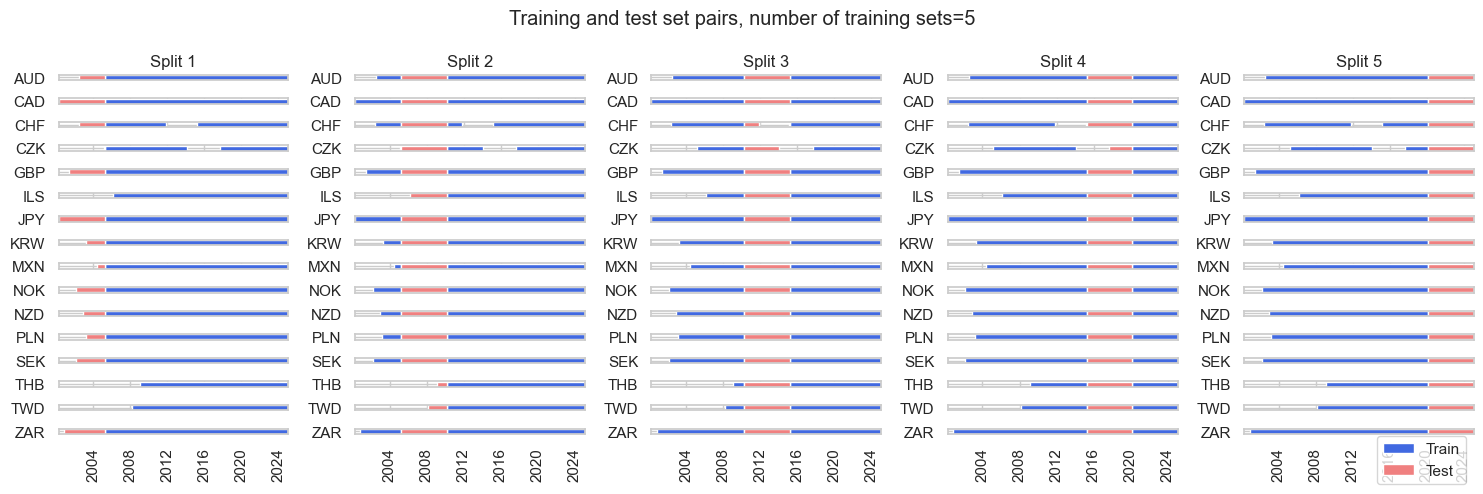

Define splitter and scorer #

splitter = msl.RollingKFoldPanelSplit(n_splits=5)

scorer = make_scorer(msl.sharpe_ratio, greater_is_better=True)

splitter.visualise_splits(X_fx, y_fx, figsize=(15, 5))

Signal generation #

Grids #

# Specify model options and grids

mods_mls = {

"mls": msl.ModifiedLinearRegression(method="analytic", error_offset=1e-5),

}

grid_mls = {

"mls": {"positive": [True, False], "fit_intercept": [True, False]},

}

# Random forest grid

mods_rf = {

"rf_full": RandomForestRegressor(

n_estimators = 200,

max_features = "sqrt",

max_samples = 0.1,

random_state = 42,

),

"rf_restricted": RandomForestRegressor(

n_estimators = 200,

max_features = "sqrt",

max_samples = 0.1,

monotonic_cst = [1 for i in range(len(factorz))],

random_state = 42,

)

}

grid_rf = {

"rf_full": {},

"rf_restricted": {},

}

Learning vol-targeted positions #

# Instantiation

xcatx = [f for f in factorz.keys()] + ["FXXR_VT10"]

cidx = cids_fx

so_fxv = msl.SignalOptimizer(

df = dfx,

xcats = xcatx,

cids = cidx,

blacklist = fxblack,

freq = "M",

lag = 1,

xcat_aggs = ["last", "sum"]

)

# Learn with linear regression

so_fxv.calculate_predictions(

name = "LSV",

models = mods_mls,

hyperparameters = grid_mls,

scorers = {"sharpe": scorer},

inner_splitters = {"Rolling": splitter},

search_type = "grid",

normalize_fold_results = False,

cv_summary = "mean",

min_cids = 2,

min_periods = 36,

test_size = 1,

n_jobs_outer = -1,

split_functions={"Rolling": lambda n: n // 36},

)

dfa = so_fxv.get_optimized_signals(name="LSV")

dfx = msm.update_df(dfx, dfa)

# Illustrate model choice

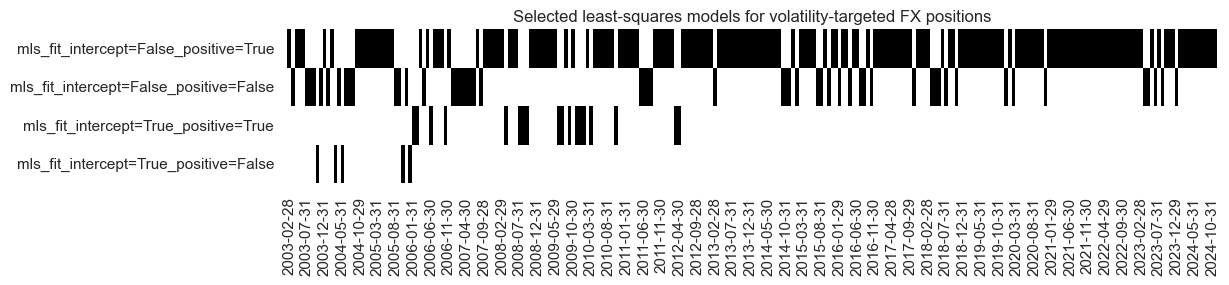

so_fxv.models_heatmap(

"LSV",

title="Selected least-squares models for volatility-targeted FX positions",

figsize=(12, 2),

)

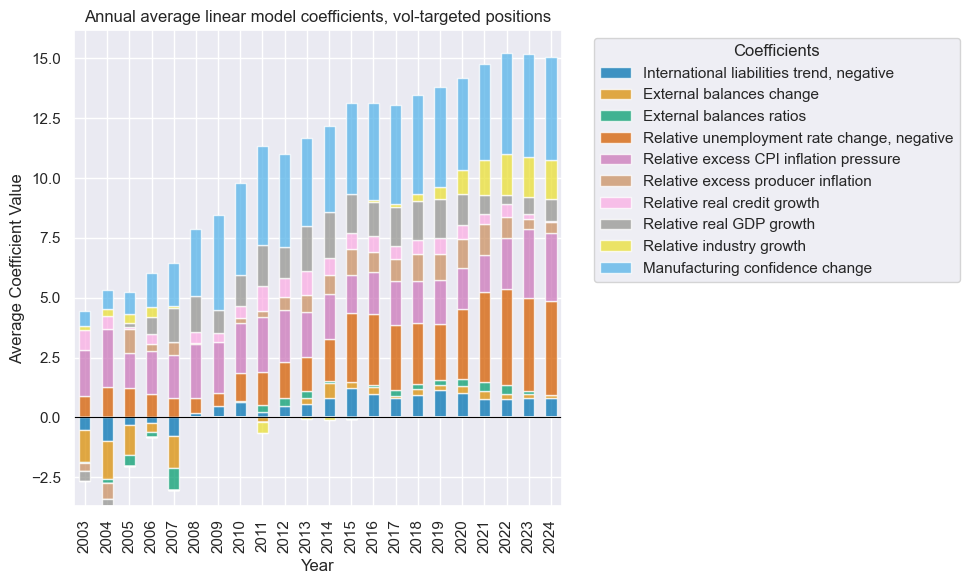

so_fxv.coefs_stackedbarplot(

"LSV",

title="Annual average linear model coefficients, vol-targeted positions",

ftrs_renamed=factorz_labs,

)

# Learn with random forest

so_fxv.calculate_predictions(

name = "RFV",

models = mods_rf,

hyperparameters = grid_rf,

scorers = {"sharpe": scorer},

inner_splitters = {"Rolling": splitter},

search_type = "grid",

normalize_fold_results = False,

cv_summary = "mean",

min_cids = 2,

min_periods = 36,

test_size = 1,

n_jobs_outer = -1,

)

dfa = so_fxv.get_optimized_signals(name="RFV")

dfx = msm.update_df(dfx, dfa)

# Illustrate model choice

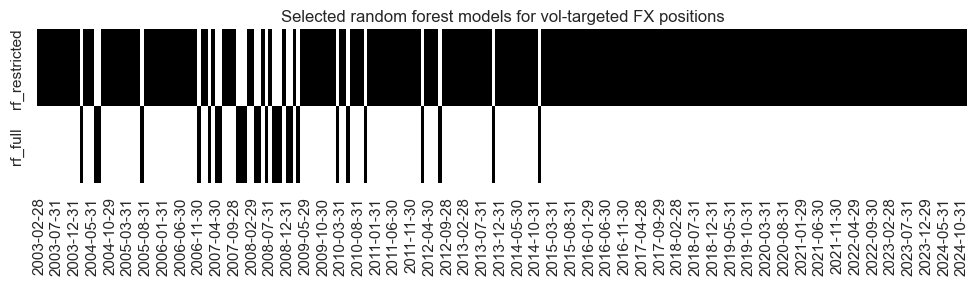

so_fxv.models_heatmap(

"RFV",

title="Selected random forest models for vol-targeted FX positions",

figsize=(12, 2),

)

so_fxv.coefs_stackedbarplot(

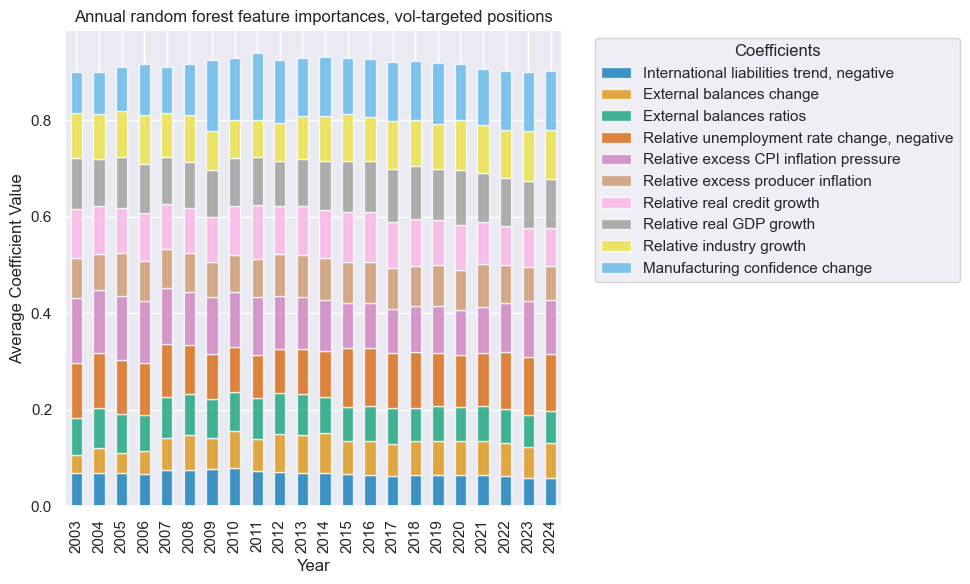

"RFV",

title="Annual random forest feature importances, vol-targeted positions",

ftrs_renamed=factorz_labs,

)

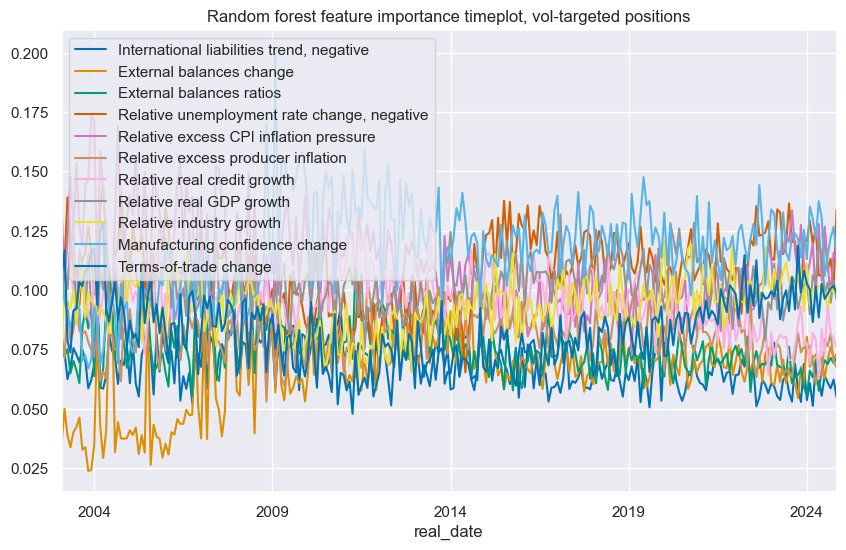

so_fxv.feature_importance_timeplot(

"RFV",

title="Random forest feature importance timeplot, vol-targeted positions",

ftrs_renamed=factorz_labs,

)

# Zn-scores

xcatx = ["LSV", "RFV"]

cidx = cids_fx

dfa = pd.DataFrame(columns=list(dfx.columns))

for xc in xcatx:

dfaa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="Z",

est_freq="m",

)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

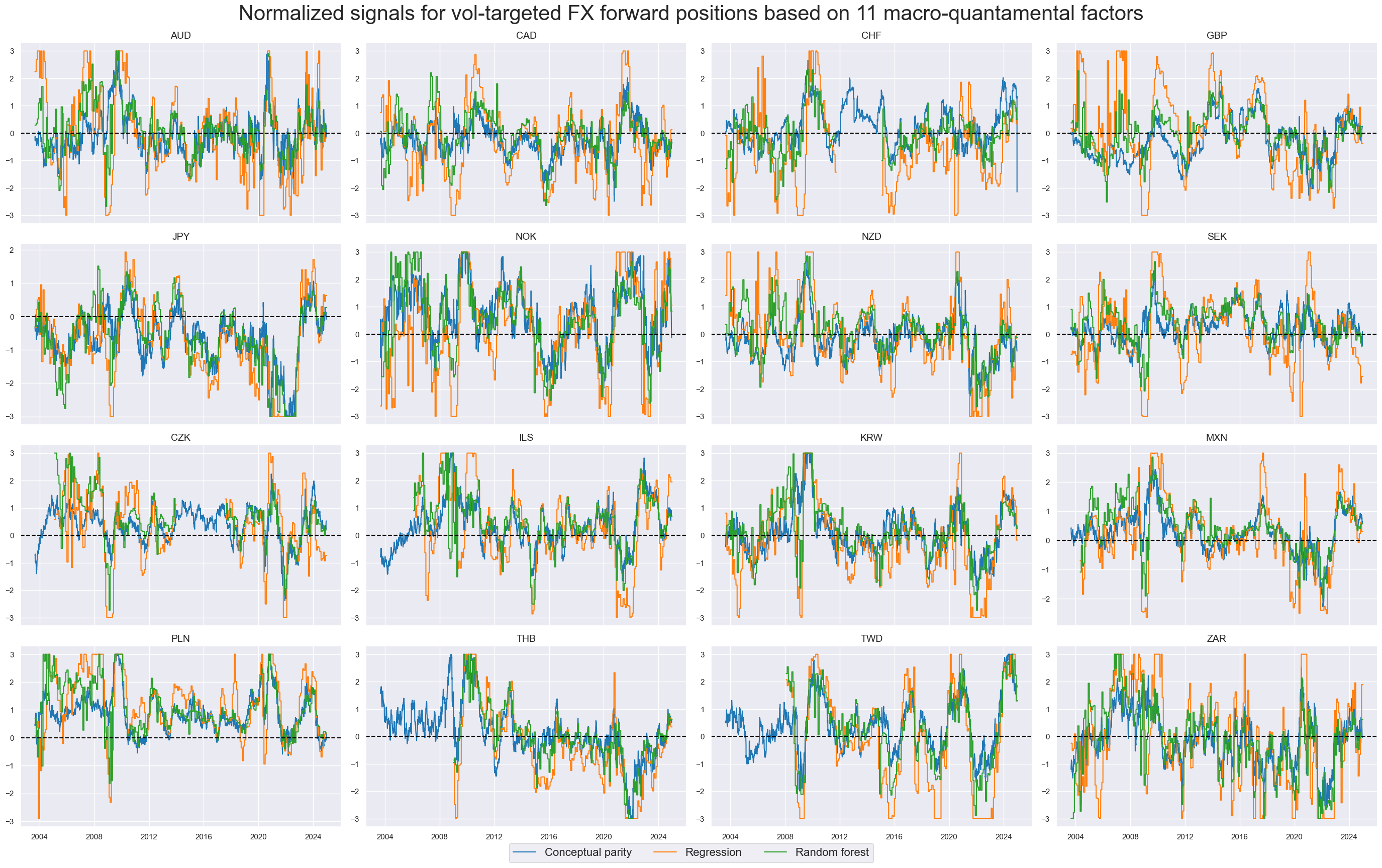

xcatx = ["ALL_AVGZ", "LSVZ", "RFVZ"]

cidx = cids_fx

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

start="2003-08-29",

title = "Normalized signals for vol-targeted FX forward positions based on 11 macro-quantamental factors",

xcat_labels = ["Conceptual parity", "Regression", "Random forest"],

title_fontsize=30,

same_y=False,

cs_mean=False,

legend_fontsize=16,

)

Learning hedged positions #

# Instantiation

xcatx = [f for f in factorz.keys()] + ["FXXRHvGDRB_NSA"]

cidx = cids_fx

so_fxh = msl.SignalOptimizer(

df = dfx,

xcats = xcatx,

cids = cidx,

blacklist = fxblack,

freq = "M",

lag = 1,

xcat_aggs = ["last", "sum"]

)

# Learn with linear regression

so_fxh.calculate_predictions(

name = "LSH",

models = mods_mls,

hyperparameters = grid_mls,

scorers = {"sharpe": scorer},

inner_splitters = {"Rolling": splitter},

search_type = "grid",

normalize_fold_results = False,

cv_summary = "mean",

min_cids = 2,

min_periods = 36,

test_size = 1,

n_jobs_outer = -1,

split_functions={"Rolling": lambda n: n // 36},

)

dfa = so_fxh.get_optimized_signals(name="LSH")

dfx = msm.update_df(dfx, dfa)

# Illustrate model choice

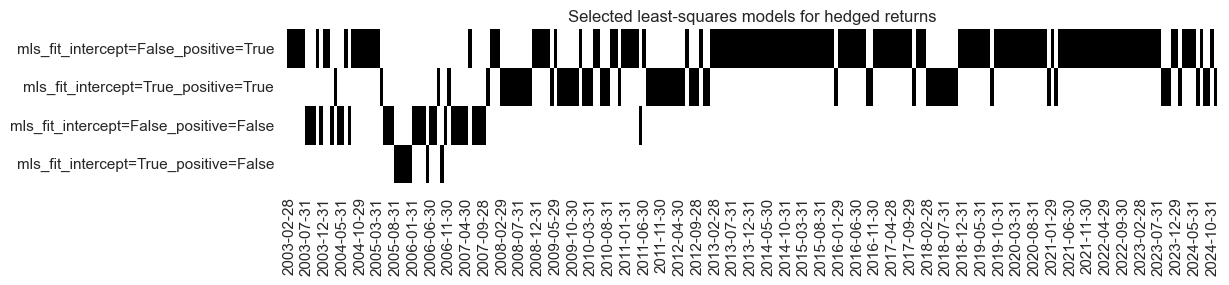

so_fxh.models_heatmap(

"LSH",

title="Selected least-squares models for hedged returns",

figsize=(12, 2),

)

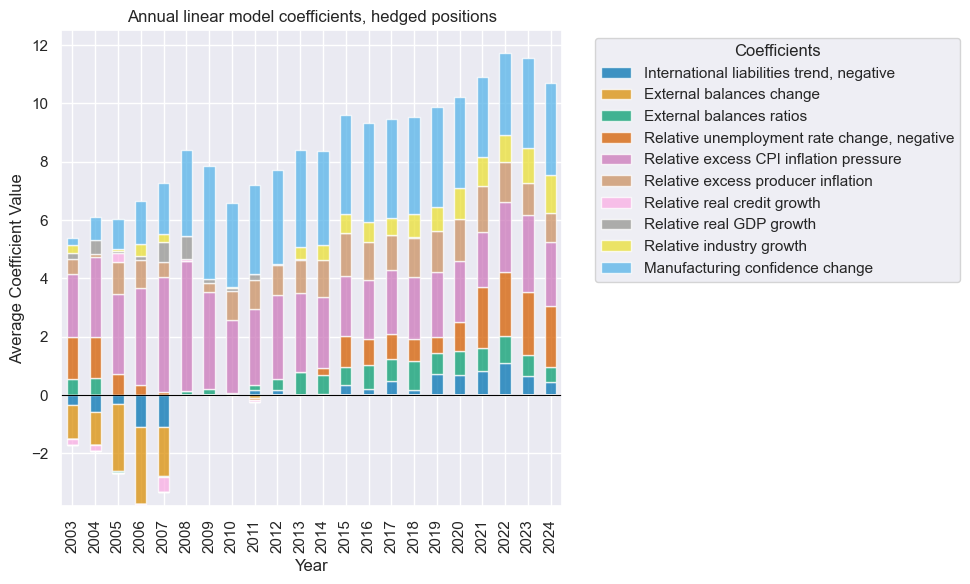

so_fxh.coefs_stackedbarplot(

"LSH",

title="Annual linear model coefficients, hedged positions",

ftrs_renamed=factorz_labs,

)

# Learn with random forest

so_fxh.calculate_predictions(

name = "RFH",

models = mods_rf,

hyperparameters = grid_rf,

scorers = {"sharpe": scorer},

inner_splitters = {"Rolling": splitter},

search_type = "grid",

normalize_fold_results = False,

cv_summary = "mean",

min_cids = 2,

min_periods = 36,

test_size = 1,

n_jobs_outer = -1,

)

dfa = so_fxh.get_optimized_signals()

dfx = msm.update_df(dfx, dfa)

# Illustrate model choice

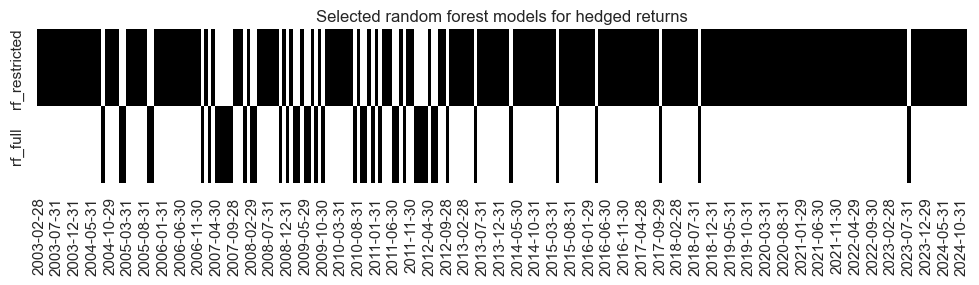

so_fxh.models_heatmap(

"RFH",

title="Selected random forest models for hedged returns",

figsize=(12, 2),

)

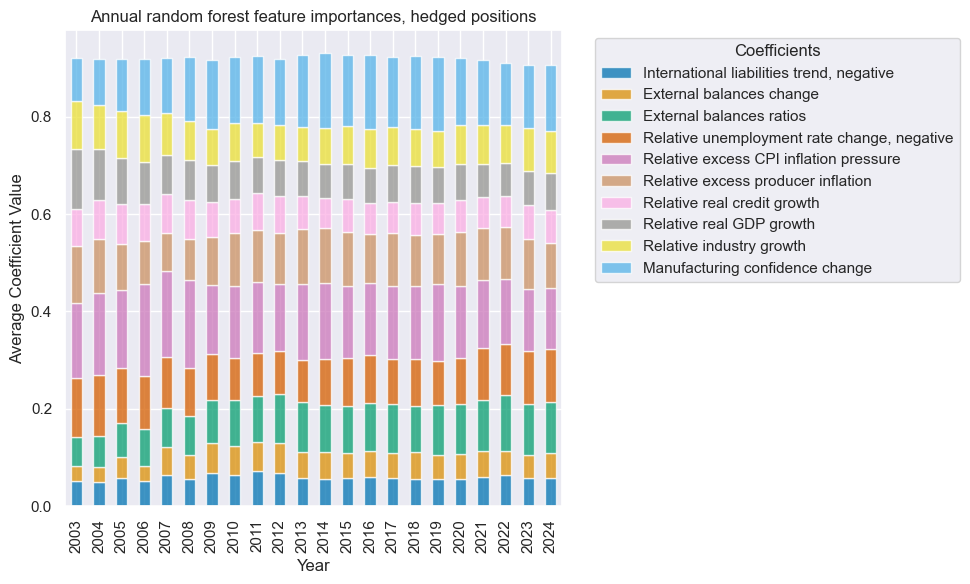

so_fxh.coefs_stackedbarplot(

"RFH",

title="Annual random forest feature importances, hedged positions",

ftrs_renamed=factorz_labs,

)

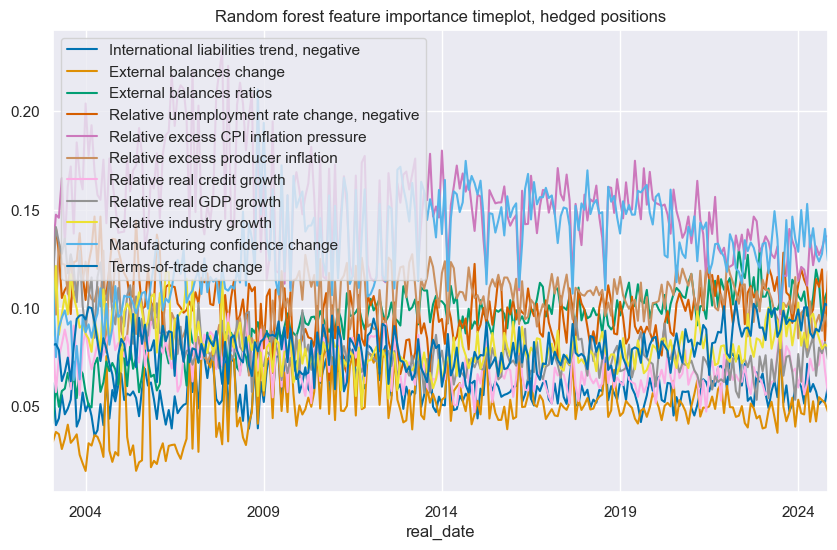

so_fxh.feature_importance_timeplot(

"RFH",

title="Random forest feature importance timeplot, hedged positions",

ftrs_renamed=factorz_labs,

)

# Zn-scores

xcatx = ["LSH", "RFH"]

cidx = cids_fx

dfa = pd.DataFrame(columns=list(dfx.columns))

for xc in xcatx:

dfaa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="Z",

est_freq="m",

)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

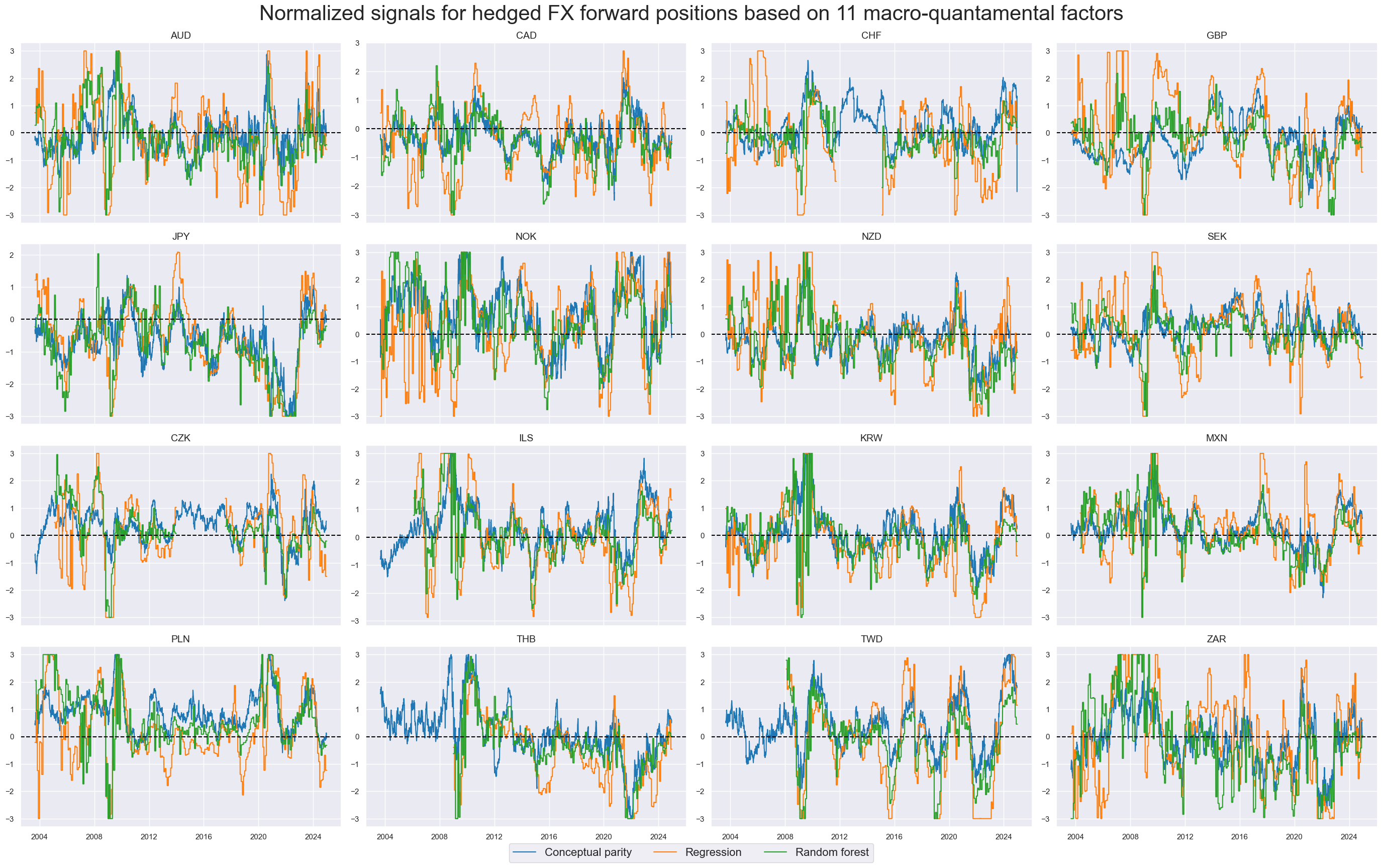

xcatx = ["ALL_AVGZ", "LSHZ", "RFHZ"]

cidx = cids_fx

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

start="2003-08-29",

title = "Normalized signals for hedged FX forward positions based on 11 macro-quantamental factors",

xcat_labels = ["Conceptual parity", "Regression", "Random forest"],

title_fontsize=30,

same_y=False,

cs_mean=False,

legend_fontsize=16,

)

Signal value checks #

Vol-targeted positions #

Specs and panel test #

cidx = cids_fx

sdate = "2003-08-29"

dict_fxv = {

"sigs": ["ALL_AVGZ", "LSVZ", "RFVZ"],

"targs": ["FXXR_VT10"],

"cidx": cidx,

"start": sdate,

"black": fxblack,

"srr": None,

"pnls": None,

}

dix = dict_fxv

sigx = dix["sigs"]

tarx = dix["targs"]

cidx = dix["cidx"]

blax = dix["black"]

start = dix["start"]

def crmaker(sig, targ):

crx = msp.CategoryRelations(

dfx,

xcats=[sig, targ],

cids=cidx,

freq="M",

lag=1,

xcat_aggs=["last", "sum"],

start=start,

blacklist=blax,

)

return crx

lcrs = [crmaker(sig, targ) for sig in sigx for targ in tarx]

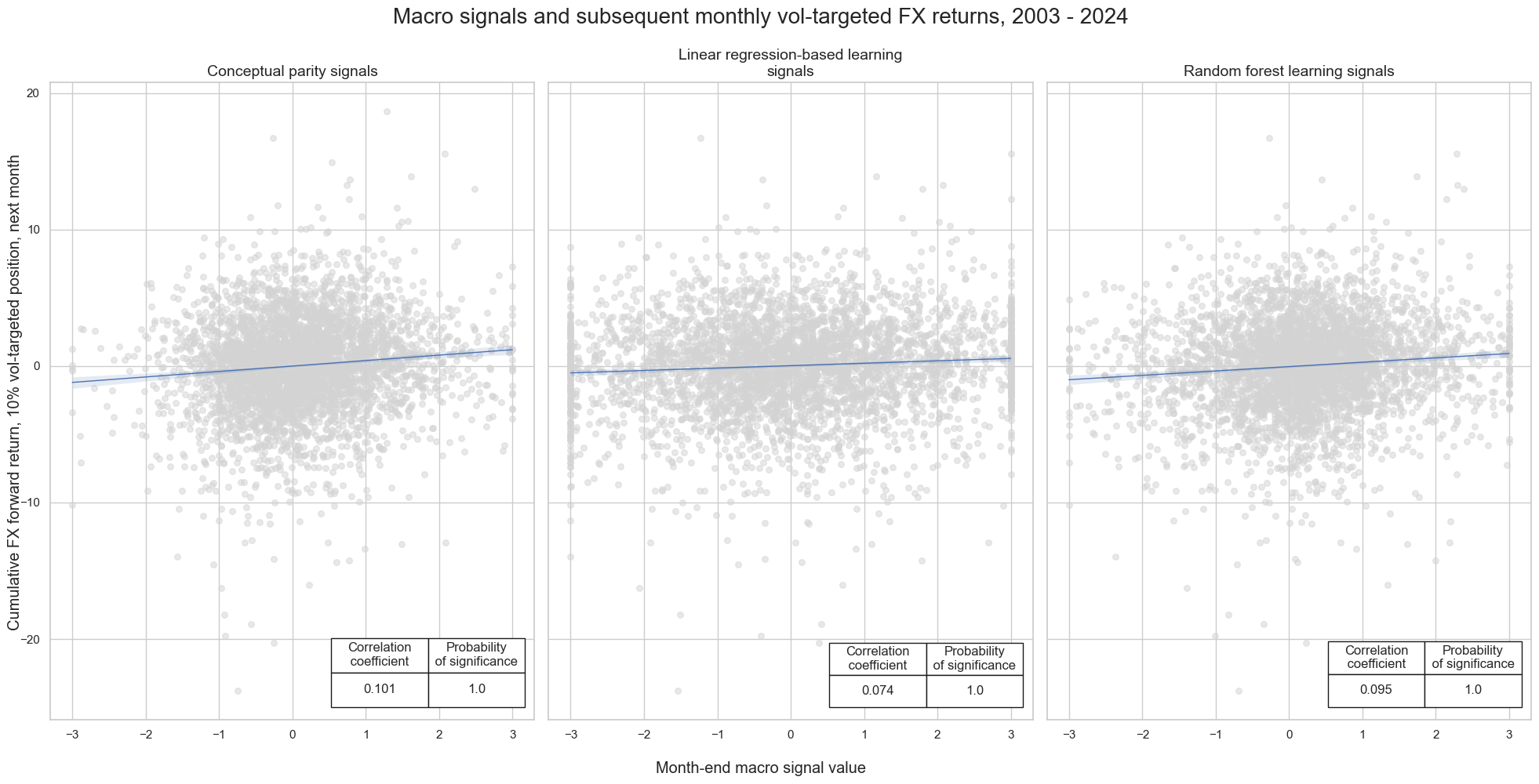

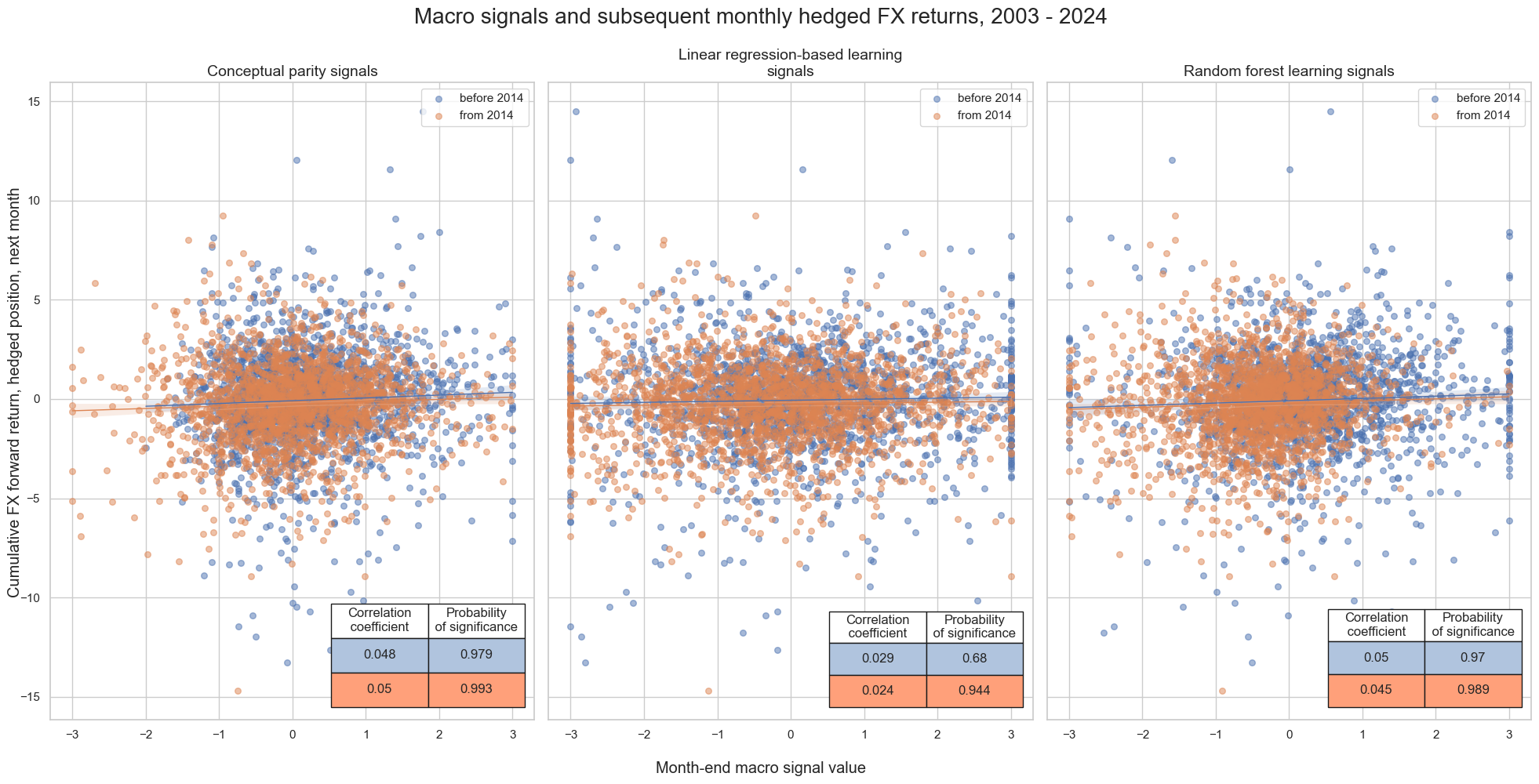

msv.multiple_reg_scatter(

lcrs,

ncol=3,

nrow=1,

figsize=(20, 10),

title="Macro signals and subsequent monthly vol-targeted FX returns, 2003 - 2024",

xlab="Month-end macro signal value",

ylab="Cumulative FX forward return, 10% vol-targeted position, next month",

coef_box="lower right",

prob_est="map",

subplot_titles=[

"Conceptual parity signals",

"Linear regression-based learning signals",

"Random forest learning signals",

],

)

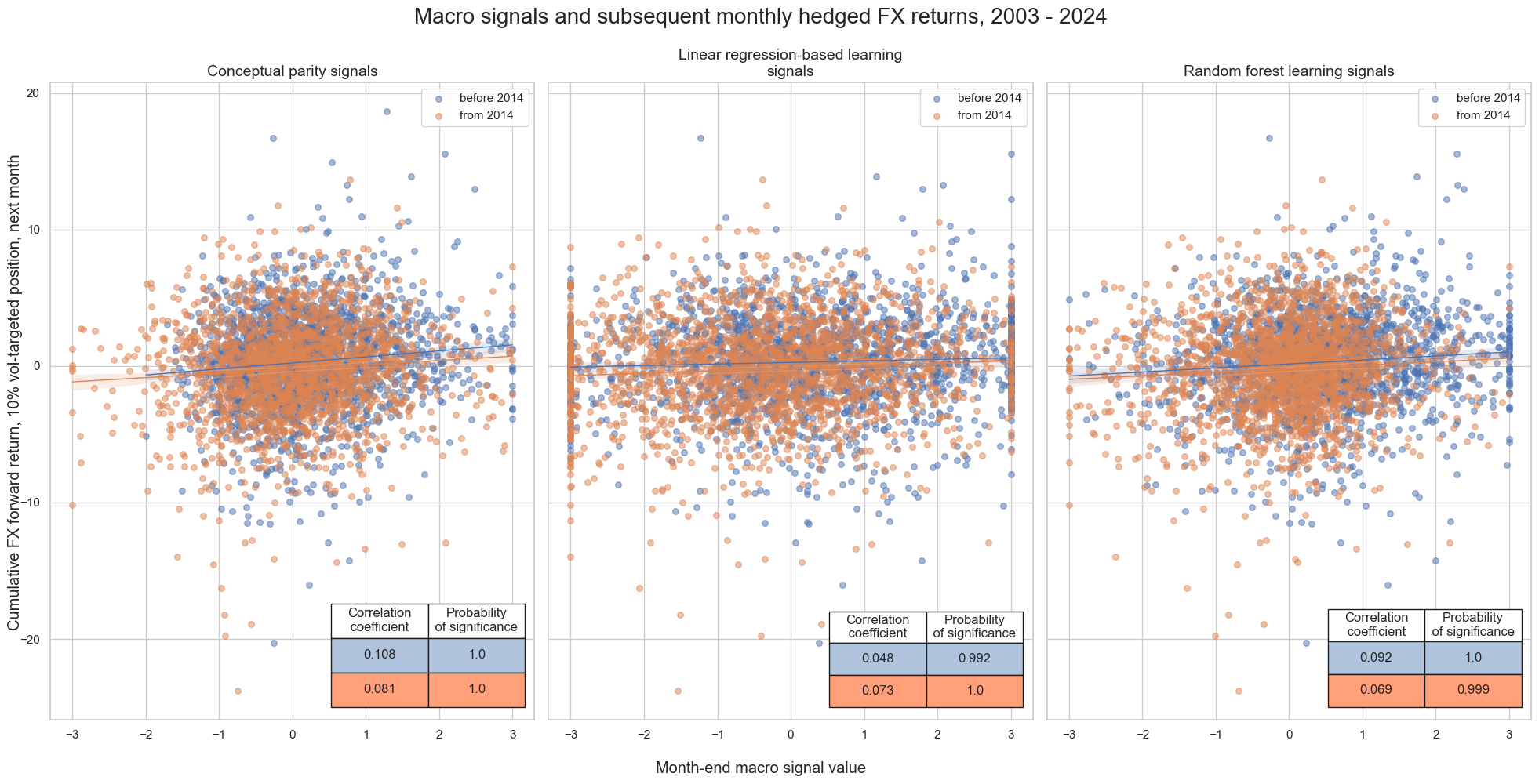

msv.multiple_reg_scatter(

lcrs,

ncol=3,

nrow=1,

figsize=(20, 10),

title="Macro signals and subsequent monthly hedged FX returns, 2003 - 2024",

xlab="Month-end macro signal value",

ylab="Cumulative FX forward return, 10% vol-targeted position, next month",

coef_box="lower right",

prob_est="map",

subplot_titles=[

"Conceptual parity signals",

"Linear regression-based learning signals",

"Random forest learning signals",

],

separator=2014,

)

dix = dict_fxv

sigx = dix["sigs"]

tarx = dix["targs"]

cidx = dix["cidx"]

blax = dix["black"]

start = dix["start"]

def crmaker(sig, targ):

crx = msp.CategoryRelations(

dfx,

xcats=[sig, targ],

cids=cidx,

freq="Q",

lag=1,

xcat_aggs=["last", "sum"],

start=start,

blacklist=blax,

)

return crx

lcrs = [crmaker(sig, targ) for sig in sigx for targ in tarx]

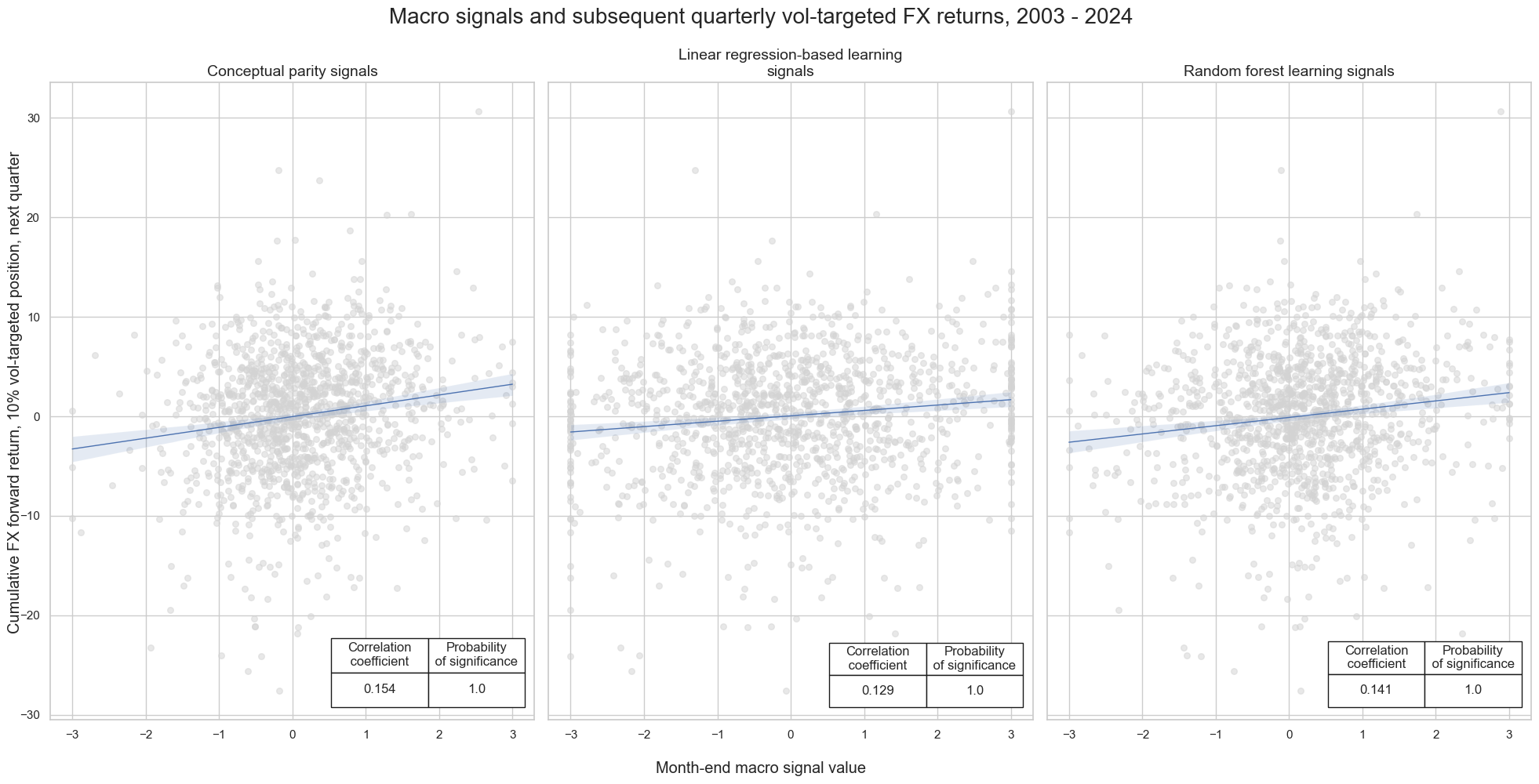

msv.multiple_reg_scatter(

lcrs,

ncol=3,

nrow=1,

figsize=(20, 10),

title="Macro signals and subsequent quarterly vol-targeted FX returns, 2003 - 2024",

xlab="Month-end macro signal value",

ylab="Cumulative FX forward return, 10% vol-targeted position, next quarter",

coef_box="lower right",

prob_est="map",

subplot_titles=[

"Conceptual parity signals",

"Linear regression-based learning signals",

"Random forest learning signals",

],

)

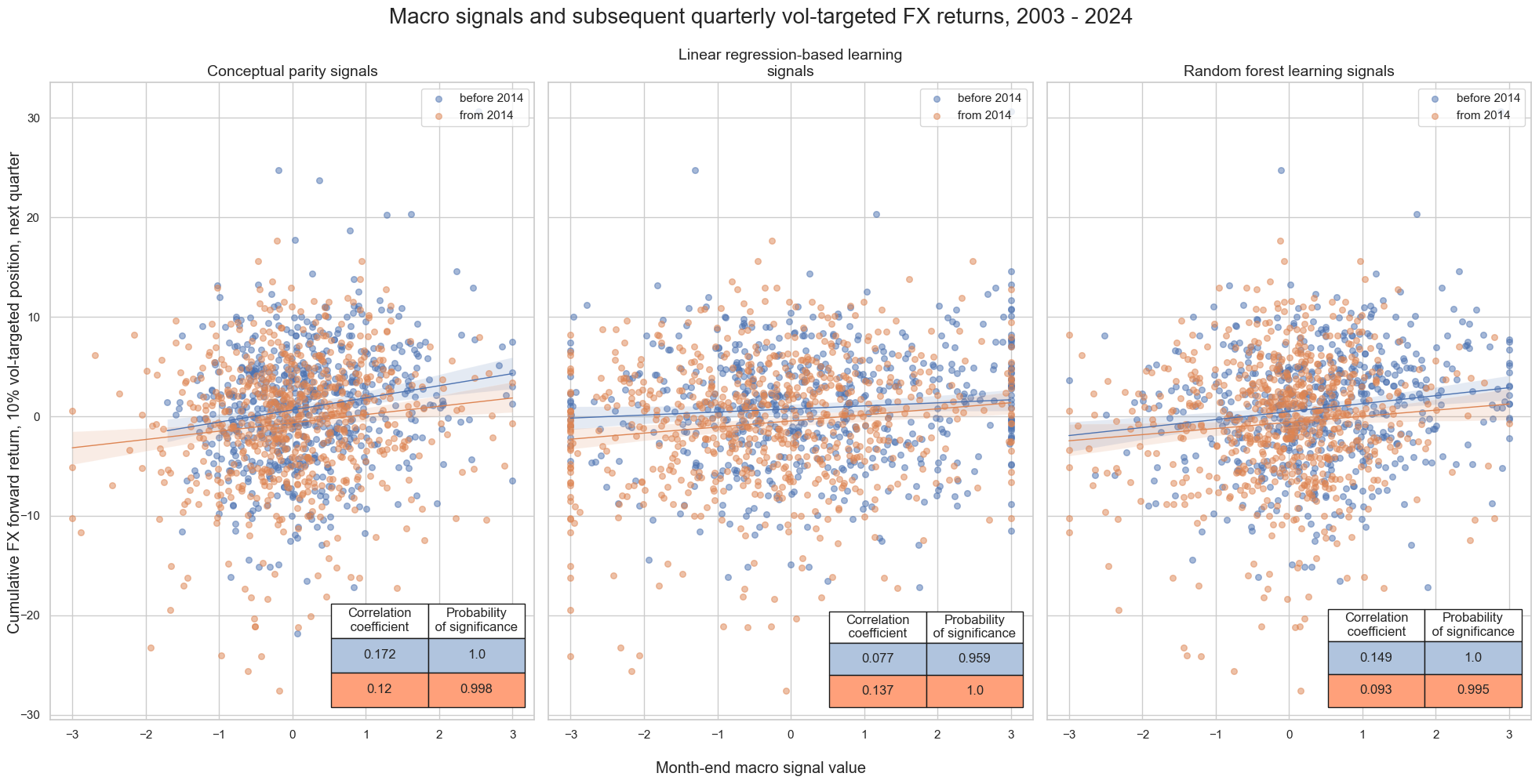

msv.multiple_reg_scatter(

lcrs,

ncol=3,

nrow=1,

figsize=(20, 10),

title="Macro signals and subsequent quarterly vol-targeted FX returns, 2003 - 2024",

xlab="Month-end macro signal value",

ylab="Cumulative FX forward return, 10% vol-targeted position, next quarter",

coef_box="lower right",

prob_est="map",

subplot_titles=[

"Conceptual parity signals",

"Linear regression-based learning signals",

"Random forest learning signals",

],

separator=2014,

)

Accuracy and correlation check #

## Compare optimized signals with simple average z-scores

dix = dict_fxv

sigx = dix["sigs"]

tarx = dix["targs"]

cidx = dix["cidx"]

blax = dix["black"]

startx = dix["start"]

srr = mss.SignalReturnRelations(

df=dfx,

rets=tarx,

sigs=sigx,

cids=cidx,

cosp=True,

freqs=["M"],

agg_sigs=["last"],

start=startx,

blacklist=blax,

slip=1,

ms_panel_test=True,

)

dix["srr"] = srr

selcols = [

"accuracy",

"bal_accuracy",

"pos_sigr",

"pos_retr",

"pearson",

"map_pval",

"kendall",

"kendall_pval",

]

srr.multiple_relations_table().round(3)[selcols]

| accuracy | bal_accuracy | pos_sigr | pos_retr | pearson | map_pval | kendall | kendall_pval | ||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Return | Signal | Frequency | Aggregation | ||||||||

| FXXR_VT10 | ALL_AVGZ | M | last | 0.531 | 0.530 | 0.528 | 0.522 | 0.095 | 0.0 | 0.059 | 0.0 |

| LSVZ | M | last | 0.512 | 0.513 | 0.487 | 0.522 | 0.071 | 0.0 | 0.041 | 0.0 | |

| RFVZ | M | last | 0.526 | 0.523 | 0.601 | 0.522 | 0.098 | 0.0 | 0.060 | 0.0 |

Naive PnL #

dix = dict_fxv

sigx = dix["sigs"]

tarx = dix["targs"]

cidx = dix["cidx"]

blax = dix["black"]

startx = dix["start"]

pnls = msn.NaivePnL(

df=dfx,

ret=tarx[0],

sigs=sigx,

cids=cidx,

start=startx,

blacklist=blax,

bms=["USD_GB10YXR_NSA", "EUR_FXXR_NSA", "USD_EQXR_NSA"],

)

for sig in sigx:

pnls.make_pnl(

sig=sig,

sig_op="raw",

rebal_freq="monthly",

neutral="zero",

rebal_slip=1,

vol_scale=10,

)

pnls.make_long_pnl(vol_scale=10, label="Long only")

dix['pnls'] = pnls

dix = dict_fxv

pnls = dict_fxv["pnls"]

sigx = dix["sigs"]

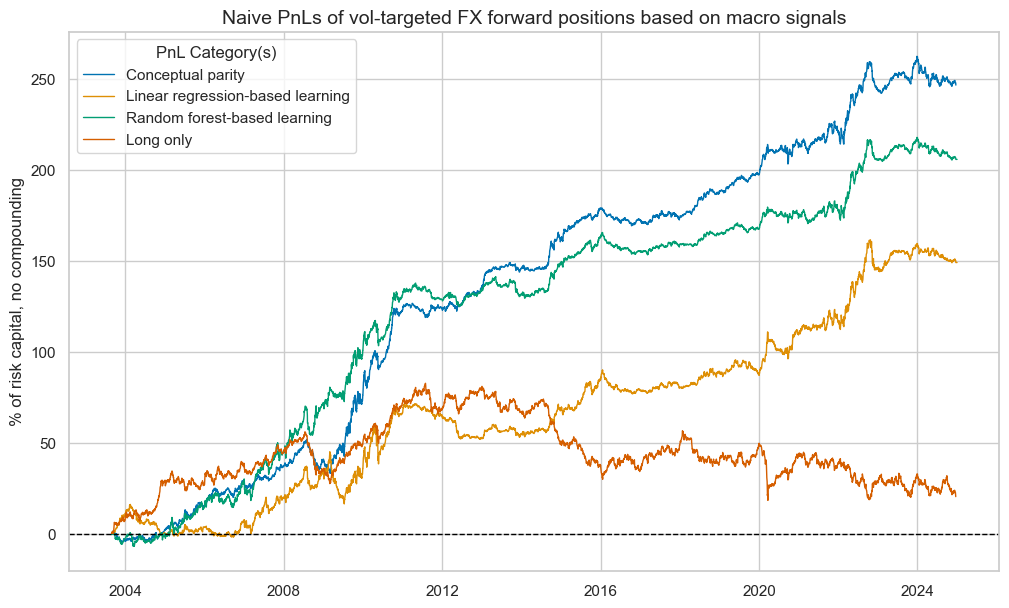

pnls.plot_pnls(

title="Naive PnLs of vol-targeted FX forward positions based on macro signals",

title_fontsize=14,

xcat_labels=[

"Conceptual parity",

"Linear regression-based learning",

"Random forest-based learning",

"Long only",

],

)

pnls.evaluate_pnls(pnl_cats=["PNL_" + sig for sig in sigx] + ["Long only"])

| xcat | PNL_ALL_AVGZ | PNL_LSVZ | PNL_RFVZ | Long only |

|---|---|---|---|---|

| Return % | 11.573196 | 6.991206 | 9.645992 | 0.967029 |

| St. Dev. % | 10.0 | 10.0 | 10.0 | 10.0 |

| Sharpe Ratio | 1.15732 | 0.699121 | 0.964599 | 0.096703 |

| Sortino Ratio | 1.759249 | 1.013046 | 1.414893 | 0.132339 |

| Max 21-Day Draw % | -11.562754 | -20.972745 | -14.553378 | -24.329186 |

| Max 6-Month Draw % | -14.960068 | -18.956451 | -10.168273 | -24.479089 |

| Peak to Trough Draw % | -18.687284 | -28.622746 | -15.973817 | -64.270266 |

| Top 5% Monthly PnL Share | 0.479377 | 0.724625 | 0.519515 | 4.494745 |

| USD_GB10YXR_NSA correl | -0.107952 | -0.05807 | -0.063287 | -0.008622 |

| EUR_FXXR_NSA correl | -0.014618 | -0.042602 | 0.030355 | 0.505311 |

| USD_EQXR_NSA correl | 0.135619 | 0.000256 | 0.064407 | 0.283902 |

| Traded Months | 257 | 257 | 257 | 257 |

dix = dict_fxv

pnls = dix["pnls"]

sigx = dix["sigs"]

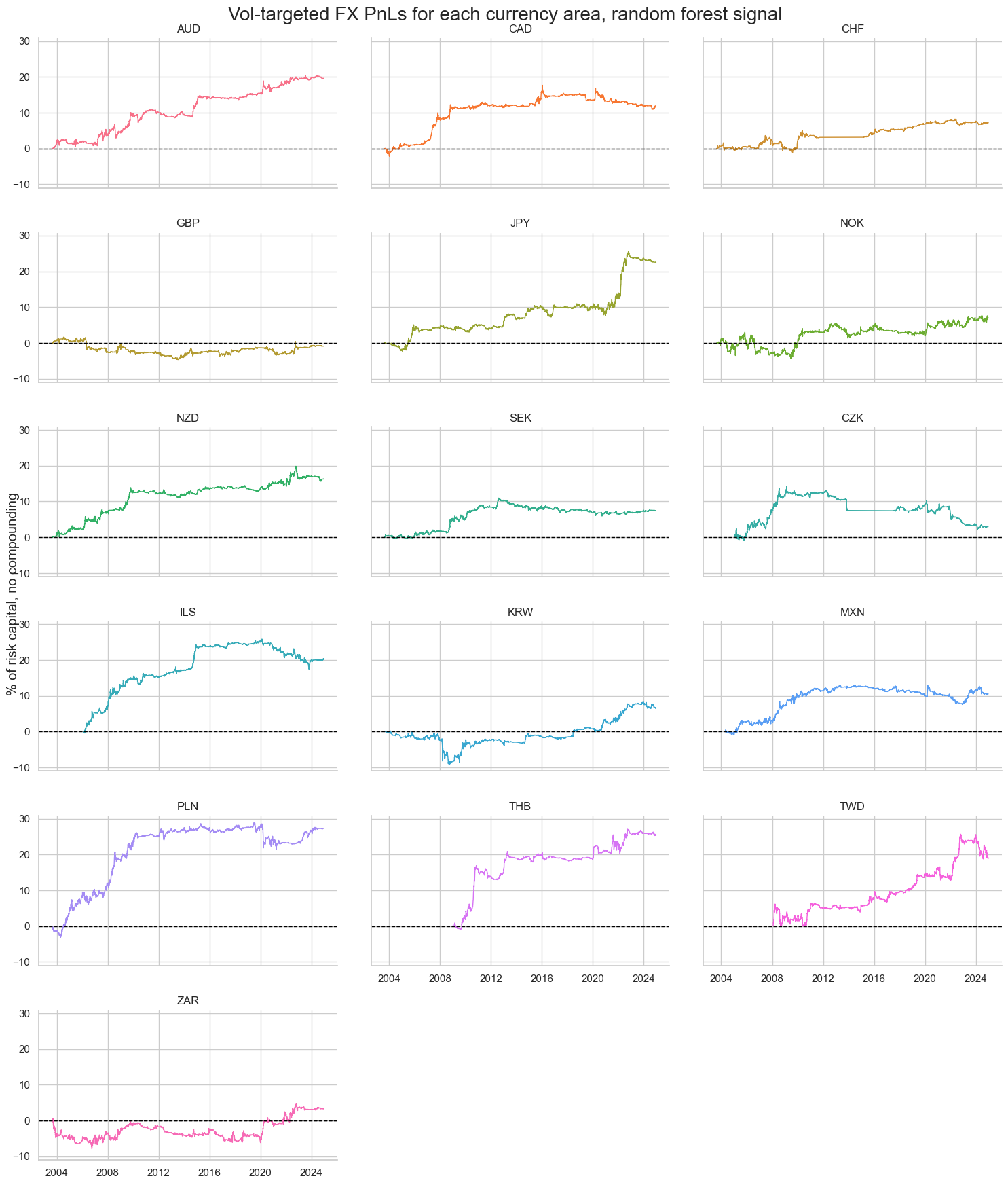

pnls.plot_pnls(pnl_cats=["PNL_RFVZ"], pnl_cids=cids_fx, facet=True, title = "Vol-targeted FX PnLs for each currency area, random forest signal")

pnls.evaluate_pnls(pnl_cats=["PNL_RFVZ"], pnl_cids=cids_fx)

| cid | AUD | CAD | CHF | CZK | GBP | ILS | JPY | KRW | MXN | NOK | NZD | PLN | SEK | THB | TWD | ZAR |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Return % | 0.916191 | 0.563574 | 0.40357 | 0.181651 | -0.041862 | 1.069398 | 1.050794 | 0.304151 | 0.51101 | 0.32508 | 0.766878 | 1.283235 | 0.345011 | 1.588763 | 1.116021 | 0.149844 |

| St. Dev. % | 1.606308 | 1.419869 | 1.316372 | 1.99747 | 1.276242 | 1.80057 | 1.960339 | 1.714892 | 1.56284 | 2.222054 | 1.497604 | 2.33447 | 1.323055 | 1.975754 | 2.417985 | 2.062155 |

| Sharpe Ratio | 0.570371 | 0.39692 | 0.306578 | 0.090941 | -0.032801 | 0.593922 | 0.536027 | 0.177359 | 0.326975 | 0.146297 | 0.51207 | 0.54969 | 0.260769 | 0.80413 | 0.46155 | 0.072664 |

| Sortino Ratio | 0.823092 | 0.575731 | 0.472787 | 0.143537 | -0.04618 | 0.937302 | 0.796399 | 0.242347 | 0.462236 | 0.206906 | 0.741676 | 0.790419 | 0.378639 | 1.466272 | 0.769407 | 0.104174 |

| Max 21-Day Draw % | -3.502589 | -2.172801 | -2.21007 | -3.077397 | -2.586212 | -2.049386 | -1.982875 | -5.79044 | -2.036673 | -3.027575 | -2.601862 | -5.961496 | -1.18196 | -3.585332 | -4.533752 | -3.041174 |

| Max 6-Month Draw % | -2.470959 | -3.162021 | -2.164 | -3.605455 | -3.302787 | -2.819012 | -2.510821 | -7.106388 | -2.55023 | -4.89763 | -3.452304 | -4.858807 | -1.262605 | -4.212953 | -6.066868 | -4.811437 |

| Peak to Trough Draw % | -3.804048 | -6.812088 | -4.795057 | -11.963634 | -6.325556 | -8.464626 | -3.280933 | -9.272184 | -5.382261 | -7.451822 | -4.249911 | -7.43646 | -5.05745 | -5.249365 | -6.915655 | -8.481324 |

| Top 5% Monthly PnL Share | 0.837075 | 1.449536 | 1.606123 | 6.425507 | -11.725726 | 1.007353 | 1.06243 | 2.412736 | 1.193445 | 2.712075 | 1.080883 | 0.879976 | 1.736402 | 1.192052 | 1.58733 | 6.780772 |

| USD_GB10YXR_NSA correl | -0.011597 | -0.031706 | -0.005453 | 0.009301 | 0.017541 | 0.040662 | -0.159795 | -0.030107 | -0.074606 | -0.005592 | -0.05054 | -0.052828 | -0.015632 | -0.004054 | 0.0161 | 0.008854 |

| EUR_FXXR_NSA correl | 0.057203 | -0.100224 | 0.040467 | 0.045255 | -0.11448 | 0.238139 | -0.213114 | 0.026429 | 0.092679 | 0.016609 | 0.090237 | 0.114813 | -0.050312 | -0.01881 | 0.041415 | -0.088263 |

| USD_EQXR_NSA correl | -0.003128 | -0.069028 | 0.018508 | 0.037521 | -0.054222 | 0.092203 | 0.06142 | 0.028468 | 0.103331 | 0.006571 | 0.028785 | 0.154093 | 0.045762 | -0.015967 | -0.023483 | -0.075457 |

| Traded Months | 257 | 257 | 257 | 257 | 257 | 257 | 257 | 257 | 257 | 257 | 257 | 257 | 257 | 257 | 257 | 257 |

Hedged positions #

Specs and panel test #

cidx = cids_fx

sdate = "2003-08-29"

dict_fxh = {

"sigs": ["ALL_AVGZ", "LSHZ", "RFHZ"],

"targs": ["FXXRHvGDRB_NSA"],

"cidx": cidx,

"start": sdate,

"black": fxblack,

"srr": None,

"pnls": None,

}

dix = dict_fxh

sigx = dix["sigs"]

tarx = dix["targs"]

cidx = dix["cidx"]

blax = dix["black"]

start = dix["start"]

def crmaker(sig, targ):

crx = msp.CategoryRelations(

dfx,

xcats=[sig, targ],

cids=cidx,

freq="M",

lag=1,

xcat_aggs=["last", "sum"],

start=start,

blacklist=blax,

)

return crx

lcrs = [crmaker(sig, targ) for sig in sigx for targ in tarx]

msv.multiple_reg_scatter(

lcrs,

ncol=3,

nrow=1,

figsize=(20, 10),

title="Macro signals and subsequent monthly hedged FX returns, 2003 - 2024",

xlab="Month-end macro signal value",

ylab="Cumulative FX forward return, hedged position, next month",

coef_box="lower right",

prob_est="map",

subplot_titles=[

"Conceptual parity signals",

"Linear regression-based learning signals",

"Random forest learning signals",

],

)

msv.multiple_reg_scatter(

lcrs,

ncol=3,

nrow=1,

figsize=(20, 10),

title="Macro signals and subsequent monthly hedged FX returns, 2003 - 2024",

xlab="Month-end macro signal value",

ylab="Cumulative FX forward return, hedged position, next month",

coef_box="lower right",

prob_est="map",

subplot_titles=[

"Conceptual parity signals",

"Linear regression-based learning signals",

"Random forest learning signals",

],

separator=2014,

)

dix = dict_fxh

sigx = dix["sigs"]

tarx = dix["targs"]

cidx = dix["cidx"]

blax = dix["black"]

start = dix["start"]

def crmaker(sig, targ):

crx = msp.CategoryRelations(

dfx,

xcats=[sig, targ],

cids=cidx,

freq="Q",

lag=1,

xcat_aggs=["last", "sum"],

start=start,

blacklist=blax,

)

return crx

lcrs = [crmaker(sig, targ) for sig in sigx for targ in tarx]

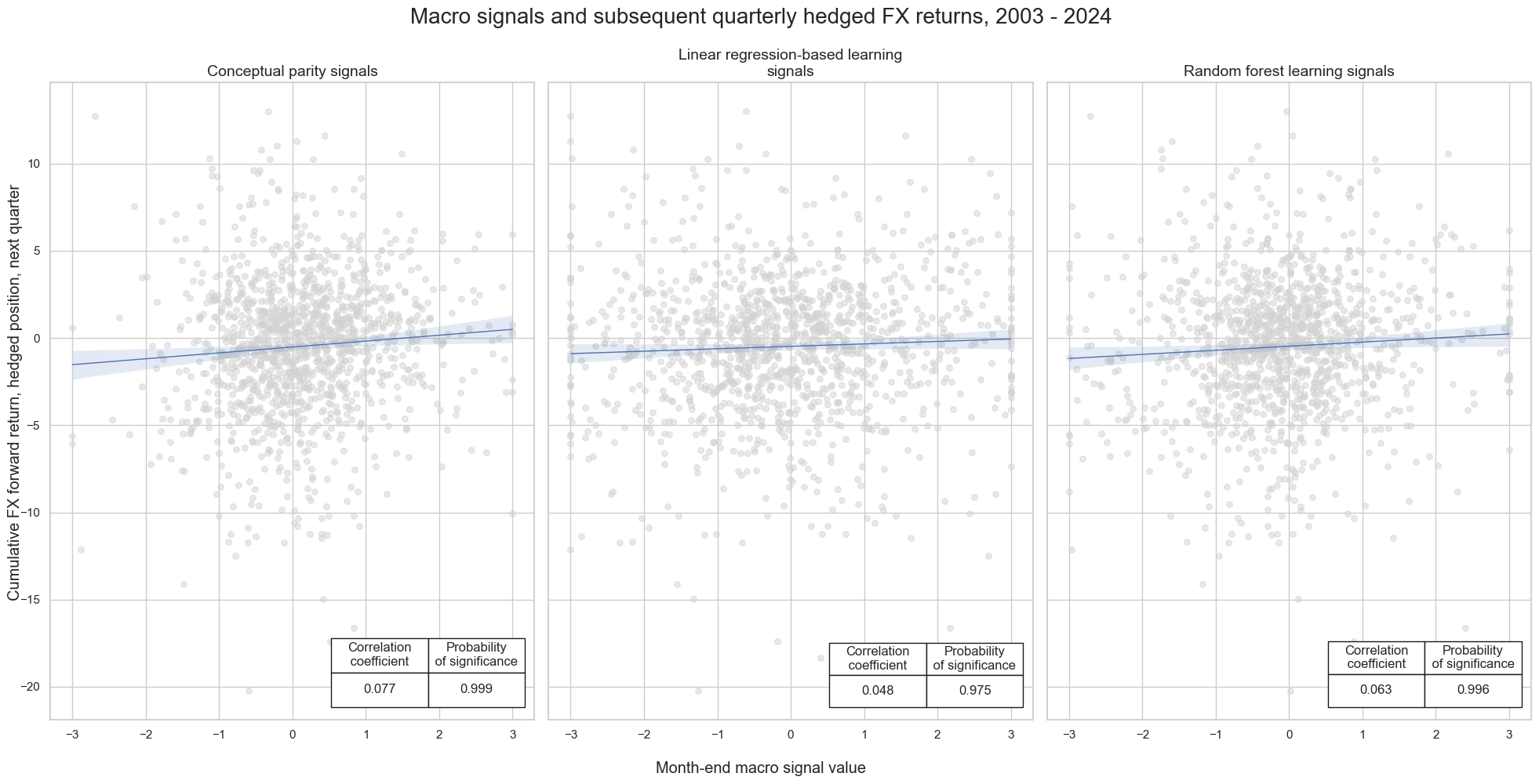

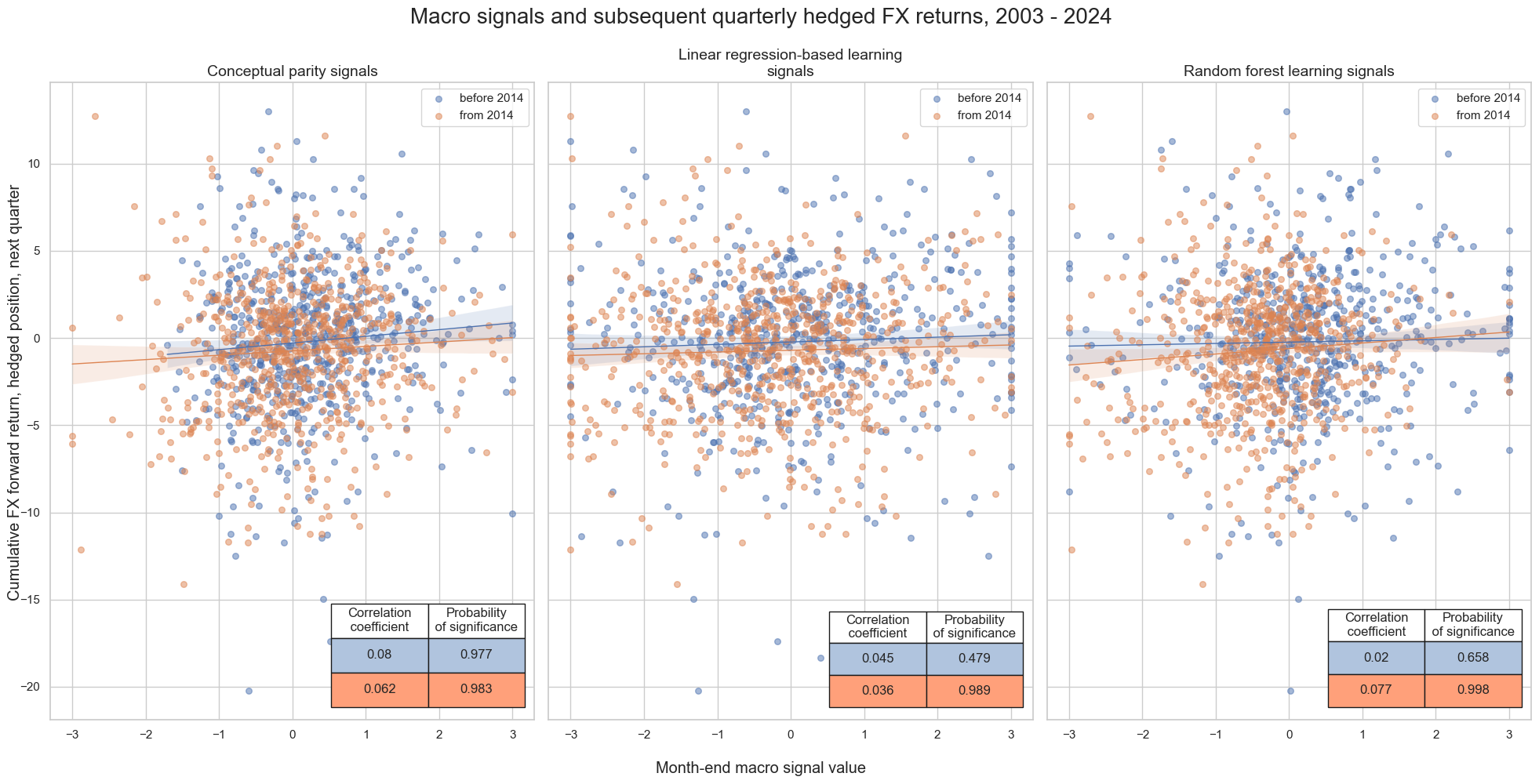

msv.multiple_reg_scatter(

lcrs,

ncol=3,

nrow=1,

figsize=(20, 10),

title="Macro signals and subsequent quarterly hedged FX returns, 2003 - 2024",

xlab="Month-end macro signal value",

ylab="Cumulative FX forward return, hedged position, next quarter",

coef_box="lower right",

prob_est="map",

subplot_titles=[

"Conceptual parity signals",

"Linear regression-based learning signals",

"Random forest learning signals",

],

)

msv.multiple_reg_scatter(

lcrs,

ncol=3,

nrow=1,

figsize=(20, 10),

title="Macro signals and subsequent quarterly hedged FX returns, 2003 - 2024",

xlab="Month-end macro signal value",

ylab="Cumulative FX forward return, hedged position, next quarter",

coef_box="lower right",

prob_est="map",

subplot_titles=[

"Conceptual parity signals",

"Linear regression-based learning signals",

"Random forest learning signals",

],

separator=2014,

)

Accuracy and correlation check #

## Compare optimized signals with simple average z-scores

dix = dict_fxh

sigx = dix["sigs"]

tarx = dix["targs"]

cidx = dix["cidx"]

blax = dix["black"]

startx = dix["start"]

srr = mss.SignalReturnRelations(

df=dfx,

rets=tarx,

sigs=sigx,

cids=cidx,

cosp=True,

freqs=["M"],

agg_sigs=["last"],

start=startx,

blacklist=blax,

slip=1,

ms_panel_test=True,

)

dix["srr"] = srr

selcols = [

"accuracy",

"bal_accuracy",

"pos_sigr",

"pos_retr",

"pearson",

"map_pval",

"kendall",

"kendall_pval",

]

srr.multiple_relations_table().round(3)[selcols]

| accuracy | bal_accuracy | pos_sigr | pos_retr | pearson | map_pval | kendall | kendall_pval | ||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Return | Signal | Frequency | Aggregation | ||||||||

| FXXRHvGDRB_NSA | ALL_AVGZ | M | last | 0.528 | 0.529 | 0.528 | 0.482 | 0.049 | 0.000 | 0.042 | 0.000 |

| LSHZ | M | last | 0.509 | 0.508 | 0.467 | 0.482 | 0.028 | 0.038 | 0.018 | 0.091 | |

| RFHZ | M | last | 0.534 | 0.532 | 0.453 | 0.482 | 0.053 | 0.001 | 0.047 | 0.000 |

Naive PnL #

dix = dict_fxh

sigx = dix["sigs"]

tarx = dix["targs"]

cidx = dix["cidx"]

blax = dix["black"]

startx = dix["start"]

pnls = msn.NaivePnL(

df=dfx,

ret=tarx[0],

sigs=sigx,

cids=cidx,

start=startx,

blacklist=blax,

bms=["USD_GB10YXR_NSA", "EUR_FXXR_NSA", "USD_EQXR_NSA"],

)

for sig in sigx:

pnls.make_pnl(

sig=sig,

sig_op="raw",

rebal_freq="monthly",

neutral="zero",

rebal_slip=1,

vol_scale=10,

)

pnls.make_long_pnl(vol_scale=10, label="Long only")

dix["pnls"] = pnls

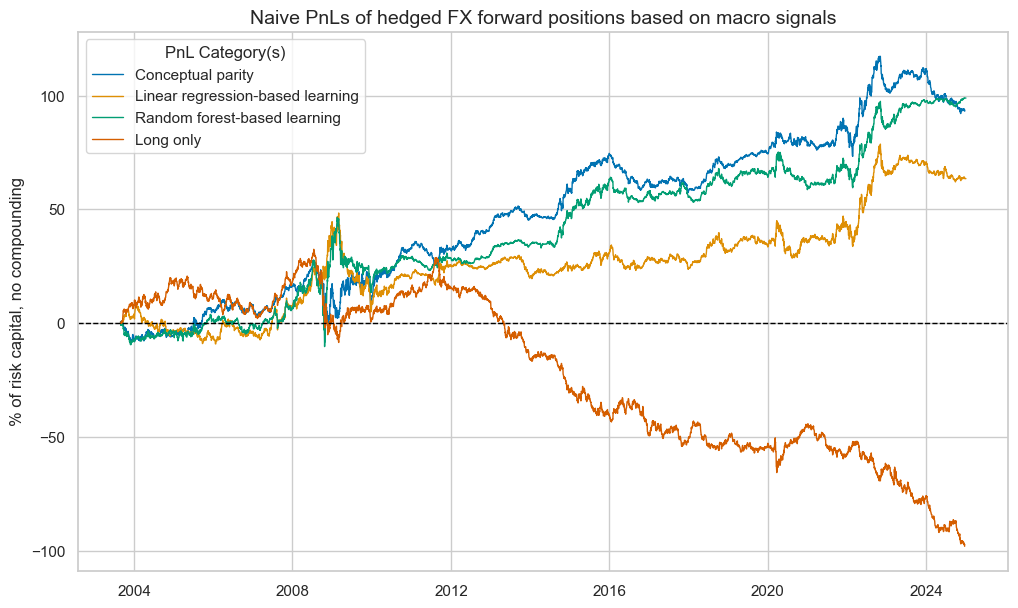

dix = dict_fxh

pnls = dix["pnls"]

sigx = dix["sigs"]

pnls.plot_pnls(

title="Naive PnLs of hedged FX forward positions based on macro signals",

title_fontsize=14,

xcat_labels=[

"Conceptual parity",

"Linear regression-based learning",

"Random forest-based learning",

"Long only",

],

)

pnls.evaluate_pnls(pnl_cats=["PNL_" + sig for sig in sigx] + ["Long only"])

| xcat | PNL_ALL_AVGZ | PNL_LSHZ | PNL_RFHZ | Long only |

|---|---|---|---|---|

| Return % | 4.371751 | 2.97701 | 4.635429 | -4.595695 |

| St. Dev. % | 10.0 | 10.0 | 10.0 | 10.0 |

| Sharpe Ratio | 0.437175 | 0.297701 | 0.463543 | -0.45957 |

| Sortino Ratio | 0.634468 | 0.419443 | 0.647475 | -0.628564 |

| Max 21-Day Draw % | -20.193632 | -15.243791 | -26.888151 | -23.712188 |

| Max 6-Month Draw % | -23.852403 | -28.851387 | -24.264262 | -33.29414 |

| Peak to Trough Draw % | -28.924819 | -43.47515 | -38.002827 | -130.39716 |

| Top 5% Monthly PnL Share | 1.080057 | 1.597565 | 1.059348 | -0.660979 |

| USD_GB10YXR_NSA correl | -0.07334 | -0.0184 | -0.061603 | 0.149457 |

| EUR_FXXR_NSA correl | -0.079704 | -0.18641 | -0.166692 | 0.499291 |

| USD_EQXR_NSA correl | 0.036703 | -0.039598 | 0.008995 | -0.089722 |

| Traded Months | 257 | 257 | 257 | 257 |

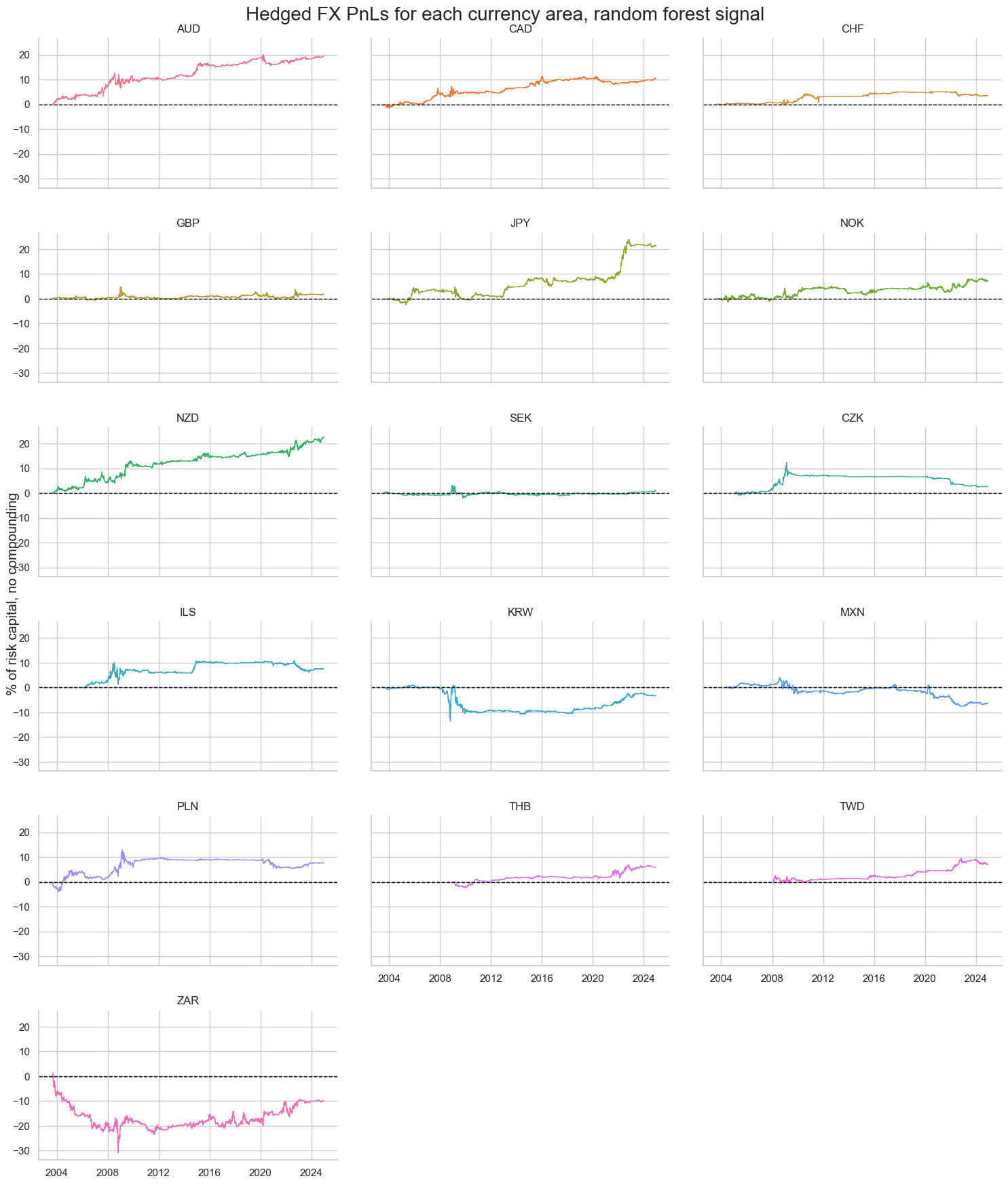

dix = dict_fxh

pnls = dix["pnls"]

sigx = dix["sigs"]

pnls.plot_pnls(pnl_cats=["PNL_RFHZ"], pnl_cids=cids_fx, facet=True, title = "Hedged FX PnLs for each currency area, random forest signal")

pnls.evaluate_pnls(pnl_cats=["PNL_RFHZ"], pnl_cids=cids_fx)

| cid | AUD | CAD | CHF | CZK | GBP | ILS | JPY | KRW | MXN | NOK | NZD | PLN | SEK | THB | TWD | ZAR |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Return % | 0.914134 | 0.500497 | 0.198047 | 0.160895 | 0.084854 | 0.402986 | 1.008701 | -0.153109 | -0.309631 | 0.339651 | 1.065441 | 0.354967 | 0.033853 | 0.372088 | 0.415826 | -0.462428 |

| St. Dev. % | 2.185229 | 1.605812 | 0.860307 | 1.464976 | 1.452942 | 1.98409 | 2.107353 | 2.711666 | 1.775893 | 1.662936 | 2.031713 | 2.017494 | 0.979363 | 1.056361 | 1.009289 | 3.967962 |

| Sharpe Ratio | 0.418324 | 0.311678 | 0.230205 | 0.109828 | 0.058402 | 0.203109 | 0.478658 | -0.056463 | -0.174352 | 0.204248 | 0.524405 | 0.175944 | 0.034566 | 0.352236 | 0.411999 | -0.11654 |

| Sortino Ratio | 0.599076 | 0.430168 | 0.372181 | 0.18357 | 0.083173 | 0.305251 | 0.684705 | -0.083776 | -0.250708 | 0.290343 | 0.778096 | 0.248668 | 0.049728 | 0.583566 | 0.678884 | -0.160722 |

| Max 21-Day Draw % | -4.458108 | -3.200651 | -1.956676 | -4.463537 | -3.35628 | -6.409828 | -2.231307 | -7.319215 | -3.470926 | -3.433432 | -2.840344 | -2.777292 | -2.904183 | -1.763307 | -2.089691 | -12.418258 |

| Max 6-Month Draw % | -5.954793 | -3.004945 | -2.376887 | -4.955997 | -3.887387 | -5.732091 | -4.644383 | -11.366033 | -4.931902 | -3.891563 | -3.874994 | -5.503784 | -3.397354 | -2.121334 | -2.261274 | -9.033691 |

| Peak to Trough Draw % | -6.145171 | -3.742913 | -3.393439 | -10.069927 | -5.075318 | -8.833061 | -5.374178 | -14.582551 | -11.696147 | -4.381968 | -4.609159 | -7.610126 | -5.175616 | -3.418658 | -3.001471 | -32.100931 |

| Top 5% Monthly PnL Share | 0.909814 | 1.20764 | 2.3932 | 5.141337 | 5.962226 | 2.651177 | 1.125075 | -5.44129 | -1.856367 | 2.132598 | 1.060932 | 2.472955 | 11.25977 | 1.953303 | 1.596115 | -3.063043 |

| USD_GB10YXR_NSA correl | -0.03272 | -0.032432 | -0.008826 | 0.085455 | 0.00486 | 0.031284 | -0.183631 | -0.009299 | -0.015709 | 0.013866 | -0.092184 | 0.016045 | 0.052612 | -0.036613 | 0.000053 | -0.025174 |

| EUR_FXXR_NSA correl | -0.16552 | -0.23948 | 0.054663 | -0.058671 | -0.101999 | 0.114717 | -0.245962 | 0.00816 | -0.009367 | -0.031542 | -0.06326 | -0.015122 | -0.0608 | -0.155909 | -0.051019 | -0.001058 |

| USD_EQXR_NSA correl | -0.0382 | -0.033676 | 0.019192 | -0.079868 | -0.018731 | 0.032018 | 0.019384 | 0.050104 | 0.016776 | -0.057228 | 0.055331 | -0.045742 | -0.068592 | 0.024063 | 0.000473 | 0.049462 |

| Traded Months | 257 | 257 | 257 | 257 | 257 | 257 | 257 | 257 | 257 | 257 | 257 | 257 | 257 | 257 | 257 | 257 |