Equity country allocation scorecard #

Get packages and JPMaQS data #

import tqdm

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

import warnings

import os

import gc

from datetime import date, datetime

import macrosynergy.management as msm

import macrosynergy.panel as msp

import macrosynergy.signal as mss

import macrosynergy.pnl as msn

import macrosynergy.learning as msl

import macrosynergy.visuals as msv

from macrosynergy.panel.panel_imputer import MeanPanelImputer

from macrosynergy.panel.adjust_weights import adjust_weights

from macrosynergy.download import JPMaQSDownload

from macrosynergy.visuals import ScoreVisualisers

pd.set_option('display.width', 400)

import warnings

warnings.simplefilter("ignore")

# Cross-sections of interest

cids_dmeq = ["AUD", "CAD", "CHF", "EUR", "GBP", "JPY", "SEK", "USD"]

cids_eueq = ["DEM", "ESP", "FRF", "ITL", "NLG"]

cids_aseq = ["CNY", "HKD", "INR", "KRW", "MYR", "SGD", "THB", "TWD"]

cids_exeq = ["BRL", "TRY", "ZAR"]

cids_nueq = ["MXN", "PLN"]

cids_no_jpmaqs = ["HKD", "TRY"]

cids_eq = sorted(list(set(cids_dmeq + cids_eueq + cids_aseq + cids_exeq + cids_nueq) - set(cids_no_jpmaqs + cids_eueq)))

cids = cids_eq

# Category tickers

inf = (

[

f"{cat}_{at}"

for cat in [

"CPIC",

"CPIH",

]

for at in [

"SA_P1M1ML12",

"SA_P1Q1QL4",

]

] + ["PPIH_NSA_P1M1ML12"]

)

surveys = [

f"{cat}_{at}"

for cat in ["CCSCORE", "MBCSCORE"]

for at in [

"SA_D3M3ML3",

"SA_D1Q1QL1",

"SA_D1M1ML12",

"SA_D1Q1QL4",

]

]

flows = [

f"{flow}_NSA_D1M1ML12" for flow in ["NIIPGDP", "IIPLIABGDP"]

]

trade = (

[

f"{cat}_{at}"

for cat in ["CABGDPRATIO", "MTBGDPRATIO"]

for at in [

"SA_3MMAv60MMA", "SA_1QMAv20QMA",

"SA_6MMA_D1M1ML6", "NSA_12MMA_D1M1ML3"

]

]

)

fxrel = [

f"{cat}_NSA_{t}"

for cat in ["REEROADJ", "CTOT"]

for t in ["P1W4WL1", "P1M1ML12", "P1M12ML1"]

] + ["PPPFXOVERVALUE_NSA_P1M12ML1"]

eq = ["EQCRR_VT10", "EQCRY_VT10", "EQCRR_NSA", "EQCRY_NSA"]

add = [

"INFTEFF_NSA",

]

eco = (

inf

+ surveys

+ flows

+ trade

+ fxrel

+ eq

+ add

)

mkt = [

"EQXR_NSA",

"EQCALLRUSD_NSA",

"FXTARGETED_NSA",

"FXUNTRADABLE_NSA",

]

xcats = eco + mkt

# Tickers for download

single_tix = ["USD_GB10YXR_NSA", "EUR_FXXR_NSA"]

tickers = [cid + "_" + xcat for cid in cids for xcat in xcats] + single_tix

# Download series from J.P. Morgan DataQuery by tickers

start_date = "1990-12-31"

end_date = (pd.Timestamp.today() - pd.offsets.BDay(1)).strftime('%Y-%m-%d')

# Retrieve credentials

oauth_id = os.getenv("DQ_CLIENT_ID") # Replace with own client ID

oauth_secret = os.getenv("DQ_CLIENT_SECRET") # Replace with own secret

# Download from DataQuery

downloader = JPMaQSDownload(client_id=oauth_id, client_secret=oauth_secret)

df = downloader.download(

tickers=tickers,

start_date=start_date,

end_date=end_date,

metrics=["value"],

suppress_warning=True,

show_progress=True,

)

dfx = df.copy()

dfx.info()

Downloading data from JPMaQS.

Timestamp UTC: 2025-09-24 09:40:10

Connection successful!

Requesting data: 100%|██████████| 38/38 [00:07<00:00, 4.93it/s]

Downloading data: 100%|██████████| 38/38 [00:24<00:00, 1.56it/s]

Some expressions are missing from the downloaded data. Check logger output for complete list.

189 out of 743 expressions are missing. To download the catalogue of all available expressions and filter the unavailable expressions, set `get_catalogue=True` in the call to `JPMaQSDownload.download()`.

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 3994576 entries, 0 to 3994575

Data columns (total 4 columns):

# Column Dtype

--- ------ -----

0 real_date datetime64[ns]

1 cid object

2 xcat object

3 value float64

dtypes: datetime64[ns](1), float64(1), object(2)

memory usage: 121.9+ MB

Renaming, availability and blacklisting #

# Removing Australia and New Zealand CPI multiple transformation frequencies - maintaining monthly version now

dfx = dfx.loc[

~(

(dfx["cid"].isin(["AUD", "NZD"])) & (dfx["xcat"].isin(inf)) & (dfx["xcat"].str.contains("Q"))

)

]

Renaming quarterly categories #

dict_repl = {

"CPIC_SJA_P1Q1QL1AR": "CPIC_SJA_P3M3ML3AR",

"CPIC_SJA_P2Q2QL2AR": "CPIC_SJA_P6M6ML6AR",

"CPIC_SA_P1Q1QL4": "CPIC_SA_P1M1ML12",

"CPIH_SJA_P1Q1QL1AR": "CPIH_SJA_P3M3ML3AR",

"CPIH_SJA_P2Q2QL2AR": "CPIH_SJA_P6M6ML6AR",

"CPIH_SA_P1Q1QL4": "CPIH_SA_P1M1ML12",

"CCSCORE_SA_D1Q1QL1": "CCSCORE_SA_D3M3ML3",

"MBCSCORE_SA_D1Q1QL1": "MBCSCORE_SA_D3M3ML3",

"CCSCORE_SA_D1Q1QL4": "CCSCORE_SA_D1M1ML12",

"MBCSCORE_SA_D1Q1QL4": "MBCSCORE_SA_D1M1ML12",

"CABGDPRATIO_SA_1QMAv20QMA": "CABGDPRATIO_SA_3MMAv60MMA",

"MTBGDPRATIO_SA_1QMAv20QMA": "MTBGDPRATIO_SA_3MMAv60MMA",

}

dfx["xcat2"] = dfx["xcat"].map(dict_repl).fillna(dfx["xcat"])

dfx = dfx.drop(columns="xcat").rename(columns={"xcat2": "xcat"})

Check availability #

xcatx = sorted(list(set(inf) - set(dict_repl.keys())))

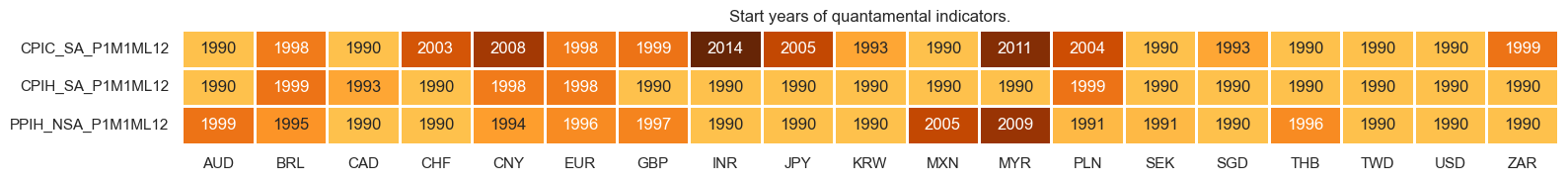

msm.check_availability(df=dfx, xcats=xcatx, cids=cids_eq, missing_recent=False)

xcatx = sorted(list(set(surveys) - set(dict_repl.keys())))

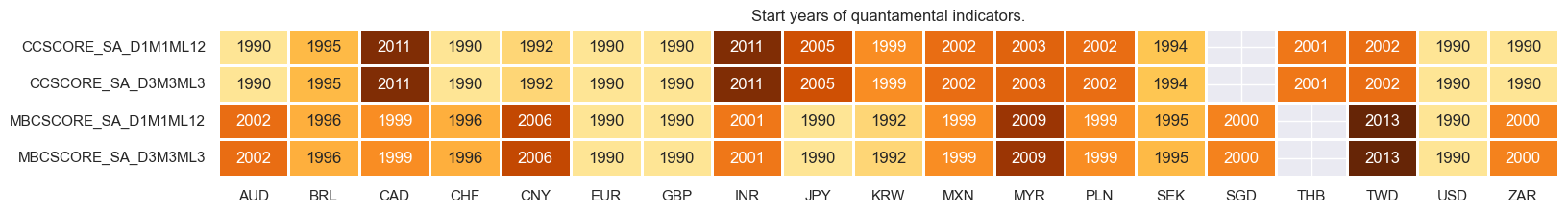

msm.check_availability(df=dfx, xcats=xcatx, cids=cids_eq, missing_recent=False)

xcatx = sorted(list(set(trade) - set(dict_repl.keys())))

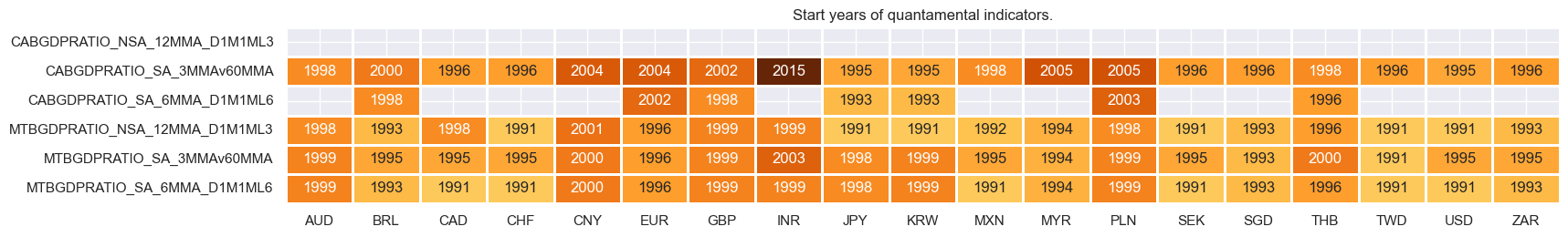

msm.check_availability(df=dfx, xcats=xcatx, cids=cids_eq, missing_recent=False)

xcatx = sorted(list(set(eq) - set(dict_repl.keys())))

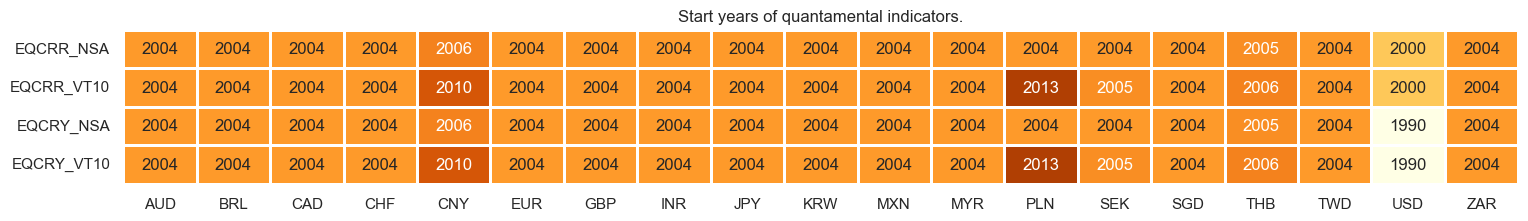

msm.check_availability(df=dfx, xcats=xcatx, cids=cids_eq, missing_recent=False)

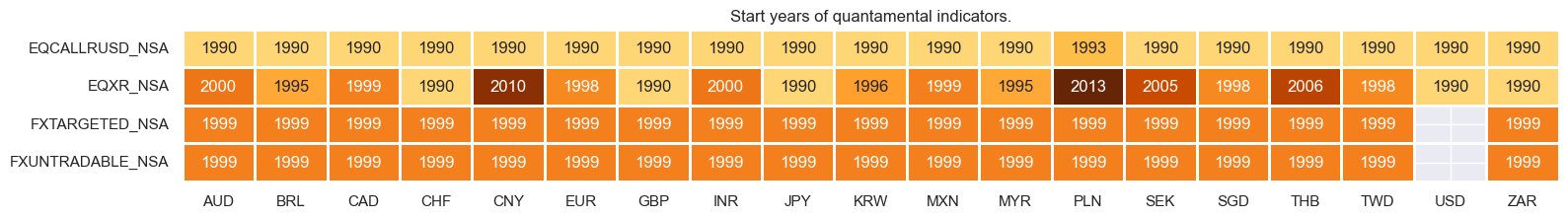

xcatx = sorted(list(set(mkt) - set(dict_repl.keys())))

msm.check_availability(df=dfx, xcats=xcatx, cids=cids_eq, missing_recent=False)

Blacklisting dictionary for empirical research #

# At present no blacklisting for cash equity

equsdblack={}

Equity returns #

cidx = cids_eq

xcatx = ["EQCALLRUSD_NSA"]

start_date = "1995-01-01"

dfa = msp.make_relative_value(

dfx,

xcats=xcatx,

cids=cidx,

start=start_date,

blacklist=equsdblack, # Using the FX Blacklisting for returns in USD

rel_meth="subtract",

complete_cross=False,

postfix="vGLB",

)

dfx = msm.update_df(dfx, dfa)

Factor construction and checks #

# Initiate category dictionary for thematic factors

dict_facts = {}

# Initiate labeling dictionary

dict_lab = {}

Auxiliary categories #

# Stitching for India and China: extending core with corresponding headline

cidx = ["INR", "CNY"]

merging_xcatx = {

"CPIC_SA_P1M1ML12": ["CPIC_SA_P1M1ML12", "CPIH_SA_P1M1ML12"],

}

for new_cat, xcatx in merging_xcatx.items():

dfa = msm.merge_categories(df=dfx, xcats=xcatx, new_xcat=new_cat, cids=cidx)

dfx = msm.update_df(dfx, dfa)

Relative real equity carry #

# Real index carry versions

xcatx = ["CPIH_SA_P1M1ML12", "CPIC_SA_P1M1ML12", "PPIH_NSA_P1M1ML12"]

cidx = cids_eq

calcs = [

"EQCRR_CPIH = EQCRY_NSA + CPIH_SA_P1M1ML12",

"EQCRR_CPIC = EQCRY_NSA + CPIC_SA_P1M1ML12",

"EQCRR_PPIH = EQCRY_NSA + PPIH_NSA_P1M1ML12",

]

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cidx)

dfx = msm.update_df(dfx, dfa)

ecrr = ["EQCRR_NSA", "EQCRR_CPIH", "EQCRR_CPIC", "EQCRR_PPIH"]

# Relative value scores

xcatx = ecrr

cidx = cids_eq

start_date = "1995-01-01"

dfa = msp.make_relative_value(

dfx,

xcats=xcatx,

cids=cidx,

start=start_date,

blacklist=equsdblack,

rel_meth="subtract",

complete_cross=False,

postfix="vGLB",

)

dfx = msm.update_df(dfx, dfa)

for xcat in xcatx:

dfa = msp.make_zn_scores(

dfx,

xcat=xcat+"vGLB",

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

# Conceptual relative factor score

xcatx = [xc + "vGLB_ZN" for xc in ecrr]

cidx = cids_eq

cfs = "EQCRRvGLB"

dfa = msp.linear_composite(

df=dfx,

xcats=xcatx,

cids=cids_eq,

new_xcat=cfs,

complete_xcats=False,

)

dfx= msm.update_df(dfx, dfa)

# Re-score

dfa = msp.make_zn_scores(

dfx,

xcat=cfs,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

dict_facts[cfs] = "Relative real equity carry"

Relative real currency weakness #

# Imputing PPP for USD. # TWD unavailable for this indicator (will only use REERs)

cidx = list(set(cids_eq) - {"USD"})

dfu = msp.linear_composite(

dfx,

xcats="PPPFXOVERVALUE_NSA_P1M12ML1",

cids=cidx,

weights=None,

complete_cids=False,

complete_xcats=False,

new_cid='USD'

)

dfx = msm.update_df(dfx, dfu)

# Define negative categories

xcatx = [

"PPPFXOVERVALUE_NSA_P1M12ML1",

"REEROADJ_NSA_P1M12ML1",

"REEROADJ_NSA_P1M1ML12",

"REEROADJ_NSA_P1W4WL1",

]

calcs = []

for xc in xcatx:

calcs.append(f"{xc}N = - {xc}")

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cids_eq)

dfx = msm.update_df(dfx, dfa)

# All constituents

fxweak = [

'PPPFXOVERVALUE_NSA_P1M12ML1N',

'REEROADJ_NSA_P1M12ML1N',

'REEROADJ_NSA_P1M1ML12N',

'REEROADJ_NSA_P1W4WL1N'

]

# Relative value scores

xcatx = fxweak

cidx = cids_eq

start_date = "1995-01-01"

dfa = msp.make_relative_value(

dfx,

xcats=xcatx,

cids=cidx,

start=start_date,

blacklist=equsdblack,

rel_meth="subtract",

complete_cross=False,

postfix="vGLB",

)

dfx = msm.update_df(dfx, dfa)

for xcat in xcatx:

dfa = msp.make_zn_scores(

dfx,

xcat=xcat+"vGLB",

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

# Conceptual relative factor score

xcatx = [xc + "vGLB_ZN" for xc in fxweak]

cidx = cids_eq

cfs = "FXWEAKvGLB"

dfa = msp.linear_composite(

df=dfx,

xcats=xcatx,

cids=cids_eq,

new_xcat=cfs,

complete_xcats=False,

)

dfx= msm.update_df(dfx, dfa)

# Re-score

dfa = msp.make_zn_scores(

dfx,

xcat=cfs,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

dict_facts[cfs] = "Relative real currency weakness"

Relative terms-of-trade improvements #

# All constituents

tot = ['CTOT_NSA_P1M12ML1', 'CTOT_NSA_P1M1ML12', 'CTOT_NSA_P1W4WL1']

# Relative value scores

xcatx = tot

cidx = cids_eq

start_date = "1995-01-01"

dfa = msp.make_relative_value(

dfx,

xcats=xcatx,

cids=cidx,

start=start_date,

blacklist=equsdblack,

rel_meth="subtract",

complete_cross=False,

postfix="vGLB",

)

dfx = msm.update_df(dfx, dfa)

for xcat in xcatx:

dfa = msp.make_zn_scores(

dfx,

xcat=xcat+"vGLB",

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

# Conceptual relative factor score

xcatx = [xc + "vGLB_ZN" for xc in tot]

cidx = cids_eq

cfs = "TOTDvGLB"

dfa = msp.linear_composite(

df=dfx,

xcats=xcatx,

cids=cids_eq,

new_xcat=cfs,

complete_xcats=False,

)

dfx= msm.update_df(dfx, dfa)

# Re-score

dfa = msp.make_zn_scores(

dfx,

xcat=cfs,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

dict_facts[cfs] = "Relative terms-of-trade improvement"

Relative external balances strength #

# All constituents

xbal = [

'MTBGDPRATIO_SA_3MMAv60MMA',

'CABGDPRATIO_SA_3MMAv60MMA',

'MTBGDPRATIO_NSA_12MMA_D1M1ML3',

'MTBGDPRATIO_SA_6MMA_D1M1ML6'

]

# Relative value scores

xcatx = xbal

cidx = cids_eq

start_date = "1995-01-01"

dfa = msp.make_relative_value(

dfx,

xcats=xcatx,

cids=cidx,

start=start_date,

blacklist=equsdblack,

rel_meth="subtract",

complete_cross=False,

postfix="vGLB",

)

dfx = msm.update_df(dfx, dfa)

for xcat in xcatx:

dfa = msp.make_zn_scores(

dfx,

xcat=xcat+"vGLB",

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

# Conceptual relative factor score

xcatx = [xc + "vGLB_ZN" for xc in xbal]

cidx = cids_eq

cfs = "XBSvGLB"

dfa = msp.linear_composite(

df=dfx,

xcats=xcatx,

cids=cids_eq,

new_xcat=cfs,

complete_xcats=False,

)

dfx= msm.update_df(dfx, dfa)

# Re-score

dfa = msp.make_zn_scores(

dfx,

xcat=cfs,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

dict_facts[cfs] = "Relative external balances strength"

Relative investment position improvements #

# Change a sign

calcs = ["IIPLIABGDP_NSA_D1M1ML12N = - IIPLIABGDP_NSA_D1M1ML12"]

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cids_eq)

dfx = msm.update_df(dfx, dfa)

# All constituents

iip = [

'IIPLIABGDP_NSA_D1M1ML12N',

'NIIPGDP_NSA_D1M1ML12',

]

# Relative value scores

xcatx = iip

cidx = cids_eq

start_date = "1995-01-01"

dfa = msp.make_relative_value(

dfx,

xcats=xcatx,

cids=cidx,

start=start_date,

blacklist=equsdblack,

rel_meth="subtract",

complete_cross=False,

postfix="vGLB",

)

dfx = msm.update_df(dfx, dfa)

for xcat in xcatx:

dfa = msp.make_zn_scores(

dfx,

xcat=xcat+"vGLB",

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

# Conceptual relative factor score

xcatx = [xc + "vGLB_ZN" for xc in iip]

cidx = cids_eq

cfs = "IIPDvGLB"

dfa = msp.linear_composite(

df=dfx,

xcats=xcatx,

cids=cids_eq,

new_xcat=cfs,

complete_xcats=False,

)

dfx= msm.update_df(dfx, dfa)

# Re-score

dfa = msp.make_zn_scores(

dfx,

xcat=cfs,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

dict_facts[cfs] = "Relative investment position improvement"

Relative confidence improvement #

# All constituents

conf = [

'MBCSCORE_SA_D3M3ML3', 'MBCSCORE_SA_D1M1ML12',

'CCSCORE_SA_D3M3ML3', 'CCSCORE_SA_D1M1ML12',

]

# Relative value scores

xcatx = conf

cidx = cids_eq

start_date = "1995-01-01"

dfa = msp.make_relative_value(

dfx,

xcats=xcatx,

cids=cidx,

start=start_date,

blacklist=equsdblack,

rel_meth="subtract",

complete_cross=False,

postfix="vGLB",

)

dfx = msm.update_df(dfx, dfa)

for xcat in xcatx:

dfa = msp.make_zn_scores(

dfx,

xcat=xcat+"vGLB",

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

# Conceptual relative factor score

xcatx = [xc + "vGLB_ZN" for xc in conf]

cidx = cids_eq

cfs = "CONDvGLB"

dfa = msp.linear_composite(

df=dfx,

xcats=xcatx,

cids=cids_eq,

new_xcat=cfs,

complete_xcats=False,

)

dfx= msm.update_df(dfx, dfa)

# Re-score

dfa = msp.make_zn_scores(

dfx,

xcat=cfs,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

dict_facts[cfs] = "Relative confidence improvement"

Overview visuals of all relative factors #

dict_factz = {k+"_ZN": v for k, v in dict_facts.items()}

xcatx = list(dict_factz.keys())

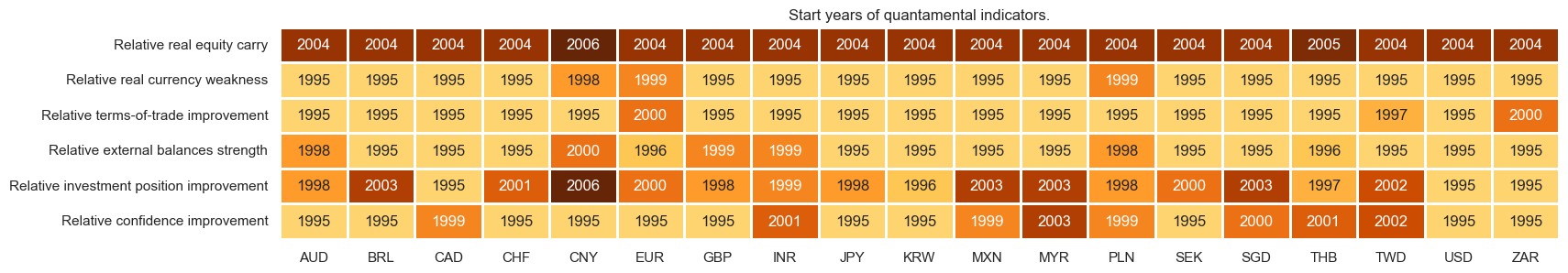

msm.check_availability(

df=dfx,

xcats=xcatx,

cids=cids_eq,

missing_recent=False,

start="1995-01-01",

xcat_labels=dict_factz,

)

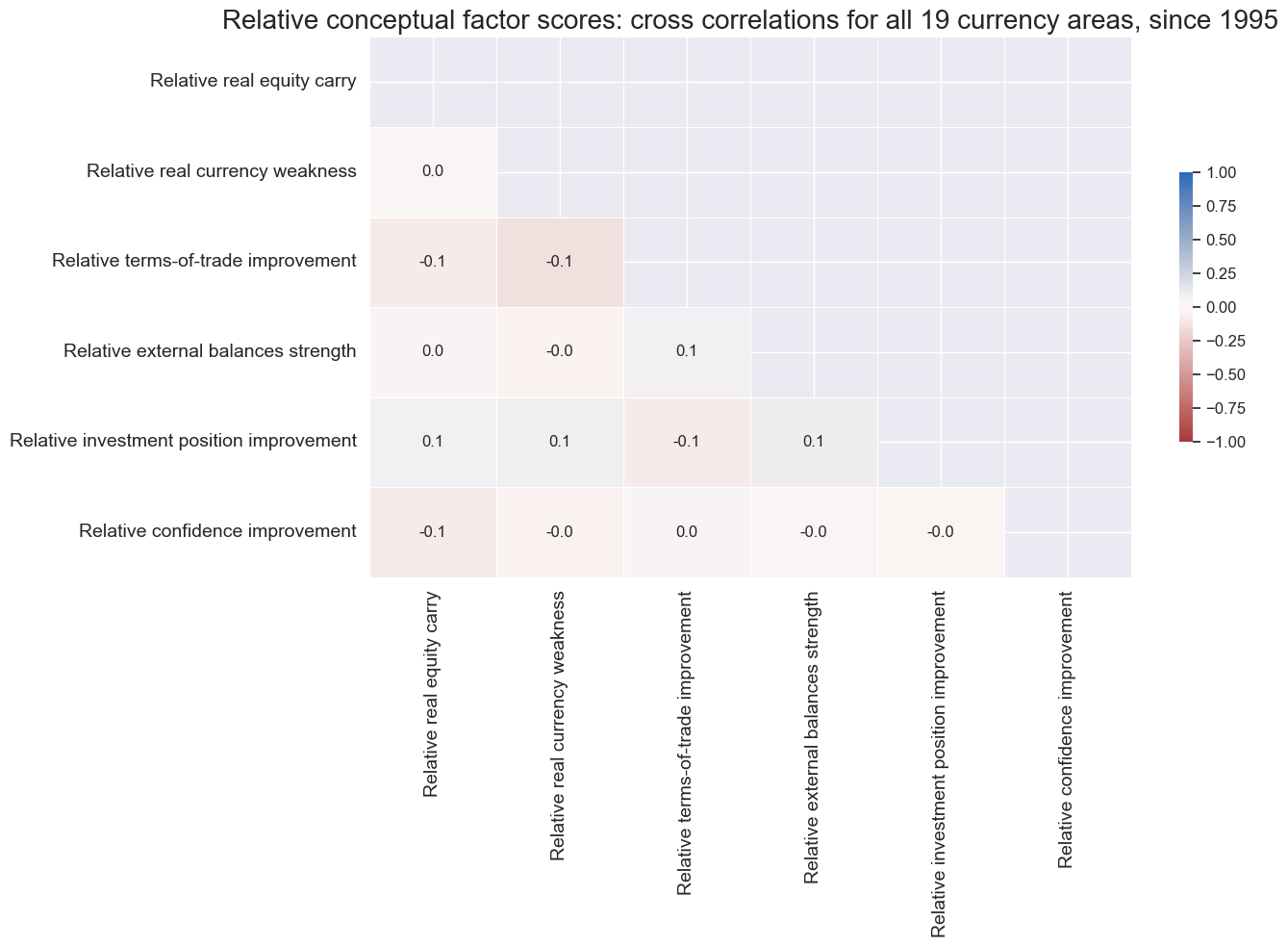

cidx = cids_eq

xcatx = list(dict_factz.keys())

start = "1995-01-01"

msp.correl_matrix(

dfx,

cids=cidx,

xcats=xcatx,

max_color=1.0,

annot=True,

fmt=".1f",

freq="M",

cluster=False,

title=f"Relative conceptual factor scores: cross correlations for all {str(len(cids_eq))} currency areas, since 1995",

title_fontsize=20,

xcat_labels=dict_factz,

start=start,

size=(14, 10),

)

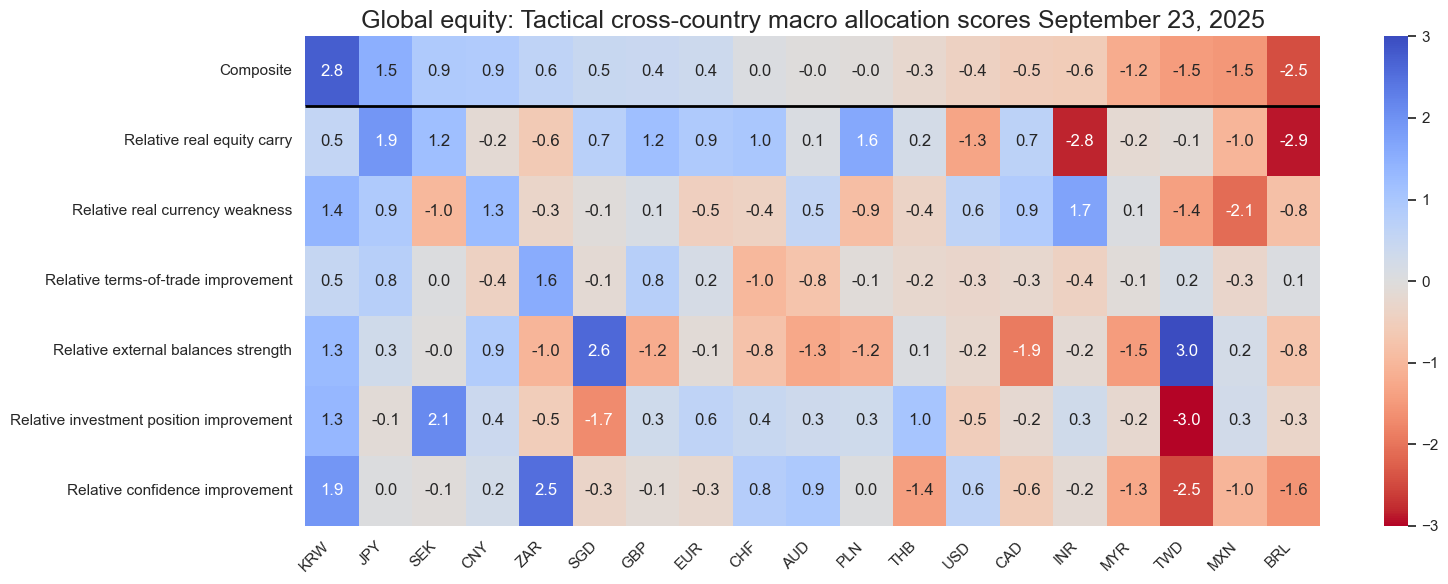

Global condensed scorecard #

Snapshot #

xcatx = list(dict_factz.keys())

cidx = cids_eq

# Set data of snapshot

backdate = datetime.strptime("2018-09-01", "%Y-%m-%d")

lastdate = datetime.strptime(end_date, "%Y-%m-%d")

snapdate = lastdate # lastdate or backdate

sv = ScoreVisualisers(

df=dfx,

cids=cidx,

xcats = xcatx,

xcat_labels=dict_factz,

xcat_comp="Composite",

no_zn_scores=True,

rescore_composite=True,

blacklist=equsdblack,

)

sv.view_snapshot(

cids=cidx,

date=snapdate,

transpose=True,

sort_by_composite = True,

title=f"Global equity: Tactical cross-country macro allocation scores {snapdate.strftime("%B %d, %Y")}",

title_fontsize=18,

figsize=(16, 6),

xcats=xcatx + ["Composite"],

xcat_labels=dict_factz,

round_decimals=1,

)

Global history #

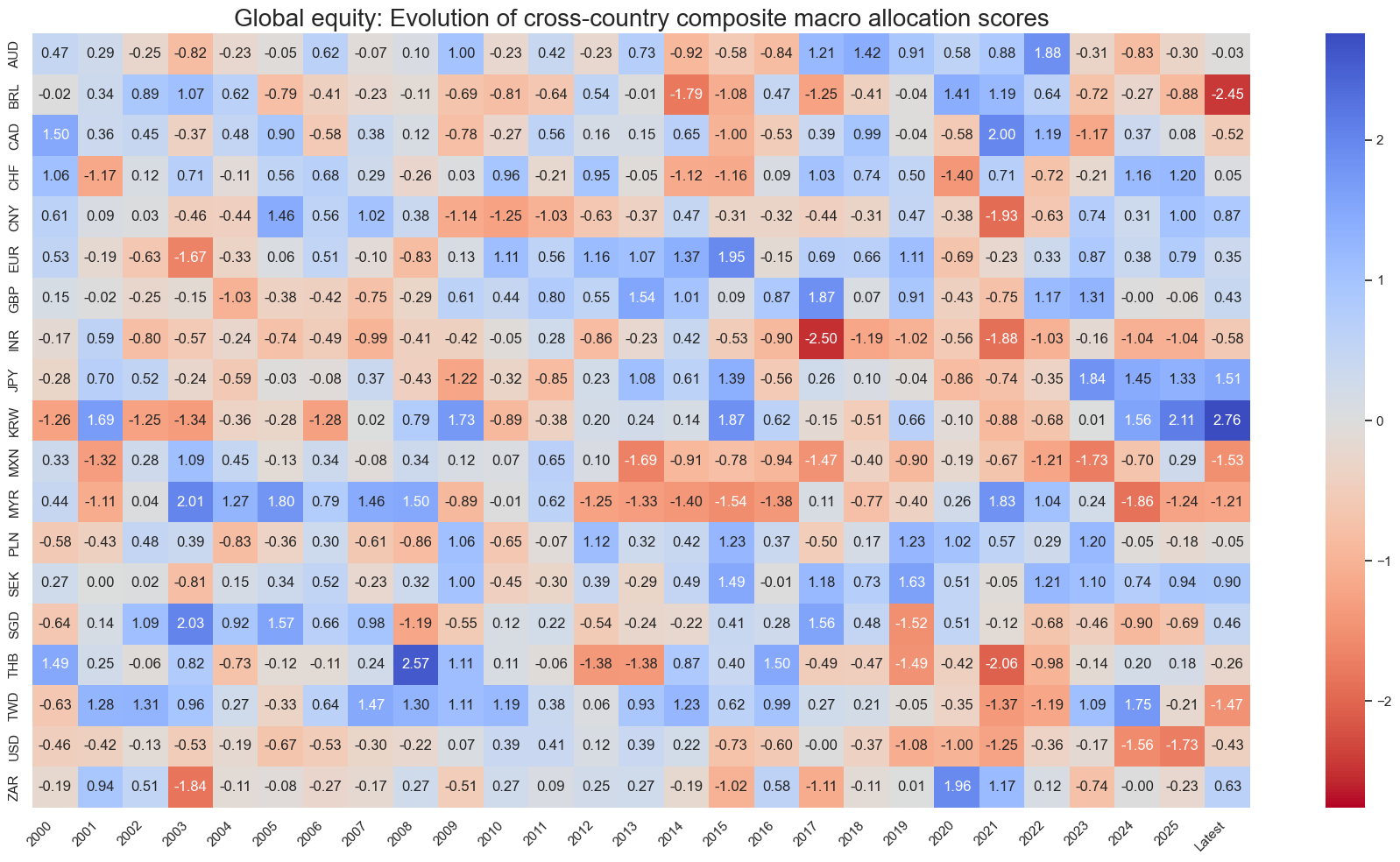

sv.view_score_evolution(

xcat="Composite",

cids=cidx,

freq="A",

include_latest_day=True,

transpose=False,

title="Global equity: Evolution of cross-country composite macro allocation scores",

start="2000-01-01",

figsize=(18, 10),

)

Latest day: 2025-09-23 00:00:00

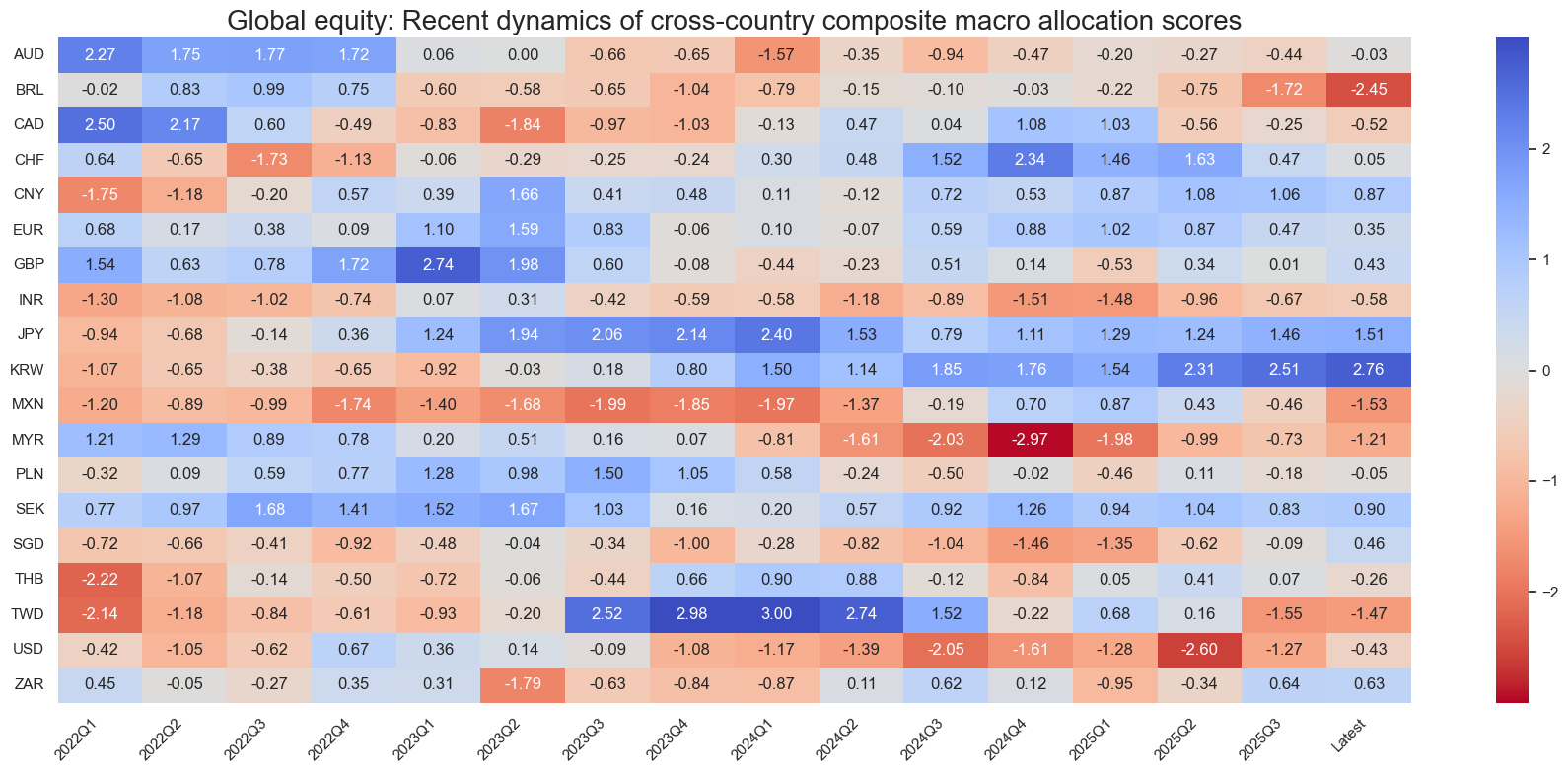

sv.view_score_evolution(

xcat="Composite",

cids=cidx,

freq="Q",

include_latest_day=True,

transpose=False,

title="Global equity: Recent dynamics of cross-country composite macro allocation scores",

start="2022-01-01",

figsize=(18, 8),

)

Latest day: 2025-09-23 00:00:00

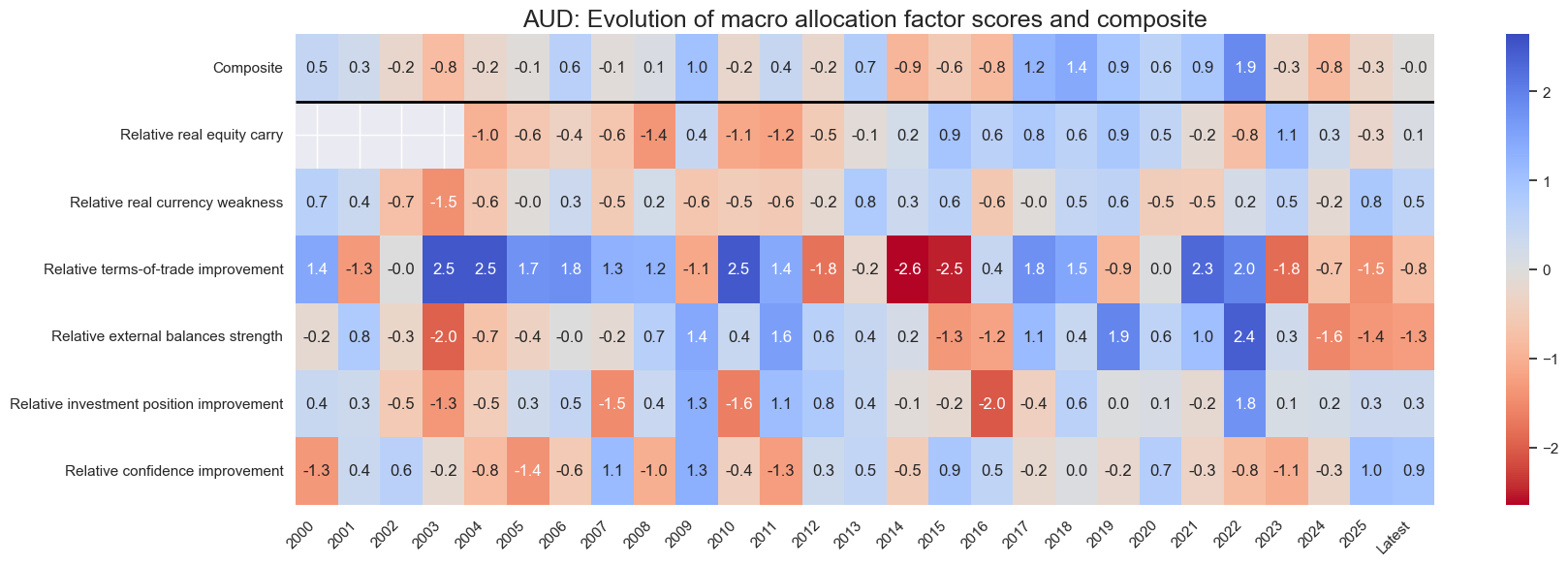

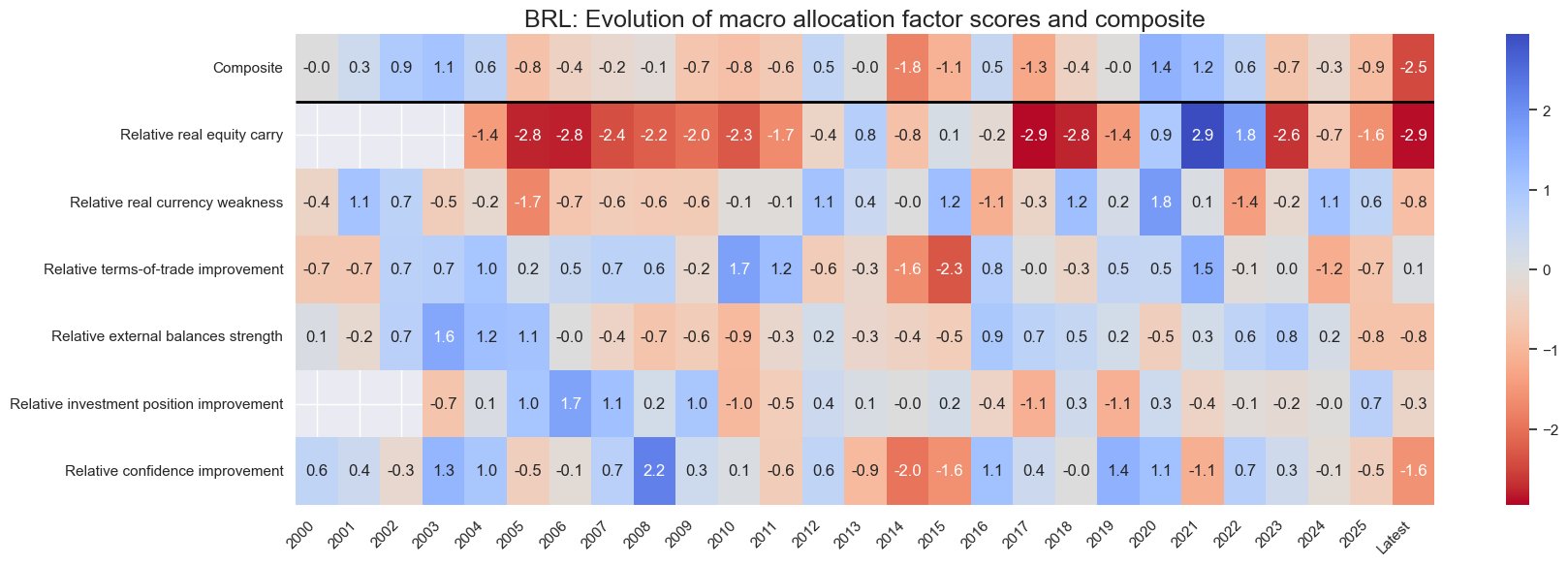

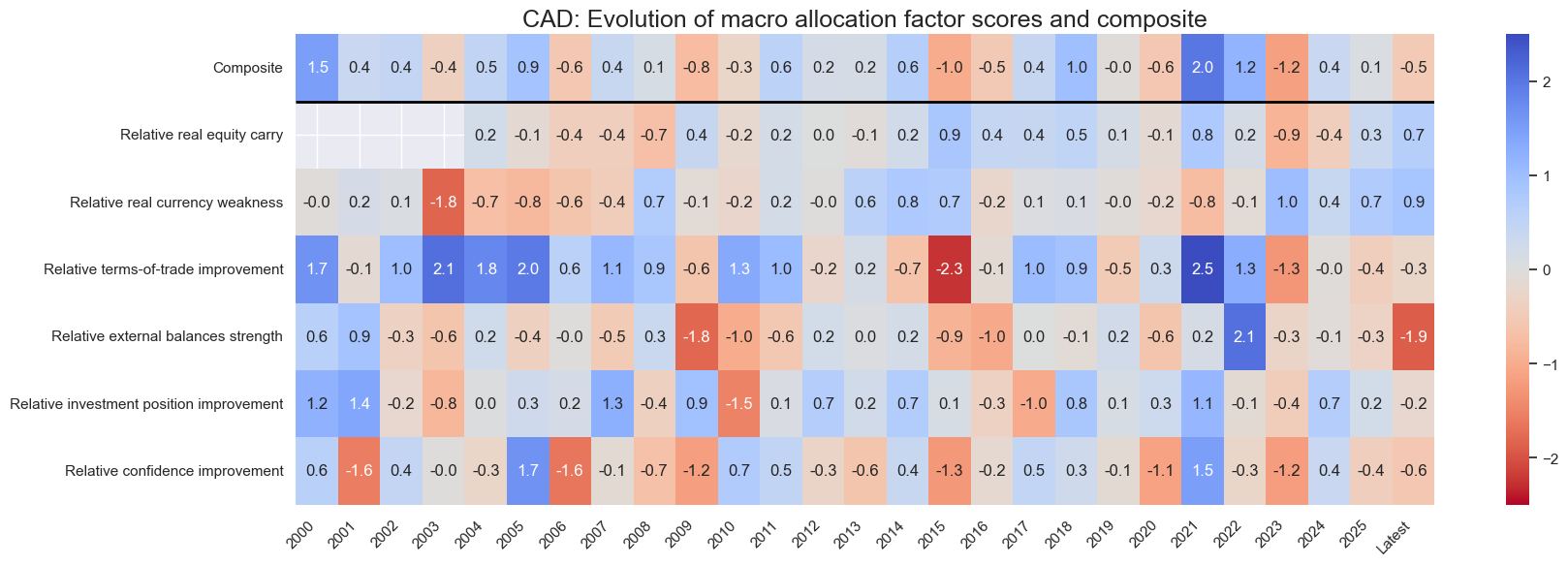

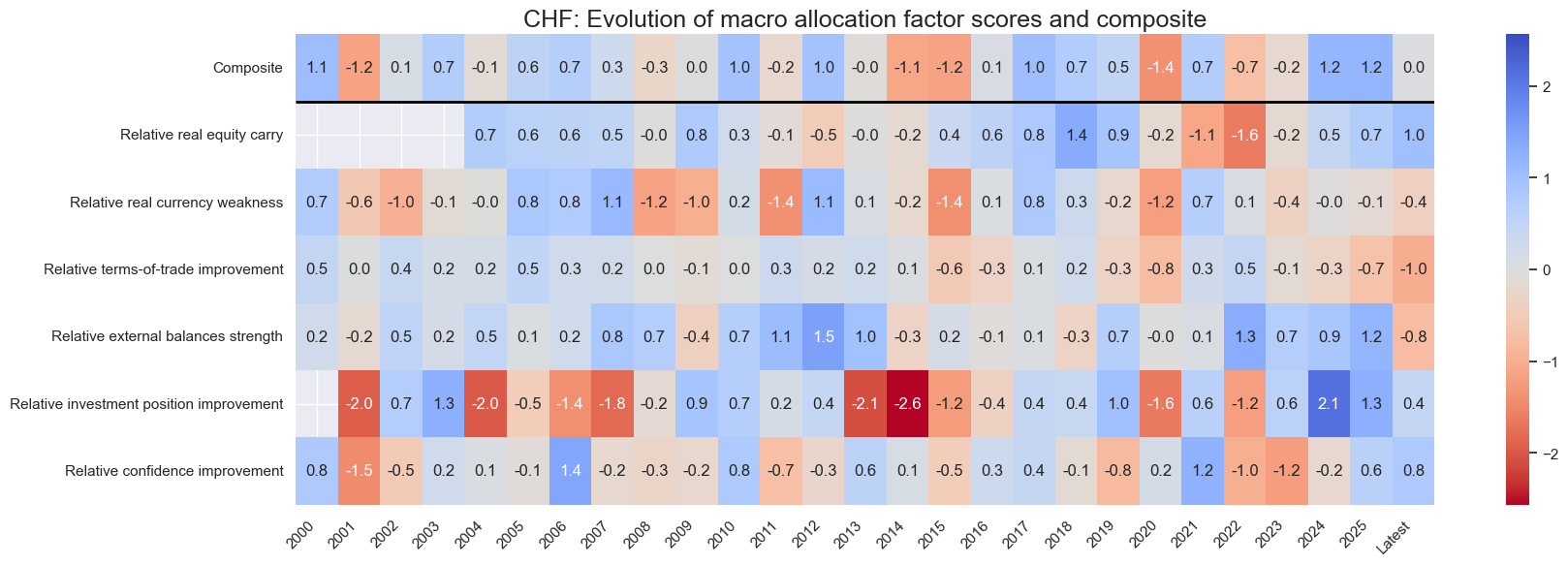

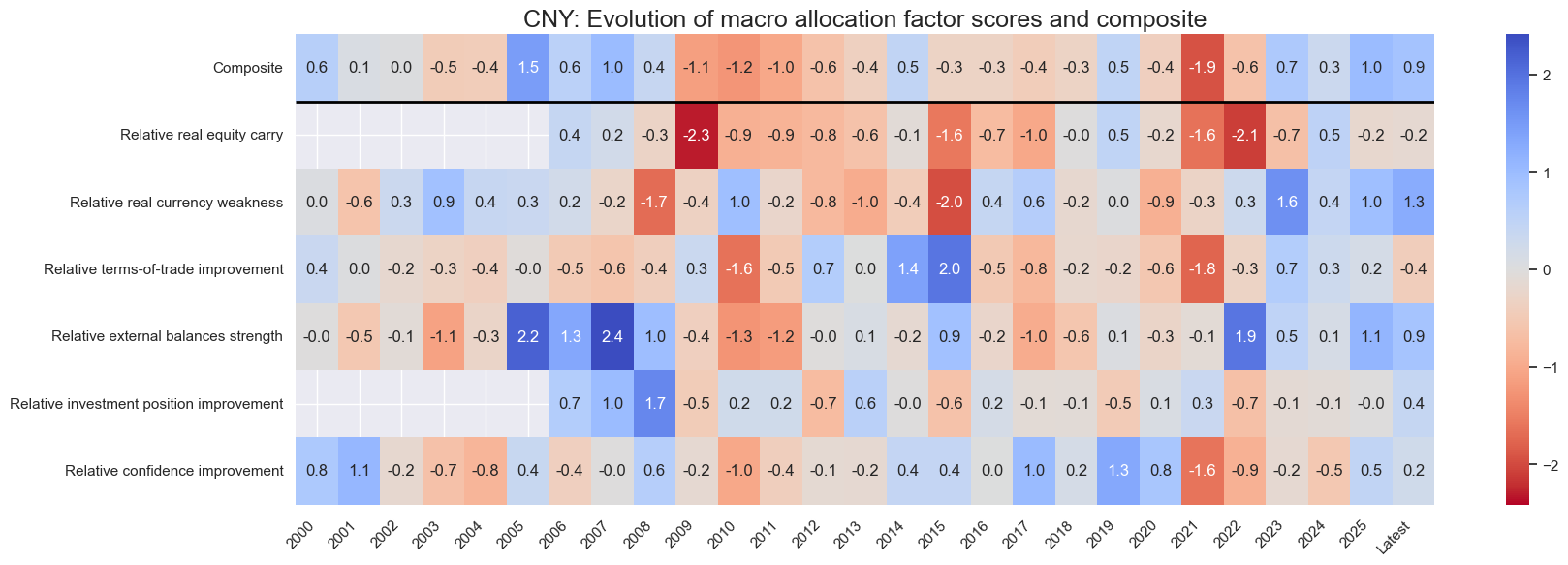

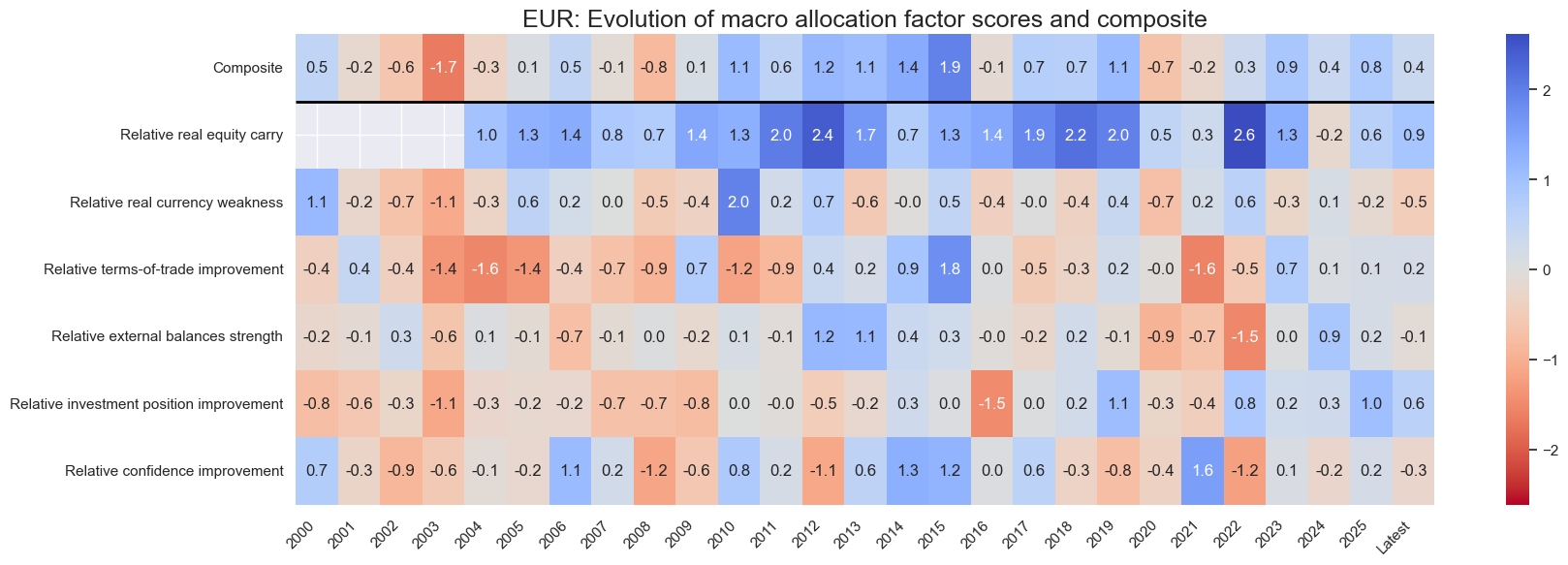

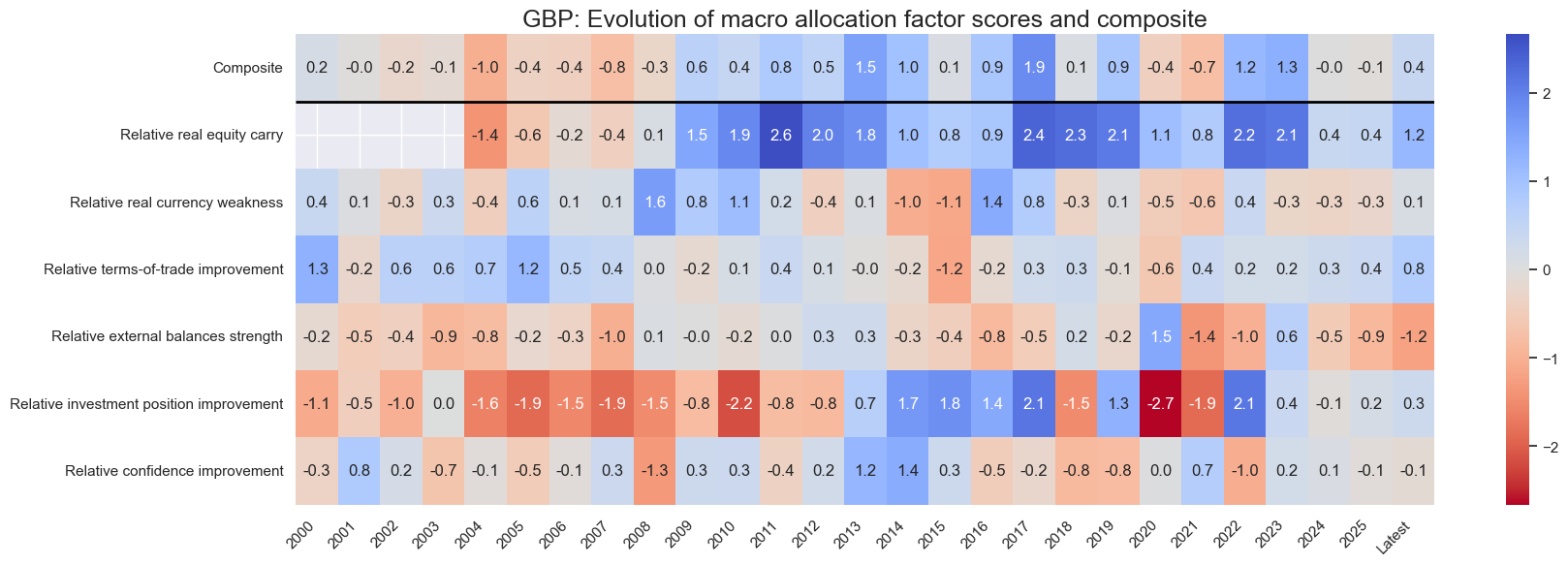

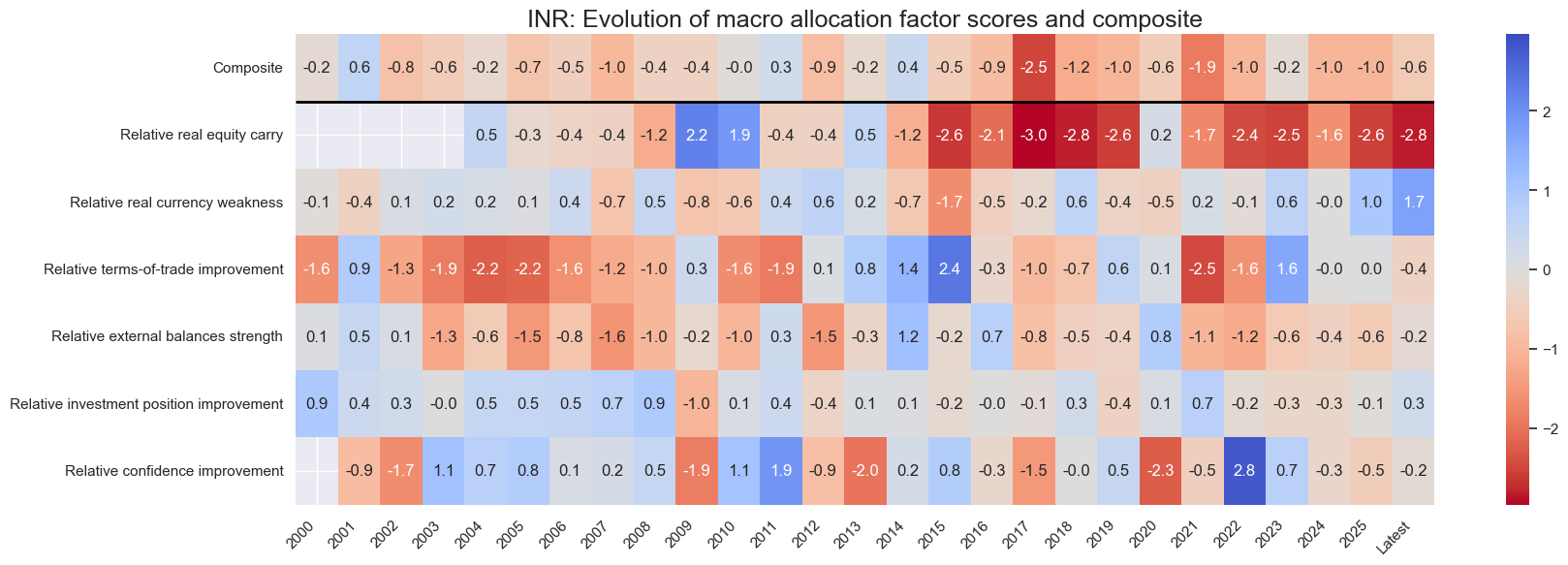

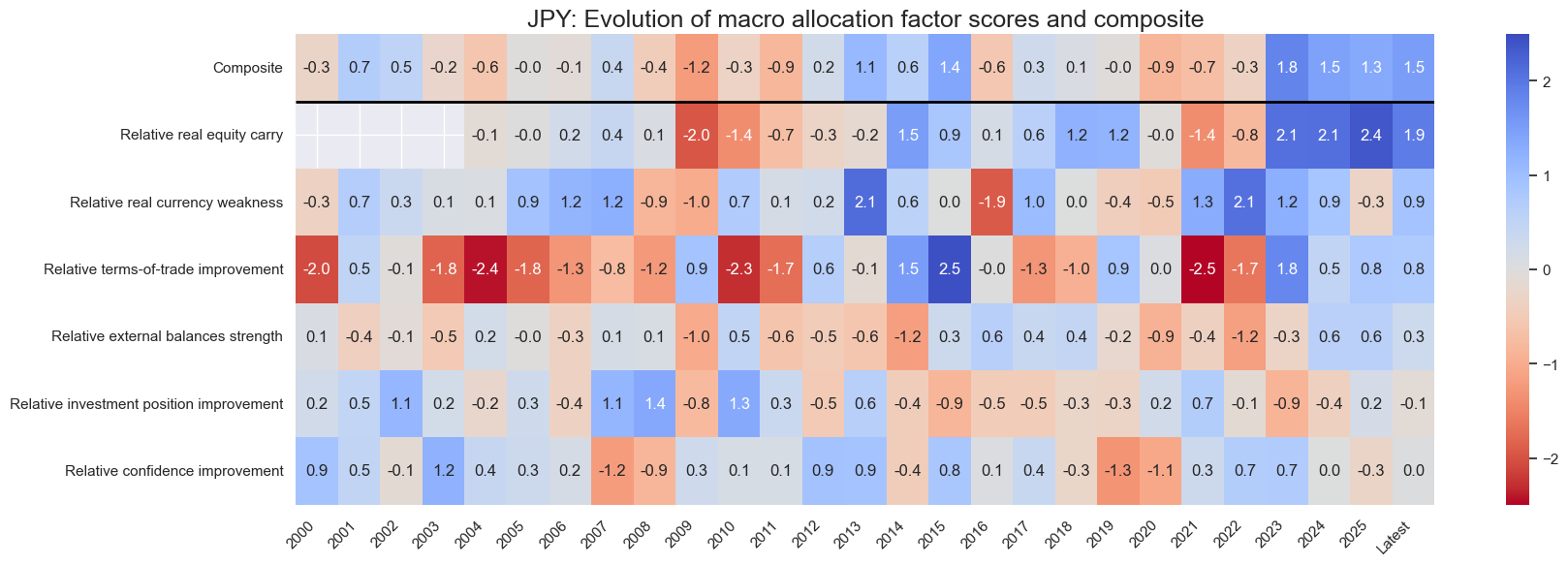

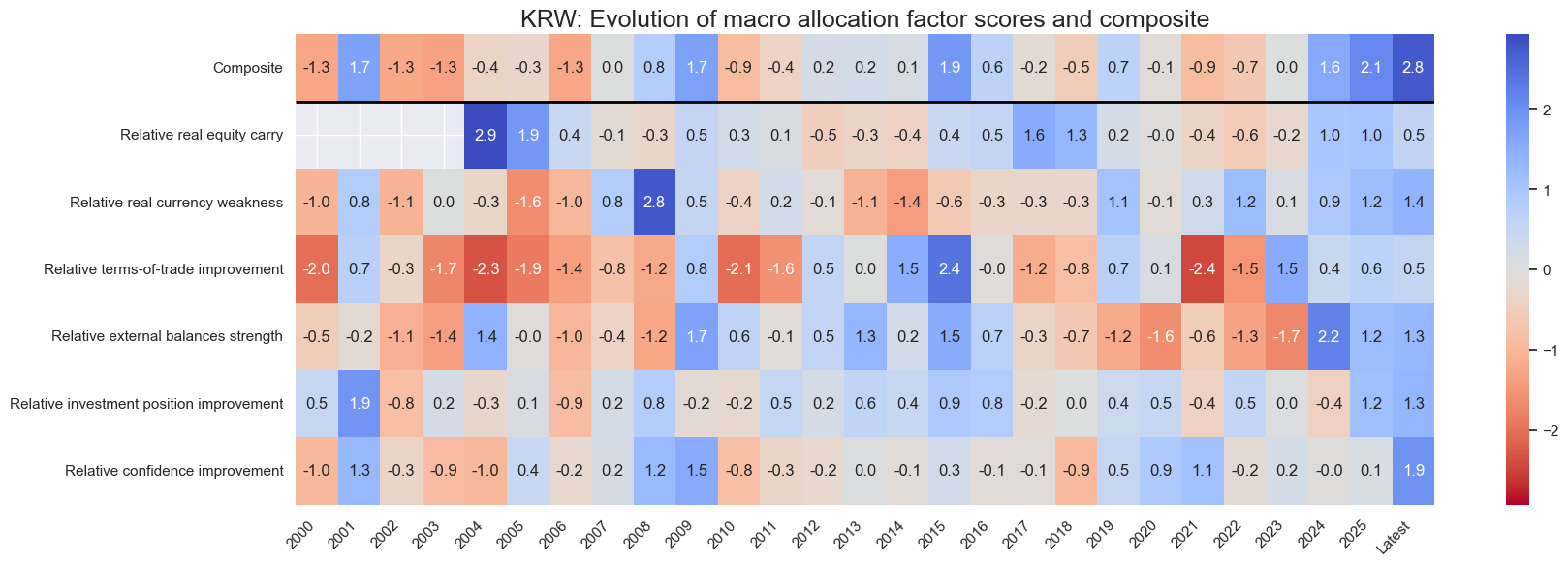

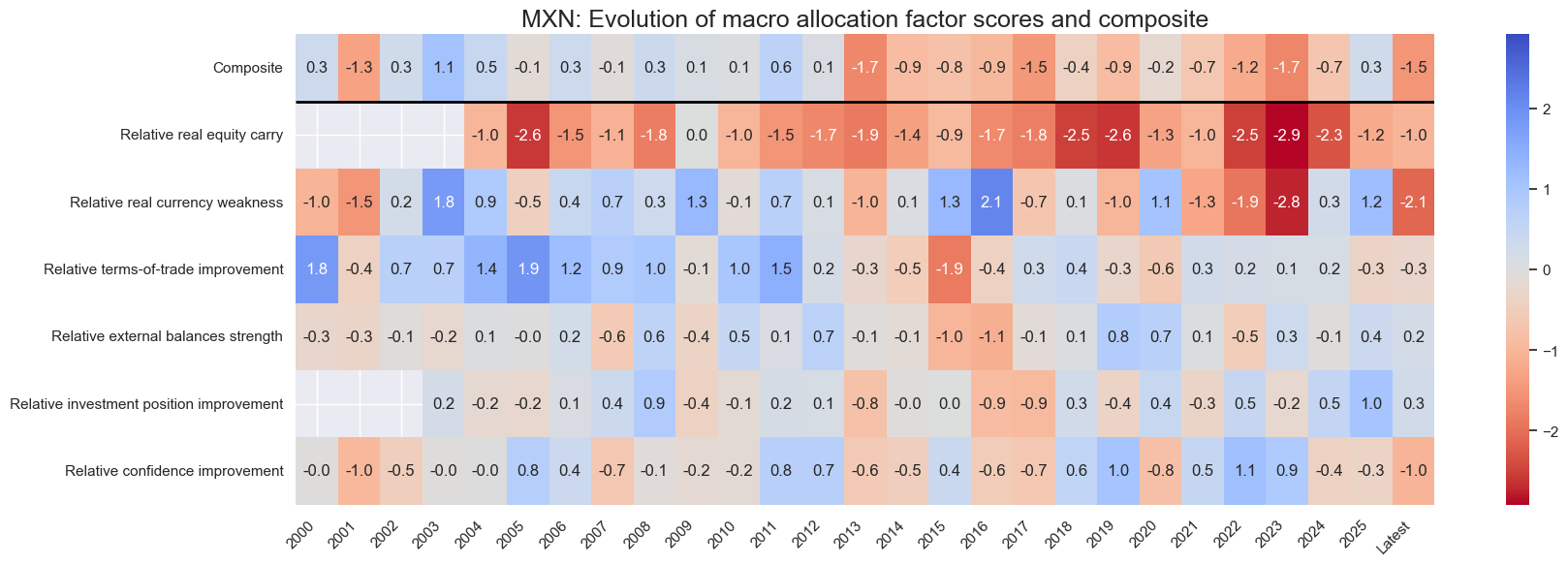

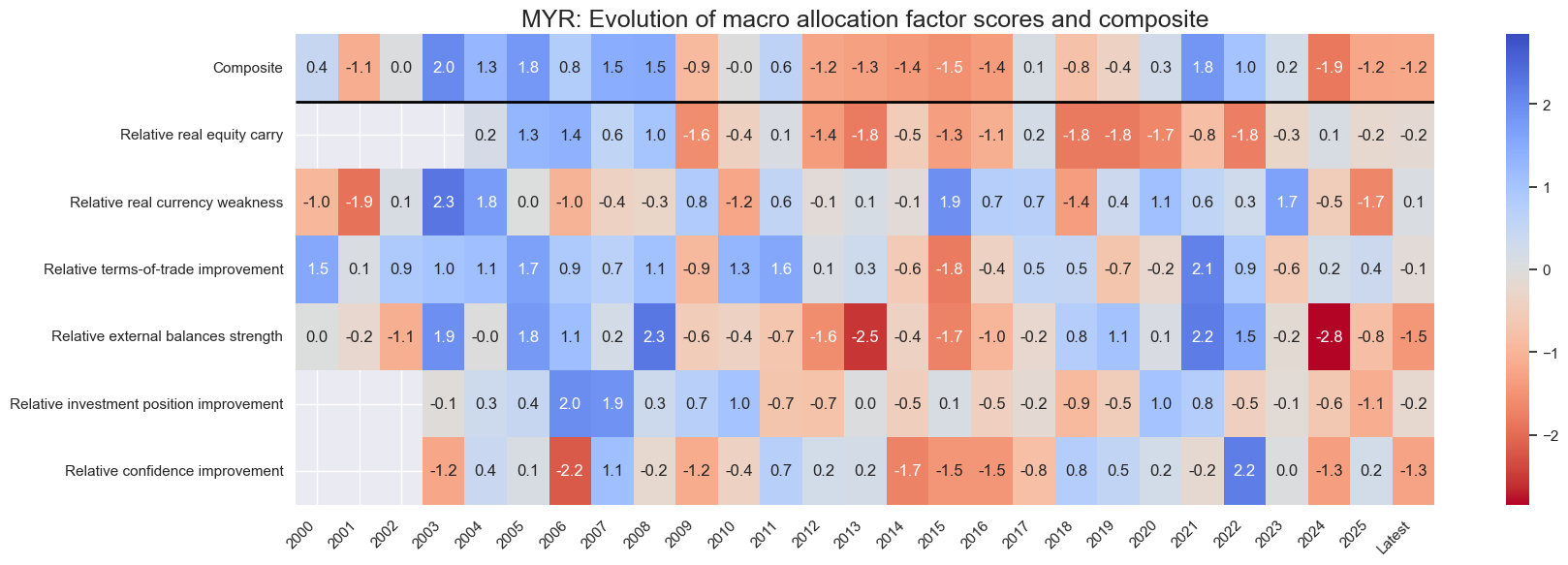

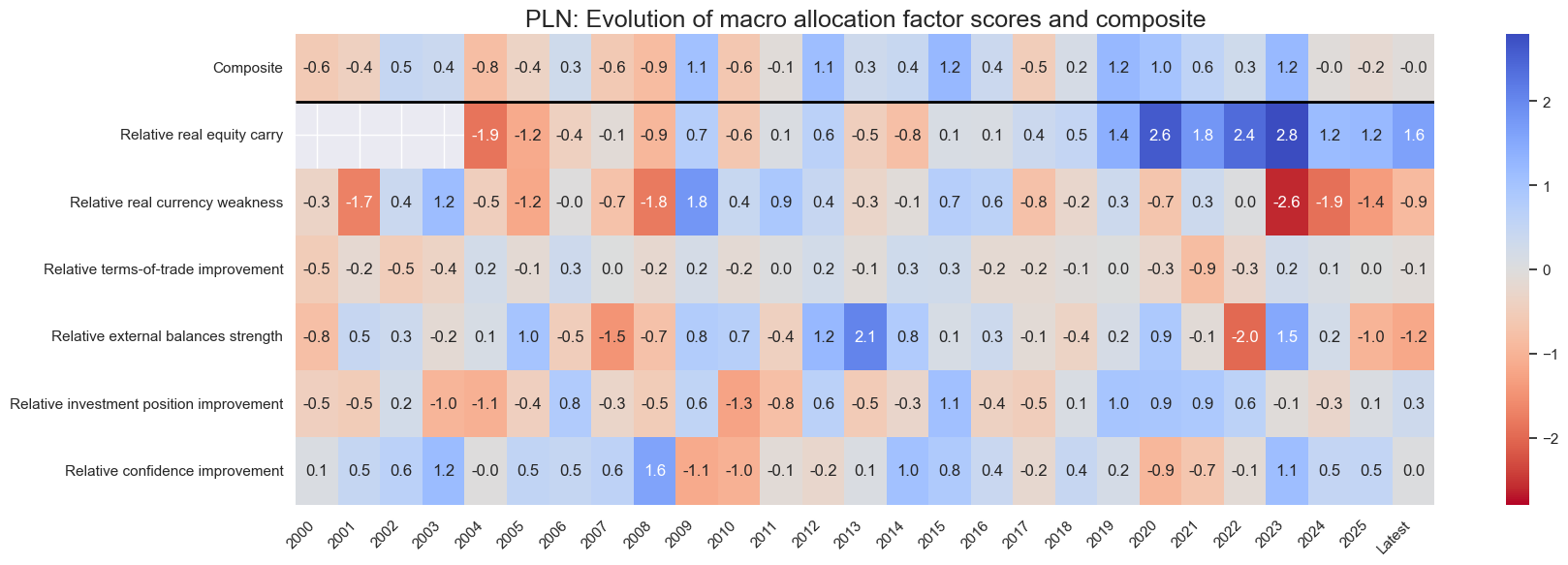

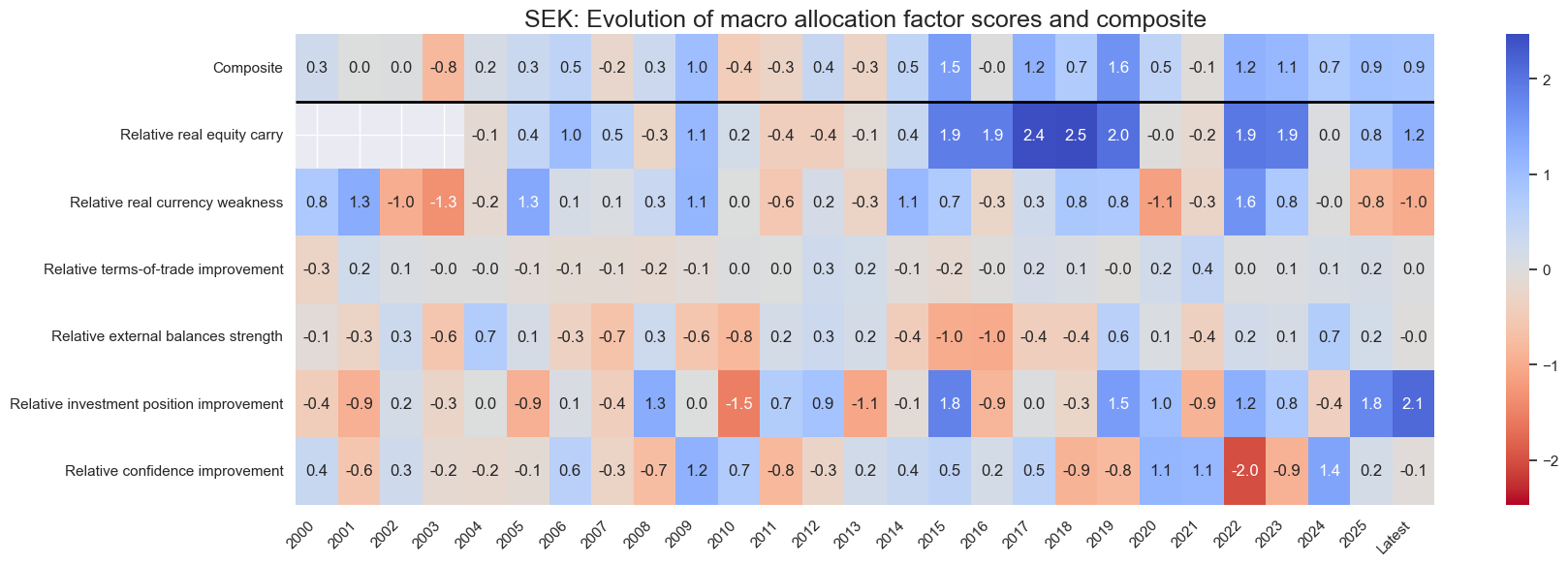

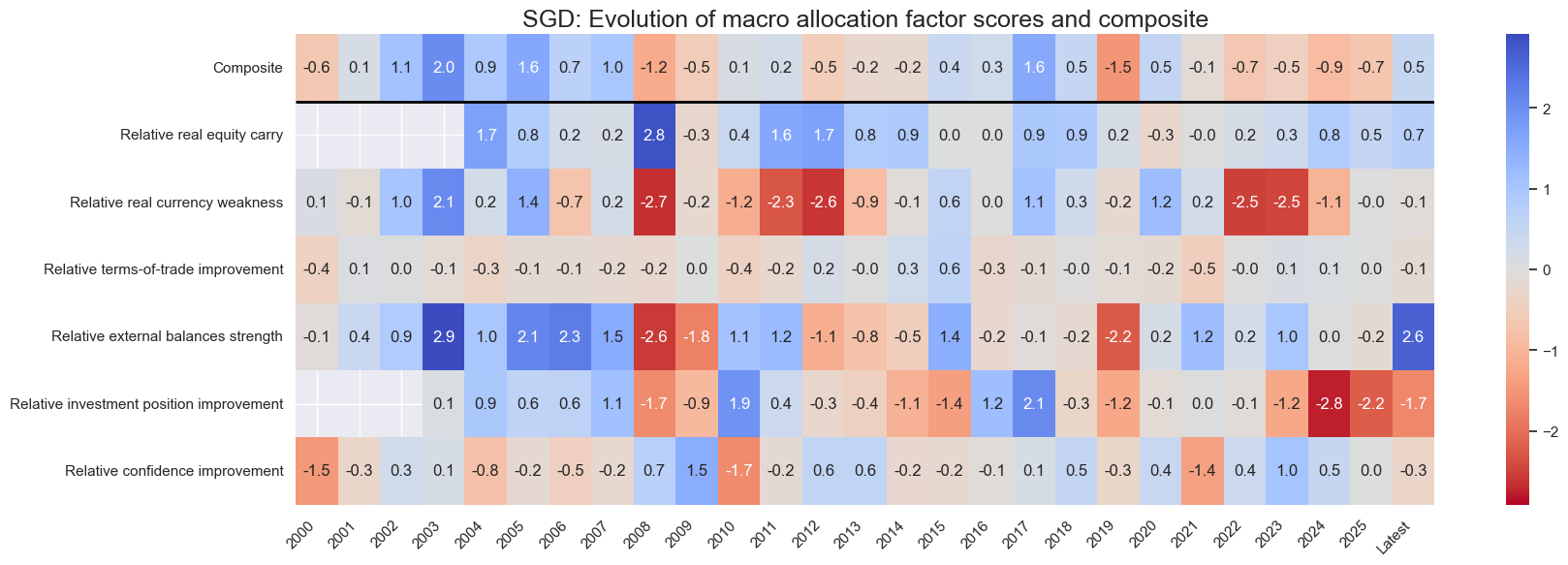

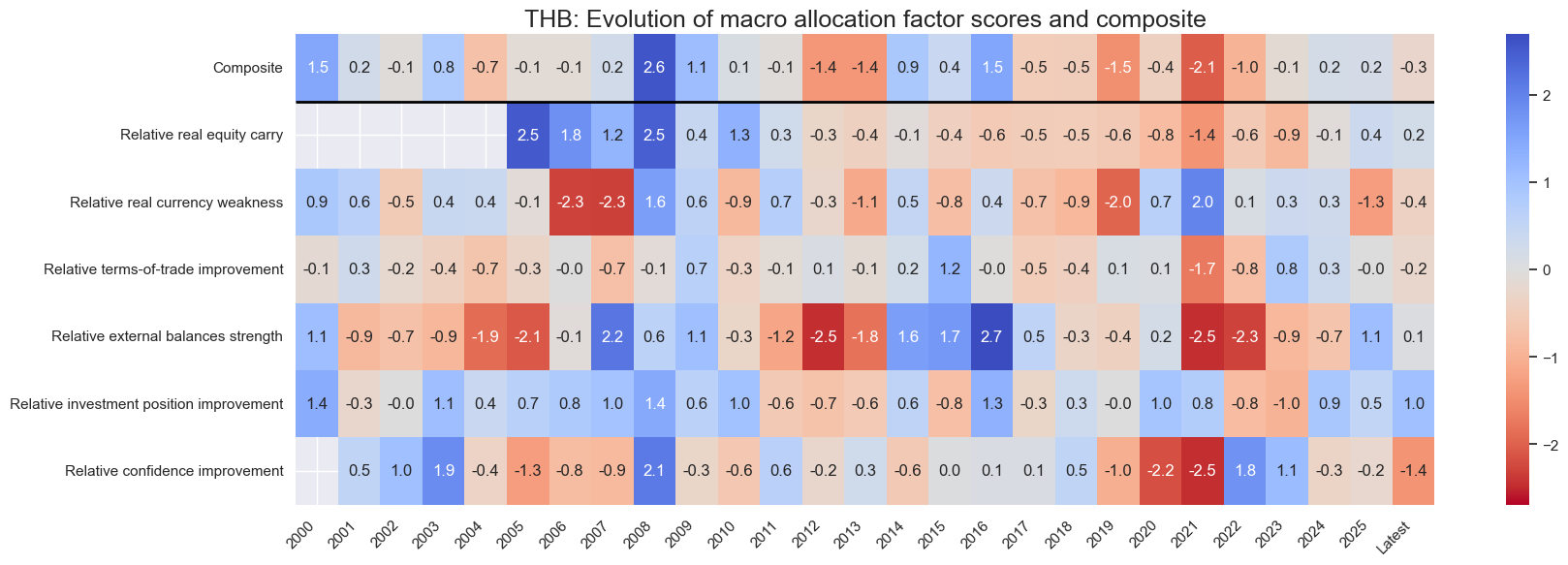

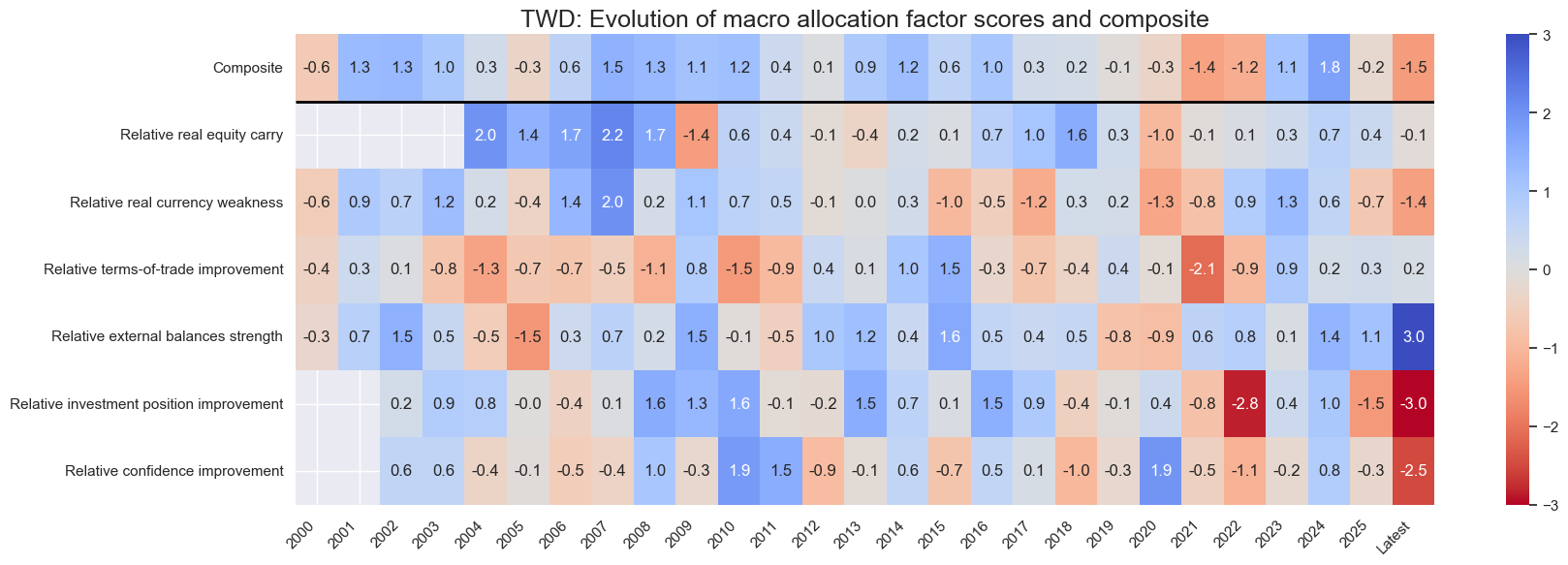

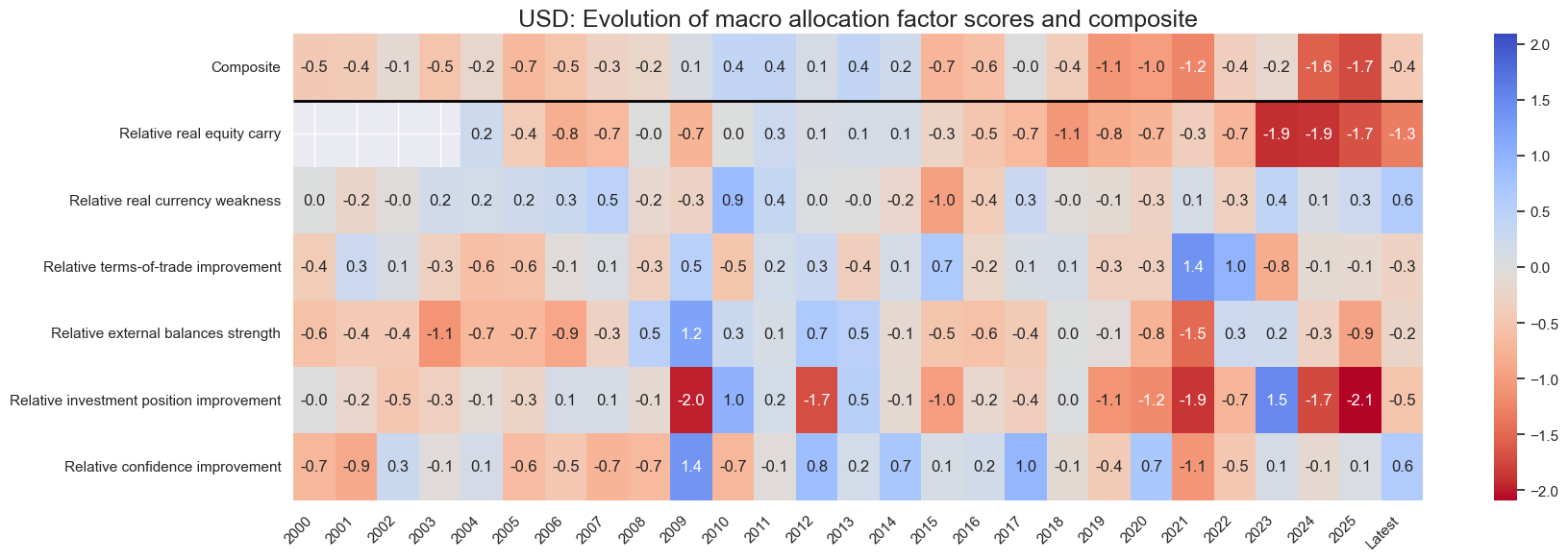

Country history #

xcatx = list(dict_factz.keys()) + ["Composite"]

cidx = cids_eq

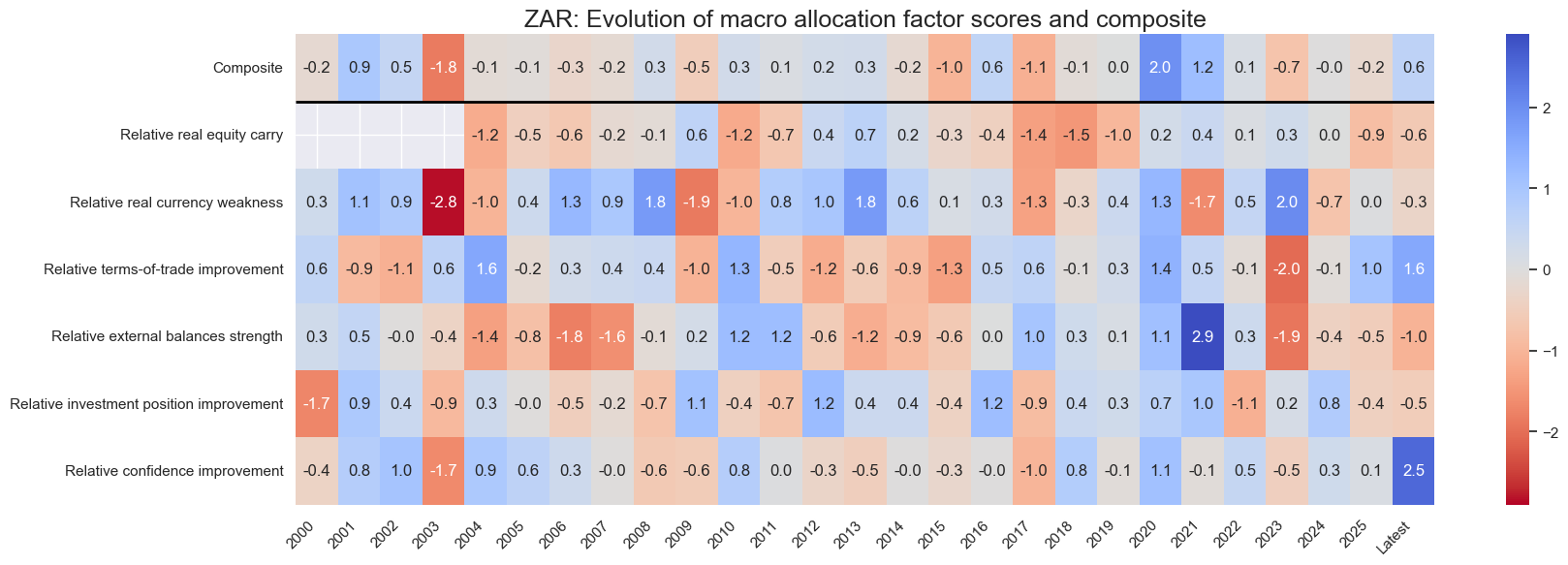

for cid in cids_eq:

sv.view_cid_evolution(

cid=cid,

xcats=xcatx,

xcat_labels=dict_lab,

freq="A",

transpose=False,

title=f"{cid}: Evolution of macro allocation factor scores and composite",

title_fontsize=18,

figsize=(18, 6),

round_decimals=1,

start="2000-01-01",

)

Latest day: 2025-09-23 00:00:00

Latest day: 2025-09-23 00:00:00

Latest day: 2025-09-23 00:00:00

Latest day: 2025-09-23 00:00:00

Latest day: 2025-09-23 00:00:00

Latest day: 2025-09-23 00:00:00

Latest day: 2025-09-23 00:00:00

Latest day: 2025-09-23 00:00:00

Latest day: 2025-09-23 00:00:00

Latest day: 2025-09-23 00:00:00

Latest day: 2025-09-23 00:00:00

Latest day: 2025-09-23 00:00:00

Latest day: 2025-09-23 00:00:00

Latest day: 2025-09-23 00:00:00

Latest day: 2025-09-23 00:00:00

Latest day: 2025-09-23 00:00:00

Latest day: 2025-09-23 00:00:00

Latest day: 2025-09-23 00:00:00

Latest day: 2025-09-23 00:00:00

Predictive power and economic value #

Predictive power of factors #

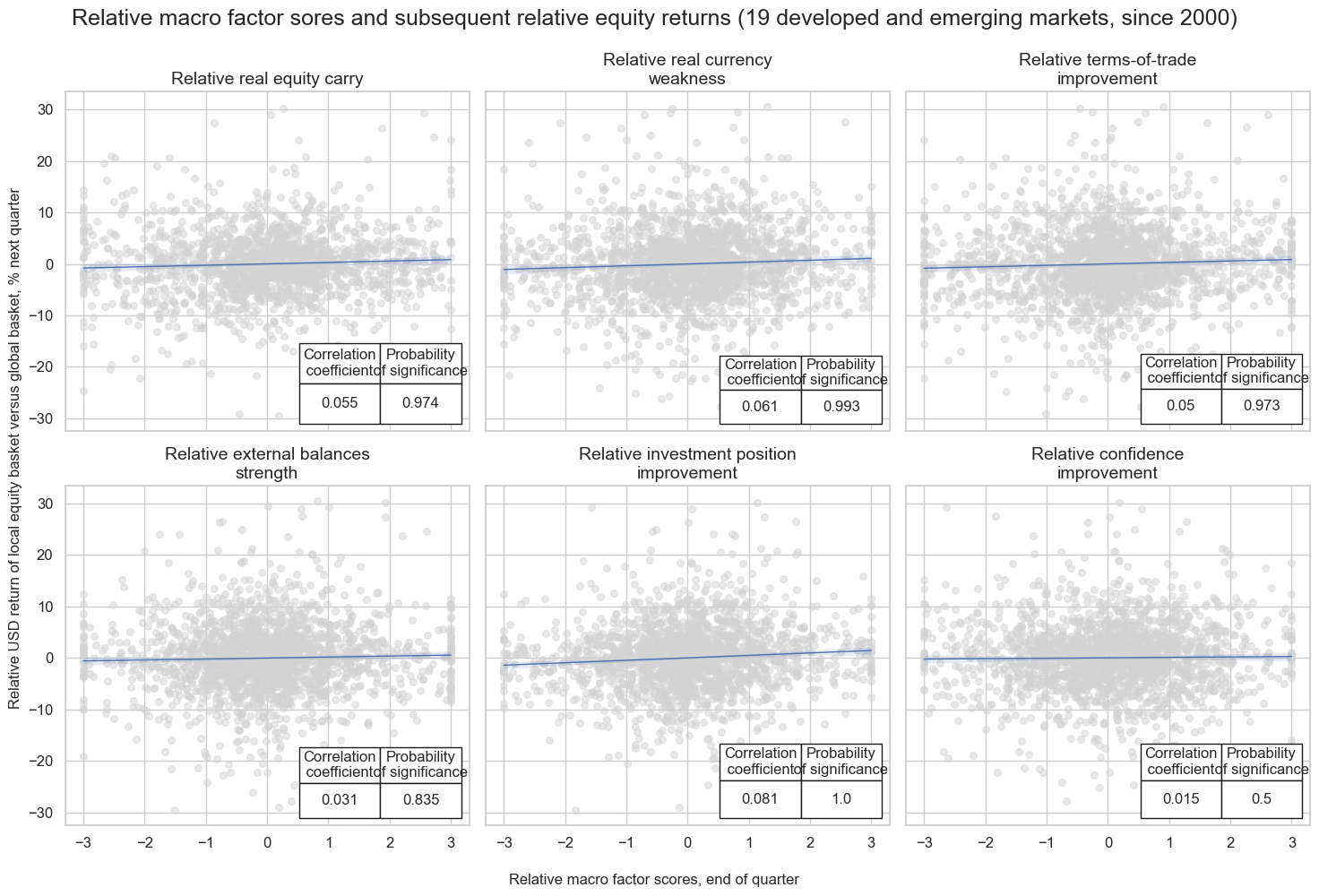

xcatx = list(dict_factz.keys())

cidx = cids_eq

start = "2000-01-01"

catregs = {

sig : msp.CategoryRelations(

dfx,

xcats=[sig, "EQCALLRUSD_NSAvGLB"],

cids=cidx,

freq="Q",

lag=1,

slip=1,

blacklist=equsdblack,

xcat_aggs=["last", "sum"],

start=start,

)

for sig in xcatx

}

msv.multiple_reg_scatter(

cat_rels=list(catregs.values()),

figsize=(15,10),

ncol=3,

nrow=2,

title="Relative macro factor sores and subsequent relative equity returns (19 developed and emerging markets, since 2000)",

title_fontsize=18,

xlab="Relative macro factor scores, end of quarter",

ylab="Relative USD return of local equity basket versus global basket, % next quarter",

coef_box="lower right",

prob_est="map",

share_axes=True,

subplot_titles=[dict_factz[x] for x in xcatx],

)

Predictive power of composite #

# Conceptual relative factor score

xcatx = list(dict_factz.keys())

cidx = cids_eq

cfs = "ALLvGLB"

dfa = msp.linear_composite(

df=dfx,

xcats=xcatx,

cids=cids_eq,

new_xcat=cfs,

complete_xcats=False,

)

dfx= msm.update_df(dfx, dfa)

# Re-score

dfa = msp.make_zn_scores(

dfx,

xcat=cfs,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

dict_alls = {cfs: "Relative overall factor"} | dict_facts

dict_allz = {cfs+"_ZN": "Relative overall factor"} | dict_factz

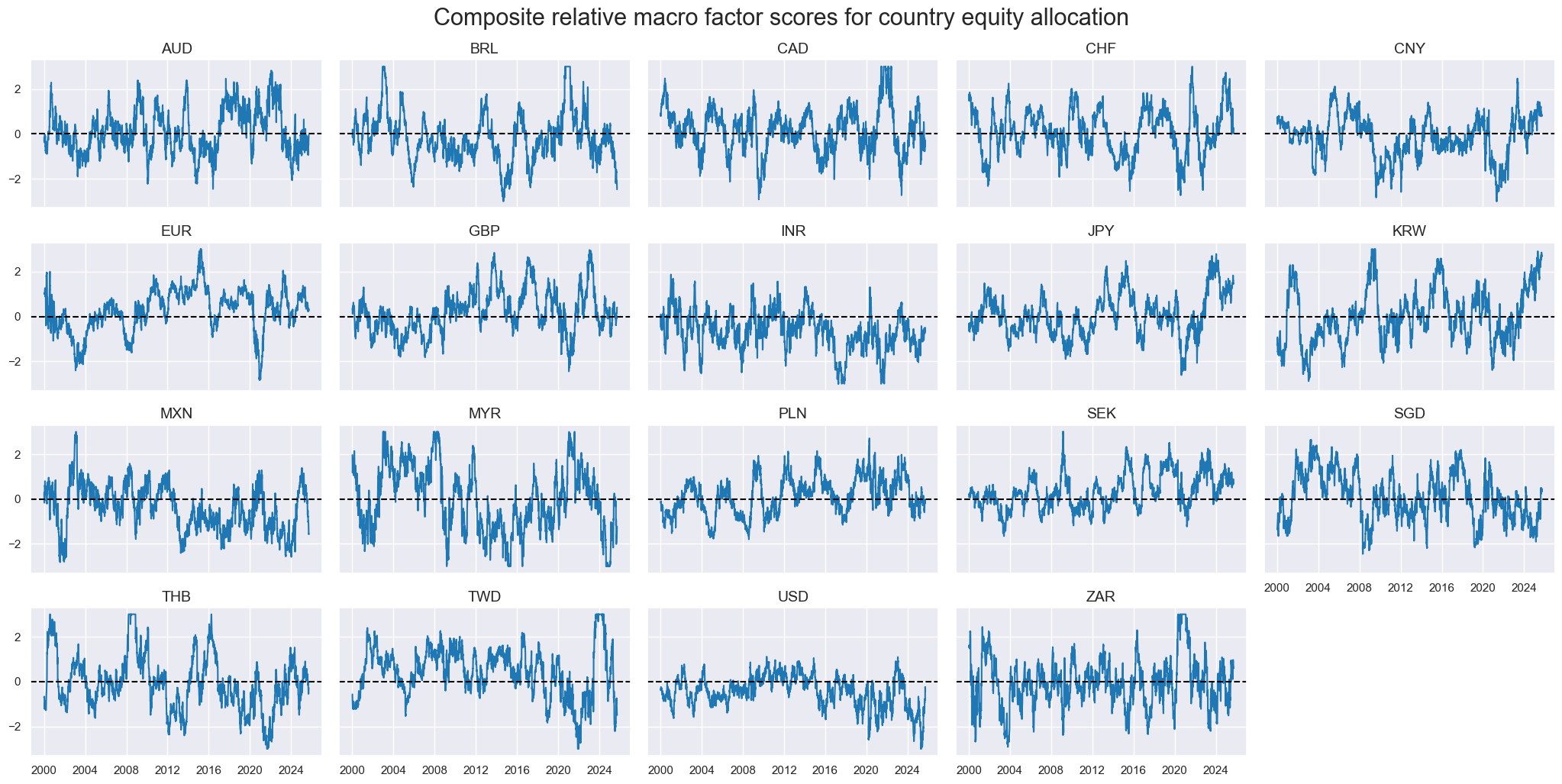

xcatx = ["ALLvGLB_ZN"]

cidx = cids_eq

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=5,

start="2000-01-01",

same_y=True,

height=1.7,

title="Composite relative macro factor scores for country equity allocation",

title_fontsize=22,

)

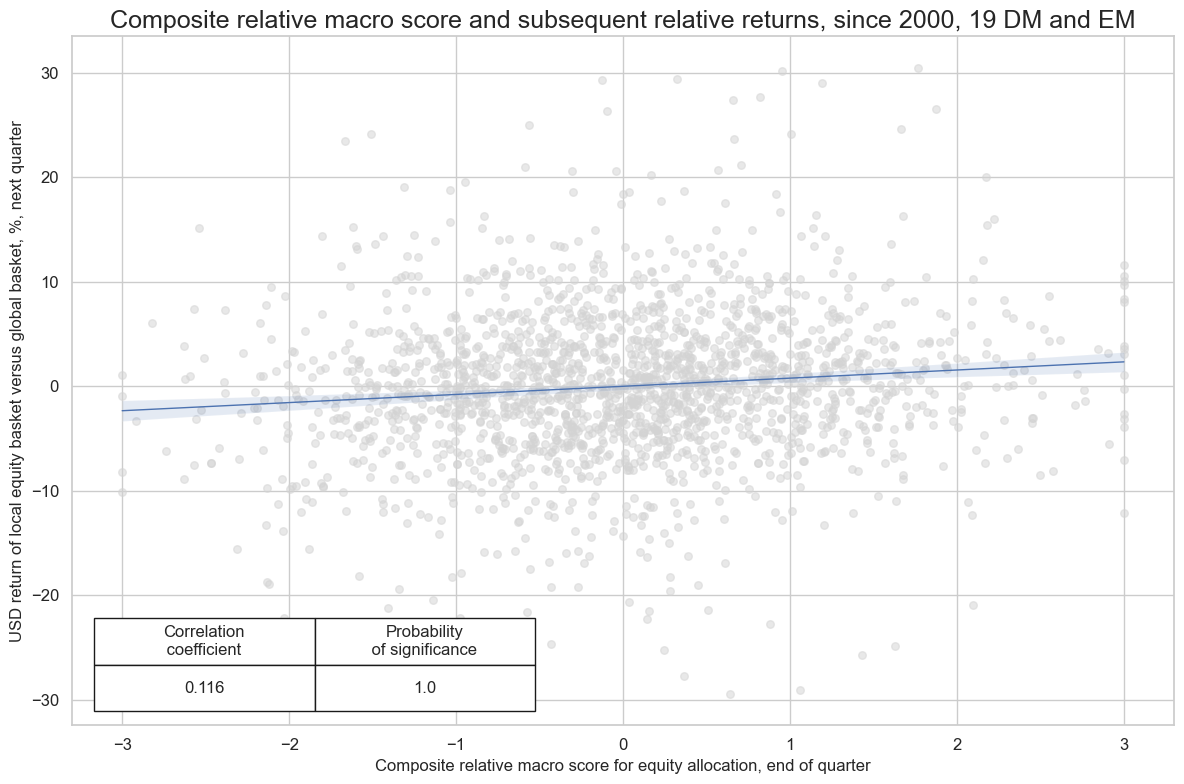

sig = "ALLvGLB_ZN"

ret = "EQCALLRUSD_NSAvGLB"

cidx = cids_eq

freq = "m"

start = "2000-01-01"

crx = msp.CategoryRelations(

dfx,

xcats=[sig, ret],

cids=cidx,

freq="Q",

lag=1,

slip=1,

xcat_aggs=["last", "sum"],

start=start,

blacklist=None,

)

crx.reg_scatter(

labels=False,

coef_box="lower left",

xlab="Composite relative macro score for equity allocation, end of quarter",

ylab="USD return of local equity basket versus global basket, %, next quarter",

title="Composite relative macro score and subsequent relative returns, since 2000, 19 DM and EM",

title_fontsize=18,

size=(12, 8),

prob_est="map",

)

Stylized relative position PnL #

sig = "ALLvGLB_ZN"

ret = "EQCALLRUSD_NSAvGLB"

cidx = cids_eq

blax = None

sdate = "2000-01-01"

pnls = msn.NaivePnL(

df=dfx,

ret=ret,

sigs=[sig],

cids=cidx,

start=sdate,

blacklist=blax,

bms=["USD_GB10YXR_NSA", "EUR_FXXR_NSA", "USD_EQXR_NSA"],

)

pnls.make_pnl(

sig=sig,

sig_op="zn_score_pan",

rebal_freq="monthly",

neutral="zero",

thresh=3,

rebal_slip=1,

vol_scale=10,

pnl_name="PROP_PNL",

)

pnls.make_pnl(

sig=sig,

sig_op="binary",

rebal_freq="monthly",

neutral="zero",

rebal_slip=1,

vol_scale=10,

pnl_name="BIN_PNL",

)

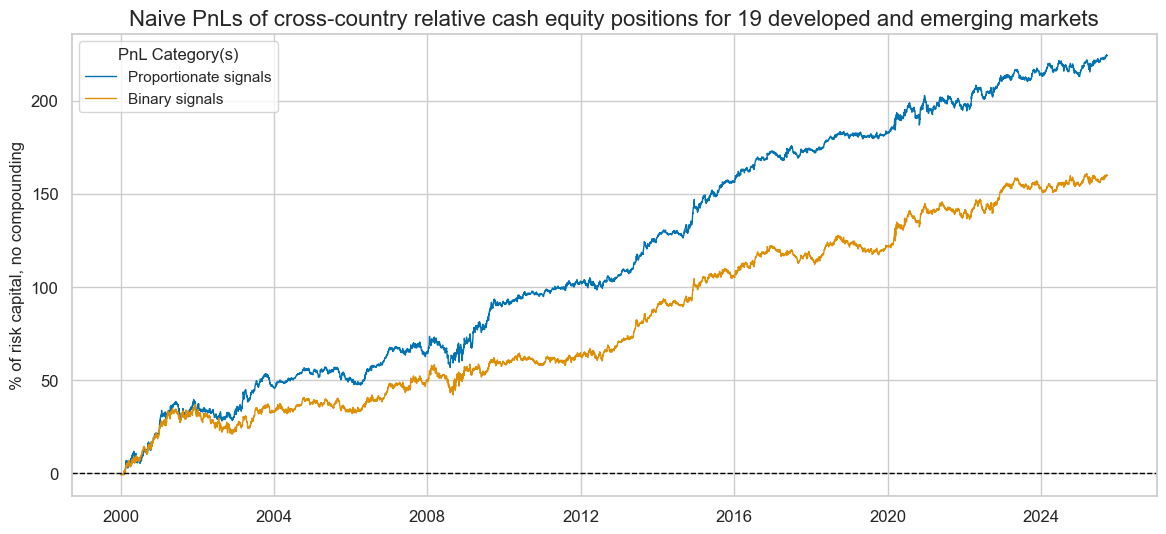

pnls.plot_pnls(

title="Naive PnLs of cross-country relative cash equity positions for 19 developed and emerging markets",

title_fontsize=16,

xcat_labels=["Proportionate signals", "Binary signals"],

figsize=(14,6)

)

display(pnls.evaluate_pnls(["PROP_PNL", "BIN_PNL"]))

| xcat | PROP_PNL | BIN_PNL |

|---|---|---|

| Return % | 8.717149 | 6.215304 |

| St. Dev. % | 10.0 | 10.0 |

| Sharpe Ratio | 0.871715 | 0.62153 |

| Sortino Ratio | 1.287248 | 0.907071 |

| Max 21-Day Draw % | -9.331289 | -7.623355 |

| Max 6-Month Draw % | -15.498525 | -14.325042 |

| Peak to Trough Draw % | -16.769772 | -16.163088 |

| Top 5% Monthly PnL Share | 0.492196 | 0.544589 |

| USD_GB10YXR_NSA correl | 0.029689 | 0.050645 |

| EUR_FXXR_NSA correl | 0.112782 | 0.125806 |

| USD_EQXR_NSA correl | -0.079334 | -0.12193 |

| Traded Months | 309 | 309 |

sigs = list(dict_factz.keys())

targ = "EQCALLRUSD_NSAvGLB"

cidx = cids_eq

blax = None

sdate = "2003-01-01"

single_pnls = msn.NaivePnL(

df=dfx,

ret=targ,

sigs=sigs,

cids=cidx,

start=sdate,

blacklist=blax,

bms=["USD_GB10YXR_NSA", "EUR_FXXR_NSA", "USD_EQXR_NSA"],

)

for sig in sigs:

single_pnls.make_pnl(

sig=sig,

sig_op="raw",

rebal_freq="monthly",

neutral="zero",

rebal_slip=1,

vol_scale=10,

)

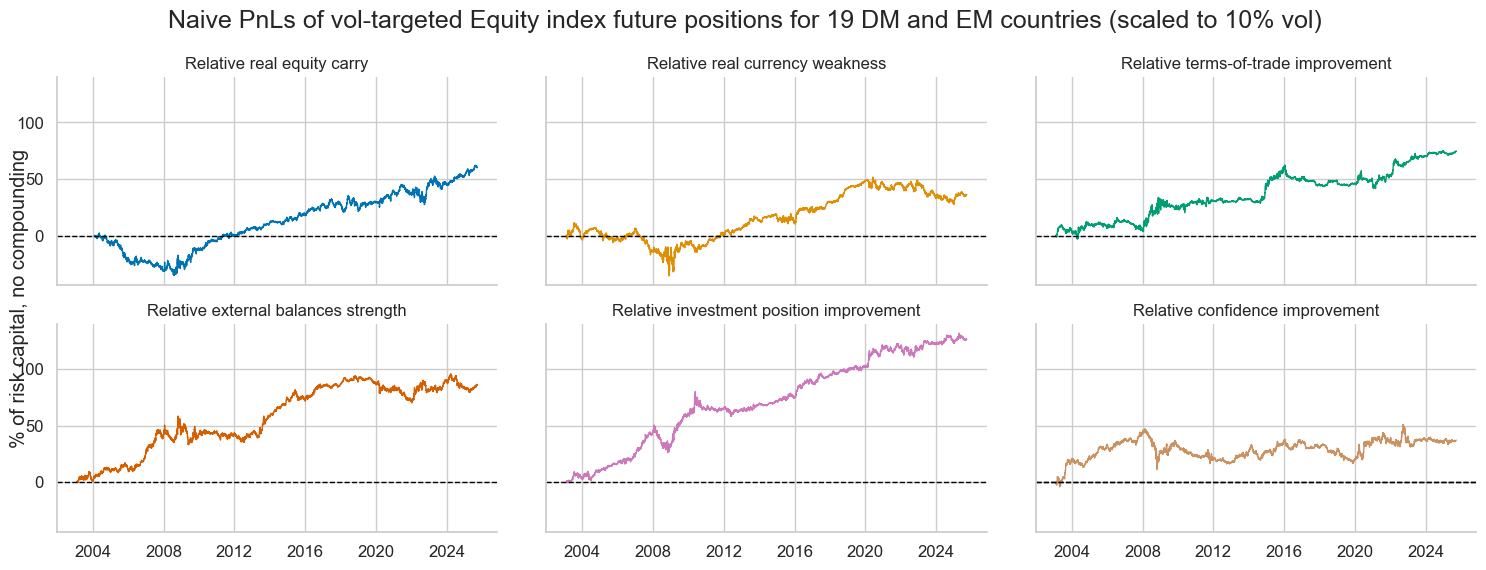

single_pnls.plot_pnls(

title="Naive PnLs of vol-targeted Equity index future positions for 19 DM and EM countries (scaled to 10% vol)",

title_fontsize=18,

xcat_labels=list(dict_factz.values()),

facet=True,

figsize=(12, 10)

)

Wealth enhancement #

Weights and pseudo-weights #

# Equal weight calculation

cidx = cids_eq

# Simple weight in the global equity basket for each country when the equity futures start being traded

calcs = [

"GEQPWGT = 0 * EQCALLRUSD_NSA + 1",

]

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cidx)

dfa["tot_cids"] = dfa.groupby(["real_date", "xcat"])["value"].transform("count")

dfa["value"] = dfa["value"] / dfa["tot_cids"]

dfx = msm.update_df(dfx, dfa.drop(columns=["tot_cids"]))

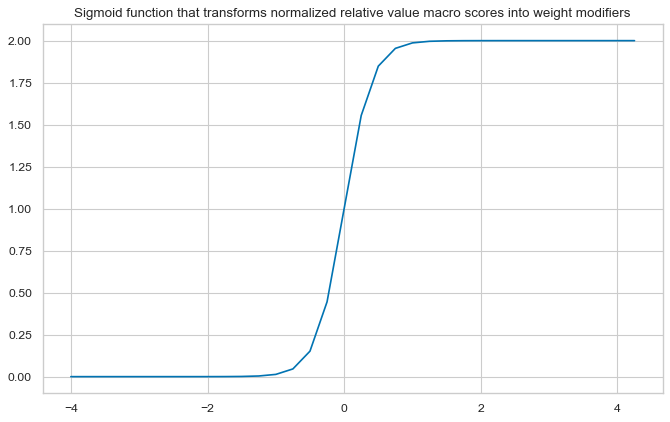

# Define appropriate sigmoid function for adjusting weights

amplitude = 2

steepness = 5

midpoint = 0

def sigmoid(x, a=amplitude, b=steepness, c=midpoint):

return a / (1 + np.exp(-b * (x - c)))

ar = np.array([i / 4 for i in range(-16, 18)])

plt.figure(figsize=(10, 6), dpi=80)

plt.plot(ar, sigmoid(ar))

plt.title("Sigmoid function that transforms normalized relative value macro scores into weight modifiers")

plt.show()

# Adjusted weights calculation

cidx = cids_eq

dfj = adjust_weights(

dfx,

weights_xcat="GEQPWGT",

adj_zns_xcat="ALLvGLB_ZN",

method="generic",

adj_func=sigmoid,

blacklist=equsdblack,

cids=cidx,

adj_name="GEQPWGT_MOD",

)

dfx = msm.update_df(dfx, dfj)

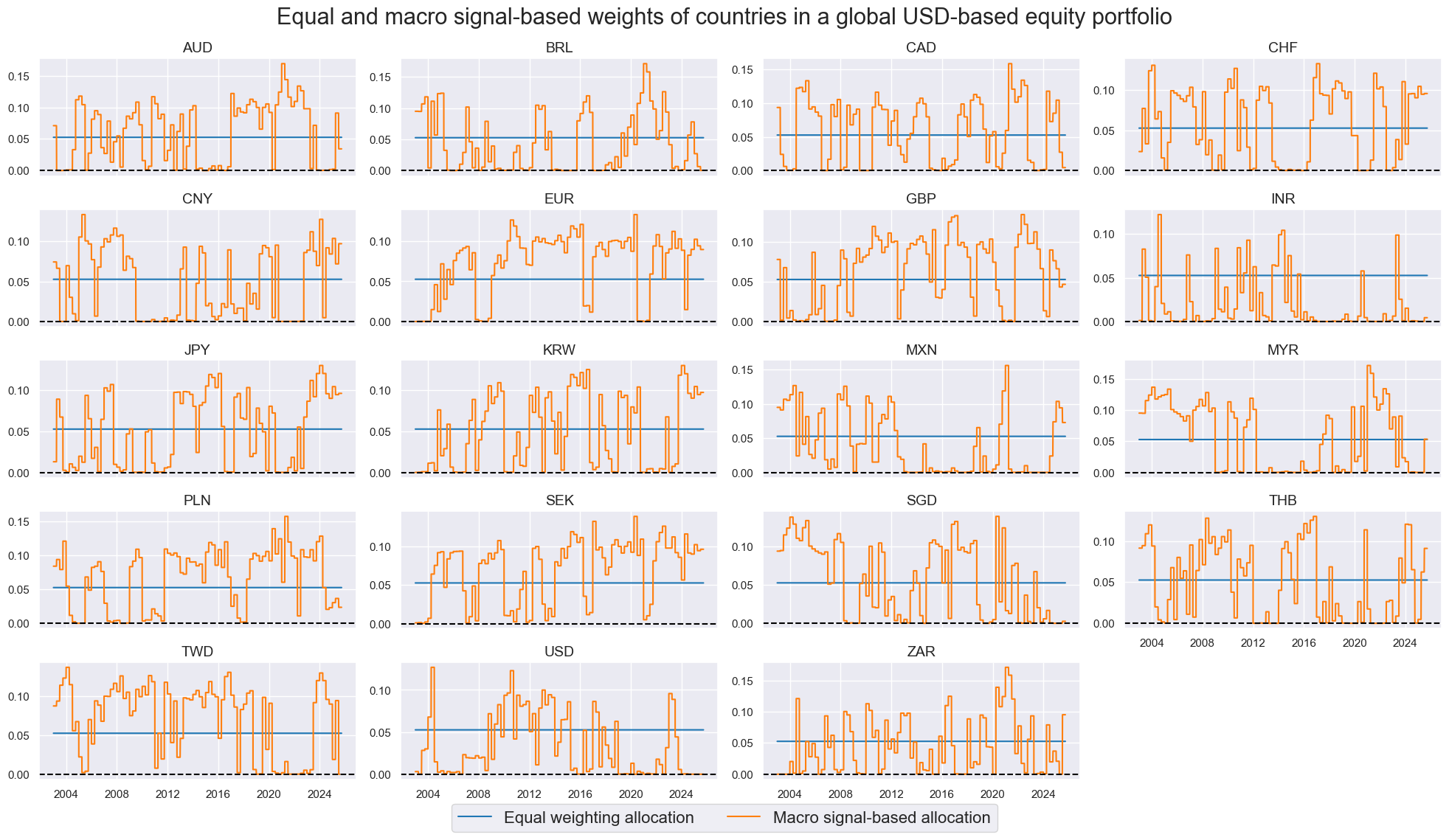

# Visualize weights

cidx = cids_eq

xcatx = ["GEQPWGT", "GEQPWGT_MOD"]

# Reduce frequency to monthly in accordance with PnL simulation

for xc in xcatx:

dfa = dfx.loc[dfx["xcat"] == xc]

dfa["last_period_bd"] = pd.to_datetime(dfa["real_date"]) + pd.tseries.offsets.BQuarterEnd(0)

mask = pd.to_datetime(dfa["last_period_bd"]) == pd.to_datetime(dfa["real_date"])

dfa.loc[~mask, "value"] = np.nan

dfa["value"] = dfa.groupby("cid")["value"].ffill(limit=75) # max 25 business days

dfa = dfa.drop(columns="xcat").assign(xcat=f"{xc}_M")

dfx = msm.update_df(dfx, dfa)

xcatxx =[xc + "_M" for xc in xcatx]

msp.view_timelines(

dfx,

xcats=xcatxx,

cids=cidx,

ncol=4,

start="2003-01-01",

same_y=False,

cumsum=False,

title="Equal and macro signal-based weights of countries in a global USD-based equity portfolio",

title_fontsize=22,

xcat_labels=["Equal weighting allocation", "Macro signal-based allocation"],

height=1.5,

aspect=2.2,

legend_fontsize=16,

)

# U.S. only "weight"

cidx = ["USD"]

calcs = [

# Always long one unit of US equity

"USEQPWGT = 0 * EQCALLRUSD_NSA + 1",

]

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cidx)

dfx = msm.update_df(dfx, dfa)

Evaluation #

dict_mod = {

"sigs": ["GEQPWGT_MOD", "GEQPWGT", "USEQPWGT"],

"targ": "EQCALLRUSD_NSA",

"cidx": cids_eq,

"start": "2000-01-01",

"black": equsdblack,

"srr": None,

"pnls": None,

}

dix = dict_mod

sigs = dix["sigs"]

ret = dix["targ"]

cidx = dix["cidx"]

start = dix["start"]

black = dix["black"]

pnls = msn.NaivePnL(

df=dfx,

ret=ret,

sigs=sigs,

cids=cidx,

start=start,

blacklist=black,

)

for sig in sigs:

pnls.make_pnl(

sig=sig,

sig_op="raw",

rebal_freq="quarterly",

neutral="zero",

rebal_slip=1,

)

dix["pnls"] = pnls

dix = dict_mod

pnls = dix["pnls"]

sigs = dix["sigs"]

pnl_cats = ["PNL_" + sig for sig in sigs]

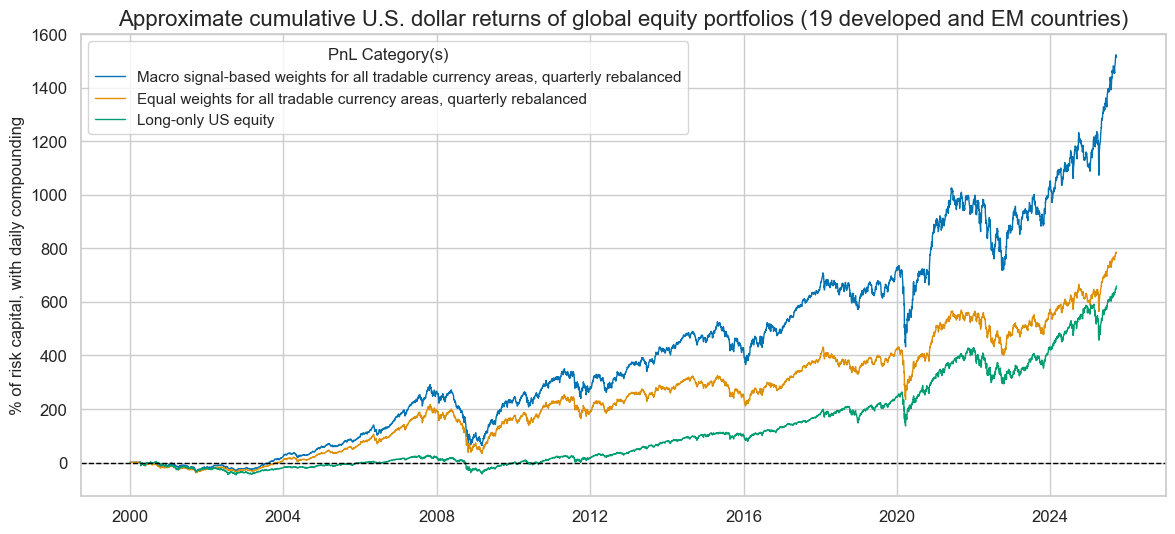

pnls.plot_pnls(

pnl_cats=pnl_cats,

title="Approximate cumulative U.S. dollar returns of global equity portfolios (19 developed and EM countries)",

title_fontsize=16,

compounding=True,

xcat_labels={

"PNL_GEQPWGT": "Equal weights for all tradable currency areas, quarterly rebalanced",

"PNL_GEQPWGT_MOD": "Macro signal-based weights for all tradable currency areas, quarterly rebalanced",

"PNL_USEQPWGT": "Long-only US equity",

},

figsize=(14,6)

)

pnls.evaluate_pnls(pnl_cats=pnl_cats)

| xcat | PNL_GEQPWGT_MOD | PNL_GEQPWGT | PNL_USEQPWGT |

|---|---|---|---|

| Return % | 12.089165 | 9.650414 | 9.902037 |

| St. Dev. % | 15.887407 | 15.31639 | 19.678504 |

| Sharpe Ratio | 0.760928 | 0.630071 | 0.503191 |

| Sortino Ratio | 1.071502 | 0.872544 | 0.712426 |

| Max 21-Day Draw % | -44.234854 | -46.065109 | -38.21883 |

| Max 6-Month Draw % | -74.633423 | -72.113718 | -55.794825 |

| Peak to Trough Draw % | -81.359015 | -79.047799 | -68.560921 |

| Top 5% Monthly PnL Share | 0.563015 | 0.662894 | 0.587019 |

| Traded Months | 309 | 309 | 309 |