EM local bond markets scorecard #

Get packages and JPMaQS data #

Set up parameters and import packages #

# Constants and credentials

import os

import pandas as pd

REQUIRED_VERSION: str = "1.4.0"

DQ_CLIENT_ID: str = os.getenv("DQ_CLIENT_ID") # Use your DataQuery ID if it is not an environment variable

DQ_CLIENT_SECRET: str = os.getenv("DQ_CLIENT_SECRET") # Use your DataQuery secret if it is not an environment variable

PROXY = {} # Configure if behind corporate firewall

START_DATE: str = "2000-01-01" # Start date for data download

END_DATE: str = (pd.Timestamp.today() - pd.offsets.BDay(1)).strftime('%Y-%m-%d')

import macrosynergy as msy

msy.check_package_version(required_version=REQUIRED_VERSION)

# If version check fails: pip install macrosynergy --upgrade

from datetime import date, datetime

import os

import macrosynergy.management as msm

import macrosynergy.panel as msp

import macrosynergy.pnl as msn

import macrosynergy.visuals as msv

import macrosynergy.signal as mss

from macrosynergy.download import JPMaQSDownload

from macrosynergy.visuals import ScoreVisualisers

pd.set_option('display.width', 400)

import warnings

warnings.simplefilter("ignore")

Download quantamental indicators #

# Cross-sections of interest

cids_latm = ["BRL", "COP", "CLP", "MXN", "PEN"] # Latam countries

cids_emea = ["CZK", "HUF", "PLN", "RON", "RUB", "TRY", "ZAR"] # EMEA countries, "ILS" not included

cids_emas = ["IDR", "MYR", "PHP", "THB"] # EM Asia countries "CNY", "INR", "KRW", "SGD", "TWD"

cids_em = sorted(cids_latm + cids_emea + cids_emas)

cids = sorted(cids_em + ["USD"])

# Quantamental category groups

# External ratio trends

xbch = [

"MTBGDPRATIO_NSA_12MMA_D1M1ML3",

"MTBGDPRATIO_SA_6MMA_D1M1ML6",

"MTBGDPRATIO_SA_3MMAv60MMA",

"CABGDPRATIO_SA_3MMAv60MMA",

"CABGDPRATIO_SA_1QMAv20QMA",

]

# Intuitive GDP growth estimates

igdp = [

"INTRGDP_NSA_P1M1ML12",

"INTRGDP_NSA_P1M1ML12_3MMA",

"INTRGDPv5Y_NSA_P1M1ML12_3MMA",

]

# Terms of trade trends

tots = [

"CTOT_NSA_P1M1ML12",

"CTOT_NSA_P1W4WL1",

"CTOT_NSA_P1M60ML1",

]

# International investment position trends

niip = [

"NIIPGDP_NSA_D1Mv2YMA",

"NIIPGDP_NSA_D1Mv5YMA",

"IIPLIABGDP_NSA_D1Mv2YMA",

"IIPLIABGDP_NSA_D1Mv5YMA",

]

# Government balances

dsus = [

"GGSBGDPRATIO_NSA",

"GGOBGDPRATIO_NSA",

"GGPBGDPRATIO_NSA",

]

# Term premia estimates

dutp = [

"DU02YETP_NSA",

"DU05YETP_NSA",

"DU10YETP_NSA",

]

# ALl macro categories

macro = igdp + tots + niip + xbch + dsus + dutp

# Market categories

blkl = [

"FXTARGETED_NSA",

"FXUNTRADABLE_NSA",

]

rets = [

"LCBIRUSD_NSA",

"LCBIXRUSD_NSA",

"LCBIXRUSD_VT10",

]

mkts = blkl + rets

xcats = macro + mkts

# Tickers for download

single_tix = ["USD_GB10YXR_NSA", "EUR_FXXR_NSA", "USD_EQXR_NSA"]

tickers = (

[cid + "_" + xcat for cid in cids for xcat in xcats]

+ single_tix

+ [cid + "_" + xcat for cid in ["USD"] for xcat in xcats]

)

# Download macro-quantamental indicators from JPMaQS via the DataQuery API

with JPMaQSDownload(

client_id=DQ_CLIENT_ID, client_secret=DQ_CLIENT_SECRET, proxy=PROXY

) as downloader:

df: pd.DataFrame = downloader.download(

tickers=tickers,

start_date=START_DATE,

metrics=["value"],

suppress_warning=True,

show_progress=True,

)

Downloading data from JPMaQS.

Timestamp UTC: 2025-11-05 09:57:12

Connection successful!

Requesting data: 100%|██████████| 23/23 [00:04<00:00, 4.92it/s]

Downloading data: 100%|██████████| 23/23 [00:33<00:00, 1.44s/it]

Some expressions are missing from the downloaded data. Check logger output for complete list.

32 out of 445 expressions are missing. To download the catalogue of all available expressions and filter the unavailable expressions, set `get_catalogue=True` in the call to `JPMaQSDownload.download()`.

dfx = df.copy().sort_values(["cid", "xcat", "real_date"])

dfx.info()

<class 'pandas.core.frame.DataFrame'>

Index: 2572595 entries, 13484 to 2538884

Data columns (total 4 columns):

# Column Dtype

--- ------ -----

0 real_date datetime64[ns]

1 cid object

2 xcat object

3 value float64

dtypes: datetime64[ns](1), float64(1), object(2)

memory usage: 98.1+ MB

Re-namings, availability checks and blacklists #

Renaming quarterly categories #

dict_repl = {

"CABGDPRATIO_SA_1QMAv20QMA": "CABGDPRATIO_SA_3MMAv60MMA",

}

dfx["xcat"] = dfx["xcat"].map(lambda v: dict_repl.get(v, v))

to_drop = set(dict_repl) # faster membership tests than list/dict_keys

dfx = dfx[~dfx["xcat"].isin(to_drop)]

if hasattr(dfx["xcat"], "cat"):

dfx["xcat"] = dfx["xcat"].cat.remove_categories(list(to_drop))

dfx["xcat"] = dfx["xcat"].cat.remove_unused_categories()

Availability check #

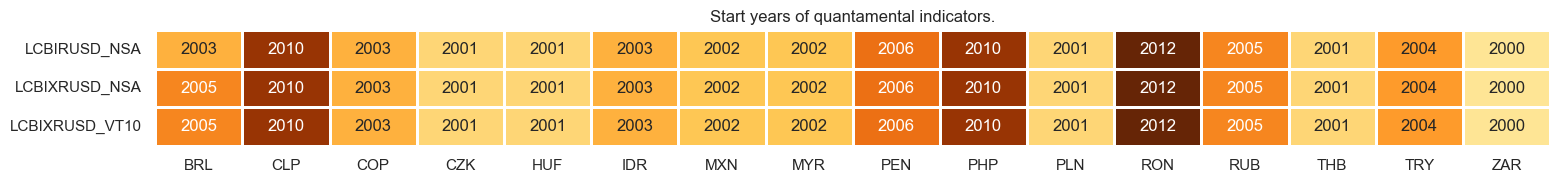

xcatx = rets

cidx = cids_em

msm.check_availability(dfx, xcats = xcatx, cids = cidx, missing_recent=False)

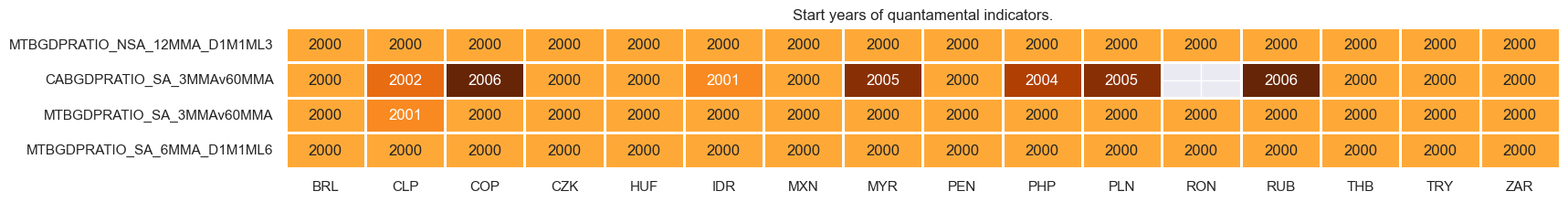

xcatx = list(set([dict_repl.get(item, item) for item in xbch]))

cidx = cids_em

msm.check_availability(dfx, xcats = xcatx, cids = cidx, missing_recent=False)

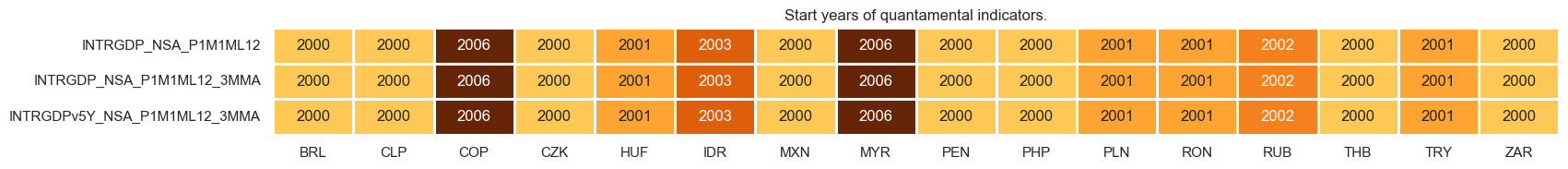

xcatx = igdp

cidx = cids_em

msm.check_availability(dfx, xcats = xcatx, cids = cidx, missing_recent=False)

xcatx = list(set([dict_repl.get(item, item) for item in tots]))

cidx = cids_em

msm.check_availability(dfx, xcats = xcatx, cids = cidx, missing_recent=False)

xcatx = niip

cidx = cids_em

msm.check_availability(dfx, xcats = xcatx, cids = cidx, missing_recent=False)

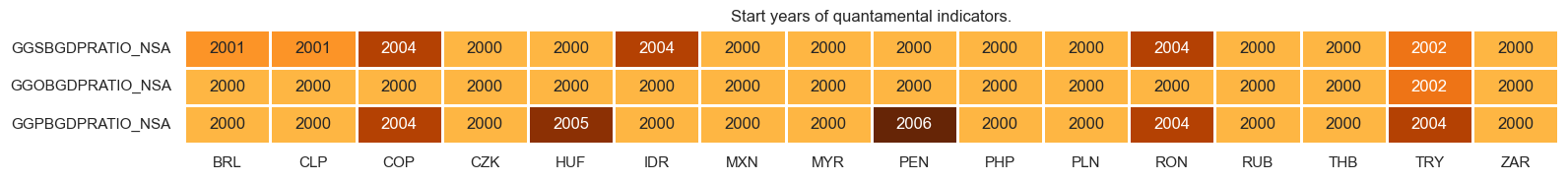

xcatx = dsus

cidx = cids_em

msm.check_availability(dfx, xcats = xcatx, cids = cidx, missing_recent=False)

xcatx = dutp

cidx = cids_em

msm.check_availability(dfx, xcats = xcatx, cids = cidx, missing_recent=False)

Blacklisting based on FX forward markets #

dfb = dfx[dfx["xcat"].isin(["FXUNTRADABLE_NSA"])].loc[

:, ["cid", "xcat", "real_date", "value"]

]

dfba = (

dfb.groupby(["cid", "real_date"])

.aggregate(value=pd.NamedAgg(column="value", aggfunc="max"))

.reset_index()

)

dfba["xcat"] = "FXBLACK"

fxblack = msp.make_blacklist(dfba, "FXBLACK")

fxblack

{'MYR': (Timestamp('2018-07-02 00:00:00'), Timestamp('2025-11-04 00:00:00')),

'PEN': (Timestamp('2021-07-01 00:00:00'), Timestamp('2021-07-30 00:00:00')),

'RUB': (Timestamp('2022-02-01 00:00:00'), Timestamp('2025-11-04 00:00:00')),

'THB': (Timestamp('2007-01-01 00:00:00'), Timestamp('2008-11-28 00:00:00')),

'TRY_1': (Timestamp('2000-01-03 00:00:00'), Timestamp('2003-09-30 00:00:00')),

'TRY_2': (Timestamp('2020-01-01 00:00:00'), Timestamp('2024-07-31 00:00:00'))}

Local-currency bond index returns #

xcatx = [

"LCBIRUSD_NSA",

]

cidx = sorted(list(set(cids_em) - set(["RUB"])))

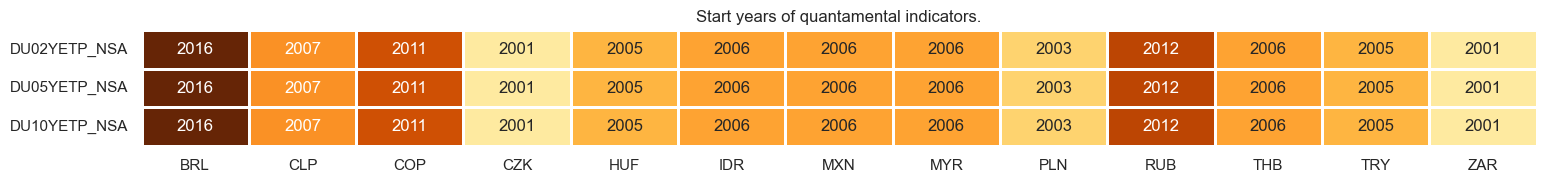

msp.view_ranges(

dfx,

cids=cidx,

xcats=xcatx,

kind="box",

sort_cids_by="std",

title=None,

ylab="% annualized",

start="2000-01-01",

title_fontsize=20,

)

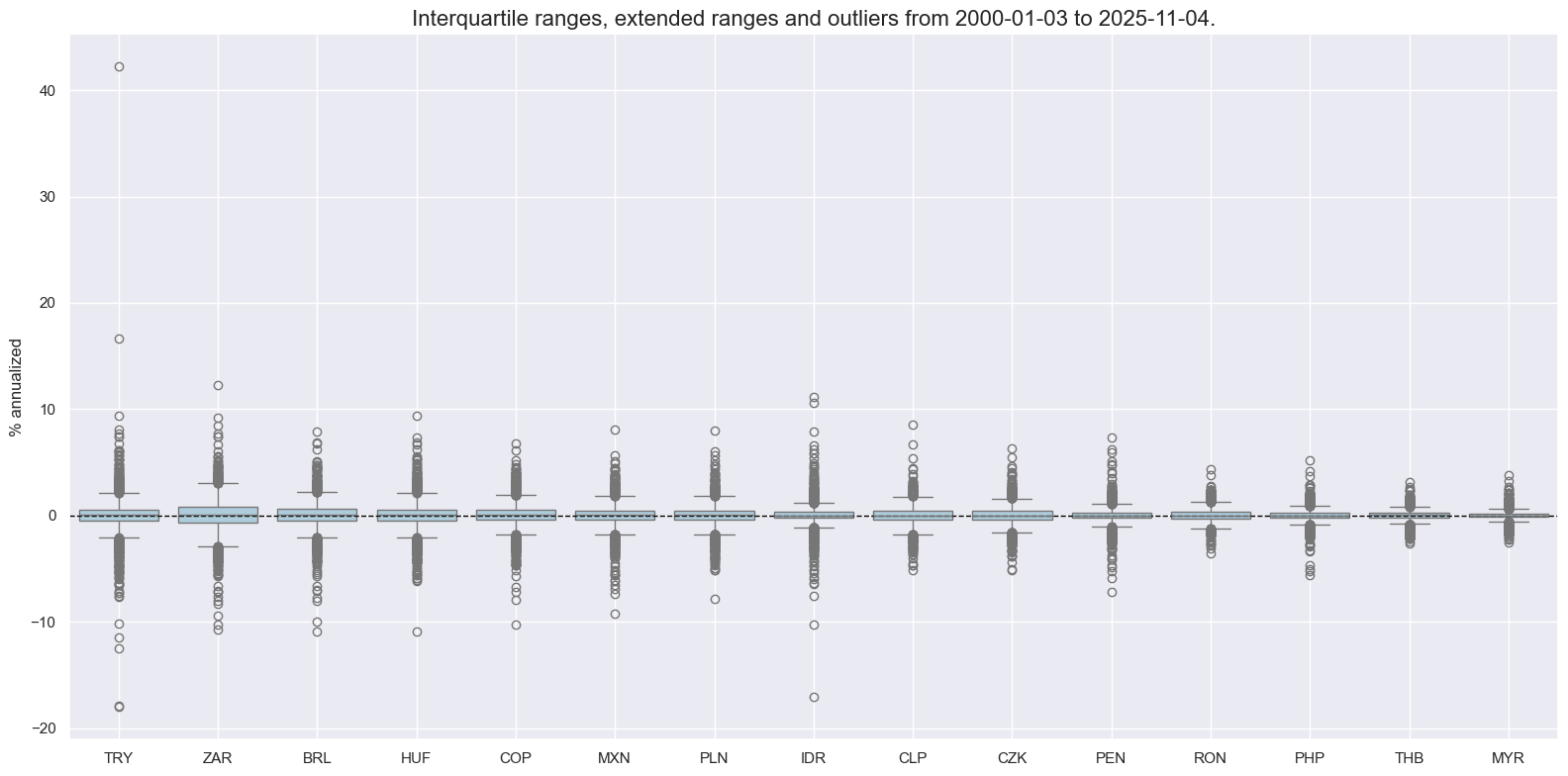

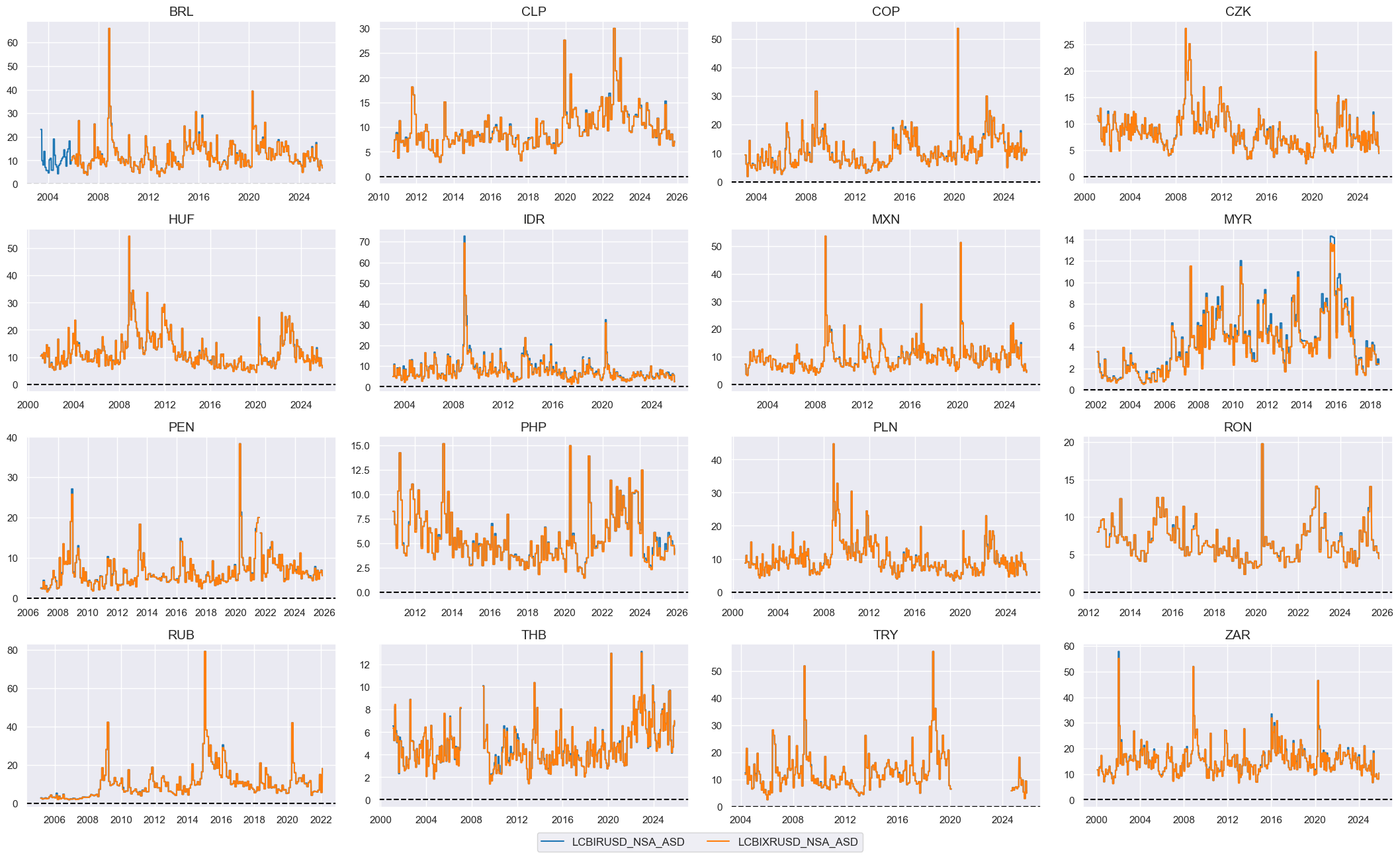

xcatx = ["LCBIRUSD_NSA", "LCBIXRUSD_NSA", "LCBIXRUSD_VT10"]

cidx = cids_em

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

start="2000-01-01",

cumsum=True,

same_y=False,

height=2.0,

size=(10, 10),

all_xticks=True,

blacklist=fxblack,

title="Emerging markets local-currency bond index returns (% cumulative, temporary flatlining means untradability)",

title_fontsize=22,

xcat_labels=[

"USD dollar returns",

"USD excess returns",

"Vol-targeted USD excess returns",

],

)

# Estimated short-term historical volatility

xcatx = ["LCBIRUSD_NSA", "LCBIXRUSD_NSA"]

cidx = cids_em

dfa = pd.DataFrame(columns=dfx.columns)

for xc in xcatx:

dfaa = msp.historic_vol(

dfx,

xcat=xc,

cids=cidx,

lback_periods=21,

lback_meth="ma",

half_life=11,

est_freq="M",

blacklist=fxblack,

postfix="_ASD",

)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

# Checkup of volatilities

xcatx = ["LCBIRUSD_NSA_ASD", "LCBIXRUSD_NSA_ASD"]

cidx = cids_em

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

start="2000-01-01",

same_y=False,

height=2.2,

size=(10, 10),

all_xticks=True,

)

Factor construction and checks #

# Initiate labeling dictionary

dict_lab = {}

concept_factors_zn = {}

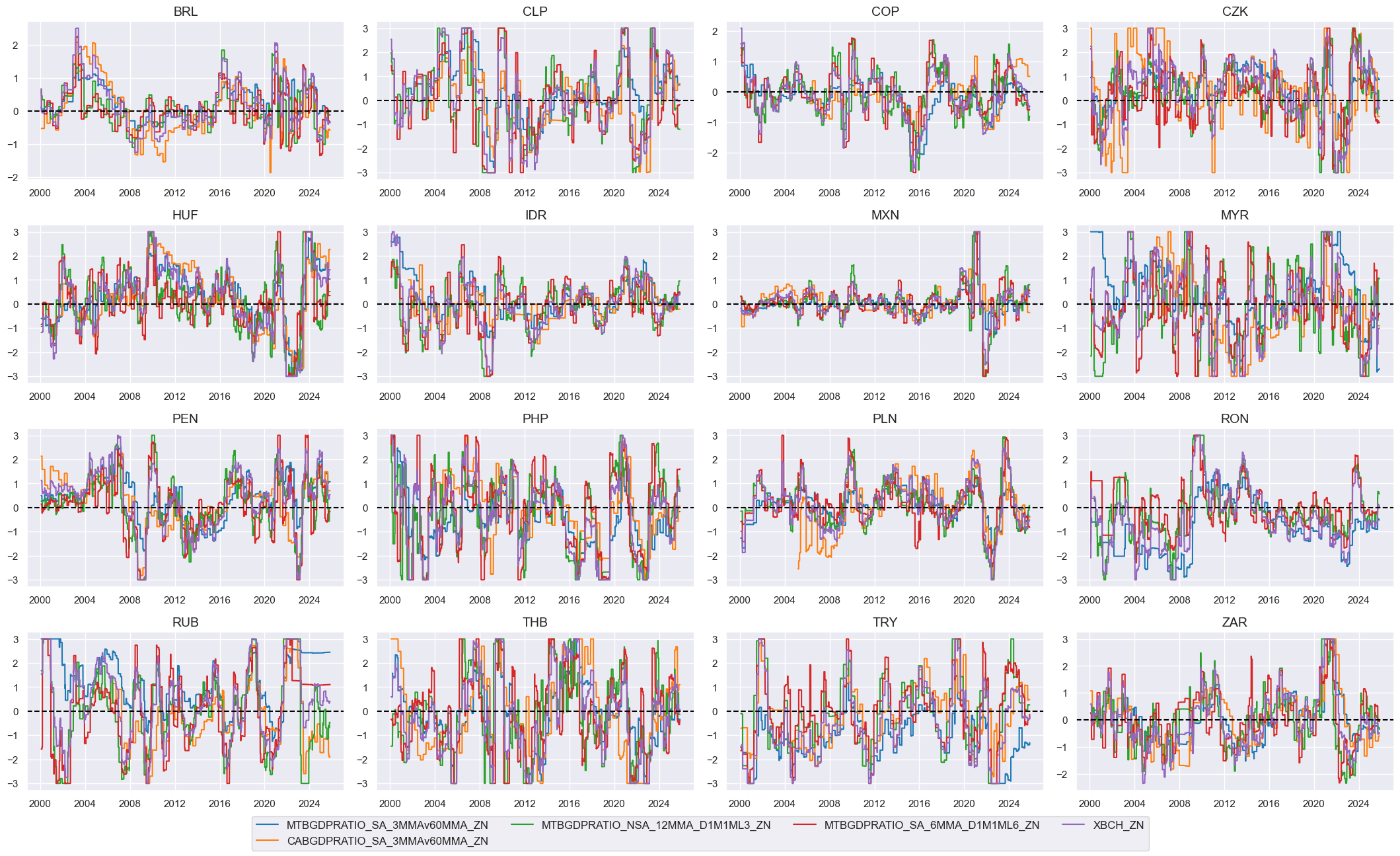

External balance improvement #

# All constituents, signs, and weights

dict_xbch = {

"MTBGDPRATIO_SA_3MMAv60MMA": {"sign": 1, "weight": 1/4},

"CABGDPRATIO_SA_3MMAv60MMA": {"sign": 1, "weight": 1/4},

'MTBGDPRATIO_NSA_12MMA_D1M1ML3': {"sign": 1, "weight": 1/4},

'MTBGDPRATIO_SA_6MMA_D1M1ML6': {"sign": 1, "weight": 1/4},

}

# Normalized categories with theoretical positive effects

dix = dict_xbch

cidx = cids_em

# Contingent negative values

if any (v["sign"] < 0 for v in dix.values()):

calcs=[]

dfa = pd.DataFrame(columns=dfx.columns)

for xc, values in dix.items():

if values["sign"] < 0:

calcs.append(f"{xc}NEG = {xc} * -1")

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cidx)

dfx = msm.update_df(dfx, dfa)

# Sequential normalization of categories

postfixes = ["NEG" if v["sign"] < 0 else "" for v in dix.values()]

xcatx = [k + pf for k, pf in zip(dix.keys(), postfixes)]

for xc in xcatx:

dfa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

xbchz = [xc + "_ZN" for xc in xcatx]

# Conceptual factor score

dix = dict_xbch

xcatx = xbchz

cidx = cids_em

# Composite score

weights = [v["weight"] for v in dix.values()]

cfs = "XBCH"

dfa = msp.linear_composite(

df=dfx,

xcats=xcatx,

cids=cidx,

weights=weights,

new_xcat=cfs,

complete_xcats=False,

)

dfx= msm.update_df(dfx, dfa)

# Re-score

dfa = msp.make_zn_scores(

dfx,

xcat=cfs,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

cfs_zn = f"{cfs}_ZN"

concept_factors_zn[cfs_zn] = "External balance improvement"

# Visualize

xcatx = xbchz + ["XBCH_ZN"]

cidx = cids_em

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

start="2000-01-01",

same_y=False,

height=2.2,

size=(10, 10),

all_xticks=True,

)

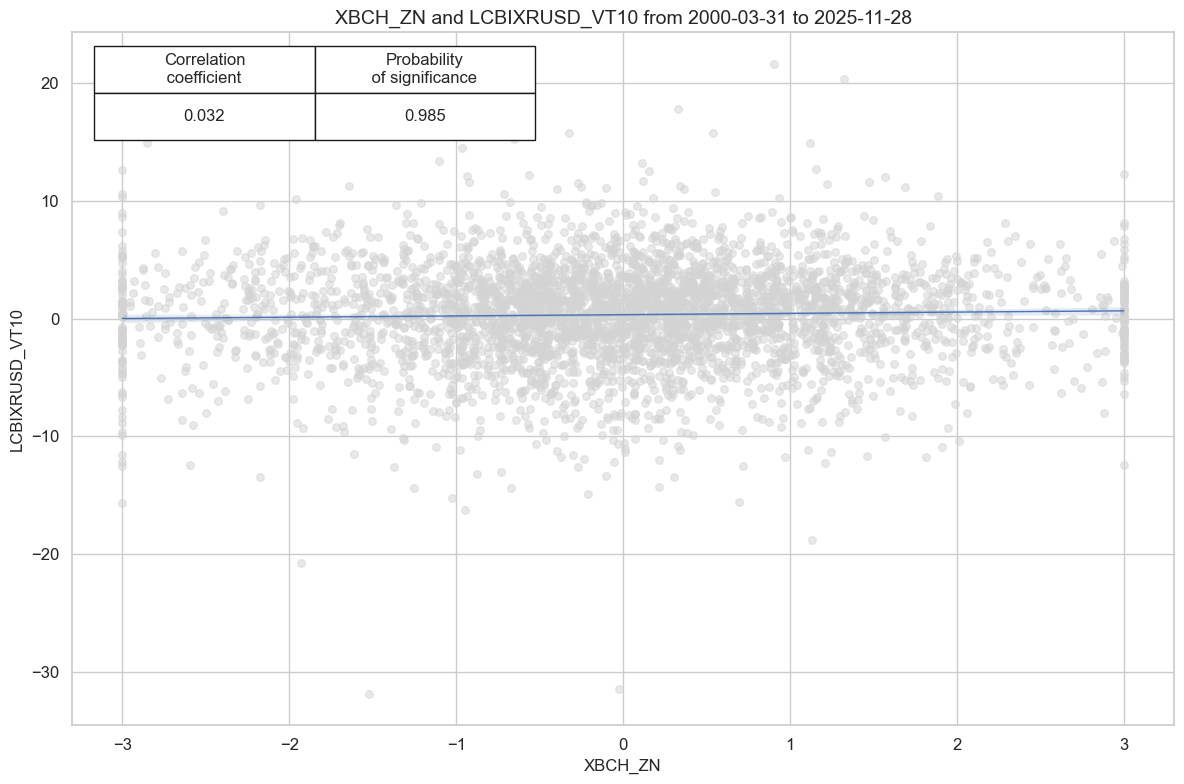

# checking - to delete later

cidx = cids_em

sig = "XBCH_ZN"

targ = "LCBIXRUSD_VT10"

cr = msp.CategoryRelations(

dfx,

xcats=[sig, targ],

cids=cidx,

freq="M",

blacklist=fxblack,

lag=1,

xcat_aggs=["last", "sum"],

start="2000-01-01",

)

cr.reg_scatter(coef_box="upper left", prob_est="map")

srr = mss.SignalReturnRelations(

dfx,

cids=cidx,

sigs=sig,

rets=targ,

freqs="M",

start="2000-01-01",

blacklist=fxblack,

)

display(srr.multiple_relations_table().round(3))

| accuracy | bal_accuracy | pos_sigr | pos_retr | pos_prec | neg_prec | pearson | pearson_pval | kendall | kendall_pval | auc | ||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Return | Signal | Frequency | Aggregation | |||||||||||

| LCBIXRUSD_VT10 | XBCH_ZN | M | last | 0.524 | 0.524 | 0.5 | 0.568 | 0.591 | 0.456 | 0.032 | 0.044 | 0.023 | 0.034 | 0.524 |

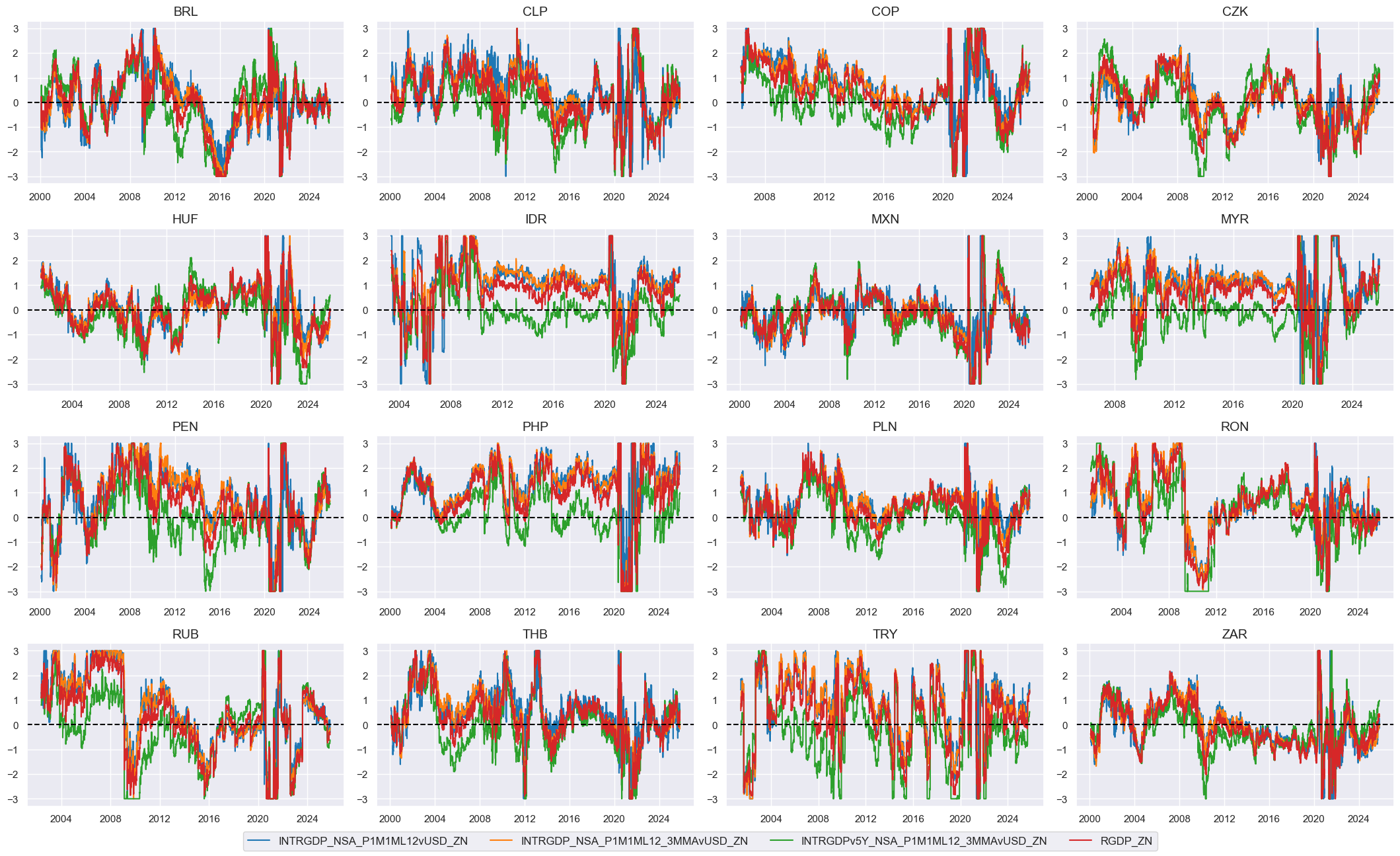

Relative GDP growth #

# Preparatory: relative values to U.S.

xcatx = igdp

cidx = cids

cidx = cids

for xc in xcatx:

dfa = msp.make_relative_value(

dfx,

xcats=xcatx,

cids=cidx,

basket=["USD"],

rel_meth="subtract",

postfix="vUSD",

)

dfx = msm.update_df(df=dfx, df_add=dfa)

# All constituents, signs, and weights

dict_rgdp = {

'INTRGDP_NSA_P1M1ML12vUSD': {"sign": 1, "weight": 1/3},

'INTRGDP_NSA_P1M1ML12_3MMAvUSD': {"sign": 1, "weight": 1/3},

'INTRGDPv5Y_NSA_P1M1ML12_3MMAvUSD': {"sign": 1, "weight": 1/3},

}

# Normalized categories with theoretical positive effects

dix = dict_rgdp

cidx = cids_em

# Contingent negative values

if any (v["sign"] < 0 for v in dix.values()):

calcs=[]

dfa = pd.DataFrame(columns=dfx.columns)

for xc, values in dix.items():

if values["sign"] < 0:

calcs.append(f"{xc}NEG = {xc} * -1")

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cidx)

dfx = msm.update_df(dfx, dfa)

# Sequential normalization of categories

postfixes = ["NEG" if v["sign"] < 0 else "" for v in dix.values()]

xcatx = [k + pf for k, pf in zip(dix.keys(), postfixes)]

for xc in xcatx:

dfa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

rgdpz = [xc + "_ZN" for xc in xcatx]

# Conceptual factor score

dix = dict_rgdp

xcatx = rgdpz

cidx = cids

# Composite score

weights = [v["weight"] for v in dix.values()]

cfs = "RGDP"

dfa = msp.linear_composite(

df=dfx,

xcats=xcatx,

cids=cidx,

weights=weights,

new_xcat=cfs,

complete_xcats=False,

)

dfx= msm.update_df(dfx, dfa)

# Re-score

dfa = msp.make_zn_scores(

dfx,

xcat=cfs,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

cfs_zn = f"{cfs}_ZN"

concept_factors_zn[cfs_zn] = "Relative GDP growth"

# Visualize

xcatx = rgdpz + ["RGDP_ZN"]

cidx = cids_em

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

start="2000-01-01",

same_y=False,

height=2.2,

size=(10, 10),

all_xticks=True,

)

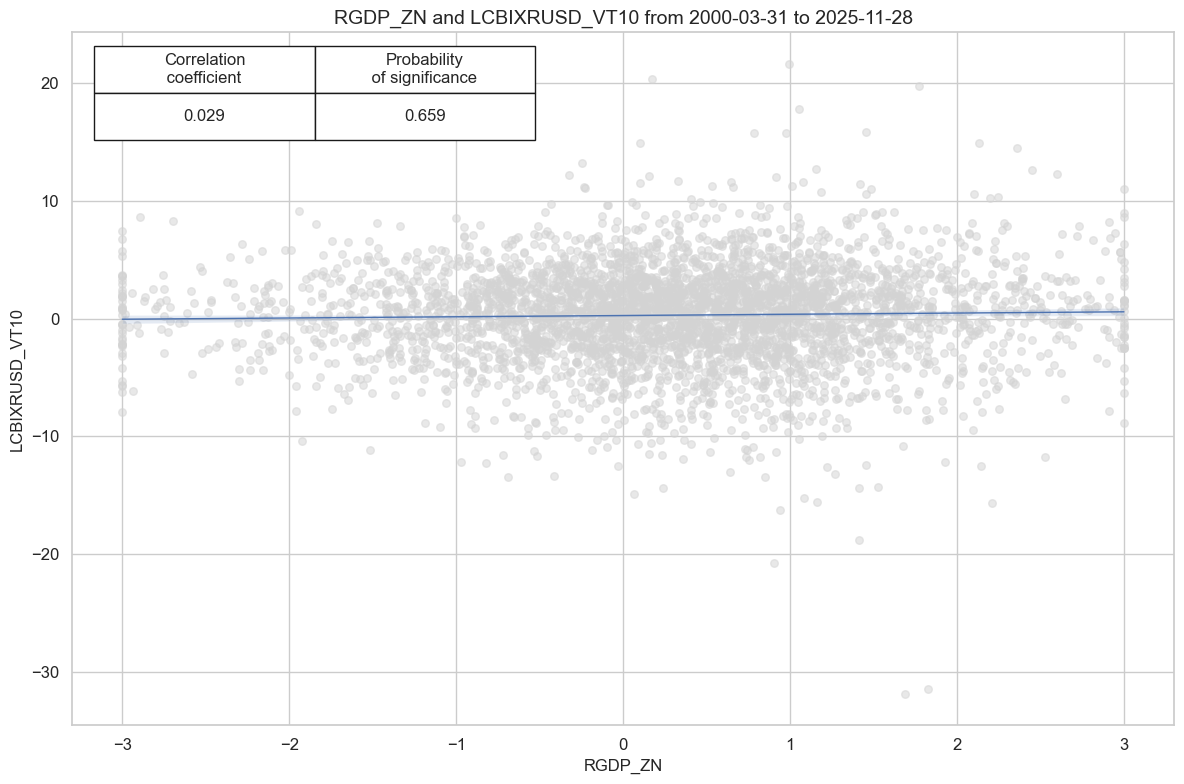

# checking - to delete later

cidx = cids_em

sig = "RGDP_ZN"

targ = "LCBIXRUSD_VT10"

cr = msp.CategoryRelations(

dfx,

xcats=[sig, targ],

cids=cidx,

freq="M",

blacklist=fxblack,

lag=1,

xcat_aggs=["last", "sum"],

start="2000-01-01",

)

cr.reg_scatter(coef_box="upper left", prob_est="map")

srr = mss.SignalReturnRelations(

dfx,

cids=cidx,

sigs=sig,

rets=targ,

freqs="M",

start="2000-01-01",

blacklist=fxblack,

)

display(srr.multiple_relations_table().round(3))

| accuracy | bal_accuracy | pos_sigr | pos_retr | pos_prec | neg_prec | pearson | pearson_pval | kendall | kendall_pval | auc | ||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Return | Signal | Frequency | Aggregation | |||||||||||

| LCBIXRUSD_VT10 | RGDP_ZN | M | last | 0.525 | 0.51 | 0.626 | 0.565 | 0.572 | 0.447 | 0.029 | 0.075 | 0.022 | 0.039 | 0.509 |

Terms-of-trade improvement #

# All constituents, signs, and weights

dict_tot = {

"CTOT_NSA_P1M1ML12": {"sign": 1, "weight": 1/3},

"CTOT_NSA_P1W4WL1": {"sign": 1, "weight": 1/3},

"CTOT_NSA_P1M60ML1": {"sign": 1, "weight": 1/3},

}

# Normalized categories with theoretical positive effects

dix = dict_tot

cidx = cids_em

# Contingent negative values

if any (v["sign"] < 0 for v in dix.values()):

calcs=[]

dfa = pd.DataFrame(columns=dfx.columns)

for xc, values in dix.items():

if values["sign"] < 0:

calcs.append(f"{xc}NEG = {xc} * -1")

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cidx)

dfx = msm.update_df(dfx, dfa)

# Sequential normalization of categories

postfixes = ["NEG" if v["sign"] < 0 else "" for v in dix.values()]

xcatx = [k + pf for k, pf in zip(dix.keys(), postfixes)]

for xc in xcatx:

dfa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

totz = [xc + "_ZN" for xc in xcatx]

# Conceptual factor score

dix = dict_tot

xcatx = totz

cidx = cids_em

# Composite score

weights = [v["weight"] for v in dix.values()]

cfs = "TOT"

dfa = msp.linear_composite(

df=dfx,

xcats=xcatx,

cids=cidx,

weights=weights,

new_xcat=cfs,

complete_xcats=False,

)

dfx= msm.update_df(dfx, dfa)

# Re-score

dfa = msp.make_zn_scores(

dfx,

xcat=cfs,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

cfs_zn = f"{cfs}_ZN"

concept_factors_zn[cfs_zn] = "Terms of trade improvement"

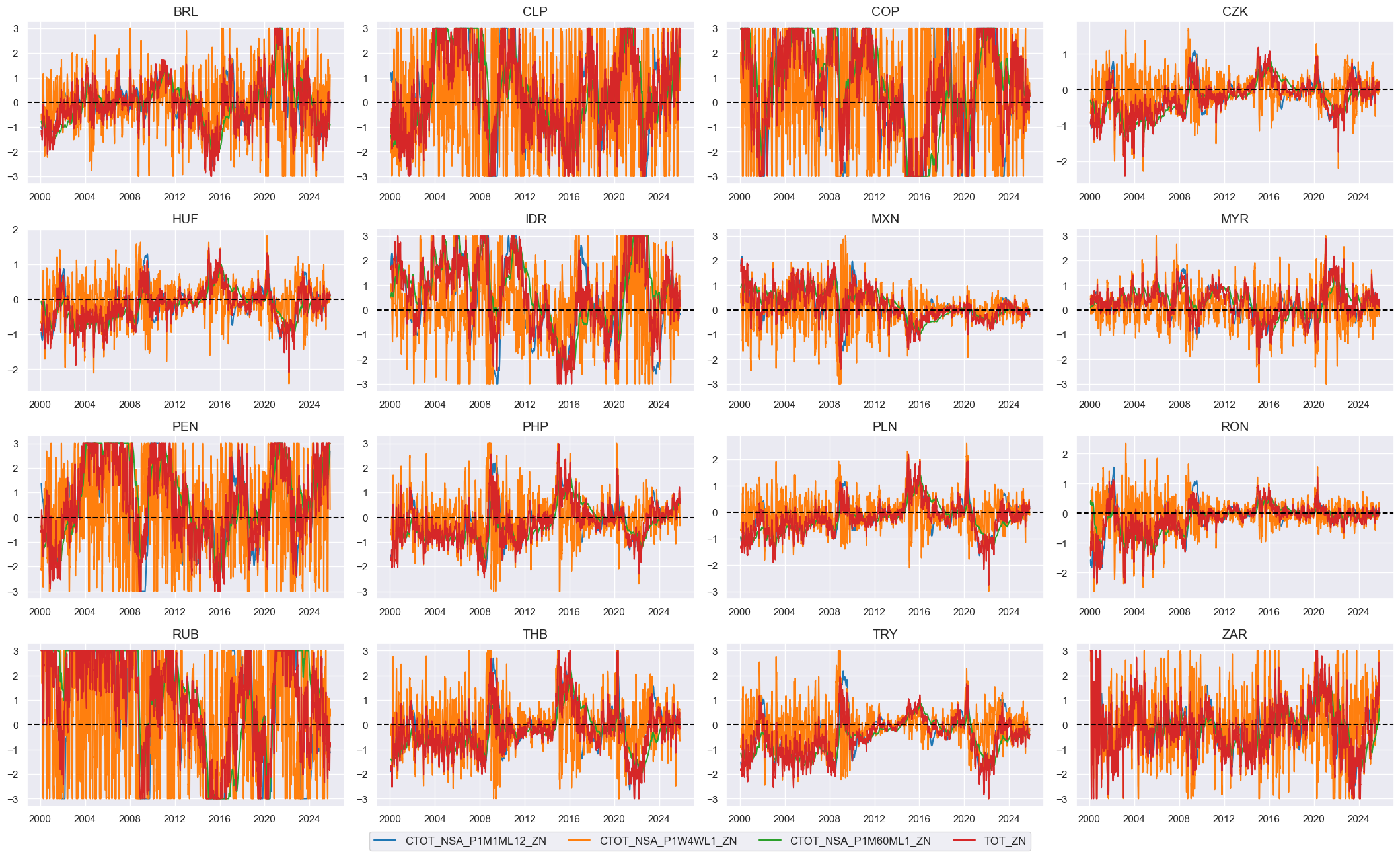

# Visualize

xcatx = totz + ["TOT_ZN"]

cidx = cids_em

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

start="2000-01-01",

same_y=False,

height=2.2,

size=(10, 10),

all_xticks=True,

)

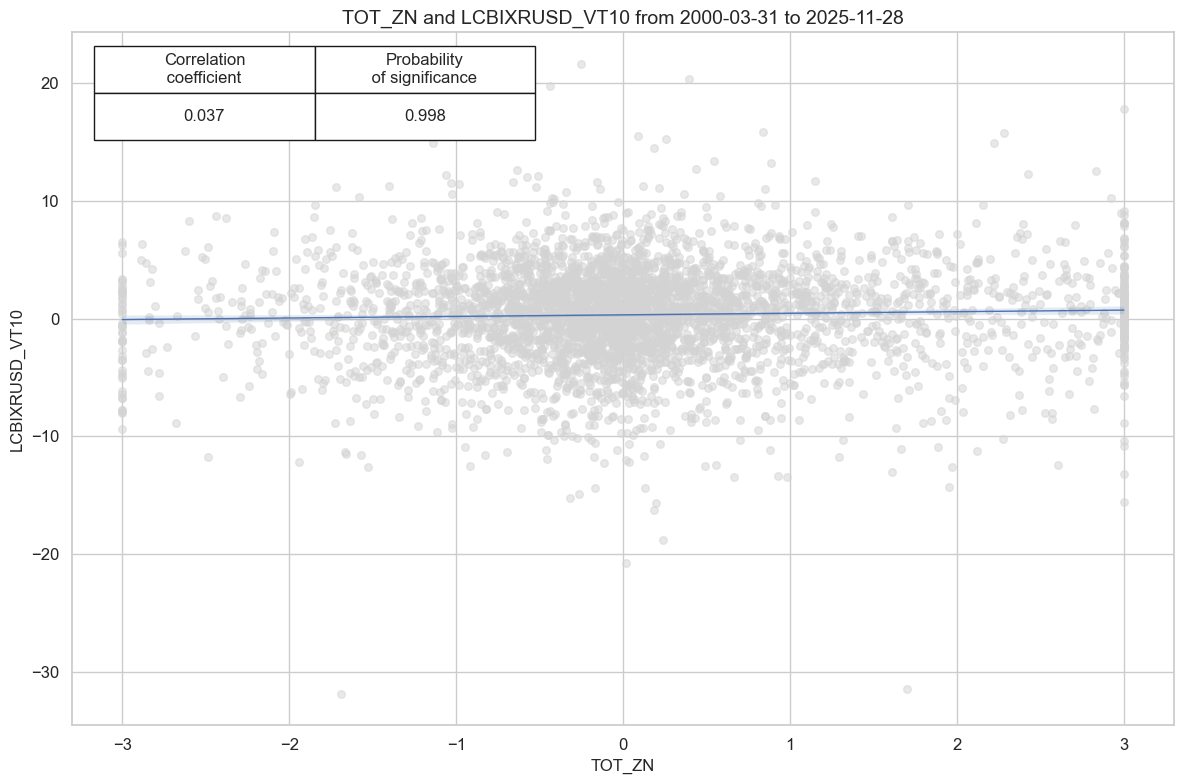

# checking - to delete later

cidx = cids_em

sig = "TOT_ZN"

targ = "LCBIXRUSD_VT10"

cr = msp.CategoryRelations(

dfx,

xcats=[sig, targ],

cids=cidx,

freq="M",

blacklist=fxblack,

lag=1,

xcat_aggs=["last", "sum"],

start="2000-01-01",

)

cr.reg_scatter(coef_box="upper left", prob_est="map")

srr = mss.SignalReturnRelations(

dfx,

cids=cidx,

sigs=sig,

rets=targ,

freqs="M",

start="2000-01-01",

blacklist=fxblack,

)

display(srr.multiple_relations_table().round(3))

| accuracy | bal_accuracy | pos_sigr | pos_retr | pos_prec | neg_prec | pearson | pearson_pval | kendall | kendall_pval | auc | ||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Return | Signal | Frequency | Aggregation | |||||||||||

| LCBIXRUSD_VT10 | TOT_ZN | M | last | 0.515 | 0.517 | 0.486 | 0.568 | 0.586 | 0.449 | 0.037 | 0.02 | 0.027 | 0.012 | 0.518 |

International investment dynamics #

# All constituents, signs, and weights

dict_iipd = {

'NIIPGDP_NSA_D1Mv2YMA': {"sign": 1, "weight": 1/4},

'NIIPGDP_NSA_D1Mv5YMA': {"sign": 1, "weight": 1/4},

'IIPLIABGDP_NSA_D1Mv2YMA': {"sign": -1, "weight": 1/4},

'IIPLIABGDP_NSA_D1Mv5YMA': {"sign": -1, "weight": 1/4},

}

# Normalized categories with theoretical positive effects

dix = dict_iipd

cidx = cids_em

# Contingent negative values

if any (v["sign"] < 0 for v in dix.values()):

calcs=[]

dfa = pd.DataFrame(columns=dfx.columns)

for xc, values in dix.items():

if values["sign"] < 0:

calcs.append(f"{xc}NEG = {xc} * -1")

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cidx)

dfx = msm.update_df(dfx, dfa)

# Sequential normalization of categories

postfixes = ["NEG" if v["sign"] < 0 else "" for v in dix.values()]

xcatx = [k + pf for k, pf in zip(dix.keys(), postfixes)]

for xc in xcatx:

dfa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

iipdz = [xc + "_ZN" for xc in xcatx]

# Conceptual factor score

dix = dict_iipd

xcatx = iipdz

cidx = cids_em

# Composite score

weights = [v["weight"] for v in dix.values()]

cfs = "IIPD"

dfa = msp.linear_composite(

df=dfx,

xcats=xcatx,

cids=cidx,

weights=weights,

new_xcat=cfs,

complete_xcats=False,

)

dfx= msm.update_df(dfx, dfa)

# Re-score

dfa = msp.make_zn_scores(

dfx,

xcat=cfs,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

cfs_zn = f"{cfs}_ZN"

concept_factors_zn[cfs_zn] = "International investment dynamics"

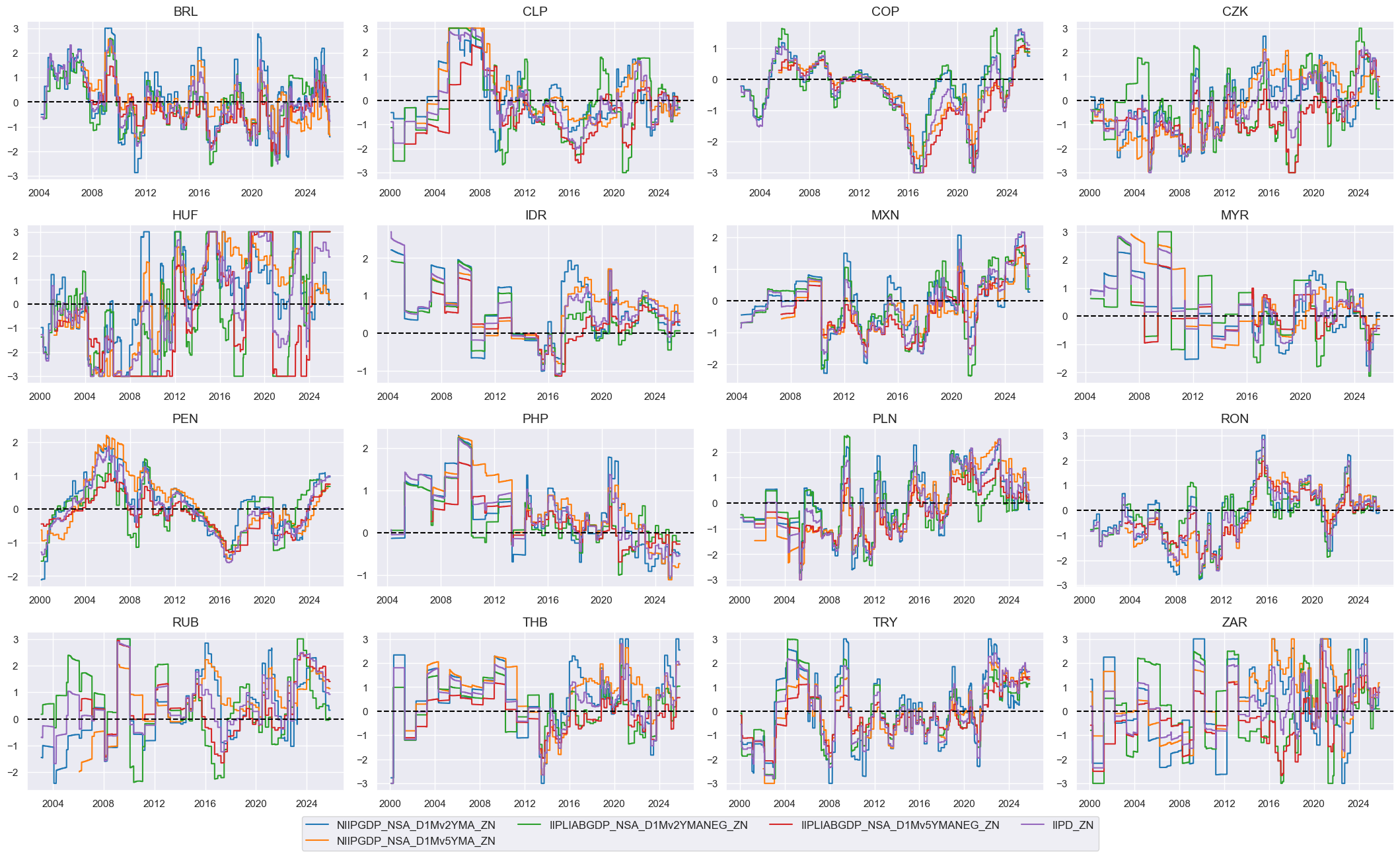

# Visualize

xcatx = iipdz + ["IIPD_ZN"]

cidx = cids_em

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

start="2000-01-01",

same_y=False,

height=2.2,

size=(10, 10),

all_xticks=True,

)

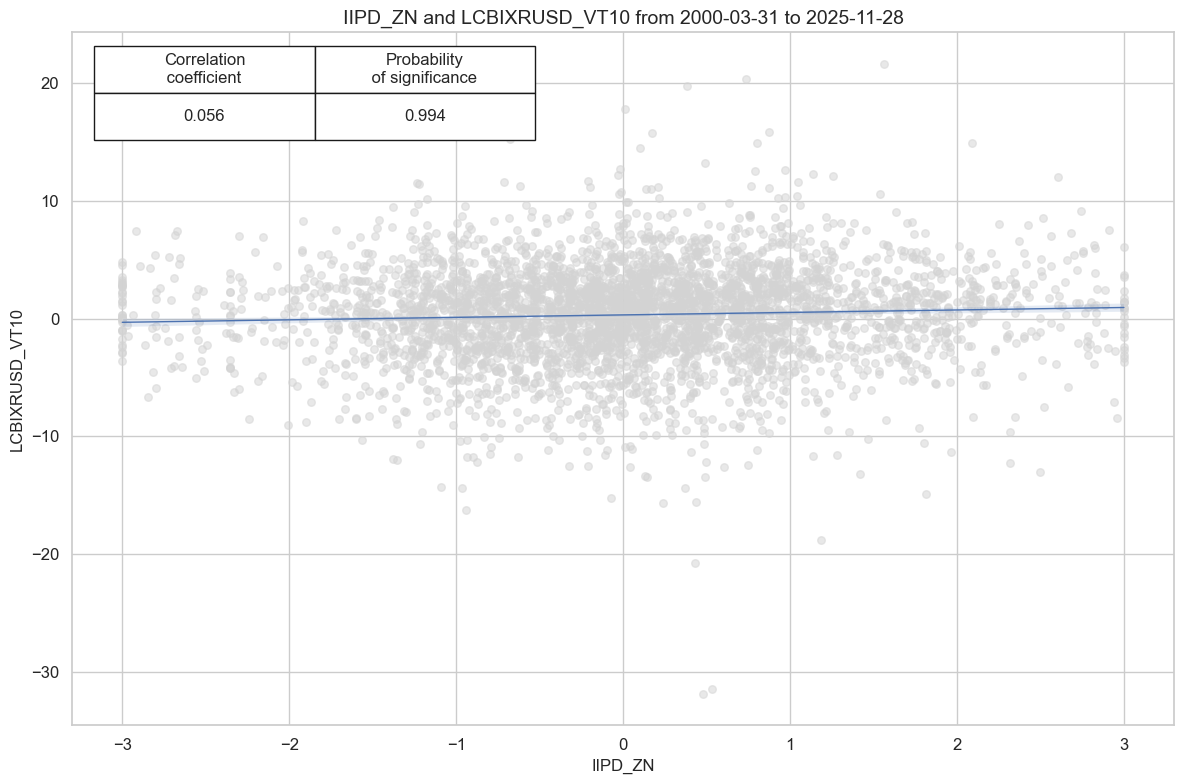

# checking - to delete later

cidx = cids_em

sig = "IIPD_ZN"

targ = "LCBIXRUSD_VT10"

cr = msp.CategoryRelations(

dfx,

xcats=[sig, targ],

cids=cidx,

freq="M",

blacklist=fxblack,

lag=1,

xcat_aggs=["last", "sum"],

start="2000-01-01",

# xcat_trims=[10, 10] # maybe trim outlier

)

cr.reg_scatter(coef_box="upper left", prob_est="map")

srr = mss.SignalReturnRelations(

dfx,

cids=cidx,

sigs=sig,

rets=targ,

freqs="M",

start="2000-01-01",

blacklist=fxblack,

)

display(srr.multiple_relations_table().round(3))

| accuracy | bal_accuracy | pos_sigr | pos_retr | pos_prec | neg_prec | pearson | pearson_pval | kendall | kendall_pval | auc | ||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Return | Signal | Frequency | Aggregation | |||||||||||

| LCBIXRUSD_VT10 | IIPD_ZN | M | last | 0.538 | 0.536 | 0.514 | 0.567 | 0.602 | 0.47 | 0.056 | 0.0 | 0.046 | 0.0 | 0.536 |

Fiscal balance strength #

# Preparatory calculation

calcs = [

"XGGPBGDPRATIO_NSA = GGPBGDPRATIO_NSA + 3",

"XGGOBGDPRATIO_NSA = GGOBGDPRATIO_NSA + 3",

"XGGSBGDPRATIO_NSA = GGSBGDPRATIO_NSA + 3",

]

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cids_em)

dfx = msm.update_df(dfx, dfa)

# All constituents, signs, and weights

dict_gbal = {

'XGGPBGDPRATIO_NSA': {"sign": 1, "weight": 1/3},

'XGGOBGDPRATIO_NSA': {"sign": 1, "weight": 1/3},

'XGGSBGDPRATIO_NSA': {"sign": 1, "weight": 1/3},

}

# Normalized categories with theoretical positive effects

dix = dict_gbal

cidx = cids_em

# Contingent negative values

if any (v["sign"] < 0 for v in dix.values()):

calcs=[]

dfa = pd.DataFrame(columns=dfx.columns)

for xc, values in dix.items():

if values["sign"] < 0:

calcs.append(f"{xc}NEG = {xc} * -1")

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cidx)

dfx = msm.update_df(dfx, dfa)

# Sequential normalization of categories

postfixes = ["NEG" if v["sign"] < 0 else "" for v in dix.values()]

xcatx = [k + pf for k, pf in zip(dix.keys(), postfixes)]

for xc in xcatx:

dfa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

xgbalz = [xc + "_ZN" for xc in xcatx]

# Conceptual factor score

dix = dict_gbal

xcatx = xgbalz

cidx = cids_em

# Composite score

weights = [v["weight"] for v in dix.values()]

cfs = "XGBAL"

dfa = msp.linear_composite(

df=dfx,

xcats=xcatx,

cids=cidx,

weights=weights,

new_xcat=cfs,

complete_xcats=False,

)

dfx= msm.update_df(dfx, dfa)

# Re-score

dfa = msp.make_zn_scores(

dfx,

xcat=cfs,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

cfs_zn = f"{cfs}_ZN"

concept_factors_zn[cfs_zn] = "Fiscal balance strength"

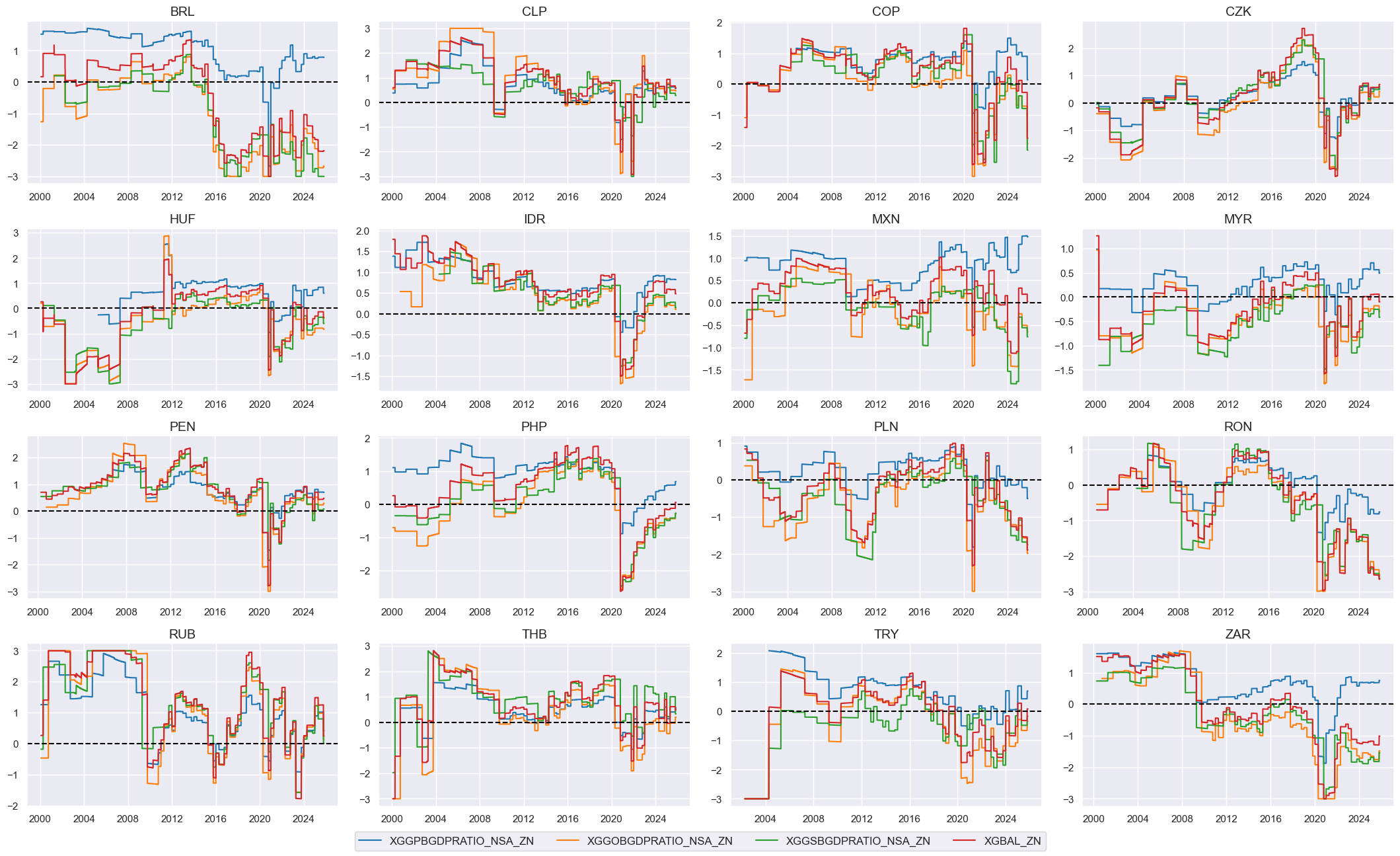

# Visualize

xcatx = xgbalz + ["XGBAL_ZN"]

cidx = cids_em

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

start="2000-01-01",

same_y=False,

height=2.2,

size=(10, 10),

all_xticks=True,

)

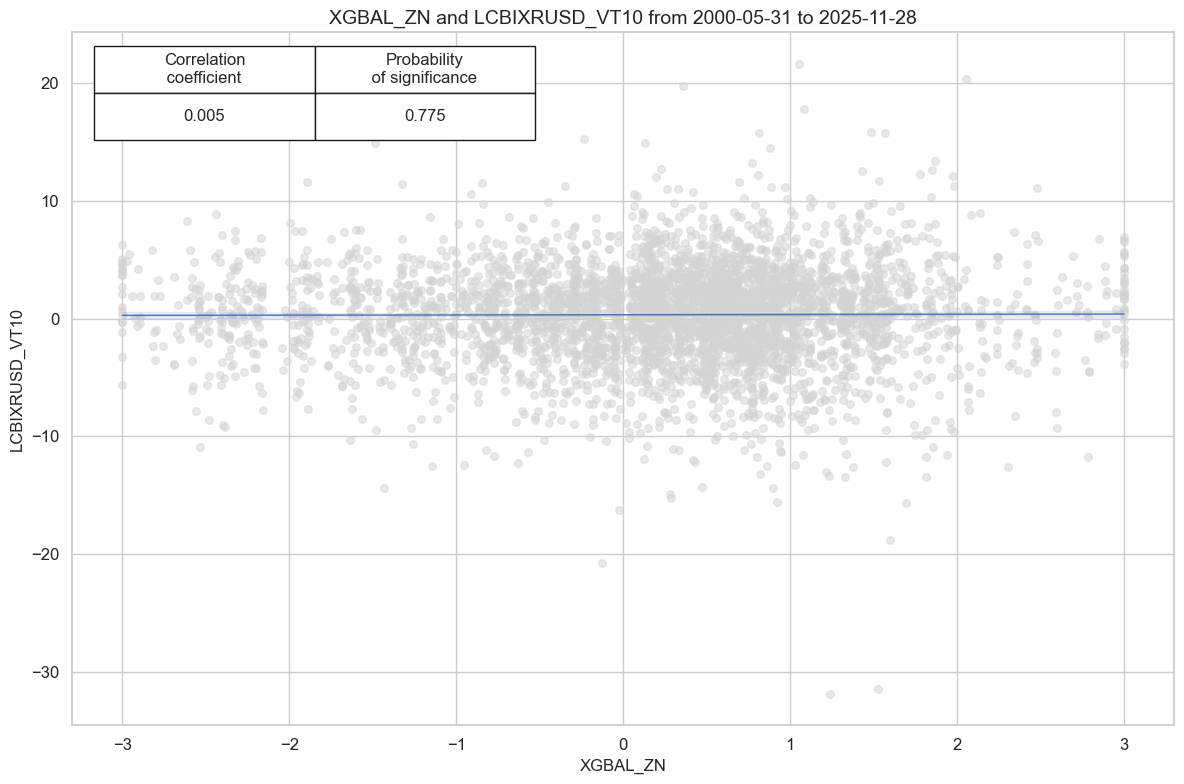

# checking - to delete later

cidx = cids_em

sig = "XGBAL_ZN"

targ = "LCBIXRUSD_VT10"

cr = msp.CategoryRelations(

dfx,

xcats=[sig, targ],

cids=cidx,

freq="M",

blacklist=fxblack,

lag=1,

xcat_aggs=["last", "sum"],

start="2000-01-01",

# xcat_trims=[10, 10] # maybe trim outlier

)

cr.reg_scatter(coef_box="upper left", prob_est="map")

srr = mss.SignalReturnRelations(

dfx,

cids=cidx,

sigs=sig,

rets=targ,

freqs="M",

start="2000-01-01",

blacklist=fxblack,

)

display(srr.multiple_relations_table().round(3))

| accuracy | bal_accuracy | pos_sigr | pos_retr | pos_prec | neg_prec | pearson | pearson_pval | kendall | kendall_pval | auc | ||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Return | Signal | Frequency | Aggregation | |||||||||||

| LCBIXRUSD_VT10 | XGBAL_ZN | M | last | 0.532 | 0.513 | 0.651 | 0.568 | 0.577 | 0.449 | 0.005 | 0.744 | 0.01 | 0.348 | 0.512 |

Duration term premia #

# All constituents, signs, and weights

dict_dutp = {

"DU02YETP_NSA": {"sign": 1, "weight": 1/3},

"DU05YETP_NSA": {"sign": 1, "weight": 1/3},

"DU10YETP_NSA": {"sign": 1, "weight": 1/3},

}

# Normalized categories with theoretical positive effects

dix = dict_dutp

cidx = cids_em

# Contingent negative values

if any (v["sign"] < 0 for v in dix.values()):

calcs=[]

dfa = pd.DataFrame(columns=dfx.columns)

for xc, values in dix.items():

if values["sign"] < 0:

calcs.append(f"{xc}NEG = {xc} * -1")

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cidx)

dfx = msm.update_df(dfx, dfa)

# Sequential normalization of categories

postfixes = ["NEG" if v["sign"] < 0 else "" for v in dix.values()]

xcatx = [k + pf for k, pf in zip(dix.keys(), postfixes)]

for xc in xcatx:

dfa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="median", # zero is not neutral

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

dutpz = [xc + "_ZN" for xc in xcatx]

# Global imputation of missing premia

xcatx = ["DU02YETP_NSA_ZN", "DU05YETP_NSA_ZN", "DU10YETP_NSA_ZN"]

cidx = cids_em

dfi = msp.impute_panel(dfx, cids=cidx, xcats=xcatx, threshold=0.5)

dfx = msm.update_df(dfx, dfi)

# Conceptual factor score

dix = dict_dutp

xcatx = dutpz

cidx = cids_em

# Composite score

weights = [v["weight"] for v in dix.values()]

cfs = "DUTP"

dfa = msp.linear_composite(

df=dfx,

xcats=xcatx,

cids=cidx,

weights=weights,

new_xcat=cfs,

complete_xcats=False,

)

dfx= msm.update_df(dfx, dfa)

# Re-score

dfa = msp.make_zn_scores(

dfx,

xcat=cfs,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

cfs_zn = f"{cfs}_ZN"

concept_factors_zn[cfs_zn] = "Duration term premium"

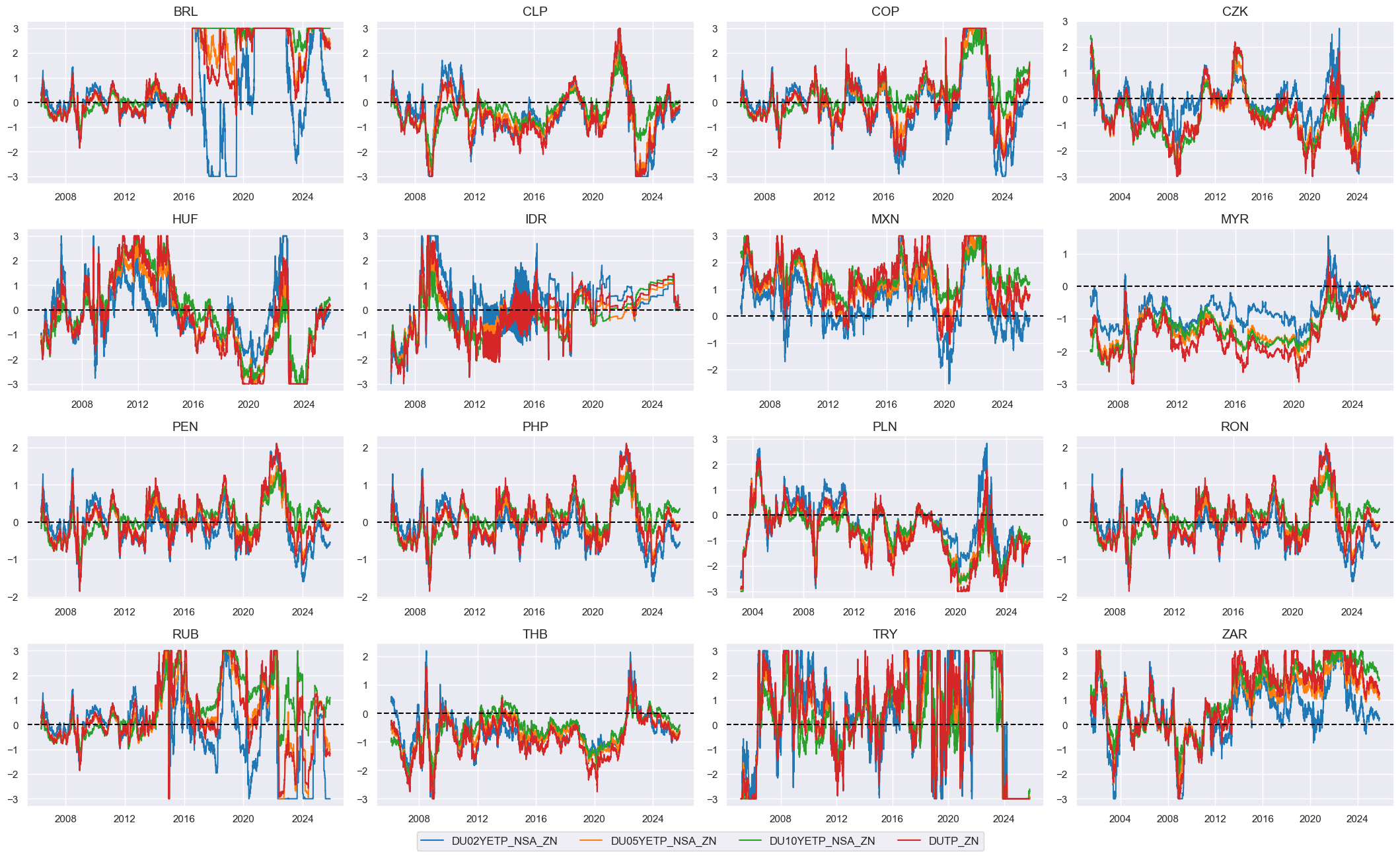

# Visualize

xcatx = dutpz + ["DUTP_ZN"]

cidx = cids_em

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

start="2000-01-01",

same_y=False,

height=2.2,

size=(10, 10),

all_xticks=True,

)

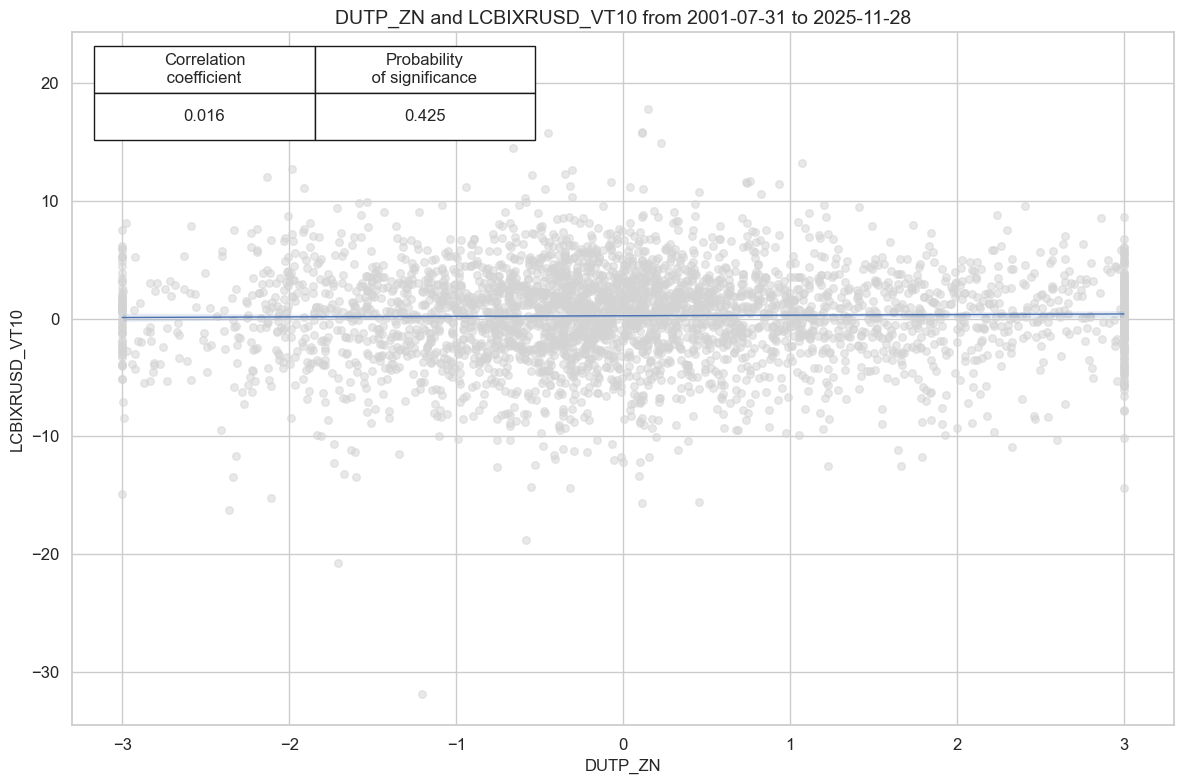

# checking - to delete later

cidx = cids_em

sig = "DUTP_ZN"

targ = "LCBIXRUSD_VT10"

cr = msp.CategoryRelations(

dfx,

xcats=[sig, targ],

cids=cidx,

freq="M",

blacklist=fxblack,

lag=1,

xcat_aggs=["last", "sum"],

start="2000-01-01",

# xcat_trims=[10, 10] # maybe trim outlier

)

cr.reg_scatter(coef_box="upper left", prob_est="map")

srr = mss.SignalReturnRelations(

dfx,

cids=cidx,

sigs=sig,

rets=targ,

freqs="M",

start="2000-01-01",

blacklist=fxblack,

)

display(srr.multiple_relations_table().round(3))

| accuracy | bal_accuracy | pos_sigr | pos_retr | pos_prec | neg_prec | pearson | pearson_pval | kendall | kendall_pval | auc | ||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Return | Signal | Frequency | Aggregation | |||||||||||

| LCBIXRUSD_VT10 | DUTP_ZN | M | last | 0.515 | 0.518 | 0.473 | 0.558 | 0.577 | 0.459 | 0.016 | 0.326 | 0.014 | 0.226 | 0.518 |

Factor overview and combination #

# Weighted linear combinations

xcatx = list(concept_factors_zn.keys())

cidx = cids_em

sdate = "2000-01-01"

new_cat = "COMP"

dfa = msp.linear_composite(

dfx,

xcats=xcatx,

cids=cidx,

complete_xcats=False,

start=sdate,

new_xcat=new_cat,

)

dfx = msm.update_df(dfx, dfa)

dfa = msp.make_zn_scores(

dfx,

xcat=new_cat,

cids=cidx,

sequential=True,

min_obs=261 * 5,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

cfs_zn = f"{new_cat}_ZN"

concept_factors_zn[cfs_zn] = "Composite"

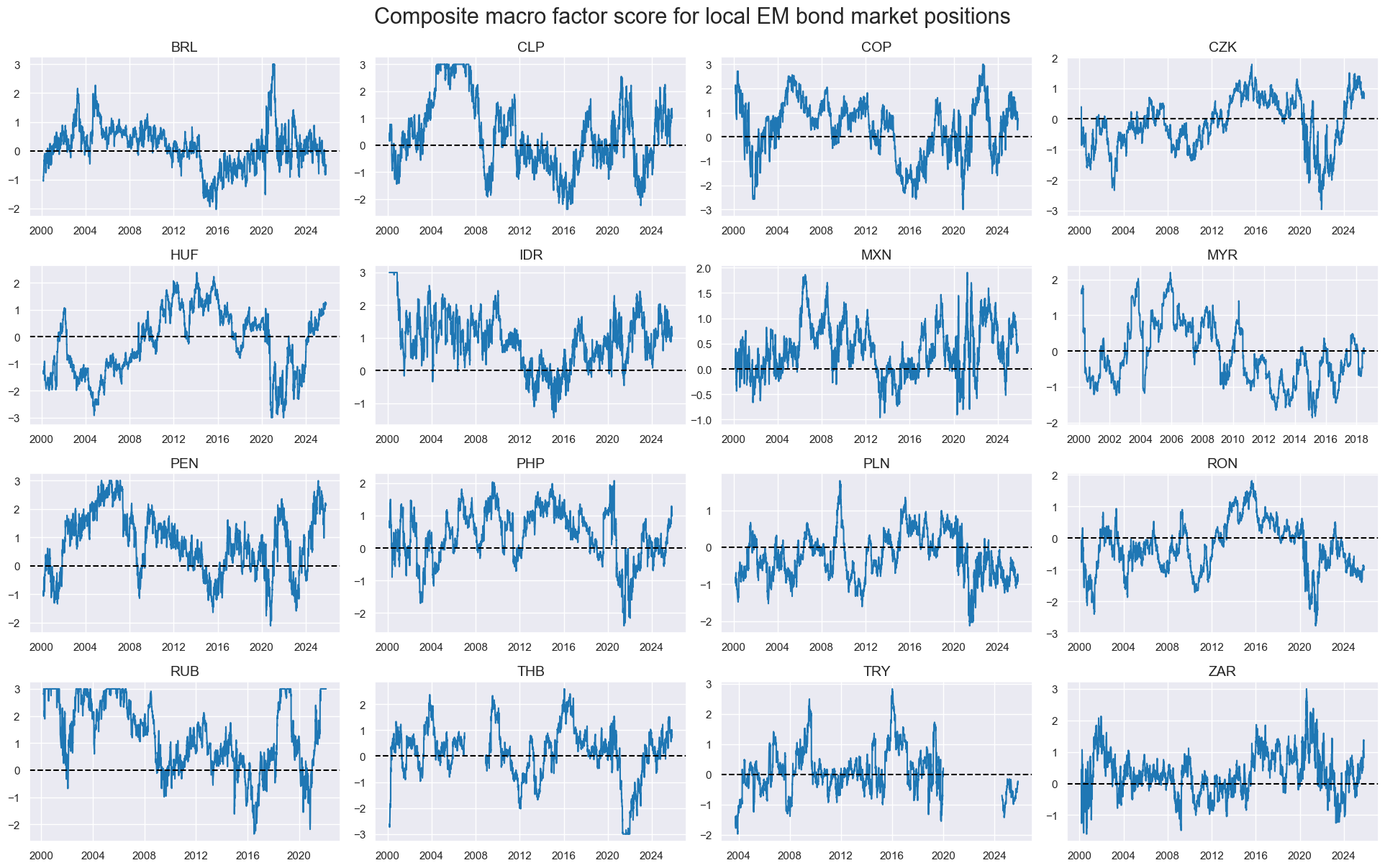

xcatx = ["COMP_ZN"]

cidx = cids_em

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

start="2000-01-01",

same_y=False,

title="Composite macro factor score for local EM bond market positions",

title_fontsize=22,

height=2,

size=(10, 10),

all_xticks=True,

blacklist=fxblack,

)

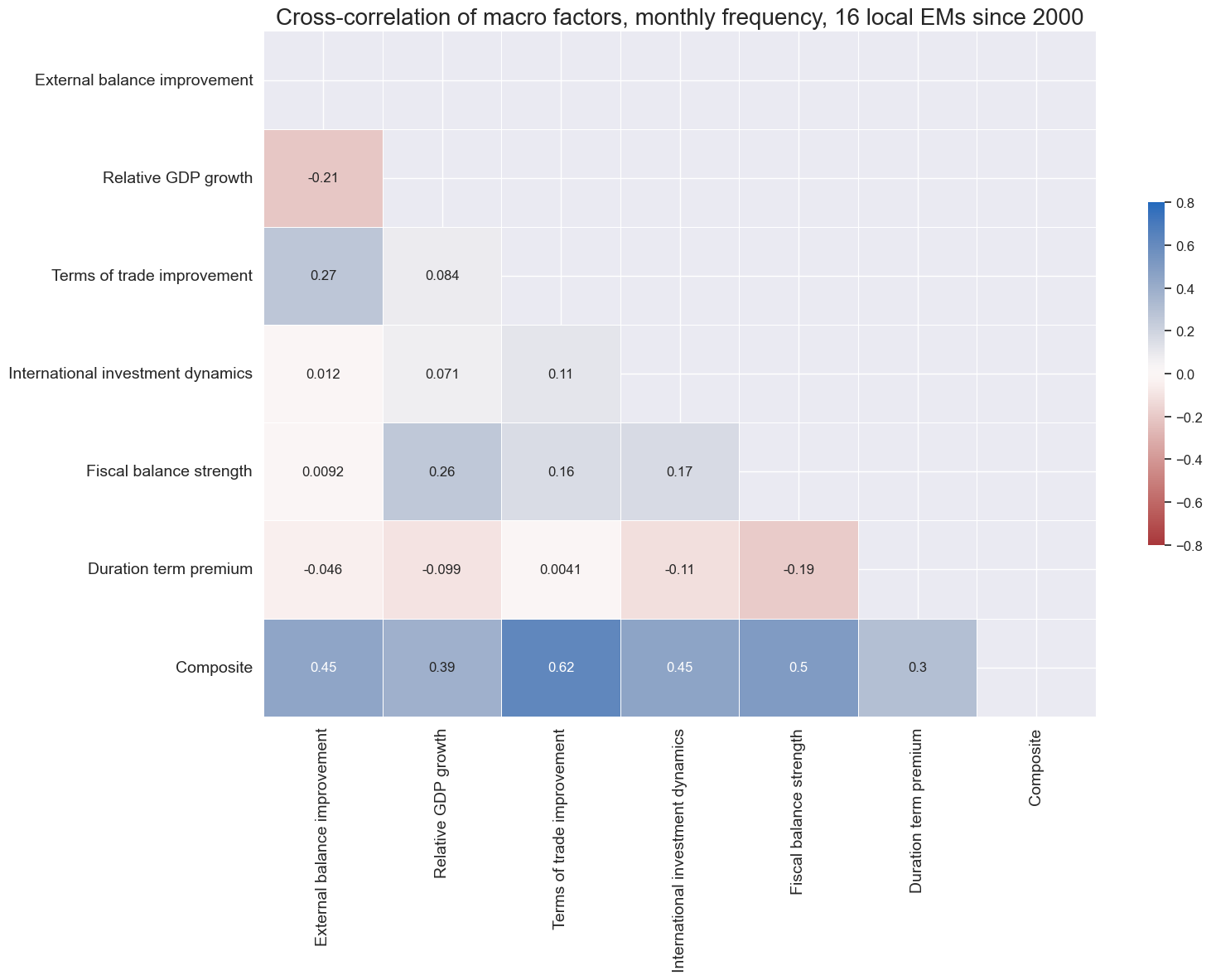

xcatx = list(concept_factors_zn.keys())

cidx = cids_em

sdate = "2000-01-01"

msp.correl_matrix(

dfx,

xcats=xcatx,

cids=cidx,

freq="M",

title="Cross-correlation of macro factors, monthly frequency, 16 local EMs since 2000",

title_fontsize=20,

size=(16, 12),

max_color=0.8,

xcat_labels=concept_factors_zn,

show=True,

annot=True,

start=sdate,

)

list(concept_factors_zn.keys())

['XBCH_ZN', 'RGDP_ZN', 'TOT_ZN', 'IIPD_ZN', 'XGBAL_ZN', 'DUTP_ZN', 'COMP_ZN']

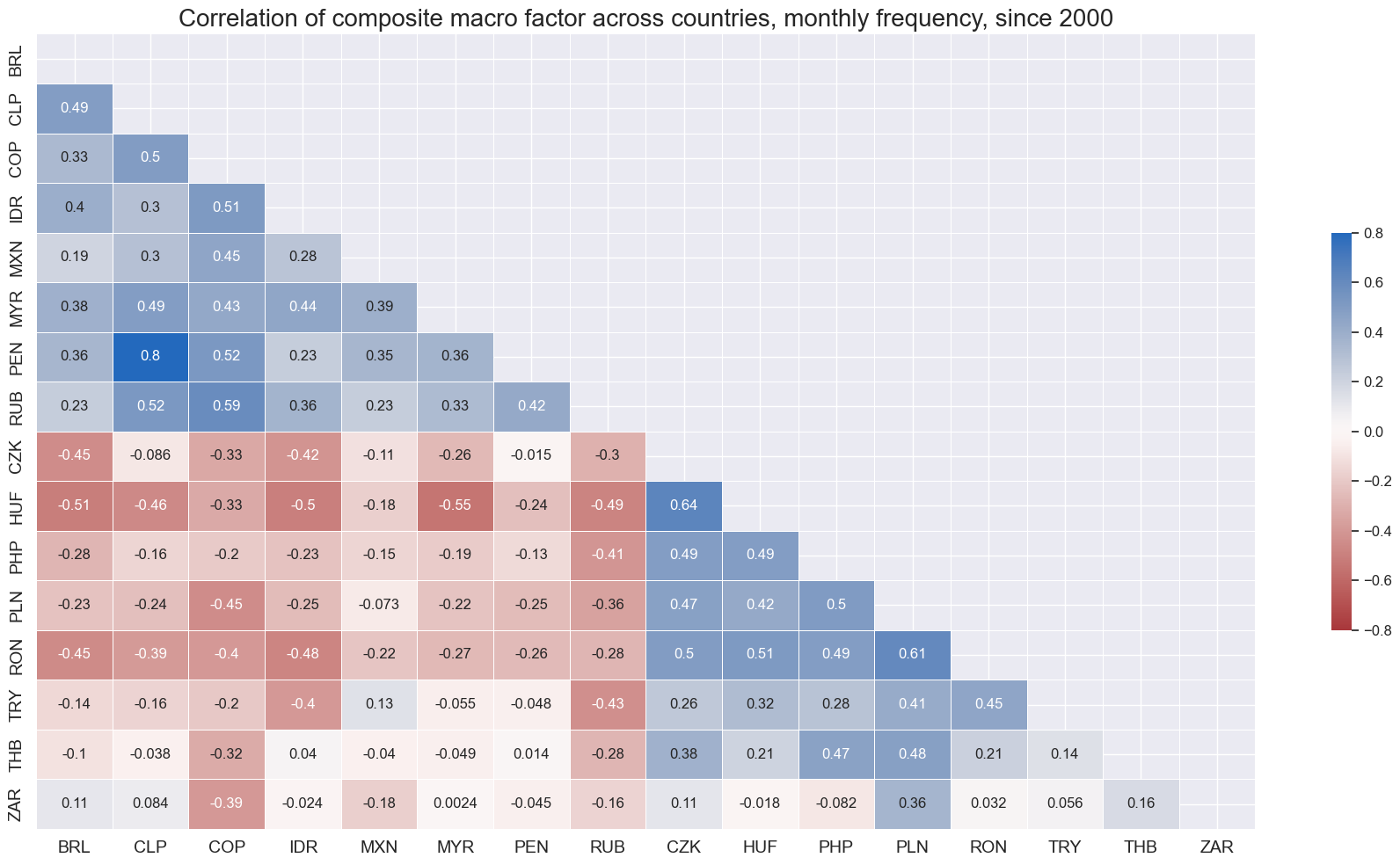

xcatx = ['COMP_ZN']

cidx = cids_em

sdate = "2000-01-01"

msp.correl_matrix(

dfx,

xcats=xcatx,

cids=cidx,

freq="M",

title="Correlation of composite macro factor across countries, monthly frequency, since 2000",

title_fontsize=20,

size=(18, 10),

max_color=0.8,

xcat_labels=concept_factors_zn,

show=True,

annot=True,

start=sdate,

cluster=True,

)

Macro-quantamental scorecards #

Snapshot #

xcatx = list(concept_factors_zn.keys())

cidx = cids_em

# Set data of snapshot

backdate = datetime.strptime("2008-09-01", "%Y-%m-%d")

lastdate = datetime.strptime(END_DATE, "%Y-%m-%d")

snapdate = lastdate

sv = ScoreVisualisers(

df=dfx,

cids=cidx,

xcats = xcatx,

xcat_labels=concept_factors_zn,

xcat_comp="COMP_ZN",

no_zn_scores=True,

rescore_composite=False,

blacklist=fxblack,

)

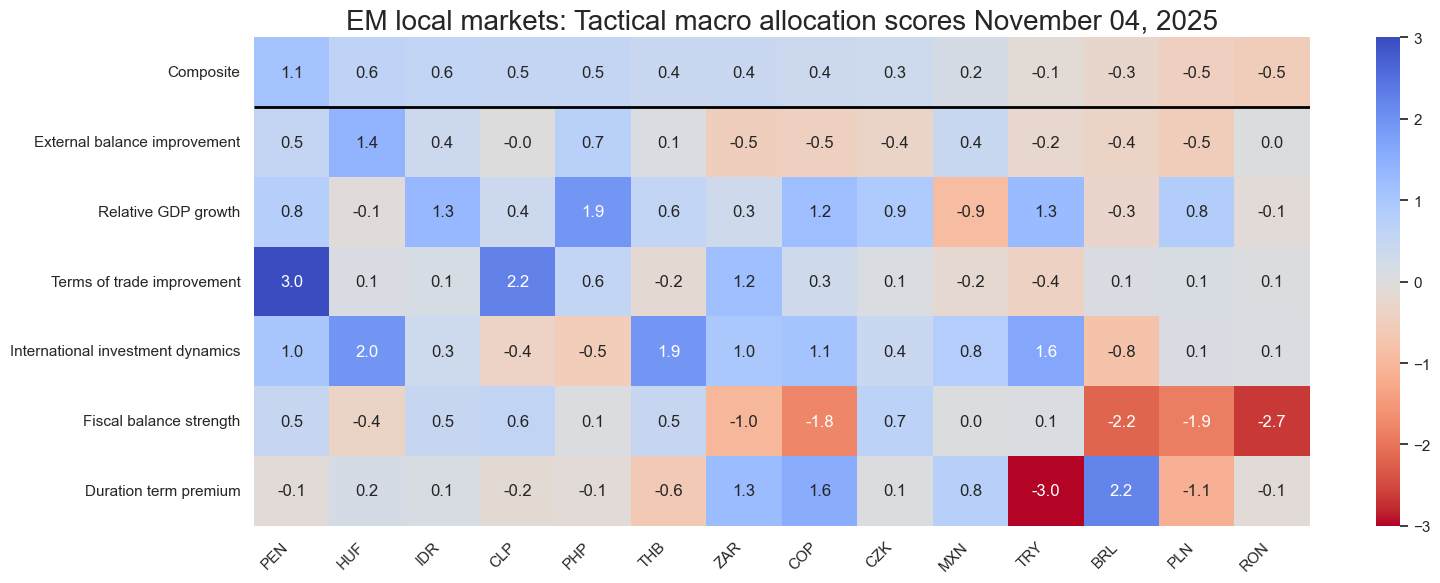

sv.view_snapshot(

cids=cidx,

date=snapdate,

transpose=True,

sort_by_composite = True,

title=f"EM local markets: Tactical macro allocation scores {snapdate.strftime("%B %d, %Y")}",

title_fontsize=20,

figsize=(16, 6),

xcats=xcatx,

xcat_labels=concept_factors_zn,

round_decimals=1,

)

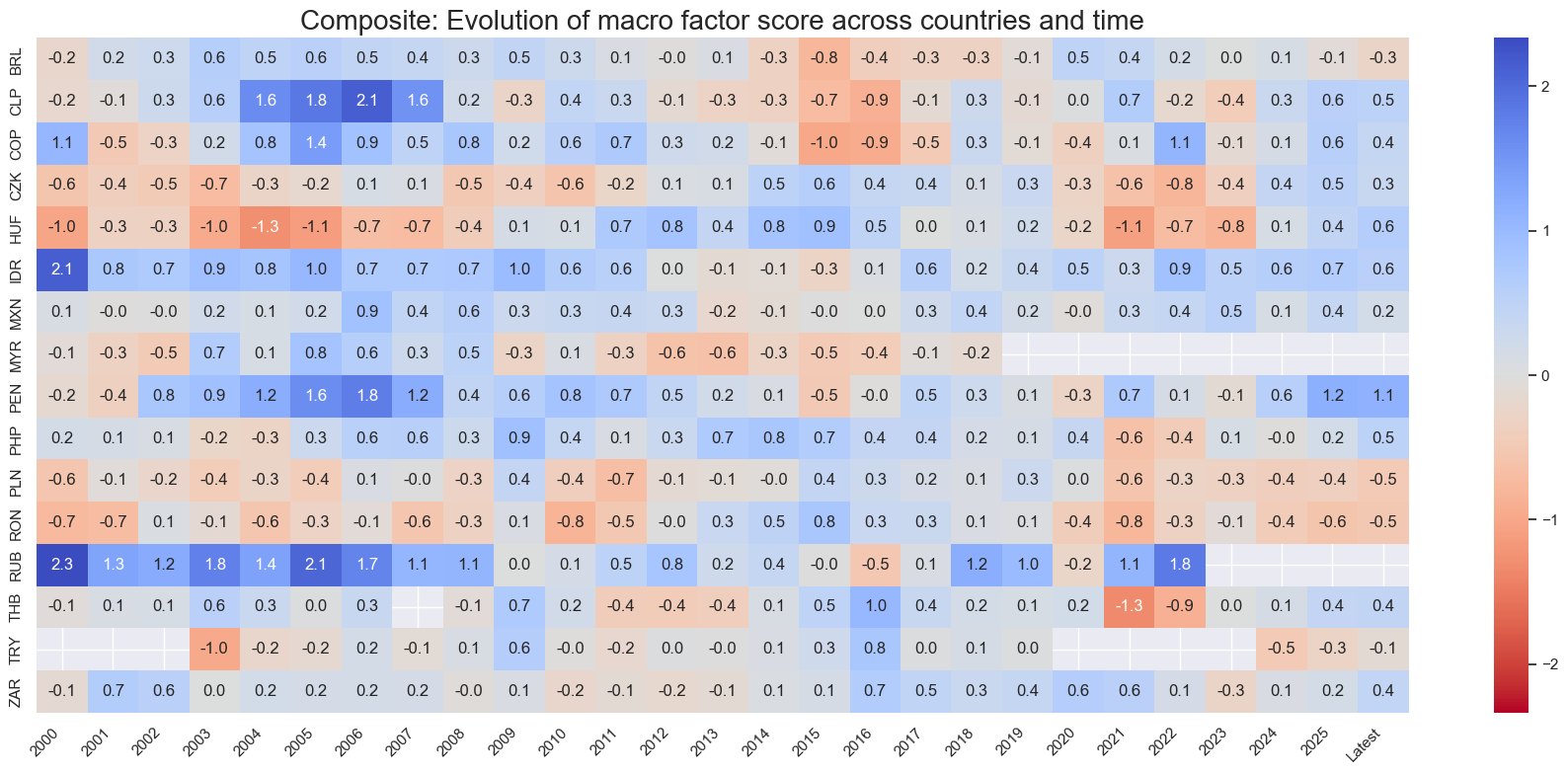

Global history #

cidx = cids_em

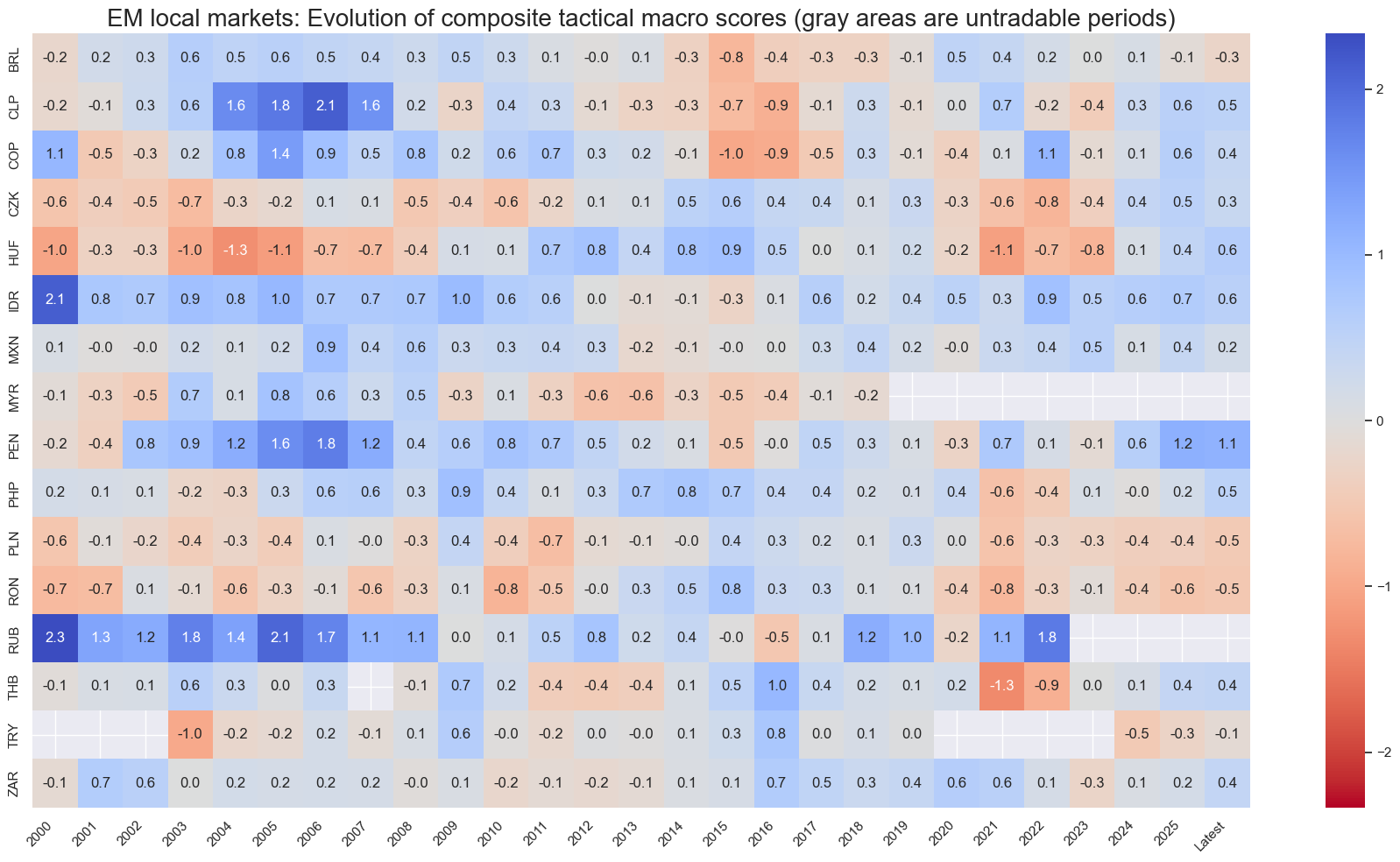

sv.view_score_evolution(

xcat="COMP_ZN",

cids=cidx,

freq="A",

include_latest_day=True,

transpose=False,

title="EM local markets: Evolution of composite tactical macro scores (gray areas are untradable periods)",

title_fontsize=20,

start="2000-01-01",

figsize=(18, 10),

round_decimals=1,

)

Latest day: 2025-11-04 00:00:00

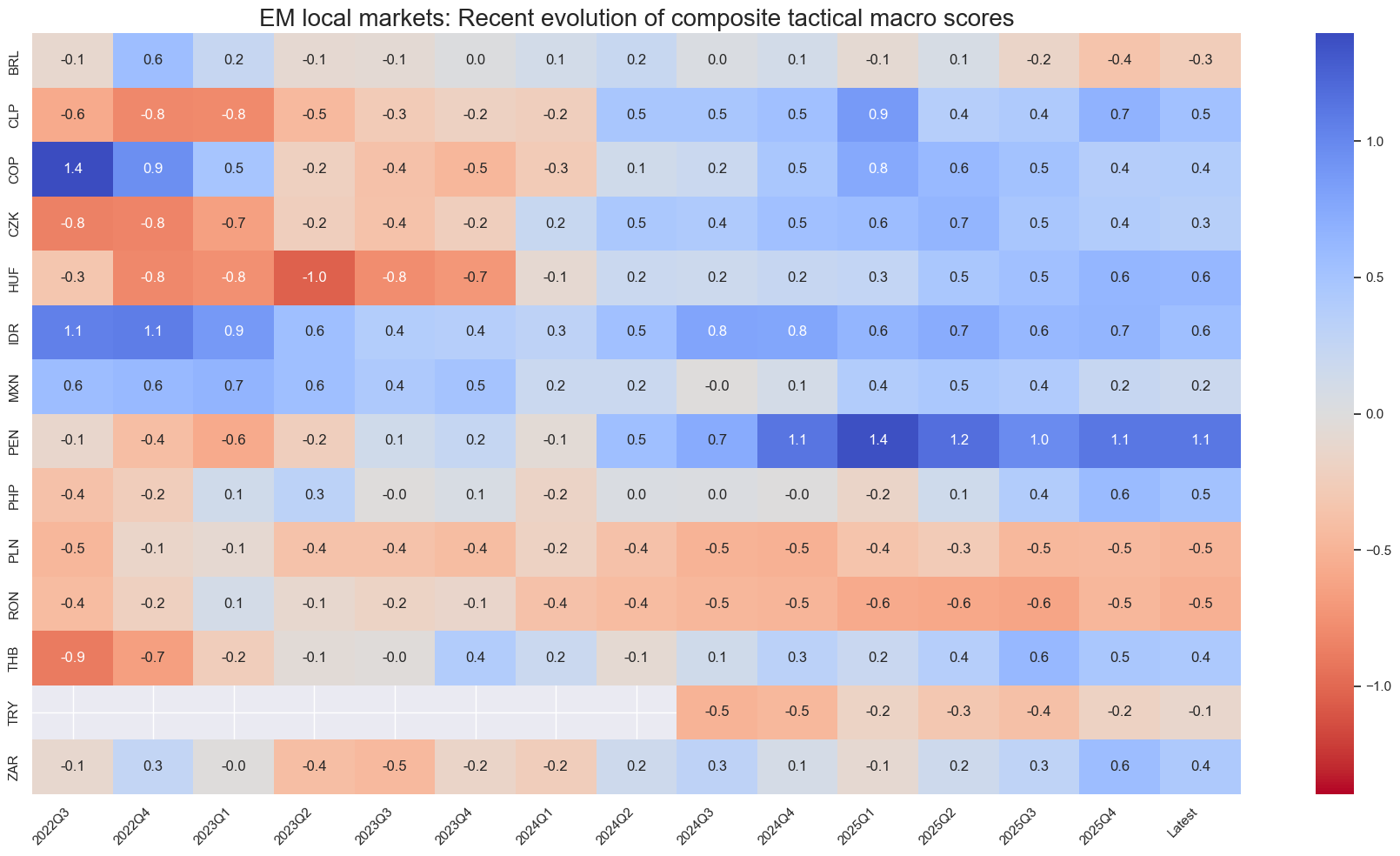

cidx = cids_em

sv.view_score_evolution(

xcat="COMP_ZN",

cids=cidx,

freq="Q",

include_latest_day=True,

transpose=False,

title="EM local markets: Recent evolution of composite tactical macro scores",

title_fontsize=20,

start="2022-07-01",

figsize=(18, 10),

round_decimals=1,

)

Latest day: 2025-11-04 00:00:00

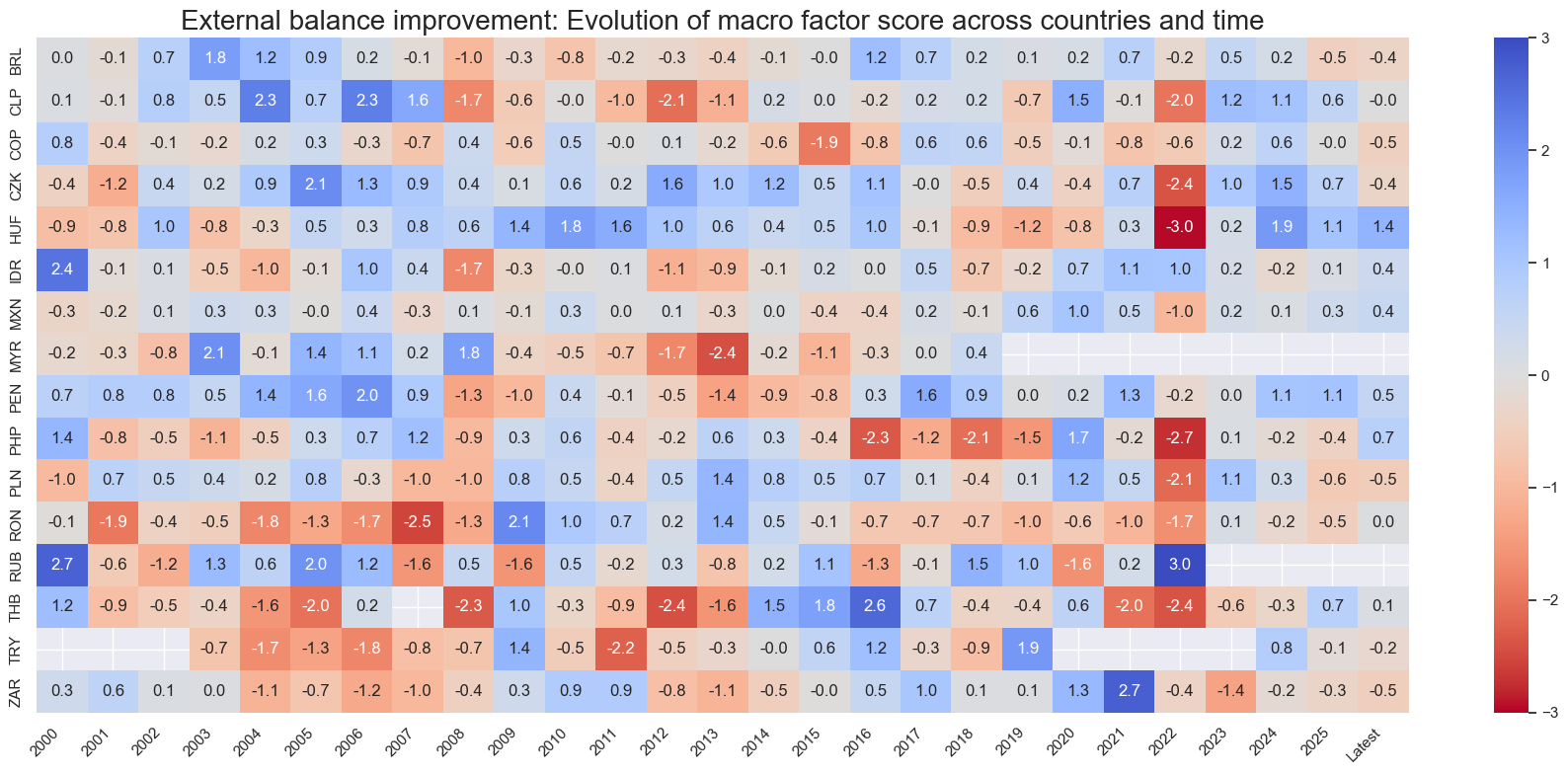

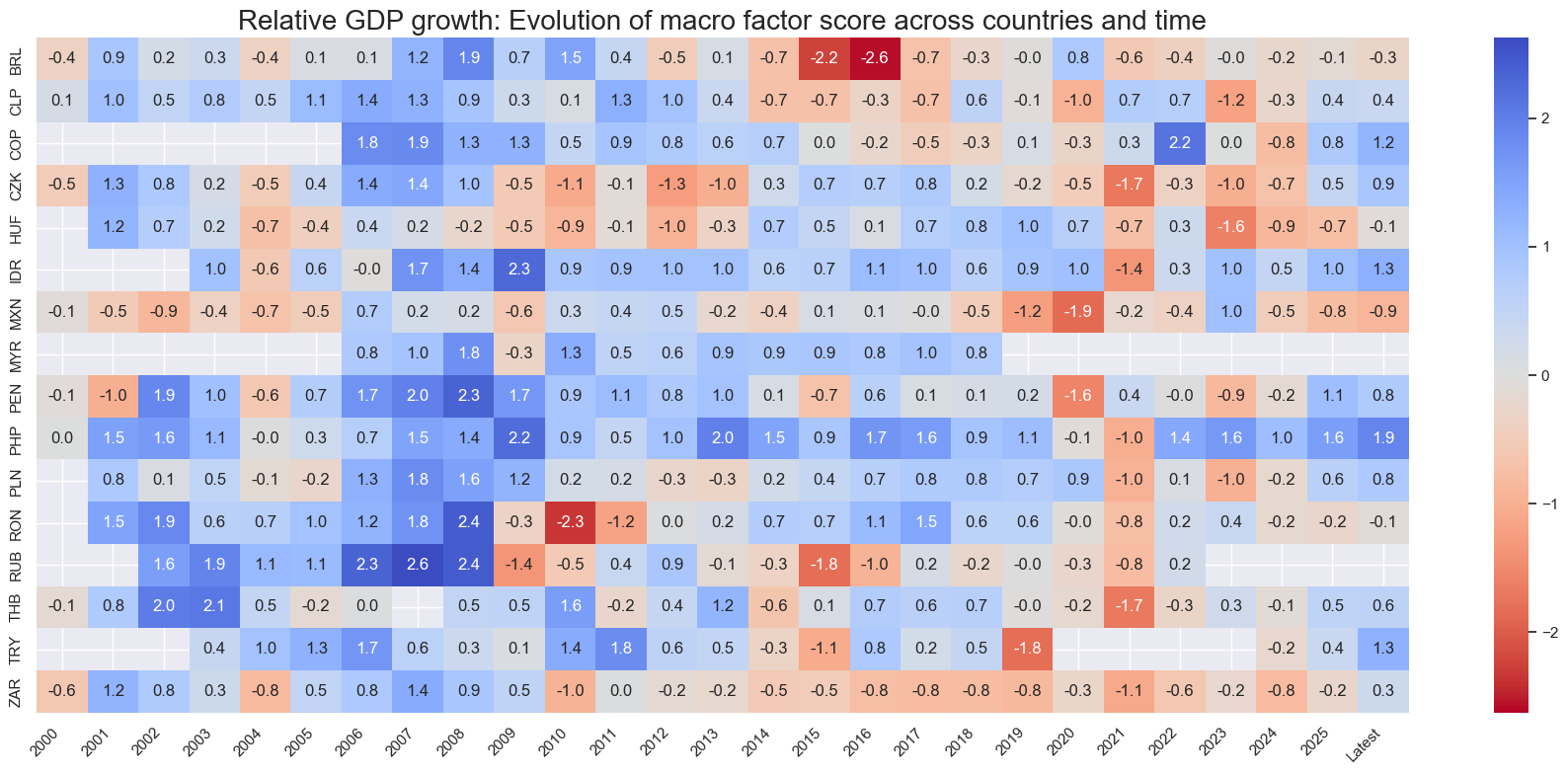

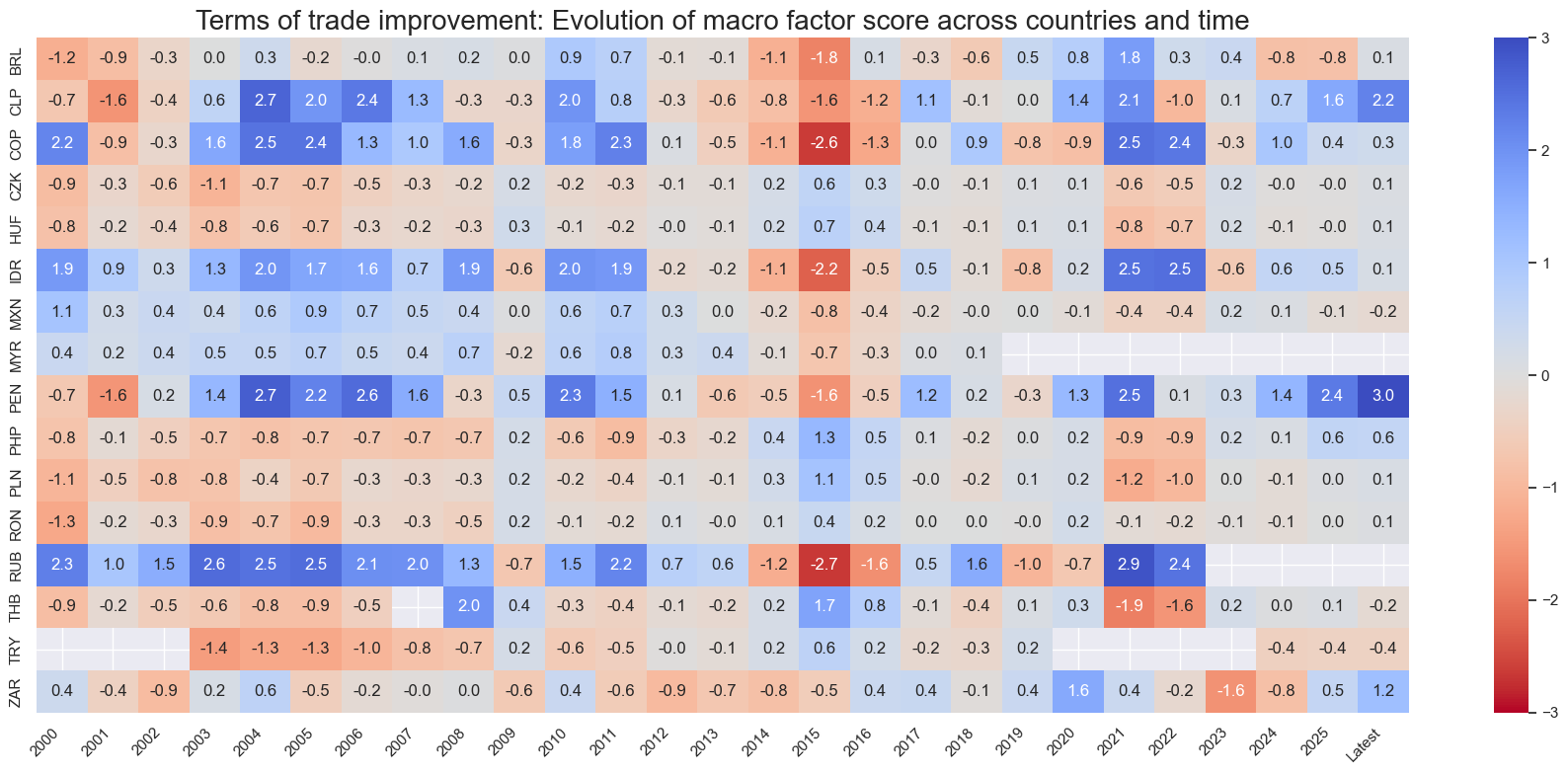

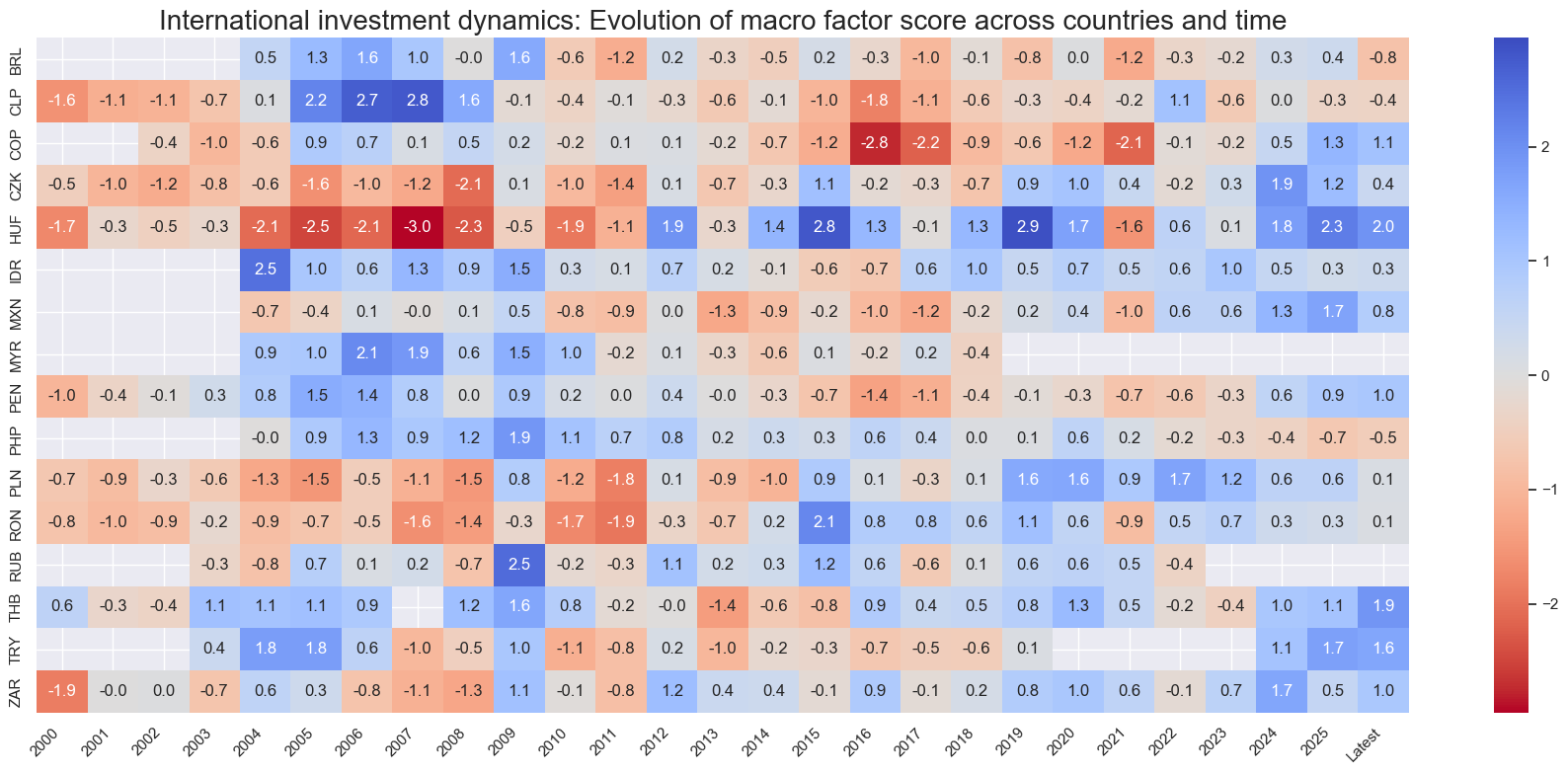

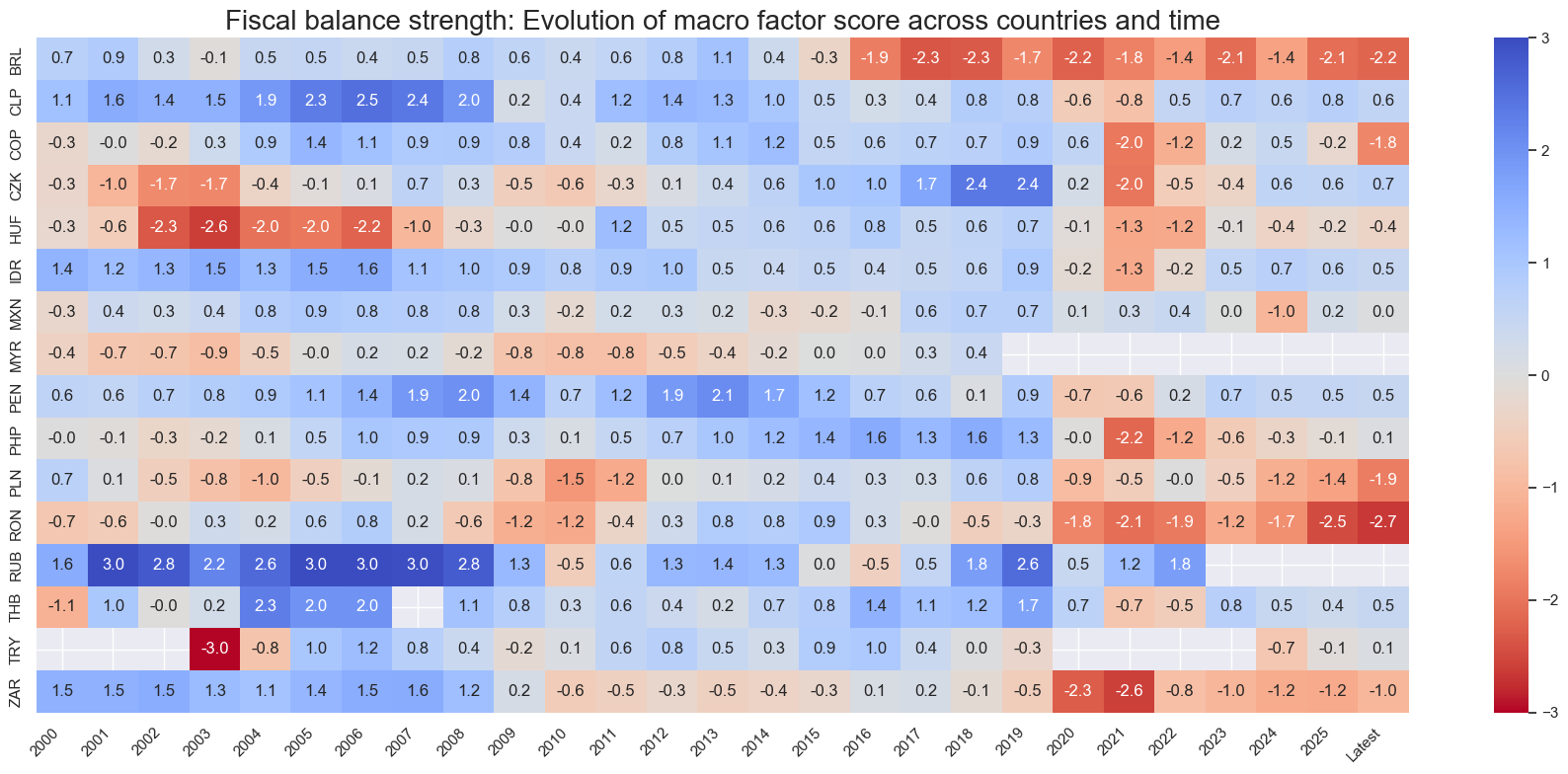

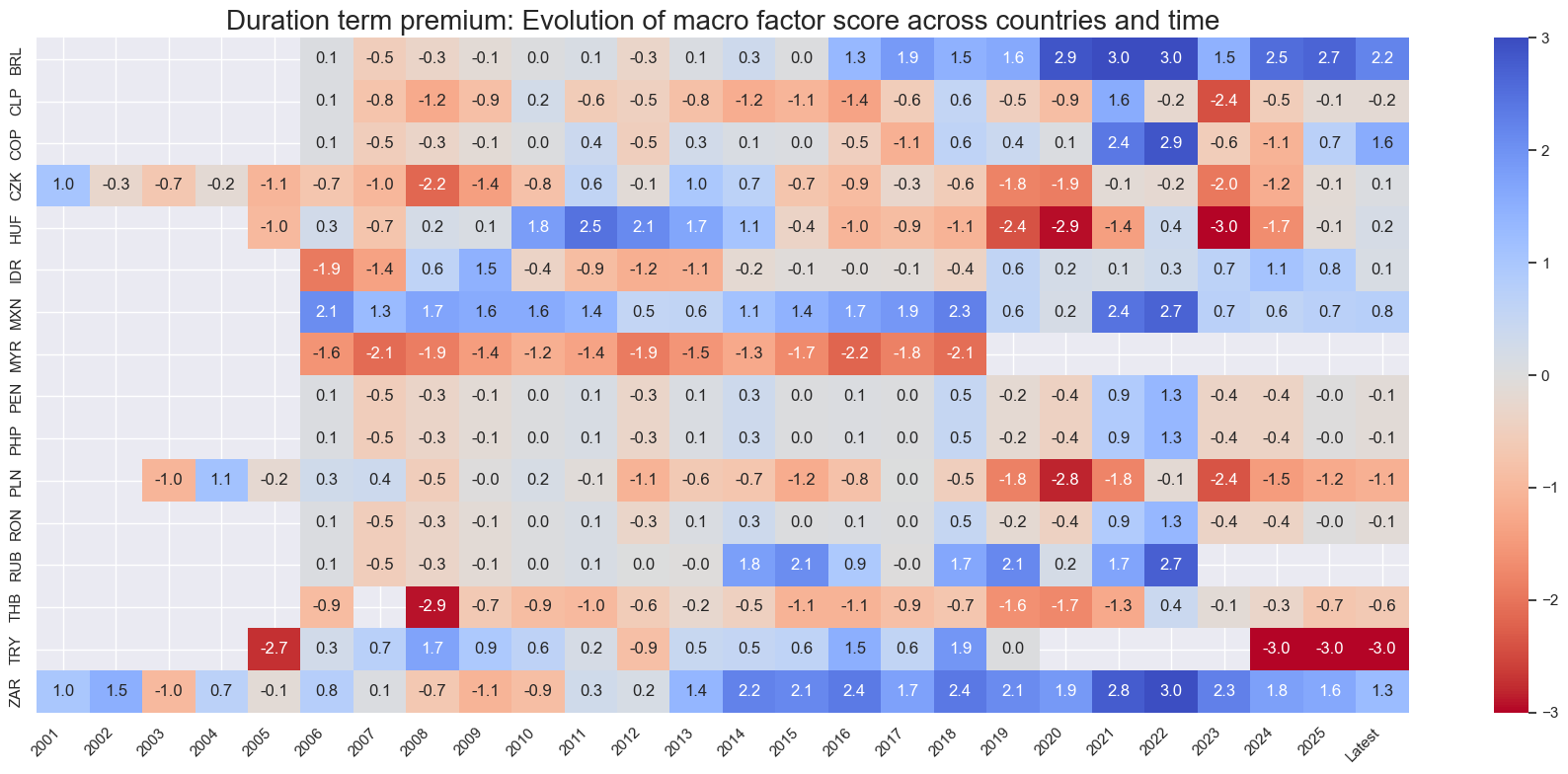

Thematic history #

xcatx = list(concept_factors_zn.keys())

cidx = cids_em

for xcat in xcatx:

xc_name = concept_factors_zn[xcat]

sv.view_score_evolution(

xcat=xcat,

cids=cidx,

freq="A",

transpose=False,

title=f"{xc_name}: Evolution of macro factor score across countries and time",

title_fontsize=20,

figsize=(18, 8),

round_decimals=1,

start="2000-01-01",

)

Latest day: 2025-11-04 00:00:00

Latest day: 2025-11-04 00:00:00

Latest day: 2025-11-04 00:00:00

Latest day: 2025-11-04 00:00:00

Latest day: 2025-11-04 00:00:00

Latest day: 2025-11-04 00:00:00

Latest day: 2025-11-04 00:00:00

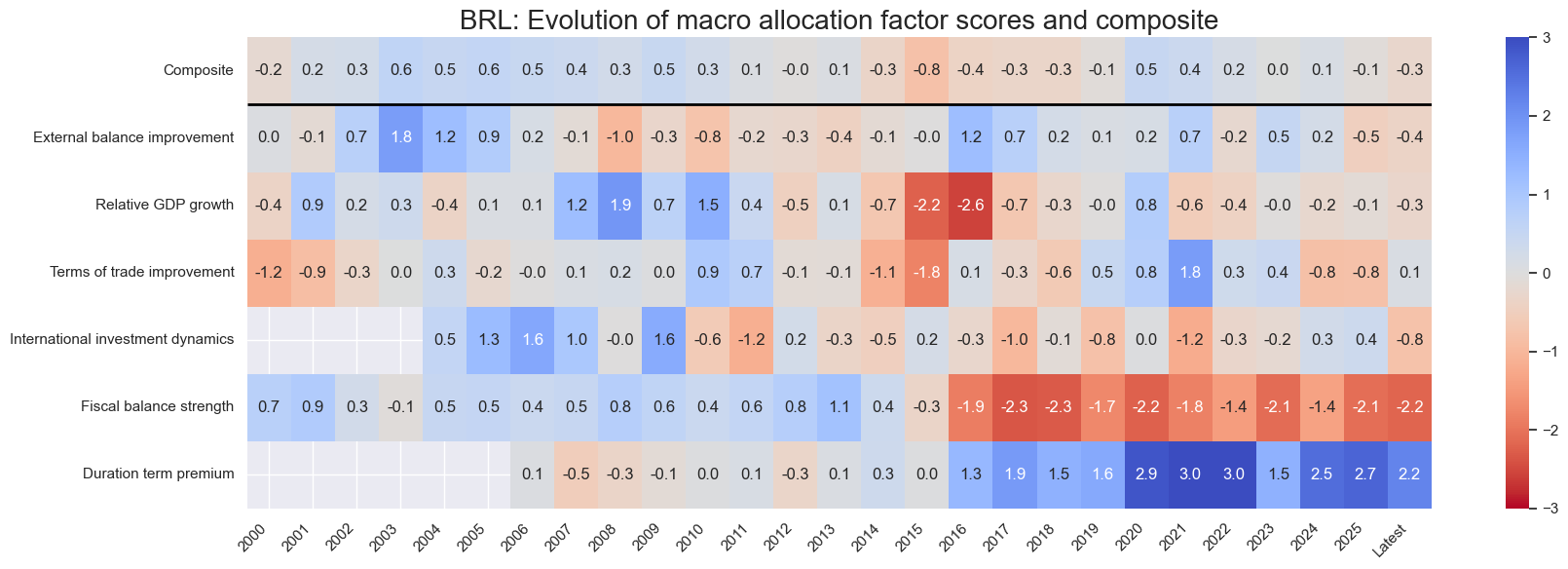

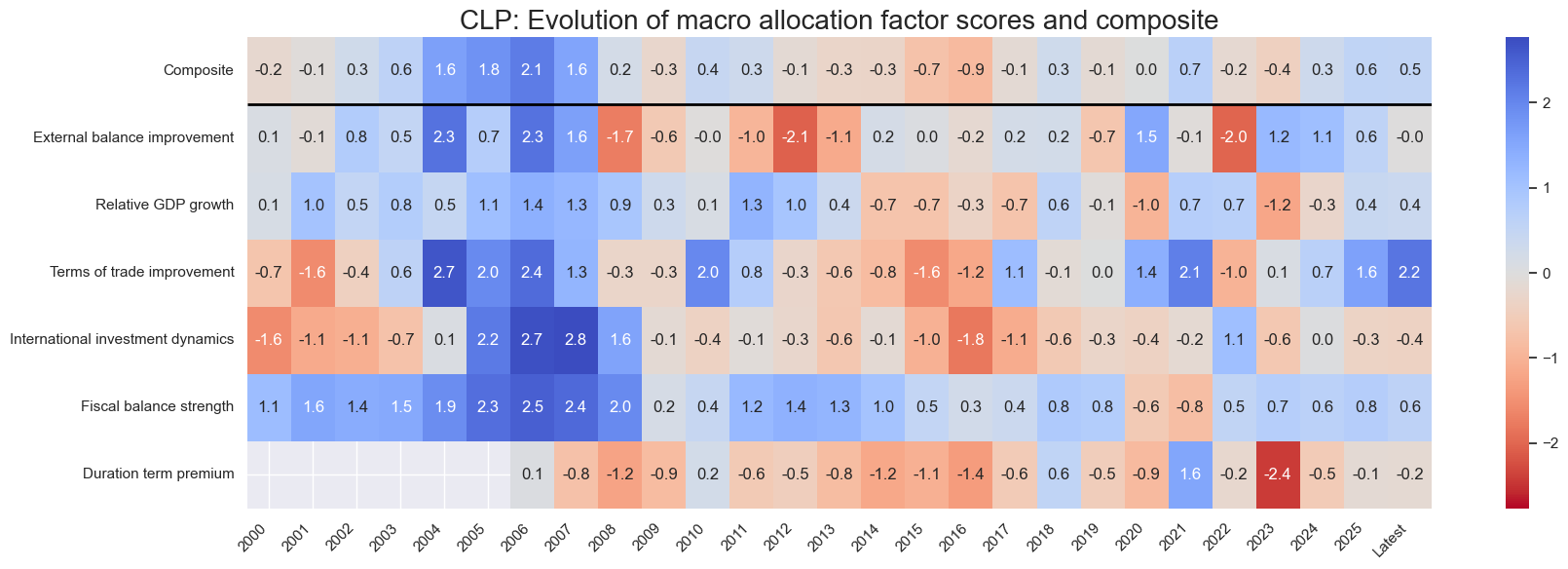

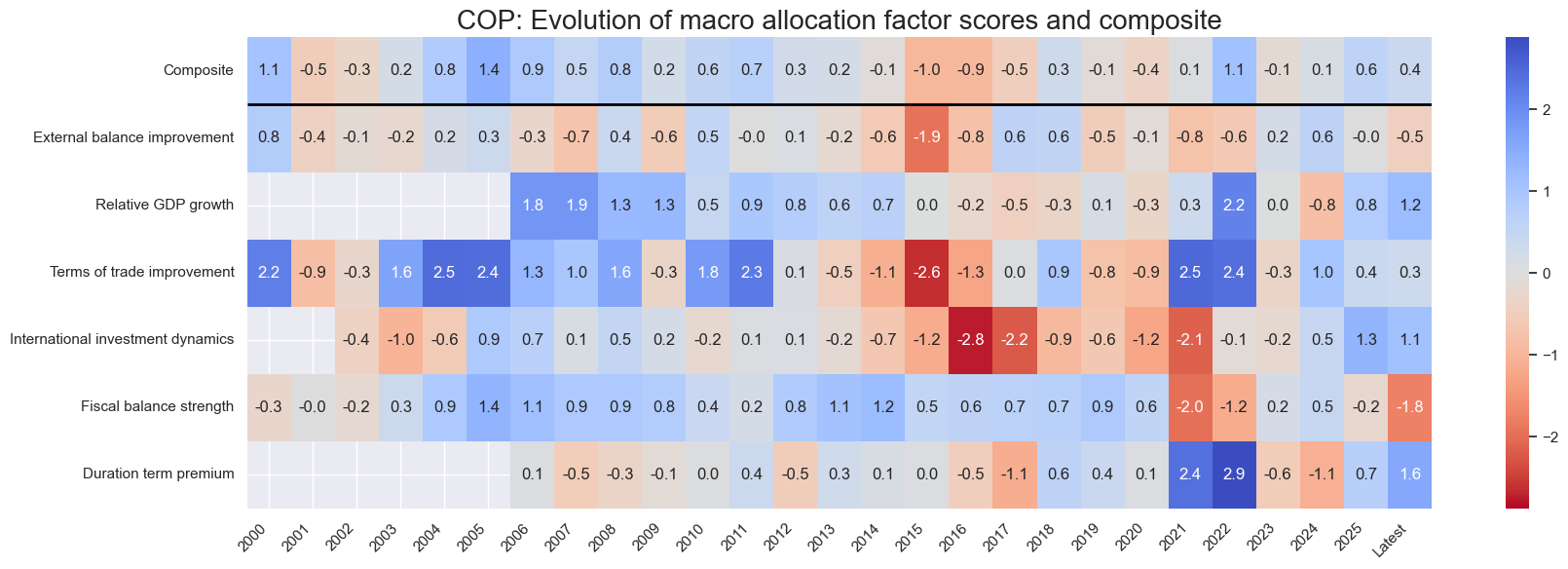

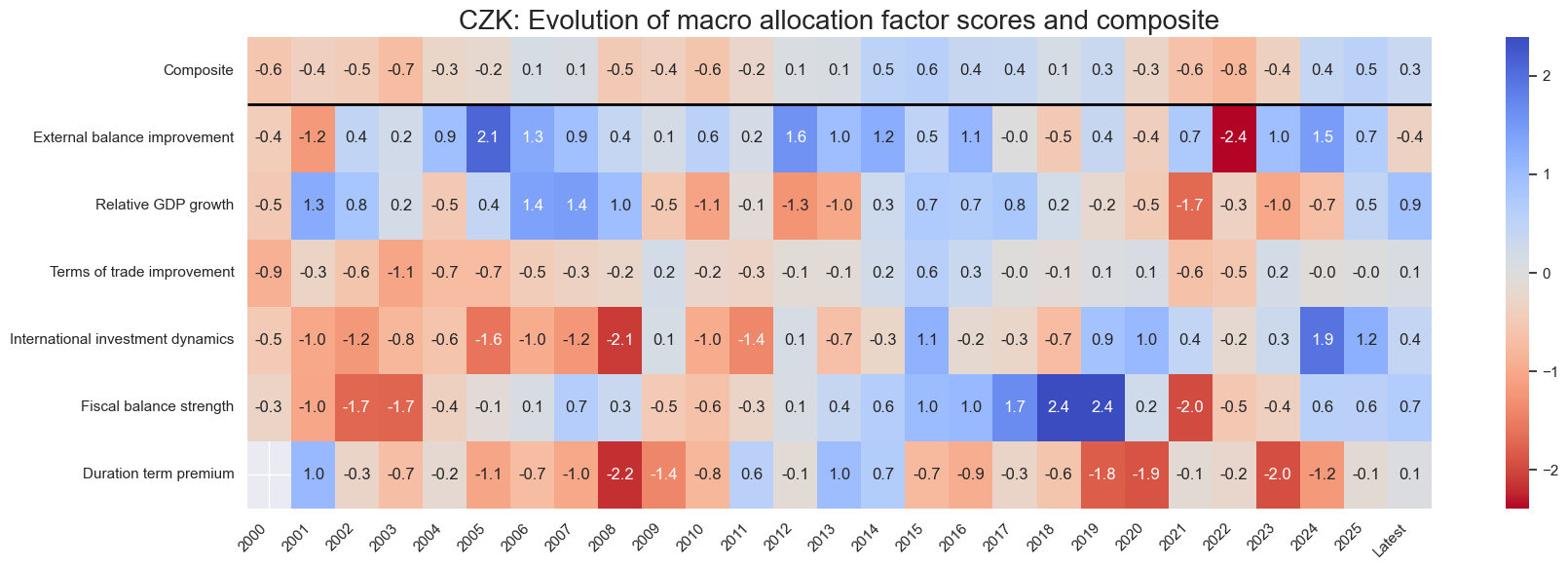

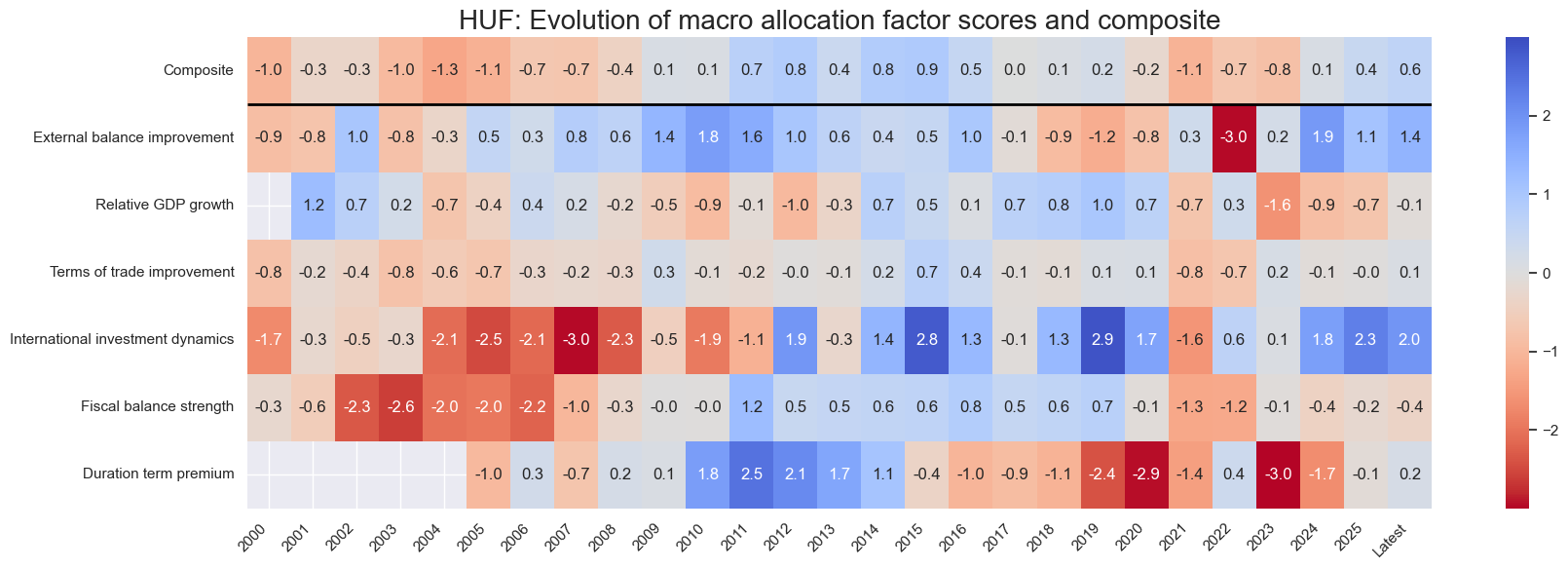

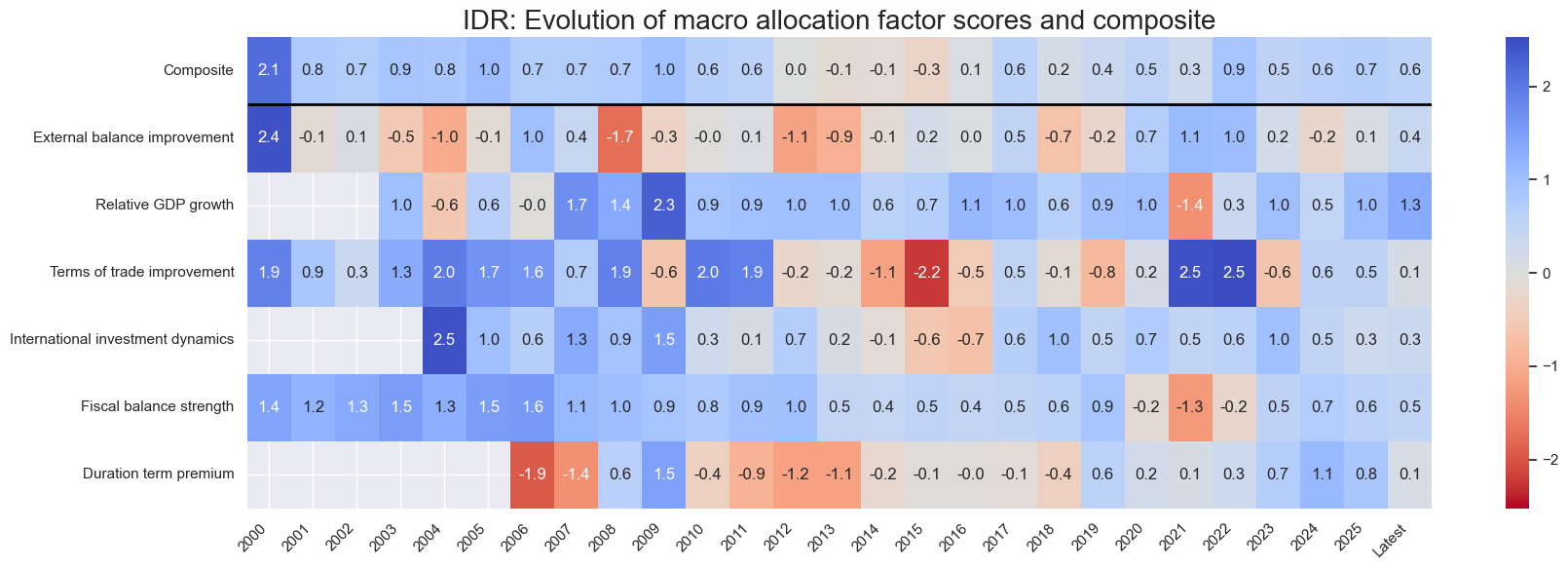

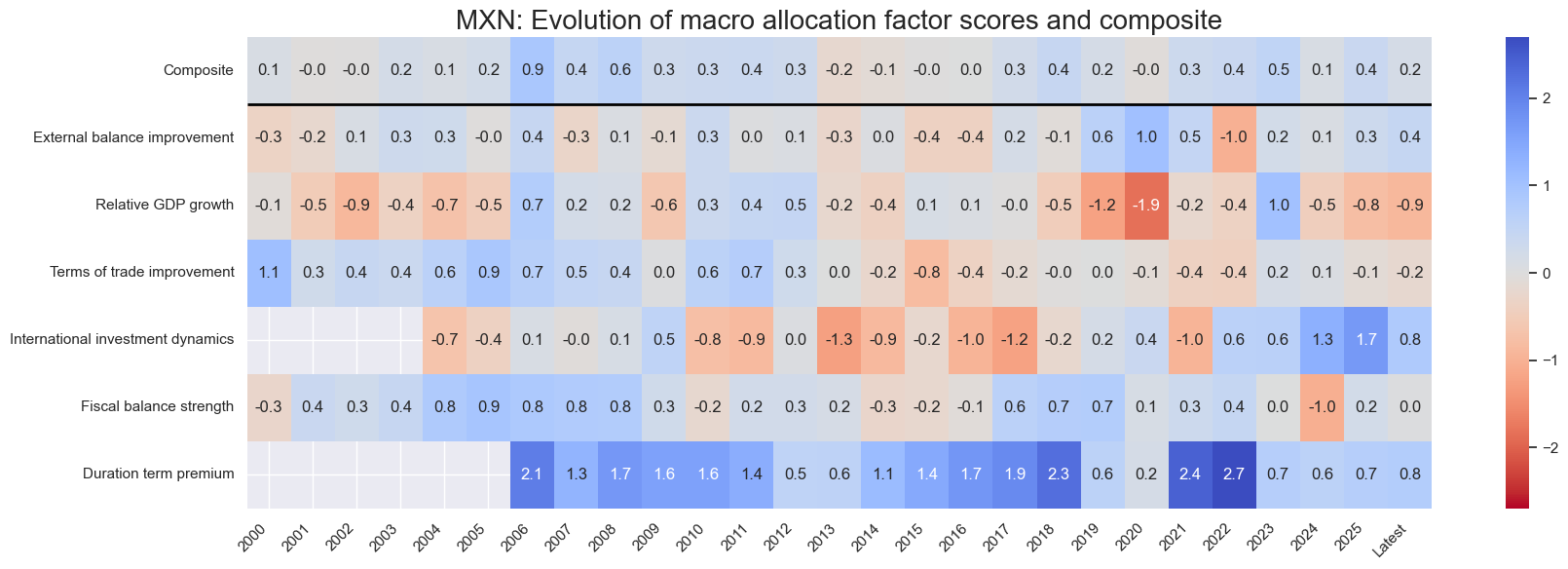

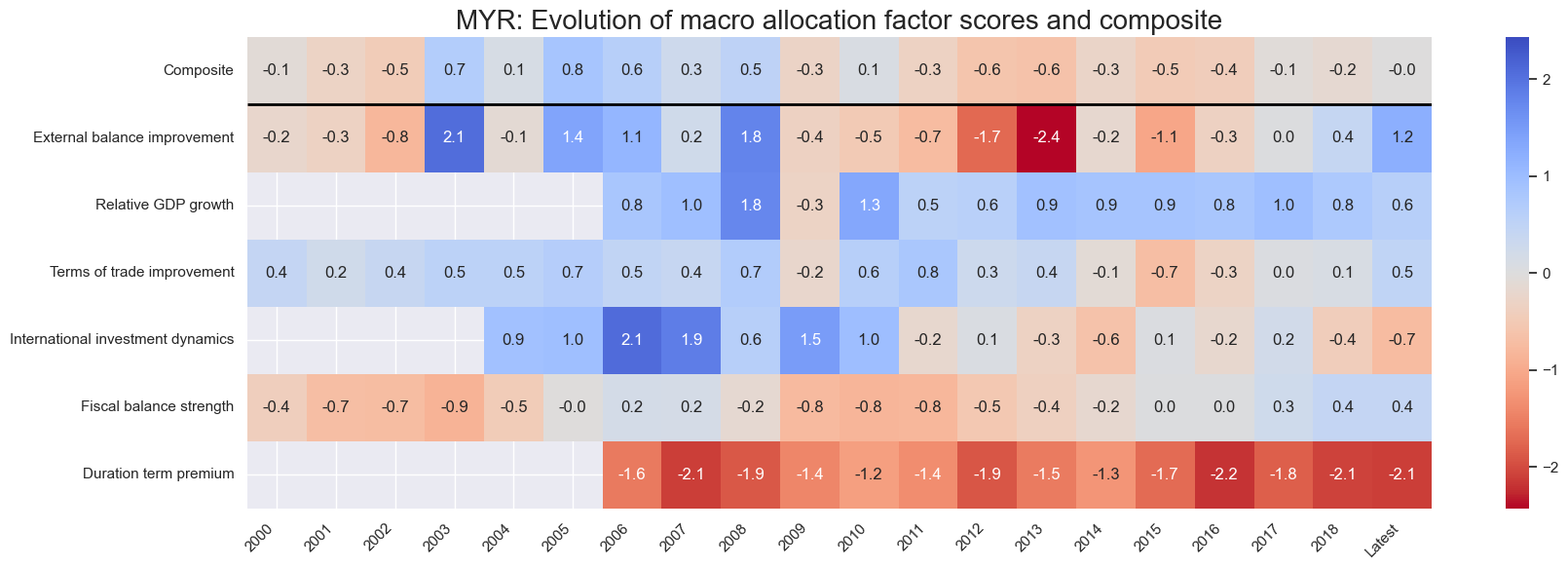

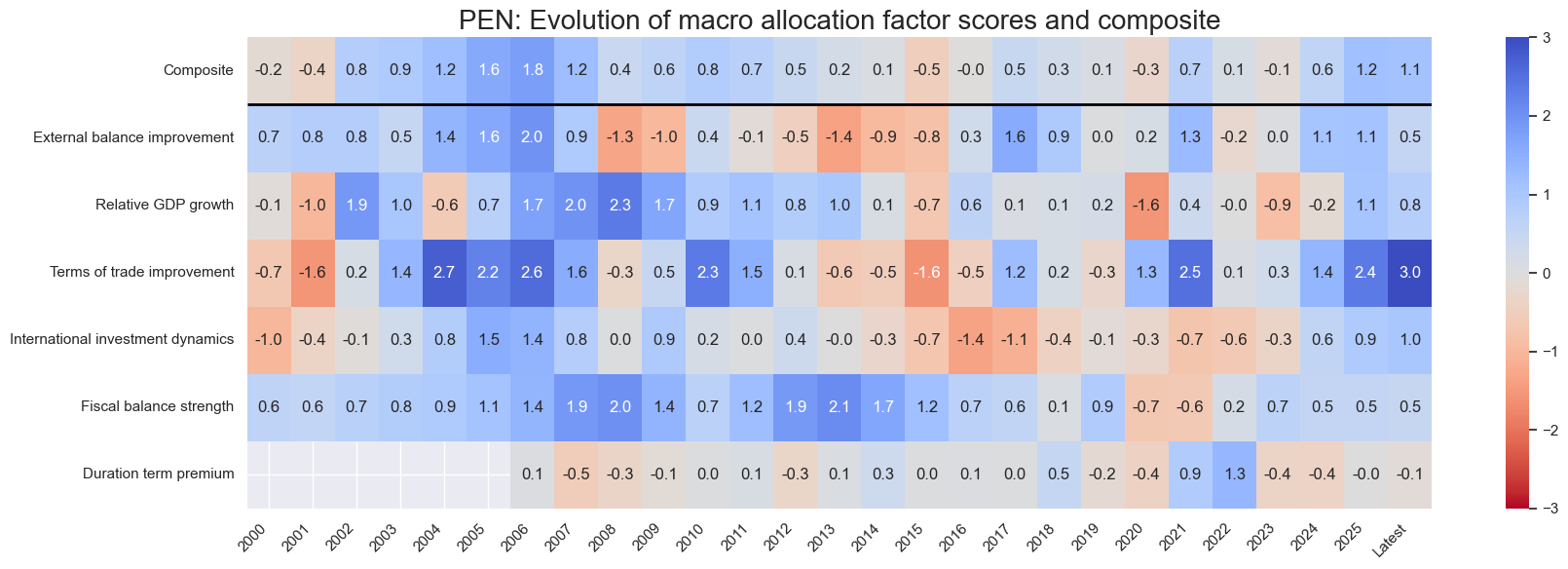

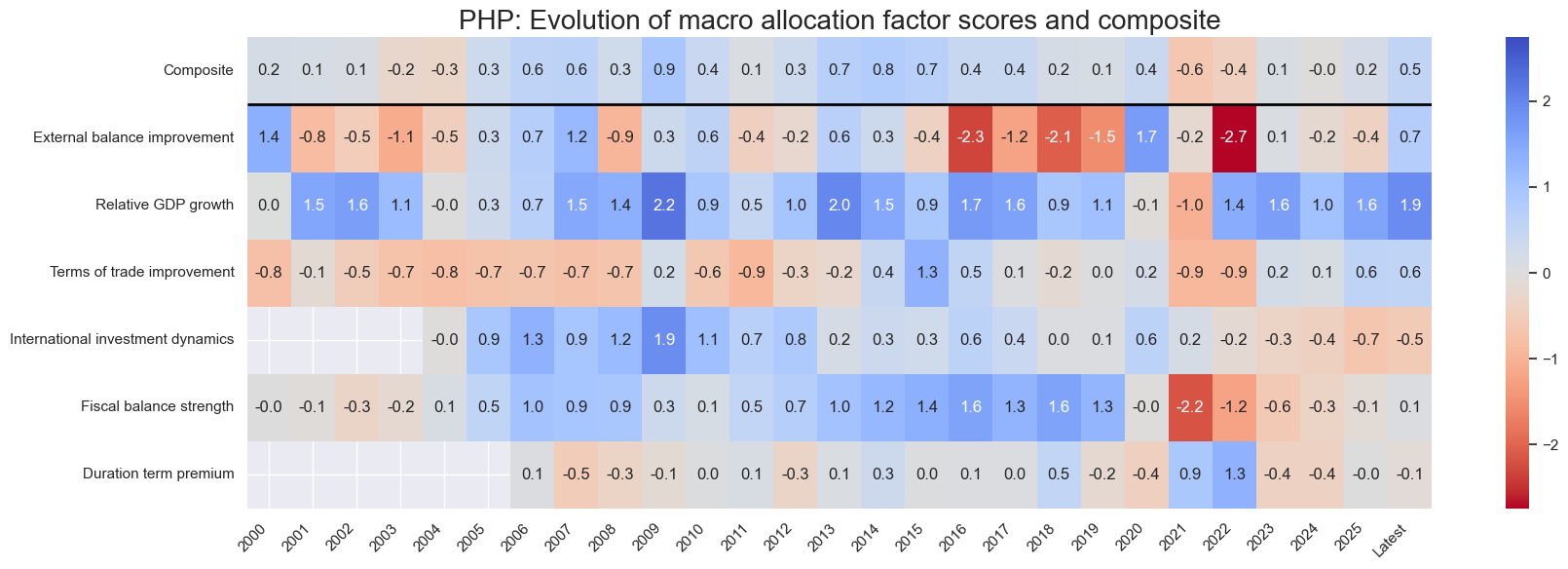

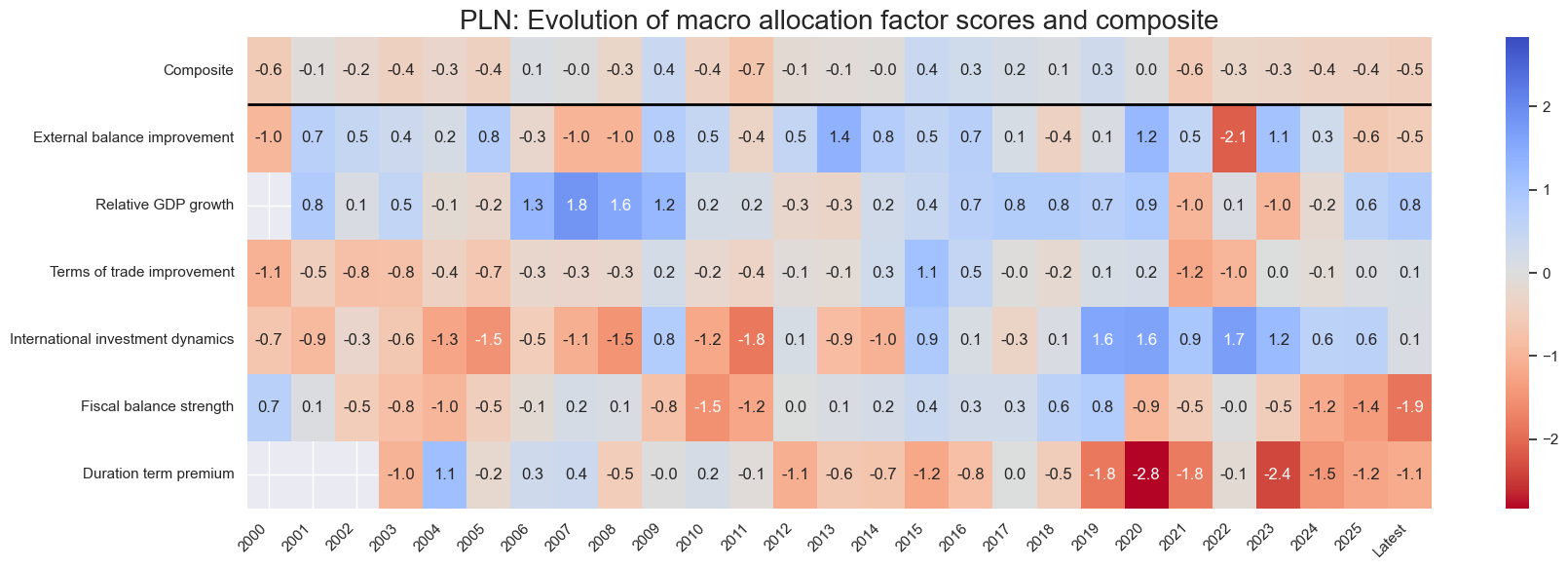

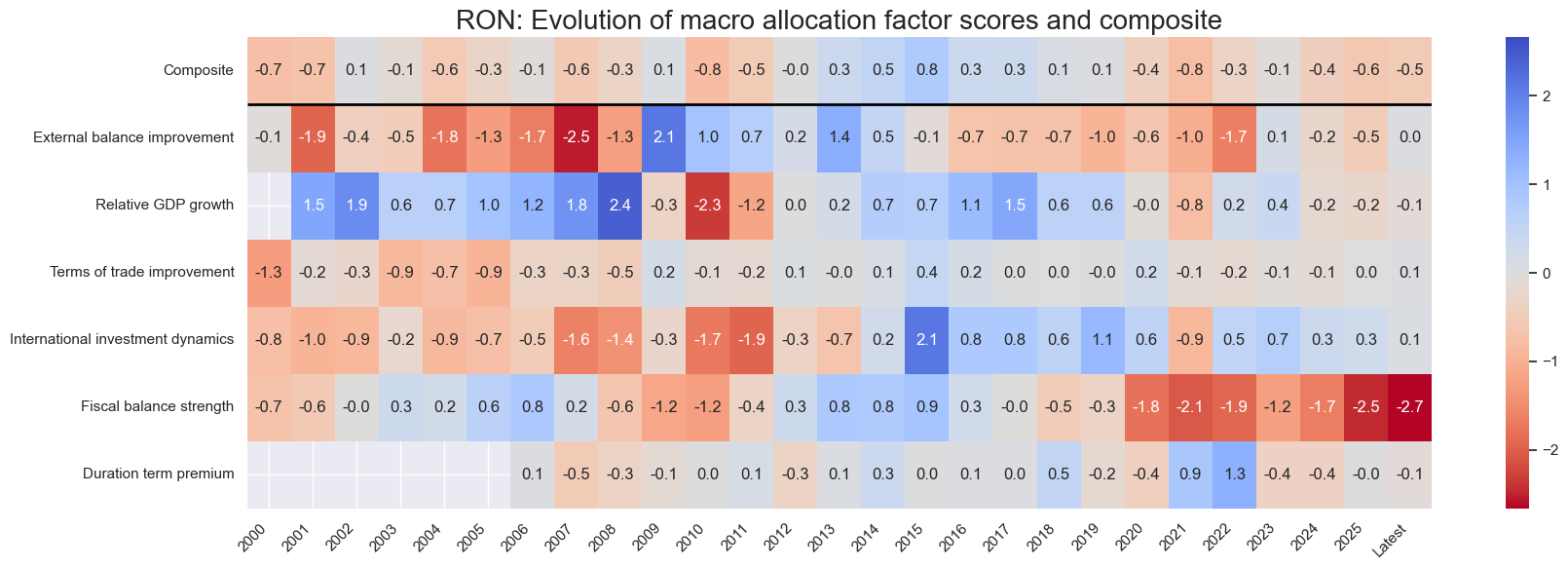

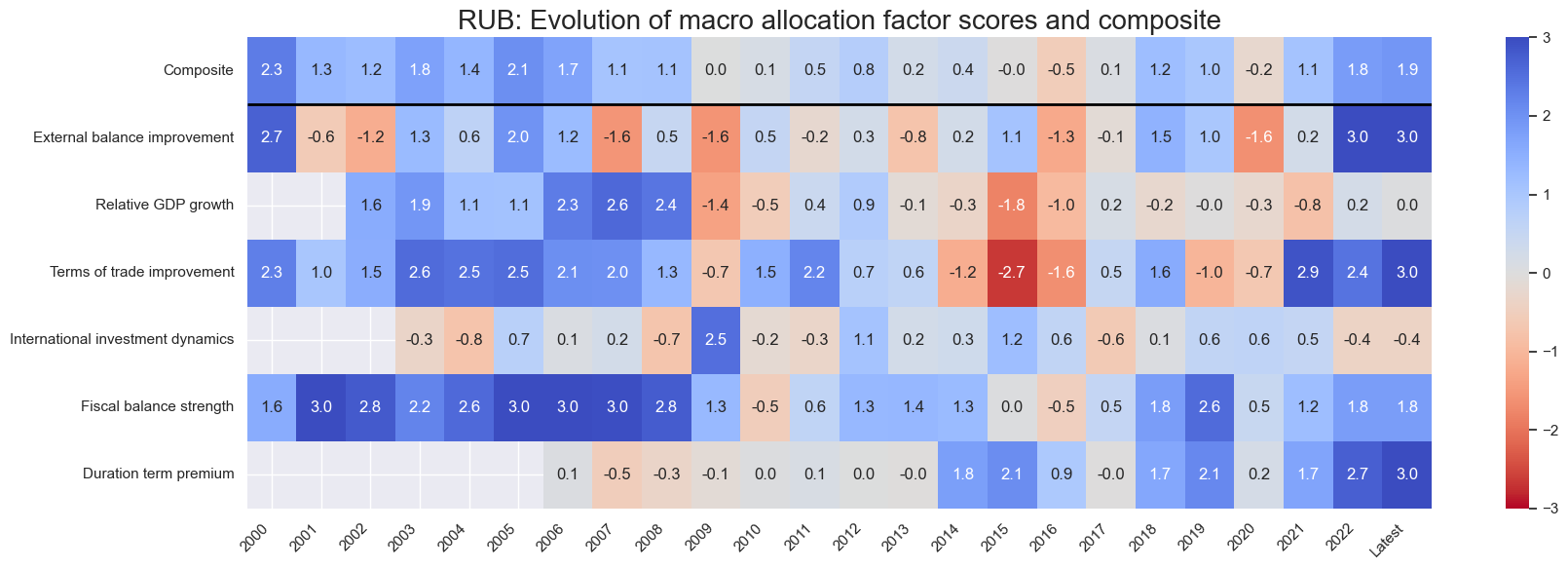

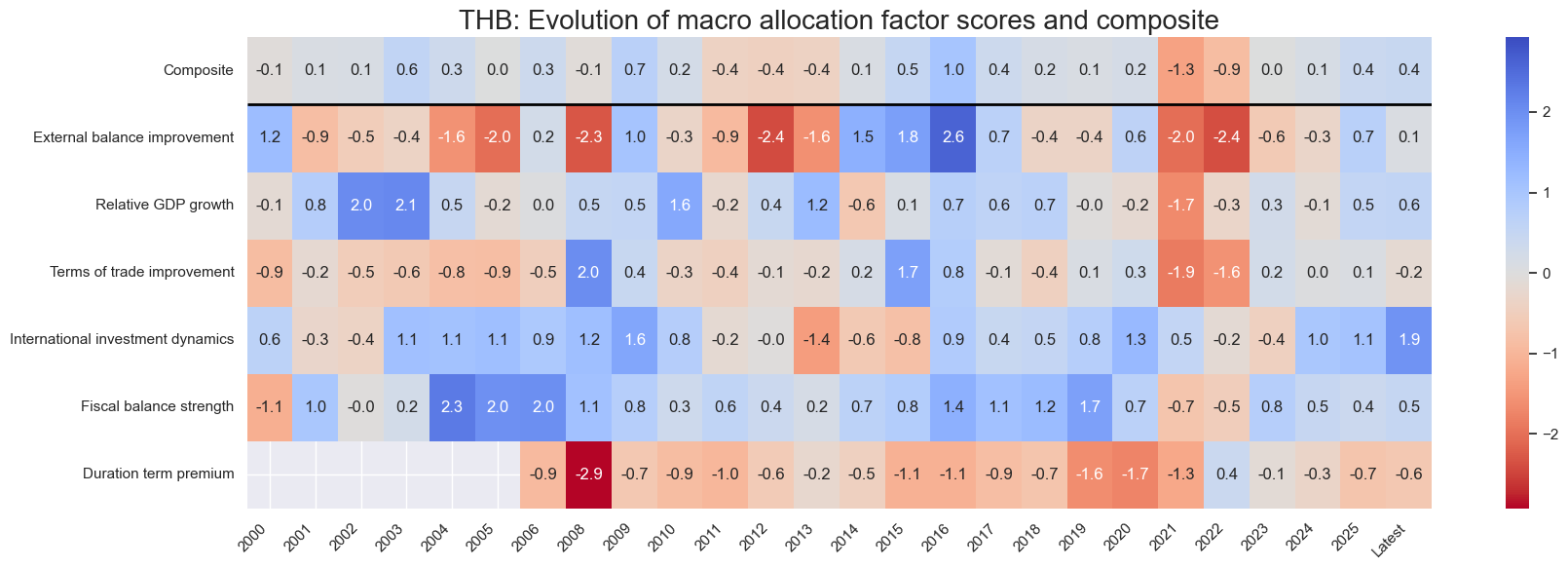

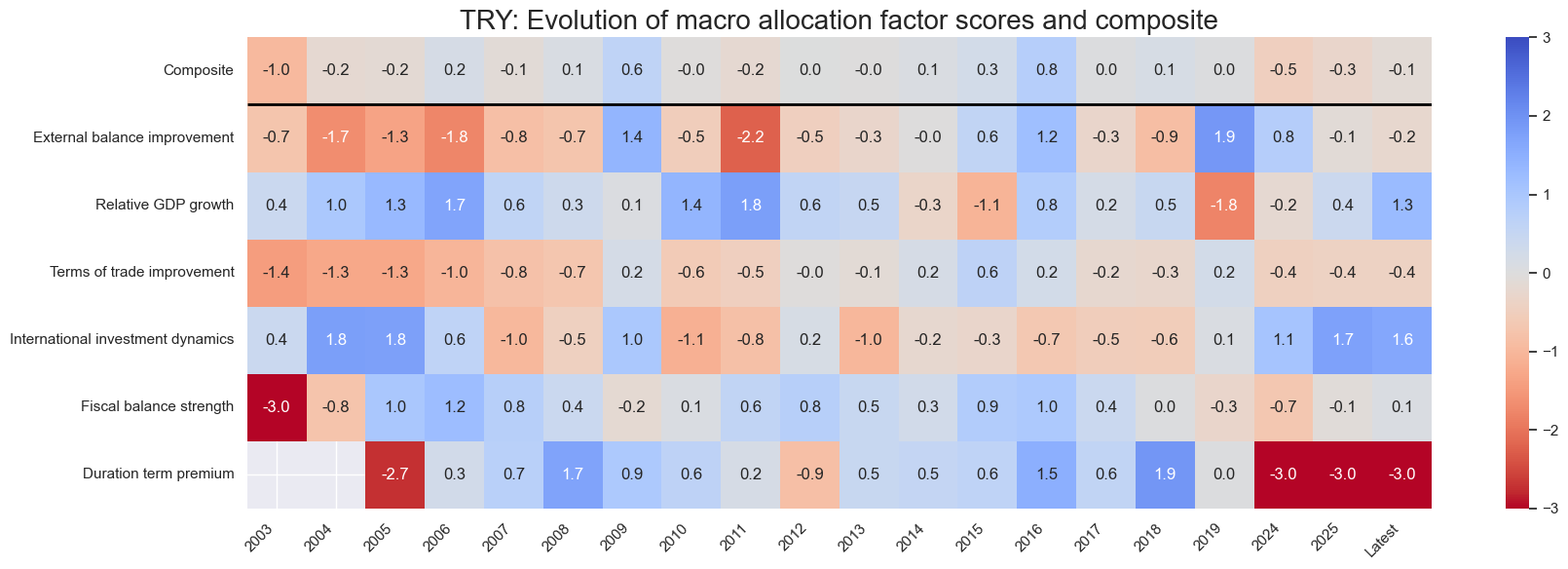

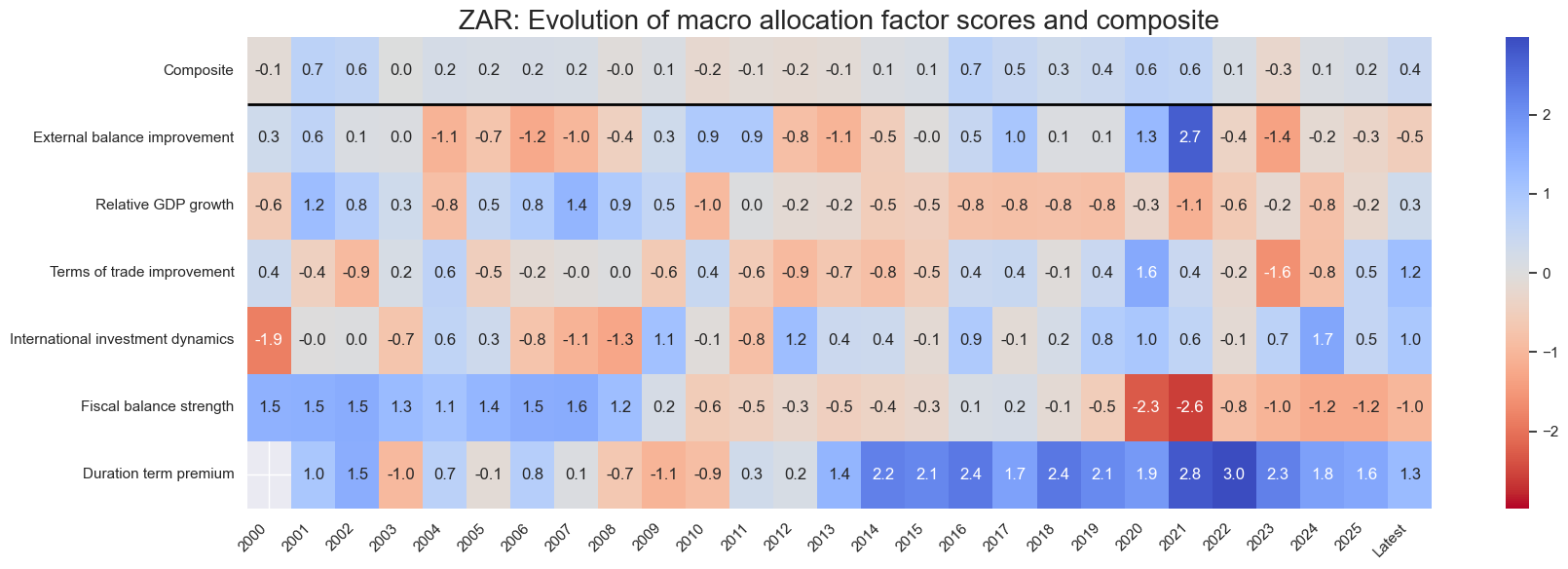

Country history #

xcatx = list(concept_factors_zn.keys())

cidx = cids_em

for cid in cidx:

sv.view_cid_evolution(

cid=cid,

xcats=xcatx,

xcat_labels=concept_factors_zn,

freq="A",

transpose=False,

title=f"{cid}: Evolution of macro allocation factor scores and composite",

title_fontsize=20,

figsize=(18, 6),

round_decimals=1,

start="2000-01-01",

)

Latest day: 2025-11-04 00:00:00

Latest day: 2025-11-04 00:00:00

Latest day: 2025-11-04 00:00:00

Latest day: 2025-11-04 00:00:00

Latest day: 2025-11-04 00:00:00

Latest day: 2025-11-04 00:00:00

Latest day: 2025-11-04 00:00:00

Latest day: 2018-06-29 00:00:00

Latest day: 2025-11-04 00:00:00

Latest day: 2025-11-04 00:00:00

Latest day: 2025-11-04 00:00:00

Latest day: 2025-11-04 00:00:00

Latest day: 2022-01-31 00:00:00

Latest day: 2025-11-04 00:00:00

Latest day: 2025-11-04 00:00:00

Latest day: 2025-11-04 00:00:00

Value checks #

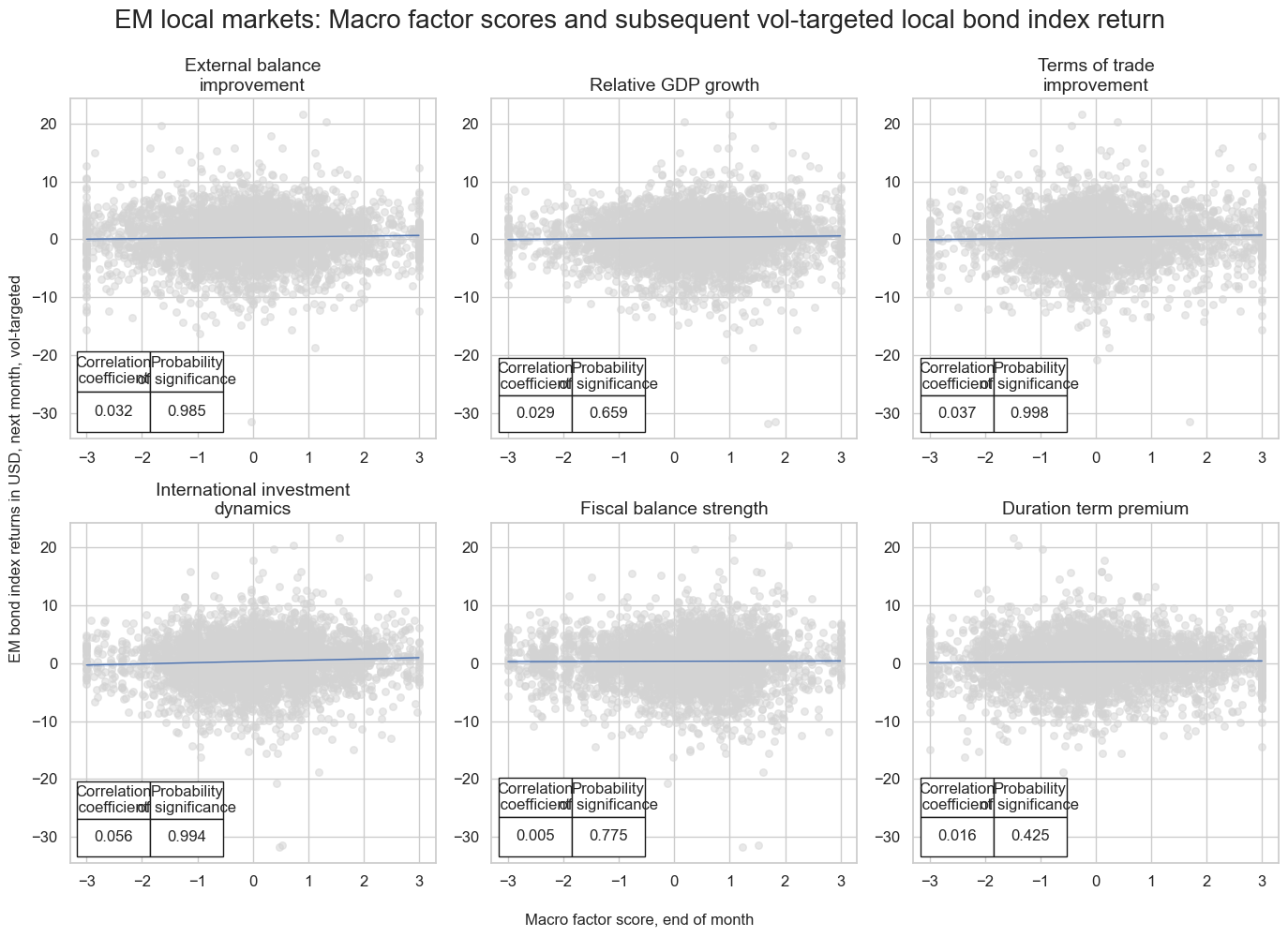

Specs and panel test #

dict_lm = {

"sigs": list(concept_factors_zn.keys()),

"targ": "LCBIXRUSD_VT10",

"cidx": cids_em,

"black": fxblack,

"start": "2000-01-01",

"srr": None,

"pnls": None,

}

dix = dict_lm

sigs = [k for k in concept_factors_zn.keys() if k != 'COMP_ZN']

targ = dix["targ"]

cidx = dix["cidx"]

blax = dix["black"]

start = dix["start"]

# Dictionary to store CategoryRelations objects

crx = []

# Create CategoryRelations objects for all signals

for sig in sigs:

crx.append(

msp.CategoryRelations(

dfx,

xcats=[sig, targ],

cids=cidx,

freq="M",

lag=1,

xcat_aggs=["last", "sum"],

start=start,

blacklist=blax,

xcat_trims=[None, None],

)

)

# Display scatter plots for all signals

msv.multiple_reg_scatter(

cat_rels=crx,

coef_box="lower left",

ncol=3,

nrow=2,

xlab="Macro factor score, end of month",

ylab="EM bond index returns in USD, next month, vol-targeted",

title="EM local markets: Macro factor scores and subsequent vol-targeted local bond index return",

title_fontsize=20,

figsize=(14, 10),

prob_est="map",

subplot_titles=[concept_factors_zn[sig] for sig in sigs],

share_axes=False,

)

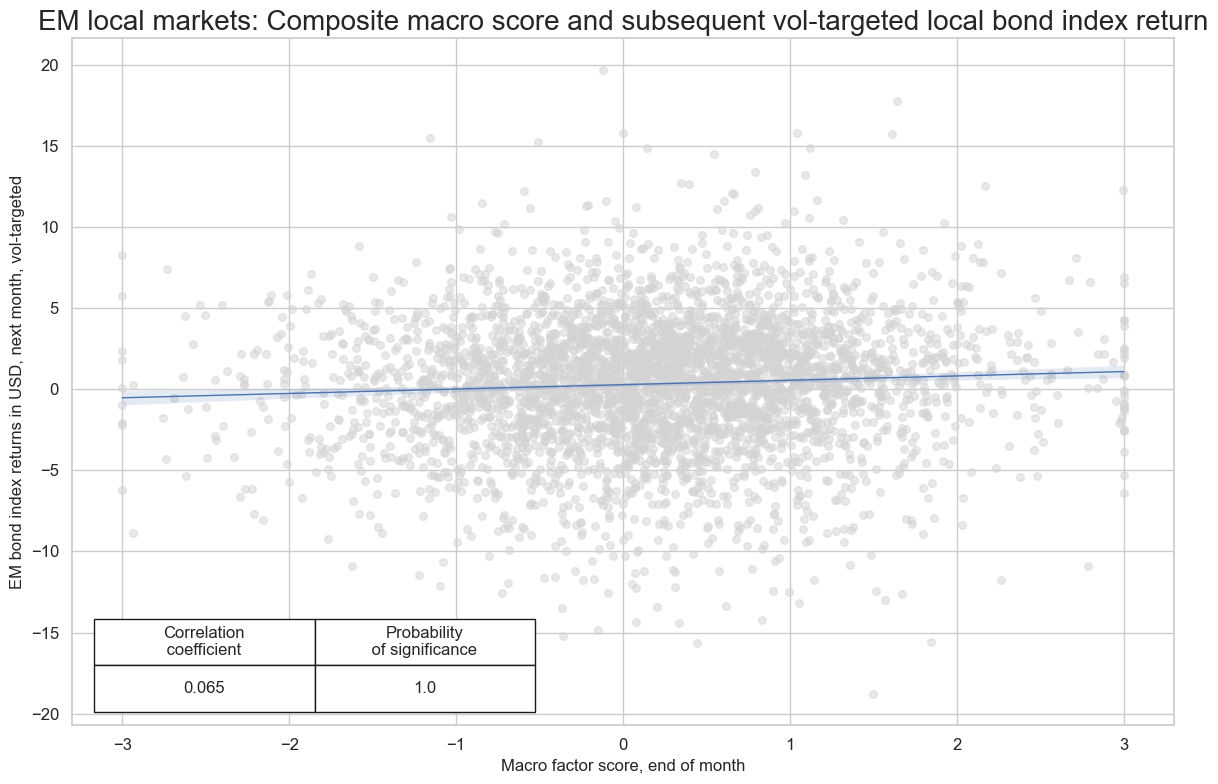

dix = dict_lm

sig = "COMP_ZN"

targ = dix["targ"]

cidx = dix["cidx"]

blax = dix["black"]

start = dix["start"]

crx = msp.CategoryRelations(

dfx,

xcats=[sig, targ],

cids=cidx,

freq="m",

lag=1,

slip=1,

xcat_aggs=["last", "sum"],

start=start,

blacklist=blax,

xcat_trims=[20, 20], # purely for better plot viewing, little impact on results

)

crx.reg_scatter(

labels=False,

coef_box="lower left",

xlab="Macro factor score, end of month",

ylab="EM bond index returns in USD, next month, vol-targeted",

title="EM local markets: Composite macro score and subsequent vol-targeted local bond index return",

title_fontsize=20,

size=(12, 8),

prob_est="map",

)

Accuracy and correlation check #

dix = dict_lm

sigs = dix["sigs"]

targ = dix["targ"]

cidx = dix["cidx"]

blax = dix["black"]

start = dix["start"]

srr = mss.SignalReturnRelations(

dfx,

cids=cidx,

sigs=sigs,

rets=targ,

freqs="M",

start=start,

blacklist=blax,

)

dix["srr"] = srr

dix = dict_lm

srrx = dix["srr"]

display(srrx.multiple_relations_table().round(3))

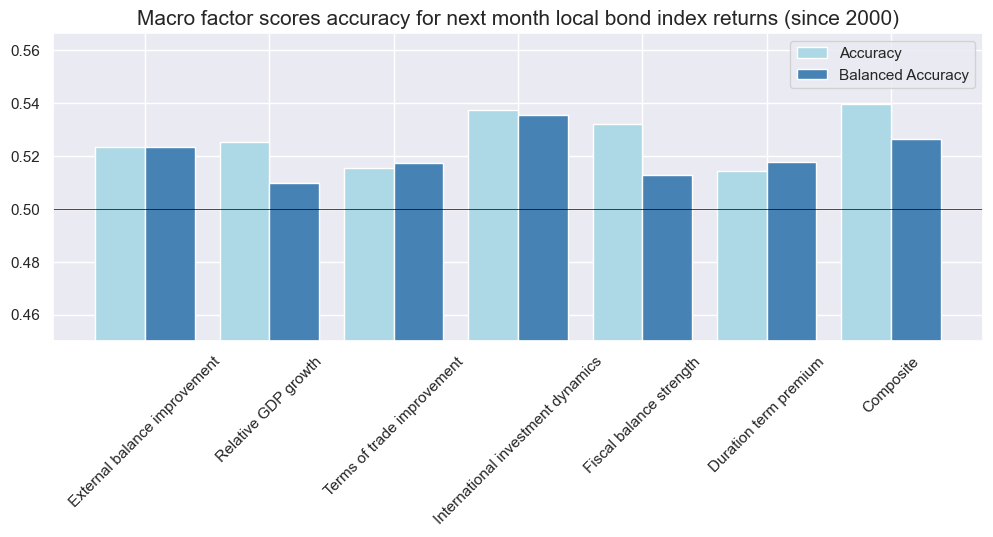

srrx.accuracy_bars(type="signals",

freq="m",

size=(12, 4),

title="Macro factor scores accuracy for next month local bond index returns (since 2000)",

title_fontsize=15,

x_labels=concept_factors_zn,

x_labels_rotate=45,

)

| accuracy | bal_accuracy | pos_sigr | pos_retr | pos_prec | neg_prec | pearson | pearson_pval | kendall | kendall_pval | auc | ||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Return | Signal | Frequency | Aggregation | |||||||||||

| LCBIXRUSD_VT10 | COMP_ZN | M | last | 0.540 | 0.527 | 0.606 | 0.568 | 0.589 | 0.464 | 0.066 | 0.000 | 0.051 | 0.000 | 0.526 |

| DUTP_ZN | M | last | 0.515 | 0.518 | 0.473 | 0.558 | 0.577 | 0.459 | 0.016 | 0.326 | 0.014 | 0.226 | 0.518 | |

| IIPD_ZN | M | last | 0.538 | 0.536 | 0.514 | 0.567 | 0.602 | 0.470 | 0.056 | 0.000 | 0.046 | 0.000 | 0.536 | |

| RGDP_ZN | M | last | 0.525 | 0.510 | 0.626 | 0.565 | 0.572 | 0.447 | 0.029 | 0.075 | 0.022 | 0.039 | 0.509 | |

| TOT_ZN | M | last | 0.515 | 0.517 | 0.486 | 0.568 | 0.586 | 0.449 | 0.037 | 0.020 | 0.027 | 0.012 | 0.518 | |

| XBCH_ZN | M | last | 0.524 | 0.524 | 0.500 | 0.568 | 0.591 | 0.456 | 0.032 | 0.044 | 0.023 | 0.034 | 0.524 | |

| XGBAL_ZN | M | last | 0.532 | 0.513 | 0.651 | 0.568 | 0.577 | 0.449 | 0.005 | 0.744 | 0.010 | 0.348 | 0.512 |

Naive PnLs #

dix = dict_lm

sig = "COMP_ZN"

targ = dix["targ"]

cidx = dix["cidx"]

blax = dix["black"]

start = dix["start"]

pnls = msn.NaivePnL(

df=dfx,

ret=targ,

sigs=[sig],

cids=cidx,

start=sdate,

blacklist=fxblack,

bms=["USD_GB10YXR_NSA", "EUR_FXXR_NSA", "USD_EQXR_NSA"],

)

pnls.make_pnl(

sig=sig,

sig_add=0,

sig_op="raw", # "zn_score_pan",

rebal_freq="monthly",

neutral="zero",

thresh=2,

rebal_slip=1,

vol_scale=10,

pnl_name="PNL0",

)

pnls.make_pnl(

sig=sig,

sig_add=1,

sig_op="zn_score_pan", # "zn_score_pan",

rebal_freq="monthly",

neutral="zero",

thresh=1,

rebal_slip=1,

vol_scale=10,

pnl_name="PNL1",

winsorize_first=True,

)

pnls.make_long_pnl(vol_scale=10, label="Risk parity")

dix["pnls"] = pnls

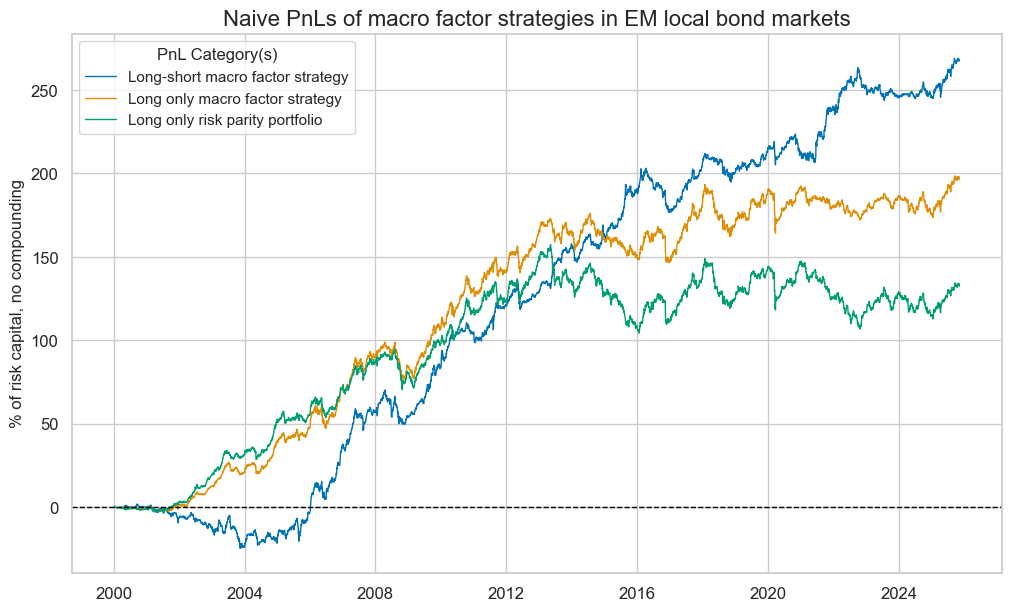

pnls = dix["pnls"]

pnl_labels = {

"PNL0": "Long-short macro factor strategy",

"PNL1": "Long only macro factor strategy",

"Risk parity": "Long only risk parity portfolio",

}

pnls.plot_pnls(

title="Naive PnLs of macro factor strategies in EM local bond markets",

title_fontsize=16,

figsize=(12, 7),

xcat_labels=pnl_labels,

)

display(pnls.evaluate_pnls(["PNL0", "PNL1", "Risk parity"]))

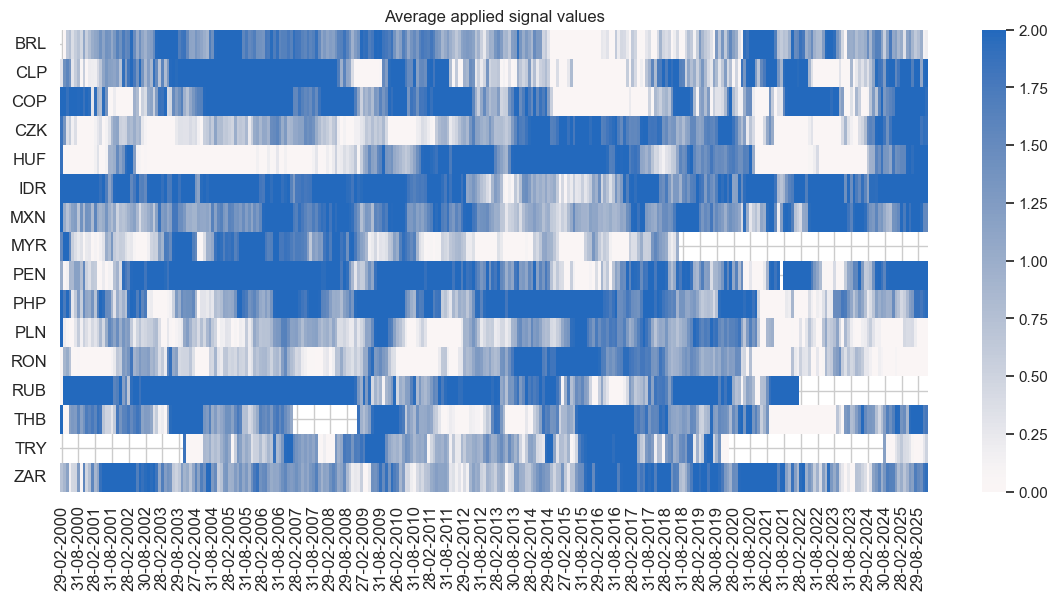

pnls.signal_heatmap(

pnl_name="PNL1",

freq="M",

title="Average applied signal values",

title_fontsize=None,

figsize=(14, 6)

)

| xcat | PNL0 | PNL1 | Risk parity |

|---|---|---|---|

| Return % | 10.410447 | 7.645079 | 5.130162 |

| St. Dev. % | 10.0 | 10.0 | 10.0 |

| Sharpe Ratio | 1.041045 | 0.764508 | 0.513016 |

| Sortino Ratio | 1.526962 | 1.075313 | 0.710554 |

| Max 21-Day Draw % | -16.146929 | -22.946575 | -22.638608 |

| Max 6-Month Draw % | -18.377232 | -24.691496 | -25.167761 |

| Peak to Trough Draw % | -26.572656 | -31.286012 | -53.009082 |

| Top 5% Monthly PnL Share | 0.520985 | 0.631905 | 0.902861 |

| USD_GB10YXR_NSA correl | -0.027386 | 0.023568 | 0.038606 |

| EUR_FXXR_NSA correl | 0.128432 | 0.526235 | 0.575365 |

| USD_EQXR_NSA correl | 0.079573 | 0.243739 | 0.257852 |

| Traded Months | 311 | 311 | 311 |

cids_em

['BRL',

'CLP',

'COP',

'CZK',

'HUF',

'IDR',

'MXN',

'MYR',

'PEN',

'PHP',

'PLN',

'RON',

'RUB',

'THB',

'TRY',

'ZAR']

dix = dict_lm

sigs = sigs = list(set(dix["sigs"]) - set(["COMP_ZN"]))

ret = dix["targ"]

cidx = dix["cidx"]

blax = dix["black"]

start = dix["start"]

single_pnls = msn.NaivePnL(

df=dfx,

ret=targ,

sigs=sigs,

cids=cidx,

start=start,

blacklist=blax,

bms=["USD_GB10YXR_NSA", "EUR_FXXR_NSA", "USD_EQXR_NSA"],

)

for sig in sigs:

single_pnls.make_pnl(

sig=sig,

sig_op="raw",

rebal_freq="monthly",

neutral="zero",

thresh=2,

rebal_slip=1,

vol_scale=10,

)

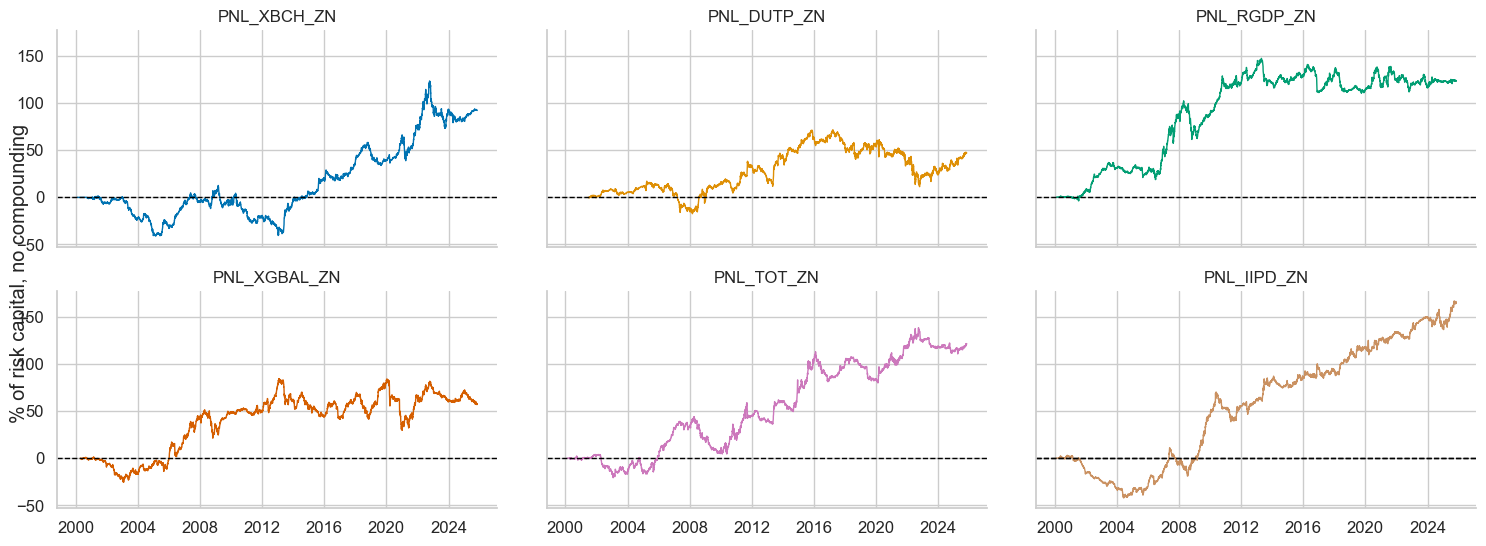

single_pnls.plot_pnls(

title=None,

title_fontsize=18,

xcat_labels=None,

facet=True,

figsize=(12, 10)

)