Diversified trend following in emerging FX markets #

Get packages and JPMaQS data #

# Set up environment

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

import seaborn as sns

from scipy.stats import norm

import itertools

import macrosynergy.management as msm

import macrosynergy.panel as msp

import macrosynergy.signal as mss

import macrosynergy.pnl as msn

import macrosynergy.visuals as msv

from macrosynergy.download import JPMaQSDownload

from macrosynergy.management.utils import merge_categories

from datetime import timedelta, date, datetime

from itertools import combinations

import warnings

import os

warnings.simplefilter("ignore")

# Cross section lists

cids_g3 = ["EUR", "JPY", "USD"] # DM large currency areas

cids_dmsc = ["AUD", "CAD", "CHF", "GBP", "NOK", "NZD", "SEK"] # DM small currency areas

cids_latm = ["BRL", "COP", "CLP", "MXN", "PEN"] # Latam

cids_emea = ["CZK", "HUF", "ILS", "PLN", "RON", "RUB", "TRY", "ZAR"] # EMEA

cids_emas = ["IDR", "INR", "KRW", "MYR", "PHP", "THB", "TWD"] # EM Asia ex China

cids_dm = cids_g3 + cids_dmsc

cids_em = cids_latm + cids_emea + cids_emas

cids = cids_dm + cids_em

cids.sort()

# FX cross-section lists

cids_nofx = ["EUR", "USD", "RUB"] # not suitable for analysis

cids_fx = list(set(cids) - set(cids_nofx))

cids_fx.sort()

cids_dmfx = list(set(cids_dm).intersection(cids_fx))

cids_dmfx.sort()

cids_emfx = list(set(cids_em).intersection(cids_fx))

cids_emfx.sort()

cids_eur = ["CHF", "CZK", "HUF", "NOK", "PLN", "RON", "SEK"] # trading against EUR

cids_eud = ["GBP", "TRY"] # trading against EUR and USD

cids_usd = list(set(cids_fx) - set(cids_eur + cids_eud)) # trading against USD

# Category lists

xbts = [ # long-term trends

"MTBGDPRATIO_SA_3MMAv60MMA",

"CABGDPRATIO_SA_3MMAv60MMA",

"CABGDPRATIO_SA_1QMAv20QMA",

]

xbds = [ # shorter-term dynamcis

"MTBGDPRATIO_SA_3MMA_D1M1ML3",

"MTBGDPRATIO_SA_6MMA_D1M1ML6",

"CABGDPRATIO_SA_3MMA_D1M1ML3",

"CABGDPRATIO_SA_1QMA_D1Q1QL1"

]

xbs = xbts + xbds

niip = [ # NIIP

"NIIPGDP_NSA_D1M1ML12",

"NIIPGDP_NSA_D1Mv2YMA",

"NIIPGDP_NSA_D1Mv5YMA",

]

il = [ # International Liabilities

"IIPLIABGDP_NSA_D1M1ML12",

"IIPLIABGDP_NSA_D1Mv2YMA",

"IIPLIABGDP_NSA_D1Mv5YMA",

]

nils = niip + il

gdp = [

# Intutive growth estimates

"INTRGDP_NSA_P1M1ML12_3MMA",

"INTRGDPv5Y_NSA_P1M1ML12_3MMA",

"INTRGDP_NSA_P1M1ML12_D3M3ML3",

# Technical growth estimates

"RGDPTECH_SA_P1M1ML12_3MMA",

"RGDPTECHv5Y_SA_P1M1ML12_3MMA",

"RGDPTECH_SA_P1M1ML12_D3M3ML3",

]

# Excess inflation

cpi = [

"CPIH_SA_P1M1ML12",

"CPIH_SJA_P6M6ML6AR",

"CPIC_SA_P1M1ML12",

"CPIC_SJA_P6M6ML6AR",

]

cpi_aux = [

"INFTEFF_NSA",

"INFTARGET_NSA",

"INFE2Y_JA"

]

inf = cpi + cpi_aux

reer = [ # Real appreciation

"REER_NSA_P1M12ML1",

"REER_NSA_P1M60ML1"

]

pcr = [

"PCREDITBN_SJA_P1M1ML12",

"PCREDITGDP_SJA_D1M1ML12"

]

exp = [

"EXPORTS_SA_P1M1ML12_3MMA",

"EXPORTS_SA_P6M6ML6AR",

]

oth = reer + pcr + exp

main = xbs + nils + gdp + inf + oth

rets = [

"FXXR_NSA",

"FXXR_VT10",

"FXCRY_NSA",

"EQXR_NSA",

"FXTARGETED_NSA",

"FXUNTRADABLE_NSA",

]

xcats = main + rets

# Resultant tickers

tickers = [cid + "_" + xcat for cid in cids for xcat in xcats]

print(f"Maximum number of tickers is {len(tickers)}")

Maximum number of tickers is 1140

# Download series from J.P. Morgan DataQuery by tickers

start_date = "1998-01-01"

end_date = None

# Retrieve credentials

client_id: str = os.getenv("DQ_CLIENT_ID")

client_secret: str = os.getenv("DQ_CLIENT_SECRET")

with JPMaQSDownload(client_id=client_id, client_secret=client_secret) as dq:

df = dq.download(

tickers=tickers,

start_date=start_date,

end_date=end_date,

suppress_warning=True,

metrics=["value"],

report_time_taken=True,

show_progress=True,

)

Downloading data from JPMaQS.

Timestamp UTC: 2025-10-23 16:09:02

Connection successful!

Requesting data: 100%|██████████| 57/57 [00:11<00:00, 4.94it/s]

Downloading data: 100%|██████████| 57/57 [01:49<00:00, 1.93s/it]

Time taken to download data: 125.65 seconds.

Some expressions are missing from the downloaded data. Check logger output for complete list.

79 out of 1140 expressions are missing. To download the catalogue of all available expressions and filter the unavailable expressions, set `get_catalogue=True` in the call to `JPMaQSDownload.download()`.

dfx = df.copy()

dfx.info()

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 7151073 entries, 0 to 7151072

Data columns (total 4 columns):

# Column Dtype

--- ------ -----

0 real_date datetime64[ns]

1 cid object

2 xcat object

3 value float64

dtypes: datetime64[ns](1), float64(1), object(2)

memory usage: 218.2+ MB

Blacklist, renamings, and availability check #

Blacklist dictionary #

dfb = df[df["xcat"].isin(["FXTARGETED_NSA", "FXUNTRADABLE_NSA"])].loc[

:, ["cid", "xcat", "real_date", "value"]

]

dfba = (

dfb.groupby(["cid", "real_date"])

.aggregate(value=pd.NamedAgg(column="value", aggfunc="max"))

.reset_index()

)

dfba["xcat"] = "FXBLACK"

fxblack = msp.make_blacklist(dfba, "FXBLACK")

fxblack

{'BRL': (Timestamp('2012-12-03 00:00:00'), Timestamp('2013-09-30 00:00:00')),

'CHF': (Timestamp('2011-10-03 00:00:00'), Timestamp('2015-01-30 00:00:00')),

'CZK': (Timestamp('2014-01-01 00:00:00'), Timestamp('2017-07-31 00:00:00')),

'ILS': (Timestamp('1999-01-01 00:00:00'), Timestamp('2005-12-30 00:00:00')),

'INR': (Timestamp('1999-01-01 00:00:00'), Timestamp('2004-12-31 00:00:00')),

'MYR_1': (Timestamp('1999-01-01 00:00:00'), Timestamp('2007-11-30 00:00:00')),

'MYR_2': (Timestamp('2018-07-02 00:00:00'), Timestamp('2025-10-22 00:00:00')),

'PEN': (Timestamp('2021-07-01 00:00:00'), Timestamp('2021-07-30 00:00:00')),

'RON': (Timestamp('1999-01-01 00:00:00'), Timestamp('2005-11-30 00:00:00')),

'RUB_1': (Timestamp('1999-01-01 00:00:00'), Timestamp('2005-11-30 00:00:00')),

'RUB_2': (Timestamp('2022-02-01 00:00:00'), Timestamp('2025-10-22 00:00:00')),

'THB': (Timestamp('2007-01-01 00:00:00'), Timestamp('2008-11-28 00:00:00')),

'TRY_1': (Timestamp('1999-01-01 00:00:00'), Timestamp('2003-09-30 00:00:00')),

'TRY_2': (Timestamp('2020-01-01 00:00:00'), Timestamp('2024-07-31 00:00:00'))}

Availability check #

# Replace quarterly tickers with approximately equivalent monthly tickers

dict_repl = {

"CABGDPRATIO_SA_1QMAv20QMA": "CABGDPRATIO_SA_3MMAv60MMA",

"CABGDPRATIO_SA_1QMA_D1Q1QL1": "CABGDPRATIO_SA_3MMA_D1M1ML3",

}

dfx["xcat"] = dfx["xcat"].replace(dict_repl, regex=False)

xcatx = [xb for xb in xbs if xb not in dict_repl.keys()]

cidx = cids

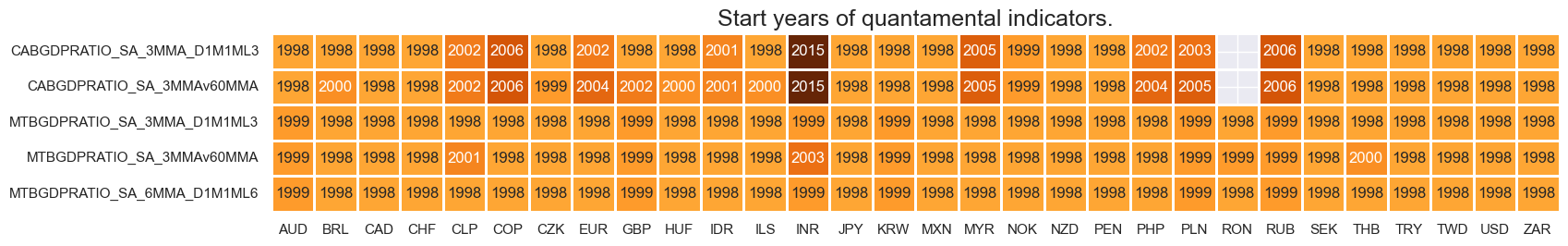

msm.check_availability(dfx, xcats=xcatx, cids=cidx, missing_recent=False)

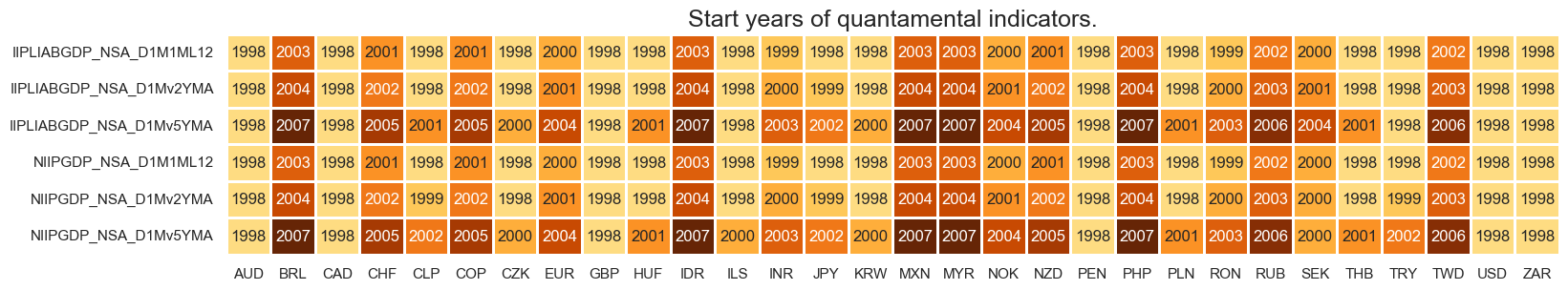

xcatx = nils

cidx = cids

msm.check_availability(dfx, xcats=xcatx, cids=cidx, missing_recent=False)

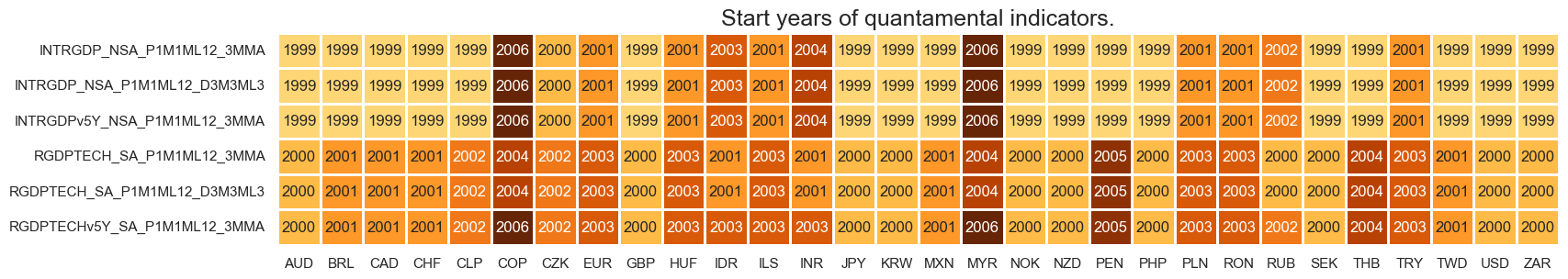

xcatx = gdp

cidx = cids

msm.check_availability(dfx, xcats=xcatx, cids=cidx, missing_recent=False)

xcatx = inf

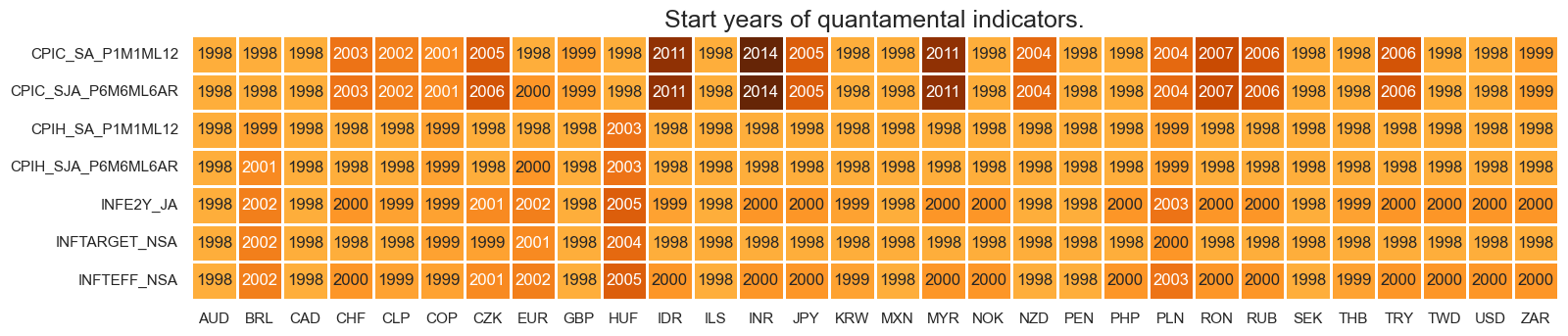

cidx = cids

msm.check_availability(dfx, xcats=xcatx, cids=cidx, missing_recent=False)

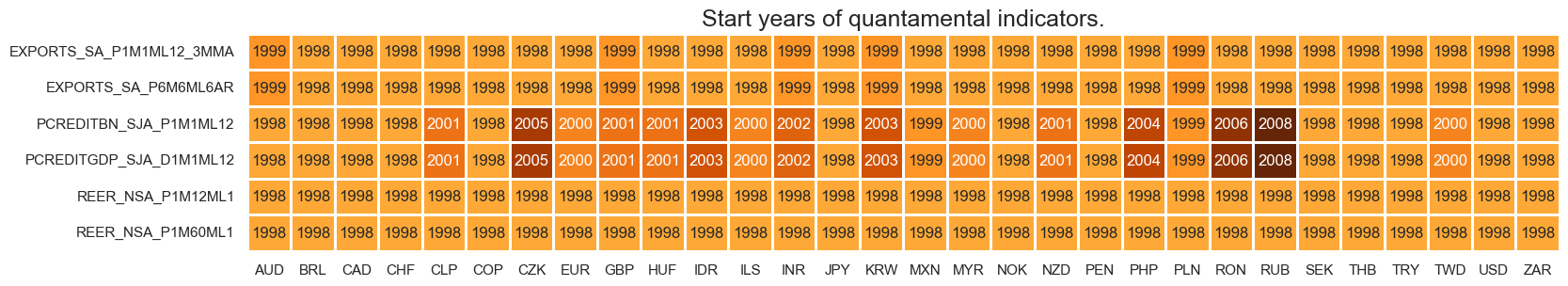

xcatx = oth

cidx = cids

msm.check_availability(dfx, xcats=xcatx, cids=cidx, missing_recent=False)

Feature engineering and checks #

External balance trends #

# Indicator list and visualization

xbx = [

"MTBGDPRATIO_SA_3MMAv60MMA",

"CABGDPRATIO_SA_3MMAv60MMA",

"MTBGDPRATIO_SA_3MMA_D1M1ML3",

"MTBGDPRATIO_SA_6MMA_D1M1ML6",

]

xcatx = xbx

cidx = cids_fx

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

start="2000-01-01",

same_y=False,

height=2.2,

size=(10, 10),

all_xticks=True,

)

# Indicator scores

xcatx = xbx # shorter term dynamics

cidx = cids_fx

dfa = pd.DataFrame(columns=dfx.columns)

for xc in xcatx:

dfaa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=522, # oos scaling after 2 years of panel data

est_freq="m",

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

# Weighted factor score

dict_indx = {

"MTBGDPRATIO_SA_3MMA_D1M1ML3_ZN": 1 / 4,

"MTBGDPRATIO_SA_6MMA_D1M1ML6_ZN": 1 / 4,

"MTBGDPRATIO_SA_3MMAv60MMA_ZN": 1 / 4,

"CABGDPRATIO_SA_3MMAv60MMA_ZN": 1 / 4,

}

fact = "XBTREND"

xcatx = list(dict_indx.keys())

weights = list(dict_indx.values())

cidx = cids_fx

# Create weighted composite

dfa = msp.linear_composite(

dfx,

xcats=xcatx,

weights=weights,

cids=cidx,

complete_xcats=False,

new_xcat=fact,

)

dfx = msm.update_df(dfx, dfa)

# Re-score the composite factor

dfa = msp.make_zn_scores(

dfx,

xcat=fact,

cids=cidx,

sequential=True,

min_obs=522, # oos scaling after 2 years of panel data

est_freq="m",

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

)

dfx = msm.update_df(dfx, dfa)

# Visualize factor score

msp.view_timelines(

dfx,

xcats=[fact + "_ZN"],

cids=cidx,

ncol=4,

start="2000-01-01",

same_y=True,

height=2.2,

size=(10, 10),

all_xticks=True,

)

International investment trends #

# Change sign of liability growth

xcatx = nils

cidx = cids_fx

calcs = []

for xc in xcatx:

if "IIPLIABGDP" in xc:

calcs.append(f"{xc}_NEG = - {xc}")

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cidx)

dfx = msm.update_df(dfx, dfa)

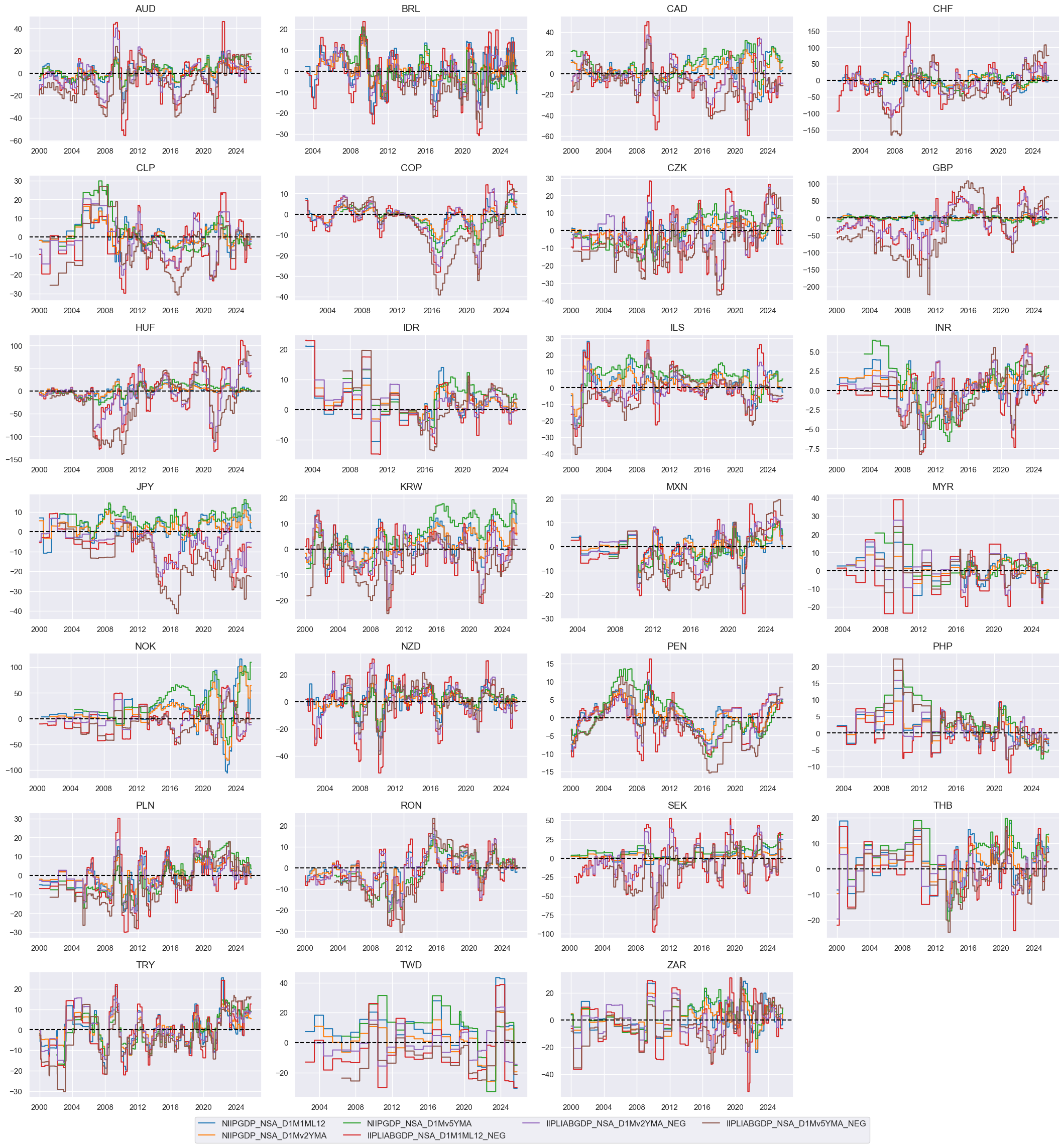

# Indicator list and visualization

nilx = [

"NIIPGDP_NSA_D1M1ML12",

"NIIPGDP_NSA_D1Mv2YMA",

"NIIPGDP_NSA_D1Mv5YMA",

"IIPLIABGDP_NSA_D1M1ML12_NEG",

"IIPLIABGDP_NSA_D1Mv2YMA_NEG",

"IIPLIABGDP_NSA_D1Mv5YMA_NEG",

]

xcatx = nilx

cidx = cids_fx

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

start="2000-01-01",

same_y=False,

height=2.2,

size=(10, 10),

all_xticks=True,

)

# Indicator scores

xcatx = nilx # shorter term dynamics

cidx = cids_fx

dfa = pd.DataFrame(columns=dfx.columns)

for xc in xcatx:

dfaa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=522, # oos scaling after 2 years of panel data

est_freq="m",

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

# Weighted factor score

dict_indx = {

"NIIPGDP_NSA_D1M1ML12_ZN": 1 / 6,

"NIIPGDP_NSA_D1Mv2YMA_ZN": 1 / 6,

"NIIPGDP_NSA_D1Mv5YMA_ZN": 1 / 6,

"IIPLIABGDP_NSA_D1M1ML12_NEG_ZN": 1 / 6,

"IIPLIABGDP_NSA_D1Mv2YMA_NEG_ZN": 1 / 6,

"IIPLIABGDP_NSA_D1Mv5YMA_NEG_ZN": 1 / 6,

}

fact = "IITREND"

xcatx = list(dict_indx.keys())

weights = list(dict_indx.values())

cidx = cids_fx

# Create weighted composite

dfa = msp.linear_composite(

dfx,

xcats=xcatx,

weights=weights,

cids=cidx,

complete_xcats=False,

new_xcat=fact,

)

dfx = msm.update_df(dfx, dfa)

# Re-score the composite factor

dfa = msp.make_zn_scores(

dfx,

xcat=fact,

cids=cidx,

sequential=True,

min_obs=522, # oos scaling after 2 years of panel data

est_freq="m",

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

)

dfx = msm.update_df(dfx, dfa)

# Visualize factor score

msp.view_timelines(

dfx,

xcats=[fact + "_ZN"],

cids=cidx,

ncol=4,

start="2000-01-01",

same_y=True,

height=2.2,

size=(10, 10),

all_xticks=True,

)

Relative excess inflation rates #

# Backward-extension of INFTARGET_NSA

# Duplicate targets

cidx = cids

calcs = [f"INFTARGET_BX = INFTARGET_NSA"]

dfa = msp.panel_calculator(dfx, calcs, cids=cidx)

# Add all dates back to 1990 to the frame, filling "value " with NaN

all_dates = np.sort(dfx['real_date'].unique())

all_combinations = pd.DataFrame(

list(itertools.product(dfa['cid'].unique(), dfa['xcat'].unique(), all_dates)),

columns=['cid', 'xcat', 'real_date']

)

dfax = pd.merge(all_combinations, dfa, on=['cid', 'xcat', 'real_date'], how='left')

# Backfill the values with first target value

dfax = dfax.sort_values(by=['cid', 'xcat', 'real_date'])

dfax['value'] = dfax.groupby(['cid', 'xcat'])['value'].bfill()

dfx = msm.update_df(dfx, dfax)

# Extended effective inflation target by hierarchical merging

hierarchy = ["INFTEFF_NSA", "INFTARGET_BX"]

dfa = merge_categories(dfx, xcats=hierarchy, new_xcat="INFTEFF_BX")

dfx = msm.update_df(dfx, dfa)

# Excess inflation rates relative to target inflation - minimum denominator of 2% to avoid extreme values

xcatx = cpi

calcs = [f"X{xc} = ( {xc} - INFTEFF_BX ) / np.clip( INFTEFF_BX , 2 , 9999 )" for xc in xcatx]

dfa = msp.panel_calculator(

dfx,

calcs=calcs,

cids=cids,

)

dfx = msm.update_df(dfx, dfa)

# Relative excess inflation rates

xcatx = cpi

dfa = pd.DataFrame(columns=list(dfx.columns))

for xc in xcatx:

calc_eur = [f"X{xc}vBM = X{xc} - iEUR_X{xc}"]

calc_usd = [f"X{xc}vBM = X{xc} - iUSD_X{xc}"]

calc_eud = [f"X{xc}vBM = X{xc} - 0.5 * ( iEUR_X{xc} + iUSD_X{xc} )"]

dfa_eur = msp.panel_calculator(dfx, calcs=calc_eur, cids=cids_eur)

dfa_usd = msp.panel_calculator(dfx, calcs=calc_usd, cids=cids_usd)

dfa_eud = msp.panel_calculator(dfx, calcs=calc_eud, cids=cids_eud)

dfa = msm.update_df(dfa, pd.concat([dfa_eur, dfa_usd, dfa_eud]))

dfx = msm.update_df(dfx, dfa)

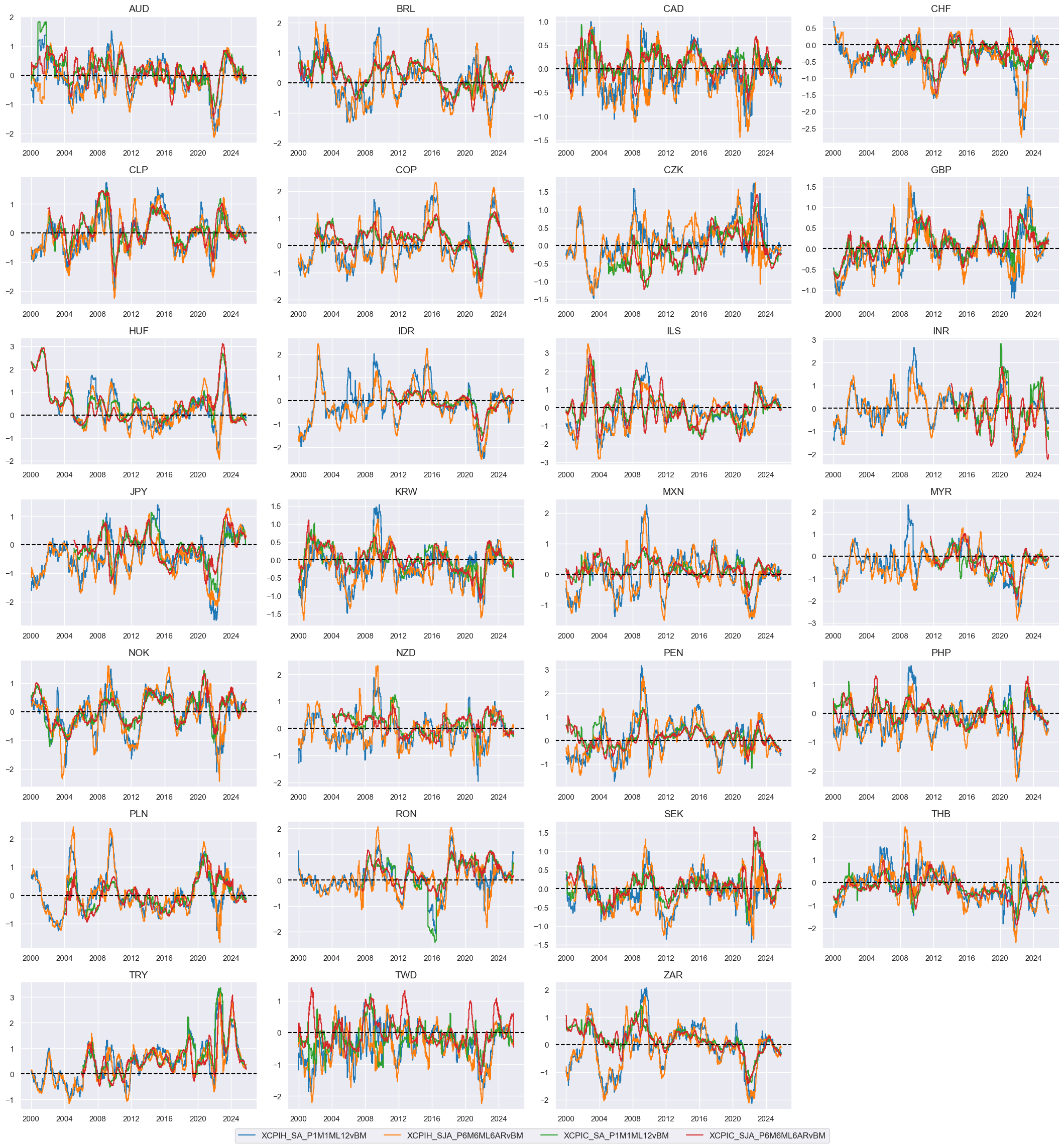

# Indicator list and visualization

rxi = [

"XCPIH_SA_P1M1ML12vBM",

"XCPIH_SJA_P6M6ML6ARvBM",

"XCPIC_SA_P1M1ML12vBM",

"XCPIC_SJA_P6M6ML6ARvBM",

]

xcatx = rxi

cidx = cids_fx

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

start="2000-01-01",

same_y=False,

height=2.2,

size=(10, 10),

all_xticks=True,

)

# Indicator scores

xcatx = rxi

cidx = cids_fx

dfa = pd.DataFrame(columns=dfx.columns)

for xc in xcatx:

dfaa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=522, # oos scaling after 2 years of panel data

est_freq="m",

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

# Weighted factor score

dict_indx = {

"XCPIH_SA_P1M1ML12vBM_ZN": 1 / 4,

"XCPIH_SJA_P6M6ML6ARvBM_ZN": 1 / 4,

"XCPIC_SA_P1M1ML12vBM_ZN": 1 / 4,

"XCPIC_SJA_P6M6ML6ARvBM_ZN": 1 / 4,

}

fact = "RXINFTREND"

xcatx = list(dict_indx.keys())

weights = list(dict_indx.values())

cidx = cids_fx

# Create weighted composite

dfa = msp.linear_composite(

dfx,

xcats=xcatx,

weights=weights,

cids=cidx,

complete_xcats=False,

new_xcat=fact,

)

dfx = msm.update_df(dfx, dfa)

# Re-score the composite factor

dfa = msp.make_zn_scores(

dfx,

xcat=fact,

cids=cidx,

sequential=True,

min_obs=522, # oos scaling after 2 years of panel data

est_freq="m",

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

)

dfx = msm.update_df(dfx, dfa)

# Visualize factor score

msp.view_timelines(

dfx,

xcats=[fact + "_ZN"],

cids=cidx,

ncol=4,

start="2000-01-01",

same_y=True,

height=2.2,

size=(10, 10),

all_xticks=True,

)

Relative growth trends #

# Relative growth rates

grow = [

"INTRGDP_NSA_P1M1ML12_3MMA",

"INTRGDPv5Y_NSA_P1M1ML12_3MMA",

"RGDPTECH_SA_P1M1ML12_3MMA",

"RGDPTECHv5Y_SA_P1M1ML12_3MMA",

]

xcatx = grow

dfa = pd.DataFrame(columns=list(dfx.columns))

for xc in xcatx:

calc_eur = [f"{xc}vBM = {xc} - iEUR_{xc}"]

calc_usd = [f"{xc}vBM = {xc} - iUSD_{xc}"]

calc_eud = [f"{xc}vBM = {xc} - 0.5 * ( iEUR_{xc} + iUSD_{xc} )"]

dfa_eur = msp.panel_calculator(dfx, calcs=calc_eur, cids=cids_eur)

dfa_usd = msp.panel_calculator(dfx, calcs=calc_usd, cids=cids_usd)

dfa_eud = msp.panel_calculator(dfx, calcs=calc_eud, cids=cids_eud)

dfa = msm.update_df(dfa, pd.concat([dfa_eur, dfa_usd, dfa_eud]))

dfx = msm.update_df(dfx, dfa)

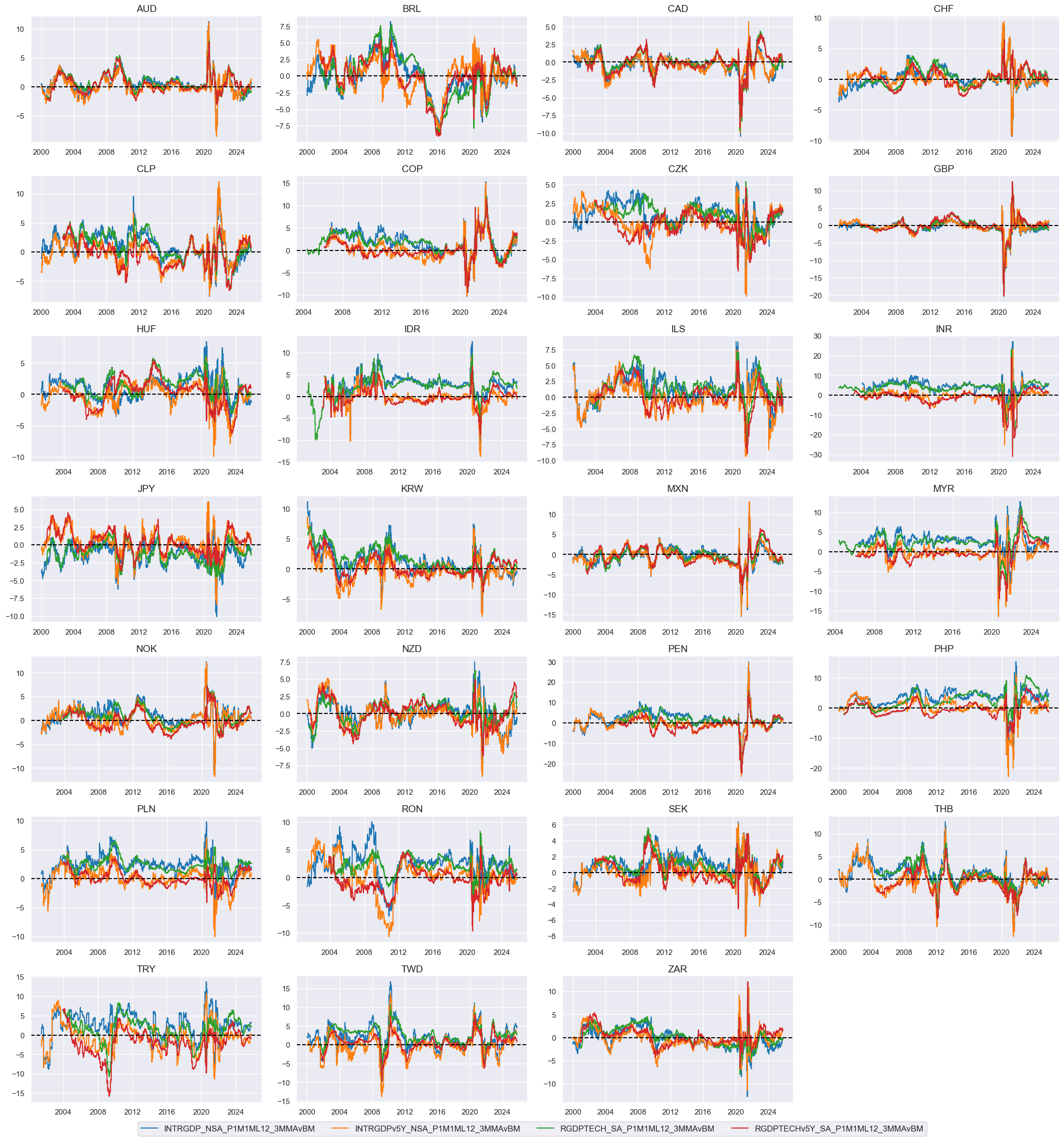

# Indicator list and visualization

rgrow = [g + "vBM" for g in grow]

xcatx = rgrow

cidx = cids_fx

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

start="2000-01-01",

same_y=False,

height=2.2,

size=(10, 10),

all_xticks=True,

)

# Indicator scores

xcatx = rgrow

cidx = cids_fx

dfa = pd.DataFrame(columns=dfx.columns)

for xc in xcatx:

dfaa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=522, # oos scaling after 2 years of panel data

est_freq="m",

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

# Weighted factor score

dict_indx = {

"INTRGDP_NSA_P1M1ML12_3MMAvBM_ZN": 1 / 4,

"INTRGDPv5Y_NSA_P1M1ML12_3MMAvBM_ZN": 1 / 4,

"RGDPTECH_SA_P1M1ML12_3MMAvBM_ZN": 1 / 4,

"RGDPTECHv5Y_SA_P1M1ML12_3MMAvBM_ZN": 1 / 4,

}

fact = "RGDPTREND"

xcatx = list(dict_indx.keys())

weights = list(dict_indx.values())

cidx = cids_fx

# Create weighted composite

dfa = msp.linear_composite(

dfx,

xcats=xcatx,

weights=weights,

cids=cidx,

complete_xcats=False,

new_xcat=fact,

)

dfx = msm.update_df(dfx, dfa)

# Re-score the composite factor

dfa = msp.make_zn_scores(

dfx,

xcat=fact,

cids=cidx,

sequential=True,

min_obs=522, # oos scaling after 2 years of panel data

est_freq="m",

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

)

dfx = msm.update_df(dfx, dfa)

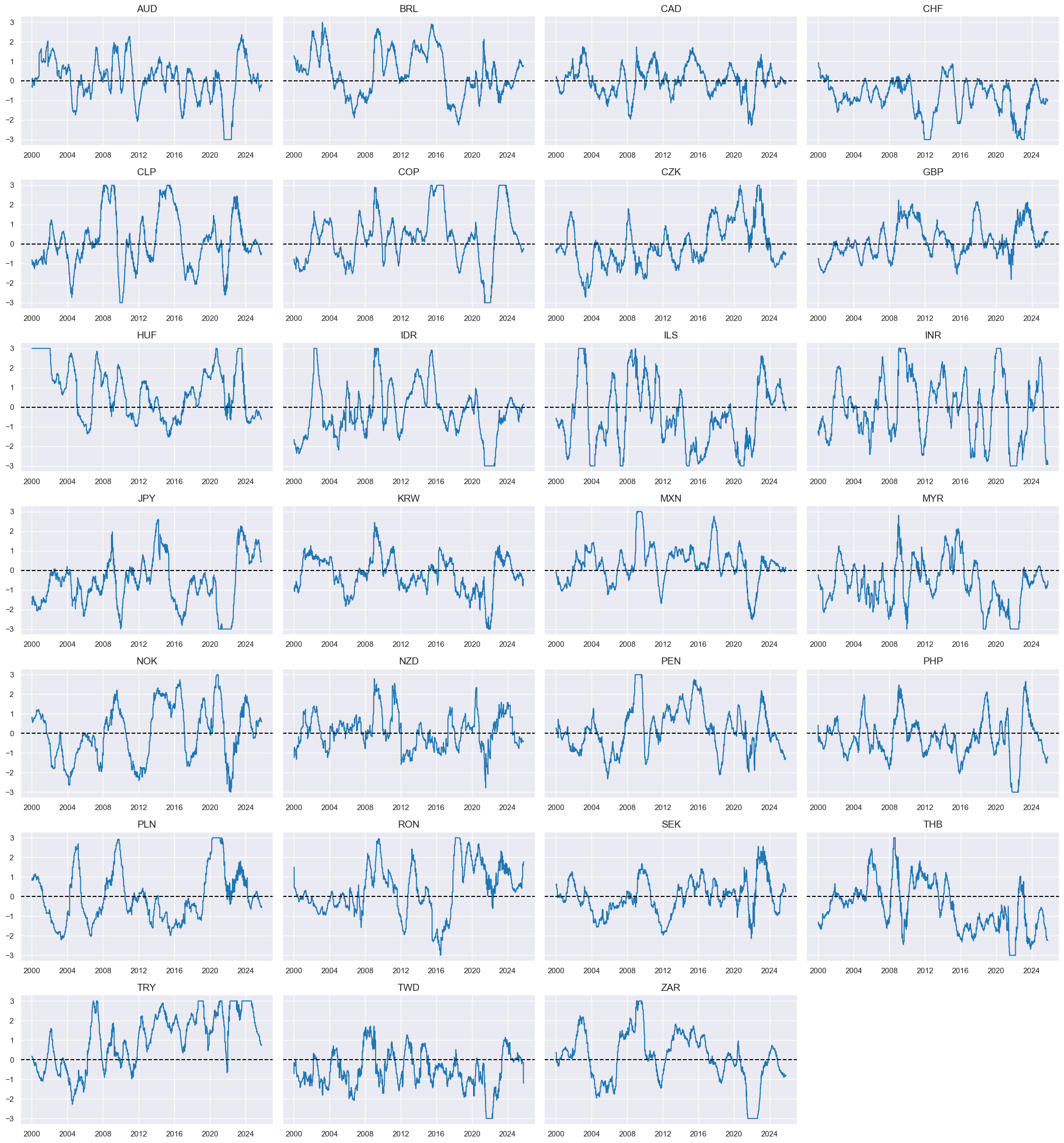

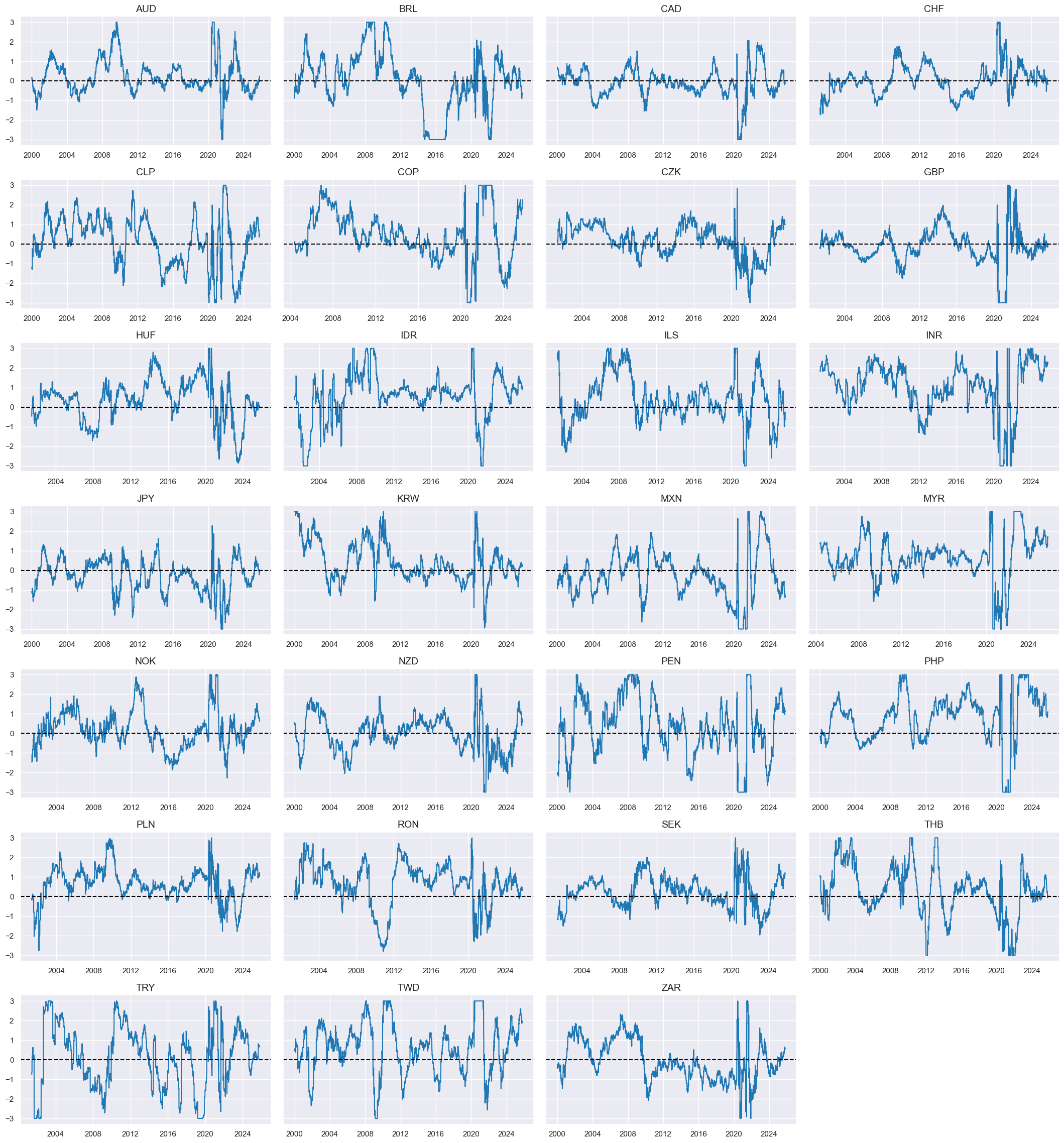

# Visualize factor score

msp.view_timelines(

dfx,

xcats=[fact + "_ZN"],

cids=cidx,

ncol=4,

start="2000-01-01",

same_y=True,

height=2.2,

size=(10, 10),

all_xticks=True,

)

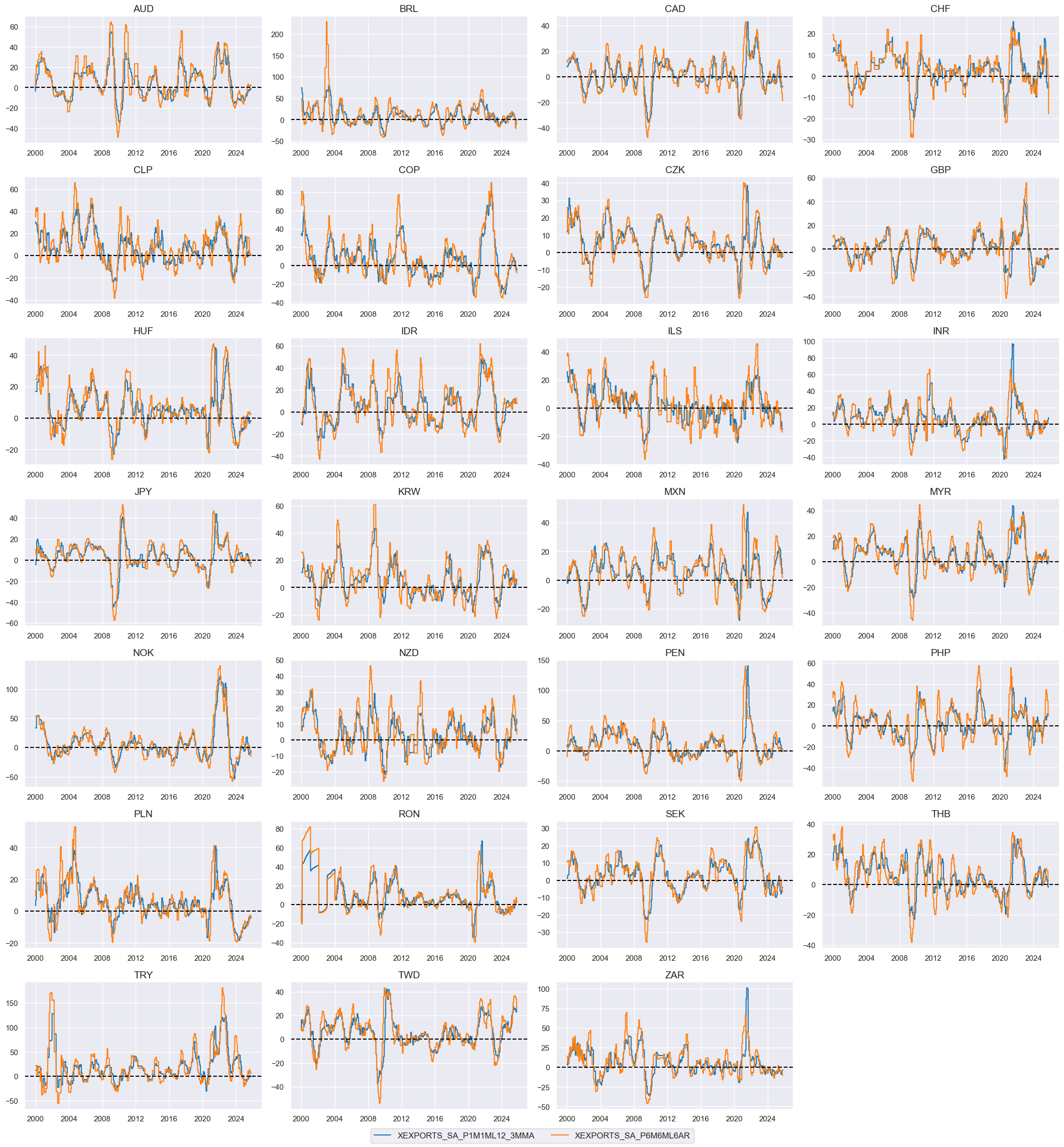

Local-currency currency export growth #

# Excess export growth rates (in excess of inflation target)

lcexp = [

"EXPORTS_SA_P1M1ML12_3MMA",

"EXPORTS_SA_P6M6ML6AR",

]

xcatx = lcexp

calcs = [f"X{xc} = {xc} - ( INFTEFF_BX )" for xc in xcatx]

dfa = msp.panel_calculator(

dfx,

calcs=calcs,

cids=cids,

)

dfx = msm.update_df(dfx, dfa)

xexp = ["X" + xc for xc in lcexp]

xcatx = xexp

cidx = cids_fx

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

start="2000-01-01",

same_y=False,

height=2.2,

size=(10, 10),

all_xticks=True,

)

# Indicator scores

xcatx = xexp

cidx = cids_fx

dfa = pd.DataFrame(columns=dfx.columns)

for xc in xcatx:

dfaa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=522, # oos scaling after 2 years of panel data

est_freq="m",

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

# Weighted factor score

dict_indx = {

"XEXPORTS_SA_P1M1ML12_3MMA_ZN": 1 / 2,

"XEXPORTS_SA_P6M6ML6AR_ZN": 1 / 2,

}

fact = "XEXPTREND"

xcatx = list(dict_indx.keys())

weights = list(dict_indx.values())

cidx = cids_fx

# Create weighted composite

dfa = msp.linear_composite(

dfx,

xcats=xcatx,

weights=weights,

cids=cidx,

complete_xcats=False,

new_xcat=fact,

)

dfx = msm.update_df(dfx, dfa)

# Re-score the composite factor

dfa = msp.make_zn_scores(

dfx,

xcat=fact,

cids=cidx,

sequential=True,

min_obs=522, # oos scaling after 2 years of panel data

est_freq="m",

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

)

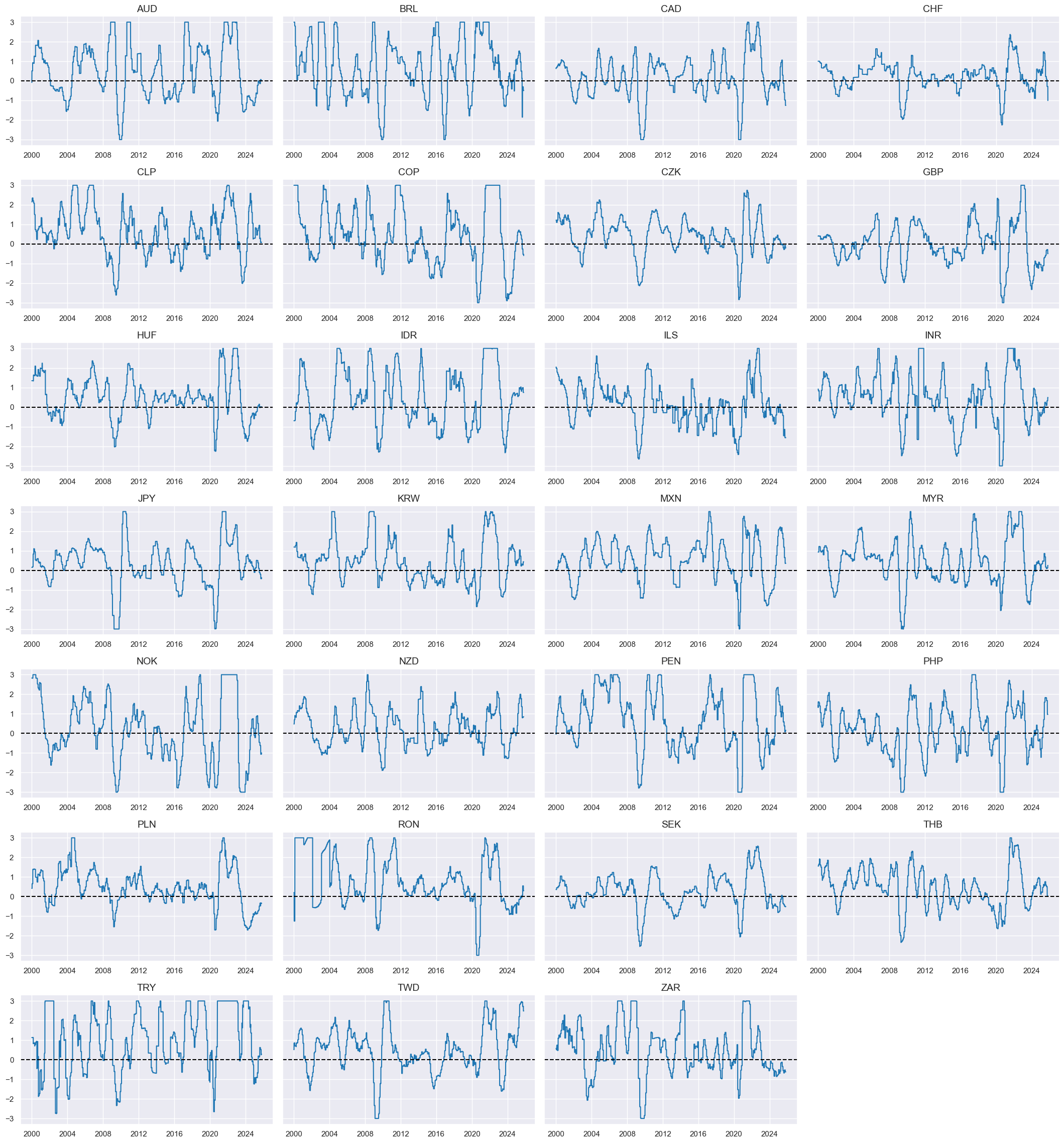

dfx = msm.update_df(dfx, dfa)

# Visualize factor score

msp.view_timelines(

dfx,

xcats=[fact + "_ZN"],

cids=cidx,

ncol=4,

start="2000-01-01",

same_y=True,

height=2.2,

size=(10, 10),

all_xticks=True,

)

Composite macro support scores #

# Weighted linear combinations

factz = [

"XBTREND_ZN",

"IITREND_ZN",

"RGDPTREND_ZN",

"RXINFTREND_ZN",

"XEXPTREND_ZN",

]

xcatx = factz

sdate = "2000-01-01"

new_cat = "MACRO"

cidx = cids_fx

dfa = msp.linear_composite(

dfx,

xcats=xcatx,

cids=cidx,

complete_xcats=False,

start=sdate,

new_xcat=new_cat,

)

dfx = msm.update_df(dfx, dfa)

dfa = msp.make_zn_scores(

dfx,

xcat=new_cat,

cids=cidx,

sequential=True,

min_obs=261 * 5,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZC",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

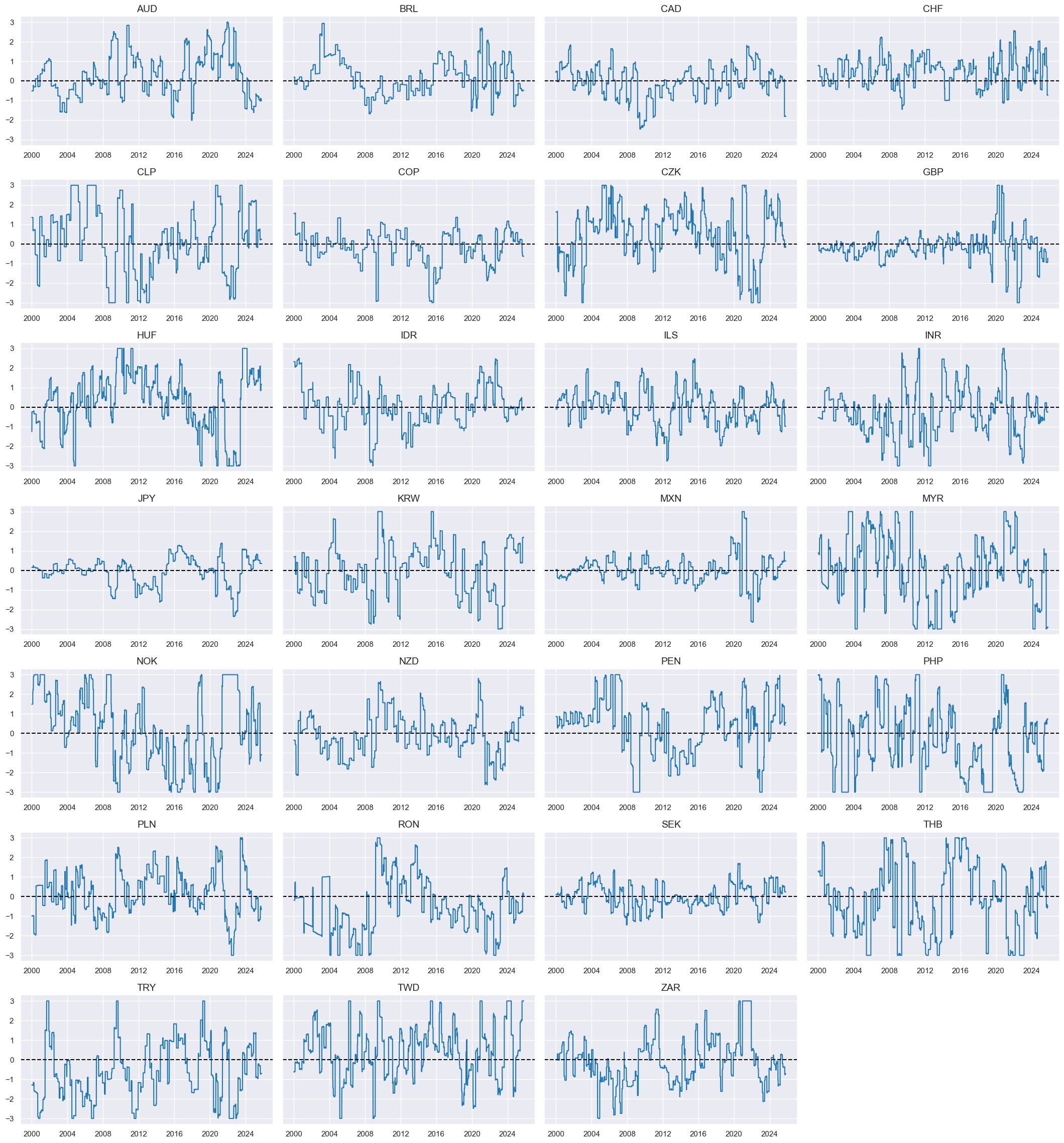

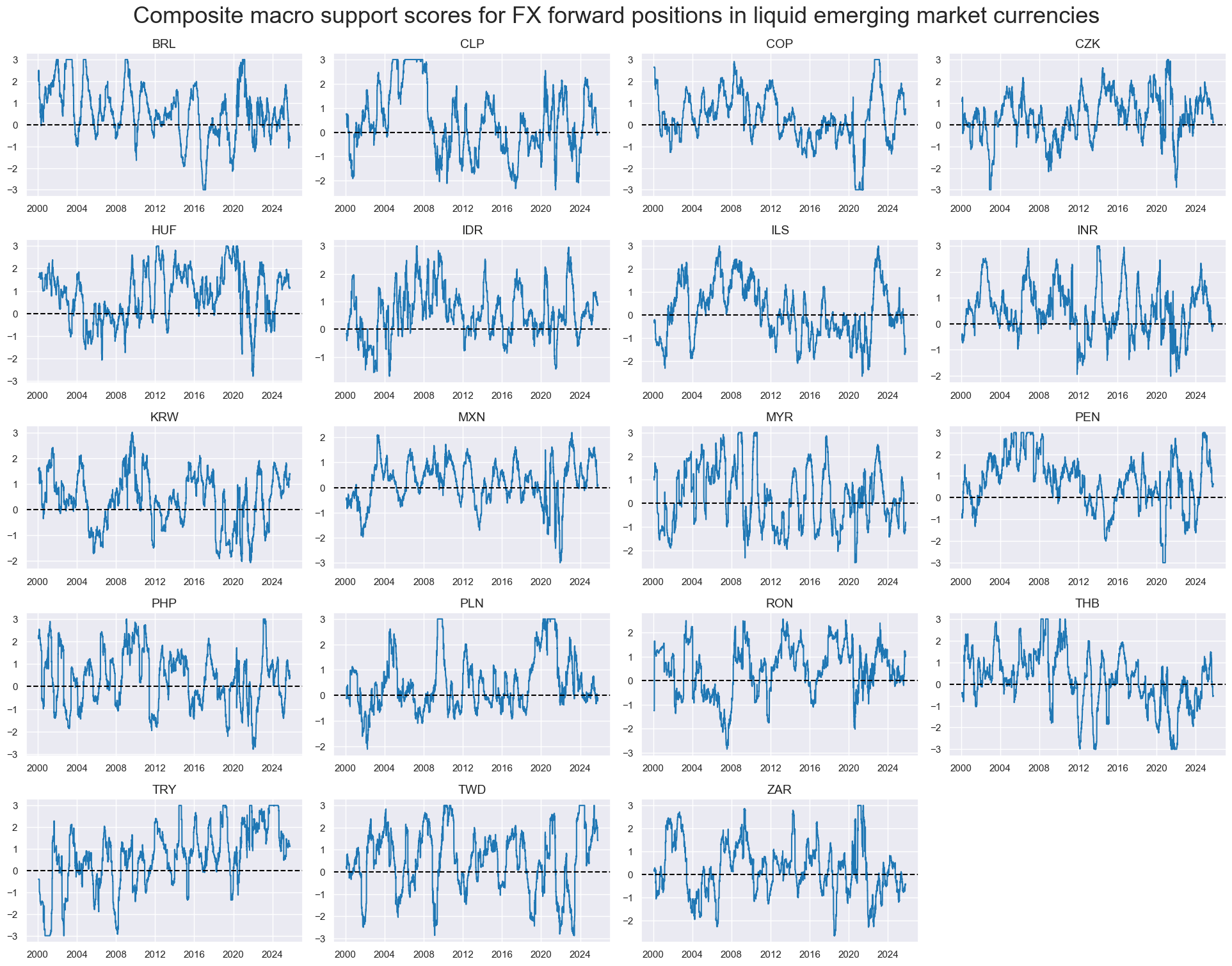

xcatx = ["MACRO_ZC"]

cidx = cids_emfx

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

start="2000-01-01",

same_y=False,

title="Composite macro support scores for FX forward positions in liquid emerging market currencies",

title_fontsize=26,

height=2,

size=(10, 10),

all_xticks=True,

)

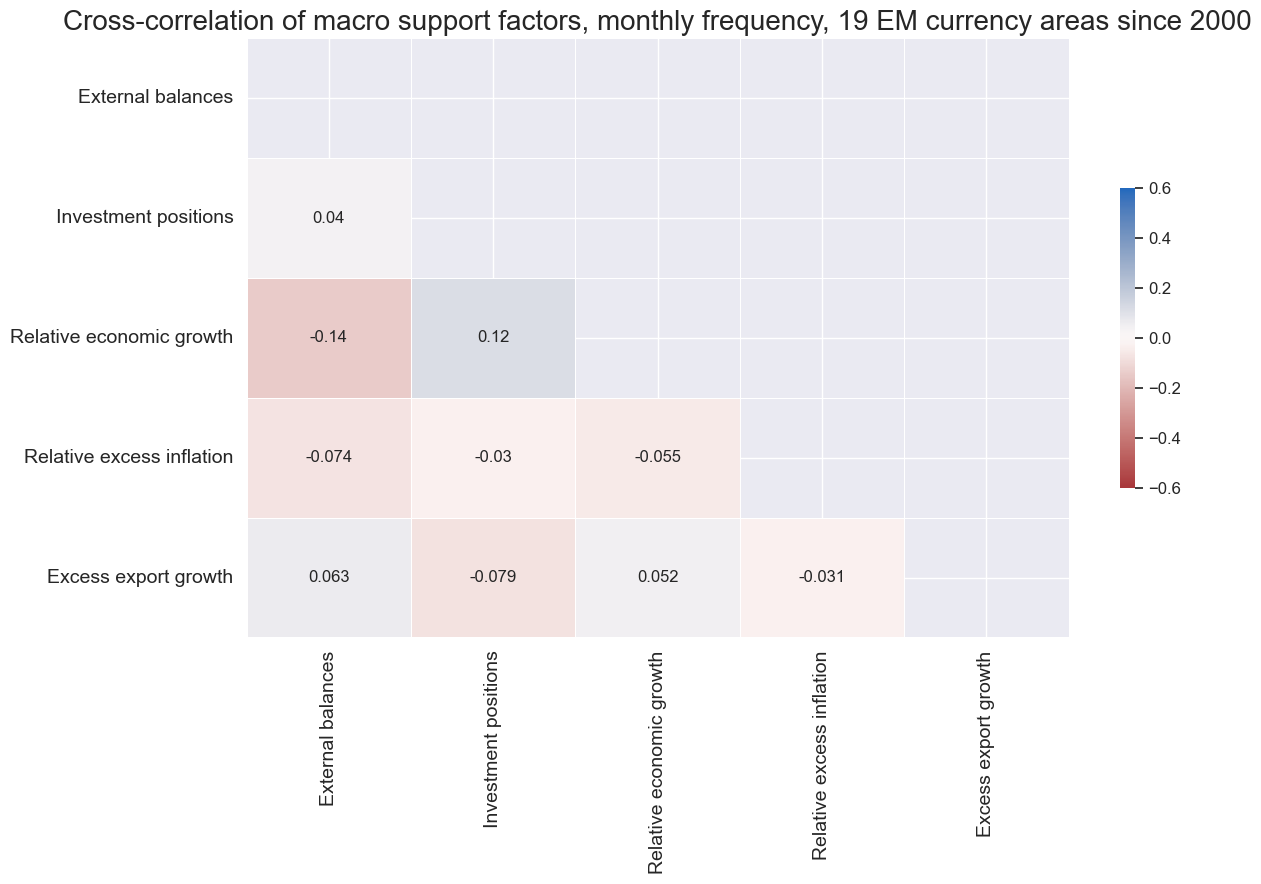

xcatx = factz

factz_labels = {

"XBTREND_ZN": "External balances",

"IITREND_ZN": "Investment positions",

"RGDPTREND_ZN": "Relative economic growth",

"RXINFTREND_ZN": "Relative excess inflation",

"XEXPTREND_ZN": "Excess export growth",

}

msp.correl_matrix(

dfx,

xcats=xcatx,

cids=cidx,

freq="M",

title="Cross-correlation of macro support factors, monthly frequency, 19 EM currency areas since 2000",

title_fontsize=20,

size=(13, 9),

max_color=0.6,

xcat_labels=factz_labels,

show=True,

annot=True

)

Trends #

Robust trends #

# Returns and adjustment scores

fxrs = ["FXXR_NSA"]

scoresz = [

"XBTREND_ZN",

"IITREND_ZN",

"RGDPTREND_ZN",

"RXINFTREND_ZN",

"XEXPTREND_ZN",

"MACRO_ZC",

]

# Creating a function that returns the cdf as dataframe

def norm_cdf_df(df):

"""Apply scipy.stats.norm.cdf to a DataFrame and return a DataFrame."""

return pd.DataFrame(norm.cdf(df.values), index=df.index, columns=df.columns)

# T-stat trend following strategy (Tzotchev, D. (2018).

cidx = cids_fx

lookbacks = [32, 64, 126, 252, 504] # 1.5, 3, 6, 12, 24 months

calcs = []

for fxr in fxrs:

signals = []

for lb in lookbacks:

mean_calc = f"{fxr}_MEAN_{lb} = {fxr}.rolling( {lb} ).mean( )"

std_calc = f"{fxr}_STD_{lb} = {fxr}.rolling( {lb} ).std( ddof=1 )"

tstat_calc = (

f"{fxr}_TSTAT_{lb} = {fxr}_MEAN_{lb} / ( {fxr}_STD_{lb} / np.sqrt( {lb} ) )"

)

prob_calc = f"{fxr}_PROB_{lb} = norm_cdf_df( {fxr}_TSTAT_{lb} )"

signal_calc = f"{fxr}_SIGNAL_{lb} = 2 * {fxr}_PROB_{lb} - 1"

signals.append( f"{fxr}_SIGNAL_{lb}" )

calcs += [mean_calc, std_calc, tstat_calc, prob_calc, signal_calc]

composite_signal = f"{fxr}_RTS = ( {' + '.join(signals)} ) / {len(lookbacks)}"

calcs.append(composite_signal)

# Calculate the signals

dfa = msp.panel_calculator(dfx, calcs, cids=cidx, blacklist=fxblack, external_func={"norm_cdf_df": norm_cdf_df})

dfx = msm.update_df(dfx, dfa)

# Rename trends for simplicity

dict_rename = {

"FXXR_NSA_RTS": "ROBFXR_TREND",

"FXNA_NSA_RTS": "ROBFNA_TREND",

}

dfx["xcat"] = dfx["xcat"].replace(dict_rename, regex=True)

# Composite signals names:

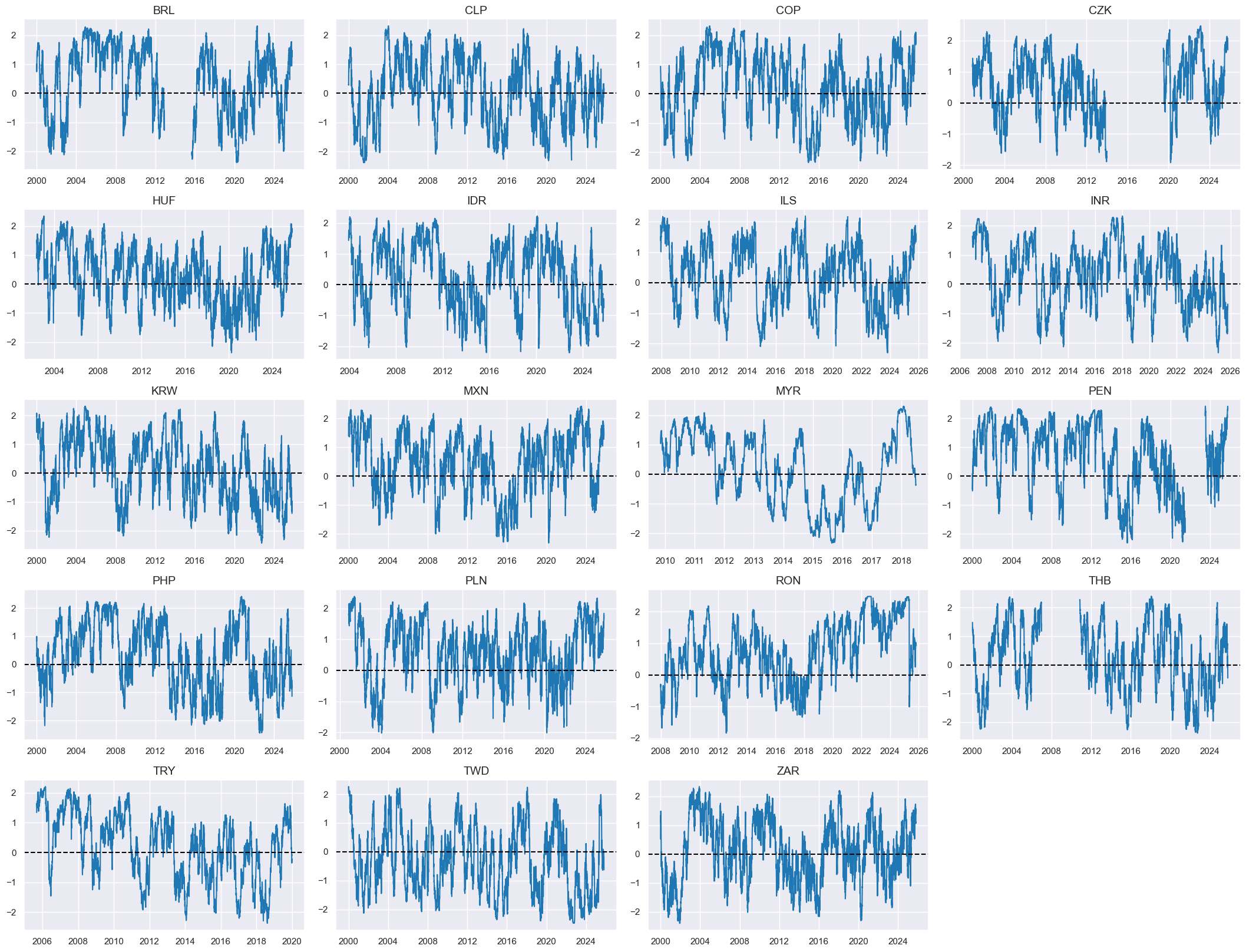

robtrends = ["ROBFXR_TREND"]

# Normalize trend signals sequentially (for modification)

xcatx = robtrends

cidx = cids_fx

for xc in xcatx:

dfaa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=522, # oos scaling after 2 years of panel data

est_freq="m",

neutral="zero",

pan_weight=1,

thresh=3,

postfix="Z",

)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

robtrends = [tr + "Z" for tr in robtrends]

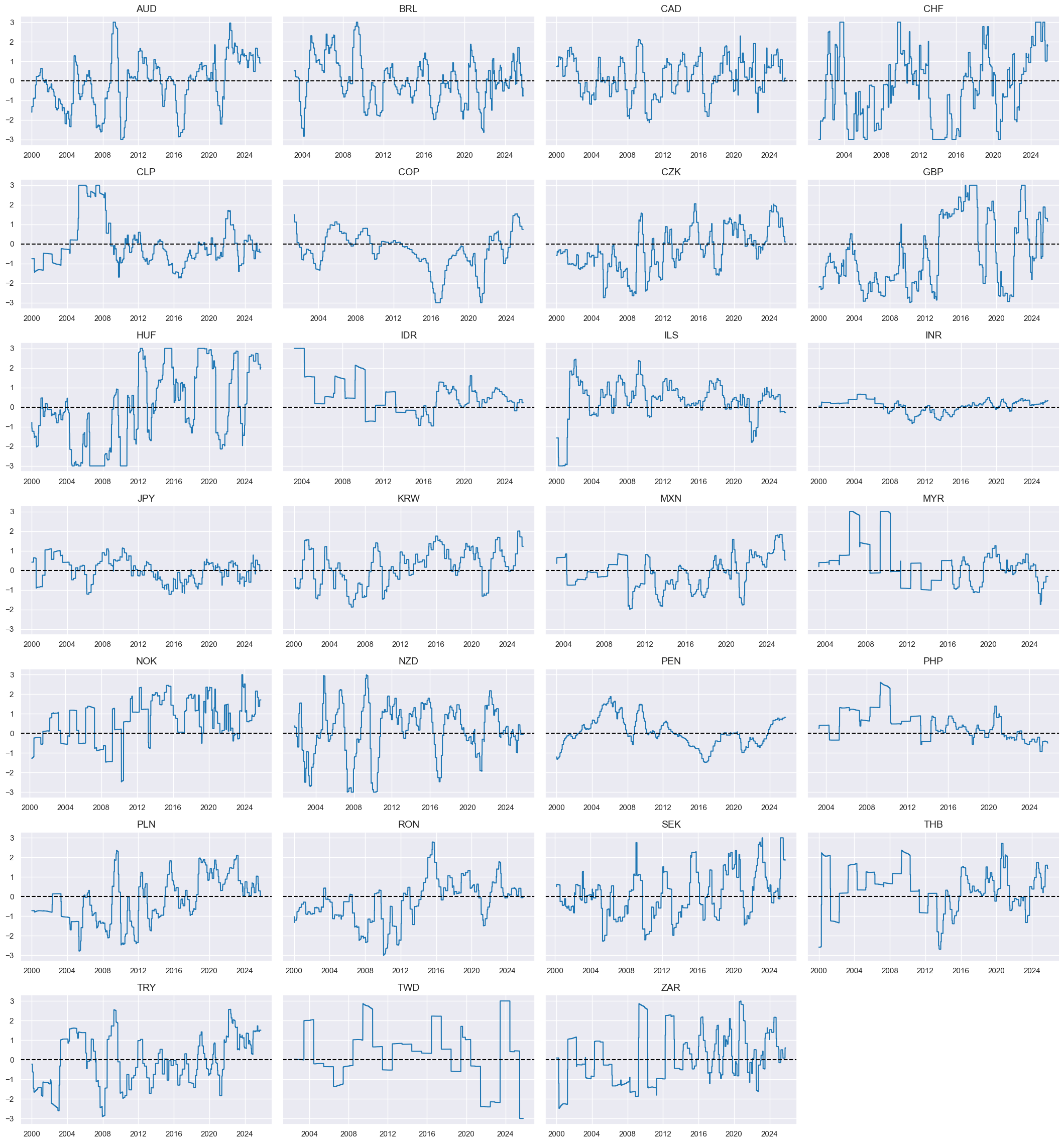

xcatx = robtrends

cidx = cids_emfx

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

start="2000-01-01",

same_y=False,

height=2.2,

size=(10, 10),

all_xticks=True,

)

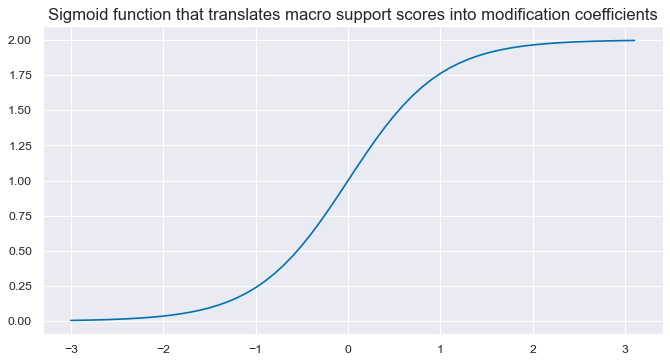

Modified robust trends #

# Illustrate sigmoid function

def sigmoid(x):

return 2 / (1 + np.exp(-2 * x))

ar = np.arange(-3, 3.2, 0.1)

plt.figure(figsize=(10, 5), dpi=80)

plt.plot(ar, sigmoid(ar))

plt.title(

"Sigmoid function that translates macro support scores into modification coefficients",

fontsize=15,

)

plt.show()

# Calculate general modification coefficients (independent of sign)

calcs = []

for zd in scoresz:

calcs += [f"{zd}_C = ( {zd} ).applymap( lambda x: 2 / (1 + np.exp( - 2 * x)) ) "]

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cidx)

dfx = msm.update_df(dfx, dfa)

# Visualize general modification coefficients

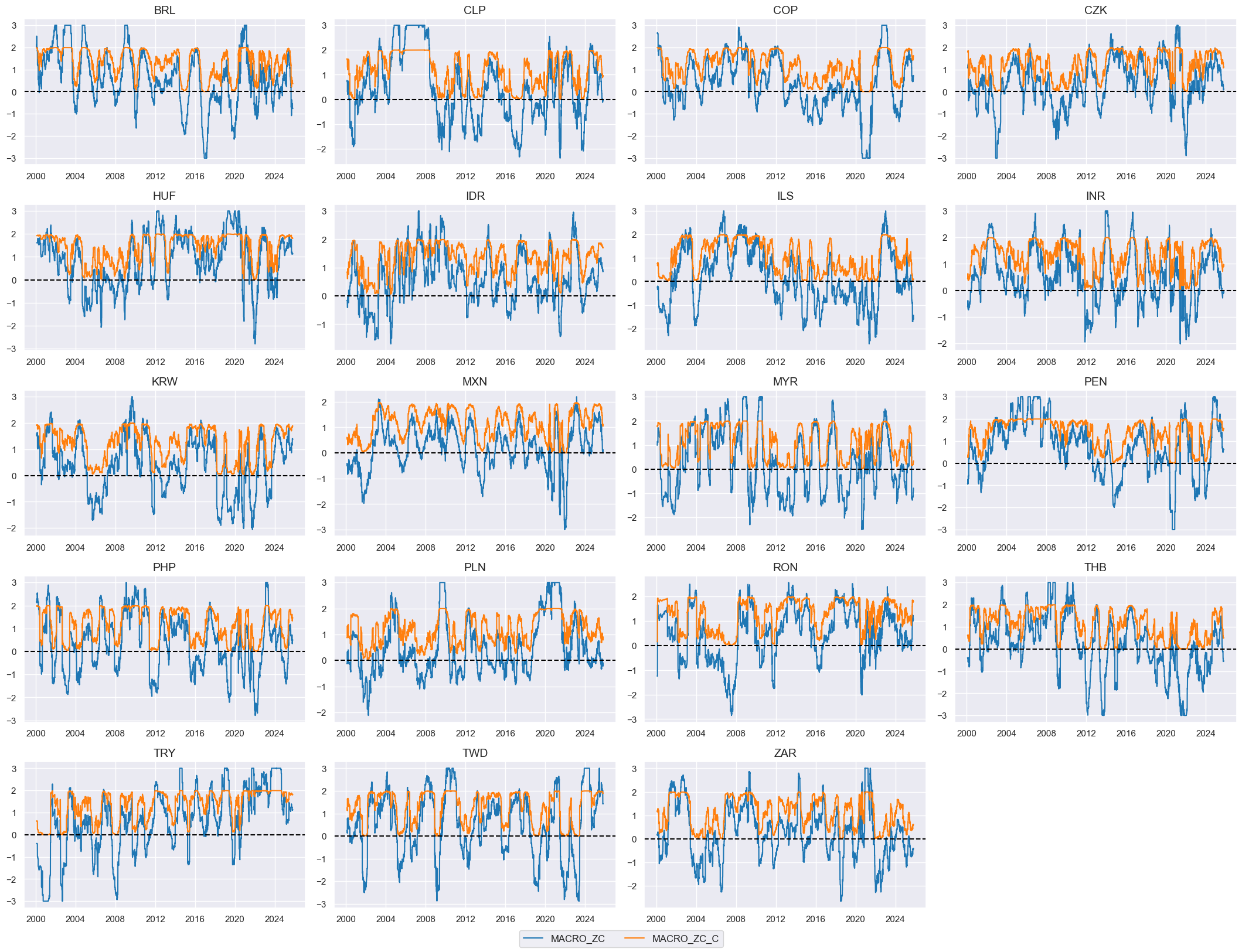

xcatx = ["MACRO_ZC", "MACRO_ZC_C"]

cidx = cids_emfx

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

start="2000-01-01",

same_y=False,

height=2.2,

size=(10, 10),

all_xticks=True,

)

# Modified robust trends based on sign-dependent modification

calcs = []

for tr in robtrends:

for xs in scoresz:

trxs = tr + "m" + xs.split("_")[0]

calcs += [f"{trxs}_C = (1 - np.sign( {tr} )) + np.sign( {tr} ) * {xs}_C"]

calcs += [f"{trxs} = {trxs}_C * {tr}"]

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cids_fx, blacklist=fxblack)

dfx = msm.update_df(dfx, dfa)

rob_trends_mod = [xc for xc in dfa["xcat"].unique() if not xc.endswith("_C")]

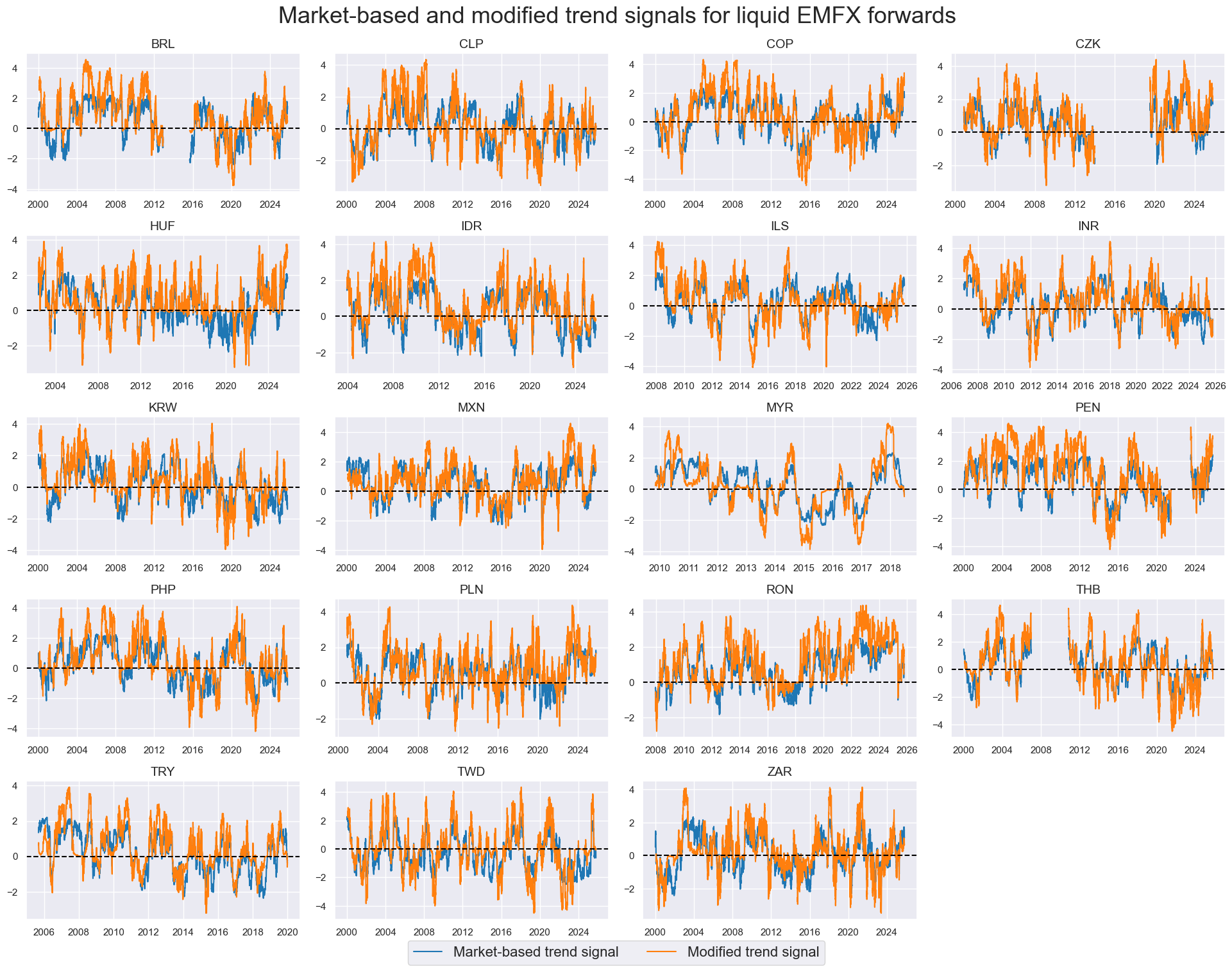

xcatx = ["ROBFXR_TRENDZ", "ROBFXR_TRENDZmMACRO"]

cidx = cids_emfx

dict_labs = {

"ROBFXR_TRENDZ": "Market-based trend signal",

"ROBFXR_TRENDZmMACRO": "Modified trend signal",

}

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

start="2000-01-01",

same_y=False,

title="Market-based and modified trend signals for liquid EMFX forwards",

title_fontsize=26,

height=2,

size=(8, 8),

all_xticks=True,

xcat_labels=dict_labs,

legend_fontsize=16,

)

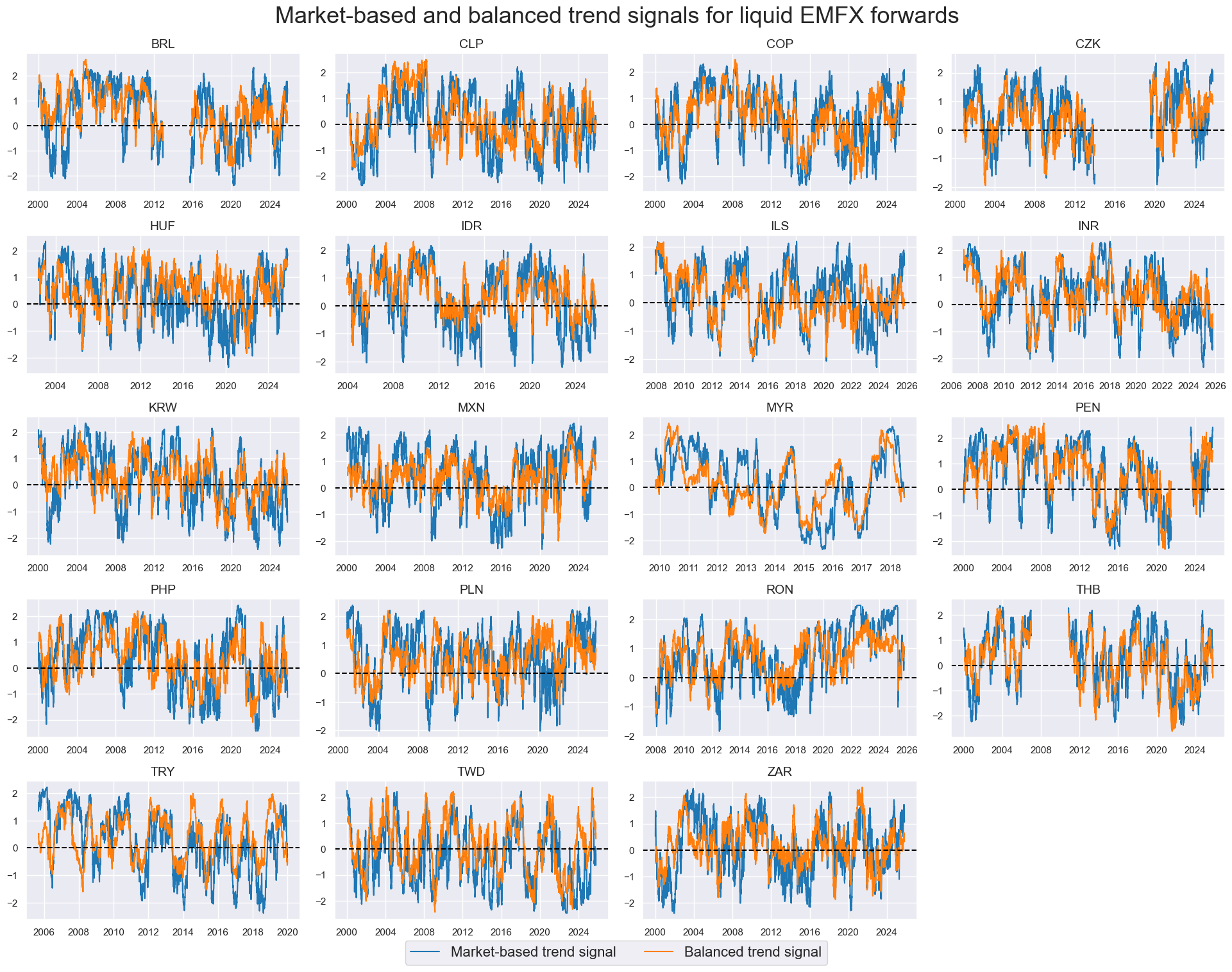

Balanced robust trends #

# Balanced robust trend calculation

calcs = []

for tr in robtrends:

for xs in scoresz:

trxs = tr + "b" + xs.split("_")[0]

calcs += [f"{trxs} = ( {tr} + ( {xs} ) ) / 2"]

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cids_fx, blacklist=fxblack)

dfx = msm.update_df(dfx, dfa)

rob_trends_bal = [xc for xc in dfa["xcat"].unique() if not xc.endswith("_C")]

xcatx = ["ROBFXR_TRENDZ", "ROBFXR_TRENDZbMACRO"]

cidx = cids_emfx

dict_labs = {

"ROBFXR_TRENDZ": "Market-based trend signal",

"ROBFXR_TRENDZbMACRO": "Balanced trend signal",

}

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

start="2000-01-01",

same_y=False,

title="Market-based and balanced trend signals for liquid EMFX forwards",

title_fontsize=26,

height=2,

size=(8, 8),

all_xticks=True,

xcat_labels=dict_labs,

legend_fontsize=16,

)

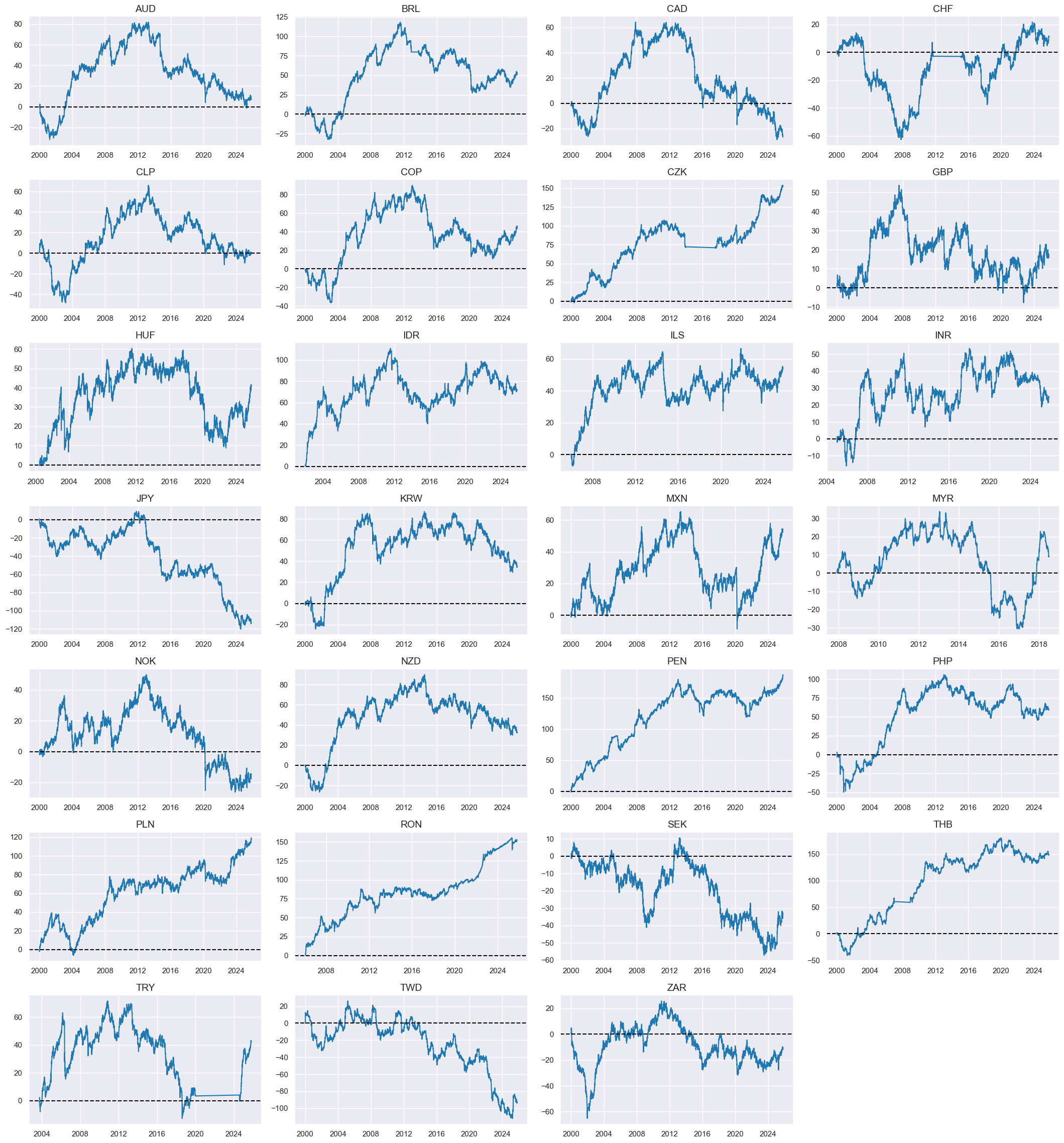

Targets #

Directional vol-targeted returns #

xcatx = ["FXXR_VT10"]

cidx = cids_fx

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

cumsum=True,

start="2000-01-01",

same_y=False,

height=2.2,

size=(10, 10),

all_xticks=True,

blacklist=fxblack,

)

Value checks #

Specs and panel test #

sigs = [

"ROBFXR_TRENDZ",

"ROBFXR_TRENDZmMACRO",

"ROBFXR_TRENDZbMACRO",

]

targ = "FXXR_VT10"

cidx = cids_emfx

dict_rob = {

"sigs": sigs,

"targ": targ,

"cidx": cidx,

"black": fxblack,

"srr": None,

"pnls": None,

}

dix = dict_rob

sigs = dix["sigs"]

targ = dix["targ"]

cidx = dix["cidx"]

blax = dix["black"]

# Dictionary to store CategoryRelations objects

crx = []

# Create CategoryRelations objects for all signals

for sig in sigs:

crx.append(

msp.CategoryRelations(

dfx,

xcats=[sig, targ],

cids=cidx,

freq="M",

lag=1,

xcat_aggs=["last", "sum"],

start="2000-01-01",

blacklist=blax,

xcat_trims=[None, None],

)

)

# Display scatter plots for all signals

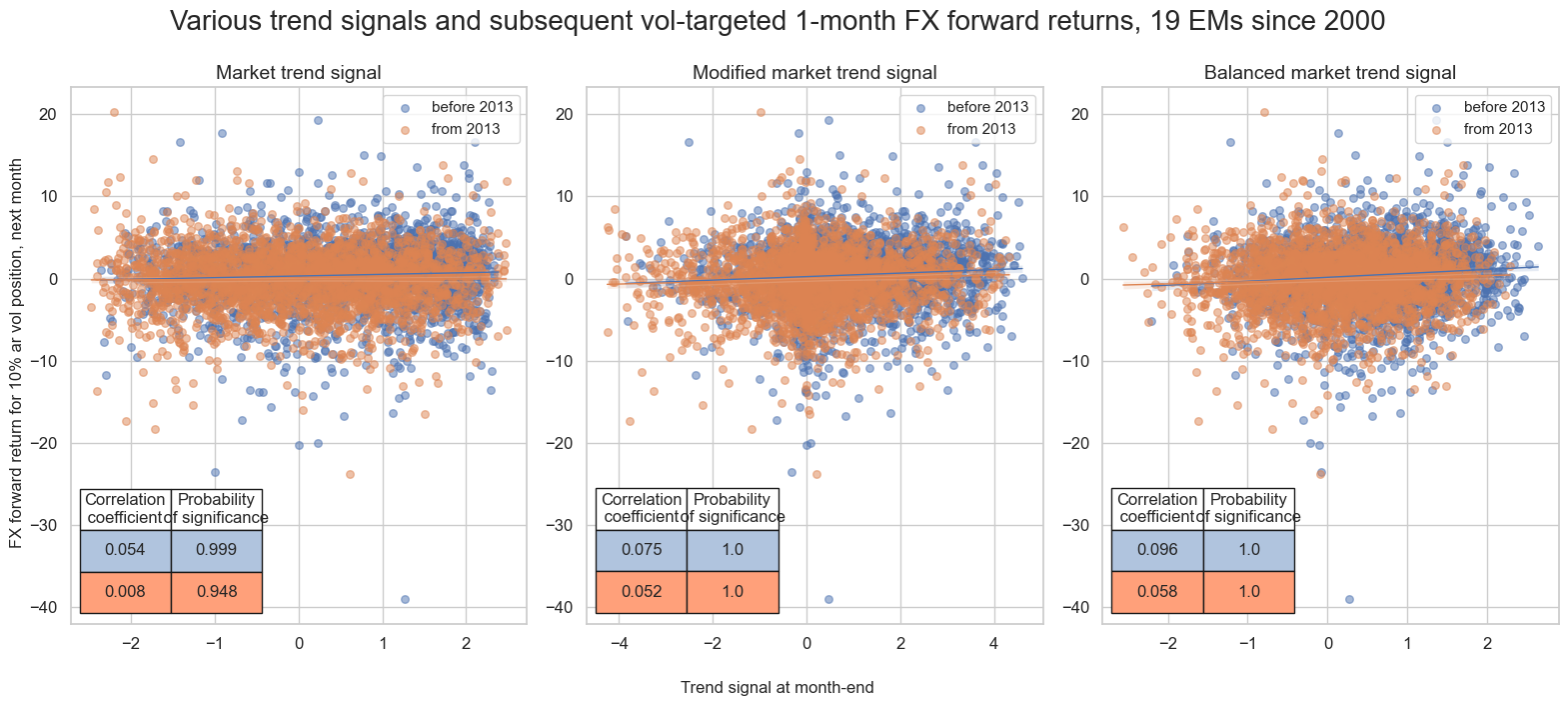

msv.multiple_reg_scatter(

cat_rels=crx,

coef_box="lower left",

ncol=3,

nrow=1,

separator=2013,

xlab="Trend signal at month-end",

ylab="FX forward return for 10% ar vol position, next month",

title="Various trend signals and subsequent vol-targeted 1-month FX forward returns, 19 EMs since 2000",

title_fontsize=20,

figsize=(16, 7),

prob_est="map",

subplot_titles=["Market trend signal", "Modified market trend signal", "Balanced market trend signal"],

share_axes=False,

)

Accuracy and correlation check #

dix = dict_rob

sigs = dix["sigs"]

targ = dix["targ"]

cidx = dix["cidx"]

blax = dix["black"]

srr = mss.SignalReturnRelations(

dfx,

cids=cidx,

sigs=sigs,

rets=targ,

freqs="M",

start="2000-01-01",

blacklist=blax,

)

dix["srr"] = srr

dix = dict_rob

srrx = dix["srr"]

display(srrx.multiple_relations_table().round(3))

dict_labs = {

"ROBFXR_TRENDZ": "Market-based trend signal",

"ROBFXR_TRENDZmMACRO": "Modified trend signal",

"ROBFXR_TRENDZbMACRO": "Balanced trend signal",

}

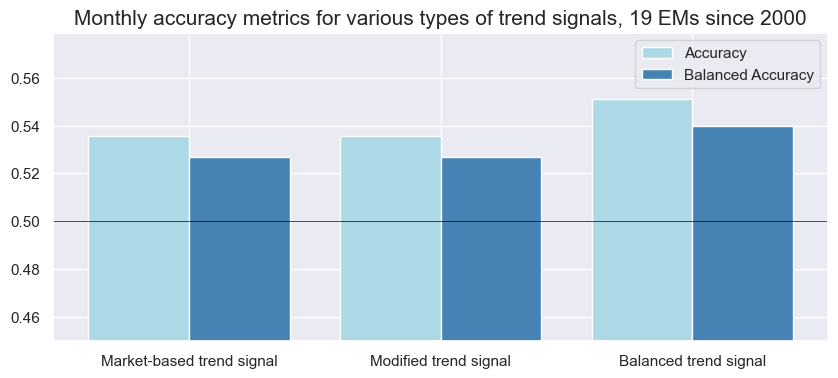

srrx.accuracy_bars(type="signals",

title="Monthly accuracy metrics for various types of trend signals, 19 EMs since 2000",

freq="m",

size=(10, 4),

title_fontsize=15,

x_labels=dict_labs

)

| accuracy | bal_accuracy | pos_sigr | pos_retr | pos_prec | neg_prec | pearson | pearson_pval | kendall | kendall_pval | auc | ||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Return | Signal | Frequency | Aggregation | |||||||||||

| FXXR_VT10 | ROBFXR_TRENDZ | M | last | 0.536 | 0.527 | 0.607 | 0.547 | 0.568 | 0.485 | 0.043 | 0.002 | 0.035 | 0.0 | 0.526 |

| ROBFXR_TRENDZbMACRO | M | last | 0.551 | 0.540 | 0.667 | 0.547 | 0.574 | 0.506 | 0.089 | 0.000 | 0.060 | 0.0 | 0.536 | |

| ROBFXR_TRENDZmMACRO | M | last | 0.536 | 0.527 | 0.607 | 0.547 | 0.568 | 0.485 | 0.076 | 0.000 | 0.049 | 0.0 | 0.526 |

Naive PnL #

dix = dict_rob

sigx = dix["sigs"]

targ = dix["targ"]

cidx = dix["cidx"]

blax = dix["black"]

naive_pnl = msn.NaivePnL(

dfx,

ret=targ,

sigs=sigx,

cids=cidx,

start="2000-01-01",

blacklist=blax,

bms=["USD_EQXR_NSA"],

)

for sig in sigx:

naive_pnl.make_pnl(

sig,

sig_neg=False,

sig_op="raw",

thresh=5,

rebal_freq="daily",

vol_scale=10,

rebal_slip=1,

pnl_name=sig + "_PZN",

)

naive_pnl.make_long_pnl(vol_scale=10, label="Long only")

dix["pnls"] = naive_pnl

dix = dict_rob

sigx = dix["sigs"]

cidx = dix["cidx"]

naive_pnl = dix["pnls"]

pnls = [sig + "_PZN" for sig in sigx] + ["Long only"]

dict_labs = {

"ROBFXR_TRENDZ_PZN": "Market-based trend signal",

"ROBFXR_TRENDZmMACRO_PZN": "Modified trend signal",

"ROBFXR_TRENDZbMACRO_PZN": "Balanced trend signal",

"Long only": "Long-only risk parity",

}

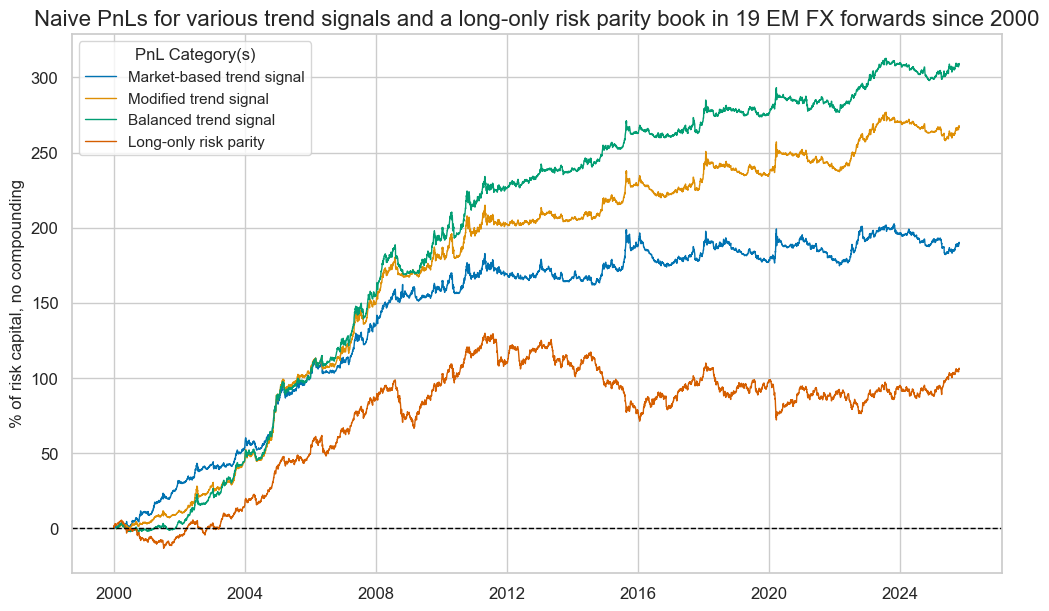

naive_pnl.plot_pnls(

pnl_cats=pnls,

pnl_cids=["ALL"],

start="2000-01-01",

title="Naive PnLs for various trend signals and a long-only risk parity book in 19 EM FX forwards since 2000",

title_fontsize=16,

xcat_labels=dict_labs,

figsize=(12, 7),

)

df_eval = naive_pnl.evaluate_pnls(

pnl_cats=pnls,

pnl_cids=["ALL"],

start="2000-01-01",

)

display(df_eval.transpose().astype("float").round(2))

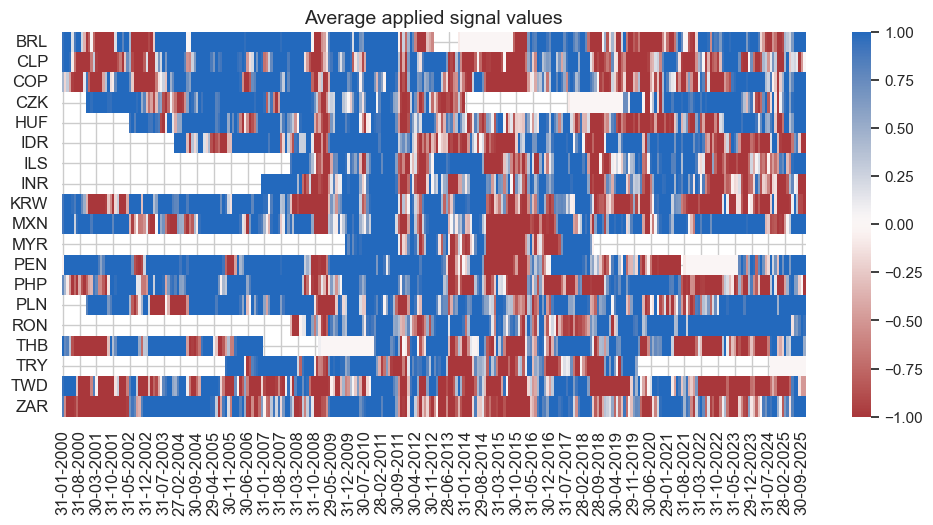

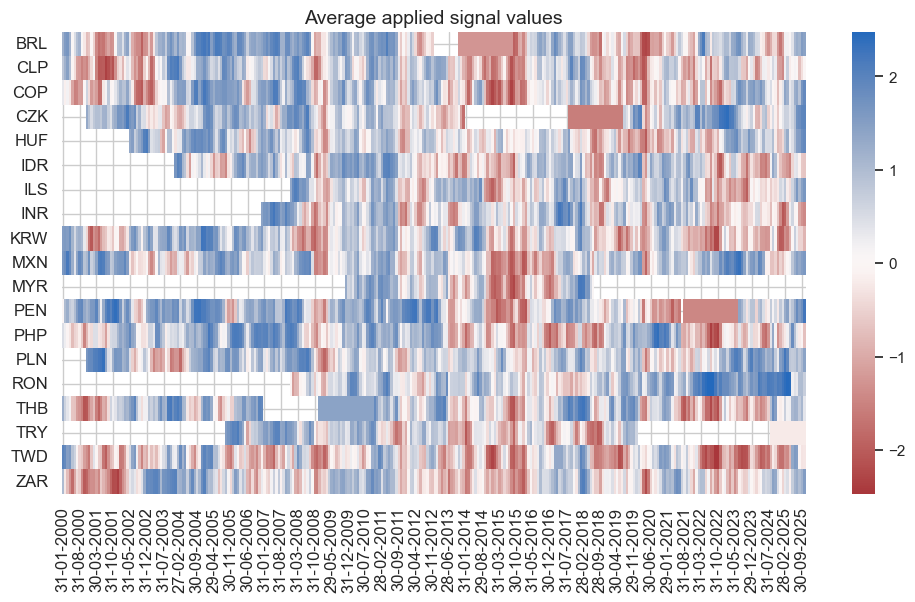

naive_pnl.signal_heatmap(

pnl_name='ROBFXR_TRENDZ_PZN',

pnl_cids=cidx,

freq="m",

start="2000-01-01",

figsize=(12, 6)

)

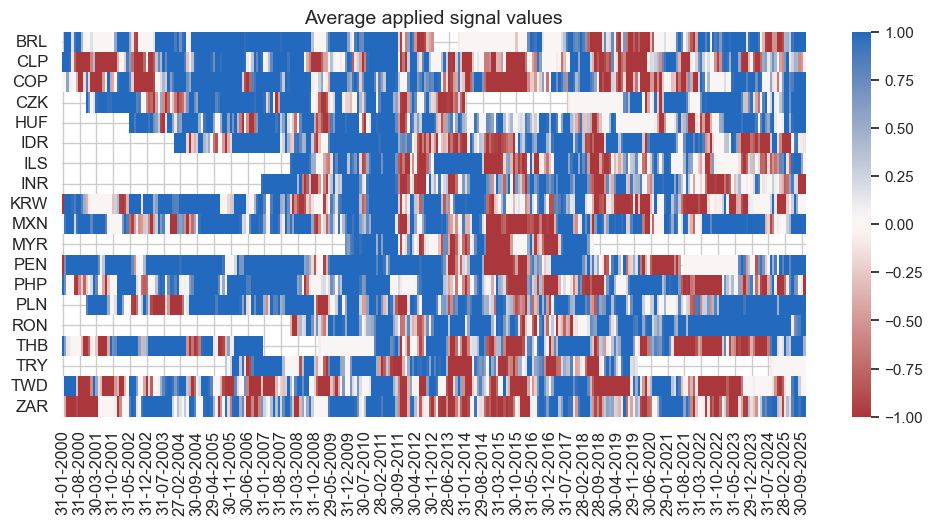

naive_pnl.signal_heatmap(

pnl_name='ROBFXR_TRENDZbMACRO_PZN',

pnl_cids=cidx,

freq="m",

start="2020-01-01",

figsize=(12, 6)

)

| Return % | St. Dev. % | Sharpe Ratio | Sortino Ratio | Max 21-Day Draw % | Max 6-Month Draw % | Peak to Trough Draw % | Top 5% Monthly PnL Share | USD_EQXR_NSA correl | Traded Months | |

|---|---|---|---|---|---|---|---|---|---|---|

| xcat | ||||||||||

| ROBFXR_TRENDZ_PZN | 7.35 | 10.0 | 0.73 | 1.04 | -12.73 | -18.51 | -24.88 | 0.76 | -0.03 | 310.0 |

| ROBFXR_TRENDZmMACRO_PZN | 10.38 | 10.0 | 1.04 | 1.49 | -16.03 | -12.57 | -19.85 | 0.61 | 0.04 | 310.0 |

| ROBFXR_TRENDZbMACRO_PZN | 11.99 | 10.0 | 1.20 | 1.73 | -17.40 | -17.71 | -19.91 | 0.51 | 0.08 | 310.0 |

| Long only | 4.10 | 10.0 | 0.41 | 0.56 | -21.26 | -26.00 | -58.50 | 1.08 | 0.32 | 310.0 |

Naive PnL of binary strategy #

dix = dict_rob

sigx = dix["sigs"]

targ = dix["targ"]

cidx = dix["cidx"]

blax = dix["black"]

naive_pnl = msn.NaivePnL(

dfx,

ret=targ,

sigs=sigx,

cids=cidx,

start="2000-01-01",

blacklist=blax,

bms=["USD_EQXR_NSA"],

)

for sig in sigx:

naive_pnl.make_pnl(

sig,

sig_neg=False,

sig_op="binary",

entry_barrier=1.0,

exit_barrier=0.25,

rebal_freq="daily",

vol_scale=10,

rebal_slip=1,

pnl_name=sig + "_BIN",

)

naive_pnl.make_long_pnl(vol_scale=10, label="Long only")

dix["pnls2"] = naive_pnl

dix = dict_rob

sigx = dix["sigs"]

cidx = dix["cidx"]

naive_pnl = dix["pnls2"]

pnls = [sig + "_BIN" for sig in sigx] + ["Long only"]

dict_labs = {

"ROBFXR_TRENDZ_BIN": "Binary market trend signal",

"ROBFXR_TRENDZmMACRO_BIN": "Binary modified trend signal",

"ROBFXR_TRENDZbMACRO_BIN": "Binary balanced trend signal",

"Long only": "Long-only risk parity",

}

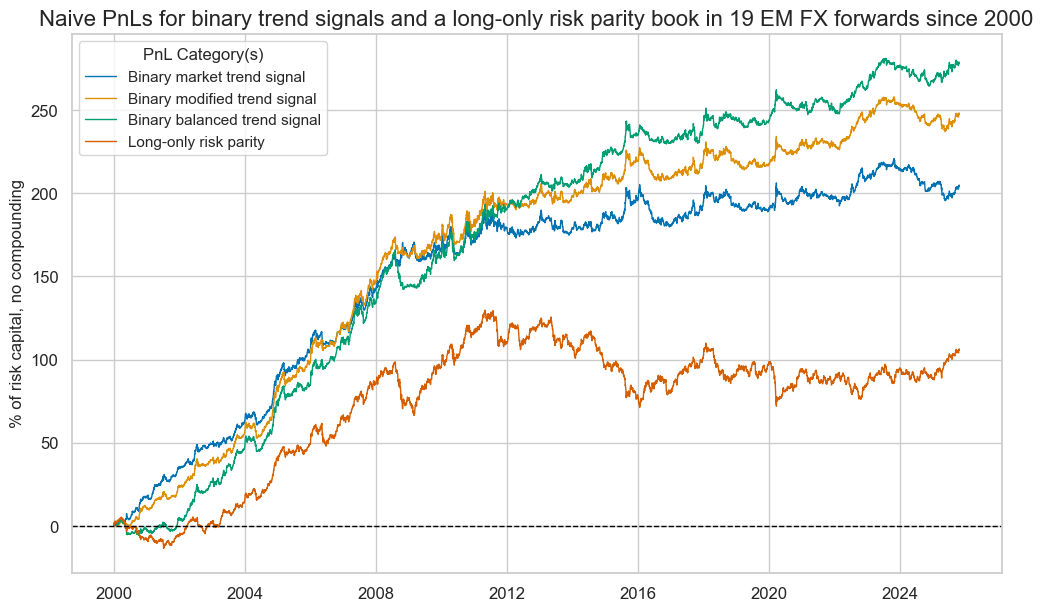

naive_pnl.plot_pnls(

pnl_cats=pnls,

pnl_cids=["ALL"],

start="2000-01-01",

title="Naive PnLs for binary trend signals and a long-only risk parity book in 19 EM FX forwards since 2000",

title_fontsize=16,

xcat_labels=dict_labs,

figsize=(12, 7),

)

df_eval = naive_pnl.evaluate_pnls(

pnl_cats=pnls,

pnl_cids=["ALL"],

start="2000-01-01",

)

display(df_eval.transpose().astype("float").round(2))

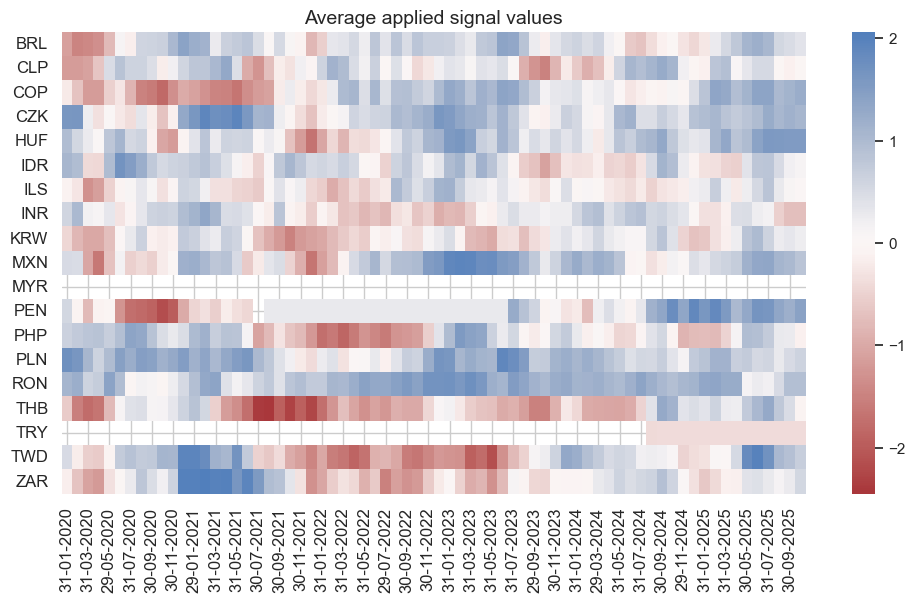

naive_pnl.signal_heatmap(

pnl_name='ROBFXR_TRENDZ_BIN',

pnl_cids=cidx,

freq="m",

start="2000-01-01",

figsize=(12, 5)

)

naive_pnl.signal_heatmap(

pnl_name='ROBFXR_TRENDZmMACRO_BIN',

pnl_cids=cidx,

freq="m",

start="2000-01-01",

figsize=(12, 5)

)

| Return % | St. Dev. % | Sharpe Ratio | Sortino Ratio | Max 21-Day Draw % | Max 6-Month Draw % | Peak to Trough Draw % | Top 5% Monthly PnL Share | USD_EQXR_NSA correl | Traded Months | |

|---|---|---|---|---|---|---|---|---|---|---|

| xcat | ||||||||||

| ROBFXR_TRENDZ_BIN | 7.93 | 10.0 | 0.79 | 1.13 | -14.70 | -21.23 | -25.36 | 0.62 | -0.01 | 310.0 |

| ROBFXR_TRENDZmMACRO_BIN | 9.63 | 10.0 | 0.96 | 1.38 | -16.82 | -17.74 | -20.91 | 0.54 | 0.03 | 310.0 |

| ROBFXR_TRENDZbMACRO_BIN | 10.81 | 10.0 | 1.08 | 1.56 | -16.73 | -21.16 | -23.73 | 0.49 | 0.08 | 310.0 |

| Long only | 4.10 | 10.0 | 0.41 | 0.56 | -21.26 | -26.00 | -58.50 | 1.08 | 0.32 | 310.0 |