Cross-country rates relative value with macro factors #

import numpy as np

import pandas as pd

from pandas import Timestamp

import matplotlib.pyplot as plt

from datetime import date

import seaborn as sns

import os

from datetime import datetime

import macrosynergy.management as msm

import macrosynergy.panel as msp

import macrosynergy.signal as mss

import macrosynergy.pnl as msn

import macrosynergy.visuals as msv

import macrosynergy.learning as msl

from macrosynergy.management.utils import merge_categories

from macrosynergy.download import JPMaQSDownload

from sklearn.ensemble import RandomForestRegressor

from sklearn.metrics import root_mean_squared_error, make_scorer

from sklearn.linear_model import Ridge

pd.set_option("display.width", 400)

import warnings

warnings.simplefilter("ignore")

# Cross-sections of interest

cids_dm = ["AUD", "CAD", "CHF", "EUR", "GBP", "JPY", "NOK", "NZD", "SEK", "USD"]

cids_latm = ["BRL", "COP", "CLP", "MXN"] # Latam countries

cids_emea = ["CZK", "HUF", "ILS", "PLN", "RUB", "TRY", "ZAR"] # EMEA countries

cids_emas = ["IDR", "INR", "KRW", "MYR", "THB", "TWD"] # EM Asia countries

cids_em = cids_latm + cids_emea + cids_emas

cids = sorted(cids_dm + cids_em)

cids_dux = sorted(list(set(cids) - set(["IDR", "INR", "NZD"])))

# Quantamental categories of interest

infl = [

"CPIH_SA_P1M1ML12",

"CPIH_SJA_P6M6ML6AR",

"CPIH_SJA_P3M3ML3AR",

"CPIC_SA_P1M1ML12",

"CPIC_SJA_P6M6ML6AR",

"CPIC_SJA_P3M3ML3AR",

"INFTEFF_NSA",

]

infl_changes = [

"CPIH_SA_P1M1ML12_D1M1ML3",

"CPIC_SA_P1M1ML12_D1M1ML3",

]

infs = infl + infl_changes

irs = [

"RYLDIRS05Y_NSA",

"DU05YCRY_NSA",

"DU05YCRY_VT10",

]

reer = [

"REEROADJ_NSA_P1W4WL1",

"REEROADJ_NSA_P1M1ML12",

"REEROADJ_NSA_P1M12ML1",

"REEROADJ_NSA_P1M60ML1",

]

reals = irs + reer

external_balances = [

"CABGDPRATIO_NSA_12MMA",

"CABGDPRATIOE_NSA_12MMA",

"CABGDPRATIO_SA",

"CABGDPRATIO_SA_3MMA",

"BXBGDPRATIO_NSA_12MMA",

"BXBGDPRATIOE_NSA_12MMA",

]

mtb_changes = [

"MTBGDPRATIO_SA_3MMA_D1M1ML3",

"MTBGDPRATIO_SA_6MMA_D1M1ML6",

"MTBGDPRATIO_NSA_12MMA_D1M1ML3",

]

interv_liquidity = [

"INTLIQGDP_NSA_D1M1ML1",

"INTLIQGDP_NSA_D1M1ML3",

"INTLIQGDP_NSA_D1M1ML6",

]

xliq = external_balances + mtb_changes + interv_liquidity

gdp = [

"INTRGDPv5Y_NSA_P1M1ML12_3MMA",

"RGDPTECHv5Y_SA_P1M1ML12_3MMA",

"RGDP_SA_P1Q1QL4_20QMA",

]

pcons = [

"RRSALES_SA_P1M1ML12",

"RRSALES_SA_P1M1ML12_3MMA",

"RRSALES_SA_P1Q1QL4",

"RPCONS_SA_P1Q1QL4",

"RPCONS_SA_P1M1ML12_3MMA",

"RPCONS_SA_P1Q1QL1AR",

"RPCONS_SA_P2Q2QL2AR",

"RPCONS_SA_P3M3ML3AR",

"RPCONS_SA_P6M6ML6AR",

]

growth = gdp + pcons

credit = [

"PCREDITBN_SJA_P1M1ML12",

]

house_prices = [

"HPI_SA_P1M1ML12",

"HPI_SA_P1M1ML12_3MMA",

"HPI_SA_P1Q1QL4",

"HPI_SA_P3M3ML3AR",

"HPI_SA_P6M6ML6AR",

"HPI_SA_P1Q1QL1AR",

"HPI_SA_P2Q2QL2AR",

]

credhouse = credit + house_prices

govs = ["GGFTGDPRATIO_NSA", "GGOBGDPRATIO_NSA"]

main = (

infl

+ infs

+ reals

+ xliq

+ growth

+ credhouse

+ govs

)

econ = ["FXTARGETED_NSA", "FXUNTRADABLE_NSA"]

mkts = [

"DU02YXR_VT10",

"DU05YXR_NSA",

"DU05YXR_VT10",

"DU10YXR_VT10",

]

xcats = main + econ + mkts

# Resultant tickers for download

xtra = ["USD_EQXR_NSA", "USD_GB10YXR_NSA"]

tickers = [cid + "_" + xcat for cid in cids for xcat in xcats] + xtra

# Download series from J.P. Morgan DataQuery by tickers

start_date = "2000-01-01"

end_date = None

# Retrieve credentials

oauth_id = os.getenv("DQ_CLIENT_ID") # Replace with own client ID

oauth_secret = os.getenv("DQ_CLIENT_SECRET") # Replace with own secret

# Download from DataQuery

with JPMaQSDownload(client_id=oauth_id, client_secret=oauth_secret) as downloader:

df = downloader.download(

tickers=tickers,

start_date=start_date,

end_date=end_date,

metrics=["value"],

suppress_warning=True,

show_progress=True,

)

dfx = df.copy()

dfx.info()

Downloading data from JPMaQS.

Timestamp UTC: 2025-10-22 14:59:22

Connection successful!

Requesting data: 100%|██████████| 76/76 [00:15<00:00, 4.93it/s]

Downloading data: 100%|██████████| 76/76 [00:25<00:00, 2.96it/s]

Some expressions are missing from the downloaded data. Check logger output for complete list.

228 out of 1514 expressions are missing. To download the catalogue of all available expressions and filter the unavailable expressions, set `get_catalogue=True` in the call to `JPMaQSDownload.download()`.

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 8116912 entries, 0 to 8116911

Data columns (total 4 columns):

# Column Dtype

--- ------ -----

0 real_date datetime64[ns]

1 cid object

2 xcat object

3 value float64

dtypes: datetime64[ns](1), float64(1), object(2)

memory usage: 247.7+ MB

Availability, renaming and blacklisting #

Renaming quarterly categories #

dict_repl = {

"HPI_SA_P1Q1QL4": "HPI_SA_P1M1ML12_3MMA",

"HPI_SA_P1Q1QL1AR": "HPI_SA_P3M3ML3AR",

"HPI_SA_P2Q2QL2AR": "HPI_SA_P6M6ML6AR",

# Real retail sales

"RRSALES_SA_P1Q1QL4": "RRSALES_SA_P1M1ML12_3MMA",

"RPCONS_SA_P1Q1QL4": "RPCONS_SA_P1M1ML12_3MMA",

"RPCONS_SA_P1Q1QL1AR": "RPCONS_SA_P3M3ML3AR",

"RPCONS_SA_P2Q2QL2AR": "RPCONS_SA_P6M6ML6AR",

}

for key, value in dict_repl.items():

dfx["xcat"] = dfx["xcat"].str.replace(key, value)

Check availability #

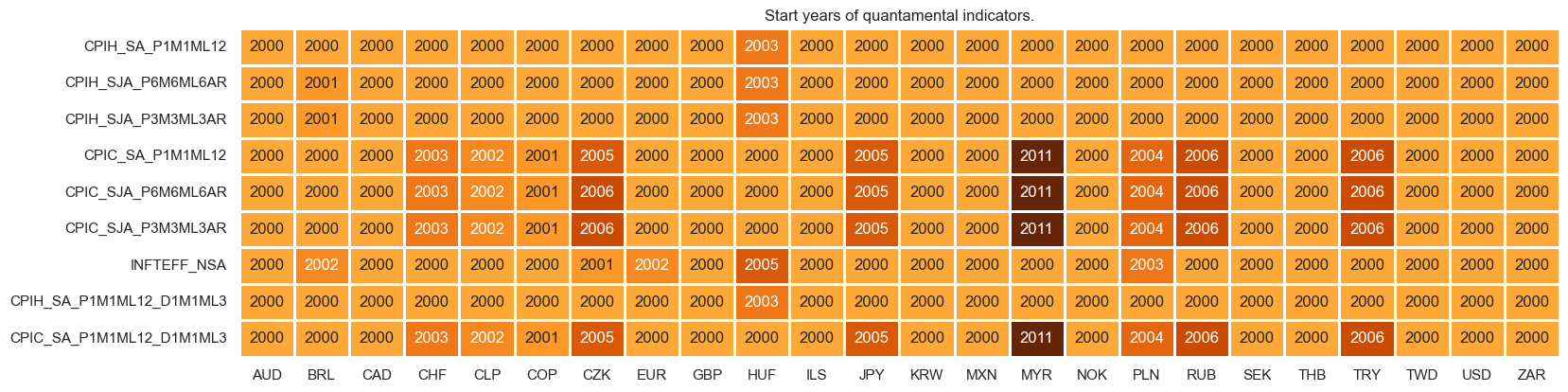

xcatx = infs

cidx = cids_dux

msm.check_availability(df=dfx, xcats=xcatx, cids=cidx, missing_recent=False)

xcatx = reals

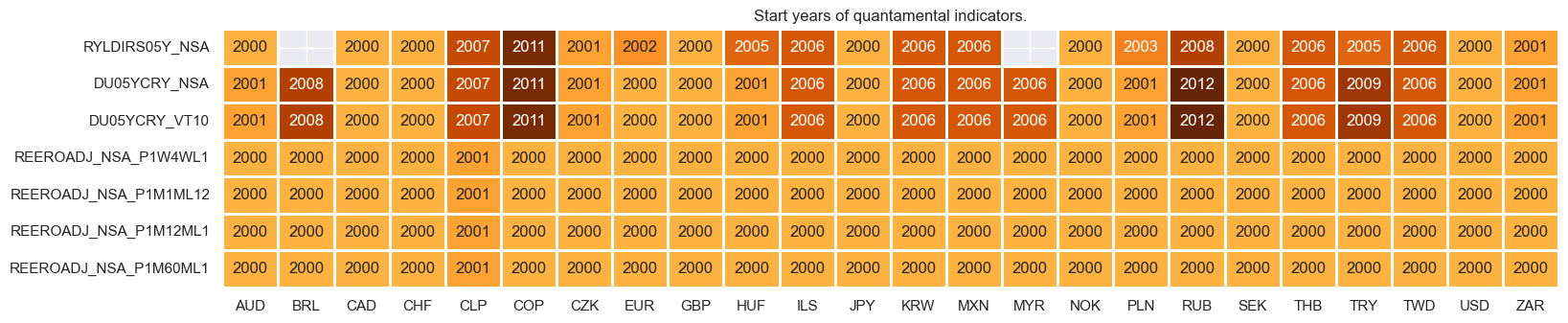

cidx = cids_dux

msm.check_availability(df=dfx, xcats=xcatx, cids=cidx, missing_recent=False)

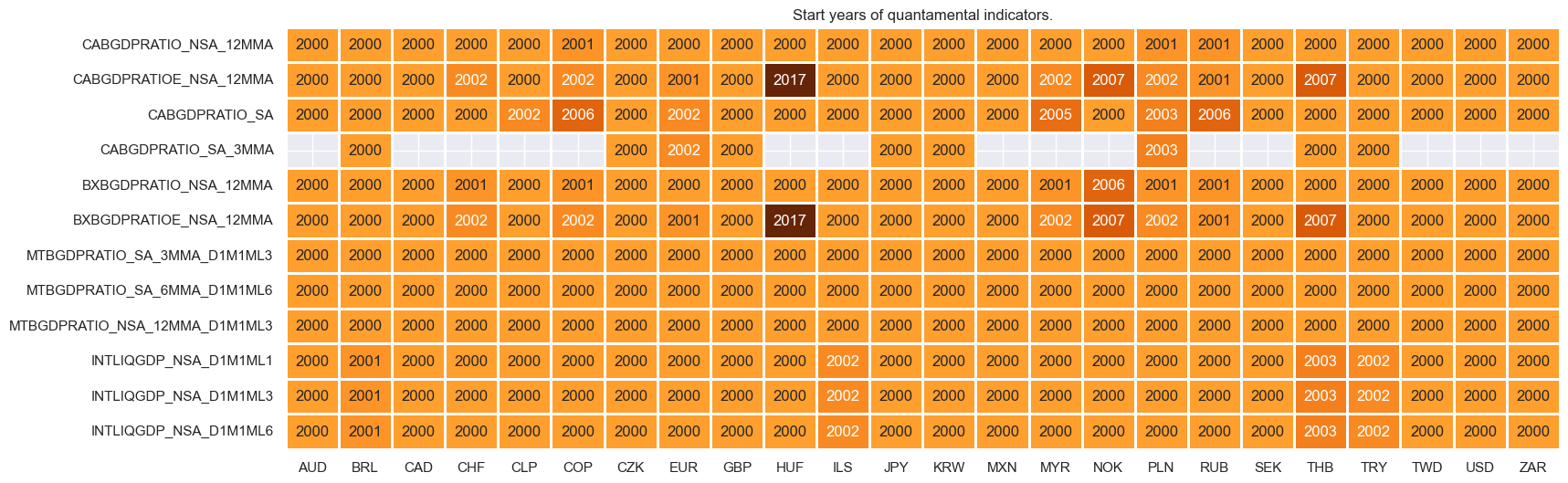

xcatx = xliq

cidx = cids_dux

msm.check_availability(df=dfx, xcats=xcatx, cids=cidx, missing_recent=False)

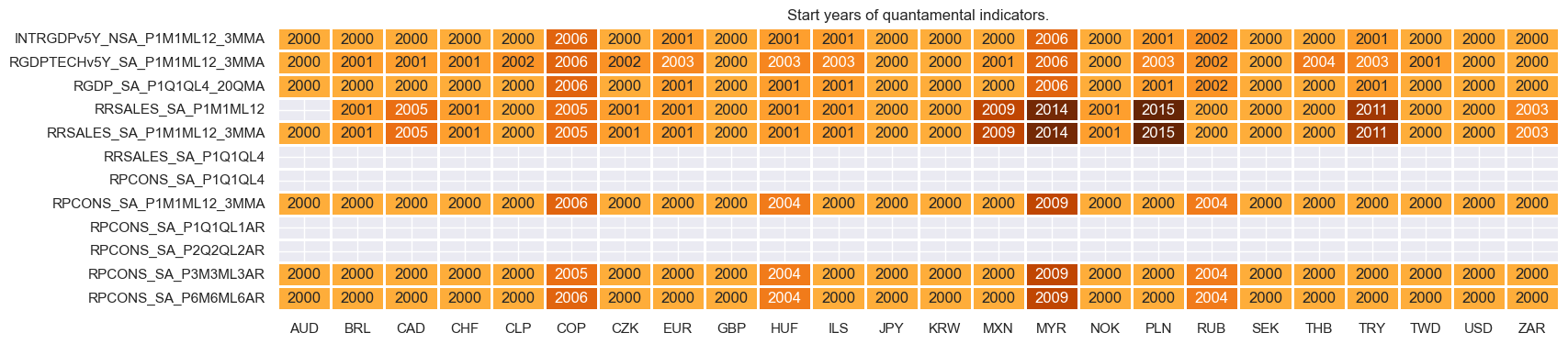

xcatx = growth

cidx = cids_dux

msm.check_availability(df=dfx, xcats=xcatx, cids=cidx, missing_recent=False)

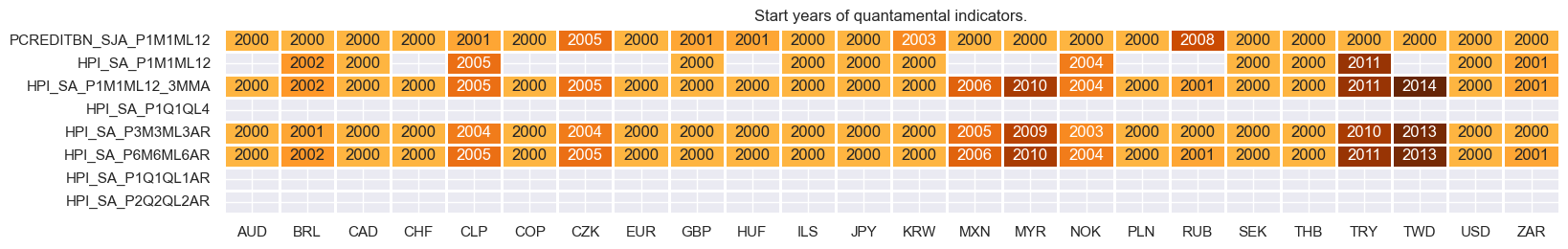

xcatx = credhouse

cidx = cids_dux

msm.check_availability(df=dfx, xcats=xcatx, cids=cidx, missing_recent=False)

xcatx = govs

cidx = cids_dux

msm.check_availability(df=dfx, xcats=xcatx, cids=cidx, missing_recent=False)

Blacklisting dictionary for empirical research #

# Create blacklisting dictionary

dfb = df[df["xcat"].isin(["FXTARGETED_NSA", "FXUNTRADABLE_NSA"])].loc[

:, ["cid", "xcat", "real_date", "value"]

]

dfba = (

dfb.groupby(["cid", "real_date"])

.aggregate(value=pd.NamedAgg(column="value", aggfunc="max"))

.reset_index()

)

dfba["xcat"] = "FXBLACK"

fxblack = msp.make_blacklist(dfba, "FXBLACK")

fxblack

{'BRL': (Timestamp('2012-12-03 00:00:00'), Timestamp('2013-09-30 00:00:00')),

'CHF': (Timestamp('2011-10-03 00:00:00'), Timestamp('2015-01-30 00:00:00')),

'CZK': (Timestamp('2014-01-01 00:00:00'), Timestamp('2017-07-31 00:00:00')),

'ILS': (Timestamp('2000-01-03 00:00:00'), Timestamp('2005-12-30 00:00:00')),

'INR': (Timestamp('2000-01-03 00:00:00'), Timestamp('2004-12-31 00:00:00')),

'MYR_1': (Timestamp('2000-01-03 00:00:00'), Timestamp('2007-11-30 00:00:00')),

'MYR_2': (Timestamp('2018-07-02 00:00:00'), Timestamp('2025-10-21 00:00:00')),

'RUB_1': (Timestamp('2000-01-03 00:00:00'), Timestamp('2005-11-30 00:00:00')),

'RUB_2': (Timestamp('2022-02-01 00:00:00'), Timestamp('2025-10-21 00:00:00')),

'THB': (Timestamp('2007-01-01 00:00:00'), Timestamp('2008-11-28 00:00:00')),

'TRY_1': (Timestamp('2000-01-03 00:00:00'), Timestamp('2003-09-30 00:00:00')),

'TRY_2': (Timestamp('2020-01-01 00:00:00'), Timestamp('2024-07-31 00:00:00'))}

Factor engineering and checks #

dict_facts = {}

Relative inflation shortfall ratios #

# Base indicators and score weights

dict_xinfl = {

"CPIH_SA_P1M1ML12": (1/6, -1),

"CPIH_SJA_P6M6ML6AR": (1/6, -1),

"CPIH_SJA_P3M3ML3AR": (1/6, -1),

"CPIC_SA_P1M1ML12": (1/6, -1),

"CPIC_SJA_P6M6ML6AR": (1/6, -1),

"CPIC_SJA_P3M3ML3AR": (1/6, -1),

}

# Effective target capped at 2%

dfa = msp.panel_calculator(df, ["INFTEBASIS = INFTEFF_NSA.clip(lower=2)"], cids=cids_dux)

dfx = msm.update_df(dfx, dfa)

# Excess inflation ratios

cidx = cids_dux

xcatx = list(dict_xinfl.keys())

for xc in xcatx:

calcs = [f"{xc}vIETR = ( {xc} - INFTEFF_NSA ) / INFTEBASIS",]

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cids_dux)

dfx = msm.update_df(dfx, dfa)

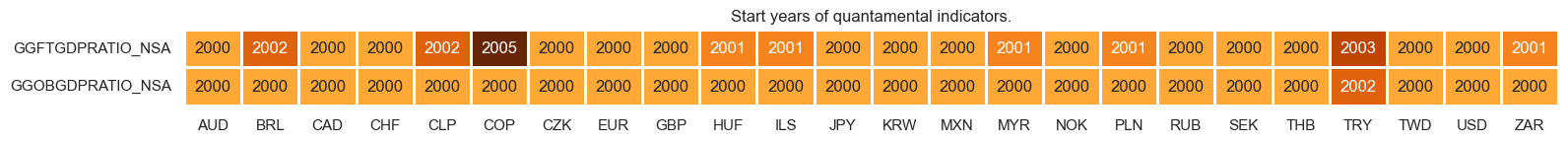

cidx = cids_dux

xcatx = [xc + "vIETR" for xc in list(dict_xinfl.keys())]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=True,

all_xticks=True,

size=(12, 7),

aspect=1.8

)

# Relative value of constituents

cidx = cids_dux

xcatx = [xc + "vIETR" for xc in list(dict_xinfl.keys())]

dfa = msp.make_relative_value(

df=dfx,

xcats=xcatx,

cids=cidx,

blacklist=fxblack,

postfix="vGLB",

)

dfx = msm.update_df(dfx, dfa)

# Scoring of relative values

cidx = cids_dux

xcatx = [xc + "vIETRvGLB" for xc in list(dict_xinfl.keys())]

dfa = pd.DataFrame(columns=dfx.columns)

for xc in xcatx:

dfaa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

cidx = cids_dux

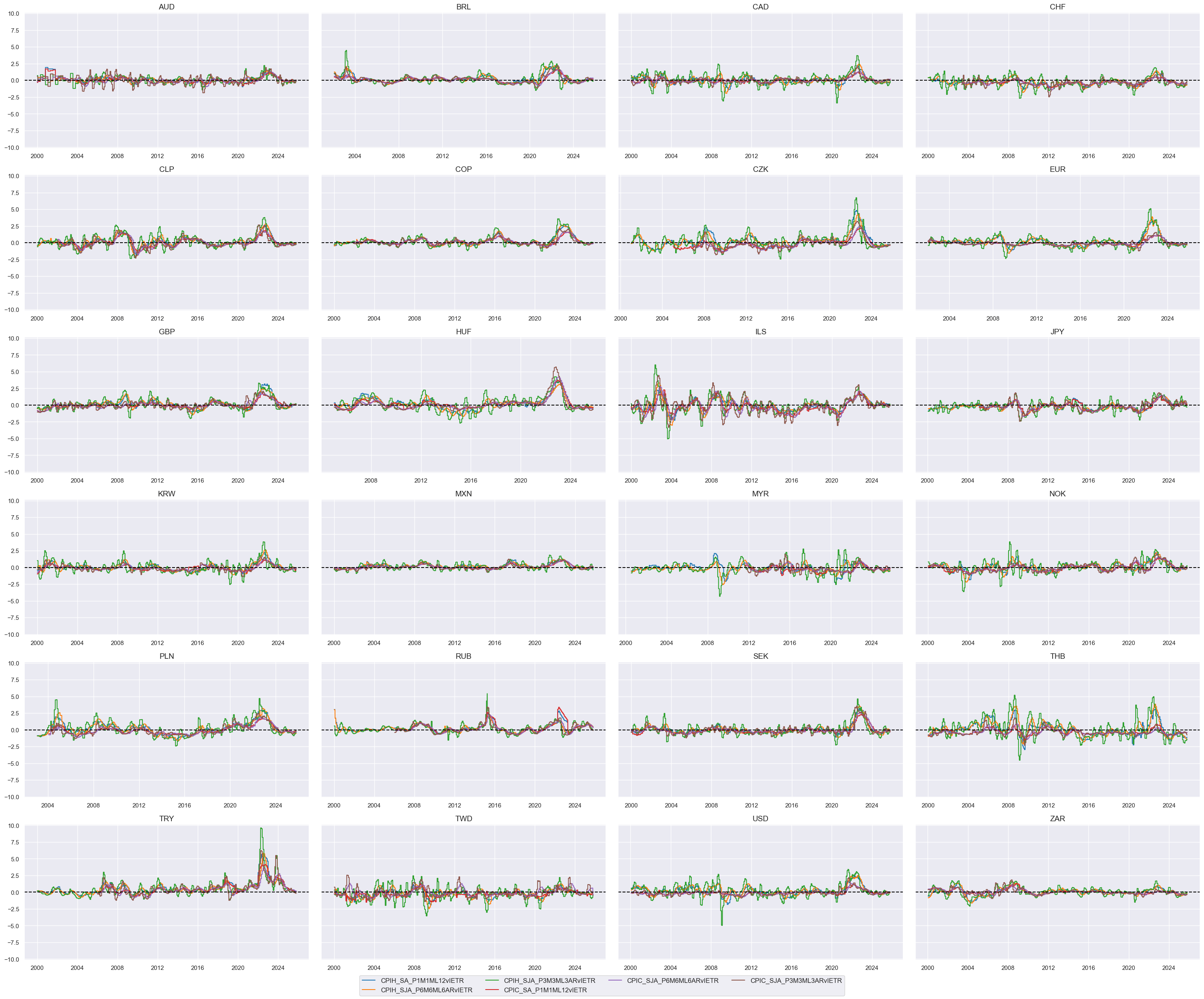

xcatx = [xc + "vIETRvGLB_ZN" for xc in list(dict_xinfl.keys())]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=True,

all_xticks=True,

size=(12, 7),

aspect=1.8

)

# Weighted linear combination

cidx = cids_dux

dix = dict_xinfl

xcatx = [k + "vIETRvGLB_ZN" for k in list(dix.keys())]

weights = [v[0] for v in list(dix.values())]

signs = [v[1] for v in list(dix.values())]

czs = "XINFLvGLB_NEG"

dfa = msp.linear_composite(

dfx,

xcats=xcatx,

cids=cidx,

weights=weights,

signs=signs,

normalize_weights=True,

complete_xcats=False, # score works with what is available

new_xcat=czs,

)

dfx = msm.update_df(dfx, dfa)

# Re-scoring

dfa = msp.make_zn_scores(

dfx,

xcat=czs,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

dict_facts[czs + "_ZN"] = "Relative inflation shortfall"

cids_dux

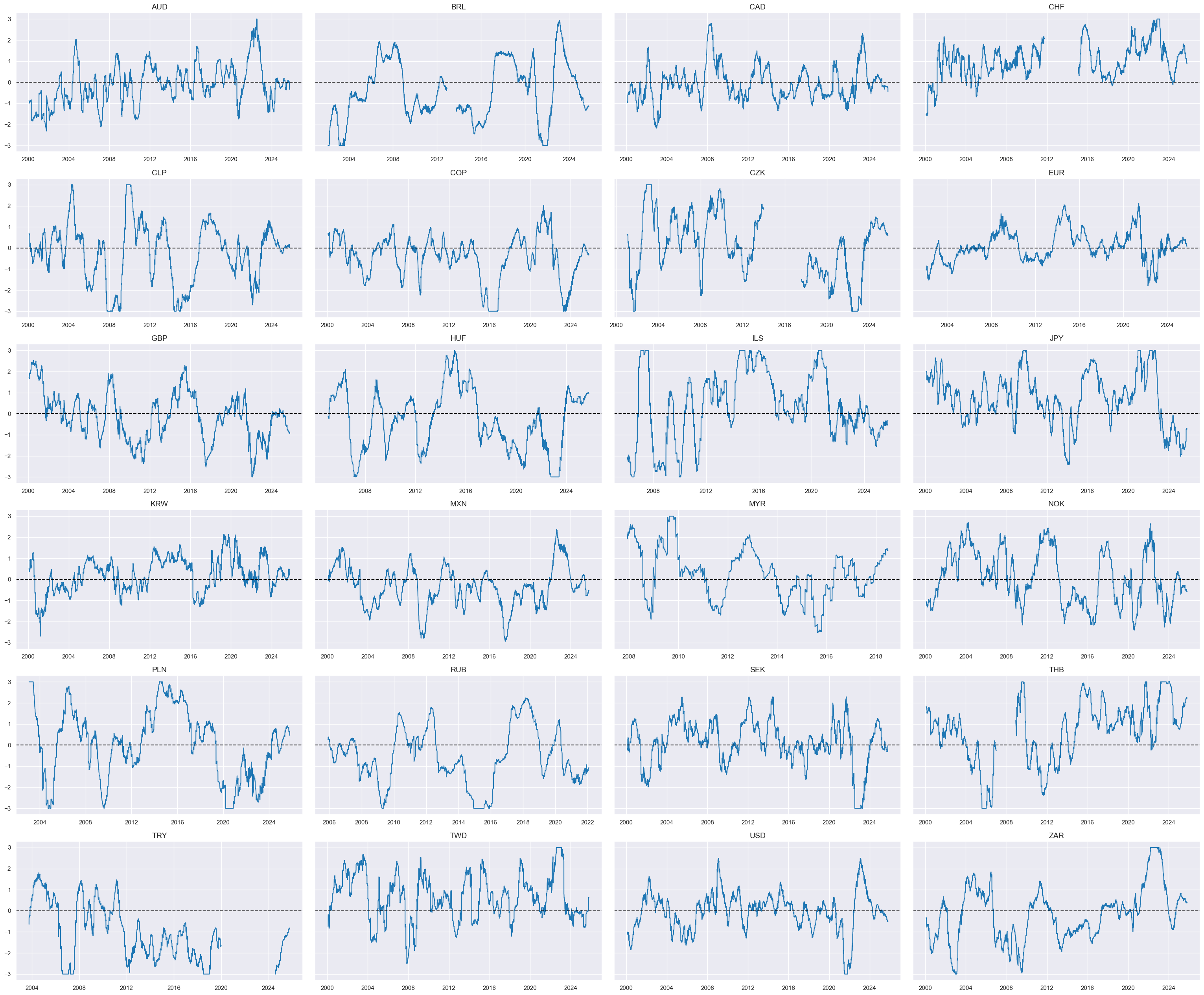

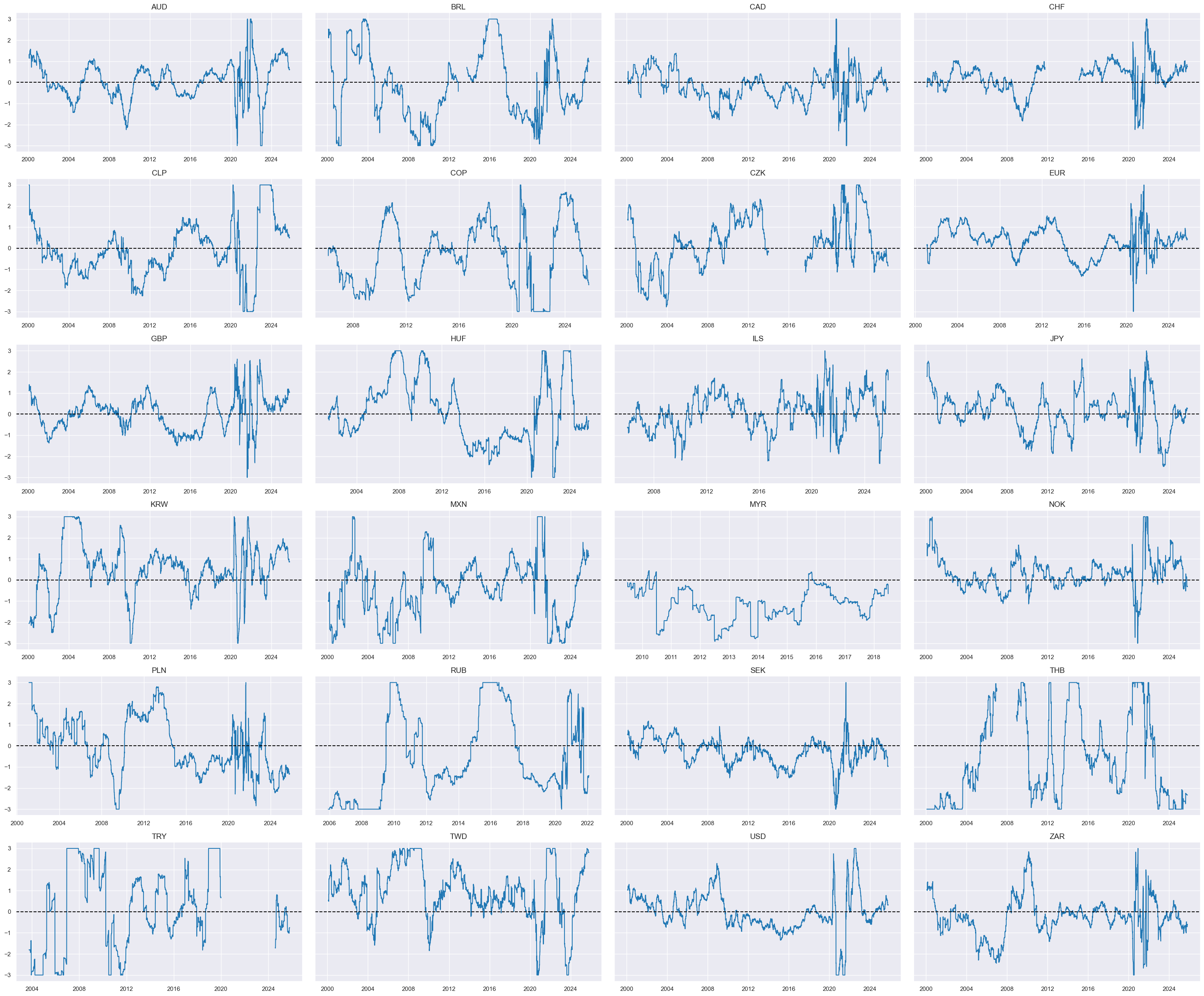

xcatx = 'XINFLvGLB_NEG_ZN'

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=True,

all_xticks=True,

size=(12, 7),

aspect=1.8

)

Relative disinflation ratios #

dict_infl_chg = {

"CPIH_SA_P1M1ML12_D1M1ML3": (1/2, -1),

"CPIC_SA_P1M1ML12_D1M1ML3": (1/2, -1),

}

cidx = cids_dux

xcatx = list(dict_infl_chg.keys())

for xc in xcatx:

calcs = [f"{xc}R = {xc} / INFTEBASIS",]

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cids_dux)

dfx = msm.update_df(dfx, dfa)

cidx = cids_dux

xcatx = [xc + "R" for xc in list(dict_infl_chg.keys())]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=False,

all_xticks=True,

size=(12, 7),

aspect=1.8

)

# Relative value of constituents

cidx = cids_dux

xcatx = [xc + "R" for xc in list(dict_infl_chg.keys())]

dfa = msp.make_relative_value(

df=dfx,

xcats=xcatx,

cids=cidx,

blacklist=fxblack,

postfix="vGLB",

)

dfx = msm.update_df(dfx, dfa)

# Scoring of relative values

cidx = cids_dux

xcatx = [xc + "RvGLB" for xc in list(dict_infl_chg.keys())]

dfa = pd.DataFrame(columns=dfx.columns)

for xc in xcatx:

dfaa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

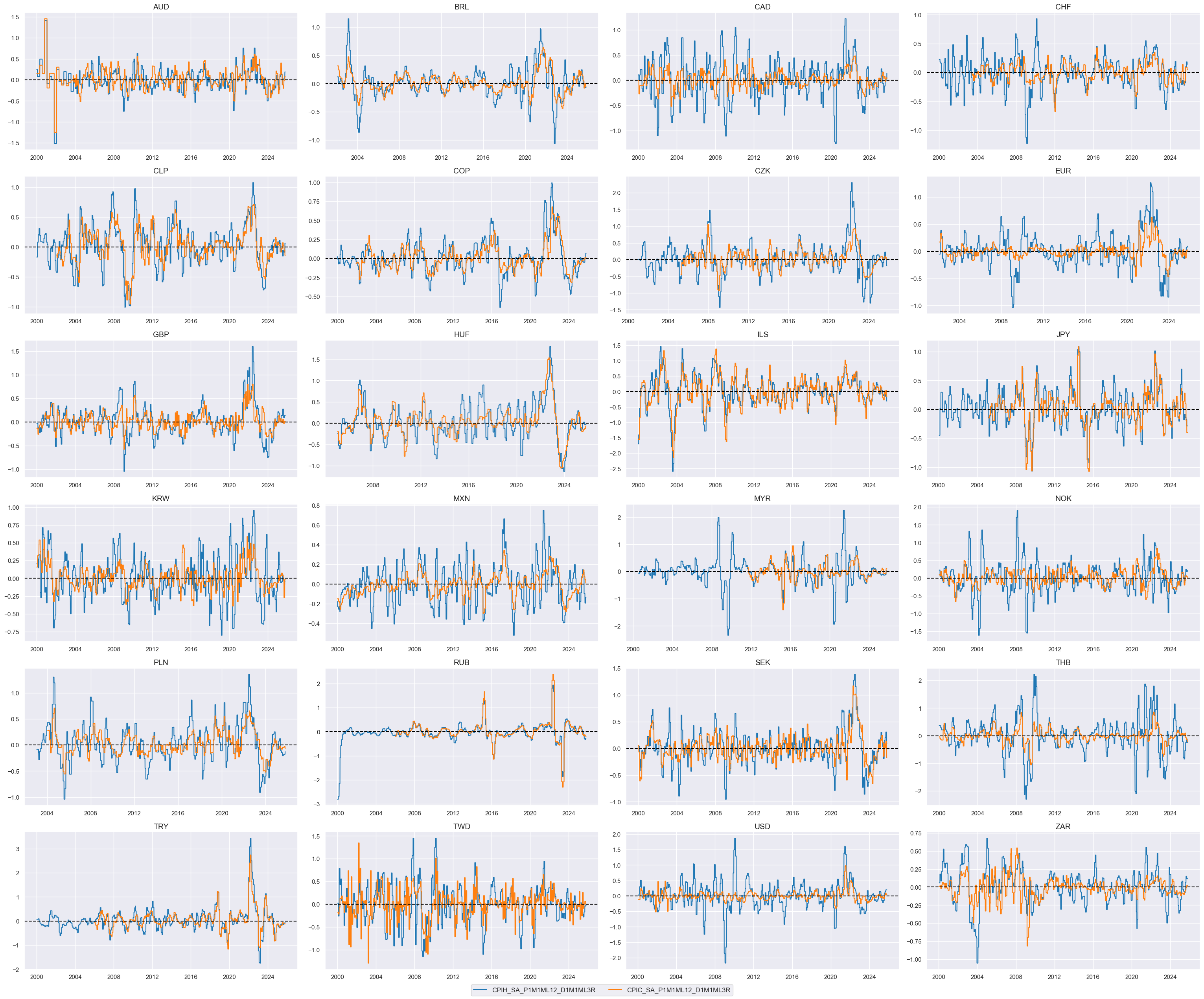

cidx = cids_dux

xcatx = [xc + "RvGLB_ZN" for xc in list(dict_infl_chg.keys())]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=True,

all_xticks=True,

size=(12, 7),

aspect=1.8

)

# Weighted linear combination

cidx = cids_dux

dix = dict_infl_chg

xcatx = [k + "RvGLB_ZN" for k in list(dix.keys())]

weights = [v[0] for v in list(dix.values())]

signs = [v[1] for v in list(dix.values())]

czs = "INFLCHGRvGLB_NEG"

dfa = msp.linear_composite(

dfx,

xcats=xcatx,

cids=cidx,

weights=weights,

signs=signs,

normalize_weights=True,

complete_xcats=False, # score works with what is available

new_xcat=czs,

)

dfx = msm.update_df(dfx, dfa)

# Re-scoring

dfa = msp.make_zn_scores(

dfx,

xcat=czs,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

dict_facts[czs + "_ZN"] = "Relative disinflation ratio"

cids_dux

xcatx = ['INFLCHGRvGLB_NEG_ZN']

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=True,

all_xticks=True,

size=(12, 7),

aspect=1.8

)

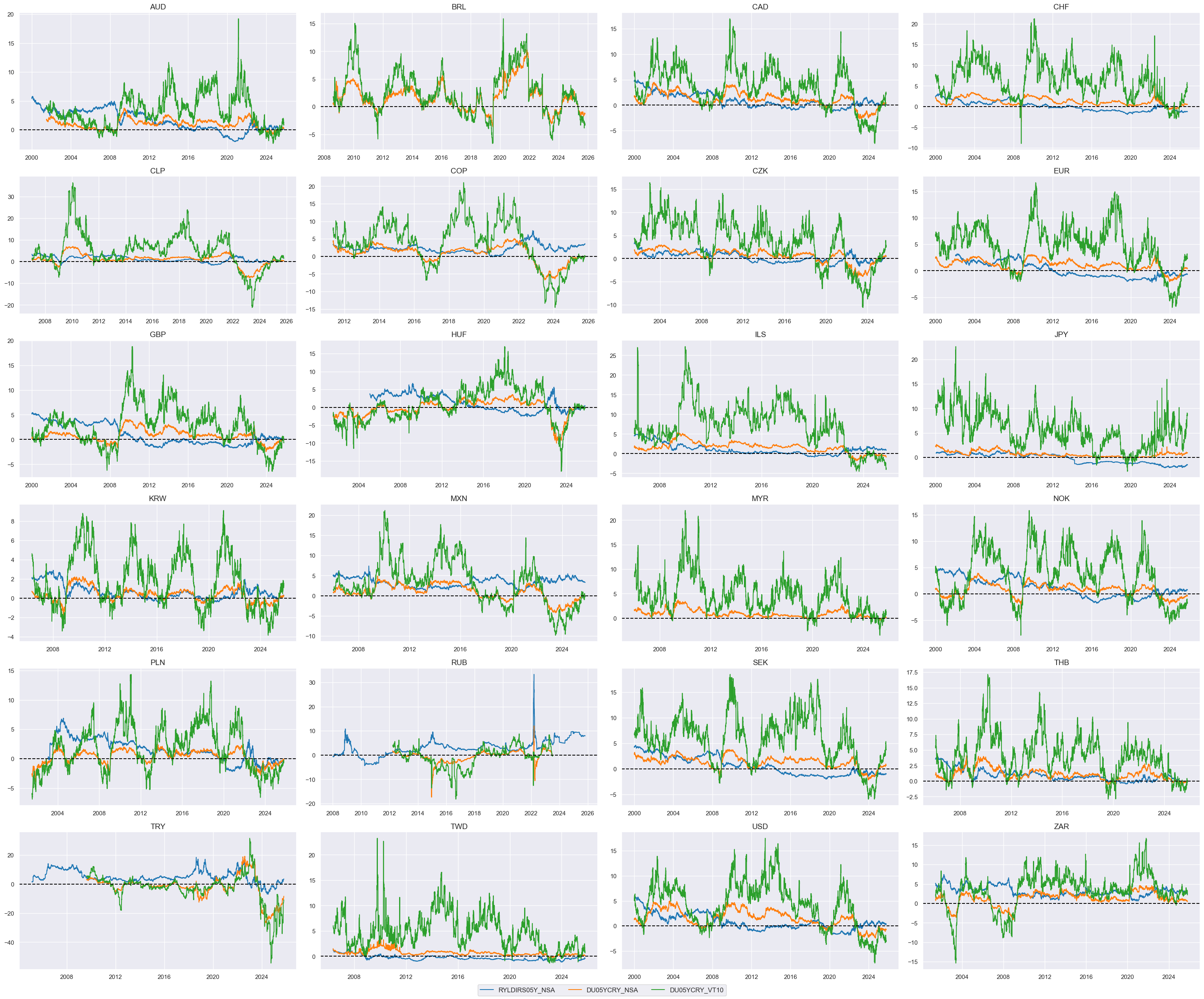

Relative real yields and carry #

# Base indicators and score weights

dict_ir = {

"RYLDIRS05Y_NSA": (1/2, 1),

"DU05YCRY_NSA": (1/4, 1),

"DU05YCRY_VT10": (1/4, 1),

}

cidx = cids_dux

xcatx = list(dict_ir.keys())

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=False,

all_xticks=True,

size=(12, 7),

aspect=1.8

)

# Relative value of constituents

cidx = cids_dux

xcatx = list(dict_ir.keys())

dfa = msp.make_relative_value(

df=dfx,

xcats=xcatx,

cids=cidx,

blacklist=fxblack,

postfix="vGLB",

)

dfx = msm.update_df(dfx, dfa)

# Scoring of relative values

cidx = cids_dux

xcatx = [xc + "vGLB" for xc in list(dict_ir.keys())]

dfa = pd.DataFrame(columns=dfx.columns)

for xc in xcatx:

dfaa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

cidx = cids_dux

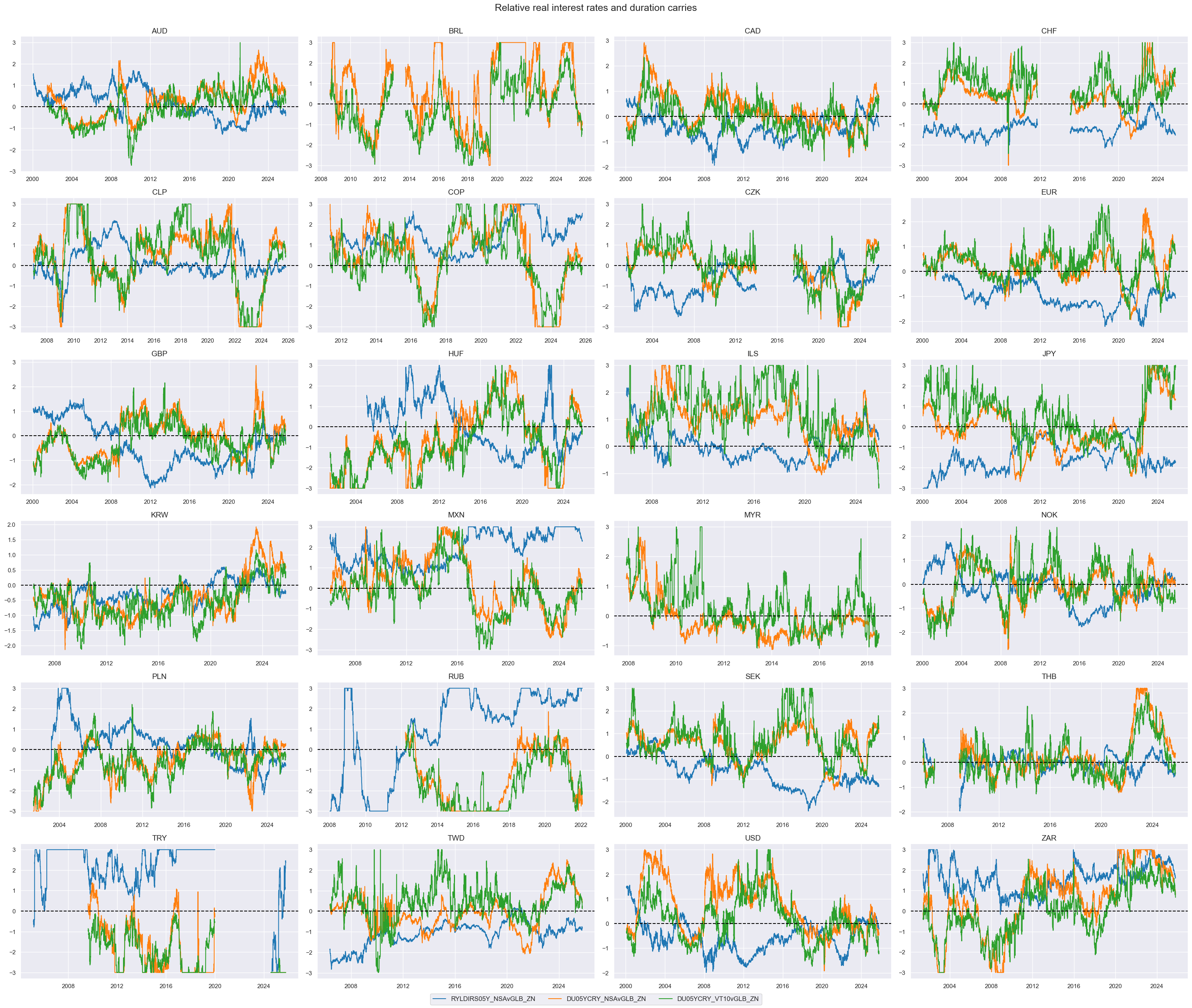

xcatx = [xcat + "vGLB_ZN" for xcat in list(dict_ir.keys())]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=False,

all_xticks=True,

size=(12, 7),

aspect=1.8,

title = "Relative real interest rates and duration carries"

)

# Weighted linear combination

cidx = cids_dux

dix = dict_ir

xcatx = [k + "vGLB_ZN" for k in list(dix.keys())]

weights = [v[0] for v in list(dix.values())]

signs = [v[1] for v in list(dix.values())]

czs = "RRCRvGLB"

dfa = msp.linear_composite(

dfx,

xcats=xcatx,

cids=cidx,

weights=weights,

signs=signs,

normalize_weights=True,

complete_xcats=False, # score works with what is available

new_xcat=czs,

)

dfx = msm.update_df(dfx, dfa)

# Re-scoring

dfa = msp.make_zn_scores(

dfx,

xcat=czs,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

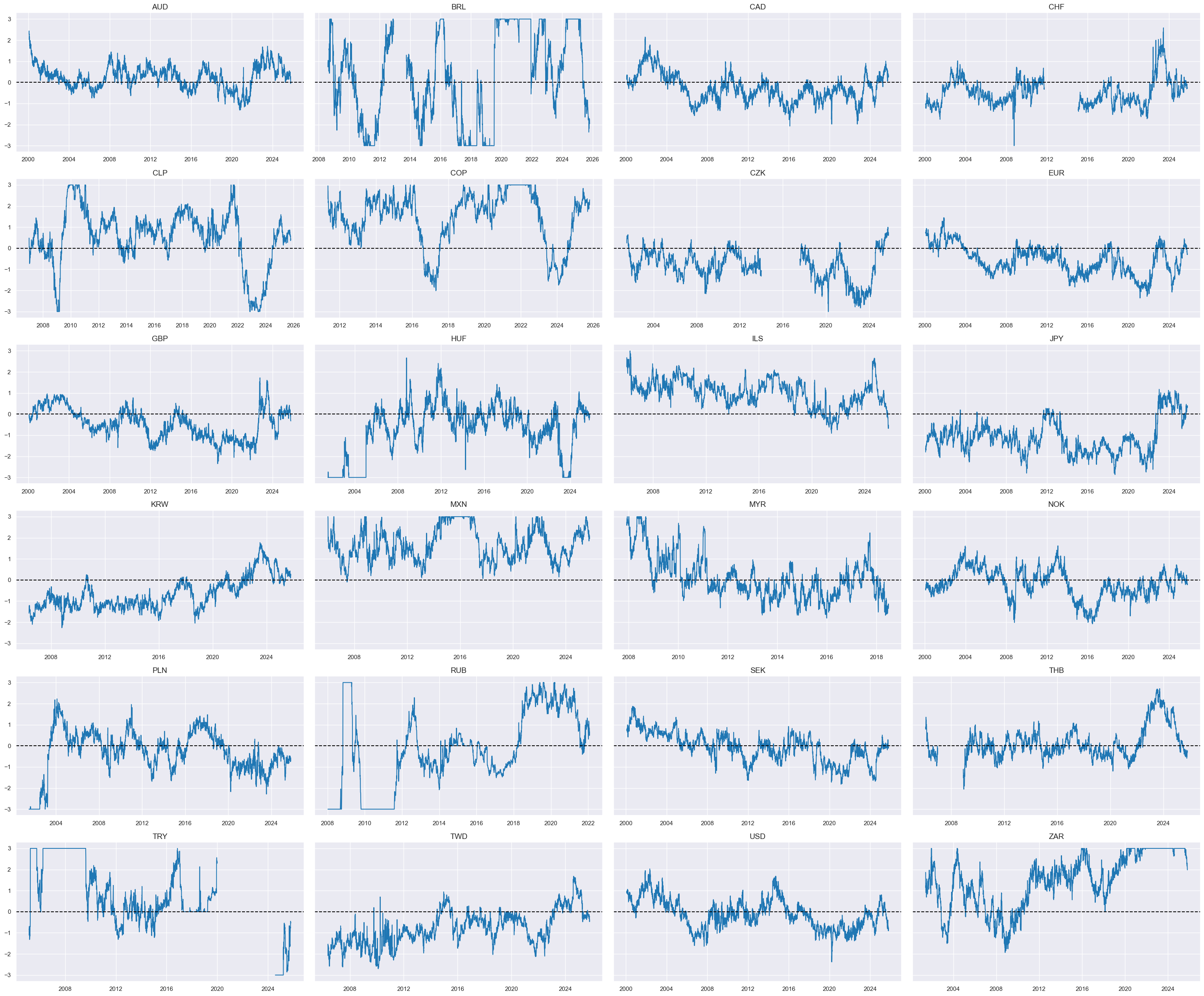

dict_facts[czs + "_ZN"] = "Relative real yields and carry"

cids_dux

xcatx = ['RRCRvGLB_ZN']

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=True,

all_xticks=True,

size=(12, 7),

aspect=1.8

)

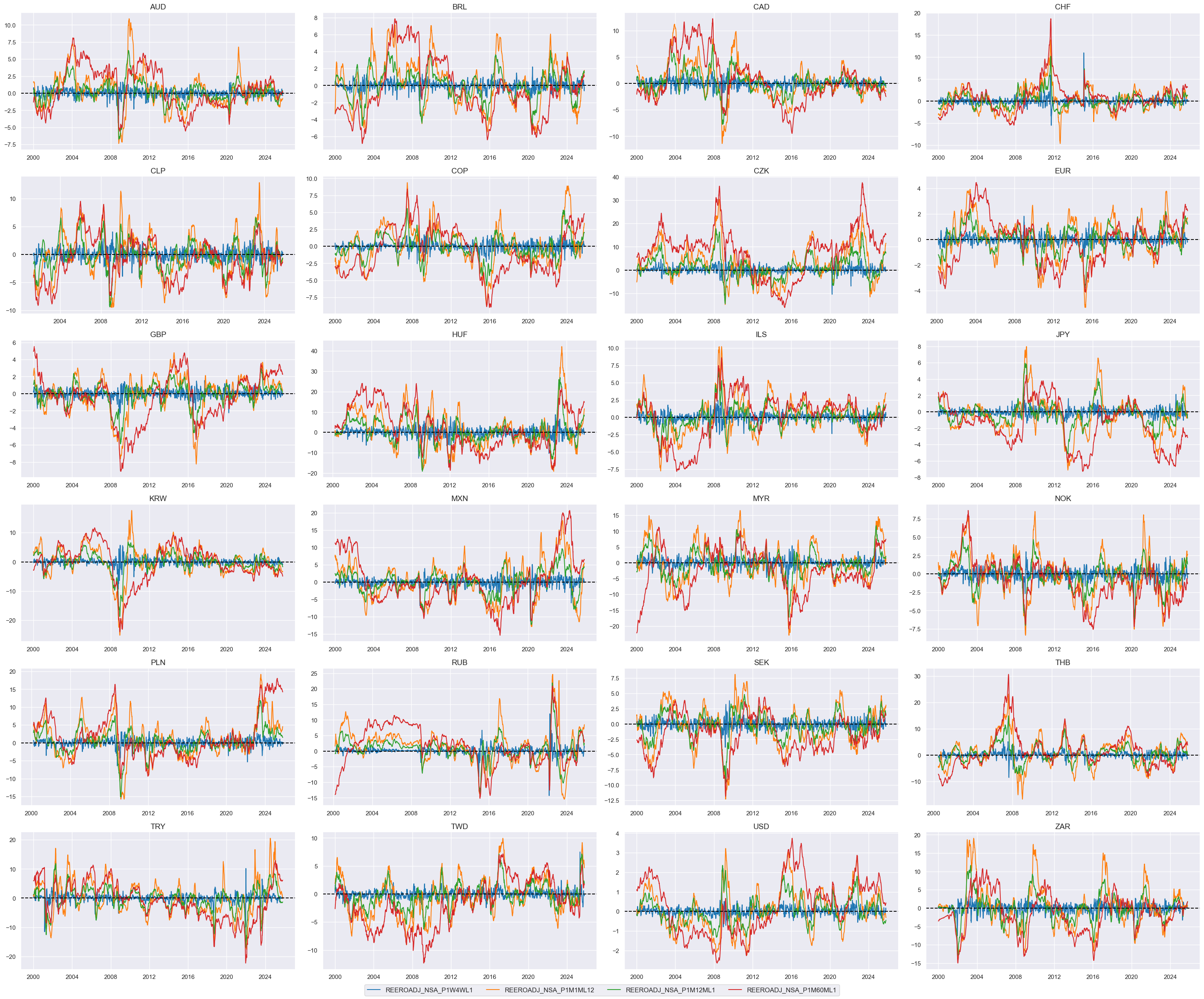

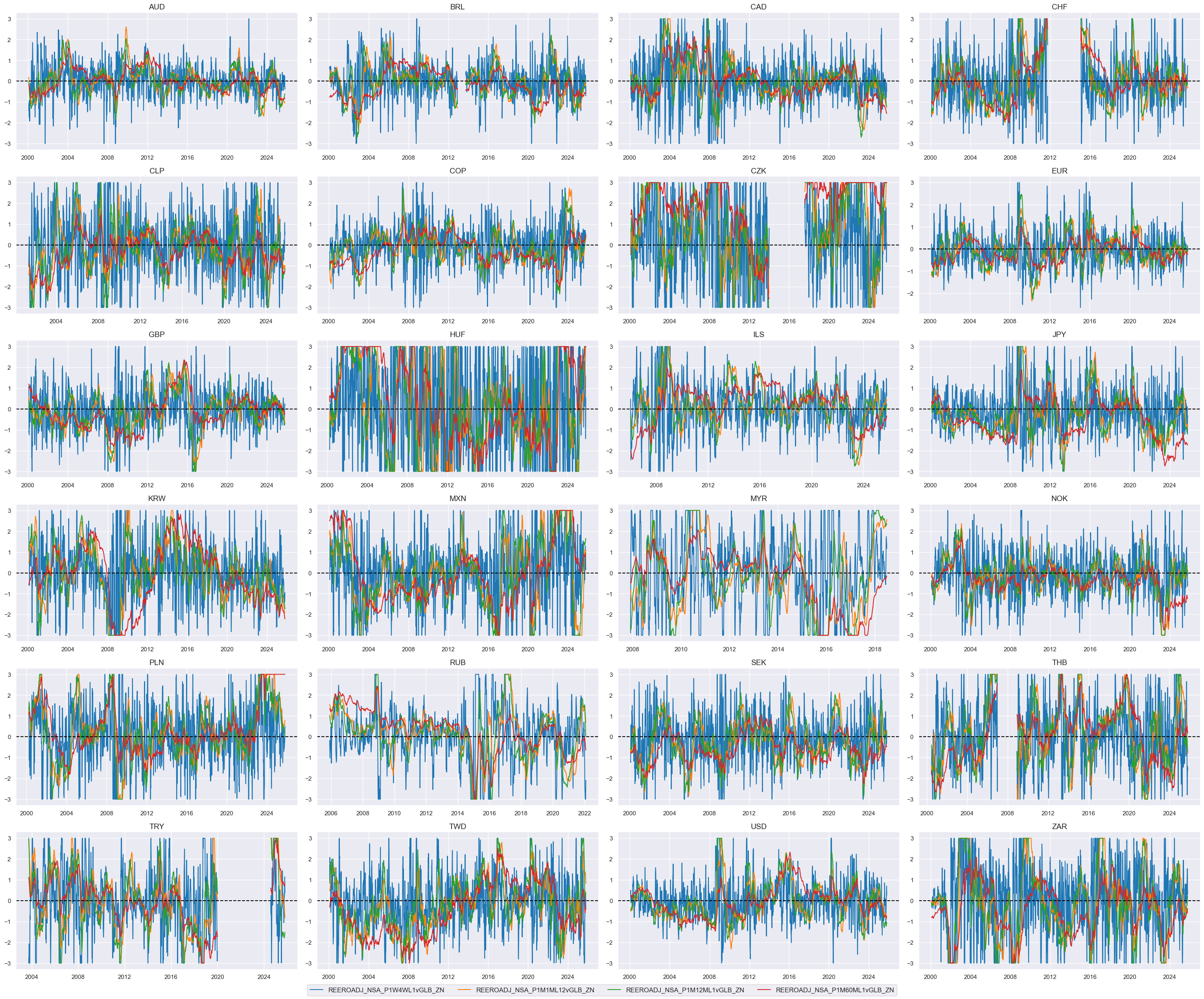

Relative openness-adjusted real appreciation #

dict_reer = {

"REEROADJ_NSA_P1W4WL1": (1/4, 1),

"REEROADJ_NSA_P1M1ML12": (1/4, 1),

"REEROADJ_NSA_P1M12ML1": (1/4, 1),

"REEROADJ_NSA_P1M60ML1": (1/4, 1),

}

cidx = cids_dux

xcatx = list(dict_reer.keys())

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=False,

all_xticks=True,

size=(12, 7),

aspect=1.8

)

# Relative value of constituents

cidx = cids_dux

xcatx = list(dict_reer.keys())

dfa = msp.make_relative_value(

df=dfx,

xcats=xcatx,

cids=cidx,

blacklist=fxblack,

postfix="vGLB",

)

dfx = msm.update_df(dfx, dfa)

# Scoring of relative values

cidx = cids_dux

xcatx = [xc + "vGLB" for xc in list(dict_reer.keys())]

dfa = pd.DataFrame(columns=dfx.columns)

for xc in xcatx:

dfaa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

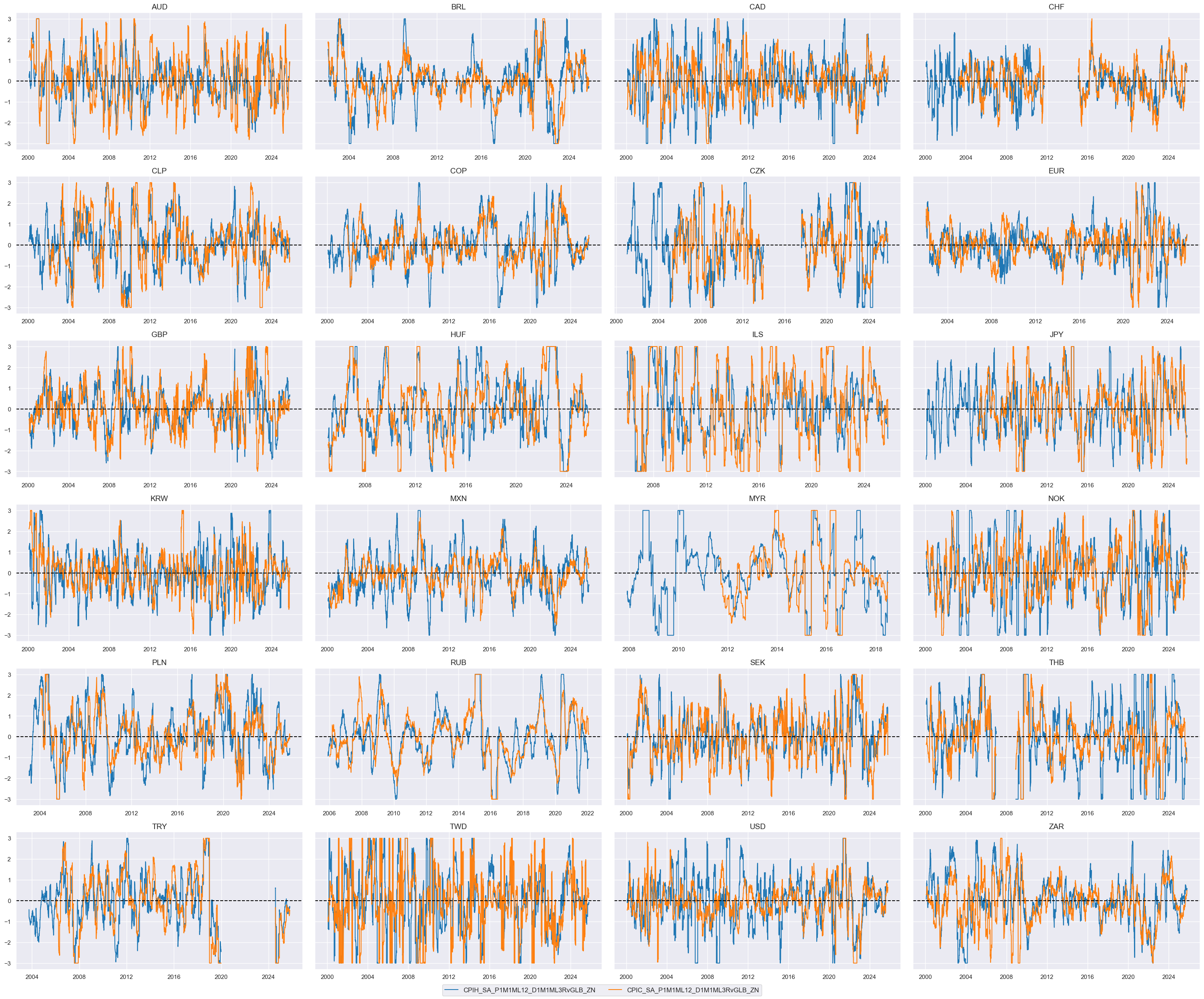

cidx = cids_dux

xcatx = [xcat + "vGLB_ZN" for xcat in list(dict_reer.keys())]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=False,

all_xticks=True,

size=(12, 7),

aspect=1.8,

)

# Weighted linear combination

cidx = cids_dux

dix = dict_reer

xcatx = [k + "vGLB_ZN" for k in list(dix.keys())]

weights = [v[0] for v in list(dix.values())]

signs = [v[1] for v in list(dix.values())]

czs = "REEROACHGvGLB"

dfa = msp.linear_composite(

dfx,

xcats=xcatx,

cids=cidx,

weights=weights,

signs=signs,

normalize_weights=True,

complete_xcats=False, # score works with what is available

new_xcat=czs,

)

dfx = msm.update_df(dfx, dfa)

# Re-scoring

dfa = msp.make_zn_scores(

dfx,

xcat=czs,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

dict_facts[czs + "_ZN"] = "Relative real appreciation"

cids_dux

xcatx = ['REEROACHGvGLB_ZN']

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=True,

all_xticks=True,

size=(12, 7),

aspect=1.8

)

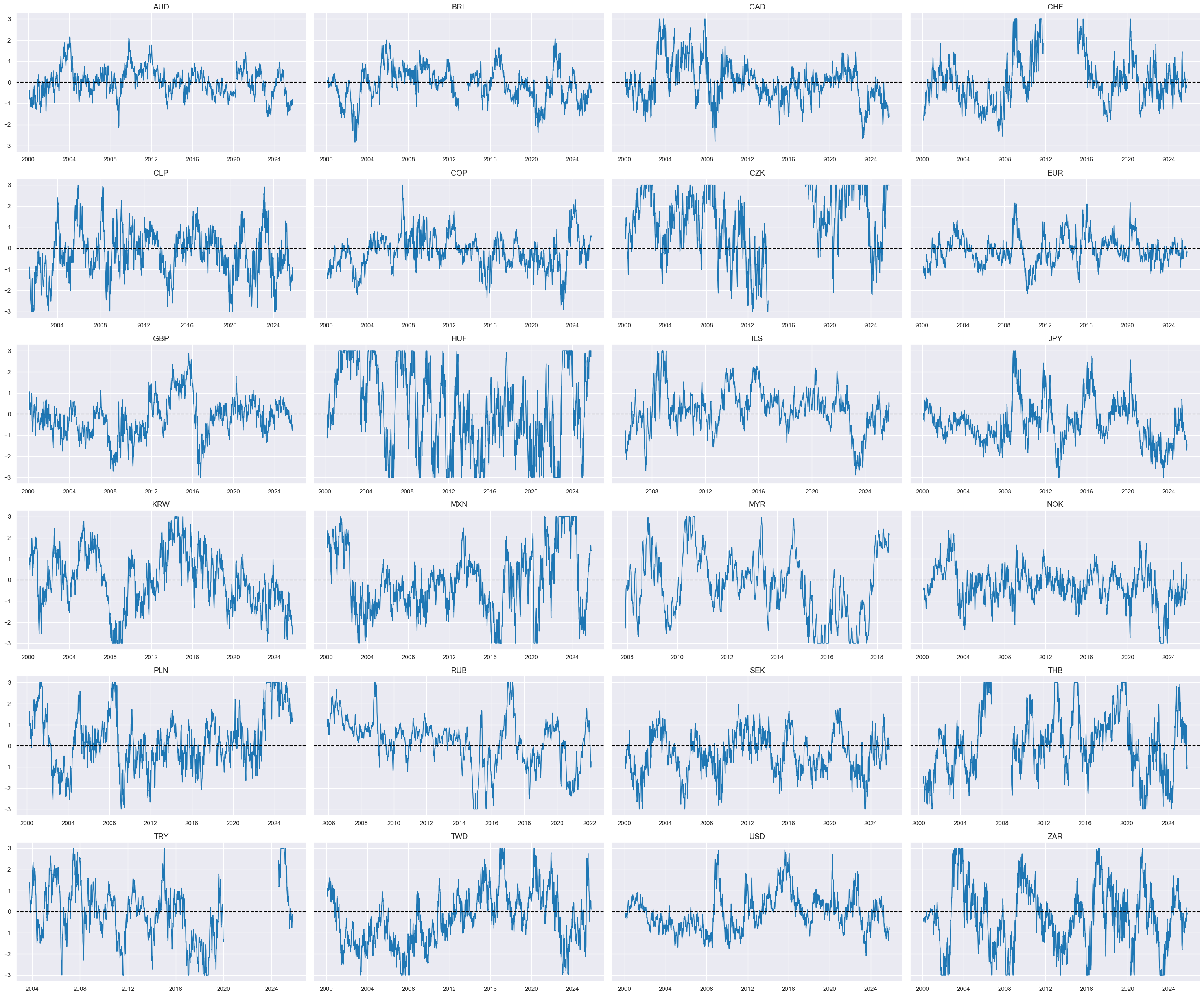

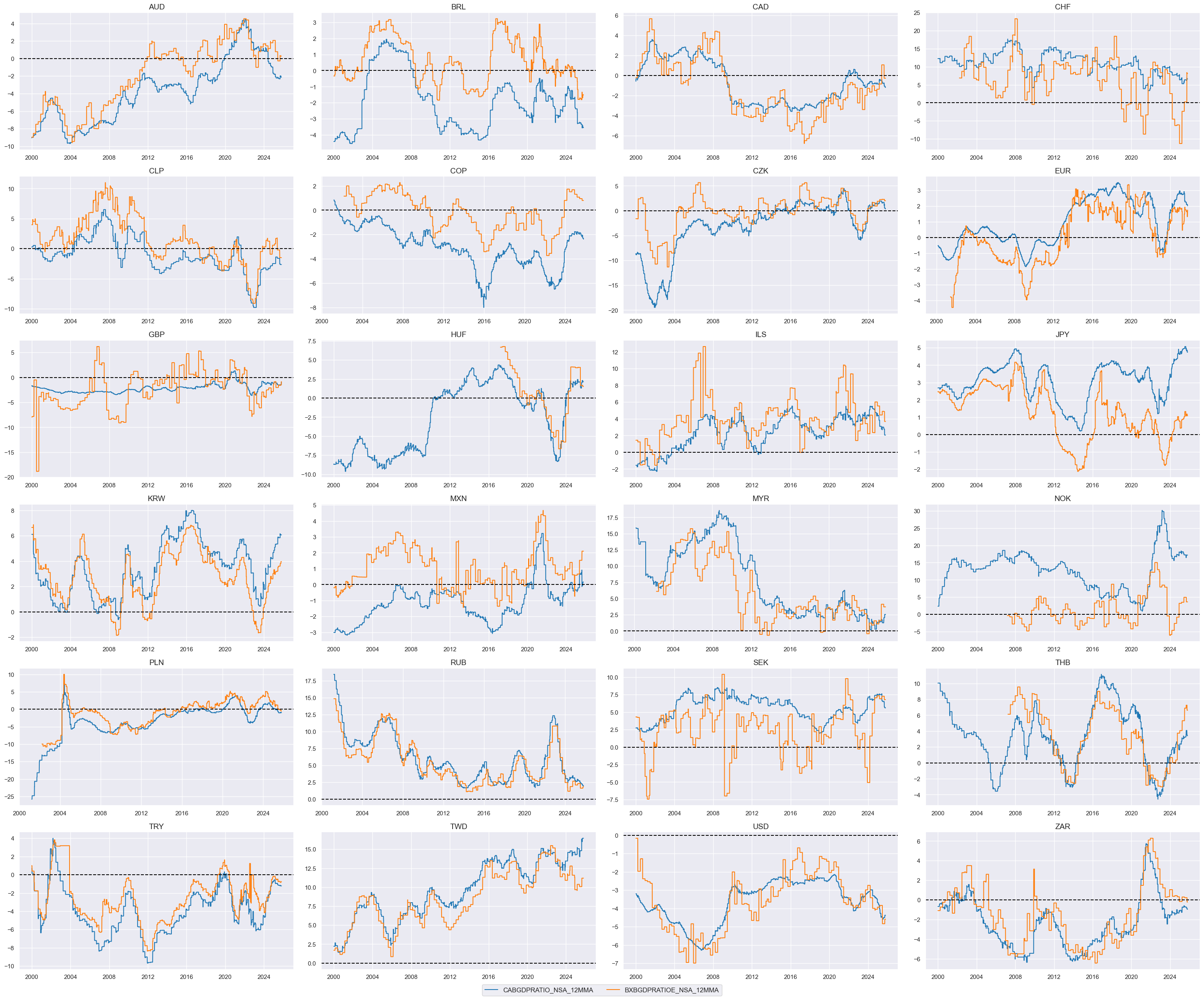

Relative external balances #

dict_xb = {

"CABGDPRATIO_NSA_12MMA": (1/2, 1),

"BXBGDPRATIOE_NSA_12MMA": (1/2, 1),

}

cidx = cids_dux

xcatx = list(dict_xb.keys())

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=False,

all_xticks=True,

size=(12, 7),

aspect=1.8

)

# Relative value of constituents

cidx = cids_dux

xcatx = list(dict_xb.keys())

dfa = msp.make_relative_value(

df=dfx,

xcats=xcatx,

cids=cidx,

blacklist=fxblack,

postfix="vGLB",

)

dfx = msm.update_df(dfx, dfa)

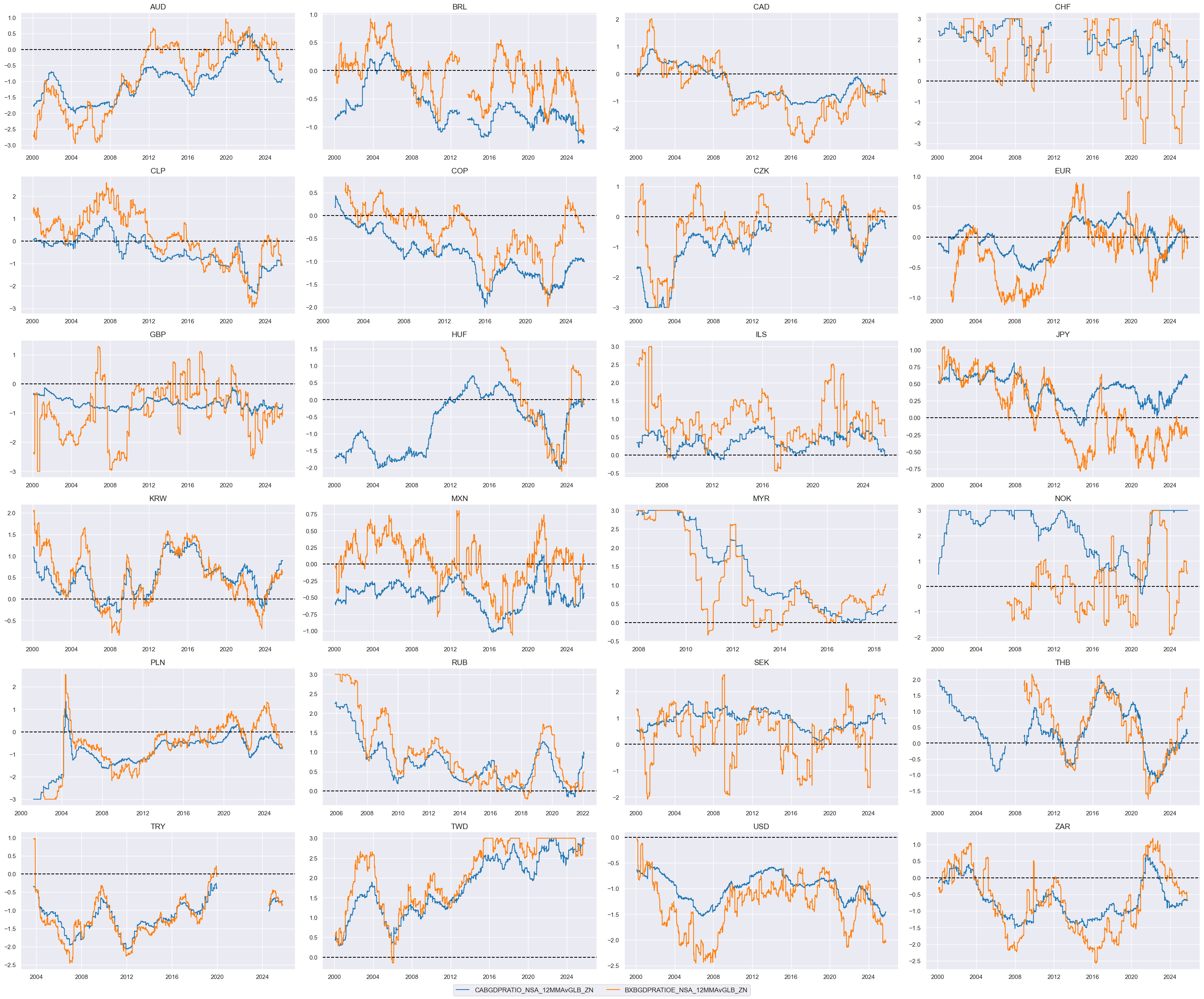

# Scoring of relative values

cidx = cids_dux

xcatx = [xc + "vGLB" for xc in list(dict_xb.keys())]

dfa = pd.DataFrame(columns=dfx.columns)

for xc in xcatx:

dfaa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

cidx = cids_dux

xcatx = [xcat + "vGLB_ZN" for xcat in list(dict_xb.keys())]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=False,

all_xticks=True,

size=(12, 7),

aspect=1.8,

)

# Weighted linear combination

cidx = cids_dux

dix = dict_xb

xcatx = [k + "vGLB_ZN" for k in list(dix.keys())]

weights = [v[0] for v in list(dix.values())]

signs = [v[1] for v in list(dix.values())]

czs = "XBALvGLB"

dfa = msp.linear_composite(

dfx,

xcats=xcatx,

cids=cidx,

weights=weights,

signs=signs,

normalize_weights=True,

complete_xcats=False, # score works with what is available

new_xcat=czs,

)

dfx = msm.update_df(dfx, dfa)

# Re-scoring

dfa = msp.make_zn_scores(

dfx,

xcat=czs,

cids=cidx,

sequential=True,

min_obs=261 * 3, # why not 3?

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

dict_facts[czs + "_ZN"] = "Relative external balances"

cids_dux

xcatx = ['XBALvGLB_ZN']

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=True,

all_xticks=True,

size=(12, 7),

aspect=1.8

)

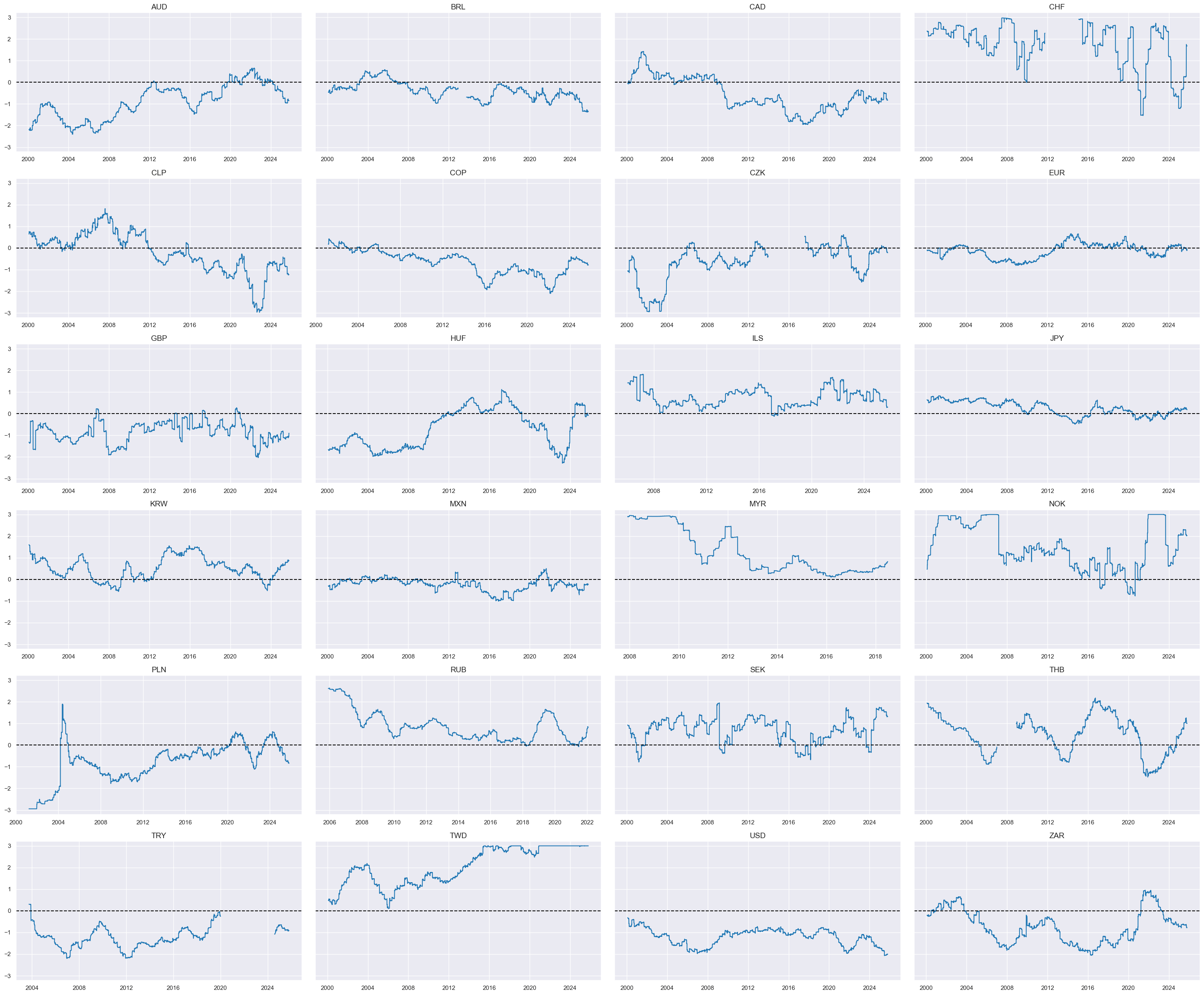

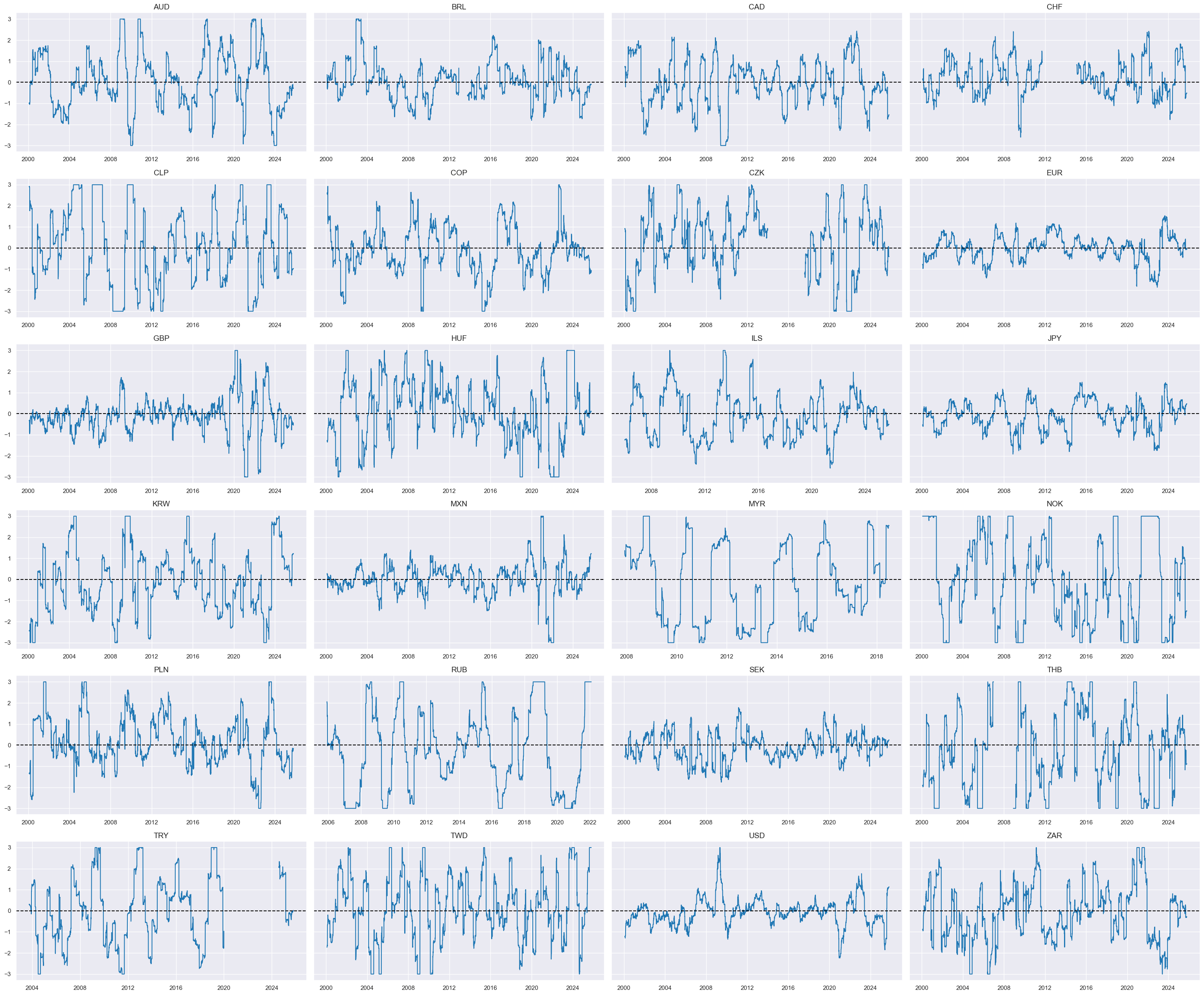

Relative trade balance ratio changes #

dict_mtb = {

"MTBGDPRATIO_SA_3MMA_D1M1ML3": (1/3, 1),

"MTBGDPRATIO_SA_6MMA_D1M1ML6": (1/3, 1),

"MTBGDPRATIO_NSA_12MMA_D1M1ML3": (1/3, 1),

}

cidx = cids_dux

xcatx = list(dict_mtb.keys())

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=False,

all_xticks=True,

size=(12, 7),

aspect=1.8

)

# Relative value of constituents

cidx = cids_dux

xcatx = list(dict_mtb.keys())

dfa = msp.make_relative_value(

df=dfx,

xcats=xcatx,

cids=cidx,

blacklist=fxblack,

postfix="vGLB",

)

dfx = msm.update_df(dfx, dfa)

# Scoring of relative values

cidx = cids_dux

xcatx = [xc + "vGLB" for xc in list(dict_mtb.keys())]

dfa = pd.DataFrame(columns=dfx.columns)

for xc in xcatx:

dfaa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

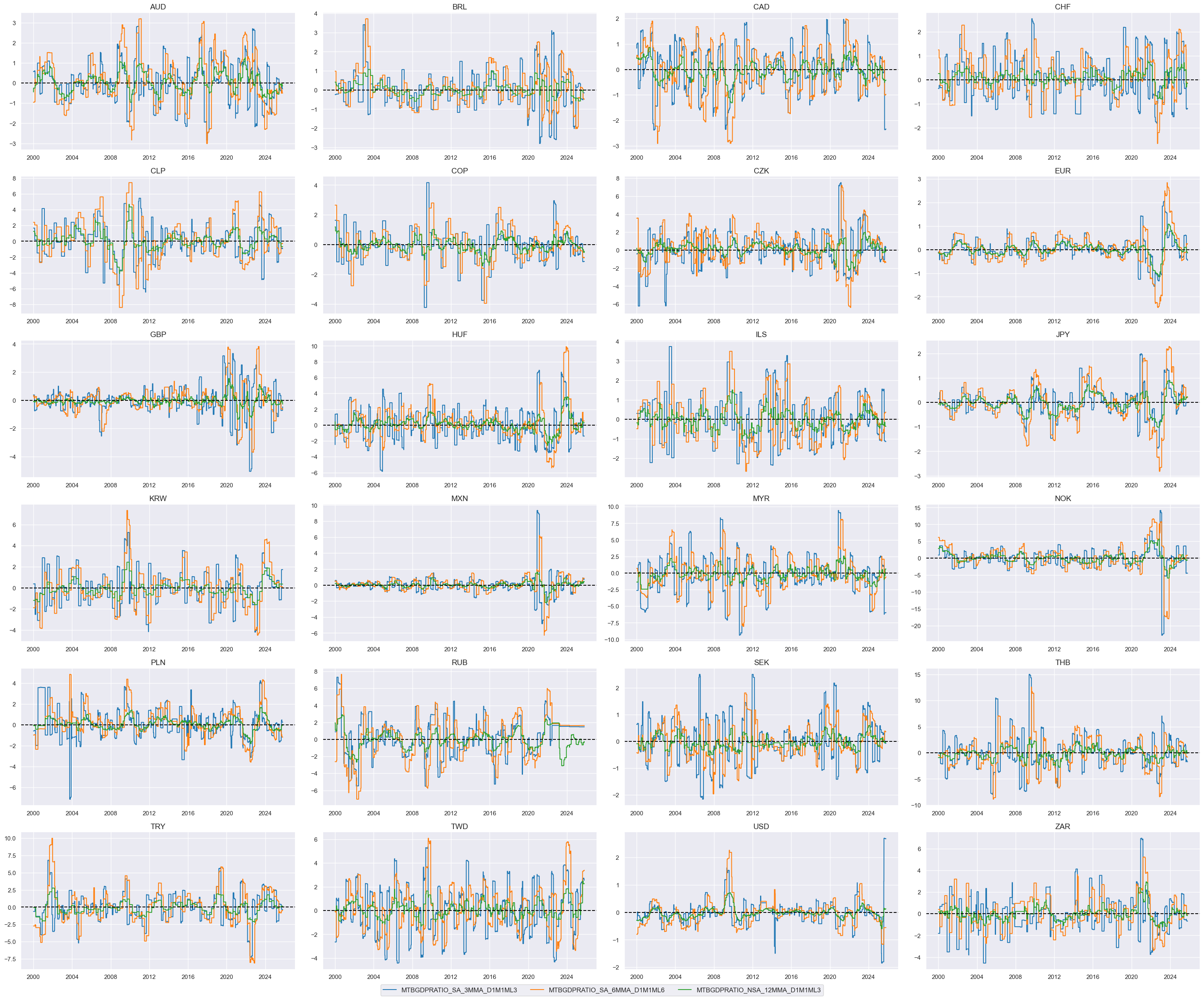

cidx = cids_dux

xcatx = [xcat + "vGLB_ZN" for xcat in list(dict_mtb.keys())]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=False,

all_xticks=True,

size=(12, 7),

aspect=1.8,

title = "Merchandise trade balance differences"

)

# Weighted linear combination

cidx = cids_dux

dix = dict_mtb

xcatx = [k + "vGLB_ZN" for k in list(dix.keys())]

weights = [v[0] for v in list(dix.values())]

signs = [v[1] for v in list(dix.values())]

czs = "MTBCHGvGLB"

dfa = msp.linear_composite(

dfx,

xcats=xcatx,

cids=cidx,

weights=weights,

signs=signs,

normalize_weights=True,

complete_xcats=False, # score works with what is available

new_xcat=czs,

)

dfx = msm.update_df(dfx, dfa)

# Re-scoring

dfa = msp.make_zn_scores(

dfx,

xcat=czs,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

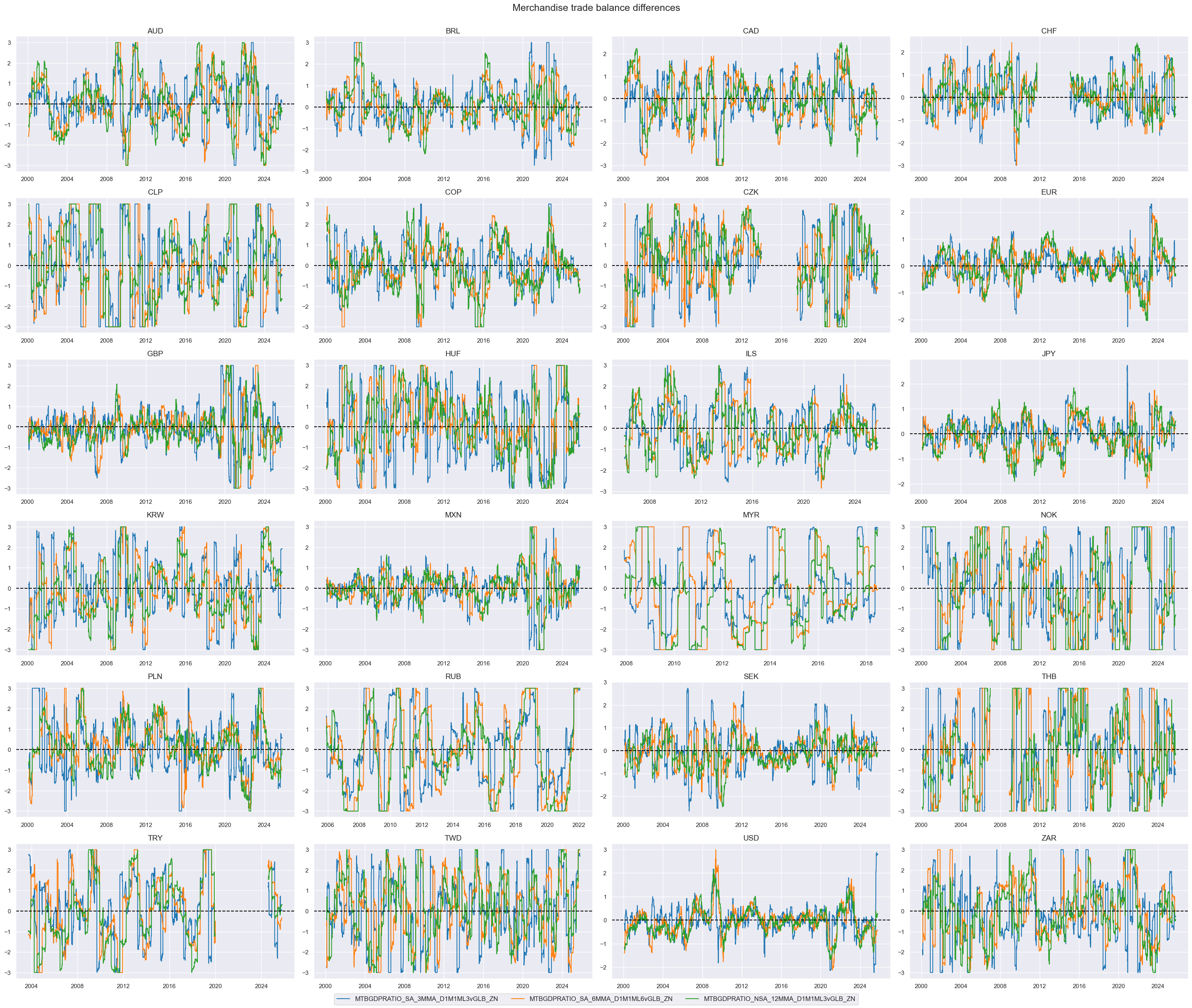

dict_facts[czs + "_ZN"] = "Relative trade balance changes"

cids_dux

xcatx = ['MTBCHGvGLB_ZN']

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=True,

all_xticks=True,

size=(12, 7),

aspect=1.8

)

Relative liquidity growth #

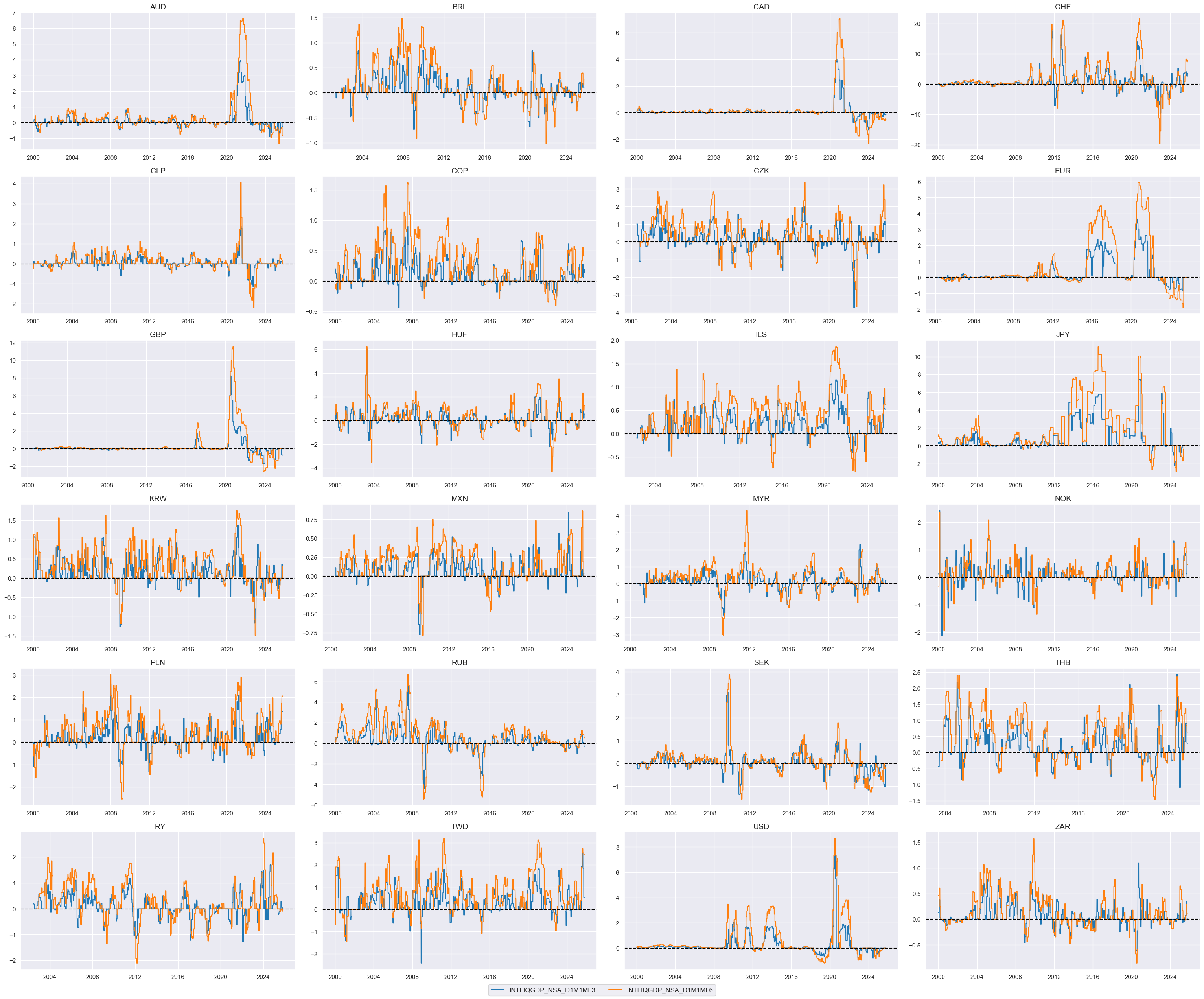

dict_liq = {

"INTLIQGDP_NSA_D1M1ML3": (1/2, 1),

"INTLIQGDP_NSA_D1M1ML6": (1/2, 1),

}

cidx = cids_dux

xcatx = list(dict_liq.keys())

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=False,

all_xticks=True,

size=(12, 7),

aspect=1.8

)

# Relative value of constituents

cidx = cids_dux

xcatx = list(dict_liq.keys())

dfa = msp.make_relative_value(

df=dfx,

xcats=xcatx,

cids=cidx,

blacklist=fxblack,

postfix="vGLB",

)

dfx = msm.update_df(dfx, dfa)

# Scoring of relative values

cidx = cids_dux

xcatx = [xc + "vGLB" for xc in list(dict_liq.keys())]

dfa = pd.DataFrame(columns=dfx.columns)

for xc in xcatx:

dfaa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

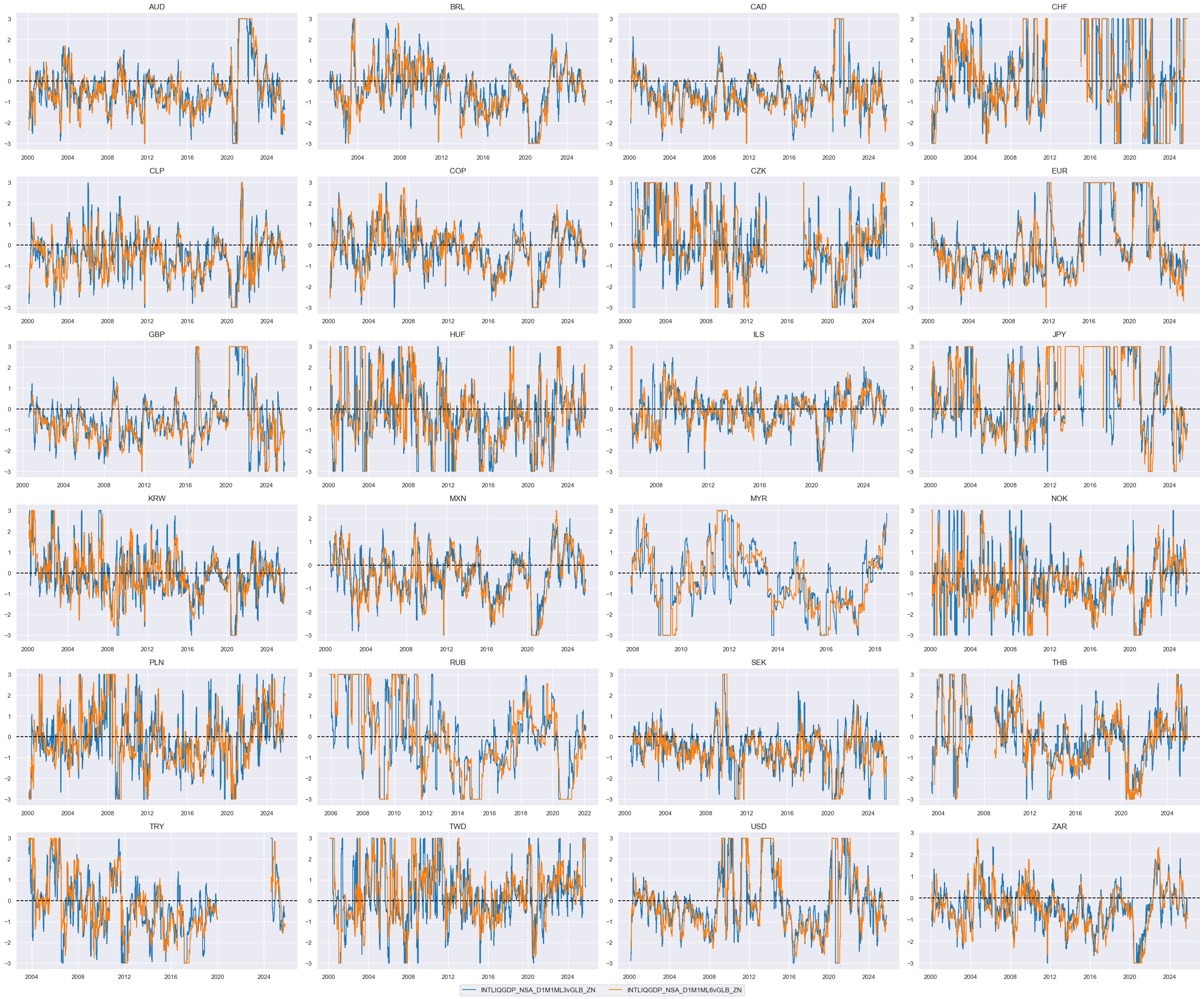

cidx = cids_dux

xcatx = [xcat + "vGLB_ZN" for xcat in list(dict_liq.keys())]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=False,

all_xticks=True,

size=(12, 7),

aspect=1.8,

)

# Weighted linear combination

cidx = cids_dux

dix = dict_liq

xcatx = [k + "vGLB_ZN" for k in list(dix.keys())]

weights = [v[0] for v in list(dix.values())]

signs = [v[1] for v in list(dix.values())]

czs = "LIQCHGvGLB"

dfa = msp.linear_composite(

dfx,

xcats=xcatx,

cids=cidx,

weights=weights,

signs=signs,

normalize_weights=True,

complete_xcats=False, # score works with what is available

new_xcat=czs,

)

dfx = msm.update_df(dfx, dfa)

# Re-scoring

dfa = msp.make_zn_scores(

dfx,

xcat=czs,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

dict_facts[czs + "_ZN"] = "Relative liquidity growth"

cids_dux

xcatx = ['LIQCHGvGLB_ZN']

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=True,

all_xticks=True,

size=(12, 7),

aspect=1.8

)

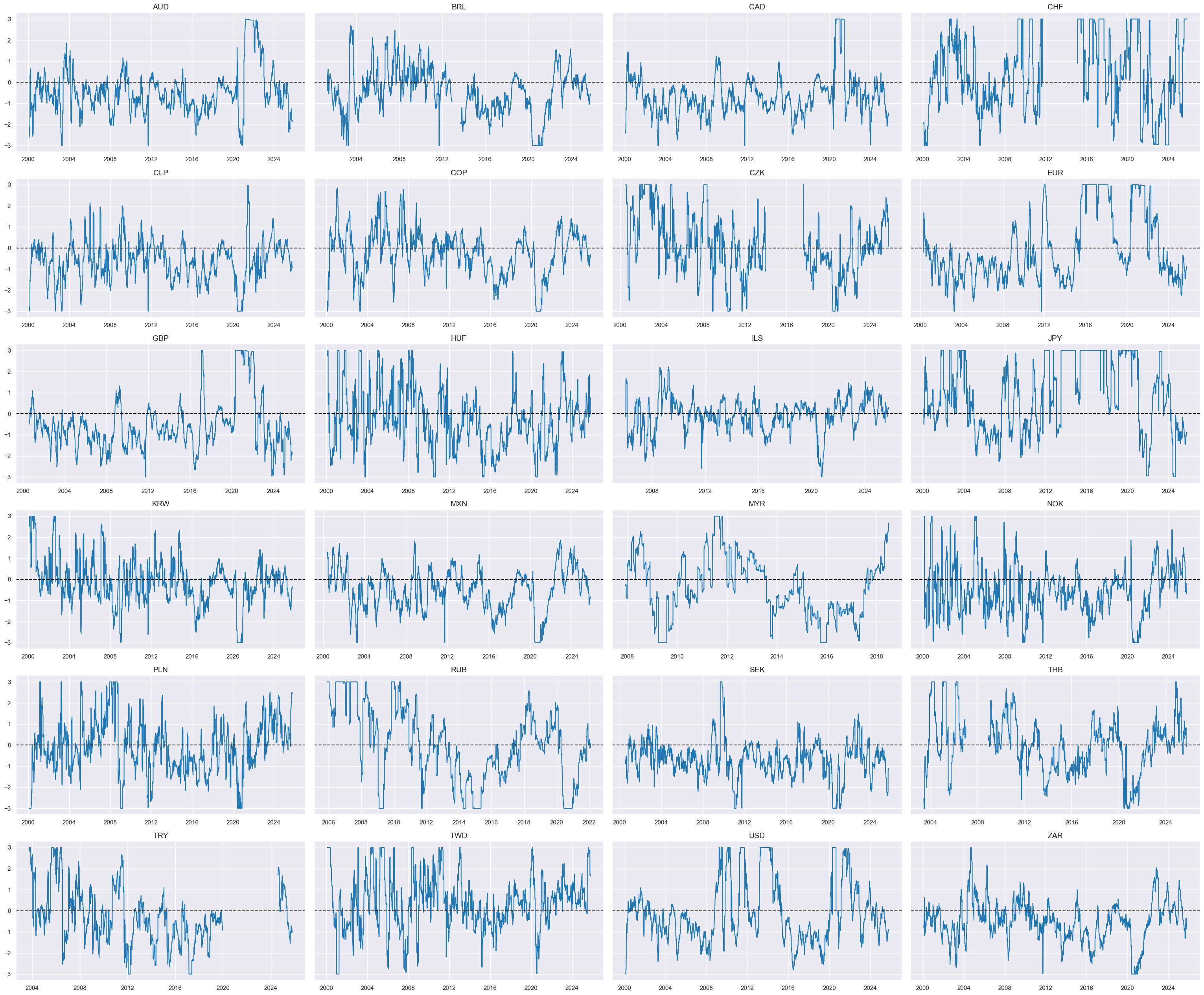

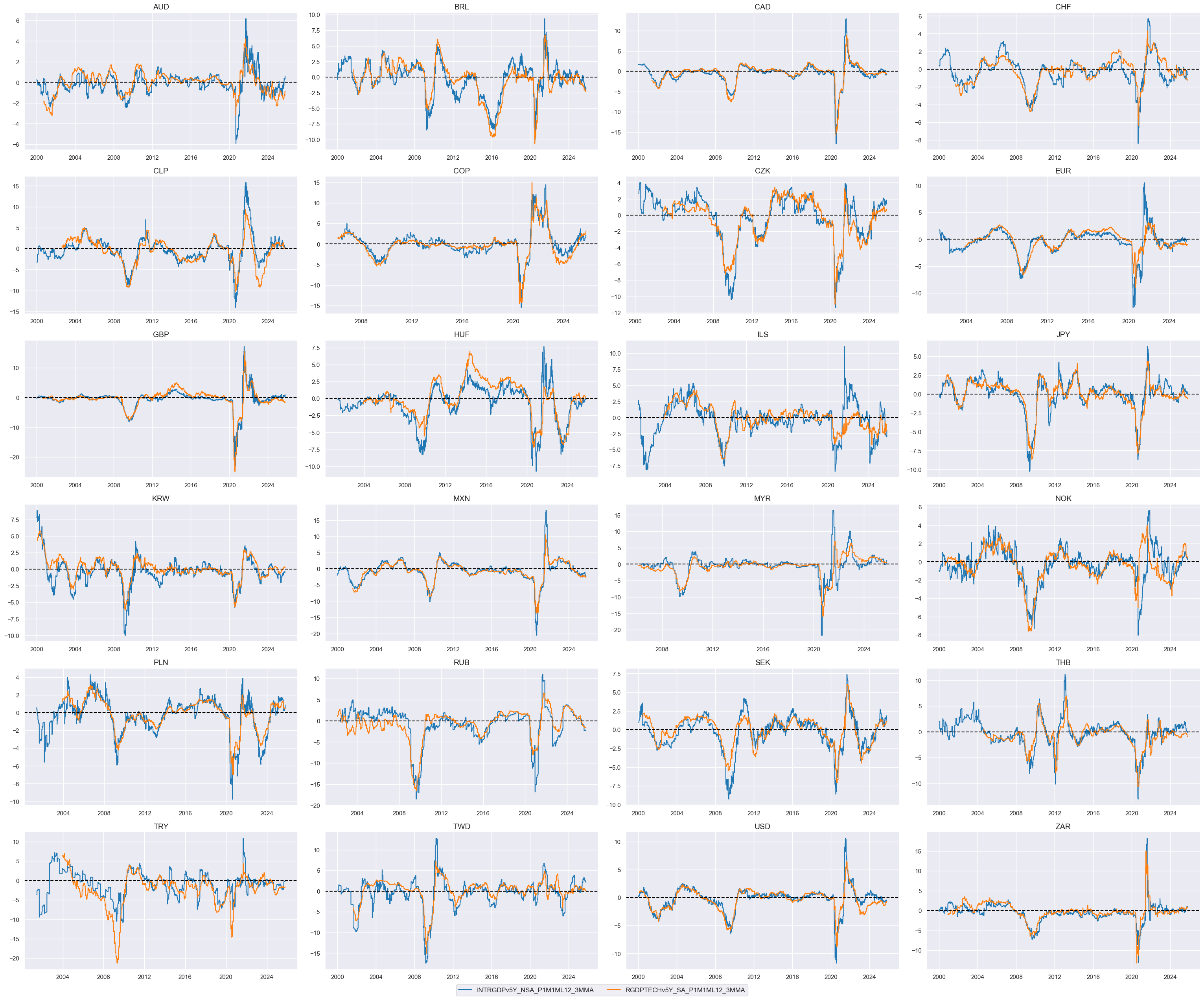

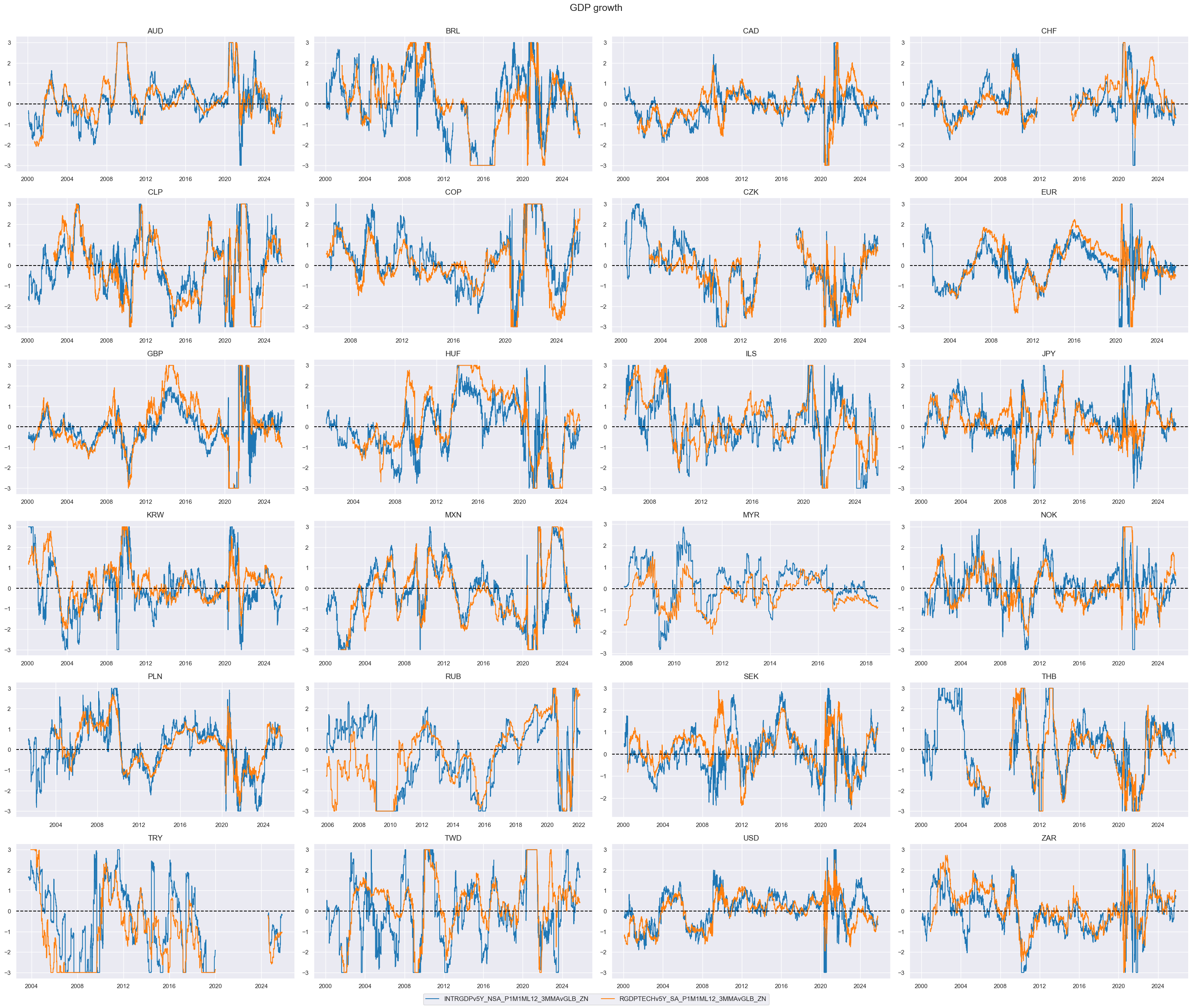

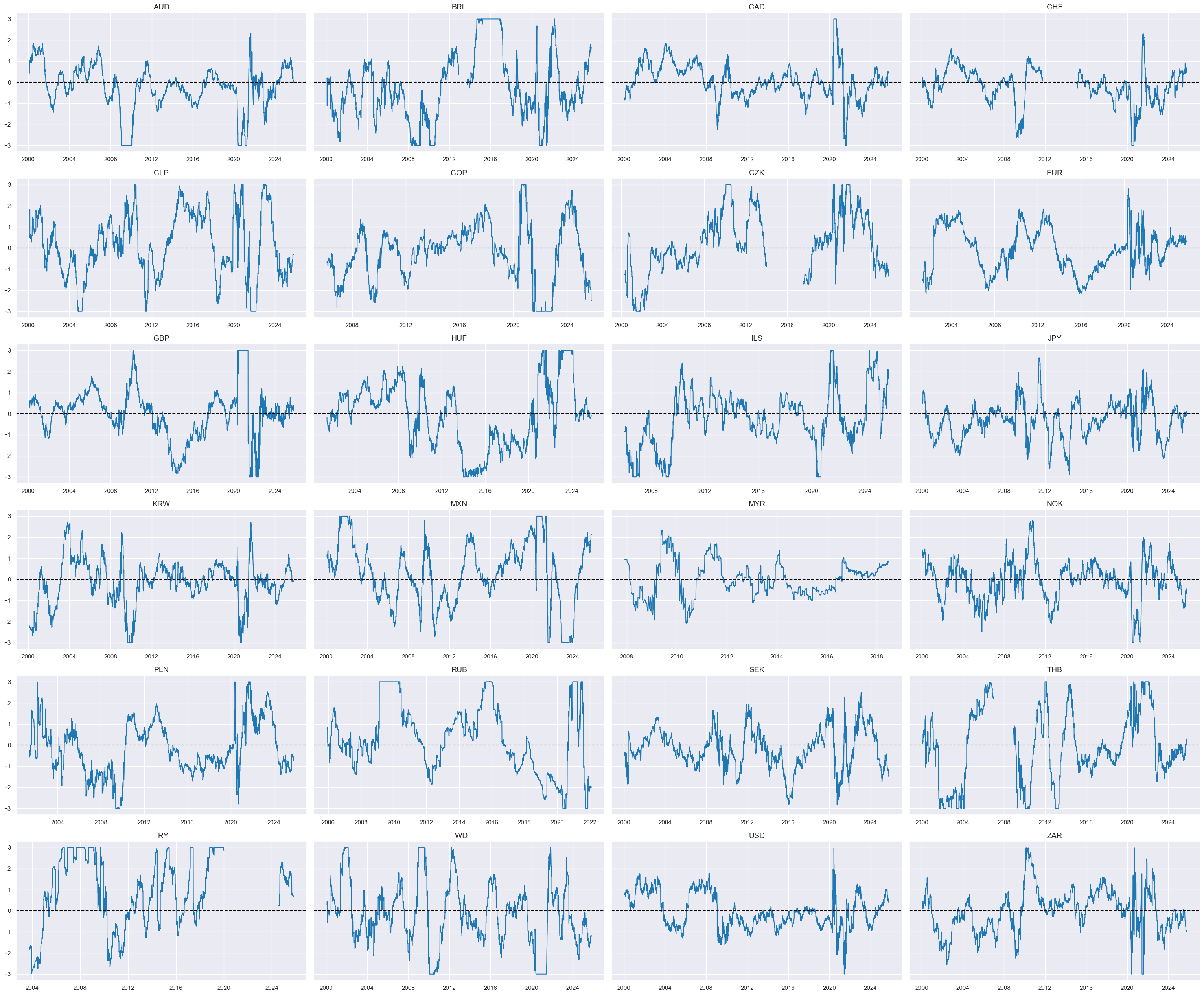

Relative GDP growth shortfall #

dict_gdp = {

"INTRGDPv5Y_NSA_P1M1ML12_3MMA": (1/2, -1),

"RGDPTECHv5Y_SA_P1M1ML12_3MMA": (1/2, -1),

}

cidx = cids_dux

xcatx = list(dict_gdp.keys())

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=False,

all_xticks=True,

size=(12, 7),

aspect=1.8

)

# Relative value of constituents

cidx = cids_dux

xcatx = list(dict_gdp.keys())

dfa = msp.make_relative_value(

df=dfx,

xcats=xcatx,

cids=cidx,

blacklist=fxblack,

postfix="vGLB",

)

dfx = msm.update_df(dfx, dfa)

# Scoring of relative values

cidx = cids_dux

xcatx = [xc + "vGLB" for xc in list(dict_gdp.keys())]

dfa = pd.DataFrame(columns=dfx.columns)

for xc in xcatx:

dfaa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

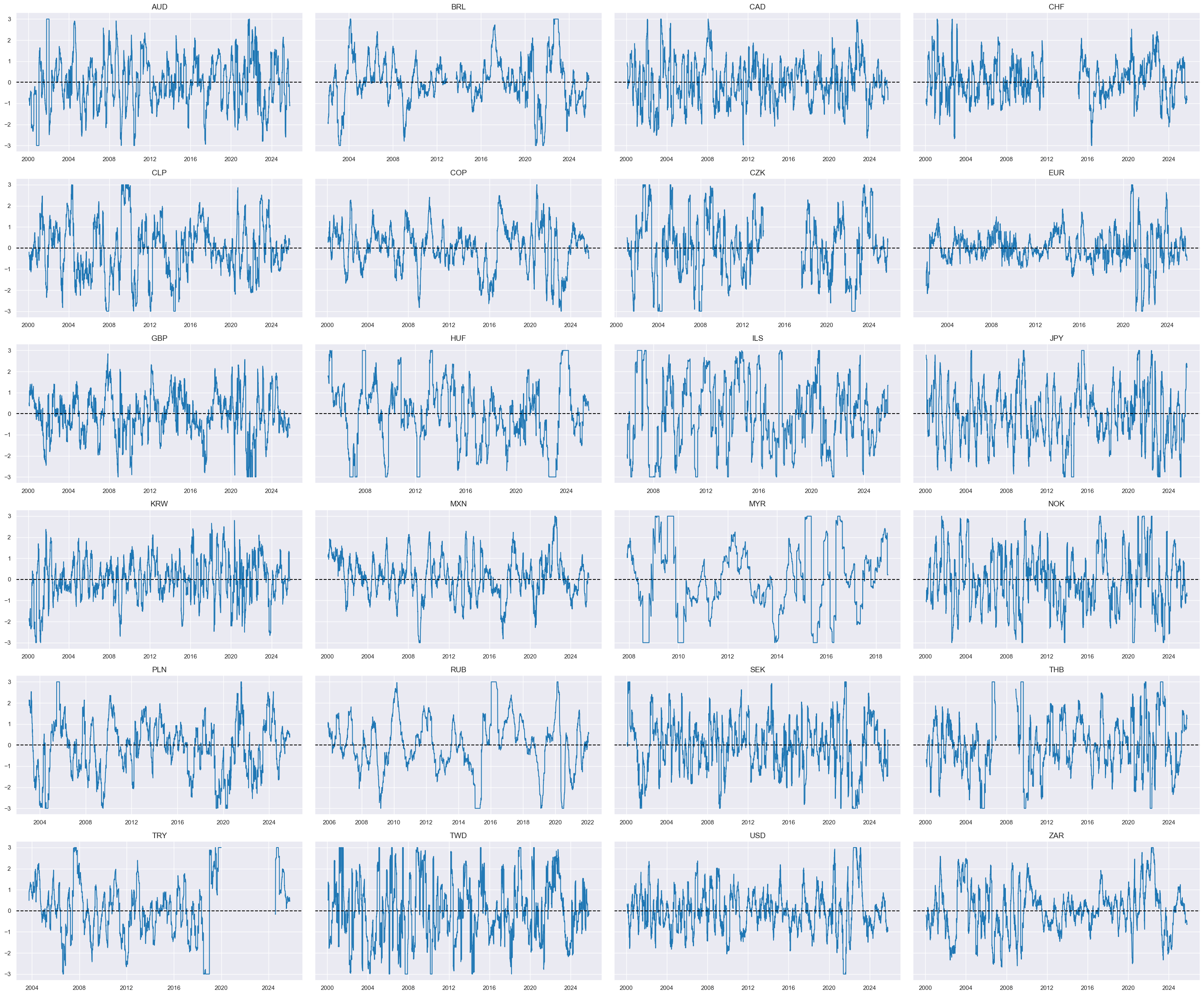

cidx = cids_dux

xcatx = [xcat + "vGLB_ZN" for xcat in list(dict_gdp.keys())]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=False,

all_xticks=True,

size=(12, 7),

aspect=1.8,

title = "GDP growth"

)

# Weighted linear combination

cidx = cids_dux

dix = dict_gdp

xcatx = [k + "vGLB_ZN" for k in list(dix.keys())]

weights = [v[0] for v in list(dix.values())]

signs = [v[1] for v in list(dix.values())]

czs = "RGDPGROWTHvGLB_NEG"

dfa = msp.linear_composite(

dfx,

xcats=xcatx,

cids=cidx,

weights=weights,

signs=signs,

normalize_weights=True,

complete_xcats=False, # score works with what is available

new_xcat=czs,

)

dfx = msm.update_df(dfx, dfa)

# Re-scoring

dfa = msp.make_zn_scores(

dfx,

xcat=czs,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

dict_facts[czs + "_ZN"] = "Relative GDP growth shortfall"

cids_dux

xcatx = ['RGDPGROWTHvGLB_NEG_ZN']

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=True,

all_xticks=True,

size=(12, 7),

aspect=1.8

)

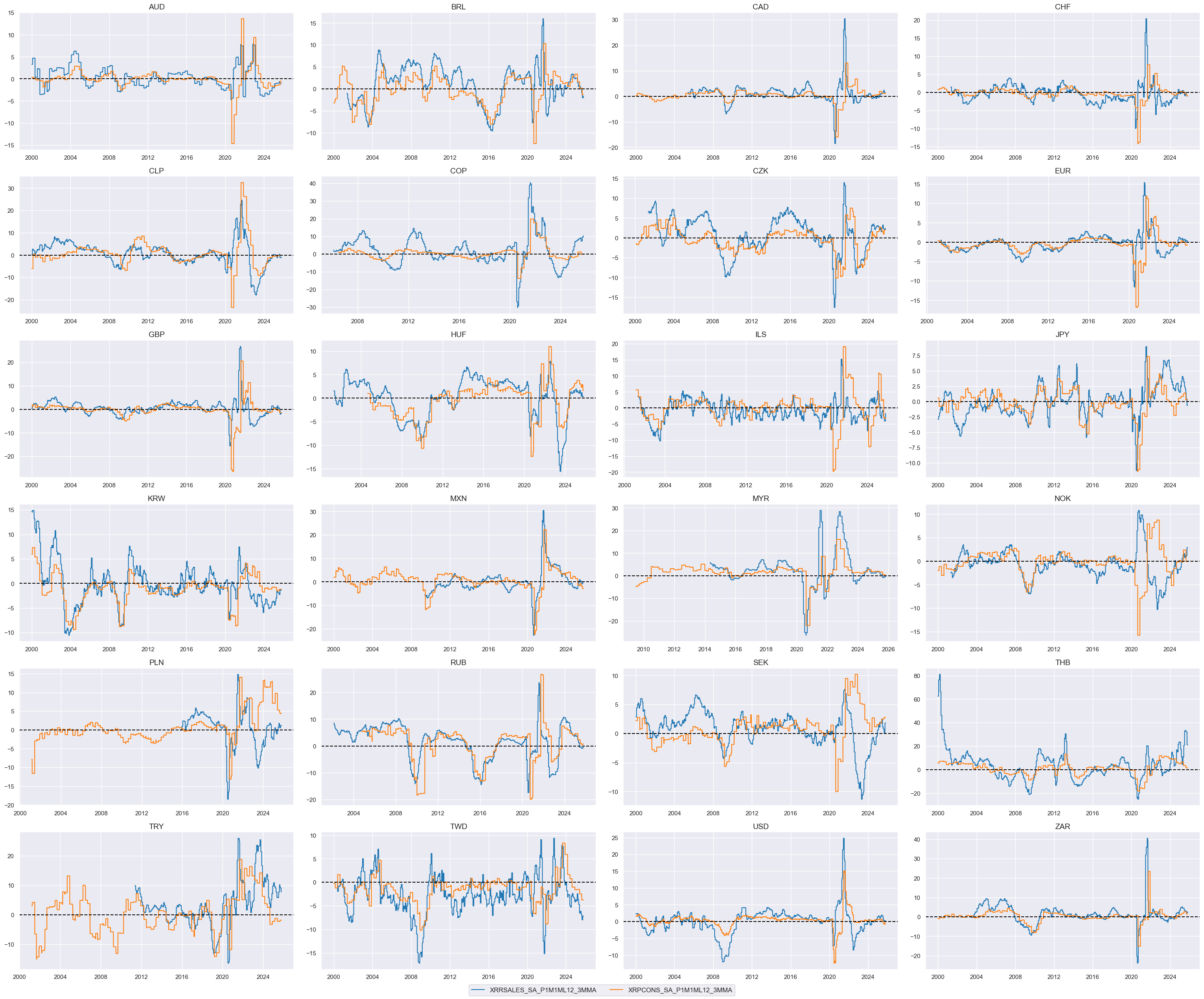

Relative consumption growth shortfall #

dict_pcons = {

"RRSALES_SA_P1M1ML12_3MMA": (1/6, -1),

"RPCONS_SA_P1M1ML12_3MMA": (1/6, -1),

}

# Excess private consumption

cidx = cids_dux

xcatx = list(dict_pcons.keys())

for xc in xcatx:

calcs = [f"X{xc} = {xc} - RGDP_SA_P1Q1QL4_20QMA",]

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cids_dux)

dfx = msm.update_df(dfx, dfa)

cidx = cids_dux

xcatx = [f"X{xcat}" for xcat in dict_pcons.keys()]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=False,

all_xticks=True,

size=(12, 7),

aspect=1.8

)

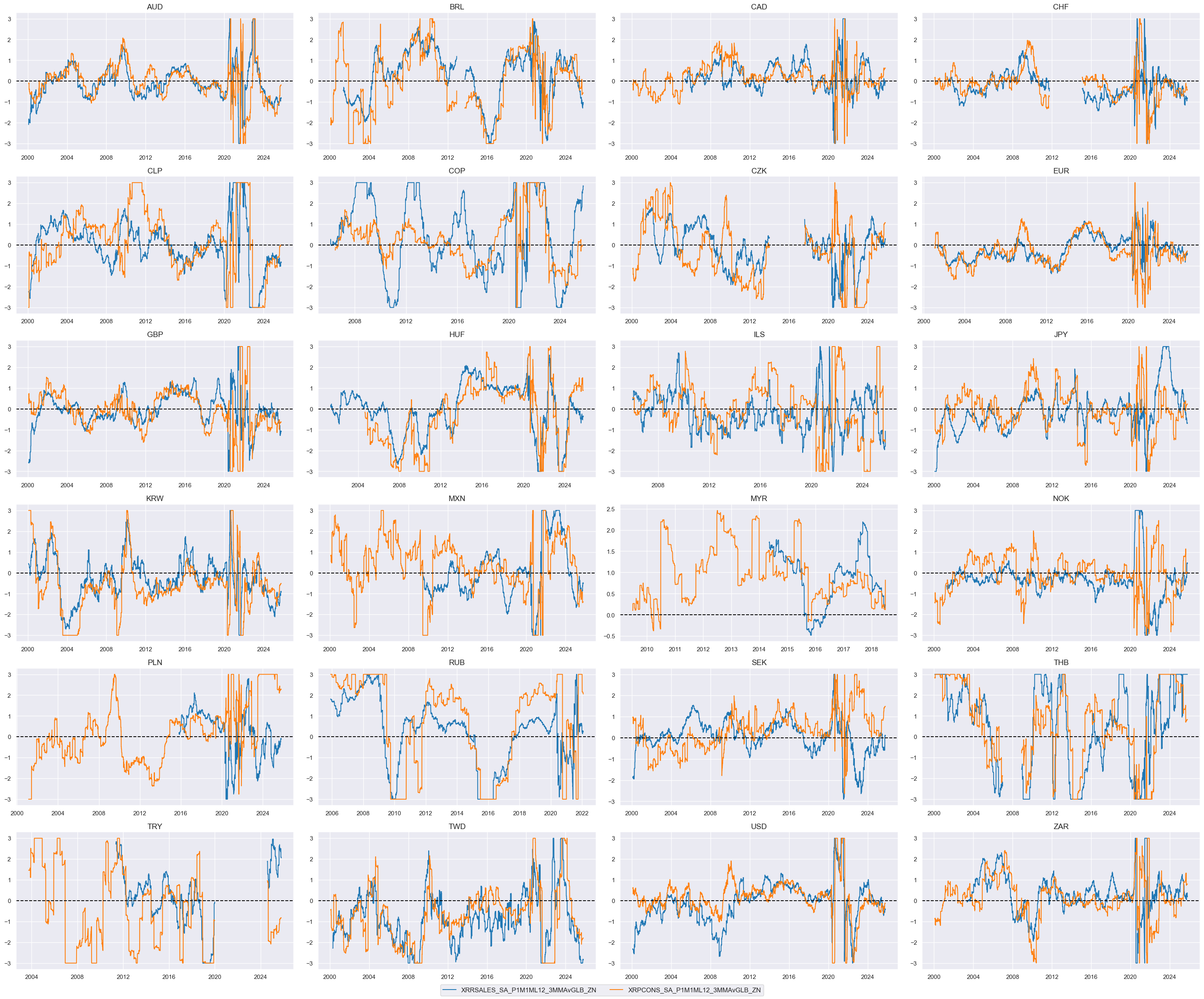

# Relative value of constituents

cidx = cids_dux

xcatx = [f"X{xcat}" for xcat in dict_pcons.keys()]

dfa = msp.make_relative_value(

df=dfx,

xcats=xcatx,

cids=cidx,

blacklist=fxblack,

postfix="vGLB",

)

dfx = msm.update_df(dfx, dfa)

# Scoring of relative values

cidx = cids_dux

xcatx = ["X" + xc + "vGLB" for xc in list(dict_pcons.keys())]

dfa = pd.DataFrame(columns=dfx.columns)

for xc in xcatx:

dfaa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

cidx = cids_dux

xcatx = ["X" + xcat + "vGLB_ZN" for xcat in list(dict_pcons.keys())]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=False,

all_xticks=True,

size=(12, 7),

aspect=1.8,

)

# Weighted linear combination

cidx = cids_dux

dix = dict_pcons

xcatx = ["X" + k + "vGLB_ZN" for k in list(dix.keys())]

weights = [v[0] for v in list(dix.values())]

signs = [v[1] for v in list(dix.values())]

czs = "PCONSGROWTHvGLB_NEG"

dfa = msp.linear_composite(

dfx,

xcats=xcatx,

cids=cidx,

weights=weights,

signs=signs,

normalize_weights=True,

complete_xcats=False, # score works with what is available

new_xcat=czs,

)

dfx = msm.update_df(dfx, dfa)

# Re-scoring

dfa = msp.make_zn_scores(

dfx,

xcat=czs,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

dict_facts[czs + "_ZN"] = "Relative consumption growth shortfall"

cids_dux

xcatx = ['PCONSGROWTHvGLB_NEG_ZN']

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=True,

all_xticks=True,

size=(12, 7),

aspect=1.8

)

Relative credit growth shortfall #

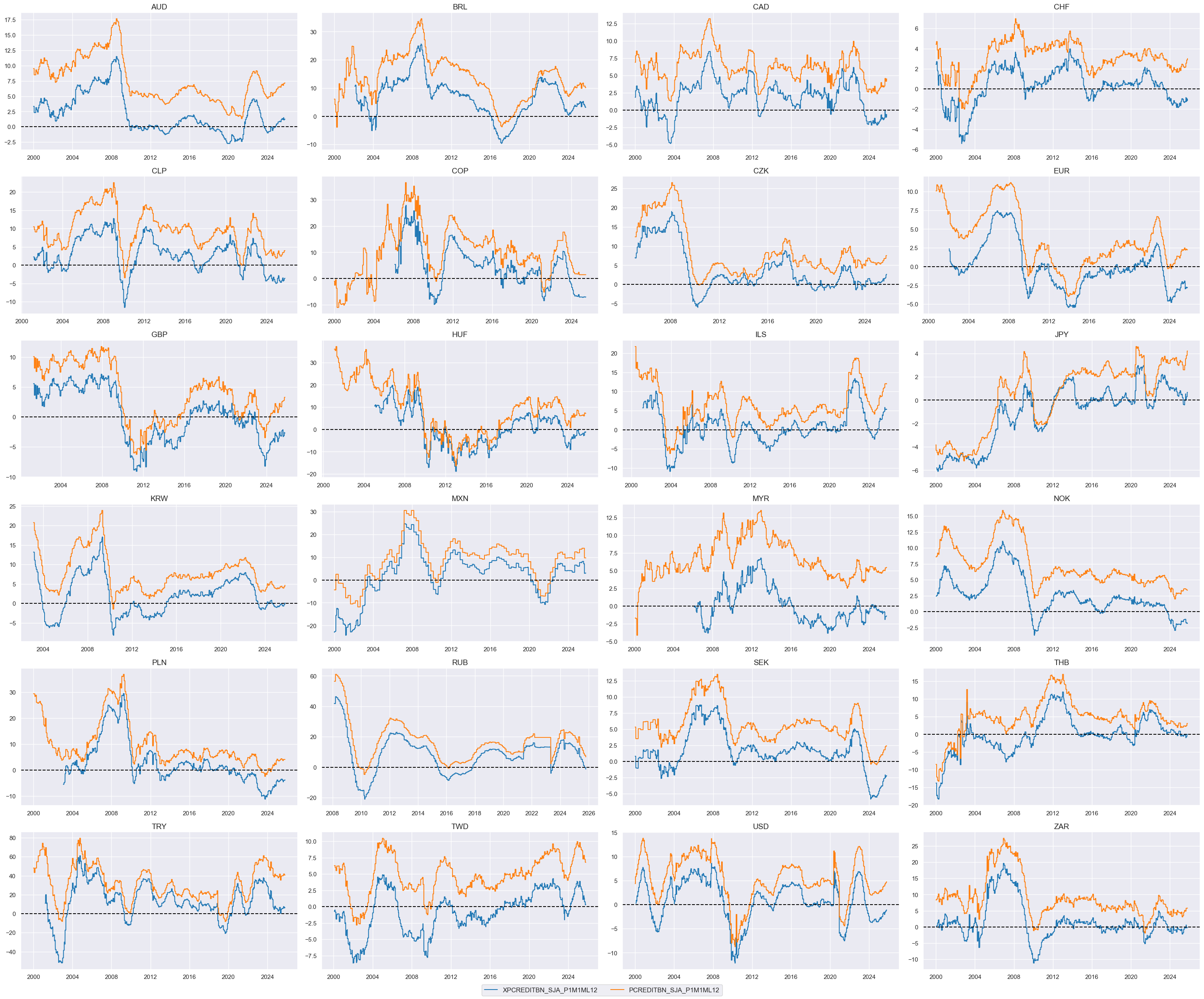

dict_credit = {

"XPCREDITBN_SJA_P1M1ML12" : (1/2, -1),

"PCREDITBN_SJA_P1M1ML12" : (1/2, -1),

}

calcs = [

"XPCREDITBN_SJA_P1M1ML12 = PCREDITBN_SJA_P1M1ML12 - INFTEFF_NSA - RGDP_SA_P1Q1QL4_20QMA",

]

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cids)

dfx = msm.update_df(dfx, dfa)

cidx = cids_dux

xcatx = list(dict_credit.keys())

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=False,

all_xticks=True,

size=(12, 7),

aspect=1.8

)

# Relative value of constituents

cidx = cids_dux

xcatx = list(dict_credit.keys())

dfa = msp.make_relative_value(

df=dfx,

xcats=xcatx,

cids=cidx,

blacklist=fxblack,

postfix="vGLB",

)

dfx = msm.update_df(dfx, dfa)

# Scoring of relative values

cidx = cids_dux

xcatx = [xc + "vGLB" for xc in list(dict_credit.keys())]

dfa = pd.DataFrame(columns=dfx.columns)

for xc in xcatx:

dfaa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

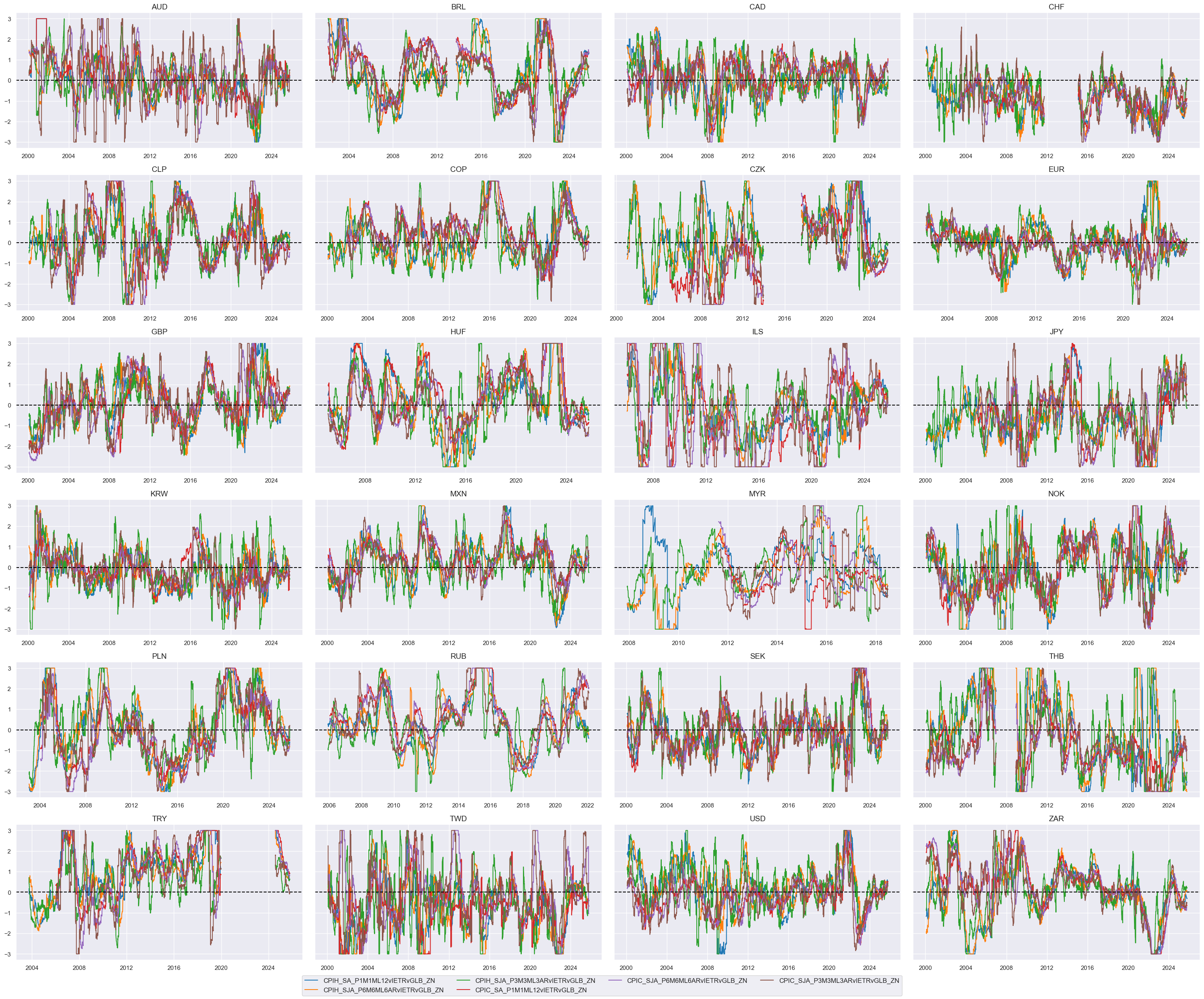

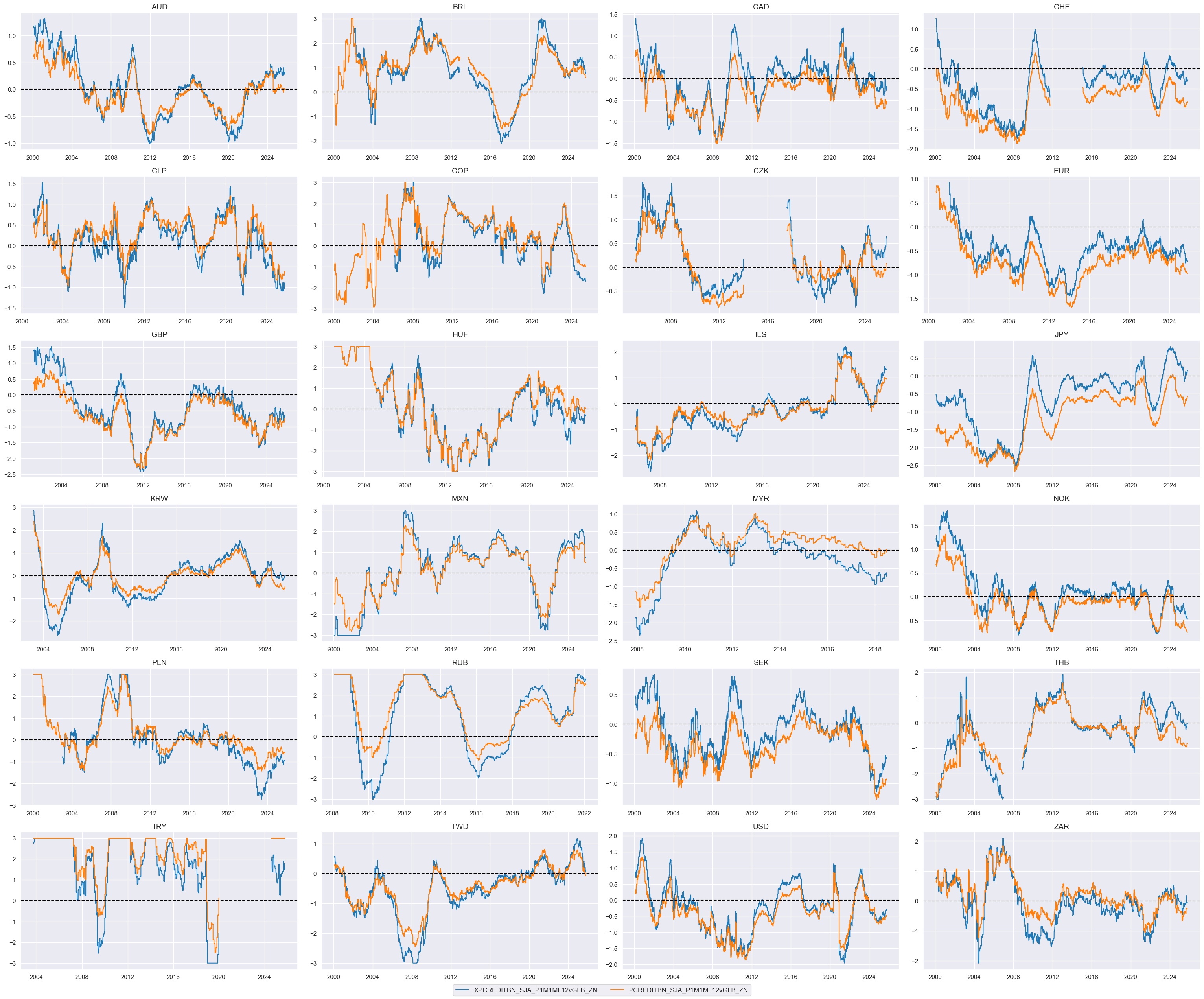

cidx = cids_dux

xcatx = [xc + "vGLB_ZN" for xc in list(dict_credit.keys())]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=False,

all_xticks=True,

size=(12, 7),

aspect=1.8,

)

# Weighted linear combination

cidx = cids_dux

dix = dict_credit

xcatx = [k + "vGLB_ZN" for k in list(dix.keys())]

weights = [v[0] for v in list(dix.values())]

signs = [v[1] for v in list(dix.values())]

czs = "PCREDITGROWTHvGLB_NEG"

dfa = msp.linear_composite(

dfx,

xcats=xcatx,

cids=cidx,

weights=weights,

signs=signs,

normalize_weights=True,

complete_xcats=False, # score works with what is available

new_xcat=czs,

)

dfx = msm.update_df(dfx, dfa)

# Re-scoring

dfa = msp.make_zn_scores(

dfx,

xcat=czs,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

dict_facts[czs + "_ZN"] = "Relative credit growth shortfall"

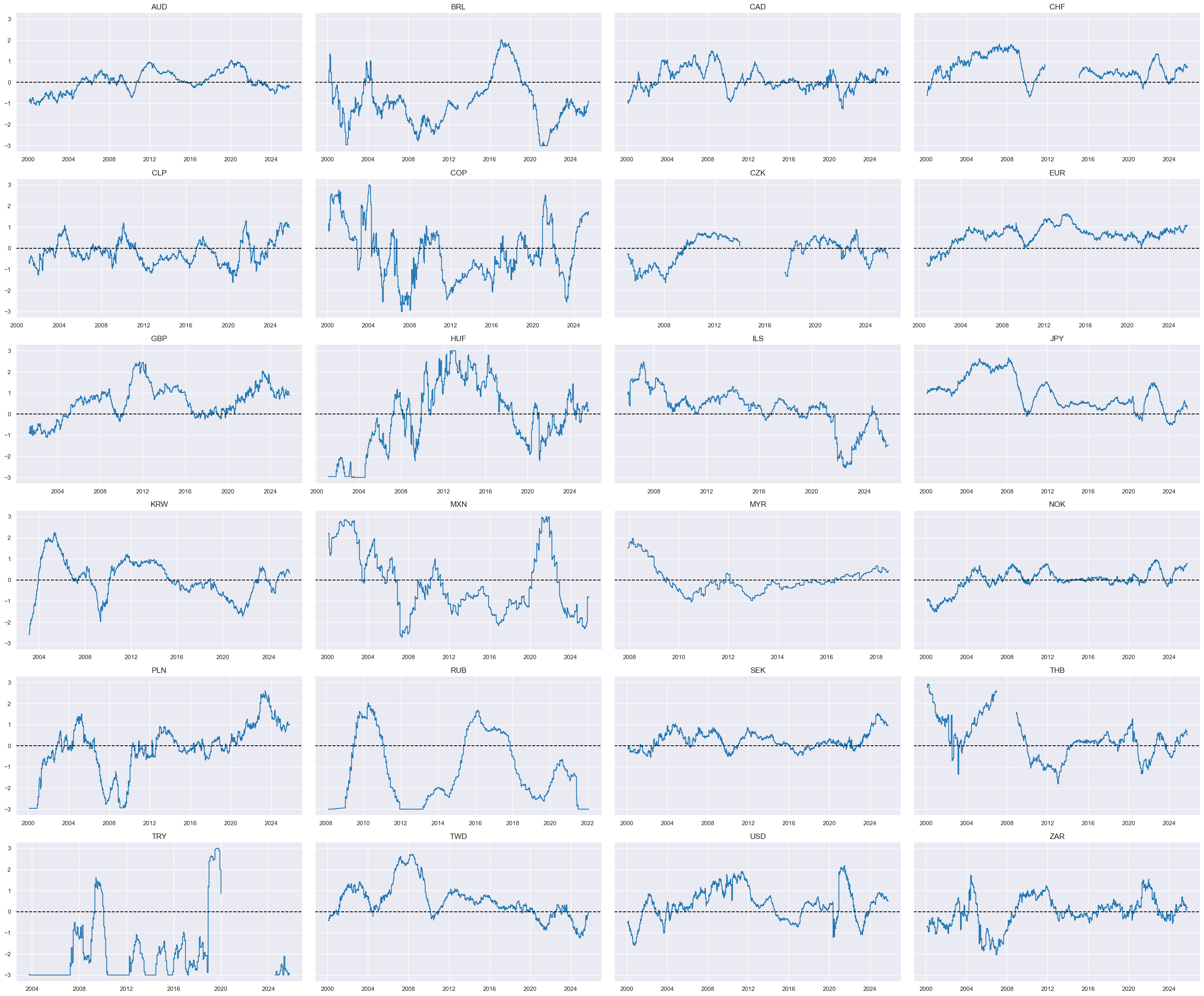

cids_dux

xcatx = 'PCREDITGROWTHvGLB_NEG_ZN'

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=True,

all_xticks=True,

size=(12, 7),

aspect=1.8

)

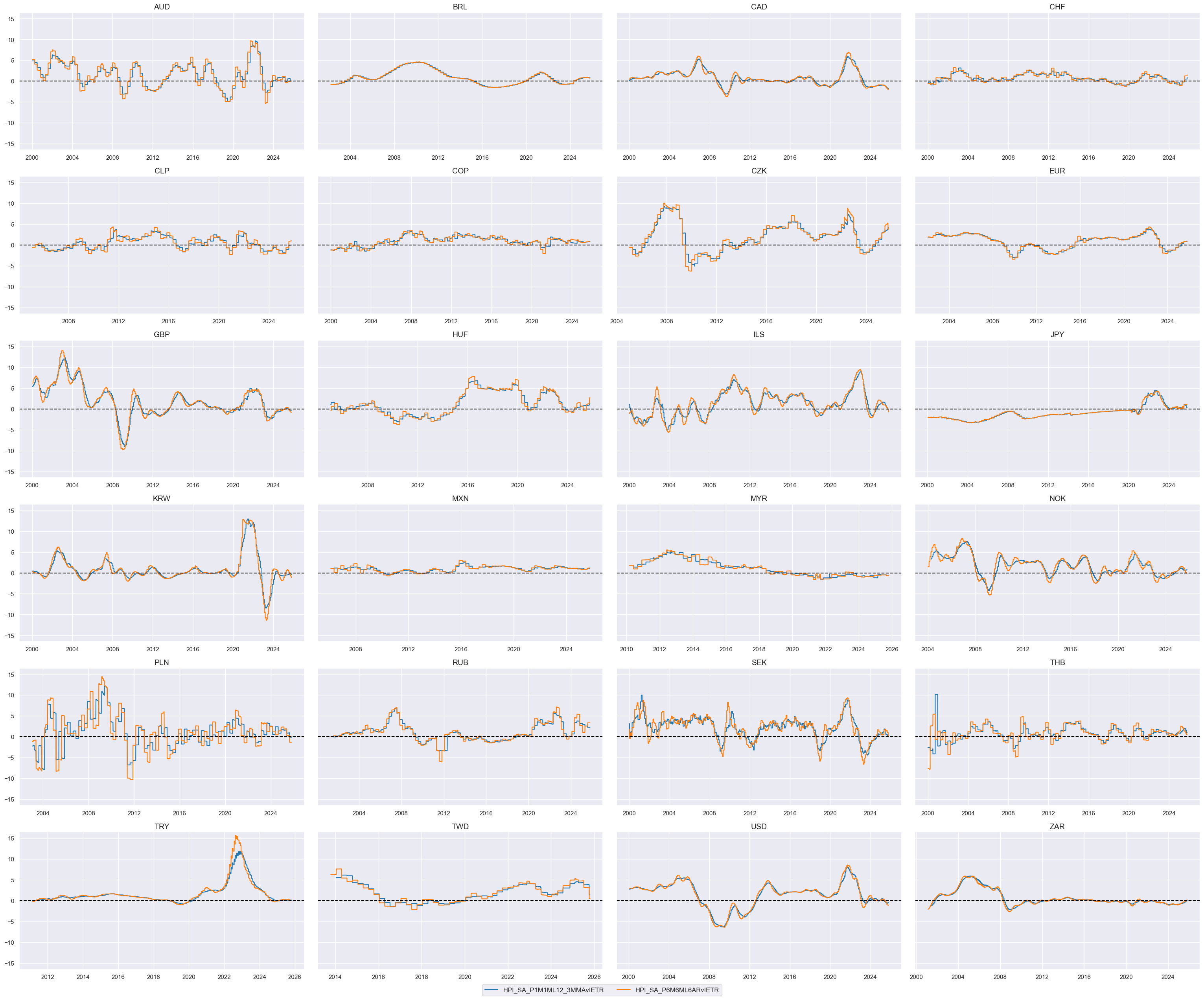

Relative house price growth shortfall ratios #

dict_hpi = {

"HPI_SA_P1M1ML12_3MMA" : (1/2, -1),

"HPI_SA_P6M6ML6AR": (1/2, -1)

}

cidx = cids_dux

xcatx = list(dict_hpi.keys())

for xc in xcatx:

calcs = [f"{xc}vIETR = ( {xc} - INFTEFF_NSA ) / INFTEBASIS",]

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cids_dux)

dfx = msm.update_df(dfx, dfa)

cidx = cids_dux

xcatx = [xc + "vIETR" for xc in list(dict_hpi.keys())]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=True,

all_xticks=True,

size=(12, 7),

aspect=1.8

)

# Relative value of constituents

cidx = cids_dux

xcatx = list(dict_hpi.keys())

dfa = msp.make_relative_value(

df=dfx,

xcats=xcatx,

cids=cidx,

blacklist=fxblack,

postfix="vGLB",

)

dfx = msm.update_df(dfx, dfa)

# Scoring of relative values

cidx = cids_dux

xcatx = [xc + "vGLB" for xc in list(dict_hpi.keys())]

dfa = pd.DataFrame(columns=dfx.columns)

for xc in xcatx:

dfaa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

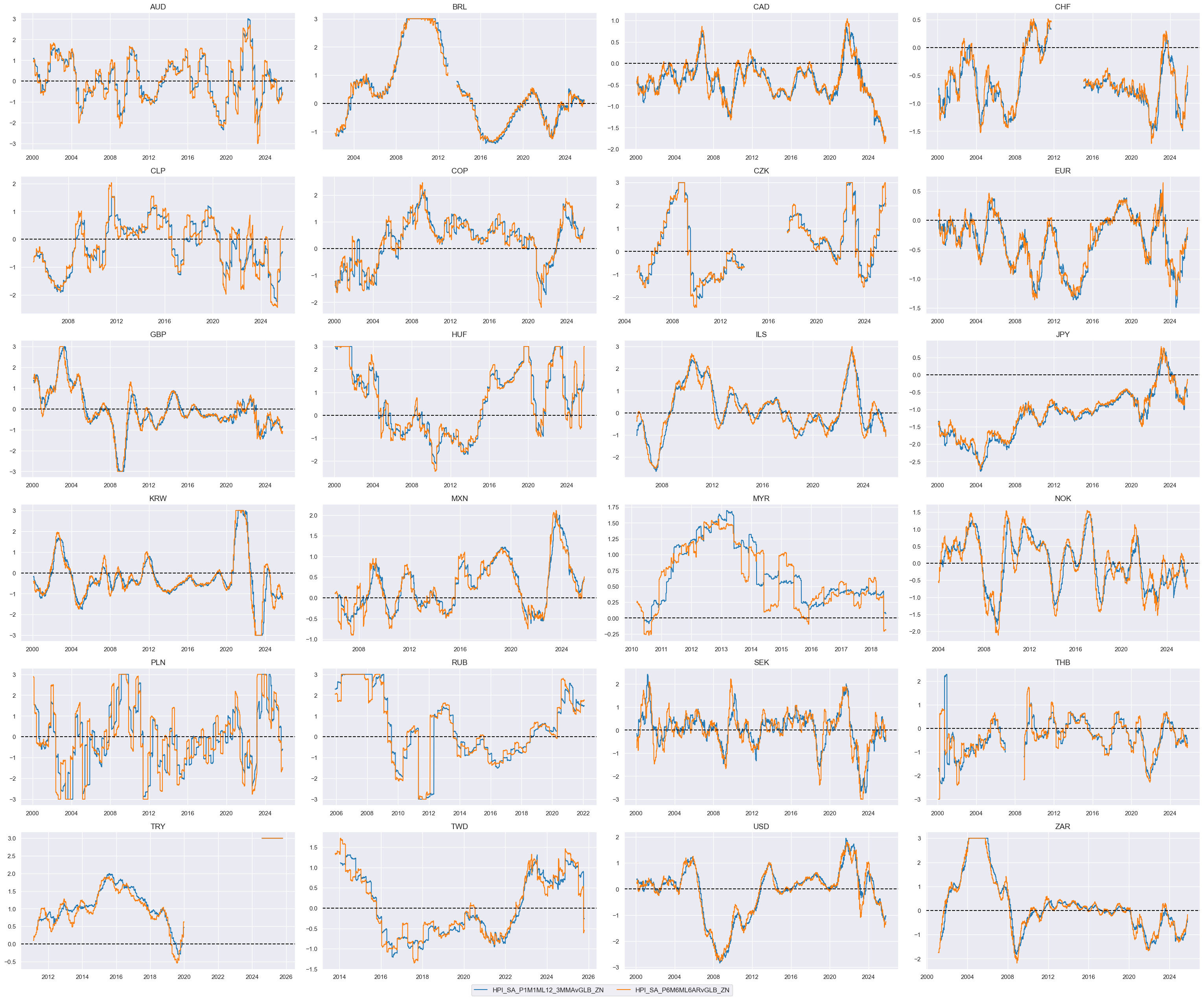

cidx = cids_dux

xcatx = [xcat + "vGLB_ZN" for xcat in list(dict_hpi.keys())]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=False,

all_xticks=True,

size=(12, 7),

aspect=1.8,

)

# Weighted linear combination (degenerate case)

cidx = cids_dux

dix = dict_hpi

xcatx = [k + "vGLB_ZN" for k in list(dix.keys())]

weights = [v[0] for v in list(dix.values())]

signs = [v[1] for v in list(dix.values())]

czs = "XHPIvGLB_NEG"

dfa = msp.linear_composite(

dfx,

xcats=xcatx,

cids=cidx,

weights=weights,

signs=signs,

normalize_weights=True,

complete_xcats=False, # score works with what is available

new_xcat=czs,

)

dfx = msm.update_df(dfx, dfa)

# Re-scoring

dfa = msp.make_zn_scores(

dfx,

xcat=czs,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

dict_facts[czs + "_ZN"] = "Relative house price shortfall"

cids_dux

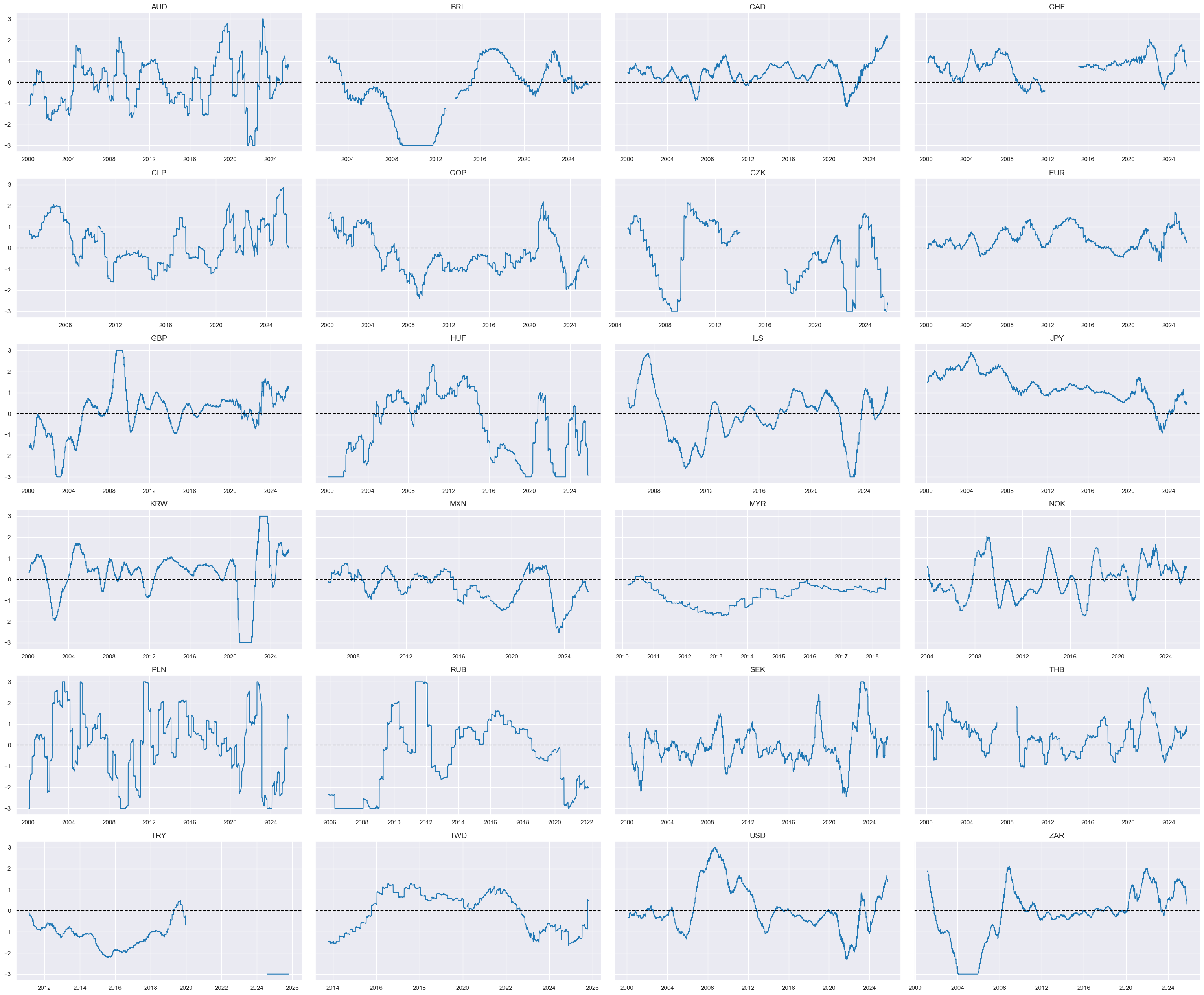

xcatx = 'XHPIvGLB_NEG_ZN'

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=True,

all_xticks=True,

size=(12, 7),

aspect=1.8

)

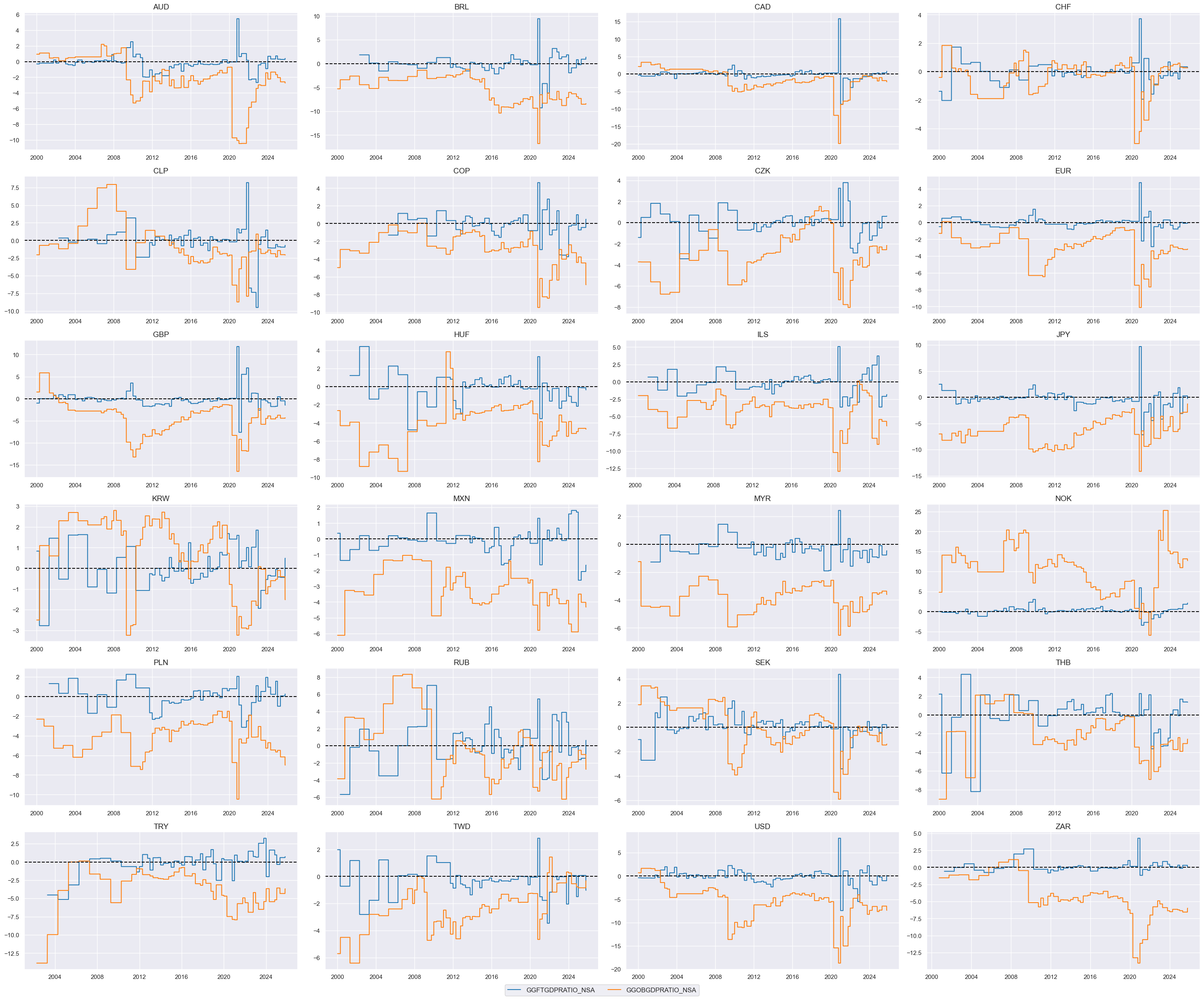

Relative fiscal austerity #

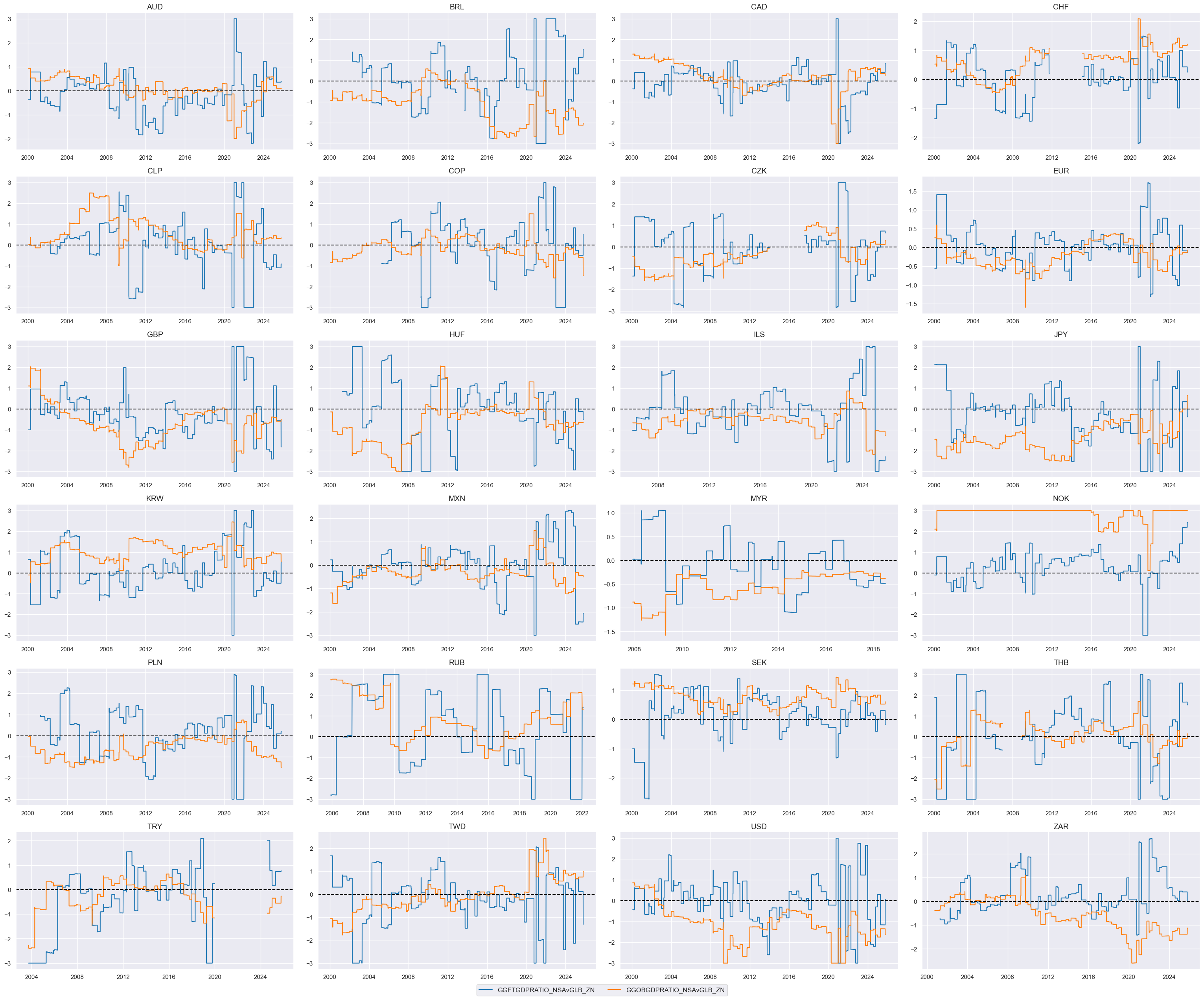

dict_fisc = {

"GGFTGDPRATIO_NSA" : (1/2, -1),

"GGOBGDPRATIO_NSA" : (1/2, 1),

}

cidx = cids_dux

xcatx = list(dict_fisc.keys())

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=False,

all_xticks=True,

size=(12, 7),

aspect=1.8

)

# Relative value of constituents

cidx = cids_dux

xcatx = list(dict_fisc.keys())

dfa = msp.make_relative_value(

df=dfx,

xcats=xcatx,

cids=cidx,

blacklist=fxblack,

postfix="vGLB",

)

dfx = msm.update_df(dfx, dfa)

# Scoring of relative values

cidx = cids_dux

xcatx = [xc + "vGLB" for xc in list(dict_fisc.keys())]

dfa = pd.DataFrame(columns=dfx.columns)

for xc in xcatx:

dfaa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

cidx = cids_dux

xcatx = [xcat + "vGLB_ZN" for xcat in list(dict_fisc.keys())]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=False,

all_xticks=True,

size=(12, 7),

aspect=1.8,

)

# Weighted linear combination (degenerate case)

cidx = cids_dux

dix = dict_fisc

xcatx = [k + "vGLB_ZN" for k in list(dix.keys())]

weights = [v[0] for v in list(dix.values())]

signs = [v[1] for v in list(dix.values())]

czs = "AUSTERITYvGLB"

dfa = msp.linear_composite(

dfx,

xcats=xcatx,

cids=cidx,

weights=weights,

signs=signs,

normalize_weights=True,

complete_xcats=False, # score works with what is available

new_xcat=czs,

)

dfx = msm.update_df(dfx, dfa)

# Re-scoring

dfa = msp.make_zn_scores(

dfx,

xcat=czs,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

dict_facts[czs + "_ZN"] = "Relative fiscal austerity"

cids_dux

xcatx = 'AUSTERITYvGLB_ZN'

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

same_y=True,

all_xticks=True,

size=(12, 7),

aspect=1.8

)

Visual checks #

dict_facts

{'XINFLvGLB_NEG_ZN': 'Relative inflation shortfall',

'INFLCHGRvGLB_NEG_ZN': 'Relative disinflation ratio',

'RRCRvGLB_ZN': 'Relative real yields and carry',

'REEROACHGvGLB_ZN': 'Relative real appreciation',

'XBALvGLB_ZN': 'Relative external balances',

'MTBCHGvGLB_ZN': 'Relative trade balance changes',

'LIQCHGvGLB_ZN': 'Relative liquidity growth',

'RGDPGROWTHvGLB_NEG_ZN': 'Relative GDP growth shortfall',

'PCONSGROWTHvGLB_NEG_ZN': 'Relative consumption growth shortfall',

'PCREDITGROWTHvGLB_NEG_ZN': 'Relative credit growth shortfall',

'XHPIvGLB_NEG_ZN': 'Relative house price shortfall',

'AUSTERITYvGLB_ZN': 'Relative fiscal austerity'}

factorz = [k for k in dict_facts.keys() ]

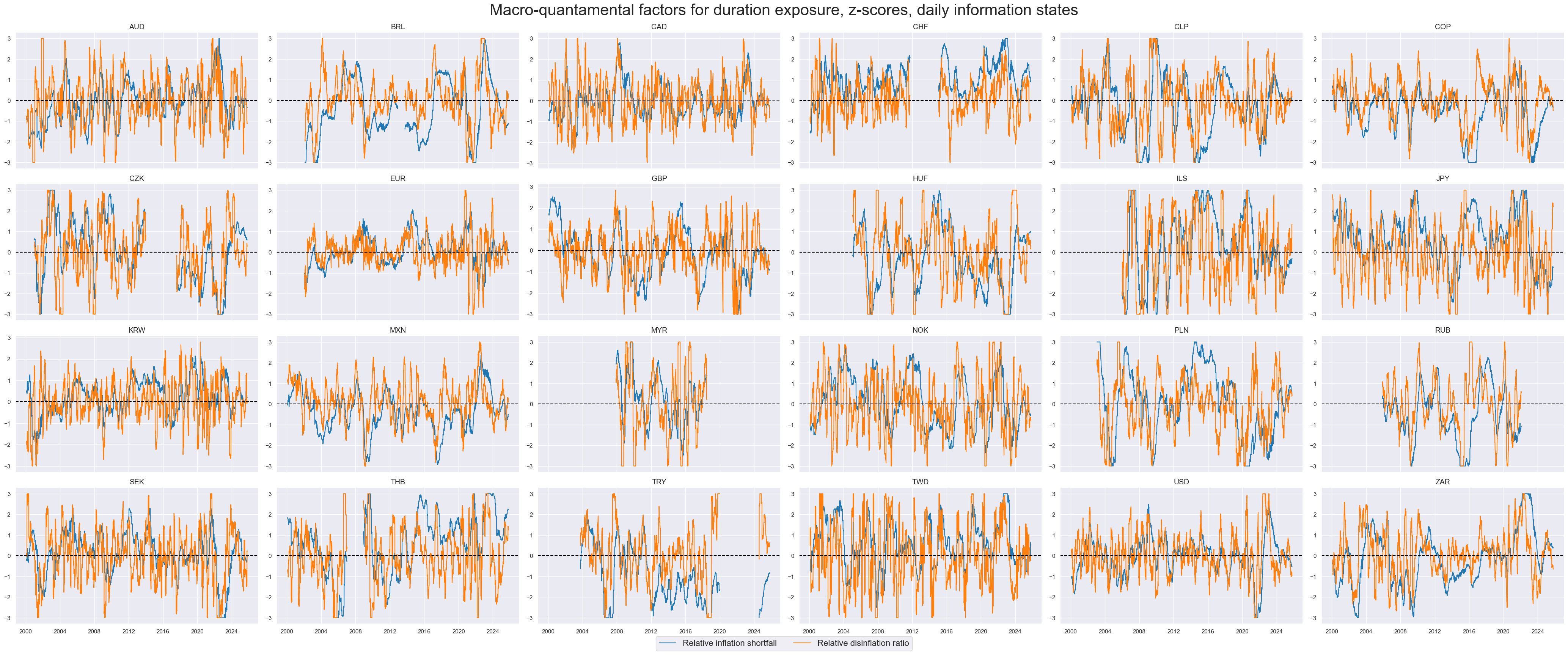

xcatx = ["XINFLvGLB_NEG_ZN", "INFLCHGRvGLB_NEG_ZN"]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cids_dux,

ncol=6,

start="2000-01-01",

title="Macro-quantamental factors for duration exposure, z-scores, daily information states",

title_fontsize=30,

same_y=False,

cs_mean=False,

legend_fontsize=16,

xcat_labels=dict_facts,

)

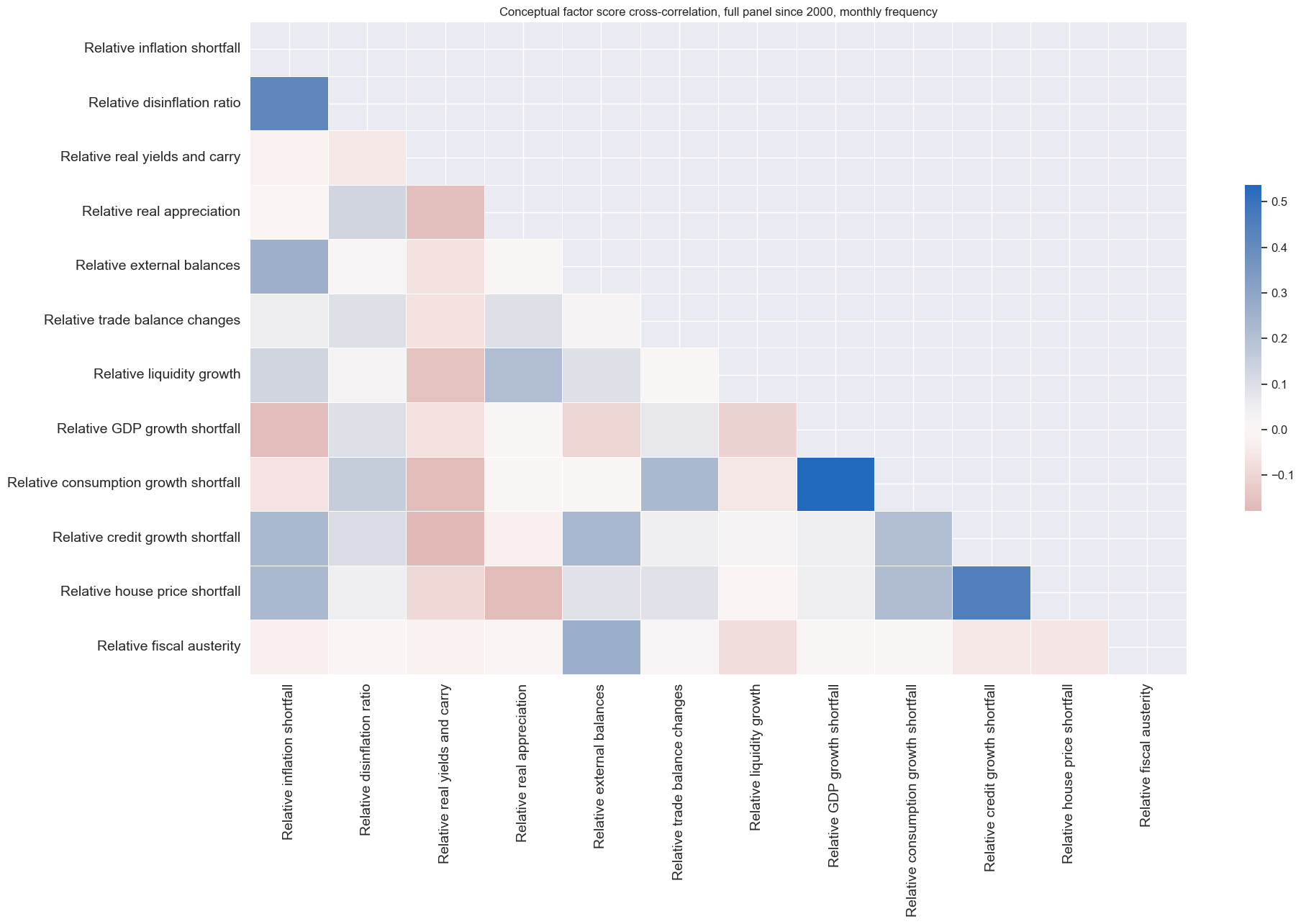

msp.correl_matrix(

df = dfx,

xcats = factorz,

cids = cids_dux,

freq='m',

title="Conceptual factor score cross-correlation, full panel since 2000, monthly frequency",

size=(20, 13),

xcat_labels=dict_facts,

# cluster=True,

)

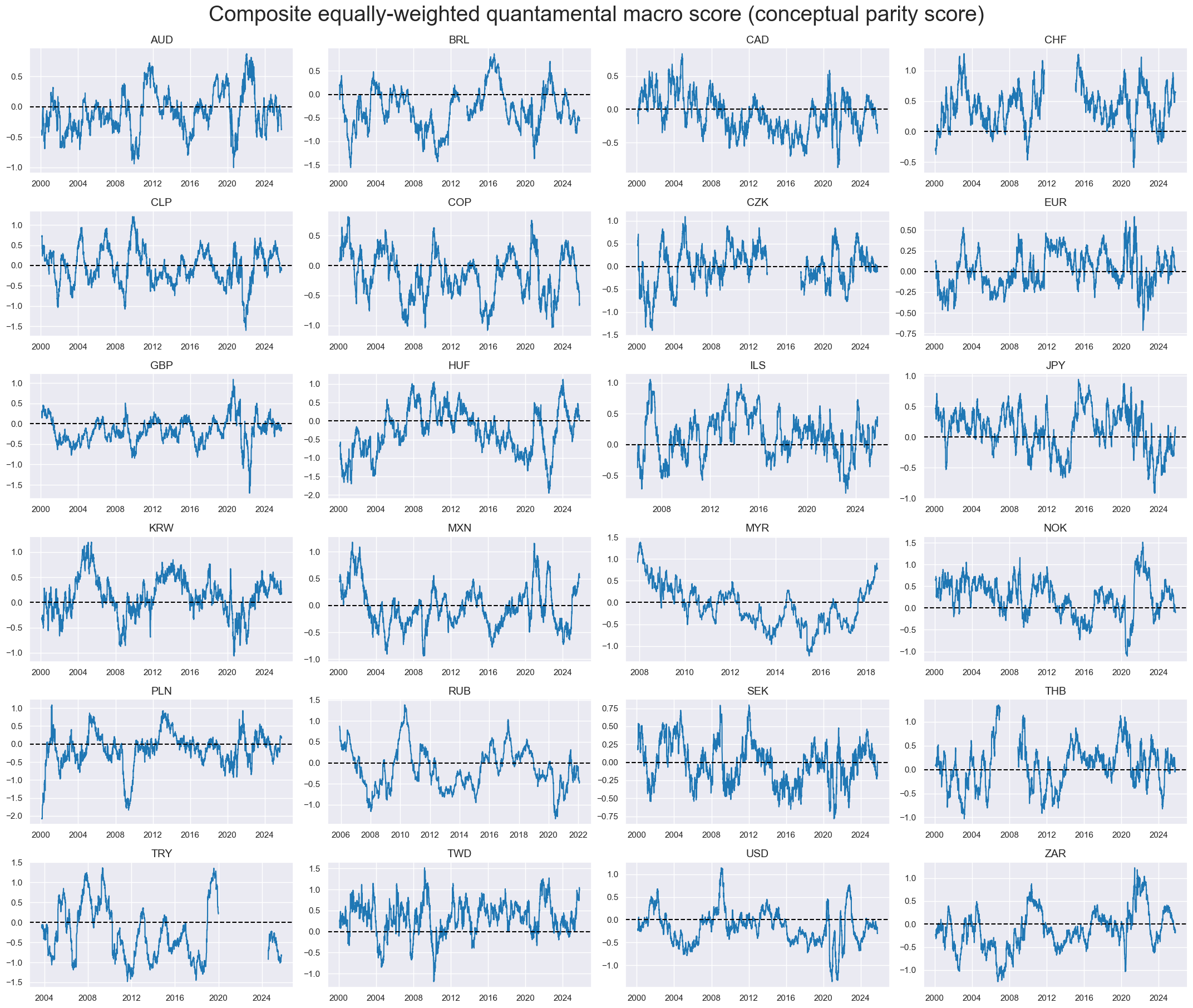

Conceptual parity #

dfa = msp.linear_composite(

df=dfx,

xcats=factorz,

cids=cids,

new_xcat="MACRO_AVGZ",

)

dfx = msm.update_df(dfx, dfa)

xcatx = ["MACRO_AVGZ"]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

cumsum=False,

ncol=4,

start="2000-01-01",

title_fontsize=28,

size=(10, 6),

aspect=1.8,

height=2,

same_y=False,

title="Composite equally-weighted quantamental macro score (conceptual parity score)",

blacklist=fxblack,

all_xticks=True,

legend_fontsize=16,

)

Target relative returns #

cidx = cids_dux

xcatx = ["DU05YXR_VT10", "DU05YXR_NSA"]

dfa = msp.make_relative_value(

df=dfx,

xcats=xcatx,

cids=cidx,

blacklist=fxblack,

)

dfx = msm.update_df(dfx, dfa)

dict_rets = {

"DU05YXR_NSA": "Simple 5-year IRS returns",

"DU05YXR_VT10": "Vol-targeted 5-year IRS returns",

"DU05YXR_NSAR": "Relative simple 5-year IRS returns",

"DU05YXR_VT10R": "Relative vol-targeted 5-year IRS returns",

}

dict_labs = dict_facts | dict_rets

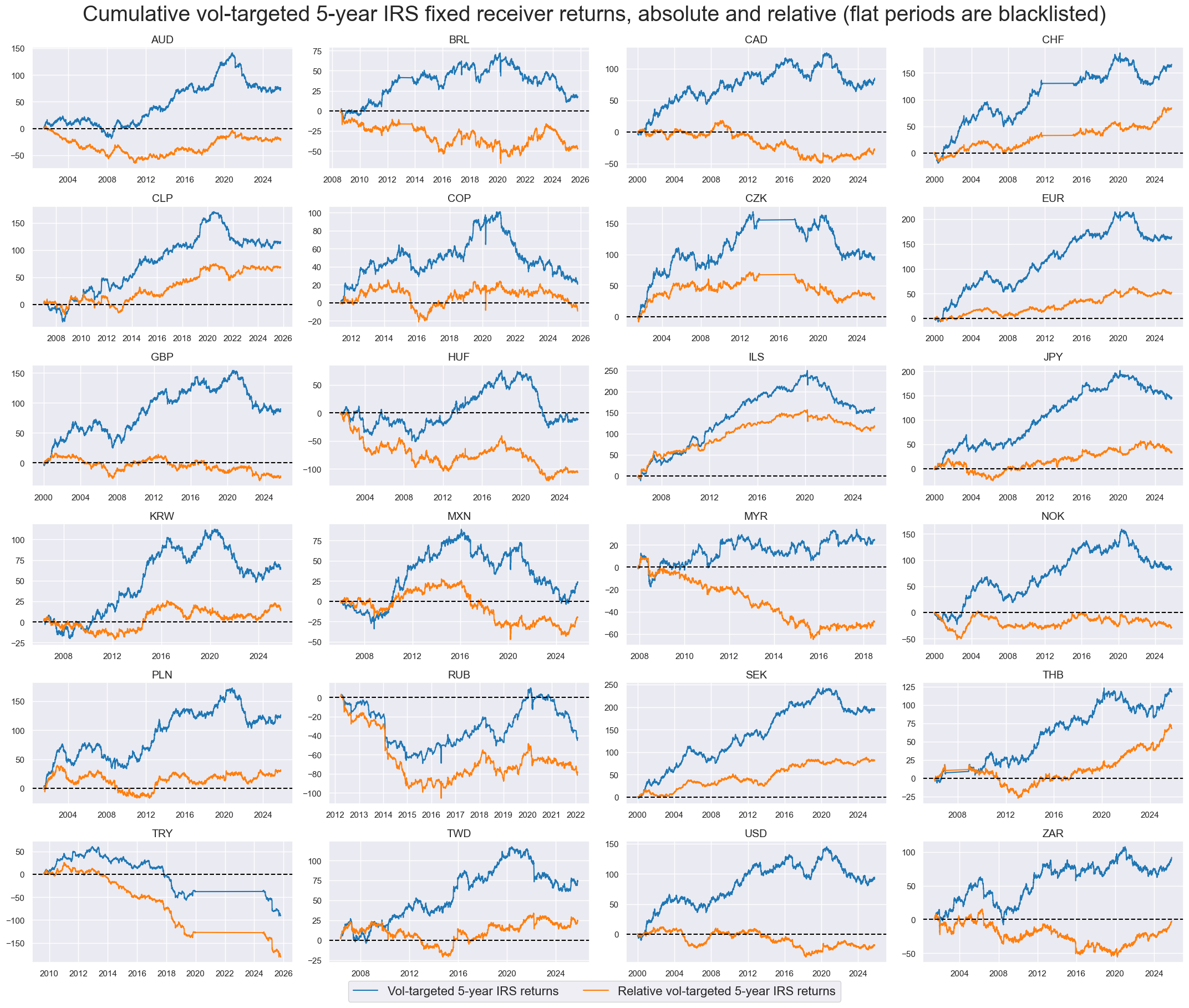

cidx = cids_dux

xcatx = ["DU05YXR_VT10", "DU05YXR_VT10R"]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

cumsum=True,

ncol=4,

start="2000-01-01",

title_fontsize=28,

size=(10, 6),

aspect=1.8,

height=2,

same_y=False,

title="Cumulative vol-targeted 5-year IRS fixed receiver returns, absolute and relative (flat periods are blacklisted)",

blacklist=fxblack,

xcat_labels=dict_labs,

all_xticks=True,

legend_fontsize=16,

)

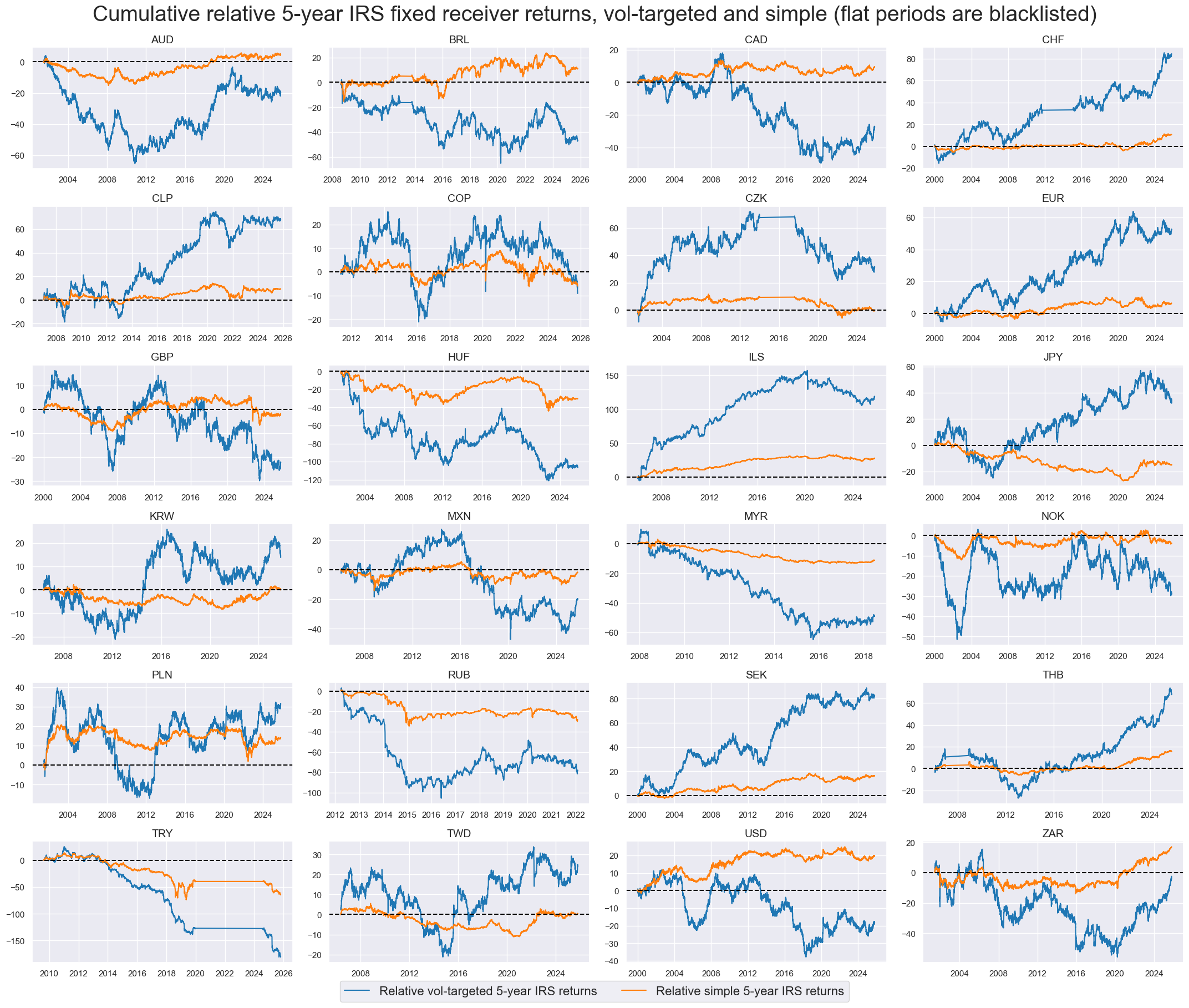

cidx = cids_dux

xcatx = ["DU05YXR_VT10R", "DU05YXR_NSAR"]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

cumsum=True,

ncol=4,

start="2000-01-01",

title_fontsize=28,

size=(10, 6),

aspect=1.8,

height=2,

same_y=False,

title="Cumulative relative 5-year IRS fixed receiver returns, vol-targeted and simple (flat periods are blacklisted)",

blacklist=fxblack,

xcat_labels=dict_labs,

all_xticks=True,

legend_fontsize=16,

)

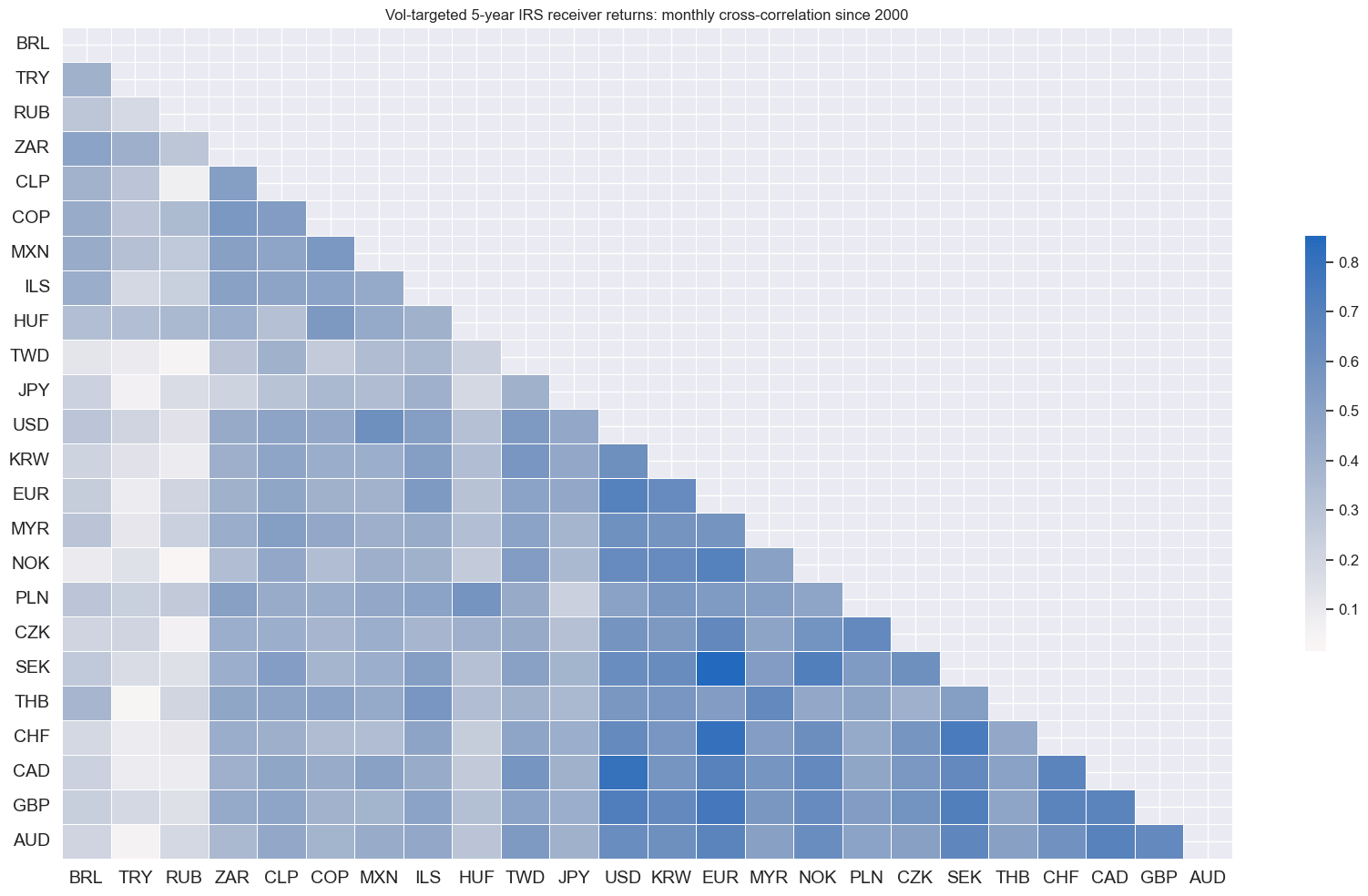

cidx = cids_dux

msp.correl_matrix(

dfx,

xcats="DU05YXR_VT10",

cids=cidx,

freq="M",

title="Vol-targeted 5-year IRS receiver returns: monthly cross-correlation since 2000",

size=(17, 10),

cluster=True,

)

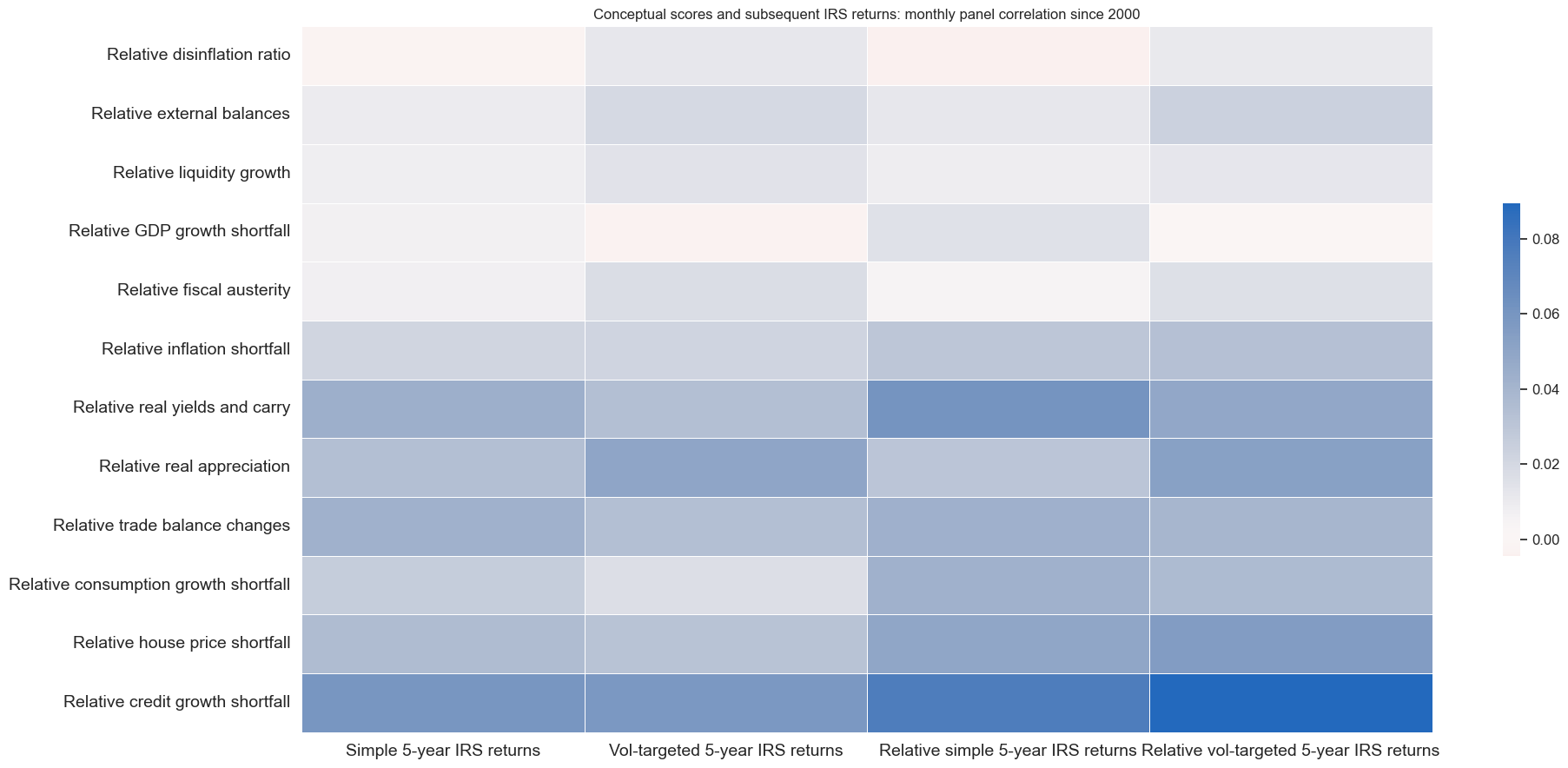

cidx = cids_dux

xcatx = [k for k in dict_rets.keys()]

xcatx2 = factorz

msp.correl_matrix(

dfx,

xcats=xcatx,

cids=cidx,

xcats_secondary=xcatx2,

lags_secondary={k:1 for k in xcatx2},

freq="M",

title="Conceptual scores and subsequent IRS returns: monthly panel correlation since 2000",

size=(20, 9),

cluster=True,

xcat_labels=dict_rets,

xcat_secondary_labels=dict_facts,

)

Signal generation #

Regularized (Ridge) regression #

so = msl.SignalOptimizer(

df=dfx,

cids=cids_dux,

xcats=factorz + ["DU05YXR_VT10R"],

xcat_aggs=["last", "sum"],

lag=1,

blacklist=fxblack,

freq="M",

start="2000-01-01",

)

so.calculate_predictions(

name="Ridge",

models={

"Ridge": Ridge(positive=True, fit_intercept=False, random_state=42),

},

hyperparameters={

"Ridge": {

"alpha": [1, 10, 100, 1000, 10000],

},

},

scorers={

"SHARPE": make_scorer(msl.sharpe_ratio, greater_is_better=True),

},

inner_splitters={

"Expanding": msl.ExpandingKFoldPanelSplit(n_splits=5),

},

cv_summary="mean-std",

test_size=1,

)

dfa = so.get_optimized_signals("Ridge")

dfx = msm.update_df(dfx, dfa)

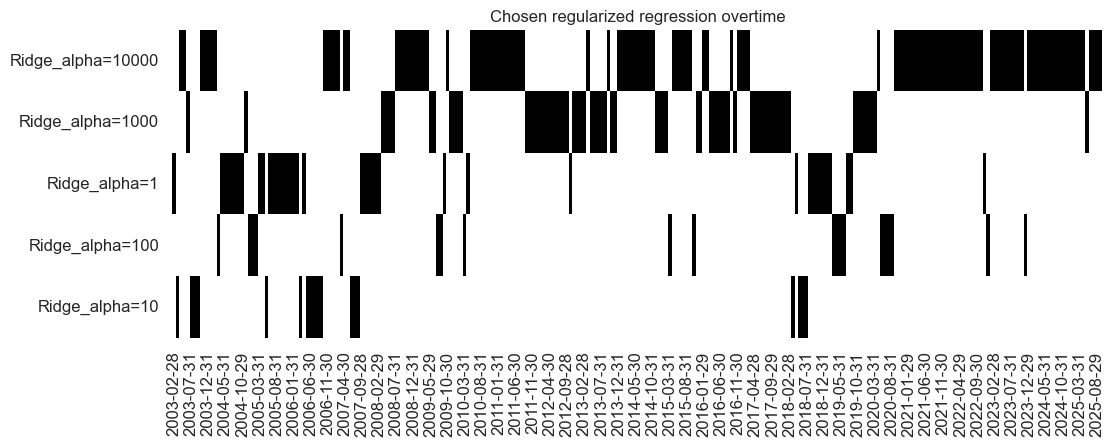

The first 5 yeras are dominated a model close to an OLS linear regression. As more time progresses, greater regularization is imposed.

alpha=1000

dominated the 2010s whilst

alpha=10000

has dominated the 2020s. There is some instability in the middle years of the process, highlighting difficulties in finding a regularization hyperparameter to optimize Sharpe. A residual-based metric will lead to a more stable model selection.

so.models_heatmap(

"Ridge",

title="Chosen regularized regression overtime",

figsize=(12, 4),

)

dict_facts1 = {

"XINFLvGLB_NEG_ZN": "Relative inflation shortfall",

"INFLCHGRvGLB_NEG_ZN": "Relative disinflation ratio",

"RRCRvGLB_ZN": "Relative real yields and carry",

"REEROACHGvGLB_ZN": "Relative real appreciation",

"XBALvGLB_ZN": "Relative external balances",

"MTBCHGvGLB_ZN": "Relative trade balance changes",

"LIQCHGvGLB_ZN": "Relative liquidity growth",

"RGDPGROWTHvGLB_NEG_ZN": "Relative GDP growth shortfall",

"PCONSGROWTHvGLB_NEG_ZN": "Relative consumption growth shortfall",

"PCREDITGROWTHvGLB_NEG_ZN": "Relative credit growth shortfall",

"XHPIvGLB_NEG_ZN": "Relative house price shortfall",

"AUSTERITYvGLB_ZN": "Relative fiscal austerity",

}

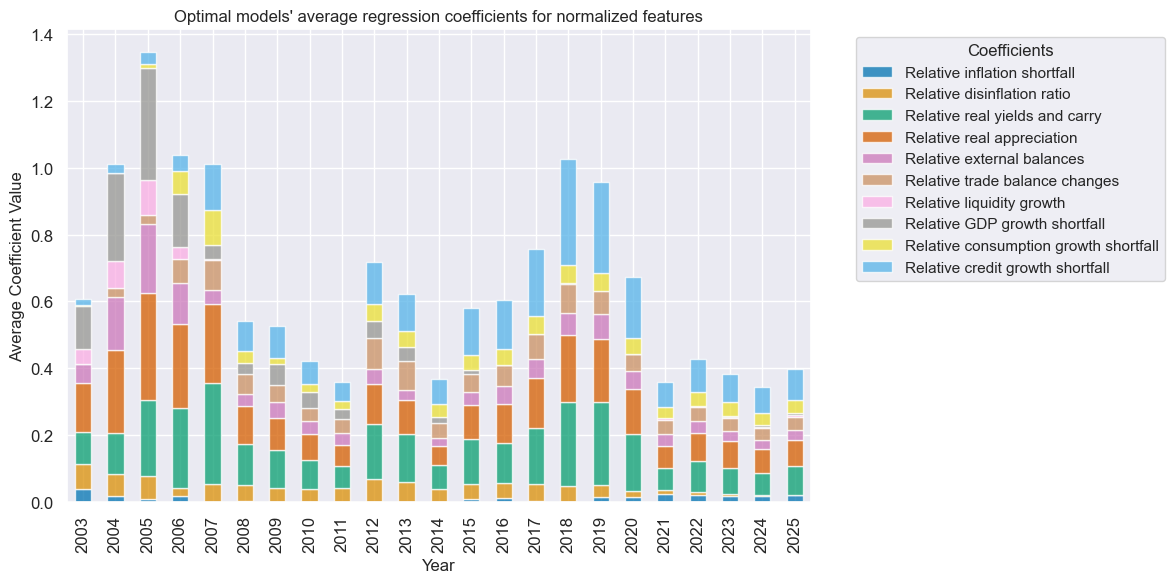

so.coefs_stackedbarplot(

"Ridge",

title="Optimal models' average regression coefficients for normalized features",

ftrs_renamed=dict_facts1,

figsize=(12, 6),

)

Random forest regression #

so.calculate_predictions(

name="RF",

models={

"RF_DEEP": RandomForestRegressor(

random_state=42,

max_samples=None,

n_estimators=100,

monotonic_cst=[1 for i in factorz],

),

"RF_SHALLOW": RandomForestRegressor(

random_state=42,

max_samples=0.1,

n_estimators=100,

monotonic_cst=[1 for i in factorz],

),

},

hyperparameters={

"RF_DEEP": {

"min_samples_leaf": [12, 36, 60],

"max_features": [0.3, None],

"max_samples": [None, 0.5]

},

"RF_SHALLOW": {

"min_samples_leaf": [1, 6],

"max_features": [0.3, None],

"max_samples": [0.1, 0.25]

},

},

scorers={

"SHARPE": make_scorer(msl.sharpe_ratio, greater_is_better=True),

},

inner_splitters={

"Expanding": msl.ExpandingKFoldPanelSplit(n_splits=5),

},

cv_summary="mean-std",

test_size=1,

)

dfa = so.get_optimized_signals("RF")

dfx = msm.update_df(dfx, dfa)

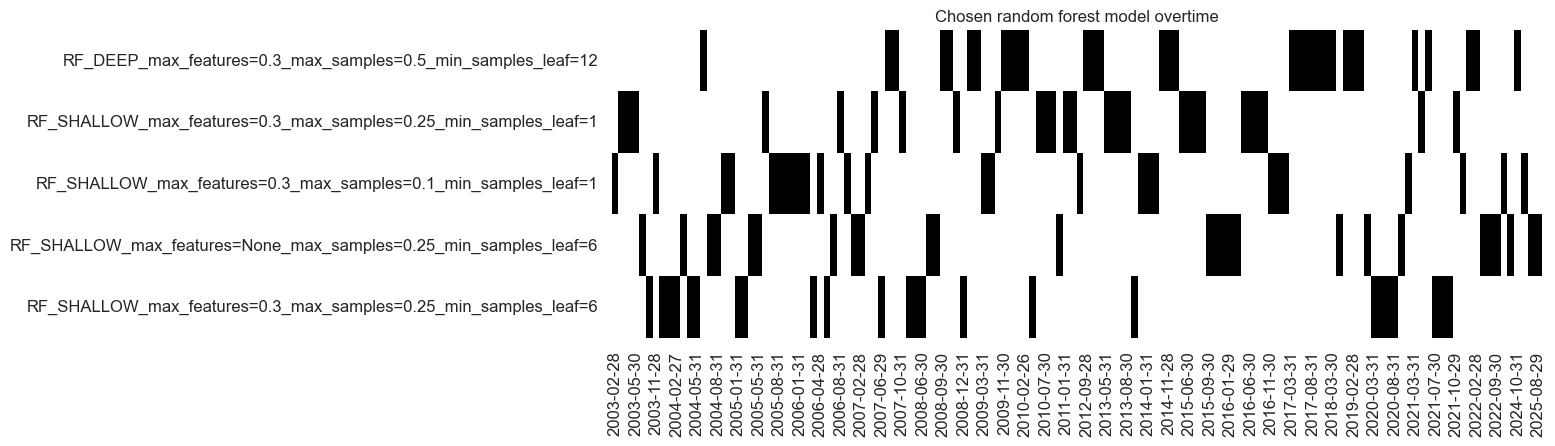

so.models_heatmap(

"RF",

title="Chosen random forest model overtime",

figsize=(12, 4),

)

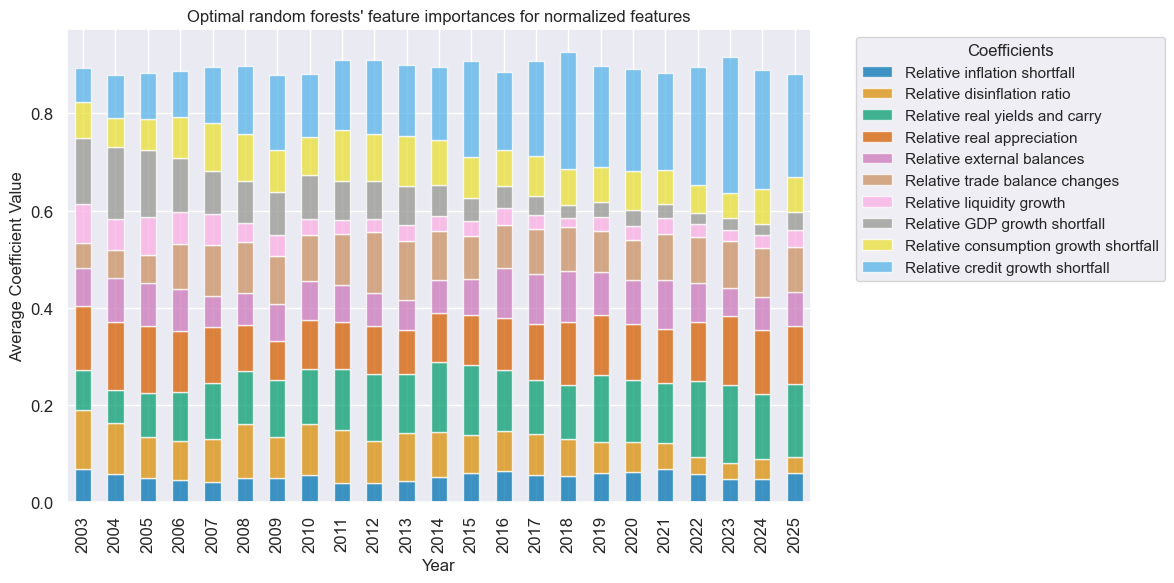

so.coefs_stackedbarplot(

"RF",

title="Optimal random forests' feature importances for normalized features",

ftrs_renamed=dict_facts,

figsize=(12, 6),

)

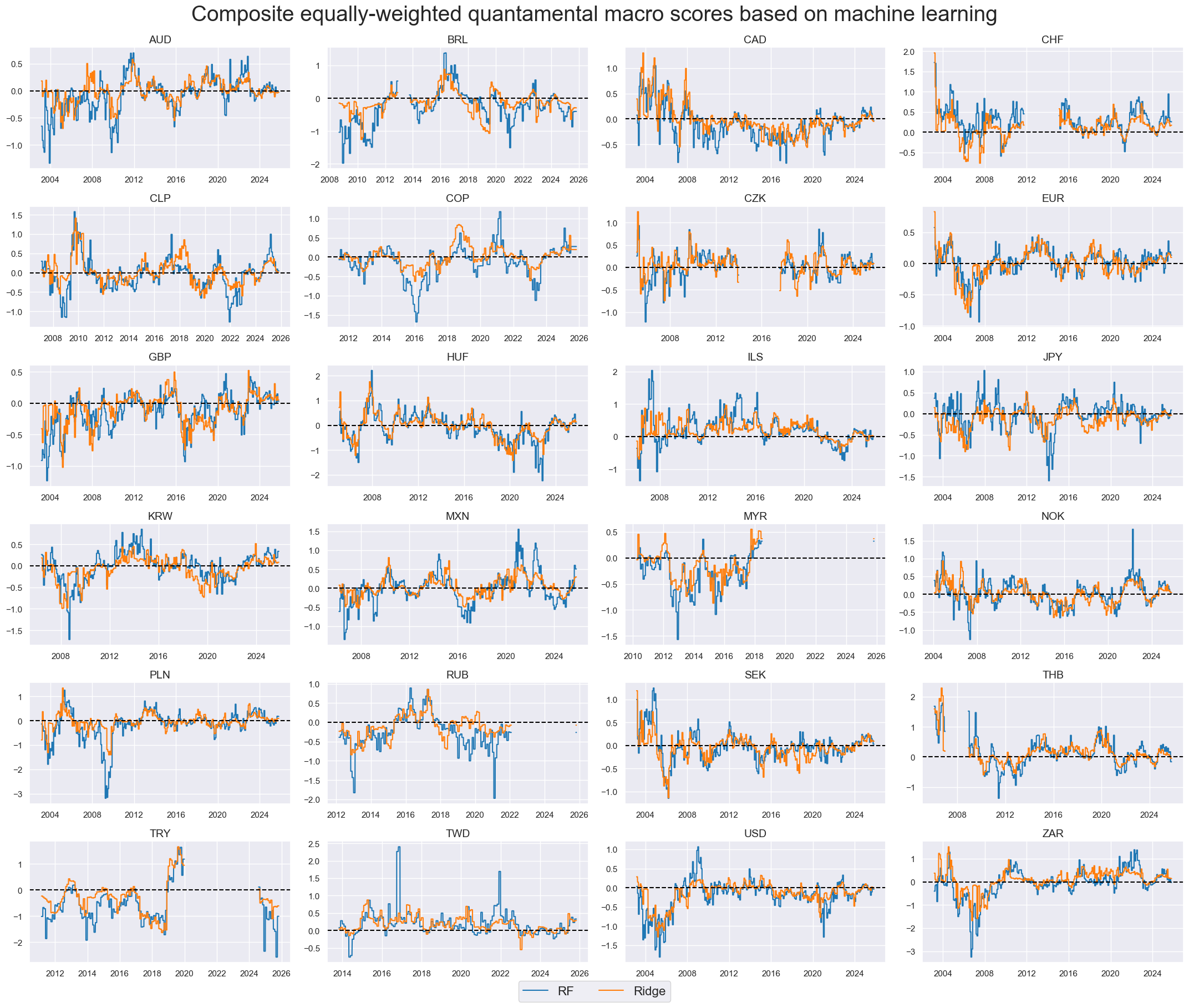

xcatx = ["RF", "Ridge"]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

cumsum=False,

ncol=4,

start="2000-01-01",

title_fontsize=28,

size=(10, 6),

aspect=1.8,

height=2,

same_y=False,

title="Composite equally-weighted quantamental macro scores based on machine learning",

#blacklist=fxblack,

all_xticks=True,

legend_fontsize=16,

)

Signal value checks #

Accuracy and correlation check #

srr = mss.SignalReturnRelations(

df = dfx,

rets = ["DU05YXR_VT10R"],

sigs = ["RF", "Ridge", "MACRO_AVGZ"],

cids = cids_dux,

blacklist = fxblack,

freqs = "M",

slip = 1,

cosp = True,

ms_panel_test = True

)

srr.multiple_relations_table().round(3)

| accuracy | bal_accuracy | pos_sigr | pos_retr | pos_prec | neg_prec | pearson | pearson_pval | kendall | kendall_pval | auc | map_pval | ||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Return | Signal | Frequency | Aggregation | ||||||||||||

| DU05YXR_VT10R | MACRO_AVGZ | M | last | 0.539 | 0.540 | 0.472 | 0.516 | 0.559 | 0.522 | 0.099 | 0.0 | 0.068 | 0.0 | 0.540 | 0.0 |

| RF | M | last | 0.536 | 0.537 | 0.473 | 0.516 | 0.555 | 0.519 | 0.100 | 0.0 | 0.073 | 0.0 | 0.537 | 0.0 | |

| Ridge | M | last | 0.542 | 0.542 | 0.496 | 0.516 | 0.559 | 0.526 | 0.104 | 0.0 | 0.071 | 0.0 | 0.542 | 0.0 |

Naive PnL #

xcatx = ["MACRO_AVGZ", "RF", "Ridge"]

pnl = msn.NaivePnL(

df=dfx,

ret="DU05YXR_VT10R",

sigs=xcatx,

cids=cids_dux,

blacklist=fxblack,

start="2004-01-01",

bms=["USD_GB10YXR_NSA"],

)

for xcat in xcatx:

pnl.make_pnl(

sig=xcat,

sig_op="zn_score_pan",

rebal_freq="monthly",

rebal_slip=1,

vol_scale=10,

neutral="zero",

thresh=3,

)

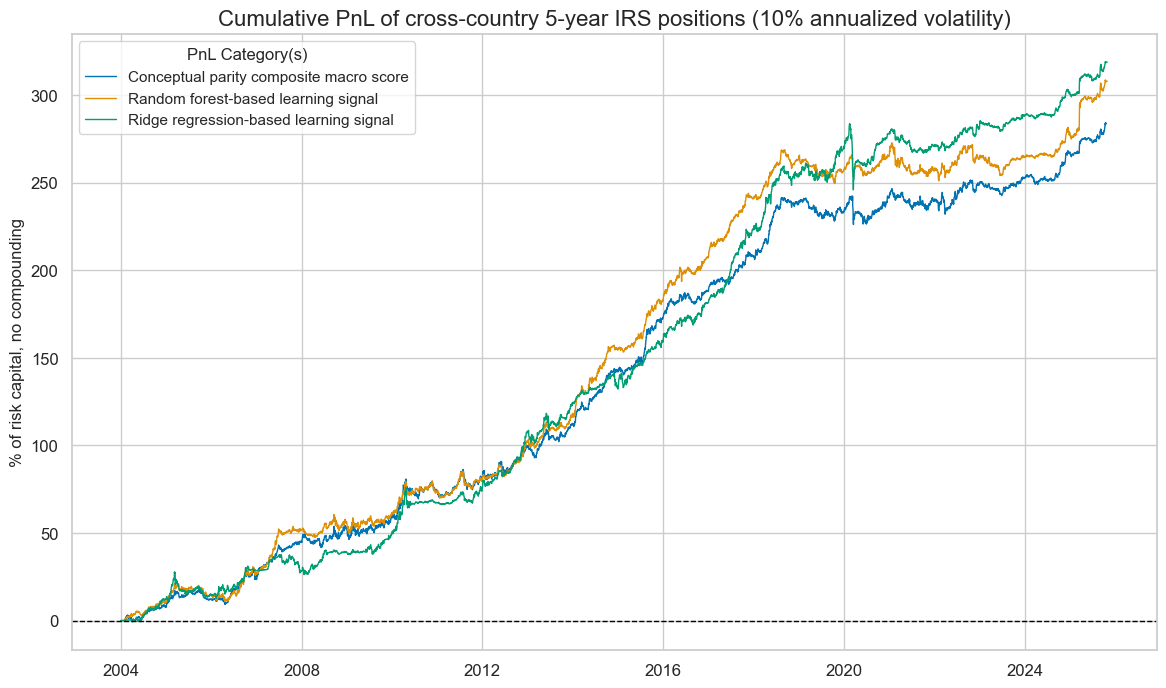

dict_pnl_labs = {

"PNL_MACRO_AVGZ": "Conceptual parity composite macro score",

"PNL_RF": "Random forest-based learning signal",

"PNL_Ridge": "Ridge regression-based learning signal",

}

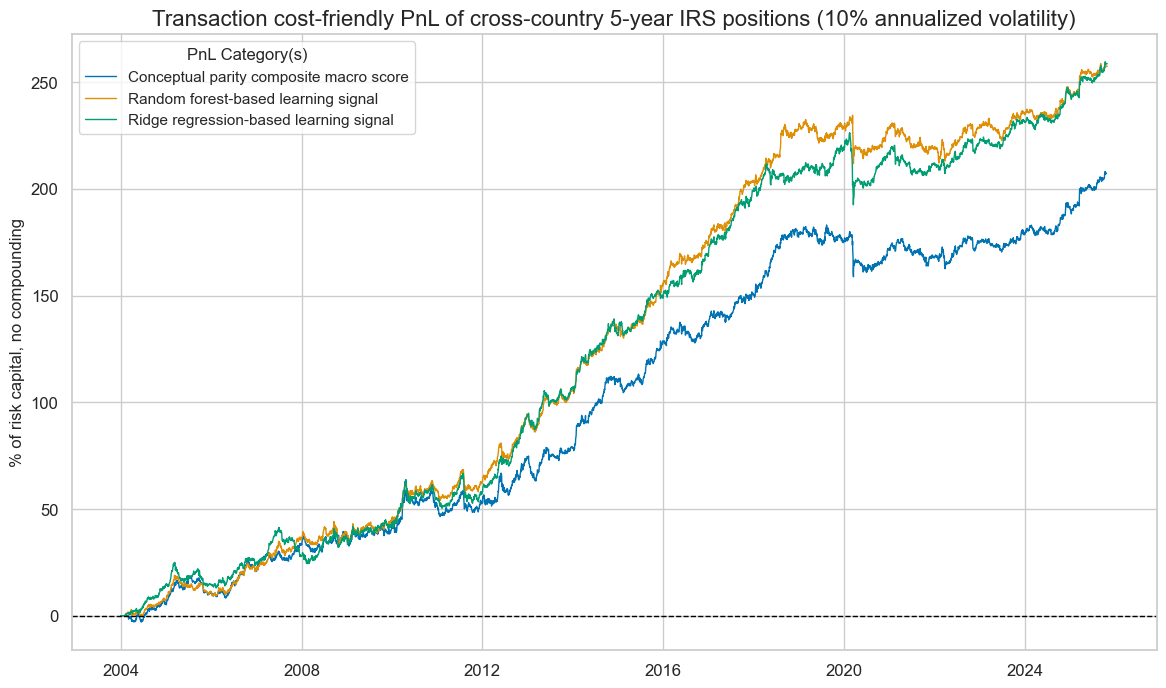

pnl.plot_pnls(

title="Cumulative PnL of cross-country 5-year IRS positions (10% annualized volatility)",

title_fontsize=16,

figsize=(14, 8),

xcat_labels=dict_pnl_labs,

)

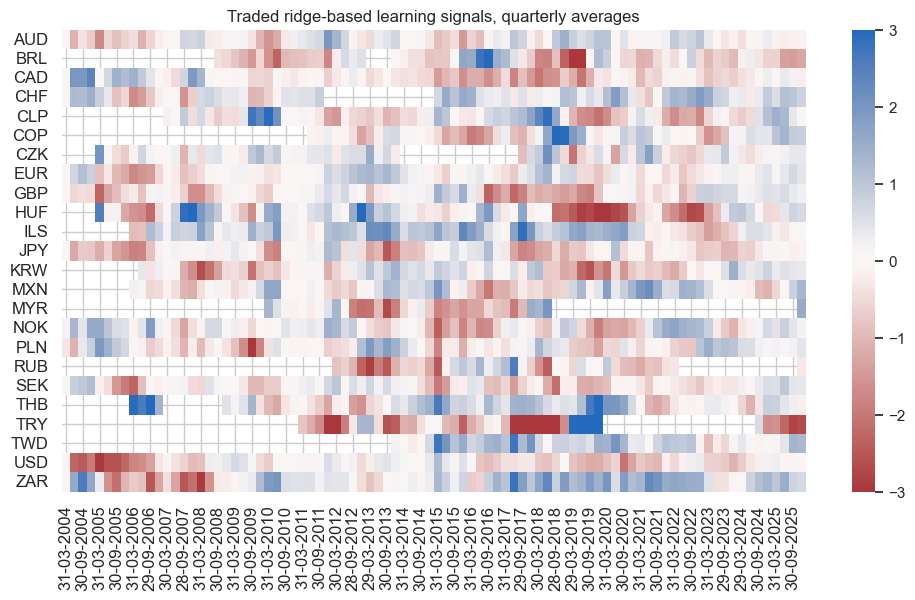

pnl.signal_heatmap(

pnl_name="PNL_Ridge",

title="Traded ridge-based learning signals, quarterly averages",

freq="Q",

start="2004-01-01",

figsize=(12, 6),

)

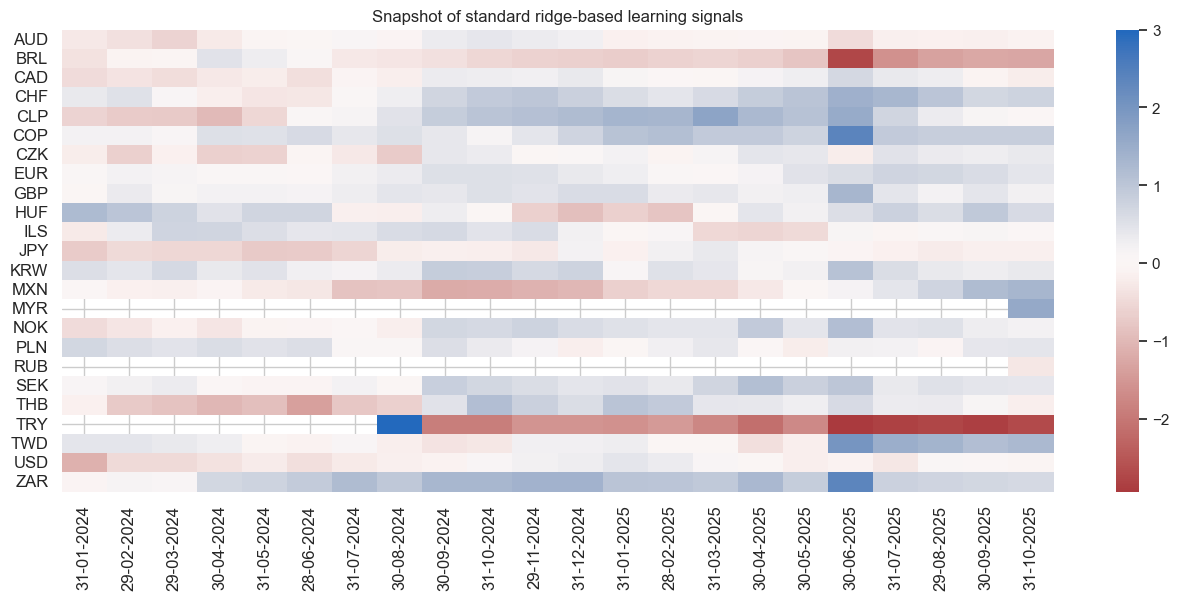

pnl.signal_heatmap(

pnl_name="PNL_Ridge",

title="Snapshot of standard ridge-based learning signals",

freq="M",

start="2024-01-01",

figsize=(16, 6),

)

pnl.evaluate_pnls(pnl_cats=pnl.pnl_names)

| xcat | PNL_MACRO_AVGZ | PNL_RF | PNL_Ridge |

|---|---|---|---|

| Return % | 13.02969 | 14.110828 | 14.613863 |

| St. Dev. % | 10.0 | 10.0 | 10.0 |

| Sharpe Ratio | 1.302969 | 1.411083 | 1.461386 |

| Sortino Ratio | 1.933513 | 2.110505 | 2.14532 |

| Max 21-Day Draw % | -15.374353 | -12.727549 | -37.076849 |

| Max 6-Month Draw % | -12.073497 | -17.586084 | -19.313699 |

| Peak to Trough Draw % | -16.165687 | -21.674408 | -37.767905 |

| Top 5% Monthly PnL Share | 0.367345 | 0.363474 | 0.357058 |

| USD_GB10YXR_NSA correl | 0.055675 | 0.074601 | -0.013329 |

| Traded Months | 262 | 262 | 262 |

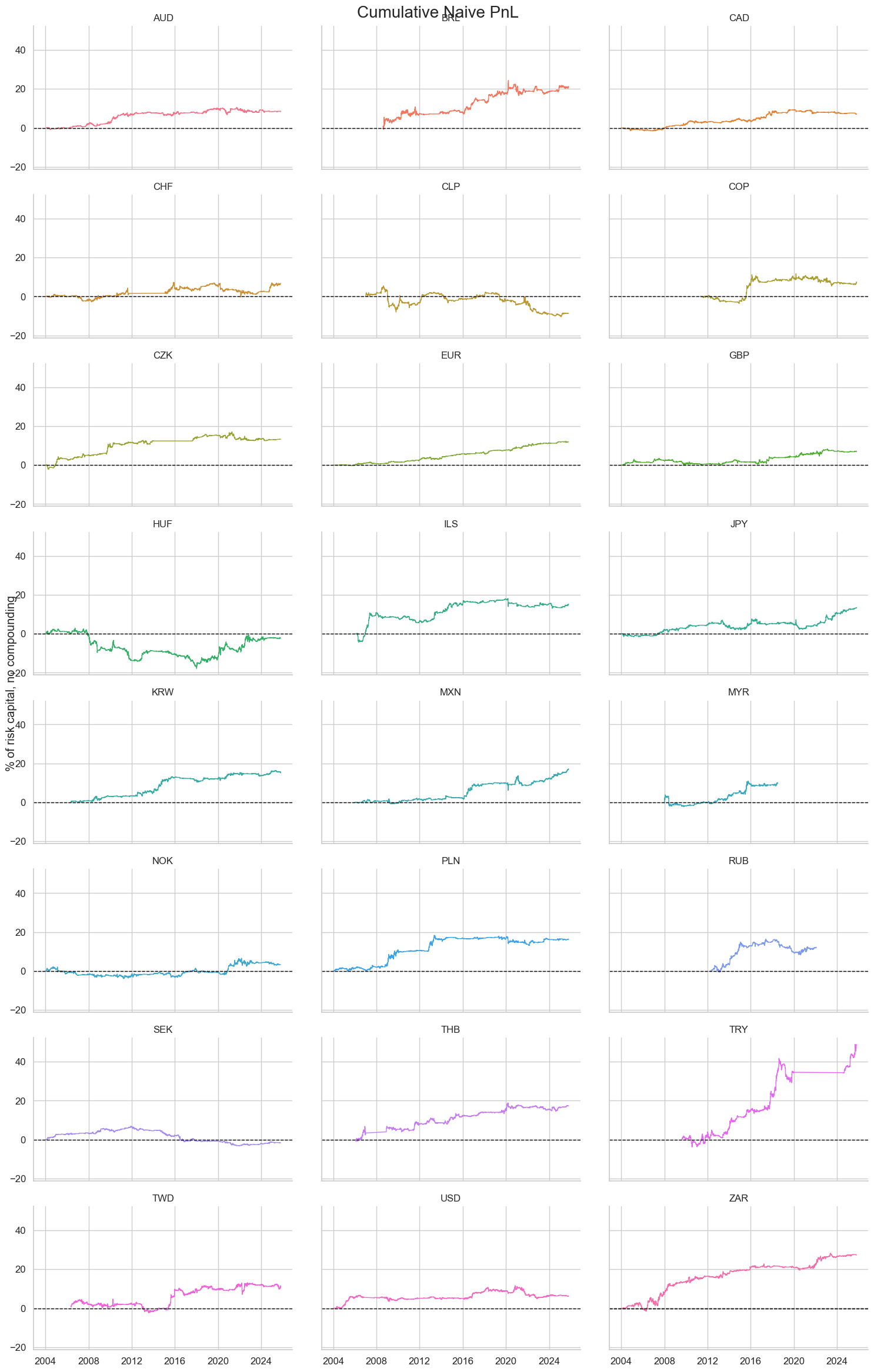

pnl.plot_pnls(pnl_cats=["PNL_MACRO_AVGZ"], pnl_cids=cids_dux, facet=True)

Transaction cost-friendly Naive PnL #

# Transaction cost-friendly strategy

xcatx = ["MACRO_AVGZ", "RF", "Ridge"]

pnl = msn.NaivePnL(

df=dfx,

ret="DU05YXR_VT10R",

sigs=xcatx,

cids=cids_dux,

blacklist=fxblack,

start="2004-01-01",

bms=["USD_GB10YXR_NSA"],

)

for xcat in xcatx:

pnl.make_pnl(

sig=xcat,

sig_op="binary",

rebal_freq="monthly",

rebal_slip=1,

vol_scale=10,

neutral="zero",

thresh=3,

entry_barrier=1,

exit_barrier=0.01,

)

pnl.plot_pnls(

title="Transaction cost-friendly PnL of cross-country 5-year IRS positions (10% annualized volatility)",

title_fontsize=16,

figsize=(14, 8),

xcat_labels=dict_pnl_labs,

)

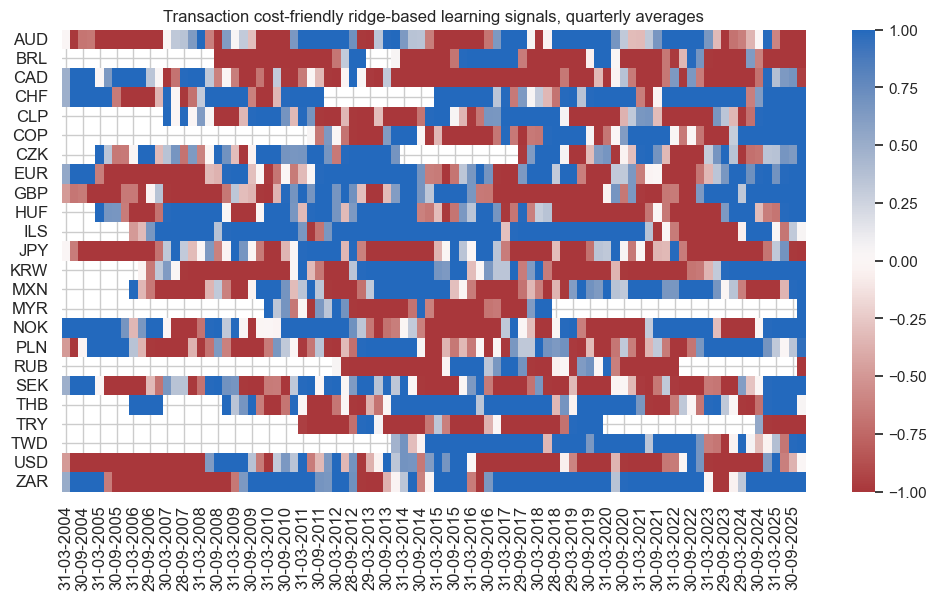

pnl.signal_heatmap(

pnl_name="PNL_Ridge",

title="Transaction cost-friendly ridge-based learning signals, quarterly averages",

freq="Q",

start="2004-01-01",

figsize=(12, 6),

)

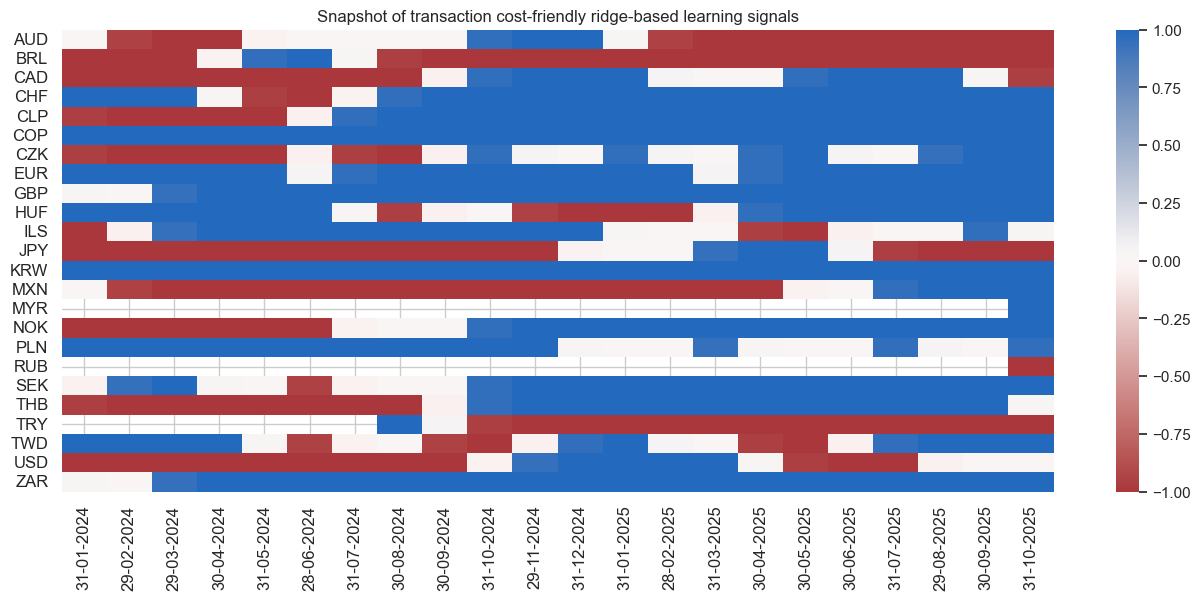

pnl.signal_heatmap(

pnl_name="PNL_Ridge",

title="Snapshot of transaction cost-friendly ridge-based learning signals",

freq="M",

start="2024-01-01",

figsize=(16, 6),

)

pnl.evaluate_pnls(pnl_cats=pnl.pnl_names)

| xcat | PNL_MACRO_AVGZ | PNL_RF | PNL_Ridge |

|---|---|---|---|

| Return % | 9.508542 | 11.835772 | 11.847645 |

| St. Dev. % | 10.0 | 10.0 | 10.0 |

| Sharpe Ratio | 0.950854 | 1.183577 | 1.184764 |

| Sortino Ratio | 1.384235 | 1.716192 | 1.71296 |

| Max 21-Day Draw % | -20.672086 | -21.357749 | -33.334513 |

| Max 6-Month Draw % | -21.220375 | -16.44629 | -22.215746 |

| Peak to Trough Draw % | -24.248707 | -22.650229 | -33.693642 |

| Top 5% Monthly PnL Share | 0.489614 | 0.396567 | 0.373884 |

| USD_GB10YXR_NSA correl | 0.015106 | 0.011364 | -0.012643 |

| Traded Months | 262 | 262 | 262 |