Dimension reduction and statistical learning #

Get packages and JPMaQS data #

Packages #

# >>> Define constants <<< #

import os

# Minimum Macrosynergy package version required for this notebook

MIN_REQUIRED_VERSION: str = "1.0.0"

# DataQuery credentials: Remember to replace with your own client ID and secret

DQ_CLIENT_ID: str = os.getenv("DQ_CLIENT_ID")

DQ_CLIENT_SECRET: str = os.getenv("DQ_CLIENT_SECRET")

# Define any Proxy settings required (http/https)

PROXY = {}

# Start date for the data (argument passed to the JPMaQSDownloader class)

START_DATE: str = "2000-01-01"

# Standard library imports

import numpy as np

import pandas as pd

import seaborn as sns

import warnings

from functools import partial

import itertools

# Scikit-learn imports

from sklearn.pipeline import Pipeline

from sklearn.decomposition import PCA

from sklearn.preprocessing import StandardScaler

from sklearn.compose import ColumnTransformer

from sklearn.metrics import make_scorer, root_mean_squared_error

# Macrosynergy package imports

import macrosynergy.management as msm

import macrosynergy.panel as msp

import macrosynergy.pnl as msn

import macrosynergy.signal as mss

import macrosynergy.learning as msl

import macrosynergy.visuals as msv

from macrosynergy.download import JPMaQSDownload

warnings.simplefilter("ignore")

# Check installed Macrosynergy package meets version requirement

import macrosynergy as msy

msy.check_package_version(required_version=MIN_REQUIRED_VERSION)

Data #

# IRS cross-section lists

cids_dm = [

"AUD",

"CAD",

"CHF",

"EUR",

"GBP",

"JPY",

"NOK",

"NZD",

"SEK",

"USD",

] # DM currency areas

cids_iliq = [

"NOK",

"NZD",

]

cids = sorted(set(cids_dm) - set(cids_iliq))

# Category tickers

cpi = [

# CPI inflation

"CPIH_SA_P1M1ML12",

"CPIH_SJA_P6M6ML6AR",

"CPIC_SA_P1M1ML12",

"CPIC_SJA_P6M6ML6AR",

"INFE2Y_JA",

]

ppi = [

# PPI inflation

"PPIH_NSA_P1M1ML12_3MMA",

"PPIH_SA_P6M6ML6AR",

"PGDPTECH_SA_P1M1ML12_3MMA",

"PGDP_SA_P1Q1QL4",

]

inf = cpi + ppi

dem = [

# Domestic demand growth

"RRSALES_SA_P1M1ML12_3MMA",

"RRSALES_SA_P1Q1QL4",

"RPCONS_SA_P1Q1QL4",

"RPCONS_SA_P1M1ML12_3MMA",

"IMPORTS_SA_P1M1ML12_3MMA",

]

out = [

# Output growth

"INTRGDP_NSA_P1M1ML12_3MMA",

"RGDPTECH_SA_P1M1ML12_3MMA",

"IP_SA_P1M1ML12_3MMA",

]

lab = [

# Labour market tightening and tightness

"EMPL_NSA_P1M1ML12_3MMA",

"EMPL_NSA_P1Q1QL4",

"UNEMPLRATE_NSA_3MMA_D1M1ML12",

"UNEMPLRATE_NSA_D1Q1QL4",

"UNEMPLRATE_SA_3MMAv5YMA",

"WAGES_NSA_P1M1ML12_3MMA",

"WAGES_NSA_P1Q1QL4",

]

ecg = dem + out + lab

mon = [

# Money and liquidity growth

"MNARROW_SJA_P1M1ML12",

"MBROAD_SJA_P1M1ML12",

"MBASEGDP_SA_D1M1ML6",

"INTLIQGDP_NSA_D1M1ML6",

]

crh = [

# Credit and housing market

"PCREDITBN_SJA_P1M1ML12",

"PCREDITGDP_SJA_D1M1ML12",

"HPI_SA_P1M1ML12_3MMA",

"HPI_SA_P1Q1QL4",

]

mcr = mon + crh

main = inf + ecg + mcr

adds = [

# Additional variables for benchmark calculation

"RGDP_SA_P1Q1QL4_20QMM",

"INFTEFF_NSA",

"WFORCE_NSA_P1Y1YL1_5YMM",

"WFORCE_NSA_P1Q1QL4_20QMM",

]

ecos = main + adds

rets = [

# Target returns

"DU05YXR_VT10",

"DU05YXR_NSA",

]

xcats = ecos + rets

# Asset return tickers for benchmark correlation analysis

xtra = ["USD_EQXR_NSA", "USD_GB10YXR_NSA"]

tickers = [cid + "_" + xcat for cid in cids for xcat in xcats] + xtra

# Download series from J.P. Morgan DataQuery by tickers

start_date = "2000-01-01"

print(f"Maximum number of tickers is {len(tickers)}")

# Retrieve credentials

client_id: str = os.getenv("DQ_CLIENT_ID")

client_secret: str = os.getenv("DQ_CLIENT_SECRET")

with JPMaQSDownload(client_id=client_id, client_secret=client_secret) as dq:

df = dq.download(

tickers=tickers,

start_date=start_date,

suppress_warning=True,

metrics=["value"],

report_time_taken=True,

show_progress=True,

)

Maximum number of tickers is 306

Downloading data from JPMaQS.

Timestamp UTC: 2025-09-11 13:13:39

Connection successful!

Requesting data: 100%|██████████████████████████| 16/16 [00:03<00:00, 4.84it/s]

Downloading data: 100%|█████████████████████████| 16/16 [00:15<00:00, 1.05it/s]

Time taken to download data: 19.78 seconds.

Some expressions are missing from the downloaded data. Check logger output for complete list.

56 out of 306 expressions are missing. To download the catalogue of all available expressions and filter the unavailable expressions, set `get_catalogue=True` in the call to `JPMaQSDownload.download()`.

dfx = df.copy()

dfx.info()

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 1657842 entries, 0 to 1657841

Data columns (total 4 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 real_date 1657842 non-null datetime64[ns]

1 cid 1657842 non-null object

2 xcat 1657842 non-null object

3 value 1657842 non-null float64

dtypes: datetime64[ns](1), float64(1), object(2)

memory usage: 50.6+ MB

Renaming and availability #

Renaming #

dict_repl = {

# Wages

"WAGES_NSA_P1Q1QL4": "WAGES_NSA_P1M1ML12_3MMA",

# House prices

"HPI_SA_P1Q1QL4": "HPI_SA_P1M1ML12_3MMA",

# Labour market

"EMPL_NSA_P1Q1QL4": "EMPL_NSA_P1M1ML12_3MMA",

"UNEMPLRATE_NSA_D1Q1QL4": "UNEMPLRATE_NSA_3MMA_D1M1ML12",

"UNEMPLRATE_SA_D2Q2QL2": "UNEMPLRATE_SA_D6M6ML6",

# Other

"RRSALES_SA_P1Q1QL4": "RRSALES_SA_P1M1ML12_3MMA",

"RPCONS_SA_P1Q1QL4": "RPCONS_SA_P1M1ML12_3MMA",

"WFORCE_NSA_P1Y1YL1_5YMM": "WFORCE_NSA_P1Q1QL4_20QMM",

}

for key, value in dict_repl.items():

dfx["xcat"] = dfx["xcat"].str.replace(key, value)

eco_lists = [inf, ecg, mcr, adds] # remove replaced tickers from economic concept lists

for i in range(len(eco_lists)):

eco_lists[i][:] = [xc for xc in eco_lists[i] if xc in dfx["xcat"].unique()]

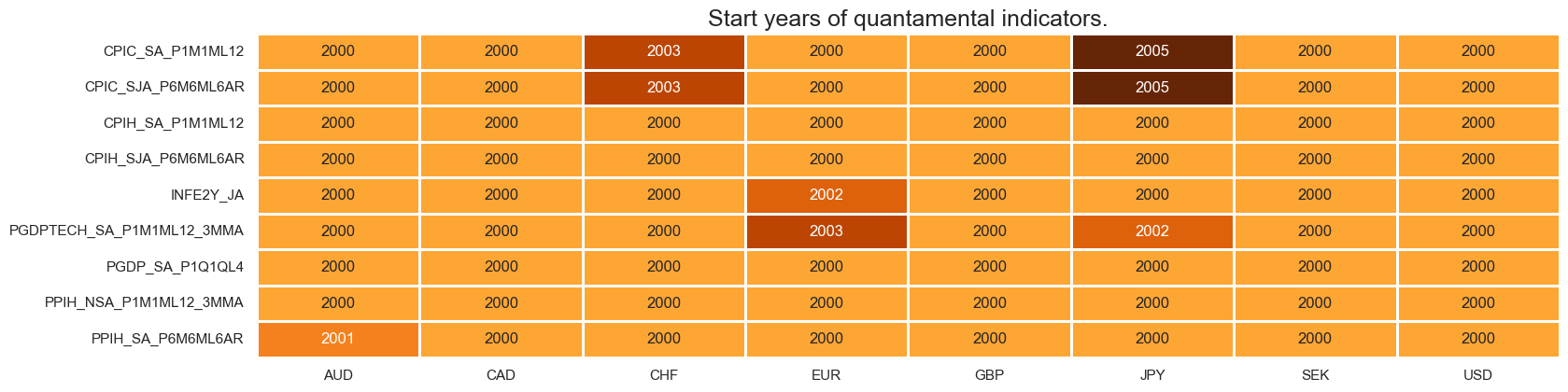

Check availability #

xcatx = inf

msm.check_availability(df=dfx, xcats=xcatx, cids=cids, missing_recent=False)

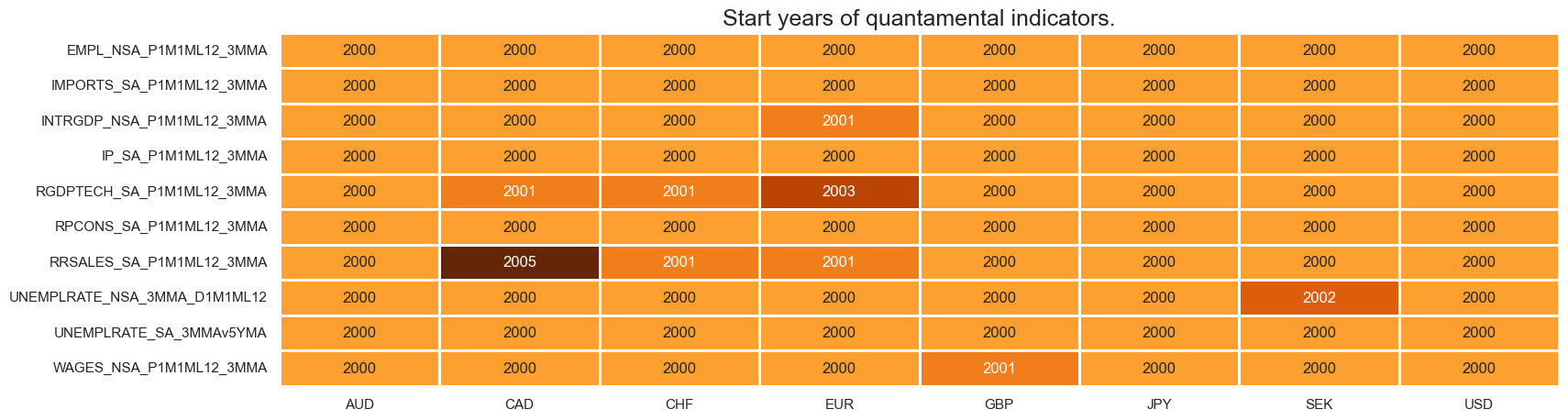

xcatx = ecg

msm.check_availability(df=dfx, xcats=xcatx, cids=cids, missing_recent=False)

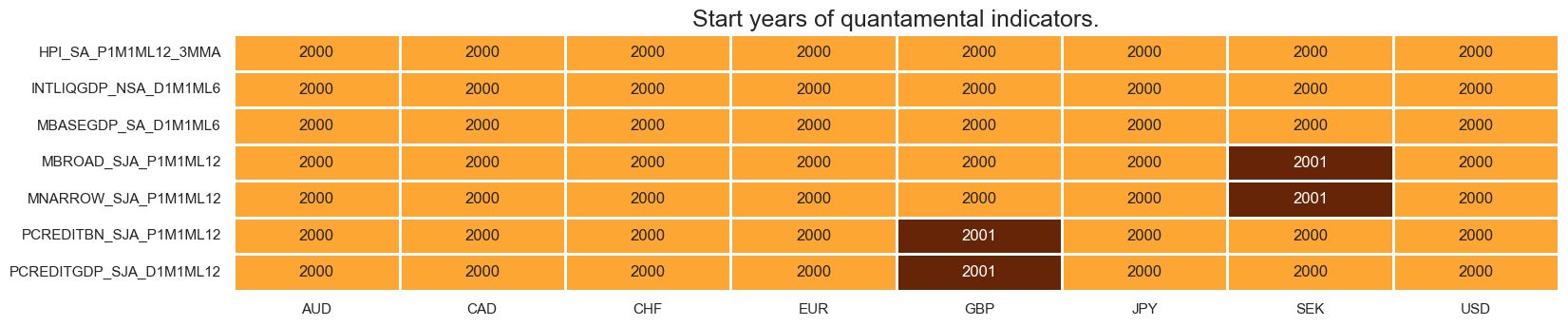

xcatx = mcr

msm.check_availability(df=dfx, xcats=xcatx, cids=cids, missing_recent=False)

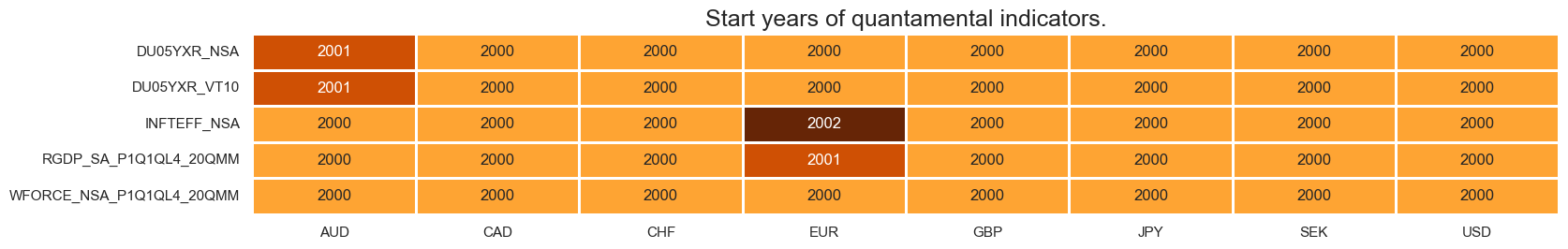

xcatx = adds + rets

msm.check_availability(df=dfx, xcats=xcatx, cids=cids, missing_recent=False)

Transformation and checks #

dict_labels = {}

dict_factorz = {}

Inflation shortfall #

# All excess inflation rates

xcatx = inf

dfa = msp.panel_calculator(

df=dfx, calcs=[f"X{xcat}N = - {xcat} + INFTEFF_NSA" for xcat in xcatx], cids=cids

)

dfx = msm.update_df(dfx, dfa)

xinf = [f"X{xcat}N" for xcat in inf]

# Category-wise sequential normalization

xcatx = xinf

for xcat in xcatx:

dfa = msp.make_zn_scores(

df=dfx,

xcat=xcat,

cids=cids,

neutral="zero",

thresh=3,

est_freq="M",

pan_weight=1,

postfix="_ZN",

)

dfx = msm.update_df(dfx, dfa)

# Labels

dict_labels["XCPIH_SA_P1M1ML12N_ZN"] = "CPI, %oya, excess, negative"

dict_labels["XCPIH_SJA_P6M6ML6ARN_ZN"] = "CPI, %6m/6m, saar, excess, negative"

dict_labels["XCPIC_SA_P1M1ML12N_ZN"] = "Core CPI, %oya, excess, negative"

dict_labels["XCPIC_SJA_P6M6ML6ARN_ZN"] = "Core CPI, %6m/6m, saar, excess, negative"

dict_labels["XINFE2Y_JAN_ZN"] = "CPI inflation expectations, excess, negative"

dict_labels["XPPIH_NSA_P1M1ML12_3MMAN_ZN"] = "PPI, %oya, 3mma, excess, negative"

dict_labels["XPPIH_SA_P6M6ML6ARN_ZN"] = "PPI, %6m/6m, saar, excess, negative"

dict_labels["XPGDPTECH_SA_P1M1ML12_3MMAN_ZN"] = "GDP deflator nowcast, %oya, 3mma, excess, negative"

dict_labels["XPGDP_SA_P1Q1QL4N_ZN"] = "GDP deflator, %oya, excess, negative"

# Factors

dict_factorz["XCPINZ"] = [f"X{xcat}N_ZN" for xcat in cpi]

dict_factorz["XPPINZ"] = [f"X{xcat}N_ZN" for xcat in ppi]

dict_factorz["XINFNZ_BROAD"] = [f"X{xcat}N_ZN" for xcat in inf]

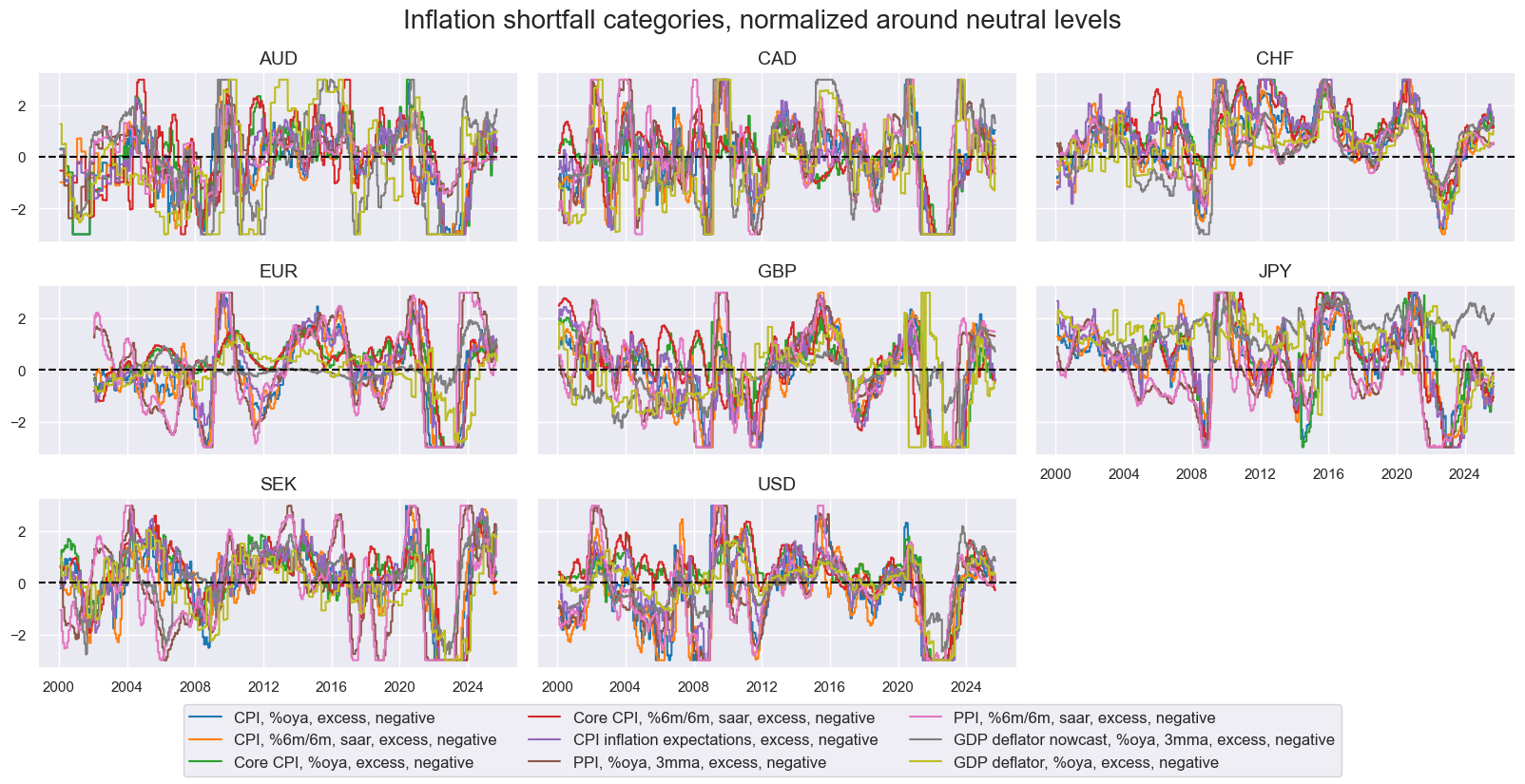

# Visual check of factor groups

factor = "XINFNZ_BROAD" # XCPINZ, XPPINZ, XINFNZ_BROAD

xcatx = dict_factorz[factor]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cids,

ncol=3,

aspect=2,

height=1.8,

start="2000-01-01",

same_y=True,

title="Inflation shortfall categories, normalized around neutral levels",

title_fontsize=20,

xcat_labels=dict_labels,

)

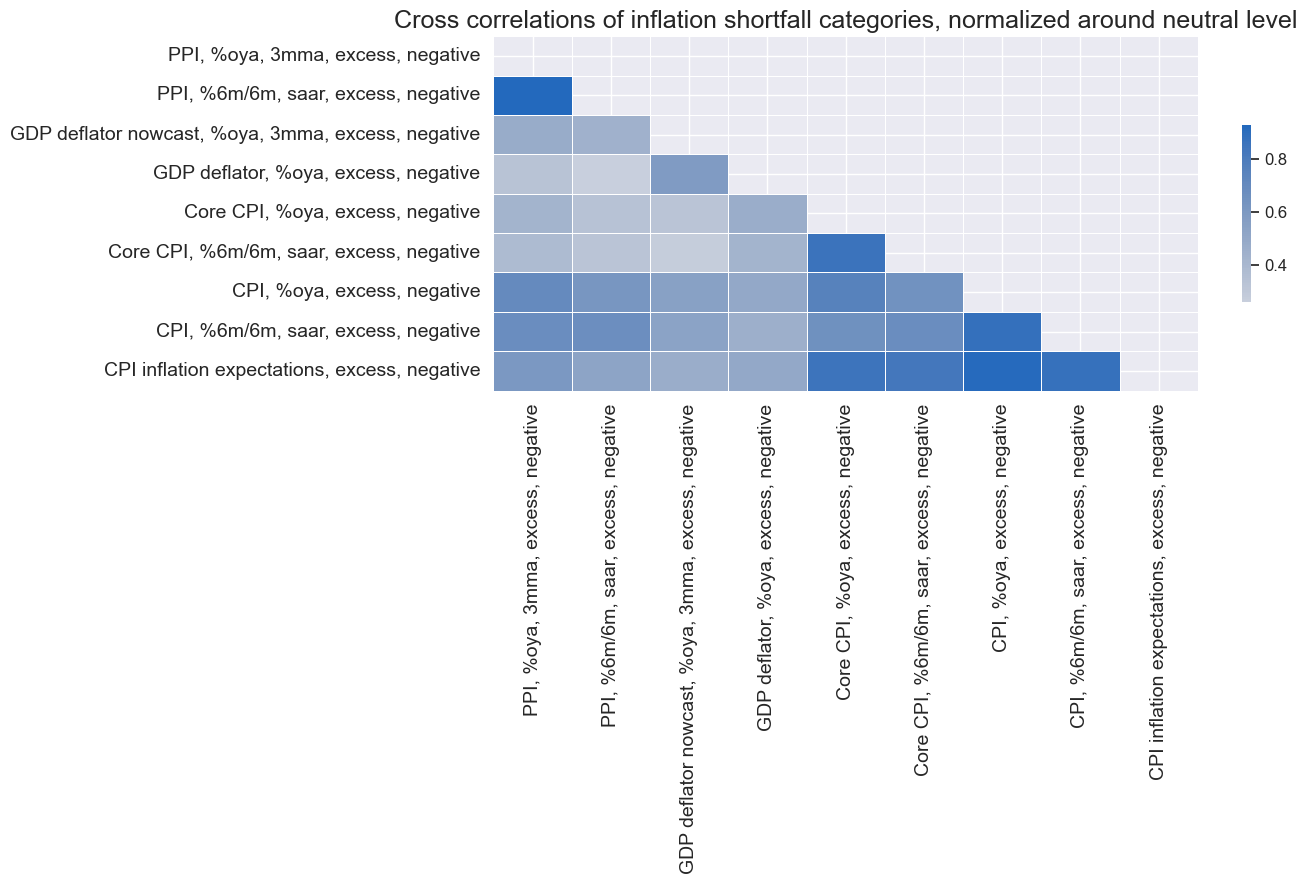

height = len(xcatx)

width = round(height * 1.5)

msp.correl_matrix(

dfx,

xcats=xcatx,

cids=cids,

freq="M",

size=(width, height),

cluster=True,

title="Cross correlations of inflation shortfall categories, normalized around neutral level",

title_fontsize=18,

xcat_labels={xcat:dict_labels[xcat] for xcat in xcatx},

)

Economic activity shortfall #

# All excess activity growth rates

act = [xcat for xcat in ecg if xcat in dem + out]

xcatx = act

dfa = msp.panel_calculator(

df=dfx,

calcs=[f"X{xcat}N = - {xcat} + RGDP_SA_P1Q1QL4_20QMM" for xcat in xcatx],

cids=cids,

)

dfx = msm.update_df(dfx, dfa)

xact = ["X" + xcat + "N" for xcat in act]

# Excess employment, excess wage growth and unemployment shortfalls

calcs = []

calcs += [

"XEMPL_NSA_P1M1ML12_3MMAN = - EMPL_NSA_P1M1ML12_3MMA + WFORCE_NSA_P1Q1QL4_20QMM"

]

calcs += [

"WAGEGROWTH_NEUTRAL = INFTEFF_NSA + RGDP_SA_P1Q1QL4_20QMM - WFORCE_NSA_P1Q1QL4_20QMM"

]

calcs += ["XWAGES_NSA_P1M1ML12_3MMAN = - WAGES_NSA_P1M1ML12_3MMA + WAGEGROWTH_NEUTRAL"]

dfa = msp.panel_calculator(df=dfx, calcs=calcs, cids=cids)

dfx = msm.update_df(dfx, dfa)

xoth = [xcat for xcat in list(dfa["xcat"].unique()) if xcat != "WAGEGROWTH_NEUTRAL"] + [

"UNEMPLRATE_NSA_3MMA_D1M1ML12",

"UNEMPLRATE_SA_3MMAv5YMA",

]

xecg = xact + xoth

# Category-wise sequential normalization

xcatx = xecg

for xcat in xcatx:

dfa = msp.make_zn_scores(

df=dfx,

xcat=xcat,

cids=cids,

neutral="zero",

thresh=3,

est_freq="M",

pan_weight=1,

postfix="_ZN",

)

dfx = msm.update_df(dfx, dfa)

# Labels

dict_labels["XRRSALES_SA_P1M1ML12_3MMAN_ZN"] = "Retail sales, %oya, 3mma, excess, negative"

dict_labels["XRPCONS_SA_P1M1ML12_3MMAN_ZN"] = "Private consumption, %oya, 3mma, excess, negative"

dict_labels["XIMPORTS_SA_P1M1ML12_3MMAN_ZN"] = "Imports, %oya, 3mma, excess, negative"

dict_labels["XINTRGDP_NSA_P1M1ML12_3MMAN_ZN"] = "GDP, intuitive nowcast, %oya, 3mma, excess, negative"

dict_labels["XRGDPTECH_SA_P1M1ML12_3MMAN_ZN"] = "GDP, technical nowcast, %oya, 3mma, excess, negative"

dict_labels["XIP_SA_P1M1ML12_3MMAN_ZN"] = "Industrial production, %oya, 3mma, excess, negative"

dict_labels["XEMPL_NSA_P1M1ML12_3MMAN_ZN"] = "Employment, %oya, 3mma, excess, negative"

dict_labels["XWAGES_NSA_P1M1ML12_3MMAN_ZN"] = "Wages, %oya, 3mma, excess, negative"

dict_labels["UNEMPLRATE_NSA_3MMA_D1M1ML12_ZN"] = "Unemployment rate, diff oya, 3mma"

dict_labels["UNEMPLRATE_SA_3MMAv5YMA_ZN"] = "Unemployment rate, diff over 5yma"

# Factors

dict_factorz["XDEMNZ"] = [f"{xcat}_ZN" for xcat in xecg if any(s in xcat for s in dem)]

dict_factorz["XOUTNZ"] = [f"{xcat}_ZN" for xcat in xecg if any(s in xcat for s in out)]

dict_factorz["XLABNZ"] = [f"{xcat}_ZN" for xcat in xecg if any(s in xcat for s in lab)]

dict_factorz["XECGNZ_BROAD"] = [

f"{xcat}_ZN" for xcat in xecg if any(s in xcat for s in ecg)

]

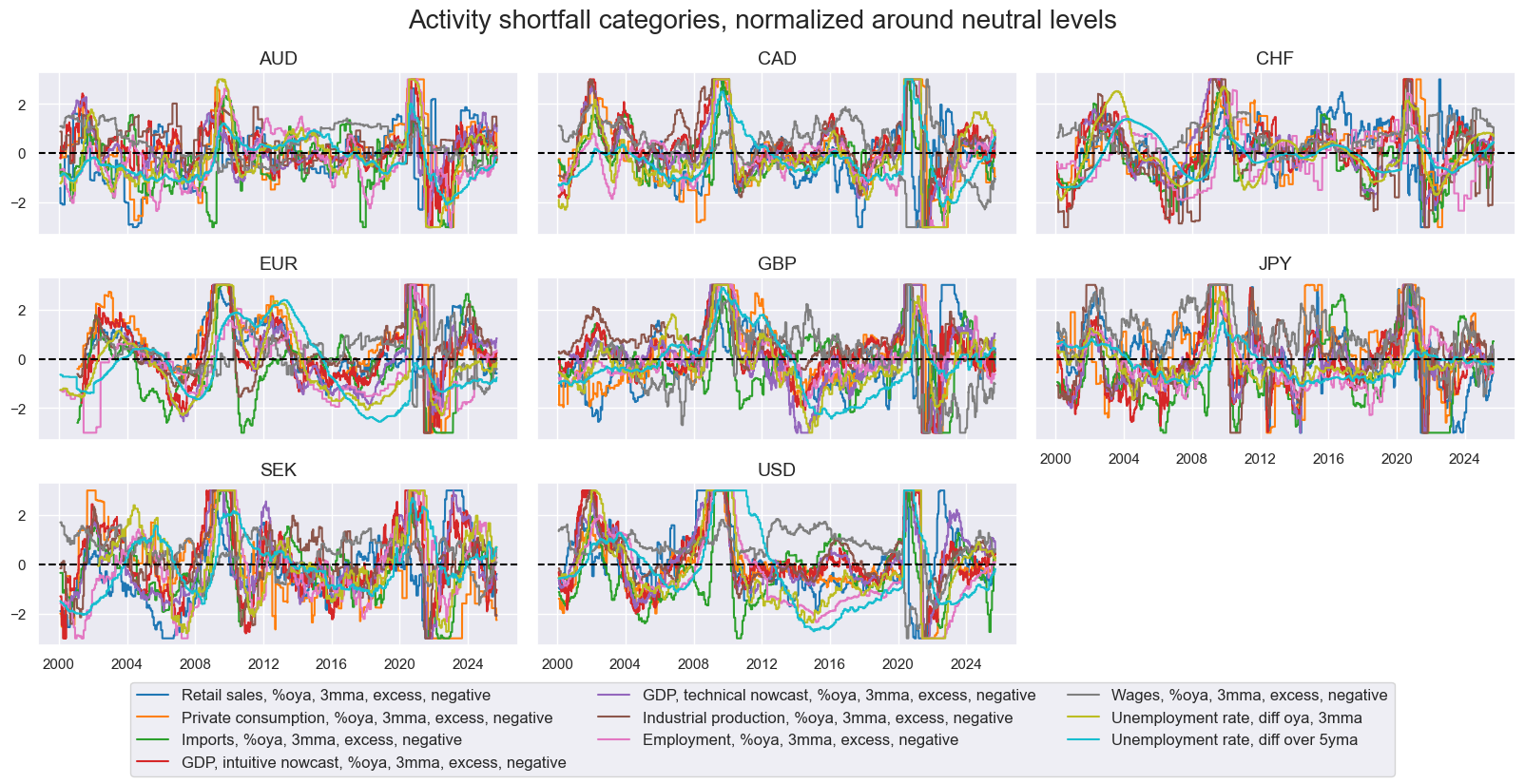

# Visual check of factor groups

factor = "XECGNZ_BROAD" # XDEMNZ, XOUTNZ, XLABNZ, XECGNZ_BROAD

xcatx = dict_factorz[factor]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cids,

ncol=3,

aspect=2,

height=1.8,

start="2000-01-01",

same_y=True,

title="Activity shortfall categories, normalized around neutral levels",

title_fontsize=20,

xcat_labels=dict_labels,

)

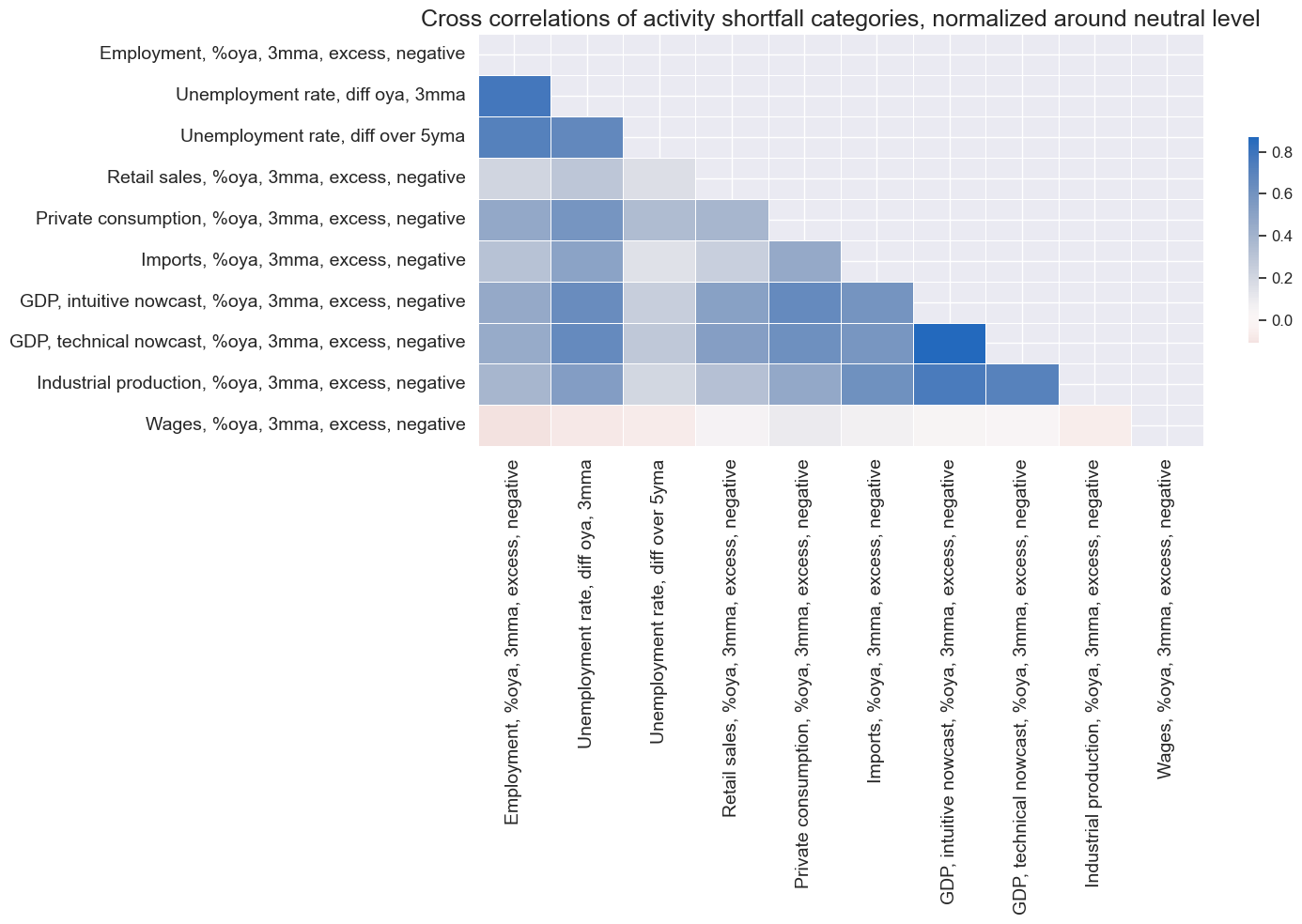

height = len(xcatx)

width = round(height * 1.5)

msp.correl_matrix(

dfx,

xcats=xcatx,

cids=cids,

freq="M",

size=(width, height),

cluster=True,

title="Cross correlations of activity shortfall categories, normalized around neutral level",

title_fontsize=18,

xcat_labels={xcat:dict_labels[xcat] for xcat in xcatx},

)

Excess money and credit growth #

# Excess money and credit growth rates

xcatx = [

"MNARROW_SJA_P1M1ML12",

"MBROAD_SJA_P1M1ML12",

"PCREDITBN_SJA_P1M1ML12",

"PCREDITGDP_SJA_D1M1ML12",

]

dfa = msp.panel_calculator(

df=dfx,

calcs=[

f"X{xcat}N = - {xcat} + ( RGDP_SA_P1Q1QL4_20QMM + INFTEFF_NSA )"

for xcat in xcatx

],

cids=cids,

)

dfx = msm.update_df(dfx, dfa)

xmcr1 = ["X" + xcat + "N" for xcat in xcatx]

# Excess house price growth & pseudo excess liquidity growth

calcs = []

calcs += ["XHPI_SA_P1M1ML12_3MMAN = - HPI_SA_P1M1ML12_3MMA + INFTEFF_NSA"]

calcs += ["INTLIQGDP_NSA_D1M1ML6N = - INTLIQGDP_NSA_D1M1ML6"]

calcs += ["MBASEGDP_SA_D1M1ML6N = - MBASEGDP_SA_D1M1ML6"]

dfa = msp.panel_calculator(df=dfx, calcs=calcs, cids=cids)

dfx = msm.update_df(dfx, dfa)

xmcr2 = list(dfa["xcat"].unique())

xmcr = xmcr1 + xmcr2

# Category-wise sequential normalization

xcatx = xmcr

for xcat in xcatx:

dfa = msp.make_zn_scores(

df=dfx,

xcat=xcat,

cids=cids,

neutral="zero",

thresh=3,

est_freq="M",

pan_weight=1,

postfix="_ZN",

)

dfx = msm.update_df(dfx, dfa)

# Labels

dict_labels["XMNARROW_SJA_P1M1ML12N_ZN"] = "Narrow money, %oya, excess, negative"

dict_labels["XMBROAD_SJA_P1M1ML12N_ZN"] = "Broad money, %oya, excess, negative"

dict_labels["XPCREDITBN_SJA_P1M1ML12N_ZN"] = "Private credit, %oya, excess, negative"

dict_labels["XPCREDITGDP_SJA_D1M1ML12N_ZN"] = "Private credit, diff oya, % of GDP, excess, negative"

dict_labels["XHPI_SA_P1M1ML12_3MMAN_ZN"] = "House prices, %oya, 3mma, excess, negative"

dict_labels["MBASEGDP_SA_D1M1ML6N_ZN"] = "Monetary base, diff over 6 months, % of GDP, excess, negative"

dict_labels["INTLIQGDP_NSA_D1M1ML6N_ZN"] = "Liquidity, diff over 6 months, % of GDP, excess, negative"

# Factors

dict_factorz["XMONNZ"] = [f"{xcat}_ZN" for xcat in xmcr if any(s in xcat for s in mon)]

dict_factorz["XCRHNZ"] = [f"{xcat}_ZN" for xcat in xmcr if any(s in xcat for s in crh)]

dict_factorz["XMCRNZ_BROAD"] = [

f"{xcat}_ZN" for xcat in xmcr if any(s in xcat for s in mcr)

]

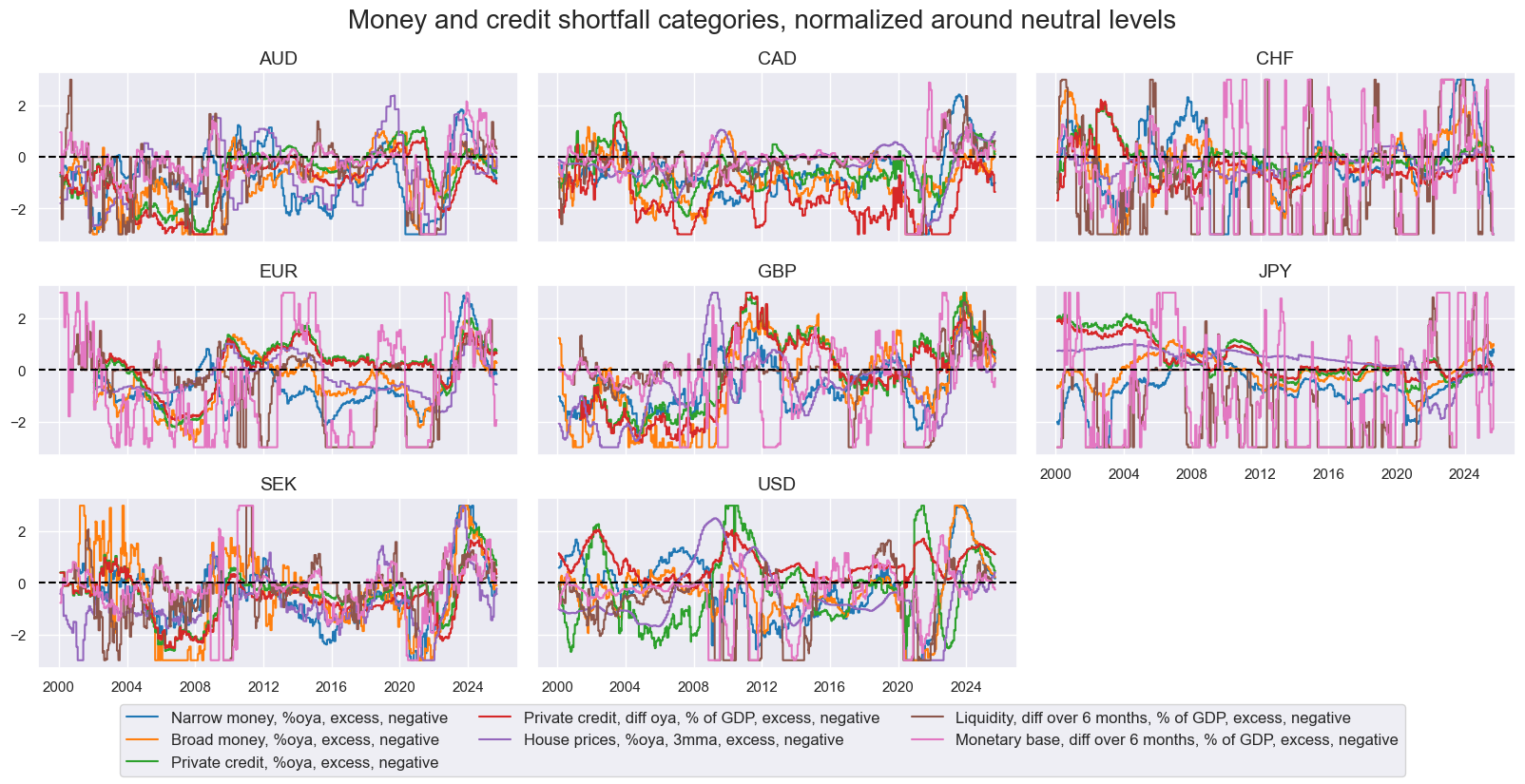

factor = "XMCRNZ_BROAD" # XMONNZ, XCRHNZ

xcatx = dict_factorz[factor]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cids,

ncol=3,

aspect=2,

height=1.8,

start="2000-01-01",

same_y=True,

title="Money and credit shortfall categories, normalized around neutral levels",

title_fontsize=20,

xcat_labels=dict_labels,

)

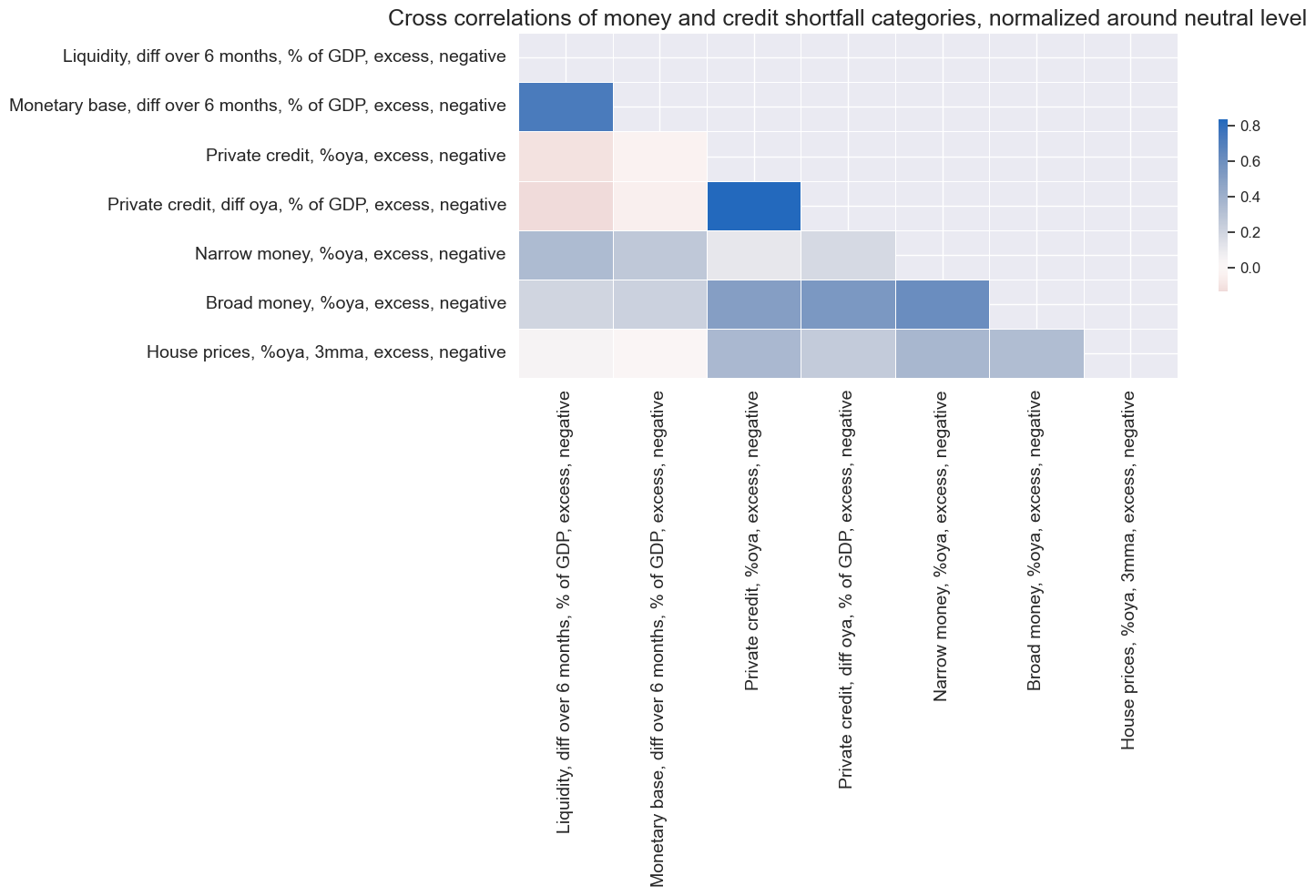

height = len(xcatx)

width = round(height * 1.6)

msp.correl_matrix(

dfx,

xcats=xcatx,

cids=cids,

freq="M",

size=(15, 10),

cluster=True,

title="Cross correlations of money and credit shortfall categories, normalized around neutral level",

title_fontsize=18,

xcat_labels={xcat:dict_labels[xcat] for xcat in xcatx},

)

Equally-weighted conceptual scores #

dfa = pd.DataFrame(columns=dfx.columns)

for k, v in dict_factorz.items():

dfaa = msp.linear_composite(

df=dfx,

xcats=v,

cids=cids,

new_xcat=k,

)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

narrow_factorz = [k for k in dict_factorz.keys() if "BROAD" not in k]

broad_factorz = [k for k in dict_factorz.keys() if "BROAD" in k]

dict_factlabels ={

"XINFNZ_BROAD": "Broad inflation shortfall",

"XECGNZ_BROAD": "Broad economic activity shortfall",

"XMCRNZ_BROAD": "Broad money and credit growth shortfall",

"XCPINZ": "CPI inflation shortfall",

"XPPINZ": "PPI inflation shortfall",

"XDEMNZ": "Domestic demand growth shortfall",

"XOUTNZ": "Output growth shortfall",

"XLABNZ": "Labour market slack",

"XMONNZ": "Money growth shortfall",

"XCRHNZ": "Credit and house price growth shortfall",

}

dict_labels.update(dict_factlabels)

# Visual check of factor groups

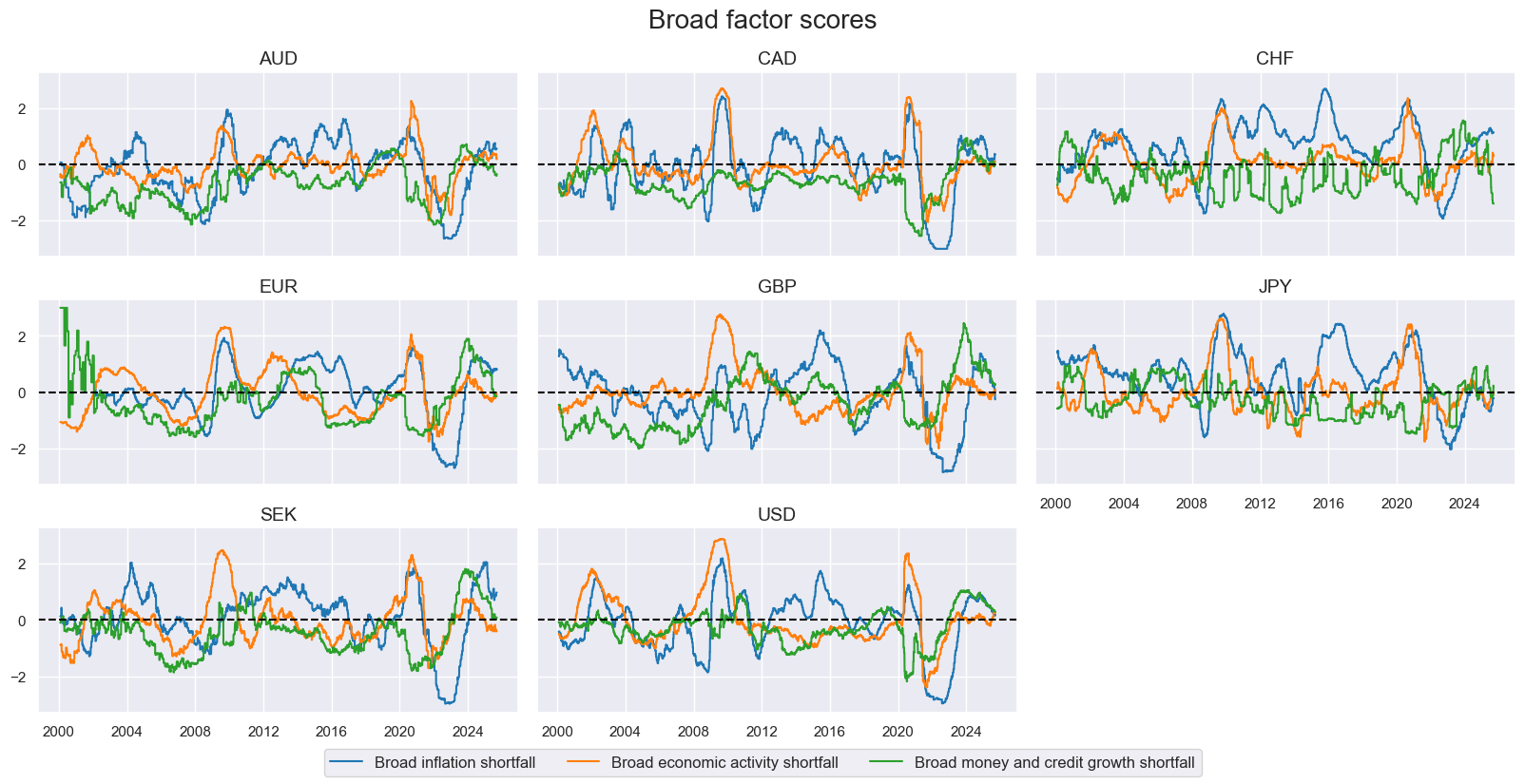

xcatx = broad_factorz # narrow_factorz broad_factorz

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cids,

ncol=3,

aspect=2,

height=1.8,

start="2000-01-01",

same_y=True,

title="Broad factor scores",

title_fontsize=20,

xcat_labels={xcat:dict_labels[xcat] for xcat in xcatx},

)

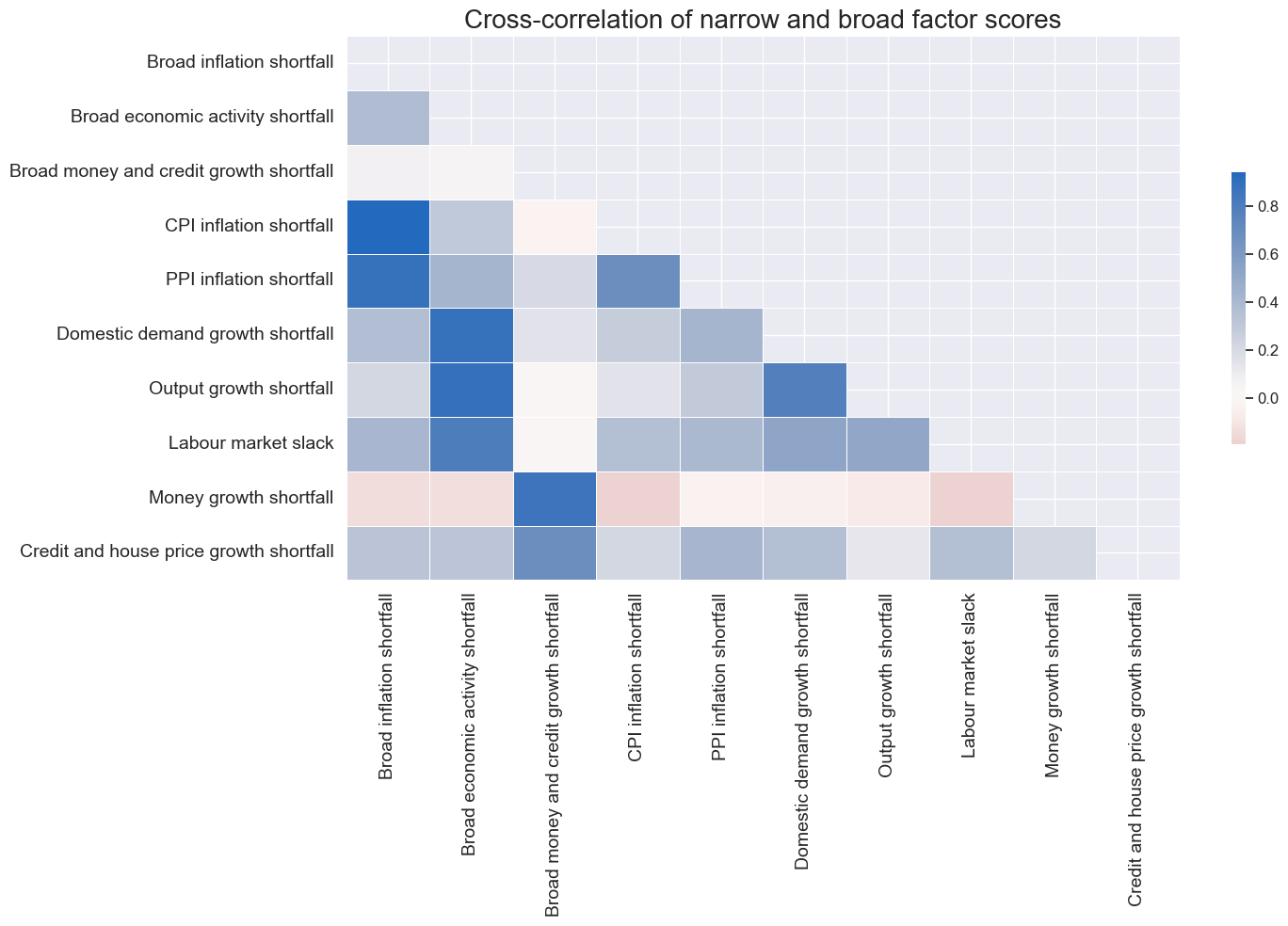

xcatx = broad_factorz + narrow_factorz

height = len(xcatx)

width = round(height * 1.5)

msp.correl_matrix(

dfx,

xcats=xcatx,

cids=cids,

freq="M",

size=(width, height),

cluster=False,

title="Cross-correlation of narrow and broad factor scores",

title_fontsize=20,

xcat_labels={xcat:dict_labels[xcat] for xcat in xcatx},

)

Target returns #

xcatx = ["DU05YXR_NSA", "DU05YXR_VT10"]

msp.view_timelines(

dfx,

xcats=xcatx,

cumsum=True,

cids=cids,

ncol=3,

aspect=1.8,

start="2000-01-01",

same_y=True,

title="Cumulative excess returns on 5-year IRS fixed receiver positions, unadjusted and 10% vol-target",

title_fontsize=26,

)

Signal generation #

Preparation #

scorer = {"RMSE": make_scorer(root_mean_squared_error, greater_is_better=False)}

splitter = {"Rolling": msl.RollingKFoldPanelSplit(5)}

from sklearn.base import BaseEstimator, TransformerMixin

from sklearn.cross_decomposition import PLSRegression

class PLSTransformer(BaseEstimator, TransformerMixin):

def __init__(self, n_components=2):

self.n_components = n_components

self.model = PLSRegression(n_components=n_components)

def fit(self, X, y=None):

# PLS needs y for supervised decomposition

# If you're fitting inside a preprocessing pipeline, pass y through

self.model.fit(X, y)

return self

def transform(self, X):

return self.model.transform(X)

from sklearn.base import MetaEstimatorMixin

class DataFrameTransformer(BaseEstimator, TransformerMixin, MetaEstimatorMixin):

def __init__(self, transformer, column_names=None):

# Attributes

self.transformer = transformer

self.column_names = column_names

def fit(self, X, y=None):

# Fit estimator

self.transformer.fit(X, y)

return self

def transform(self, X):

# Transform the data

transformation = self.transformer.transform(X)

if isinstance(transformation, pd.DataFrame):

return transformation

else:

# scikit-learn returns a numpy array, convert it back to DataFrame

if self.column_names is None:

columns = [f"Factor_{i}" for i in range(transformation.shape[1])]

else:

columns = self.column_names[: transformation.shape[1]]

return pd.DataFrame(

data=transformation,

columns=columns,

index=X.index,

)

Kitchen-sink PCA and PLS #

xcatx = list(

itertools.chain(*[dict_factorz[narrow_xcat] for narrow_xcat in narrow_factorz])

) + ["DU05YXR_VT10"]

cidx = cids

so_full = msl.SignalOptimizer(

df=dfx,

xcats=xcatx,

cids=cidx,

freq="W",

lag=1,

xcat_aggs=["last", "sum"],

)

so_full.calculate_predictions(

name="KS",

models={

"PCR": Pipeline(

[

("scaler", msl.PanelStandardScaler()),

("pca", msl.PanelPCA(n_components=3)),

("twlr", msl.TimeWeightedLinearRegression()),

]

),

"PLS": Pipeline(

[

("scaler", msl.PanelStandardScaler()),

("pls", DataFrameTransformer(PLSTransformer(n_components=3))),

("twlr", msl.TimeWeightedLinearRegression()),

]

),

},

scorers=scorer,

hyperparameters={

"PCR": {"twlr__fit_intercept": [True, False], "twlr__half_life": [1*52, 3*52, 5*52], "pca__n_components": [3, 0.95]},

"PLS": {"twlr__fit_intercept": [True, False], "twlr__half_life": [1*52, 3*52, 5*52], "pls__transformer__n_components": [3, 5]},

},

inner_splitters=splitter,

min_cids=3,

test_size=4,

store_correlations=True,

min_periods=24,

)

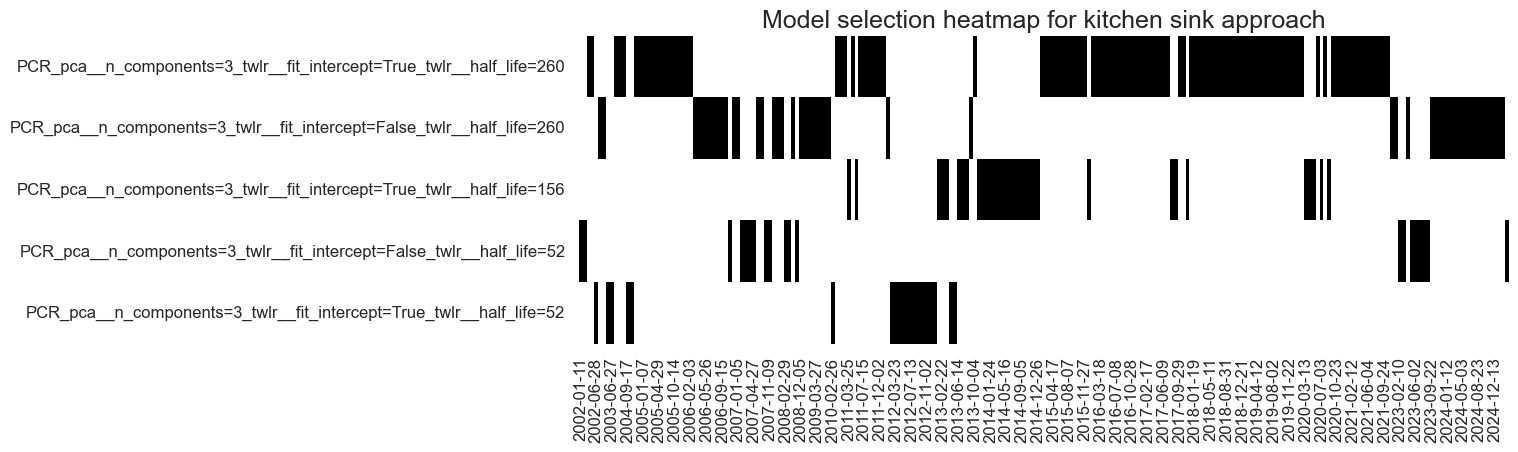

so_full.models_heatmap(

"KS",

title="Model selection heatmap for kitchen sink approach",

title_fontsize=18,

figsize=(12, 4),

)

dfa = so_full.get_optimized_signals("KS")

dfx = msm.update_df(dfx, dfa)

Broad-factor PCA and PLS #

xcatx = list(

itertools.chain(*[dict_factorz[narrow_xcat] for narrow_xcat in narrow_factorz])

) + ["DU05YXR_VT10"]

cidx = cids

so_broad = msl.SignalOptimizer(

df=dfx,

xcats=xcatx,

cids=cidx,

freq="W",

lag=1,

xcat_aggs=["last", "sum"],

)

so_broad.calculate_predictions(

name="BROAD",

models={

"PCR_1EACH": Pipeline(

[

("scaler", msl.PanelStandardScaler()),

(

"ct",

DataFrameTransformer(

ColumnTransformer(

[

(

"pca_inf",

msl.PanelPCA(n_components=1),

dict_factorz["XINFNZ_BROAD"],

),

(

"pca_grow",

msl.PanelPCA(n_components=1),

dict_factorz["XECGNZ_BROAD"],

),

(

"pca_lend",

msl.PanelPCA(n_components=1),

dict_factorz["XMCRNZ_BROAD"],

),

]

),

column_names=["INF", "GROW", "LEND"],

),

),

("twlr", msl.TimeWeightedLinearRegression()),

]

),

"PCR_0.95EACH": Pipeline(

[

("scaler", msl.PanelStandardScaler()),

(

"ct",

DataFrameTransformer(

ColumnTransformer(

[

(

"pca_inf",

PCA(n_components=0.95),

dict_factorz["XINFNZ_BROAD"],

),

(

"pca_grow",

PCA(n_components=0.95),

dict_factorz["XECGNZ_BROAD"],

),

(

"pca_lend",

PCA(n_components=0.95),

dict_factorz["XMCRNZ_BROAD"],

),

]

)

),

),

("twlr", msl.TimeWeightedLinearRegression()),

]

),

"PLS_1EACH": Pipeline(

[

("scaler", msl.PanelStandardScaler()),

(

"ct",

DataFrameTransformer(

ColumnTransformer(

[

(

"pls_inf",

PLSTransformer(n_components=1),

dict_factorz["XINFNZ_BROAD"],

),

(

"pls_grow",

PLSTransformer(n_components=1),

dict_factorz["XECGNZ_BROAD"],

),

(

"pls_lend",

PLSTransformer(n_components=1),

dict_factorz["XMCRNZ_BROAD"],

),

]

),

column_names=["INF", "GROW", "LEND"],

),

),

("twlr", msl.TimeWeightedLinearRegression()),

]

),

},

scorers=scorer,

hyperparameters={

"PCR_1EACH": {"twlr__fit_intercept": [True, False], "twlr__half_life": [1*52, 3*52, 5*52]},

"PCR_0.95EACH": {"twlr__fit_intercept": [True, False], "twlr__half_life": [1*52, 3*52, 5*52]},

"PLS_1EACH": {"twlr__fit_intercept": [True, False], "twlr__half_life": [1*52, 3*52, 5*52]},

},

inner_splitters=splitter,

min_cids=3,

min_periods=24,

test_size=4,

)

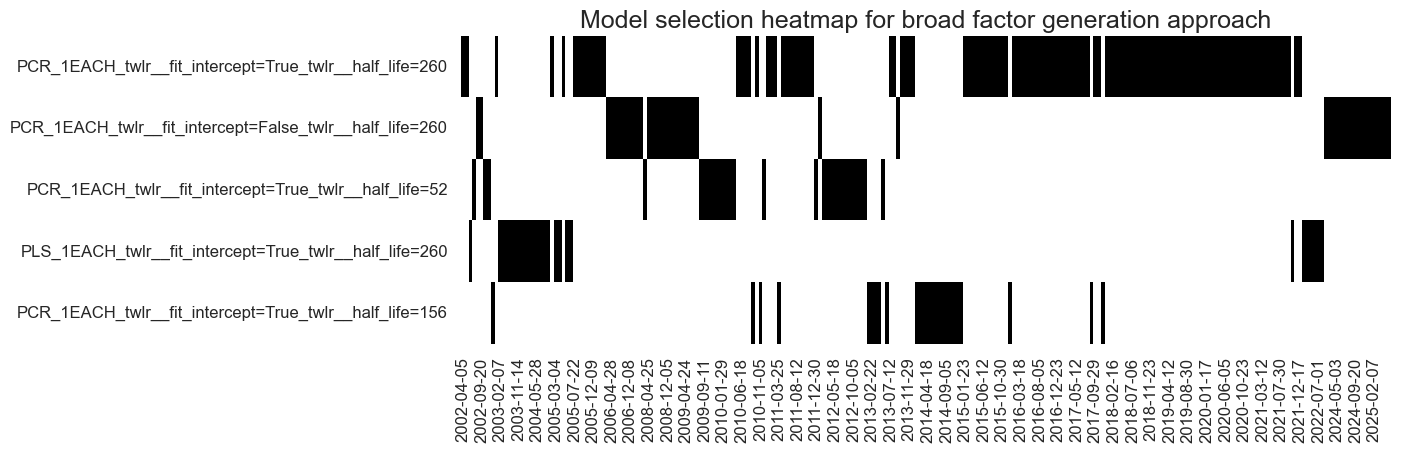

so_broad.models_heatmap(

"BROAD",

title="Model selection heatmap for broad factor generation approach",

title_fontsize=18,

figsize=(12, 4),

)

dfa = so_broad.get_optimized_signals("BROAD")

dfx = msm.update_df(dfx, dfa)

2-stage factor PCA/PLS #

xcatx = list(

itertools.chain(*[dict_factorz[narrow_xcat] for narrow_xcat in narrow_factorz])

) + ["DU05YXR_VT10"]

cidx = cids

so_narrow = msl.SignalOptimizer(

df=dfx,

xcats=xcatx,

cids=cidx,

freq="W",

lag=1,

xcat_aggs=["last", "sum"],

)

so_narrow.calculate_predictions(

name="TWOSTAGE",

models={

"PCR": Pipeline(

[

("scaler", msl.PanelStandardScaler()),

(

"ct",

DataFrameTransformer(

transformer=ColumnTransformer(

[

(

"pca_cpi",

PCA(n_components=1),

dict_factorz["XCPINZ"],

),

(

"pca_ppi",

PCA(n_components=1),

dict_factorz["XPPINZ"],

),

(

"pca_dem",

PCA(n_components=1),

dict_factorz["XDEMNZ"],

),

(

"pca_out",

PCA(n_components=1),

dict_factorz["XOUTNZ"],

),

(

"pca_lab",

PCA(n_components=1),

dict_factorz["XLABNZ"],

),

(

"pca_mon",

PCA(n_components=1),

dict_factorz["XMONNZ"],

),

(

"pca_cre",

PCA(n_components=1),

dict_factorz["XCRHNZ"],

),

]

),

column_names=["CPI", "PPI", "DEM", "OUT", "LAB", "MON", "CRE"],

),

),

("scaler2", msl.PanelStandardScaler()),

(

"ct2",

DataFrameTransformer(

ColumnTransformer(

[

("pca_inf", PCA(n_components=1), ["CPI", "PPI"]),

(

"pca_grow",

PCA(n_components=1),

["DEM", "OUT", "LAB"],

),

("pca_lend", PCA(n_components=1), ["MON", "CRE"]),

]

)

),

),

("twlr", msl.TimeWeightedLinearRegression()),

]

),

"PLS": Pipeline(

[

("scaler", msl.PanelStandardScaler()),

(

"ct",

DataFrameTransformer(

transformer=ColumnTransformer(

[

(

"pls_cpi",

PLSTransformer(n_components=1),

dict_factorz["XCPINZ"],

),

(

"pls_ppi",

PLSTransformer(n_components=1),

dict_factorz["XPPINZ"],

),

(

"pls_dem",

PLSTransformer(n_components=1),

dict_factorz["XDEMNZ"],

),

(

"pls_out",

PLSTransformer(n_components=1),

dict_factorz["XOUTNZ"],

),

(

"pls_lab",

PLSTransformer(n_components=1),

dict_factorz["XLABNZ"],

),

(

"pls_mon",

PLSTransformer(n_components=1),

dict_factorz["XMONNZ"],

),

(

"pls_cre",

PLSTransformer(n_components=1),

dict_factorz["XCRHNZ"],

),

]

),

column_names=["CPI", "PPI", "DEM", "OUT", "LAB", "MON", "CRE"],

),

),

("scaler2", msl.PanelStandardScaler()),

(

"ct2",

DataFrameTransformer(

ColumnTransformer(

[

(

"pls_inf",

PLSTransformer(n_components=1),

["CPI", "PPI"],

),

(

"pls_grow",

PLSTransformer(n_components=1),

["DEM", "OUT", "LAB"],

),

(

"pls_lend",

PLSTransformer(n_components=1),

["MON", "CRE"],

),

]

),

),

),

("twlr", msl.TimeWeightedLinearRegression()),

]

),

},

scorers=scorer,

hyperparameters={

"PCR": {"twlr__fit_intercept": [True, False], "twlr__half_life": [1*52, 3*52, 5*52]},

"PLS": {"twlr__fit_intercept": [True, False], "twlr__half_life": [1*52, 3*52, 5*52]},

},

inner_splitters=splitter,

min_cids=3,

min_periods=24,

test_size=4,

)

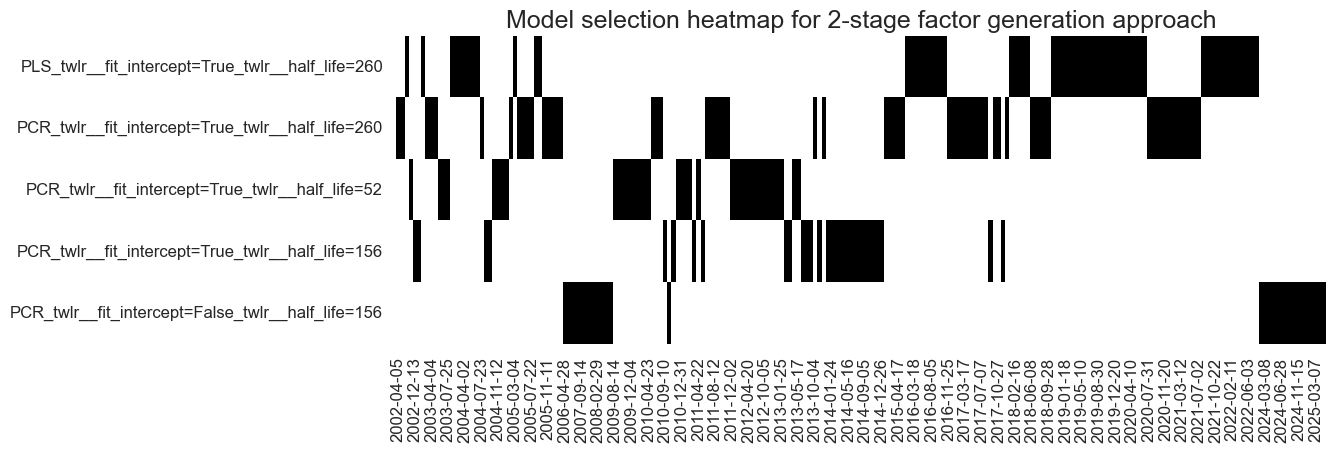

so_narrow.models_heatmap(

"TWOSTAGE",

title="Model selection heatmap for 2-stage factor generation approach",

title_fontsize=18,

figsize=(12, 4),

)

dfa = so_narrow.get_optimized_signals("TWOSTAGE")

dfx = msm.update_df(dfx, dfa)

Conceptual parity #

dfa = msp.linear_composite(

df=dfx, xcats=broad_factorz, cids=cids, new_xcat="PARITY"

)

dfx = msm.update_df(dfx, dfa)

Value checks #

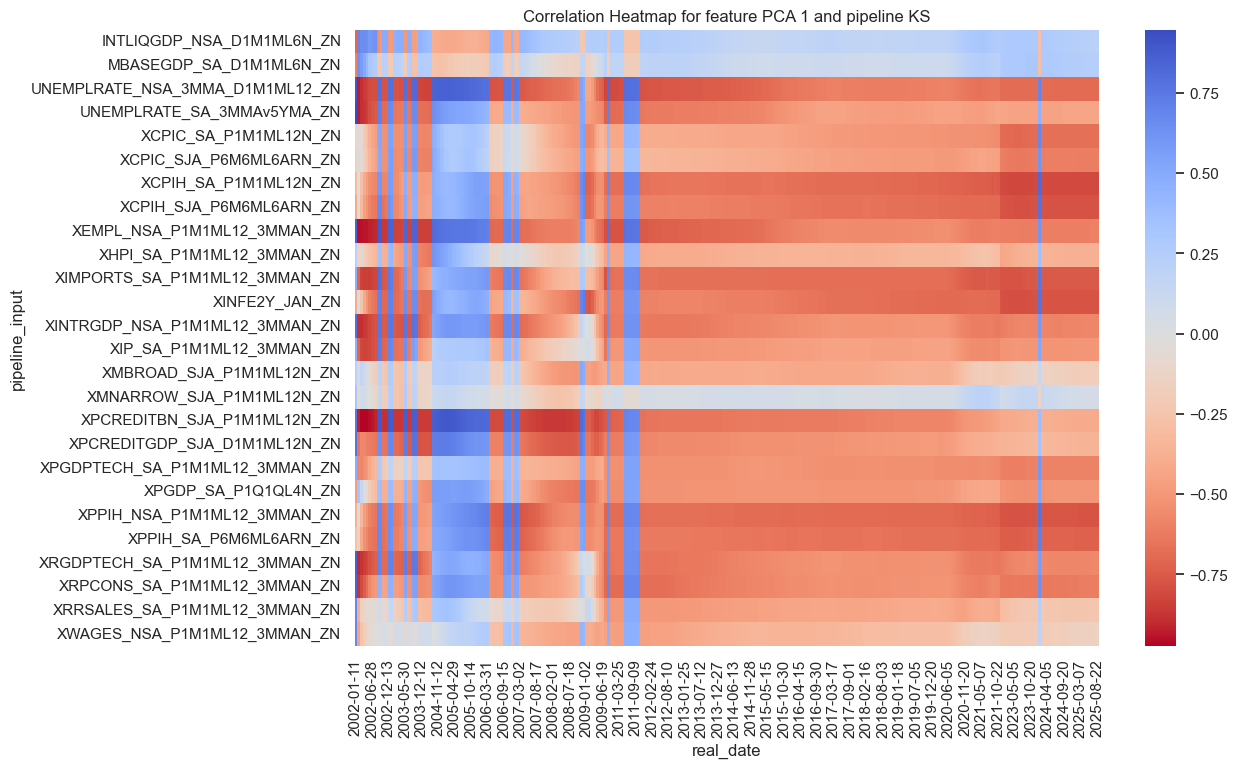

Kitchen-sink component inference #

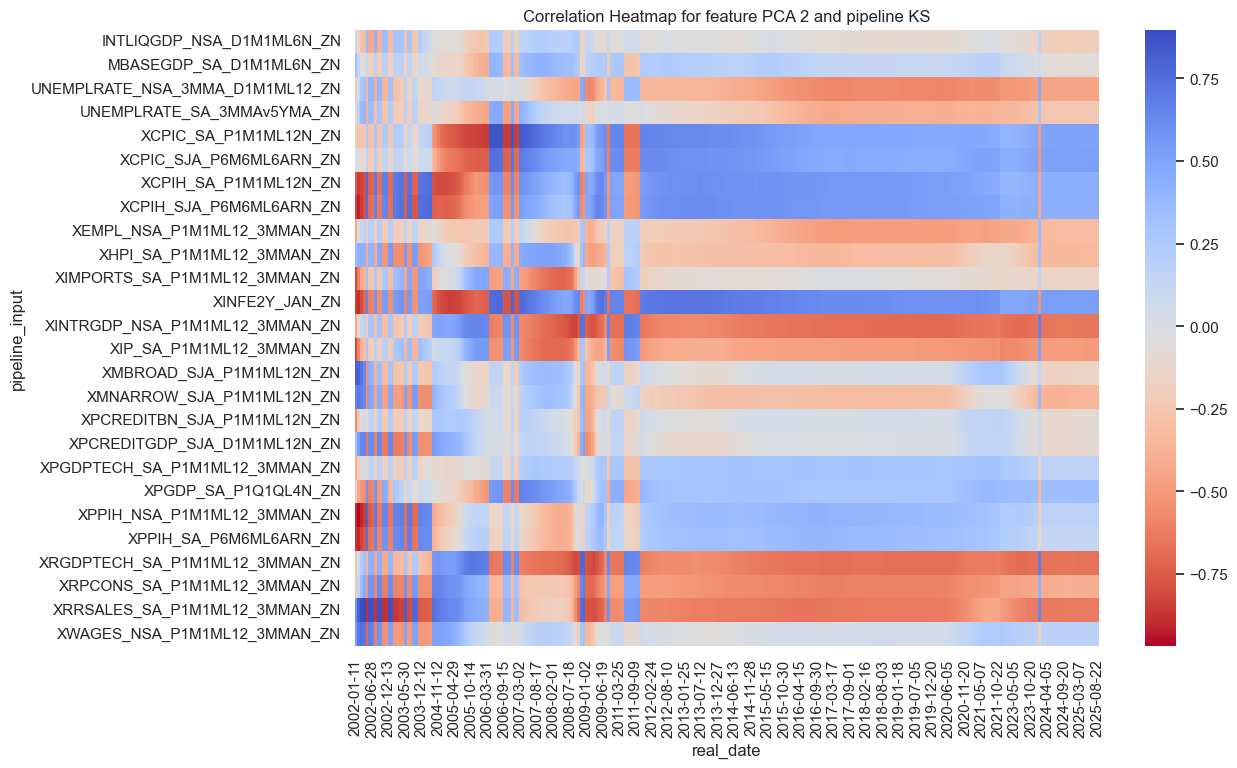

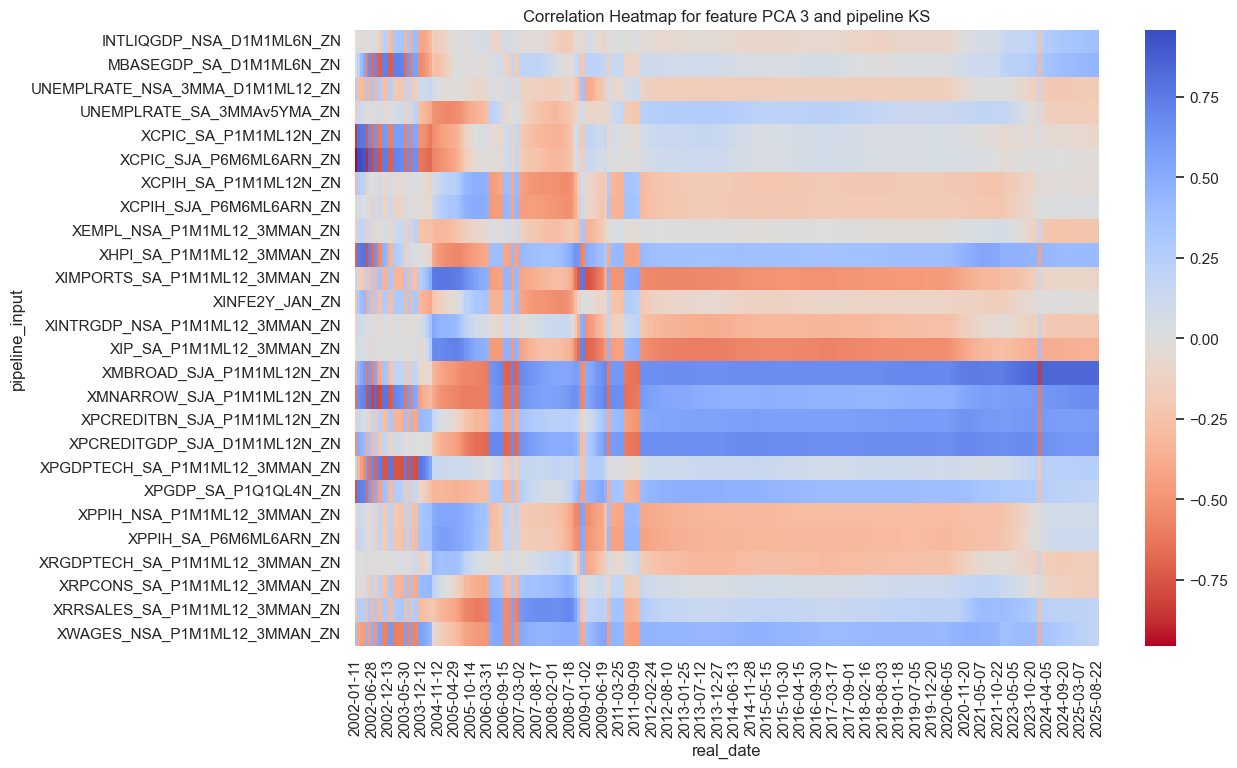

The kitchen-sink latent factors have converged to inflation, growth and lending factors in order.

so_full.correlations_heatmap(name="KS",feature_name="PCA 1")

so_full.correlations_heatmap(name="KS",feature_name="PCA 2")

so_full.correlations_heatmap(name="KS",feature_name="PCA 3")

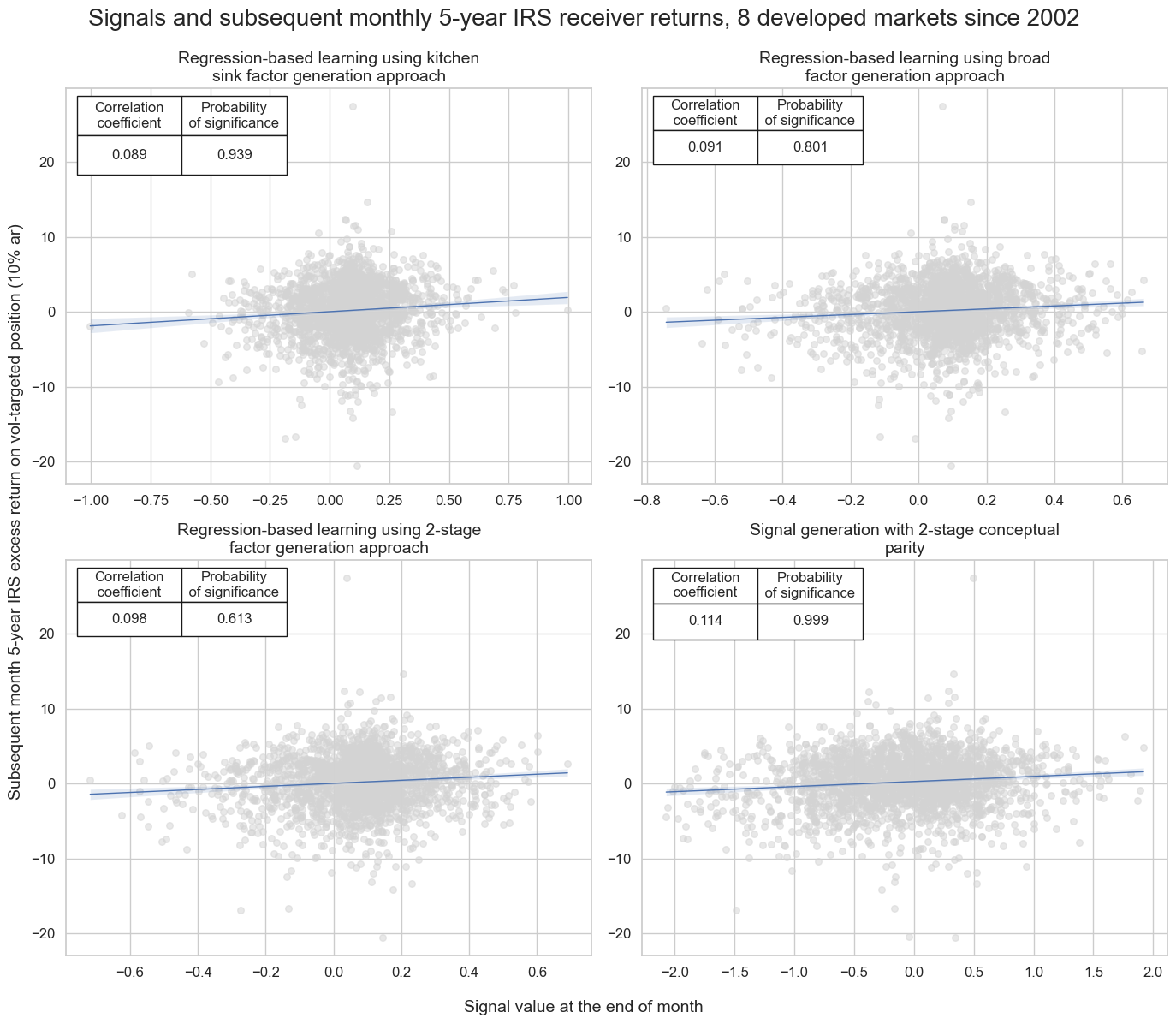

Forward correlation and accuracy #

dict_labels["BROAD"] = "Regression-based learning using broad factor generation approach"

dict_labels["TWOSTAGE"] = "Regression-based learning using 2-stage factor generation approach"

dict_labels["KS"] = "Regression-based learning using kitchen sink factor generation approach"

dict_labels["PARITY"] = "Signal generation with 2-stage conceptual parity"

xcatx = ["KS", "BROAD", "TWOSTAGE", "PARITY"]

titles = [dict_labels[k] for k in xcatx]

crs = []

for xcat in xcatx:

cr = msp.CategoryRelations(

df=dfx,

xcats=[xcat, "DU05YXR_VT10"],

cids=cids,

freq="M",

lag=1,

xcat_aggs=["last", "sum"],

slip=1,

start="2002-01-11",

)

crs.append(cr)

msv.multiple_reg_scatter(

cat_rels=crs,

ncol=2,

nrow=2,

figsize=(14, 12),

prob_est="map",

coef_box="upper left",

title="Signals and subsequent monthly 5-year IRS receiver returns, 8 developed markets since 2002",

title_fontsize=20,

subplot_titles=titles,

xlab="Signal value at the end of month",

ylab="Subsequent month 5-year IRS excess return on vol-targeted position (10% ar)",

share_axes=False,

label_fontsize=14,

)

xcatx = ["KS", "BROAD", "TWOSTAGE", "PARITY"]

dict_short_labels = {}

dict_short_labels["BROAD"] = "Broad factor approach"

dict_short_labels["TWOSTAGE"] = "2-stage factor approach"

dict_short_labels["KS"] = "Kitchen sink approach"

dict_short_labels["PARITY"] = "2-stage conceptual parity"

srr = mss.SignalReturnRelations(

dfx,

cids=cids,

sigs=xcatx,

rets=["DU05YXR_VT10"],

freqs=["M", "W"],

start="2002-02-28",

)

pd.set_option("display.precision", 3)

display(srr.multiple_relations_table().round(3))

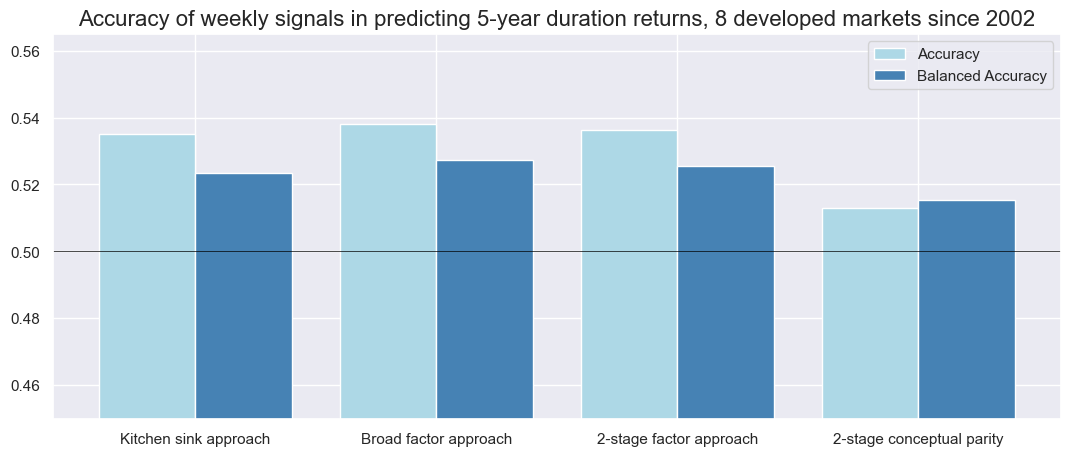

srr.accuracy_bars(

type="signals",

title="Accuracy of weekly signals in predicting 5-year duration returns, 8 developed markets since 2002",

freq="W",

size=(13, 5),

x_labels=dict_short_labels

)

| accuracy | bal_accuracy | pos_sigr | pos_retr | pos_prec | neg_prec | pearson | pearson_pval | kendall | kendall_pval | auc | ||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Return | Signal | Frequency | Aggregation | |||||||||||

| DU05YXR_VT10 | BROAD | M | last | 0.542 | 0.525 | 0.754 | 0.546 | 0.558 | 0.492 | 0.094 | 0.0 | 0.057 | 0.000 | 0.519 |

| KS | M | last | 0.545 | 0.529 | 0.750 | 0.546 | 0.560 | 0.498 | 0.087 | 0.0 | 0.048 | 0.001 | 0.522 | |

| PARITY | M | last | 0.531 | 0.533 | 0.473 | 0.551 | 0.587 | 0.480 | 0.114 | 0.0 | 0.063 | 0.000 | 0.534 | |

| TWOSTAGE | M | last | 0.536 | 0.519 | 0.732 | 0.546 | 0.556 | 0.483 | 0.093 | 0.0 | 0.049 | 0.001 | 0.515 | |

| BROAD | W | last | 0.538 | 0.527 | 0.758 | 0.535 | 0.548 | 0.507 | 0.049 | 0.0 | 0.033 | 0.000 | 0.520 | |

| KS | W | last | 0.535 | 0.524 | 0.751 | 0.535 | 0.547 | 0.500 | 0.038 | 0.0 | 0.027 | 0.000 | 0.518 | |

| PARITY | W | last | 0.513 | 0.515 | 0.470 | 0.538 | 0.554 | 0.476 | 0.059 | 0.0 | 0.034 | 0.000 | 0.515 | |

| TWOSTAGE | W | last | 0.536 | 0.525 | 0.734 | 0.535 | 0.548 | 0.502 | 0.046 | 0.0 | 0.030 | 0.000 | 0.520 |

Naive PnLs #

xcatx = ["KS", "BROAD", "TWOSTAGE", "PARITY"]

naive_pnl = msn.NaivePnL(

dfx,

cids=cids,

ret="DU05YXR_VT10",

sigs=xcatx,

start="2002-02-28",

bms=["USD_GB10YXR_NSA", "USD_EQXR_NSA"],

)

for sig in xcatx:

naive_pnl.make_pnl(

sig,

sig_neg=False,

sig_op="zn_score_pan",

thresh=2,

rebal_freq="weekly",

vol_scale=10,

rebal_slip=1,

pnl_name=sig,

)

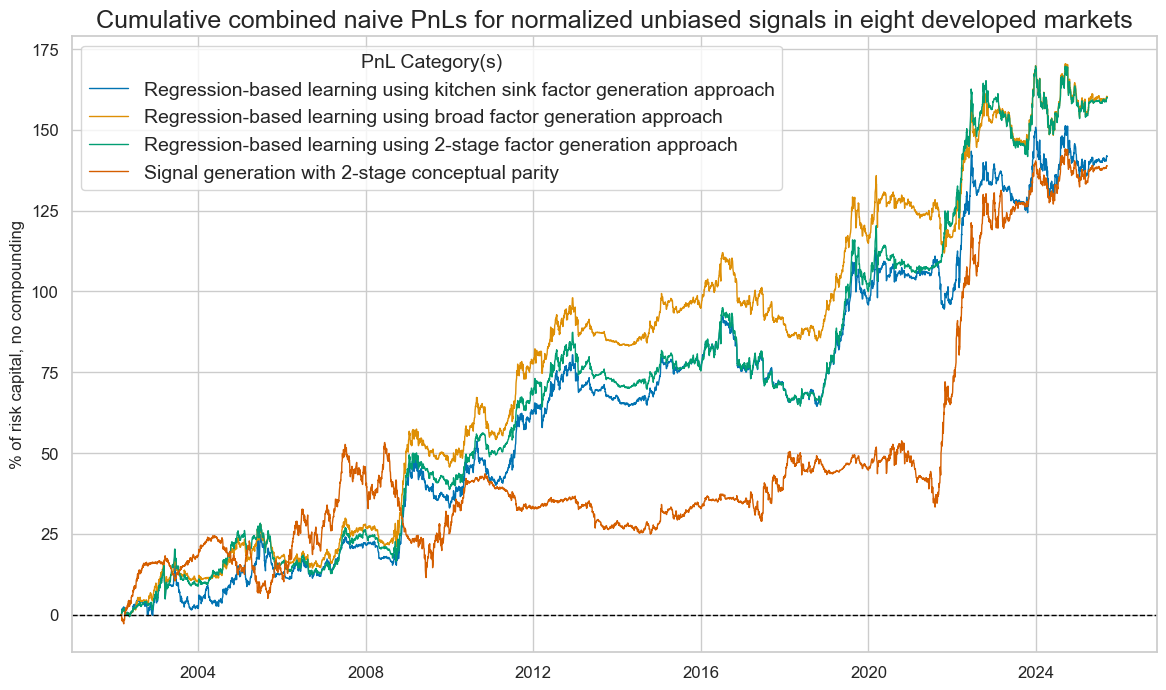

naive_pnl.plot_pnls(

title="Cumulative combined naive PnLs for normalized unbiased signals in eight developed markets",

title_fontsize=18,

figsize=(14, 8),

xcat_labels={xcat:dict_labels[xcat] for xcat in xcatx},

legend_fontsize=14,

)

pd.set_option("display.precision", 2)

naive_pnl.evaluate_pnls(pnl_cats=naive_pnl.pnl_names, label_dict=dict_short_labels).round(2)

| xcat | Broad factor approach | 2-stage factor approach | Kitchen sink approach | 2-stage conceptual parity |

|---|---|---|---|---|

| Return % | 6.81 | 6.79 | 6.02 | 5.9 |

| St. Dev. % | 10.0 | 10.0 | 10.0 | 10.0 |

| Sharpe Ratio | 0.68 | 0.68 | 0.6 | 0.59 |

| Sortino Ratio | 0.99 | 0.98 | 0.86 | 0.86 |

| Max 21-Day Draw % | -11.58 | -11.38 | -12.26 | -12.43 |

| Max 6-Month Draw % | -17.56 | -18.24 | -18.02 | -26.76 |

| Peak to Trough Draw % | -27.33 | -30.43 | -27.83 | -41.79 |

| Top 5% Monthly PnL Share | 0.84 | 0.89 | 0.93 | 1.09 |

| USD_GB10YXR_NSA correl | 0.4 | 0.36 | 0.38 | -0.1 |

| USD_EQXR_NSA correl | -0.2 | -0.18 | -0.18 | -0.01 |

| Traded Months | 284 | 284 | 284 | 284 |

xcatx = ["KS", "BROAD", "TWOSTAGE", "PARITY"]

naive_pnl = msn.NaivePnL(

dfx,

ret="DU05YXR_VT10",

sigs=xcatx,

start="2002-02-28",

bms=["USD_GB10YXR_NSA", "USD_EQXR_NSA"],

)

for sig in xcatx:

naive_pnl.make_pnl(

sig,

sig_neg=False,

sig_op="zn_score_pan",

sig_add=1,

thresh=2,

rebal_freq="weekly",

vol_scale=10,

rebal_slip=1,

pnl_name=sig,

)

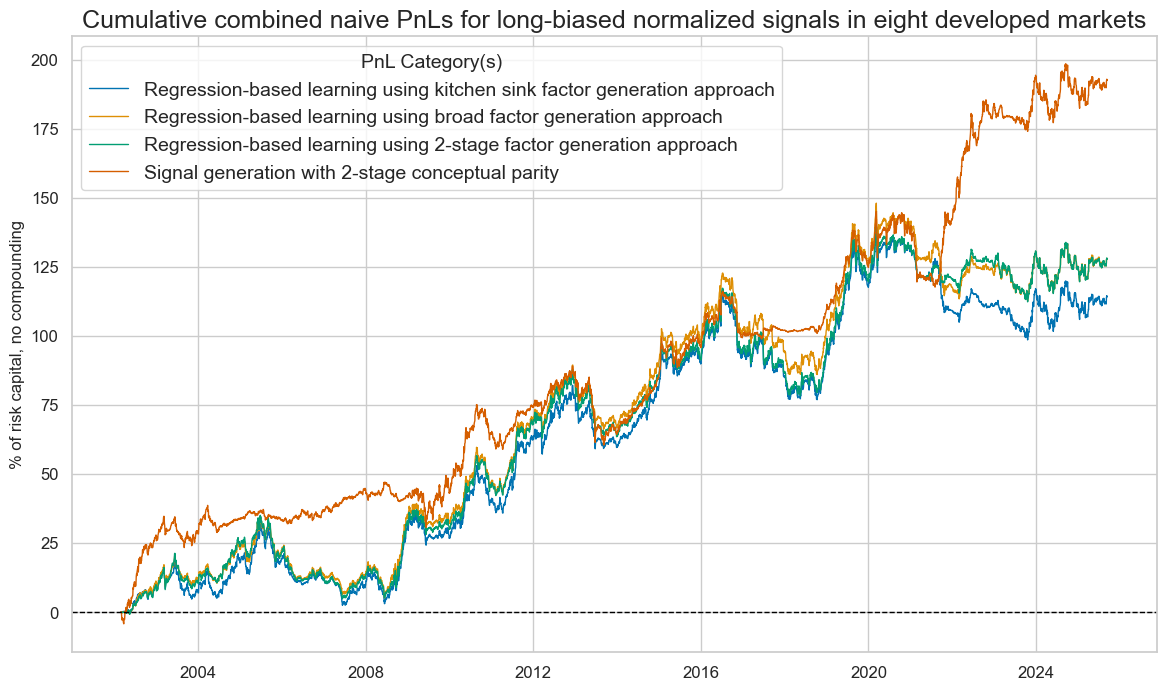

naive_pnl.plot_pnls(

title="Cumulative combined naive PnLs for long-biased normalized signals in eight developed markets",

title_fontsize=18,

figsize=(14, 8),

xcat_labels={xcat:dict_labels[xcat] for xcat in xcatx},

legend_fontsize=14,

)

pd.set_option("display.precision", 2)

naive_pnl.evaluate_pnls(pnl_cats=naive_pnl.pnl_names, label_dict=dict_short_labels).round(2)

| xcat | Broad factor approach | 2-stage factor approach | Kitchen sink approach | 2-stage conceptual parity |

|---|---|---|---|---|

| Return % | 5.43 | 5.43 | 4.85 | 8.19 |

| St. Dev. % | 10.0 | 10.0 | 10.0 | 10.0 |

| Sharpe Ratio | 0.54 | 0.54 | 0.49 | 0.82 |

| Sortino Ratio | 0.77 | 0.78 | 0.69 | 1.17 |

| Max 21-Day Draw % | -12.82 | -13.7 | -13.0 | -17.88 |

| Max 6-Month Draw % | -21.15 | -22.77 | -21.54 | -25.35 |

| Peak to Trough Draw % | -36.77 | -38.97 | -40.5 | -28.49 |

| Top 5% Monthly PnL Share | 1.0 | 1.0 | 1.12 | 0.69 |

| USD_GB10YXR_NSA correl | 0.6 | 0.59 | 0.6 | 0.37 |

| USD_EQXR_NSA correl | -0.22 | -0.21 | -0.21 | -0.16 |

| Traded Months | 284 | 284 | 284 | 284 |