Introduction to the Macrosynergy package #

This notebook shows how the

macrosynergy

package streamlines working with JPMaQS data. For more detail on the JPMaQS setup, see

this notebook

.

It begins with an overview of obtaining and describing the data, including tools for exploring availability, distributions, and time series. The next section focuses on preprocessing , showing how to filter, transform, and standardize data, as well as create indicators. Following this, the relating section highlights methods for investigating relationships across different panels, including correlation analysis and regression-based exploration. The final section, signaling , illustrates how to assess the predictive power of signals in relation to returns.

Together, these steps provide a practical workflow for systematic data analysis using the Macrosynergy package.

Get packages and JPMaQS data #

# Uncomment to update the package

"""

%%capture

! pip install macrosynergy --upgrade"""

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

import seaborn as sns

import os

import macrosynergy.management as msm

import macrosynergy.panel as msp

import macrosynergy.signal as mss

import macrosynergy.pnl as msn

import macrosynergy.visuals as msv

import macrosynergy.learning as msl

from macrosynergy.download import JPMaQSDownload

# machine learning modules

from sklearn.pipeline import Pipeline

from sklearn.linear_model import LogisticRegression, LinearRegression, Ridge

from sklearn.neighbors import KNeighborsClassifier, KNeighborsRegressor

from sklearn.metrics import (make_scorer, balanced_accuracy_score,r2_score,)

import warnings

warnings.simplefilter("ignore")

The

JPMaQSDownload()

function connects to the JPMaQS DataQuery API and downloads macro-financial data for analysis.

See the JPMaQS Intro Notebook for full details.

Important details:

-

client_id: Your API client identifier. -

client_secret: Secret used to authenticate. -

oauth: WhenTrue, enables OAuth flow for secure token retrieval.

Note that

client_id

and

client_secret

are recommended to be stored as environment variables for security.

cids_dm = ["AUD", "CAD", "CHF", "EUR", "GBP", "JPY", "NOK", "NZD", "SEK", "USD"]

cids_em = ["CLP","COP", "CZK", "HUF", "IDR", "ILS", "INR", "KRW", "MXN", "PLN", "THB", "TRY", "TWD", "ZAR",]

cids = cids_dm + cids_em

cids_dux = list(set(cids) - set(["IDR", "NZD"]))

ecos = [

# Inflation

"CPIC_SA_P1M1ML12",

"CPIC_SJA_P3M3ML3AR",

"CPIC_SJA_P6M6ML6AR",

"CPIH_SA_P1M1ML12",

"CPIH_SJA_P3M3ML3AR",

"CPIH_SJA_P6M6ML6AR",

# Nominal and real yields

"RYLDIRS02Y_NSA",

"RYLDIRS05Y_NSA",

"INFTEFF_NSA",

# GDP

"RGDP_SA_P1Q1QL4_20QMA",

"INTRGDP_NSA_P1M1ML12_3MMA",

"INTRGDPv5Y_NSA_P1M1ML12_3MMA",

# Private credit

"PCREDITGDP_SJA_D1M1ML12",

"PCREDITBN_SJA_P1M1ML12",

]

mkts = [

# Duration returns

"DU02YXR_NSA",

"DU05YXR_NSA",

"DU02YXR_VT10",

"DU05YXR_VT10",

# Equity returns

"EQXR_NSA",

"EQXR_VT10",

# FX

"FXXR_NSA",

"FXXR_VT10",

"FXCRR_NSA",

"FXTARGETED_NSA",

"FXUNTRADABLE_NSA",

]

xcats = ecos + mkts

# Download series from J.P. Morgan DataQuery by tickers

start_date = "2000-01-01"

end_date = "2023-05-01"

tickers = [cid + "_" + xcat for cid in cids for xcat in xcats]

print(f"Maximum number of tickers is {len(tickers)}")

# Download series from J.P. Morgan DataQuery by tickers

client_id: str = os.getenv("DQ_CLIENT_ID")

client_secret: str = os.getenv("DQ_CLIENT_SECRET")

with JPMaQSDownload(client_id=client_id, client_secret=client_secret) as dq:

df = dq.download(

tickers=tickers,

start_date="2000-01-01",

suppress_warning=True,

show_progress=True,

metrics='all'

)

Maximum number of tickers is 600

Downloading data from JPMaQS.

Timestamp UTC: 2025-09-01 11:31:45

Connection successful!

Requesting data: 100%|██████████| 150/150 [00:30<00:00, 4.88it/s]

Downloading data: 100%|██████████| 150/150 [00:49<00:00, 3.01it/s]

Some expressions are missing from the downloaded data. Check logger output for complete list.

105 out of 3000 expressions are missing. To download the catalogue of all available expressions and filter the unavailable expressions, set `get_catalogue=True` in the call to `JPMaQSDownload.download()`.

The

Macrosynergy

package works with data frames of a standard JPMaQS format. These are long-form DataFrames.

They must include at least four columns:

-

cid: cross-section identifier -

xcat: extended category -

real_date: real-time date -

value: data value

# uncomment if running on Kaggle

"""for dirname, _, filenames in os.walk('/kaggle/input'):

for filename in filenames:

print(os.path.join(dirname, filename))

df = pd.read_csv('../input/fixed-income-returns-and-macro-trends/JPMaQS_Quantamental_Indicators.csv', index_col=0, parse_dates=['real_date'])""";

The description of each JPMaQS category is available either under Macro Quantamental Academy , JPMorgan Markets (password protected), or on Kaggle (just for the tickers used in this notebook).

df['ticker'] = df['cid'] + "_" + df["xcat"]

dfx = df.copy()

dfx.info()

dfx.head(3)

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 3649147 entries, 0 to 3649146

Data columns (total 9 columns):

# Column Dtype

--- ------ -----

0 real_date datetime64[ns]

1 cid object

2 xcat object

3 value float64

4 grading float64

5 eop_lag float64

6 mop_lag float64

7 last_updated datetime64[ns]

8 ticker object

dtypes: datetime64[ns](2), float64(4), object(3)

memory usage: 250.6+ MB

| real_date | cid | xcat | value | grading | eop_lag | mop_lag | last_updated | ticker | |

|---|---|---|---|---|---|---|---|---|---|

| 0 | 2000-01-03 | AUD | CPIC_SJA_P3M3ML3AR | 3.006383 | 2.0 | 95.0 | 186.0 | 2023-01-13 01:03:23 | AUD_CPIC_SJA_P3M3ML3AR |

| 1 | 2000-01-04 | AUD | CPIC_SJA_P3M3ML3AR | 3.006383 | 2.0 | 96.0 | 187.0 | 2023-01-13 01:03:23 | AUD_CPIC_SJA_P3M3ML3AR |

| 2 | 2000-01-05 | AUD | CPIC_SJA_P3M3ML3AR | 3.006383 | 2.0 | 97.0 | 188.0 | 2023-01-13 01:03:23 | AUD_CPIC_SJA_P3M3ML3AR |

Describing #

View available data history with

check_availability

and

missing_in_df

#

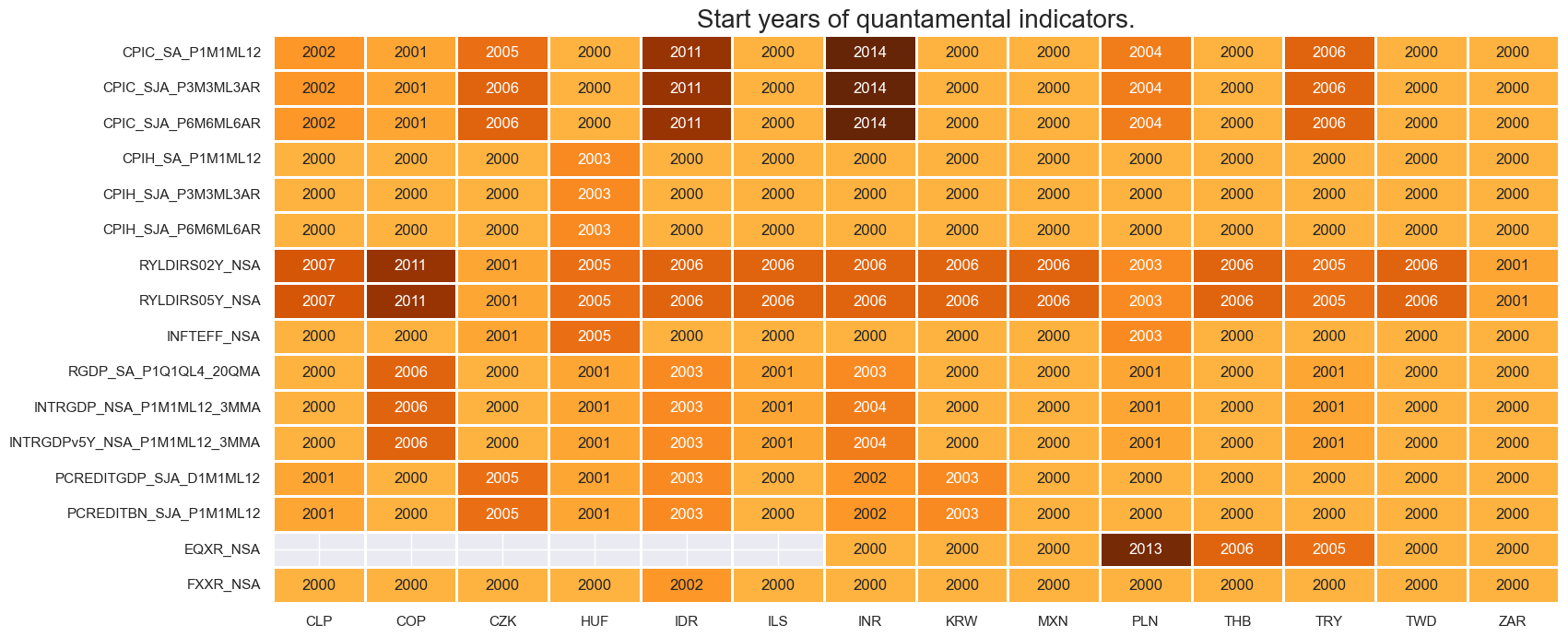

The

check_availability()

function summarizes data availability across time, categories, and countries or markets (cross-sections). It shows unavailable series and uses color intensity to indicate the starting year of available data (darker = more recent).

This is useful as a quick data coverage check before building anything.

Important parameters include:

-

df: Your JPMaQS-standard DataFrame containing the research dataset. -

xcats: A list of signal names to check (e.g., “FX carry”, “Real yield”). -

cids: A list of cross-sections (e.g., “USD”, “EUR”, “JPY”) to evaluate. -

start: Earliest date to consider. -

missing_recent: IfTrue, displays missing data in the most recent period.

msm.check_availability(

dfx,

xcats=ecos + ["EQXR_NSA"]+ ["FXXR_NSA"],

cids=cids_em,

start="2000-01-01",

title_fontsize=20

)

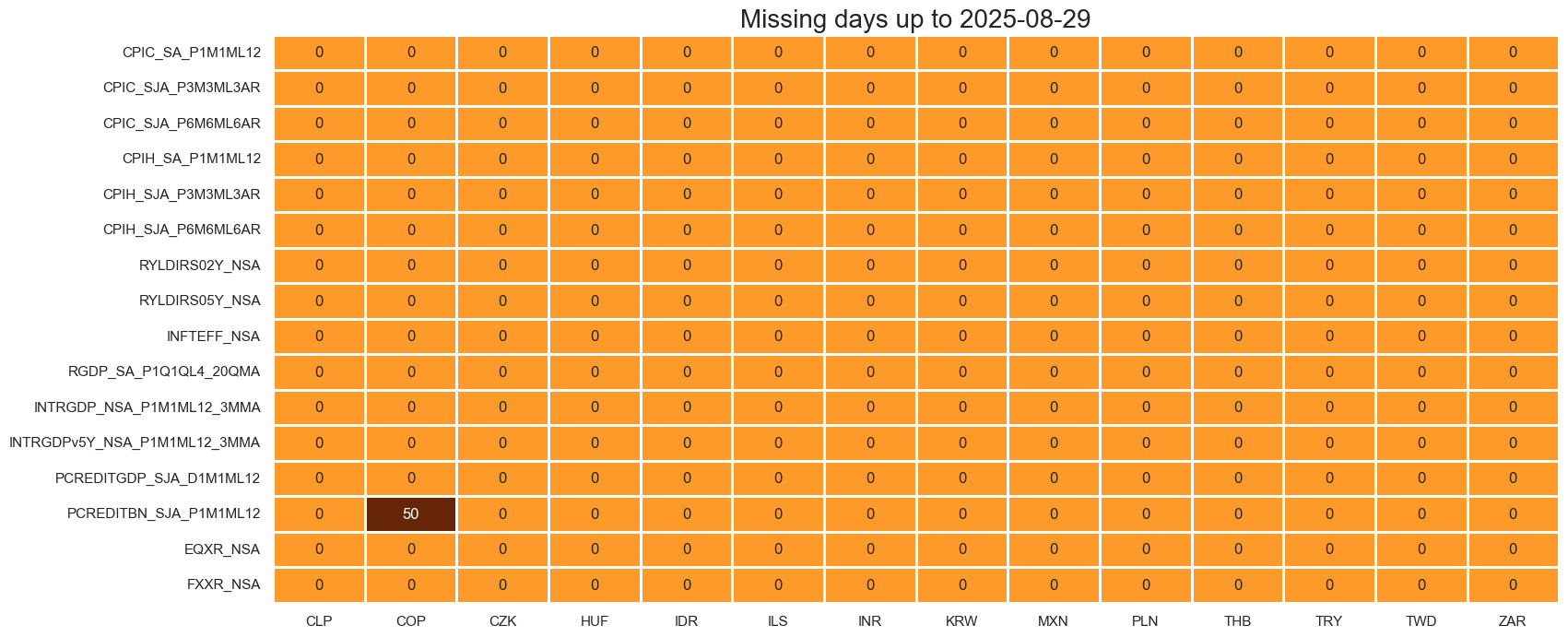

The

missing_in_df()

function lists categories entirely missing across all selected cross-sections and specific cross-sections that are missing for each selected category.

This saves you from having to spot mistakes due to ‘NAs’ later.

cats_exp = ["EQCRR_NSA", "FXCRR_NSA", "INTRGDP_NSA_P1M1ML12_3MMA", "RUBBISH"]

msm.missing_in_df(dfx, xcats=cats_exp, cids=cids)

Missing XCATs across DataFrame: ['RUBBISH', 'EQCRR_NSA']

Missing cids for FXCRR_NSA: ['USD']

Missing cids for INTRGDP_NSA_P1M1ML12_3MMA: []

Visualize Panel Distributions and Time Series with

view_ranges

and

view_timelines

#

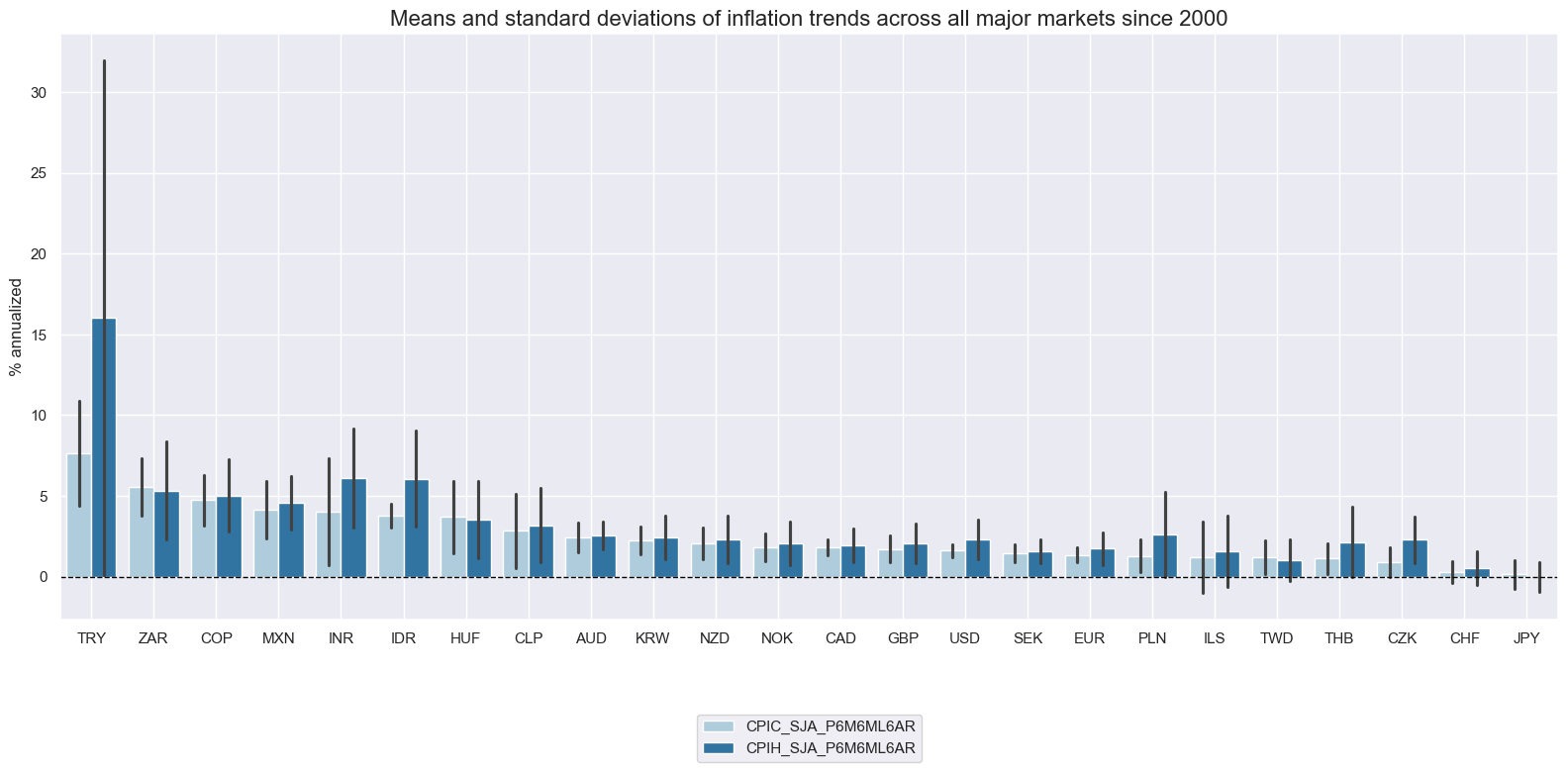

The

view_ranges()

function compares data ranges across cross-sections or categories.

The function is ideal for comparing scale and volatility.

Important parameters include:

-

startandend: Date window. -

kind: Plot type:-

barfor a barplot that focuses on means and standard deviations of one or more categories across sections for a given sample period; and

-

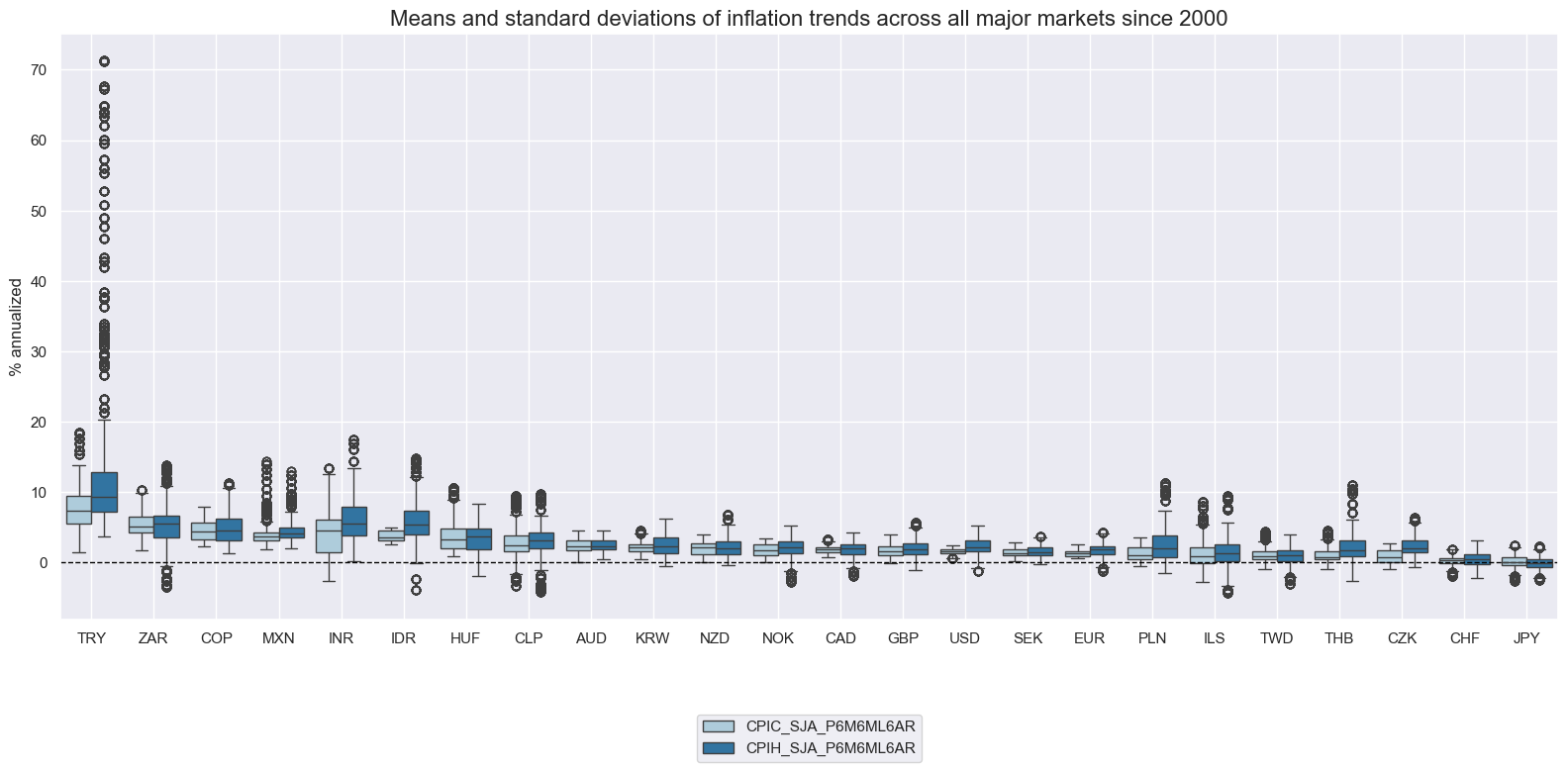

xcats_sel = ["CPIC_SJA_P6M6ML6AR", "CPIH_SJA_P6M6ML6AR"]

msp.view_ranges(

dfx,

xcats=xcats_sel,

kind="bar",

sort_cids_by="mean", # Countries sorted by mean of the first category

title="Means and standard deviations of inflation trends across all major markets since 2000",

ylab="% annualized",

start="2000-01-01",

end="2020-01-01",

title_fontsize=20

)

-

boxfor visualizaion of 25%, 50% (median), and 75% quantiles and outliers beyond a normal range.

xcats_sel = ["CPIC_SJA_P6M6ML6AR", "CPIH_SJA_P6M6ML6AR"]

msp.view_ranges(

dfx,

xcats=xcats_sel,

kind="box",

sort_cids_by="mean", # Countries sorted by mean of the first category

title="Means and standard deviations of inflation trends across all major markets since 2000",

ylab="% annualized",

start="2000-01-01",

end="2020-01-01",

title_fontsize=20

)

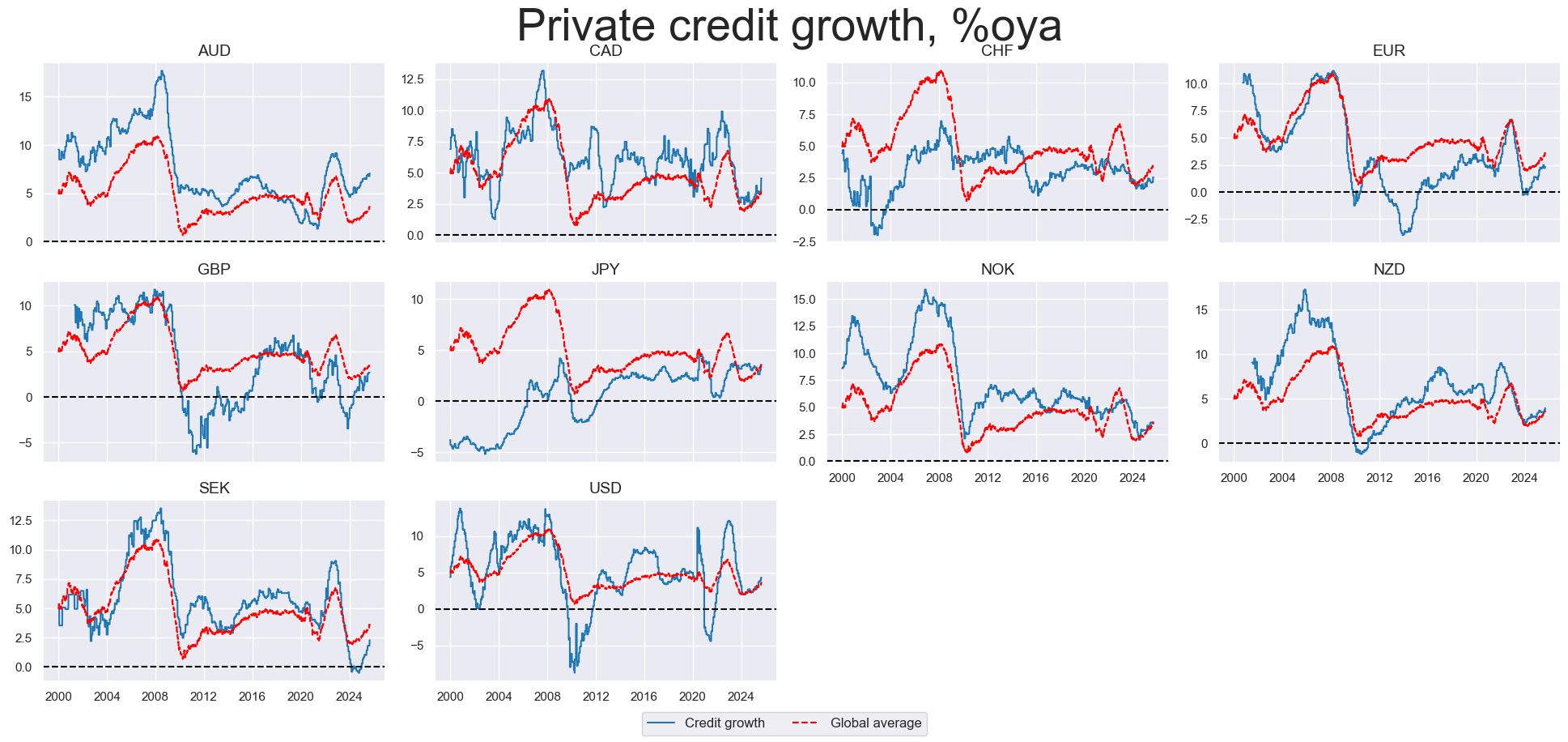

The

view_timelines()

function visualizes time series data as line charts across multiple cross-sections or categories.

Important parameters include:

-

cumsum: WhenTrue, plots the cumulative sum of the signal over time instead of raw values. This is useful for return-type or flow-type indicators where you want to track performance or net change over a period. -

same_y: WhenTrue, all charts in the grid share the same y-axis scale, making comparison easier. -

blacklist: A dictionary specifying date ranges to exclude for certain assets (e.g. due to data quality issues). Ensures that unreliable data doesn’t distort visual analysis or backtests. -

cs_mean: WhenTrue, adds a cross-sectional average line to each plot, letting you quickly compare each asset to the market mean.

msp.view_timelines(

dfx,

xcats=["PCREDITBN_SJA_P1M1ML12"],

cids=cids_dm,

ncol=4,

start="1995-01-01",

title="Private credit growth, %oya",

same_y=False,

cs_mean=True,

xcat_labels=["Credit growth", "Global average"],

height=2, # this argument implicitly controls the size of plots relative to labels

title_fontsize=40

)

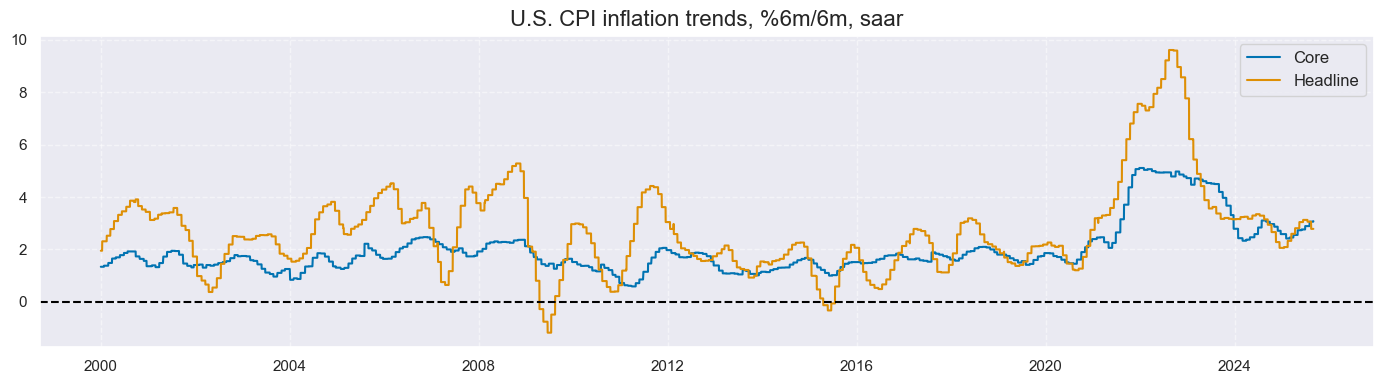

One can display a single chart, displaying several categories for a single cross-section by passing a single-string list to

xcats

and specifying a cross-section as a list with single element, such as

cids=["USD"]

msp.view_timelines(

dfx,

xcats=["CPIC_SJA_P6M6ML6AR", "CPIH_SJA_P6M6ML6AR"],

cids=["USD"],

start="2000-01-01",

title="U.S. CPI inflation trends, %6m/6m, saar",

xcat_labels=["Core", "Headline"],

size = (14, 4),

title_fontsize=16

)

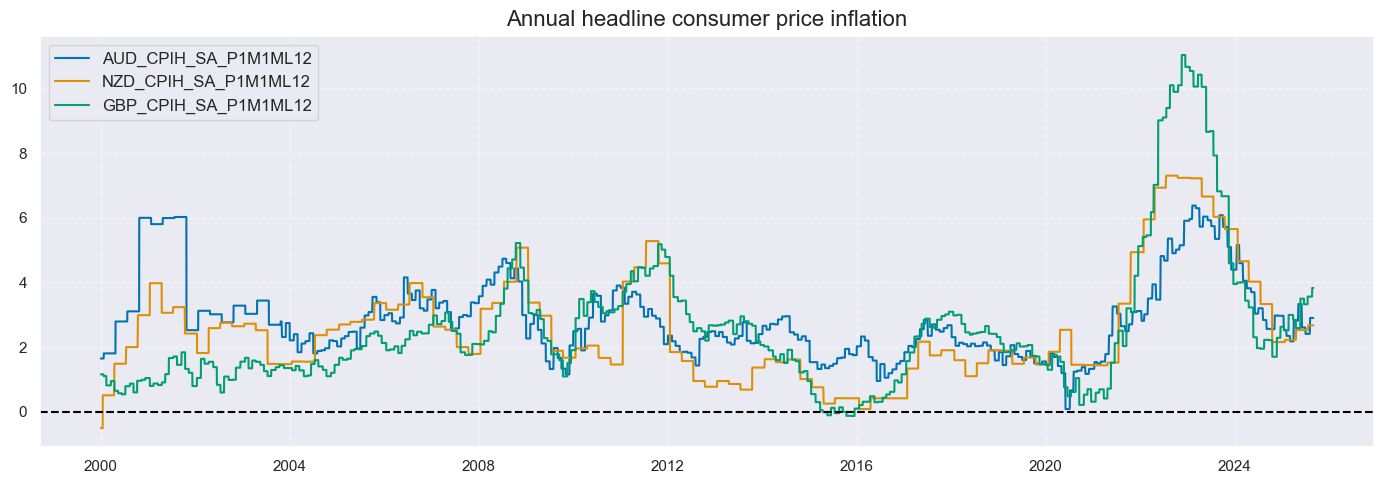

Setting

single_chart=True

allows plotting a single category for various cross-sections in one plot. Per default, full tickers are used as labels.

cidsx = ["AUD", "NZD", "GBP"]

msp.view_timelines(

dfx,

xcats=["CPIH_SA_P1M1ML12"],

cids=cidsx,

cumsum=False,

start="2000-01-01",

same_y=False,

title="Annual headline consumer price inflation",

single_chart=True,

size = (14, 5),

title_fontsize=16

)

Pre-processing #

Exclude series sections with

make_blacklist

and

reduce_df

#

The

make_blacklist()

function converts binary values in a DataFrame into a summary dictionary of blacklisted time periods. When applied to the

blacklist

argument of some package functions those cross-sections are excluded from analysis.

Generally, values of 1 in the original binary series are blacklisted.

-

nan_black: IfTrue, the function also treats missing values (NaNs) as blacklisted periods.

Below, we selected two indicators of FX tradability and flexibility:

-

FXTARGETED_NSAis a dummy variable that equals1when the exchange rate is targeted, through a peg or another regime that materially limits flexibility; and0otherwise. -

FXUNTRADABLE_NSAis a dummy variable that equals1when liquidity in the main FX forward market is restricted or when distortions arise between tradable offshore and untradable onshore contracts.

If one cross section has multiple blacklist periods, the keys are numbered.

# Combine FX tradability and targeting flags into a unified blacklist

dfb = df[df["xcat"].isin(["FXTARGETED_NSA", "FXUNTRADABLE_NSA"])][

["cid", "xcat", "real_date", "value"]

]

# Take max value across indicators per date to flag invalid periods (1 if either condition is true)

dfba = (

dfb.groupby(["cid", "real_date"])

.agg(value=pd.NamedAgg(column="value", aggfunc="max"))

.reset_index()

)

dfba["xcat"] = "FXBLACK"

fxblack = msp.make_blacklist(dfba, "FXBLACK")

fxblack

{'CHF': (Timestamp('2011-10-03 00:00:00'), Timestamp('2015-01-30 00:00:00')),

'CZK': (Timestamp('2014-01-01 00:00:00'), Timestamp('2017-07-31 00:00:00')),

'ILS': (Timestamp('2000-01-03 00:00:00'), Timestamp('2005-12-30 00:00:00')),

'INR': (Timestamp('2000-01-03 00:00:00'), Timestamp('2004-12-31 00:00:00')),

'THB': (Timestamp('2007-01-01 00:00:00'), Timestamp('2008-11-28 00:00:00')),

'TRY_1': (Timestamp('2000-01-03 00:00:00'), Timestamp('2003-09-30 00:00:00')),

'TRY_2': (Timestamp('2020-01-01 00:00:00'), Timestamp('2024-07-31 00:00:00'))}

The resulting blacklist dictionary can be passed to various package functions to automatically exclude affected periods from analysis. To filter a DataFrame independently of specific functions, use the

reduce_df()

helper.

# Apply blacklist to remove invalid FX return periods

dffx = df[df["xcat"] == "FXXR_NSA"]

print("Original shape:", dffx.shape)

dffxx = msm.reduce_df(dffx, blacklist=fxblack)

print("Shape after applying blacklist:", dffxx.shape)

Original shape: (153348, 9)

Shape after applying blacklist: (146001, 9)

Custom calculated panels with

panel_calculator

and

update_df

#

The

panel_calculator

function transforms data across all cross-sections in a panel.

It is most useful for quickly creating new data panels using formulas, in a way that is easy to repeat and share.

Formulas are expressed as strings, where capitalized category names act as wide dataframes in Python. In this setup, a category such as

"OLDCAT"

represents a dataframe with time periods as rows and cross-sections as columns. Any operation you could normally perform on such a dataframe in Python can also be written directly into the formula string.

The

calcs

parameter collects the list of formulas.

When writing these formulas, panel category names not at the beginning or end of the string must always have a space before and after the name. Calculated category and panel operations must be separated by ‘=’.

Examples:

-

“NEWCAT = ( OLDCAT1 + 0.5) * OLDCAT2”

-

“NEWCAT = np.log( OLDCAT1 ) - np.abs( OLDCAT2 ) ** 1/2”

Following on,

update_df

integrates the panels back into your main dataset.

Important parameters are:

-

df_add: the new DataFrame you want to add. -

xcat_replace: IfTrue, replace overlapping values for listed categories usingdf_add.

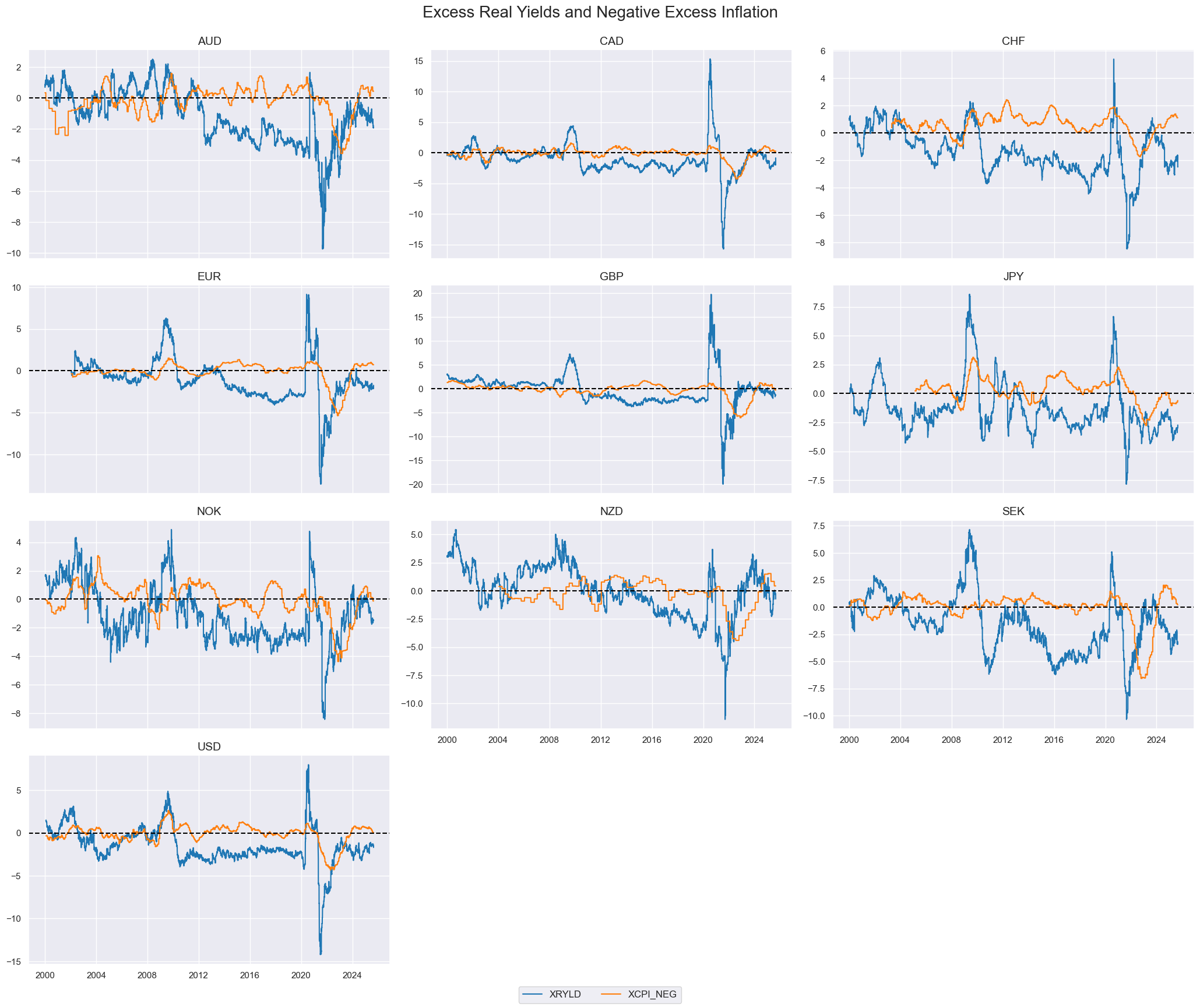

# Define custom panels

calcs = [

"XGDP_NEG = - INTRGDPv5Y_NSA_P1M1ML12_3MMA", # negative GDP trend

"XCPI_NEG = - ( CPIC_SJA_P6M6ML6AR + CPIH_SA_P1M1ML12 ) / 2 + INFTEFF_NSA", # excess inflation

"XPCG_NEG = - PCREDITBN_SJA_P1M1ML12 + INFTEFF_NSA + RGDP_SA_P1Q1QL4_20QMA", # excess credit growth

"XRYLD = RYLDIRS05Y_NSA - INTRGDP_NSA_P1M1ML12_3MMA", # excess real yield

"XXRYLD = XRYLD + XCPI_NEG" # combined signal

]

# Calculate and merge

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cids)

dfx = msm.update_df(dfx, dfa)

# Visualization

msp.view_timelines(

dfx,

xcats=["XRYLD", "XCPI_NEG"],

cids=cids_dm,

ncol=3,

title="Excess Real Yields and Negative Excess Inflation",

start="2000-01-01",

same_y=False,

title_fontsize=20

)

Multiple transformations can be conveniently created using list comprehensions or other string-based iterations.

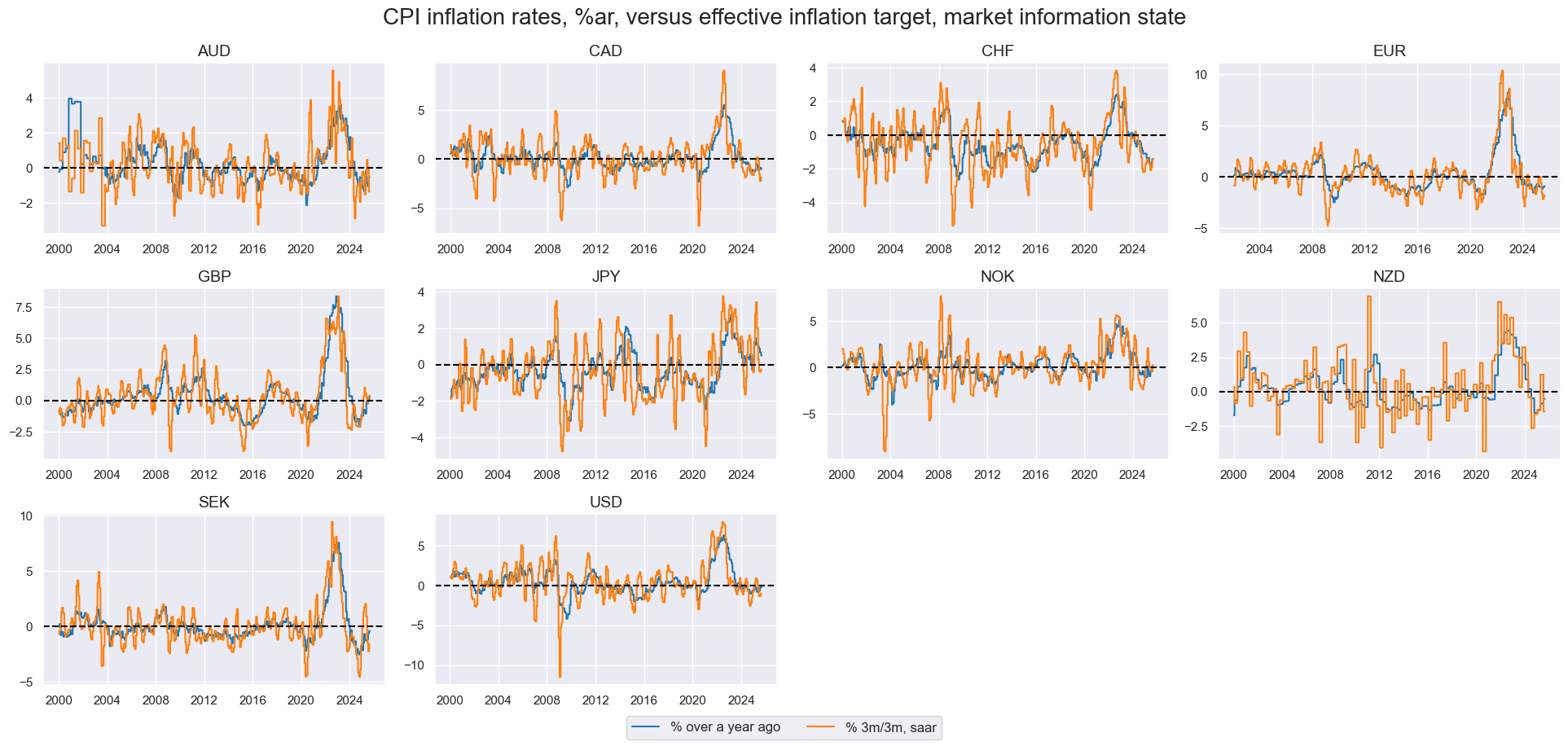

infs = ["CPIH_SA_P1M1ML12", "CPIH_SJA_P6M6ML6AR", "CPIH_SJA_P3M3ML3AR"]

calcs = [f"{inf}vIET = ( {inf} - INFTEFF_NSA )" for inf in infs]

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cids)

dfx = msm.update_df(dfx, dfa)

xcatxl = ["CPIH_SA_P1M1ML12vIET", "CPIH_SJA_P3M3ML3ARvIET"]

msp.view_timelines(

dfx,

xcats=xcatxl,

cids=cids_dm,

ncol=4,

cumsum=False,

start="2000-01-01",

same_y=False,

all_xticks=True,

title="CPI inflation rates, %ar, versus effective inflation target, market information state",

xcat_labels=["% over a year ago", "% 3m/3m, saar"],

height=2,

title_fontsize=20

)

To use a single quantamental indicator instead of a full panel, prefix the category name with

"i"

followed by the cross-section identifier.

This tells the

panel_calculator

function to treat the input as a specific cross-section rather than the entire panel.

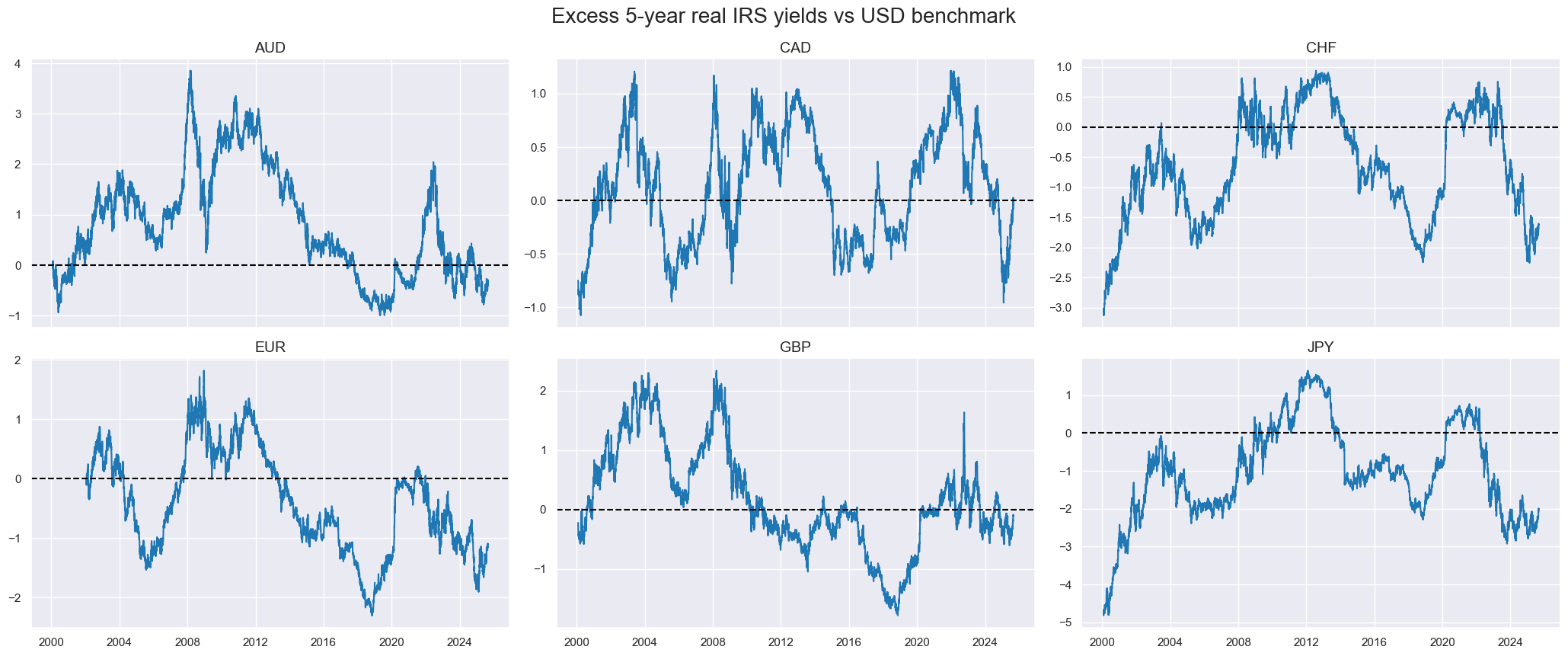

cidx = cids_dm[:6]

calcs = ["RYLDvUSD = RYLDIRS05Y_NSA - iUSD_RYLDIRS05Y_NSA"]

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cidx)

dfx = msm.update_df(dfx, dfa)

msp.view_timelines(

dfx,

xcats=["RYLDvUSD"],

cids=cidx,

ncol=3,

start="2000-01-01",

same_y=False,

title = "Excess 5-year real IRS yields vs USD benchmark",

title_fontsize=20

)

Compute panels versus basket with

make_relative_value

#

The

make_relative_value()

function calculates relative signal values in relation to a cross-sectional benchmark at each date. This can done be through subtraction or division.

Important parameters include:

-

rel_meth: The method for making the signal relative, i.e.'subtract'(default) or'divide'. -

rel_reference: The benchmark you compare against, i.e'mean'(default) or'median'. -

complete_cross: IfTrue, requires all cross-sections to be present on a date and if not, the category is excluded. -

basket: Specifies which cross-sections to use as the relative value benchmark. By default, all cross-sections listed in cids and available in the DataFrame for the given time period are included. However, the benchmark can also be restricted to a valid subset of these cross-sections. -

blacklist: cross-sections and date ranges to exclude, typically created withmake_blacklist(). Removing invalid or distorted data is essential, since distortions in just one cross-section can bias all relative value calculations.

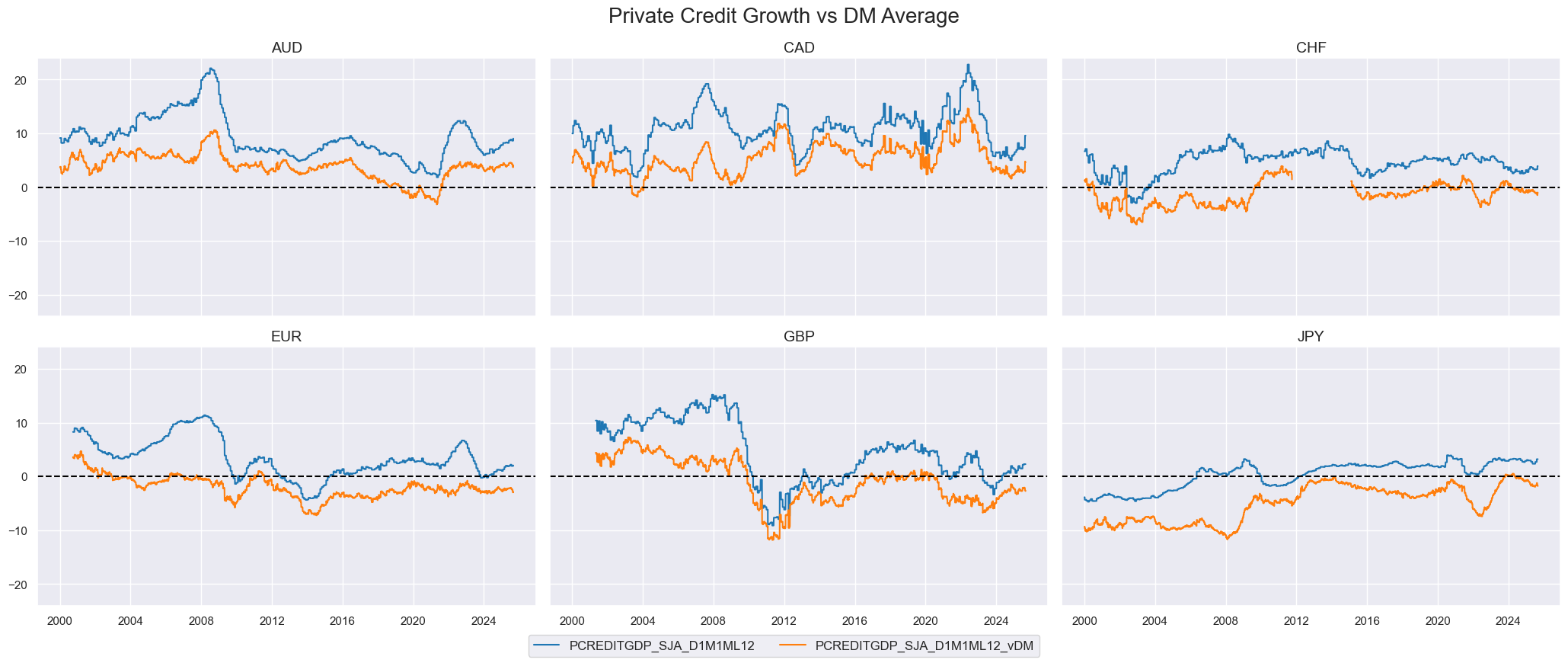

# Compare private credit growth to DM average

cidsx = cids_dm[:6]

xcat = "PCREDITGDP_SJA_D1M1ML12"

dfy = msp.make_relative_value(

dfx,

xcats=[xcat],

cids=cidx,

start="2000-01-01",

blacklist=fxblack,

rel_meth="subtract",

complete_cross=False,

postfix="_vDM",

)

dfx = msm.update_df(dfx, dfy)

msp.view_timelines(

pd.concat([dfx[dfx["xcat"] == xcat], dfy]),

xcats=[xcat, f"{xcat}_vDM"],

cids=cidx,

ncol=3,

same_y=True,

start="2000-01-01",

title="Private Credit Growth vs DM Average",

title_fontsize=20

)

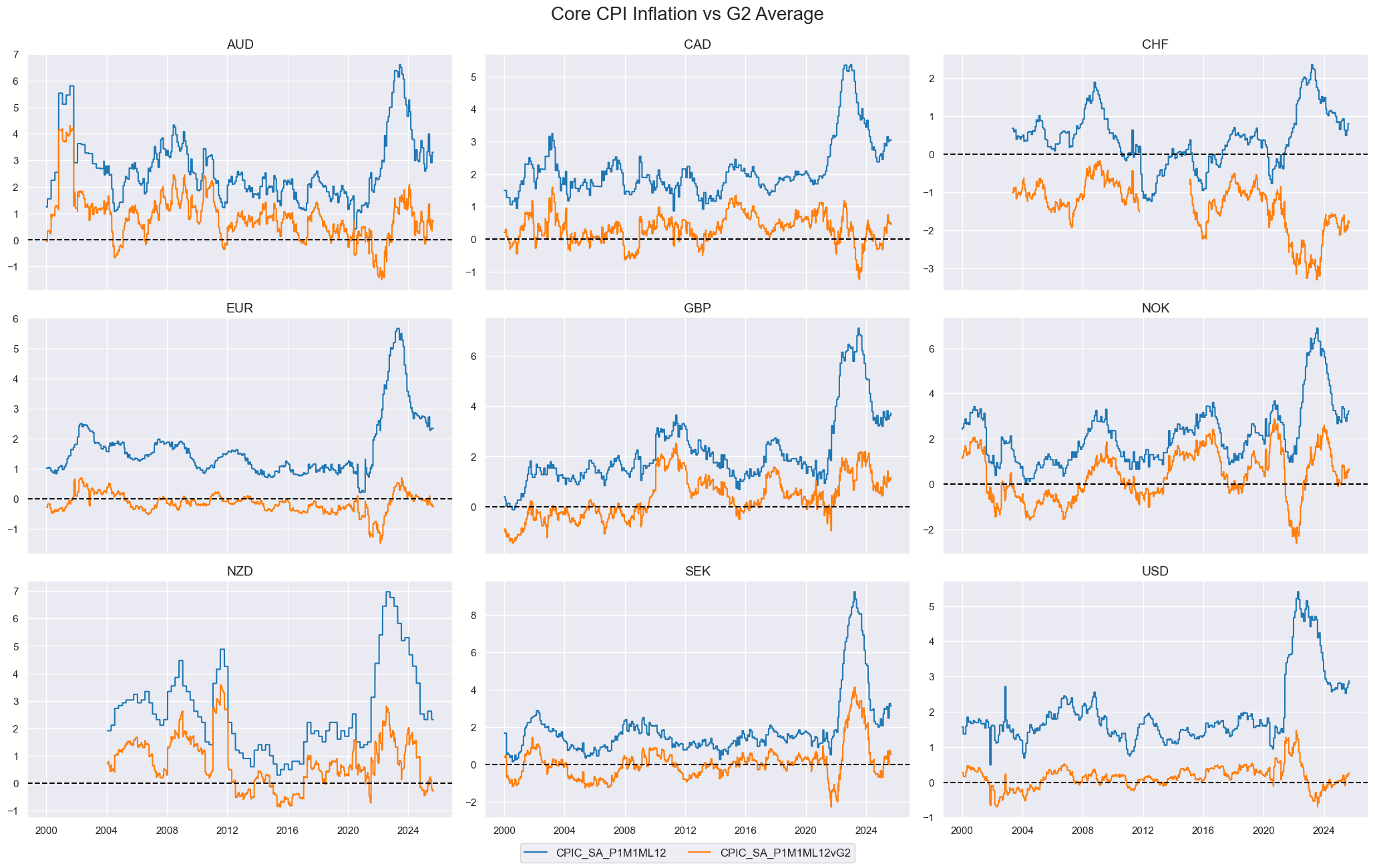

# Core CPI inflation relative to G2 (USD, EUR)

cidx = [cid for cid in cids_dm if cid != "JPY"]

xcat = "CPIC_SA_P1M1ML12"

dfy = msp.make_relative_value(

dfx,

xcats=[xcat],

cids=cidx,

start="2000-01-01",

blacklist=fxblack,

basket=["EUR", "USD"],

rel_meth="subtract",

postfix="vG2"

)

dfx = msm.update_df(dfx, dfy)

msp.view_timelines(

dfx,

xcats=[xcat, f"{xcat}vG2"],

cids=cidx,

ncol=3,

same_y=False,

start="2000-01-01",

title="Core CPI Inflation vs G2 Average",

title_fontsize=20

)

Normalize panels with

make_zn_scores

#

The

make_zn_scores()

function standardizes values across categories using sequentially expanding estimates of means and deviations, ensuring the point-in-time property of the data is preserved. Unlike a traditional z-score, which is always centered around the mean, this function lets you specify a user-defined neutral level.

A zn-score is simply the normalized distance of a value from that chosen neutral point.

Important parameters include:

-

sequential: IfTrue, z-scores are computed step by step through time. -

neutral: The value considered as the benchmark. i.e.'zero','median','mean', or any number. -

pan_weight: Controls how much weight the overall panel has versus individual cross-sections when calculating z-score parameters (the neutral level and mean absolute deviation). The default is1, meaning parameters are based on the full panel. A value of0means parameters are calculated separately for each cross-section. -

thresh: A cutoff for zn-scores. The minimum threshold is 1 mean absolute deviation. -

min_obs: Minimum number of observations required to calculate z-scores. -

est_freq: Frequency at which z-scores are estimated. i.e'D'(daily, default),'W'(weekly),'M'(monthly),'Q'(quarterly).

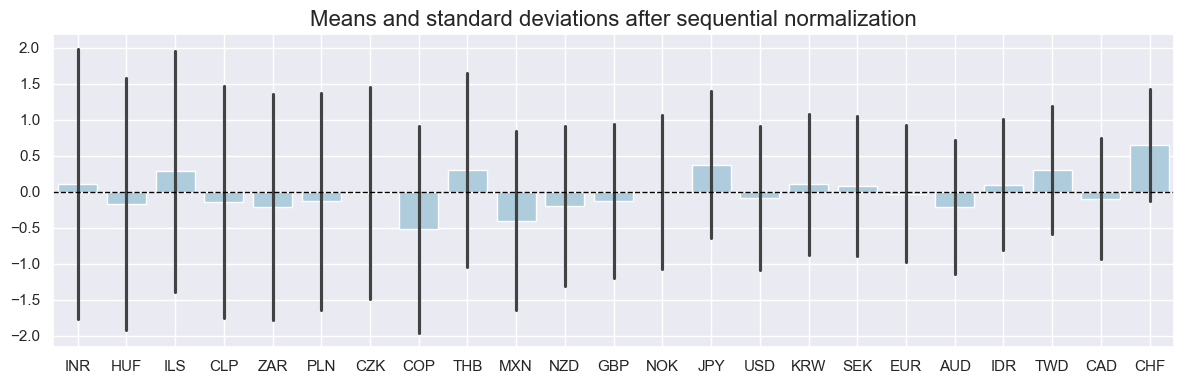

macros = ["XGDP_NEG", "XCPI_NEG", "XPCG_NEG", "RYLDIRS05Y_NSA"]

for xcat in macros:

dfa = msp.make_zn_scores(

dfx,

xcat=xcat,

cids=cids,

neutral="zero",

thresh=3,

est_freq="M", # Month

pan_weight=1,

postfix="_ZN",

)

dfx = msm.update_df(dfx, dfa)

# Compare original and normalized GDP

cidx = [cid for cid in cids if cid not in ["TRY"]]

msp.view_ranges(

dfx,

xcats=["XCPI_NEG_ZN"],

cids=cidx,

kind="bar",

sort_cids_by="std",

start="2000-01-01",

size=(12,4),

title="Means and standard deviations after sequential normalization",

title_fontsize=20)

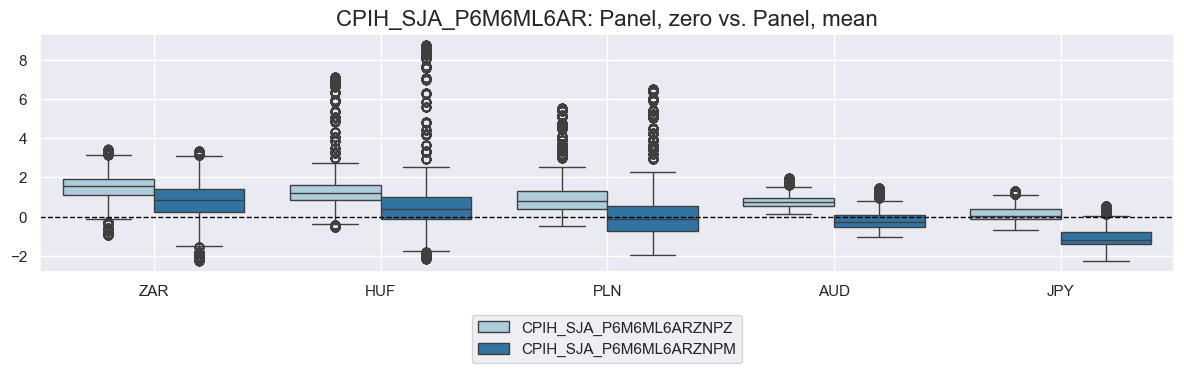

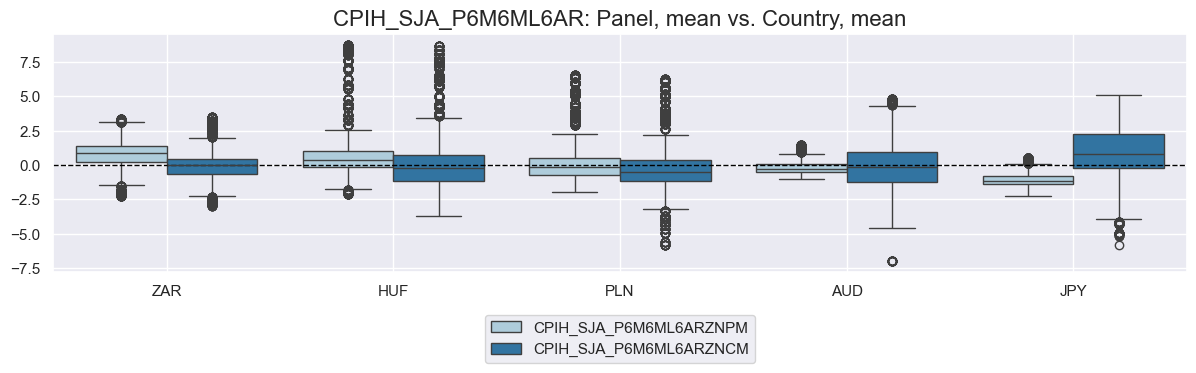

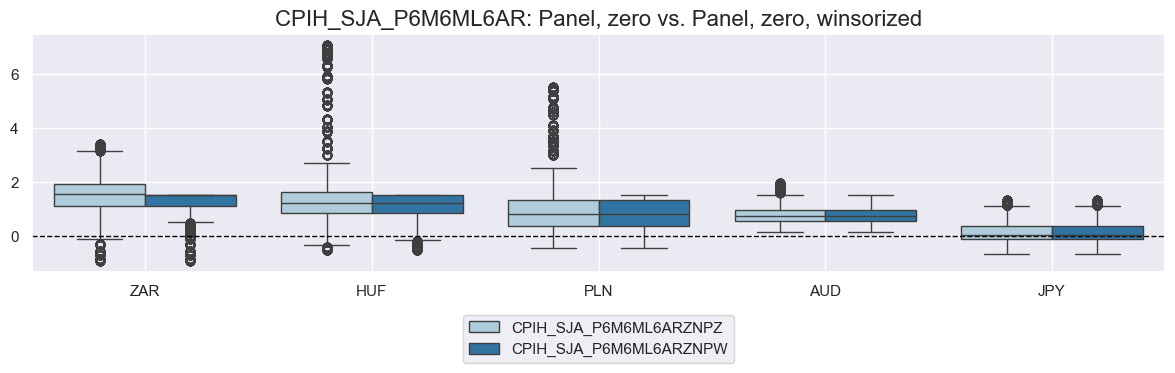

xcat = "CPIH_SJA_P6M6ML6AR"

cidx = ["ZAR", "HUF", "PLN", "AUD", "JPY"]

# Scoring variants

score_configs = {

"ZNPZ": {"neutral": "zero", "pan_weight": 1, "thresh": None, "label": "Panel, zero"},

"ZNPM": {"neutral": "mean", "pan_weight": 1, "thresh": None, "label": "Panel, mean"},

"ZNCM": {"neutral": "mean", "pan_weight": 0, "thresh": None, "label": "Country, mean"},

"ZNPW": {"neutral": "zero", "pan_weight": 1, "thresh": 1.5, "label": "Panel, zero, winsorized"},

}

dfy = pd.DataFrame(columns=dfx.columns)

for postfix, cfg in score_configs.items():

dfa = msp.make_zn_scores(

dfx,

xcat=xcat,

cids=cidx,

sequential=True,

neutral=cfg["neutral"],

pan_weight=cfg["pan_weight"],

thresh=cfg["thresh"],

postfix=postfix,

est_freq="m",

)

dfy = msm.update_df(dfy, dfa)

# Compare pairs of scoring methods

for pair in [("ZNPZ", "ZNPM"), ("ZNPM", "ZNCM"), ("ZNPZ", "ZNPW")]:

msp.view_ranges(

dfy,

xcats=[f"{xcat}{pair[0]}", f"{xcat}{pair[1]}"],

kind="box",

sort_cids_by="mean",

start="2000-01-01",

size=(12, 4),

title=f"{xcat}: {score_configs[pair[0]]['label']} vs. {score_configs[pair[1]]['label']}",

title_fontsize=16

)

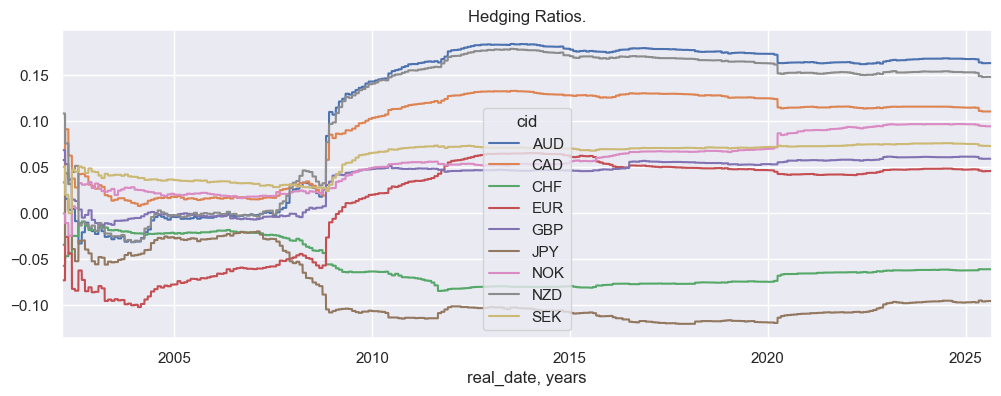

Estimate and visualize hedged returns with

return_beta

#

The

return_beta()

function estimates the beta (elasticity) of a return category with respect to a benchmark using simple OLS. It can return either the time series of betas or the hedged returns, i.e. the returns of a composite position that combines the asset and the benchmark to neutralize the asset’s benchmark exposure.

Important parameters include:

-

reqfreq: how often the hedge ratios are recalculated. At the end of each chosen period, a new hedge ratio is estimated and then applied to all days in the next period. i.e.'W'(weekly),'M'(monthly, default),'Q'(quarterly). -

min_obs: Minimum number of observations needed to calculate a beta. If the regression window is too short, no beta is produced. -

max_obs: Maximum number of observations to use. If there is more data available, the function cuts down on the sample. -

hedged_returns: IfTrue, the function outputs hedged returns in addition to (or instead of) the betas. -

blacklist: Exclude specified cross-sections and time ranges from the regression

# Estimate hedge ratios and construct hedged FX returns

cidx = ["AUD", "CAD", "CHF", "EUR", "GBP", "JPY", "NOK", "NZD", "SEK"]

dfx = dfx[["cid", "xcat", "real_date", "value"]] # drop unused columns

dfh = msp.return_beta(

dfx,

xcat="FXXR_NSA",

cids=cidx,

benchmark_return="USD_EQXR_NSA",

oos=False, # use in-sample beta estimation

hedged_returns=True,

start="2002-01-01",

refreq="M"

)

dfx = msm.update_df(dfx, dfh)

The

beta_display()

function provides a quick visualization of the estimated hedge ratios over time across cross-sections.

If the

subplots

parameter is set to

True

, the function creates one subplot per cross-section which is useful for comparing shapes or patterns individually without overlap.

If

subplots=False

(default), all betas are plotted together on the same axes, useful for spotting relative differences across cross-sections.

sns.set(rc={"figure.figsize": (12, 4)})

msp.beta_display(dfh)

The

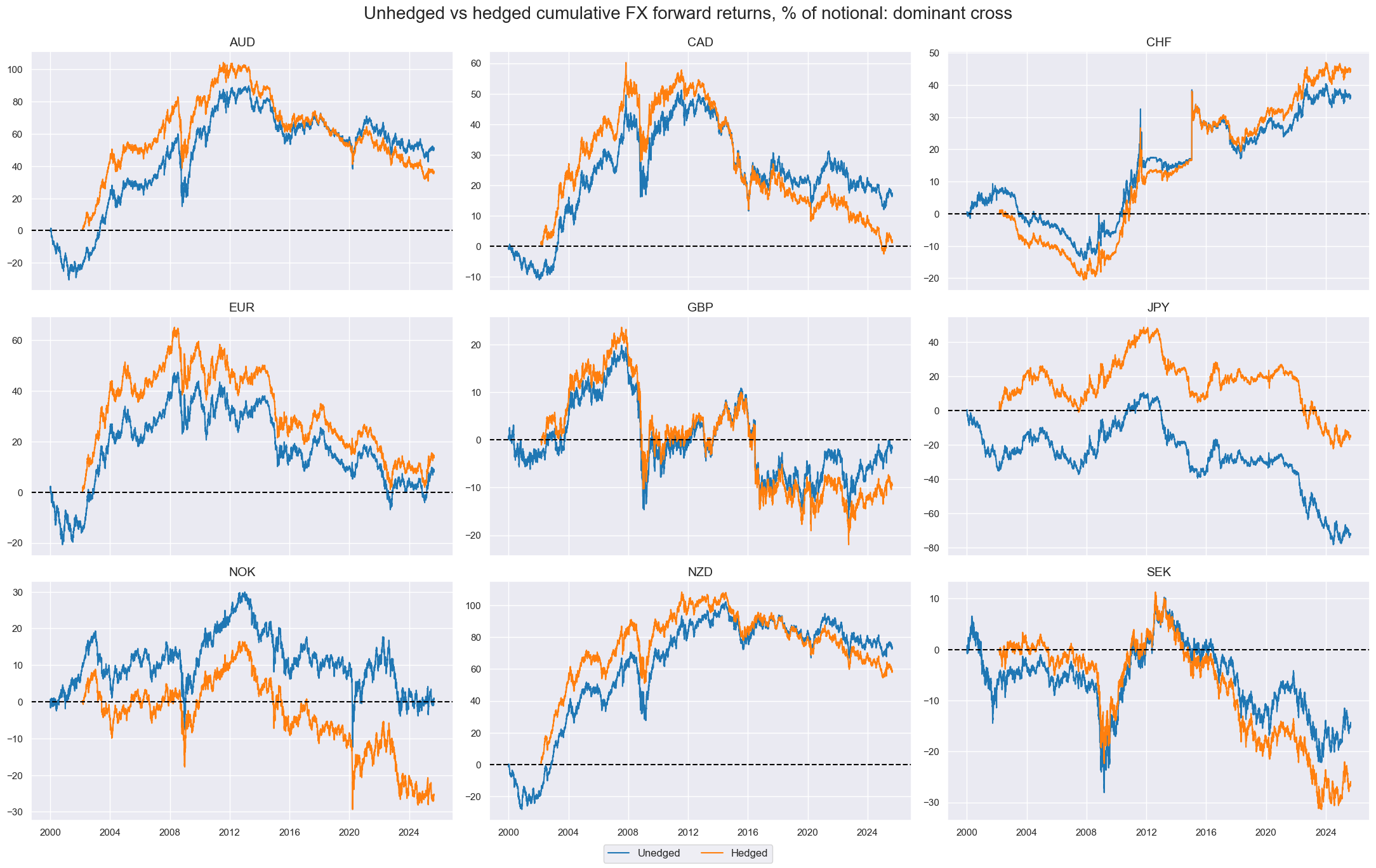

view_timelines()

function (introduced earlier in this notebook) can be used to visualize the cumulative differences between hedged and unhedged returns.

xcatx = ["FXXR_NSA", "FXXR_NSA_H"]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=3,

cumsum=True,

start="2000-01-01",

same_y=False,

all_xticks=False,

title="Unhedged vs hedged cumulative FX forward returns, % of notional: dominant cross",

xcat_labels=["Unedged", "Hedged"],

height=3,

title_fontsize=20

)

Generate returns (and carry) of a group of contracts with

Basket

#

The

Basket

class calculates returns and carry for groups of financial contracts, applying different weighting methods.

The main input is a list of contracts, where each contract is defined as a combination of a cross-section and a category, representing a specific market and asset type.

Key parameters of the class:

-

contracts: A list on cross-sections included in the Basket. -

ret: The return category to use when calculating basket return, this specifies which type of return data is aggregated into the basket performance. -

cry: The carry category to use alongside returns. Default is none. -

blacklist: A list of periods to exclude from the basket calculation.

In the example below, we create a

Basket

object for a set of FX forward returns.

# Define contracts for the basket (FX returns)

cids_fxcry = ["AUD", "INR", "NZD", "PLN", "TWD", "ZAR"]

contracts = [cid + "_FX" for cid in cids_fxcry]

# Create the basket object

basket_fxcry = msp.Basket(

dfx,

contracts=contracts,

ret="XR_NSA",

cry="CRR_NSA",

start="2010-01-01",

end="2023-01-01",

blacklist=fxblack,

)

The

make_basket()

function calculates and stores performance metrics, returns and carry, using a chosen weighting method. The available weighting options provide flexibility to construct a composite measure tailored to your objectives.

The choices of the

weight_meth

parameter are:

-

equal: Each contract gets the same weight, irregardless of volatility or size. -

fixed: You provide a fixed set of weights that remain constant. -

invsd: Weights are set to be inversely proportional to volatility.-

lback_meth: How the variable used for weights is aggregated over time. i.e.'ema'(Exponential moving average, default) or'ma'(Simple moving average) -

lblack_periods: Number of periods used for the look-back. Default is21.

-

-

values: Weights are based on the absolute level of a chosen variable. -

inv_values: Weights are based on the inverse of the absolute level of a chosen variable.

basket_fxcry.make_basket(weight_meth="equal", basket_name="GLB_FXCRY")

basket_fxcry.make_basket(weight_meth="invsd", basket_name="GLB_FXCRYVW")

basket_fxcry.make_basket(

weight_meth="fixed",

weights=[1 / 3, 1 / 6, 1 / 12, 1 / 6, 1 / 3, 1 / 12],

basket_name="GLB_FXCRYFW",

)

The

return_basket()

function returns the basket’s performance metrics in a standardized format.

dfb = basket_fxcry.return_basket()

print(dfb.tail())

utiks = list((dfb["cid"] + "_" + dfb["xcat"]).unique())

f"Unique basket tickers: {utiks}"

real_date cid xcat value

20341 2022-12-26 GLB FXCRYFW_CRR_NSA -0.377433

20342 2022-12-27 GLB FXCRYFW_CRR_NSA -0.397963

20343 2022-12-28 GLB FXCRYFW_CRR_NSA -0.344370

20344 2022-12-29 GLB FXCRYFW_CRR_NSA -0.253848

20345 2022-12-30 GLB FXCRYFW_CRR_NSA 0.065548

"Unique basket tickers: ['GLB_FXCRY_XR_NSA', 'GLB_FXCRY_CRR_NSA', 'GLB_FXCRYVW_XR_NSA', 'GLB_FXCRYVW_CRR_NSA', 'GLB_FXCRYFW_XR_NSA', 'GLB_FXCRYFW_CRR_NSA']"

Use the

return_weights()

function to inspect the time series of weights used in the basket. These can be repurposed for feature weighting or diagnostics.

You pick the basket name or list of baskets for which you want performance data returned with the

basket_names

parameter.

dfw = basket_fxcry.return_weights()

weights_pivot = dfw.pivot_table(index="real_date", columns=["xcat", "cid"], values="value").replace(0, np.nan)

weights_pivot.tail(3).round(2)

| xcat | FX_GLB_FXCRYFW_WGT | FX_GLB_FXCRYVW_WGT | FX_GLB_FXCRY_WGT | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| cid | AUD | INR | NZD | PLN | TWD | ZAR | AUD | INR | NZD | PLN | TWD | ZAR | AUD | INR | NZD | PLN | TWD | ZAR |

| real_date | ||||||||||||||||||

| 2022-12-28 | 0.29 | 0.14 | 0.07 | 0.14 | 0.29 | 0.07 | 0.09 | 0.26 | 0.1 | 0.24 | 0.23 | 0.07 | 0.17 | 0.17 | 0.17 | 0.17 | 0.17 | 0.17 |

| 2022-12-29 | 0.29 | 0.14 | 0.07 | 0.14 | 0.29 | 0.07 | 0.09 | 0.27 | 0.1 | 0.23 | 0.23 | 0.07 | 0.17 | 0.17 | 0.17 | 0.17 | 0.17 | 0.17 |

| 2022-12-30 | 0.29 | 0.14 | 0.07 | 0.14 | 0.29 | 0.07 | 0.09 | 0.27 | 0.1 | 0.24 | 0.23 | 0.07 | 0.17 | 0.17 | 0.17 | 0.17 | 0.17 | 0.17 |

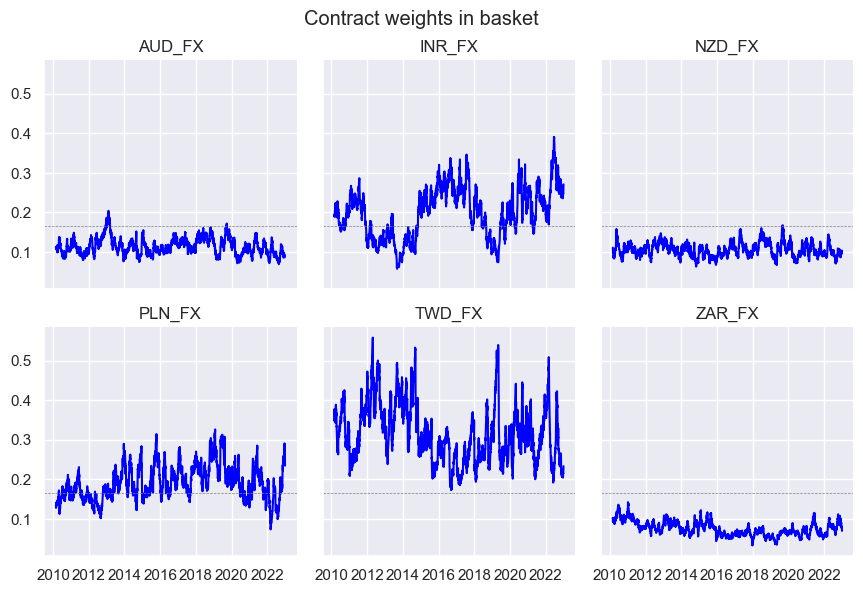

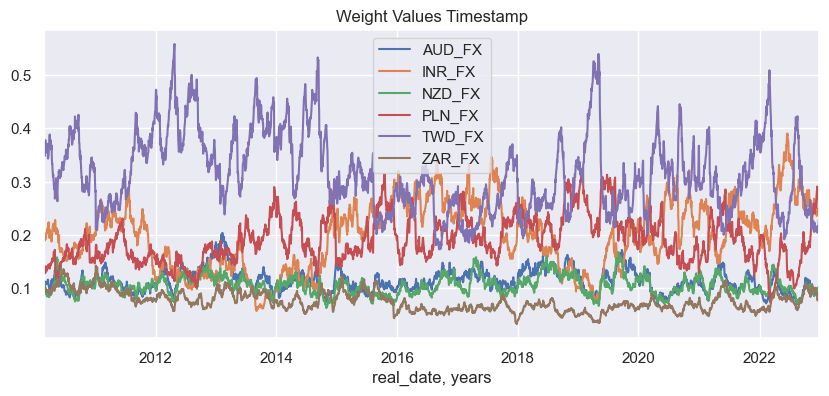

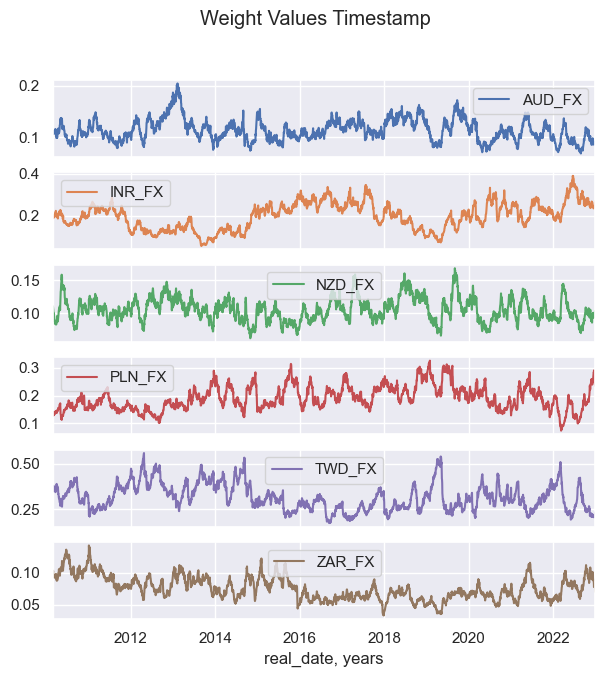

The

weight_visualizer

function visualizes weight allocations over time.

Important parameters are:

-

subplots: If

True, each contract is shown on a seperate plot and ifFalse(default), all contracts are shown on a single plot. -

facet_grid: If

True, splits the chart into multiple small coordinate grids when there are many contracts.Falseis the default. -

all_tickers: If

True(default), all tickers are included in the visualization. -

single_tickers: Lets you zoom in on the weight of one specific contract. Only works if

all_tickers=False.

basket_fxcry.weight_visualiser(basket_name="GLB_FXCRYVW", facet_grid=True)

basket_fxcry.weight_visualiser(basket_name="GLB_FXCRYVW", subplots=False, size=(10, 4))

basket_fxcry.weight_visualiser(basket_name="GLB_FXCRYVW", subplots=True, )

Calculate linear combinations of panels with

linear_composite

#

The

linear_composite()

function calculates linear combinations of different categories to produce a composite series. It can generate a composite even when some component data are missing, making it more flexible and practical. This is particularly useful when combining categories that capture a common underlying factor, since you can still work with the available information rather than discarding incomplete data.

Important parameters are:

-

weights: How categories or cross-sections are combined in the composite. There are 3 main options:-

None(default): All categories or cross-sections are given equal weights. -

list of floats: You provide weights(e.g. [0.6, 0.4]), which are applied to all available categories or cross-sections. By default, these are normalized to sum to 1 per period, unless

normalize_weights=False. -

string: You can specify another category to use as a time-varying weight (e.g., GDP, market cap). The weight category is multiplied with the corresponding main category for each cross-section. By default, the weights are normalized to sum to 1 each period, unless

normalize_weights=False.

-

-

normalize_weights: IfTrue(default), the weights are normalized to sum to 1. -

signs: An array indicating whether each component should enter with a positive or negative sign. -

complete_xcats/complete_cids: IfTrue, all cross-sections/categories are required to be present at each time point.

The examples below show how to use

linear_composite()

in three ways:

-

Combine two categories per cross-section (e.g. inflation metrics).

-

Combine two cross-sections of one category (e.g. EUR vs USD inflation).

-

Apply category-based weights (e.g. using GDP as weights).

If one of the inputs is missing at a given time, the function defaults to the available value.

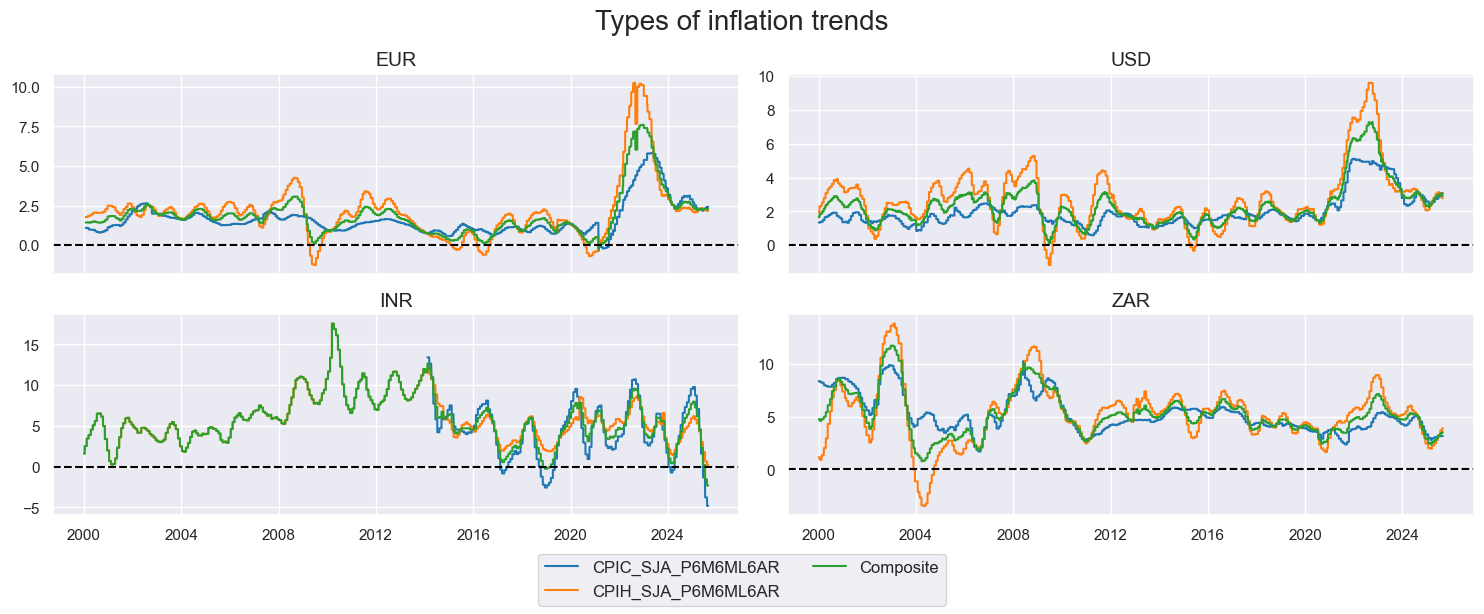

# Average core and headline inflation metrics by country

cidx = ["EUR", "USD", "INR", "ZAR"]

xcatx = ["CPIC_SJA_P6M6ML6AR", "CPIH_SJA_P6M6ML6AR"]

dflc = msp.linear_composite(

df=dfx,

xcats=xcatx,

cids=cidx,

weights=[1, 1],

signs=[1, 1],

complete_xcats=False,

new_xcat="Composite"

)

dfx = msm.update_df(dfx, dflc)

msp.view_timelines(

dfx,

xcats=xcatx + ["Composite"],

cids=cidx,

ncol=2,

start="1995-01-01",

same_y=False,

title="Types of inflation trends",

aspect=2.5,

height=2,

title_fontsize=20

)

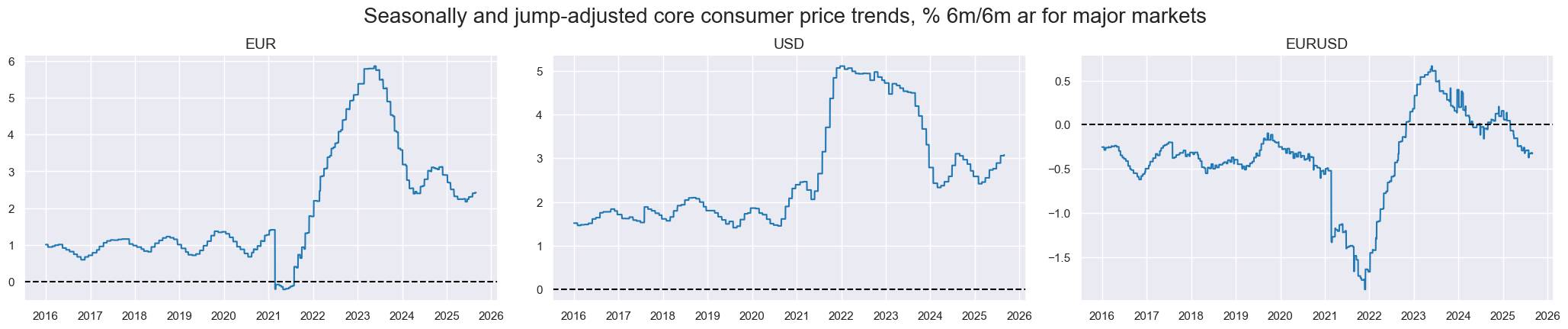

# Cross-sectional inflation gap: EUR minus USD

dflc = msp.linear_composite(

df=dfx,

xcats="CPIC_SJA_P6M6ML6AR",

cids=["EUR", "USD"],

weights=[1, 1],

signs=[1, -1],

complete_cids=False,

start="2016-01-01",

new_cid="EUR-USD"

)

dfx = msm.update_df(dfx, dflc)

You can also use a category as a dynamic weight. Below, we use 5-year real GDP growth to weight the EUR vs USD inflation difference.

cidx = ["EUR", "USD"]

xcat="CPIC_SJA_P6M6ML6AR"

signs = [1, -1]

dflc = msp.linear_composite(

df=dfx,

start = "2016-01-01",

xcats=xcat,

cids=cidx,

signs=signs,

complete_cids=False,

new_cid="EURUSD",

)

dfx = msm.update_df(dfx, dflc)

msp.view_timelines(

df=dfx,

xcats="CPIC_SJA_P6M6ML6AR",

cids=cidx +["EURUSD"],

ncol=4,

start = "2016-01-01",

same_y=False,

title = "Seasonally and jump-adjusted core consumer price trends, % 6m/6m ar for major markets",

title_fontsize=20

)

macros = ["XGDP_NEG", "XCPI_NEG", "XPCG_NEG", "RYLDIRS05Y_NSA"]

xcatx = macros

dfa = msp.linear_composite(

dfx,

xcats=[xc + "_ZN" for xc in xcatx],

cids=cids,

new_xcat="MACRO_AVGZ",

)

dfx = msm.update_df(dfx, dfa)

Relating #

Investigate relations between panels with

CategoryRelations

#

The

CategoryRelations

class is a tool for quickly visualizing and analyzing the relationship between two category panels (time-series). You can specify key arguments such as the analysis period and the type of aggregation, which determine how the relationship is calculated and displayed.

Key arguments:

-

freq: Frequency at which the series are to be sampled. i.e.'D','W','M'(default),'Q','A'. -

years: Specifies the number of years over which data should be aggregated. This overrides thefreqparameter and cannot be combined with lags. The default isNone, and the function uses whateverfreqyou specify.

-

fwin: Length of the forward-looking moving average window for the second category. Default is1. -

blacklist: Cross-sections and time periods to exclude. -

slip: How many periods to shift (‘slip’) the explanatory variable (first category). This simulates delays such as data being published late or taking time to act upon. Default is0.

-

xcat_aggs: The two aggregation methods you want to use. Default is'mean'for both. Others include'median','sum','min','max', etc. -

xcat_trims: The two maximum absolute values allowed for each of the two categories. Any observations exceeding these thresholds are removed entirely from the analysis (trimmed). Default isNonefor both. Trimming happens only after all other transformations have been completed. -

xcat1_chg: Specification whether to transform the first category into changes rather than levels. Default isNone. The available options are:-

'diff': Calculates the first difference -

'pch': Calculates the percentage change

-

-

n_periods: Number of periods used when calculating changes in the first category (set byxcat1_chg). Default is1.

cr = msp.CategoryRelations(

dfx,

xcats=["CPIC_SJA_P6M6ML6AR", "DU05YXR_VT10"],

cids=cids_dm,

xcat1_chg="diff",

n_periods=1,

freq="Q",

lag=1,

fwin=1, # default forward window is one

xcat_aggs=["last", "sum",], # the first method refers to the first item in xcats list, the second - to the second

start="2000-01-01",

xcat_trims=[10, 10],

)

for attribute, value in cr.__dict__.items():

print(attribute, " = ", value)

xcats = ['CPIC_SJA_P6M6ML6AR', 'DU05YXR_VT10']

cids = ['AUD', 'CAD', 'CHF', 'EUR', 'GBP', 'JPY', 'NOK', 'NZD', 'SEK', 'USD']

val = value

freq = Q

lag = 1

years = None

aggs = ['last', 'sum']

xcat1_chg = diff

n_periods = 1

xcat_trims = [10, 10]

slip = 0

df = CPIC_SJA_P6M6ML6AR DU05YXR_VT10

real_date cid

2001-12-31 AUD 1.135315 -3.172330

2002-03-29 AUD 0.446704 -3.966165

2002-06-28 AUD -0.575002 3.346755

2002-09-30 AUD 0.233650 7.388278

2002-12-31 AUD 0.203154 2.739271

... ... ...

2024-09-30 CHF 0.383461 8.498372

2024-12-31 CHF -0.185516 7.098018

2025-03-31 CHF -0.443607 -4.128092

2025-06-30 CHF -0.130310 3.260313

2025-09-30 CHF 0.123553 -0.046946

[812 rows x 2 columns]

Plot regression scatter with

reg_scatter

#

The

reg_scatter()

function visualizes the relationship between two categories by displaying a scatter-plot, making it easy to see both the strength of the association and potential outliers. The analysis can also be split by

cid

(cross-section) or

year

, helping to reveal how the relationship changes across markets or over time.

Important parameters:

-

fit_reg: IfTrue, adds a regression line. -

prob_est: Type of estimator to use for calculating the probability of a significant relationship between the feature category and the target category. Options are:-

pool(default): Pools all cross-sections and periods together into one regression. -

map: (Macrosynergy panel test) where significance is assessed using panel regressions with period-specific random effects. This avoids the problem of ‘pseudo-replication’ that arises when simply stacking data, which can exaggerate significance because cross-sections often share common global factors. The method adjusts both targets and features for these global influences, giving more weight to deviations from the period mean. In practice, if global effects dominate, the test focuses on whether a feature explains cross-sectional differences at each point in time. This approach automatically accounts for similarity across markets, making the significance test more reliable and broadly applicable. -

kendall: Kendall rank correlation coefficient.

-

The

years

parameter, when combined with

labels=true

, can be used to visualize medium-term concurrent relations.

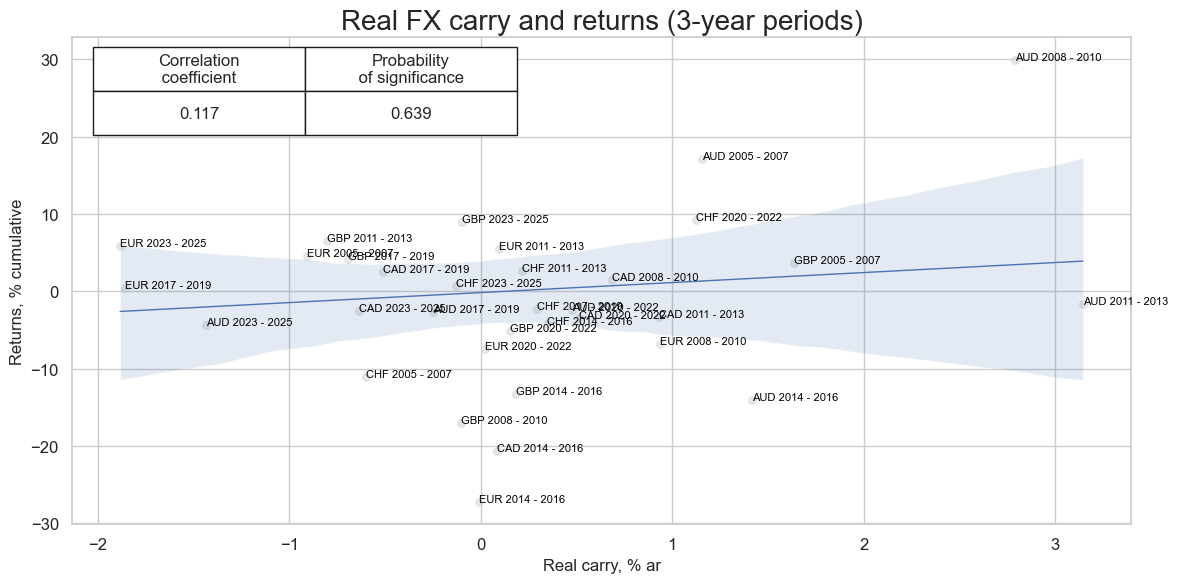

cids_sel = cids_dm[:5]

cr = msp.CategoryRelations(

df,

xcats=["FXCRR_NSA", "FXXR_NSA"],

cids=cids_sel,

freq="M",

years=3,

lag=0,

xcat_aggs=["mean", "sum"],

start="2005-01-01",

blacklist=fxblack,

)

cr.reg_scatter(

title="Real FX carry and returns (3-year periods)",

title_fontsize=20,

labels=True,

prob_est="map",

xlab="Real carry, % ar",

ylab="Returns, % cumulative",

coef_box="upper left",

size=(12, 6),

)

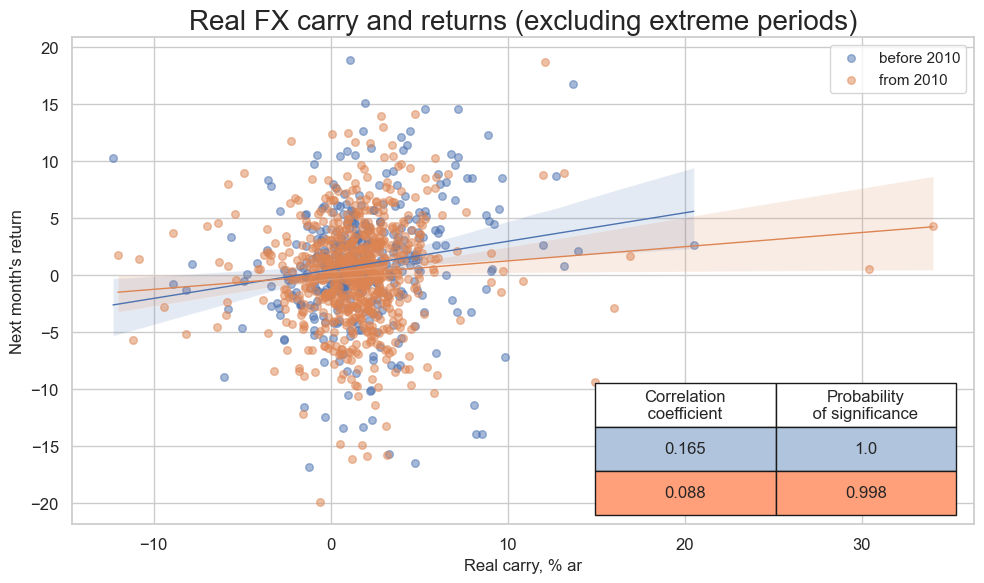

The

separator

argument is used to check whether a relationship remains stable across different time periods or markets.

In practice, it splits the scatter plots either by cross-section (

cids

) or by time, such as calendar year (

year

).

cidx = cids_em

cr = msp.CategoryRelations(

dfx,

xcats=["FXCRR_NSA", "FXXR_NSA"],

cids=list(set(cids_em) - set(["ILS", "CLP"])),

freq="Q",

years=None,

lag=1,

xcat_aggs=["last", "sum"],

start="2000-01-01",

blacklist=fxblack,

xcat_trims=[40, 20],

)

cr.reg_scatter(

title="Real FX carry and returns (excluding extreme periods)",

title_fontsize=20,

reg_order=1,

labels=False,

xlab="Real carry, % ar",

ylab="Next month's return",

coef_box="lower right",

prob_est="map",

separator=2010,

size=(10, 6),

)

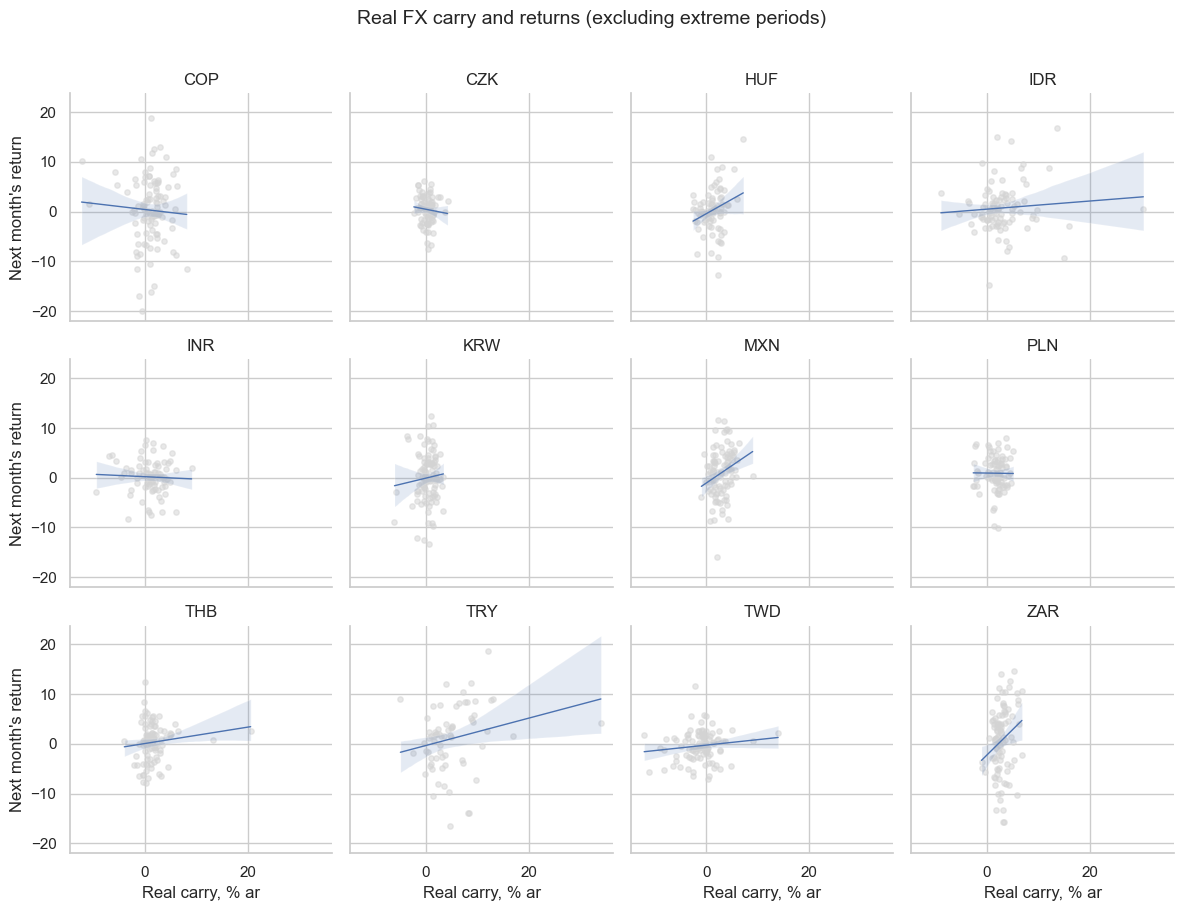

cr.reg_scatter(

title="Real FX carry and returns (excluding extreme periods)",

reg_order=1,

labels=False,

xlab="Real carry, % ar",

ylab="Next month's return",

separator="cids",

tick_fontsize=20,

title_adj=1.01,

)

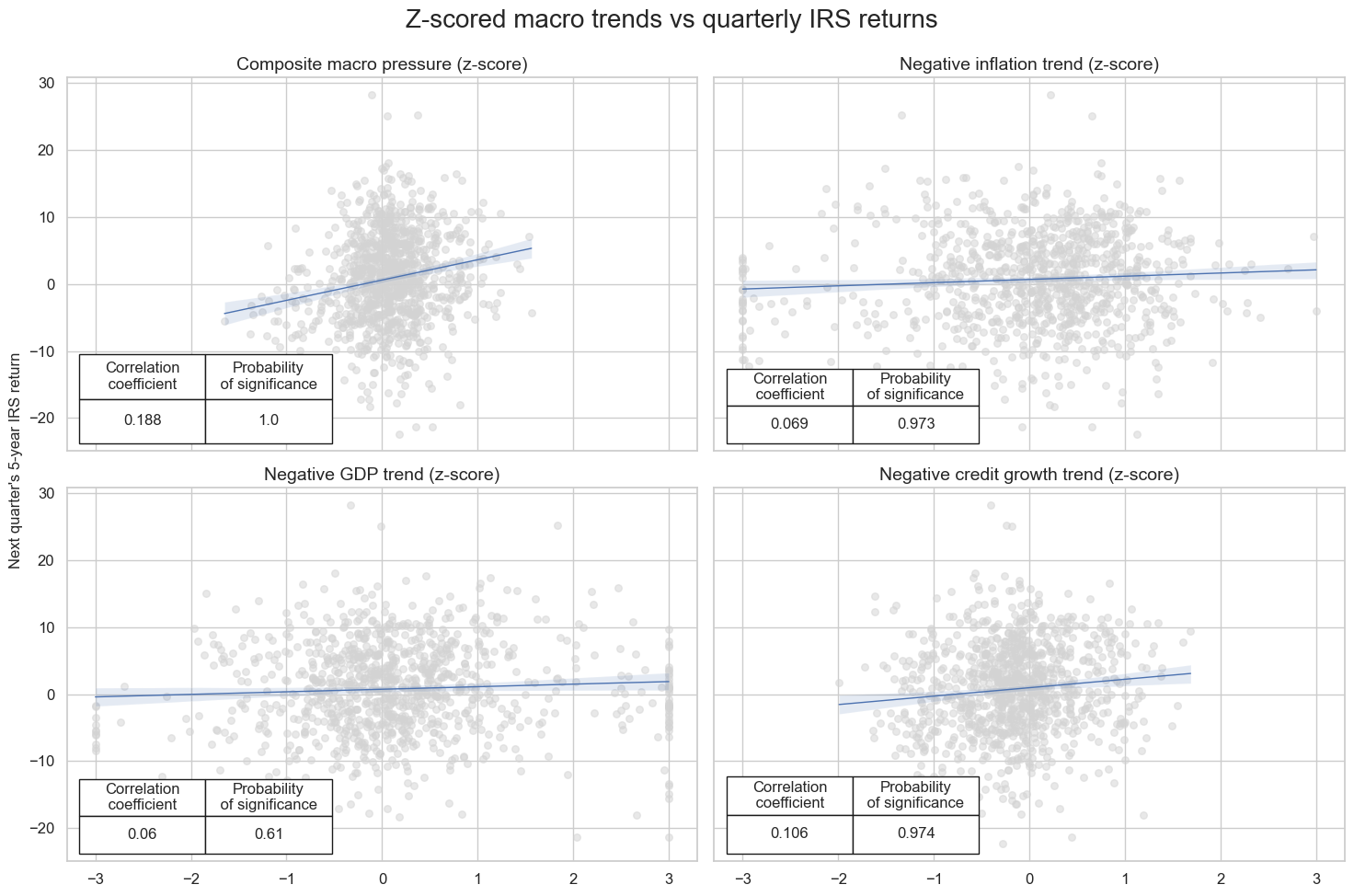

The

multiple_reg_scatter()

function is for comparison of several pairs of two categories relationships side by side, including the strength of the linear association and any potential outliers.

Important parameters:

-

cat_rels: List of category relationships to plot. -

share_axes: IfTrue, the plots share their axes. Default isFalse. -

coef_box: IfTrue, displays a summary box for each scatter-plot showing: the estimated regression coefficient, it’s standard error, and significance level. Default isFalse.

crx = msp.CategoryRelations(

dfx,

xcats=["MACRO_AVGZ", "DU05YXR_VT10"],

cids=cids_dm,

n_periods=1,

freq="Q",

lag=1,

xcat_aggs=["last", "sum"],

start="2000-01-01",

)

crxx = msp.CategoryRelations(

dfx,

xcats=["XCPI_NEG_ZN", "DU05YXR_VT10"],

cids=cids_dm,

n_periods=1,

freq="Q",

lag=1,

xcat_aggs=["last", "sum"],

start="2000-01-01",

)

crxxx = msp.CategoryRelations(

dfx,

xcats=["XGDP_NEG_ZN", "DU05YXR_VT10"],

cids=cids_dm,

n_periods=1,

freq="Q",

lag=1,

xcat_aggs=["last", "sum"],

start="2000-01-01",

)

crxxxx = msp.CategoryRelations(

dfx,

xcats=["XPCG_NEG_ZN", "DU05YXR_VT10"],

cids=cids_dm,

n_periods=1,

freq="Q",

lag=1,

xcat_aggs=["last", "sum"],

start="2000-01-01",

)

msv.multiple_reg_scatter(

[crx, crxx, crxxx, crxxxx],

title="Z-scored macro trends vs quarterly IRS returns",

ylab="Next quarter's 5-year IRS return",

ncol=2,

nrow=2,

figsize=(15, 10),

prob_est="map",

coef_box="lower left",

subplot_titles=[

"Composite macro pressure (z-score)",

"Negative inflation trend (z-score)",

"Negative GDP trend (z-score)",

"Negative credit growth trend (z-score)",

],

)

Call the

.ols_table()

function to run a basic pooled OLS regression and return a statsmodels summary.

cr = msp.CategoryRelations(

dfx,

xcats=["CPIC_SJA_P6M6ML6AR", "DU05YXR_VT10"],

cids=cids_dm,

xcat1_chg="diff",

n_periods=1,

freq="M",

lag=1,

xcat_aggs=["last", "sum"],

start="2000-01-01",

)

cr.ols_table()

OLS Regression Results

==============================================================================

Dep. Variable: DU05YXR_VT10 R-squared: 0.000

Model: OLS Adj. R-squared: 0.000

Method: Least Squares F-statistic: 1.262

Date: Mon, 01 Sep 2025 Prob (F-statistic): 0.261

Time: 12:35:00 Log-Likelihood: -7890.4

No. Observations: 2896 AIC: 1.578e+04

Df Residuals: 2894 BIC: 1.580e+04

Df Model: 1

Covariance Type: nonrobust

======================================================================================

coef std err t P>|t| [0.025 0.975]

--------------------------------------------------------------------------------------

const 0.2439 0.069 3.554 0.000 0.109 0.378

CPIC_SJA_P6M6ML6AR -0.3380 0.301 -1.123 0.261 -0.928 0.252

==============================================================================

Omnibus: 187.185 Durbin-Watson: 1.806

Prob(Omnibus): 0.000 Jarque-Bera (JB): 660.911

Skew: -0.244 Prob(JB): 3.05e-144

Kurtosis: 5.289 Cond. No. 4.39

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

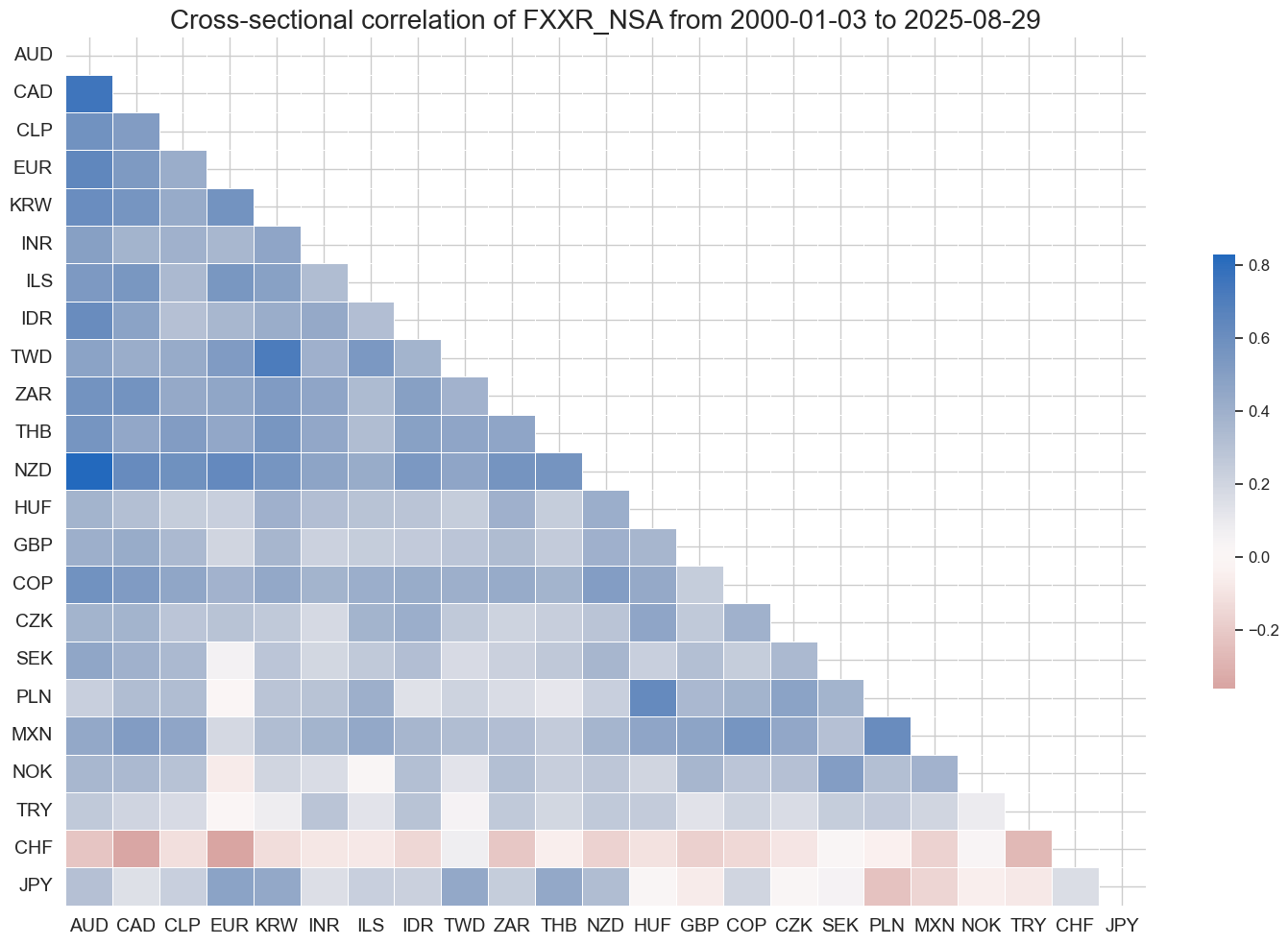

Visualize relations across sections or categories with

correl_matrix

#

The

correl_matrix()

function visualizes Pearson correlations in two ways:

-

Within a single category across multiple cross-sections.

-

Across different categories. This makes it easy to spot common patterns or overlaps either between markets or between signals.

Important parameters:

-

freq: Frequency at which the standard JMPaQS frequency of business daily data is downsampled to. i.e'W','M'(default), or'Q'. -

cluster: IfTrue, the series in the correlation matrix are reordered using hierarchical clustering, so assets or categories with similar correlation patterns are grouped together. Default isFalse.

cids = cids_dm + cids_em

msp.correl_matrix(

dfx, xcats="FXXR_NSA",

freq="Q",

cids=cids,

size=(15, 10),

cluster=True,

title_fontsize=20

)

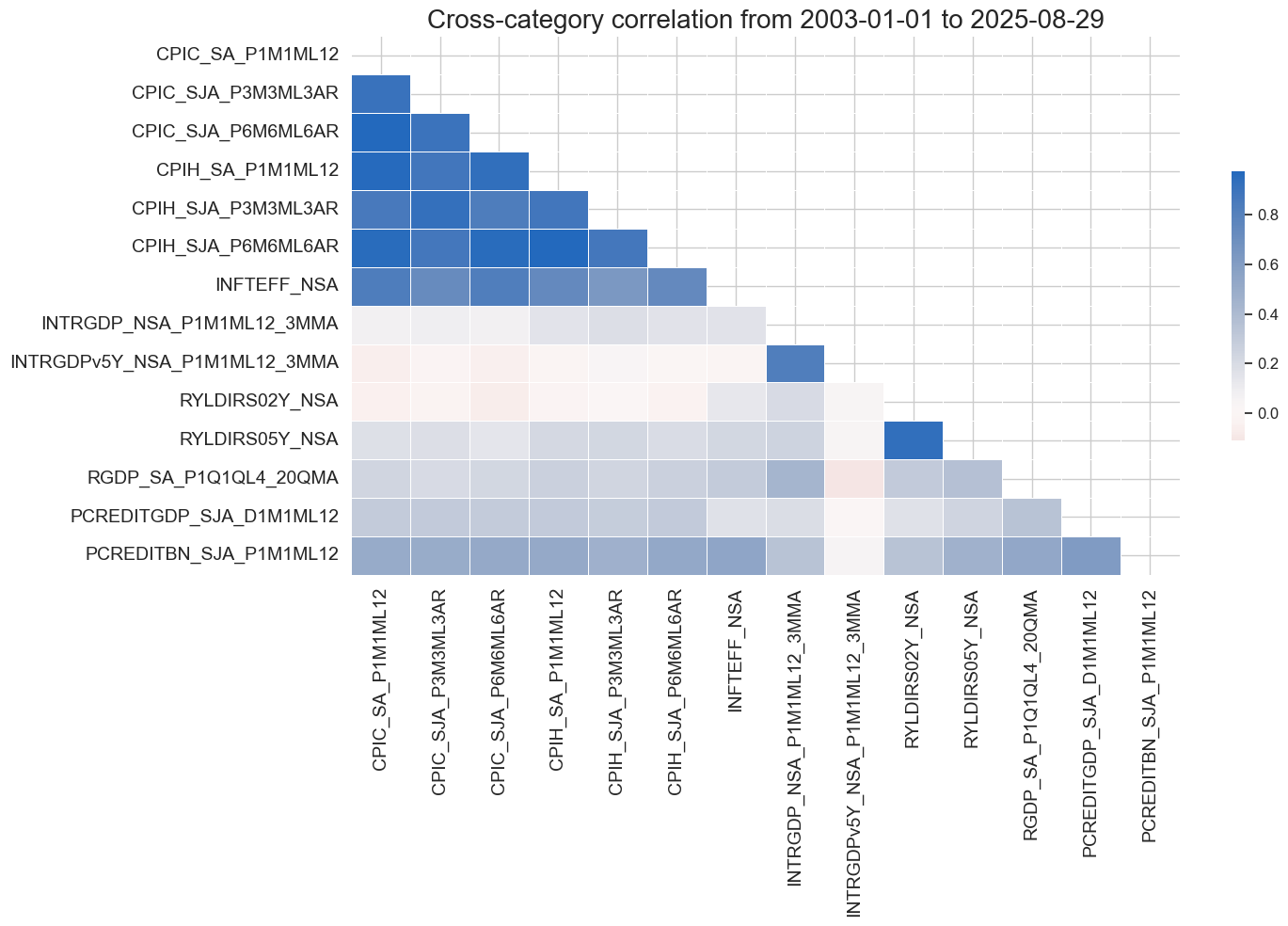

Passing a list of categories to the

xcats

argument to display correlations across categories:

xcatx = ecos

msp.correl_matrix(

dfx,

xcats=xcatx,

cids=cids,

freq="M",

start="2003-01-01",

size=(15, 10),

cluster=True,

title_fontsize=20

)

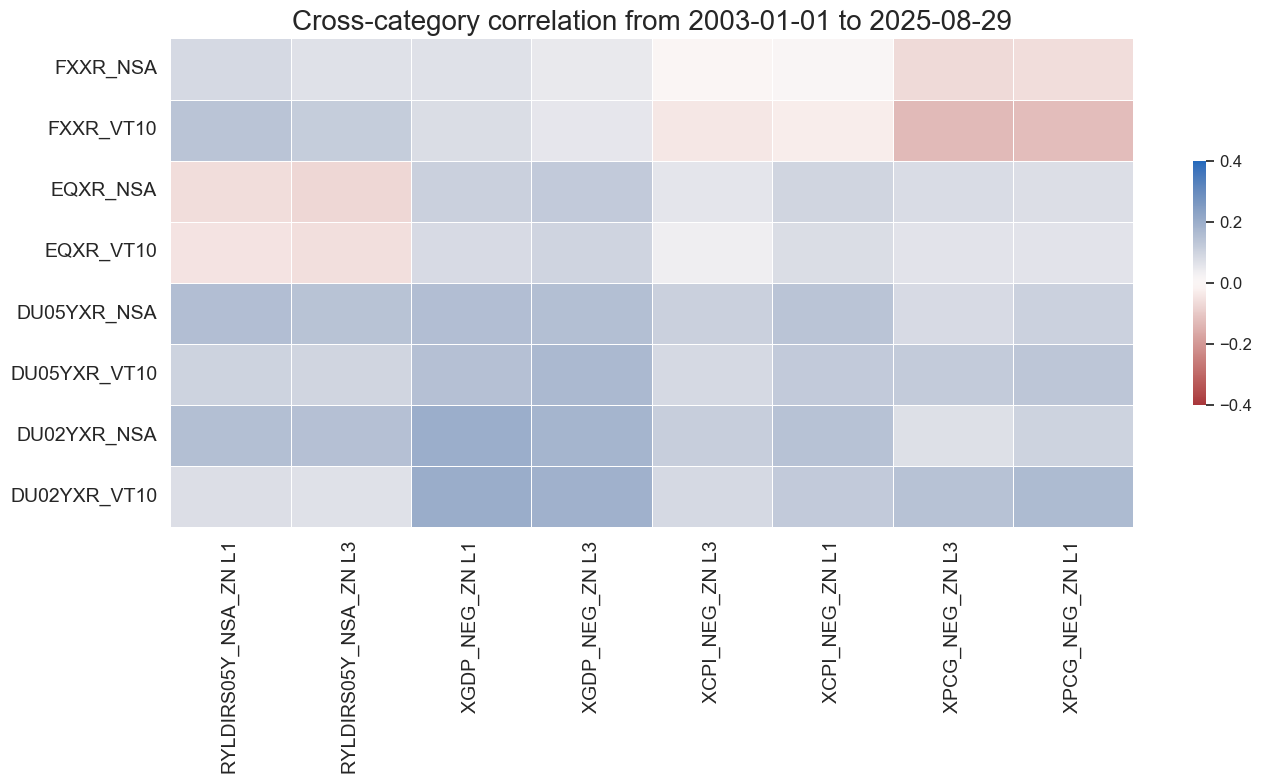

In the example below we analyze correlations between inflation trends and subsequent asset returns, allowing for multiple explanatory lags. Lags are passed as a dictionary so we can test several horizons in one go. Here, we use monthly lags of 1, 3, and 6 months:

macroz = [m + "_ZN" for m in macros]

feats = macroz

rets=["DU02YXR_VT10",

"DU02YXR_NSA",

"DU05YXR_VT10",

"DU05YXR_NSA",

"EQXR_NSA",

"EQXR_VT10",

"FXXR_NSA",

"FXXR_VT10"]

lag_dict = {"XGDP_NEG_ZN": [1, 3],

"XCPI_NEG_ZN": [1, 3], # excess inflation

"XPCG_NEG_ZN": [1, 3], # excess real interest rate

"RYLDIRS05Y_NSA_ZN": [1, 3]}

msp.correl_matrix(

dfx,

xcats=feats,

xcats_secondary=rets,

cids="EUR",

freq="M",

start="2003-01-01",

lags=lag_dict,

max_color=0.4,

cluster=True,

title_fontsize=20

)

Signaling #

SignalReturnRelations #

The

SignalReturnRelations

class is built to analyze, visualize, and compare how panels of trading signals relate to panels of subsequent returns. Unlike CategoryRelations, it focuses on association measures such as positive/negative return splits and both parametric and non-parametric correlations.

The class converts data to a chosen trading or rebalancing frequency and accounts for whether a signal is expected to predict returns with a positive or negative sign, which is crucial for interpreting results. Importantly, no regressions are run: features must have a meaningful zero point, since the sign of the signal directly drives the accuracy statistics.

Important parameters:

-

rets: Target return category/categories. -

sigs: Signal categories for which detailed relational statistics can be calculated. -

sig_neg: List ofTrue/Falsein relation to the list of signals. Default isFalse. -

agg_sigs: Aggregation method for down-sampling to a lower frequency. Default is'last'. Options include'mean','median', and'sum'. If a single method is provided for multiple signal categories, it is applied to all of them. -

freqs: All frequencies at which the series can be sampled. i.e.'D','W','M'(default),'Q', and'A'. Return series are always summed over the selected period, while signal series are aggregated using the method(s) specified inagg_sigs.

dfx

| cid | xcat | real_date | value | |

|---|---|---|---|---|

| 0 | AUD | CPIC_SA_P1M1ML12 | 2000-01-03 | 1.244168 |

| 1 | AUD | CPIC_SA_P1M1ML12 | 2000-01-04 | 1.244168 |

| 2 | AUD | CPIC_SA_P1M1ML12 | 2000-01-05 | 1.244168 |

| 3 | AUD | CPIC_SA_P1M1ML12 | 2000-01-06 | 1.244168 |

| 4 | AUD | CPIC_SA_P1M1ML12 | 2000-01-07 | 1.244168 |

| ... | ... | ... | ... | ... |

| 5958343 | ZAR | XXRYLD | 2025-08-25 | 3.186982 |

| 5958344 | ZAR | XXRYLD | 2025-08-26 | 3.201803 |

| 5958345 | ZAR | XXRYLD | 2025-08-27 | 3.221633 |

| 5958346 | ZAR | XXRYLD | 2025-08-28 | 3.191177 |

| 5958347 | ZAR | XXRYLD | 2025-08-29 | 3.199969 |

5958348 rows × 4 columns

# Instantiate signal-return relations class for the list of signals, multiple returns and frequencies

srr = mss.SignalReturnRelations(

dfx,

sigs=["MACRO_AVGZ", "XGDP_NEG_ZN", "XCPI_NEG_ZN", "XPCG_NEG_ZN", "RYLDIRS05Y_NSA_ZN"],

cosp=True,

rets=["DU05YXR_VT10", "EQXR_VT10", "FXXR_VT10"],

freqs=["M"],

blacklist=fxblack,

slip=1

)

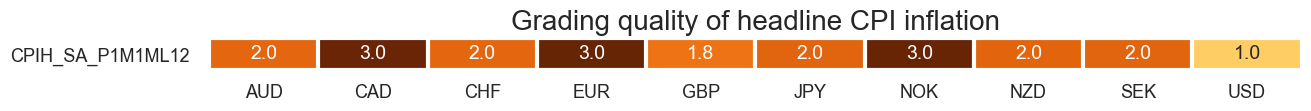

Signal-return analysis #

The

view_grades()

function displays a heatmap of data quality grades across time and cross-sections.

xcat_gr = "CPIH_SA_P1M1ML12"

df_gr = df[(df["xcat"] == xcat_gr) & (df["cid"].isin(cids_dm))].copy()

msv.view_grades(

df_gr,

xcats=[xcat_gr],

cids=cids_dm,

start="2000-01-01",

end="2020-01-01",

grade="grading", # already present in df (float64)

title="Grading quality of headline CPI inflation",

title_fontsize=20,

figsize=(13, 1)

)

Summary tables #

The

summary_table()

function gives a quick snapshot of how well the main signal aligns with future returns. It shows classification accuracy, return bias, precision, and both linear and rank correlations; across the full panel, by year, and by cross-section.

The columns of the summary table:

-

accuracy : % of correct sign predictions (positive vs negative returns). Ignores imbalance between up/down returns.

-

bal_accuracy : balanced accuracy = average of true positive rate (sensitivity) and true negative rate (specificity). Adjusts for class imbalance. Range 0-1.

-

pos_sigr : proportion of times the signal predicts a positive return (measures long bias of the signal).

-

pos_retr : proportion of positive returns in the dataset (measures bias of the returns themselves).

-

pos_prec : positive precision = % of positive return predictions that were correct. Range 0-1.

-

neg_prec : negative precision = % of negative return predictions that were correct. Range 0-1.

-

pearson : Pearson correlation coefficient between signal and subsequent returns (linear association, -1 to +1).

-

pearson_pval : p-value for testing whether Pearson correlation ≠ 0 (probability result occurred by chance).

-

kendall : Kendall rank correlation (non-parametric measure of monotonic association, -1 to +1).

-

kendall_pval : p-value for Kendall correlation significance.

The rows of the summary table:

-

Panel : statistic across the entire dataset (all cross-sections and sample period, excluding blacklisted data).

-

Mean years : average value of the statistic across years.

-

Mean cids : average value across cross-sections (e.g., countries, assets).

-

Positive ratio : proportion of years (or cross-sections) where the statistic is above its neutral benchmark:

-

Neutral = 0.5 for classification stats (accuracy, balanced accuracy, precision).

-

Neutral = 0 for correlation measures (Pearson, Kendall).

-

srr.summary_table().round(2)

| accuracy | bal_accuracy | pos_sigr | pos_retr | pos_prec | neg_prec | pearson | pearson_pval | kendall | kendall_pval | auc | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| M: MACRO_AVGZ/last => DU05YXR_VT10 | 0.55 | 0.54 | 0.58 | 0.55 | 0.58 | 0.50 | 0.11 | 0.00 | 0.06 | 0.00 | 0.54 |

| Mean years | 0.54 | 0.52 | 0.59 | 0.56 | 0.57 | 0.46 | 0.06 | 0.35 | 0.03 | 0.32 | 0.52 |

| Positive ratio | 0.81 | 0.73 | 0.65 | 0.73 | 0.77 | 0.46 | 0.85 | 0.58 | 0.77 | 0.65 | 0.73 |

| Mean cids | 0.55 | 0.54 | 0.58 | 0.54 | 0.58 | 0.51 | 0.10 | 0.24 | 0.06 | 0.28 | 0.54 |

| Positive ratio | 0.83 | 0.83 | 0.71 | 0.92 | 0.92 | 0.54 | 0.96 | 0.79 | 0.92 | 0.71 | 0.83 |

Use the

single_relation_table()

function for a compact one-line summary showing frequency, signal (with

_NEG

if inverse), and return name.

srr.single_relation_table().round(2)

| accuracy | bal_accuracy | pos_sigr | pos_retr | pos_prec | neg_prec | pearson | pearson_pval | kendall | kendall_pval | auc | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| M: MACRO_AVGZ/last => DU05YXR_VT10 | 0.55 | 0.54 | 0.58 | 0.55 | 0.58 | 0.5 | 0.11 | 0.0 | 0.06 | 0.0 | 0.54 |

The

cross_section_table()

function summarizes accuracy and correlation stats by country and panel average.

It also shows the share of countries with positive signal-return relationships.

srr.cross_section_table().round(2)

| accuracy | bal_accuracy | pos_sigr | pos_retr | pos_prec | neg_prec | pearson | pearson_pval | kendall | kendall_pval | auc | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| M: MACRO_AVGZ/last => DU05YXR_VT10 | 0.55 | 0.54 | 0.58 | 0.55 | 0.58 | 0.50 | 0.11 | 0.00 | 0.06 | 0.00 | 0.54 |

| Mean | 0.55 | 0.54 | 0.58 | 0.54 | 0.58 | 0.51 | 0.10 | 0.24 | 0.06 | 0.28 | 0.54 |

| PosRatio | 0.83 | 0.83 | 0.71 | 0.92 | 0.92 | 0.54 | 0.96 | 0.79 | 0.92 | 0.71 | 0.83 |

| AUD | 0.56 | 0.54 | 0.59 | 0.57 | 0.61 | 0.48 | 0.13 | 0.03 | 0.05 | 0.17 | 0.54 |

| CAD | 0.52 | 0.52 | 0.57 | 0.51 | 0.52 | 0.51 | 0.05 | 0.38 | 0.02 | 0.58 | 0.52 |

| CHF | 0.58 | 0.56 | 0.69 | 0.56 | 0.60 | 0.52 | 0.14 | 0.02 | 0.08 | 0.05 | 0.55 |

| CLP | 0.48 | 0.48 | 0.49 | 0.51 | 0.50 | 0.47 | 0.06 | 0.36 | 0.02 | 0.73 | 0.48 |

| COP | 0.54 | 0.54 | 0.47 | 0.53 | 0.57 | 0.51 | -0.05 | 0.55 | 0.02 | 0.65 | 0.54 |

| CZK | 0.51 | 0.51 | 0.42 | 0.54 | 0.56 | 0.47 | 0.08 | 0.23 | 0.02 | 0.61 | 0.51 |

| EUR | 0.57 | 0.56 | 0.58 | 0.57 | 0.62 | 0.50 | 0.20 | 0.00 | 0.12 | 0.00 | 0.56 |

| GBP | 0.55 | 0.54 | 0.62 | 0.56 | 0.59 | 0.50 | 0.21 | 0.00 | 0.09 | 0.02 | 0.54 |

| HUF | 0.59 | 0.59 | 0.65 | 0.51 | 0.58 | 0.60 | 0.14 | 0.02 | 0.09 | 0.02 | 0.58 |

| IDR | 0.66 | 0.63 | 0.67 | 0.63 | 0.72 | 0.55 | 0.22 | 0.00 | 0.18 | 0.00 | 0.63 |

| ILS | 0.53 | 0.50 | 0.65 | 0.59 | 0.59 | 0.41 | 0.02 | 0.82 | -0.01 | 0.88 | 0.50 |

| INR | 0.47 | 0.47 | 0.55 | 0.49 | 0.46 | 0.48 | 0.04 | 0.57 | -0.01 | 0.84 | 0.47 |

| JPY | 0.49 | 0.47 | 0.59 | 0.57 | 0.54 | 0.40 | 0.06 | 0.29 | 0.02 | 0.59 | 0.47 |

| KRW | 0.60 | 0.61 | 0.67 | 0.52 | 0.59 | 0.62 | 0.15 | 0.02 | 0.08 | 0.06 | 0.60 |

| MXN | 0.53 | 0.53 | 0.54 | 0.55 | 0.58 | 0.48 | 0.03 | 0.61 | 0.06 | 0.17 | 0.53 |

| NOK | 0.50 | 0.50 | 0.50 | 0.53 | 0.53 | 0.47 | 0.12 | 0.04 | 0.06 | 0.11 | 0.50 |

| NZD | 0.57 | 0.56 | 0.73 | 0.55 | 0.58 | 0.54 | 0.17 | 0.00 | 0.09 | 0.01 | 0.55 |

| PLN | 0.56 | 0.55 | 0.59 | 0.55 | 0.59 | 0.50 | 0.21 | 0.00 | 0.10 | 0.01 | 0.55 |

| SEK | 0.59 | 0.58 | 0.57 | 0.58 | 0.65 | 0.51 | 0.18 | 0.00 | 0.12 | 0.00 | 0.58 |

| THB | 0.60 | 0.59 | 0.69 | 0.56 | 0.62 | 0.56 | 0.01 | 0.89 | 0.05 | 0.31 | 0.58 |

| TRY | 0.57 | 0.56 | 0.32 | 0.46 | 0.55 | 0.57 | 0.10 | 0.27 | 0.05 | 0.37 | 0.55 |

| TWD | 0.50 | 0.51 | 0.47 | 0.52 | 0.53 | 0.48 | 0.07 | 0.26 | 0.03 | 0.44 | 0.51 |

| USD | 0.57 | 0.57 | 0.49 | 0.53 | 0.60 | 0.54 | 0.08 | 0.17 | 0.06 | 0.13 | 0.57 |

| ZAR | 0.54 | 0.52 | 0.72 | 0.57 | 0.58 | 0.46 | 0.09 | 0.13 | 0.07 | 0.06 | 0.51 |

The

yearly_table()

function breaks down signal performance by year, assessing consistency over time.

srr.yearly_table().round(2)

| accuracy | bal_accuracy | pos_sigr | pos_retr | pos_prec | neg_prec | pearson | pearson_pval | kendall | kendall_pval | auc | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| M: MACRO_AVGZ/last => DU05YXR_VT10 | 0.55 | 0.54 | 0.58 | 0.55 | 0.58 | 0.50 | 0.11 | 0.00 | 0.06 | 0.00 | 0.54 |

| Mean | 0.54 | 0.52 | 0.59 | 0.56 | 0.57 | 0.46 | 0.06 | 0.35 | 0.03 | 0.32 | 0.52 |

| PosRatio | 0.81 | 0.73 | 0.65 | 0.73 | 0.77 | 0.46 | 0.85 | 0.58 | 0.77 | 0.65 | 0.73 |

| 2000 | 0.51 | 0.53 | 0.46 | 0.78 | 0.81 | 0.26 | 0.10 | 0.40 | 0.06 | 0.45 | 0.55 |

| 2001 | 0.46 | 0.37 | 0.74 | 0.61 | 0.55 | 0.20 | 0.04 | 0.61 | -0.06 | 0.32 | 0.40 |

| 2002 | 0.60 | 0.49 | 0.81 | 0.67 | 0.66 | 0.31 | 0.04 | 0.56 | 0.06 | 0.24 | 0.49 |

| 2003 | 0.49 | 0.43 | 0.81 | 0.55 | 0.52 | 0.34 | -0.03 | 0.72 | -0.02 | 0.65 | 0.46 |

| 2004 | 0.56 | 0.51 | 0.68 | 0.63 | 0.64 | 0.39 | 0.05 | 0.51 | 0.05 | 0.35 | 0.51 |

| 2005 | 0.52 | 0.52 | 0.52 | 0.51 | 0.53 | 0.51 | 0.04 | 0.61 | -0.00 | 0.97 | 0.52 |

| 2006 | 0.49 | 0.48 | 0.34 | 0.48 | 0.45 | 0.51 | -0.04 | 0.56 | -0.06 | 0.16 | 0.48 |

| 2007 | 0.60 | 0.58 | 0.36 | 0.43 | 0.54 | 0.63 | 0.08 | 0.24 | 0.06 | 0.19 | 0.58 |

| 2008 | 0.51 | 0.58 | 0.29 | 0.63 | 0.74 | 0.41 | 0.21 | 0.00 | 0.14 | 0.00 | 0.57 |

| 2009 | 0.51 | 0.54 | 0.88 | 0.48 | 0.49 | 0.59 | 0.05 | 0.39 | 0.08 | 0.07 | 0.52 |

| 2010 | 0.63 | 0.58 | 0.75 | 0.64 | 0.68 | 0.49 | 0.12 | 0.04 | 0.10 | 0.01 | 0.57 |

| 2011 | 0.53 | 0.51 | 0.59 | 0.63 | 0.64 | 0.38 | -0.10 | 0.09 | -0.02 | 0.64 | 0.51 |

| 2012 | 0.54 | 0.53 | 0.57 | 0.58 | 0.60 | 0.46 | 0.05 | 0.41 | 0.04 | 0.37 | 0.53 |

| 2013 | 0.52 | 0.52 | 0.69 | 0.50 | 0.51 | 0.53 | 0.08 | 0.21 | 0.05 | 0.23 | 0.52 |

| 2014 | 0.60 | 0.55 | 0.62 | 0.72 | 0.76 | 0.35 | 0.12 | 0.06 | 0.10 | 0.02 | 0.56 |

| 2015 | 0.56 | 0.57 | 0.77 | 0.53 | 0.56 | 0.58 | 0.10 | 0.11 | 0.06 | 0.11 | 0.55 |

| 2016 | 0.50 | 0.50 | 0.64 | 0.49 | 0.49 | 0.51 | 0.03 | 0.62 | 0.03 | 0.51 | 0.50 |

| 2017 | 0.55 | 0.56 | 0.41 | 0.51 | 0.58 | 0.53 | 0.15 | 0.01 | 0.06 | 0.11 | 0.55 |

| 2018 | 0.46 | 0.46 | 0.42 | 0.51 | 0.47 | 0.45 | 0.02 | 0.72 | 0.00 | 0.95 | 0.46 |

| 2019 | 0.54 | 0.51 | 0.64 | 0.60 | 0.61 | 0.42 | 0.02 | 0.69 | 0.03 | 0.45 | 0.51 |

| 2020 | 0.59 | 0.45 | 0.85 | 0.67 | 0.66 | 0.24 | -0.05 | 0.40 | -0.10 | 0.01 | 0.47 |

| 2021 | 0.53 | 0.52 | 0.47 | 0.37 | 0.40 | 0.65 | 0.07 | 0.23 | 0.00 | 0.94 | 0.52 |

| 2022 | 0.69 | 0.49 | 0.08 | 0.27 | 0.26 | 0.73 | 0.07 | 0.24 | 0.06 | 0.16 | 0.50 |

| 2023 | 0.54 | 0.56 | 0.32 | 0.55 | 0.64 | 0.49 | 0.09 | 0.14 | 0.07 | 0.07 | 0.56 |

| 2024 | 0.57 | 0.58 | 0.83 | 0.54 | 0.57 | 0.60 | 0.05 | 0.37 | 0.05 | 0.22 | 0.55 |

| 2025 | 0.57 | 0.55 | 0.79 | 0.56 | 0.58 | 0.51 | 0.15 | 0.03 | 0.08 | 0.08 | 0.53 |

Use the

multiple_relations_table()

function to compare multiple signals (and/or frequencies) against a return series in one table.

Each row shows a signal-return pair with its frequency and standard metrics.

srr.multiple_relations_table().round(2)

| accuracy | bal_accuracy | pos_sigr | pos_retr | pos_prec | neg_prec | pearson | pearson_pval | kendall | kendall_pval | auc | ||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Return | Signal | Frequency | Aggregation | |||||||||||

| DU05YXR_VT10 | MACRO_AVGZ | M | last | 0.55 | 0.54 | 0.58 | 0.54 | 0.58 | 0.51 | 0.10 | 0.00 | 0.06 | 0.00 | 0.54 |

| RYLDIRS05Y_NSA_ZN | M | last | 0.55 | 0.54 | 0.71 | 0.54 | 0.56 | 0.51 | 0.08 | 0.00 | 0.05 | 0.00 | 0.53 | |

| XCPI_NEG_ZN | M | last | 0.53 | 0.53 | 0.54 | 0.54 | 0.56 | 0.49 | 0.04 | 0.00 | 0.03 | 0.00 | 0.53 | |

| XGDP_NEG_ZN | M | last | 0.52 | 0.51 | 0.55 | 0.54 | 0.55 | 0.48 | 0.04 | 0.00 | 0.03 | 0.00 | 0.51 | |

| XPCG_NEG_ZN | M | last | 0.52 | 0.53 | 0.36 | 0.54 | 0.58 | 0.48 | 0.06 | 0.00 | 0.05 | 0.00 | 0.53 | |

| EQXR_VT10 | MACRO_AVGZ | M | last | 0.53 | 0.51 | 0.58 | 0.59 | 0.60 | 0.42 | 0.05 | 0.00 | 0.03 | 0.01 | 0.51 |

| RYLDIRS05Y_NSA_ZN | M | last | 0.51 | 0.47 | 0.67 | 0.59 | 0.57 | 0.37 | -0.06 | 0.00 | -0.04 | 0.00 | 0.47 | |

| XCPI_NEG_ZN | M | last | 0.54 | 0.53 | 0.55 | 0.59 | 0.62 | 0.44 | 0.08 | 0.00 | 0.05 | 0.00 | 0.53 | |

| XGDP_NEG_ZN | M | last | 0.51 | 0.50 | 0.55 | 0.59 | 0.60 | 0.41 | 0.03 | 0.07 | 0.01 | 0.60 | 0.50 | |

| XPCG_NEG_ZN | M | last | 0.48 | 0.50 | 0.38 | 0.59 | 0.60 | 0.41 | 0.02 | 0.14 | 0.02 | 0.09 | 0.50 | |

| FXXR_VT10 | MACRO_AVGZ | M | last | 0.52 | 0.52 | 0.59 | 0.52 | 0.54 | 0.50 | 0.05 | 0.00 | 0.03 | 0.00 | 0.52 |

| RYLDIRS05Y_NSA_ZN | M | last | 0.52 | 0.52 | 0.72 | 0.52 | 0.53 | 0.50 | 0.04 | 0.00 | 0.04 | 0.00 | 0.51 | |

| XCPI_NEG_ZN | M | last | 0.51 | 0.51 | 0.54 | 0.52 | 0.53 | 0.49 | 0.01 | 0.39 | 0.01 | 0.21 | 0.51 | |

| XGDP_NEG_ZN | M | last | 0.51 | 0.51 | 0.56 | 0.52 | 0.53 | 0.49 | 0.04 | 0.01 | 0.02 | 0.01 | 0.51 | |

| XPCG_NEG_ZN | M | last | 0.51 | 0.51 | 0.35 | 0.52 | 0.54 | 0.49 | 0.00 | 0.76 | 0.00 | 0.59 | 0.51 |

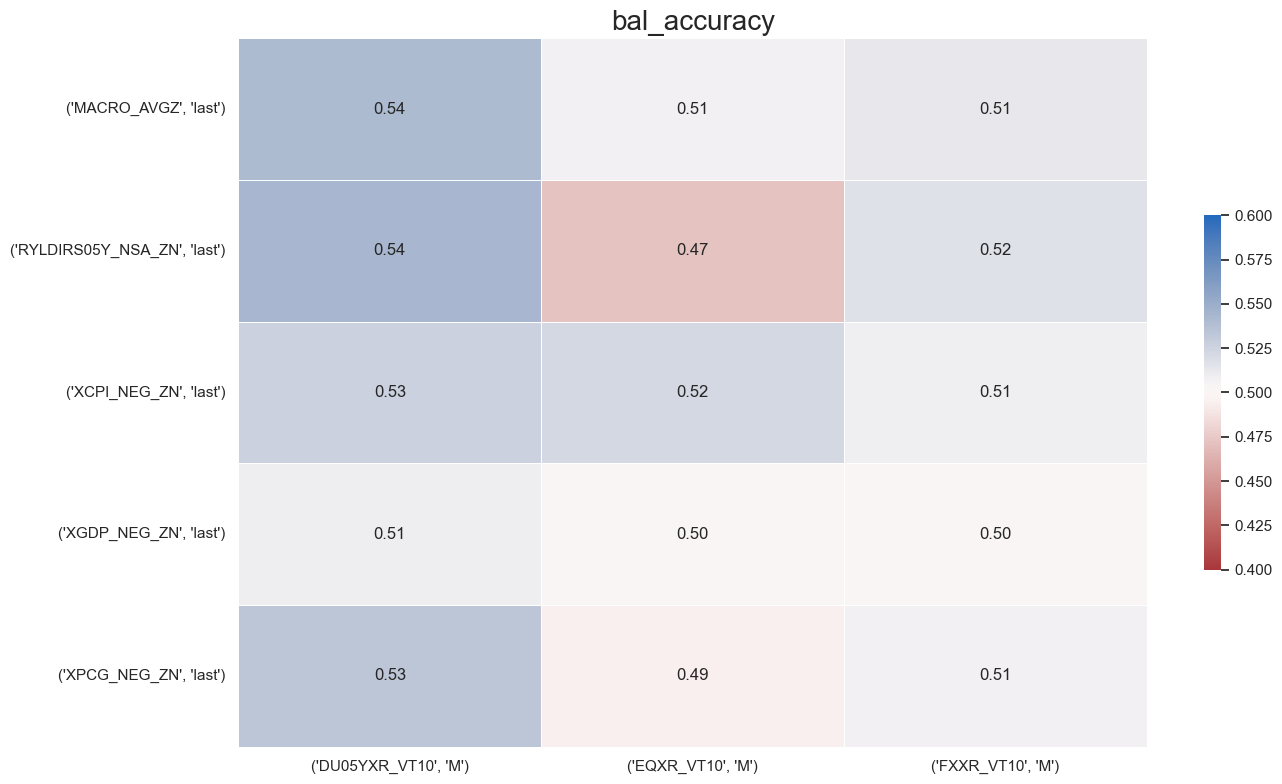

The

single_statistic_table()

function shows a table and heatmap for one chosen metric across all signal-return pairs.

Darker shades in the heatmap indicate stronger or more positive values.

srr.single_statistic_table(stat="bal_accuracy",

show_heatmap=True,

min_color= 0.4,

max_color = 0.6,

title_fontsize=20,

round=2

)

| Return | DU05YXR_VT10 | EQXR_VT10 | FXXR_VT10 | |

|---|---|---|---|---|

| Frequency | M | M | M | |

| Signal | Aggregation | |||

| MACRO_AVGZ | last | 0.540963 | 0.507256 | 0.512603 |

| RYLDIRS05Y_NSA_ZN | last | 0.543418 | 0.472620 | 0.516887 |

| XCPI_NEG_ZN | last | 0.526198 | 0.522384 | 0.508718 |

| XGDP_NEG_ZN | last | 0.509713 | 0.500545 | 0.503055 |

| XPCG_NEG_ZN | last | 0.533591 | 0.493772 | 0.507683 |

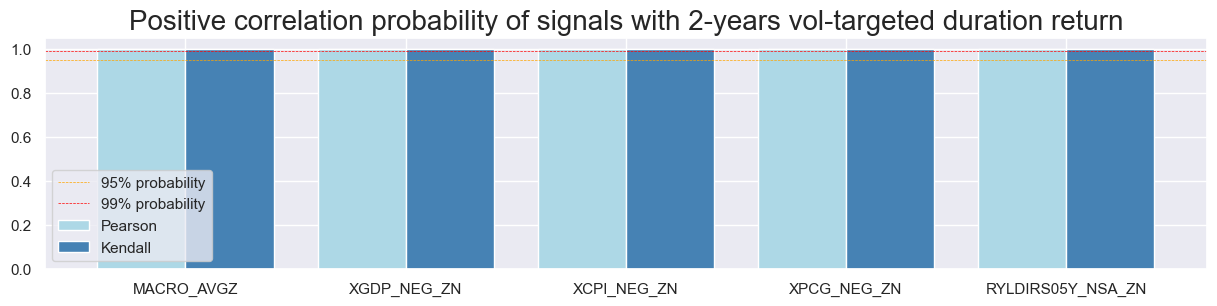

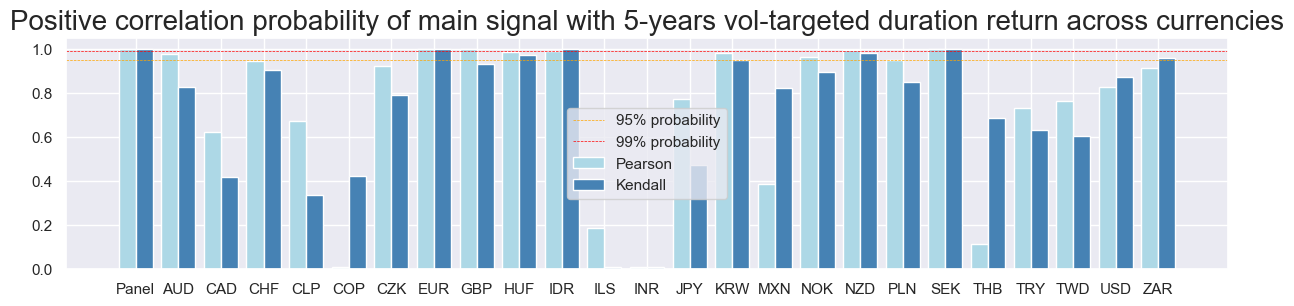

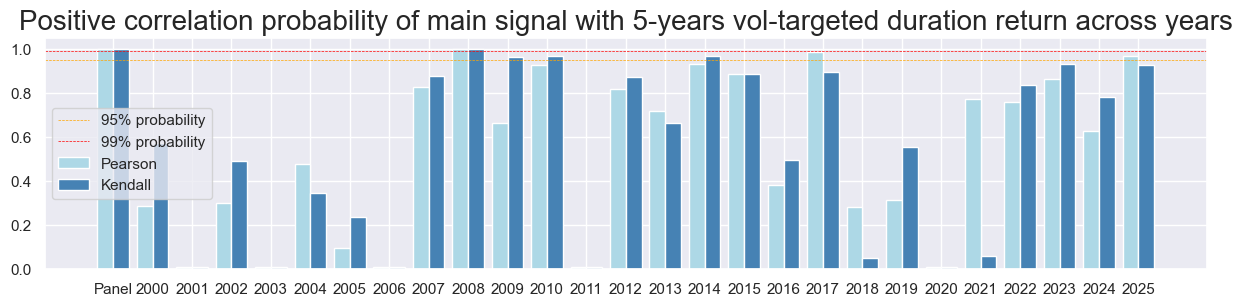

Correlation_bars #

The

correlation_bars()

function plots correlation probabilities (Pearson and Kendall), and their significance, across signals, countries, or years.

You can segment bars by cross-section, calendar year, or signal to see where the relation is strongest or most reliable.

Important parameters:

-

ret: target return category -

sigs: one signal, or a list of signals -

type: segmentation for the bars. i.e."cross_section"(default),"years", or"signals" -

freq: sampling frequency (e.g."M"), if you stored multiple

srr.correlation_bars(type="signals",

size=(15, 3),

title="Positive correlation probability of signals with 2-years vol-targeted duration return",

title_fontsize=20

)

srr.correlation_bars(type="cross_section",

title="Positive correlation probability of main signal with 5-years vol-targeted duration return across currencies",

size=(15, 3),

title_fontsize=20)

srr.correlation_bars(type="years",

size=(15, 3),

title="Positive correlation probability of main signal with 5-years vol-targeted duration return across years",

title_fontsize=20

)

Accuracy_bars #

The

accuracy_bars()

function works like

correlation_bars()

, but shows accuracy and balanced accuracy instead.

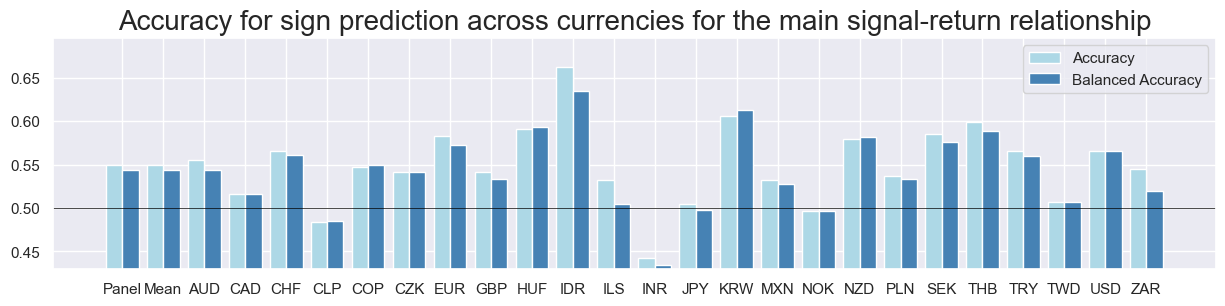

srr.accuracy_bars(type="cross_section",

title="Accuracy for sign prediction across currencies for the main signal-return relationship",

size=(15, 3),

title_fontsize=20

)

Backtesting #

NaivePnL #

The

NaivePnl()

class provides a quick and simple overview of a stylized PnL profile based on trading signals. It is called ‘naive’ because it deliberately ignores transaction costs and position constraints such as risk limits. These are excluded since costs and limitations depend on factors like trading size, institutional practices, and regulations.

Important parameters:

-

ret: Return category. -

sigs: Signal categories. -

bms: List of benchmark tickers against which the correlations of PnL strategies are calculated and displayed. -

blacklist: Cross-sections with date ranges to exclude.

sigs = ["MACRO_AVGZ", "XGDP_NEG_ZN", "XCPI_NEG_ZN", "XPCG_NEG_ZN", "RYLDIRS05Y_NSA_ZN"]

naive_pnl = msn.NaivePnL(

dfx,

ret="DU05YXR_VT10",

sigs=sigs,

cids=cids,

start="2004-01-01",

blacklist=fxblack,

bms=["USD_DU05YXR_NSA"],

)

make_pnl #

The

make_pnl()

function calculates the daily PnL for a chosen signal category and appends it to the class instance’s main DataFrame. A single signal category can generate many different PnL series, depending on how the signal is transformed or specified in its final form.

Important parameters:

-

sig: The signal category you want to turn into a PnL. -

sig_op: Signal transformation. Options:-

zn_score_pan(default): Panel z-score: normalize across the whole cross-section. -

zn_score_cs: Cross-sectional z-score: normalize within a smaller group or per-asset time series. -

binary: Reduces the signal to +1/-1 positions (long or short). -

raw: No transformation.

-

-

rebal_freq: How often positions are rebalanced according to the signal. Options are'daily'(default),'weekly', or'monthly'. At each rebalancing date, only the signal value on that date is used to set positions. Ifmake_zn_scores()is chosen as the method to produce raw signals, this same rebalancing frequency is also applied there. -

rebal_slip: Slippage (delay) in days for rebalancing. Default is1. -

thresh: Cutoff value for capping scores at a specified threshold,the maximum absolute score the function can output. The minimum allowed threshold is one standard deviation. By default, no threshold is applied. -

leverage: Multiplies the raw PnL series by a constant factor. This is a mechanical scaling, it does not change the time-varying riskiness of the strategy, only its overall level. -

vol_scale: Normalizes the strategy’s risk to a target volatility. The function estimates realized volatility over an expanding or rolling window and then scales positions so that the annualized volatility matches the chosen level. This creates a risk-managed PnL, where exposure shrinks during high-vol regimes and expands during low-vol regimes

i.e. Use

leverage

when you want a simple fixed rescaling of PnL and use

vol_scale

when you want dynamic adjustment to volatility.

for sig in sigs:

naive_pnl.make_pnl(

sig,

sig_neg=False,

sig_op="zn_score_pan",

rebal_freq="monthly",

vol_scale=10,

rebal_slip=1,

thresh=2,

pnl_name=sig + "_NEGPZN"

)

for sig in sigs:

naive_pnl.make_pnl(

sig,

sig_neg=False,

sig_op="binary",

rebal_freq="monthly",

vol_scale=10,

rebal_slip=1,

thresh=2,

pnl_name=sig + "_NEGBN")

make_long_pnl #

The

make_long_pnl()

function generates a daily long-only PnL by assuming equal long positions across all markets and time. This acts as a simple benchmark, providing a baseline to compare against signal-driven PnLs.

The

vol_scale

parameter adjusts the PnL to match a chosen annualized volatility level. This makes it easier to compare strategies by putting returns on a common risk scale, helping assess performance relative to volatility.

naive_pnl.make_long_pnl(vol_scale=10, label="Long_Only")

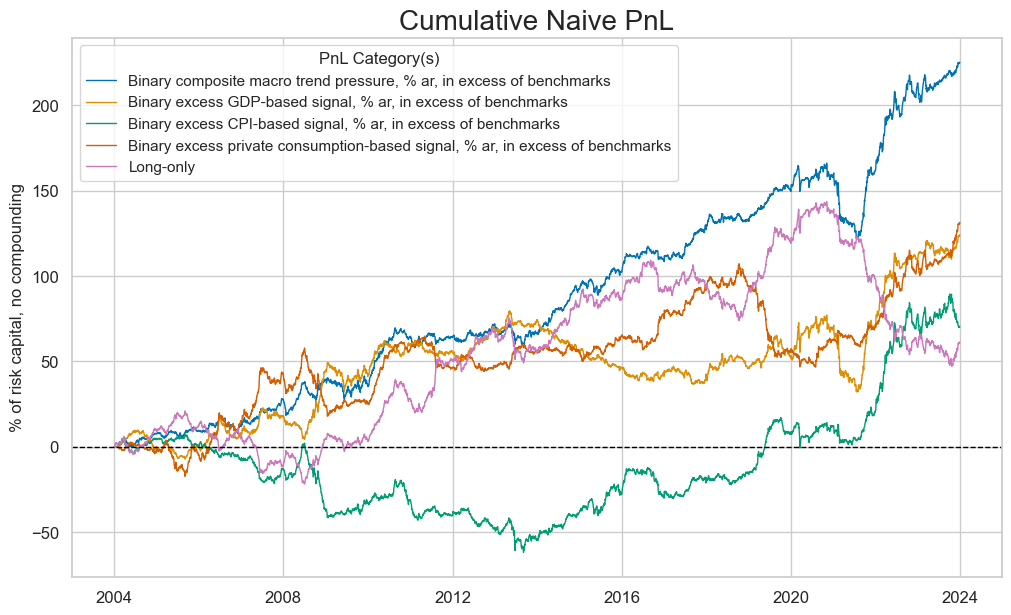

plot_pnls #

Available naive PnLs can be listed with the

pnl_names

attribute:

The

plot_pnls()

function plots cumulative PnL as a line chart. It can show one or multiple PnL types across one or more cross-sections.

dict_labels = {"MACRO_AVGZ_NEGBN": "Binary composite macro trend pressure, % ar, in excess of benchmarks",

"Long_Only": "Long-only",

"XGDP_NEG_ZN_NEGBN": "Binary excess GDP-based signal, % ar, in excess of benchmarks",

"XCPI_NEG_ZN_NEGBN": "Binary excess CPI-based signal, % ar, in excess of benchmarks",

"XPCG_NEG_ZN_NEGBN": "Binary excess private consumption-based signal, % ar, in excess of benchmarks"

}

naive_pnl.plot_pnls(

pnl_cats=[

"MACRO_AVGZ_NEGBN",

"XGDP_NEG_ZN_NEGBN",

"XCPI_NEG_ZN_NEGBN",

"XPCG_NEG_ZN_NEGBN",

"Long_Only",

],

xcat_labels=dict_labels,

pnl_cids=["ALL"],

start="2004-01-01",

end="2023-12-31",

title_fontsize=20

)

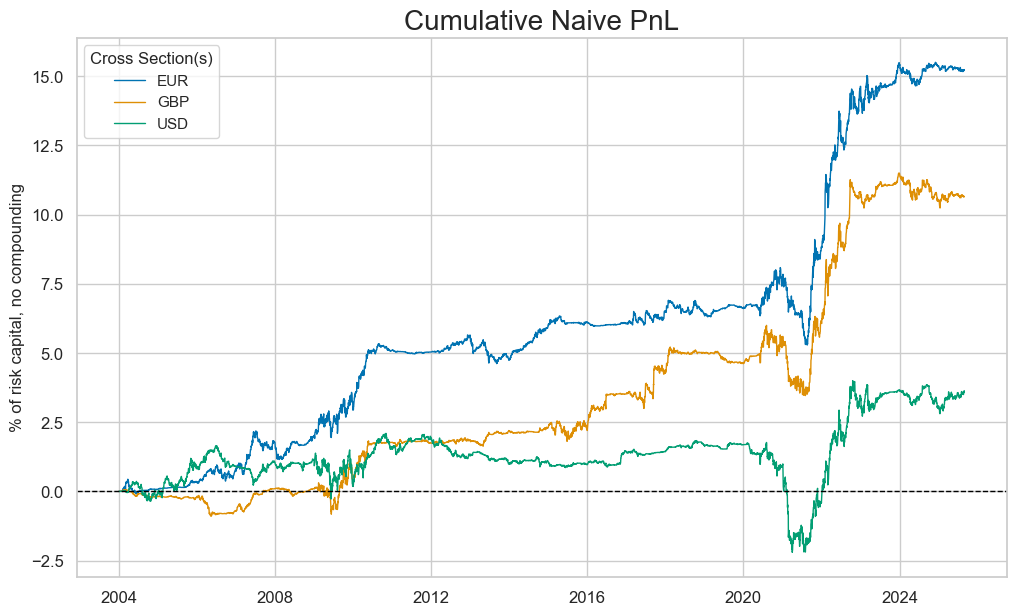

cidx = ["EUR", "GBP", "USD"]

naive_pnl.plot_pnls(

pnl_cats=["MACRO_AVGZ_NEGPZN"],

pnl_cids=cidx,

title_fontsize=20,

start="2004-01-01",

# end="2021-01-01",

)

evaluate_pnls #

The

evaluate_pnls()

function returns a small dataframe of key PnL statistics. For definitions of Sharpe and Sortino ratios, please see

here

The table can only have multiple PnL categories or multiple cross-sections, not both at the same time. The table also shows the daily benchmark correlation of PnLs.

df_eval = naive_pnl.evaluate_pnls(

pnl_cats=["MACRO_AVGZ_NEGBN", "XPCG_NEG_ZN_NEGBN", ], pnl_cids=["ALL"], start="2004-01-01", end="2023-12-01"

)

display(df_eval.astype("float").round(2))

| xcat | MACRO_AVGZ_NEGBN | XPCG_NEG_ZN_NEGBN |

|---|---|---|

| Return % | 11.13 | 6.30 |

| St. Dev. % | 9.61 | 9.68 |

| Sharpe Ratio | 1.16 | 0.65 |

| Sortino Ratio | 1.69 | 0.97 |

| Max 21-Day Draw % | -22.17 | -16.95 |

| Max 6-Month Draw % | -34.91 | -40.03 |

| Peak to Trough Draw % | -44.13 | -60.53 |

| Top 5% Monthly PnL Share | 0.56 | 0.92 |

| USD_DU05YXR_NSA correl | -0.02 | -0.37 |

| Traded Months | 240.00 | 240.00 |

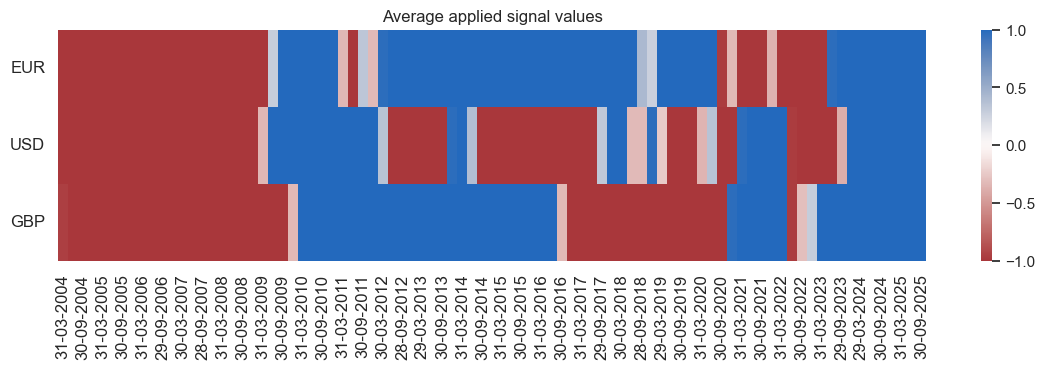

signal_heatmap #

The

signal_heatmap()

function shows a heatmap of signal values over time and cross-sections for a specific strategy.

naive_pnl.signal_heatmap(

pnl_name="XPCG_NEG_ZN_NEGBN",

pnl_cids=["EUR", "USD", "GBP"],

freq="q",

start="2004-01-01",

)

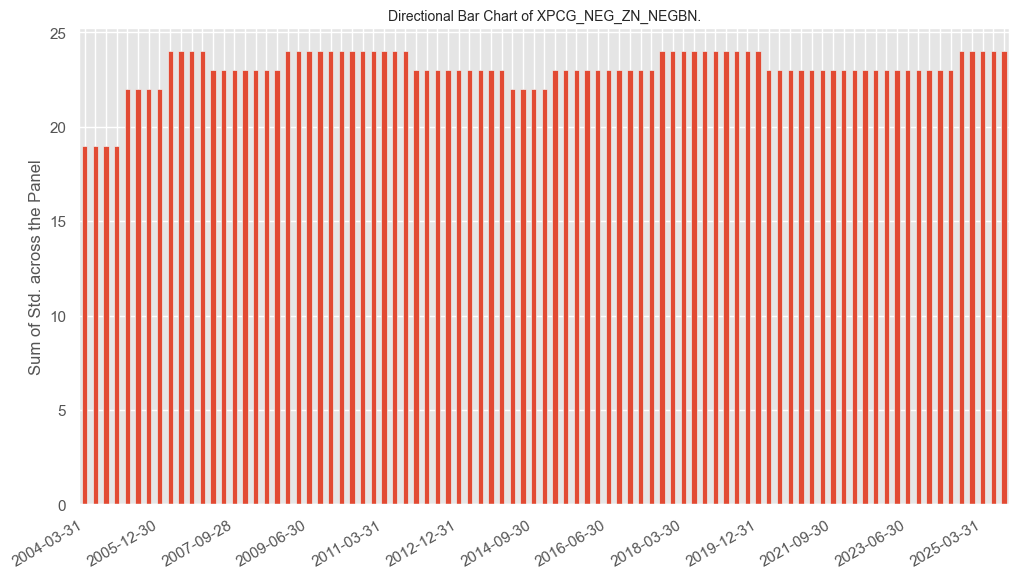

agg_signal_bars #

The

agg_signal_bars()

function shows the size and direction of the aggregate signal over time.

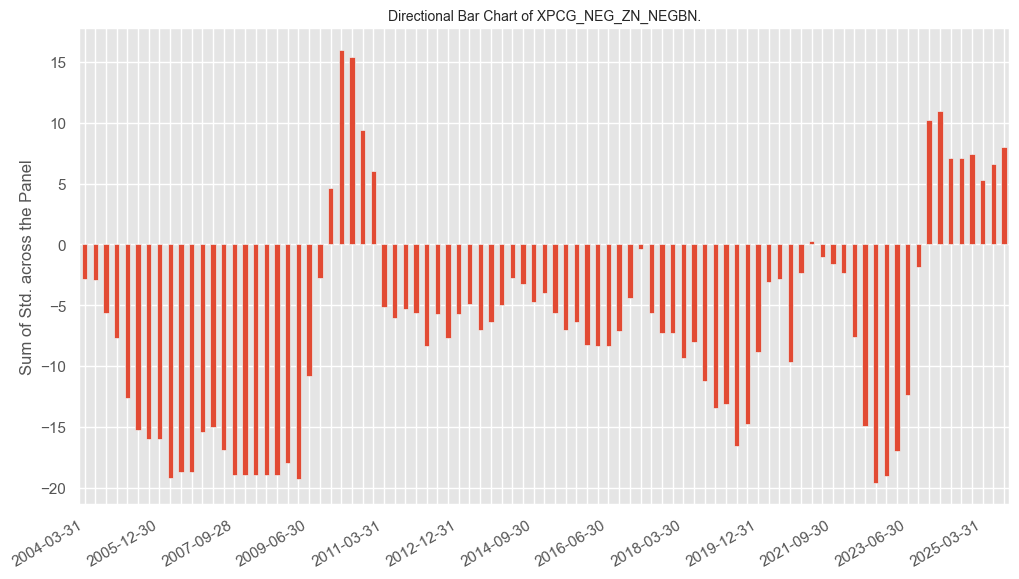

naive_pnl.agg_signal_bars(

pnl_name="XPCG_NEG_ZN_NEGBN",

freq="q",

metric="direction",

)

naive_pnl.agg_signal_bars(

pnl_name="XPCG_NEG_ZN_NEGBN",

freq="q",

metric="strength",

)