Economic surprises and commodity futures returns #

Get packages and JPMaQS data #

Import and setup #

This notebook uses standard packages from the Python data science stack, plus the specialised

macrosynergy

package, which streamlines workflows in two key areas:

-

JPMaQS data download : Simplifies access to macro-quantamental indicators via the JPMorgan DataQuery REST API, handling formatting and filtering with minimal code.

-

Analysing quantamental signals : Accelerates analysis of macro trading signals, with built-in tools for normalisation, charting, and performance attribution.

For full documentation, see our Introduction to the Macrosynergy package or the Kaggle notebook . Technical reference documentation of the package is available on GitHub .

Installation:

pip install macrosynergy --upgrade

Credentials: Set your JPMorgan DataQuery credentials either directly in code or as environment variables:

DQ_CLIENT_ID: str = "your_client_id"

DQ_CLIENT_SECRET: str = "your_client_secret"

Corporate users behind firewalls can configure proxy settings via the PROXY = {} variable ( example here ).

# Constants and credentials

import os

REQUIRED_VERSION: str = "1.2.2"

DQ_CLIENT_ID: str = os.getenv("DQ_CLIENT_ID")

DQ_CLIENT_SECRET: str = os.getenv("DQ_CLIENT_SECRET")

PROXY = {} # Configure if behind corporate firewall

START_DATE: str = "1990-01-01"

import macrosynergy as msy

msy.check_package_version(required_version=REQUIRED_VERSION)

# If version check fails: pip install macrosynergy --upgrade

if not DQ_CLIENT_ID or not DQ_CLIENT_SECRET:

raise ValueError(

"Missing DataQuery credentials. Please set DQ_CLIENT_ID and DQ_CLIENT_SECRET as environment variables or insert them directly in the notebook."

)

# Standard imports

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

import seaborn as sns

from typing import Dict, List, Tuple

import warnings

# Macrosynergy package

import macrosynergy.management as msm

import macrosynergy.panel as msp

import macrosynergy.pnl as msn

import macrosynergy.signal as mss

import macrosynergy.visuals as msv

from macrosynergy.download import JPMaQSDownload

We download macro-quantamental indicators from JPMaQS using the J.P. Morgan DataQuery API via the

macrosynergy

package.

DataQuery expressions follow the structure:

DB(JPMAQS,<cross_section>_<category>,<info>)

, where:

-

JPMAQS: the dataset name -

<cross_section>_<category>: the JPMaQS ticker (e.g.,USD_EQXR01XD) -

<info>: time series type

Common

<info>

attributes include:

-

value: latest available indicator value -

eop_lag: days since end of observation period -

mop_lag: days since mean observation period -

grade: real-time quality metric -

last_updated: timestamp of the last update for the time series

This notebook uses

value

and

eop_lag

attributes.

The

JPMaQSDownload

class takes a list of JPMaQS tickers (

<cross_section>_<category>

format) via

.download(tickers,

start_date,

metrics)

and handles the DataQuery expression construction, throttle limits, and parallel data requests automatically.

Data selection and download #

# Currency area groupings for macro analysis

cids_dmca: List[str] = [

"AUD", "CAD", "CHF", "EUR", "GBP",

"JPY", "NOK", "NZD", "SEK", "USD"

] # Developed market currency areas

cids_latm: List[str] = ["BRL", "COP", "CLP", "MXN", "PEN"] # Latin America

cids_emea: List[str] = ["CZK", "HUF", "ILS", "PLN", "RON", "RUB", "TRY", "ZAR"] # EMEA

cids_emas: List[str] = ["CNY", "IDR", "INR", "KRW", "MYR", "PHP", "SGD", "THB", "TWD"] # EM Asia

# Aggregate currency groupings

cids_dm: List[str] = cids_dmca

cids_em: List[str] = cids_latm + cids_emea + cids_emas

cids: List[str] = sorted(cids_dm + cids_em)

# Commodity-sensitive FX

cids_cofx: List[str] = ["AUD", "BRL", "CAD", "CLP", "NZD", "PEN", "RUB"]

# Commodity cross-sections by sector

cids_bams: List[str] = ["ALM", "CPR", "LED", "NIC", "TIN", "ZNC"] # Base metals

cids_prms: List[str] = ["PAL", "PLT"] # Precious industrial metals

cids_fuen: List[str] = ["BRT", "WTI", "HOL", "GSO"] # Energy

cids_gold: List[str] = ["GLD"] # Gold

cids_coms: List[str] = cids_bams + cids_prms + cids_fuen # Non-gold commodities

# Quantamental categories of interest

# Industrial production transformations

ip_monthly: List[str] = ["P3M3ML3AR", "P6M6ML6AR", "P1M1ML12_3MMA"]

ip_quarterly: List[str] = ["P1Q1QL1AR", "P2Q2QL2AR", "P1Q1QL4"]

# Generate all IP indicators (monthly + quarterly)

ips: List[str] = [

f"IP_SA_{transform}_ARMAS"

for transform in ip_monthly + ip_quarterly

]

# Confidence survey transformations

confidence_monthly: List[str] = [

"_3MMA",

"_D1M1ML1",

"_D3M3ML3",

"_D6M6ML6",

"_3MMA_D1M1ML12",

"_D1M1ML12",

]

confidence_quarterly: List[str] = ["_D1Q1QL1", "_D2Q2QL2", "_D1Q1QL4"]

confidence_transforms: List[str] = [""] + confidence_monthly + confidence_quarterly

# Manufacturing confidence (all transformations)

mcs: List[str] = [

f"MBCSCORE_SA{transformation}_ARMAS"

for transformation in confidence_transforms

]

# Construction confidence (all transformations)

ccs: List[str] = [

f"CBCSCORE_SA{transformation}_ARMAS"

for transformation in confidence_transforms

]

# Core analytical factors (primary signals)

main: List[str] = ips + mcs + ccs

# Economic context indicators

econ: List[str] = [

"USDGDPWGT_SA_1YMA", # USD-weighted GDP trends (1-year)

"USDGDPWGT_SA_3YMA", # USD-weighted GDP trends (3-year)

"IVAWGT_SA_1YMA", # Investment value-added weights

]

# Market context indicators

mark: List[str] = [

"COXR_VT10", # Commodity return, vol-targeted

"EQXR_NSA", # Equity index futures returns

"EQXR_VT10", # Equity index futures returns, vol-targeted

]

# Combine all categories

xcats: List[str] = main + econ + mark

For further documentation of the indicators used see the Macro Quantamental Academy or JPMorgan Markets (password protected):

# Construct list of JPMaQS tickers for download

tickers: List[str] = []

# Core analytical indicators for all cross-sections

tickers += [f"{cid}_{xcat}" for cid in cids for xcat in main]

# Economic context indicators for all cross-sections

tickers += [f"{cid}_{xcat}" for cid in cids for xcat in econ]

# Market context indicators with specific rules

for xcat in mark:

if xcat.startswith("CO"): # Commodity returns: use commodity cross-sections

tickers += [f"{cid}_{xcat}" for cid in cids_coms + cids_gold]

elif xcat.startswith("EQ"): # Equity indicators: USD only (S&P 500)

tickers += [f"USD_{xcat}"]

else:

raise NotImplementedError(f"Unknown category for mark: {xcat}")

print(f"Maximum number of JPMaQS tickers to be downloaded is {len(tickers)}")

Maximum number of JPMaQS tickers to be downloaded is 943

# Download macro-quantamental indicators from JPMaQS via the DataQuery API

with JPMaQSDownload(

client_id=DQ_CLIENT_ID,

client_secret=DQ_CLIENT_SECRET,

proxy=PROXY

) as downloader:

df: pd.DataFrame = downloader.download(

tickers=tickers,

start_date=START_DATE,

metrics=["value", "eop_lag"],

suppress_warning=True,

show_progress=True,

report_time_taken=True,

get_catalogue=True,

)

Downloading the JPMAQS catalogue from DataQuery...

Downloaded JPMAQS catalogue with 23201 tickers.

Removed 788/1886 expressions that are not in the JPMaQS catalogue.

Downloading data from JPMaQS.

Timestamp UTC: 2025-06-26 14:05:41

Connection successful!

Requesting data: 100%|█████████████████████████████████████████████████████████████████| 55/55 [00:11<00:00, 4.93it/s]

Downloading data: 100%|████████████████████████████████████████████████████████████████| 55/55 [00:38<00:00, 1.44it/s]

Time taken to download data: 55.63 seconds.

# Preserve original downloaded data for debugging and comparison

dfx = df.copy()

dfx.info()

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 3790405 entries, 0 to 3790404

Data columns (total 5 columns):

# Column Dtype

--- ------ -----

0 real_date datetime64[ns]

1 cid object

2 xcat object

3 value float64

4 eop_lag float64

dtypes: datetime64[ns](1), float64(2), object(2)

memory usage: 144.6+ MB

Availability #

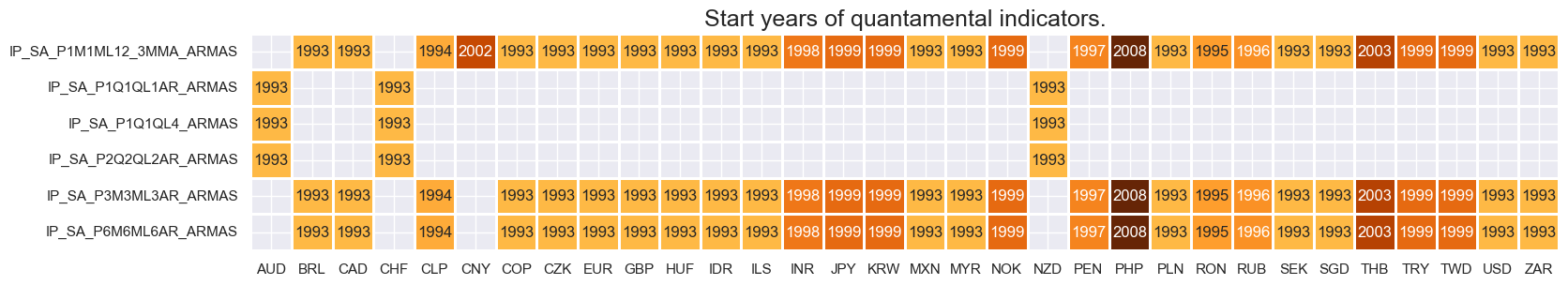

# Availability of industry growth rates

xcatx = [xc for xc in main if xc[:3] == "IP_"]

cidx = cids

msm.check_availability(df, xcats=xcatx, cids=cidx, missing_recent=False)

# Availability of manufacturing survey scores

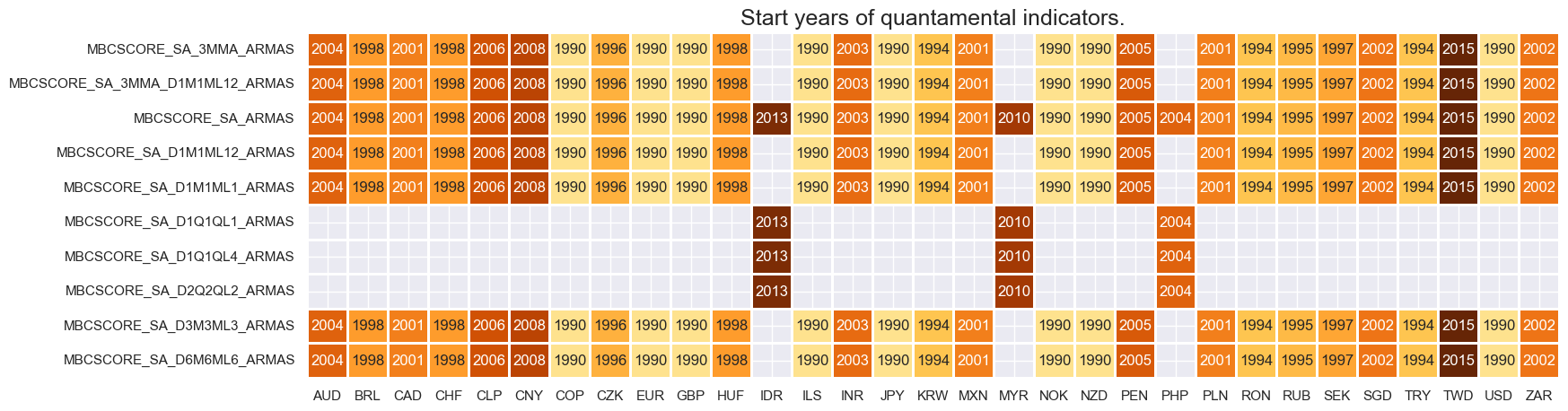

xcatx = [xc for xc in main if xc[:3] == "MBC"]

cidx = cids

msm.check_availability(df, xcats=xcatx, cids=cidx, missing_recent=False)

# Availability of construction survey scores

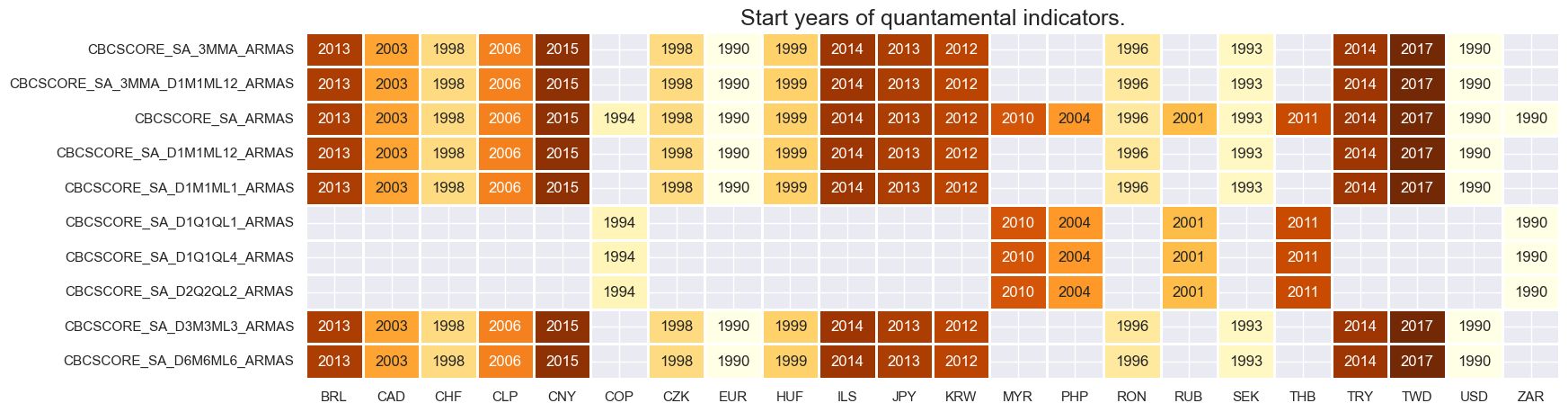

xcatx = [xc for xc in main if xc[:3] == "CBC"]

cidx = cids

msm.check_availability(dfx, xcats=xcatx, cids=cidx, missing_recent=False)

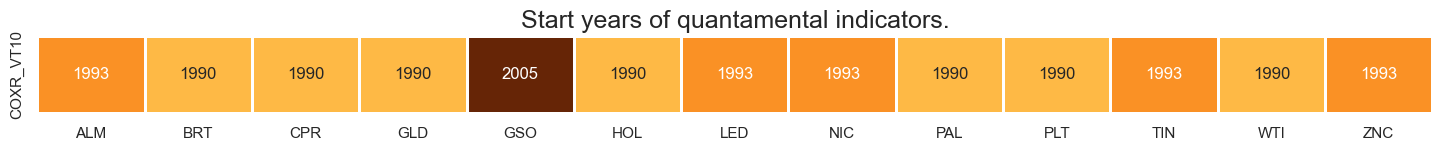

# Availability of market indicators for commodity strategy

xcatx = mark

cidx = cids_coms + ["GLD"] # Commodity cross-sections for strategy focus

msm.check_availability(dfx, xcats=xcatx, cids=cidx, missing_recent=False)

Feature engineering and checks #

Extract base tickers and their release frequencies #

# Step 1: Extract category tickers for all base indicators of surprises

base_xcats = [xcat for xcat in main if xcat.endswith("_ARMAS")]

# Step 2: Get availability counts for each country-indicator combination

xcatx: List[str] = base_xcats

cidx: List[str] = cids

availability_counts: pd.DataFrame = (

msm.reduce_df(dfx, xcats=xcatx, cids=cidx)

.groupby(["cid", "xcat"], as_index=False)["value"]

.count()

)

# Step 3: Extract observation period frequency from transformation codes

availability_counts["transformation"] = (

availability_counts["xcat"].str.split("_").str[2]

) # Cleaner extraction

availability_counts["frequency"] = availability_counts["transformation"].str[

2:3

] # 3rd character (M or Q)

# Step 4: Create country-indicator base identifiers (e.g., "AUD_IP")

availability_counts["country_indicator"] = (

availability_counts["cid"]

+ "_"

+ availability_counts["xcat"]

.str.split("_")

.str[0] # First part (IP, MBCSCORE, CBCSCORE)

)

# Step 5: Determine dominant frequency for each country-indicator combination

# (Quarterly takes precedence over monthly if both exist)

frequency_priority = {"Q": 2, "M": 1, None: 0} # Clear priority mapping

availability_counts["freq_priority"] = availability_counts["frequency"].map(

frequency_priority

)

# Step 6: Get the highest frequency for each country-indicator base

dominant_frequency = availability_counts.groupby("country_indicator", as_index=False)[

"freq_priority"

].max()

# Step 7: Convert back to frequency labels and create final mapping

priority_to_freq = {2: "Q", 1: "M", 0: "M"} # Default unknown to M

dominant_frequency["frequency"] = dominant_frequency["freq_priority"].map(

priority_to_freq

)

# Step 8: Create final frequency dictionary

quarterly_indicators = dominant_frequency[dominant_frequency["frequency"] == "Q"][

"country_indicator"

].tolist()

monthly_indicators = dominant_frequency[dominant_frequency["frequency"] == "M"][

"country_indicator"

].tolist()

dict_freq = {"Q": quarterly_indicators, "M": monthly_indicators}

print(f"Quarterly indicators: {len(dict_freq['Q'])}")

print(f"Monthly indicators: {len(dict_freq['M'])}")

Quarterly indicators: 12

Monthly indicators: 73

Normalize and annualize ARMA surprises #

# Generate ARMAS surprise indicators for strategy signals

xcatx = base_xcats

cidx = cids

dfxx = msm.reduce_df(dfx, xcats=xcatx, cids=cidx)

# Create sparse dataframe with information state changes

isc_obj = msm.InformationStateChanges.from_qdf(

df=dfxx,

norm=True, # normalizes changes by first release values

std="std",

halflife=36, # for volatility scaling only

min_periods=36,

score_by="level",

)

# Convert to dense quantamental dataframe

dfa = isc_obj.to_qdf(value_column="zscore", postfix="N", thresh=3)

dfa = dfa.dropna(subset=["value"])

basic_cols = ["real_date", "cid", "xcat", "value"]

dfx = msm.update_df(dfx, dfa[basic_cols])

# Convert surprise indicators to annualized units for strategy signals

xcatx = [xc + "N" for xc in base_xcats]

cidx = cids

dfa = msm.reduce_df(dfx, xcats=xcatx, cids=cidx)

dfa["cx"] = dfa["cid"] + "_" + dfa["xcat"].str.split("_").str[0]

filt_q = dfa["cx"].isin(dict_freq["Q"])

# Apply frequency-based scaling for annualization

dfa.loc[filt_q, "value"] *= np.sqrt(1/4) # Quarterly indicators

dfa.loc[~filt_q, "value"] *= np.sqrt(1/12) # Monthly indicators

# Add annualized suffix and clean up

dfa["xcat"] += "A"

basic_cols = ["real_date", "cid", "xcat", "value"]

dfx = msm.update_df(dfx, dfa[basic_cols])

Rename quarterly indicators to monthly equivalents for strategy consistency #

dict_repl = {

# Industrial production: quarterly → monthly equivalents

"IP_SA_P1Q1QL1AR": "IP_SA_P3M3ML3AR",

"IP_SA_P2Q2QL2AR": "IP_SA_P6M6ML6AR",

"IP_SA_P1Q1QL4": "IP_SA_P1M1ML12_3MMA",

# Manufacturing confidence: quarterly → monthly equivalents

"MBCSCORE_SA_D1Q1QL1": "MBCSCORE_SA_D3M3ML3",

"MBCSCORE_SA_D2Q2QL2": "MBCSCORE_SA_D6M6ML6",

"MBCSCORE_SA_D1Q1QL4": "MBCSCORE_SA_3MMA_D1M1ML12",

# Construction confidence: quarterly → monthly equivalents

"CBCSCORE_SA_D1Q1QL1": "CBCSCORE_SA_D3M3ML3",

"CBCSCORE_SA_D2Q2QL2": "CBCSCORE_SA_D6M6ML6",

"CBCSCORE_SA_D1Q1QL4": "CBCSCORE_SA_3MMA_D1M1ML12",

}

# Build complete replacement mapping in one step

models = ["_ARMAS", "_ARMASN", "_ARMASNA"]

complete_replacements = {

quarterly_indicator + suffix: monthly_indicator + suffix

for quarterly_indicator, monthly_indicator in dict_repl.items()

for suffix in models

}

# Transform quarterly indicators to monthly equivalents in single operation

dfx["xcat"] = dfx["xcat"].replace(complete_replacements)

dfx = dfx.sort_values(["cid", "xcat", "real_date"])

# Create user-friendly indicator names for visualization

indicator_labels = {

"IP_SA_P1M1ML12_3MMA_ARMAS": "Industry growth",

"MBCSCORE_SA_ARMAS": "Manufacturing confidence",

"CBCSCORE_SA_ARMAS": "Construction confidence",

}

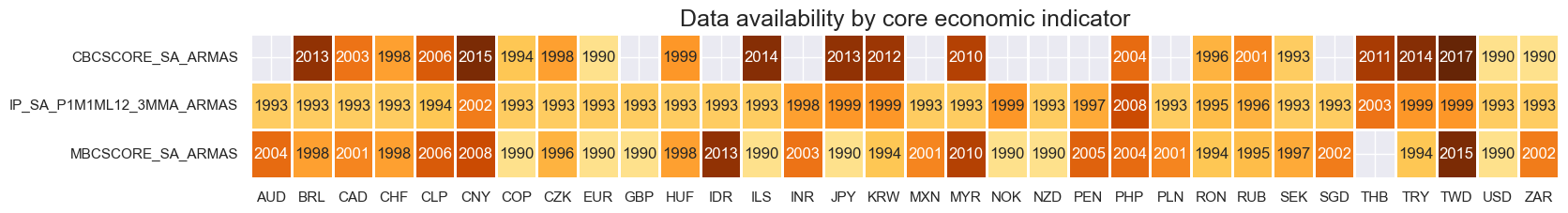

# Generate availability chart for core economic indicators

xcatx: List[str] = list(indicator_labels.keys())

cidx: List[str] = cids

msm.check_availability(

dfx,

xcats=xcatx,

cids=cidx,

missing_recent=False,

title="Data availability by core economic indicator",

start_size=(18, 2),

#xcat_labels=indicator_labels

)

# Create indicator groups for strategy signal construction

def filter_by_indicator_type(indicators: List[str]) -> Dict[str, List[str]]:

"""Group indicators by economic report type."""

return {

'industrial': [ind for ind in indicators if ind.startswith("IP_")],

'manufacturing': [ind for ind in indicators if ind.startswith("MBC")],

'construction': [ind for ind in indicators if ind.startswith("CBC")]

}

# Annualized surprise indicators (available in dataset)

available_armas: List[str] = list(set(base_xcats) & set(dfx.xcat.unique())) # Remove quarterly (non-existing)

annualized_surprises: List[str] = [xc + "NA" for xc in available_armas]

surprise_groups: Dict[str, List[str]] = filter_by_indicator_type(annualized_surprises)

print(f"Surprise indicators: {len(annualized_surprises)}")

Surprise indicators: 17

Composite economic surprises (across transformations of base indicator) #

# Create linear composites of surprises and changes

cidx = cids

# Surprises configuration

dict_surprises: Dict[str, List[str]] = {

"IND": surprise_groups["industrial"],

"MBC": surprise_groups["manufacturing"],

"CBC": surprise_groups["construction"],

}

composite_dfs = []

# Create surprise composites

for base, xcatx in dict_surprises.items():

with warnings.catch_warnings():

warnings.simplefilter("ignore", category=UserWarning)

composite_dfs.append(msp.linear_composite(dfx, xcats=xcatx, cids=cidx, new_xcat=f"{base}_ARMASNA"))

# Store in main dataframe

dfa = pd.concat(composite_dfs, axis=0, ignore_index=True)

dfx = msm.update_df(dfx, dfa)

# Labels and list of composite factors

dict_csnames: Dict[str, List[str]] = {

"IND_ARMASNA": "Industrial production composite",

"MBC_ARMASNA": "Manufacturing business confidence composite",

"CBC_ARMASNA": "Construction business confidence composite",

}

comp_surprises = [key for key in dict_csnames.keys()]

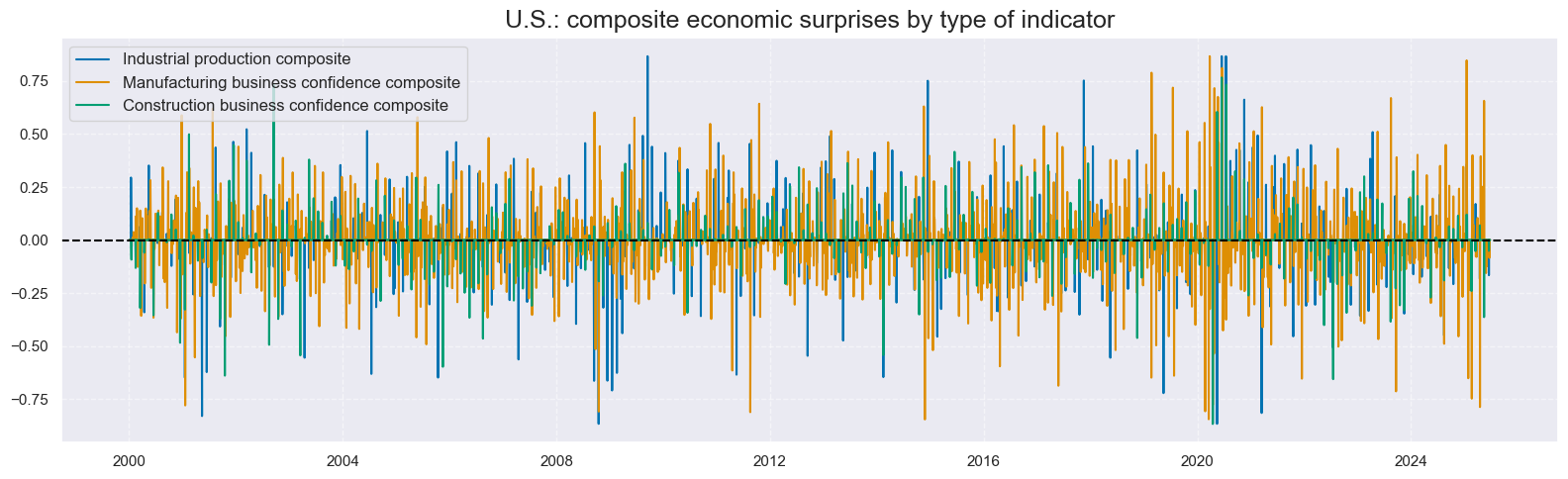

# Inspect time-series of linear composite factors

xcatx = comp_surprises

cidx = ["USD"]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=3,

title="U.S.: composite economic surprises by type of indicator",

size=(16, 5),

xcat_labels=dict_csnames,

start="2000-01-01",

)

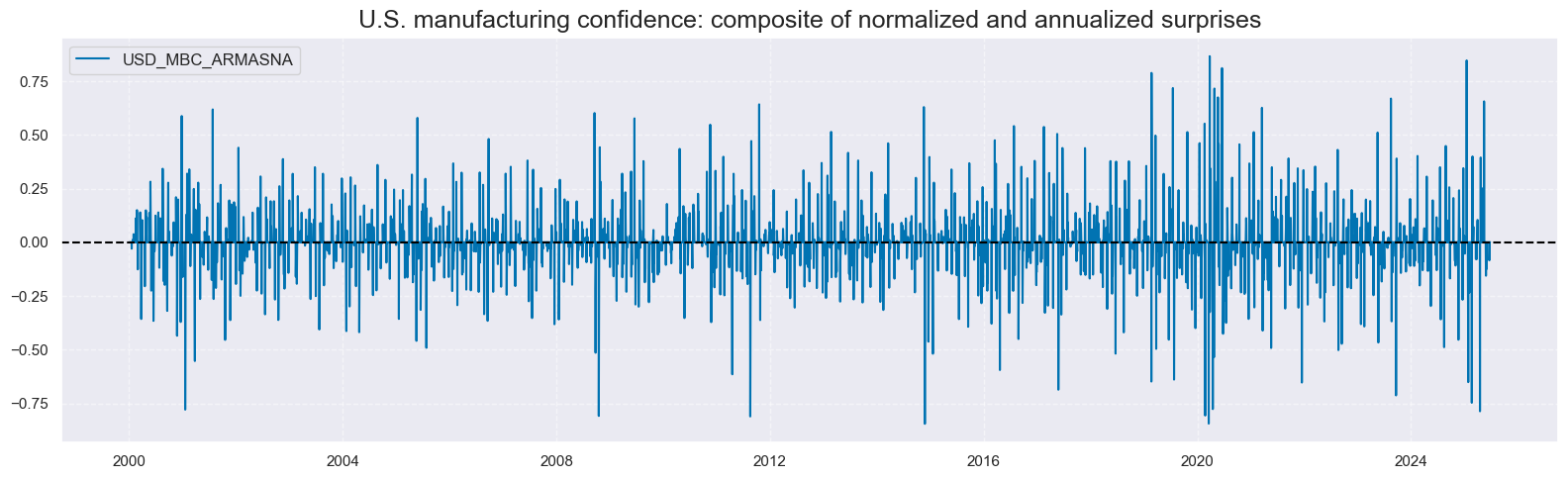

# Inspect time-series of specific linear composite factor

xcatx = ["MBC_ARMASNA"]

cidx = ["USD"]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

title="U.S. manufacturing confidence: composite of normalized and annualized surprises",

size=(16, 5),

start="2000-01-01",

)

Exponentially moving sums #

xcatx = comp_surprises

cidx = cids

hts = [3] # Half-lives

dfa = msm.reduce_df(dfx, xcats=xcatx, cids=cidx)

dfa["ticker"] = dfa["cid"] + "_" + dfa["xcat"]

p = dfa.pivot(index="real_date", columns="ticker", values="value")

store = []

for ht in hts:

proll = p.ewm(halflife=ht).sum()

proll.columns += f"_{ht}DXMS"

df_temp = proll.stack().to_frame("value").reset_index()

df_temp[["cid", "xcat"]] = df_temp["ticker"].str.split("_", n=1, expand=True)

store.append(df_temp[["cid", "xcat", "real_date", "value"]])

dfx = msm.update_df(dfx, pd.concat(store, axis=0, ignore_index=True))

# Generate lists of moving sum indicators

dict_csnames_3d = {

k + "_3DXMS": v + " 3-day half-life moving sum" for k, v in dict_csnames.items()

}

comp_surprises_3d = [key for key in dict_csnames_3d.keys()]

# Inspect time-series of linear composite factors

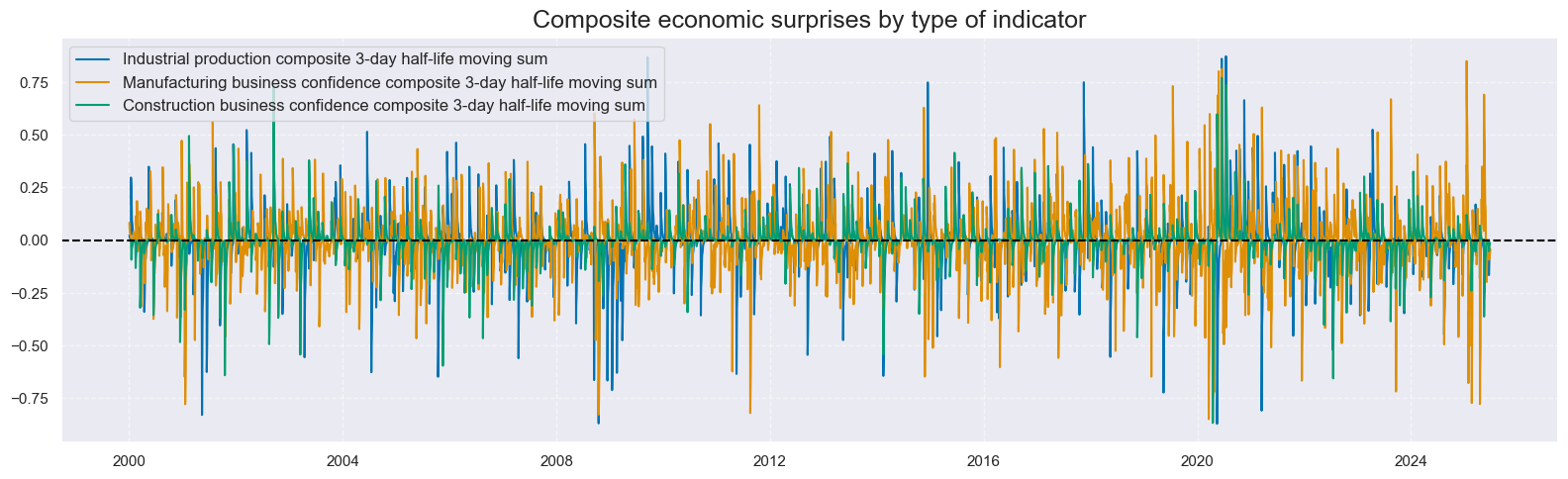

xcatx = comp_surprises_3d

cidx = ["USD"]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=3,

title="Composite economic surprises by type of indicator",

size=(16, 5),

xcat_labels=dict_csnames_3d,

start="2000-01-01",

)

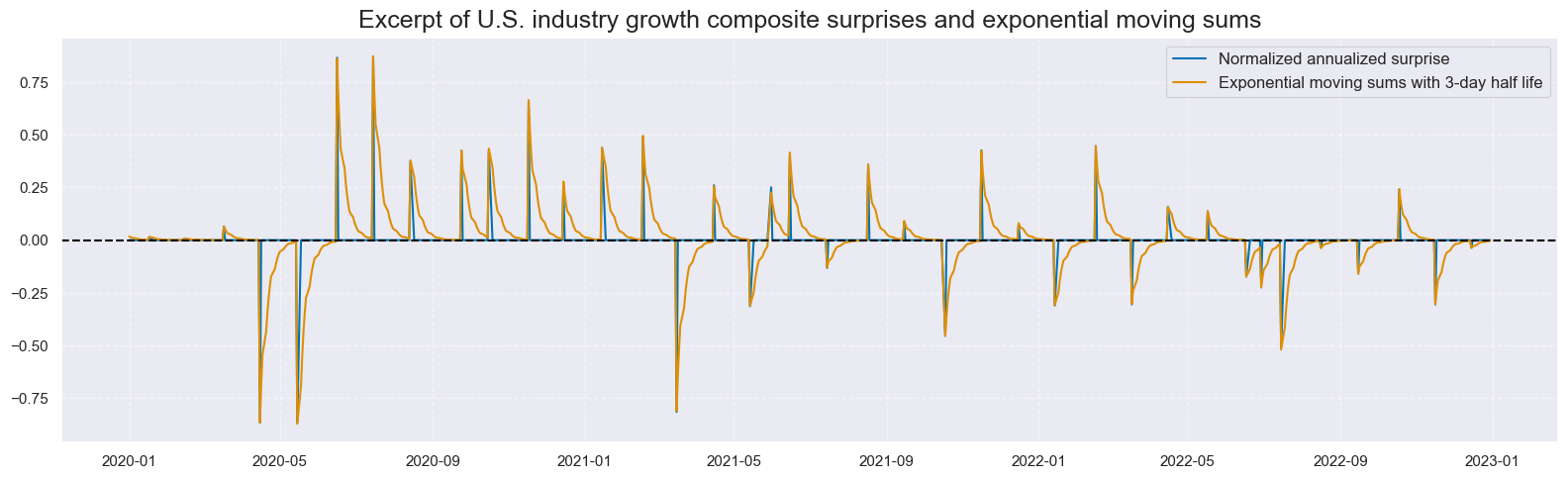

xc = "IND"

xcatx = [xc + "_ARMASNA", xc + "_ARMASNA_3DXMS"]

cidx = ["USD"]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

start="2020-01-01",

end="2023-01-01",

title="Excerpt of U.S. industry growth composite surprises and exponential moving sums",

xcat_labels=[

"Normalized annualized surprise",

"Exponential moving sums with 3-day half life",

],

size=(16, 5),

)

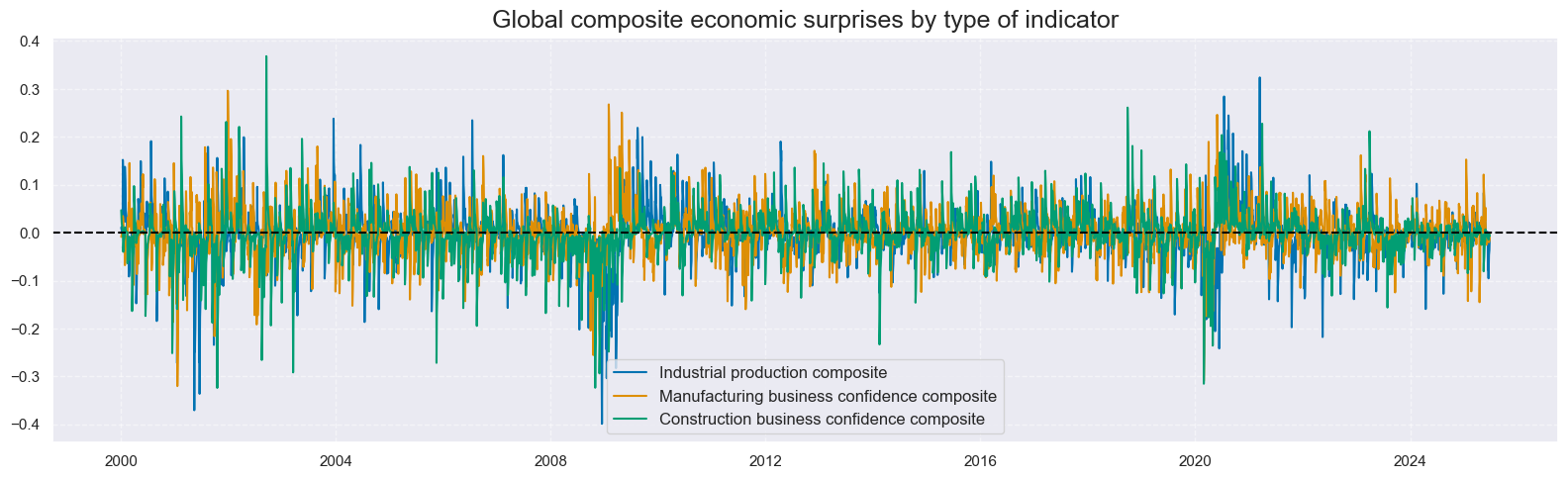

Global composite surprises #

# Create global weighted composites using investment value-added weights

xcatx: List[str] = comp_surprises_3d

cidx: List[str] = cids

store: List[pd.DataFrame] = []

for xcat in xcatx:

dfr = msm.reduce_df(dfx, cids=cidx, xcats=[xcat, "IVAWGT_SA_1YMA"])

with warnings.catch_warnings():

warnings.simplefilter("ignore", category=UserWarning)

dfa = msp.linear_composite(

df=dfr,

xcats=xcat,

cids=cidx,

weights="IVAWGT_SA_1YMA",

new_cid="GLB",

complete_cids=False,

)

store.append(dfa)

dfx = msm.update_df(dfx, pd.concat(store, axis=0, ignore_index=True))

# Plot global composite signals by indicator type

cidx: List[str] = ["GLB"]

xcatx: List[str] = comp_surprises_3d

# Restructure data for plotting multiple series on single charts

dfa = msm.reduce_df(dfx, xcats=xcatx, cids=cidx)

dfa["ticker"] = dfa["cid"] + "_" + dfa["xcat"]

dfa["cid"] = dfa["ticker"].str[4:7] # Extract indicator type (IND, MBC, CBC)

dfa["xcat"] = dfa["ticker"].str[8:] # Extract signal type for comparison

# Labels and list of composite factors

dict_csnames_3d: Dict[str, List[str]] = {

"IND_ARMASNA_3DXMS": "Industrial production composite",

"MBC_ARMASNA_3DXMS": "Manufacturing business confidence composite",

"CBC_ARMASNA_3DXMS": "Construction business confidence composite",

}

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=3,

title="Global composite economic surprises by type of indicator",

size=(16, 5),

xcat_labels=dict_csnames_3d,

start="2000-01-01",

)

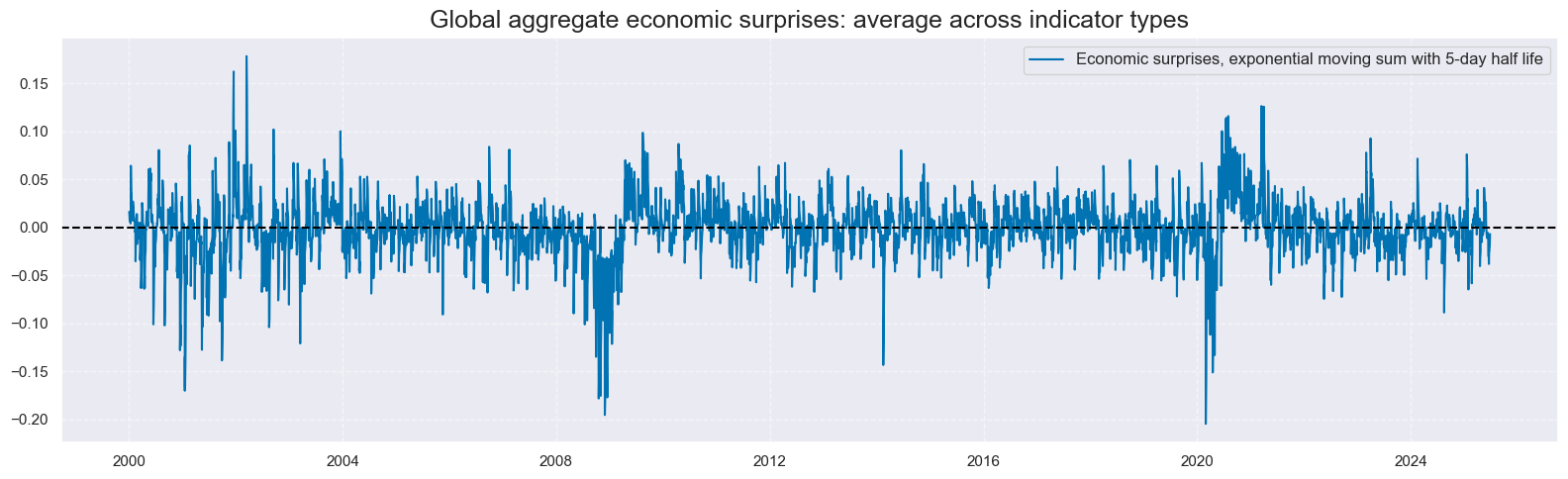

Grand total global economic surprises #

# Create global aggregates across indicator categories (IND + MBC + CBC)

cidx: List[str] = ["GLB"]

dict_aggs: Dict[str, List[str]] = {

"ARMASNA_3DXMS": comp_surprises_3d, # 3-day surprise aggregate

}

store: List[pd.DataFrame] = []

for aggregate_name, component_xcats in dict_aggs.items():

store.append(msp.linear_composite(dfx, xcats=component_xcats, cids=cidx, new_xcat=aggregate_name))

dfx = msm.update_df(dfx, pd.concat(store, axis=0, ignore_index=True))

# Store list of global aggregate indicators

global_aggregates: List[str] = list(dict_aggs.keys())

xcat_labels = {

"ARMASNA_3DXMS": "Economic surprises, exponential moving sum with 5-day half life"

}

xcatx = list(xcat_labels.keys())

cidx = ["GLB"]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

title="Global aggregate economic surprises: average across indicator types",

xcat_labels=xcat_labels,

size=(16, 5),

start="2000-01-01",

)

Target returns and checks #

Vol-targeted contract returns #

# Industrial commodities

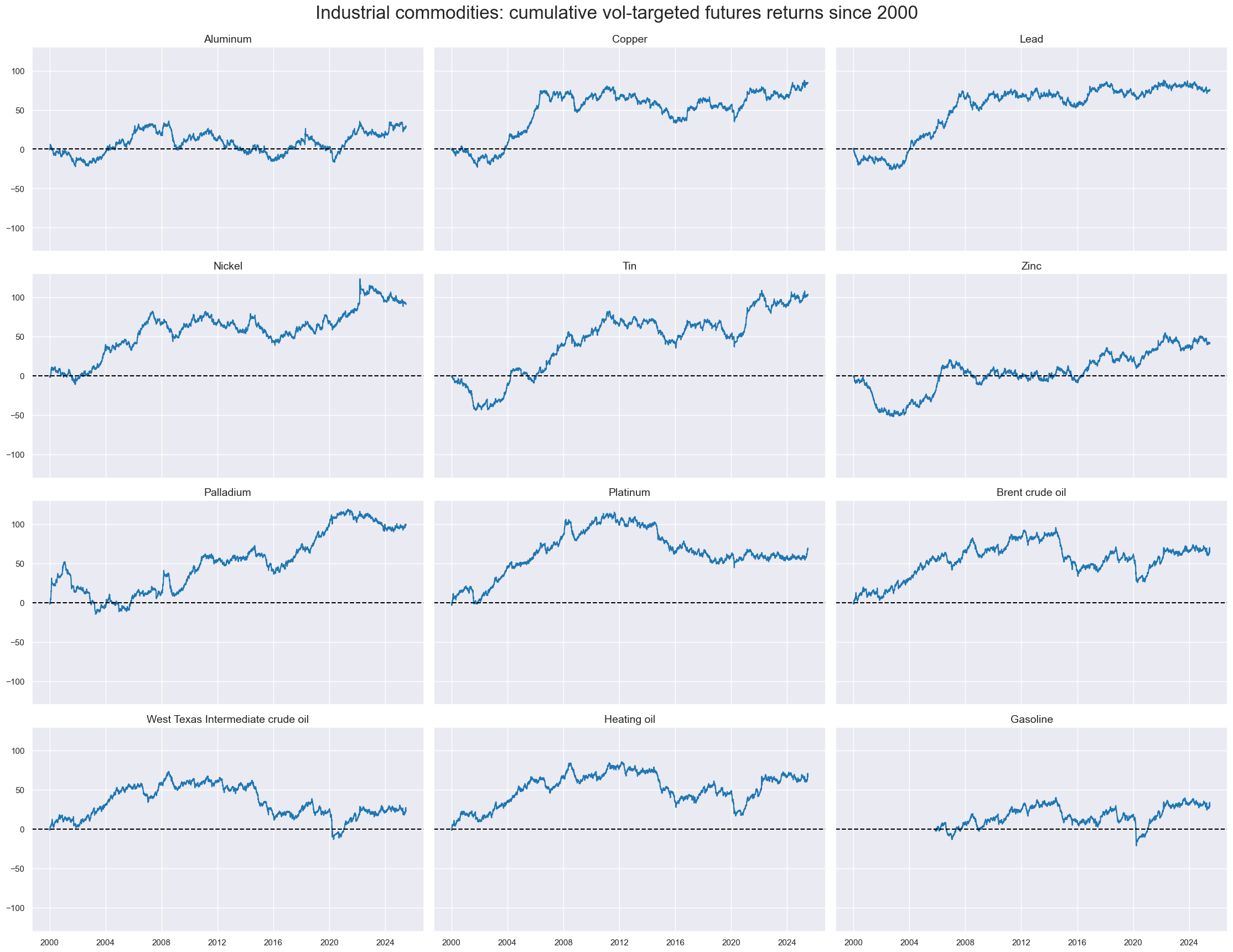

cidx = cids_coms

xcatx = ["COXR_VT10"]

dict_coms: Dict[str, List[str]] = {

"BRT": "Brent crude oil",

"WTI": "West Texas Intermediate crude oil",

"GSO": "Gasoline",

"HOL": "Heating oil",

"ALM": "Aluminum",

"CPR": "Copper",

"LED": "Lead",

"NIC": "Nickel",

"TIN": "Tin",

"ZNC": "Zinc",

"PAL": "Palladium",

"PLT": "Platinum",

"NGS": "Natural gas",

}

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

cumsum=True,

title="Industrial commodities: cumulative vol-targeted futures returns since 2000",

title_fontsize=24,

cid_labels=dict_coms,

same_y=True,

size=(14, 6),

aspect=1.75,

single_chart=False,

start="2000-01-01",

)

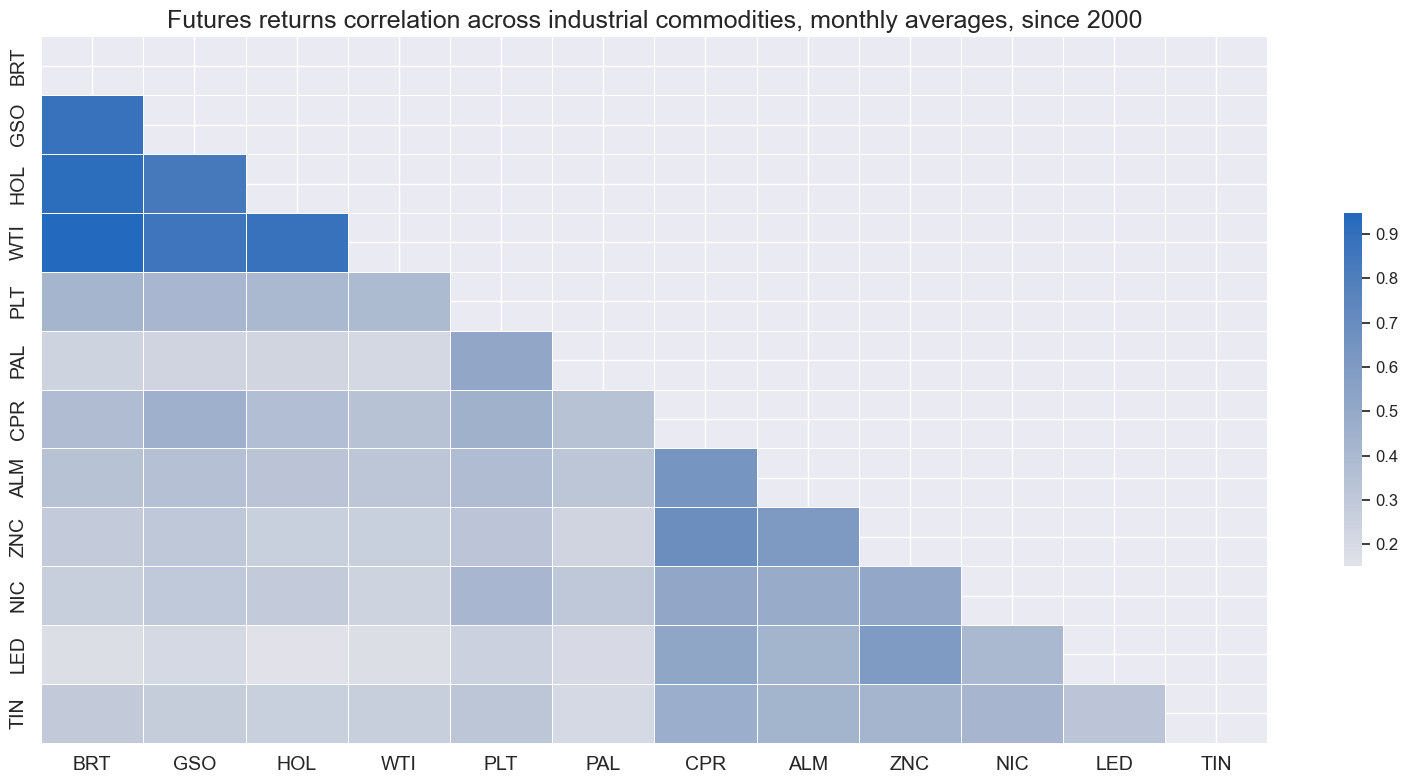

cidx = cids_coms

xcatx = ["COXR_VT10"]

msv.view_correlation(

df=dfx,

xcats=xcatx,

cids=cidx,

cluster=True,

freq="M",

title="Futures returns correlation across industrial commodities, monthly averages, since 2000",

title_fontsize=18,

size=(16, 8),

start="2000-01-01",

)

Hedged vol-targeted contract returns #

store: List[str] = []

cidx = cids_coms

with warnings.catch_warnings():

warnings.simplefilter("ignore", category=UserWarning)

dfh = msp.return_beta(

dfx,

xcat="COXR_VT10",

cids=cidx,

benchmark_return="GLD_COXR_VT10",

oos=True,

min_obs=24,

max_obs=60,

hedged_returns=True,

# start="2000-01-01",

refreq="m",

hr_name="HvGLD",

)

dfh.xcat = dfh.xcat.cat.rename_categories({"COXR_VT10_HR": "COXR_BETAvGLD"})

dfx = msm.update_df(df=dfx, df_add=dfh, xcat_replace=True)

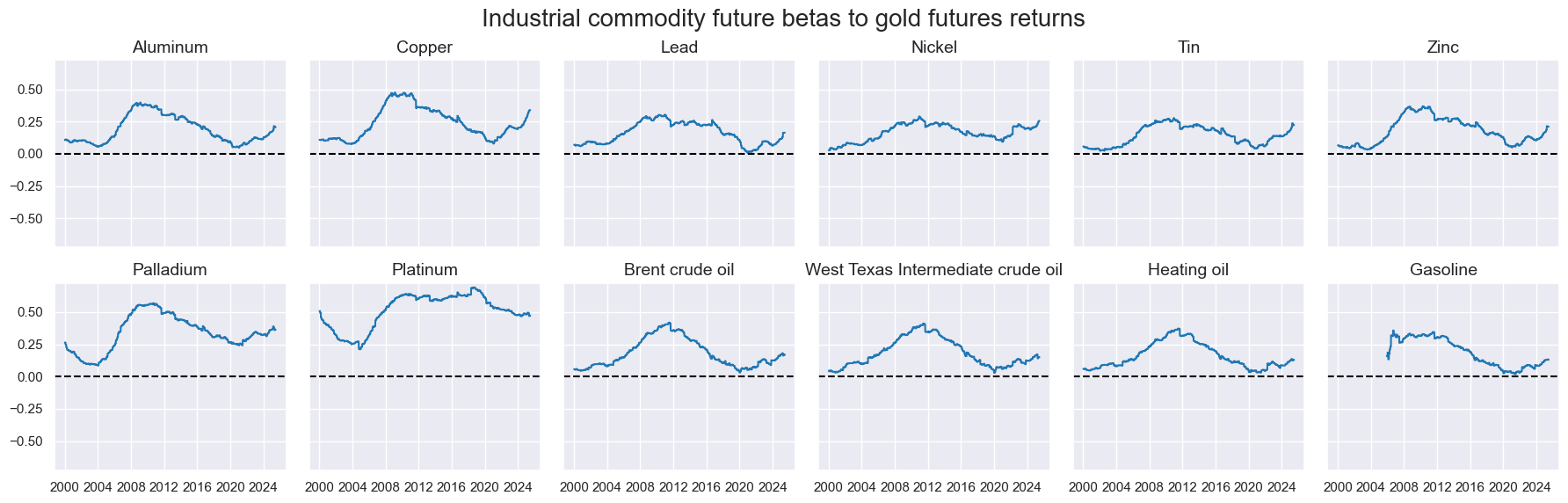

# Plot the betas

xcatx: List[str] = ["COXR_BETAvGLD"]

cidx = cids_coms

msv.timelines(

dfx,

xcats=xcatx,

cids=cidx,

start="2000-01-01",

ncol=6,

title="Industrial commodity future betas to gold futures returns",

title_fontsize=20,

cid_labels=dict_coms,

height=2,

aspect=1,

single_chart=False,

ax_hline=0,

)

# Plot hedged returns

xcatx: List[str] = ["COXR_VT10", "COXR_VT10_HvGLD",]

cidx = cids_coms

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

# start="2000-01-01",

cumsum=True,

title="Industrial commodities: cumulative vol-targeted futures returns",

title_fontsize=24,

cid_labels=dict_coms,

xcat_labels=["unhedged returns", "hedged returns"],

same_y=True,

size=(14, 6),

aspect=1.75,

single_chart=False,

start="2000-01-01",

)

Commodity basket returns #

# Create basket against Gold

store = []

baskets: List[Tuple[str, List[str]]] = [("", cids_coms), ("BAMS", cids_bams), ("PRMS", cids_prms), ("FUEN", cids_fuen)]

targets = ["", "_HvGLD"]

for cat, cidx in baskets:

for target in targets:

xcat = f"COXR_VT10{target}"

dfa = msp.linear_composite(

df=msm.reduce_df(dfx, xcats=[xcat], cids=cidx),

xcats=xcat,

cids=cidx,

weights=None, # equal weights

new_cid="GLB",

complete_cids=False, # uses available contracts only

)

# Rename to basket of commodities

dfa["xcat"] = f"CO{cat:s}XR_VT10{target:s}"

store.append(dfa)

dfx = msm.update_df(dfx, pd.concat(store, axis=0, ignore_index=True))

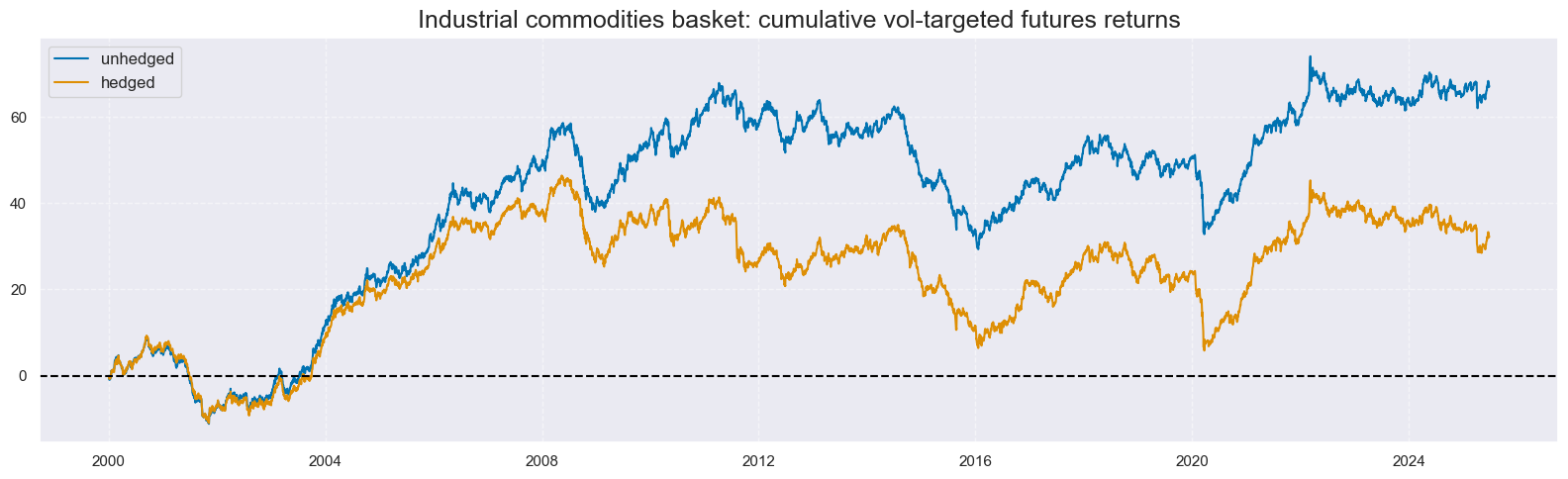

# Plot basket returns

targets = ["", "_HvGLD"]

xcatx: List[str] = [f"COXR_VT10{target:s}" for target in targets]

cidx = ["GLB"]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

cumsum=True,

title="Industrial commodities basket: cumulative vol-targeted futures returns",

xcat_labels=[

"unhedged",

"hedged",

],

size=(16, 5),

start="2000-01-01",

)

Value checks #

Unhedged basket trading #

Specs and panel test #

dict_unhedged = {

"sig": "ARMASNA_3DXMS",

"targ": "COXR_VT10",

"cidx": ["GLB"],

"start": "2000-01-01",

"black": None,

"crr": None,

"srr": None,

"pnls": None,

}

dix = dict_unhedged

sig = dix["sig"]

targ = dix["targ"]

cidx = dix["cidx"]

start = dix["start"]

crx = msp.CategoryRelations(

dfx,

xcats=[sig, targ],

cids=cidx,

freq="D",

lag=1,

xcat_aggs=["last", "sum"],

start=start,

)

with warnings.catch_warnings():

warnings.simplefilter("ignore")

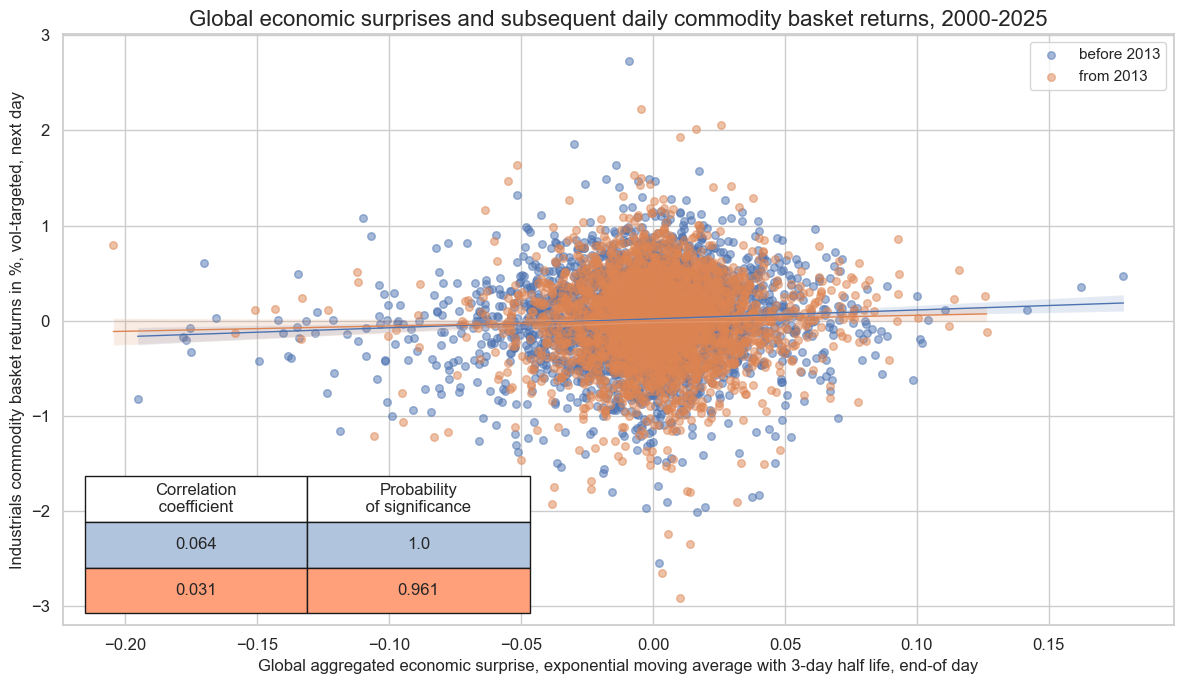

crx.reg_scatter(

labels=False,

coef_box="lower left",

separator=2013,

title="Global economic surprises and subsequent daily commodity basket returns, 2000-2025",

title_fontsize=16,

xlab="Global aggregated economic surprise, exponential moving average with 3-day half life, end-of day",

ylab="Industrials commodity basket returns in %, vol-targeted, next day",

size=(12, 7),

prob_est="map",

)

Accuracy and correlation check #

dix = dict_unhedged

sig = dix["sig"]

targ = dix["targ"]

cidx = dix["cidx"]

start = dix["start"]

srr = mss.SignalReturnRelations(

dfx,

cids=cidx,

sigs=sig,

rets=targ,

freqs="D",

start=start,

)

dix["srr"] = srr

dix = dict_unhedged

srr = dix["srr"]

display(srr.multiple_relations_table().astype("float").round(3).T)

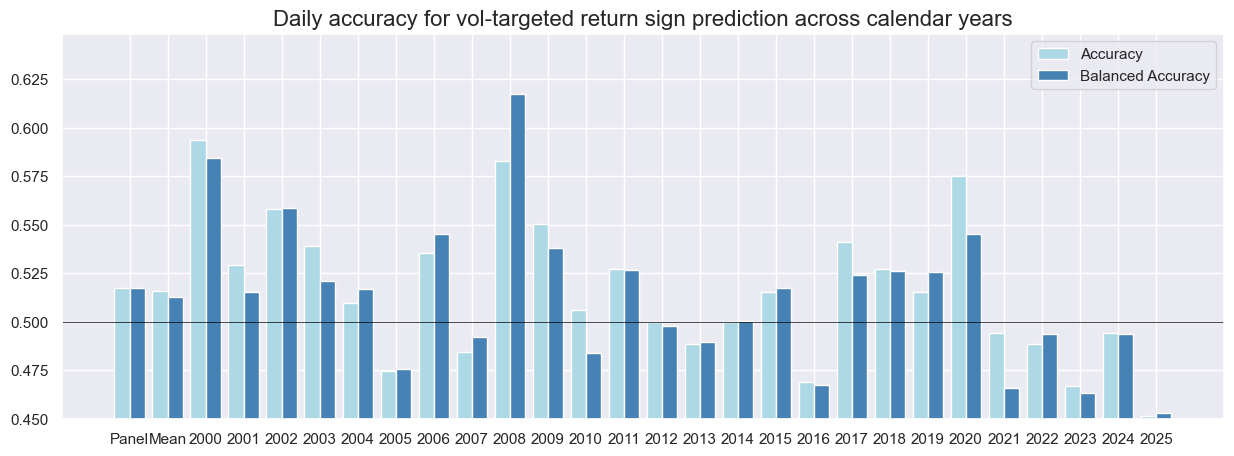

| Return | COXR_VT10 |

|---|---|

| Signal | ARMASNA_3DXMS |

| Frequency | D |

| Aggregation | last |

| accuracy | 0.517 |

| bal_accuracy | 0.517 |

| pos_sigr | 0.501 |

| pos_retr | 0.527 |

| pos_prec | 0.545 |

| neg_prec | 0.490 |

| pearson | 0.048 |

| pearson_pval | 0.000 |

| kendall | 0.025 |

| kendall_pval | 0.002 |

| auc | 0.517 |

dix = dict_unhedged

srr = dix["srr"]

srr.accuracy_bars(

type="years",

title="Daily accuracy for vol-targeted return sign prediction across calendar years",

size=(15, 5),

)

Naive PnL #

dix = dict_unhedged

sig = dix["sig"]

targ = dix["targ"]

cidx = dix["cidx"]

start = dix["start"]

naive_pnl = msn.NaivePnL(

dfx,

ret=targ,

sigs=[sig],

cids=cidx,

start=start,

bms=["USD_EQXR_NSA"],

)

for long_bias in (0, 1):

naive_pnl.make_pnl(

sig,

sig_neg=False,

sig_op="zn_score_cs",

sig_add=long_bias,

thresh=2,

rebal_freq="daily",

vol_scale=None,

rebal_slip=0,

pnl_name=sig + f"_PZN{long_bias:d}",

)

naive_pnl.make_long_pnl(vol_scale=None, label="Long only")

dix["pnls"] = naive_pnl

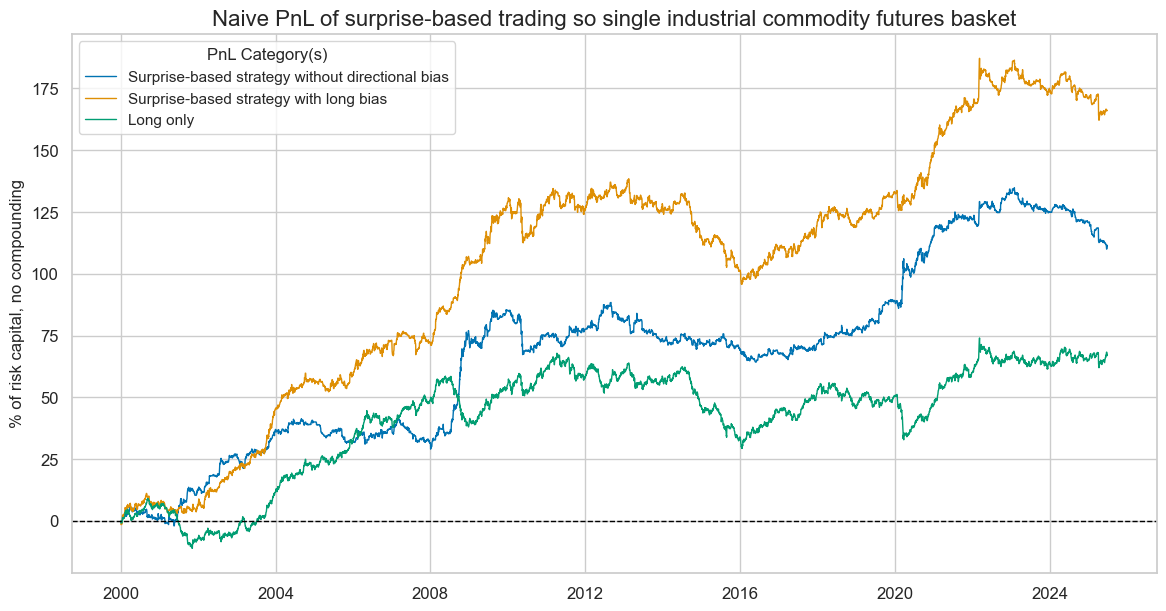

dix = dict_unhedged

naive_pnl = dix["pnls"]

sig = dix["sig"]

pnl_labels = {

f"{sig:s}_PZN0": "Surprise-based strategy without directional bias",

f"{sig:s}_PZN1": "Surprise-based strategy with long bias",

"Long only": "Long only",

}

pnls = list(pnl_labels.keys())

naive_pnl.plot_pnls(

pnl_cats=pnls,

pnl_cids=["ALL"],

start=start,

title="Naive PnL of surprise-based trading so single industrial commodity futures basket",

title_fontsize=16,

xcat_labels=pnl_labels,

figsize=(14, 7),

)

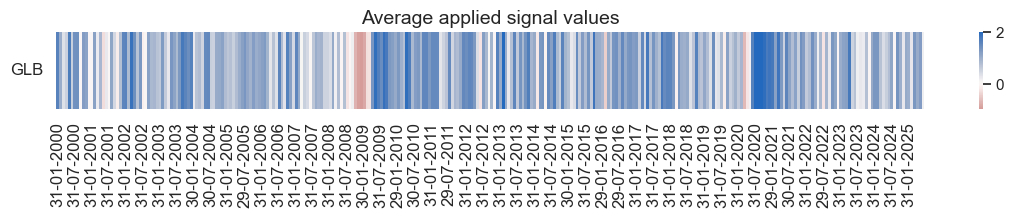

dix = dict_unhedged

naive_pnl = dix["pnls"]

display(naive_pnl.evaluate_pnls())

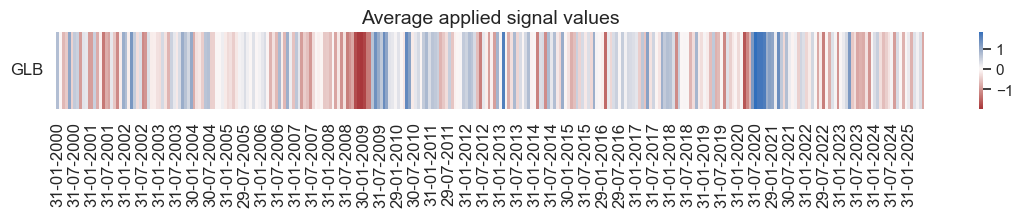

naive_pnl.signal_heatmap(

pnl_name="ARMASNA_3DXMS_PZN1",

freq="m",

)

| xcat | ARMASNA_3DXMS_PZN0 | ARMASNA_3DXMS_PZN1 | Long only |

|---|---|---|---|

| Return % | 4.37104 | 6.523791 | 2.635708 |

| St. Dev. % | 7.427 | 8.913999 | 7.191436 |

| Sharpe Ratio | 0.588534 | 0.731859 | 0.366506 |

| Sortino Ratio | 0.882928 | 1.035662 | 0.507064 |

| Max 21-Day Draw % | -15.375868 | -17.217568 | -14.302399 |

| Max 6-Month Draw % | -16.807392 | -20.328708 | -20.143069 |

| Peak to Trough Draw % | -24.853876 | -42.617399 | -38.519882 |

| Top 5% Monthly PnL Share | 0.938577 | 0.610671 | 1.030927 |

| USD_EQXR_NSA correl | -0.075653 | 0.145845 | 0.286987 |

| Traded Months | 306 | 306 | 306 |

Hedged basket trading #

Specs and panel test #

dict_hedged = {

"sig": "ARMASNA_3DXMS",

"targ": "COXR_VT10_HvGLD",

"cidx": ["GLB"],

"start": "2000-01-01",

"black": None,

"crr": None,

"srr": None,

"pnls": None,

}

dix = dict_hedged

sig = dix["sig"]

targ = dix["targ"]

cidx = dix["cidx"]

start = dix["start"]

crx = msp.CategoryRelations(

dfx,

xcats=[sig, targ],

cids=cidx,

freq="D",

lag=1,

xcat_aggs=["last", "sum"],

start=start,

)

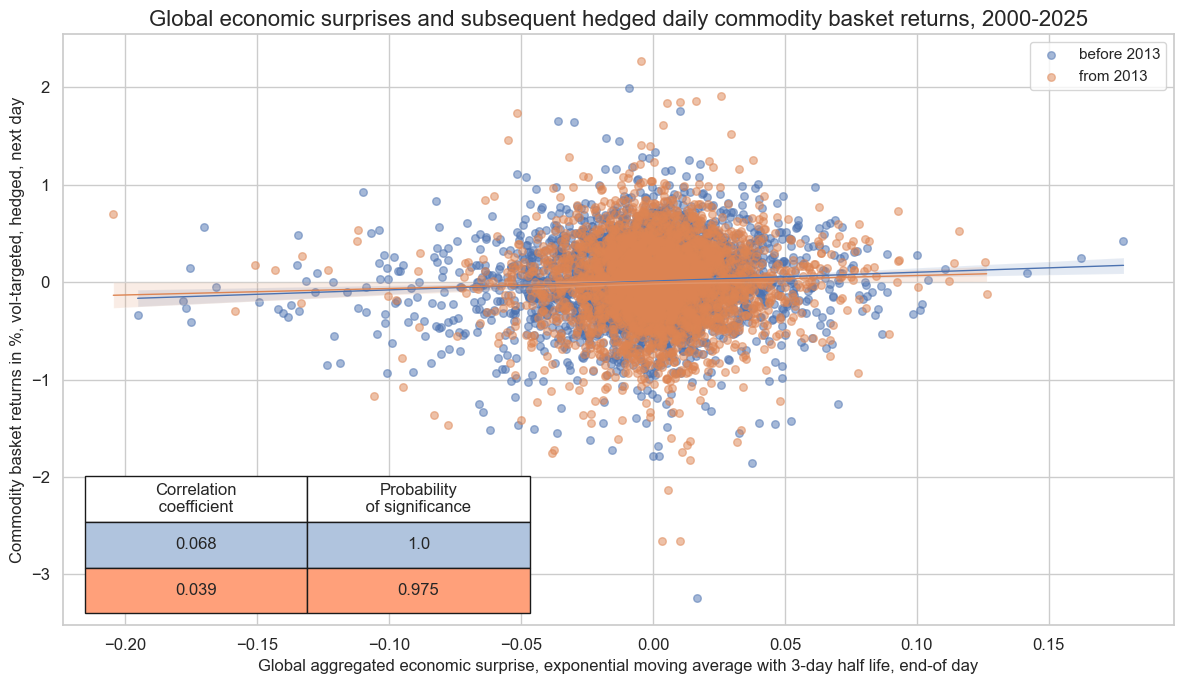

with warnings.catch_warnings():

warnings.simplefilter("ignore")

crx.reg_scatter(

labels=False,

coef_box="lower left",

separator=2013,

xlab="Global aggregated economic surprise, exponential moving average with 3-day half life, end-of day",

ylab="Commodity basket returns in %, vol-targeted, hedged, next day",

title="Global economic surprises and subsequent hedged daily commodity basket returns, 2000-2025",

title_fontsize=16,

size=(12, 7),

prob_est="map",

)

Accuracy and correlation check #

dix = dict_hedged

sig = dix["sig"]

targ = dix["targ"]

cidx = dix["cidx"]

start = dix["start"]

srr = mss.SignalReturnRelations(

dfx,

cids=cidx,

sigs=sig,

rets=targ,

freqs="D",

start=start,

)

dix["srr"] = srr

dix = dict_hedged

srr = dix["srr"]

display(srr.multiple_relations_table().astype("float").round(3).T)

| Return | COXR_VT10_HvGLD |

|---|---|

| Signal | ARMASNA_3DXMS |

| Frequency | D |

| Aggregation | last |

| accuracy | 0.508 |

| bal_accuracy | 0.508 |

| pos_sigr | 0.501 |

| pos_retr | 0.525 |

| pos_prec | 0.533 |

| neg_prec | 0.483 |

| pearson | 0.054 |

| pearson_pval | 0.000 |

| kendall | 0.026 |

| kendall_pval | 0.002 |

| auc | 0.508 |

Naive PnL #

dix = dict_hedged

sig = dix["sig"]

targ = dix["targ"]

cidx = dix["cidx"]

start = dix["start"]

naive_pnl = msn.NaivePnL(

dfx,

ret=targ,

sigs=[sig],

cids=cidx,

start=start,

bms=["USD_EQXR_NSA"],

)

for long_bias in (0, 1):

naive_pnl.make_pnl(

sig,

sig_neg=False,

sig_op="zn_score_cs",

sig_add=long_bias,

thresh=2,

rebal_freq="daily",

vol_scale=None,

rebal_slip=0,

pnl_name=sig + f"_PZN{long_bias:d}",

)

naive_pnl.make_long_pnl(vol_scale=None, label="Long only")

dix["pnls"] = naive_pnl

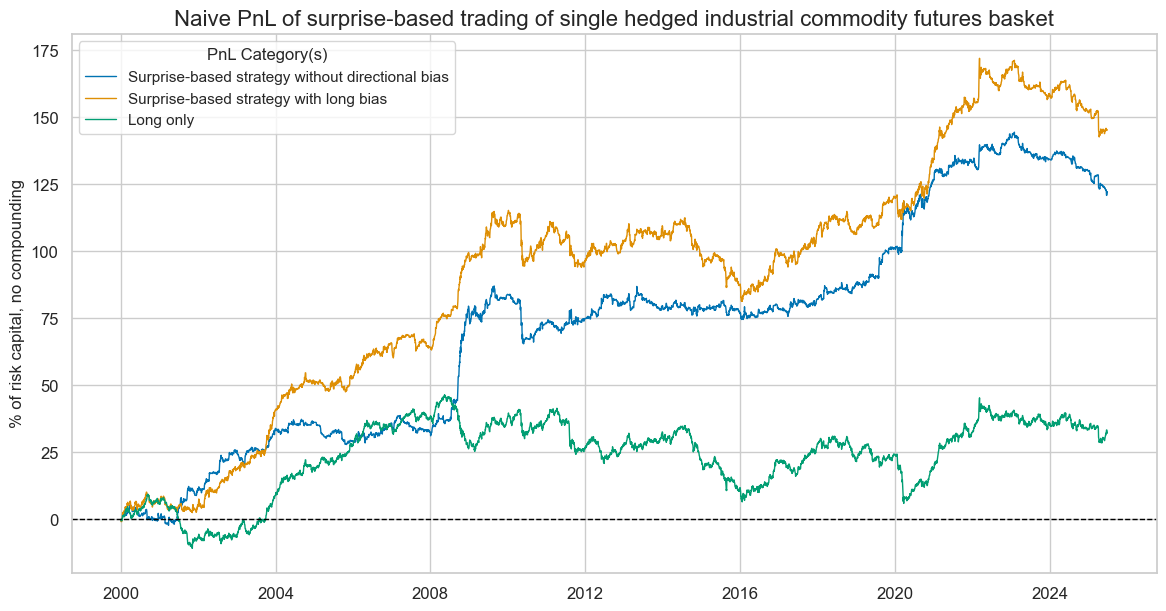

dix = dict_hedged

naive_pnl = dix["pnls"]

sig = dix["sig"]

pnl_labels = {

f"{sig:s}_PZN0": "Surprise-based strategy without directional bias",

f"{sig:s}_PZN1": "Surprise-based strategy with long bias",

"Long only": "Long only",

}

pnls = list(pnl_labels.keys())

naive_pnl.plot_pnls(

pnl_cats=pnls,

pnl_cids=["ALL"],

start=start,

title="Naive PnL of surprise-based trading of single hedged industrial commodity futures basket",

title_fontsize=16,

xcat_labels=pnl_labels,

figsize=(14, 7),

)

dix = dict_hedged

naive_pnl = dix["pnls"]

display(naive_pnl.evaluate_pnls())

naive_pnl.signal_heatmap(

pnl_name="ARMASNA_3DXMS_PZN0",

freq="m",

)

| xcat | ARMASNA_3DXMS_PZN0 | ARMASNA_3DXMS_PZN1 | Long only |

|---|---|---|---|

| Return % | 4.792582 | 5.706744 | 1.268342 |

| St. Dev. % | 7.02999 | 8.322689 | 6.660833 |

| Sharpe Ratio | 0.681734 | 0.685685 | 0.190418 |

| Sortino Ratio | 1.046182 | 0.967819 | 0.26069 |

| Max 21-Day Draw % | -15.713679 | -19.359406 | -13.492343 |

| Max 6-Month Draw % | -17.007099 | -19.048991 | -19.006064 |

| Peak to Trough Draw % | -23.609668 | -33.977972 | -40.533251 |

| Top 5% Monthly PnL Share | 0.846206 | 0.683088 | 2.084462 |

| USD_EQXR_NSA correl | -0.084836 | 0.152752 | 0.307985 |

| Traded Months | 306 | 306 | 306 |