FX tail risk premia #

The category measures option-implied premia of the tail risk in FX forwards. The premium is calculated as the difference between the implied volatility of out-of-the-money options and at-the-money options, divided by the volatility of at-the-money options. A high ratio implies that the implied volatility of the out-of-the money option is larger and that buying protection against movements to the tail of return distribution is disproportionately expensive.

The out-of-the-money part of the ratio is based on 10-delta options. A 10-delta implied volatility is the implied volatility of an option that has roughly a 10% probability to be in the money. It is an option with a low likelihood of being exercised. There are two types of tail risk premium:

-

The downside tail risk premium is charged for the risk of large depreciation of the local currency versus the benchmark. It is calculated as the implied volatility of a 10-delta put (benchmark call) to the implied volatility of an at-the-money option of the same type.

-

The upside tail risk premium is charged for the risk of large appreciation of the local currency versus the benchmark. It is calculated as the ratio of implied volatility of a 10-delta call (benchmark put) to the implied volatility of an at-the-money option of the same type.

Imports #

Only the standard Python data science packages and the specialized

macrosynergy

package are needed.

import pandas as pd

import macrosynergy.management as msm

import macrosynergy.panel as msp

import macrosynergy.signal as mss

import macrosynergy.visuals as msv

from macrosynergy.download import JPMaQSDownload

from timeit import default_timer as timer

from datetime import timedelta, date

import os

import warnings

warnings.simplefilter("ignore")

The

JPMaQS

indicators we consider are downloaded using the J.P. Morgan Dataquery API interface within the

macrosynergy

package. This is done by specifying

ticker strings

, formed by appending an indicator category code

<category>

to a currency area code

<cross_section>

. These constitute the main part of a full quantamental indicator ticker, taking the form

DB(JPMAQS,<cross_section>_<category>,<info>)

, where

<info>

denotes the time series of information for the given cross-section and category. The following types of information are available:

-

valuegiving the latest available values for the indicator -

eop_lagreferring to days elapsed since the end of the observation period -

mop_lagreferring to the number of days elapsed since the mean observation period -

gradedenoting a grade of the observation, giving a metric of real time information quality.

After instantiating the

JPMaQSDownload

class within the

macrosynergy.download

module, one can use the

download(tickers,start_date,metrics)

method to easily download the necessary data, where

tickers

is an array of ticker strings,

start_date

is the first collection date to be considered and

metrics

is an array comprising the times series information to be downloaded.

cids_dmca = [

"AUD",

"CAD",

"CHF",

"EUR",

"GBP",

"JPY",

"NOK",

"NZD",

"SEK",

"USD",

] # DM currency areas

cids_dmec = ["DEM", "ESP", "FRF", "ITL", "NLG"] # DM euro area countries

cids_latm = ["BRL", "COP", "CLP", "MXN", "PEN"] # Latam countries

cids_emea = ["CZK", "HUF", "ILS", "PLN", "RON", "RUB", "TRY", "ZAR"] # EMEA countries

cids_emas = [

"CNY",

"HKD",

"IDR",

"INR",

"KRW",

"MYR",

"PHP",

"SGD",

"THB",

"TWD",

] # EM Asia countries

cids_dm = cids_dmca + cids_dmec

cids_em = cids_latm + cids_emea + cids_emas

cids = sorted(cids_dm + cids_em)

main = [

"FXPPTAILDOWN_NSA",

"FXPPTAILUP_NSA",

"FXPPTAILDOWNUSD_NSA",

"FXPPTAILUPUSD_NSA",

]

econ = ["IVAWGT_SA_1YMA"] # economic context

vols = ["EQXRxEASD_NSA", "FXXRxEASD_NSA", "DU10YXRxEASD_NSA", "CDS10YXRxEASD_NSA"]

mark = ["EQXR_NSA",

"EQXR_VT10",

"FXXR_NSA",

"FXXR_VT10",

"FXTARGETED_NSA",

"FXUNTRADABLE_NSA",

"CDS10YXR_NSA",

"CDS10YXR_VT10",

"LCBIR_NSA",

"FCBIR_NSA"] # market links

xcats = main + econ + mark + vols

cids_co = ["GLD"] # gold

xcats_co = ["COXR_VT10", "COXR_NSA"] # Commodity future returns

tix_co = [c + "_" + x for c in cids_co for x in xcats_co]

# Download series from J.P. Morgan DataQuery by tickers

start_date = "2000-01-01"

tickers = [cid + "_" + xcat for cid in cids for xcat in xcats] + tix_co

print(f"Maximum number of tickers is {len(tickers)}")

# Retrieve credentials

client_id: str = os.getenv("DQ_CLIENT_ID")

client_secret: str = os.getenv("DQ_CLIENT_SECRET")

# Download from DataQuery

with JPMaQSDownload(client_id=client_id, client_secret=client_secret) as downloader:

start = timer()

assert downloader.check_connection()

df = downloader.download(

tickers=tickers,

start_date=start_date,

metrics=["value", "eop_lag", "mop_lag", "grading"],

suppress_warning=True,

)

end = timer()

dfd = df

print("Download time from DQ: " + str(timedelta(seconds=end - start)))

Maximum number of tickers is 724

Downloading data from JPMaQS.

Timestamp UTC: 2025-04-14 09:22:31

Connection successful!

Some expressions are missing from the downloaded data. Check logger output for complete list.

684 out of 2896 expressions are missing. To download the catalogue of all available expressions and filter the unavailable expressions, set `get_catalogue=True` in the call to `JPMaQSDownload.download()`.

Download time from DQ: 0:01:29.823632

Availability #

cids_exp = sorted(

list(set(cids) - set(cids_dmec) - set(["HKD"]))

) # cids expected in category panels

msm.missing_in_df(dfd, xcats=main, cids=cids_exp)

No missing XCATs across DataFrame.

Missing cids for FXPPTAILDOWNUSD_NSA: ['USD']

Missing cids for FXPPTAILDOWN_NSA: ['USD']

Missing cids for FXPPTAILUPUSD_NSA: ['USD']

Missing cids for FXPPTAILUP_NSA: ['USD']

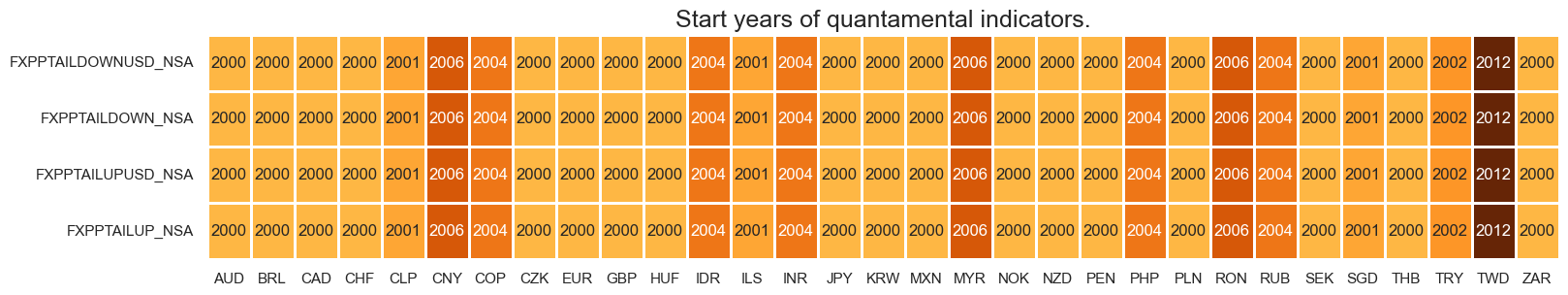

Whilst most quantamental indicators of FX tail risk premia are available from 2000, including all those for developed markets, some emerging market series’ are only available from the mid-2000s onwards.

For the explanation of currency symbols, which are related to currency areas or countries for which categories are available, please view Appendix 1 .

xcatx = main

cidx = cids_exp

dfx = msm.reduce_df(dfd, xcats=xcatx, cids=cidx)

dfs = msm.check_startyears(

dfx,

)

msm.visual_paneldates(dfs, size=(18, 3))

print("Last updated:", date.today())

Last updated: 2025-04-14

History #

FX tail risk premium against dominant benchmark #

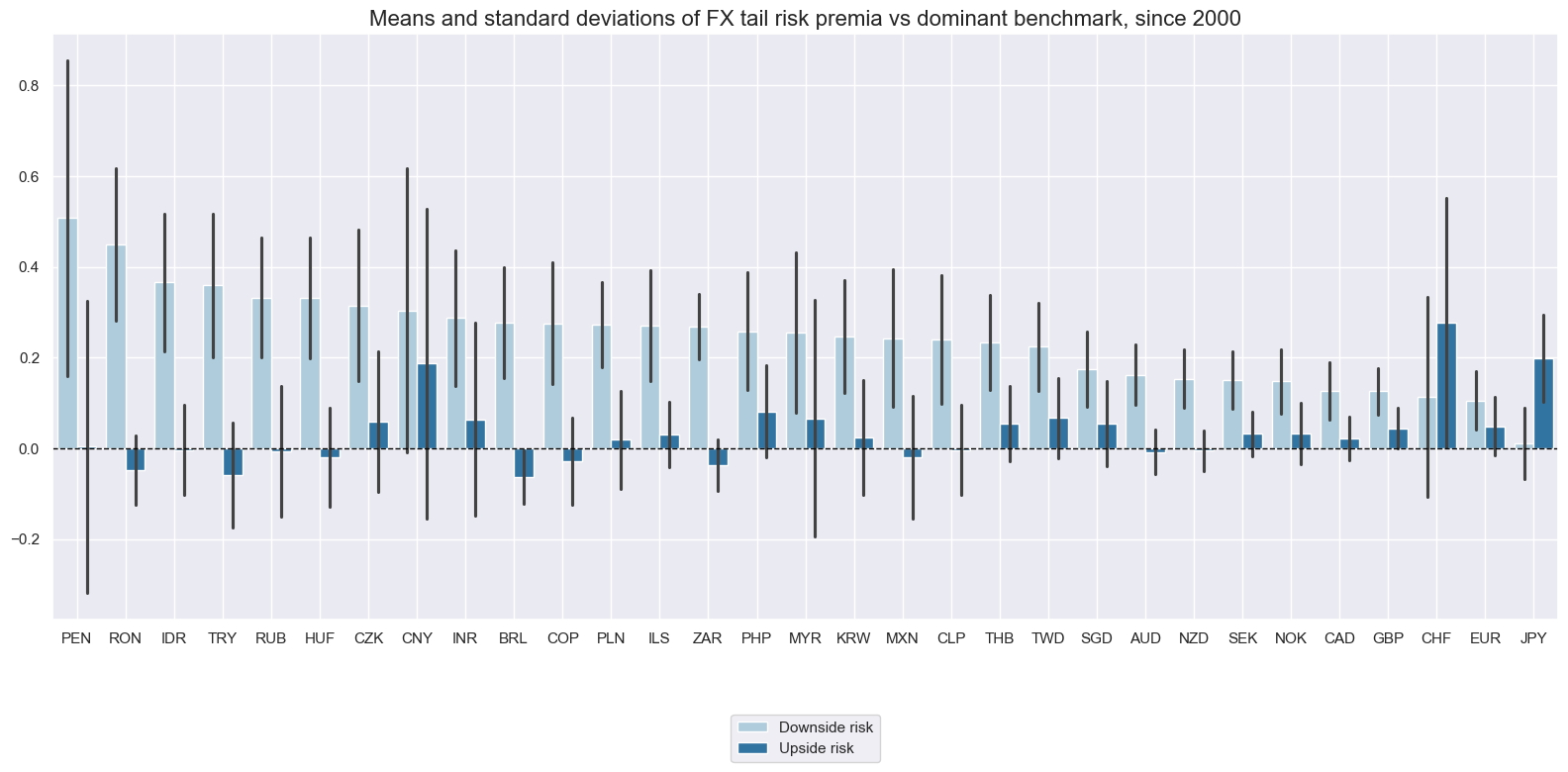

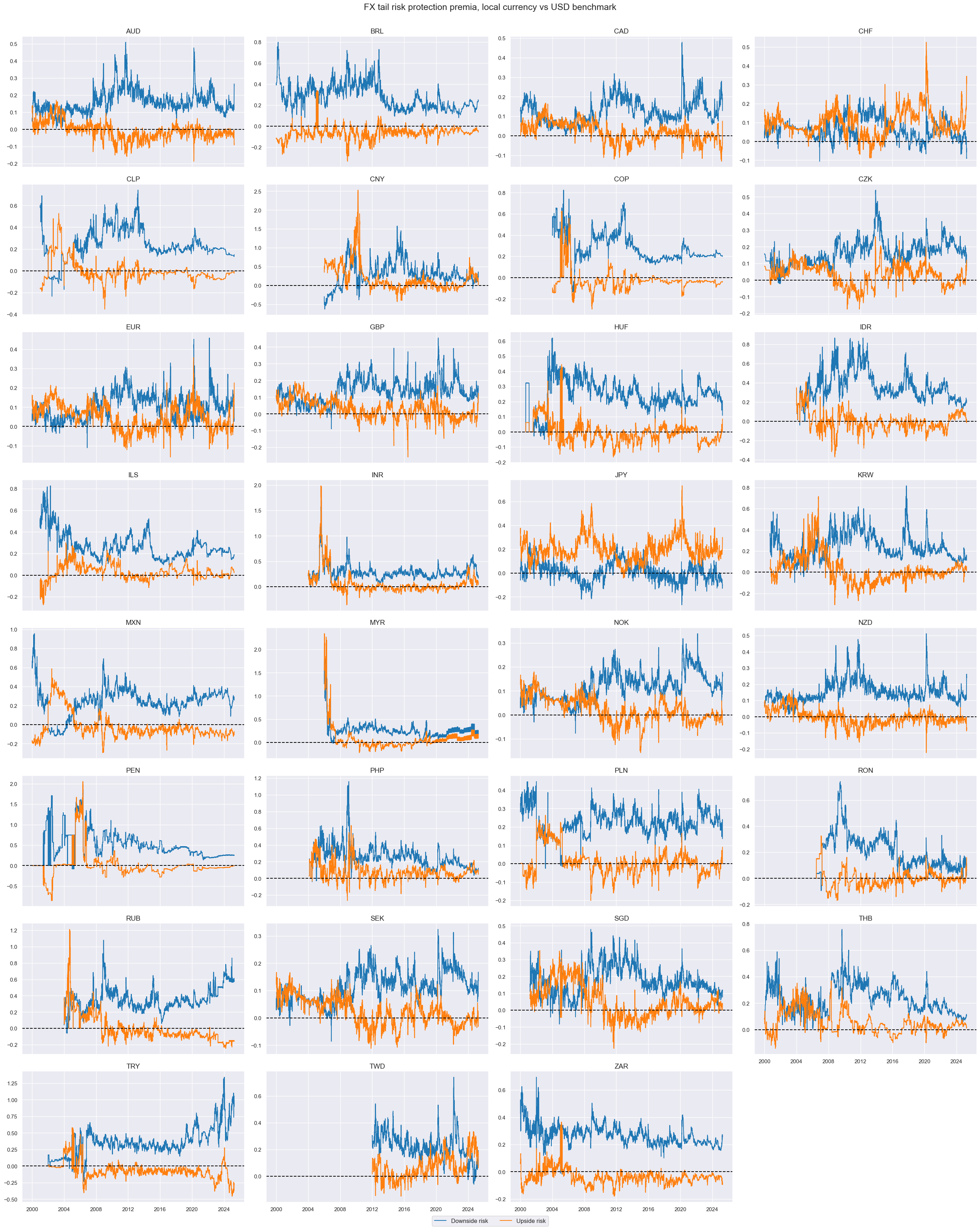

Downside risk premia have on average been positive for all non-USD currencies since 2000. They have been the largest in some EM currencies with historically low spot-exchange rate volatility in normal times, such as Peru and Romania. This is likely related to the risk of breaks in managed FX regimes. Upside risk premia have been more balanced and closer to zero, with the notable exceptions of CHF, JPY and CNY. CHF, JPY and GBP have been the oly currencies with higher average upside risk premia and downside risk premia.

xcatx = ["FXPPTAILDOWN_NSA", "FXPPTAILUP_NSA"]

cidx = cids_exp

msp.view_ranges(

dfd,

xcats=xcatx,

cids=cidx,

sort_cids_by="mean",

start=start_date,

title="Means and standard deviations of FX tail risk premia vs dominant benchmark, since 2000",

xcat_labels=["Downside risk", "Upside risk"],

kind="bar",

size=(16, 8),

)

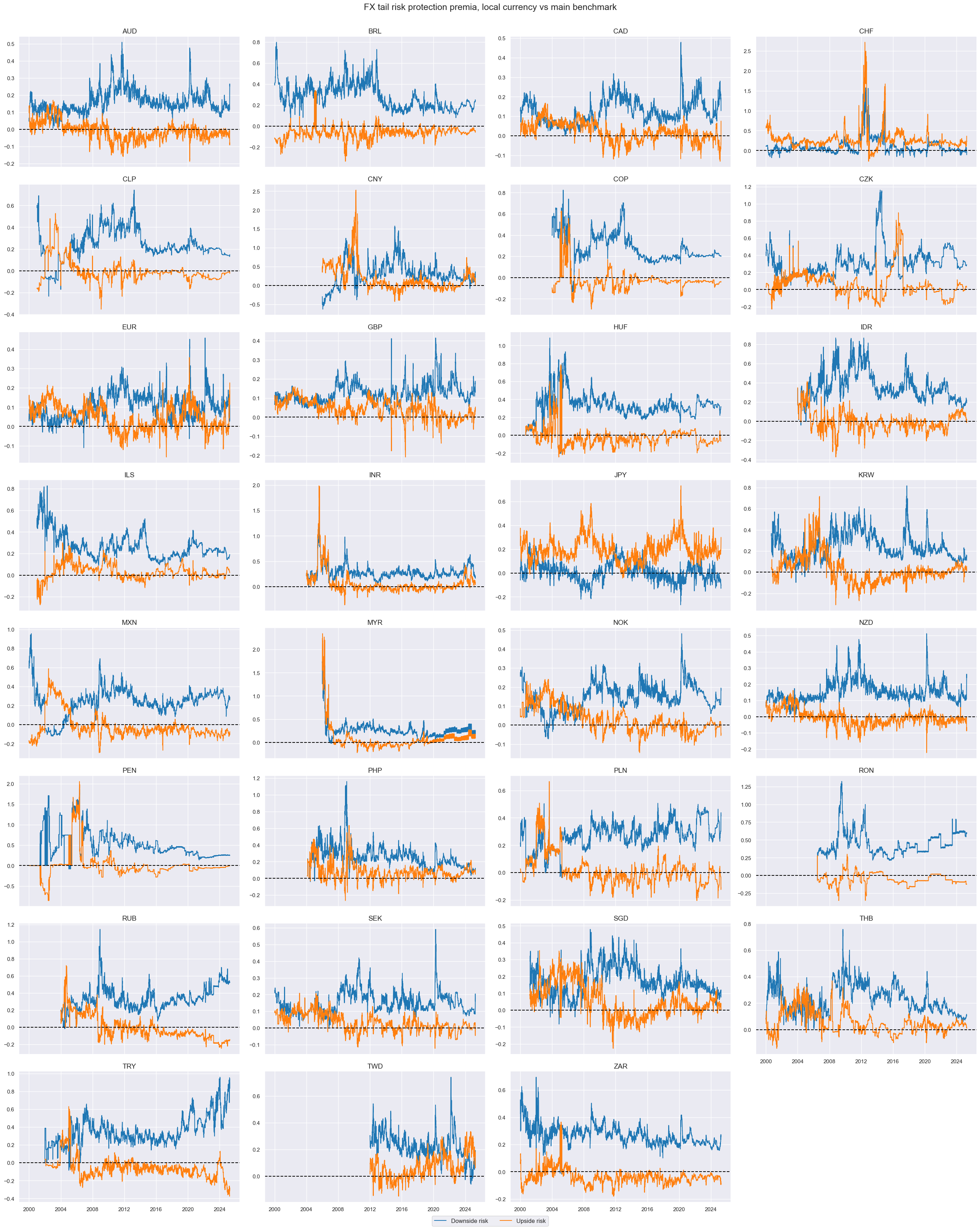

xcatx = ["FXPPTAILDOWN_NSA", "FXPPTAILUP_NSA"]

cidx = cids_exp

msp.view_timelines(

dfd,

xcats=xcatx,

cids=cidx,

start=start_date,

title="FX tail risk protection premia, local currency vs main benchmark",

xcat_labels=["Downside risk", "Upside risk"],

ncol=4,

same_y=False,

)

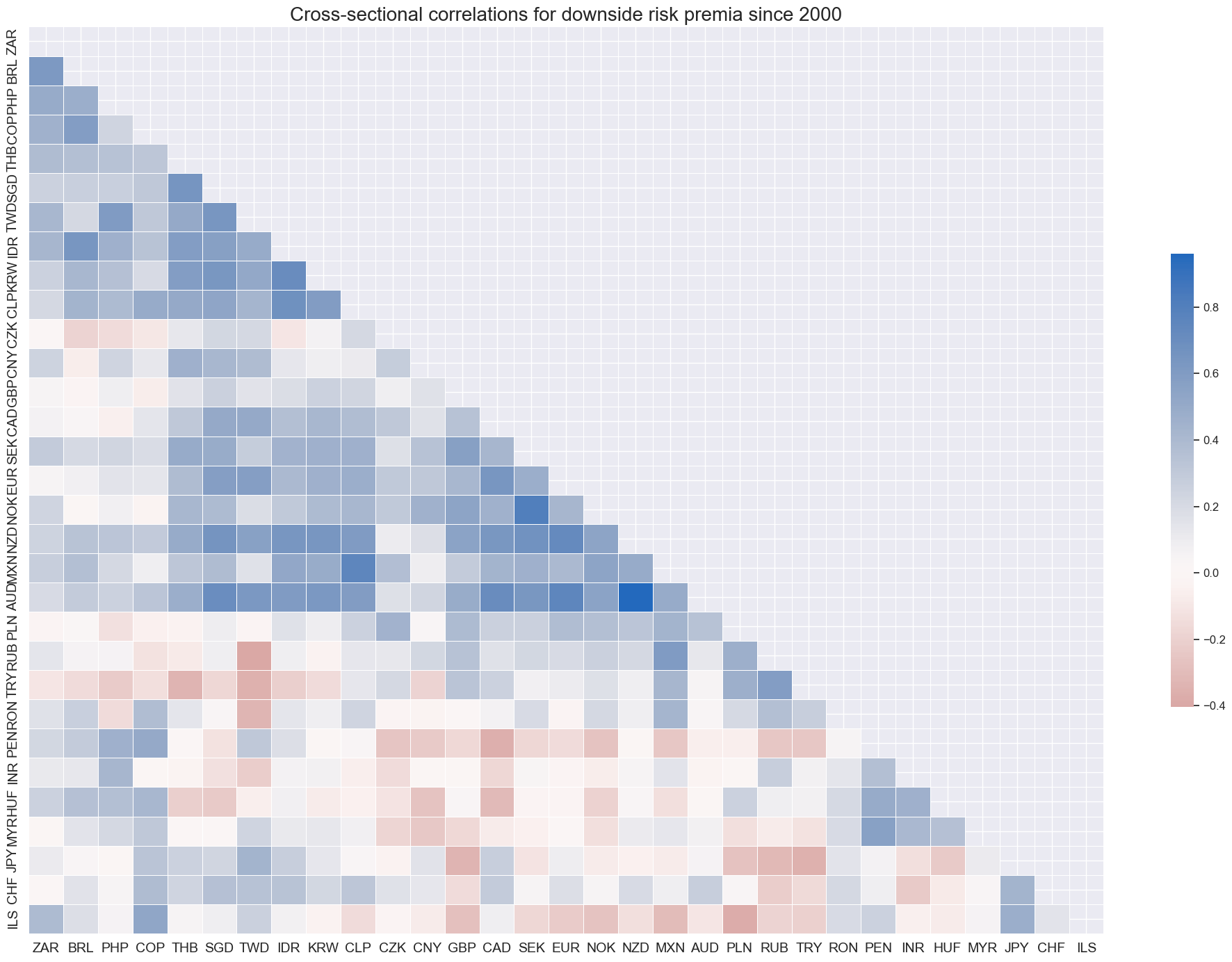

Downside risk premia have been positively correlated across most exchange rate pairs.

xcatx = "FXPPTAILDOWN_NSA"

cidx = cids_exp

dfd_vrp7 = dfd[dfd["xcat"] == "FXPPTAILDOWN_NSA"][

["real_date", "cid", "xcat", "value"]

].set_index("real_date")

dfw_vrp7 = dfd_vrp7.groupby(["cid", "xcat"]).resample("M").mean().reset_index()

msp.correl_matrix(

dfw_vrp7,

xcats=xcatx,

cids=cidx,

size=(20, 14),

title="Cross-sectional correlations for downside risk premia since 2000",

cluster=True,

)

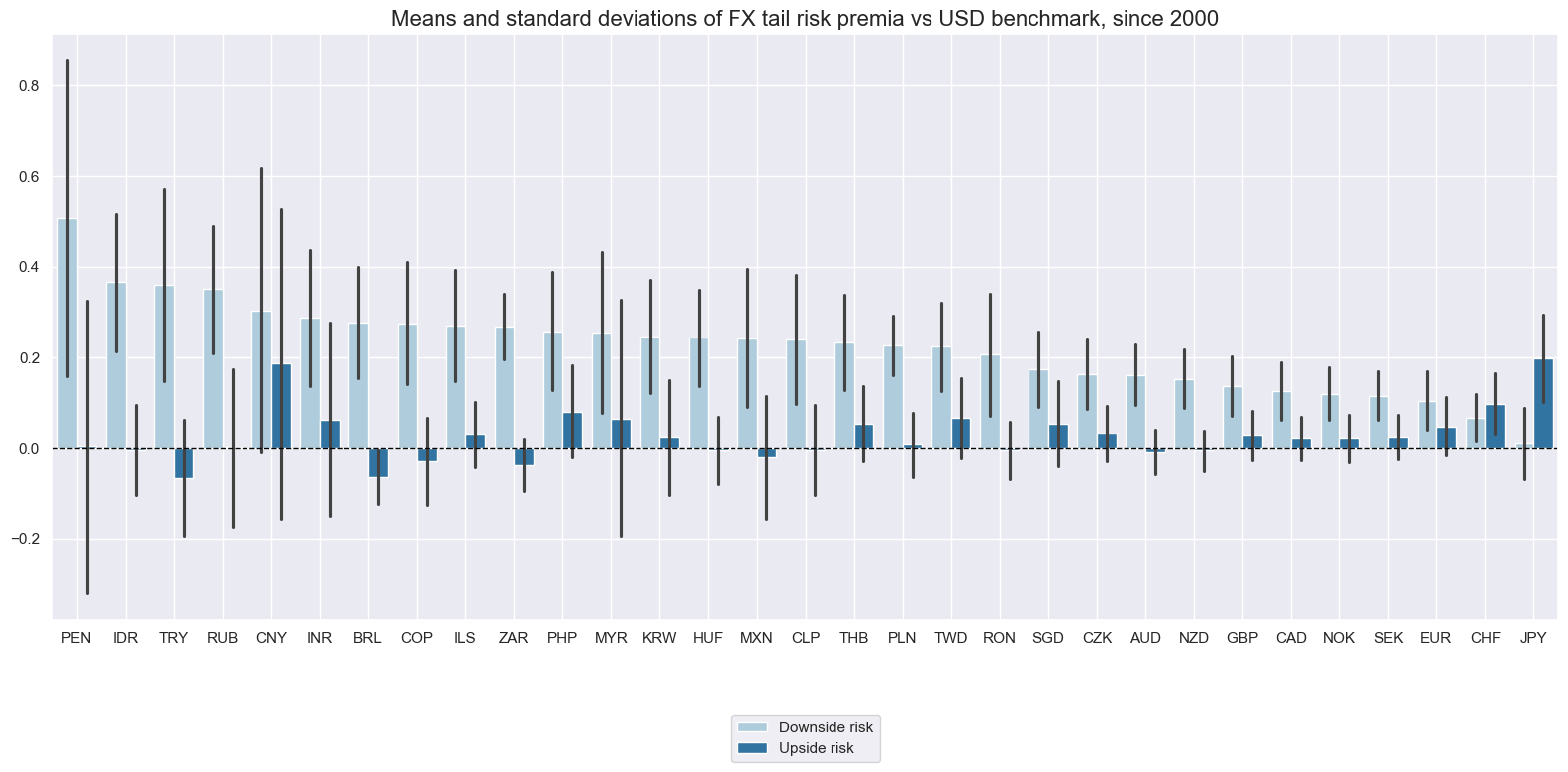

FX tail risk premium against USD #

As for dominant benchmarks, downside tail risk premia have been positive for all currencies against the USD.

xcatx = ["FXPPTAILDOWNUSD_NSA", "FXPPTAILUPUSD_NSA"]

cidx = cids_exp

msp.view_ranges(

dfd,

xcats=xcatx,

cids=cidx,

sort_cids_by="mean",

start=start_date,

title="Means and standard deviations of FX tail risk premia vs USD benchmark, since 2000",

xcat_labels=["Downside risk", "Upside risk"],

kind="bar",

size=(16, 8),

)

xcatx = ["FXPPTAILDOWNUSD_NSA", "FXPPTAILUPUSD_NSA"]

cidx = cids_exp

msp.view_timelines(

dfd,

xcats=xcatx,

cids=cidx,

start=start_date,

title="FX tail risk protection premia, local currency vs USD benchmark",

xcat_labels=["Downside risk", "Upside risk"],

ncol=4,

same_y=False,

all_xticks=False,

)

Importance #

Research Links #

“One of the pillars of modern finance theory is the concept of ‘risk premium’, i.e. that a more risky investment should, on the long run, also be more profitable.” Lempérière, et al.

“(FX) tail risk is mostly influenced by the long position of the carry trade… Historically, Carry trades have been a success story for most investors and a major source of funds for emerging economies maintaining higher interest rates.” Ganepola

“We propose a new decomposition of the variance risk premium in terms of upside and downside variance risk premia. These components reflect market compensation for changes in good and bad uncertainties. Their difference is a measure of skewness risk premium, which captures investors’ asymmetric views on favorable versus undesirable risks.” Feunou, Jahan-Parvar, Okou

“… this paper proposes and empirically shows that the two seemingly unrelated markets, sovereign credit and far-out-of-the-money (FOM) FX options, are related by no-arbitrage because they share the same tail risk. “ Georgievska

“… we show that much of this predictability (future market returns) may be attributed to time variation in the part of the variance risk premium associated with the special compensation demanded by investors for bearing jump tail risk, consistent with the idea that market fears play an important role in understanding the return predictability.” Bollerslev, Todorov & Xu

“Developed economies have higher inward and outward tail risk spillovers than developing economies.” He, Yu, Luo & Yan

“We show that the currency volatility risk premium has substantial predictive power for the cross-section of currency returns. Currencies with low implied volatility relative to historical realized volatility those with relatively cheap volatility insurance predictably appreciate, while currencies with relatively more expensive volatility insurance predictably depreciate.” Della Corte, et al.

Empirical Clues #

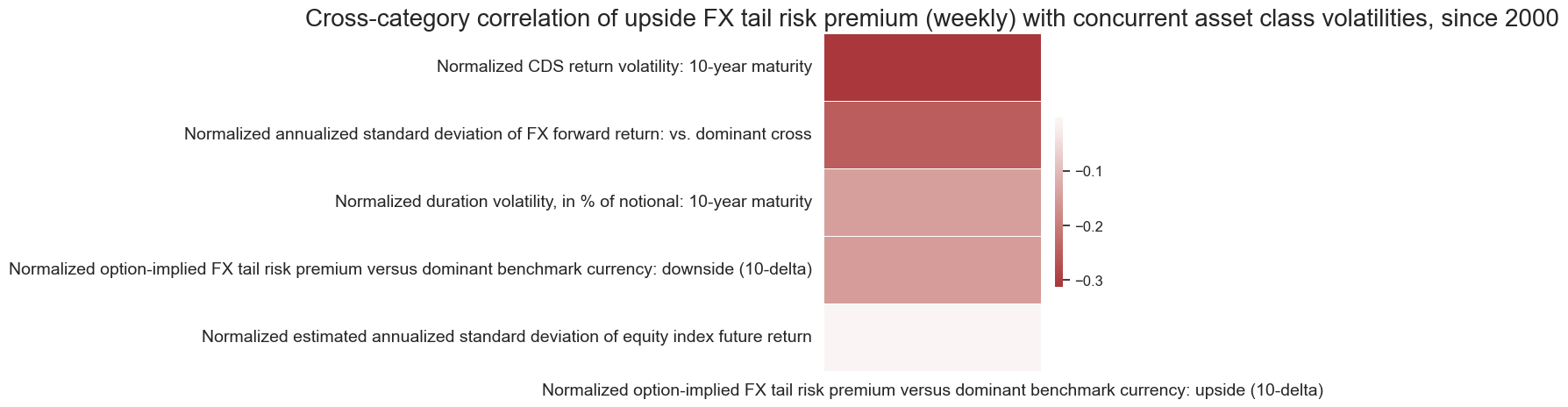

Before running further analysis, we exclude periods when FX markets had limited tradability. We then normalize the relevant time series using the make_zn_scores() function, which centers the data around a neutral reference point (such as the mean of the whole panel or the mean of particular cross-section). A zn-score indicates how far a value deviates from this reference, scaled by a selected spread measure (e.g., standard deviation).

dfb = dfd[dfd["xcat"].isin(["FXTARGETED_NSA", "FXUNTRADABLE_NSA"])].loc[

:, ["cid", "xcat", "real_date", "value"]

]

dfba = (

dfb.groupby(["cid", "real_date"])

.aggregate(value=pd.NamedAgg(column="value", aggfunc="max"))

.reset_index()

)

dfba["xcat"] = "FXBLACK"

fxblack = msp.make_blacklist(dfba, "FXBLACK")

dfx=dfd.copy()

xcatx = main + vols

zn_variants = [

{"postfix": "PZ", "pan_weight": 1},

{"postfix": "IZ", "pan_weight": 0},

]

for xcat in xcatx:

for variant in zn_variants:

dfa = msp.make_zn_scores(

dfx,

xcat=xcat,

cids=cids,

neutral="mean",

sequential=True,

min_obs=261 * 3,

pan_weight=variant["pan_weight"],

thresh=3,

postfix=variant["postfix"],

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

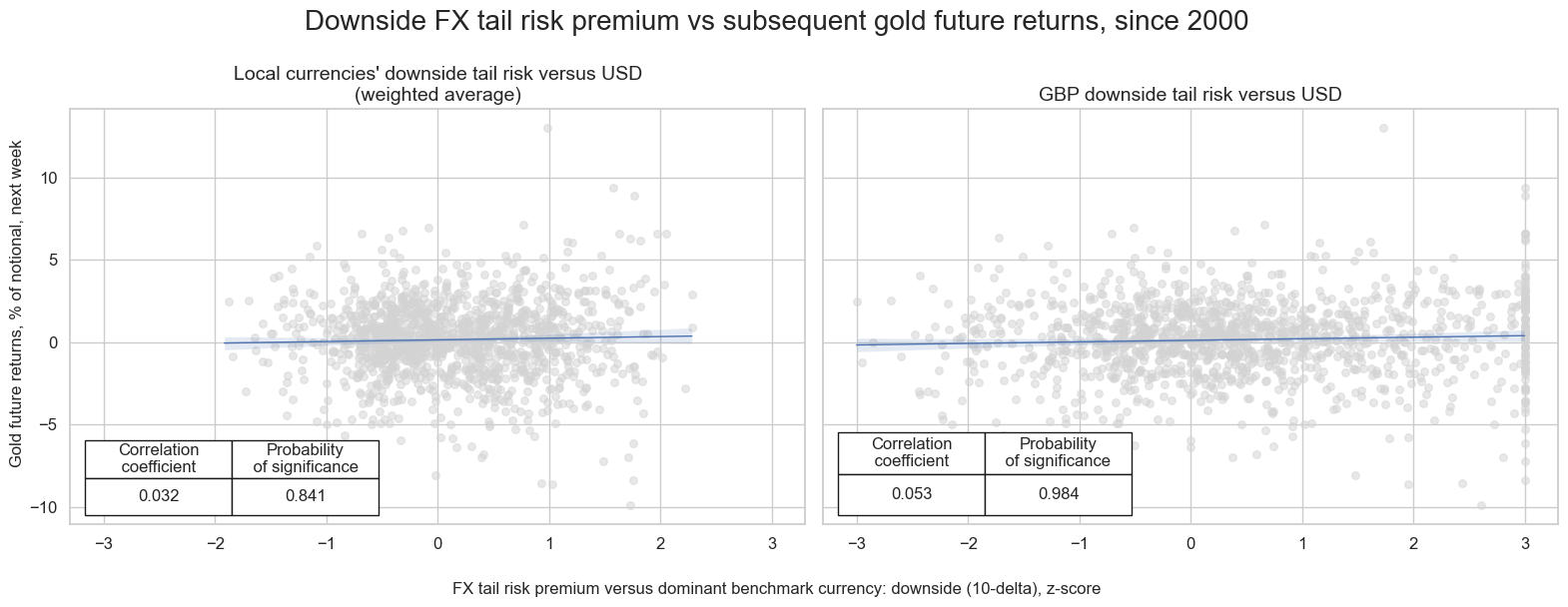

FX tail risk premia versus the USD and gold returns #

FX tail risk premia on various currencies vis-a-vis the dollar imply tail risk premia on gold as well. First, gold futures are denominated in dollars and its sharp appreciation would naturally weigh on the dollar price of international commodities. Second, sharpe dollar appreciation can put stress on dollar funding, another tail risk that would affect commodities in general and gold in particular.

# Step 1: Filter for Gold-related commodity returns

gold_cats = ["COXR_VT10", "COXR_NSA"]

dfx_gld = dfx[dfx["xcat"].isin(gold_cats) & (dfx["cid"] == "GLD")]

# Step 2: Define the indicators and currencies to map to the gold cross-section

xcatx = ["FXPPTAILDOWNUSD_NSAIZ", "IVAWGT_SA_1YMA"]

#currencies = ["EUR", "GBP", "CHF"]

currencies = cids

# Step 3: Loop through each currency, align it to gold's cross-section, and update the result

dfx_gold = dfx_gld.copy()

for cid in currencies:

df_curr = dfx[(dfx["xcat"].isin(xcatx)) & (dfx["cid"] == cid)]

df_curr = msm.update_df(dfx_gld, df_curr)

df_curr["cid"] = cid

dfx_gold = msm.update_df(dfx_gold, df_curr)

# Step 4: Create a composite cross-section for the downside weighted with respective Share in world GDP (USD terms): based on 1-year moving average

composite_cid = "Weighted local currency tail risk vis-a-vis USD"

dflc = msp.linear_composite(

df=dfx,

xcats="FXPPTAILDOWNUSD_NSAIZ",

cids=currencies,

weights="IVAWGT_SA_1YMA",

normalize_weights=True,

complete_cids=False,

new_cid=composite_cid,

)

dflc = msm.update_df(dfx_gld, dflc)

dfx_gold = msm.update_df(dfx_gold, dflc)

# Copy COXR_NSA for GLD and assign to new cid

df_copy = dfx[(dfx["xcat"].isin(["COXR_NSA", "COXR_VT10"])) & (dfx["cid"] == "GLD")].copy()

df_copy["cid"] = composite_cid

# Update main DataFrame with the copied data

dfx_gold = msm.update_df(dfx_gold, df_copy)

Positive predictive power of the US dollar upside risk premium for Gold returns holds on daily, weekly, and monthly frequencies. This relationship is particularly strong for USD/GBP downside risk.

sigx = {

"FXPPTAILDOWNUSD_NSAIZ": "FX tail risk premium versus dominant benchmark currency: downside (10-delta), z-score"

}

targx = {

"COXR_NSA": "Gold future returns, % of notional",

}

# --- Common Parameters ---

xcats = list(sigx.keys()) + list(targx.keys())

common_kwargs = {

"df": dfx_gold,

"xcats": xcats,

"freq": "W",

"lag": 1,

"xcat_aggs": ["last", "sum"],

"start": "2000-01-01",

}

# --- Create CategoryRelations Objects ---

cr_comp = msp.CategoryRelations(

cids=["Weighted local currency tail risk vis-a-vis USD"], **common_kwargs

)

cr_gbp = msp.CategoryRelations(cids=["GBP"], **common_kwargs)

msv.multiple_reg_scatter(

[cr_comp, cr_gbp],

title="Downside FX tail risk premium vs subsequent gold future returns, since 2000",

xlab=list(sigx.values())[0],

ylab=f"{list(targx.values())[0]}, next week",

ncol=2,

nrow=1,

figsize=(16, 6),

subplot_titles=[

"Local currencies' downside tail risk versus USD (weighted average)",

"GBP downside tail risk versus USD",

],

prob_est="map",

coef_box="lower left",

)

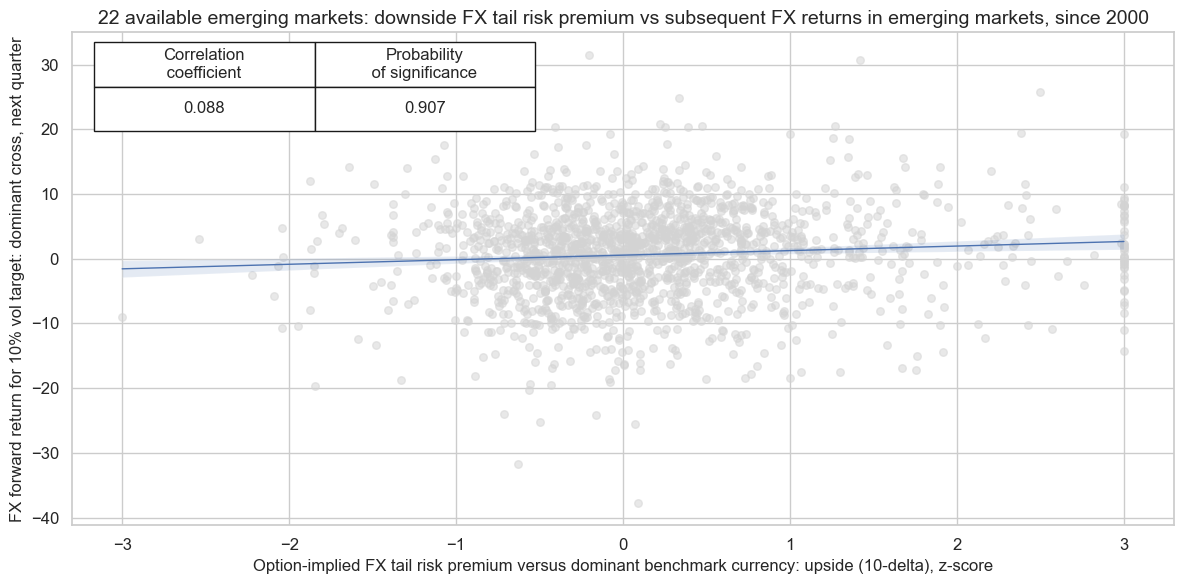

FX tail risk premia and subsequent FX forward returns #

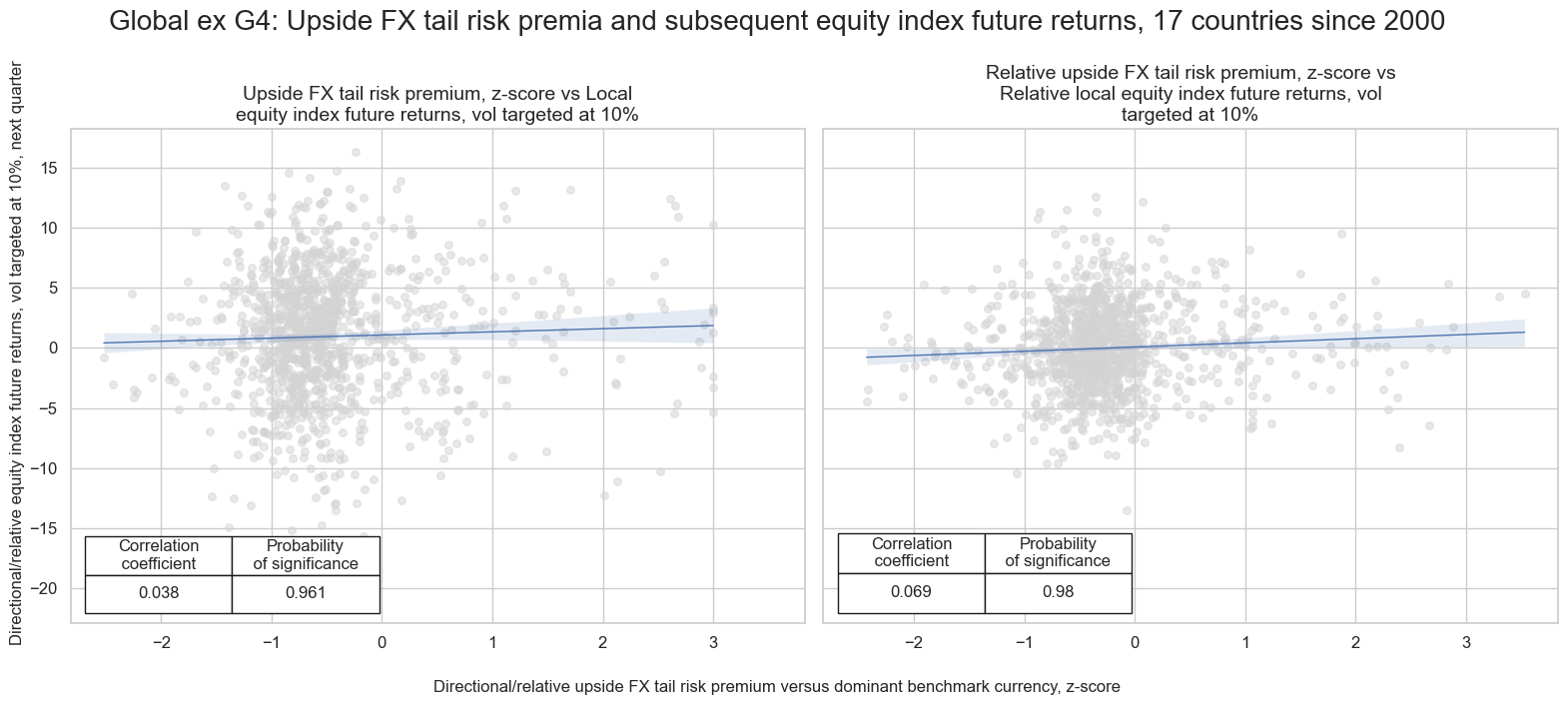

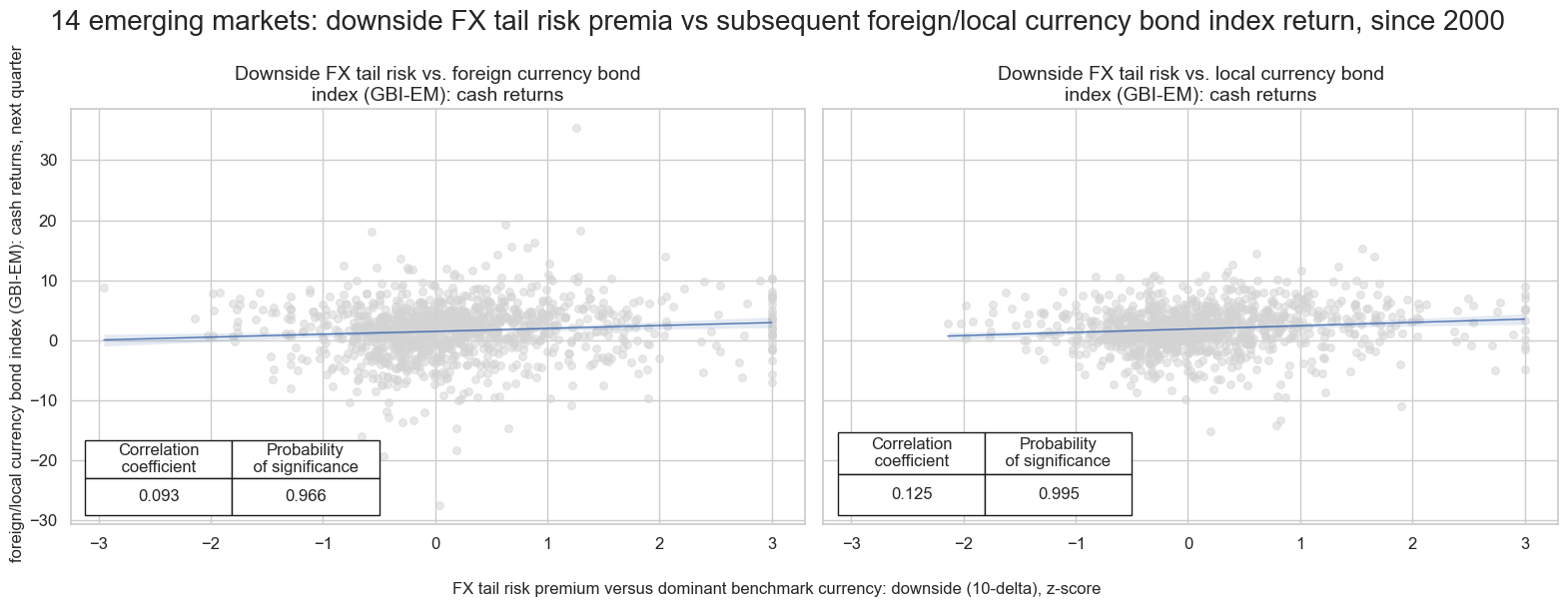

There is some evidence that downside risk premia have positive predictive power for subsequent FX returns in emerging markets, suggesting that investors have, on balance, been compensated for bearing such risks. The predictive relationship is also positive in developed markets, however it fails to reach significance accordint to rigorous Macrosynergy panel test.

# Define signal and target mappings

sigx = {"FXPPTAILDOWN_NSAPZ": "Option-implied FX tail risk premium versus dominant benchmark currency: upside (10-delta), z-score"}

targx = {"FXXR_VT10": "FX forward return for 10% vol target: dominant cross"}

# Get common cross-section identifiers

cidx = msm.common_cids(dfx, xcats=list(sigx.keys()) + list(targx.keys()))

cidx = set(cids_em) & set(cidx)

cr = msp.CategoryRelations(

dfx,

xcats=[list(sigx.keys())[0], list(targx.keys())[0]], # Assign correct signals & targets

cids=cidx, # Use the corresponding cross-sections for this market

freq="Q",

lag=1,

xcat_aggs=["last", "sum"],

blacklist=fxblack ,

start="2000-01-01",

)

cr.reg_scatter(

prob_est = "map",

xlab = f"{list(sigx.values())[0]}",

coef_box="upper left",

ylab = f"{list(targx.values())[0]}, next quarter",

size = (12, 6),

title=f"{len(cidx)} available emerging markets: downside FX tail risk premium vs subsequent FX returns in emerging markets, since 2000" ,)

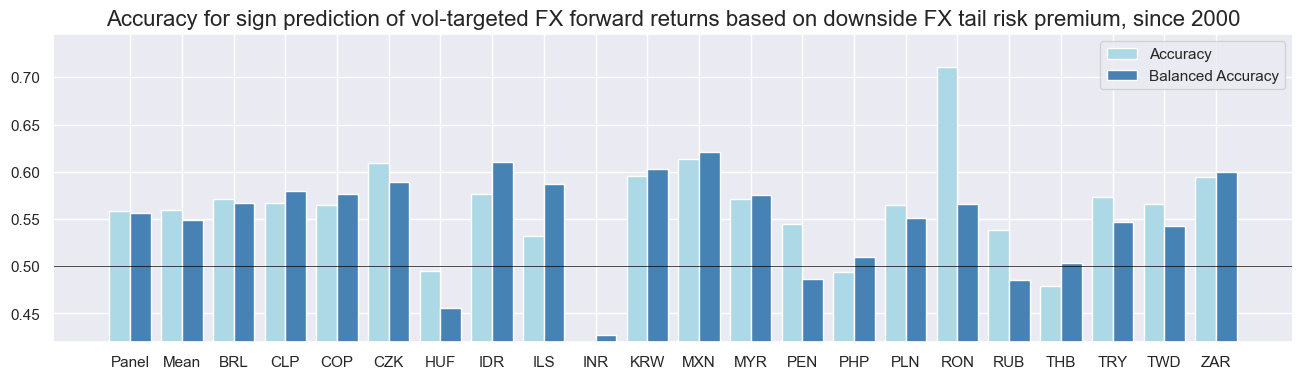

In emerging markets, the accuracy of predicting the sign of FX forward returns using normalized downside FX tail risk premia is well above 50% for majority of countries.

xcatx = ["FXPPTAILDOWN_NSAPZ", "FXXR_VT10"]

cidx = cids_exp

sr = mss.SignalReturnRelations(

dfx,

rets=xcatx[1],

sigs=xcatx[0],

agg_sigs="mean",

cids=cids_em,

blacklist=fxblack,

freqs="Q",

cosp=True,

)

sr.accuracy_bars(size = (16, 4),

title = "Accuracy for sign prediction of vol-targeted FX forward returns based on downside FX tail risk premium, since 2000",

)

Appendices #

Appendix 1: Currency symbols #

The word ‘cross-section’ refers to currencies, currency areas or economic areas. In alphabetical order, these are AUD (Australian dollar), BRL (Brazilian real), CAD (Canadian dollar), CHF (Swiss franc), CLP (Chilean peso), CNY (Chinese yuan renminbi), COP (Colombian peso), CZK (Czech Republic koruna), DEM (German mark), ESP (Spanish peseta), EUR (Euro), FRF (French franc), GBP (British pound), HKD (Hong Kong dollar), HUF (Hungarian forint), IDR (Indonesian rupiah), ITL (Italian lira), JPY (Japanese yen), KRW (Korean won), MXN (Mexican peso), MYR (Malaysian ringgit), NLG (Dutch guilder), NOK (Norwegian krone), NZD (New Zealand dollar), PEN (Peruvian sol), PHP (Phillipine peso), PLN (Polish zloty), RON (Romanian leu), RUB (Russian ruble), SEK (Swedish krona), SGD (Singaporean dollar), THB (Thai baht), TRY (Turkish lira), TWD (Taiwanese dollar), USD (U.S. dollar), ZAR (South African rand).