EM sovereign debt and macro risk premium scores #

Get packages and JPMaQS data #

import numpy as np

import pandas as pd

from pandas import Timestamp

import matplotlib.pyplot as plt

import os

import io

from datetime import datetime

import macrosynergy.management as msm

import macrosynergy.panel as msp

import macrosynergy.signal as mss

import macrosynergy.pnl as msn

import macrosynergy.visuals as msv

from macrosynergy.download import JPMaQSDownload

from macrosynergy.visuals import ScoreVisualisers

from macrosynergy.panel.adjust_weights import adjust_weights

import warnings

pd.set_option('display.width', 400)

warnings.simplefilter("ignore")

cids_fc_latam = [ # Latam foreign currency debt countries

"BRL",

"CLP",

"COP",

"DOP",

"MXN",

"PEN",

"UYU",

]

cids_fc_emeu = [ # EM Europe foreign currency debt countries

"HUF",

"PLN",

"RON",

"RUB",

"RSD",

"TRY",

]

cids_fc_meaf = [ # Middle-East and Africa foreign currency debt countries

"AED",

"EGP",

"NGN",

"OMR",

"QAR",

"ZAR",

"SAR",

]

cids_fc_asia = [ # Asia foreign currency debt countries

"CNY",

"IDR",

"INR",

"PHP",

]

cids_fc = sorted(list(set(cids_fc_latam + cids_fc_emeu + cids_fc_meaf + cids_fc_asia)))

cids_emxfc = ['CZK', 'ILS', 'KRW', 'MYR', 'SGD', 'THB', 'TWD']

cids_em = sorted(cids_fc + cids_emxfc)

# Category tickers

# Features

govfin = [

"GGOBGDPRATIO_NSA",

"GGOBGDPRATIONY_NSA",

"GGDGDPRATIO_NSA",

]

xbal = [

"CABGDPRATIO_NSA_12MMA",

"MTBGDPRATIO_NSA_12MMA",

]

xliab = [

"NIIPGDP_NSA_D1Mv2YMA",

"NIIPGDP_NSA_D1Mv5YMA",

"IIPLIABGDP_NSA_D1Mv2YMA",

"IIPLIABGDP_NSA_D1Mv5YMA",

]

xdebt = [

"ALLIFCDSGDP_NSA",

"GGIFCDSGDP_NSA",

]

risk_metrics = [

"LTFCRATING_NSA",

"LTLCRATING_NSA",

"FCBICRY_NSA",

"FCBICRY_VT10",

"CDS05YSPRD_NSA",

"CDS05YXRxEASD_NSA",

]

# Targets

rets = ["FCBIR_NSA", "FCBIXR_NSA", "FCBIXR_VT10"]

bms = ["USD_EQXR_NSA", "UHY_CRXR_NSA", "UIG_CRXR_NSA"]

# Create ticker list

xcats = govfin + xbal + xliab + xdebt + risk_metrics + rets

tickers = [cid + "_" + xcat for cid in cids_em for xcat in xcats] + bms

print(f"Maximum number of tickers is {len(tickers)}")

Maximum number of tickers is 623

# Download series from J.P. Morgan DataQuery by tickers

client_id: str = os.getenv("DQ_CLIENT_ID")

client_secret: str = os.getenv("DQ_CLIENT_SECRET")

start_date = "1998-01-01"

end_date = (pd.Timestamp.today() - pd.offsets.BDay(1)).strftime('%Y-%m-%d')

with JPMaQSDownload(client_id=client_id, client_secret=client_secret) as dq:

df = dq.download(

tickers=tickers,

start_date=start_date,

end_date=end_date,

suppress_warning=True,

metrics=[

"value",

],

show_progress=True,

)

dfx = df.copy()

dfx.info()

Downloading data from JPMaQS.

Timestamp UTC: 2025-03-28 15:59:19

Connection successful!

Requesting data: 100%|██████████████████████████| 32/32 [00:06<00:00, 4.85it/s]

Downloading data: 100%|█████████████████████████| 32/32 [00:25<00:00, 1.28it/s]

Some expressions are missing from the downloaded data. Check logger output for complete list.

81 out of 623 expressions are missing. To download the catalogue of all available expressions and filter the unavailable expressions, set `get_catalogue=True` in the call to `JPMaQSDownload.download()`.

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 3233494 entries, 0 to 3233493

Data columns (total 4 columns):

# Column Dtype

--- ------ -----

0 real_date datetime64[ns]

1 cid object

2 xcat object

3 value float64

dtypes: datetime64[ns](1), float64(1), object(2)

memory usage: 98.7+ MB

Availability checks and blacklisting #

Availability #

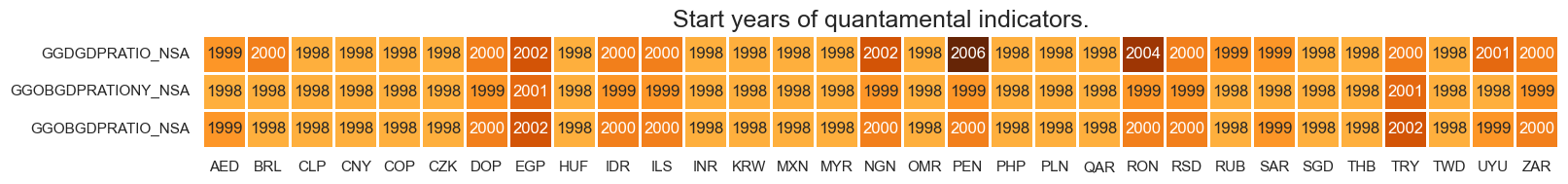

xcatx = govfin

msm.check_availability(df=dfx, xcats=xcatx, cids=cids_em, missing_recent=False)

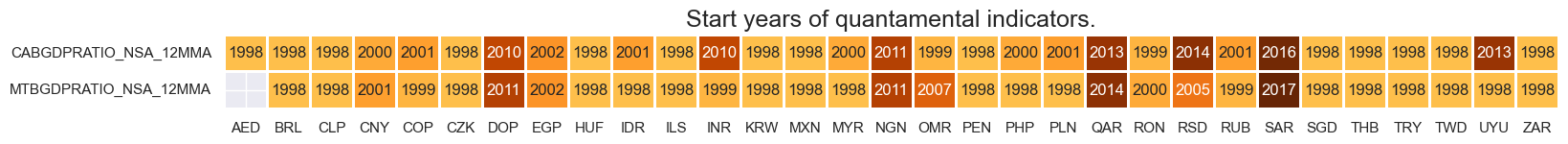

xcatx = xbal

msm.check_availability(df=dfx, xcats=xcatx, cids=cids_em, missing_recent=False)

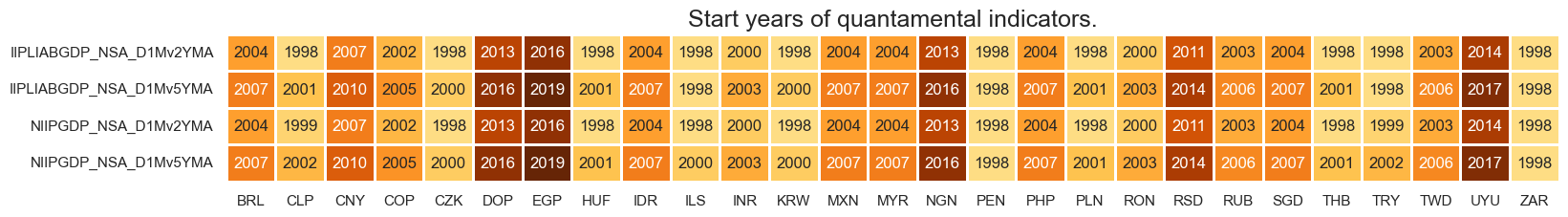

xcatx = xliab

msm.check_availability(df=dfx, xcats=xcatx, cids=cids_em, missing_recent=False)

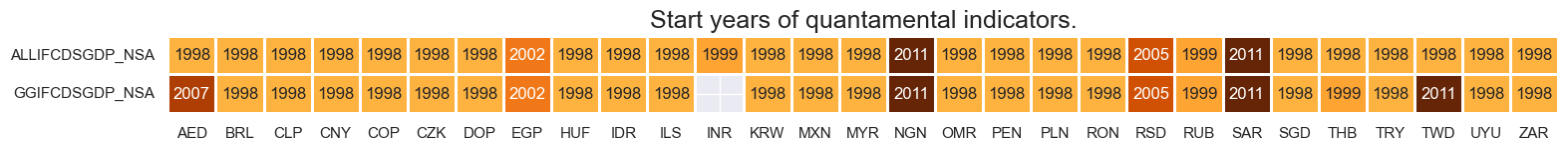

xcatx = xdebt

msm.check_availability(df=dfx, xcats=xcatx, cids=cids_em, missing_recent=False)

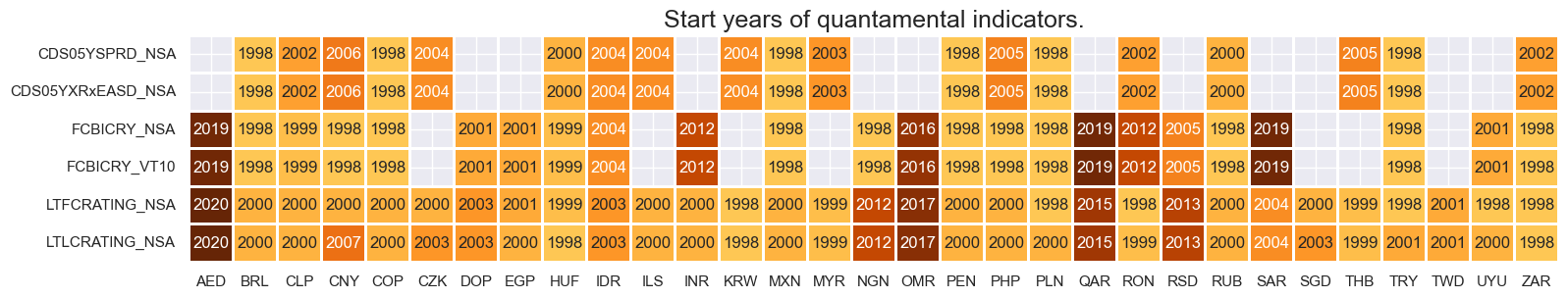

xcatx = risk_metrics

msm.check_availability(df=dfx, xcats=xcatx, cids=cids_em, missing_recent=False)

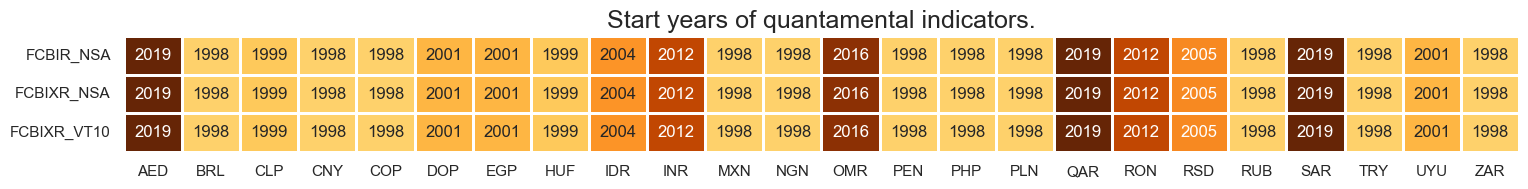

xcatx = rets

msm.check_availability(df=dfx, xcats=xcatx, cids=cids_em, missing_recent=False)

Blacklist #

black_fc = {'RUB': [Timestamp('2022-02-01 00:00:00'), Timestamp('2035-02-26 00:00:00')]}

Factor construction and checks #

Macro risk score #

# Governing dictionary

dict_macros = {

"GOVFIN":{

"GGOBGDPRATIO_NSA": ["median", ""],

"GGOBGDPRATIONY_NSA": ["median", ""],

"GGDGDPRATIO_NSA": ["median", "NEG"],

},

"XBAL":{

"CABGDPRATIO_NSA_12MMA": ["zero", ""],

"MTBGDPRATIO_NSA_12MMA": ["zero", ""],

},

"XLIAB":{

"NIIPGDP_NSA_D1Mv2YMA": ["zero", ""],

"NIIPGDP_NSA_D1Mv5YMA": ["zero", ""],

"IIPLIABGDP_NSA_D1Mv2YMA": ["zero", "NEG"],

"IIPLIABGDP_NSA_D1Mv5YMA": ["zero", "NEG"],

},

"XDEBT":{

"ALLIFCDSGDP_NSA": ["median", "NEG"],

"GGIFCDSGDP_NSA": ["median", "NEG"],

},

}

dict_factz = {}

dict_labels = {}

# Normalize all macro-quantamental categories based on the broad EM set

cidx = cids_em

for fact in dict_macros.keys():

dict_fact = dict_macros[fact]

xcatx = list(dict_fact.keys())

dfa = pd.DataFrame(columns=list(dfx.columns))

for xc in xcatx:

postfix = dict_fact[xc][1]

neutral = dict_fact[xc][0]

dfaa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral=neutral,

pan_weight=1,

thresh=3,

postfix="_" + postfix + "ZN",

est_freq="m",

)

dfaa["value"] = dfaa["value"] * (1 if postfix == "" else -1)

dfa = msm.update_df(dfa, dfaa)

dict_factz[fact] = dfa["xcat"].unique()

dfx = msm.update_df(dfx, dfa)

# Combine quantamental scores to conceptual scores

cidx = cids_em

for key, value in dict_factz.items():

dfa = msp.linear_composite(

dfx,

xcats=value,

cids=cidx,

complete_xcats=False,

new_xcat=key,

)

dfx = msm.update_df(dfx, dfa)

for key in dict_factz.keys():

dfa = msp.make_zn_scores(

dfx,

xcat=key,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

macroz = [fact + "_ZN" for fact in dict_factz.keys()]

dict_labels["GGOBGDPRATIO_NSA_ZN"] = "Excess general government balance, % of GDP, current year"

dict_labels["GGOBGDPRATIONY_NSA_ZN"] = "Excess government balance, % of GDP, next year"

dict_labels["GGDGDPRATIO_NSA_NEGZN"] = "Excess general government debt ratio, % of GDP, negative"

dict_labels["GOVFIN_ZN"] = "Government finances score"

dict_labels["CABGDPRATIO_NSA_12MMA_ZN"] = "Current account balance, 12mma, % of GDP"

dict_labels["MTBGDPRATIO_NSA_12MMA_ZN"] = "Merchandise trade balance, 12mma, % of GDP"

dict_labels["XBAL_ZN"] = "External balances score"

dict_labels["IIPLIABGDP_NSA_D1Mv2YMA_NEGZN"] = "International liabilities, latest versus 2yma, % of GDP, negative"

dict_labels["IIPLIABGDP_NSA_D1Mv5YMA_NEGZN"] = "International liabilities, latest versus 5yma, % of GDP, negative"

dict_labels["NIIPGDP_NSA_D1Mv2YMA_ZN"] = "Net international investment position, latest versus 2yma, % of GDP"

dict_labels["NIIPGDP_NSA_D1Mv5YMA_ZN"] = "Net international investment position, latest versus 5yma, % of GDP"

dict_labels["XLIAB_ZN"] = "International investment score"

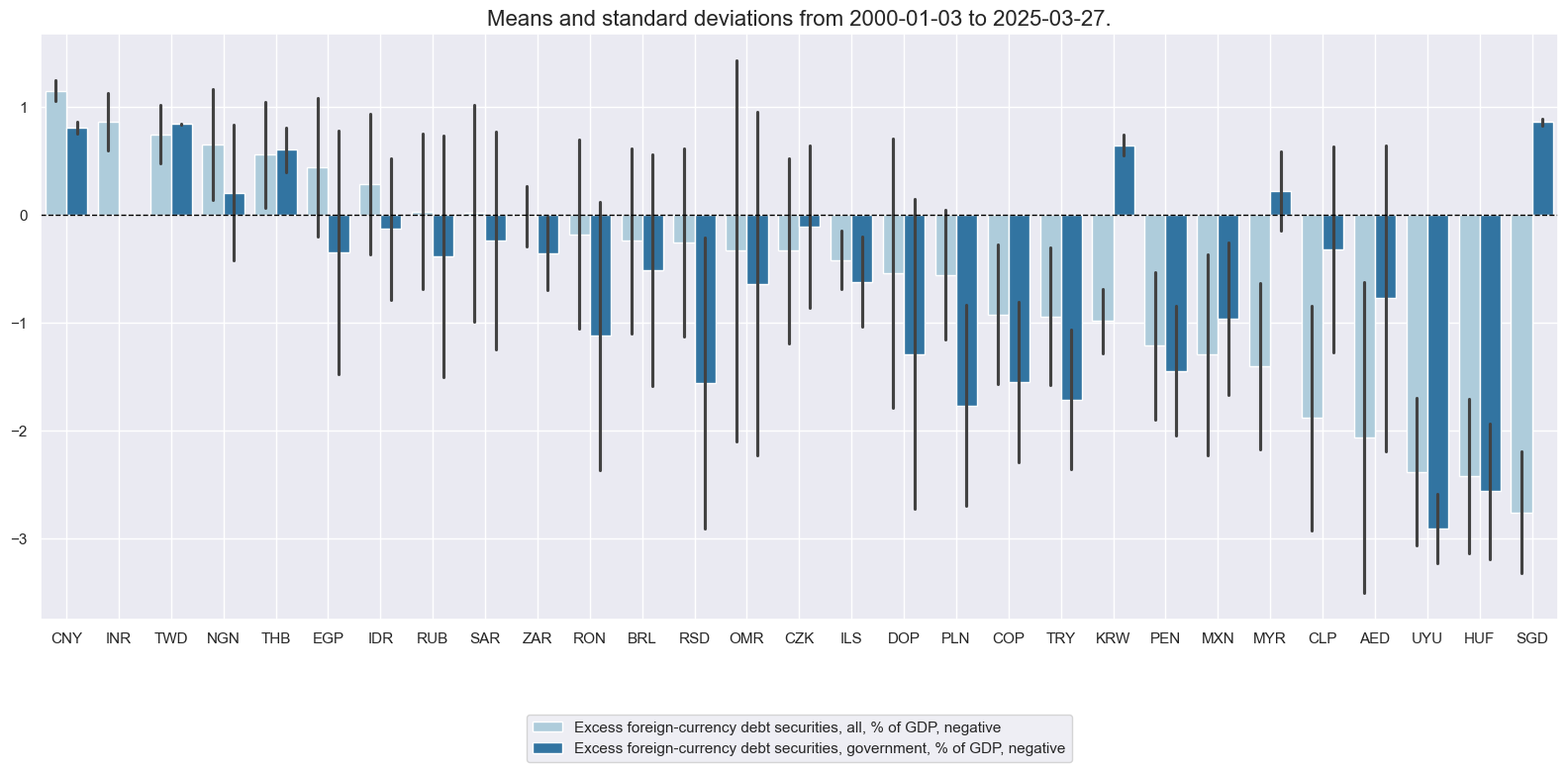

dict_labels["ALLIFCDSGDP_NSA_NEGZN"] = "Excess foreign-currency debt securities, all, % of GDP, negative"

dict_labels["GGIFCDSGDP_NSA_NEGZN"] = "Excess foreign-currency debt securities, government, % of GDP, negative"

dict_labels["XDEBT_ZN"] = "Foreign debt score"

# Box for quantamental score review

factor = "XDEBT" # "GOVFIN" "XBAL" "XLIAB" "XDEBT"

xcatx = list(dict_factz[factor])

cidx = cids_fc

sdate = "2000-01-01"

msp.view_ranges(

dfx,

xcats=xcatx,

kind="bar",

sort_cids_by="mean", # countries sorted by mean of the first category

start=sdate,

xcat_labels=dict_labels,

)

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

start=sdate,

same_y=True,

xcat_labels=dict_labels,

title=f"{dict_labels[factor+'_ZN']} factor, {sdate} to today",

title_fontsize=22,

legend_fontsize=16,

height=2,

)

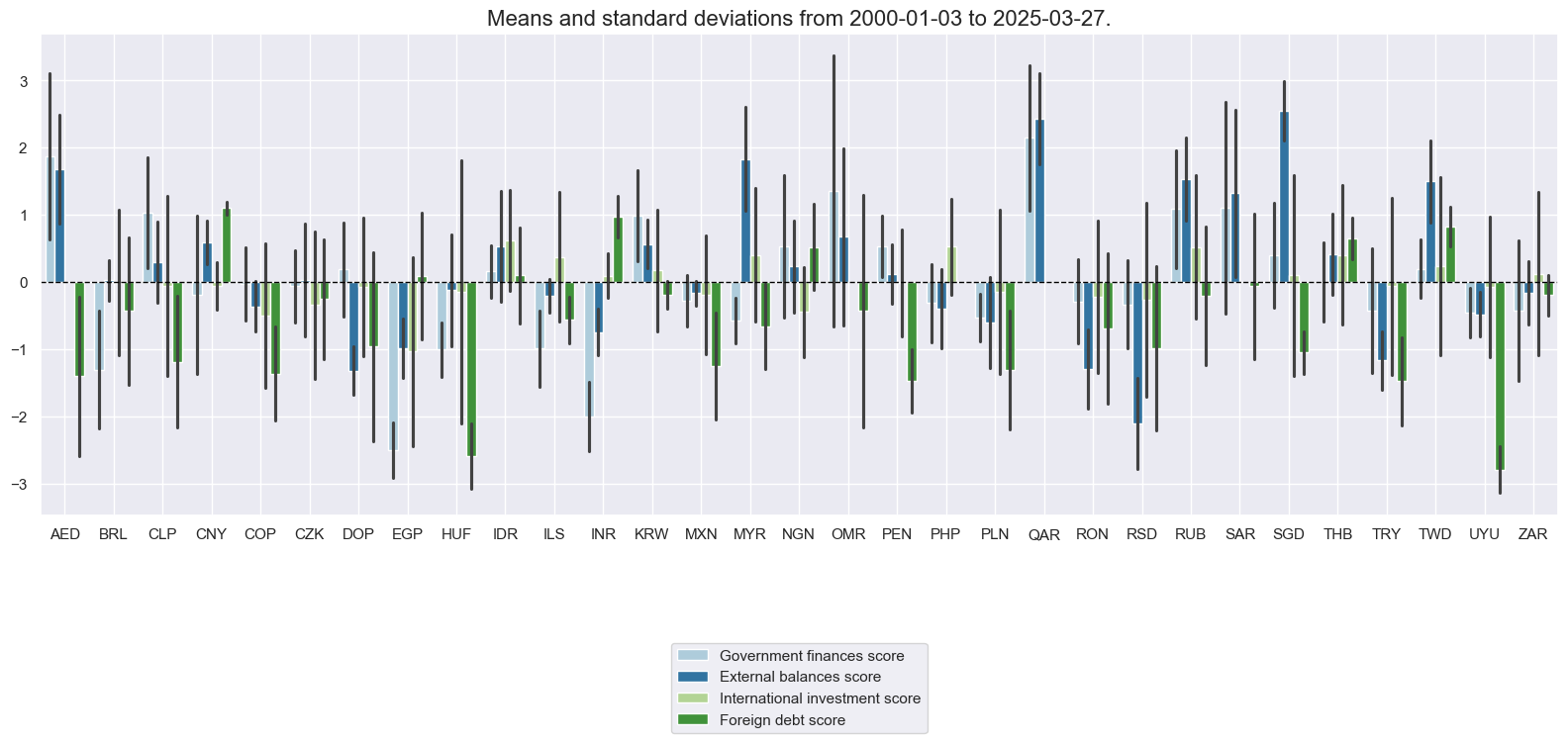

xcatx = macroz

cidx = cids_fc

sdate = "2000-01-01"

msp.view_ranges(

dfx,

xcats=xcatx,

kind="bar",

sort_cids_by=None,

start=sdate,

xcat_labels=dict_labels,

)

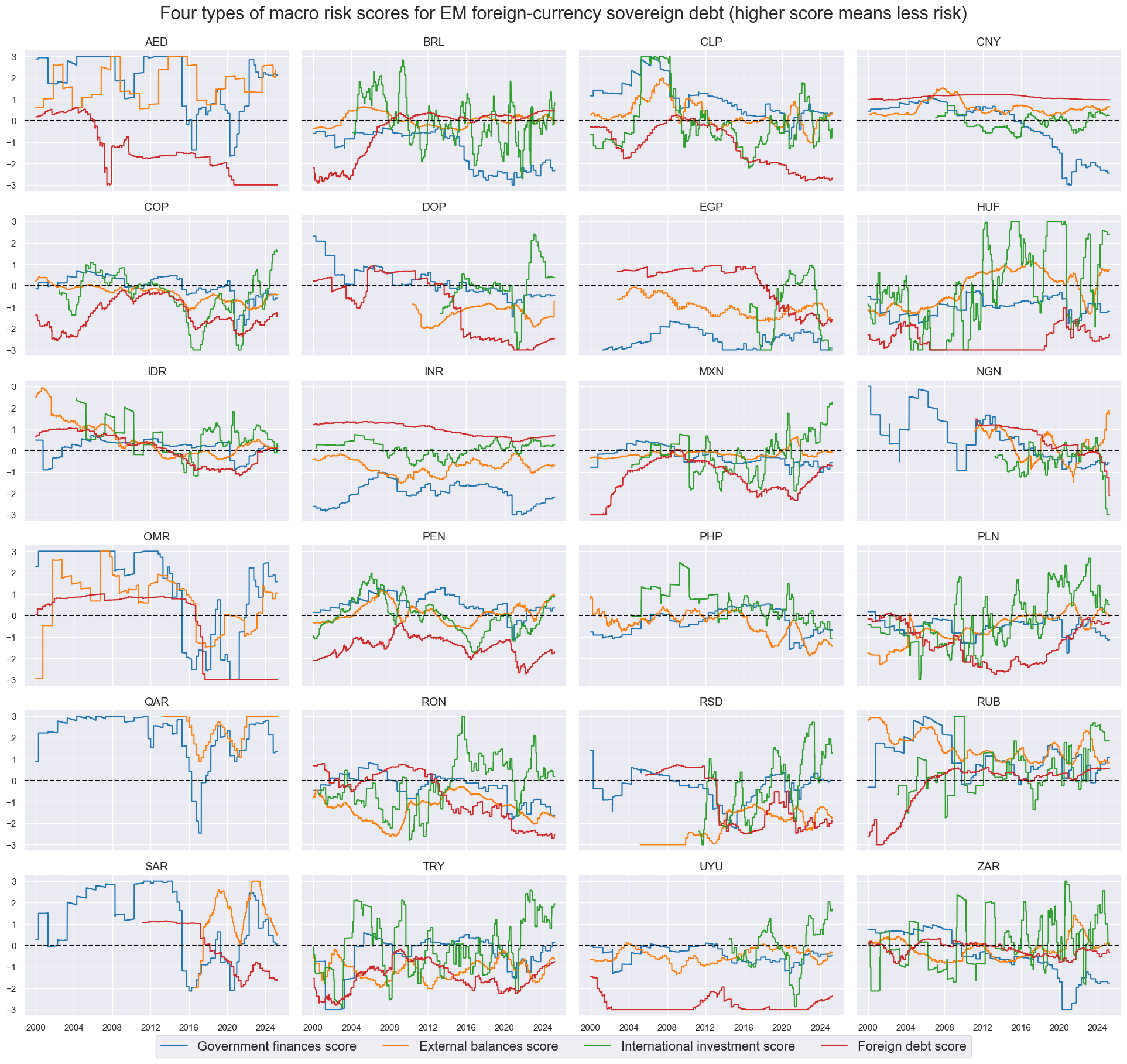

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

start=sdate,

same_y=True,

xcat_labels=dict_labels,

title=f"Four types of macro risk scores for EM foreign-currency sovereign debt (higher score means less risk)",

title_fontsize=22,

legend_fontsize=16,

height=2,

)

Spread and rating scores #

# Use index carry where CDS spreads not available ("priced risk" score)

msm.missing_in_df(df, xcats=["CDS05YSPRD_NSA"], cids=cids_fc) # countries without CDS

cidx = ['AED', 'DOP', 'EGP', 'INR', 'NGN', 'OMR', 'QAR', 'RSD', 'SAR', 'UYU']

calcs = ["CDS05YSPRD_NSA = FCBICRY_NSA"]

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cidx)

dfx = msm.update_df(dfx, dfa)

# Use inverse rating score ("rated risk" score)

calcs = ["LTFCRATING_INV = 1 / LTFCRATING_NSA"]

cidx = cids_fc

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cidx)

dfx = msm.update_df(dfx, dfa)

No missing XCATs across DataFrame.

Missing cids for CDS05YSPRD_NSA: ['AED', 'DOP', 'EGP', 'INR', 'NGN', 'OMR', 'QAR', 'RSD', 'SAR', 'UYU']

# Normalize spreads and ratings

cidx = cids_fc

xcatx = ["CDS05YSPRD_NSA", "LTFCRATING_INV"]

for xc in xcatx:

dfa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="median",

pan_weight=1,

blacklist=black_fc,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

dict_labels["CDS05YSPRD_NSA_ZN"] = "Credit spread score"

dict_labels["LTFCRATING_INV_ZN"] = "Rated risk score"

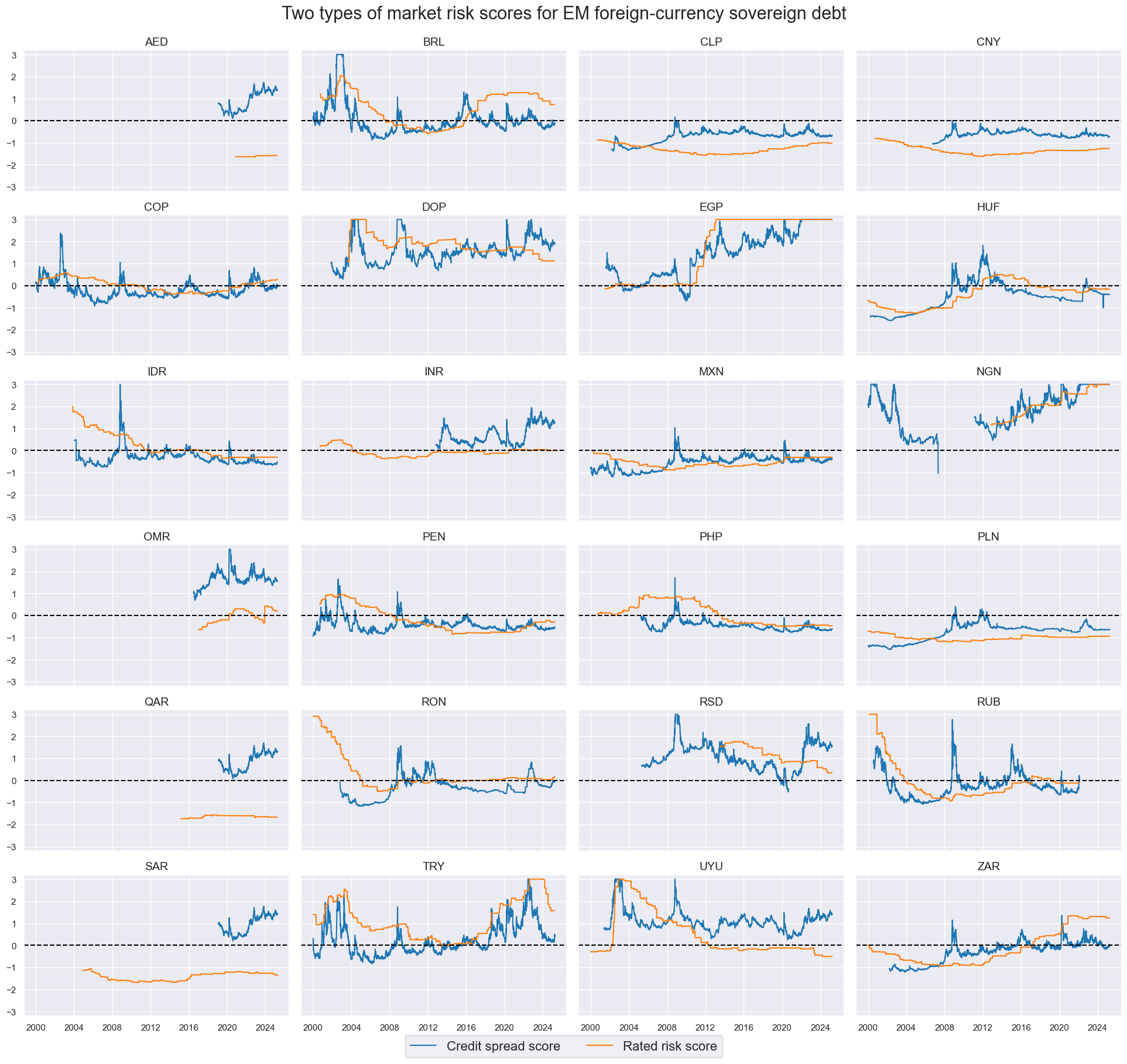

xcatx = ["CDS05YSPRD_NSA_ZN", "LTFCRATING_INV_ZN"]

cidx = cids_fc

sdate = "2000-01-01"

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

start=sdate,

same_y=True,

xcat_labels=dict_labels,

title='Two types of market risk scores for EM foreign-currency sovereign debt',

title_fontsize=22,

legend_fontsize=16,

height=2,

blacklist=black_fc

)

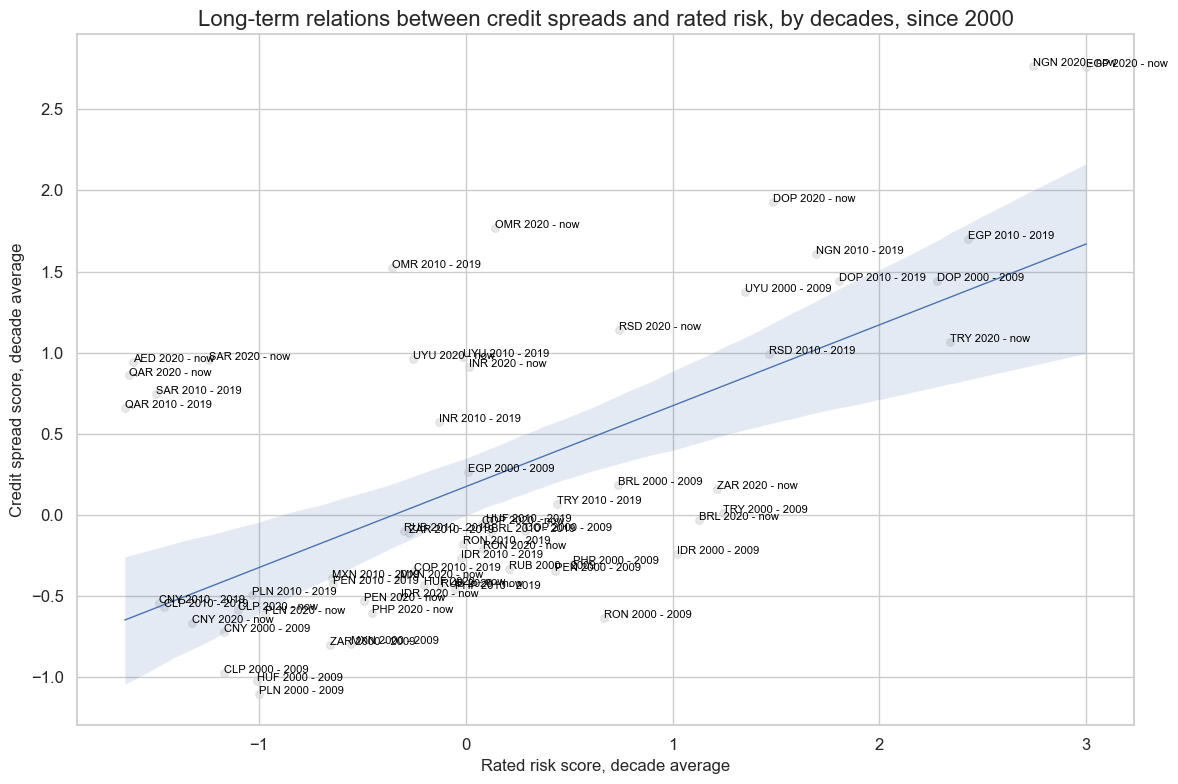

xcatx = ["LTFCRATING_INV_ZN", "CDS05YSPRD_NSA_ZN"]

cidx = cids_fc

cr = msp.CategoryRelations(

dfx,

xcats=xcatx,

cids=cidx,

years=10,

lag=0,

xcat_aggs=["mean", "mean"],

blacklist=black_fc,

start="2000-01-01",

)

cr.reg_scatter(

labels=True,

label_fontsize=12,

title="Long-term relations between credit spreads and rated risk, by decades, since 2000",

title_fontsize=16,

xlab="Rated risk score, decade average",

ylab="Credit spread score, decade average",

)

Macro risk premia #

# Calculations of Spread-based premium scores

cidx = cids_fc

calcs_spread = [

"SPREADvGOVFIN = CDS05YSPRD_NSA_ZN + GOVFIN_ZN",

"SPREADvXBAL = CDS05YSPRD_NSA_ZN + XBAL_ZN",

"SPREADvXLIAB = CDS05YSPRD_NSA_ZN + XLIAB_ZN",

"SPREADvXDEBT = CDS05YSPRD_NSA_ZN + XDEBT_ZN",

]

calcs_rating = [

"RATINGvGOVFIN = LTFCRATING_INV_ZN + GOVFIN_ZN",

"RATINGvXBAL = LTFCRATING_INV_ZN + XBAL_ZN",

"RATINGvXLIAB = LTFCRATING_INV_ZN + XLIAB_ZN",

"RATINGvXDEBT = LTFCRATING_INV_ZN + XDEBT_ZN",

]

calcs = calcs_spread + calcs_rating

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cidx)

dfx = msm.update_df(dfx, dfa)

spread_macros = ["SPREADvGOVFIN", "SPREADvXBAL", "SPREADvXLIAB", "SPREADvXDEBT"]

rating_macros = ["RATINGvGOVFIN", "RATINGvXBAL", "RATINGvXLIAB", "RATINGvXDEBT"]

dict_labels["SPREADvGOVFIN"] = "Spread-government finances risk premia"

dict_labels["SPREADvXBAL"] = "Spread-external balances risk premia"

dict_labels["SPREADvXLIAB"] = "Spread-international investment risk premia"

dict_labels["SPREADvXDEBT"] = "Spread-foreign debt risk premia"

dict_labels["RATINGvGOVFIN"] = "Rating-government finances risk premia"

dict_labels["RATINGvXBAL"] = "Rating-external balances risk premia"

dict_labels["RATINGvXLIAB"] = "Rating-international investment risk premia"

dict_labels["RATINGvXDEBT"] = "Rating-foreign debt risk premia"

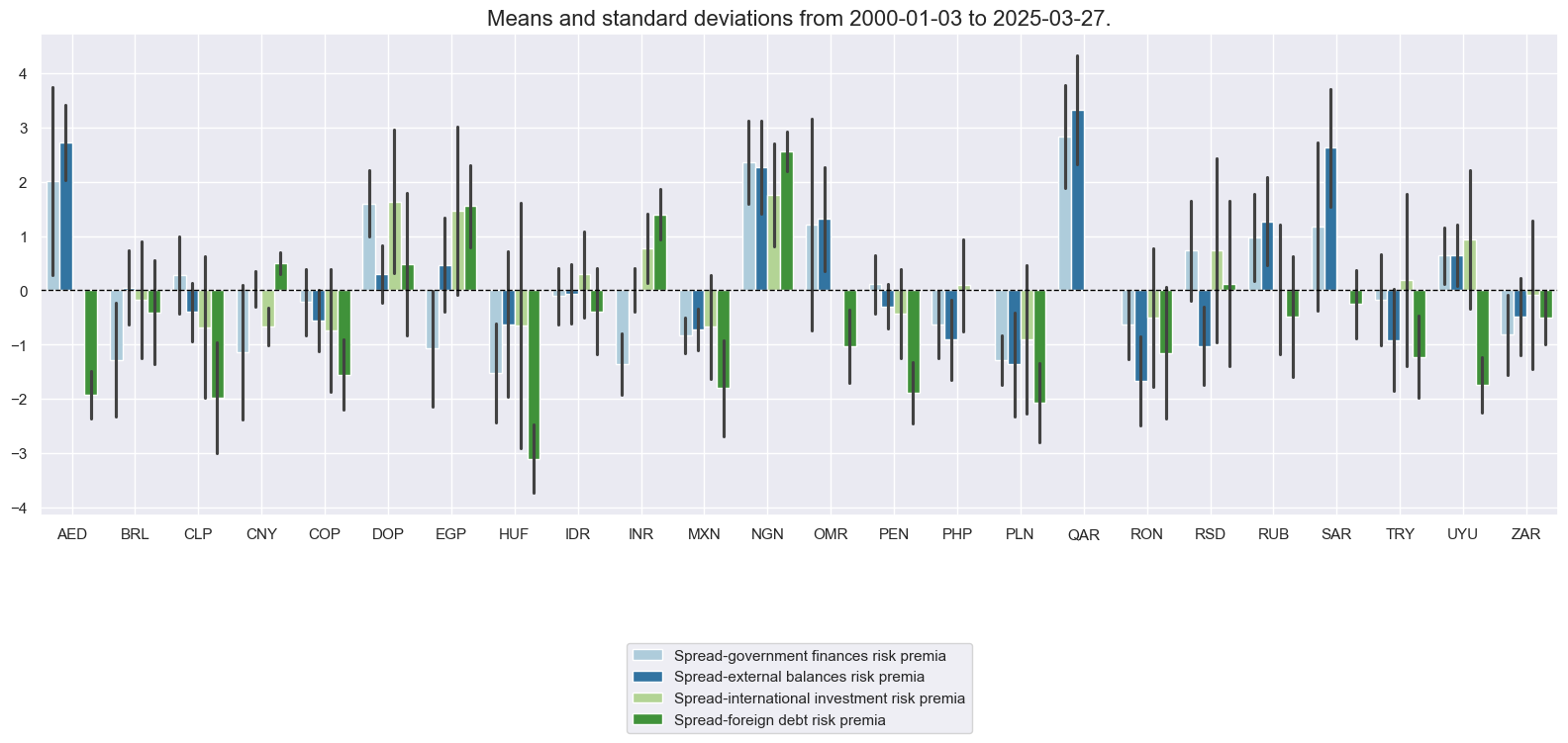

xcatx = spread_macros

cidx = cids_fc

sdate = "2000-01-01"

msp.view_ranges(

dfx,

xcats=xcatx,

kind="bar",

sort_cids_by=None,

start=sdate,

xcat_labels=dict_labels,

)

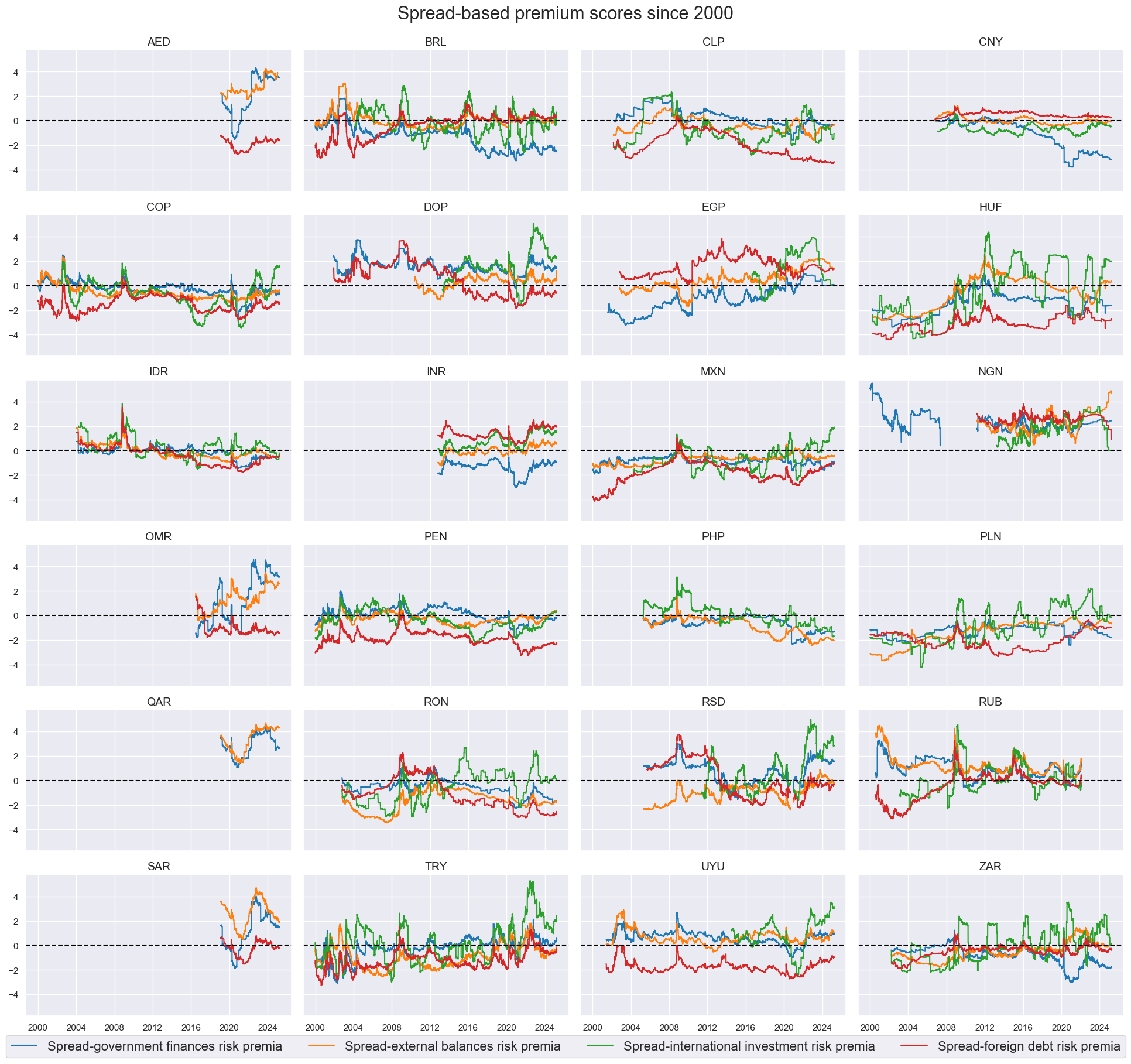

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

start=sdate,

same_y=True,

xcat_labels=dict_labels,

title='Spread-based premium scores since 2000',

title_fontsize=22,

legend_fontsize=16,

height=2,

)

cidx = cids_fc

dict_risks = {

"SPREADvMACRO": spread_macros,

"RATINGvMACRO": rating_macros,

"RISKvMACRO": ["SPREADvMACRO", "RATINGvMACRO"],

"RISKxMACRO": ["CDS05YSPRD_NSA_ZN", "LTFCRATING_INV_ZN"],

}

for key, value in dict_risks.items():

dfa = msp.linear_composite(

dfx,

xcats=value,

cids=cidx,

complete_xcats=False,

new_xcat=key,

)

dfx = msm.update_df(dfx, dfa)

dict_labels["SPREADvMACRO"] = "Spread-based premium score"

dict_labels["RATINGvMACRO"] = "Rating-based premium score"

dict_labels["RISKvMACRO"] = "Overall macro risk premium score"

dict_labels["RISKxMACRO"] = "Market risk score"

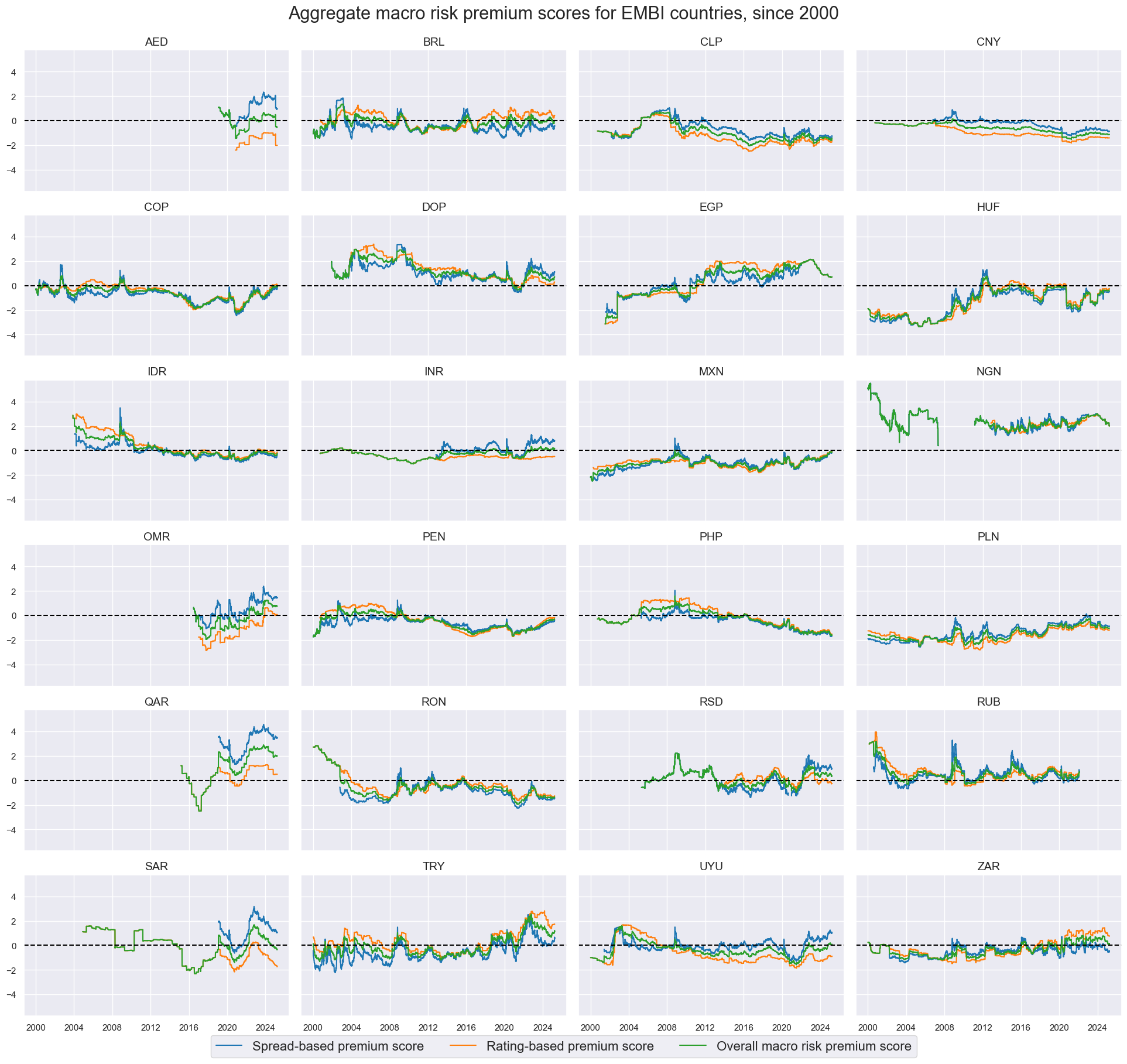

risk_macros = ["SPREADvMACRO", "RATINGvMACRO", "RISKvMACRO"]

xcatx = risk_macros

cidx = cids_fc

sdate = "2000-01-01"

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

blacklist=black_fc,

ncol=4,

start=sdate,

same_y=True,

xcat_labels=dict_labels,

title="Aggregate macro risk premium scores for EMBI countries, since 2000",

title_fontsize=22,

legend_fontsize=16,

height=2,

)

Relative macro risk premia #

cidx = cids_fc

xcatx = risk_macros + ["RISKxMACRO"] + ["FCBIXR_NSA", "FCBIXR_VT10"]

dfa = msp.make_relative_value(

df = dfx,

xcats = xcatx,

cids = cidx,

start="2000-01-01",

blacklist=black_fc,

postfix="vEM",

)

dfx = msm.update_df(dfx, dfa)

risk_macros_vEM = [xcat + "vEM" for xcat in risk_macros]

dict_labels["SPREADvMACROvEM"] = "Relative spread-based premium score"

dict_labels["RATINGvMACROvEM"] = "Relative rating-based premium score"

dict_labels["RISKvMACROvEM"] = "Relative overall macro risk premium score"

dict_labels["RISKxMACROvEM"] = "Relative market risk score"

xcatx = risk_macros_vEM

cidx = cids_fc

sdate = "2000-01-01"

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

start=sdate,

same_y=True,

xcat_labels=dict_labels,

title="Available history of relative macro risk premium scores for EMBI countries, since 2000",

title_fontsize=22,

legend_fontsize=16,

height=2,

)

EM foreign currency debt scorecards #

Snapshot #

black_fc

{'RUB': [Timestamp('2022-02-01 00:00:00'), Timestamp('2035-02-26 00:00:00')]}

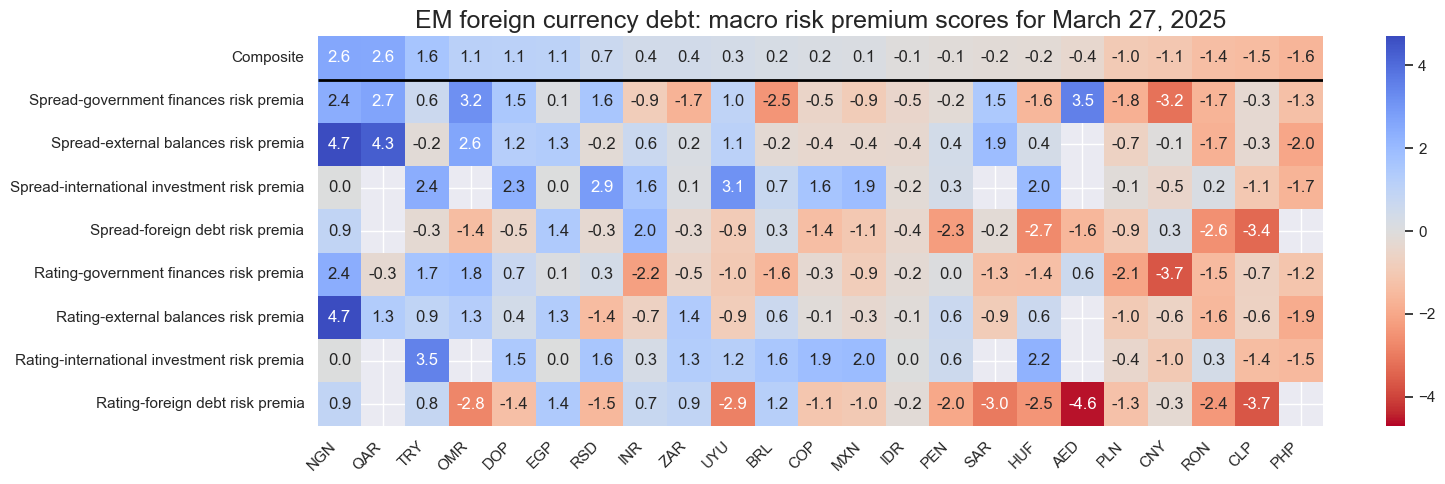

xcatx = spread_macros + rating_macros

cidx = cids_fc

# Set date of snapshot

backdate = datetime.strptime("2025-03-26", "%Y-%m-%d")

lastdate = datetime.strptime(end_date, "%Y-%m-%d")

snapdate = lastdate # lastdate # lastdate or backdate

sv = ScoreVisualisers(

df=dfx,

cids=cidx,

xcats = xcatx,

no_zn_scores=True,

rescore_composite=True,

blacklist = black_fc,

)

sv.view_snapshot(

cids=cidx,

date=snapdate,

transpose=True,

sort_by_composite = True,

title=f"EM foreign currency debt: macro risk premium scores for {snapdate.strftime('%B %d, %Y')}",

title_fontsize=18,

figsize=(16, 5),

xcats=xcatx + ["Composite"],

xcat_labels=dict_labels,

round_decimals=1,

)

History #

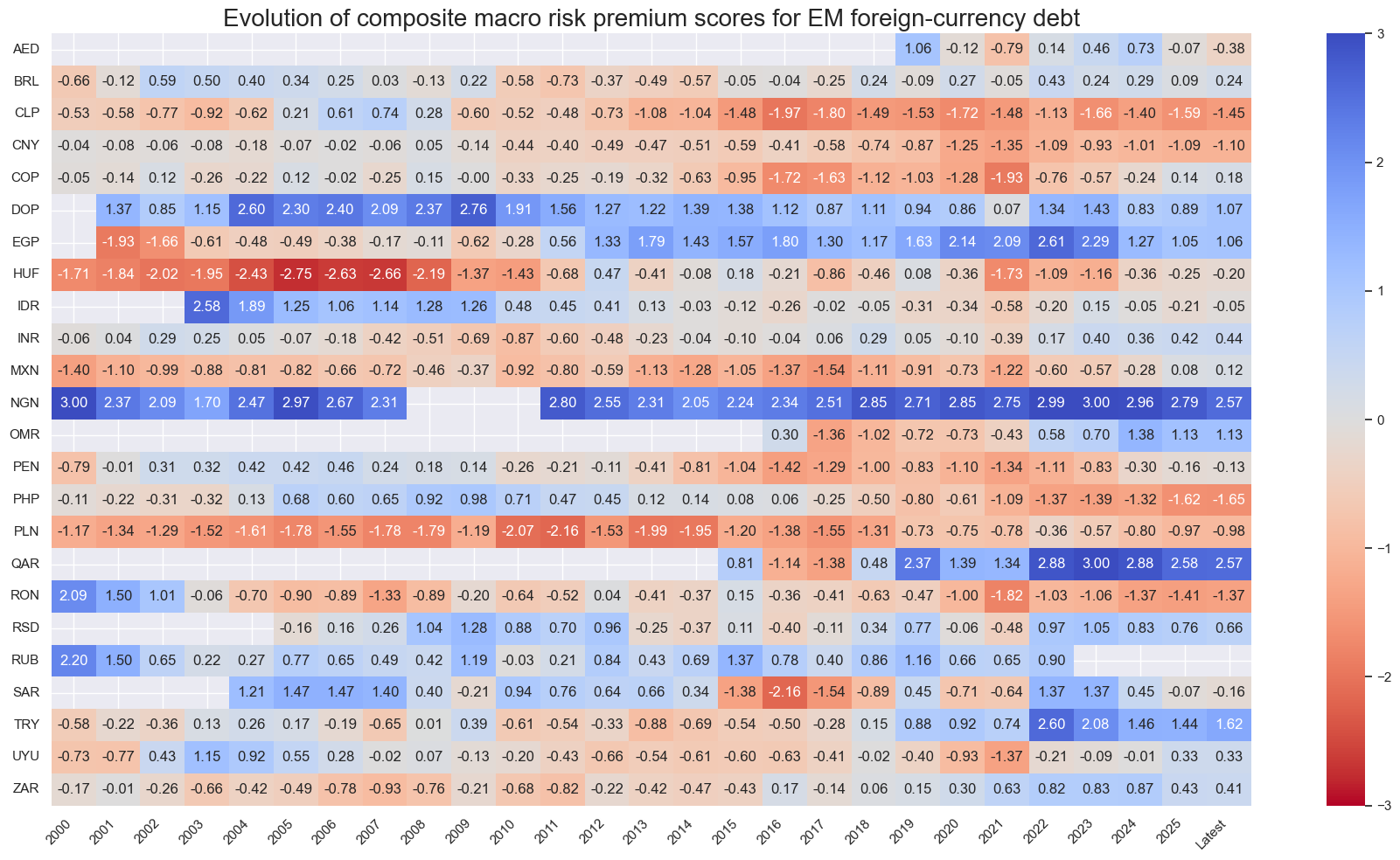

sv.view_score_evolution(

xcat="Composite",

cids=cidx,

freq="A",

include_latest_day=True,

transpose=False,

title="Evolution of composite macro risk premium scores for EM foreign-currency debt",

start="2000-01-01",

figsize=(18, 10),

)

Latest day: 2025-03-27 00:00:00

Country focus #

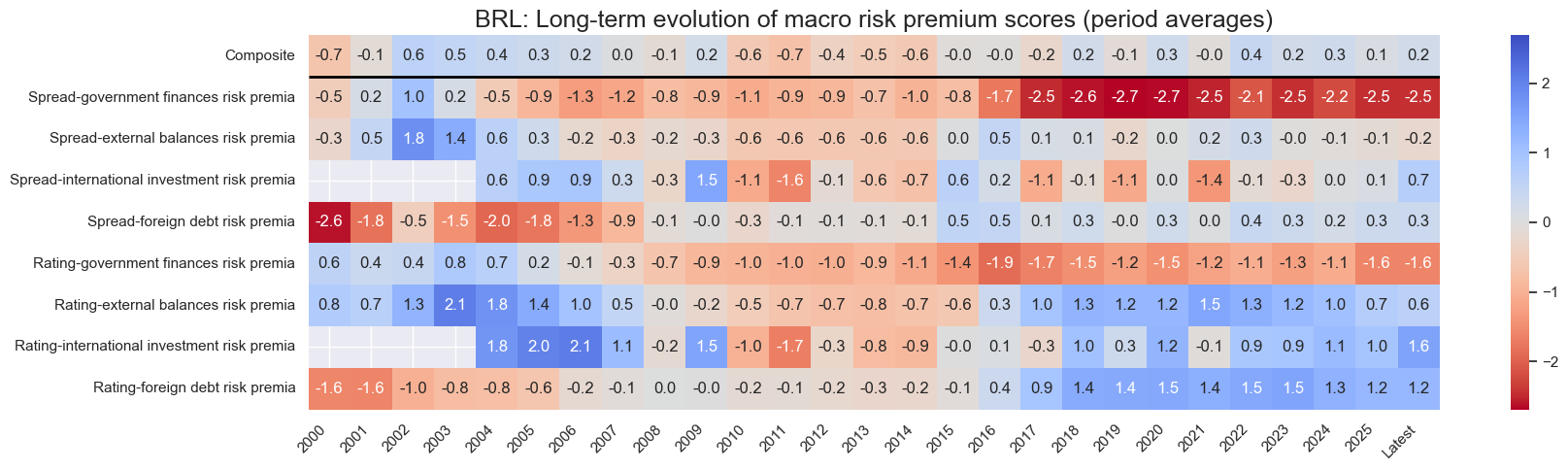

cid = "BRL"

xcatx = spread_macros + rating_macros + ["Composite"]

sv.view_cid_evolution(

cid=cid,

xcats=xcatx,

xcat_labels=dict_labels,

freq="A",

transpose=False,

title=f"{cid}: Long-term evolution of macro risk premium scores (period averages)",

title_fontsize=18,

figsize=(18, 5),

round_decimals=1,

start="2000-01-01",

)

Latest day: 2025-03-27 00:00:00

Value checks #

Simple directional signals #

Specs and panel test #

dict_dir = {

"sigs": risk_macros + ["RISKxMACRO"],

"targ": "FCBIXR_NSA",

"cidx": cids_fc,

"start": "2000-01-01",

"black": black_fc,

"srr": None,

"pnls": None,

}

dix = dict_dir

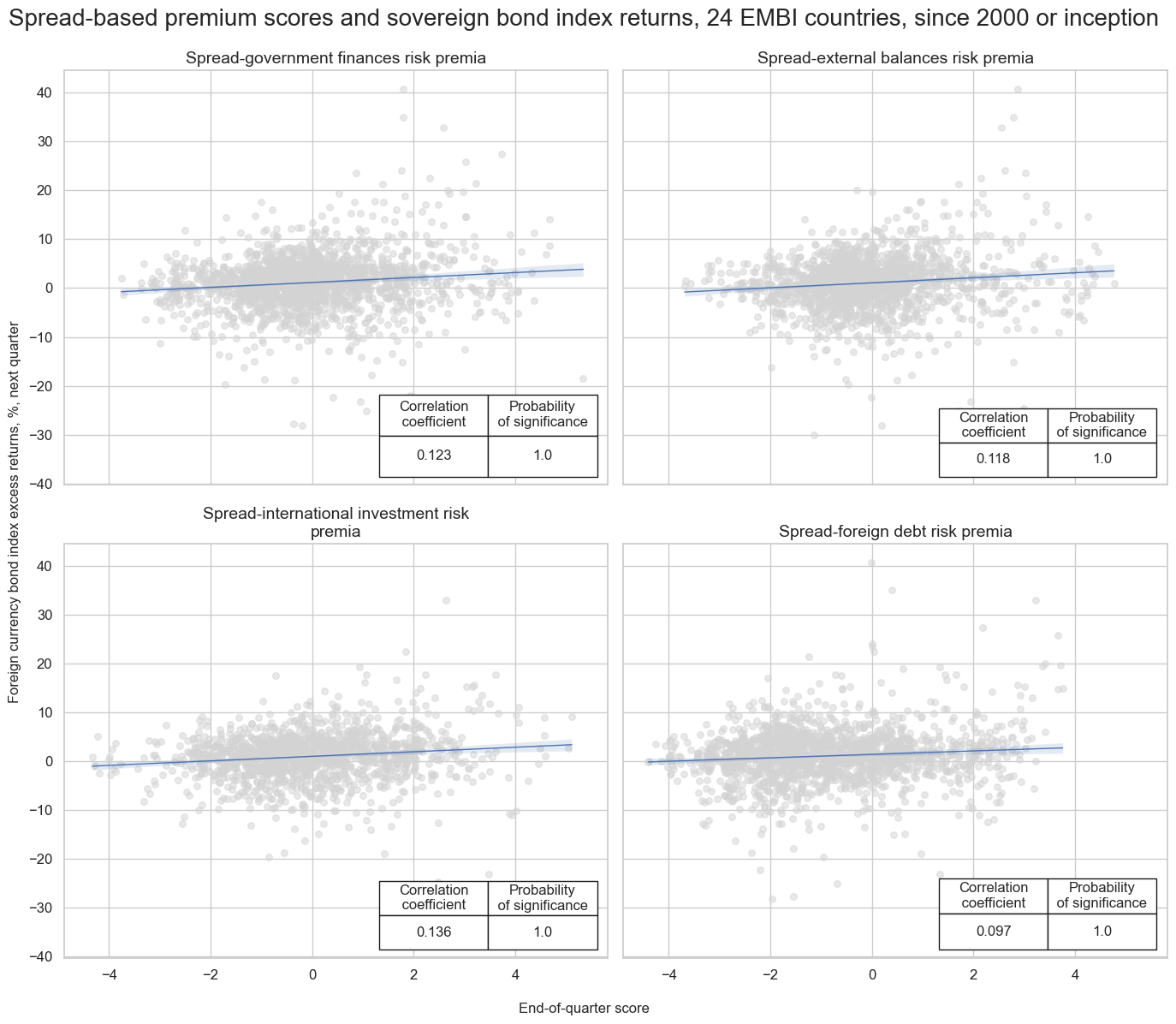

sigs = spread_macros

ret = dix["targ"]

cidx = dix["cidx"]

start = dix["start"]

black = dix["black"]

catregs = {}

for sig in sigs:

catregs[sig] = msp.CategoryRelations(

dfx,

xcats=[sig, ret],

cids=cidx,

freq="Q",

lag=1,

xcat_aggs=["last", "sum"],

start=start,

blacklist=black_fc,

)

msv.multiple_reg_scatter(

cat_rels=[v for k, v in catregs.items()],

ncol=2,

nrow=2,

figsize=(14, 12),

title="Spread-based premium scores and sovereign bond index returns, 24 EMBI countries, since 2000 or inception",

title_xadj=0.5,

title_yadj=0.99,

title_fontsize=20,

xlab="End-of-quarter score",

ylab="Foreign currency bond index excess returns, %, next quarter",

coef_box="lower right",

prob_est="map",

single_chart=True,

subplot_titles=[dict_labels[key] for key in sigs]

)

SPREADvXLIAB misses: ['AED', 'OMR', 'QAR', 'SAR'].

SPREADvXDEBT misses: ['PHP', 'QAR'].

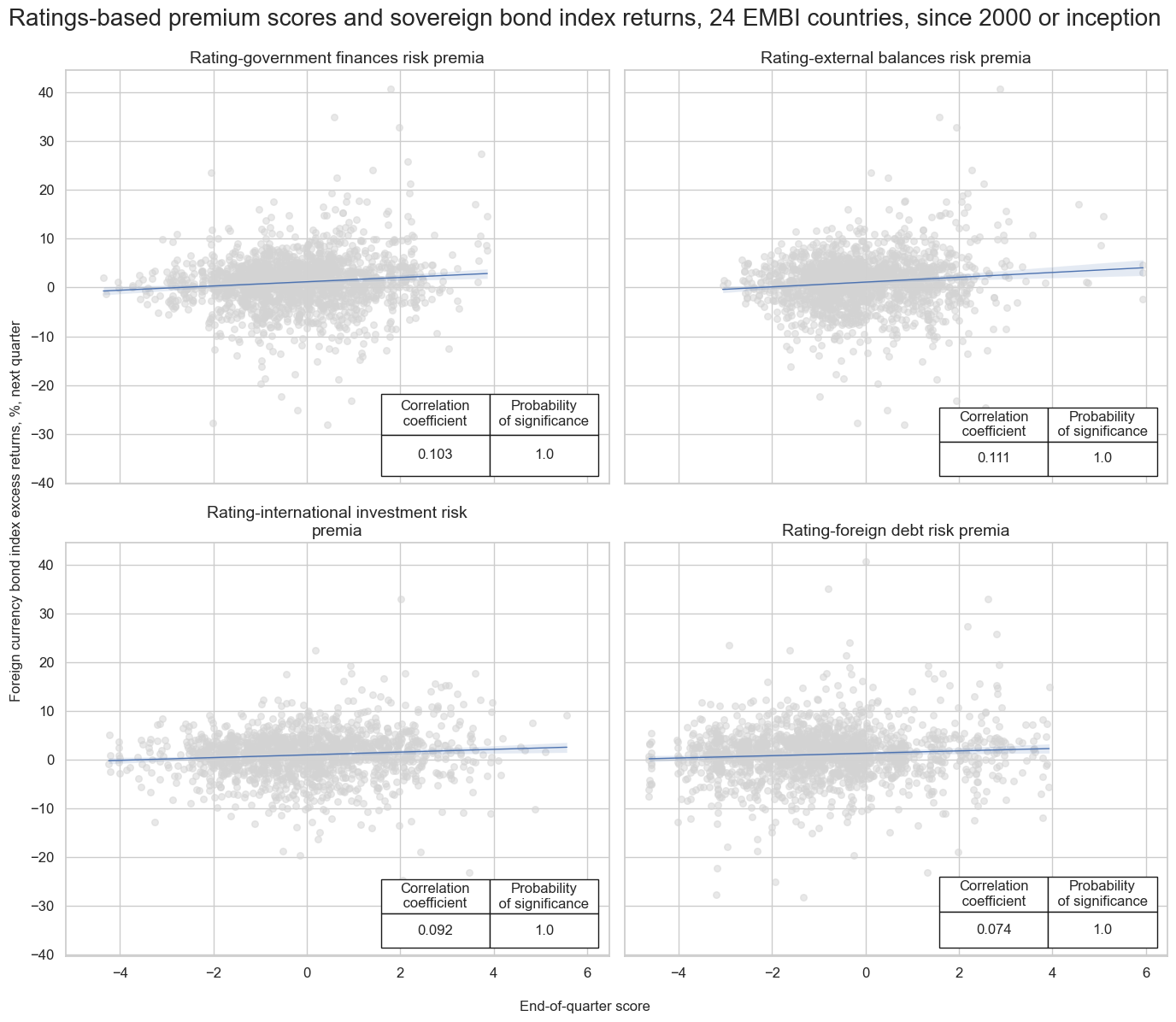

dix = dict_dir

sigs = rating_macros

ret = dix["targ"]

cidx = dix["cidx"]

start = dix["start"]

black = dix["black"]

catregs = {}

for sig in sigs:

catregs[sig] = msp.CategoryRelations(

dfx,

xcats=[sig, ret],

cids=cidx,

freq="Q",

lag=1,

xcat_aggs=["last", "sum"],

start=start,

blacklist=black_fc,

)

msv.multiple_reg_scatter(

cat_rels=[v for k, v in catregs.items()],

ncol=2,

nrow=2,

figsize=(14, 12),

title="Ratings-based premium scores and sovereign bond index returns, 24 EMBI countries, since 2000 or inception",

title_xadj=0.5,

title_yadj=0.99,

title_fontsize=20,

xlab="End-of-quarter score",

ylab="Foreign currency bond index excess returns, %, next quarter",

coef_box="lower right",

prob_est="map",

single_chart=True,

subplot_titles=[dict_labels[key] for key in sigs]

)

RATINGvXLIAB misses: ['AED', 'OMR', 'QAR', 'SAR'].

RATINGvXDEBT misses: ['PHP', 'QAR'].

dix = dict_dir

sigs = dix["sigs"]

ret = dix["targ"]

cidx = dix["cidx"]

start = dix["start"]

black = dix["black"]

catregs = {}

for sig in sigs:

catregs[sig] = msp.CategoryRelations(

dfx,

xcats=[sig, ret],

cids=cidx,

freq="Q",

lag=1,

xcat_aggs=["last", "sum"],

# xcat_trims=[50, 50], # remove single outlier

start=start,

blacklist=black_fc,

)

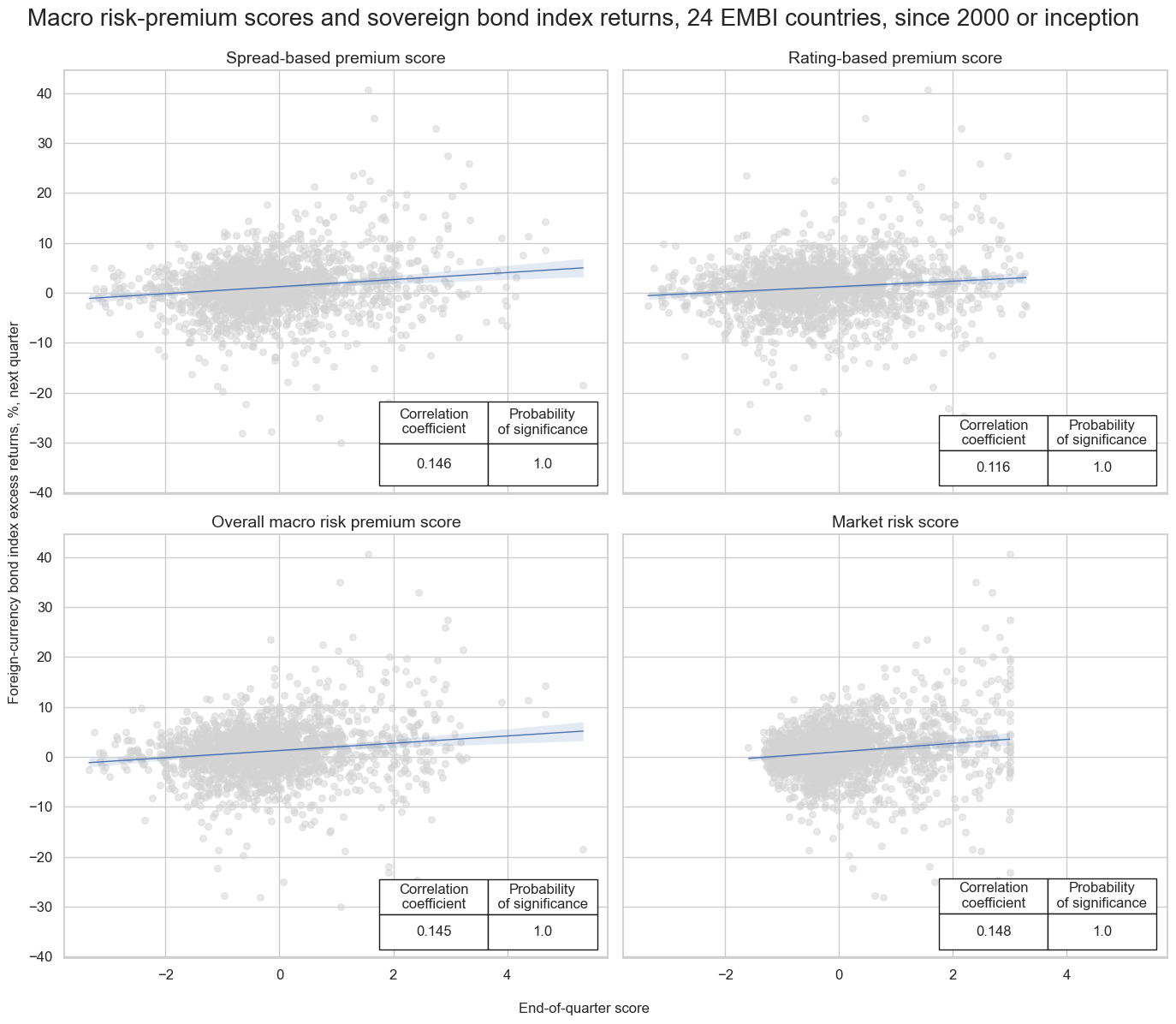

msv.multiple_reg_scatter(

cat_rels=[v for k, v in catregs.items()],

ncol=2,

nrow=2,

figsize=(14, 12),

title="Macro risk-premium scores and sovereign bond index returns, 24 EMBI countries, since 2000 or inception",

title_xadj=0.5,

title_yadj=0.99,

title_fontsize=20,

xlab="End-of-quarter score",

ylab="Foreign-currency bond index excess returns, %, next quarter",

coef_box="lower right",

prob_est="map",

single_chart=True,

subplot_titles=[dict_labels[key] for key in sigs]

)

Accuracy #

dix = dict_dir

sigs = dix["sigs"]

rets = dix["targ"]

cidx = dix["cidx"]

start = dix["start"]

black = dix["black"]

freqs = ["M"]

srr = mss.SignalReturnRelations(

dfx,

sigs=sigs,

rets=rets,

freqs=freqs,

blacklist=black_fc,

start=start,

slip=1

)

dix["srr"] = srr

dix = dict_dir

srr = dix["srr"]

tbl=srr.multiple_relations_table().round(3)

display(tbl.loc[:, ["accuracy", "bal_accuracy", "pos_sigr", "pos_retr"]])

| accuracy | bal_accuracy | pos_sigr | pos_retr | ||||

|---|---|---|---|---|---|---|---|

| Return | Signal | Frequency | Aggregation | ||||

| FCBIXR_NSA | RATINGvMACRO | M | last | 0.485 | 0.518 | 0.354 | 0.606 |

| RISKvMACRO | M | last | 0.487 | 0.520 | 0.354 | 0.608 | |

| RISKxMACRO | M | last | 0.508 | 0.515 | 0.467 | 0.607 | |

| SPREADvMACRO | M | last | 0.480 | 0.513 | 0.351 | 0.606 |

Naive PnL #

dix = dict_dir

sigs = dix["sigs"]

ret = dix["targ"]

cidx = dix["cidx"]

start = dix["start"]

black = dix["black"]

pnls = msn.NaivePnL(

df=dfx,

ret=ret,

sigs=sigs,

cids=cidx,

start=start,

blacklist=black,

bms=bms,

)

for sig in sigs:

pnls.make_pnl(

sig=sig,

sig_op="zn_score_pan",

thresh=1,

sig_add = 1,

rebal_freq="monthly",

neutral="zero",

rebal_slip=1,

vol_scale=10,

)

pnls.make_long_pnl(vol_scale=10, label="Long only")

dix["pnls"] = pnls

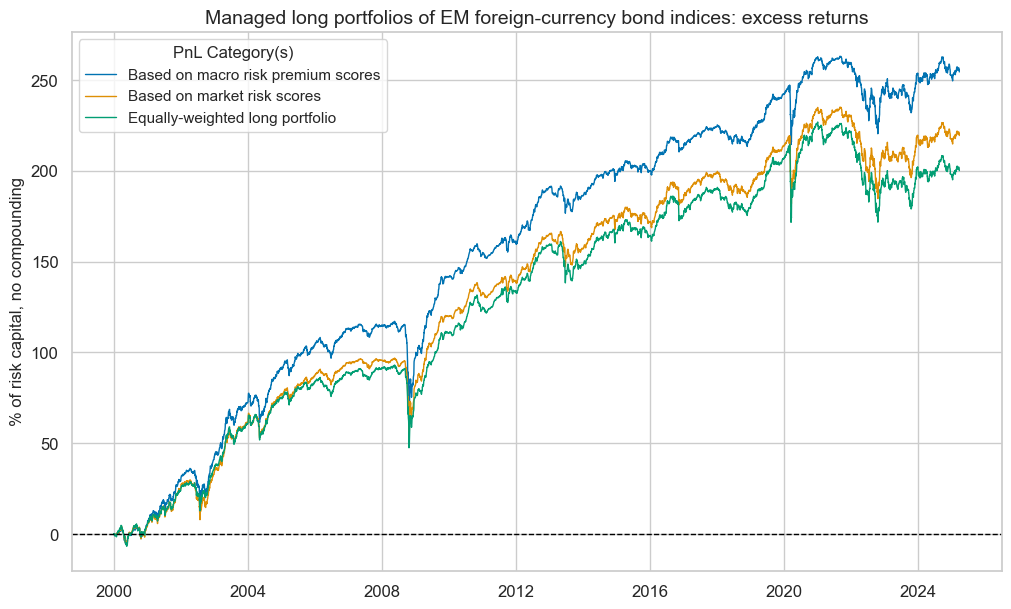

dix = dict_dir

pnls = dix["pnls"]

pnls.plot_pnls(

title="Managed long portfolios of EM foreign-currency bond indices: excess returns",

pnl_cats=["PNL_RISKvMACRO", "PNL_RISKxMACRO"] + ["Long only"],

xcat_labels=["Based on macro risk premium scores", "Based on market risk scores", "Equally-weighted long portfolio"],

title_fontsize=14,

)

pnls.evaluate_pnls(pnl_cats=["PNL_RISKvMACRO", "PNL_RISKxMACRO"] + ["Long only"])

| xcat | PNL_RISKvMACRO | PNL_RISKxMACRO | Long only |

|---|---|---|---|

| Return % | 10.086282 | 8.699071 | 7.931267 |

| St. Dev. % | 10.0 | 10.0 | 10.0 |

| Sharpe Ratio | 1.008628 | 0.869907 | 0.793127 |

| Sortino Ratio | 1.396034 | 1.192898 | 1.070307 |

| Max 21-Day Draw % | -46.602394 | -38.265147 | -40.965664 |

| Max 6-Month Draw % | -54.460819 | -41.889435 | -44.858775 |

| Peak to Trough Draw % | -55.093225 | -50.318638 | -55.111764 |

| Top 5% Monthly PnL Share | 0.565154 | 0.634878 | 0.655361 |

| USD_EQXR_NSA correl | 0.288231 | 0.306169 | 0.275905 |

| UHY_CRXR_NSA correl | 0.356278 | 0.37949 | 0.348014 |

| UIG_CRXR_NSA correl | 0.361183 | 0.371218 | 0.33375 |

| Traded Months | 303 | 303 | 303 |

Vol-targeted positions #

Specs and panel test #

dict_dvt = {

"sigs": risk_macros + ["RISKxMACRO"],

"targ": "FCBIXR_VT10",

"cidx": cids_fc,

"start": "2000-01-01",

"black": black_fc,

"srr": None,

"pnls": None,

}

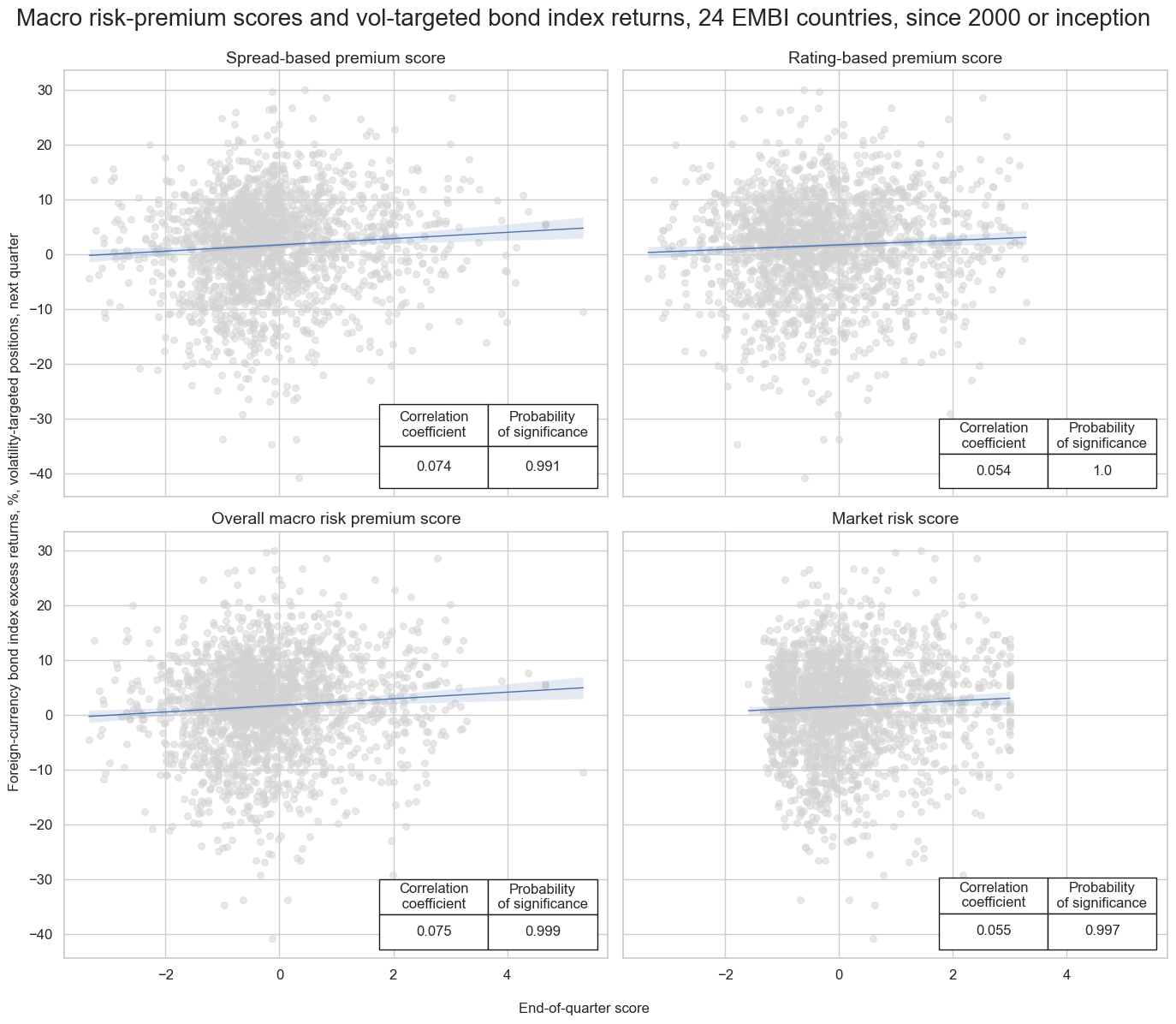

dix = dict_dvt

sigs = dix["sigs"]

ret = dix["targ"]

cidx = dix["cidx"]

start = dix["start"]

black = dix["black"]

catregs = {}

for sig in sigs:

catregs[sig] = msp.CategoryRelations(

dfx,

xcats=[sig, ret],

cids=cidx,

freq="Q",

lag=1,

xcat_aggs=["last", "sum"],

start=start,

blacklist=black_fc,

)

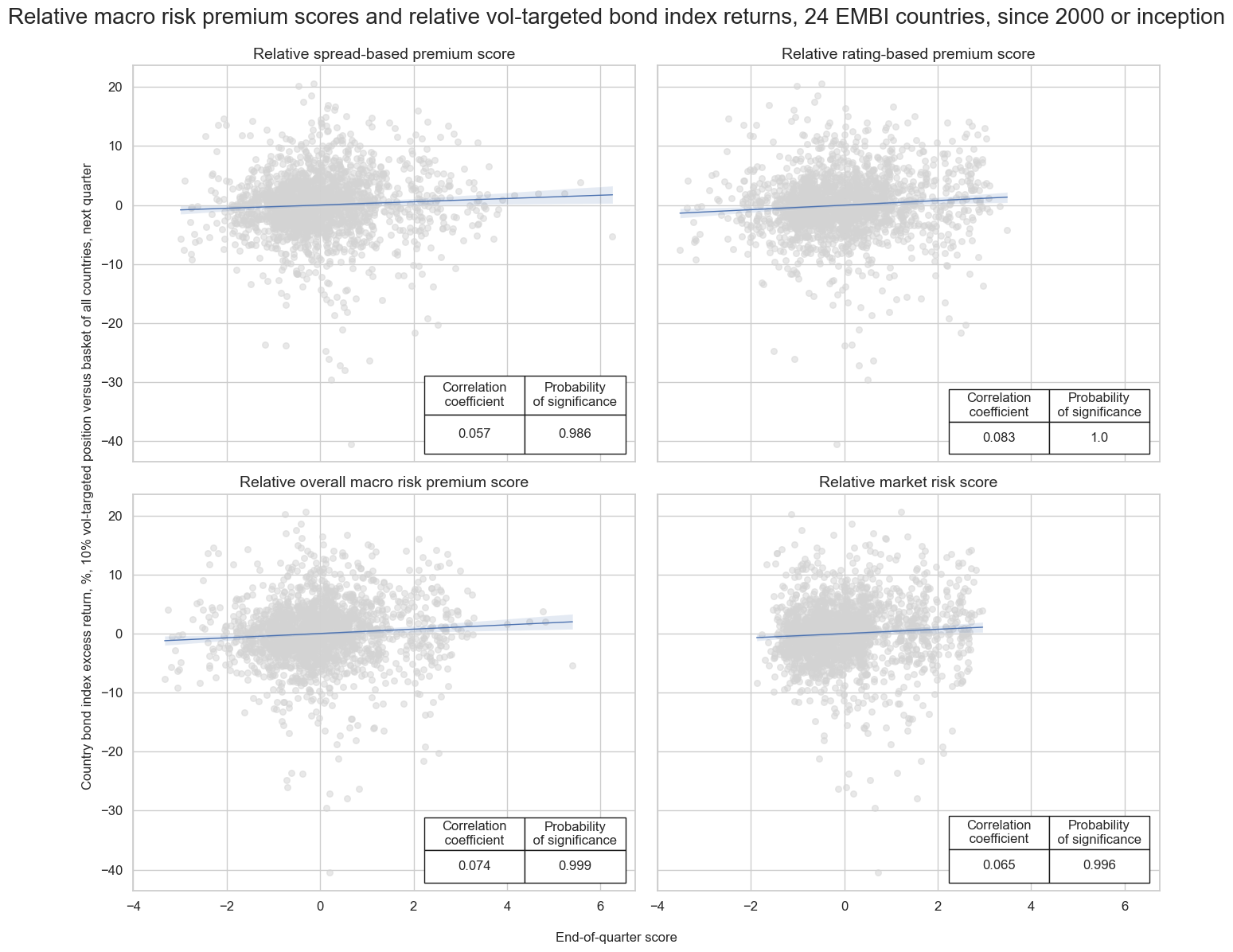

msv.multiple_reg_scatter(

cat_rels=[v for k, v in catregs.items()],

ncol=2,

nrow=2,

figsize=(14, 12),

title="Macro risk-premium scores and vol-targeted bond index returns, 24 EMBI countries, since 2000 or inception",

title_xadj=0.5,

title_yadj=0.99,

title_fontsize=20,

xlab="End-of-quarter score",

ylab="Foreign-currency bond index excess returns, %, volatility-targeted positions, next quarter",

coef_box="lower right",

prob_est="map",

single_chart=True,

subplot_titles=[dict_labels[key] for key in sigs]

)

Accuracy #

dix = dict_dvt

sigs = dix["sigs"]

rets = dix["targ"]

cidx = dix["cidx"]

start = dix["start"]

black = dix["black"]

freqs = ["M"]

srr = mss.SignalReturnRelations(

dfx,

sigs=sigs,

rets=rets,

freqs=freqs,

blacklist=black_fc,

start=start,

slip=1

)

dix["srr"] = srr

dix = dict_dvt

srr = dix["srr"]

tbl=srr.multiple_relations_table().round(3)

display(tbl.loc[:, ["accuracy", "bal_accuracy", "pos_sigr", "pos_retr"]])

| accuracy | bal_accuracy | pos_sigr | pos_retr | ||||

|---|---|---|---|---|---|---|---|

| Return | Signal | Frequency | Aggregation | ||||

| FCBIXR_VT10 | RATINGvMACRO | M | last | 0.487 | 0.519 | 0.354 | 0.603 |

| RISKvMACRO | M | last | 0.487 | 0.520 | 0.354 | 0.605 | |

| RISKxMACRO | M | last | 0.509 | 0.516 | 0.467 | 0.605 | |

| SPREADvMACRO | M | last | 0.480 | 0.512 | 0.351 | 0.603 |

Naive PnL #

dix = dict_dvt

sigs = dix["sigs"]

ret = dix["targ"]

cidx = dix["cidx"]

start = dix["start"]

black = dix["black"]

pnls = msn.NaivePnL(

df=dfx,

ret=ret,

sigs=sigs,

cids=cidx,

start=start,

blacklist=black,

bms=bms,

)

for sig in sigs:

pnls.make_pnl(

sig=sig,

sig_op="zn_score_pan",

sig_add=1,

thresh=1,

rebal_freq="monthly",

neutral="zero",

rebal_slip=1,

vol_scale=10,

)

pnls.make_long_pnl(vol_scale=10, label="Long only")

dix["pnls"] = pnls

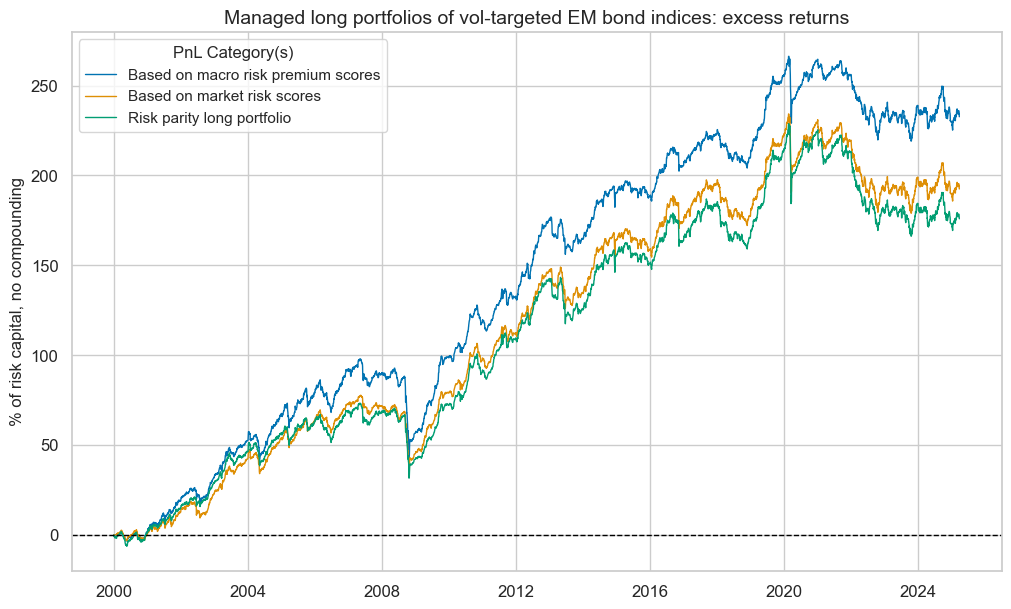

dix = dict_dvt

pnls = dix["pnls"]

pnls.plot_pnls(

title="Managed long portfolios of vol-targeted EM bond indices: excess returns",

pnl_cats=["PNL_RISKvMACRO", "PNL_RISKxMACRO"] + ["Long only"],

xcat_labels=["Based on macro risk premium scores", "Based on market risk scores", "Risk parity long portfolio"],

title_fontsize=14,

)

pnls.evaluate_pnls(pnl_cats=["PNL_RISKvMACRO", "PNL_RISKxMACRO"] + ["Long only"])

| xcat | PNL_RISKvMACRO | PNL_RISKxMACRO | Long only |

|---|---|---|---|

| Return % | 9.222642 | 7.62826 | 6.970166 |

| St. Dev. % | 10.0 | 10.0 | 10.0 |

| Sharpe Ratio | 0.922264 | 0.762826 | 0.697017 |

| Sortino Ratio | 1.239685 | 1.010269 | 0.918472 |

| Max 21-Day Draw % | -37.135863 | -43.183415 | -42.952576 |

| Max 6-Month Draw % | -50.187556 | -37.888666 | -38.226275 |

| Peak to Trough Draw % | -56.289829 | -55.307603 | -62.665322 |

| Top 5% Monthly PnL Share | 0.596767 | 0.702271 | 0.780514 |

| USD_EQXR_NSA correl | 0.25207 | 0.270382 | 0.221496 |

| UHY_CRXR_NSA correl | 0.307254 | 0.32819 | 0.279345 |

| UIG_CRXR_NSA correl | 0.290278 | 0.305616 | 0.257284 |

| Traded Months | 303 | 303 | 303 |

Relative value positions #

Specs and panel test #

dict_rv = {

"sigs": risk_macros_vEM + ["RISKxMACROvEM"],

"targ": "FCBIXR_VT10vEM",

"cidx": cids_fc,

"start": "2000-01-01",

"black": black_fc,

"srr": None,

"pnls": None,

}

dix = dict_rv

sigs = dix["sigs"]

ret = dix["targ"]

cidx = dix["cidx"]

start = dix["start"]

black = dix["black"]

catregs = {}

for sig in sigs:

catregs[sig] = msp.CategoryRelations(

dfx,

xcats=[sig, ret],

cids=cidx,

freq="Q",

lag=1,

xcat_aggs=["last", "sum"],

start=start,

blacklist=black_fc,

)

msv.multiple_reg_scatter(

cat_rels=[v for k, v in catregs.items()],

ncol=2,

nrow=2,

figsize=(14, 12),

title="Relative macro risk premium scores and relative vol-targeted bond index returns, 24 EMBI countries, since 2000 or inception",

title_xadj=0.5,

title_yadj=0.99,

title_fontsize=20,

xlab="End-of-quarter score",

ylab="Country bond index excess return, %, 10% vol-targeted position versus basket of all countries, next quarter",

coef_box="lower right",

prob_est="map",

single_chart=True,

subplot_titles=[dict_labels[key] for key in sigs]

)

Accuracy #

dix = dict_rv

sigs = dix["sigs"]

rets = dix["targ"]

cidx = dix["cidx"]

start = dix["start"]

black = dix["black"]

freqs = ["M"]

srr = mss.SignalReturnRelations(

dfx,

sigs=sigs,

rets=rets,

freqs=freqs,

blacklist=black_fc,

start=start,

slip=1

)

dix["srr"] = srr

dix = dict_rv

srr = dix["srr"]

tbl=srr.multiple_relations_table().round(3)

display(tbl.loc[:, ["accuracy", "bal_accuracy", "pos_sigr", "pos_retr"]])

| accuracy | bal_accuracy | pos_sigr | pos_retr | ||||

|---|---|---|---|---|---|---|---|

| Return | Signal | Frequency | Aggregation | ||||

| FCBIXR_VT10vEM | RATINGvMACROvEM | M | last | 0.523 | 0.523 | 0.464 | 0.502 |

| RISKvMACROvEM | M | last | 0.527 | 0.528 | 0.446 | 0.504 | |

| RISKxMACROvEM | M | last | 0.526 | 0.527 | 0.442 | 0.504 | |

| SPREADvMACROvEM | M | last | 0.522 | 0.522 | 0.449 | 0.503 |

Naive PnL #

dix = dict_rv

sigs = dix["sigs"]

ret = dix["targ"]

cidx = dix["cidx"]

start = dix["start"]

black = dix["black"]

pnls = msn.NaivePnL(

df=dfx,

ret=ret,

sigs=sigs,

cids=cidx,

start=start,

blacklist=black,

bms=bms,

)

for sig in sigs:

pnls.make_pnl(

sig=sig,

sig_op="zn_score_pan",

thresh=1,

rebal_freq="monthly",

neutral="zero",

rebal_slip=1,

vol_scale=10,

)

dix["pnls"] = pnls

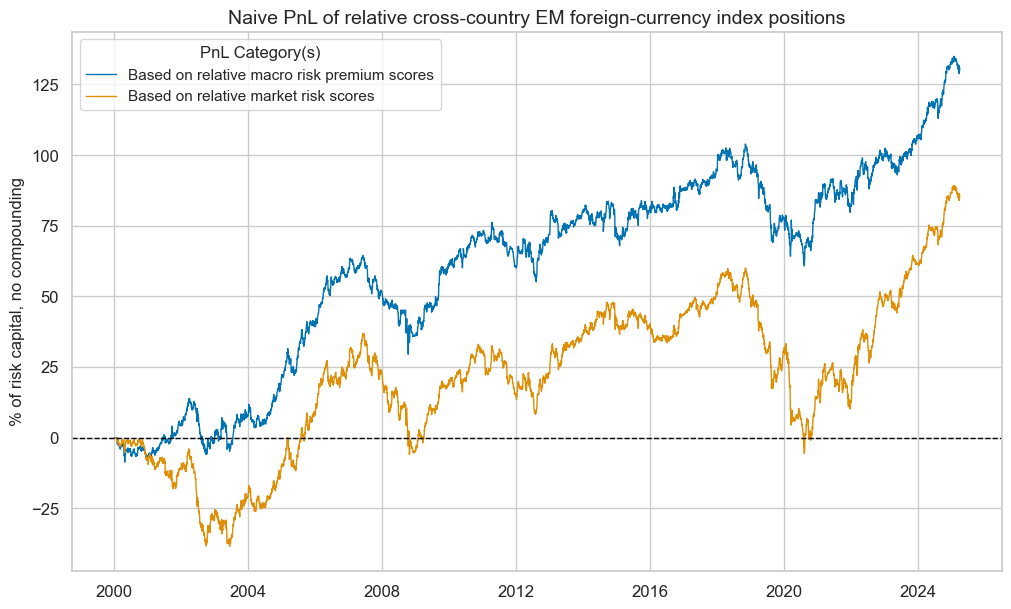

dix = dict_rv

pnls = dix["pnls"]

pnls.plot_pnls(

title="Naive PnL of relative cross-country EM foreign-currency index positions",

pnl_cats=["PNL_RISKvMACROvEM", "PNL_RISKxMACROvEM"],

xcat_labels=["Based on relative macro risk premium scores", "Based on relative market risk scores"],

title_fontsize=14,

)

pnls.evaluate_pnls(pnl_cats=["PNL_RISKvMACROvEM", "PNL_RISKxMACROvEM"])

| xcat | PNL_RISKvMACROvEM | PNL_RISKxMACROvEM |

|---|---|---|

| Return % | 5.150947 | 3.366461 |

| St. Dev. % | 10.0 | 10.0 |

| Sharpe Ratio | 0.515095 | 0.336646 |

| Sortino Ratio | 0.740373 | 0.467092 |

| Max 21-Day Draw % | -15.526189 | -23.165584 |

| Max 6-Month Draw % | -25.876187 | -33.566946 |

| Peak to Trough Draw % | -43.094496 | -65.589155 |

| Top 5% Monthly PnL Share | 0.854825 | 1.430886 |

| USD_EQXR_NSA correl | 0.14404 | 0.23967 |

| UHY_CRXR_NSA correl | 0.148551 | 0.250277 |

| UIG_CRXR_NSA correl | 0.143413 | 0.249483 |

| Traded Months | 303 | 303 |

EMBI Global proxy and modification #

Import EMBI global weights #

# Dictionary for labelling and mapping

dict_cids = {

"AED": ["AE", "UAE"],

"ARS": ["AR", "Argentina"],

"BRL": ["BR", "Brazil"],

"CLP": ["CL", "Chile"],

"CNY": ["CN", "China"],

"COP": ["CO", "Colombia"],

"EGP": ["EG", "Egypt"],

"DOP": ["DO", "Dominican Republic"],

"HUF": ["HU", "Hungary"],

"IDR": ["ID", "Indonesia"],

"INR": ["IN", "India"],

"MXN": ["MX", "Mexico"],

"MYR": ["MY", "Malaysia"],

"NGN": ["NG", "Nigeria"],

"OMR": ["OM", "Oman"],

"PAB": ["PA", "Panama"],

"PEN": ["PE", "Peru"],

"PHP": ["PH", "Philippines"],

"PLN": ["PL", "Poland"],

"QAR": ["QA", "Qatar"],

"SAR": ["SA", "Saudi Arabia"],

"RON": ["RO", "Romania"],

"RSD": ["CS", "Serbia"],

"RUB": ["RU", "Russia"],

"THB": ["TH", "Thailand"],

"TRY": ["TR", "Turkey"],

"UYU": ["UY", "Uruguay"],

"VEF": ["VE", "Venezuela"],

"ZAR": ["ZA", "South Africa"],

}

# Import EMBI weights from DataQuery

## Mapping dataframe

expression_mapping_csv = "expression,country,cid\n"

DQ_ticker = "StatIndxWght"

for cid in cids_fc:

expression_mapping_csv += f'"DB(SAGE,FC_EMBIG_{dict_cids[cid][0]},{DQ_ticker})",{dict_cids[cid][0]},{cid}\n'

df_map = pd.read_csv(io.StringIO(expression_mapping_csv), sep=",")

extra_expression = {

"expression": "DB(SAGE,EMBIG,AM_IDX_TOT)",

"country": "ALL",

"cid": "ALL",

"ticker": "ALL_EMBI_IDX",

}

df_map["ticker"] = df_map["cid"] + "_" + "EMBIWGT"

df_map = pd.concat([df_map, pd.DataFrame([extra_expression])], ignore_index=True)

## Download wide dataframe from J.P. Morgan DataQuery

with JPMaQSDownload() as downloader:

dfw_weights = downloader.download(

expressions=df_map["expression"].tolist(),

start_date="1998-01-01",

dataframe_format="wide",

show_progress=True,

)

dfw_weights = dfw_weights.rename(columns=df_map.set_index("expression")["ticker"].to_dict())

st, ed = dfw_weights.index.min(), dfw_weights.index.max()

bdates = pd.bdate_range(st, ed, freq="B")

# Forward filling weights and convert to quantamental dataframe (and merge)

dfw_weights = dfw_weights.reindex(bdates).ffill()

dfw_weights.index.name = "real_date"

df_embi = msm.utils.ticker_df_to_qdf(dfw_weights)

dfx = msm.update_df(dfx, df_embi)

Downloading data from JPMaQS.

Timestamp UTC: 2025-03-28 16:03:08

Connection successful!

Requesting data: 100%|████████████████████████████| 2/2 [00:00<00:00, 4.89it/s]

Downloading data: 100%|███████████████████████████| 2/2 [00:12<00:00, 6.35s/it]

Some dates are missing from the downloaded data.

301 out of 7106 dates are missing.

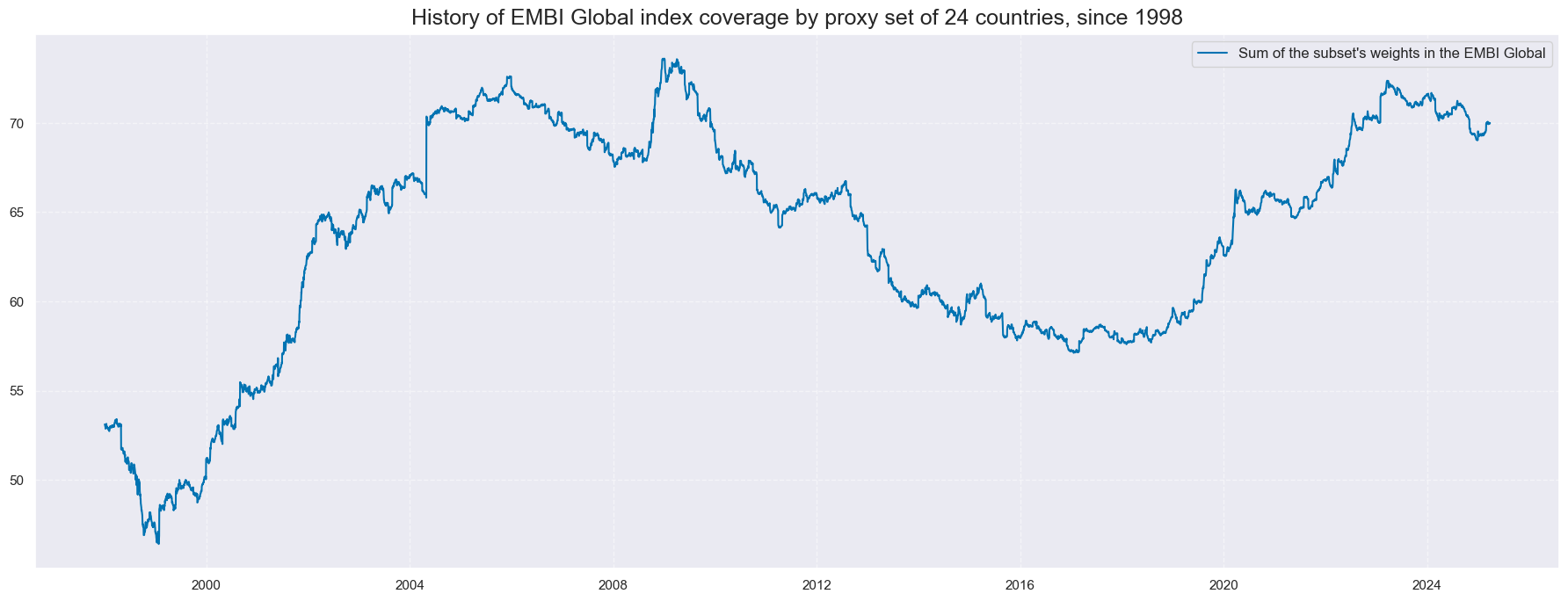

Normalise weights and show EMBI coverage #

mask = dfx["xcat"] == "EMBIWGT"

dfx.loc[mask, "value"] = dfx.loc[mask].groupby("real_date")["value"].transform(lambda x: (x / x.sum() ) * 1 )

df_sum = df_embi[df_embi['xcat'] == 'EMBIWGT' ]

df_sum = (

df_sum.groupby("real_date")["value"]

.sum()

.reset_index()

.assign(xcat="SUM", cid='ALL')

)

df_sum = df_sum[["real_date", "cid", "xcat", "value"]]

df_sum['value'] = df_sum['value']

msp.view_timelines(

df_sum,

xcats=['SUM'],

cids=['ALL'],

start="1998-01-01",

title="History of EMBI Global index coverage by proxy set of 24 countries, since 1998",

size=(18, 7),

xcat_labels=["Sum of the subset's weights in the EMBI Global"]

)

Modified weights #

Calculation #

cidx = cids_fc

xcatx = risk_macros_vEM + risk_macros

for xc in xcatx:

dfa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

sequential=True,

min_obs=261 * 3,

neutral="zero",

pan_weight=1,

thresh=3,

postfix="_ZN",

est_freq="m",

)

dfx = msm.update_df(dfx, dfa)

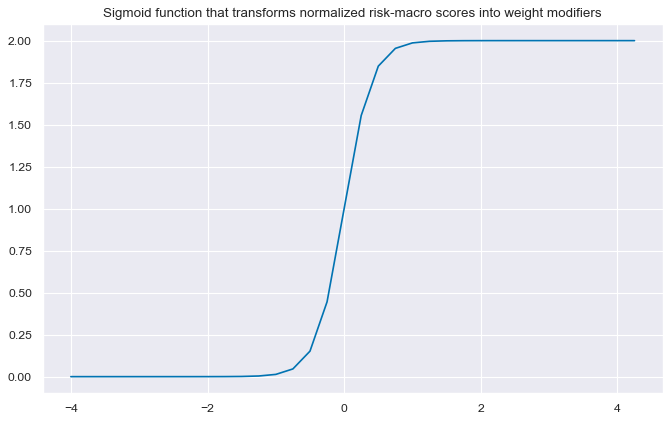

# Define appropriate sigmoid function for adjusting weights

amplitude = 2

steepness = 5

midpoint = 0

def sigmoid(x, a=amplitude, b=steepness, c=midpoint):

return a / (1 + np.exp(-b * (x - c)))

ar = np.array([i / 4 for i in range(-16, 18)])

plt.figure(figsize=(10, 6), dpi=80)

plt.plot(ar, sigmoid(ar))

plt.title("Sigmoid function that transforms normalized risk-macro scores into weight modifiers")

plt.show()

# Calculate adjusted weights

dfj = adjust_weights(

dfx,

weights_xcat="EMBIWGT",

adj_zns_xcat="RISKvMACRO_ZN",

method="generic",

adj_func=sigmoid,

blacklist=black_fc,

cids=cidx,

adj_name="EMBIWGT_MOD",

)

dfj["value"] = dfj["value"] # remove after change in function

dfx = msm.update_df(dfx, dfj)

dict_labels["EMBIWGT"] = "EMBI Global proxy weights"

dict_labels["EMBIWGT_MOD"] = "EMBIG weights modified by macro risk premia"

# View timelines of weights

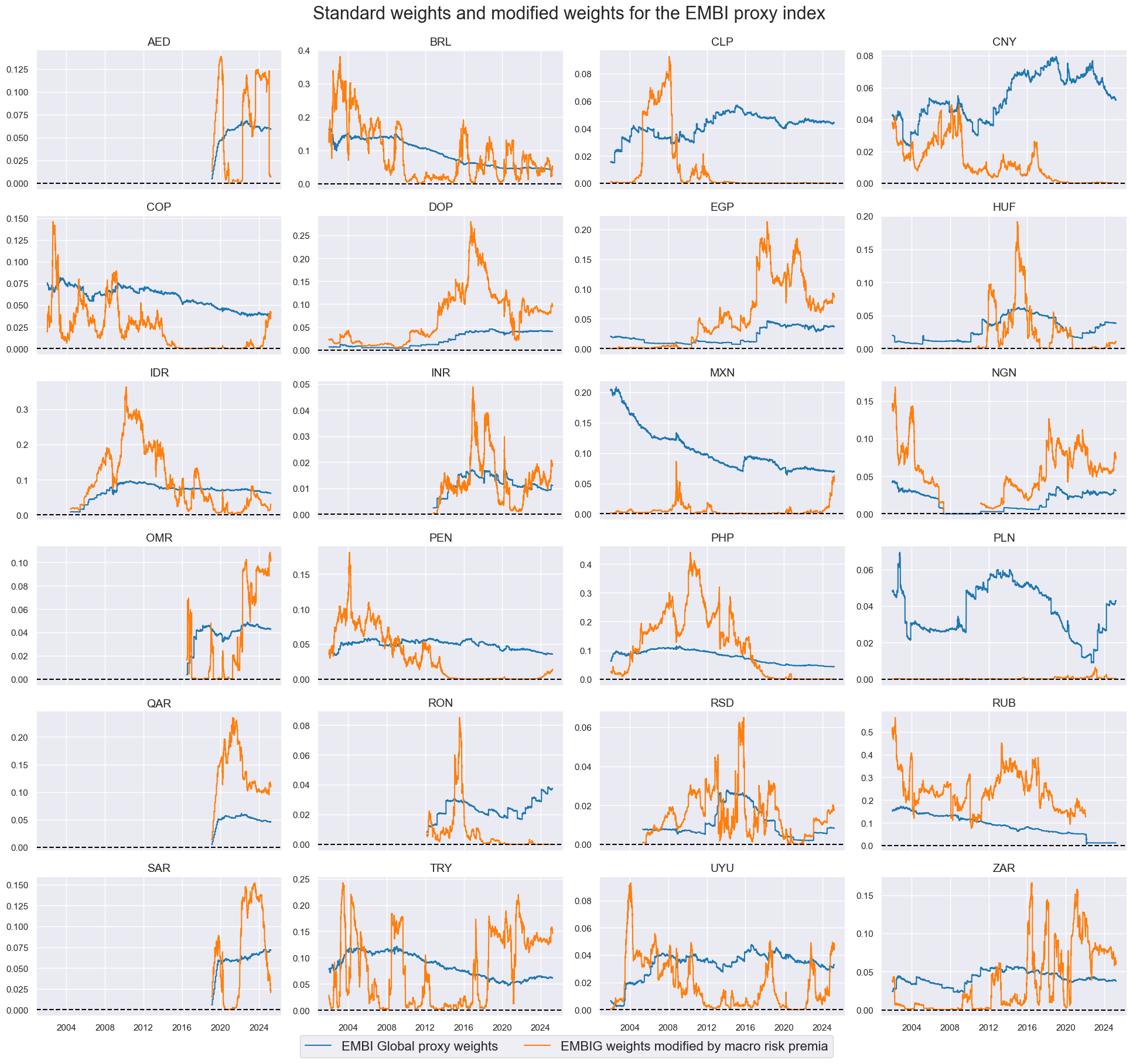

xcatx = ["EMBIWGT", "EMBIWGT_MOD"]

cidx = cids_fc

sdate = "2002-01-01"

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

start=sdate,

same_y=False,

xcat_labels=dict_labels,

title="Standard weights and modified weights for the EMBI proxy index",

title_fontsize=22,

legend_fontsize=16,

height=2,

)

Evaluation #

dict_mod = {

"sigs": ["EMBIWGT_MOD", "EMBIWGT"],

"targ": "FCBIR_NSA",

"cidx": cids_fc,

"start": "2002-01-01",

"black": black_fc,

"srr": None,

"pnls": None,

}

dix = dict_mod

sigs = dix["sigs"]

ret = dix["targ"]

cidx = dix["cidx"]

start = dix["start"]

black = dix["black"]

pnls = msn.NaivePnL(

df=dfx,

ret=ret,

sigs=sigs,

cids=cidx,

start=start,

blacklist=black,

bms=bms,

)

for sig in sigs:

pnls.make_pnl(

sig=sig,

sig_op="raw",

rebal_freq="monthly",

neutral="zero",

rebal_slip=1,

vol_scale=None,

)

dix["pnls"] = pnls

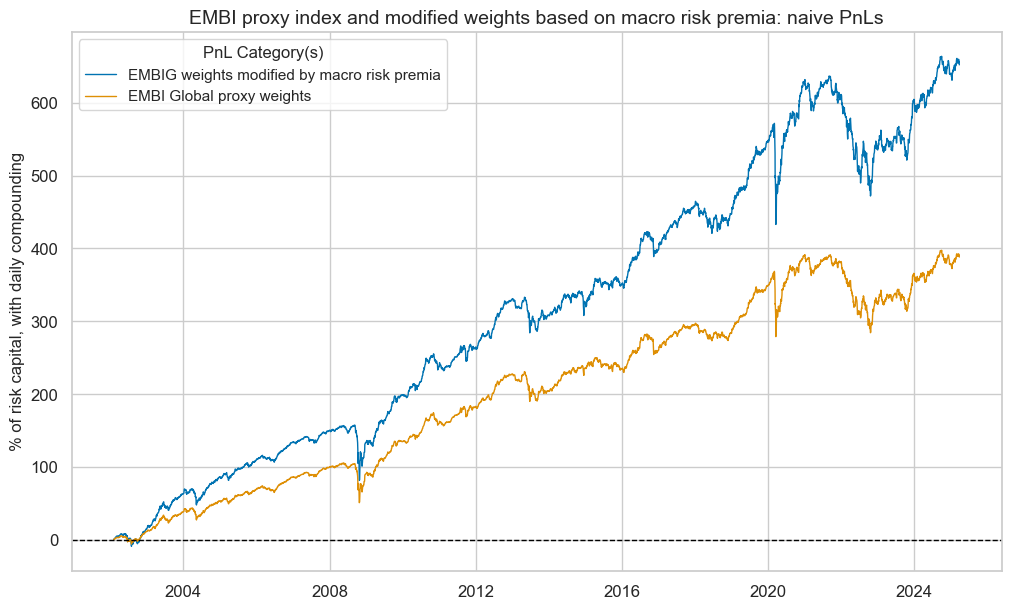

dix = dict_mod

pnls = dix["pnls"]

sigs = dix["sigs"]

pnl_cats=["PNL_" + sig for sig in sigs]

pnls.plot_pnls(

title="EMBI proxy index and modified weights based on macro risk premia: naive PnLs",

pnl_cats=pnl_cats,

xcat_labels=[dict_labels[k] for k in sigs],

title_fontsize=14,

compounding=True,

)

pnls.evaluate_pnls(pnl_cats=pnl_cats)

| xcat | PNL_EMBIWGT_MOD | PNL_EMBIWGT |

|---|---|---|

| Return % | 9.006917 | 7.050288 |

| St. Dev. % | 7.538961 | 6.269362 |

| Sharpe Ratio | 1.194716 | 1.124562 |

| Sortino Ratio | 1.669615 | 1.550268 |

| Max 21-Day Draw % | -29.591046 | -25.999432 |

| Max 6-Month Draw % | -33.380698 | -29.848671 |

| Peak to Trough Draw % | -33.817476 | -30.147379 |

| Top 5% Monthly PnL Share | 0.430583 | 0.452107 |

| USD_EQXR_NSA correl | 0.298719 | 0.298464 |

| UHY_CRXR_NSA correl | 0.364947 | 0.3759 |

| UIG_CRXR_NSA correl | 0.384813 | 0.385917 |

| Traded Months | 278 | 278 |

Adjusted weights #

dfa = msp.adjust_weights(

df=dfx,

weights_xcat="EMBIWGT",

adj_zns_xcat="RISKvMACRO_ZN",

method="lincomb",

params=dict(min_score=-3, coeff_new=0.5),

blacklist=black_fc,

adj_name="EMBIWGT_ADJ",

)

dfx = msm.update_df(dfx, dfa)

dict_labels["EMBIWGT_ADJ"] = (

"EMBIG weights adjusted towards weights of macro risk premium scores"

)

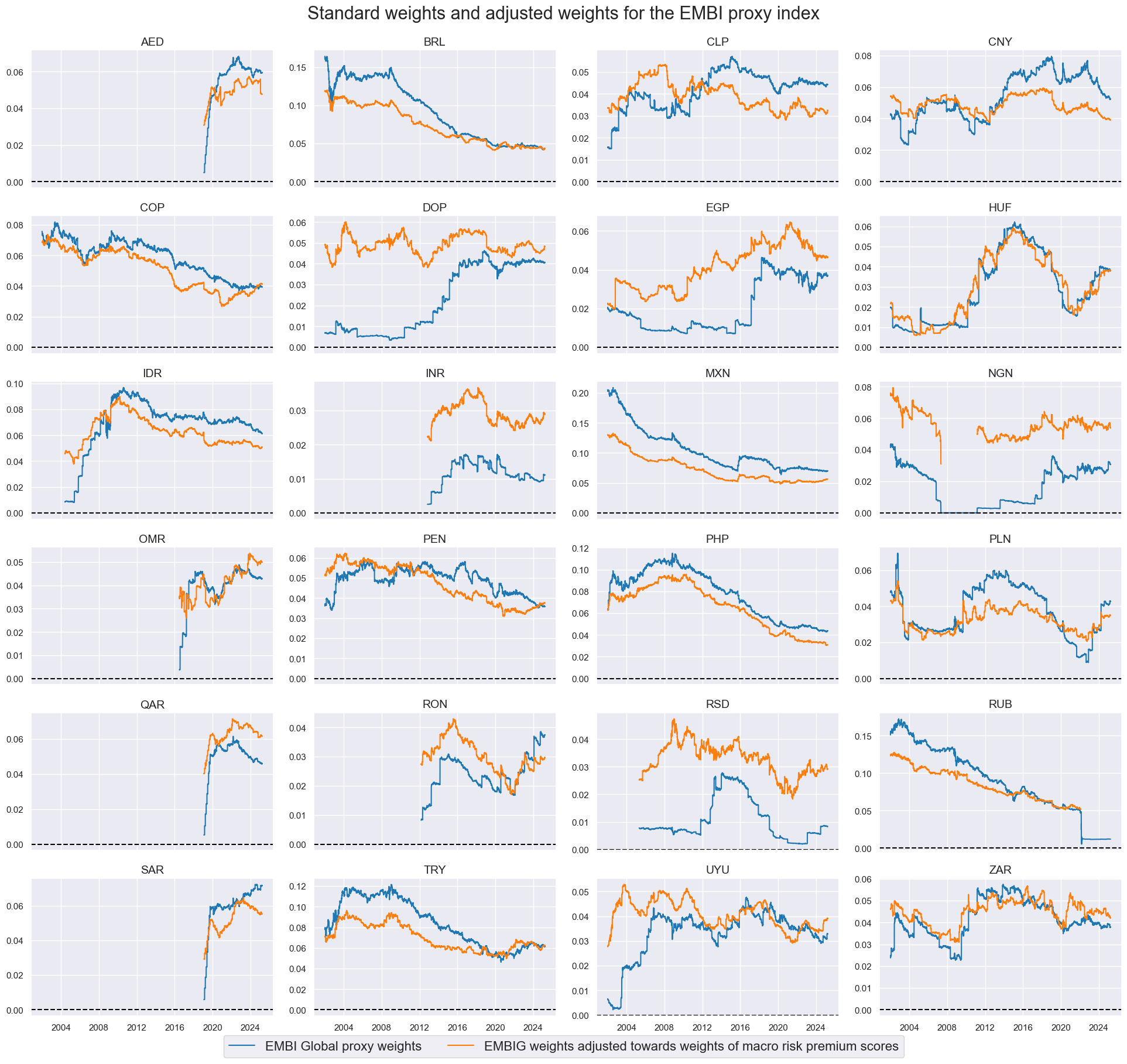

# View timelines of weights

xcatx = ["EMBIWGT", "EMBIWGT_ADJ"]

cidx = cids_fc

sdate = "2002-01-01"

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

start=sdate,

same_y=False,

xcat_labels=dict_labels,

title="Standard weights and adjusted weights for the EMBI proxy index",

title_fontsize=22,

legend_fontsize=16,

height=2,

)

Evaluation #

dict_adj = {

"sigs": ["EMBIWGT_ADJ", "EMBIWGT"],

"targ": "FCBIR_NSA",

"cidx": cids_fc,

"start": "2002-01-01",

"black": black_fc,

"srr": None,

"pnls": None,

}

dix = dict_adj

sigs = dix["sigs"]

ret = dix["targ"]

cidx = dix["cidx"]

start = dix["start"]

black = dix["black"]

pnls = msn.NaivePnL(

df=dfx,

ret=ret,

sigs=sigs,

cids=cidx,

start=start,

blacklist=black,

bms=bms,

)

for sig in sigs:

pnls.make_pnl(

sig=sig,

sig_op="raw",

rebal_freq="monthly",

neutral="zero",

rebal_slip=1,

vol_scale=None,

)

dix["pnls"] = pnls

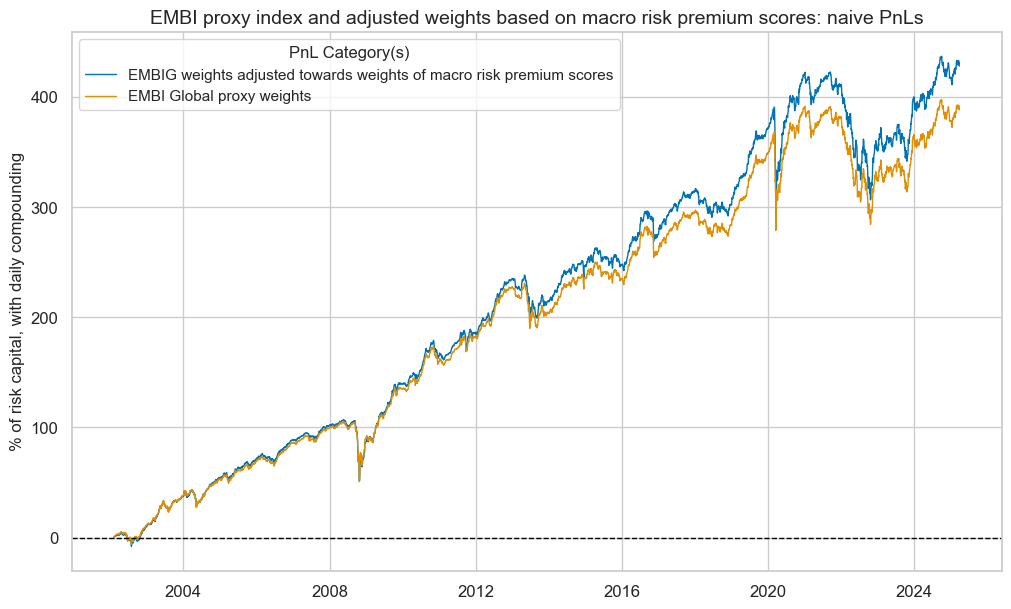

dix = dict_adj

pnls = dix["pnls"]

sigs = dix["sigs"]

pnl_cats=["PNL_" + sig for sig in sigs]

pnls.plot_pnls(

title="EMBI proxy index and adjusted weights based on macro risk premium scores: naive PnLs",

pnl_cats=pnl_cats,

xcat_labels=[dict_labels[k] for k in sigs],

title_fontsize=14,

compounding=True,

)

pnls.evaluate_pnls(pnl_cats=pnl_cats)

| xcat | PNL_EMBIWGT_ADJ | PNL_EMBIWGT |

|---|---|---|

| Return % | 7.380201 | 7.050288 |

| St. Dev. % | 6.130066 | 6.269362 |

| Sharpe Ratio | 1.203935 | 1.124562 |

| Sortino Ratio | 1.650475 | 1.550268 |

| Max 21-Day Draw % | -26.669767 | -25.999432 |

| Max 6-Month Draw % | -30.385632 | -29.848671 |

| Peak to Trough Draw % | -30.790447 | -30.147379 |

| Top 5% Monthly PnL Share | 0.441507 | 0.452107 |

| USD_EQXR_NSA correl | 0.297108 | 0.298464 |

| UHY_CRXR_NSA correl | 0.370191 | 0.3759 |

| UIG_CRXR_NSA correl | 0.375442 | 0.385917 |

| Traded Months | 278 | 278 |

Annex #

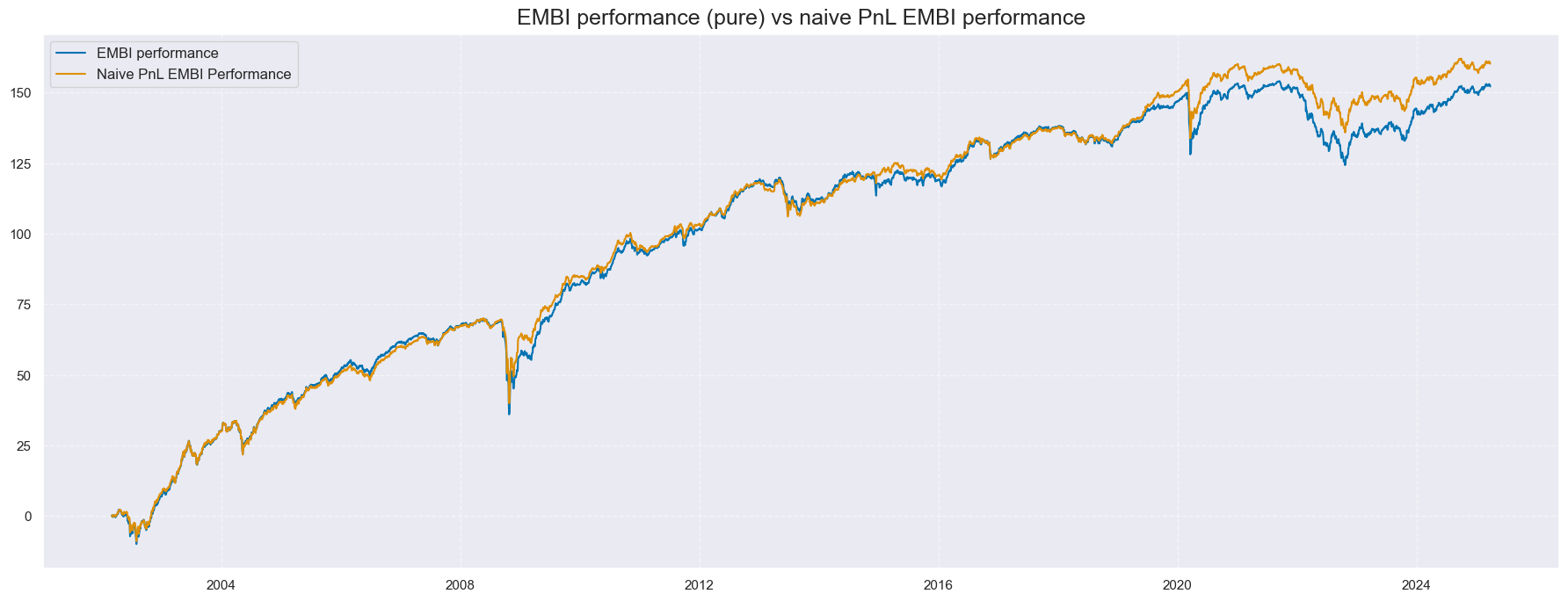

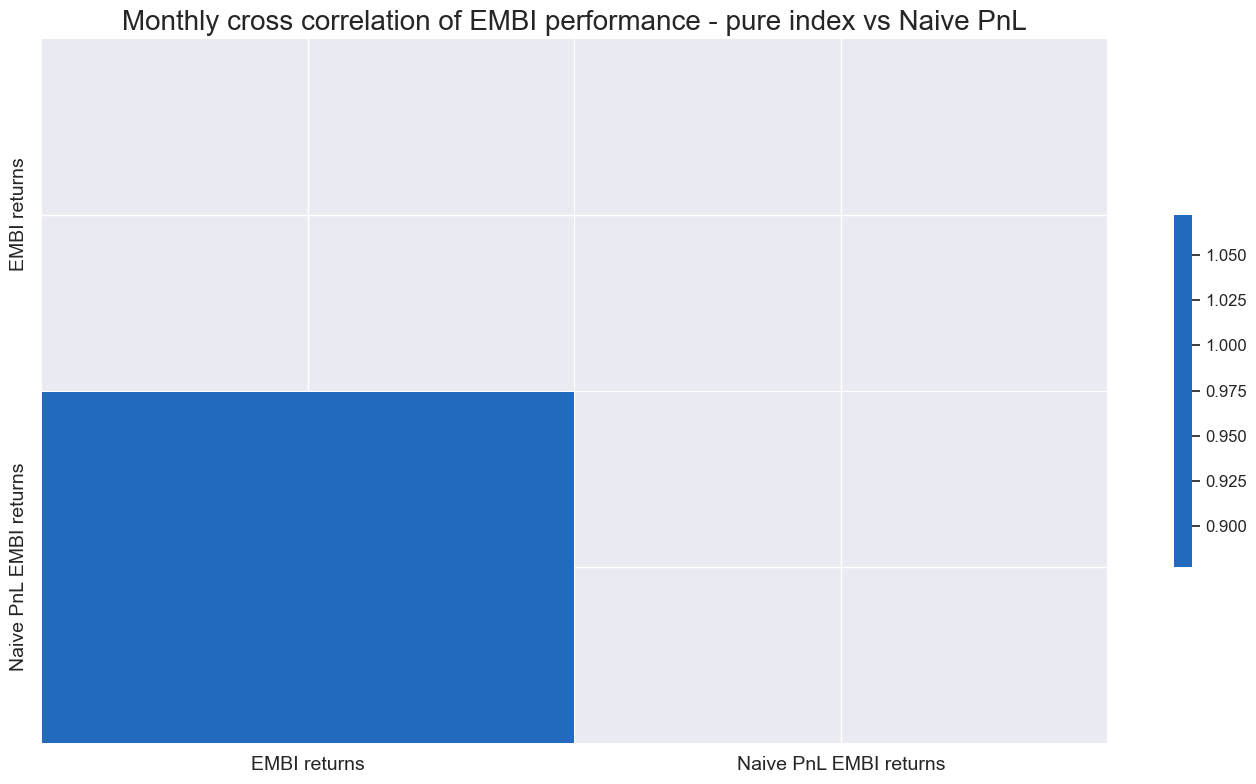

We check that the Naive PnL function generates a performance, given the EMBI weights, similar to that of the actual index. In order to do so, we compute the index performance by extracting from DQ the index levels, calculating returns, calculating the correlation and plotting.

df_idx = dfx[dfx["xcat"] == "EMBI_IDX"].copy()

df_idx = df_idx.sort_values("real_date")

df_idx["value"] = df_idx["value"].pct_change() * 100

df_idx["xcat"] = "EMBI_RET_PURE"

df_idx["cid"] = "ALL"

df_idx = df_idx.dropna(subset=["value"])

df_idx = df_idx[["real_date", "xcat", "cid", "value"]]

dfx = msm.update_df(dfx, df_idx)

# We take the returns coming from the Naive PnL function

naive_pnldf = pnls.df[pnls.df['xcat'] == 'PNL_EMBIWGT'].copy()

naive_pnldf_all = naive_pnldf[naive_pnldf['cid'] == 'ALL']

naive_pnldf_all["xcat"] = "EMBIPNLRET"

ret_df = naive_pnldf_all.copy()

embi_pure_df = dfx[dfx['xcat'] == 'EMBI_RET_PURE']

ret_df = msm.update_df(ret_df, embi_pure_df)

msp.correl_matrix(

ret_df,

xcats=['EMBIPNLRET', 'EMBI_RET_PURE'],

cids=['ALL'],

freq="M",

cluster=False,

title="Monthly cross correlation of EMBI performance - pure index vs Naive PnL",

size=(14, 8),

xcat_labels=['EMBI returns','Naive PnL EMBI returns']

)

xcatx = ['EMBI_RET_PURE', 'EMBIPNLRET']

msp.view_timelines(

ret_df,

xcats=xcatx,

cids=['ALL'],

start="2002-03-01",

title='EMBI performance (pure) vs naive PnL EMBI performance',

size=(18, 7),

cumsum=True,

xcat_labels=['EMBI performance', 'Naive PnL EMBI Performance'],

)