Conditional short-term trend signals #

Get packages and JPMaQS data #

import os

import numpy as np

import pandas as pd

import itertools

import macrosynergy.management as msm

import macrosynergy.panel as msp

import macrosynergy.pnl as msn

import macrosynergy.signal as mss

import macrosynergy.learning as msl

import macrosynergy.visuals as msv

from macrosynergy.download import JPMaQSDownload

from macrosynergy.management.utils import merge_categories

import warnings

warnings.simplefilter("ignore")

# Cross-sections of currencies

cids_ecos = ["EUR", "USD"]

# Cross-sections of commodities

cids_nfm = ["GLD", "SIV", "PAL", "PLT"]

cids_fme = ["ALM", "CPR", "LED", "NIC", "TIN", "ZNC"]

cids_ene = ["BRT", "WTI", "NGS", "GSO", "HOL"]

cids_sta = ["COR", "WHT", "SOY", "CTN"]

cids_liv = ["CAT", "HOG"]

cids_mis = ["CFE", "SGR", "NJO", "CLB"]

cids_com = cids_nfm + cids_fme + cids_ene + cids_sta + cids_liv + cids_mis

# Mixed contracts identifiers

cids_alc = sorted(cids_ecos) + sorted(cids_com) # all contracts list

# Country categories

# CPI inflation

cpi = [

"CPIH_SA_P1M1ML12",

"CPIC_SA_P1M1ML12",

"CPIC_SJA_P6M6ML6AR",

"INFE2Y_JA",

]

# PPI inflation

ppi = [

"PGDPTECH_SA_P1M1ML12_3MMA",

"PGDPTECHX_SA_P1M1ML12_3MMA",

"PPIH_NSA_P1M1ML12_3MMA",

"PPIH_SA_P6M6ML6AR",

]

# Other inflation-related indicators

opi = [

"WAGES_NSA_P1M1ML12_3MMA",

"WAGES_NSA_P1Q1QL4",

"NRSALES_SA_P1M1ML12_3MMA",

"PCREDITBN_SJA_P1M1ML12",

"HPI_SA_P1M1ML12_3MMA",

"HPI_SA_P1Q1QL4",

]

# Benchmarks

bms = ["RGDP_SA_P1Q1QL4_20QMM", "INFTARGET_NSA", "WFORCE_NSA_P1Y1YL1_5YMM"]

# Equity returns

eqr = ["EQXR_NSA", "EQXR_VT10"]

ecos = cpi + ppi + opi + bms + eqr

# Commodity categories

com = ["COXR_NSA", "COXR_VT10"]

# Tickers

tix_eco = [cid + "_" + xcat for cid in cids_ecos for xcat in ecos]

tix_com = [cid + "_" + xcat for cid in cids_com for xcat in com]

tickers = tix_eco + tix_com

# Download series from J.P. Morgan DataQuery by tickers

start_date = "1990-01-01"

end_date = None

# Retrieve credentials

oauth_id = os.getenv("DQ_CLIENT_ID") # Replace with own client ID

oauth_secret = os.getenv("DQ_CLIENT_SECRET") # Replace with own secret

# Download from DataQuery

downloader = JPMaQSDownload(client_id=oauth_id, client_secret=oauth_secret)

df = downloader.download(

tickers=tickers,

start_date=start_date,

end_date=end_date,

metrics=["value"],

suppress_warning=True,

show_progress=True,

)

dfx = df.copy()

dfx.info()

Downloading data from JPMaQS.

Timestamp UTC: 2025-03-05 16:03:50

Connection successful!

Requesting data: 100%|██████████| 5/5 [00:01<00:00, 4.93it/s]

Downloading data: 100%|██████████| 5/5 [00:30<00:00, 6.05s/it]

Some expressions are missing from the downloaded data. Check logger output for complete list.

4 out of 88 expressions are missing. To download the catalogue of all available expressions and filter the unavailable expressions, set `get_catalogue=True` in the call to `JPMaQSDownload.download()`.

Some dates are missing from the downloaded data.

2 out of 9180 dates are missing.

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 648525 entries, 0 to 648524

Data columns (total 4 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 real_date 648525 non-null datetime64[ns]

1 cid 648525 non-null object

2 xcat 648525 non-null object

3 value 648525 non-null float64

dtypes: datetime64[ns](1), float64(1), object(2)

memory usage: 19.8+ MB

Availability and blacklisting #

Rename #

Rename quarterly tickers to roughly equivalent monthly tickers to simplify subsequent operations.

dict_repl = {

"WAGES_NSA_P1Q1QL4": "WAGES_NSA_P1M1ML12_3MMA",

"HPI_SA_P1Q1QL4": "HPI_SA_P1M1ML12_3MMA",

}

for key, value in dict_repl.items():

dfx["xcat"] = dfx["xcat"].str.replace(key, value)

Backfill inflation target #

# Backward-extension of inflation target with oldest available

# Duplicate targets

cidx = cids_ecos

calcs = [f"INFTARGET_BX = INFTARGET_NSA"]

dfa = msp.panel_calculator(dfx, calcs, cids=cidx)

# Add all dates back to 1990 to the frame, filling "value " with NaN

all_dates = np.sort(dfx['real_date'].unique())

all_combinations = pd.DataFrame(

list(itertools.product(dfa['cid'].unique(), dfa['xcat'].unique(), all_dates)),

columns=['cid', 'xcat', 'real_date']

)

dfax = pd.merge(all_combinations, dfa, on=['cid', 'xcat', 'real_date'], how='left')

# Backfill the values with first target value

dfax = dfax.sort_values(by=['cid', 'xcat', 'real_date'])

dfax['value'] = dfax.groupby(['cid', 'xcat'])['value'].bfill()

dfx = msm.update_df(dfx, dfax)

# Extended effective inflation target by hierarchical merging

hierarchy = ["INFTARGET_NSA", "INFTARGET_BX"]

dfa = merge_categories(dfx, xcats=hierarchy, new_xcat="INFTARGETX_NSA")

dfx = msm.update_df(dfx, dfa)

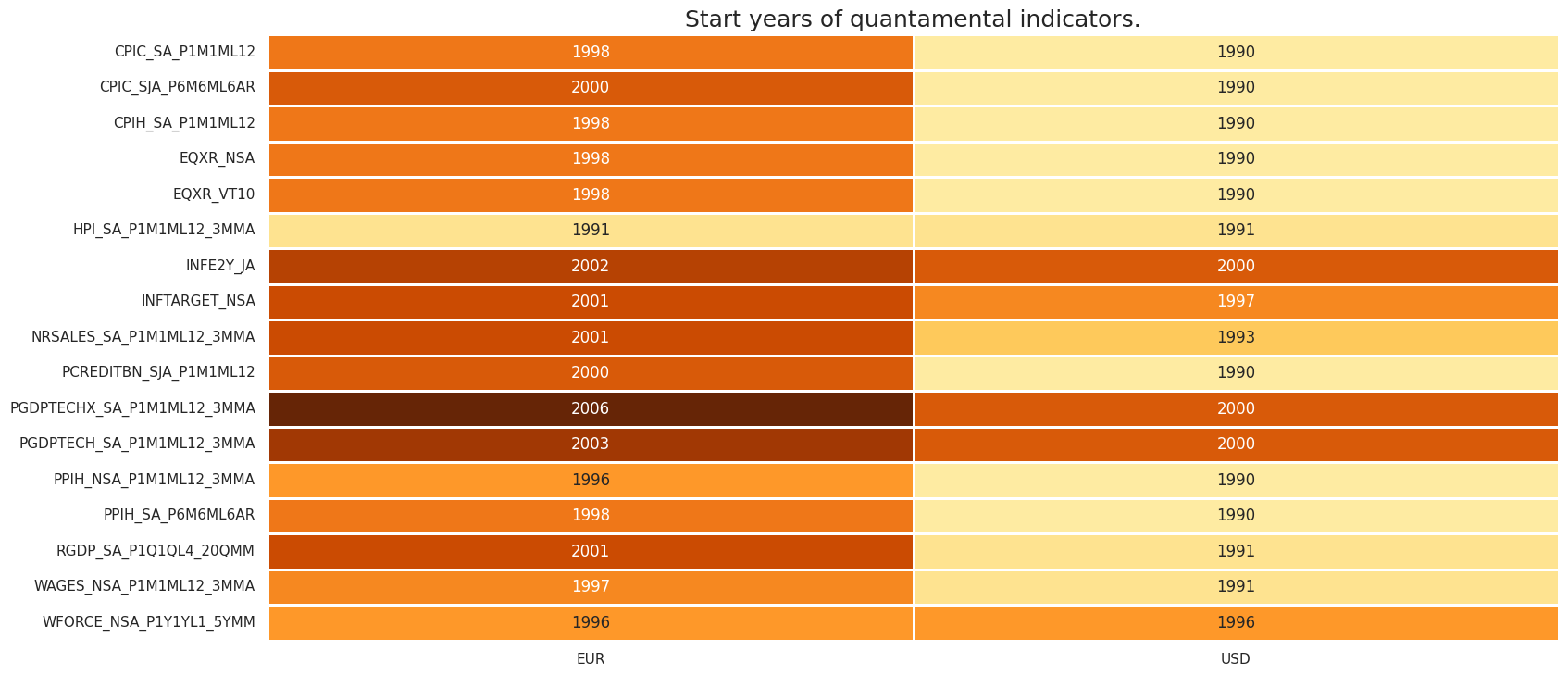

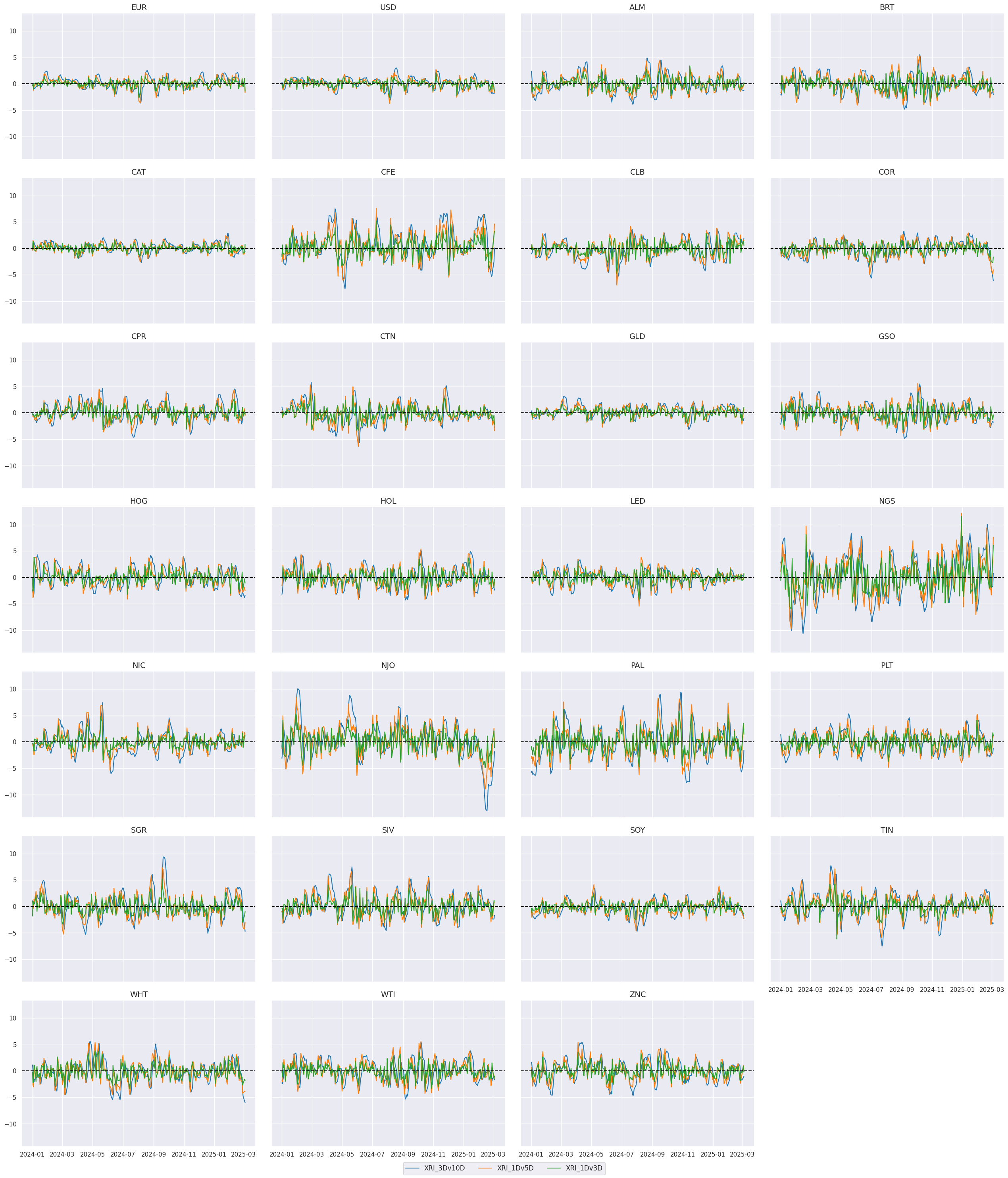

Check availability #

xcatx = ecos

cidx = cids_ecos

msm.check_availability(df=dfx, xcats=xcatx, cids=cidx, missing_recent=False)

xcatx = com

cidx = cids_com

msm.check_availability(df=dfx, xcats=xcatx, cids=cidx, missing_recent=False)

Factor calculation #

Short-term return trends #

dict_xrs = {"COXR_NSA": cids_com, "EQXR_NSA": cids_ecos}

dfa = pd.DataFrame(columns=dfx.columns)

for xr, cidx in dict_xrs.items():

calcs = [

f"XRI = ( {xr} ).cumsum()",

f"XRI_3DMA = XRI.rolling(3).mean()",

f"XRI_3DMA = XRI.rolling(3).mean()",

f"XRI_5DMA = XRI.rolling(5).mean()",

f"XRI_10DMA = XRI.rolling(10).mean()",

f"XRI_1Dv5D = ( XRI - XRI_5DMA )",

f"XRI_1Dv3D = ( XRI - XRI_3DMA )",

f"XRI_3Dv10D = ( XRI_3DMA - XRI_10DMA )",

]

dfaa = msp.panel_calculator(dfx, calcs, cids=cidx)

dfa = msm.update_df(dfa, dfaa)

dfx = msm.update_df(dfx, dfa)

trends = ["XRI_3Dv10D", "XRI_1Dv5D", "XRI_1Dv3D"]

xcatx = ["XRI_3DMA", "XRI_10DMA"]

cidx = ["WTI"]

sx = "1995-01-01"

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=1,

start=sx,

title=None,

same_y=True,

size = (12, 7),

aspect = 1.5,

)

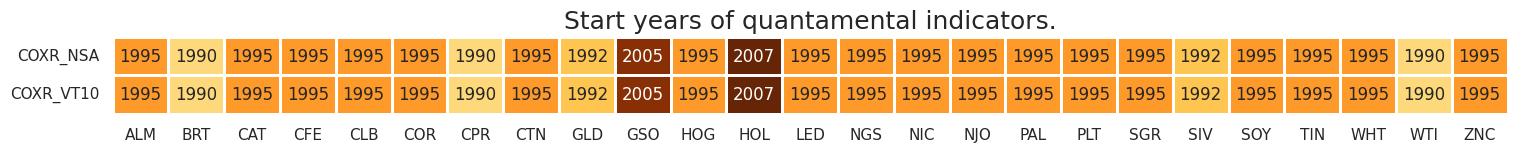

xcatx = trends

cidx = cids_alc

sx = "1995-01-01"

msp.view_ranges(

dfx,

xcats=xcatx,

cids=cidx,

kind="bar",

start=sx,

sort_cids_by="mean", # here sorted by standard deviations

title=None,

ylab=None,

xcat_labels=None,

size=(12, 6),

)

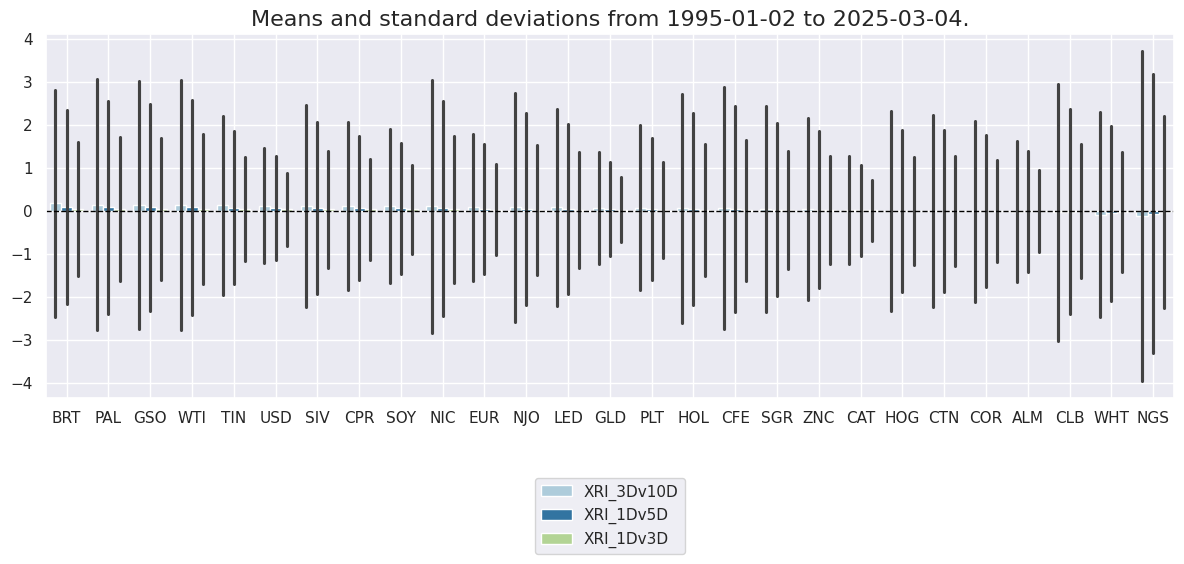

xcatx = trends

cidx = cids_alc

sx = "2024-01-01"

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=4,

start=sx,

title=None,

same_y=True,

size = (12, 7),

aspect = 1.5,

)

xcatx = trends

cid_groups = {

"FOD": {"csts": cids_sta + cids_liv + ["CFE", "SGR", "NJO"], "wgts": None},

"ENY": {"csts": cids_ene, "wgts": None},

"FON": {"csts": ["FOD", "ENY"], "wgts": (2, 1)},

"MTS": {"csts": cids_fme + cids_nfm, "wgts": None},

"COM": {"csts": ["FOD", "ENY", "MTS"], "wgts": None},

"EQY": {"csts": ["EUR", "USD"], "wgts": None},

"ACE": {"csts": ["COM", "EQY"], "wgts": None},

}

for group, value in cid_groups.items():

for xc in xcatx:

dfa = msp.linear_composite(

df=dfx,

xcats=xc,

cids=value["csts"],

weights=value["wgts"],

complete_cids=False,

new_cid=group,

)

dfx = msm.update_df(dfx, dfa)

gcids = list(cid_groups.keys())

secs =["FOD", "ENY", "MTS", "COM", "EQY", "ACE"] # selected sectors

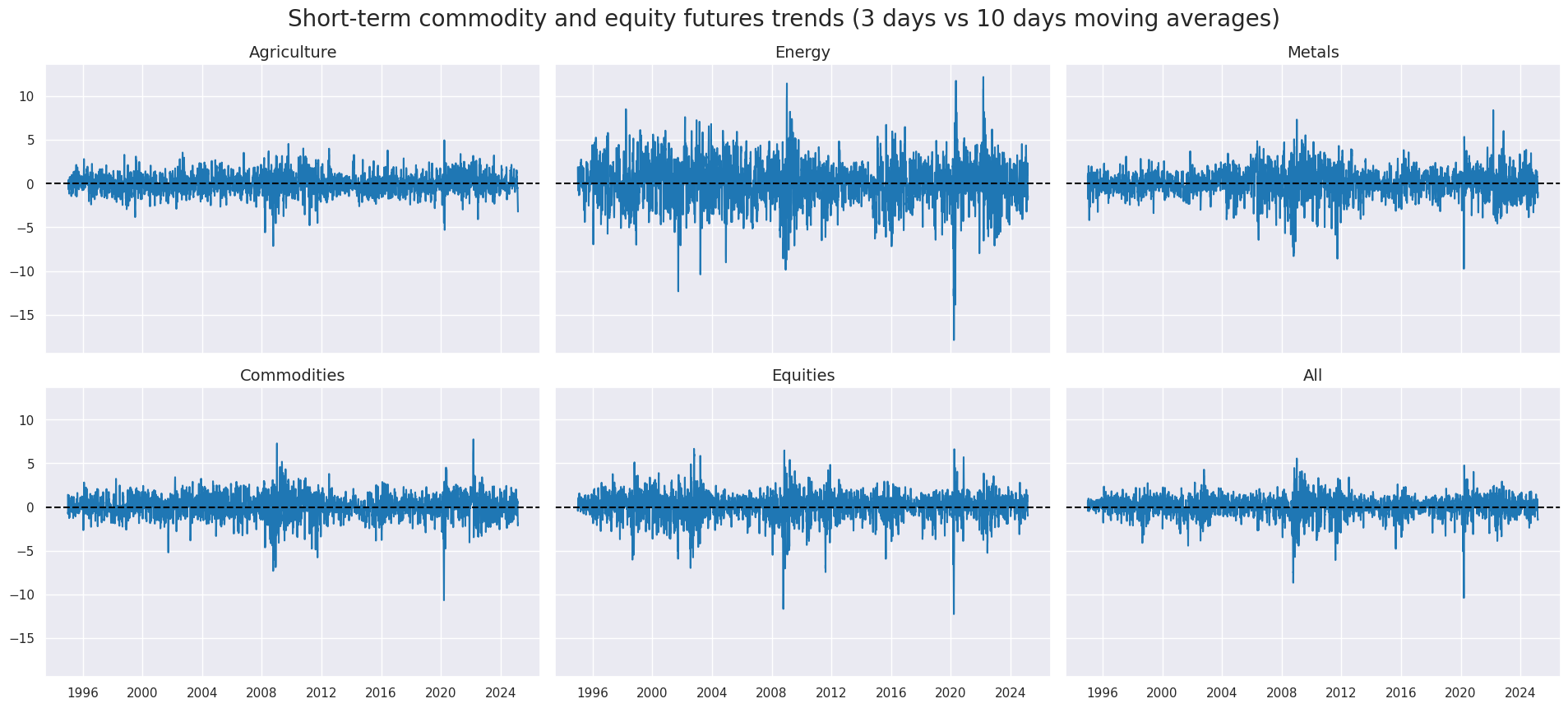

xcatx = "XRI_3Dv10D"

cidx = secs

sx = "1995-01-01"

msp.view_timelines(

dfx,

xcats=xcatx,

cid_labels=["Agriculture", "Energy", "Metals", "Commodities", "Equities", "All"],

cids=cidx,

ncol=3,

start=sx,

title="Short-term commodity and equity futures trends (3 days vs 10 days moving averages)",

title_fontsize=20,

same_y=True,

size = (12, 7),

aspect = 1.5,

)

Conditioning factors #

cidx = cids_ecos

calcs = []

# Excess inflation measures

xcatx = cpi + ppi + ["HPI_SA_P1M1ML12_3MMA"]

for xc in xcatx:

calcs.append(f"X{xc} = {xc} - INFTARGETX_NSA ")

# Excess wage growth

xcatx = ["WAGES_NSA_P1M1ML12_3MMA"]

for xc in xcatx:

calcs.append(f"X{xc} = {xc} - RGDP_SA_P1Q1QL4_20QMM - INFTARGETX_NSA + WFORCE_NSA_P1Y1YL1_5YMM ")

# Excess sales and credit growth

xcatx = ["NRSALES_SA_P1M1ML12_3MMA", "PCREDITBN_SJA_P1M1ML12"]

for xc in xcatx:

calcs.append(f"X{xc} = {xc} - RGDP_SA_P1Q1QL4_20QMM - INFTARGETX_NSA")

# Actual calculation and addition

dfa = msp.panel_calculator(dfx, calcs, cids=cidx)

dfx = msm.update_df(dfx, dfa)

# Lists of relevant excess indicators

xall = [s.split(' ', 1)[0] for s in calcs]

xcpi = [x for x in xall if "CPI" in x or "INFE" in x]

xppi = [x for x in xall if "PPI" in x or "PGDPTECH" in x]

xopi = [x for x in xall if x not in xcpi + xppi]

xinf = xcpi + xppi + xopi

xopi

['XHPI_SA_P1M1ML12_3MMA',

'XWAGES_NSA_P1M1ML12_3MMA',

'XNRSALES_SA_P1M1ML12_3MMA',

'XPCREDITBN_SJA_P1M1ML12']

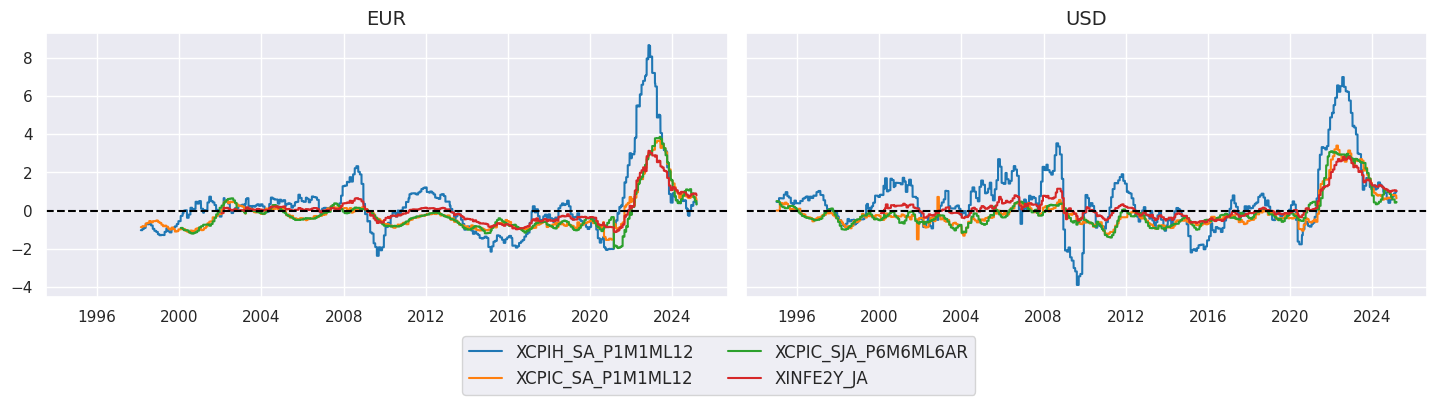

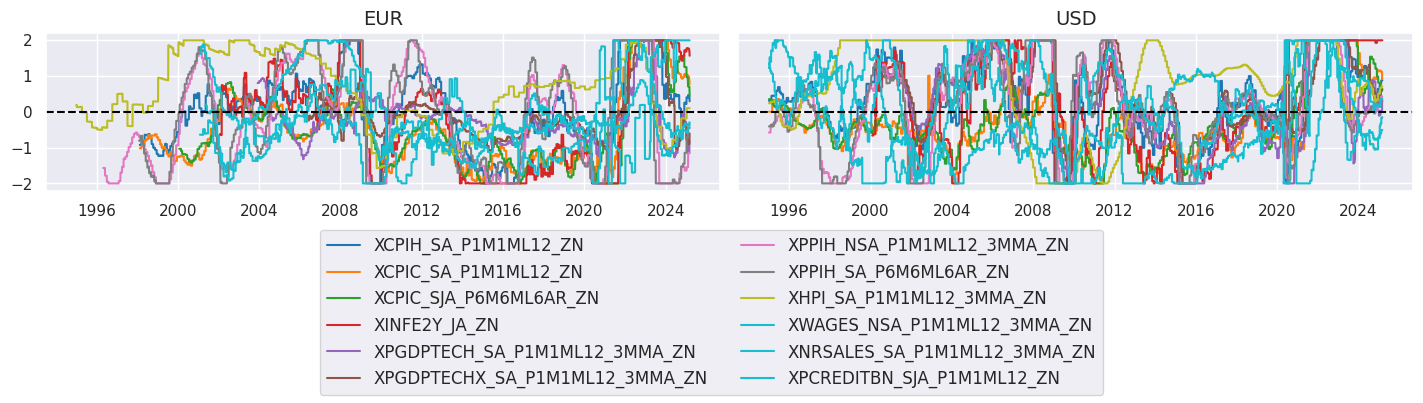

xcatx = xcpi

cidx = cids_ecos

sx = "1995-01-01"

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=2,

start=sx,

title=None,

same_y=True,

size = (12, 7),

aspect = 1.7,

)

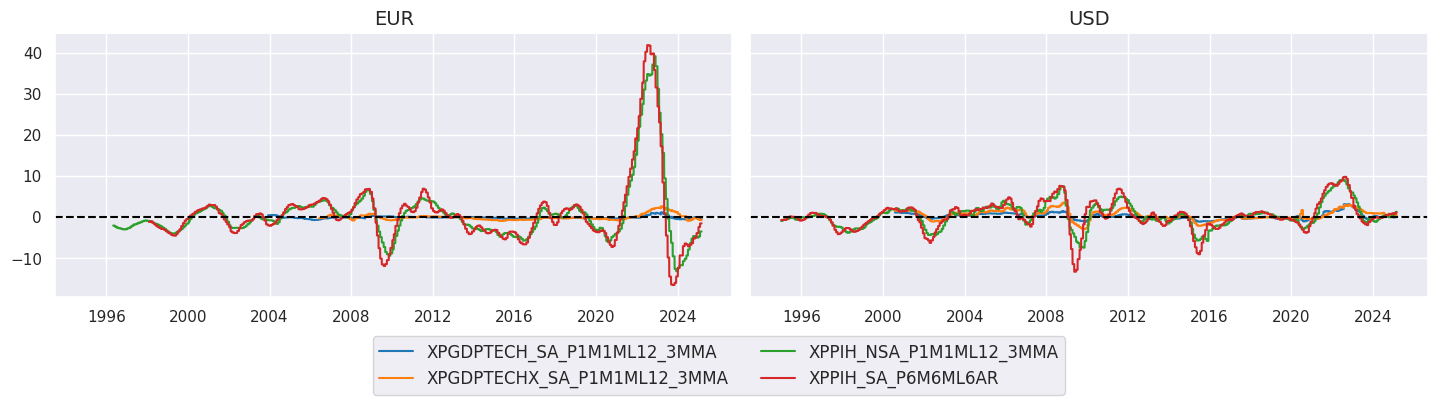

xcatx = xppi

cidx = cids_ecos

sx = "1995-01-01"

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=2,

start=sx,

title=None,

same_y=True,

size = (12, 7),

aspect = 1.7,

)

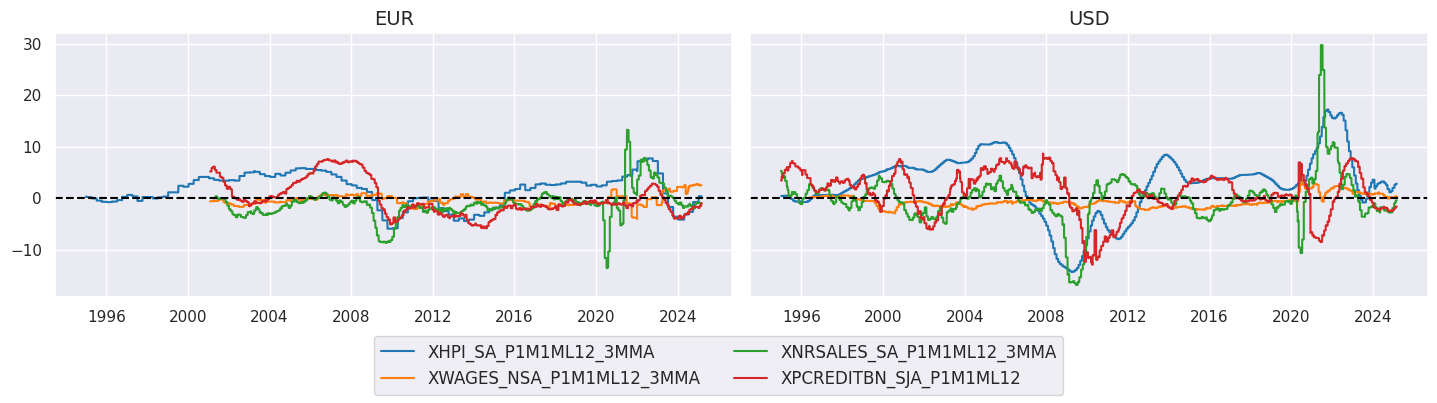

xcatx = xopi

cidx = cids_ecos

sx = "1995-01-01"

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=2,

start=sx,

title=None,

same_y=True,

size = (12, 7),

aspect = 1.7,

)

# Normalization of broadest excess inflation

xcatx = xinf

cidx = cids_ecos

for xc in xcatx:

dfa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

neutral="zero",

thresh=2,

est_freq="M",

pan_weight=1,

postfix="_ZN",

)

dfx = msm.update_df(dfx, dfa)

# Lists of normalized excess indicators

xcpiz = [s + "_ZN" for s in xcpi]

xppiz = [s + "_ZN" for s in xppi]

xopiz = [s + "_ZN" for s in xopi]

xinfz = [s + "_ZN" for s in xinf]

xcatx = xinfz

cidx = cids_ecos

sx = "1995-01-01"

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=2,

start=sx,

title=None,

same_y=True,

size = (12, 7),

aspect = 1.7,

)

# Groupwise linear combination

cidx = cids_ecos

xcat_groups = {

"XCPI": xcpiz,

"XPPI": xppiz,

"XOPI": xopiz,

}

for group, xcatx in xcat_groups.items():

dfa = msp.linear_composite(

df=dfx,

xcats=xcatx,

cids=cidx,

complete_xcats=False,

new_xcat=group,

)

dfx = msm.update_df(dfx, dfa)

# Re-scoring

comps = list(xcat_groups.keys())

for xc in comps:

dfa = msp.make_zn_scores(

dfx,

xcat=xc,

cids=cidx,

neutral="zero",

thresh=2,

est_freq="M",

pan_weight=1,

postfix="_ZN",

)

dfx = msm.update_df(dfx, dfa)

compz = [s + "_ZN" for s in comps]

# Final composite and re-normalization

cidx = cids_ecos

xcatx = compz

dfa = msp.linear_composite(

df=dfx,

xcats=xcatx,

cids=cidx,

complete_xcats=False,

new_xcat="XINFS",

)

dfx = msm.update_df(dfx, dfa)

dfa = msp.make_zn_scores(

dfx,

xcat="XINFS",

cids=cidx,

neutral="zero",

thresh=2,

est_freq="M",

pan_weight=1,

postfix="_ZN",

)

dfx = msm.update_df(dfx, dfa)

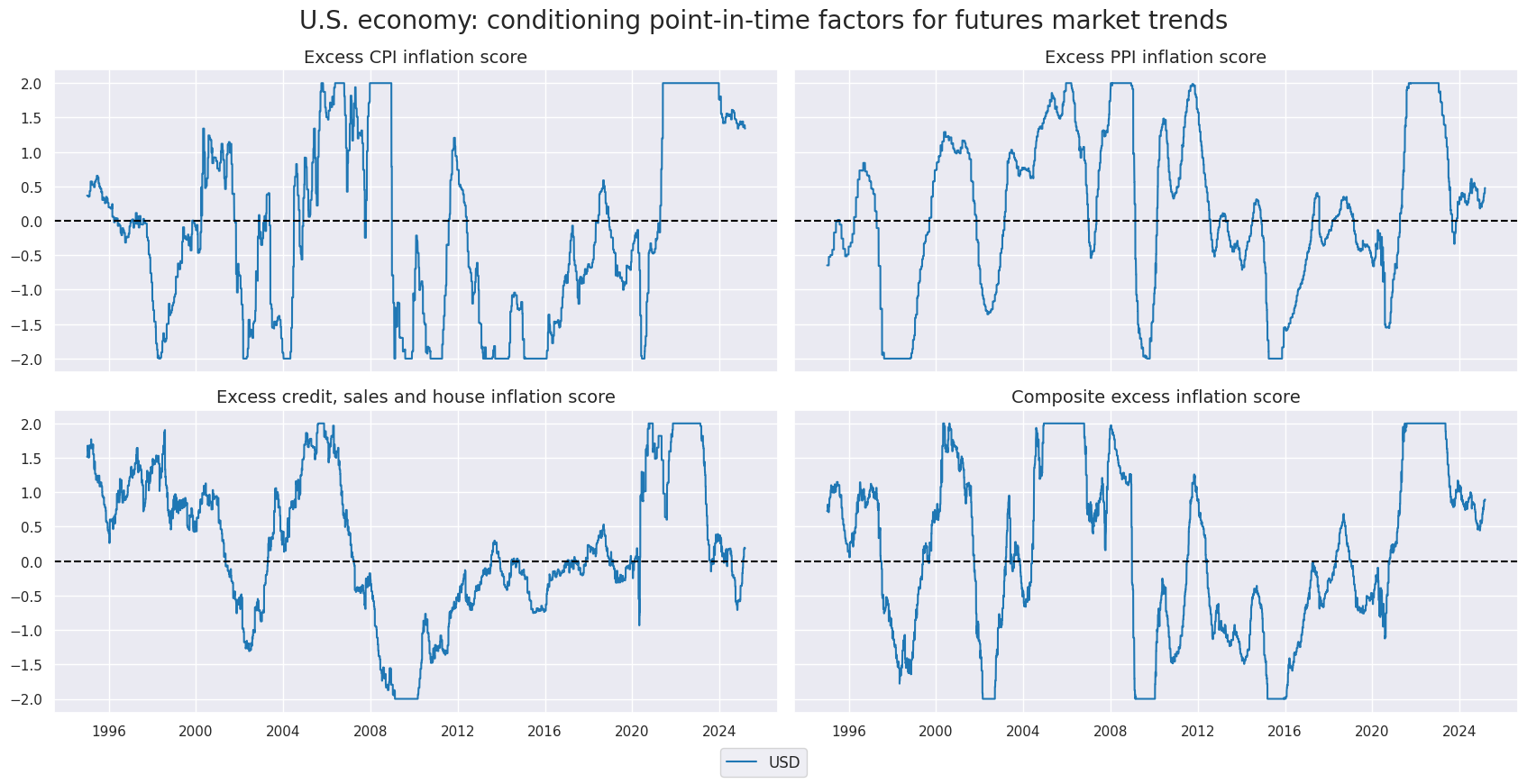

xcatx = compz + ["XINFS_ZN"]

cidx = "USD"

sx = "1995-01-01"

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

xcat_labels=[

"Excess CPI inflation score",

"Excess PPI inflation score",

"Excess credit, sales and house inflation score",

"Composite excess inflation score",

],

ncol=2,

start=sx,

title="U.S. economy: conditioning point-in-time factors for futures market trends",

title_fontsize=20,

xcat_grid=True,

same_y=True,

size = (10, 6),

aspect = 2,

)

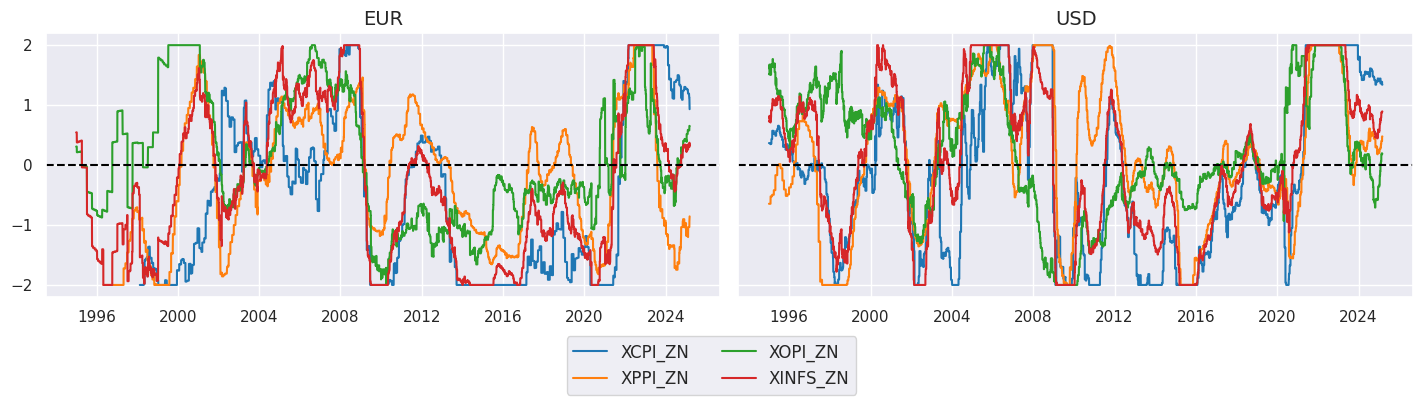

xcatx = compz + ["XINFS_ZN"]

cidx = cids_ecos

sx = "1995-01-01"

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=2,

start=sx,

title=None,

same_y=True,

size = (12, 7),

aspect = 1.7,

)

Conditional short-term trends #

# Sign-conditioned trends

cidx = gcids

us_condz_s = ["USD_" + s for s in ['XCPI_ZN', 'XINFS_ZN']]

calcs = []

for trend in trends:

for cond in us_condz_s:

calcs += [f"{trend}_{cond[:-3]} = -1 * i{cond} * {trend}"]

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cidx)

dfx = msm.update_df(dfx, dfa)

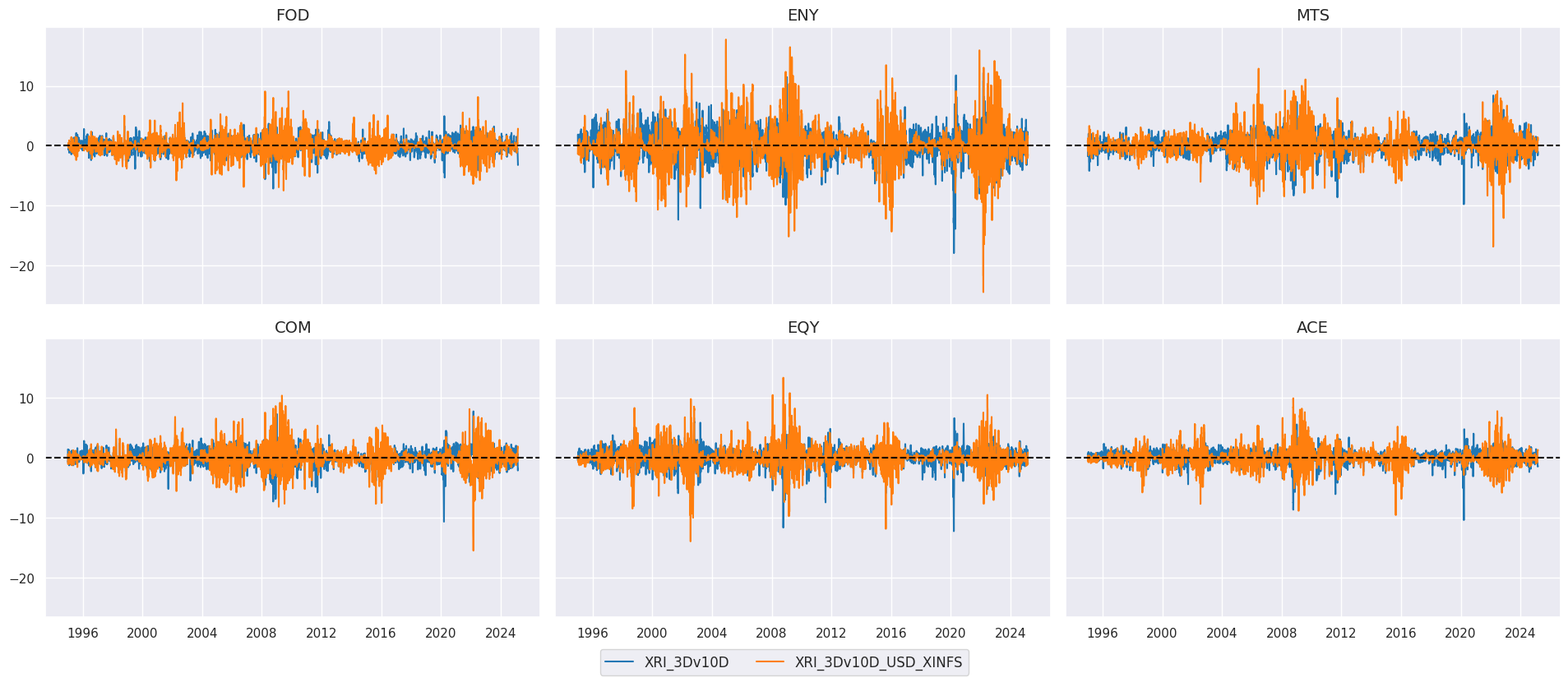

xcatx = ["XRI_3Dv10D", "XRI_3Dv10D_USD_XINFS"]

cidx = secs

sx = "1995-01-01"

msp.view_timelines(

dfx,

xcats=xcatx,

# cid_labels=["Agriculture", "Energy", "Metals", "Commodities", "Equities", "All"],

cids=cidx,

ncol=3,

start=sx,

title=None,

title_fontsize=20,

same_y=True,

size = (12, 7),

aspect = 1.5,

)

# Renaming to currency cids

mofs = ["_USD_XCPI", "_USD_XINFS", ""]

sm_trends = [trend + mof for trend in trends for mof in mofs]

cidx = cids_ecos

contracts = [

cid + "_" + smt for cid in gcids for smt in sm_trends

]

calcs = []

for contract in contracts:

calcs.append(f"{contract} = i{contract}")

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cidx)

dfx = msm.update_df(dfx, dfa)

# Negative of simple trends

cidx = cids_ecos

contracts = [

cid + "_" + smt for cid in gcids for smt in trends

]

calcs = []

for contract in contracts:

calcs.append(f"{contract}N = -1 * i{contract}")

dfa = msp.panel_calculator(dfx, calcs=calcs, cids=cidx)

dfx = msm.update_df(dfx, dfa)

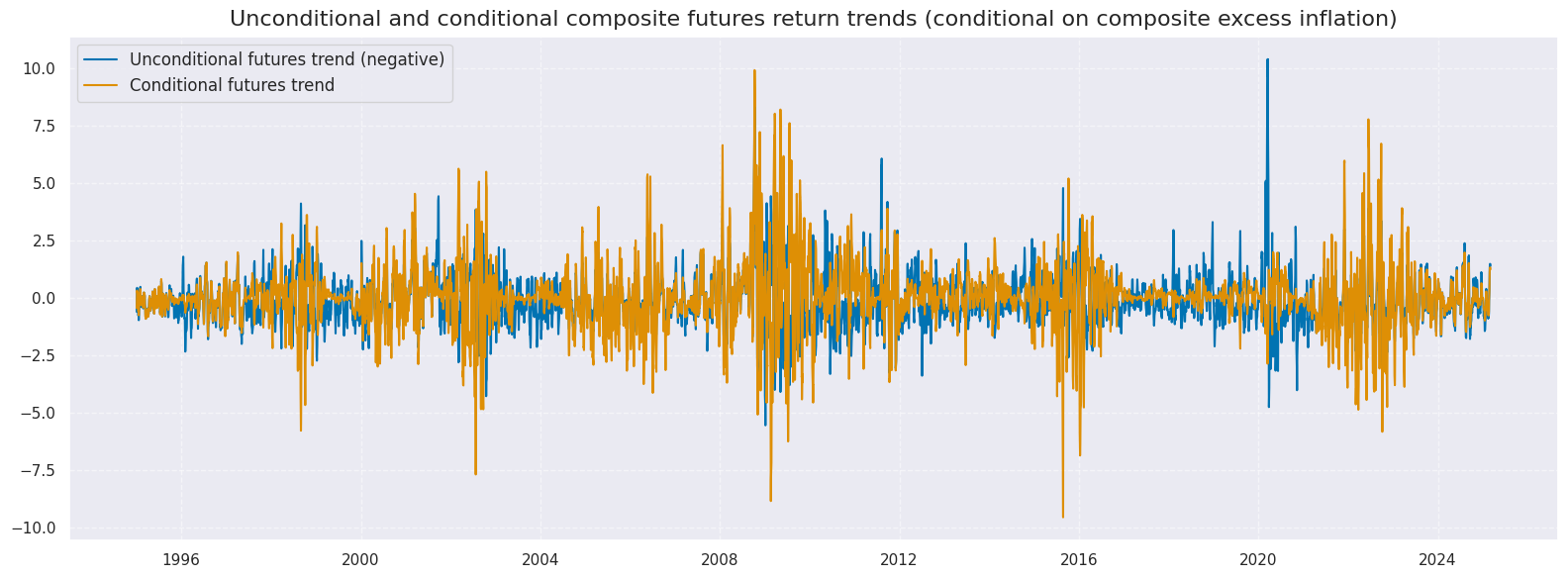

xcatx = ["ACE_XRI_3Dv10DN", "ACE_XRI_3Dv10D_USD_XINFS"]

cidx = ["USD"]

sx = "1995-01-01"

msp.view_timelines(

dfx,

xcats=xcatx,

xcat_labels=["Unconditional futures trend (negative)", "Conditional futures trend"],

cids=cidx,

start=sx,

title="Unconditional and conditional composite futures return trends (conditional on composite excess inflation)",

title_fontsize=16,

same_y=True,

size = (16, 6),

aspect = 1.5,

)

Combined signals #

# Combine by trends and modifying factors across contracts

mofns = ["_USD_XCPI", "_USD_XINFS", "N"]

secs =["FOD", "ENY", "MTS", "COM", "EQY", "ACE"]

for trend in trends:

dfa = msp.linear_composite(

df=dfx,

xcats=[sec + "_" + trend + mof for mof in mofns for sec in secs],

cids=["USD"],

complete_xcats=False,

new_xcat=trend + "_USD_ALL_CM",

)

dfx = msm.update_df(dfx, dfa)

dfa = msp.linear_composite(

df=dfx,

xcats=[sec + "_" + trend + "N" for sec in secs],

cids=["USD"],

complete_xcats=False,

new_xcat=trend + "_USD_ALL_N",

)

dfx = msm.update_df(dfx, dfa)

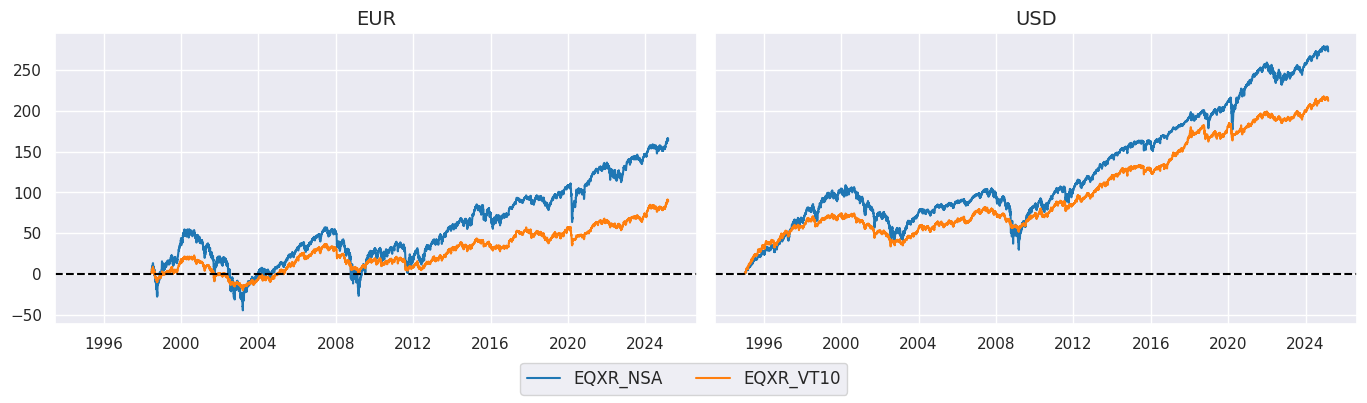

Target returns #

cidx = cids_ecos

xcatx = ["EQXR_NSA", "EQXR_VT10"]

msp.view_timelines(

dfx,

xcats=xcatx,

cids=cidx,

ncol=2,

start="1995-01-01",

same_y=True,

cumsum=True,

)

Value checks #

All contracts and modifiers #

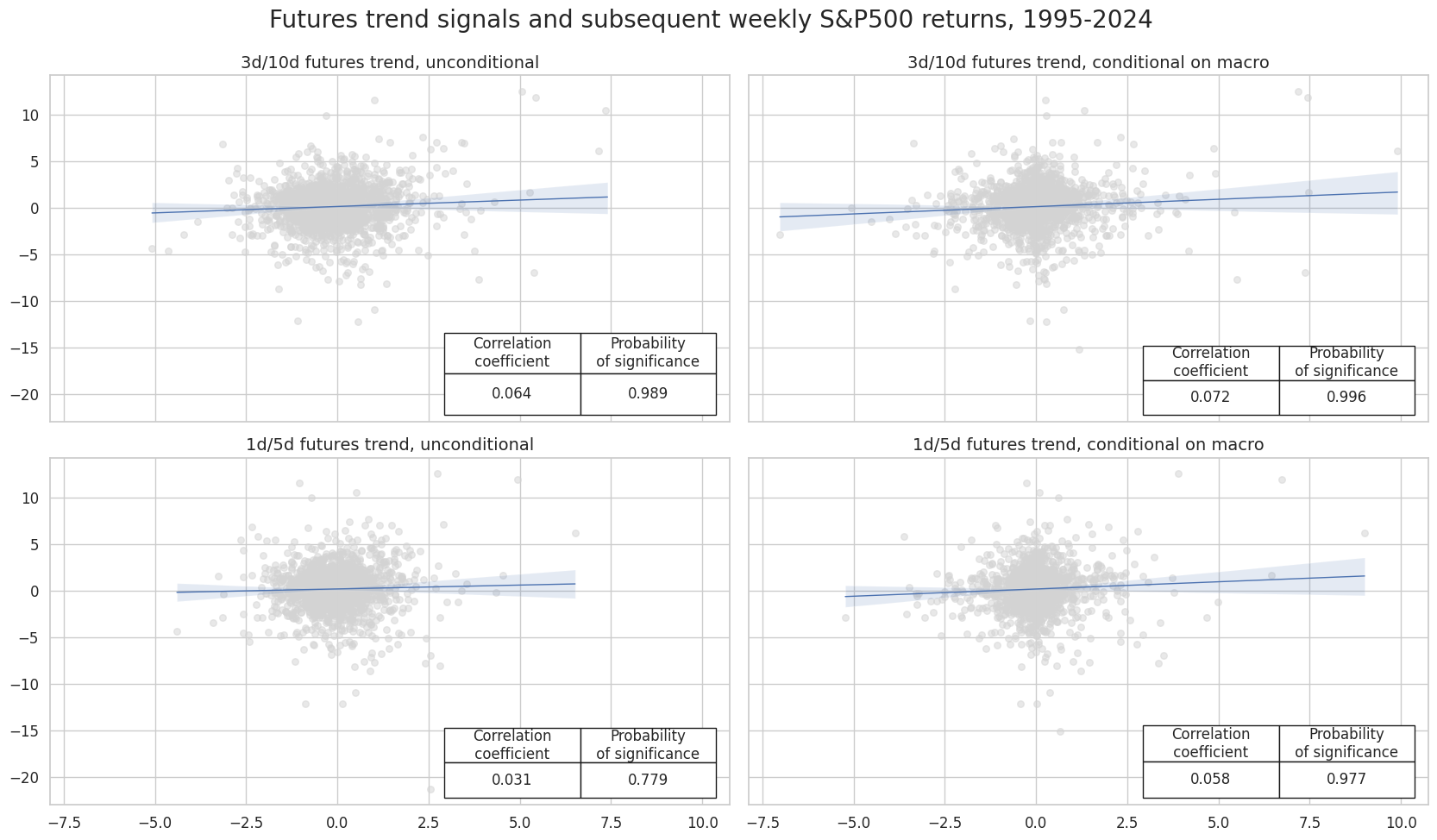

Specs and test #

trendx = ["XRI_3Dv10D", "XRI_1Dv5D"]

all_mods = ["_USD_ALL_N", "_USD_ALL_CM"]

all_cm_trends = [trend + mod for trend in trendx for mod in all_mods]

cidx = ["USD"]

dict_all_cmw = {

"sigs": all_cm_trends,

"targs": ["EQXR_NSA", "EQXR_VT10"],

"cidx": cidx,

"start": "1995-01-01",

"srr": None,

"pnls": None,

"pnls_lb": None,

}

dix = dict_all_cmw

sigs = dix["sigs"]

targ = dix["targs"][0] # assuming just one target

cidx = dix["cidx"]

start = dix["start"]

# Initialize the dictionary to store CategoryRelations instances

dict_cr = {}

for sig in sigs:

dict_cr[sig] = msp.CategoryRelations(

dfx,

xcats=[sig, targ],

cids=cidx,

freq="W",

lag=1,

xcat_aggs=["last", "sum"],

start=start,

)

# Plotting the results

crs = list(dict_cr.values())

crs_keys = list(dict_cr.keys())

msv.multiple_reg_scatter(

cat_rels=crs,

title="Futures trend signals and subsequent weekly S&P500 returns, 1995-2024",

ylab=None,

ncol=2,

nrow=2,

figsize=(17, 10),

prob_est="pool",

coef_box="lower right",

subplot_titles=[

"3d/10d futures trend, unconditional",

"3d/10d futures trend, conditional on macro",

"1d/5d futures trend, unconditional",

"1d/5d futures trend, conditional on macro",

],

)

Accuracy and correlation check #

dix = dict_all_cmw

sigx = dix["sigs"]

targx = dix["targs"][0]

cidx = dix["cidx"]

start = dix["start"]

srr = mss.SignalReturnRelations(

dfx,

cids=cidx,

sigs=sigx,

rets=targx,

freqs="W",

slip=0,

start=start,

)

dix["srr"] = srr

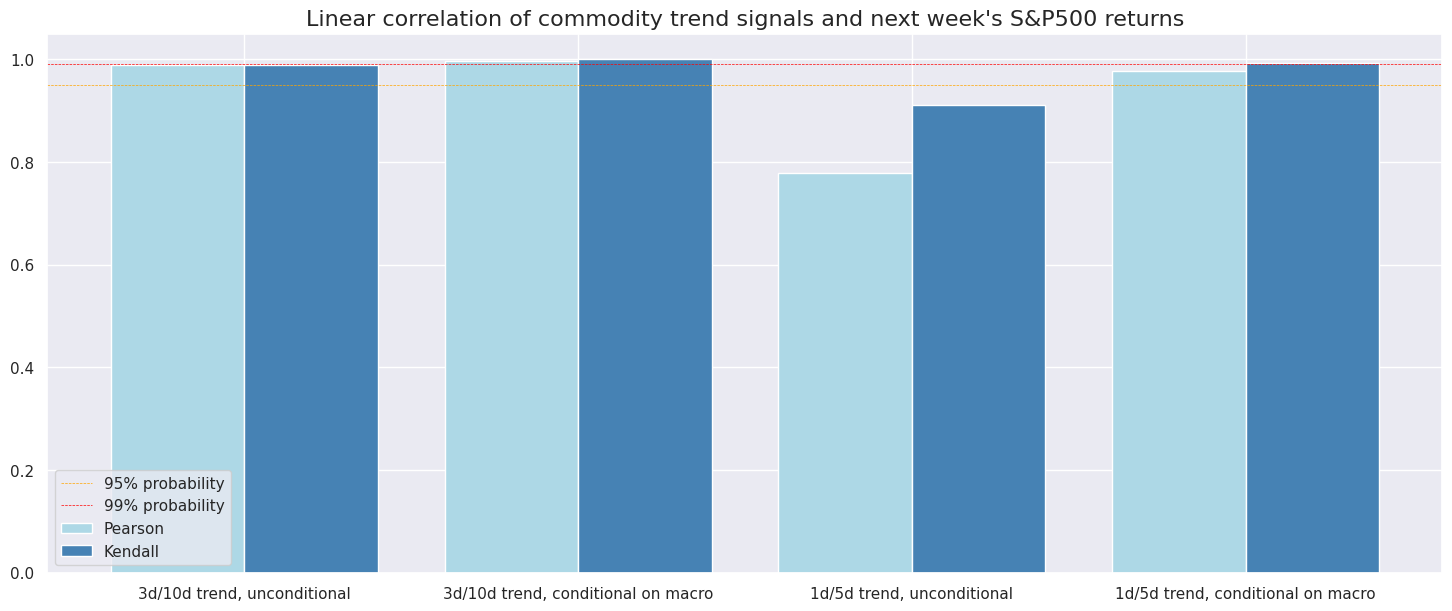

dix = dict_all_cmw

srr = dix["srr"]

colx = [

"accuracy",

"bal_accuracy",

"pos_sigr",

"pos_retr",

"pearson",

"pearson_pval",

"kendall",

"kendall_pval",

]

kills = ["Return", "Frequency", "Aggregation"]

display(

srr.multiple_relations_table()

.reset_index(level=kills, drop=True)

.astype("float")

.round(3)[colx]

)

dict_labels = {

"XRI_3Dv10D_USD_ALL_N": "3d/10d trend, unconditional",

"XRI_3Dv10D_USD_ALL_CM": "3d/10d trend, conditional on macro",

"XRI_1Dv5D_USD_ALL_N": "1d/5d trend, unconditional",

"XRI_1Dv5D_USD_ALL_CM": "1d/5d trend, conditional on macro",

}

srr.correlation_bars(

type="signals",

title="Linear correlation of commodity trend signals and next week's S&P500 returns",

size=(18, 7),

x_labels=dict_labels,

)

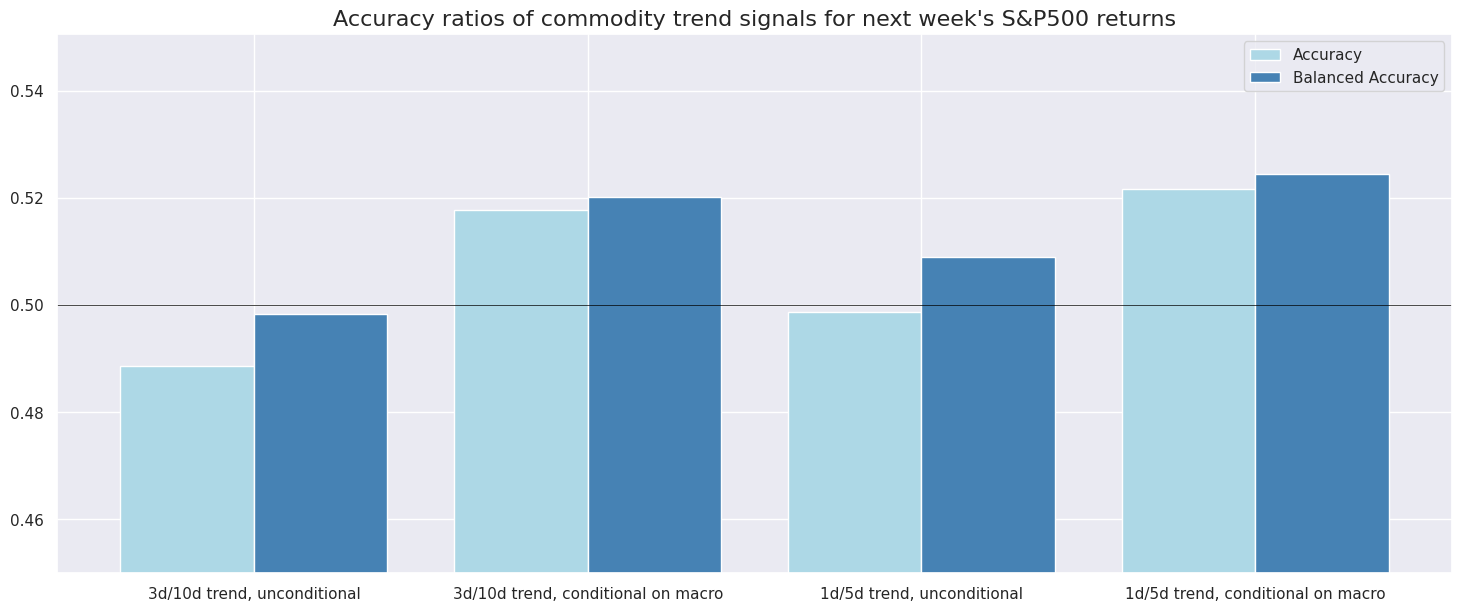

srr.accuracy_bars(

type="signals",

title="Accuracy ratios of commodity trend signals for next week's S&P500 returns",

size=(18, 7),

x_labels=dict_labels,

)

| accuracy | bal_accuracy | pos_sigr | pos_retr | pearson | pearson_pval | kendall | kendall_pval | |

|---|---|---|---|---|---|---|---|---|

| Signal | ||||||||

| XRI_1Dv5D_USD_ALL_CM | 0.522 | 0.524 | 0.480 | 0.57 | 0.058 | 0.023 | 0.046 | 0.006 |

| XRI_1Dv5D_USD_ALL_N | 0.499 | 0.509 | 0.428 | 0.57 | 0.031 | 0.221 | 0.029 | 0.089 |

| XRI_3Dv10D_USD_ALL_CM | 0.518 | 0.520 | 0.483 | 0.57 | 0.072 | 0.004 | 0.060 | 0.000 |

| XRI_3Dv10D_USD_ALL_N | 0.489 | 0.498 | 0.429 | 0.57 | 0.064 | 0.011 | 0.043 | 0.011 |

Naive PnL #

dix = dict_all_cmw

sigx = dix["sigs"]

targ = dix["targs"][1]

cidx = dix["cidx"]

start = dix["start"]

naive_pnl = msn.NaivePnL(

dfx,

ret=targ,

sigs=sigx,

cids=cidx,

start=start,

bms=["USD_EQXR_NSA"],

)

for sig in sigx:

naive_pnl.make_pnl(

sig,

sig_neg=False,

sig_op="zn_score_cs",

sig_add=0,

thresh=4,

rebal_freq="weekly",

vol_scale=10,

rebal_slip=0,

pnl_name=sig+"_ZN"

)

naive_pnl.make_long_pnl(vol_scale=10, label="Long only")

dix["pnls"] = naive_pnl

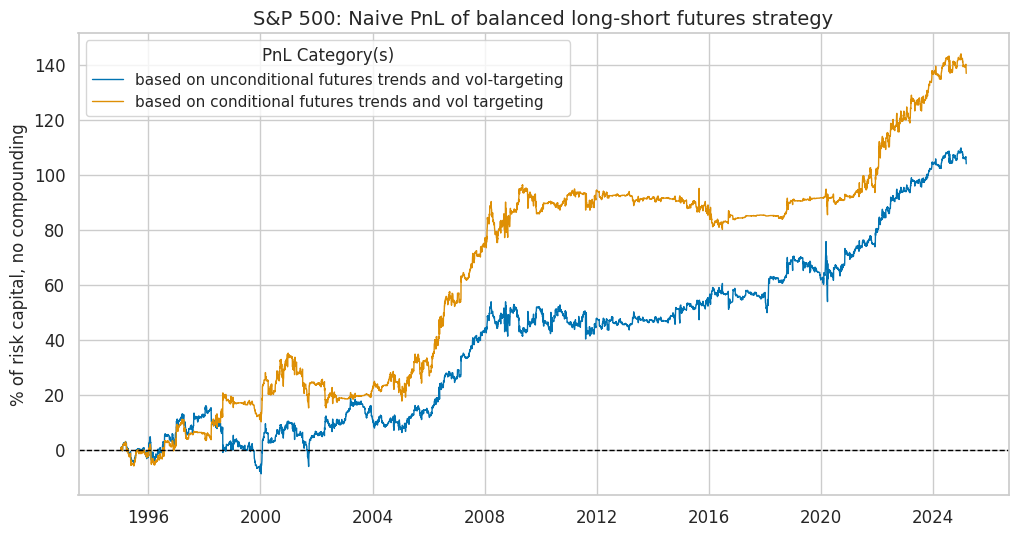

dix = dict_all_cmw

start = dix["start"]

sigx = ["XRI_3Dv10D_USD_ALL_N", "XRI_3Dv10D_USD_ALL_CM"]

naive_pnl = dix["pnls"]

pnls = [s + "_ZN" for s in sigx]

desc = [

"based on unconditional futures trends and vol-targeting",

"based on conditional futures trends and vol targeting",

]

labels = {key: desc for key, desc in zip(pnls, desc)}

naive_pnl.plot_pnls(

pnl_cats=pnls,

start=start,

title="S&P 500: Naive PnL of balanced long-short futures strategy",

title_fontsize=14,

xcat_labels=labels,

figsize=(12, 6),

)

df_eval = naive_pnl.evaluate_pnls(

pnl_cats=pnls,

start=start,

)

display(df_eval.transpose().astype("float").round(3))

| Return % | St. Dev. % | Sharpe Ratio | Sortino Ratio | Max 21-Day Draw % | Max 6-Month Draw % | Peak to Trough Draw % | Top 5% Monthly PnL Share | USD_EQXR_NSA correl | Traded Months | |

|---|---|---|---|---|---|---|---|---|---|---|

| xcat | ||||||||||

| XRI_3Dv10D_USD_ALL_N_ZN | 3.449 | 10.0 | 0.345 | 0.504 | -11.680 | -15.171 | -24.676 | 1.044 | 0.209 | 363.0 |

| XRI_3Dv10D_USD_ALL_CM_ZN | 4.539 | 10.0 | 0.454 | 0.689 | -8.473 | -17.633 | -19.908 | 0.951 | 0.047 | 363.0 |

dix = dict_all_cmw

sigx = dix["sigs"]

targ = dix["targs"][1]

cidx = dix["cidx"]

start = dix["start"]

naive_pnl = msn.NaivePnL(

dfx,

ret=targ,

sigs=sigx,

cids=cidx,

start=start,

bms=["USD_EQXR_NSA"],

)

for sig in sigx:

naive_pnl.make_pnl(

sig,

sig_neg=False,

sig_op="zn_score_cs",

sig_add=2,

thresh=2,

rebal_freq="weekly",

vol_scale=10,

rebal_slip=0,

pnl_name=sig+"_ZN"

)

naive_pnl.make_long_pnl(vol_scale=10, label="Long only")

dix["pnls_lb"] = naive_pnl

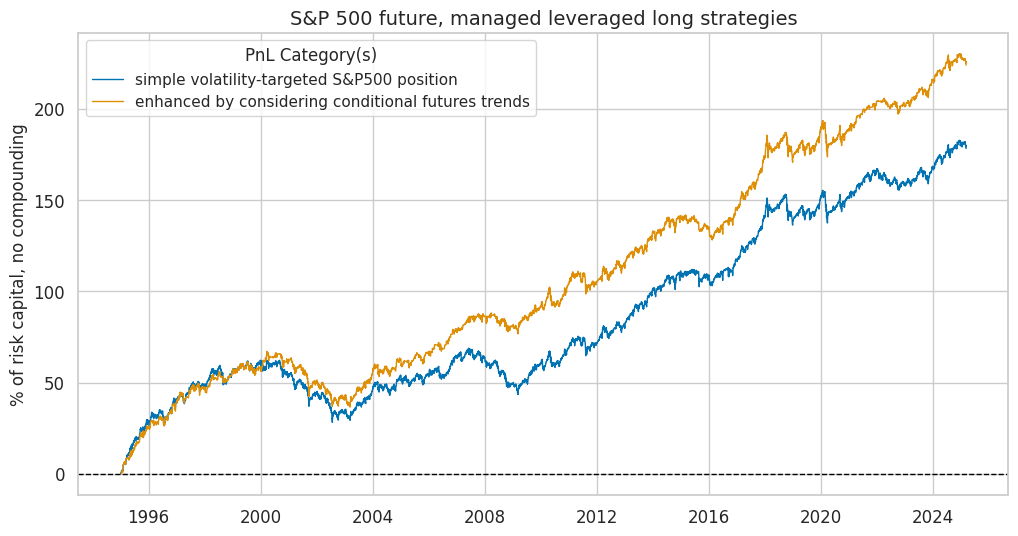

dix = dict_all_cmw

start = dix["start"]

sigx = ["XRI_3Dv10D_USD_ALL_CM"]

naive_pnl = dix["pnls_lb"]

pnls = ["Long only"] + [s + "_ZN" for s in sigx]

desc = [

"simple volatility-targeted S&P500 position",

"enhanced by considering conditional futures trends",

]

labels = {key: desc for key, desc in zip(pnls, desc)}

naive_pnl.plot_pnls(

pnl_cats=pnls,

start=start,

title="S&P 500 future, managed leveraged long strategies",

title_fontsize=14,

xcat_labels=labels,

figsize=(12, 6),

)

df_eval = naive_pnl.evaluate_pnls(

pnl_cats=pnls,

start=start,

)

display(df_eval.transpose().astype("float").round(3))

| Return % | St. Dev. % | Sharpe Ratio | Sortino Ratio | Max 21-Day Draw % | Max 6-Month Draw % | Peak to Trough Draw % | Top 5% Monthly PnL Share | USD_EQXR_NSA correl | Traded Months | |

|---|---|---|---|---|---|---|---|---|---|---|

| xcat | ||||||||||

| XRI_3Dv10D_USD_ALL_CM_ZN | 7.429 | 10.0 | 0.743 | 1.038 | -18.014 | -14.603 | -30.553 | 0.425 | 0.782 | 363.0 |

| Long only | 5.911 | 10.0 | 0.591 | 0.813 | -16.183 | -15.031 | -34.008 | 0.486 | 0.865 | 363.0 |